QuickLinks -- Click here to rapidly navigate through this document

NOTICE OF MEETING OF SHAREHOLDERS

NOTICE is hereby given that the Annual Meeting of Shareholders of Decoma International Inc. ("Decoma" or the "Corporation") will be held at the Design Exchange, 234 Bay Street, Toronto, Ontario, Canada, on Monday, May 5, 2003, commencing at 3:00 p.m. (Toronto time), for the following purposes:

- (a)

- to receive the Consolidated Financial Statements of the Corporation for the year ended December 31, 2002, and the Report of the Auditor thereon;

- (b)

- to elect directors;

- (c)

- to reappoint the Auditor, based on the recommendation of the Audit Committee of the Board of Directors, and authorize the Audit Committee to fix the Auditor's remuneration; and

- (d)

- to transact such further or other business or matters as may properly come before the meeting or any adjournment(s) thereof.

Only shareholders of record at the close of business on March 28, 2003, will be entitled to receive notice of the meeting.

Decoma's 2002 Annual Report contains the Consolidated Financial Statements of the Corporation for the year ended December 31, 2002, and the report of the Auditor thereon. The Management Information Circular dated April 4, 2003 (the "Circular") and form of proxy for the Class A Subordinate Voting Shares are enclosed with this Notice of Meeting. The Circular provides additional information concerning the matters to be dealt with at the meeting.

By order of the Board of Directors,

"R. David Benson" (signed)

Executive Vice-President,

Secretary and General Counsel

April 4, 2003

Concord, Ontario

| Note: | | If you are unable to be present at the meeting in person, please complete, date and sign the enclosed proxy and return it to the Secretary of the Corporation in the envelope provided for that purpose. |

DECOMA INTERNATIONAL INC.

50 Casmir Court — Concord — Ontario — Canada — L4K 4J5 — Tel 905-669-2888 — Fax 905-669-5075 — www.decoma.com

MANAGEMENT INFORMATION CIRCULAR

This Management Information Circular (the "Circular") is furnished to the shareholders of Decoma International Inc. ("Decoma" or the "Corporation") in connection with thesolicitation by and on behalf of management and the board of directors of the Corporation of proxies to be used at the Annual Meeting of Shareholders (the "Meeting") of the Corporation to be held at the Design Exchange, 234 Bay Street, Toronto, Ontario, Canada, on Monday, May 5, 2003, commencing at 3:00 p.m. (Toronto time), and at any adjournment(s) thereof, for the purposes set forth in the attached Notice of Annual Meeting of Shareholders (the "Notice").

This Circular, the Notice and the accompanying form of proxy are being mailed on or about April 4, 2003, to shareholders of record of the Corporation as of the close of business on March 28, 2003. The Corporation will bear all costs associated with the preparation and mailing of this Circular, the Notice and the accompanying form of proxy, as well as the costs of the solicitation of proxies. The solicitation will be primarily by mail; however, officers and regular employees of the Corporation may also directly solicit proxies (but not for additional compensation) personally, by telephone or fax or by other means of electronic transmission. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals and to obtain authorizations for the execution of proxies, and will be reimbursed for their reasonable expenses in doing so.

All references to dollar amounts in this Circular are to Canadian dollars unless otherwise stated.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the accompanying form of proxy are officers of the Corporation.A shareholder has the right to appoint a person (who need not be a shareholder of the Corporation) as nominee to attend and act for and on such shareholder's behalf at the Meeting, other than the management nominees named in the accompanying form of proxy. This right may be exercised either by striking out the names of the management nominees where they appear on the front of the form of proxy and by inserting in the blank space provided the name of the other person the shareholder wishes to appoint, or by completing and submitting another proper form of proxy naming such other person as proxy.

A shareholder who has given a proxy, in addition to revocation in any other manner permitted by applicable Canadian law, may revoke the proxy within the time periods described in this Circular by an instrument in writing executed by the shareholder or by his/her attorney authorized in writing or, if the shareholder is a body corporate, by an officer or attorney thereof duly authorized.

Shareholders desiring to be represented at the Meeting by proxy or to revoke a proxy previously given, must deposit their form of proxy or revocation of proxy, addressed to the Secretary of the Corporation, at one of the following locations: (i) the principal executive offices of the Corporation at 50 Casmir Court, Concord, Ontario, Canada L4K 4J5; (ii) the offices of Computershare Trust Company of Canada, 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1; or (iii) the offices of Computershare Trust Company, Inc., 350 Indiana Street, Suite 800, Golden, Colorado, USA 80401 (mailing address P.O. Box 1596, Denver, Colorado, USA 80201); in each case, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment(s) thereof, at which the proxy is to be used. If a shareholder who has completed a proxy attends the Meeting in person, any votes cast by such shareholder on a poll will be counted and the proxy will be disregarded.

VOTING OF PROXIES

The shares represented by any valid proxy in favour of the management nominees named in the accompanying form of proxy will be voted for or withheld from voting (abstain) on the election of directors and the reappointment of the Auditor, based on the recommendation of the Audit Committee of the Board of Directors, and the authorization of the Audit Committee to fix the remuneration of the Auditor, in accordance with any specifications or instructions made by a shareholder on the form of proxy. In the absence of any such specifications or instruction, such shares will be voted: FOR the election as directors of the management nominees named in this Circular and FOR the reappointment of Ernst & Young L.L.P. as Auditor, based on the

1

recommendation of the Audit Committee of the Board of Directors, and the authorization of the Audit Committee to fix the Auditor's remuneration.

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice and with respect to such other business or matters which may properly come before the Meeting or any adjournment(s) thereof. As of the date of this Circular, the Corporation is not aware of any other matter to be raised at the Meeting.

RECORD DATE

The Board has fixed the close of business on March 28, 2003, as the record date (the "Record Date") for the Meeting. Only holders of record of Class A Subordinate Voting Shares and Class B Shares as of the close of business on the Record Date are entitled to receive notice of and to attend and vote at the Meeting, except that, in accordance with applicable law, a transferee of Class A Subordinate Voting Shares or Class B Shares acquired after the Record Date shall be entitled to vote at the Meeting if such transferee produces properly endorsed share certificates or otherwise establishes ownership of such shares, and has demanded not later than ten days before the Meeting that the name of such transferee be included in the list of shareholders entitled to vote at the Meeting.

VOTING SECURITIES AND THEIR PRINCIPAL HOLDERS

As at March 28, 2003, there were issued and outstanding 36,154,299 Class A Subordinate Voting Shares. Holders of Class A Subordinate Voting Shares as at the time of taking any vote on the date of the Meeting are entitled to cast one (1) vote per Class A Subordinate Voting Share held by them on each matter to be acted on at the Meeting.

As at March 28, 2003, there were issued and outstanding 31,909,091 Class B Shares. Holders of Class B Shares as at the time of taking any vote on the date of the Meeting are entitled to cast twenty (20) votes per Class B Share held by them on each matter to be acted on at the Meeting.

The following table sets forth information with respect to the only shareholders known to the directors or officers of the Corporation who own beneficially, directly or indirectly, or exercise control or direction over, more than 10% of the issued and outstanding Class A Subordinate Voting Shares or Class B Shares of the Corporation, as at March 28, 2003:

| | Class of Shares

| | Number of Shares

| | Per Cent of Class

|

|---|

| Magna International Inc.(1) | | Class A Subordinate Voting | | 8,333,333 | | 23.0% |

| 1265058 Ontario Inc.(2) | | Class A Subordinate Voting | | 6,604,816 | | 18.3% |

| Magna International Inc.(1) | | Class B | | 24,957,125 | | 78.2% |

| 1265058 Ontario Inc.(2) | | Class B | | 6,951,966 | | 21.8% |

- (1)

- The Stronach Trust controls Magna International Inc. ("Magna") through the right to direct the votes attached to Magna's Class B shares. Mr. Frank Stronach, a former director of the Corporation (resigned September 16, 1998) and the founder and Chairman of Magna and Ms. Belinda Stronach, a director and Chairman of the Corporation and the President and Chief Executive Officer of Magna, together with two other family members, are the trustees of the Stronach Trust. Mr. Stronach and Ms. Stronach are also two of the members of the class of potential beneficiaries of the Stronach Trust.

