SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-12g

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

Herzog International Holdings, Inc.

(Exact name of Registrant as specified in its charter)

Nevada | | 87-0438447 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

|

5550 South Fort Apache Road, #102 Las Vegas, Nevada 89148 |

(Address of principal executive offices) |

(903)275-8541

(Registrant’s telephone number, including area code)

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

|

Title of Each Class to be so Registered |

Title of Class: COMMON

Ticker: HZOG

Name of Exchange: NASD

100,000,000 Shares Common at par value $.001 USD per share |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of a “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | x | Smaller reporting company | x |

Emerging Growth Company | ¨ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control SEC 1396 (05-19) number.

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Business

Organization and Corporate Authority. Herzog is a corporation duly organized, validity existing and in good standing under the laws of The United States of America with full corporate power and authority to own or lease and use its properties and assets, and to carry on its business as now conducted. Herzog is qualified a corporation to do business in every other jurisdiction where such qualification is necessary to conduct its business as presently conducted.

Herzog shall use its best efforts to preserve its corporate existence and business organization substantially intact, including its present relationship with the material customers maintaining compliance with the law whereas Herzog shall duly comply with all laws applicable to it and its business operations.

Perform in all material respects all of its obligations under material contracts, leases, and instruments relating to or affecting its assets, properties and business while maintaining in full force and effect the ability to carry on its business substantially in the same matter to duly and timely file all taxable periods to all federal, state, country and local tax returns required to be filed by or on the behalf of Herzog or any of its subsidiaries.

Herzog has not breached, and therefore there is no pending or threating claim that Herzog has breached any of the terms or conditions of any agreements, contracts or commitments to which it is a party or by which is or its properties is bound. The execution and performance hereof will not violate any provisions of applicable law or any agreement to which Herzog is subject. Herzog herby represents that it is not a party to any material contract or commitment other than appointment documents with its transfer agent, and that it has disclosed with all its Stockholders all relationships or dealings with related parties or affiliates.

Engaging in any activity or business not in conflict with the laws of the State of Nevada and the State of Texas or any other state, territory or possession of the United States of America, or any foreign country as the Board of Directors may from time to time determine.

NEVADA STATE BUSINESS LICENSE IDENTIFICATION # NV19931105812 Expiration Date 12/31/2022

In accordance with Title 7 of Nevada Revised Statues, pursuant to proper application duly filed and payment of appropriate prescribed fees, the above named entity is hereby granted a Nevada State Business License for business activities conducted within the State of Nevada.

Valid until the expiration date unless suspended, revoked or cancelled in accordance with the provisions in Nevada Revised Statues. License is not transferable and is not in lieu of any local business license, permit or registration.

License must be cancelled on or before its expiration date if business activity ceases. Failure to do so will result in late fees or penalties which, by law, cannot be waived.

IN WITNESS WHEROF, I have hereunto set my Hand and

Affixed the Great Seal of State, at my office on 10/07/2021

BARBARA K. CEGAVSKE

Secretary of State

Certificate Number: B202110072054247

You may view this certificate online at https://nvsos.gov

THE STATE OF TEXAS Office of the Secretary of State Certificate of Fact

The undersigned, as Secretary of State of Texas, does hereby certify that the document, Application for Registration for Herzog International Holdings, Inc., (file number 803900724), a NEVADA, USA Foreign For-Profit Corporation, was filed in this office on January 16, 2021.

It is further certified that the entity status in Texas is in existence.

It is further certified that our records indicate TOLEDO GUILLERMO as the designated registered agent for the above named entity an the designated registered office for said entity is in the State of Texas.

In testimony whereof, I have hereunto signed my name officially

& caused to be impressed hereon the Seal of State at my office in

Austin, Texas on January 20, 2021.

Ruth R. Hughs

Secretary of State

Document: 1021717670004

https://sos.texas.gov

Item 1A. Risk Factors

The statements contained in or incorporated in to this Form 10 that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition, or results of operation could be harmed.

Sophisticated Investor. Herzog acknowledges that they have carefully evaluated their financial resources and investment position and the risks associated with their knowledge and experience in financial and business matters in general, and investments in particular, qualifies them as sophisticated investors, and therefore capable of evaluating the merits and risks.

