QuickLinks -- Click here to rapidly navigate through this documentEXHIBIT 99.1

[PHOTO]

outfront

DECOMA INTERNATIONAL INC.

Annual Report 2003

DECOMA INTERNATIONAL INC. is a full service supplier of exterior vehicle appearance systems for the world's automotive industry. Decoma designs, engineers and manufactures automotive exterior components and systems which include fascias (bumpers), front and rear end modules, plastic body panels, roof modules, exterior trim components, sealing and greenhouse systems and lighting components for cars and light trucks (including sport utility vehicles and mini vans).

All amounts in this Annual Report are expressed in U.S. dollars unless otherwise noted.

CONTENTS

| Up Front — Financial Highlights | | 1 |

| Front-page News — 2003 Achievements | | 2 |

| Front and Centre — To Our Shareholders | | 4 |

| Frontline — Employee Shareholders and Employee's Charter | | 6 |

| New Frontiers | | 8 |

| Front Runners | | 10 |

| Front-to-Back | | 12 |

| Financial Review | | 14 |

This Annual Report contains forward looking statements within the meaning of applicable securities legislation. As such, readers are specifically referred to the "Forward Looking Statements" section of the Management's Discussion and Analysis of Results of Operations and Financial Position set out on page 34 of this report.

up front

FINANCIAL HIGHLIGHTS

|

|

|---|

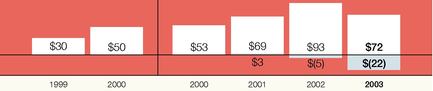

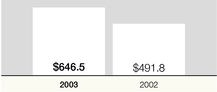

Sales

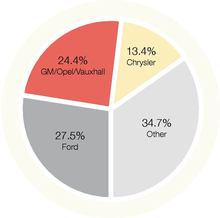

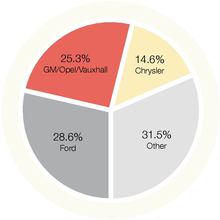

(millions) | Consolidated Sales By Customer |

Years ended July 31 Years ended December 31

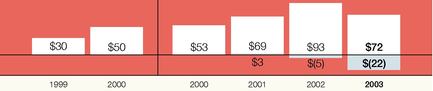

Net Income

(millions)

Years ended July 31 Years ended December 31

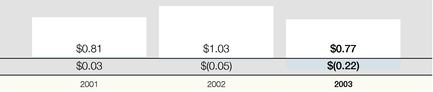

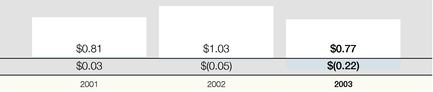

Diluted Earning Per Share

Years ended December 31

Capital Expenditures and Investments, Net

(Excluding business acquisitions and dispositions) (millions)

Years ended July 31 Years ended December 31 |

2003

2002 |

Impact of "Other charges" and "Other income" as disclosed in the Company's consolidated financial

statements, included elsewhere herein.

Annual Report 2003 1

front-page news

2003 FINANCIAL ACHIEVEMENTS

- •

- Total sales reach a record $2,356 million, increasing 15% over the previous year, despite unprecedented pricing pressure from OEMs and lower vehicle production volumes in North America and Europe.

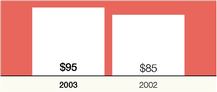

- •

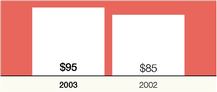

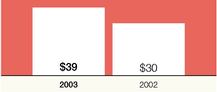

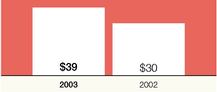

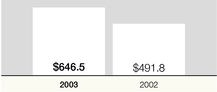

- Average content per vehicle increases from $85 to $95 in North America, and from $30 to $39 in Europe. North American production sales increase 8% to $1,507 million and in Europe production sales increase 31% to $647 million.

- •

- Decoma's North American business with new domestic Asian and European OEMs continues to grow.

2003 OPERATING ACHIEVEMENTS

- •

- Performance remains extremely strong in North America. In Europe, Decoma completes a comprehensive review and undertakes decisive action to improve operating performance.

- •

- The forward lighting assets of Federal Mogul are successfully integrated into Autosystems, adding new facilities in Mexico and Ohio and an engineering centre in Virginia.

- •

- Decoma secures its first contract incorporating a TPV application for sealing systems.

- •

- Decoma expands its global presence, launching four new facilities in Europe and continues to construct a new mould and paint facility in the southern United States. Investments in major capital projects are on time and on budget.

DECOMA'S GLOBAL FACILITIES

Manufacturing Facilities

| | Product Development and Engineering Facilities

|

|---|

| Austria | | 1 | | Mexico | | 2 | | Canada | | 1 | | Japan | | 1 |

| Belgium | | 3 | | Poland | | 1 | | Czech Republic | | 1 | | United Kingdom | | 1 |

| Canada | | 19 | | United Kingdom | | 2 | | France | | 1 | | United States | | 2 |

| Germany | | 7 | | United States | | 6 | | Germany | | 1 | | | | |

DECOMA'S PRODUCT RANGE

| |

| |

| |

|

|---|

| • Front End Modules | | • Claddings | | • Hard Tonneaus | | • Window Surround |

| • Lighting | | • Running Boards | | • Light Bars | | Modules |

| • Front Fenders | | • Rear Fenders | | • "C" Pillars | | • Sealing Systems |

| • Wheel Opening | | • Rear End Modules | | • "B" Pillars | | • Grilles |

| Mouldings | | • Rear Tail Lamps | | • Roof Modules | | • Specialty Vehicle Packages |

DECOMA'S TOP FIVE PLATFORMS

North America

| | Europe

|

|---|

• Ford Explorer

• Chrysler Sebring/Stratus

• Ford Crown Victoria/

Grand Marquis | | • Chrysler Ram Pick-Up

• Chrysler Intrepid/

300M/Concorde | | • Mercedes Benz C Class

• VW Group T5 Transit Van

• Opel Epsilon | | • Audi B6 (A4)

• BMW Mini |

2

[PHOTOS]

Roof Module |

|

VWT5 Front End Module |

|

Composite Tailgate |

| Exterior Appearance Package | | Aston Martin Headlamp | | Porsche 911 Rear Fascia |

| Composite Running Board | | Automated Roof Rack | | Lexus Grille |

FRONT AND CENTRE

TO OUR SHAREHOLDERS

2003 was another tremendous year for Decoma. Total sales and content per vehicle increased to record levels in both North America and Europe, despite lower vehicle production volumes. The last 12 months were marked by unprecedented pricing pressure from our OEM customers, however, we were able to offset these pressures in North America thanks to the positive impact of recent acquisitions, new facility and program start-ups, take-over business and productivity improvements.

We continued to expand our global reach with the construction of a new mould and paint facility in the southern United States and a new paint facility in Belgium. We also enhanced our front end module presence in Europe with new facilities in Austria, Belgium and Poland. These investments will further our market leadership and position Decoma for sales and earnings growth in the coming years.

We also made excellent progress in our content per vehicle growth through the second quarter acquisition of the forward lighting original equipment assets of Federal Mogul, which resulted in the addition of new facilities in Mexico and Ohio and an engineering centre in Virginia. This acquisition, when combined with the earlier acquisition of Autosystems and organic growth in this segment, has positioned Decoma as a leading player in North America's automotive forward lighting market. This growth is integral to our strategy to meet our customers' increasing demand for more fully integrated front end module systems.

FINANCIAL OVERVIEW

Total sales for 2003 grew to a record $2,356 million compared with $2,057 million in 2002. Currency translation had a positive impact on Decoma's sales: excluding this impact, total sales still increased by a healthy 5%.

Reported operating income, net income and diluted earnings per share declined in 2003 to $151.2 million, $71.9 million and $0.77, respectively, primarily as a result of the United Kingdom impairment and continental Europe paint consolidation charges.

Excluding other charges, other income and the future net tax liability revaluation as a result of changes to Ontario future tax rates, operating income and net income declined $7.0 million and $2.5 million respectively. This decline is the result of new facility investments, combined with customer pricing pressures, the changeover of a number of large production programs in North America, operating losses from certain European operations and lower production volumes on certain high content programs. These declines, in combination with the issuance of Convertible Debentures in 2003, resulted in a decline in diluted earnings per share of $0.08.