- (2)

- 1265058 Ontario Inc. ("1265058") is a wholly-owned subsidiary of Magna.

The Corporation has been advised that Magna and 1265058 intend to vote their respective Class A Subordinate Voting Shares and Class B Shares, as applicable, for the election as directors of the management nominees named in this Circular and for the reappointment of Ernst & Young L.L.P. as Auditor, based on the recommendation of the Audit Committee of the Board of Directors, and the authorization of the Audit Committee to fix the Auditor's remuneration.

2

Share Transfer Restrictions

Under applicable Canadian law, an offer to purchase Class B Shares would not necessarily result in an offer to purchase Class A Subordinate Voting Shares. Magna and 1265058, as the holders of all the issued and outstanding Class B Shares, are parties to an agreement (the "Trust Agreement") with Computershare Trust Company of Canada (the "Trustee") and Decoma for the purpose of ensuring that the holders from time to time of the Class A Subordinate Voting Shares will not be deprived of any rights under applicable take-over bid legislation to which they would have been entitled in the event of a take-over bid (which term includes, in certain circumstances, a private offer to purchase) if the Class B Shares and the Class A Subordinate Voting Shares were a single class of shares.

Under the Trust Agreement, Magna and 1265058 have agreed not to sell any Class B Shares, directly or indirectly, pursuant to a take-over bid, as defined under theSecurities Act (Ontario), in circumstances in which theSecurities Act (Ontario) would have required the same offer or a follow-up offer to be made to holders of Class A Subordinate Voting Shares if the sale had been a sale of Class A Subordinate Voting Shares rather than Class B Shares, but otherwise on the same terms. This prohibition will not apply if: (i) such sale is made pursuant to an offer to purchase part only of the Class B Shares made to all or any holders of the Class B Shares and an identical offer in all material respects is made concurrently to purchase the Class A Subordinate Voting Shares, which identical offer has no condition attached other than the right not to take up and pay for shares tendered if no shares are purchased pursuant to the offer for Class B Shares, or (ii) there is a concurrent unconditional offer to purchase all the Class A Subordinate Voting Shares at a price per share at least as high as the highest price per share paid pursuant to the take-over bid for the Class B Shares.

The Trust Agreement contains provisions for the authorization of action by the Trustee to enforce the relevant rights of the holders of the Class A Subordinate Voting Shares as beneficiaries of the trust. The obligation of the Trustee to take such action is conditional on Decoma or the holders of the Class A Subordinate Voting Shares providing such funds and indemnity as the Trustee may require. No holder of the Class A Subordinate Voting Shares has the right, other than through the Trust Agreement, to institute any action or proceeding or to exercise any other remedy to enforce any rights arising under the Trust Agreement unless the Trustee fails to act on a request authorized by holders of not less than 10% of the outstanding Class A Subordinate Voting Shares after provision of reasonable funds and indemnity to the Trustee.

The Trust Agreement further provides that Magna and 1265058 will not dispose of any Class B Shares, directly or indirectly, unless the disposition is conditional upon the person or company acquiring such shares becoming a party to the Trust Agreement. Conversions of Class B Shares into Class A Subordinate Voting Shares and the subsequent sale of the Class A Subordinate Voting Shares resulting from such conversion are excluded from this prohibition.

The Trust Agreement provides that it may not be amended and no material provision thereof may be waived, except with the approval of the Toronto Stock Exchange (the "TSX") and at least two-thirds of the votes cast by the holders of the Class A Subordinate Voting Shares present or represented at a meeting duly called for the purpose of considering such amendment or waiver. The two-thirds majority must include a simple majority of the votes cast by holders of the Class A Subordinate Voting Shares excluding any principal shareholder of Decoma (see "Voting Securities and Their Principal Holders") and their affiliates and associates and any persons who have an agreement to purchase Class B Shares on terms which would constitute a sale for the purposes of the Trust Agreement which would not otherwise be permitted thereunder prior to giving effect to the amendment or waiver.

The Trust Agreement does not prevent the holder of any Class B Shares from:

- (i)

- Granting a security interest, whether directly or indirectly, in Class B Shares in connection with abona fide borrowing, provided that the secured party concurrently agrees in writing to become a party to and abide by the terms of the Trust Agreement; or

- (ii)

- Selling, transferring or otherwise disposing of any or all of the Class B Shares which the holder directly or indirectly holds to a company controlled by or under common control with the holder, provided further that the transferee (if not already a party to the Trust Agreement) concurrently agrees in writing to become a party to and abide by the terms of the Trust Agreement.

3

No provision of the Trust Agreement limits the rights of any holder of the Class A Subordinate Voting Shares under applicable securities legislation.

FINANCIAL STATEMENTS AND AUDITOR'S REPORT

Management, on behalf of the Board, will submit to the shareholders at the Meeting the Consolidated Financial Statements of the Corporation for the year ended December 31, 2002, and the Report of the Auditor thereon, but no vote by the shareholders with respect thereto is required or proposed to be taken. The Consolidated Financial Statements and Auditor's Report are included in the Corporation's 2002 Annual Report which is being mailed to shareholders with the Notice and this Circular.

MATTERS TO BE ACTED ON AT THE MEETING

ELECTION OF DIRECTORS

Under the Corporation's restated articles of incorporation dated April 14, 1998 (the "Articles"), the Board consists of a minimum of three and a maximum of fifteen directors. A special resolution passed by the shareholders of the Corporation on March 2, 1998, authorizes the directors to determine the number of directors of the Corporation from time to time. The number of directors is currently fixed at eight. The term of office of each director expires at the time of the Meeting unless successors are not elected, in which case the directors remain in office until their successors are elected by the shareholders of the Corporation.

Management proposes to nominate, and the persons named in the accompanying form of proxy will vote for (in the absence of specifications or instructions to abstain from voting on the proxy), the election of the eight persons whose names are set forth below, all of whom are now and have been directors of the Corporation for the periods indicated, but will not vote for a greater number of persons than the number of nominees named in the form of proxy.A shareholder may withhold his/her vote from any individual nominee by striking a line through the particular nominee's name in the form of proxy. Management does not contemplate that any of the nominees will be unable to serve as a director. If, as a result of circumstances not now contemplated, any nominee is unavailable to serve as a director of the Corporation, the proxy will be voted for the election of such other person or persons as management (in consultation with the then remaining directors) may select. Each director elected will hold office until the close of the next annual meeting of the shareholders of the Corporation, or until his/her respective successor is elected or appointed in accordance with applicable law and the Corporation's by-laws.

4

The following table sets forth information with respect to each of the eight management nominees for director, including the number of Class A Subordinate Voting Shares and Class B Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, by each such nominee, as at March 28, 2003:

Name and Residence of Nominee

| | Age

| | Director Since

| | Other Positions and Offices Presently Held with the Corporation

| | Principal Occupation

| | Class A Subordinate Voting Shares

| | Class B Shares

|

|---|

Neil G. Davis(5)

Brampton, Ontario | | 47 | | April 16, 2001 | | None | | Partner, Davis Webb Schulze & Moon LLP (barristers & solicitors) | | 1,870 | | Nil |

Robert J. Fuller(1),(2),(3),(5)

Toronto, Ontario |

|

61 |

|

March 2, 1998 |

|

None |

|

Senior Partner, Miller Thomson LLP (barristers & solicitors) |

|

4,000 |

|

Nil |

Jennifer J. Jackson(1),(3),(5)

Toronto, Ontario |

|

54 |

|

March 2, 1998 |

|

None |

|

President, Berger Jackson Capital Services, Inc.

