- DENN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Denny's (DENN) DEF 14ADefinitive proxy

Filed: 7 Apr 22, 4:36pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 240.14a-12 | |

DENNY’S CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

April 7, 2022

203 East Main Street

Spartanburg, South Carolina 29319

To Our Stockholders:

In 2021, we continued to navigate unchartered waters as the COVID-19 pandemic impacted our business and our industry. Through these challenging times, we met every obstacle with a renewed sense of resilience, doubling down on our purpose – We Love to Feed People – to best serve our guests, our people, and our communities.

We took decisive steps to strengthen our system while steadily progressing towards a return to our 24/7 heritage. Our Board and our Executive Leadership Team worked in lockstep to implement enhanced communications, develop new safety protocols, introduce streamlined menus and add innovative products to meet our guests’ evolving preferences.

As COVID-19 continued to disrupt everyday life, we prioritized consumer convenience and successfully built on our existing Denny’s on Demand platform to deploy alternative service delivery models and roll out two new virtual restaurant concepts: The Meltdown and The Burger Den. Both concepts continue to drive incremental growth while growing our audience and strengthening our foothold in key markets across the US.

Our ongoing digital transformation – including the relaunch of Denny’s.com, Denny’s on Demand and our mobile app – gave customers new and more personalized ways to interact with the brand, whether ordering delivery, picking up food to go or enjoying the comfort of one of our booths.

Our franchisees and our restaurant teams are the backbone of our brand and, in recognition of the unprecedented challenges brought on by the pandemic, we provided over $15 million in direct financial assistance to our franchise partners and continued salaries for all unit-level management in Company stores, even during periods restaurants were closed. We also invested in benefit programs for all active and furloughed employees and enabled remote work protocols to help attract talent to Denny’s.

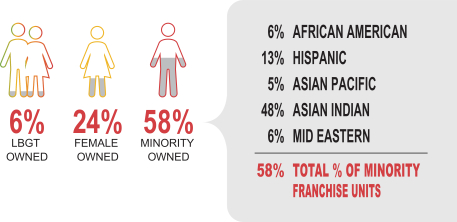

We have built a diverse and inclusive workforce through our commitment to embracing the unique qualities of each employee and valuing differences in thought, culture, and experiences. In support of this commitment, we continually remind our restaurant operators of the Rules We Live By: 1) Everyone is welcome to dine at Denny’s, 2) Everyone is treated like our favorite guest and 3) Everyone is shown kindness and respect.

Feeding our guests bodies, minds and souls is the reason we exist, and we are determined to fulfill that purpose while operating as a responsible steward for our planet and our people. That is why Denny’s purchasing decisions are guided by a commitment to animal welfare and responsible sourcing. We have made great strides to reduce energy and waste and will continue dedicating resources to make our business more sustainable. Through our partnership with No Kid Hungry, we raised $1.5 million for children facing hunger in the US in 2021.

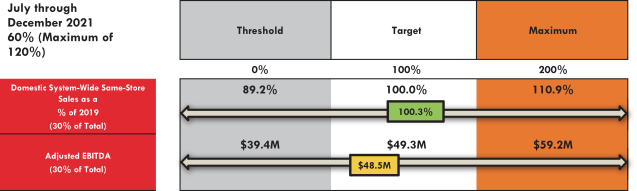

During times of upheaval, it’s our belief that continuity in senior leadership is paramount. To retain the senior leadership talent that has consistently delivered strong results for our stockholders, we adjusted compensation programs to preserve a strong linkage between pay and performance. Together with the Board, Denny’s leadership successfully reduced operating costs across the board and refined our capital structure to ensure the health and resilience of our business. As a result, our Adjusted EBITDA was well above our expectations, and we were able to limit permanent store closures while seeing encouraging sales trends across the system.

Sound strategies and effective leadership teams with a long-term focus have contributed to Denny’s 67 years of endurance. Continued oversight of these strategies by our diverse and experienced Board, coupled with officer equity holding requirements, will ensure our focus on near-term success remains aligned with long-term stockholder interest and ultimately the fulfillment of our brand purpose for many years to come.

Thank you for your continued interest and ongoing support of the Denny’s brand.

With Respect and Gratitude, | ||

|

| |

Brenda J. Lauderback | John C. Miller | |

Board Chair | CEO | |

DENNY’S

NOTICE OF 2022 ANNUAL MEETING OF

STOCKHOLDERS

When | Where | Record Date | ||

Date and Time May 18, 2022 11:00 AM (Eastern Time) | Online at www.virtualshareholdermeeting.com/DENN2022 | Stockholders as of March 22, 2022 are entitled to vote. | ||

VOTING ITEMS

Proposals | Board Vote Recommendation | For Further Details | ||

1. To elect the 9 directors named in this proxy statement | ✓ FOR each director nominee | See page 8 | ||

2. To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2022 | ✓ FOR | See page 19 | ||

3. To approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this proxy statement | ✓ FOR | See page 21 | ||

4. To vote on a stockholder proposal that requests the board of directors oversee the preparation of an analysis, made publicly available, of the feasibility of increasing tipped workers’ starting wage to a full minimum wage | × AGAINST | See page 43 | ||

Stockholders will also transact such other business as may properly come before the annual meeting of the stockholders to be held on May 18, 2022 (the “Annual Meeting”), or any adjournment or postponement thereof.

IMPORTANT NOTICE REGARDING THE AVAILBILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 18, 2022

The proxy statement and the 2021 Annual Report of Denny’s Corporation are available at http://materials.proxyvote.com/24869P.

YOUR VOTE IS IMPORTANT

We are committed to ensuring, to the extent possible, that stockholders will be afforded the ability to participate at the virtual meeting similarly to how they would participate at an in-person meeting. The question and answer session will include questions submitted in advance of, and questions submitted live during, the Annual Meeting. You may submit a question in advance of the meeting at www.proxyvote.com after logging in with your unique 16-digit control number (“Control Number”) found on your proxy card or voting instruction form (“VIF”). Questions may be submitted during the Annual Meeting through www.virtualshareholdermeeting.com/DENN2022.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately thirty minutes before the Annual Meeting begins at 11:00 a.m. (Eastern Time) on May 18, 2022.

Whether or not you plan to attend the Annual Meeting, we urge you to cast your vote in advance of the Annual Meeting via one of the methods described below and in the attached Proxy Statement. The Proxy Statement contains important information for you to consider when deciding how to vote on the above items. You do not need to attend the Annual Meeting in order to vote.

By Order of the Board of Directors

Gail Sharps Myers

Executive Vice President, Chief Legal Officer,

Chief People Officer &

Secretary

| Page | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

F. 2021 Capital Events and Announced Strategic Brand Investments | 4 | |||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

A. Nominees for Election as Directors of Denny’s Corporation | 8 | |||

B. Director Term Limits and Retirement Age and Succession Planning | 9 | |||

C. Business Experience/Director Qualifications | 9 | |||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

b) Process for Determination of Executive and Director Compensation | 15 | |||

| 15 | ||||

d) Compensation Committee Interlocks and Insider Participation | 16 | |||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

6. Communications Between Security Holders and Board of Directors | 18 | |||

| 18 | ||||

8. Board Member Attendance at Annual Meetings of Stockholders | 18 | |||

| 18 | ||||

| Page | ||||

III. Selection of Independent Registered Public Accounting Firm | 19 | |||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 26 | ||||

4. Executive Compensation Program Structure – Objective and Design | 26 | |||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

D. Electronic Access to Future Proxy Materials and Annual Reports | 52 | |||

| 52 | ||||

| 54 | ||||

| A-1 | ||||

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS This proxy statement contains forward-looking statements. All statements contained in this proxy statement other than statements of historical fact, including statements relating to trends in or expectations relating to the expected effects of our initiatives, strategies, and plans, as well as trends in or expectations regarding our financial results and long-term growth model and drivers, and regarding our business strategy and plans and our objectives for future operations, are forward-looking statements. The words “can,” “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “expect,” “seek,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the risks detailed in our filings with the Securities and Exchange Commission, including the Risk Factors section of our Annual Report on Form 10-K for the fiscal year ended December 29, 2021. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this proxy statement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results. We assume no obligation to update any of these forward-looking statements after the date of this proxy statement.

| 1 |  |

| Denny’s 2022 Proxy Statement | 2 |

PROXY STATEMENT

April 7, 2022

The Annual Meeting of Stockholders of Denny’s Corporation, a Delaware corporation, will be held virtually on Wednesday, May 18, 2022, at 11:00 a.m., Eastern Time (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Meeting. This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Denny’s Corporation (the “Board”) to be used at the upcoming Annual Meeting. The information provided herein concerns not only Denny’s Corporation, but also Denny’s, Inc., a subsidiary which Denny’s Corporation wholly owns. Substantially all operations of Denny’s Corporation are currently conducted through Denny’s, Inc. Because the Annual Meeting is virtual and being held via live webcast, stockholders will not be able to attend the Annual Meeting in person but may participate by joining the live webcast as further described below.