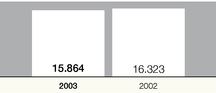

NORTH AMERICA: MOMENTUM REMAINS STRONG

The momentum we've built in recent years in Decoma's North American operations remains strong. Despite a decline in vehicle production volumes to 15.9 million units from 16.3 million units in 2002, North American production sales grew 8% to $1,507 million, while content per vehicle grew from $85 to a record $95. This growth was driven by the positive effects of currency translation, the previously noted acquisition of Federal Mogul's forward lighting operations, take-over business, sales on previously launched programs and strong volumes on certain high content platforms. As the demand for more fully integrated systems increases, Decoma is positioned to capitalize on this opportunity, which will in turn result in expanded content per vehicle.

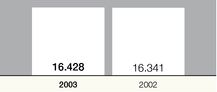

EUROPE: DECISIVE ACTION

European sales and content per vehicle grew in 2003, despite virtually level European vehicle production volumes of 16.4 million units in 2003 compared to 16.3 million units in 2002. Production sales grew to $647 million, while content per vehicle grew from $30 to $39. This growth was driven by the addition of new facilities in late 2002 and in 2003, including new facility start-ups in Austria, Germany, Poland and in Belgium, with the Company's new paint line and the take-over of an existing assembly and sequencing facility. European sales and content growth also benefited from currency translation and continued growth in our front end module business.

While we're encouraged by these gains, profitability in certain European operations did not meet our expectations. In response, we took decisive action in the fourth quarter by implementing management changes, conducting a review of our continental European operating facilities and intensifying our efforts to apply proven operating best practices throughout our European operations.

In connection with this review, we have now undertaken rationalizing certain of our German and Belgium painting operations with a view to optimizing our manufacturing and paint capacity utilization in these regions. Certain of these actions resulted in the previously announced charges taken in the fourth quarter, which total approximately $11.4 million.

4 Decoma International Inc.

We are confident that this is the most appropriate strategy to reduce operating overheads and improve long-term earnings at these German and Belgium facilities in 2005 and beyond.

In conjunction with our continental Europe review, we also completed our review of the United Kingdom marketplace and determined that we needed to write-down the carrying value of certain of our long-lived assets in this market. This write-down, which totalled $12.4 million, will have no impact on our United Kingdom operations going forward.

FROM CHALLENGES TO OPPORTUNITIES

Our North American domestic OEM customers remain locked in a competitive battle for market share that shows no sign of abating. As a result, Decoma continues to be under intense pricing pressure from our customers. In response to these challenges, Decoma has continued to develop innovative strategies, products and technologies, which we believe will provide the Company with a distinct advantage over our competitors.

Decoma has also been able to leverage the growth of new domestic OEMs in North America into new opportunities for our North American and European businesses. In 2003 we secured a number of new domestic OEM contracts, primarily for our trim products. These inroads provide an excellent foundation for developing relationships with our new domestic customers, as well as the opportunity to showcase highly engineered products such as lighting and lift gate modules.

We're meeting the pressure of pricing demands head-on, by applying the most innovative thinking in the industry to our products and processes in order to drive out costs and improve productivity. This push for continuous improvement has long been an integral part of the Decoma culture. Actively rewarding employees at every level of the organization for proposing ideas to reduce costs and improve profits makes Decoma a highly rewarding place to work, while at the same time positioning the Company to offset competitive pressures more effectively than our competitors.

In 2003, for example, more than 2,500 individual employees were involved in our Winning Teams program, which rewards employees for submitting proposals that result in measurable cost reductions or productivity gains. This enthusiastic involvement resulted in more than 600 submissions for improvements.

In 2001, Decoma incorporated Six Sigma into our culture as a problem-solving methodology for driving productivity, quality and business improvements. To date, 31 Decoma divisions are participating in Six Sigma activities, with 58 employees specially trained to apply Six Sigma problem-solving tools and methodologies. Eighty-six projects have been completed so far, allowing us to achieve significant annual savings, and we plan to expand Six Sigma in 2004.

Ideas in Motion is a program that rewards Decoma employees for proposing commercially viable ideas for products, processes and strategies. In 2003, we received 178 proposals, some of which have led to new patent applications.

In addition, the considerable investment — a minimum of 7 percent of pretax profit — the Company makes each year in research and development helps us introduce innovative, effective products and technologies to meet pricing demands while creating high-value, functional solutions that appeal to OEMs and their customers.

OUT IN FRONT

It's an achievement to be out in front. It's an even greater challenge to remain there. The coming year will be another year of significant investment to solidify our position as one of the world's leading suppliers of exterior components and systems. We have a record number of program launches in 2004, which will lay critical groundwork for success well into the future. The investments made in new programs and facilities in 2003 and continuing into 2004 will strengthen our market leadership and position Decoma for even greater growth.

Our commitment to improving operating performance in Europe will remain a top priority. We'll continue to expand into new market segments, particularly lighting and composites, which offer excellent growth opportunities.

In closing, I wish to thank our Board of Directors, our shareholders and the entire Decoma team. It is their dedication, creativity, skill and collaboration that keep Decoma out in front.

[SIGNATURE]

Alan J. Power

President and Chief Executive Officer

Annual Report 2003 5

| Autosystems America — Ohio, U.S.A. | | Decoform — Saarland, Germany | | Decoma Graz — Steiermark, Austria |

| Merplas — Merseyside, UK | | Belplas — Limburg, Belgium | | Formatex — Wielkopolska, Poland |

| Polybrite — Ontario, Canada | | Decostar — Georgia, U.S.A. | | Litetek — Matamoros, Mexico |

|

|

|

|

|

[PHOTO] |

|

[PHOTO] |

|

[PHOTO] |

|

|

|

|

|

[PHOTO] |

|

[PHOTO] |

|

[PHOTO] |

|

|

|

|

|

[PHOTO] |

|

[PHOTO] |

|

[PHOTO]

|

EMPLOYEE SHAREHOLDERS

Corporate Constitution

EMPLOYEE EQUITY AND PROFIT PARTICIPATION

Ten percent of Decoma's profit before tax will be allocated to employees. These funds will be used for the purchase of Decoma shares in trust for employees and for cash distributions to employees, recognizing length of service.

SHAREHOLDER PROFIT PARTICIPATION

Decoma will distribute, on average, twenty percent of its annual net profit after-tax to shareholders.

MANAGEMENT PROFIT PARTICIPATION

To obtain long-term contractual commitment from senior management, the Company provides a compensation arrangement which, in addition to a base salary below industry standards, allows for the distribution of up to six percent of Decoma's profit before tax.

RESEARCH AND DEVELOPMENT

Decoma will allocate a minimum of seven percent of its profit before tax for research and development to ensure the long-term viability of the Company.

SOCIAL RESPONSIBILITY

The Company will allocate a maximum of two percent of its profit before tax for charitable, cultural, educational, and political purposes to support the basic fabric of society.

MINIMUM PROFIT PERFORMANCE

Management has an obligation to produce a profit. If Decoma does not generate a minimum after-tax return of four percent on share capital for two consecutive years, the Class A shareholders, voting as a class, will have the right to elect additional directors.

BOARD OF DIRECTORS

Decoma believes that outside directors provide independent counsel and discipline. A majority of the members of Decoma's Board of Directors will be outsiders.

UNRELATED INVESTMENTS

Class A and Class B shareholders, with each class voting separately, will have the right to approve any investment in an unrelated business in the event such investment together with all other investments in unrelated businesses exceeds twenty percent of Decoma's equity.

CONSTITUTIONAL AMENDMENTS

Any change to Decoma's Corporate Constitution will require the approval of the Class A and Class B shareholders, with each class voting separately.

EMPLOYEE'S CHARTER

Decoma is committed to an operating philosophy which is based on fairness and concern for people. This philosophy is part of Decoma's Fair Enterprise culture in which employees and management share in the responsibility to ensure the success of the company. It includes these principles:

Job Security

Being competitive by making a better product for a better price is the best way to enhance job security. Decoma is committed to working together with its employees to help protect their job security. To assist its employees, Decoma will provide:

- •

- Job Counselling

- •

- Training

- •

- Employee Assistance Programs

A Safe and Healthful Workplace

Decoma strives to provide its employees with a working environment which is safe and healthful.

Fair Treatment

Decoma offers equal opportunities based on an individual's qualifications and performance, free from discrimination or favouritism.

Competitive Wages and Benefits

Decoma will provide its employees with information which will enable them to compare their total compensation, including total wages and total benefits with those earned by employees of their competitors, as well as with other plants in their community. If an employee's total compensation is found not to be competitive, then their wages will be adjusted.

Employee Equity and Profit Participation

Decoma believes that every employee should share in the financial success of the company.

Communication and Information

Through regular monthly meetings between management and employees and through publications, Decoma will provide its employees with information so that they will know what is going on in the Company and within the industry.