Item 2. Financial Information

The books and records, financial and otherwise, of Herzog are all in material respects complete and correct and have been maintained in accordance with sound business and bookeeping practices so as to acurately and fairly reflect, in reasonable detail, the transactions and disposition of assets of Herzog. Herzog maintains a system of internal accounting controls sufficient to provide reasonalble assurances that transactions have been and are executed in accordance with management’s general or specific authorization; wheras transactions are recorded as nessesary to permit the preparation of financial statememts in conformity with generally accepted accounting principals or any other criteria applicable to such statements and to maintain accountibility for assets wheras access to assets is permitted only in accordance with managements general or specific authorization wheras the recorded accountibility for assets is compared with the existing assets at reasonable intervals, and when appropriate action is taken with respect to any differences.

The information concerning Herzog set forth were delivered by Herzog pursuant hereto were, as of their respective dates, complete and acurate in all material repects and did not contain any untrue statement of material fact or omit to state a material fact required to make the statements made, in light of the circomstances under which they were made, hereto and the instuments and data deleivered.

Item 3. Properties

Trademarks, Tradenames, Etc. There are no trademarks, tradenames, copyrights, registrations, technology, knowhow and process (the Intellectual Property”) necessary for the operation of Herzog’s business as presently conducted. Any loss or expiration of any such Intellectual Property by Herzog does not infringe on the rights of any person.

Herzog shall duly continue to comply with all laws applicable to it and its properties, operations, business and employees.

See SEC 8-K Current Report Filed November 4, 1996 https://sec.gov/Archives/edgar/data/853464/0000853464-96-000003.txt

Item 4. Security Ownership of Certain Beneficial Owners and Management

The following information sets forth the percentages of voting securities of Herzog now beneficially owned by controlling shareholders, officers and directors.

Udo Herzog 7,300,000 shares, Heidi Mari Herzog 600,000 shares, Edward Dario Toledo LLC 700,000 shares and Guillermo Toledo 88,159,999 shares.

Grand Total Security Ownership of Certain Beneficial Owners and Management 96,759,999 shares of 100,000,000 Shares authorized issued and outstanding.

Item 5. Directors and Executive Officers

Guillermo Toledo, Director, CEO and CFO

Udo Herzog, President

Andrea Herzog Vice President

Item 6. Executive Compensation

Herzog is not a party to any employment agreement or agreement to lend to, or guarantee any loan to any employee or agreement related to a bonus, severance pay or similar plan, agreement, arrangement or understanding. Herzog has incurred no liability, or taken or failed to take, any action which will result in any liability with respect of any failure to comply with applicable laws dealing with minimum wages or maximum hours for any employees, and all payments due from Herzog on account of its employee health and welfare insurance, holiday and vacation pay and similar benefits have been paid. Herzog is not a party to any collective bargaining agreement governing its employees. Herzog shall duly comply with all laws applicable to it and its employees.

Item 7.

Certain Relationships and Related Transactions, and Director Independence.

Purchase of 13,696 shares of common stock of CUSIP 428048102 on May 30, 2003 at $0.10 USD per share.

Item 8. Legal Proceedings

Litigation. No action, suit, order, judgement, injunction, award or proceeding of any kind has been filed or commenced, or to the knowledge of Herzog, is threatened, before any court, commission, agency or other administrative authority against Herzog or which questions or challenges its validity and there is no suit, proceeding or investigation. Herzog is not subject to any unsatisfied judgment, order or decree entered in any lawsuit or proceeding.

There are no actions, suits or proceedings pending or, to the knowledge of Herzog threatened by or against Herzog or affecting domestic or foreign, or before any arbitrator of any kind. Herzog does not have any knowledge of any default on its part with respect to any judgment, order, writ, injunction, decree award, rule, or regulation of any court, arbitrator, or governmental agency or instrumentality.

