January 26, 2022 Landstar System, Inc. Earnings Conference Call Fourth Quarter 2021 Date Published: 01/26/2022 Exhibit 99.2

Forward Looking Statements Disclaimer: The following is a “safe harbor” statement under the Private Securities Litigation Reform Act of 1995. Statements made in this slide presentation that are not based on historical facts are “forward looking statements.” This presentation may make certain statements containing forward-looking statements, such as statements which relate to Landstar’s business objectives, plans, strategies and expectations. Such statements are by nature subject to uncertainties and risks, including but not limited to: the operational, financial and legal risks detailed in Landstar’s Form 10-K for the 2020 fiscal year, described in the section Risk Factors, and other SEC filings from time to time. These risks and uncertainties could cause actual results or events to differ materially from historical results or those anticipated. Investors should not place undue reliance on such forward-looking statements, and Landstar undertakes no obligation to publicly update or revise any forward-looking statements. Date Published: 01/26/2022

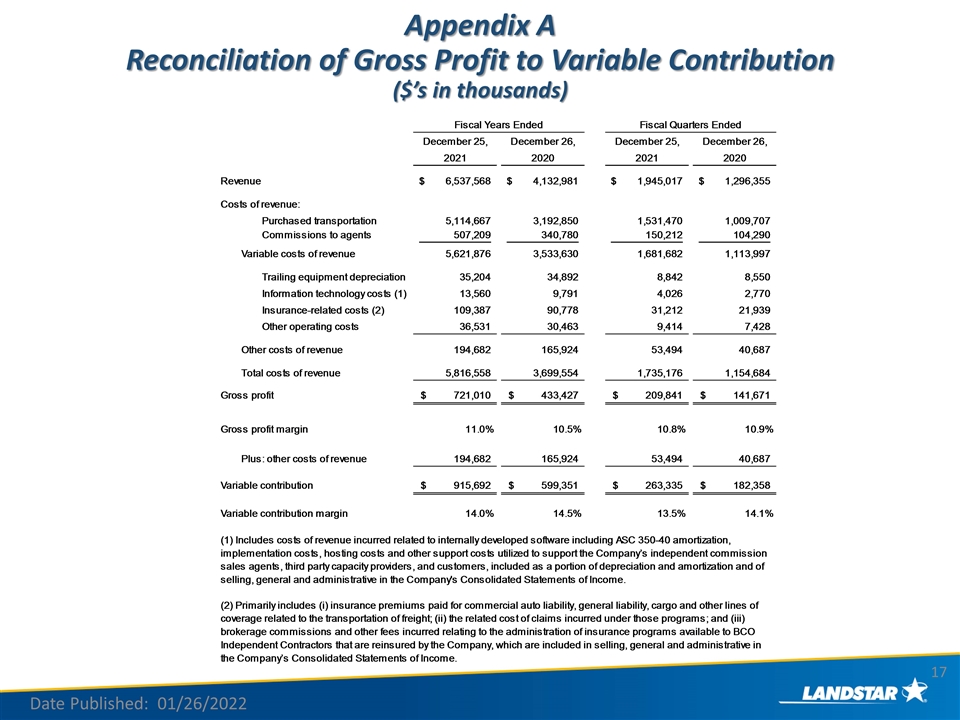

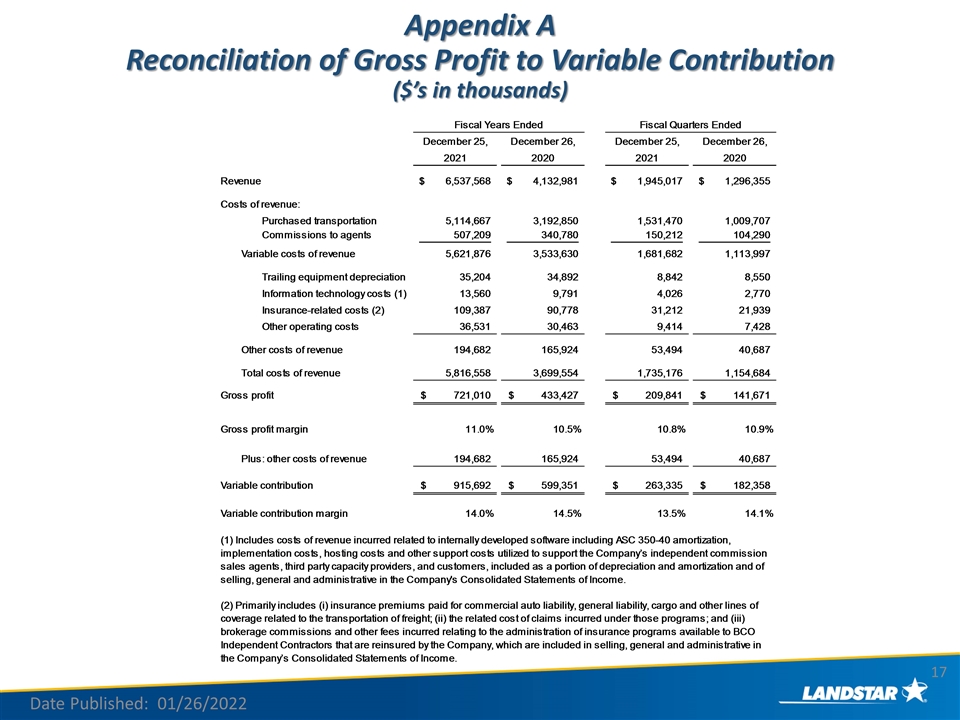

Non-GAAP Financial Measures: In this slide presentation, the Company provides the following information that may be deemed a non-GAAP financial measure: variable contribution, variable contribution margin and operating income as a percentage of variable contribution as well as (1) operating income as a percentage of gross profit and operating income as a percentage of variable contribution, each in the 2020 fiscal year period, excluding the impact of the one-time costs to buyout certain incentive commission arrangements with several agents (the “Commission Buyout Costs”) and the impact of pandemic relief incentive payments; and (2) operating income as a percentage of gross profit in the 2020 fourth quarter, excluding the impact of the Commission Buyout Costs. Management believes variable contribution and variable contribution margin are useful measures of the variable costs that we incur at a shipment-by-shipment level attributable to our transportation network of third-party capacity providers and independent agents in order to provide services to our customers. Management believes that operating income as a percentage of variable contribution is a useful measure as: (i) variable costs of revenue for a significant portion of the Company’s business are highly influenced by short-term market-based trends in the freight transportation industry, whereas other costs, including other costs of revenue, are much less impacted by short-term freight market trends; and (ii) this measure is meaningful to investors’ evaluations of the Company’s management of costs attributable to operations other than the purely variable costs associated with purchased transportation and commissions to agents that the Company incurs to provide services to our customers. Management also believes that it is appropriate to present each of the financial measures that may be deemed a non-GAAP financial measure, as referred to above, for the following reasons: (1) disclosure of these matters will allow investors to better understand the underlying trends in the Company’s financial condition and results of operations; (2) this information will facilitate comparisons by investors of the Company’s results as compared to the results of peer companies; and (3) management considers this financial information in its decision making. A tabulation of the expenses identified as costs of revenue as well as a reconciliation of gross profit to variable contribution and gross profit margin to variable contribution margin for the 2021 and 2020 fourth quarters and fiscal year periods is included in this slide presentation as Appendix A. Date Published: 01/26/2022

Who We Are Landstar is a worldwide, technology-enabled, asset-light provider of integrated transportation management solutions delivering safe, specialized transportation services to a broad range of customers utilizing a network of agents, third party capacity providers and employees. Date Published: 01/26/2022