The Hotline

Should an employee have a problem, or feel the above principles are not being met, we encourage them to call the Hotline or use the self-addressed Hotline Envelopes to register their complaints. Employees do not have to give their name, but if they do, it will be held in strict confidence. Hotline Investigators will answer the employee's call. The Hotline is committed to investigate and resolve all concerns or complaints and must report the outcome to the Global Human Resources Department. Hotline Number 1-800-263-1691.

Employee Relations Advisory Board

The Employee Relations Advisory Board is a group of people who have proven recognition and credibility relating to humanitarian and social issues. This Board will monitor, advise and ensure that Decoma operates within the spirit of the Decoma Employee's Charter and the principles of Decoma's Corporate Constitution.

7

MAKING OUR MARK IN EMERGING MARKETS.

Adding new features and integrating additional Decoma components into our window surround modules delivers benefits to our OEM customers, their customers and to Decoma. Our window surrounds can now incorporate multiple trim elements, glass division posts and fixed glass in a single assembly. For the front door window surround, Decoma recently co-developed a system to integrate the rearview mirror base into the surround, reducing labour and improving the ability to run vehicles with very different trim requirements on the same lines. For drivers, the end result is improved fit and finish and wind noise. From a manufacturing and assembly standpoint, modular systems decrease the number of parts, thereby lowering assembly time for both Decoma and OEMs, and reducing the overall cost of the systems.

THE FUTURE IS LIGHTER AND STRONGER.

Research and development is a core Decoma commitment and one that's showcased superbly in our lightweight composites expertise. We're taking a leading role in developing stronger, yet lighter components that will help our OEM customers achieve cost savings and weight savings, which in turn can translate into greater fuel efficiency. Fabricating body panels in carbon fibre composites — long used in racing and niche vehicles — can yield significantly stiffer, stronger parts weighing up to 35% less than the same parts made with conventional steel, aluminum and sheet moulding composites. As carbon fibre prices decrease, this promise grows. This prototype carbon fibre composite Jeep TJ hood, developed by Decoma, is validating that potential, helping our researchers determine the ideal combination of resins and reinforcement materials for future commercial-scale applications.

front runners

front-to-back

[PHOTO]

LEADING THE DRIVE TO MODULARIZE.

The trend toward modular assembly is revolutionizing the way vehicles are built, and it's a trend that Decoma is ideally poised to exploit. Decoma's modular capabilities, showcased here in the 2005 Volkswagon Golf, are unmatched in our industry. By 2007, Decoma will be the global leader in front end modules, in a market that only promises to grow as the drive to modularize becomes as prevalent in North America as it currently is in Europe. Decoma is working with European OEMs as they transform assembly techniques to allow for the integration of increasingly complex modules, and structuring to respond with sequencing centres that deliver components in sequence to our customers' assembly plants.

FINANCIAL REVIEW

| Management's Discussion and Analysis of Results of Operations and Financial Position | | 15 |

| Management's Responsibility for Financial Reporting | | 35 |

| Auditors' Report | | 35 |

| Significant Accounting Policies | | 36 |

| Consolidated Balance Sheets | | 40 |

| Consolidated Statements of Income and Retained Earnings | | 41 |

| Consolidated Statements of Cash Flows | | 42 |

| Notes to Consolidated Financial Statements | | 43 |

| Historical Financial Summary | | 70 |

| Decoma's Board of Directors, Officers and Operations Management | | 72 |

| Investor Information | | 73 |

14 Decoma International Inc.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL POSITION

All amounts in this Management's Discussion and Analysis of Results of Operations and Financial Position ("MD&A") are in U.S. dollars unless otherwise noted. This MD&A is current as of February 25, 2004 and should be read in conjunction with the Company's consolidated financial statements for the year ended December 31, 2003, included elsewhere herein.

Impact of Translation of Foreign Currency Results of Operations into the Company's U.S. Dollar Reporting Currency

| | Years Ended December 31,

|

|---|

| | 2003

| | 2002

| | % Change

|

|---|

| 1 Cdn. dollar equals U.S. dollars | | 0.716 | | 0.637 | | 12.4% |

| 1 Euro equals U.S. dollars | | 1.132 | | 0.946 | | 19.7% |

| 1 British Pound equals U.S. dollars | | 1.635 | | 1.503 | | 8.8% |

| | |

| |

| |

|

The preceding table reflects the average foreign exchange rates between the primary currencies in which the Company conducts business and its U.S. dollar reporting currency. Significant changes in the exchange rates of these currencies against the U.S. dollar impact the reported U.S. dollar amounts of the Company's results of operations.

The results of foreign operations are translated into U.S. dollars using the average exchange rates in the table above for the relevant period. Throughout this MD&A reference is made to the impact of translation of foreign operations on reported U.S. dollar amounts where significant.

In addition to the impact of movements in exchange rates on translation of foreign operations into U.S. dollars, the Company's results can also be influenced by the impact of movements in exchange rates on foreign currency transactions (such as raw material purchases denominated in foreign currencies). However, as a result of historical hedging programs employed by the Company, foreign currency transactions in the current period have not been fully impacted by the recent movements in exchange rates. Readers are asked to refer to the "Financial Condition, Liquidity and Capital Resources — Forward Foreign Currency Contracts" section of this MD&A for further discussion. The Company records foreign currency transactions at the hedged rate.

Finally, holding gains and losses on foreign currency denominated monetary items, which are recorded in selling, general and administrative expenses, impact reported results. This MD&A makes reference to the impact of these amounts where significant.

OVERVIEW

The following table isolates the year over year impact of certain unusual income and expense items on the Company's key earnings measures.

(U.S. dollars, in millions except per share figures)

| | Operating Income

| |

| | Net Income

| |

| | Diluted EPS

| |

|

|---|

| 2002 as reported | | $ | 173.7 | | | | $ | 93.0 | | | | $ | 1.03 | | |

| Addback Merplas deferred preproduction expenditures write-off | | | 8.3 | | | | | 8.3 | | | | | 0.08 | | |

| Deduct other income in 2002 | | | — | | | | | (3.4 | ) | | | | (0.03 | ) | |

| | |

| | | |

| | | |

| | |

| Adjusted 2002 base | | | 182.0 | | | | | 97.9 | | | | | 1.08 | | |

| United Kingdom impairment charge | | | (12.4 | ) | | | | (12.4 | ) | | | | (0.12 | ) | |

| Continental Europe paint capacity consolidation charges | | | (11.4 | ) | | | | (11.4 | ) | | | | (0.11 | ) | |

| Future net tax liability revaluation | | | — | | | | | (1.1 | ) | | | | (0.01 | ) | |

| Other income in 2003 | | | — | | | | | 1.4 | | | | | 0.01 | | |

| Decrease over adjusted 2002 base | | | (7.0 | ) | (4%) | | | (2.5 | ) | (3%) | | | (0.08 | ) | (7%) |

| | |

| | | |

| | | |

| | |

| 2003 as reported | | $ | 151.2 | | | | $ | 71.9 | | | | $ | 0.77 | | |

| | |

| | | |

| | | |

| | |

Total sales grew to $2,355.8 million in 2003. Total sales benefited $204.1 million from translation. Excluding the impact of translation, total sales increased $95.0 million or 5% over 2002 due primarily to the acquisition of certain of Federal Mogul's original equipment automotive lighting operations (the "FM Lighting Acquisition") in the second quarter of 2003, sales at recent new facility startups and higher tooling sales.

As shown in the table above, diluted earnings per share in 2003 was impacted by:

- •

- the United Kingdom impairment and continental Europe paint capacity consolidation charges (see the "Other Charges" section of this MD&A for further discussion);

- •

- the revaluation of future net tax liabilities due to an increase in the future Ontario, Canada income tax rate (see the "Results of Operations — Years Ended December 31, 2003 and 2002 — Income Taxes" section of this MD&A for further discussion); and

Annual Report 2003 15

- •

- other income from the permanent repatriation of funds from foreign operations (see the "Results of Operations — Years Ended December 31, 2003 and 2002 — Other Income" section of this MD&A for further discussion).

Similarly, 2002 diluted earnings per share was impacted by:

- •

- the Merplas deferred preproduction expenditures write-off (see the "Other Charges" section of this MD&A for further discussion); and

- •

- other income from the disposition of a non-core North American operating division and from the permanent repatriation of funds from foreign operations (see the "Results of Operations — Years Ended December 31, 2003 and 2002 — Other Income" section of this MD&A for further discussion).

