Shareholder Meeting May 16, 2012 1

This presentation contains forward-looking statements, including statements about beliefs and expectations based on the information available to, and assumptions and estimates made by, management as of the date made. These forward- looking statements cover, among other things, anticipated future revenue, expenses, capital ratios, and the future plans and prospects of First Federal Savings Bank. For a discussion of the risks and uncertainties that may cause actual results to differ from these expectations and our other forward-looking statements, refer to First Financial Service Corporation’s 2011 Annual Report on Form 10-K, including the “Risk Factors” section, and other periodic reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and First Financial Service Corporation undertakes no obligation to update them in light of new information or future events 2

Management Team Business Plan and Capital Loan Quality Return to Profitability Question and Answer 3

Greg Schreacke President Frank Perez Chief Financial Officer Dann Small Chief Lending Officer Bob Critchfield Chief Credit Officer Anne Moran Chief Retail Officer Charles Chaney Chief Operations Officer Susan Simmons Director of Human Resources Tanya Deneen Risk Management 4

Frank Perez -Chief Financial Officer Mr. Perez is a Certified Public Accountant and has over 15 years of experience in the banking industry. He has over 7 years of experience as CFO with experience in investors relations and the capital markets, including shareholder rights offerings. Experience in public accounting including Crowe Horwath, LLP, one of the largest public accounting and consulting firms in the U.S. B.S. in Accounting from Austin Peay State University. Served ten years in the U.S. Army from 1986-1996. 5

Dann Small -Chief Lending Officer Mr. Small will direct the lending program and supervise all phases of the lending operation. Mr. Small has over 30 years of experience in finance, lending, credit underwriting and executive management. Extensive experience in leading people and organizations. He has successfully turned around several struggling institutions during his career. Former Managing Partner of Southport Advisory Services, LLC, providing acquisition and asset management services to financial institutions. 6

Robert L. Critchfield -Chief Credit Officer Has responsibility for the overall management of loans, credit and risk policies. Mr. Critchfield has over 40 years of experience in the banking industry, including seventeen years as President and CEO of two commercial banks. Expert in credit, credit operations, underwriting, and credit risk management. B.B.A. in Finance from Western Michigan University and a MBA in Economics from the University of Detroit Mercy. 7

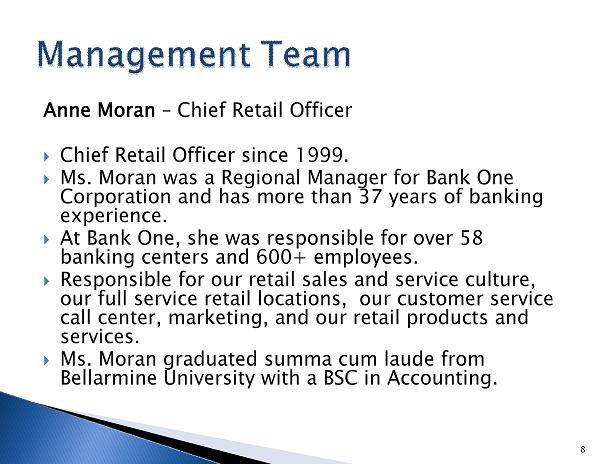

Anne Moran–Chief Retail Officer Chief Retail Officer since 1999. Ms. Moran was a Regional Manager for Bank One Corporation and has more than 37 years of banking experience. At Bank One, she was responsible for over 58 banking centers and 600+ employees. Responsible for our retail sales and service culture, our full service retail locations, our customer service call center, marketing, and our retail products and services. Ms. Moran graduated summa cum laude from Bellarmine University with a BSC in Accounting. 8

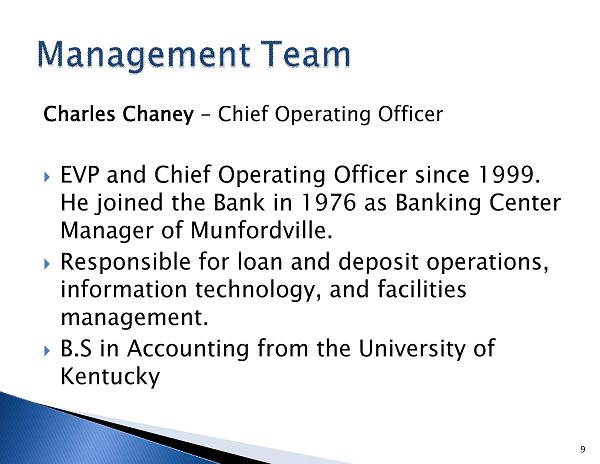

Charles Chaney-Chief Operating Officer EVP and Chief Operating Officer since 1999. He joined the Bank in 1976 as Banking Center Manager of Munfordville. Responsible for loan and deposit operations, information technology, and facilities management. B.S in Accounting from the University of Kentucky 9