(private investment funds) |

|

5,300 |

|

Nil |

Frank E. Macher(2),(5)

Ann Arbor, Michigan |

|

62 |

|

January 6, 1999 |

|

None |

|

Chairman of the Board and Chief Executive Officer,

Federal-Mogul Corporation

(auto parts manufacturer) |

|

Nil |

|

Nil |

John T. Mayberry(1),(5)

Burlington, Ontario |

|

58 |

|

March 2, 1998 |

|

None |

|

Chair of the Board and Chief Executive Officer, Dofasco Inc. (steel manufacturer) |

|

10,700 |

|

Nil |

Alan J. Power(3),(5)

King City, Ontario |

|

40 |

|

December 3, 1997 |

|

President and Chief Executive Officer |

|

President and Chief Executive Officer of the Corporation |

|

69,000 |

|

Nil |

Belinda Stronach(2),(5)

Aurora, Ontario |

|

36 |

|

April 16, 2001 |

|

Chairman of the Board

(non-executive) |

|

President and Chief Executive Officer, Magna International Inc. |

|

2,300 |

|

(4) |

Siegfried Wolf

Weikersdorf, Austria |

|

45 |

|

April 2, 2002 |

|

None |

|

Executive Vice-Chairman,

Magna International Inc. |

|

10,000 |

|

Nil |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Compensation and Corporate Governance Committee.

- (3)

- Member of the Health and Safety and Environmental Committee.

- (4)

- See "Voting Securities and Their Principal Holders".

- (5)

- On March 25, 2003, the Board of Directors revised the names, responsibilities and membership of certain of its standing committees. As a result, the Audit and Corporate Governance Committee and the Human Resources and Compensation Committee have been renamed, respectively, the Audit Committee and the Compensation and Corporate Governance Committee. For convenience, the new designations will be used in this circular when referring to these committees and their activities. See "Report on Corporate Governance — Statement of Corporate Governance Practices".

Each of the nominees has held the principal occupation identified above for the past five years with the exception of:

- (1)

- Mr. Macher was appointed Chief Executive Officer of Federal-Mogul Corporation on January 11, 2001 and Chairman of the Board on October 1, 2001. He served as President and Chief Executive Officer of ITT Automotive, Inc. from June 1997 to January 1999, and had been employed with Ford Motor Company in executive capacities for some 30 years prior to that time, serving most recently as Vice-President and General Manager, Automotive Components Division.

5

- (2)

- Ms. Stronach was appointed President and Chief Executive Officer of Magna on January 14, 2002. Prior to this appointment, Ms. Stronach served as Vice-Chairman and Chief Executive Officer of Magna since February 2001, Executive Vice-President of Magna from October 1998 and prior to that time was Vice-President of Magna's Diversa Group. Ms Stronach was appointed Chairman of Decoma on February 18, 2002.

- (3)

- Mr. Wolf is an Executive Vice-Chairman (since May 2002) and a director of Magna. He was a Vice-Chairman of Magna from March 1999 to February 2001 and from January 2002 to May 2002. Mr. Wolf was the President and Chief Executive Officer of Magna Steyr LLC from February 2001 to October 2002 and prior to that was President of Magna Europe from July 1995 to February 2001.

All nominees have been and will be granted options to purchase Class A Subordinate Voting Shares under the Corporation's Amended and Restated Incentive Stock Option Plan, effective upon their election as a director and, in the case of the Corporation's outside directors, upon the completion of every five year period of continuous service as a director.

All of the eight management nominees were elected as directors by the shareholders of the Corporation at the annual meeting of shareholders held on May 6, 2002.

There are no contracts, arrangements or understandings between any management nominee and any other person (other than the directors and officers of the Corporation acting solely in such capacity) pursuant to which the nominee has been or is to be elected as a director.

Failure by the Corporation to meet the requirements of its Corporate Constitution (the "Corporate Constitution") relating to the payment of "Required Dividends" (as defined in the Corporate Constitution) or the minimum return on stated capital required by the terms of the Class A Subordinate Voting Shares will entitle the holders of the Class A Subordinate Voting Shares, as a class, to certain rights to elect directors, the exercise of which could result in changes in the composition of the Board as discussed below under "Report on Corporate Governance — Corporate Constitution".

The directors and officers of the Corporation as a group (14 persons) owned beneficially or exercised control or direction over 176,125 Class A Subordinate Voting Shares, or approximately 0.5% of the class, and none of the Class B Shares, as at March 28, 2003. See also "Voting Securities and Their Principal Holders".

REAPPOINTMENT OF AUDITOR

At the Meeting, pursuant to the recommendation and nomination of the Audit Committee, the shareholders will be asked to reappoint Ernst & Young L.L.P. as the Auditor of the Corporation. Ernst & Young L.L. P. has been the Auditor of Decoma and its predecessors since 1989. The persons named in the accompanying form of proxy will, in the case of a ballot and in the absence of specifications or instructions not to vote (abstain) on the form of proxy, vote for the reappointment of Ernst & Young L.L.P. as the Auditor of the Corporation to hold office until the next annual meeting of shareholders of the Corporation, based on the recommendation of the Audit Committee, and the authorization of the Audit Committee to fix the Auditor's remuneration.

Representatives of Ernst & Young L.L.P. are expected to attend the Meeting and will have an opportunity to make a statement if they so desire. Such representatives are also expected to be available to respond to appropriate questions.

REPORT OF THE AUDIT COMMITTEE

Audit Committee

The Audit Committee, pursuant to the Corporation's by-laws and its Charter, has responsibility to oversee the Corporation's financial affairs as well as the specific responsibility to review the Corporation's quarterly and annual financial statements and other financial information and report to the Board on these matters. In addition, this committee is responsible for evaluating the performance of, reviewing the independence of, reviewing and approving the annual fees of and making recommendations to the shareholders of the

6

Corporation as to the annual appointment of the Auditor. Part of the committee's responsibilities involves the review and approval of the Corporation's disclosure regarding Management's Discussion and Analysis of Results of Operations and Financial Position prior to its inclusion in the Corporation's Annual Report and quarterly reports to shareholders. The committee has certain responsibilities relating to internal and external audits, internal controls and procedures, the application of accounting principles, financial reporting and integrity, guidance, risk assessment and other matters. The committee met six times during fiscal 2002 with management, representatives of the Auditor and representatives of the Corporation's Internal Audit Department, both together and separately in each case.

All members of the committee are considered by the Corporation to be "unrelated" under the TSX Guidelines for effective corporate governance. See "Report on Corporate Governance — Items 2 and 3 of the TSX Guidelines".

The committee periodically reviews and reassesses the adequacy of its Charter. The committee has considered the effect of the various audit committee reforms set forth in the Sarbanes-Oxley Act of 2002 ("SOX") and in the proposed listing requirement reforms of The Nasdaq Stock Market, Inc. ("NASDAQ") on the committee's existing Charter and the form of possible amendments to be made to reflect these matters. Subject to the finalization of the various reforms that remain outstanding, the committee anticipates that these Charter amendments will be adopted during the course of 2003. The current Charter dated May 12, 2000, was attached to the Corporation's Management Information Circular dated November 6, 2000.

7

Auditor Independence

The committee has discussed with the Auditor its independence from management and the Corporation and has considered whether the provision of non-audit services is compatible with maintaining the Auditor's independence. Fees paid to the Auditor for services provided in fiscal 2002 and fiscal 2001 were as follows:

| | Fiscal 2001

| | Fiscal 2002

|

|---|

| Audit services(1) | | US$699,798 | | US$689,953 |

| Audit-related services(2) | | US$119,344 | | US$58,831 |

| Tax services(3) | | US$216,297 | | US$240,179 |

| Other services(4) | | Nil | | US$29,375 |

- (1)

- Includes all fees in respect of services performed in order to comply with generally accepted auditing standards ("GAAS"). In some cases, these may include an appropriate allocation of fees for tax services or accounting consultations, to the extent such services were necessary to comply with GAAS.