Excluding the above items, diluted earnings per share declined $0.08 in 2003 compared to 2002. This decline is primarily attributable to an increase in the average number of diluted Class A Subordinate Voting and Class B Shares outstanding due to the issuance in March 2003 of Cdn. $100 million of 6.5% convertible unsecured subordinated debentures (the "Convertible Debentures") and to the issuance of 451,400 and 548,600 Class A Subordinate Voting Shares to the Decoma employee deferred profit sharing program during the third quarter of 2002 and second quarter of 2003, respectively, and due to a $2.5 million decline in net income. The decline in net income was due to a $7.0 million reduction in operating income primarily as a result of an $8.0 million increase in European operating losses and an $8.4 million increase in corporate segment losses primarily the result of foreign exchange losses on U.S. dollar denominated monetary items held in Canada. These reductions were partially offset by a $9.4 million increase in North American operating income.

OTHER CHARGES

Year Ended December 31, 2003

UNITED KINGDOM IMPAIRMENT CHARGE

The Company operates two facilities in the United Kingdom, Merplas and Sybex. Given the magnitude of Merplas' historic losses, the Merplas results have been separately disclosed in the Company's MD&A in order to better explain the performance of the European operating segment.

The Merplas facility was initially built to service the X400 program assembled at Jaguar's Halewood plant, and other Jaguar programs, including the X100 program, with additional capacity to service other future business opportunities. Production volumes on the Jaguar X400 and X100 programs continue at levels that are well below original planning volume estimates of 115,000 and 11,000, respectively. In 2003, production volumes were approximately 52,700 and 6,500 for the X400 and X100, respectively. Despite low volumes, Merplas has steadily reduced its operating losses from $23.4 million in 2001 to $11.5 million in 2003 through its continuous improvement efforts.

The Sybex facility's major programs include the BMW Mini and various Rover and Ford PAG Landrover programs. Sybex's operating income in 2003 and 2002 was $1.2 million and $0.5 million, respectively. While BMW Mini program volumes are strong, long-term Rover volumes are subject to uncertainty. In addition, declines in Sybex's current Landrover business were expected to be offset by the award of Landrover's Freelander fascia program which will launch in 2006 (Freelander volumes are expected to approximate 75,000 vehicles annually after ramp up). However, as a result of Ford PAG's decision to produce its 2006 Freelander program at its Halewood, England plant, the Company has decided to relocate its related 2006 Freelander fascia production from Sybex to the closer Merplas facility.

Upon completion of the 2004 business planning process, the Company identified a number of indicators of United Kingdom long-lived asset impairment including the continuation of budgeted United Kingdom operating losses, uncertain long-term production volumes for the United Kingdom market in general which affect certain of the Company's existing programs, and excess paint capacity in the United Kingdom market.

These impairment indicators required the Company to assess its United Kingdom asset base for recoverability. Estimated discounted future cash flows were used to determine the amount of the write-down. The result of this assessment was a write-down of $12.4 million of certain of the long-lived assets at the Company's Sybex facility. Although Merplas has experienced significant historic operating losses, the decision to relocate the 2006 Freelander fascia program from Sybex to Merplas significantly improves Merplas' long-term outlook. However, without additional new business, Sybex's long-term outlook deteriorates. Although the possibility of obtaining incremental new business remains, the Company has been unable to advance incremental business opportunities for Sybex to the point of concluding they are reasonably probable.

This write-down will have no near term impact on operations at either Merplas or Sybex, which will continue their operations in the normal course.

As a result of cumulative losses in the United Kingdom, this impairment charge has not been tax effected.

This impairment charge had no impact on depreciation expense in 2003. However, as a result of the impairment charge, depreciation expense in 2004 is expected to be reduced by approximately $2.5 million.

CONTINENTAL EUROPE PAINT CAPACITY CONSOLIDATION CHARGES

During 2003, the Company completed, and committed to, a plan to consolidate its continental Europe paint capacity. This plan entails mothballing the Company's Decoform paint line in Germany and transferring Decoform's painted trim and fascia business to the Company's newer paint lines at its Decorate and Belplas facilities in Germany and Belgium, respectively. Decoform will continue to mold and assemble products for Decorate.

The consolidation required the write-down of the carrying value of the Decoform paint line by $4.8 million. The consolidation will also result in severance costs associated with a reduction of the Decoform workforce of 284 employees. Severance costs of $6.7 million were accrued in 2003.

16 Decoma International Inc.

Decoform employees have a contractual notice period of up to two quarters following the quarter in which individual notice is given. The consolidation plan envisions substantially all employees working through their contractual notice periods with paint line production transfers and employee terminations completed by the end of 2004.

A continuity of the severance accrual related to this consolidation plan is as follows:

(U.S. dollars in millions)

| |

|

|---|

| Expensed | | $ | 6,658 |

| Payments | | | — |

| Currency translation | | | 141 |

| | |

|

| Balance, December 31, 2003 | | $ | 6,799 |

| | |

|

There will be no reduction in sales as a result of the consolidation of these operations. The consolidation will avoid the need for significant future capital expenditures at the Decoform facility and Decoma believes that the consolidation will also improve long-term EBIT at the affected facilities in 2005 and beyond by reducing operating overheads and paint line depreciation and by improving the utilization rates within the Company's Decorate and Belplas paint operations.

These continental Europe paint capacity consolidation charges have resulted in large accounting losses in Germany and create both taxable temporary difference and loss carryforward future tax assets. A full valuation allowance has been provided against these future tax assets resulting in no net tax recovery against these charges in the consolidated income statement.

Year Ended December 31, 2002

GOODWILL AND DEFERRED PREPRODUCTION EXPENDITURES

In 2002, the Company adopted the new accounting recommendations of The Canadian Institute of Chartered Accountants for goodwill and other intangible assets. Upon initial adoption of these recommendations, the Company recorded a goodwill write-down of $12.3 million related to its United Kingdom reporting unit. This write-down was charged against January 1, 2002 opening retained earnings. As part of its assessment of goodwill impairment, the Company also reviewed the recoverability of deferred preproduction expenditures at its Merplas facility. As a result of this review, $8.3 million of deferred preproduction expenditures were written off as a charge against income in the second quarter of 2002. As a result of cumulative losses in the United Kingdom, this write-down has not been tax effected.

RESULTS OF OPERATIONS

Years Ended December 31, 2003 and 2002

SALES

| | Years Ended December 31,

| |

|---|

| | 2003

| | 2002

| | % Change

| |

|---|

| Light Vehicle Production Volumes [in millions] | | | | | | | | | |

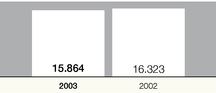

| | North America | | | 15.864 | | | 16.323 | | (3% | ) |

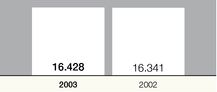

| | Western Europe | | | 16.428 | | | 16.341 | | 1% | |

| | |

| |

| |

| |

| Average Content Per Vehicle [U.S. dollars] | | | | | | | | | |

| | North America | | $ | 95 | | $ | 85 | | 12% | |

| | Europe | | | 39 | | | 30 | | 30% | |

| | |

| |

| |

| |

| Production Sales [U.S. dollars in millions] | | | | | | | | | |

| | North America | | $ | 1,506.8 | | $ | 1,391.5 | | 8% | |

| | Europe | | | | | | | | | |

| | | Excluding Merplas | | | 616.1 | | | 457.1 | | 35% | |

| | | Merplas | | | 30.4 | | | 34.7 | | (12% | ) |

| | |

| |

| | | |

| | | Total Europe | | | 646.5 | | | 491.8 | | 31% | |

| Global Tooling and Other Sales | | | 202.5 | | | 173.4 | | 17% | |

| | |

| |

| |

| |

| Total Sales | | $ | 2,355.8 | | $ | 2,056.7 | | 15% | |

| | |

| |

| |

| |

Annual Report 2003 17

Average content per vehicle in North America and in Europe has been calculated by dividing the Company's North American and European production sales by the industry's North American and European light vehicle production volumes, respectively. Excluding the effects of translation, continued growth in average content per vehicle provides a measure of the Company's ability to sell its products onto new vehicle platforms and/or expand its sales onto existing vehicle platforms. Increases in average content per vehicle may result from any one or more of: the award of takeover business; the acquisition of competitors; the expansion of the Company's existing product markets (i.e. the conversion of bumpers from steel to plastic); and the introduction of new products.

North America

North American production sales grew by 8% to $1,506.8 million in 2003.

A 3% decline in North American vehicle production volumes negatively impacted sales by $42.0 million. However, this decline was offset by significant growth in North American content per vehicle. North American content per vehicle grew $10 or 12% to approximately $95.