Item 9. Market Price of and Dividends on the Registrant's Common Equity and Related Stockholder Matters

At this time, juncture and jurisdiction Herzog will continue to maintain any Stockholder Matters by direct communication with its Certified Shareholders of Record though its Transfer Agent and Registrar currently located in Salt Lake City, Utah in the United States of America.

Item 10. Recent Sales of Unregistered Securities

No recent sales of unregistered securities to report by Herzog at this time, juncture and jurisdiction.

Item 11. Description of registrant's Securities to be Registered

100,000,000 shares of common stock at par value of $0.001 USD per share of CUSIP 428048102

Item 12. Indemnification of Directors and Officers

Herzog hereby agrees to indemnify, defend and hold harmless its Officers and Directors from and against any losses, liabilities, damages, deficiencies, lawsuits, proceedings, investigations, claims, charges, assessments cost or expenses, including interest, penalties and reasonable attorneys fees and disbursements incurred or suffered by its Directors and Officers, weather a suit is instituted or not, and if instituted, weather any trial or appellate level and weather raised by the parties hereto or any third party loss based upon. Rising out of, or otherwise due to any false or inaccurate representation or warranty made by its Officers and Directors on behalf of Herzog.

Item 13. Financial Statements and Supplementary Data

HERZOG INTERNATIONAL HOLDINGS, INC.

BALANCE SHEET

12/31/2021

ASSETS

CURRENT ASSETS

Cash: | | $17,527.10 |

Accounts Receivable: | | $0.00 |

Inventory: | | $0.00 |

Prepaid Expenses: | | $0.00 |

Notes Receivable: | | $0.00 |

Other Current Assets: | | $0.00 |

TOTAL CURRENT ASSETS: | | $17,527.10 |

FIXED ASSETS

Long-Term Investments: | | $600,001.00 |

Land: | | $0.00 |

Building: | | $0.00 |

Accumulated Building Depreciation: | | ( $0.00) |

Machinery and Equipment: | | $0.00 |

Accumulated Machinery and Equipment Depreciation: | | ( $0.00) |

Furniture and Fixtures: | | $0.00 |

Accumulated Furniture and Fixtures Depreciation: | | ( $0.00) |

Other Fixed Assets: | | $0.00 |

NET FIXED ASSETS: | | $600,001.00 |

OTHER ASSETS

Goodwill: | $0.00 |

| |

TOTAL ASSETS: | $617,528.10 |

LIABILITIES & EQUITY

CURRENT LIABILITIES

Accounts Payable (A/P): | $0.00 |

Accrued Wages: | $0.00 |

Accrued Payroll Taxes: | $0.00 |

Accrued Employee Benefits: | $0.00 |

Interest Payable: | $0.00 |

Short-Term Notes: | $0.00 |

Current Portion of Long-Term Debt: | $0.00 |

TOTAL CURRENT LIABILITIES: | $0.00 |

LONG-TERM LIABILITY

Mortgage: | $0.00 |

Other Long-Term Liabilities: | $0.00 |

TOTAL LONG-TERM LIABILITIES: | $0.00 |

OWNER'S EQUITY

Paid-In Capital: | $617,528.10 |

Net Income: | $0.00 |

TOTAL EQUITY: | $617,528.10 |

TOTAL LIABILITIES & EQUITY:$617,528.10

IRS Department of the Treasury Internal Revenue Service, New York 11742-9019

In reply refer to 0152308027 July 20, 2021 XEBEC GALLEON, INC., Texas USA. Verification of Employer Identification Number: 87-0438447 by Ms. Cathy M. Snider, Operations Manager Accounts Management Op 3 https://irs.gov

Item 14. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Herzog has not since inception, changed its accounting practices, methods or principals in any respect and there has not been any material adverse change in the assets, business, operation, liabilities (absolute, accrued, contingent or otherwise), prospects or financial condition of Herzog. Principal accounting policies followed by Herzog are in conformity with accounting principals generally accepted in the United States of America.