- (2)

- Generally consists of fees paid in respect of assurance and related services (e.g., due diligence), including such things as employee benefit plan audits, due diligence relating to M&A, accounting consultations and audits in connection with acquisitions, internal control reviews, attest services that are not required by statute or regulation and consultation concerning financial accounting and reporting standards.

- (3)

- Includes all fees paid in respect of services performed by the Auditor's tax professionals, except those services required in order to comply with GAAS which are included under "Audit services". Tax services include tax compliance, tax planning and tax advice.

- (4)

- Consists of fees in respect of all services not falling under any of the foregoing categories.

For the period commencing October 2002 to and including December 31, 2003, the committee began pre-approving all fees to be paid to the Auditor and has established a process for the approval of all such fees.

Audit Committee Report

In connection with the Consolidated Financial Statements for the fiscal year ended December 31, 2002, the committee has (i) reviewed and discussed the audited Consolidated Financial Statements with senior management, (ii) discussed with the Auditor the matters required to be discussed by the Canadian Institute of Chartered Accountants ("CICA") and the U.S. Statement on Auditing Standards No. 61 (Communication with Audit Committees) as amended, (iii) received and reviewed with the Auditor the written disclosures and related letter from the Auditor required by the CICA and U.S. Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and discussed with the Auditor the independence of the Auditor as auditor of the Corporation and (iv) reviewed with the Auditor its Audit Report on the Consolidated Financial Statements (the "Audit Report").

Management is responsible for the Corporation's internal controls and the financial reporting process. Ernst & Young L.L.P. is responsible for performing an independent audit on the Corporation's Consolidated Financial Statements in accordance with Canadian GAAS and U.S. GAAS and issuing an auditor report thereon. The committee's responsibility is to monitor and oversee these processes in accordance with its Charter.

Based on these reviews and discussions and a review of the Audit Report, the committee has recommended to the Board, and the Board has approved, the inclusion of the audited Consolidated Financial Statements in the Corporation's Annual Report, and other forms and reports required to be filed with applicable Canadian securities commissions, the Securities and Exchange Commission (the "SEC") and applicable stock exchanges in respect of the fiscal year ended December 31, 2002.

The foregoing report is dated as of March 25, 2003, and is submitted by the Audit Committee of the Board.

| John T. Mayberry | | Robert J. Fuller | | Jennifer J. Jackson |

8

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth a summary of all annual, long-term and other compensation earned for services in all capacities to the Corporation and its subsidiaries, in respect of its three most recently completed fiscal periods, with respect to individuals who were, as at December 31, 2002, the Chief Executive Officer and the four other most highly compensated executive officers (collectively, the "Named Executive Officers") of the Corporation.

| |

| | Annual Compensation (in U.S. dollars)(1)

| | Long-Term Compensation Awards

| |

|

|---|

Name and Principal Position

| | Financial Year

| | Salary

| | Bonus

| | Other Annual Compen-sation

| | Securities Under Options Granted

| | All Other Compensation

|

|---|

Alan J. Power

President and Chief Executive Officer | | 2002

2001

Stub 2000 | | US$110,000

US$110,000

US$27,774 | | US$1,885,075

US$832,755

US$258,064 | | (2) | | 100,000

100,000

— | | Nil

Nil

Nil |

S. Randall Smallbone

Executive Vice-President, Finance and Chief Financial Officer |

|

2002

2001

Stub 2000 |

|

US$108,000

US$88,000

US$27,774 |

|

US$471,268

US$305,343

US$94,623 |

|

(2) |

|

35,000

25,000

— |

|

Nil

Nil

Nil |

R. David Benson

Executive Vice-President,

Secretary and General Counsel |

|

2002

2001

Stub 2000 |

|

US$108,000

US$88,000

US$27,774 |

|

US$414,717

US$277,585

US$86,021 |

|

(2) |

|

30,000

25,000

— |

|

Nil

Nil

Nil |

Gregory J. Walton

Executive Vice-President, Sales and Marketing |

|

2002

2001

Stub 2000 |

|

US$108,000

US$88,000

US$27,774 |

|

US$414,717

US$277,585

US$86,021 |

|

(2) |

|

30,000

20,000

— |

|

Nil

Nil

Nil |

Douglas M. Harrison

Executive Vice-President, Planning & Corporate Development |

|

2002

2001

Stub 2000 |

|

US$108,000

US$88,000

US$27,774 |

|

US$282,761

US$173,490

US$53,763 |

|

(2) |

|

30,000

15,000

— |

|

Nil

Nil

Nil |

- (1)

- For fiscal year 2001, base salaries were determined in U.S. dollars. Bonus compensation, although determined in Canadian dollars, has been converted for presentation purposes into U.S. dollars at the 2001 average exchange rate of 1.54925. For Stub 2000, both base salaries and bonus compensation amounts were determined in Canadian dollars and have been converted to U.S. dollars for presentation purposes at the exchange rate of 1.5002, being the exchange rate used in connection with the conversion of the Corporation's reporting currency to U.S. dollars. For fiscal year 2002, both base salaries and bonus compensation were determined and reported in U.S. dollars.

- (2)

- Perquisites and other personal benefits do not exceed the lesser of $50,000 and 10% of the total annual salary and bonus for each Named Executive Officer.

The Named Executive Officers receive incentive bonuses which are tied to the performance of the Corporation.

Stock Option Plans, Grants and Exercises

The amended and restated incentive stock option plan (the "Stock Option Plan") enables the Corporation to provide incentive stock options and stock appreciation rights in respect of Class A Subordinate Voting Shares of the Corporation to eligible directors, senior officers, employees and consultants of the Corporation and its subsidiaries. The maximum number of shares for which options and stock appreciation rights may be granted under the Stock Option Plan is 4,100,000 Class A Subordinate Voting Shares, subject to certain adjustments. The option price is to be established at the time of the grant, but cannot be less than the closing price of the Class A Subordinate Voting Shares on the TSX (with respect to options denominated in Canadian currency) or

9

NASDAQ (with respect to options denominated in U.S. currency) on the trading day immediately prior to the date of the grants. Each option is exercisable in such manner as may be determined at the time of the grant, and options granted will be for terms not exceeding ten years. Under the Stock Option Plan, the Corporation does not provide any financial assistance to participants in order to facilitate the purchase of Class A Subordinate Voting Shares thereunder.

As at December 31, 2002, options to purchase an aggregate of 2,195,000 Class A Subordinate Voting Shares at prices ranging from $9.50 per share (being the initial public offering price for the Class A Subordinate Voting Shares) to $17.55 per share (being the market closing price(s) of the Class A Subordinate Voting Shares on the TSX on the trading day immediately prior to the date of the grant of the applicable options as required by the terms of the Stock Option Plan), were outstanding under the Stock Option Plan. The expiration dates for these options range between July 31, 2007 and June 26, 2012.

The following table sets forth certain information with respect to the grant of options under the Stock Option Plan to the Named Executive Officers during the year ended December 31, 2002:

Options Granted During the Financial Year Ended December 31, 2002, to Named Executive Officers

Name

| | Class A Subordinate Voting Shares Under Options Granted (#)

| | % of Total Options Granted in the Period

| | Exercise Price

($/Security)

| | Market Value

of Securities

Underlying Options

on the Date

of Grant

($/Security)

| | Expiration Date

|

|---|

| Alan J. Power | | 100,000 | | 23.0% | | 17.55 | | 17.55 | | June 26, 2012 |

| S. Randall Smallbone | | 35,000 | | 8.0% | | 17.55 | | 17.55 | | June 26, 2012 |

| R. David Benson | | 30,000 | | 6.9% | | 17.55 | | 17.55 | | June 26, 2012 |

| Gregory Walton | | 30,000 | | 6.9% | | 17.55 | | 17.55 | | June 26, 2012 |

| Douglas M. Harrison | | 30,000 | | 6.9% | | 17.55 | | 17.55 | | June 26, 2012 |

The following table sets forth certain information with respect to the aggregate number of unexercised options granted to the Named Executive Officers which were outstanding on December 31, 2002, and the value of such options at such date. During 2002, none of the options granted to Named Executive Officers were exercised or surrendered.