Translation of Canadian dollar sales into the Company's U.S. dollar reporting currency added approximately $102.1 million to production sales and $6 to North American content per vehicle. In addition, the FM Lighting Acquisition added approximately $51.9 million to production sales and $3 to North American content per vehicle.

The remaining net $3.3 million increase in production sales and $1 increase in North American content per vehicle was due to:

- •

- new takeover business including certain General Motors lighting and Ford running board programs;

- •

- sales on programs that launched during or subsequent to 2002 including the General Motors GMX 367 (Grand Prix) and the GMX 380 (Malibu) programs, the DaimlerChrysler AN (Dakota) program serviced by a new Michigan based specialty vehicle assembly facility launched by the Company in the fourth quarter of 2002, the Ford U231 (Aviator) program and the BMW E85 (Z4) program amongst others; and

- •

- strong volumes on other high content production programs including the General Motors GMX 210 (Impala), GMX 320 (Cadillac CTS) and GMT 820 C and D (Cadillac Escalade and Denali SUV) programs, the DaimlerChrysler DR (Ram pickup) program and the Ford U222 (Expedition) program.

These increases were partially offset by:

- •

- end of production on the DaimlerChrysler LH (Concorde, Intrepid and 300M) program during 2003 (the new Daimler Chrysler LX program did not launch until the first quarter of 2004);

- •

- lower production volumes as a result of the changeover of the Ford WIN 126 (Windstar) program to the V229 (Freestar) program during the year (V229 (Freestar) fascia production was transferred by Ford to a competitor at the end of 2003);

- •

- end of production on the General Motors MS2000 (Grand Prix) program;

- •

- lower production volumes on certain other long running high content programs including the Ford U152 (Explorer) and EN114 (Crown Victoria, Grand Marquis) programs and the DaimlerChrysler JR (Stratus, Sebring and Sebring Convertible), RS (Minivan) and PT Cruiser programs;

- •

- reduced painting content on the GMT 805 (Avalanche) and GMT 806 (Escalade EXT) programs and end of production during 2002 on the Ford CT120 (Escort) 4 door program all in Mexico;

- •

- reduced content on the DaimlerChrysler RS (Minivan) program;

- •

- the closure of the Company's specialty vehicle operation in Montreal due to the end of production of the F Car (Camaro, Firebird) at General Motors' St. Therese assembly plant in the third quarter of 2002; and

- •

- the impact of OEM price concessions.

North American Vehicle Production Volumes

(in millions) | | North American Average Content Per Vehicle | | North American Production Sales

(in millions) |

| |  | |  |

Europe

European production sales increased 31% to $646.5 million in 2003 on substantially level production volumes. European content per vehicle grew $9 or 30% to approximately $39 for 2003. Content growth was driven by the translation of Euro and British Pound sales into the Company's U.S. dollar reporting currency. This added approximately $83.1 million to European production sales and $5 to European content per vehicle.

Content growth was also driven by sales at recent new facility startups in the latter part of 2002 and in 2003 including the launch of the VW Group T5 (Transit Van) fascia and front end module assembly and sequencing program at the Company's new Modultec and Formatex facilities in Germany and Poland; the launch of the DaimlerChrysler Mercedes E Class 4 Matic front end module assembly and sequencing program at the Company's new Graz, Austria facility; the launch of the VW Group A5 (Golf) program in the fourth quarter of 2003 including fascia production at the Company's new Belplas paint line and front end module assembly and sequencing at the Company's new Brussels Sequencing Centre. These new facilities collectively added approximately $102.9 million to production sales and $6 to European content per vehicle.

18 Decoma International Inc.

The remaining net $31.3 million reduction in production sales and $2 reduction in content per vehicle is due to a number of factors including a decline in production volumes on the Jaguar X400 program produced at Merplas. Merplas' sales declined from $34.7 million in 2002 to $30.4 million in 2003. Adjusting to eliminate the impact of translation of British Pound sales into U.S. dollars, Merplas' sales declined $7.3 million. In addition, European production sales and content were negatively impacted by lower volumes on certain long running high content programs such as the DaimlerChrysler Mercedes C Class and various Rover programs and end of production of DaimlerChrysler Mercedes E Class trim production, Landrover Discovery fascia production and the Audi TT hard top program. These factors were partially offset by the launch of various new Audi production programs at the Company's facilities in Germany and strong BMW Mini volumes.

European Vehicle Production Volumes

(in millions) | | European Average Content Per Vehicle | | European Production Sales

(in millions) |

| |  | |  |

Global Tooling and Other

Tooling and other sales on a global basis increased 17% to $202.5 million for 2003. The increase came in both North America and Europe and is primarily related to translation of Canadian dollar, Euro and British pound sales into the Company's U.S. dollar reporting currency which added $18.8 million to tooling sales. The remaining $10.3 million or 6% increase relates to new program launches including the Ford U204 (Escape) refresh program in North America and the VW Group A5 (Golf) program in Europe.

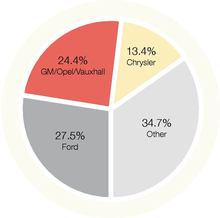

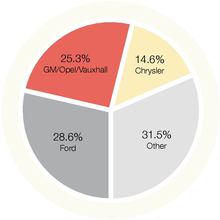

Sales by Customer

The Company' s sales by customer breakdown for 2003 and 2002 was as follows:

| | Year Ended December 31, 2003

| | Year Ended December 31, 2002

|

|---|

| | North America

| | Europe

| | Global

| | North America

| | Europe

| | Global

|

|---|

| Traditional "Big 3" Brands | | | | | | | | | | | | |

| | Ford | | 25.4% | | 2.1% | | 27.5% | | 26.5% | | 2.1% | | 28.6% |

| | GM / Opel / Vauxhall | | 22.6% | | 1.8% | | 24.4% | | 23.9% | | 1.4% | | 25.3% |

| | Chrysler | | 12.6% | | 0.8% | | 13.4% | | 13.9% | | 0.7% | | 14.6% |

| | |

| |

| |

| |

| |

| |

|

| | | 60.6% | | 4.7% | | 65.3% | | 64.3% | | 4.2% | | 68.5% |

| |

VW Group |

|

0.1% |

|

8.8% |

|

8.9% |

|

0.1% |

|

4.7% |

|

4.8% |

| | Mercedes | | — | | 8.7% | | 8.7% | | — | | 9.4% | | 9.4% |

| | BMW | | 0.6% | | 1.7% | | 2.3% | | 0.5% | | 1.6% | | 2.1% |

| | Ford Premier Automotive Group ("Ford PAG") | | 0.1% | | 2.1% | | 2.2% | | 0.1% | | 2.3% | | 2.4% |

| | Renault Nissan | | 1.5% | | 0.5% | | 2.0% | | 1.6% | | 0.6% | | 2.2% |

| | Other | | 5.5% | | 5.1% | | 10.6% | | 5.6% | | 5.0% | | 10.6% |

| | |

| |

| |

| |

| |

| |

|

| | | 68.4% | | 31.6% | | 100.0% | | 72.2% | | 27.8% | | 100.0% |

| | |

| |

| |

| |

| |

| |

|

| (i) Included above are sales to Asian new domestics | | 4.1% | | 0.1% | | 4.2% | | 3.8% | | 0.3% | | 4.1% |

| | |

| |

| |

| |

| |

| |

|

The Company continues to grow it sales with original equipment manufacturer ("OEM") customers outside the traditional "Big 3" automotive brands.

The growth in sales to the VW Group is the result of the launch of the VW Group T5 (Transit Van) and A5 (Golf) fascia and front end module programs and the recent launch of a number of new Audi programs. The Company's sales to the VW Group are expected to continue to grow as the VW A5 (Golf) program ramps up and the VW SLW (City Car) program launches at Formatex. Sales to Mercedes are also expected to grow with the launch of both the A Class program in the second half of 2004 and the Decostar facility in 2005.

Annual Report 2003 19

The Company's largest production sales programs for 2003 in each of North America and Europe included:

North America

- •

- Ford U152 (Explorer)

- •

- DaimlerChrysler JR (Stratus, Sebring and Sebring Convertible)

- •

- Ford EN114 (Crown Victoria and Grand Marquis)

- •

- DaimlerChrysler DR (Ram pick up)

- •

- DaimlerChrysler LH (Concorde, Intrepid and 300M)

Europe

- •

- DaimlerChrysler Mercedes C Class

- •

- VW Group T5 (Transit Van)

- •

- BMW Mini

- •

- Audi B6 (A4)

- •

- Opel Epsilon

The DaimlerChrysler LH (Concorde, Intrepid and 300M) program remained one of the Company's largest North American production sales programs despite the fact that this program ended in the third quarter of 2003 and the new LX program does not start up until the first quarter of 2004.