Susan Simmons –Human Resource Director Human Resource Director for the past 16 years. Been with the Company since 1986. Board member of the Elizabethtown Society for Human Resource Management. Board member for the Kentucky SHRM. Graduate of the Kentucky Bankers Association Banking School and the University of Wisconsin- Madison’s Human Resource Management School. 10

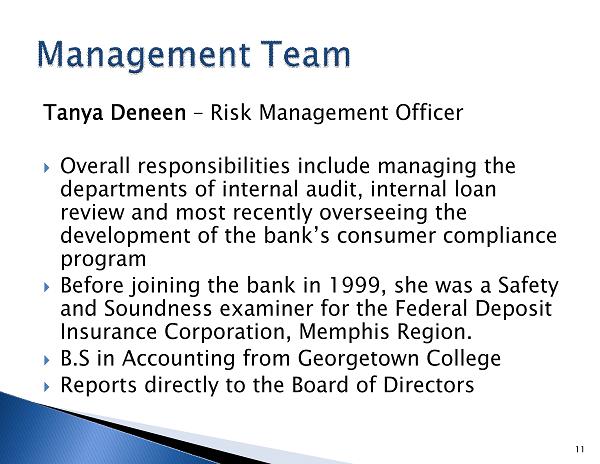

Tanya Deneen –Risk Management Officer Overall responsibilities include managing the departments of internal audit, internal loan review and most recently overseeing the development of the bank’s consumer compliance program Before joining the bank in 1999, she was a Safety and Soundness examiner for the Federal Deposit Insurance Corporation, Memphis Region. B.S in Accounting from Georgetown College Reports directly to the Board of Directors 11

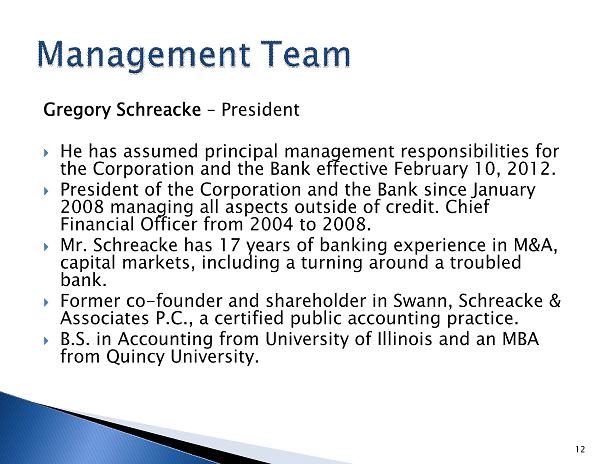

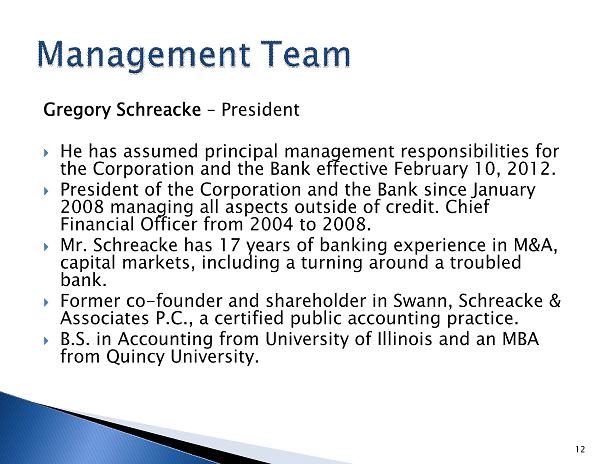

Gregory Schreacke –President He has assumed principal management responsibilities for the Corporation and the Bank effective February 10, 2012. President of the Corporation and the Bank since January 2008 managing all aspects outside of credit. Chief Financial Officer from 2004 to 2008. Mr. Schreacke has 17 years of banking experience in M&A, capital markets, including a turning around a troubled bank. Former co-founder and shareholder in Swann, Schreacke & Associates P.C., a certified public accounting practice. B.S. in Accounting from University of Illinois and an MBA from Quincy University. 12