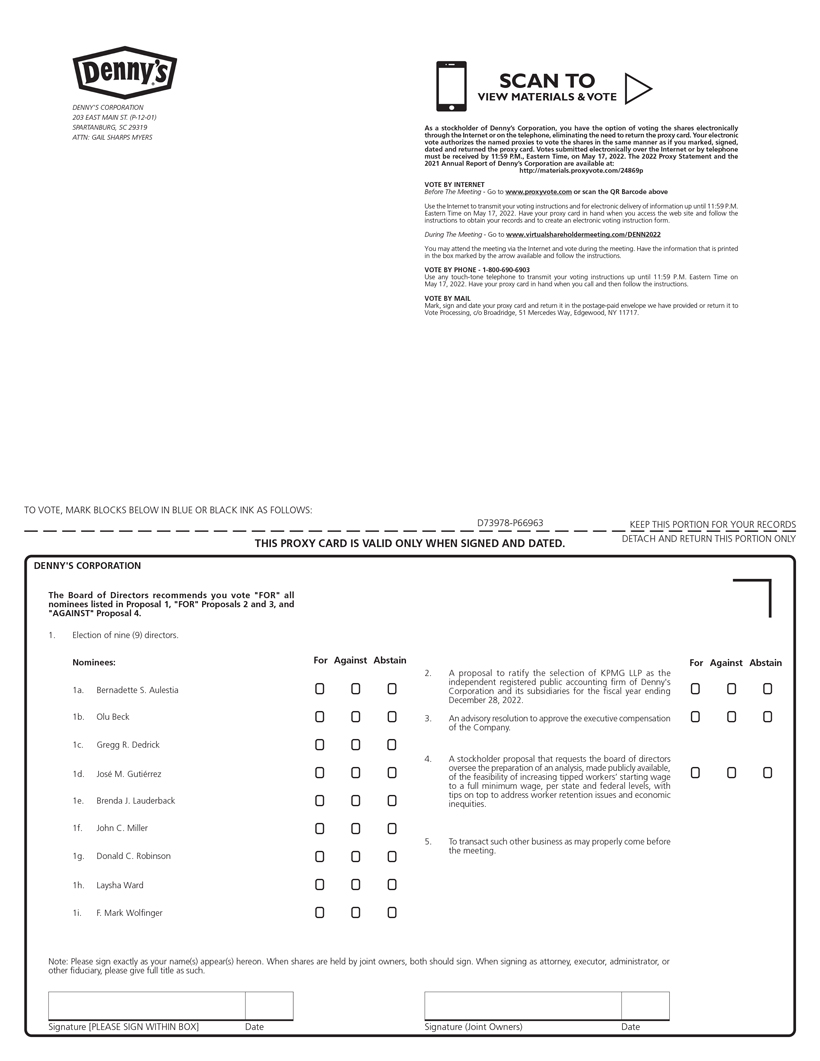

You may vote at the Annual Meeting either by proxy or personally at the Annual Meeting. Only holders of record of common stock of Denny’s Corporation, par value $0.01 per share (the “Common Stock”), as of the close of business on March 22, 2022 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting. This Proxy Statement is first being made available to each such stockholder beginning on or about April 7, 2022.

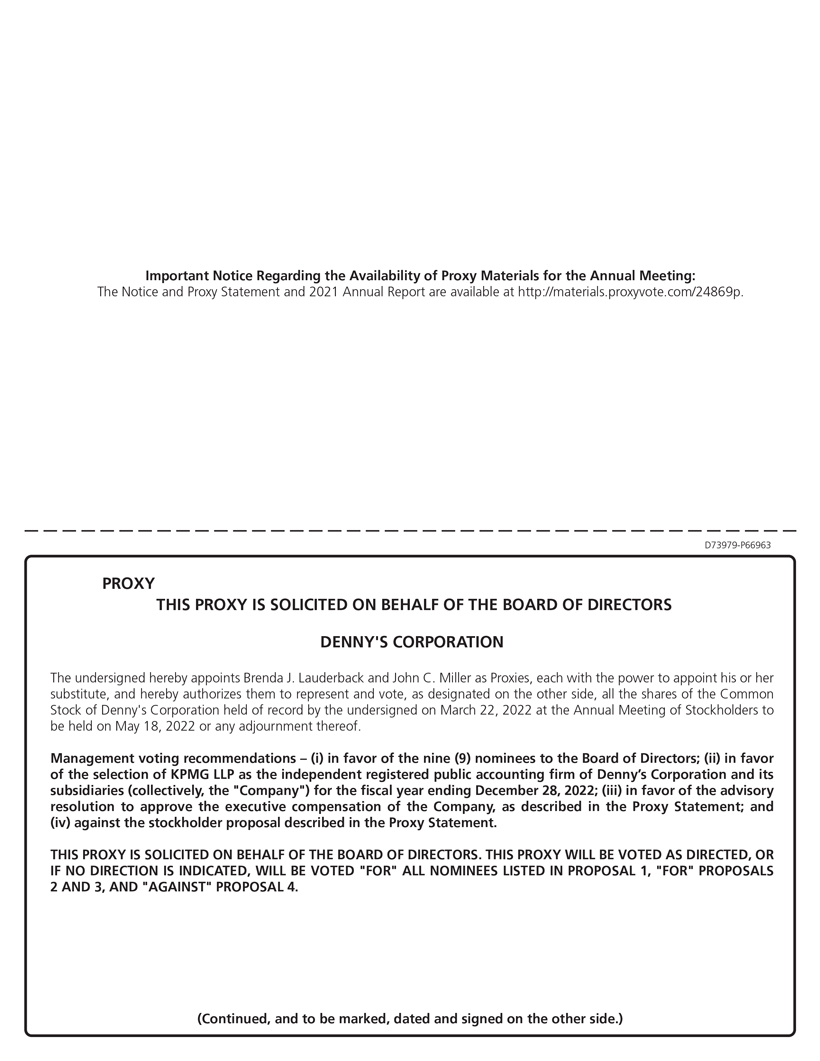

To vote by proxy, you must either properly execute and return (prior to the Annual Meeting) the proxy card or follow the instructions set forth in the enclosed proxy card to vote by phone or on the Internet. Where you have appropriately specified how your proxy is to be voted, it will be voted accordingly. If no specifications are made, your proxy will be voted (i) in favor of the nine (9) nominees to the Board; (ii) in favor of the selection of KPMG LLP as the independent registered public accounting firm of Denny’s Corporation and its subsidiaries (collectively, the “Company”) for the fiscal year ending December 28, 2022; (iii) in favor of the non-binding advisory resolution to approve the compensation of the Company’s named executive officers, as described herein; and (iv) against a stockholder proposal that requests that the Board oversee the preparation of an analysis, made publicly available, of the feasibility of increasing tipped workers’ starting wage to a full minimum wage. The Company does not know of any matter that is not referred to herein to be presented for action at the Annual Meeting. If any other matter of business is brought before the Annual Meeting, the proxy holders may vote the proxies at their discretion.

If you execute a proxy, you may revoke it at any time before it is exercised by delivering a written notice to Gail Sharps Myers, Executive Vice President, Chief Legal Officer, Chief People Officer and Secretary of Denny’s Corporation prior to the date of the Annual Meeting at Denny’s Corporation’s corporate offices, 203 East Main Street, Spartanburg, South Carolina 29319, by executing and delivering a later-dated proxy, or by participating in the virtual meeting and voting online. If you vote by telephone or by accessing the Internet voting website (which is separate from the meeting website described further below), you may also revoke your proxy by re-voting using the same procedure no later than 11:59 p.m., Eastern Time, on Tuesday, May 17, 2022.