Named Executive Officers' Aggregate Option Exercises During the Year Ended December 31, 2002, and Year-End Option Values

| | Class A Subordinate Voting Shares Acquired on Exercise

| |

| | Number of Exercisable and Unexercisable Options at December 31, 2002

| | Value of Exercisable and Unexercisable Options at December 31, 2002(1)

|

|---|

| | Aggregate Value Realized on Exercise

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| |

(#)

| |

($)

| |

(#)

| |

(#)

| |

($)

| |

($)

|

|---|

| Alan J. Power | | Nil | | Nil | | 265,000 | | 220,000 | | 385,300.00 | | Nil |

| S. Randall Smallbone | | Nil | | Nil | | 69,500 | | 65,500 | | 88,140.00 | | Nil |

| R. David Benson | | Nil | | Nil | | 47,500 | | 52,500 | | 43,150.00 | | Nil |

| Gregory Walton | | Nil | | Nil | | 38,000 | | 47,000 | | Nil | | Nil |

| Douglas M. Harrison | | Nil | | Nil | | 28,500 | | 38,250 | | 1,170.00 | | Nil |

- (1)

- Based on the difference between $12.32, being the closing trading price of the Corporation's Class A Subordinate Voting Shares on the TSX on December 31, 2002, and the exercise price of the related options. All of the unexercisable options held by the Named Executive Officers were out-of-the-money as at December 31, 2002.

On February 18, 2003, an additional 425,000 options were granted to senior officers and certain employees of the Corporation, including the Named Executive Officers, and to officers of certain subsidiaries of the Corporation. On March 3, 2003, a further 30,000 options were granted to three of the Corporation's outside

10

directors on their completion of five years of continuous service as directors pursuant to the provisions of the Stock Option Plan.

Pension Plans

None of Decoma's Named Executive Officers participate in any Corporation provided pension plans. Commencing August 1, 1998, the Corporation adopted the Employee Equity Participation and Profit Sharing Program ("EPSP") to foster employee participation in the profits and share ownership of Decoma. Commencing January 1, 2001, the Corporation adopted a defined benefit pension plan option (the "Pension Plan Option") for its eligible North American employees, which operates in conjunction with the EPSP. On December 16, 2002, the Pension Plan Option was amended by resolution of the Compensation and Corporate Governance Committee to provide for the purchase of past service credits by eligible plan participants. See "Compensation and Corporate Governance Committee Report on Executive Compensation" and "Report on Corporate Governance".

Employment Contracts

The Corporation has entered into an employment contract with Mr. Power in connection with his position as President and Chief Executive Officer of Decoma. The term of the contract commenced March 2, 1998, and continues until July 31, 2003, unless earlier terminated in accordance with its terms. Mr. Power's employment contract provides for a base salary of US$110,000, an annual cash bonus based on a specified percentage of Decoma's and certain of its affiliates' adjusted pre-tax profits before profit sharing, the grant of certain stock options (see "Compensation of Directors and Executive Officers — Stock Option Plan, Grants and Exercises" above), the maintenance of the ownership of a minimum number of Decoma Class A Subordinate Voting Shares by Mr. Power, certain insurance and other fringe benefits, and certain confidentiality and non-competition obligations. The agreement also contains a termination provision permitting Mr. Power's employment to be terminated by the Corporation by giving advance written notice of termination for a prescribed period of time or by paying a retiring allowance to Mr. Power in lieu thereof in the amount of $300,000. Mr. Power may also voluntarily resign his employment with the Corporation with notice. No notice or severance payment is required for a termination for just cause or on the voluntary resignation of Mr. Power.

The Corporation has also entered into an employment contract with Mr. Smallbone in his capacity as Executive Vice-President, Finance and Chief Financial Officer. The terms of the contract commenced February 1, 1998, and continue until July 31, 2003, unless earlier terminated in accordance with its terms. Mr. Smallbone's employment contract provides for a base salary of US$108,000, an annual cash bonus based on a specified percentage of Decoma's and certain of its affiliates' adjusted pre-tax profits before profit sharing, the ownership by Mr. Smallbone of a minimum number of Decoma Class A Subordinate Voting Shares, certain insurance and other fringe benefits, as well as certain confidentiality and non-competition obligations. Mr. Smallbone's employment contract further provides that his employment may be terminated by the Corporation either by giving advance written notice of termination for a prescribed period of time or by paying a retiring allowance in lieu thereof in the amount of $150,000. No notice or severance payment is required for a termination for just cause or on the voluntary resignation of Mr. Smallbone.

In their capacities as Executive Vice-President, Secretary and General Counsel, Executive Vice-President, Sales and Marketing and Executive Vice-President, Planning and Corporate Development, Messrs. Benson, Walton and Harrison, respectively, are under employment contracts with Decoma which expire on July 31, 2003, unless earlier terminated in accordance with their terms and which provide for, among other items, an annual base salary of US$108,000, an annual cash bonus based on specified percentages of Decoma's and certain of its affiliates' adjusted pre-tax profits before profit sharing, the ownership of a minimum number of Decoma Class A Subordinate Voting Shares, certain insurance and other fringe benefits, as well as certain confidentiality, non-competition severance and termination provisions.

No payments are required to be made under any employment contract with the Named Executive Officers in the event of a change in the control of the Corporation. The maximum total amount payable by the Corporation pursuant to such contracts for severance is approximately $800,000 in the aggregate, plus any annual bonus entitlement pro rated to the date of termination.

11

Directors' Compensation

Directors who are neither employees of the Corporation nor directors or officers of Magna were paid an annual retainer of $22,500 and a meeting fee of $1,000 for attendance at each meeting of the Board during 2002. Such directors were also paid an annual committee retainer of $3,000 (Committee Chairmen received an additional $5,000 annual retainer) and a meeting fee of $1,000 for attendance at meetings of each Committee of the Board on which they served. Compensation for the execution of written resolutions at the rate of $250 each was also provided to directors who are not employees of Decoma nor directors or officers of Magna. These directors are also entitled to compensation for Board and Committee work and travel days at the rate of $2,000 per day.

On March 25, 2003, the Compensation and Corporate Governance Committee amended the compensation paid to outside directors to adjust such compensation to competitive levels and to reflect the increasing demands being placed on directors' time and attention in overseeing the Corporation's affairs. The amendments also converted such fees to U.S. funds consistent with the Corporation's reporting currency. Effective as of January 1, 2003, the annual retainer has been changed from $22,500 to US$20,000, the annual Committee retainer from $3,000 to US$2,500, the annual Committee Chairman retainer from $5,000 to US$10,000, the Board and Committee meeting attendance fee from $1,000 to US$1,000, the written resolution fee from $250 to US$250 and the work/travel day fee from $2,000 to US$1,500. An annual retainer of US$10,000 has been established for the newly created position of lead director. Eligible directors are also entitled to be reimbursed for travelling and other out-of-pocket expenses incurred by them in attending meetings of the Board or any Committee

To encourage the directors to align their interests with shareholders, the Corporation has a Directors' Compensation Plan (the "Plan"). Under the Plan, outside directors may receive all or a percentage of their total directors' fees in the form of cash, Class A Subordinate Voting Shares or Directors' Deferred Share Units ("DDSUs"), each of which has a value equal to the market value of a Class A Subordinate Voting Share at the commencement of the relevant fiscal quarter. A DDSU is a bookkeeping entry credited to the account of an individual director, which cannot be converted to cash until the director ceases to be a member of the Board or the boards of directors of the Corporation's subsidiaries. The value of a DDSU, when converted to cash, will be equivalent of the market value of a Class A Subordinate Voting Share at the time the conversion takes place. DDSUs will attract dividends in the form of additional DDSUs at the same rate as dividends on Class A Subordinate Voting Shares.

None of the stock options granted to the directors under the Stock Option Plan have been exercised to date.

The total amount of directors' fees paid or deferred for 2002 was $251,800.