Management Team Business Plan and Capital Loan Quality Return to Profitability Question and Answer 13

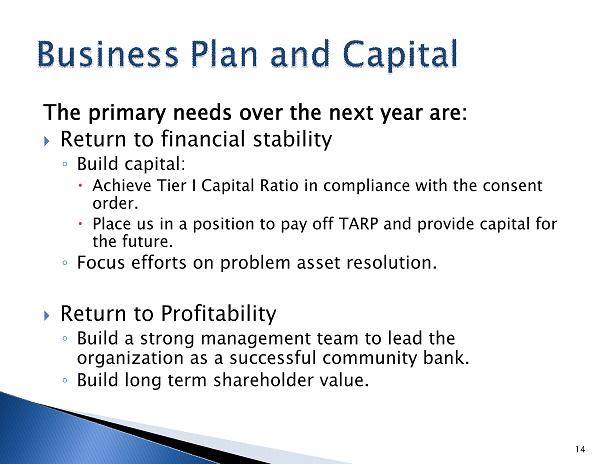

The primary needs over the next year are: Return to financial stability ◦ Build capital: Achieve Tier I Capital Ratio in compliance with the consent order. Place us in a position to pay off TARP and provide capital for the future. ◦ Focus efforts on problem asset resolution. Return to Profitability ◦ Build a strong management team to lead the organization as a successful community bank. ◦ Build long term shareholder value. 14

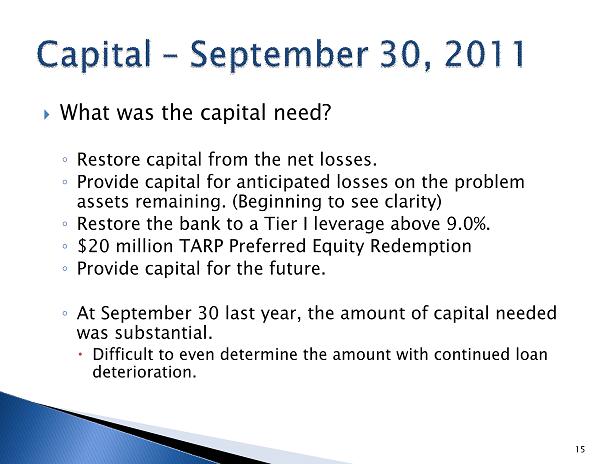

What was the capital need? ◦ Restore capital from the net losses. ◦ Provide capital for anticipated losses on the problem assets remaining. (Beginning to see clarity) ◦ Restore the bank to a Tier I leverage above 9.0%. ◦ $20 million TARP Preferred Equity Redemption ◦ Provide capital for the future. ◦ At September 30 last year, the amount of capital needed was substantial. Difficult to even determine the amount with continued loan deterioration. 15

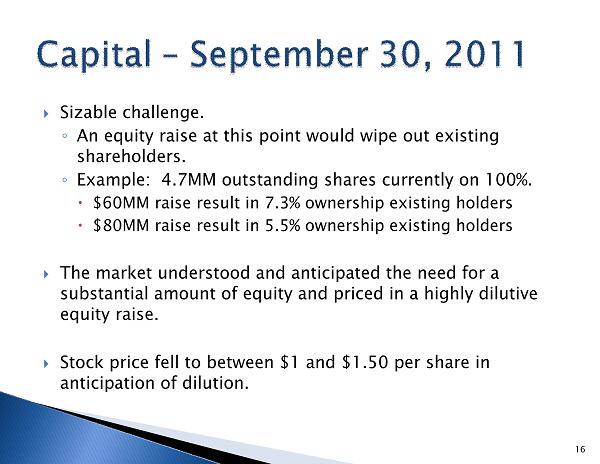

Sizable challenge. ◦ An equity raise at this point would wipe out existing shareholders. ◦ Example: 4.7MM outstanding shares currently on 100%. $60MM raise result in 7.3% ownership existing holders $80MM raise result in 5.5% ownership existing holders The market understood and anticipated the need for a substantial amount of equity and priced in a highly dilutive equity raise. Stock price fell to between $1 and $1.50 per share in anticipation of dilution. 16