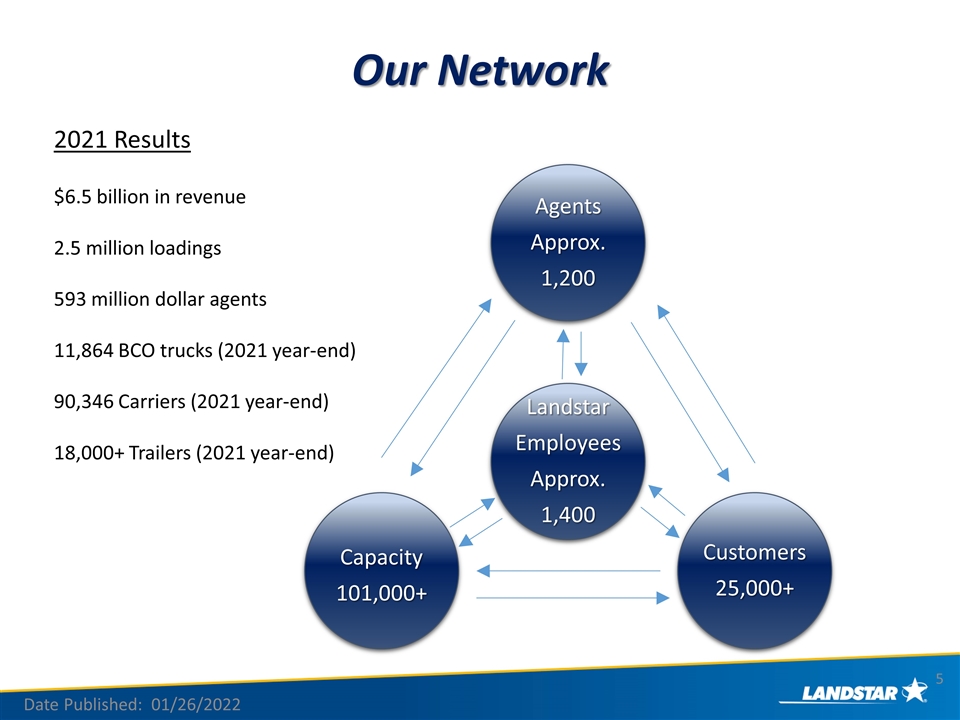

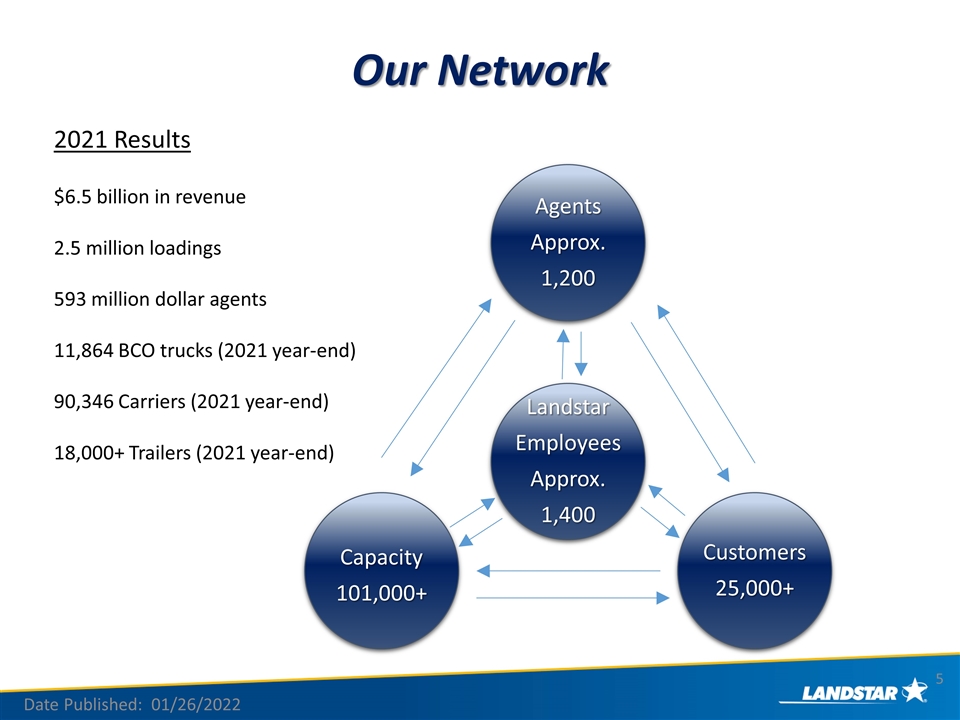

Our Network Landstar Employees Approx. 1,400 Agents Approx. 1,200 Customers 25,000+ Capacity 101,000+ Date Published: 01/26/2022 2021 Results $6.5 billion in revenue 2.5 million loadings 593 million dollar agents 11,864 BCO trucks (2021 year-end) 90,346 Carriers (2021 year-end) 18,000+ Trailers (2021 year-end)

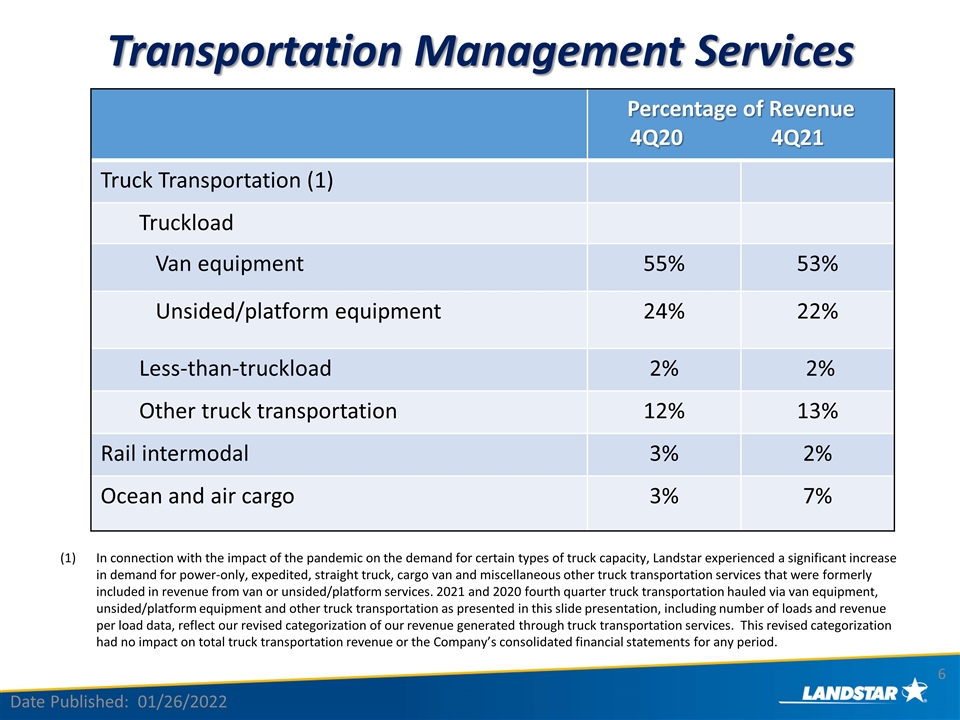

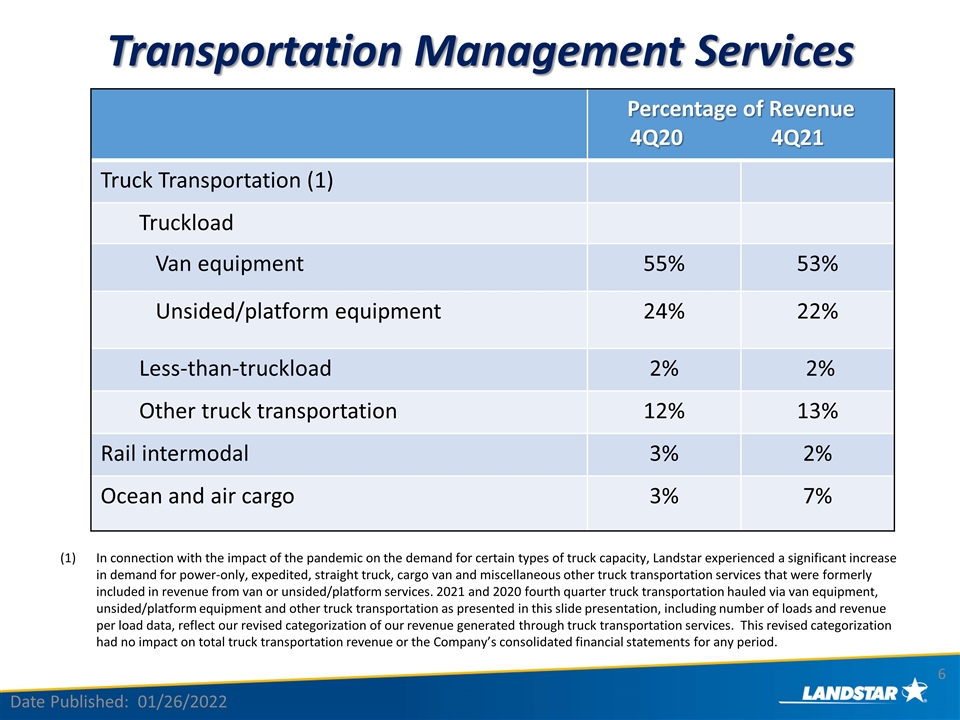

Percentage of Revenue 4Q20 4Q21 Truck Transportation (1) Truckload Van equipment 55% 53% Unsided/platform equipment 24% 22% Less-than-truckload 2% 2% Other truck transportation 12% 13% Rail intermodal 3% 2% Ocean and air cargo 3% 7% Transportation Management Services Date Published: 01/26/2022 In connection with the impact of the pandemic on the demand for certain types of truck capacity, Landstar experienced a significant increase in demand for power-only, expedited, straight truck, cargo van and miscellaneous other truck transportation services that were formerly included in revenue from van or unsided/platform services. 2021 and 2020 fourth quarter truck transportation hauled via van equipment, unsided/platform equipment and other truck transportation as presented in this slide presentation, including number of loads and revenue per load data, reflect our revised categorization of our revenue generated through truck transportation services. This revised categorization had no impact on total truck transportation revenue or the Company’s consolidated financial statements for any period.