Many of our stockholders hold their shares through stockbrokers, banks, or other nominees, rather than directly in their own names. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are a stockholder of record. As a stockholder of record, you have the right to grant your voting proxy directly to the Company and vote your shares by proxy in the manner described above, or you may personally vote your shares at the Annual Meeting. To participate and vote personally at the meeting, visit www.virtualshareholdermeeting.com/DENN2022, using the 16-digit control number on the Notice of Internet Availability of Proxy Materials (the “Notice”) or proxy card. Even if you plan to participate in the meeting, we recommend that you vote in advance by proxy, in case you later change your mind and determine not to participate in the meeting.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or other nominee, who is considered to be the stockholder of record. As the beneficial owner, you have the right to tell your nominee how to vote, and you are also invited to attend the Annual Meeting online. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting online unless you obtain a legal proxy from your nominee authorizing you to do so. Your nominee has sent you instructions on how to direct the nominee’s vote. You may vote by following those instructions and the instructions in the Notice.

At the Annual Meeting, holders of Common Stock will have one vote per share and a quorum, consisting of a majority of the outstanding shares of Common Stock as of the Record Date, represented in person or by proxy, will be required for the transaction

General

Stockholder Voting

of business by stockholders. A quorum being present, directors will be elected and the other actions proposed in the accompanying Notice of Meeting will be decided by a majority of votes cast on the matter. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum has been reached, but will not be counted in determining the number of shares voted “for” or “against” any director-nominee or on any other proposal, and therefore will not affect the outcome of any proposal. As of the close of business on the Record Date, 61,712,452 shares of Common Stock were issued and outstanding and entitled to be voted at the Annual Meeting.

Participating in the Annual Meeting

This year’s Annual Meeting will be a completely virtual meeting of stockholders and will be webcast live over the Internet. Please go to www.virtualshareholdermeeting.com/DENN2022 for instructions on how to participate in the Annual Meeting. Any stockholder may participate and listen live to the webcast of the Annual Meeting over the Internet at such site. Stockholders as of the Record Date may vote and submit questions either in advance of or while participating in the Annual Meeting via the Internet by using the 16-digit control number included in the Notice or proxy card that accompanied these proxy materials. The webcast starts at 11:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting log-in page.

Denny’s has conducted virtual-only annual stockholder meetings since 2016 and will do so again in 2022. In addition to promoting the health and safety of our employees, stockholders and their families during the ongoing COVID-19 pandemic, the decision to continue to conduct virtual-only annual stockholder meetings is driven by a number of factors discussed below.

Denny’s ownership is closely held. Currently approximately 70% of Denny’s outstanding common stock is held by 20 institutional stockholders, and approximately 80% is held by 40 institutional stockholders. We maintain an active dialogue with our institutional stockholders particularly following our year-end earnings release in February of each year. Over the last five years that we conducted meetings with the traditional meeting format, only once did any of our top 40 stockholders attend our annual meeting. Conducting the annual meeting virtually increases the opportunity for all stockholders to participate and communicate their views to a much wider audience.

Minimal stockholder attendance when we utilized the traditional meeting format. Over the last five years that we conducted traditional annual meetings, we had only three retail stockholders (aside from employees and directors) who regularly attended our annual stockholders meetings. Our total stockholder attendance from 2011 to 2015 (aside from employees and directors) dwindled from eight to three. Our regular attendees have generally continued to participate in the virtual-only meetings, making comments and/or asking questions through the virtual meeting format provided.

A virtual-only meeting format offers significant time and cost savings to both the Company and its investors. Since our stock ownership is mainly held by large institutional investors, with only routine matters typically being addressed at the meeting, virtual-only meetings offer significant time and cost savings to both the Company and its investors. Organizing and conducting a traditional stockholder meeting, attended by only a handful of people, requires the efforts of approximately 15-20 additional employees and contractors beyond those who now support our Board and virtual meetings. In addition, holding the meeting virtually allows us to make much more efficient use of the time of our independent directors, who are in our offices for a limited time for a related meeting of our Board of Directors.

Virtual meetings improve participation. Without the added cost or planning involved in attending in-person stockholder meetings, we believe virtual-only meetings offer the potential for increased overall stockholder participation. Virtual meetings give stockholders more options to pose their questions to management. Stockholders can submit questions in advance in order to get a better-formulated response, or ask tough questions anonymously that they would be hesitant to ask face-to-face. Additionally, while most of our stockholders are based in the United States, virtual meetings are especially useful to investors that are traveling abroad or based in another country. Also with a traditional meeting format, stockholders would be required to attend in person to present a submitted stockholder proposal; with a virtual-only meeting, this is done virtually, thus saving the stockholder the cost, time and expense of travel to attend the meeting in person.

Stockholder rights are not affected. We follow a set of Meeting Rules and Procedures which are posted on the virtual meeting website and afford the same treatment to all participating stockholders. Additionally, we use software that verifies the identity of each participating stockholder and ensures during the question and answer portion of the meeting that they are granted the same rights they would have at an in-person meeting. In the event stockholders representing a substantial holding communicate a desire for in-person meetings, we will consider a change in our virtual-only meeting practice.

Given the above listed factors, we feel a virtual-only meeting is the right choice for Denny’s and its stockholders at this time.

| 3 |  |

General

FISCAL 2021 Business Highlights

Fiscal 2021 Business Highlights

Denny’s once again triumphed in another historic year for our country, industry and this iconic brand. We began 2021 with less than 60% of our domestic restaurants open for on-premise dining while the remaining restaurants were operating under varying government mandated capacity restrictions related to the ongoing COVID-19 pandemic. Additionally, persistent staffing challenges across multiple business sectors significantly impacted the supply chain, and our ability to staff restaurants, especially during the late-night daypart. Despite the persistently challenging macroeconomic environment, our commitment to Denny’s founding purpose remained true: We love feeding people. Our leadership and franchise partners stayed focused and resilient during the ebbs and flows of the recovery, delivering the following results:

Domestic System-Wide Same-Store Sales Growth(1): 41% vs. 2021

|

Operating Revenue Growth: 38% year-over-year to $398.2 million |

Restaurant Openings: 20 contributing to 1,640 restaurants globally | ||

Diluted Net Income Per Share Growth: $1.27 To $1.19

|

Net Income Growth: $83.2 million To $78.1 million |

Adjusted EBITDA Growth(2): 221% year-over-year to $85.6 million |

| (1) | Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. |

| (2) | Please refer to the Reconciliation of Net Income (Loss) to Non-GAAP Financial Measures included in Appendix A. |

2021 Capital Events and Announced Strategic Brand Investments

Denny’s is committing $10 million to assist franchisees toward the $65 million rollout of new restaurant technology and kitchen equipment, in addition to new incentives to accelerate new restaurant development.

Capital Structure

• Successfully refinanced Denny’s amended and restated $350 million revolving credit facility to a new five-year $400 million credit facility with enhanced flexibility for brand investments and share repurchases

• Strong balance sheet with conservative debt leverage at 2.1x Adjusted EBITDA at year end

| Technology Transformation

• More personalized and seamless guest experience with recently revamped website and mobile app

• Initiating rollout of new cloud-based restaurant technology platform, laying the foundation for future technology initiatives to further enhance the guest experience | Kitchen Modernization

• Rollout of new kitchen equipment expected to provide immediate benefits through increased kitchen efficiency and productivity while also reducing food waste

• Long-term benefits expected through menu enhancements across all dayparts, especially at dinner with new comfort food offerings | Restaurant Development

• New development agreement with ghost-kitchen operator REEF Technology designed to enable market access into underpenetrated dense metropolitan trade areas

• New upfront cash incentive to accentuate existing domestic development commitments | |||||||||||||||

| Denny’s 2022 Proxy Statement | 4 |

General

Stockholder Returns

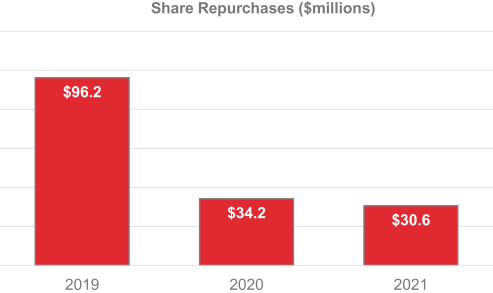

Denny’s returned over $160 million to stockholders through share repurchases over the last three years, yielding over $270 million in remaining share repurchase authorization at the end of fiscal 2021.