Although the Company has significant North American business with General Motors, including a number of individually significant programs such as the GMX 210 (Impala), individual General Motors' programs are outside the Company's top 5 sales dollar programs.

Global Tooling and Other Sales

(in millions) | | Sales by Customer |

| |  |

GROSS MARGIN

Gross margin increased to $464.7 million in 2003 compared to $423.4 million in 2002. As a percentage of total sales, gross margin declined to 19.7% compared to 20.6% for 2003 and 2002, respectively.

The gross margin percentage in North America was substantially unchanged at 25.0% in 2003 compared to 24.7% in 2002. The Company's ongoing continuous improvement programs, favourable purchase price variances on net U.S. dollar purchases within the Company's Canadian operations and increased claims for eligible research and development investment tax credits enabled the North American segment to successfully offset the impact of the changeover of a number of large North American production programs; lower North American production volumes including lower volumes on certain long running high content programs; OEM price concessions; spending at the Company's Decostar facility; increased costs within the Company's systems integration operations with the launch of two new facilities in 2003 and costs in preparation for the launch of additional facilities in 2004; growth in the Company's lighting business which currently operates at lower margins; and FM Lighting Acquisition integration costs.

European gross margin declined to 8.2% in 2003 compared to 9.8% in 2002. The decline in the European gross margin percentage is due primarily to new facility startups and the growth in front end module assembly and sequencing sales and the lower margins associated with purchased components. In addition, continued operating inefficiencies and other performance issues at the Company's Prometall and Decoform facilities negatively impacted gross margin. These negative impacts were partially offset by improvements at Merplas and within the Company's paint operations at its Decorate trim facility.

The competitive environment within the automotive industry continues to cause the Company's customers to increase pressure for price concessions and to finance or absorb more engineering costs related to product design, tooling costs and certain capital and other items. The Company has been largely successful in the past in responding to these pressures through improved operating efficiencies and cost reductions. However, customer pressure for price concessions has intensified in recent quarters. Although the Company remains highly focused on continuous improvement activities, continued significant incremental price concessions could have an adverse impact on the Company's gross margin percentage.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization costs increased to $89.9 million for 2003 compared to $78.3 million for 2002. Of this increase, $7.1 million is attributable to the translation of Canadian dollar, Euro and British Pound depreciation expense into the Company's U.S. dollar reporting currency. The Company's ongoing capital spending program also contributed to increased depreciation expense including commencement of depreciation at the Company's new Belplas paint line in the fourth quarter of 2003. These increases were partially offset by a reduction in Merplas deferred preproduction amortization as a result of the 2002 write-down of Merplas' deferred preproduction expenditures. Depreciation expense in 2002 includes $0.7 million of Merplas deferred preproduction amortization prior to the write-down.

20 Decoma International Inc.

Depreciation as a percentage of total sales was substantially unchanged at 3.8% in 2003 and 2002.

Depreciation on capital invested at Decostar will not commence until commercial production begins which is now scheduled for the first quarter of 2005.

SELLING, GENERAL AND ADMINISTRATIVE ("S, G&A")

S,G&A costs were $175.3 million for 2003, up from $137.9 million for 2002. This increase reflects the translation of Canadian dollar, Euro and British Pound S,G&A costs into the Company's U.S. dollar reporting currency which increased reported S,G&A dollars by $15.0 million. In addition, foreign exchange losses increased by $7.8 million in 2003 compared to 2002 largely on U.S. dollar denominated monetary items held in Canada. The impact of the Company's change in accounting policy to expense stock options granted on or after January 1, 2003 increased S,G&A expense by $0.3 million (readers are asked to refer to note 4 to the Company's consolidated financial statements for the year ended December 31, 2003, included elsewhere herein).

The remaining $14.3 million increase in S,G&A expense is related to the Company's Decostar and Belplas projects; the FM Lighting Acquisition; and additional S,G&A expense at recently launched facilities including Modultec, Formatex, Graz and the Brussels Sequencing Centre in Europe and increased costs within the Company's systems integration operations with the launch of two new facilities in 2003 and costs in preparation for the launch of additional facilities in 2004.

As a percentage of total sales, S,G&A increased to 7.4% for 2003 compared to 6.7% for 2002.

In addition to the benefits provided by Magna International Inc. and it's subsidiaries ("Magna") to Decoma under the affiliation agreement noted below, Magna provides certain management and administrative services to the Company, including specialized legal, environmental, immigration, tax, treasury, information systems (including wide area network infrastructure and support services) and employee relations services (including administration of Decoma's Employee Equity Participation and Profit Sharing Program), in return for a specific amount negotiated between the Company and Magna which includes an allocated share of the facility and overhead costs dedicated to providing these services. The Company is currently in discussions with Magna with respect to a formal long-term agreement detailing these arrangements. The cost of management and administrative services provided by Magna and included in S,G&A was $4.2 million for 2003 compared to $3.6 million for 2002. The increase is due to translation of Canadian dollar fees into the Company's U.S. dollar reporting currency and to an increase in the cost of the services provided.

AFFILIATION AND SOCIAL FEES

The Company is party to an affiliation agreement with Magna that provides for the payment by Decoma of an affiliation fee. The affiliation agreement provides the Company with, amongst other things, certain trademark rights, access to Magna's management and to its operating principles and policies, internal audit services, Tier 1 development assistance, global expansion assistance, vehicle system integration and modular product strategy assistance and sharing of best practices in areas such as new management techniques, employee benefits and programs, marketing and technology development initiatives.

As previously disclosed, the Company entered into an amended agreement with Magna effective August 1, 2002. Affiliation fees payable under the amended agreement were reduced to 1% of Decoma's consolidated net sales (as defined in the agreement) from the 1.5% rate that previously applied. In addition, the amended agreement provides for a fee holiday on 100% of consolidated net sales derived from future business acquisitions in the calendar year of the acquisition and 50% of consolidated net sales derived from future business acquisitions in the first calendar year following the year of acquisition. The amended agreement also entitled Decoma to a credit equal to 0.25% of Decoma's consolidated net sales for the period from January 1, 2002 to July 31, 2002. In addition, Decoma was entitled to a credit equal to 1.5% of 2001 consolidated net sales derived from the acquisition of Autosystems and 50% of 1.25% of January 1, 2002 to July 31, 2002 consolidated net sales derived from Autosystems.

Decoma's corporate constitution specifies that the Company will allocate a maximum of 2% of its profit before tax to support social and charitable activities. The Company pays 1.5% of its consolidated pretax profits to Magna which in turn allocates such amount to social and other charitable programs on behalf of Magna and its affiliated companies, including Decoma.

Affiliation and social fees expense for 2003 decreased to $24.5 million from $25.3 million for 2002. Affiliation fee expense in 2002 was 1.25% through July 31 and 1.0% thereafter on consolidated net sales, less the Autosystems related fee holiday. Affiliation fees for 2003 were 1.0% of consolidated net sales, less the acquisition related fee holidays primarily related to the FM Lighting Acquisition. The decrease in the 2003 affiliation and social fees expense is the result of a lower effective affiliation fee rate in 2003 compared to 2002 and reduced social fee expenses due to a reduction in the pretax profits on which the social fees are calculated, partially offset by an increase in consolidated net sales on which the affiliation fees are calculated.

Affiliation and social fee expense as a percentage of total sales declined to 1.0% in 2003 compared to 1.2% in 2002.

Annual Report 2003 21

OPERATING INCOME

| | Years Ended December 31,

| |

|---|

[U.S. dollars in millions]

| | 2003

| | 2002

| | % Change

| |

|---|

| Operating Income | | | | | | | | | |

| | North America | | $ | 213.8 | | $ | 204.4 | | 5% | |

| | Europe | | | | | | | | | |

| | | Excluding Merplas and other charges | | | (10.8 | ) | | 1.8 | | | |

| | | Merplas excluding deferred preproduction expenditures write-off | | | (11.5 | ) | | (16.1 | ) | 29% | |

| | | Merplas deferred preproduction expenditures write-off | | | — | | | (8.3 | ) | | |

| | | United Kingdom impairment charge | | | (12.4 | ) | | — | | | |

| | | Continental Europe paint capacity consolidation charges | | | (11.4 | ) | | — | | | |

| | |

| |

| | | |

| | | Total Europe | | | (46.1 | ) | | (22.6 | ) | (104% | ) |

| | Corporate | | | (16.5 | ) | | (8.1 | ) | | |

| | |

| |

| |

| |

| | Total Operating Income | | $ | 151.2 | | $ | 173.7 | | (13% | ) |

| | |

| |

| |

| |

As a percentage of total sales, operating income before other charges was 7.4% for 2003 compared to 8.8% for 2002.