Item 15. Financial Statements and Exhibits

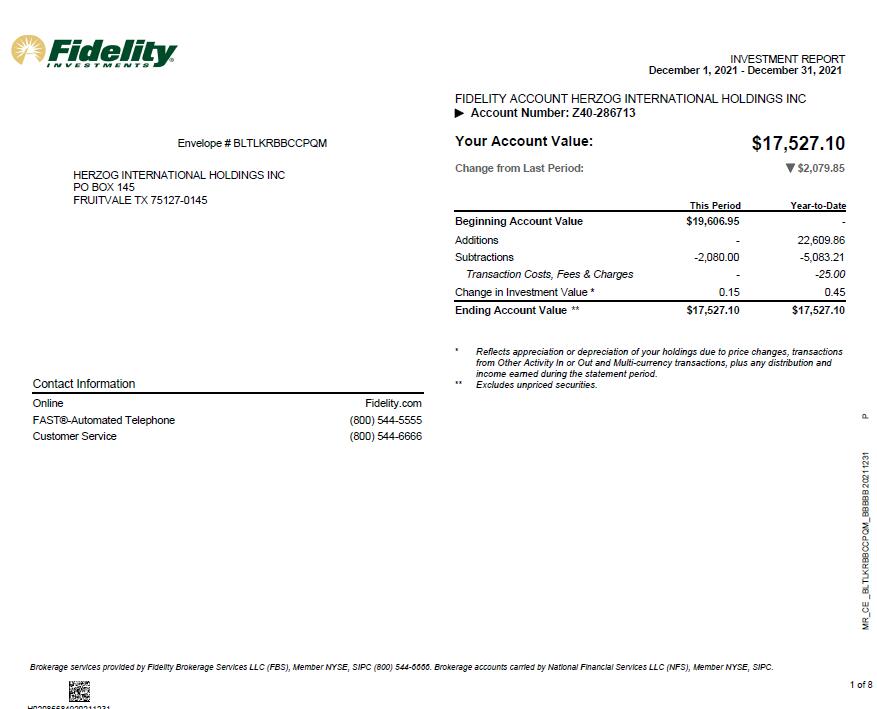

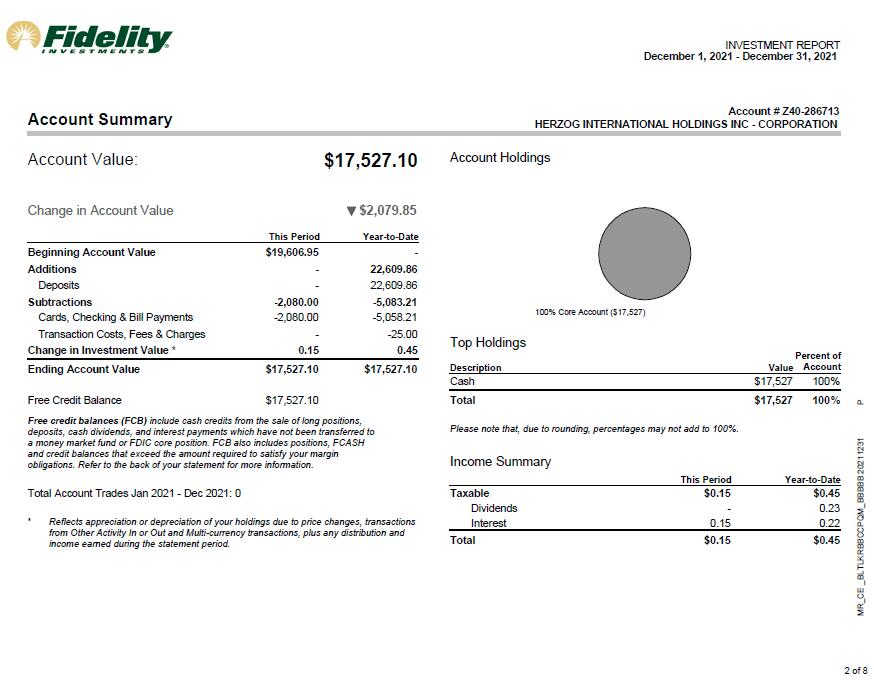

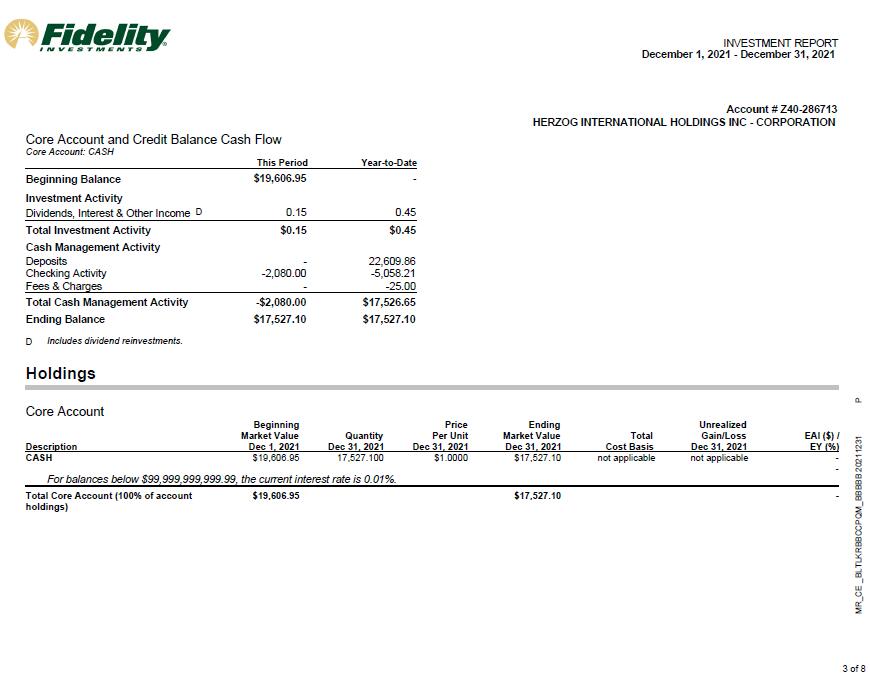