The Company temporarily suspended its share purchase program on February 27, 2020 to offset the impact of COVID-19. The suspension continued through the Company’s August 26, 2021 announced successful refinance of its credit facility and relaunch of its share repurchase program.

The following table sets forth the beneficial ownership of Common Stock by each stockholder known by the Company as of March 22, 2022, unless otherwise indicated, to own more than 5% of the outstanding shares of Common Stock. As of March 22, 2022, 61,712,452 shares of the Common Stock were issued and outstanding and entitled to be voted at the Annual Meeting.

Name and Address | Amount and Nature of Beneficial Ownership | Percentage of | ||||||

Franklin Mutual Advisers, LLC (and related entities) 101 John F. Kennedy Parkway Short Hills, NJ 07078-2789 |

| 7,434,497 | (2) |

| 11.7 | % | ||

Allspring Global Investments Holdings, LLC (and related entities) 525 Market Street 10th Floor San Francisco, CA 94105 |

| 6,625,557 | (1) |

| 10.5 | % | ||

Wellington Management Group LLP (and related entities) 280 Congress Street Boston, MA 02210 |

| 6,196,538 | (4) |

| 9.8 | % | ||

BlackRock, Inc. (and related entities) 55 East 52nd Street New York, NY 10055 | 4,193,603 | (3) |

| 6.6 | % | |||

| (1) | Based upon the Schedule 13G filed with the SEC on February 2, 2022, the shares listed are beneficially owned by one or more open-end investment companies or other managed accounts that are investment management clients of Franklin Mutual Advisers, LLC (“FMA”), an indirect wholly owned subsidiary of Franklin Resources, Inc. (“FRI”). When an investment management contract (including a sub-advisory agreement) delegates to FMA investment discretion or voting power over the securities held in the investment advisory accounts that are |

| 5 |  |

General

Equity Security Ownership

subject to that agreement, FRI treats FMA as having sole investment discretion or voting authority, as the case may be, unless the agreement specifies otherwise. Accordingly, FMA reports on Schedule 13G that it has sole investment discretion and voting authority over the securities covered by any such investment management agreement and is therefore deemed to be the beneficial owner of the shares listed, which include 7,049,381 shares over which FMA has sole voting power and 7,434,497 shares over which FMA has sole investment power. |

| (2) | Based upon the Schedule 13G/A filed with the Securities and Exchange Commission (the “SEC”) on January 18, 2022, Allspring Global Investment Holdings, LLC, a parent holding company, is the beneficial owner of 6,625,557 shares, has sole voting power with respect to 6,329,511 shares and sole investment power with respect to 6,625,557 shares. Aggregate beneficial ownership reported by Allspring Global Investments Holdings, LLC is on a consolidated basis and includes beneficial ownership of Allspring Global Investments, LLC and Allspring Funds Management, LLC. Prior to its sale on November, 1, 2021, Allspring Global Investments Holdings, LLC was a subsidiary of Wells Fargo & Company, and prior to that date, its holdings were included on Schedules 13G filed by Wells Fargo & Company, LLC. |

| (3) | Based upon the Schedule 13G filed with the SEC on February 4, 2022, Wellington Management Group, LLP, as a parent holding company along with Wellington Group Holdings LLP and Wellington Investment Advisors Holdings LLP are the beneficial owners of 6,196,538 shares and have shared voting power with respect to 5,282,375 shares and shared investment power with respect to 6,196,538 shares. Wellington Management Company LLP, an investment adviser, is deemed to be the beneficial owner of 5,627,760 shares and has shared voting power with respect to 4,894,561 shares and shared investment power respect to 5,627,760 shares. |

| (4) | Based upon the Schedule 13G/A filed with the SEC on February 1, 2022, BlackRock, Inc., as a parent holding company, is the beneficial owner of 4,193,603 shares and has sole voting power with respect to 4,088,416 shares and sole investment power with respect to 4,193,603 shares. Aggregate beneficial ownership reported by BlackRock, Inc. is on a consolidated basis and includes beneficial ownership of its subsidiaries Blackrock (Netherlands) B.V., BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management Schweiz AG, BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Institutional Trust Company, National Association, BlackRock Investment Management (Australia) Limited, BlackRock Investment Management (UK) Limited, Aperio Group, LLC, BlackRock Fund Managers Limited and BlackRock Investment Management, LLC. |

The following table sets forth, as of March 22, 2022, the beneficial ownership of Common Stock by: (i) each current member of the Board, (ii) each director nominee of Denny’s Corporation to the Board, (iii) each named executive officer included in the 2021 Summary Compensation Table elsewhere in this Proxy Statement, and (iv) all current directors and executive officers of Denny’s Corporation as a group. Except as otherwise noted, the persons named in the table below have sole voting and investment power with respect to all shares shown as beneficially owned by them.

Name | Amount and Nature of Beneficial Ownership (1) | Percentage of Common Stock | ||||||

Bernadette S. Aulestia | 38,198 | * | ||||||

Olu Beck | 6,307 | * | ||||||

Gregg R. Dedrick | 122,885 | * | ||||||

José M. Gutiérrez | 109,928 | * | ||||||

Brenda J. Lauderback | 179,536 | * | ||||||

John C. Miller | 1,355,734 | 2.2 | % | |||||

Donald C. Robinson | 146,168 | * | ||||||

Laysha Ward | 132,393 | * | ||||||

F. Mark Wolfinger | 815,932 | 1.3 | % | |||||

Robert P. Verostek | 70,242 | (2) | ||||||

Christopher D. Bode | 58,030 | * | ||||||

John W. Dillon | 88,121 | * | ||||||

All current directors and executive officers as a group (16 persons) | 3,406,412 | 5.5 | % | |||||

| * | Less than 1%. |

| (1) | The Common Stock listed as beneficially owned by the following individuals includes shares of Common Stock which such individuals have the vested right to acquire (as of March 22, 2022 or within 60 days thereafter) through the conversion of deferred stock units (“DSUs”) (on a designated date or upon termination of service as a director of Denny’s Corporation) or performance share units deferred pursuant to the Denny’s, Inc. Deferred Compensation Plan, as Amended and Restated effective March 1, 2017 (the “Deferred Compensation Plan”) (on a designated date or upon termination as an employee of Denny’s): (i) Ms. Aulestia (38,198 shares), (ii) Ms. Beck (6,307), (iii) Mr. Dedrick (45,617 shares), (iv) Mr. Dillon (2,111 shares), (v) Mr. Gutiérrez (75,271 shares), (vi) Ms. Lauderback (164,115 shares), (vii) Mr. Miller (564,599 shares), (viii) Mr. Robinson (146,168 shares), (ix) Mr. Verostek (39,409 shares), (x) Ms. Ward (98,574 shares), and (xi) all current directors and executive officers as a group (1,257,464 shares). |

| (2) | Mr. Verostek has shared voting and investment power with respect to 14,000 of the shares shown as beneficially owned by him. |

| Denny’s 2022 Proxy Statement | 6 |

General

Equity Security Ownership

Equity Compensation Plan Information

The following table sets forth information as of December 29, 2021 with respect to compensation plans of the Company under which equity securities of Denny’s Corporation are authorized for issuance.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans | |||||||||

Equity compensation plans approved by security holders | 4,400,000 | (1) | 4,349,124 | (2) | ||||||||

Equity compensation plans not approved by security holders | - | 704,166 | (3) | |||||||||

|

|

|

| |||||||||

Total | 4,400,000 | 5,053,290 | ||||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

| (1) | Includes shares issuable in connection with our outstanding performance share awards and restricted stock units awards. |

| (2) | Includes shares of Common Stock available for issuance as awards of stock options, restricted stock, restricted stock units, deferred stock units and performance awards under the Denny’s Corporation 2021 Omnibus Incentive Plan. |

| (3) | Includes shares of Common Stock available for issuance as awards of stock options and restricted stock units outside of the Denny’s Incentive Plans in accordance with Nasdaq Listing Rule 5635(c)(4). |

| 7 |  |

| ||||

Election of Directors

| ||||

| Our Board of Directors recommends that you vote FOR all nominees

| |||

ELECTION OF DIRECTORS

Nominees for Election as Directors of Denny’s Corporation

As permitted under the By-laws of Denny’s Corporation (the “By-laws”), the Board has set nine as the number of directors, as of May 18, 2022, to constitute the Board. Accordingly, it is intended that proxies in the accompanying form will be voted at the Annual Meeting for the election of nine nominees to the Board. These nominees are: Bernadette S. Aulestia, Olu Beck, Gregg R. Dedrick, José M. Gutiérrez, Brenda J. Lauderback, John C. Miller, Donald C. Robinson, Laysha Ward, and F. Mark Wolfinger, each of whom has consented to serve and be named in this Proxy Statement and will serve as a director, if elected, until the 2023 Annual Meeting of Stockholders or until his or her successor shall be elected and shall qualify, except as otherwise provided in Denny’s Corporation’s Restated Certificate of Incorporation, as amended (the “Restated Certificate of Incorporation”), and the By-laws. Each nominee currently serves as a director.