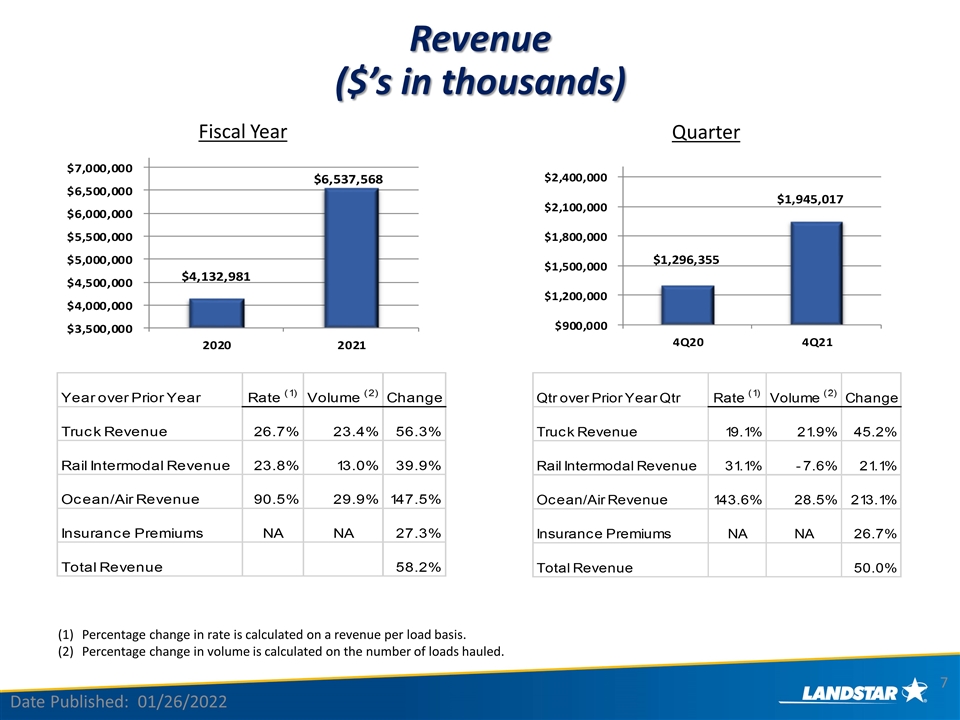

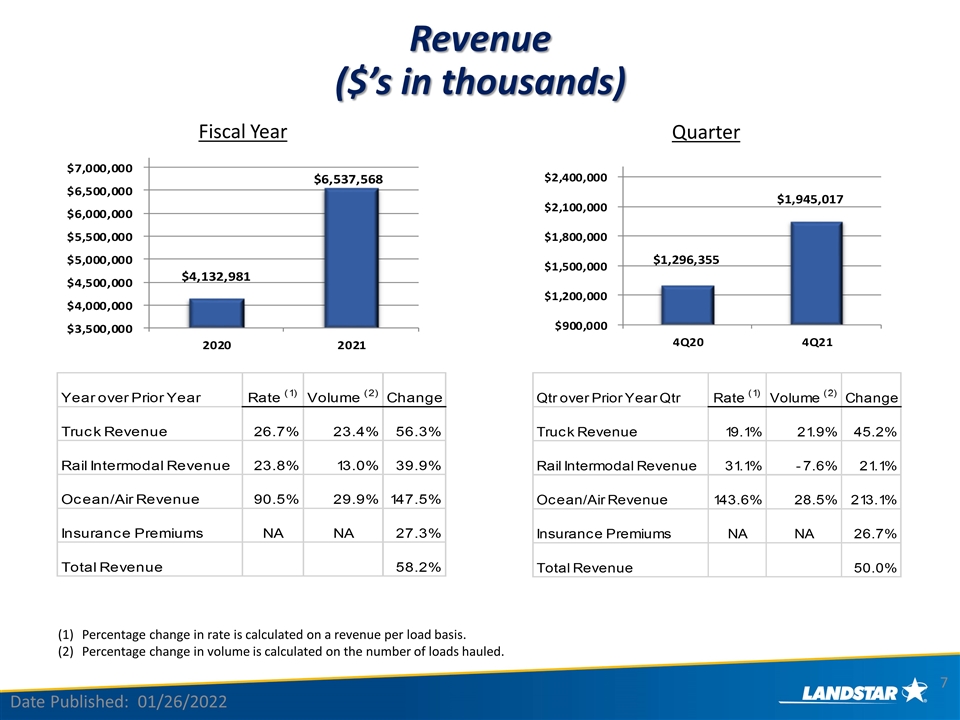

Percentage change in rate is calculated on a revenue per load basis. Percentage change in volume is calculated on the number of loads hauled. Revenue ($’s in thousands) Date Published: 01/26/2022 Quarter Fiscal Year