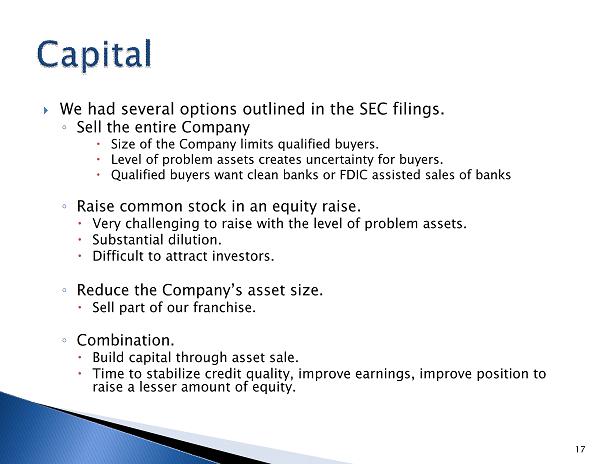

We had several options outlined in the SEC filings. ◦ Sell the entire Company Size of the Company limits qualified buyers. Level of problem assets creates uncertainty for buyers. Qualified buyers want clean banks or FDIC assisted sales of banks ◦ Raise common stock in an equity raise. Very challenging to raise with the level of problem assets. Substantial dilution. Difficult to attract investors. ◦ Reduce the Company’s asset size. Sell part of our franchise. ◦ Combination. Build capital through asset sale. Time to stabilize credit quality, improve earnings, improve position to raise a lesser amount of equity. 17

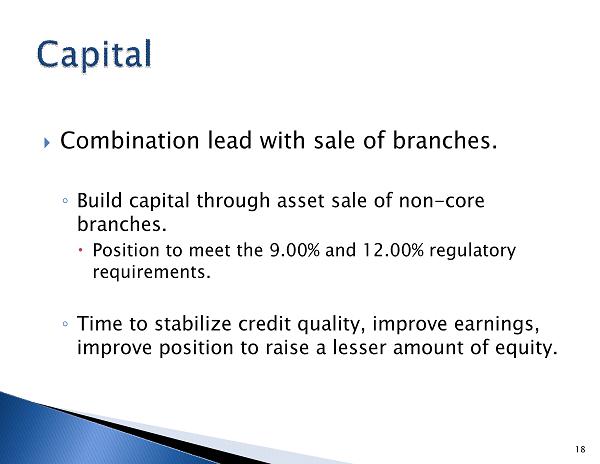

Combination lead with sale of branches. ◦Build capital through asset sale of non-core branches. Position to meet the 9.00% and 12.00% regulatory requirements. ◦Time to stabilize credit quality, improve earnings, improve position to raise a lesser amount of equity. 18

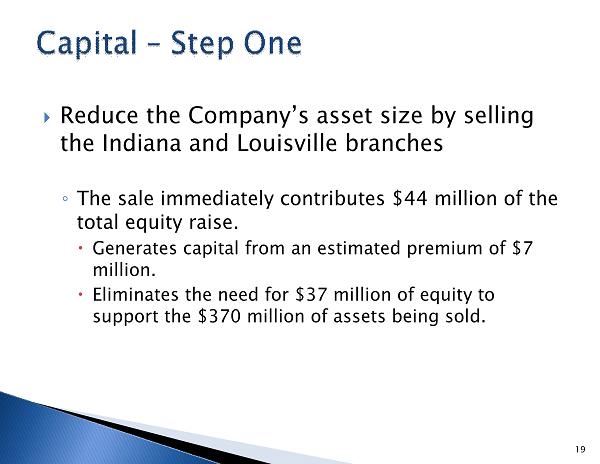

Reduce the Company’s asset size by selling the Indiana and Louisville branches ◦The sale immediately contributes $44 million of the total equity raise. Generates capital from an estimated premium of $7 million. Eliminates the need for $37 million of equity to support the $370 million of assets being sold. 19

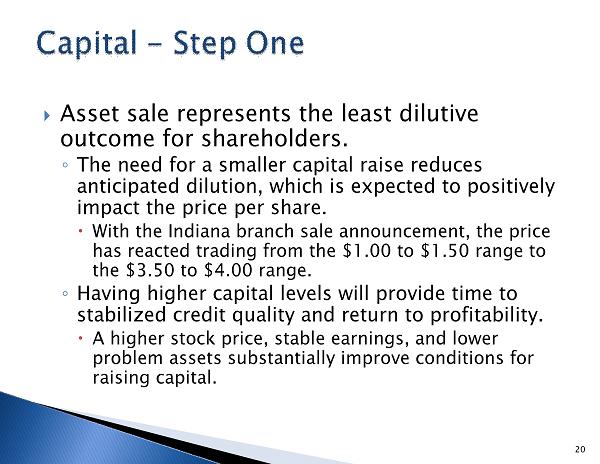

Asset sale represents the least dilutive outcome for shareholders. ◦The need for a smaller capital raise reduces anticipated dilution, which is expected to positively impact the price per share. With the Indiana branch sale announcement, the price has reacted trading from the $1.00 to $1.50 range to the $3.50 to $4.00 range. ◦Having higher capital levels will provide time to stabilized credit quality and return to profitability. A higher stock price, stable earnings, and lower problem assets substantially improve conditions for raising capital. 20