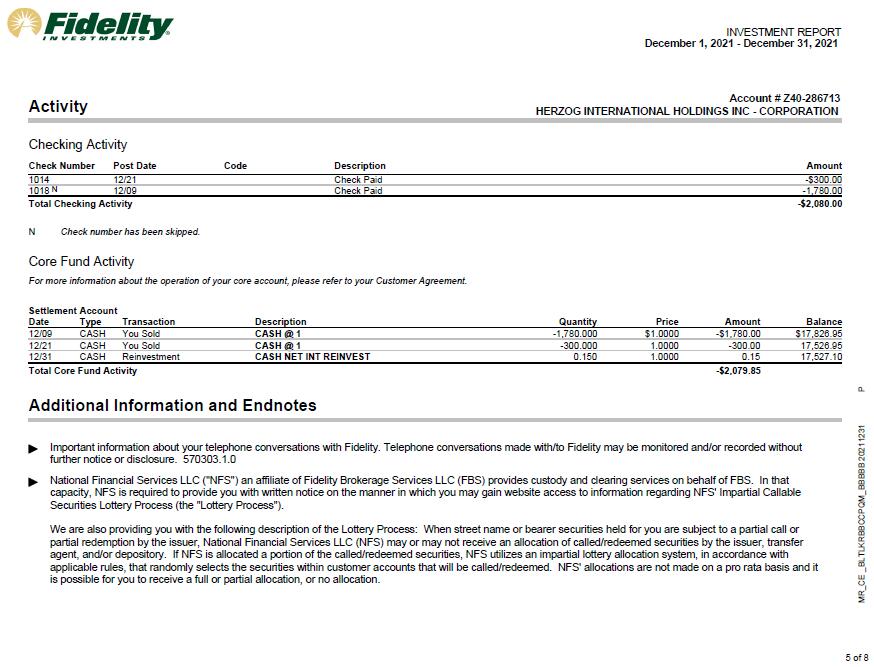

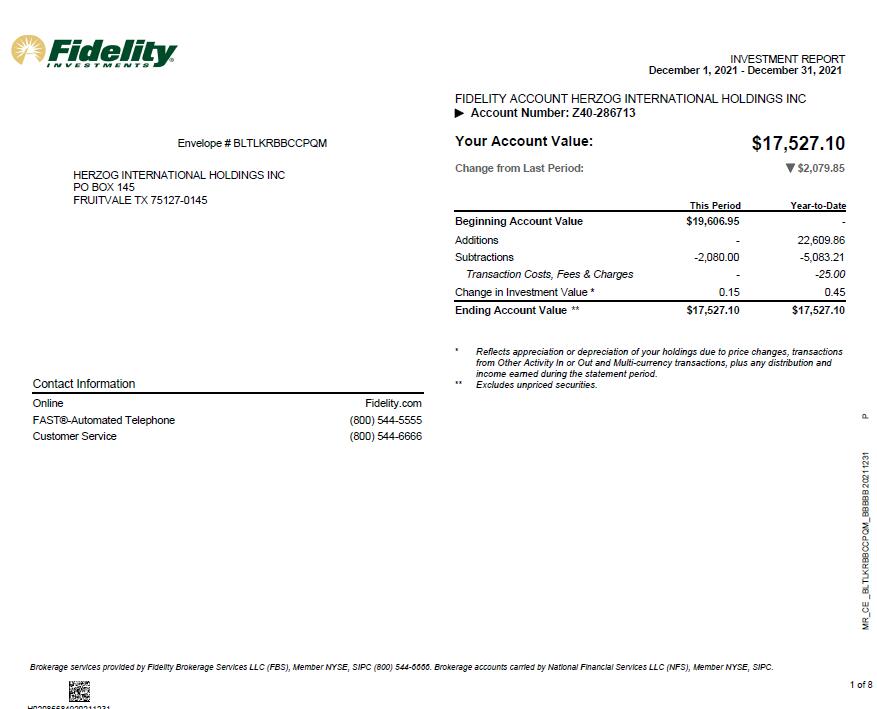

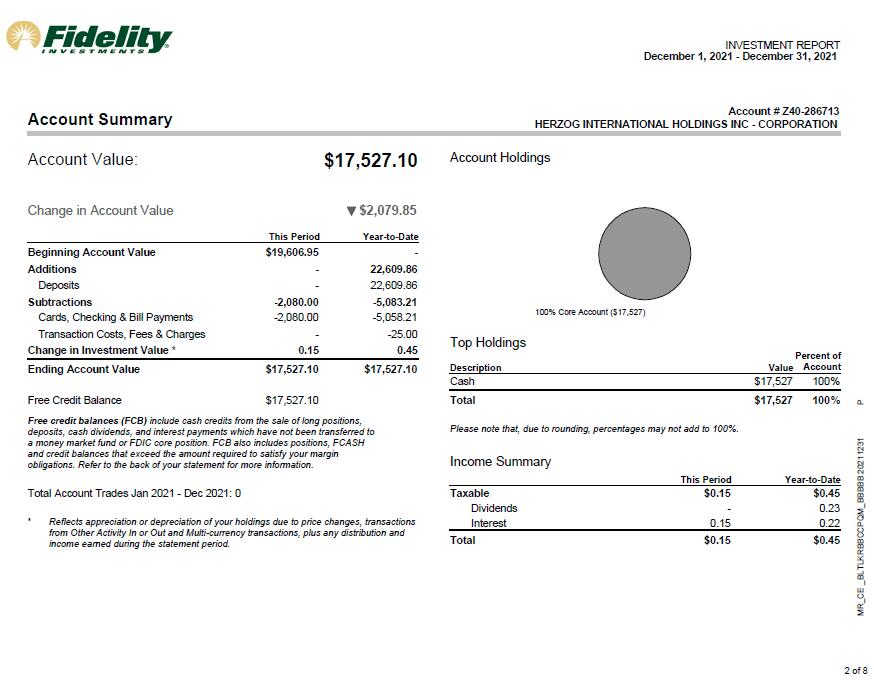

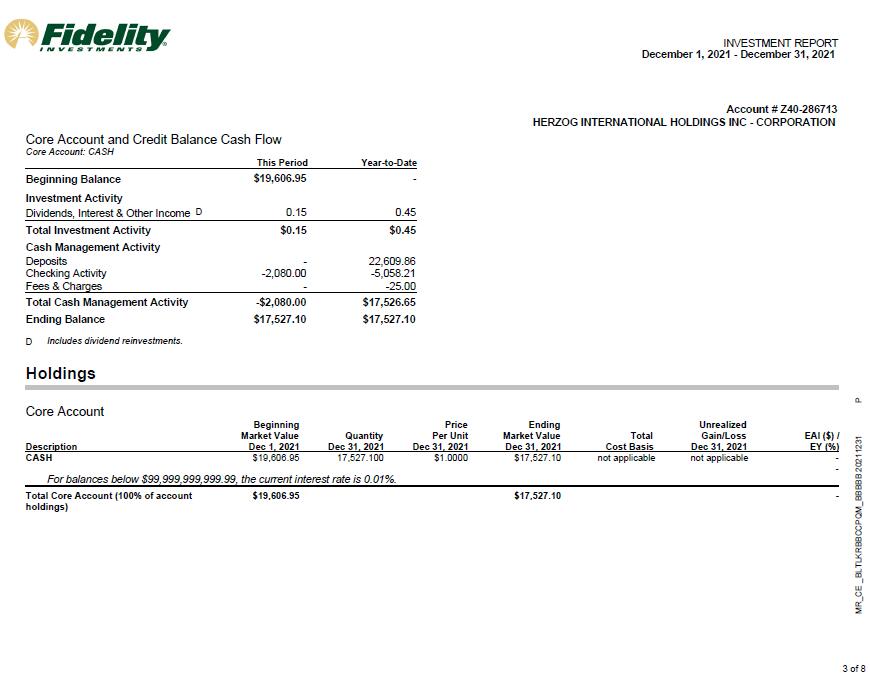

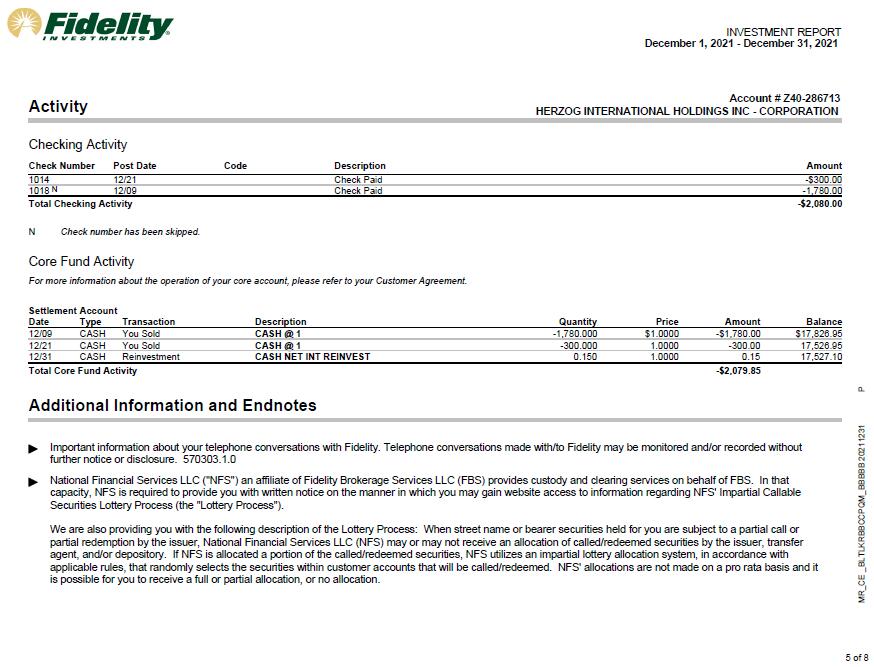