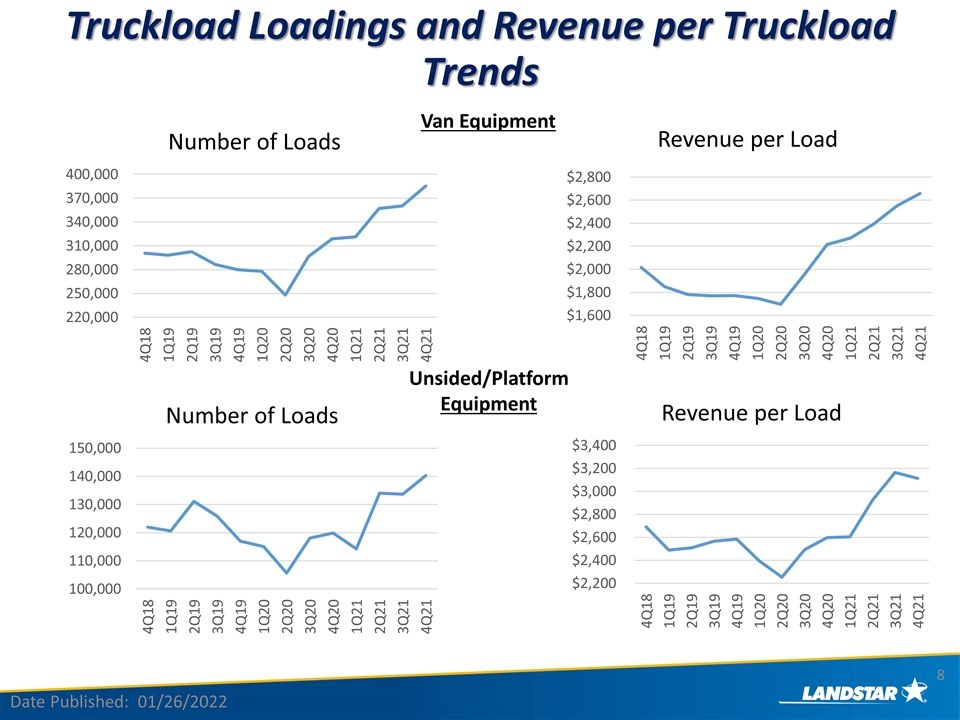

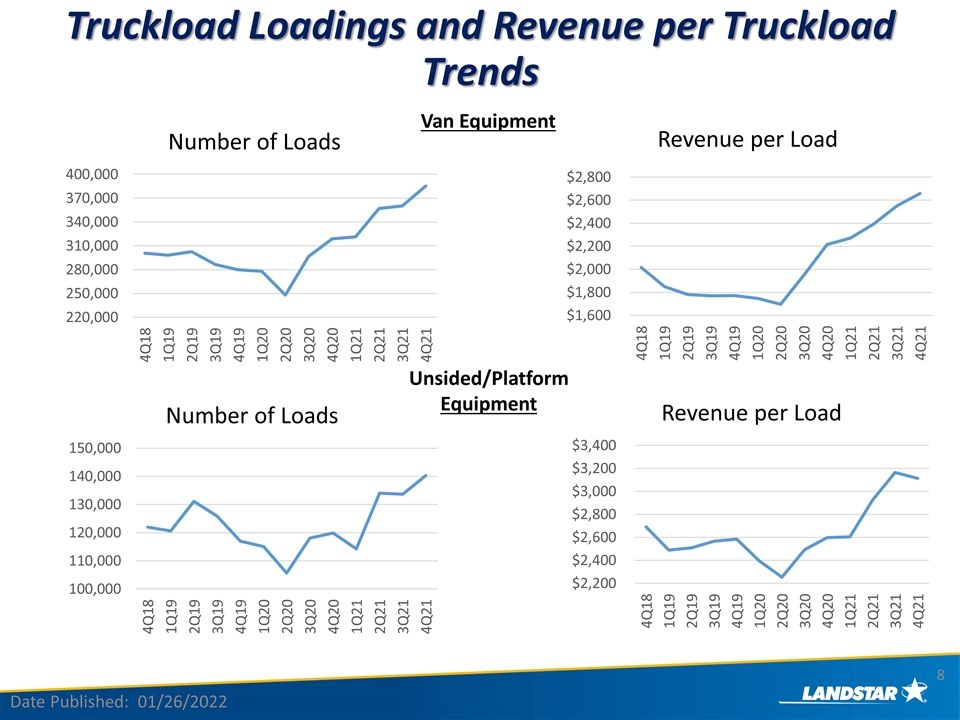

Van Equipment Unsided/Platform Equipment Truckload Loadings and Revenue per Truckload Trends Date Published: 01/26/2022

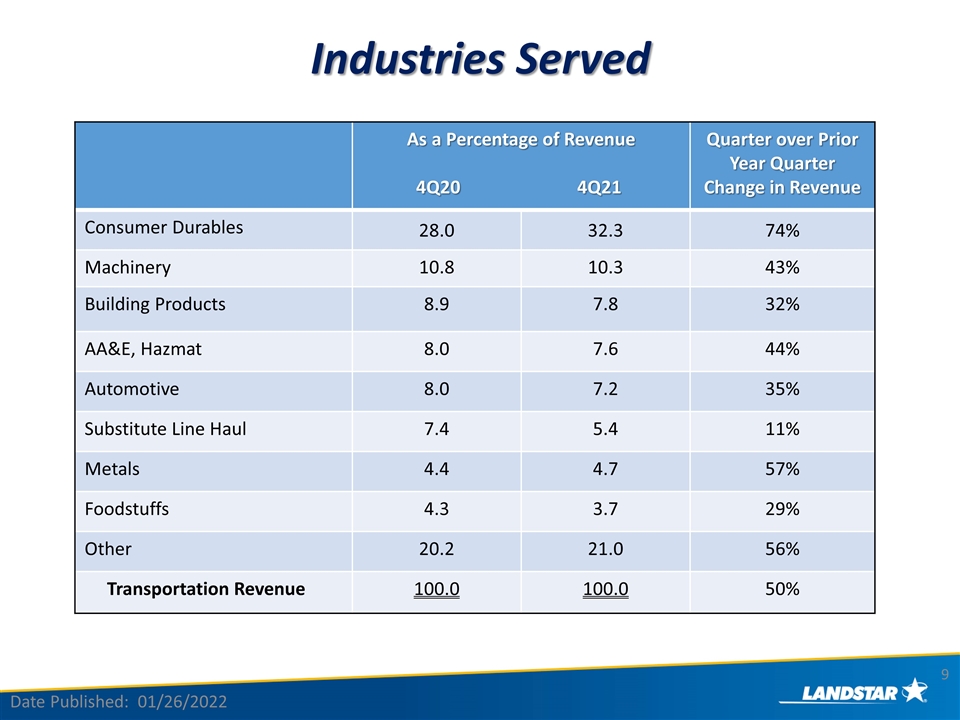

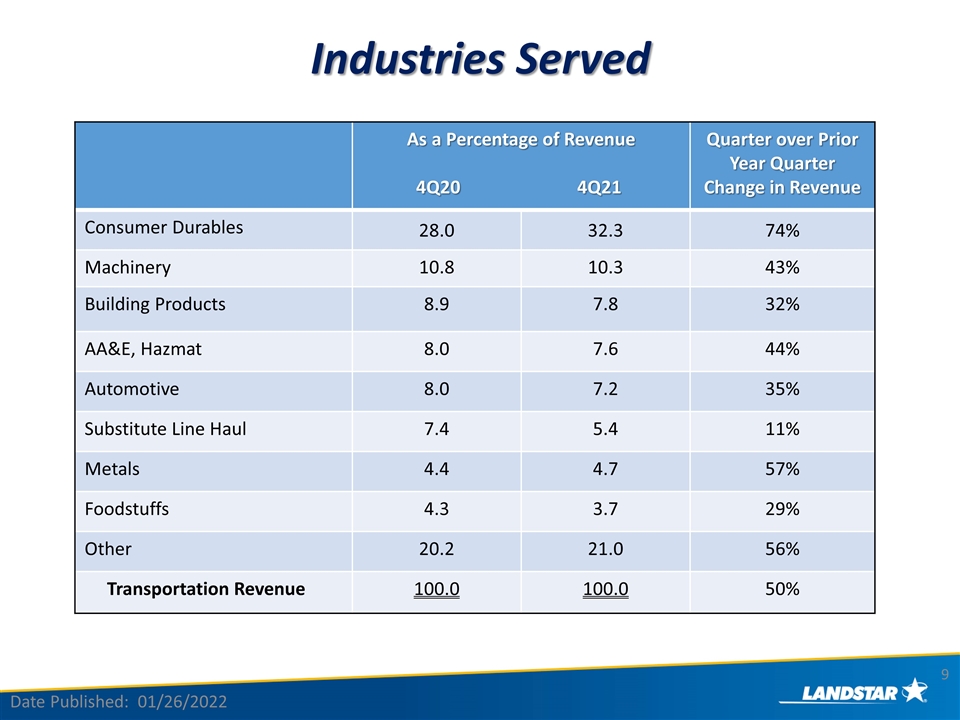

As a Percentage of Revenue 4Q20 4Q21 Quarter over Prior Year Quarter Change in Revenue Consumer Durables 28.0 32.3 74% Machinery 10.8 10.3 43% Building Products 8.9 7.8 32% AA&E, Hazmat 8.0 7.6 44% Automotive 8.0 7.2 35% Substitute Line Haul 7.4 5.4 11% Metals 4.4 4.7 57% Foodstuffs 4.3 3.7 29% Other 20.2 21.0 56% Transportation Revenue 100.0 100.0 50% Industries Served Date Published: 01/26/2022