Longer-term goals include paying off TARP and raising capital for the future. Requiring less capital makes less dilutive options more feasible ◦A higher stock price would allow the sale of fewer shares. ◦A rights offering would give existing shareholders an opportunity to maintain their ownership interest. This is an active, ongoing and fluid process. ◦The Board will act in the best interest of the shareholders. 21

Management Team Business Plan and Capital Loan Quality Return to Profitability Question and Answer 22

Fourth Quarter of 2011 Improvement. ◦ Classified asset improvement of 19%. ◦ Non-performing loan improvement of 23% First Quarter of 2012 credit quality stable. ◦ Classified loans improved 36% for 3/31/2012 compared to a year ago. ◦ Sales/contracts on $7.5 million of non-performing loans and real estate owned sold on average above the carrying value for 3/31/2012 and 6/30/2012. Indicates appropriately marked assets. Problem asset inflows have slowed from 2011. 23

24 In Thousands

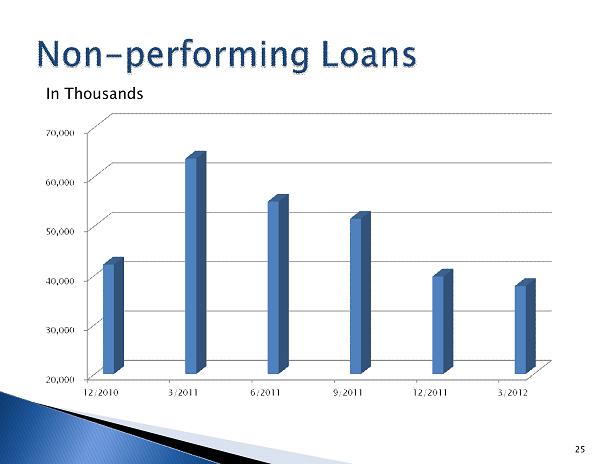

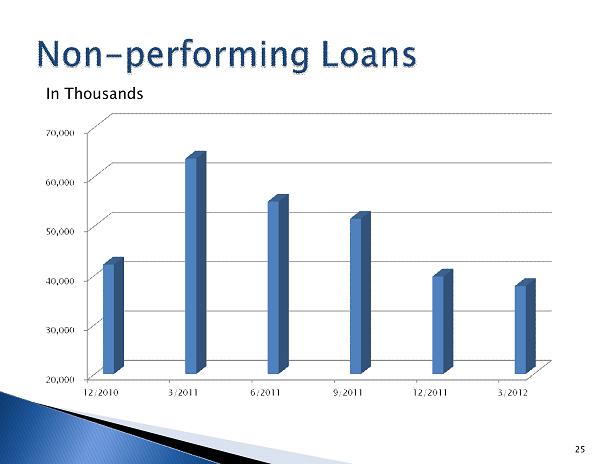

25 In Thousands

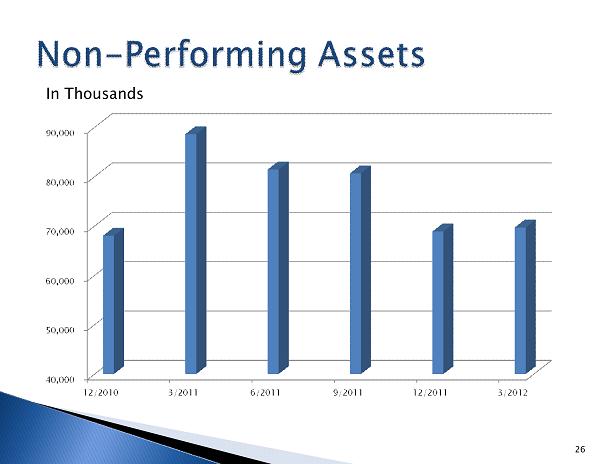

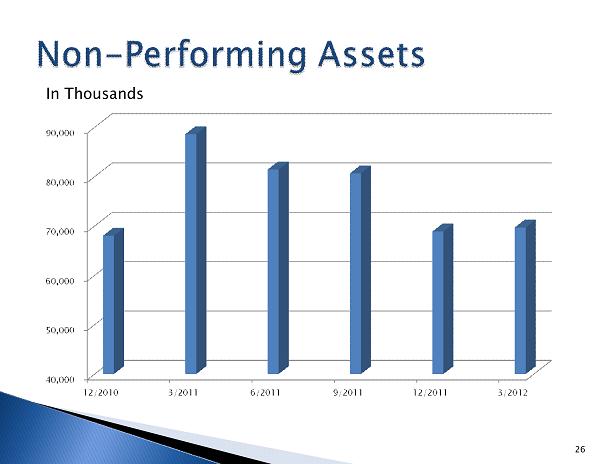

26 In Thousands

Management Team Business Plan and Capital Loan Quality Return to Profitability Question and Answer 27

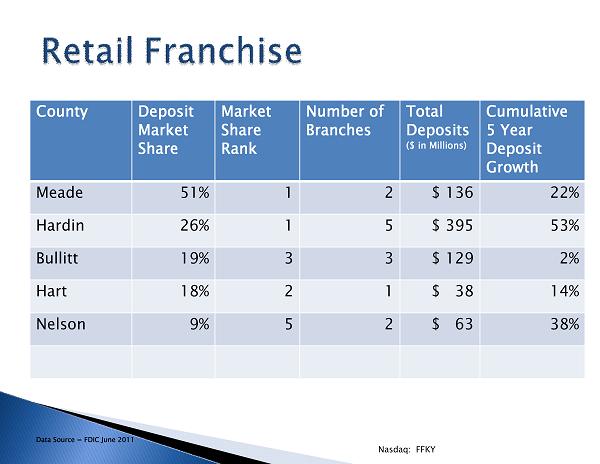

Focus on being a community bank with the dominant position in the original, historically profitable five county franchise. We will concentrate on the markets where we have the top market share and a strong presence. ◦ Market share in our 5 county core market is a combined 22%. ◦ Next largest competitor, just 8%. We will get back to our core and the basics of serving our communities. 28