The increase in the corporate segment operating loss is attributable to an increase in foreign exchange losses of $7.6 million on U.S. dollar denominated monetary items held in Canada, one time severance costs and the impact of the Company's change in accounting policy to expense stock options granted on or after January 1, 2003 which added $0.3 million to the corporate segment operating loss.

North America

North American operating income increased $9.4 million to $213.8 million for 2003. As a percentage of total North American sales, North American operating income was 13.2% in 2003 compared to 13.7% in 2002.

The 0.5% decline in North American operating income as a percentage of total sales is the result of:

- •

- a 0.8% increase in S,G&A expenses as a percentage of total sales from 5.8% in 2002 to 6.6% in 2003 as a result of increased costs related to the Company's lighting business including integration costs related to the FM Lighting Acquisition, increased costs related to Decostar and the Company's systems integration operations and the impact of a temporary reduction in sales as a result of the changeover of a number of large production programs including end of production on the DaimlerChrysler LH (Concorde, Intrepid and 300M) program (the new DaimlerChrysler LX program does not launch until the first quarter of 2004) without a similar temporary reduction in S,G&A costs; and

- •

- a 0.1% increase in depreciation expense as a percent of total sales from 3.7% in 2002 to 3.8% in 2003; partially offset by

- •

- a 0.1% reduction in affiliation and social fees as a percentage of total sales as a result of the reduction in the affiliation fee rate and as a result of the acquisition fee holiday related to the FM Lighting Acquisition, partially offset by the elimination of the acquisition affiliation fee holiday related to the 2001 acquisition of Autosystems; and

- •

- a 0.3% improvement in the North American gross margin percentage.

Europe

European operating losses were negatively impacted by the United Kingdom impairment and continental Europe paint capacity consolidated charges, partially offset by the Merplas deferred preproduction expenditures write-off in 2002. Excluding other charges, European operating income declined $8.0 million. European operating income continues to be negatively impacted by efficiency and other performance issues at the Company's Prometall and Decoform facilities. Operating income at these facilities declined by $10.0 million in 2003 compared to 2002. In addition to the impact of operating inefficiencies, this decline is also the result of:

- •

- costs associated with various Audi production programs recently launched at these facilities;

- •

- costs associated with various Porsche programs that will launch in 2004 at a new assembly and sequencing facility in Zuffenhausen, Germany with fascia and related trim production originally scheduled to come from the Company's existing Decoform facility and from third parties (Decoform Porsche production has now been shifted to Belplas as a result of the Company's continental Europe paint capacity consolidation plan); and

- •

- costs associated with the transfer, to a new facility located in Germany, and start-up of the Prometall operations.

In addition, the Company's Decotrim exterior trim facility in Belgium continues to be impacted by competitive pricing pressures and open capacity. Decotrim's operating losses grew $0.6 million in 2003 compared to 2002.

Operating results were also negatively impacted by costs incurred to support European sales growth including:

- •

- costs associated with establishing the Company's Formatex moulding, assembly and sequencing facility located in Poland to service the VW Group T5 (Transit Van) and the SLW (City Car) Polish production programs; and

22 Decoma International Inc.

- •

- costs associated with the construction and launch of the Company's new Belplas paint line and the takeover of the Brussels Sequencing Centre both to service a portion of the production volume on the VW Group A5 (Golf) program commencing in the fourth quarter of 2003.

The aggregate net change in operating income in 2003 compared to 2002 at Formatex, Belplas and the Brussels Sequencing Centre was a reduction of $9.4 million.

Finally, during the fourth quarter of 2003, the Company completed the acquisition of HDO Galvano-und Oberflächentechnik GmbH ("HDO") which operated a chroming line adjacent to the Company's Idoplas facility. The line is being converted to allow for grille chroming and will be integrated into Idoplas' operations. The Company expects to launch the chroming line in early 2004 and commence the insourcing of grille chroming business currently outsourced by Decoma's European operations at that time. As a result, the fourth quarter of 2003 was negatively impacted by chroming line start-up and launch costs.

The above costs were partially offset by:

- •

- income now being generated at the Company's Modultec mould in colour, assembly and sequencing facility which was launched in Germany in the fourth quarter of 2002 to supply the VW Group T5 (Transit Van) program and the Company's Graz, Austria assembly and sequencing facility which was launched in the first quarter of 2003 to supply Magna Steyr's DaimlerChrysler Mercedes E Class 4 Matic program (the aggregate net change in operating income in 2003 compared to 2002 at Modultec and Graz, was an improvement of $1.4 million); and

- •

- improvements at the Company's other European facilities, most notably within the paint operations at its Decorate trim facility in Germany and continued strong operating profits generated at the Company's Innoplas fascia facility in Germany despite lower production volumes on its highest content program, the DaimlerChrysler Mercedes C Class, and costs associated with the DaimlerChrysler Mercedes A Class program that will launch in the second half of 2004 (operating income at these two facilities combined improved $5.3 million in 2003 compared to 2002).

Finally, Merplas' operating loss before other charges improved to $11.5 million for 2003 compared to a loss of $16.1 million in 2002. Adjusting to eliminate the impact of translation of British Pound operating losses into U.S. dollars, Merplas' operating loss declined $6.0 million in 2003 compared to 2002. This improvement was realized despite the reduced fixed cost coverage effects of a significant drop in production sales as a result of lower Jaguar X400 production volumes. The improvement relates, in part, to the recovery of tooling and engineering costs that were expensed in prior periods. However, the balance of the improvement reflects the impact of significant operating improvements implemented at Merplas over the last two years.

EQUITY INCOME

Income from equity accounted investments, which includes the Company's 40% share of Bestop, Inc. ("Bestop") and Modular Automotive Systems, LLC, increased to $1.8 million for 2003 compared to $0.5 million for 2002 due to closure costs in 2002 with respect to one of Bestop's facilities and the resulting improvement in operating performance as a result of the closure.

INTEREST EXPENSE

Interest expense for 2003 declined to $10.7 million compared to $12.0 million for 2002 as a result of a reduction in average interest bearing net debt (including bank indebtedness, long-term debt including current portion and debt due to Magna including current portion, less cash and cash equivalents) levels and interest capitalized on the Company's Decostar and Belplas paint line projects of $1.3 million in 2003 (nil in 2002) partially offset by translation of Canadian dollar and Euro interest into the Company's U.S. dollar reporting currency. In addition, lower interest rates on debt due to Magna contributed to the reduction. The original interest rate on the first and second tranches of Euro denominated debt due to Magna was 7.0%. The first and second tranches were due October 1, 2002 and October 1, 2003, respectively. However, since the original maturity dates of this debt, the Company, with Magna's consent, was extending the repayment of this debt at 90 day intervals at market interest rates ranging from 3.14% to 4.29%. Substantially all of this debt was repaid in December 2003.

Interest on debt due to Magna and its affiliates and included in reported interest expense amounted to $11.3 million in 2003 compared to $10.1 million in 2002. This increase is the result of translation of Canadian dollar and Euro interest into the Company's U.S. dollar reporting currency partially offset by the interest rate reductions described above.

AMORTIZATION OF DISCOUNT ON CONVERTIBLE SERIES PREFERRED SHARES

The Company's amortization of the discount on the portion of the Convertible Series Preferred Shares held by Magna classified as debt increased to $8.6 million for 2003 compared to $8.4 million for 2002. The increase reflects the translation of Canadian dollar amortization into the Company's U.S. dollar reporting currency and increased amortization on the Series 4 and 5 Convertible Series Preferred Shares as the liability amount approaches face value, partially offset by lower amortization as a result of the discount on the Series 3 Convertible Series Preferred Shares being fully amortized as of July 31, 2002. As of December 31, 2003, the Series 4 Convertible Series Preferred Shares are fully amortized. Therefore, amortization in 2004 will be reduced as it will be limited to amortization on the Series 5 Convertible Series Preferred Shares only.

OTHER INCOME

Other income in 2003 of $1.4 million represents the recognition in income of a pro rata amount of the Company's cumulative translation adjustment account on the permanent repatriation of $75 million of the Company's net investment in its United States operations. This amount was not subject to tax.