If for any reason any nominee named above is not a candidate when the election occurs, it is intended that proxies in the accompanying form will be voted for the election of the other nominees named above and may be voted for any substitute nominee or, in lieu thereof, the Board may reduce the number of directors in accordance with the Restated Certificate of Incorporation and the By-laws.

Board of Directors

The Board of Directors of Denny’s Corporation is currently composed of nine talented directors with diverse skill sets and professional backgrounds, as reflected in their biographies below.

|

| Female | Male | ||||||||

Total Number of Directors | | 9 | ||||||||

Part I: Gender Identity |

|

|

|

|

|

| ||||

Directors | 5 | 4 | ||||||||

Part II: Demographic Background |

|

|

|

|

|

| ||||

African American or Black | 3 | 0 | ||||||||

Hispanic or Latinx | 1 | 1 | ||||||||

White | 0 | 3 | ||||||||

Two or More Races or Ethnicities | 1 | 0 | ||||||||

| Denny’s 2022 Proxy Statement | 8 |

Election of Directors

Director Term Limits, Retirement Age and Succession Planning

Director Term Limits, Retirement Age and Succession Planning

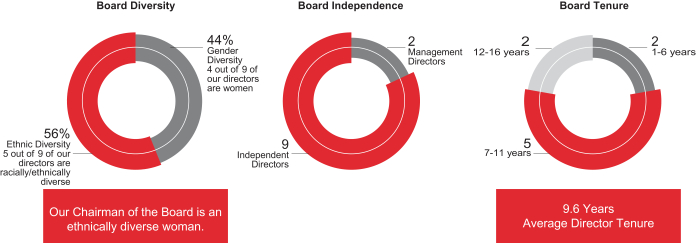

Term Limits. We do not believe that arbitrary limits on the number of consecutive terms a director may serve are appropriate in light of the substantial benefits that result from a continued focus on the Company’s business, strategy and industry over a significant period of time. We do value fresh perspectives and ideas which enhance and benefit our brand’s competitive performance, and therefore we seek to have a mix of director short-term, mid-term and long-term tenures on our Board, as demonstrated in the pie chart below which reflects the Board’s projected composition following the election of directors at the Annual Meeting. Within these parameters, each individual’s performance and continued contribution is assessed by the Corporate Governance and Nominating Committee in connection with the annual re-nomination determination.

Retirement Age. Under the Company’s Corporate Governance Policy, the standard retirement age for the Company’s directors is 75. It is the general policy of the Corporate Governance and Nominating Committee not to nominate candidates for re-election at any annual stockholder meeting to be held after he or she has attained the applicable retirement age. The Board, however, may waive the mandatory retirement age for a specific director in its sole discretion.

Succession Planning. Our Board maintains a critical focus on the Company’s succession plans. The Governance Committee has been charged with monitoring and overseeing the process of planning for CEO, senior management, and Board member succession. Under our succession planning process, the Governance Committee identifies and periodically updates the qualities and characteristics it believes are necessary for an effective CEO and senior officers. With these principles in mind, the committee periodically reviews the development and progression of potential internal candidates against these standards. Additionally, under the Company’s CEO emergency succession plans, critical advance planning for contingencies, such as the departure, death, or disability of the CEO or other top executives is set forth so that, in the event of an untimely vacancy, the Company has in place an emergency succession plan to facilitate the transition to both interim and long-term leadership. Equally important is planning for director succession. The Governance Committee periodically reviews the skills, characteristics, attributes and experiences of Board members to assure that the Board possesses the appropriate level of skill, experience and ability necessary to lead and govern the Company effectively.

Business Experience/Director Qualifications

The name, age, present principal occupation or employment, directorships and the material occupations, positions, offices or employments for at least the past five years, of each current director and each director nominee of Denny’s Corporation are set forth below. Unless otherwise indicated, each such person has held the occupation listed opposite his or her name for at least the past five years.

Bernadette S. Aulestia Director Since 2018 Age 49

| Occupation: Currently serves as the Chief Revenue & Growth Officer of Callisto Media, a technology and media company. Prior to Callisto Media, Ms. Aulestia was President, Global Distribution, Home Box Office, Inc., the premium television programming subsidiary of WarnerMedia (2015-2019); Executive Vice President, Domestic Network & Digital Distribution, HBO, Inc. (2013-2015); Senior Vice President, Domestic Network & Digital Distribution, HBO, Inc. (2009-2013); Prior to HBO, Ms. Aulestia held positions at Univision Communications, Inc., Turner Broadcasting Systems, Inc., and Kidder Peabody, Inc.

Qualifications: Ms. Aulestia is a global operating executive, independent board director, investor and advisor to public and private companies; specializing in scaled commercialization, international business development, content distribution, and cultural transformation.

Other Public Company Boards: Current - Nexstar Media Group, Inc.

| |||

| Jala-Bac Burger

| |||

| 9 |  |

Election of Directors

Business Experience/Director Qualifications

Olu Beck Director Since 2021 Age 55

| Occupation: Founder and Chief Executive Officer of The Beck Group NJ, a boutique strategic and management consulting firm (January 2013 - Current); Chief Executive Officer, Wholesome Sweeteners, Inc., a supplier of natural and organic sweeteners and snacks (2016-2018); Head of Global and US Marketing (Shopper) & Health and Wellness for Johnson and Johnson, a developer and manufacturer of consumer and healthcare products (2010 - 2012); Prior to Johnson and Johnson, Ms. Beck served in various executive leadership roles in finance and sales at Mars Incorporated, a manufacturer of confectionery, pet food, and food products, from 1989-2009, including serving as Chief Financial Officer of Uncle Ben’s Rice.

Qualifications: Ms. Beck provides our Board with experience in corporate leadership both in the US and globally, extensive general management experience in the consumer – packaged goods industry as well as sales, marketing, accounting and financial expertise. Ms. Beck has more than 25 years of experience in portfolio business management and general management, including direct experience in transformational and strategic growth - both organic and through mergers and acquisition. She brings a diversified experience base in finance, sales and marketing with global expertise from senior leadership roles managing teams in Europe, the Americas and Asia Pacific. Ms. Beck was featured in Savoy as 2021 Most Influential Black Corporate Directors. Ms. Beck has experience on private and public boards with insights into leading practices in executive compensation, corporate governance and audit.

Other Public Company Boards: Current - Freshpet, Inc., Hostess Brands, Inc. and Saputo, Inc.

| |||

|

Warm Apple Crisp

| |||

| ||||

| ||||

Gregg R. Dedrick Director Since 2010 Age 63

| Occupation: Co-founder of David Novak Leadership (formerly OGoLead), an online leadership development company (February 2018-present); Co-founder of Whole Strategies, an organizational consulting firm (2009-2013); Former Executive Vice President of Yum Brands, Inc., an operator and franchisor of fast food restaurants (2008-2009); President and Chief Concept Officer of KFC, a chicken restaurant chain (2003-2008).

Qualifications: Mr. Dedrick provides our Board with nearly 30 years of senior leadership experience in restaurant company general management, operations and organizational resource planning for corporate staff functions in franchised-based consumer and restaurant systems. Mr. Dedrick is a National Association of Corporate Directors (“NACD”) Board Leadership Fellow. | |||

|

Moons Over My Hammy | |||

| ||||

| ||||

José M. Gutiérrez Director Since 2013 Age 60 | Occupation: Retired; Senior Executive Vice President, Executive Operations, AT&T Services, Inc. (2014-2016); President of AT&T Wholesale Solutions (2012-2014), a unit of AT&T, Inc. focused on wholesale sales of communication products and services; President and Chief Executive Officer of AT&T Advertising Solutions (2010-2012), a subsidiary of AT&T, Inc., devoted to publishing and sales of Yellow and White Pages directory advertising.