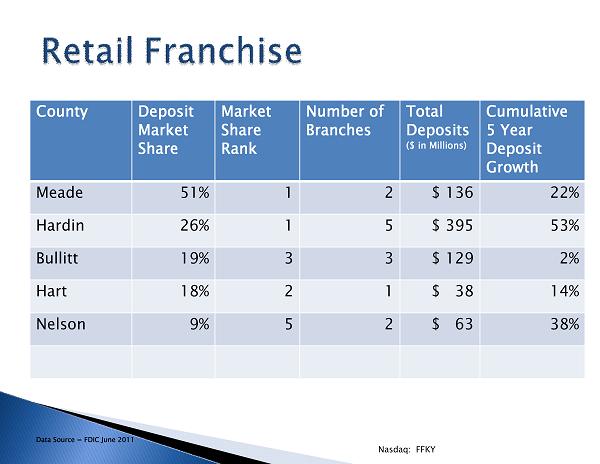

Data Source = FDIC June 2011 Nasdaq: FFKY County Deposit Market Share Market Share Rank Number of Branches Total Deposits ($ in Millions) Cumulative 5 Year Deposit Growth Meade 51% 1 2 $ 136 22% Hardin 26% 1 5 $ 395 53% Bullitt 19% 3 3 $ 129 2% Hart 18% 2 1 $ 38 14% Nelson 9% 5 2 $ 63 38%

Focus on profitability. ◦Asset allocation toward diversified lending. ◦Centralization of mortgage, consumer, and small business underwriting. Efficiency, more competitive, increased production. ◦Isolate problem assets and foreclosed real estate. Ability to focus on moving forward with resources. ◦Fee Income Expansion. Mortgage loan sales. SBA lending and loan sales. ◦Business Banking. 30

Continue to focus on a strong retail franchise. This is our franchise value. We have one of the top retail franchises in the country Sales and service Organization. • Mystery Shopping • Continued focus on small business • Weekly sales calls • Spotlight on business • Customer focused product offerings • Remote deposit capture • Mobile Banking • Business and consumer online banking • Online deposit and loan account opening 31

32 In Thousands

We are transitioning from crisis management to building a stronger franchise for the future! 33

Management Team Business Plan and Capital Loan Quality Return to Profitability Question and Answer 34

35