COMPENSATION AND CORPORATE GOVERNANCE COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The composition and mandate of the Compensation and Corporate Governance Committee are set out under "Report on Corporate Governance — Statement of Corporate Governance Practices — Item 9 of the TSX Guidelines" below. In respect of the year 2002, the Compensation and Corporate Governance Committee met on three occasions to, among other matters:

- (i)

- conduct a review of the adequacy and competitiveness of the compensation of Executive Management with reference to the report of a third party consultant retained by the committee for such purposes (which report is discussed more fully below);

- (ii)

- receive the report of the Chief Executive Officer on 2002 compensation paid to senior management of the Corporation and certain of its subsidiaries;

- (iii)

- make certain amendments and adjustments to base salary and percentage bonus amounts of certain members of senior management of the Corporation and certain of its subsidiaries based on the recommendations of the Chief Executive Officer and the findings of the above referenced compensation report;

- (iv)

- review and make recommendations regarding the grant of additional stock options to members of senior management of the Corporation and certain of its subsidiaries; and

12

- (v)

- review and approve the Corporation's proxy materials relating to executive compensation for its annual meeting held on May 6, 2002.

The committee conducted an extensive review of the salary, bonus and benefits compensation of all of the Corporation's senior management, including the Named Executive Officers, with a view to assessing the adequacy and competitiveness of such arrangements. To aid in the work of the committee, the committee retained the services of a recognized external compensation consulting firm to conduct a comparative analysis of existing compensation arrangements against a cross section of industry comparables. Based upon a review and consideration of this report's findings and a consideration of the Corporation's established compensation principles outlined below, the committee made certain adjustments to the base salary and specified percentage profit participation amounts of members of senior management of the Corporation, including the Named Executive Officers, and certain of the Corporation's subsidiaries and recommended the grant of certain options to such individuals as noted above. Having given effect to these amendments, the committee is of the view that the current compensation arrangements for such members of Executive Management are, in the aggregate, adequate and competitive with current industry standards.

Decoma has adopted the organizational and operating policies and principles utilized by Magna for many years, certain of which have been embodied in the Corporate Constitution. The Corporate Constitution balances the interests of shareholders, employees and management by specifically defining the rights of employees (including management) and investors to participate in the Corporation's profits, and reflects certain operational and compensation philosophies which align employee (including management) and shareholder interests. These philosophies and the Corporate Constitution assist in maintaining an entrepreneurial environment or culture at Decoma which encourages flexibility, productivity, ingenuity and innovation. Two key elements of this entrepreneurial culture are the emphasis on decentralization, which provides a high degree of autonomy at all levels of operation, as well as the direct participation in profits by eligible employees (including management), all of whom are also shareholders of the Corporation. It is Decoma's objective to maintain its entrepreneurial culture. Accordingly, the Corporation intends to continue to apply its established compensation philosophies, which have been essential to its ability to attract, retain and motivate skilled, entrepreneurial employees at all levels of the Decoma organization, while assisting in the alignment of the interests of Decoma's shareholders and employees.

Consistent with the Corporate Constitution, certain managers who have senior operational or corporate responsibilities receive a remuneration package consisting of a base salary (which generally is lower than comparable industry standards) and an annual incentive bonus based on direct profit participation at the operating level at which such manager is involved. All other eligible North American employees of Decoma are currently members of the Decoma DPSP. The Corporation adopted the Employee Equity Participation and Profit Sharing Program in respect of fiscal 1999 and subsequent years pursuant to which the eligible North American employees of Decoma participate in 10% of Decoma's Employee Pre-Tax Profits Before Profit Sharing (as defined in the Corporate Constitution) (see "Compensation of Directors and Executive Officers — Pension Plans"). The Decoma DPSP invests primarily in Class A Subordinate Voting Shares of the Corporation. Participating employees can allocate a portion of their share of the Decoma Employee Pre-Tax Profits Before Profit Sharing to contributions under the Pension Plan Option.

The Compensation and Corporate Governance Committee, in accordance with its mandate, is required to consider and apply, among other things, the historical operating philosophies and policies of the Corporation, including the Corporate Constitution, direct profit participation, mandatory stock ownership and use of stock options issued under the Stock Option Plan, to align the interests of management and shareholders and to create shareholder value. The Committee, therefore, applies the following criteria in determining or reviewing recommendations for compensation for management, including where applicable, the executive officers of the Corporation:

Base Salaries. Base salaries should generally be below base salaries for comparable positions within North American industrial companies (including the automotive parts supply industry) and are not customarily increased on an annual basis. As a result, fixed compensation costs are contained or reduced, with financial rewards coming principally from variable incentive compensation.

13

Incentive Compensation. The amount of direct profit participation and, therefore, the amount of compensation "at risk" increases with the level of performance and/or responsibility. Due to the variable nature of profit participation, incentive cash compensation is generally reduced in cyclical or other down periods due to reduced profits. As a result, executive officers are encouraged to emphasize consistent profitability over the medium to long term to ensure stable levels of annual compensation. Under the Corporate Constitution, the aggregate incentive bonuses paid and payable to corporate management (which includes the Named Executive Officers) in respect of any fiscal year shall not exceed 6% of the Corporation's Pre-Tax Profits Before Profit Sharing (as defined in the Corporate Constitution) for such year.

Long-Term Incentives. Minimum stock ownership in the Corporation is generally required of all profit participators (including the Named Executive Officers) in order to align their interests with those of shareholders and to encourage the enhancement of shareholder value. In addition, upon the award of options under the Corporation's Stock Option Plan, extended vesting and exercise periods are frequently used to encourage option recipients to remain as employees or senior officers of Decoma over the long term.

Written Employment Contracts. The Corporation extensively utilizes written employment contracts with its executive and senior officers and members of group or divisional management to reflect the terms of their respective employment, including compensation, severance, stock ownership, confidentiality and non-competition arrangements. Prior to the entry into, renewal and/or material amendment of employment contracts with executive or senior officers of the Corporation, the Compensation and Corporate Governance Committee reviews such officer's compensation in the context of Decoma's historical compensation philosophies and policies, such officer's individual performance and relevant industry comparators, with the objective of ensuring that the compensation payable to such officer is, in the circumstances, commensurate with the Corporation's performance and is primarily "at risk".

Decoma believes that its continued growth, strong financial returns and growth in shareholder value justify significant financial rewards for its executive and senior officers which are contingent on the continued profitability of the Corporation.

The foregoing report for the year 2002 is submitted by the Compensation and Corporate Governance Committee of the Board.

| Belinda Stronach | | Robert J. Fuller | | Frank E. Macher |

14

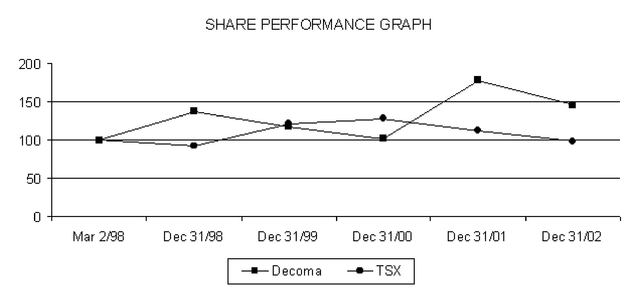

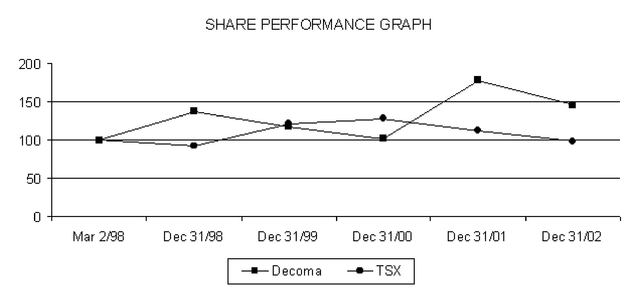

SHARE PERFORMANCE GRAPH

The following graph compares the cumulative total return (including reinvestment of dividends) for $100 invested in Class A Subordinate Voting Shares of Decoma on March 2, 1998, being the date of the completion of the initial public offering and listing of Decoma's Class A Subordinate Voting Shares on the TSX, with the cumulative total return of the TSX's S&P/TSX Composite Index, for the five subsequent calendar year-ends.

| | Mar 2/98

| | Dec 31/98

| | Dec 31/99

| | Dec 31/00

| | Dec 31/01

| | Dec 31/02

|

|---|

| Decoma Class A Subordinate Voting Shares | | 100.00 | | 137.57 | | 118.15 | | 102.49 | | 178.93 | | 146.04 |

| TSX/S&P Total Return Composite Index | | 100.00 | | 92.51 | | 121.84 | | 128.70 | | 112.52 | | 98.53 |

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

None of the directors, executive officers or senior officers of the Corporation nor any associates of such persons are or were indebted at any time during 2002 to the Corporation or its subsidiaries in connection with the purchase of the Corporation's securities or in respect of any other matter.