Annual Report 2003 23

Other income in 2002 includes a $3.9 million gain on the sale of a non-core North American operating division. Income tax expense for 2002 includes $1.0 million related to this gain. In addition, other income in 2002 includes $0.5 million as a result of the recognition in income of a pro rata amount of the Company's cumulative translation adjustment account on the permanent repatriation of Euro 10 million of the Company's net investment in its continental Europe operations. This amount was not subject to tax.

INCOME TAXES

The Company's effective income tax rate for 2003 increased to 46.8% from 41.2% for 2002. As explained in the "Other Charges" section of this MD&A, the other charges in 2003 and 2002 were not tax effected which negatively impacted the Company's effective tax rate. Similarly, the Company's other income in 2003 and 2002 was either fully or partially not subject to tax. In addition, as a result of an increase in future Ontario, Canada income tax rates and the resulting required revaluation of the Company's future net tax liabilities, the Company's 2003 tax expense increased by $1.1 million. Excluding other charges, other income and the future net tax liability revaluation as a result of Ontario, Canada future tax rate changes, the Company's effective tax rate for 2003 was substantially unchanged at 39.4% compared to 39.6% for 2002.

The Company's effective tax rate continues to be high due to Convertible Series Preferred Share amortization which is not deductible for tax purposes and losses which are not being tax benefited primarily in the United Kingdom, Germany, Belgium and Poland. Cumulative unbenefited tax loss carryforwards total approximately $143 million. Substantially all of these losses have no expiry date and will be available to shelter future taxable income in these jurisdictions.

NET INCOME

Net income for 2003 declined to $71.9 million from $93.0 million for 2002.

Excluding the impact of other charges, other income and the future net tax liability revaluation, the Company's net income declined $2.5 million (readers are asked to refer to the "Overview" section of this MD&A for further discussion). The decline in net income was due to reduced operating income partially offset by lower interest expense.

FINANCING CHARGES

The deduction from net income of financing charges on the Convertible Series Preferred Shares held by Magna (comprised of dividends declared on the Convertible Series Preferred Shares less the reduction of the Convertible Series Preferred Shares dividend equity component) decreased to $4.5 million for 2003 compared to $4.8 million for 2002. The decrease reflects the conversion of the Series 1, 2 and 3 Convertible Series Preferred Shares into the Company's Class A Subordinate Voting Shares in August 2003 partially offset by the translation of Canadian dollar dividends into the Company's U.S. dollar reporting currency.

In March of 2003, the Company issued the Convertible Debentures. Financing charges, net of income tax recoveries, related to the Convertible Debentures were $3.0 million in 2003. The Company has the option to settle Convertible Debenture interest, and principal on redemption or maturity, with Class A Subordinate Voting Shares. In addition, the holders of the Convertible Debentures have the right to convert into Class A Subordinate Voting Shares at a fixed price at any time. As a result, under current Canadian generally accepted accounting principles ("GAAP"), the Convertible Debentures are presented as equity and the carrying costs associated with the Debentures are charged to retained earnings. Therefore, Convertible Debenture carrying charges do not impact net income. However, because interest on the Convertible Debentures is paid in preference to common shareholders, the Convertible Debenture carrying charges reduce net income attributable to Class A Subordinate Voting and Class B Shares.

The Canadian Institute of Chartered Accountants recently amended Handbook Section 3860, "Financial Instruments — Disclosure and Presentation", to require certain obligations that may be settled with an entity's own equity instruments to be reflected as a liability. The amendments must be adopted in the Company's 2005 consolidated financial statements with retroactive application. Upon adoption, the Convertible Debentures currently presented entirely within equity on the consolidated balance sheet will have to be presented in part as a liability and in part as equity and the related liability carrying costs will be presented as a charge to net income.

DILUTED EARNINGS PER SHARE

| | Years Ended December 31,

| |

|---|

| | 2003

| | 2002

| | % Change

| |

|---|

| Earnings per Class A Subordinate Voting or Class B Share [U.S. dollars] | | | | | | | | | |

| | Basic | | $ | 0.88 | | $ | 1.30 | | (32% | ) |

| | Diluted

| | 0.77

| | 1.03

| | (25%

| )

|

| Average number of Class A Subordinate Voting and Class B Shares outstanding [in millions] | | | | | | | | | |

| | Basic | | | 73.4 | | | 67.8 | | 8% | |

| | Diluted

| | 104.3

| | 98.3

| | 6%

| |

24 Decoma International Inc.

The increase in the weighted average number of basic Class A Subordinate Voting and Class B Shares outstanding is due to the issuance of 14,895,729 Class A Subordinate Voting Shares on conversion of the Series 1, 2 and 3 Convertible Series Preferred Shares during the third quarter of 2003. This transaction negatively impacted basic earnings per share but had no impact on diluted shares outstanding or diluted earnings per share. Readers are asked to refer to the "Consolidated Capitalization" section of this MD&A for further discussion regarding the conversion.

Diluted earnings per share for 2003 declined to $0.77. Excluding the impact of other charges, other income and the future net tax liability revaluation, the Company's diluted earnings per share declined $0.08 (readers are asked to refer to the "Overview" section of this MD&A for further discussion). This decline is primarily attributable to an increase in the average number of diluted Class A Subordinate Voting and Class B Shares outstanding due to the issuance in March 2003 of the Convertible Debentures and to the issuance of 451,400 and 548,600 Class A Subordinate Voting Shares to the Decoma employee deferred profit sharing program during the third quarter of 2002 and second quarter of 2003, respectively, and due to the $2.5 million decline in net income.

The maximum number of shares that would be outstanding if all of the Company's stock options, Convertible Series Preferred Shares and Convertible Debentures issued and outstanding as at December 31, 2003 were exercised or converted would be 108.8 million. (Refer to note 14 of the Company's consolidated financial statements, included elsewhere herein, for further discussion.)

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

Cash Flows for the Years Ended December 31, 2003 and 2002

| | Years Ended December 31,

| |

|---|

[U.S. dollars in millions]

| | 2003

| | 2002

| |

|---|

| EBITDA before non-cash impairment charges | | | | | | | |

| | North America | | $ | 276.2 | | $ | 259.9 | |

| | Europe | | | | | | | |

| | | Excluding Merplas | | | 14.2 | | | 21.7 | |

| | | Merplas | | | (9.0 | ) | | (13.2 | ) |

| | | Continental Europe paint capacity consolidation charges | | | (6.7 | ) | | — | |

| | |

| |

| |

| | | Total Europe | | | (1.5 | ) | | 8.5 | |

| | Corporate | | | (16.5 | ) | | (8.1 | ) |

| | |

| |

| |

| | | | 258.2 | | | 260.3 | |

| Interest, cash taxes and other operating cash flows | | | (74.7 | ) | | (71.7 | ) |

| | |

| |

| |

| Cash flow from operations before changes in non-cash working capital | | | 183.5 | | | 188.6 | |

| Cash (invested in) generated from non-cash working capital | | | (51.6 | ) | | 50.0 | |

| Fixed and other asset spending, net | | | | | | | |

| | North America | | | (114.2 | ) | | (57.5 | ) |

| | Europe | | | (71.3 | ) | | (50.6 | ) |

| Acquisition spending | | | | | | | |

| | North America | | | (13.3 | ) | | (2.6 | ) |

| | Europe | | | (5.8 | ) | | — | |

| Proceeds from disposition of operating division | | | — | | | 5.7 | |

| Convertible Debenture interest payments | | | (3.8 | ) | | — | |

| Dividends | | | | | | | |

| | Convertible Series Preferred Shares | | | (12.2 | ) | | (12.1 | ) |

| | Class A Subordinate Voting and Class B Shares | | | (18.8 | ) | | (14.2 | ) |

| | |

| |

| |

| Cash generated and available for debt reduction (shortfall to be financed) | | | (107.5 | ) | | 107.3 | |

| Repayments of debt due to Magna | | | (72.4 | ) | | (7.8 | ) |

| Net decrease in long-term debt | | | (0.1 | ) | | (10.9 | ) |

| Net increase (decrease) in bank indebtedness | | | 109.7 | | | (110.3 | ) |

| Issuance of Convertible Debentures | | | 66.1 | | | — | |

| Issuances of Class A Subordinate Voting Shares | | | 4.7 | | | 4.7 | |

| Foreign exchange on cash and cash equivalents | | | 11.0 | | | 4.8 | |

| | |

| |

| |

| Net increase (decrease) in cash and cash equivalents | | $ | 11.5 | | $ | (12.2 | ) |

| | |

| |

| |