Qualifications: Mr. Gutiérrez, a telecom executive with nearly 25 years of experience leading a range of AT&T business units during his tenure with the company, provides our Board with senior leadership experience in providing consumer-facing telecommunications solutions, including direct experience in investor relations, and mergers and acquisitions. Before joining AT&T, Mr. Gutiérrez worked as a licensed CPA and strategy consultant with KPMG. Mr. Gutiérrez is an NACD Board Leadership Fellow.

Other Public Company Boards: Current - Adient plc; Prior - Dr. Pepper Snapple Group, Inc. | |||

| Hearty 9-Grain Pancake Breakfast with Seasonal Fruit | |||

| ||||

| ||||

| Denny’s 2022 Proxy Statement | 10 |

Election of Directors

Business Experience/Director Qualifications

Brenda J. Lauderback Director Since 2005 Age 71 | Occupation: Former President of the Wholesale and Retail Group for Nine West Group, Inc., a designer and marketer of women’s footwear and accessories (1995-1998); Previous roles include President of Wholesale and Manufacturing for US Shoe Corporation and more than 18 years in senior merchandising roles at the Department Store Division of Target Corporation.

Qualifications: Ms. Lauderback provides our Board extensive leadership in merchandising, marketing, product development and design and manufacturing at prominent national wholesale and retail companies. Her breadth of experience as a Director on several other publicly traded company boards also provides our Board with significant insight into leading practices in executive compensation and corporate governance. Ms. Lauderback is a National Association of Corporate Directors (NACD) Board Leadership Fellow, having completed NACD’s comprehensive program of study for Directors and corporate governance professionals. She supplements her skill sets through ongoing engagement with the Director community, and access to leading practices. Ms. Lauderback was selected as one of the top 100 Directors by NACD in 2017.

Other Public Company Boards: Current - Wolverine World Wide, Inc., Sleep Number Corporation; Prior - Big Lots, Inc., Louisiana-Pacific Corporation, Irwin Financial Corporation and Jostens, Inc.

| |||

|

Hearty 9-Grain Pancake Breakfast with Seasonal Fruit

| |||

| ||||

| ||||

John C. Miller Director Since 2011 Age 66 | Occupation: Chief Executive Officer of Denny’s Corporation (February 2020-present); Chief Executive Officer and President of Denny’s Corporation (2011-February 2020); Chief Executive Officer and President of Taco Bueno Restaurants, Inc., an operator and franchisor of quick-service Mexican eateries (2005-2011); President of Romano’s Macaroni Grill (1997-2004).

Qualifications: As CEO, Mr. Miller provides our Board with experience and perspective for leading the strategic direction of the Company. He is an accomplished restaurant industry veteran with over 40 years of restaurant operations and management experience. Prior to joining Denny’s, Mr. Miller served as President of Taco Bueno and spent 17 years with Brinker International where he served as President of Romano’s Macaroni Grill and President of Brinker’s Mexican Concepts.

| |||

| Crazy Spicy Skillet | |||

| ||||

| ||||

Donald C. Robinson Director Since 2008 Age 69

| Occupation: Retired; President of Potcake Holdings, LLC, a hospitality consulting firm (2015-2016); President and Chief Operating Officer of All Aboard Florida-Operations, LLC, a high-speed, passenger rail company from Miami to Orlando, Florida (2013-2015); President of Baha Mar Resorts, Ltd., a resort development in Nassau, Bahamas (2006-2012); Group Managing Director, Hong Kong Disneyland (2001-2006); Senior Vice President, Walt Disney World Operations (1998-2001).

Qualifications: Mr. Robinson provides our Board with over 40 years of operational leadership experience with companies providing hospitality consulting, rail service, lodging, entertainment and food service, including a 33-year career with Disney. Mr. Robinson is an NACD Board Leadership Fellow.

Other Public Company Boards: Prior - SeaWorld Entertainment, Inc. | |||

| Grand Slam w/Pancakes | |||

| ||||

| ||||

| 11 |  |

Election of Directors

Business Experience/Director Qualifications

Laysha Ward Director Since 2010 Age 54 | Occupation: Executive Vice President and Chief External Engagement Officer, Target Corporation (2017-present); Executive Vice President & Chief Corporate Social Responsibility Officer, Target Corporation (2014-2017); President, Community Relations, Target Corporation (2008-2014); Vice President, Community Relations, Target Corporation (2003-2007).

Qualifications: Ms. Ward provides our Board with nearly 30 years of retail industry leadership experience at Target Corporation in external stakeholder engagement, corporate responsibility, communications, diversity and inclusion, reputation and crisis management, demographic/segmentation customer relations, and strategic planning. In 2008, President George W. Bush nominated and the U.S. Senate confirmed Ms. Ward to serve on the board of directors of the Corporation for National and Community Service (CNCS), the nation’s largest grant maker for volunteerism and service. Her term continued through the Obama Administration. Ms. Ward is an NACD Board Leadership Fellow.

Other Public Company Boards: Current - United Airlines Holdings, Inc. | |||

|

Hearty 9-Grain Pancake Breakfast with Seasonal Fruit | |||

| ||||

| ||||

F. Mark Wolfinger Director Since 2011 Age 66

| Occupation: President of Denny’s Corporation (February 2020-present); Executive Vice President, Chief Administrative Officer and Chief Financial Officer of Denny’s Corporation (2008-February 2020); Executive Vice President, Growth Initiatives and Chief Financial Officer of Denny’s Corporation (2006-2008); Senior Vice President and Chief Financial Officer of Denny’s Corporation (2005-2006).

Qualifications: Mr. Wolfinger provides our Board with nearly 40 years of strategic and financial leadership experience in the retail and restaurant industries. Previous roles include Chief Financial Officer of Danka Business Systems and senior financial positions with Hollywood Entertainment, Metromedia Restaurant Group (operators of Bennigans, Ponderosa Steakhouse, and Steak & Ale), and the Grand Metropolitan PLC. | |||

| Lumberjack Slam | |||

| Denny’s 2022 Proxy Statement | 12 |

Election of Directors

Board Leadership

Board Structure and Responsibilities

Board Of Directors | ||||

Audit and Finance Committee | Compensation and Incentives Committee | Corporate Governance and Nominating Committee | ||

Oversees the accounting and financial reporting processes and the internal and external audit processes and reviews the financial information that will be provided to stockholders, the qualification, independence and performance of the Company’s independent registered public accounting firm and its internal auditors, the systems of internal control, risk management practices, including, but not limited to the Company’s fraud risk assessment practices, cybersecurity and other information technology risks, compliance with the Company’s standards of business conduct and code of ethics, and the Company’s finance activities, including but not limited to the Company’s financial structure and strategy, hedging and financing arrangements. | Oversees compensation practices and determines compensation and other benefits for officers, as well as reviewing and making recommendations to the Board regarding director compensation, overseeing the Company’s stock ownership guidelines and overseeing the Company’s various benefit plans. Also oversees the development and implementation of human capital development plans and succession planning practices to foster sufficient management depth at the Company to support its continued growth and the talent needed to execute long term strategies. | Oversees corporate governance, advises and makes recommendations to the Board regarding candidates for election as directors of the Company, reviews and makes recommendations regarding the Company’s non-employee director compensation policy, oversees ESG policies and practices, and addresses any related matters. | ||

Board Leadership

Our Board is responsible for overseeing the exercise of corporate power and ensuring that the Company’s business and affairs are managed to meet the Company’s stated goals and objectives and that the long-term interests of the stockholders and stakeholders are served. The Corporate Governance for the Board of Directors (“Governance Policy”) provide for the Corporate Governance and Nominating Committee to recommend to the Board on an annual basis a director for election by the Board as the chair of the Board. The Board believes that it should maintain flexibility to select the chair of the Board and Board leadership structures. It believes that a two-year term for the chair provides continuity for the Board.