INTERESTS OF MANAGEMENT AND OTHER INSIDERS IN CERTAIN TRANSACTIONS

Affiliation Agreement

The Corporation is party to an affiliation agreement with Magna that provides for the payment by Decoma of an affiliation fee. On June 25, 2002, the Corporation entered into an agreement with Magna to amend the terms of its then existing affiliation agreement. The amended agreement, which became effective August 1, 2002, provides for a term of nine years and five months, expiring on December 31, 2011, and thereafter is renewable on a year-to-year basis at the parties' option. Affiliation fees payable under the amended agreement were reduced to 1% of Decoma's consolidated net sales (as defined in the agreement) from the 1.5% that previously applied. In addition, the amended agreement provides for a fee holiday on 100% of consolidated net sales derived from the particular acquisition in the calendar year in which the acquisition occurs and 50% of consolidated net sales derived from future business acquisitions in the first calendar year following the year of acquisition. The amended agreement also provided Decoma with a credit of 0.25% of Decoma's consolidated net sales for the period from January 1, 2002 to July 31, 2002, and a credit equal to 1.5% of 2001 consolidated net sales derived from the 2001 acquisition of the Autosystems lighting business and 50% of 1.25% of January 1, 2002 to July 31, 2002, consolidated net sales derived from Autosystems.

Social Fees

Decoma's corporate constitution specifies that the Corporation will allocate a maximum of 2% of its profit before tax to support social and charitable activities. Decoma fulfils this requirement principally through social

15

and charitable programs coordinated by Magna on behalf of itself and its affiliates and accordingly, pays Magna a fee which is applied for these purposes.

Administrative Services

Magna provides certain management and administration services to Decoma, including legal, environmental, immigration, tax, internal audit, treasury, information systems and employee relations services in return for a specific amount negotiated between the Corporation and Magna. In respect of 2002, the aggregate amount paid for such services was US$3.6 million.

Registration Rights Agreement

The Corporation and Magna are parties to a registration rights agreement (the "Registration Rights Agreement") pursuant to which Magna may require the Corporation's assistance in selling Class A Subordinate Voting Shares held by Magna under an offering by prospectus in Canada or in the United States. In addition, Magna has certain rights to participate in offerings of Class A Subordinate Voting Shares undertaken by the Corporation after January 1, 2004, by requiring that up to 35% of the offered shares be comprised of Magna's holdings of Class A Subordinate Voting Shares. Magna will bear all underwriter's commissions and discounts associated with any shares it sells, however, the Corporation will bear the expenses (other than underwriter's commissions and discounts) associated with the Magna share sales effected under the Registration Rights Agreement. The Corporation is not permitted to grant to any person registration rights which are superior in any fashion to those granted to Magna under the Registration Rights Agreement without Magna's approval.

Inter-Company Purchases

Decoma's manufacturing plants buy from and sell products to Magna's plants on an ongoing basis in the normal course of their business. As such, Magna is both a supplier to and customer of Decoma, and these transactions typically are on normal commercial terms. Other than the above noted matters, there have been no material transactions in 2002 in which any insider of the Corporation has had a material interest.

REPORT ON CORPORATE GOVERNANCE

The Board believes that sound corporate governance structures and practices are essential to the well-being of the Corporation and its shareholders. Decoma has adopted certain structures and procedures to ensure that effective corporate governance practices are followed and that Decoma's Board functions independently of management. These provisions are embodied in the Corporate Constitution and governance practices discussed below.

In addition to the Corporate Constitution, the Corporation is subject to a number of legislative and regulatory corporate governance requirements and guidelines including those of the TSX, the Ontario Securities Commission ("OSC"), NASDAQ and the SEC. Recently, these legislative and regulatory bodies have promulgated a number of new or modified rules and regulations in the area of corporate governance. These matters include the proposed amendments to the current TSX corporate governance guidelines, the proposed amended listing requirements of NASDAQ, the enactment of SOX (including the promulgation of rules and porposed rules by the SEC implementing the principles of SOX) and recently proposed amendments to the Ontario Securities Act in the area of continuous disclosure. The Corporation is in compliance with those provisions of the above-noted initiatives which have been implemented and which currently apply to the Corporation. The Corporation will continue to monitor and assess those initiatives that remain at the proposal stage or which currently do not apply to the Corporation with a view to making appropriate changes to the Corporation's corporate governance structures as and when these initiatives are finalized and implemented.

The following is a discussion of the Corporation's Corporate Constitution and a comparative review of the Corporation's current corporate governance practices relative to the current TSX Guidelines for corporate governance.

16

Corporate Constitution

Decoma is a majority-owned and controlled subsidiary of Magna and, together with Decoma's predecessors, has been part of the Magna family of companies since 1989. Magna's unique, entrepreneurial corporate culture includes certain principles and corporate governance practices prescribed by Magna's Corporate Constitution. Decoma has applied the same principles and corporate governance practices, and, as a separate public company, has adopted its own Corporate Constitution.

The Corporate Constitution, which forms part of Decoma's Articles, attempts to strike a balance among Decoma's stakeholders — its employees, managers and investors — by specifically defining their respective rights to participate in the Corporation's profits, while at the same time imposing certain responsibilities or disciplines on management. Elements of these rights and disciplines include:

- •

- the entitlement of shareholders to certain minimum annual dividend distributions of not less than, on average, 20% of annual after-tax profits;

- •

- the allocation of a minimum of 7% of the Corporation's pre-tax profits to research and development activities;

- •

- the allocation of a maximum of 2% of the Corporation's pre-tax profits to the support of social objectives;

- •

- the allocation of 10% of the Corporation's employee pre-tax profits to eligible employees through the Decoma Employee Equity Participation and Profit Sharing Program;

- •

- the application of incentive, profit-based compensation arrangements for management of the Corporation;

- •

- the restriction on investments by the Corporation in unrelated businesses where the amount of any such particular investment, together with all other investments in unrelated businesses, exceeds 20% of the Corporation's equity;

- •

- the requirement for a majority of the members of the Board to be individuals who are not officers or employees of the Corporation, nor persons related to such officers or employees, and that a minimum of two directors not be officers or employees of the Corporation or its affiliates (including Magna), or directors of the Corporation's affiliates (including Magna), nor persons related to any such officers, employees or directors; and

- •

- the ability of Class A Subordinate Voting shareholders to directly elect directors, if, on average, a minimum after tax return of 4% on share capital is not achieved over a rolling consecutive two fiscal year basis.

Statement of Corporate Governance Practices

The following is a statement of the Corporation's existing corporate governance practices with specific reference to the TSX Guidelines.

Item 1 of the TSX Guidelines:

The board of directors of every corporation should explicitly assume responsibility for the stewardship of the corporation, and as part of the overall stewardship responsibility, should assume responsibility for the following matters: (a) adoption of a strategic planning process; (b) identification of the principal risks of the corporation's business and ensuring the implementation of appropriate systems to manage these risks: (c) succession planning; (d) a communications policy; and (e) integrity of the corporation's internal control and management information systems.