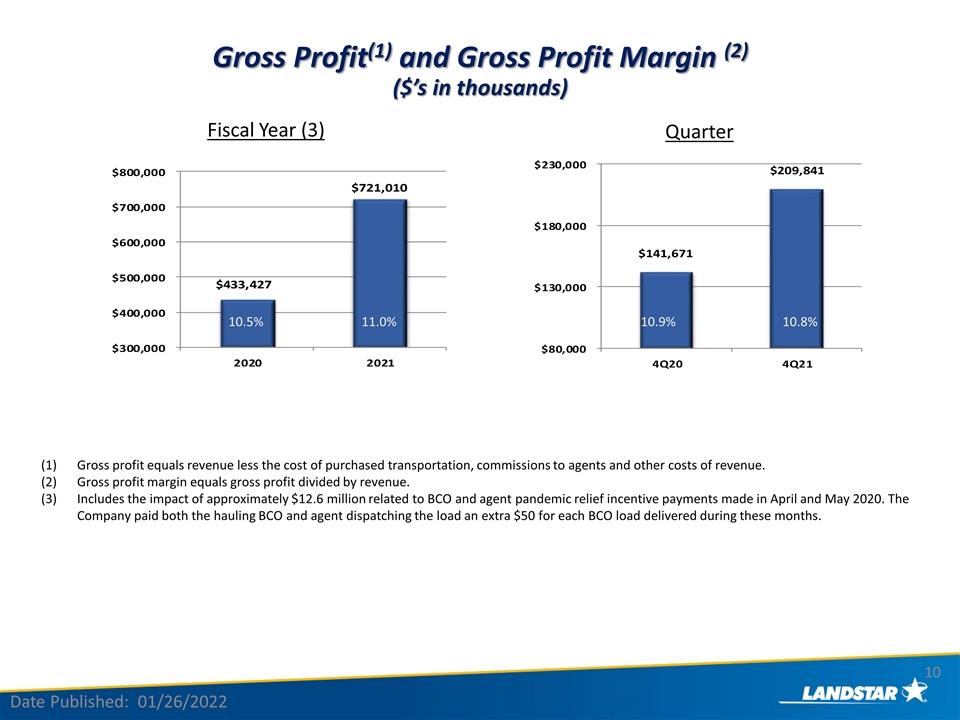

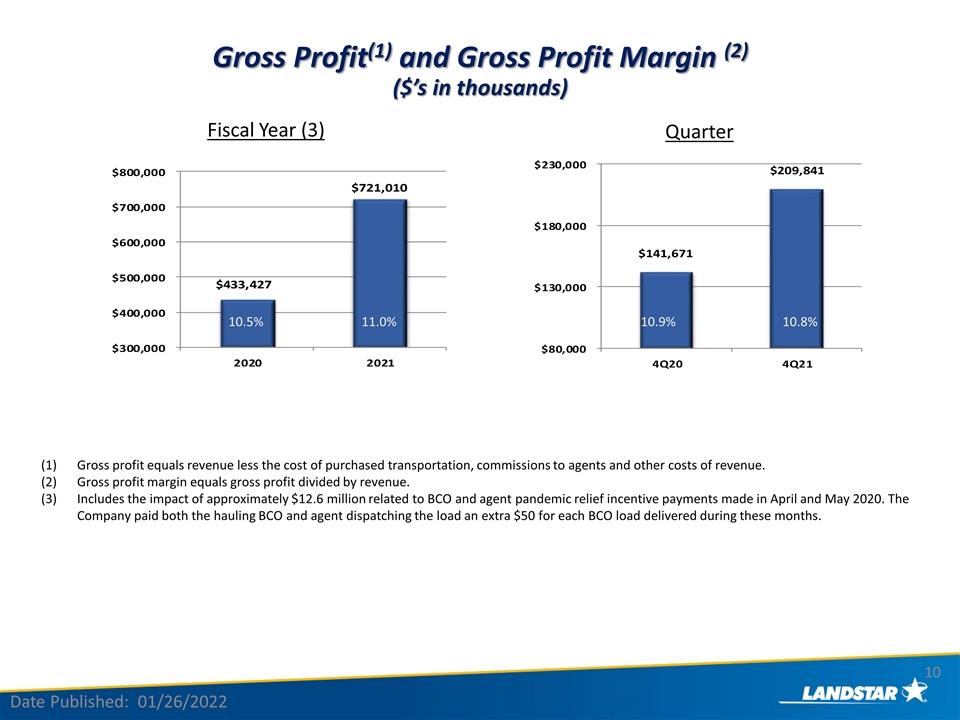

10.9% 10.8% Gross profit equals revenue less the cost of purchased transportation, commissions to agents and other costs of revenue. Gross profit margin equals gross profit divided by revenue. Includes the impact of approximately $12.6 million related to BCO and agent pandemic relief incentive payments made in April and May 2020. The Company paid both the hauling BCO and agent dispatching the load an extra $50 for each BCO load delivered during these months. Gross Profit(1) and Gross Profit Margin (2) ($’s in thousands) Date Published: 01/26/2022 Quarter Fiscal Year (3) 10.5% 11.0%

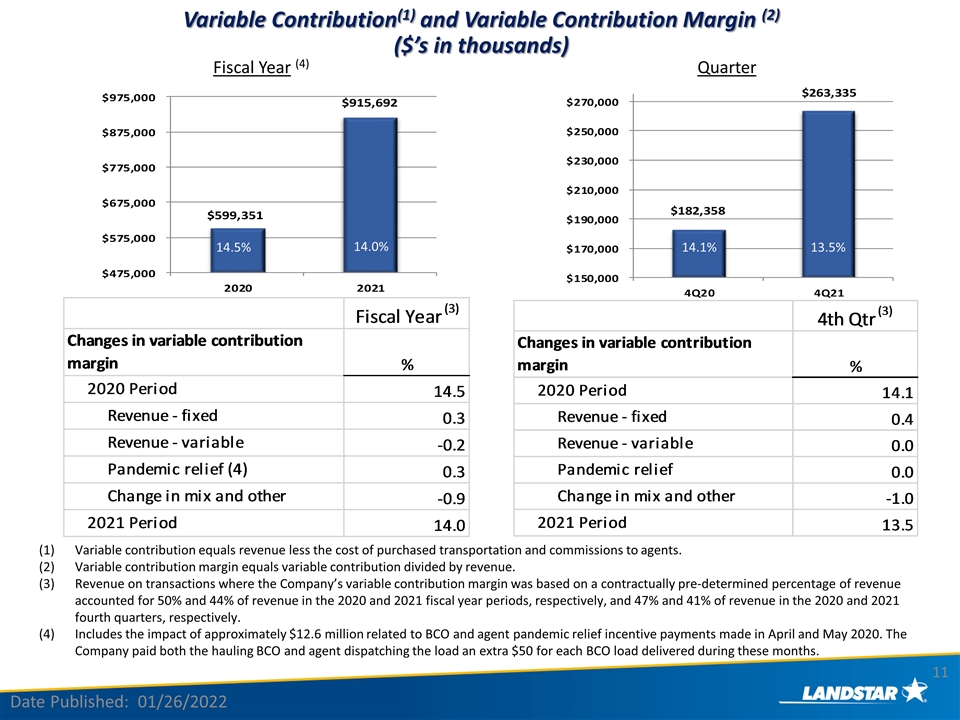

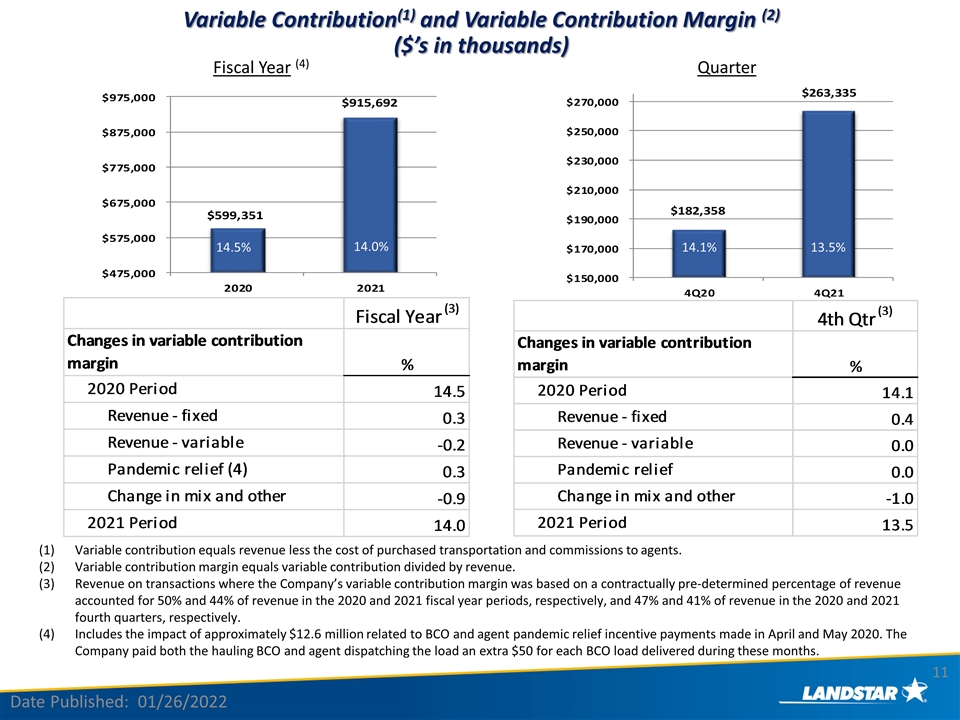

14.1% 13.5% Variable contribution equals revenue less the cost of purchased transportation and commissions to agents. Variable contribution margin equals variable contribution divided by revenue. Revenue on transactions where the Company’s variable contribution margin was based on a contractually pre-determined percentage of revenue accounted for 50% and 44% of revenue in the 2020 and 2021 fiscal year periods, respectively, and 47% and 41% of revenue in the 2020 and 2021 fourth quarters, respectively. Includes the impact of approximately $12.6 million related to BCO and agent pandemic relief incentive payments made in April and May 2020. The Company paid both the hauling BCO and agent dispatching the load an extra $50 for each BCO load delivered during these months. Variable Contribution(1) and Variable Contribution Margin (2) ($’s in thousands) Date Published: 01/26/2022 Quarter Fiscal Year (4) 14.5% 14.0%