The duties of the chair of the Board include the following:

| • | Preside over and manage the meetings of the Board; |

| • | Support a strong Board culture by fostering an environment of open dialogue, effective information flow and constructive feedback among the members of the Board and senior management, facilitating communication among the chair, the Board as a whole, Board committees, and senior management, and encouraging director participation in discussions; |

| • | Approve the scheduling of meetings of the Board, lead the preparation of the agenda for each meeting, and approve the agenda and materials for each meeting; |

| • | Serve as liaison between management and independent directors; |

| • | Represent the Board at annual meetings of stockholders and be available, when appropriate, for consultations with stockholders; |

| • | Act as an advisor to the CEO and President on strategic aspects of the business; and |

| • | Such other duties as prescribed by the Board. |

Independent Chair of the Board

Ms. Lauderback has served on the Board since May 2005 and has served as the Board Chair since May 2016. Her term will expire at the 2023 Annual Meeting of stockholders. Ms. Lauderback is an independent, non-employee Board member. Our Board believes that its leadership structure is appropriate because it effectively allocates authority, responsibility, and oversight between management and the independent members of our Board and supports the independence of our non-management directors.

| 13 |  |

Election of Directors

Independent Chair of the Board

The Board has determined that, except as noted immediately below, each current member of the Board is independent under the Nasdaq listing standards and the rules and regulations promulgated by the SEC. The Board also determined the Robert E. Marks, who served on the Board through the 2021 Annual Meeting of Stockholders, was independent under the same standards. Messrs. Miller and Wolfinger, as executive officers of the Company, are not deemed to be independent.

Board Committees

There are three standing committees of the Board: the Audit and Finance Committee, the Compensation and Incentives Committee, and the Corporate Governance and Nominating Committee. Each committee consists solely of independent directors as defined by Nasdaq listing standards applicable to each committee. The Audit and Finance Committee currently consists of Mss. Beck and Lauderback and Messrs. Dedrick, Gutiérrez and Robinson, with Mr. Gutiérrez serving as chair. The Compensation and Incentives Committee is currently comprised of Mss. Lauderback and Ward and Messrs. Dedrick and Gutiérrez, with Mr. Dedrick serving as chair. Mss. Aulestia, Lauderback and Ward and Mr. Robinson currently make up the Corporate Governance and Nominating Committee, with Mr. Robinson serving as chair. In conjunction with the election of directors at the Annual Meeting, the Board will make committee assignments for the upcoming year. For a description of our code of ethics, see the “Code of Ethics” section elsewhere in this Proxy Statement.

Summary of Responsibilities. The Audit and Finance Committee (the “Audit Committee”), which held nine meetings in 2021, has been established by the Board to assist the Board in fulfilling its responsibilities toward stockholders, potential stockholders and the investment community to oversee the Company’s accounting and financial reporting processes and audits of the Company’s consolidated financial statements. The Audit Committee’s primary responsibilities include overseeing (i) the adequacy of the Company’s internal controls and the integrity of the Company’s accounting and financial information reported to the public, (ii) the qualification, independence and performance of the Company’s independent registered public accounting firm and its internal auditors, (iii) the appropriateness of the Company’s accounting policies, (iv) the Company’s compliance with legal and regulatory requirements, (v) the Company’s risk assessment and management practices including, but not limited to, the Company’s fraud risk assessment practices, cybersecurity and other information technology risks, and (vi) the Company’s finance activities, including but not limited to the Company’s financial structure and strategy, hedging transactions, share repurchase policies and financing arrangements, while providing and maintaining an avenue of communication among the Audit Committee, the independent registered public accounting firm, internal auditors, the Company’s compliance officer, management and the Board. The Audit Committee has a written charter, which it reviews and assesses the adequacy of at least annually and amends and updates as needed. For a complete description of the Audit Committee’s powers, duties and responsibilities, see the charter of the Audit Committee available to stockholders on the Company’s website at www.dennys.com.

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each member of the Audit Committee meets the definition of independence for audit committee members set forth under Nasdaq listing standards and the rules and regulations promulgated by the SEC.

Audit Committee Financial Experts. The Board has determined that three current members of the Audit Committee, José M. Gutiérrez, Olu Beck and Donald C. Robinson, are Audit Committee Financial Experts, as that term is defined by the SEC, based upon their respective business experience and educational backgrounds. Mr. Gutiérrez has more than 20 years of accounting, business and financial experience in investor relations, audit, mergers and acquisitions which required the analysis of financial statements that present a breadth and level of complexity of the same or greater complexity as that of the Company. Ms. Beck provides our Board with more than 25 years of direct experience in transformational and strategic growth and brings diversified expertise in finance from senior leadership roles in Europe, the Americas and Asia Pacific. Mr. Robinson during his 40-plus years of operational leadership experience has had responsibility for the preparation and oversight of financial statements (of the same or greater complexity as the Company’s) particularly in connection with his role with Disney operations in Hong Kong.

Audit Committee Report. The Audit Committee fulfilled its responsibilities under and remained in compliance with its charter during the fiscal year ended December 29, 2021.

| • | The Audit Committee has reviewed and discussed the audited consolidated financial statements with management of the Company and with KPMG LLP (“KPMG”), the Company’s independent registered public accounting firm. |

| • | The Audit Committee has discussed with KPMG the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”), including Auditing Standard No. 1301, Communications with Audit Committees, and the SEC. |

| • | The Audit Committee has received the written disclosures and the letter from KPMG, required by applicable requirements of the PCAOB regarding KPMG’s communications with the Audit Committee concerning independence, and has discussed with KPMG its independence from the Company. |

| Denny’s 2022 Proxy Statement | 14 |

Election of Directors

Independent Chair of the Board

| • | The Audit Committee reviewed and discussed with management progress on the Company’s enterprise risk management processes including the evaluation of identified risks and alignment of Company processes to manage the risks within the Company’s approved strategies. |

| • | Based on the review and discussions described above, the Audit Committee has recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2021 for filing with the SEC. |

Audit and Finance Committee

José M. Gutiérrez, Chair

Olu Beck

Gregg R. Dedrick

Brenda J. Lauderback

Donald C. Robinson

Compensation and Incentives Committee

Summary of Responsibilities. The Compensation and Incentives Committee (the “Compensation Committee”), which held five meetings in 2021, is responsible for (i) overseeing the Company’s overall compensation program and philosophy, (ii) reviewing and approving the compensation of the Chief Executive Officer and senior management of the Company, (iii) administering the Company’s short- and long-term incentive plans and other stock or stock-based plans, (iv) overseeing the Company’s executive compensation disclosure and issuing the Compensation Committee’s report as required by the applicable rules and regulations governing the Company’s annual proxy statement, (v) reviewing and making recommendations to the Board regarding director compensation, (vi) overseeing the Company’s stock ownership guidelines, and (vii) overseeing the Company’s various benefit plans. The Compensation Committee has a written charter, which it reviews and assesses the adequacy of at least annually and amends and updates as needed. For a complete description of the Compensation Committee’s power, duties and responsibilities, see the charter of the Compensation Committee which may be found on the Company’s website at www.dennys.com.

Process for Determination of Executive and Director Compensation. Executive compensation is determined by the Compensation Committee pursuant to the authority granted to it by the Board. Director compensation is determined by the Board upon recommendation by the Compensation Committee. The Compensation Committee has engaged an independent consultant (FW Cook) and considered data and analysis regarding competitive pay practices among the Company’s peer group and the restaurant industry as a guide in determining the appropriate level of director and executive officer compensation. The Compensation Committee has assessed the independence of FW Cook in their capacity as the compensation consultant to the Compensation Committee pursuant to SEC and Nasdaq rules and concluded that no conflict of interest exists that would prevent FW Cook from serving as an independent consultant to the Compensation Committee.

The Compensation Committee considered the recommendation of the Company’s Chief Executive Officer (the “CEO”) with respect to compensation levels of executive officers other than the CEO. When making compensation decisions, the Compensation Committee annually analyzes tally sheets prepared for each of the named executive officers (“NEOs”). These tally sheets were prepared by our human resources department and our compensation consultant. Each of these tally sheets presents the dollar amount of each component of the NEOs’ compensation, including current cash compensation (base salary and bonus), accumulated deferred compensation balances, outstanding equity awards, retirement benefits, perquisites and any other compensation. These tally sheets reflect the annual compensation for the NEOs (both target and actual), as well as the potential payments under selected performance, termination, and change-in-control scenarios.

The overall purpose of these tally sheets is to bring together, in one place, all of the elements of actual and potential future compensation of our NEOs, as well as information about wealth accumulation, so that the Compensation Committee may analyze both the individual elements of compensation (including the compensation mix) as well as the aggregate total amount of actual and projected compensation. For additional information regarding the process and procedures for determining executive and director compensation, see the “Executive Compensation – Compensation Discussion and Analysis” section elsewhere in this Proxy Statement.