The Board oversees the business and affairs of the Corporation, supervises the day-to-day conduct of business by senior management, establishes or approves overall corporate policies where required and involves itself jointly with management in ensuring the creation of shareholder value and the preservation and protection of the Corporation's assets. For this purpose, the Board holds regularly scheduled Board meetings on a fiscal quarterly basis, with additional meetings scheduled when required. A separate strategic planning and business

17

plan review meeting is also held each fiscal year. There were nine meetings of the Board during 2002. In addition, there is continuing communication between senior management and Board members on an informal basis and through Committee meetings.

The TSX Guidelines emphasize the stewardship responsibilities of a board to oversee the conduct of the business and to supervise management (which is responsible for the day-to-day conduct of the business) and specifically identify five matters which are regarded as the principal responsibilities to be discharged by a board. These matters, which are in addition to the Board's legal obligations under theBusiness Corporations Act (Ontario), are each considered below.

(a) Adoption of a Strategic Planning Process. The Board is directly involved in Decoma's strategic planning process. Prior to the commencement of each fiscal year, the Board participates in a meeting with management devoted solely to strategic planning in which future trends and risks in the automotive industry over a three to five year horizon are jointly identified. The strategic planning and business plan review meeting in respect of the 2002 fiscal year was held in November 2001. The Corporation's capital expenditures budget was reviewed and approved at that time. Additionally, updates on industry trends, product strategies, new product developments, major new business awards, capital expenditures and specific problem areas/action plans are presented by Decoma's management and discussed as part of a management report at each regular quarterly Board meeting.

(b) Managing Risk. By means of both the annual strategic planning meeting and quarterly updates at Board meetings, the Board identifies and reviews with management the principal business risks and receives reports of management's assessment of, and proposed responses to, those risks as they develop. This process enables the Board as a whole to actively and appropriately manage all significant risks applicable to Decoma's business. In addition, the Audit Committee itself has an important role in implementing and monitoring systems put in place to deal with the risks which fall within its mandate of reviewing the financial results of the Corporation, including the monitoring of internal and external audits of Decoma's accounts, the review and oversight of internal financial control procedures and other matters in relation to Decoma's financial affairs.

(c) Appointing, Training and Monitoring Senior Management. Decoma has continued Magna's long-established policy of profit-based compensation in order to attract, retain and motivate skilled and entrepreneurial management and employees, as reflected in the Corporate Constitution. At the corporate level, the Compensation and Corporate Governance Committee effectively reviews and implements such profit-based compensation policy to ensure that management performance (as measured by the Corporation's profitability) bears a direct relationship to their levels of compensation. Through its review of all corporate officer appointments, including the Chief Executive Officer, the Board and the Compensation and Corporate Governance Committee are directly involved in management succession and manpower planning issues. The Chief Executive Officer addresses management succession and development with the Compensation and Corporate Governance Committee as part of the annual review meeting held in respect of each fiscal year. While the responsibility for direct training has traditionally been left to senior management, the Board satisfies itself that the necessary levels of skill and experience exist when reviewing the appointments of corporate officers.

(d) Communications Policy. The Board regularly reviews and monitors the programs being implemented by management to effectively communicate with the Corporation's stakeholders, including shareholders, employees and the general public. The Chief Financial Officer and the Secretary of the Corporation are primarily responsible for initiating and responding to all shareholder communications. The Board reviews and approves all material investor communications, including press releases involving the dissemination of quarterly financial or other material information and all corporate disclosure documents. The Corporation has adopted a corporate disclosure policy which, among other matters,

18

formalizes the above practices. This policy was reviewed and amended in March of 2003 to reflect the establishment of a corporate disclosure committee comprised of members of senior management which has been charged with formal responsibility for reviewing and approving the Corporation's public disclosure communications and regulatory filings. This committee reports to the Chief Executive Officer, the Chief Financial Officer and to the Audit Committee of the Board. The Corporation also places great emphasis on its employee communications programs, including the management of its Employee's Charter. These programs include monthly employee communications meetings, the publication of employee newsletters, divisional employee opinion surveys and, through the Corporation's continued affiliation with Magna, the maintenance of an employee hotline and divisional fairness committees to directly address individual employee concerns.

(e) Integrity of Internal Control and Management Information Systems. The Board, through the Audit Committee, has ensured that effective systems are in place to monitor the integrity of the Corporation's internal control and management information systems in its delegated areas. The Audit Committee meets quarterly prior to, and reports at, each quarterly Board meeting. During these meetings, the Audit Committee meets with both internal and external auditors to review the Corporation's internal control and management information systems. Additionally, management formally reports to the Environmental and Health and Safety Committee on an annual basis the status of all material environmental and occupational health and safety matters affecting the Corporation and its operating divisions, as such matters may arise from the divisional environmental and health and safety audit programs maintained by Decoma. In the event that these monitoring and review systems reveal material environmental or health and safety non-compliance issues (which, to date, has not been the case), management would promptly communicate such matters to the Board, together with proposed budgets and remediation plans, for review and consideration by the Board. In keeping with Decoma's commitment in the Employee's Charter to maintain safe and healthful workplaces, employees at all levels are encouraged to communicate to management and, where appropriate, directly to the Board, all concerns and incidents relating to environmental and health and safety issues.

Items 2 and 3 of the TSX Guidelines:

The Board of directors of every corporation should be constituted with a majority of individuals who qualify as "unrelated directors". An unrelated director is a director who is independent of management and is free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director's ability to act with a view to the best interests of the corporation, other than interests and relationships arising from shareholding. A related director is a director who is not an unrelated director. If the corporation has a significant shareholder, in addition to a majority of unrelated directors, the board should include a number of directors who do not have interests in or relationships with either the corporation or the significant shareholder. A significant shareholder is a shareholder with the ability to exercise a majority of the votes for election of the board of directors.

The application of the definition of "unrelated director" to the circumstances of each individual director should be the responsibility of the board which will be required to be disclosed on an annual basis whether the board has a majority of unrelated directors or, in the case of a corporation with a significant shareholder, whether the board is constituted with the appropriate number of directors which are not related to either the corporation or the significant shareholder. Management directors are related directors. The board will also be required to disclose on an annual basis the analysis of the application of the principles supporting this conclusion.

As noted above, the Corporate Constitution requires that a majority of the members of the Board be individuals who are not officers or employees of the Corporation, nor persons related to such officers or employees, and that a minimum of two directors not be officers or employees of the Corporation or its affiliates (including Magna), or directors of the Corporation's affiliates (including Magna), nor persons related to such officers, employees or directors.

19

In order to assess the Corporation's compliance with the TSX Guidelines and its Corporate Constitution, the Board has considered the circumstances of each of the members of the Board and have concluded that Messrs. Davis, Fuller, Macher and Mayberry and Ms. Jackson are "unrelated directors" within the meaning of the TSX Guidelines as they are "free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director's ability to act with a view to the best interests of the corporation, other than interests and relationships arising from shareholding". Mr. Fuller has represented Magna and the Stronach Trust periodically since 1969 and has advised the Board that the dollar value of the fees from this representation have not been material. Accordingly the Board considers Mr. Fuller to be an "unrelated director" within the meaning of the TSX Guidelines. Mr. Macher is the Chairman and Chief Executive Officer of Federal-Mogul Corporation, an automotive parts manufacturer which has no supplier relationship with Decoma and which is not considered to be in competition with Decoma in any material respect. The Board considers Mr. Macher to be an "unrelated director" within the meaning of the TSX Guidelines. Mr. Mayberry is the Chair of the Board and Chief Executive Officer of Dofasco Inc., a manufacturer of flat-rolled steel and tubing products used in the manufacture of automobiles and automotive parts. Decoma does not purchase significant levels of steel products from Dofasco. The Board has considered Dofasco's supplier relationship with Magna and has concluded that it does not affect Mr. Mayberry's independence as a director of Decoma and therefore considers him to be an "unrelated director" within the meaning of the TSX Guidelines.