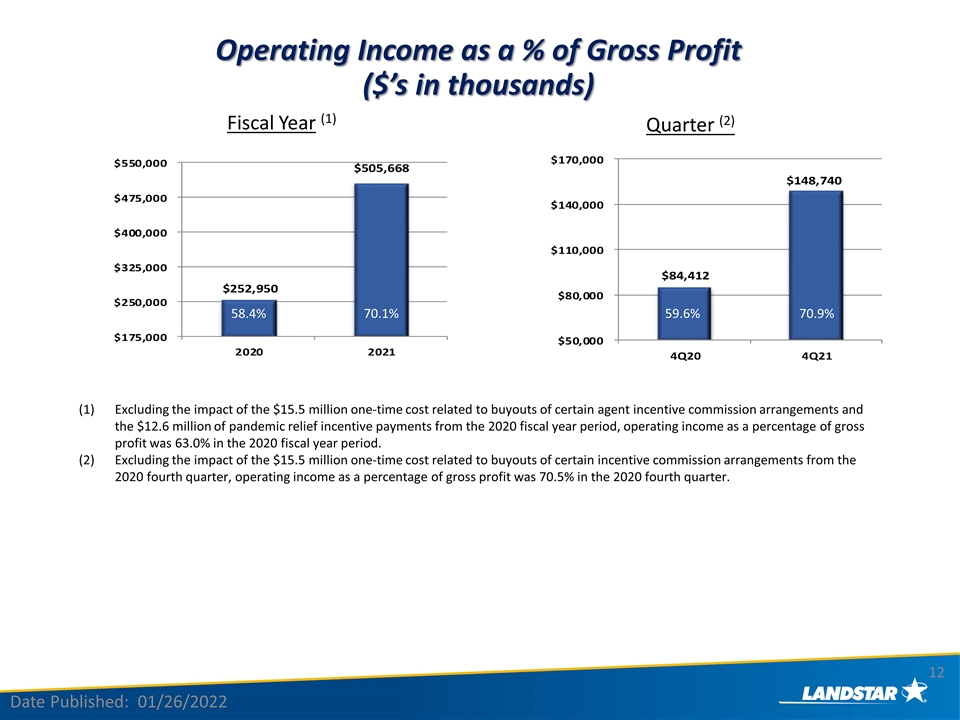

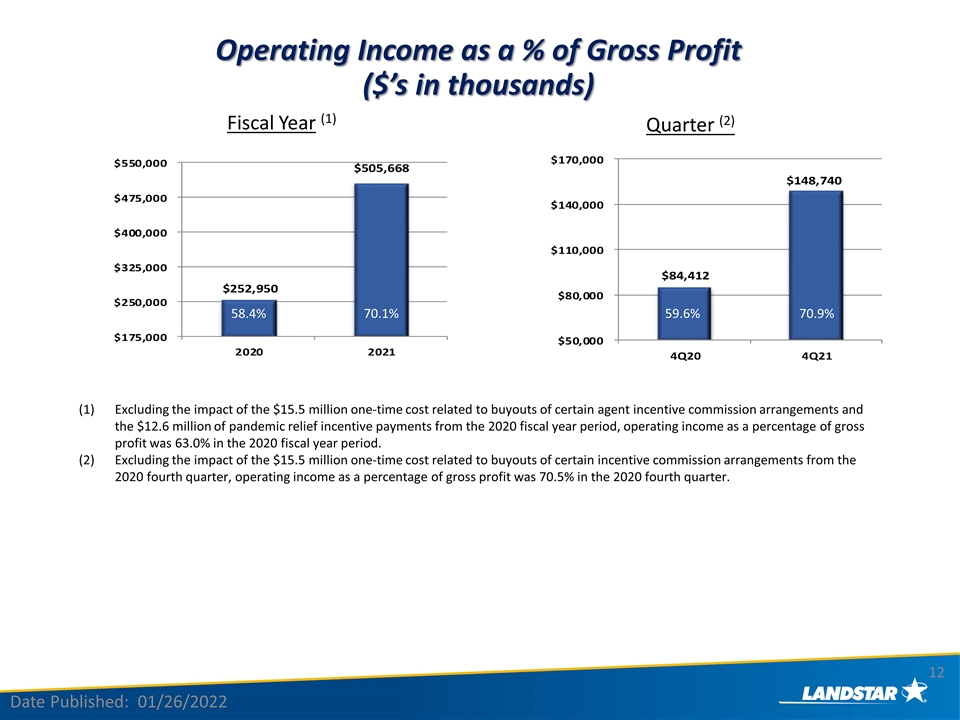

Excluding the impact of the $15.5 million one-time cost related to buyouts of certain agent incentive commission arrangements and the $12.6 million of pandemic relief incentive payments from the 2020 fiscal year period, operating income as a percentage of gross profit was 63.0% in the 2020 fiscal year period. Excluding the impact of the $15.5 million one-time cost related to buyouts of certain incentive commission arrangements from the 2020 fourth quarter, operating income as a percentage of gross profit was 70.5% in the 2020 fourth quarter. Operating Income as a % of Gross Profit ($’s in thousands) Date Published: 01/26/2022 Quarter (2) Fiscal Year (1) 59.6% 70.9% 58.4% 12 70.1%