INVESTMENT REPORT

December 1, 2021 – December 31, 2021

CASH $17,527.10

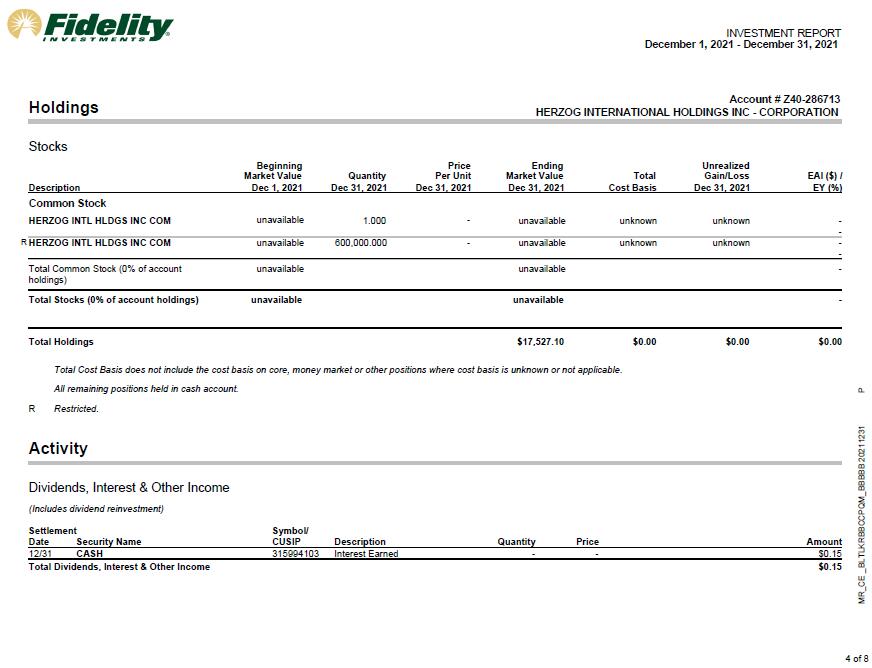

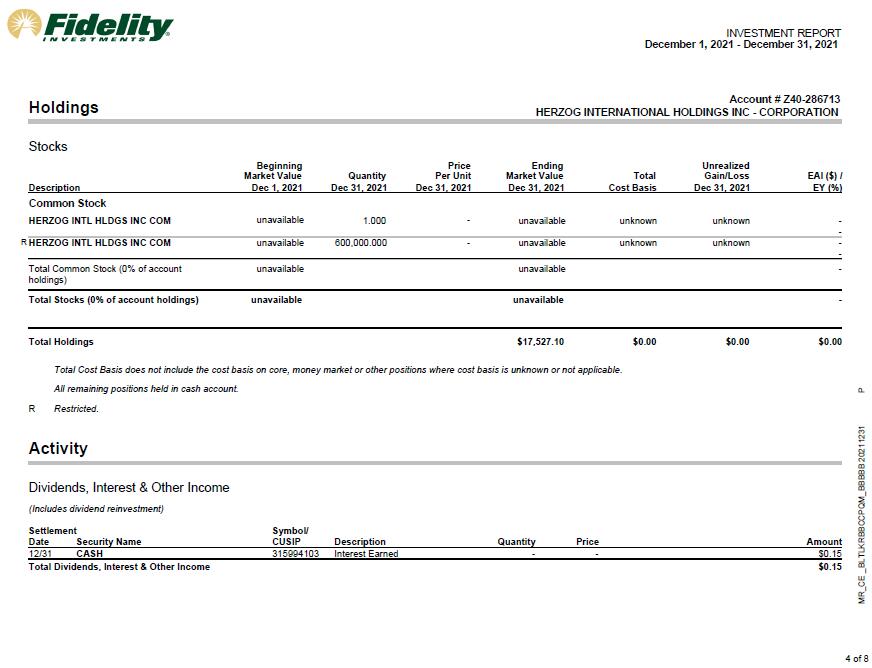

Holdings

Stocks

Description

Common Stock

HERZOG INTL HLDGS INC COM Quantity 600,001.000

Carried and cleared by the carrying and clearing firm of NATIONAL FINANCIAL SERVICE LLC., Member NYSE, SIPC.

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

HERZOG INTERNATIONAL HOLDINGS, INC. |

| |

By: | | /s/ Guillermo Toledo |

| | Name:Guillermo Toledo Title:Director Date:January 25, 2022 |