Compensation Risk Assessment. For 2021, a group of senior management from various departments of the Company completed a process by which an assessment was made of the level and materiality of identified risks associated with the Company’s compensation practices and policies for its employees. This assessment was under the direction of the Compensation Committee and the findings were reviewed and discussed with the committee. Specifically, the Company’s incentive plans and compensation practices were evaluated in order to identify incentive factors utilized and the potential risks, applicable controls, and the risk mitigation practices in place with respect to such factors. Based on this assessment, the Compensation Committee determined that the risks arising from the Company’s compensation practices and policies are not reasonably likely to have a material adverse impact on the Company.

| 15 |  |

Election of Directors

Independent Chair of the Board

Compensation Committee Interlocks and Insider Participation. The following persons served as members of the Compensation Committee during the fiscal year ended December 29, 2021: Gregg R. Dedrick, José M. Gutiérrez, Brenda J. Lauderback and Laysha Ward. No member of the Compensation Committee was an employee or officer of the Company during 2021 or anytime prior thereto. During 2021, none of the members of the Compensation Committee had any relationship, directly or indirectly, with the Company requiring disclosure under Item 404 of Regulation S-K, and none of our executive officers served on the compensation committee (or equivalent) or the board of directors of another entity whose executive officers served on our Board or Compensation Committee.

Compensation Committee Report. The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis section of this Proxy Statement and based on this review and discussion, the Compensation Committee has recommended to the Board that the “Executive Compensation – Compensation Discussion and Analysis” section be included in this Proxy Statement and incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 29, 2021.

Compensation and Incentives Committee

Gregg R. Dedrick, Chair

José M. Gutiérrez

Brenda J. Lauderback

Laysha Ward

Corporate Governance and Nominating Committee

Summary of Responsibilities. The primary responsibilities of the Corporate Governance and Nominating Committee (the “Governance Committee”), which held five meetings in 2021, include (i) developing and recommending to the Board a set of corporate governance standards in the form of the Corporate Governance Policy for the Company, (ii) maintaining and monitoring compliance with the Corporate Governance Policy, (iii) monitoring the process of assessing the effectiveness of the Board and its committees, (iv) overseeing the Company’s insider trading policy, and (v) identifying individuals qualified to become Board members and recommending director nominees to the Board for election at the annual meeting of stockholders or when necessary to fill existing vacancies on the Board. Additionally, the Governance Committee is responsible for monitoring and safeguarding the independence of the Board, monitoring and overseeing senior management succession, overseeing director education, reviewing all related party transactions while monitoring compliance with the Company’s Related Party Transaction Policy and Procedures, monitoring and overseeing the Corporate Social Responsibility (“CSR”) program of the Company which includes receiving periodic reports regarding the Company’s CSR efforts and initiatives, monitoring and receiving periodic reports regarding the Company’s minority hiring and diversity promotional initiatives, monitoring and reviewing the overall adequacy of, and providing oversight with respect to the Company’s Environmental, Social & Governance (ESG) efforts and initiatives. All members of the Governance Committee are independent within the meaning of the Nasdaq listing standards and the rules and regulations promulgated by the SEC. The Governance Committee has a written charter, which it reviews and assesses the adequacy of at least annually and amends and updates as needed. For a description of the Governance Committee’s powers, duties and responsibilities, see the charter of the Governance Committee which may be found on the Company’s website at www.dennys.com.

Corporate Governance Policy and Practice. The Board and management clearly recognize the importance of a firm commitment to key corporate governance standards. Consequently, it is the goal of the Board and management to develop and adhere to a set of standards that not only complies to the letter with all applicable regulatory guidance, but implements “best practices” of corporate governance.

The Company’s Corporate Governance Policy is posted on the Company’s website at www.dennys.com.

Director Nominations Policy and Process. The Governance Committee will consider director-nominees recommended by stockholders. A stockholder who wishes to recommend a person or persons to the Board for consideration as a nominee for election to the Board must send a written notice to the Governance Committee by mail addressed to the attention of the Secretary of Denny’s Corporation at the corporate address set forth above. The written notice must set forth (i) the name of each person whom the stockholder recommends be considered as a nominee, (ii) a business address and telephone number for each nominee (e-mail address is optional), and (iii) biographical information regarding each nominee, including the person’s employment and other relevant experience. To be considered by the Governance Committee, a stockholder director-nominee recommendation must be received no later than the 120th calendar day before the first anniversary date of Denny’s Corporation’s proxy statement prepared in connection with the previous year’s annual meeting. The Governance Committee did not receive any stockholder director-nominee recommendations by December 10, 2021, the applicable deadline for the Annual Meeting.

| Denny’s 2022 Proxy Statement | 16 |

Election of Directors

Independent Chair of the Board

In addition, in accordance with the By-laws, stockholders may directly nominate persons for election to the Board at an annual meeting. Such nominations must be sent by written notice to the Secretary of Denny’s Corporation at the corporate address set forth above and must comply with the applicable timeliness and information requirements of the By-laws. Please see the “Other Matters – 2023 Stockholder Proposals” section elsewhere in this Proxy Statement for more information.

The Governance Committee believes that a nominee recommended for a position on the Board must meet the following minimum qualifications:

| — | he or she must be at least 21 years of age; |

| — | he or she must have experience in a position with a high degree of responsibility in a business or other organization; |

| — | he or she must be able to read and understand basic financial statements; |

| — | he or she must possess integrity and have high moral character; |

| — | he or she must be willing to apply sound, independent business judgment; |

| — | he or she must have sufficient time to devote to being a member of the Board; and |

| — | he or she must be fluent in the English language. |

Annually, the Governance Committee will identify the areas of expertise or skill needed on the Board for the upcoming Board term. The Governance Committee will identify potential nominees for director from (i) the slate of current directors, (ii) referrals from professional search firms, typically in those instances when the committee identifies a needed skill or expertise not possessed by the current slate of directors, and (iii) recommendations from stockholders.

The Governance Committee will evaluate a potential nominee by considering whether the potential nominee meets the minimum qualifications identified by the committee, as well as considering the following factors:

| — | whether the potential nominee has leadership, strategic, or policy setting experience in a complex organization, including any scientific, governmental, educational, or other non-profit organization; |

| — | whether the potential nominee has experience and expertise that is relevant to the Company’s business including any specialized business experience, technical expertise, or other specialized skills, and whether the potential nominee has knowledge regarding issues affecting the Company; |

| — | whether the potential nominee is highly accomplished in his or her respective field; |

| — | whether the potential nominee has high ethical character and a reputation for honesty, integrity, and sound business judgment; |

| — | whether the potential nominee is independent, as defined by Nasdaq or other applicable listing standards and SEC rules, whether he or she is free of any conflict of interest or the appearance of any conflict of interest, and whether he or she is willing and able to represent the interests of all Denny’s stockholders; |

| — | any factor affecting the ability or willingness of the potential nominee to devote sufficient time to the Board’s activities and to enhance his or her understanding of the Company’s business; and |

| — | how the potential nominee would contribute to diversity, with a view toward the needs of the Board. |

The manner in which the Governance Committee evaluates a potential nominee will not differ based on whether the potential nominee is recommended by a stockholder.

Additionally, with respect to an incumbent director whom the Governance Committee is considering as a potential nominee for re-election, the Governance Committee will review and consider the incumbent director’s service during his or her term, including the number of meetings attended, level of participation, and overall contribution to the Company.

The Company paid fees to a professional search firm to help identify and evaluate potential nominees for director for 2021.

Corporate Governance and Nominating Committee

Donald C. Robinson, Chair

Bernadette S. Aulestia

Brenda J. Lauderback

Laysha Ward

| 17 |  |

Election of Directors

Independent Chair of the Board

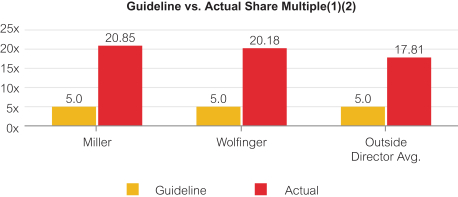

Board Diversity. The Governance Committee and the Board are committed to a diversified membership, with a particular emphasis on individuals who satisfy the factors outlined above and individuals with a wide variety of management, operating, and restaurant experience and skills, in addition to other attributes such as race, gender and national origin, as demonstrated in the circle charts below. The Governance Committee continually looks for opportunities to develop its diversity initiatives further.

Board Leadership Structure and Risk Oversight