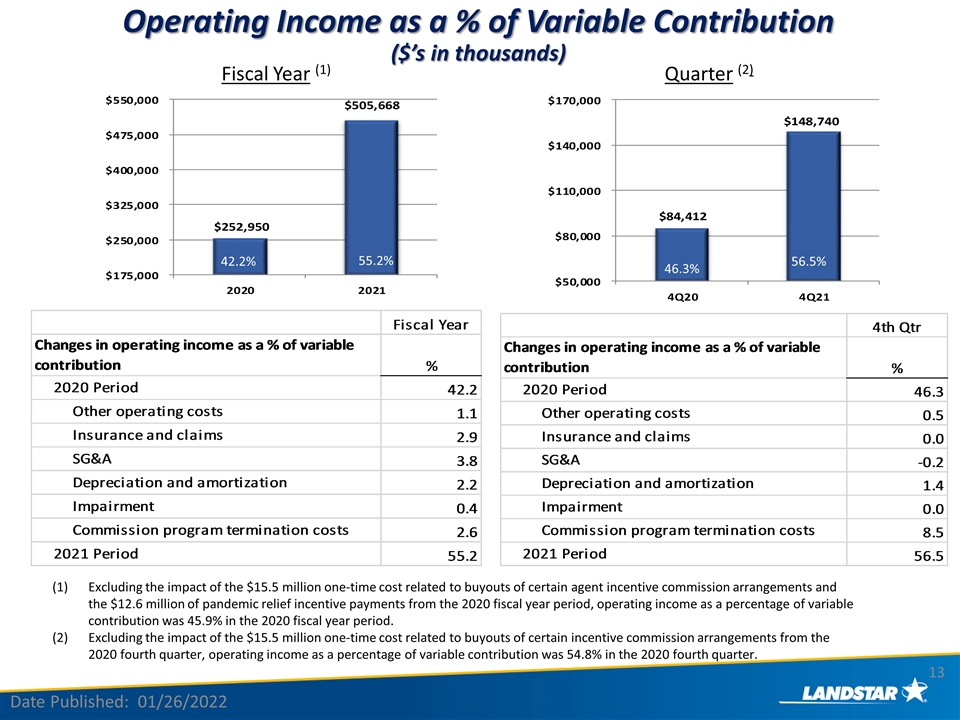

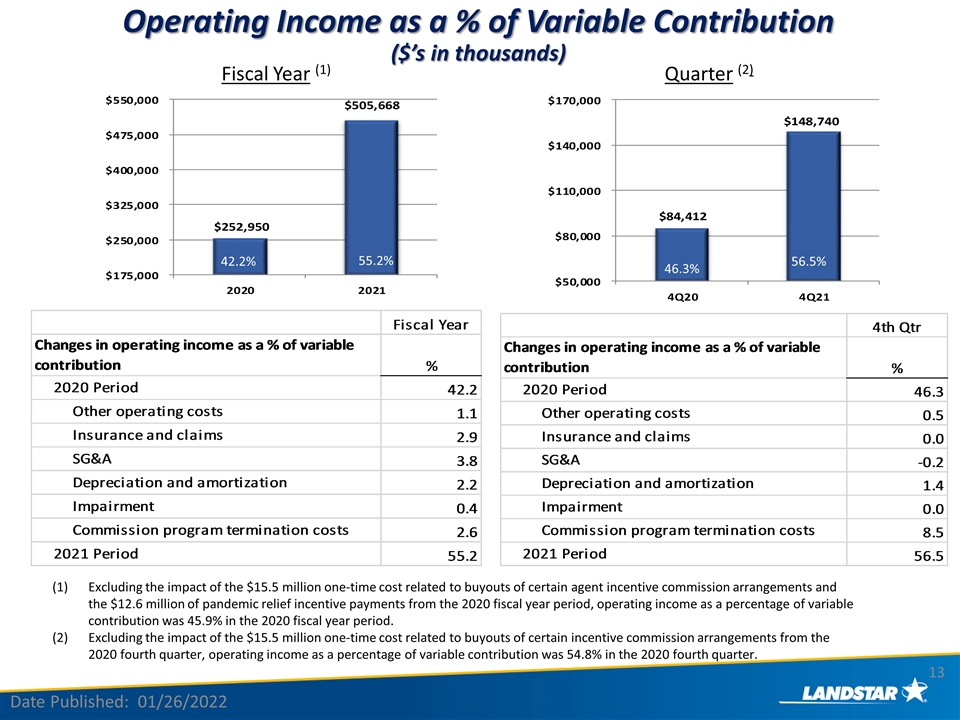

Excluding the impact of the $15.5 million one-time cost related to buyouts of certain agent incentive commission arrangements and the $12.6 million of pandemic relief incentive payments from the 2020 fiscal year period, operating income as a percentage of variable contribution was 45.9% in the 2020 fiscal year period. Excluding the impact of the $15.5 million one-time cost related to buyouts of certain incentive commission arrangements from the 2020 fourth quarter, operating income as a percentage of variable contribution was 54.8% in the 2020 fourth quarter. Operating Income as a % of Variable Contribution ($’s in thousands) Date Published: 01/26/2022 Quarter (2) Fiscal Year (1) 46.3% 56.5% 42.2% 13 55.2%

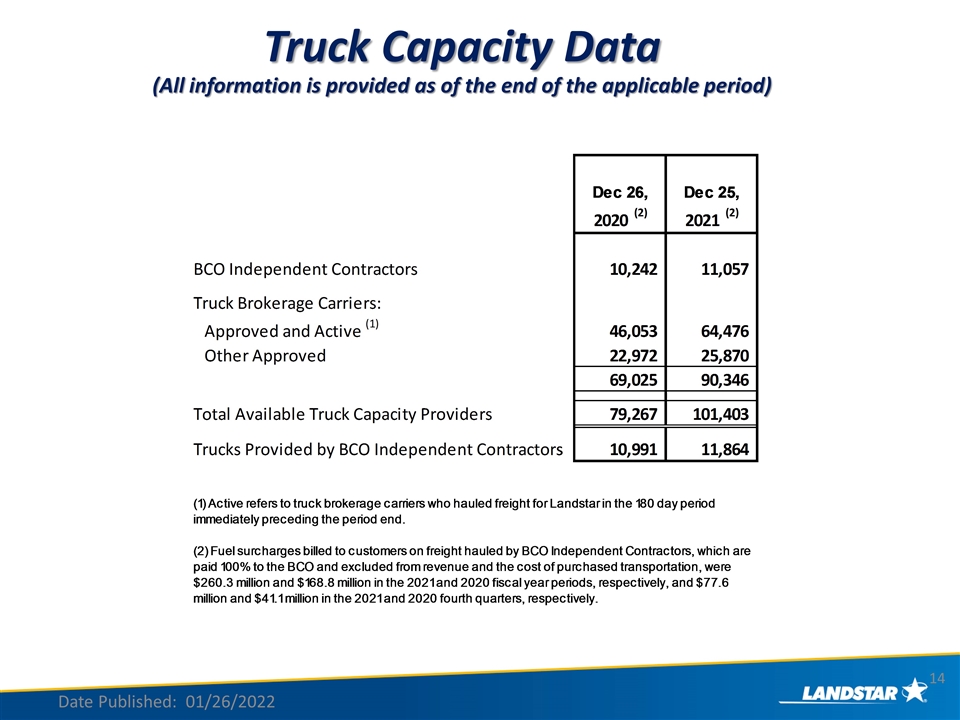

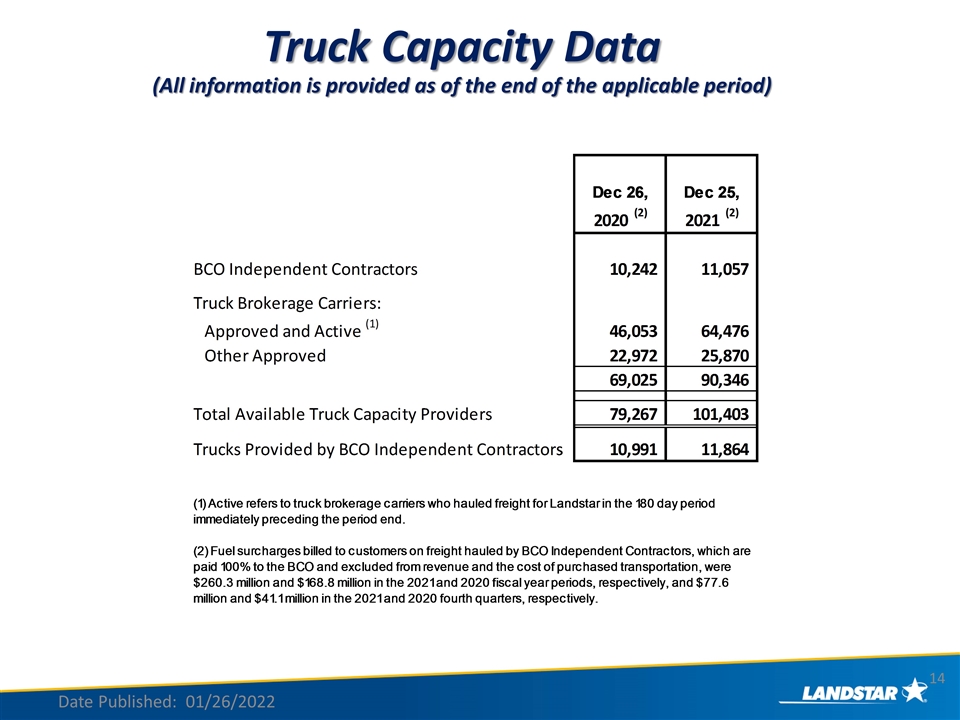

Date Published: 01/26/2022 Truck Capacity Data (All information is provided as of the end of the applicable period)

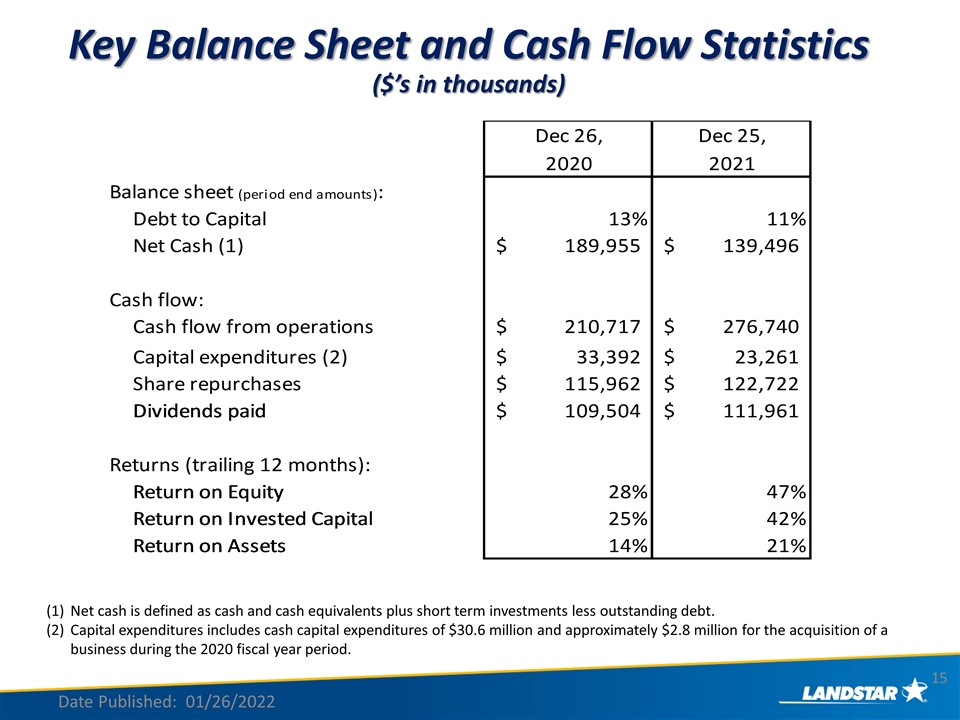

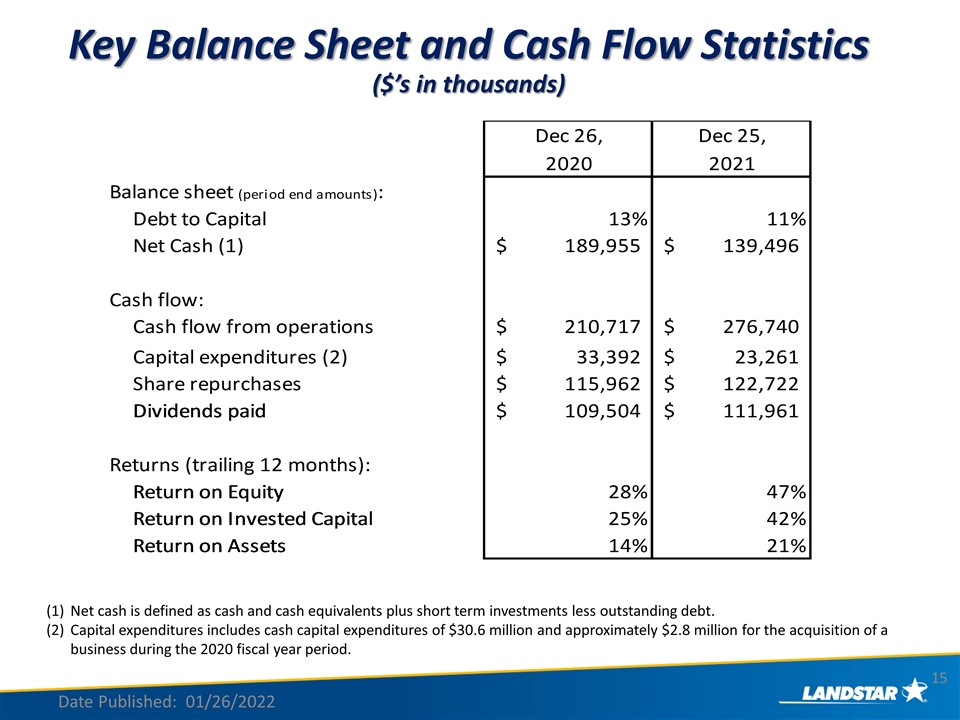

Net cash is defined as cash and cash equivalents plus short term investments less outstanding debt. Capital expenditures includes cash capital expenditures of $30.6 million and approximately $2.8 million for the acquisition of a business during the 2020 fiscal year period. Date Published: 01/26/2022 Key Balance Sheet and Cash Flow Statistics ($’s in thousands)

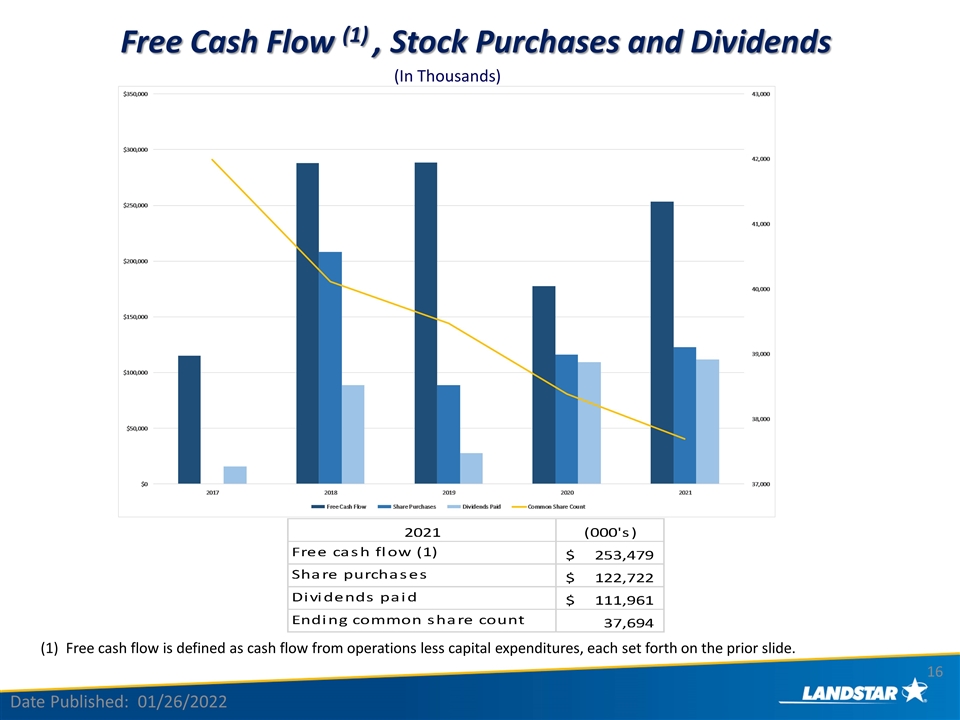

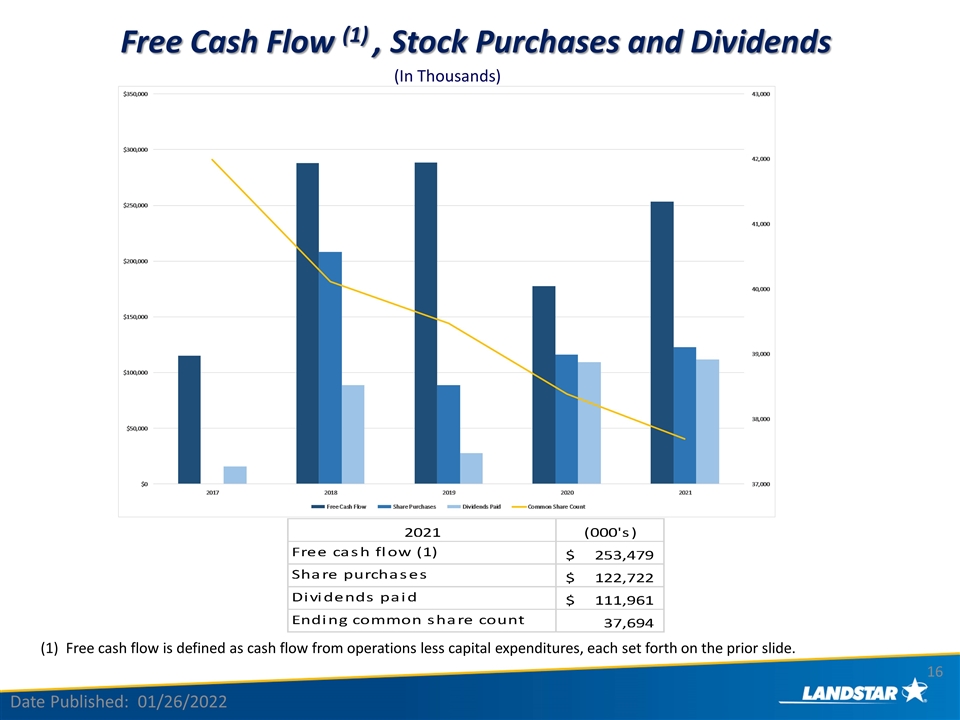

Free Cash Flow (1) , Stock Purchases and Dividends Date Published: 01/26/2022 (In Thousands) (1) Free cash flow is defined as cash flow from operations less capital expenditures, each set forth on the prior slide.

Appendix A Reconciliation of Gross Profit to Variable Contribution ($’s in thousands) Date Published: 01/26/2022 17

Date Published: 01/26/2022