UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 17, 2019

GREAT SOUTHERN BANCORP, INC.

(Exact name of Registrant as specified in its Charter)

| Maryland | | 0-18082 | | 43-1524856 |

(State or other jurisdiction of

incorporation) | | (Commission File No.) | | (IRS Employer Identification

Number) |

| 1451 East Battlefield, Springfield, Missouri | | 65804 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (417) 887-4400

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| Trading Symbol(s)

| Name of each exchange on which registered

|

Common Stock, par value $0.01 per share

| GSBC

| The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank.

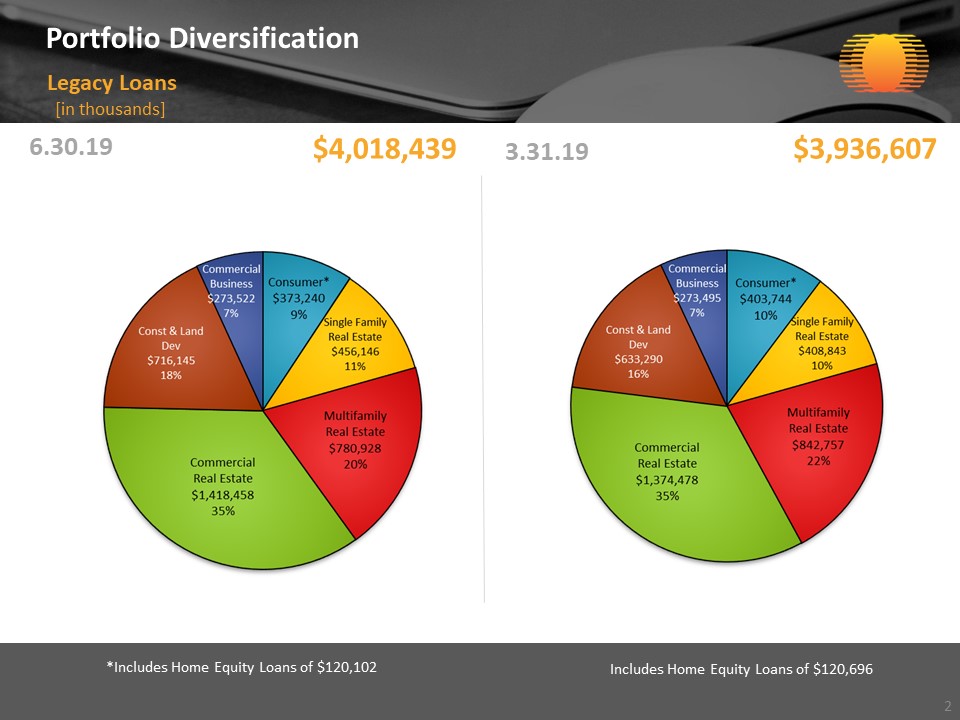

Portfolio Diversification Legacy Loans 6.30.19 $4,018,439 $3,936,607 3.31.19 *Includes Home Equity Loans of $120,102 Includes Home Equity Loans of $120,696 * [in thousands]

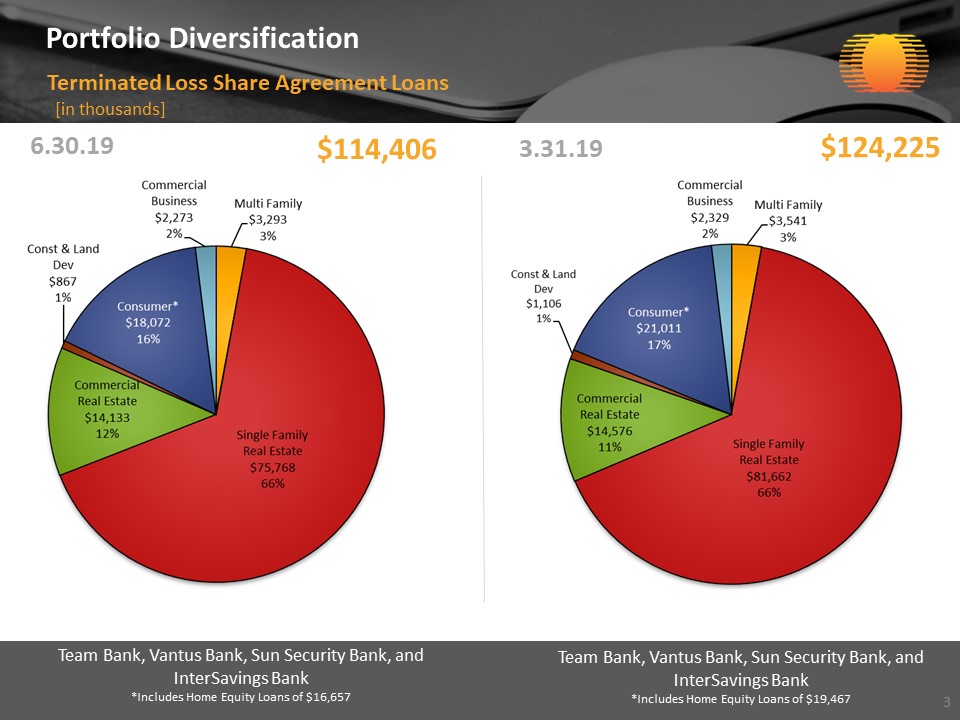

Portfolio Diversification Terminated Loss Share Agreement Loans 6.30.19 $114,406 $124,225 3.31.19 Team Bank, Vantus Bank, Sun Security Bank, and InterSavings Bank*Includes Home Equity Loans of $16,657 Team Bank, Vantus Bank, Sun Security Bank, and InterSavings Bank*Includes Home Equity Loans of $19,467 * [in thousands]

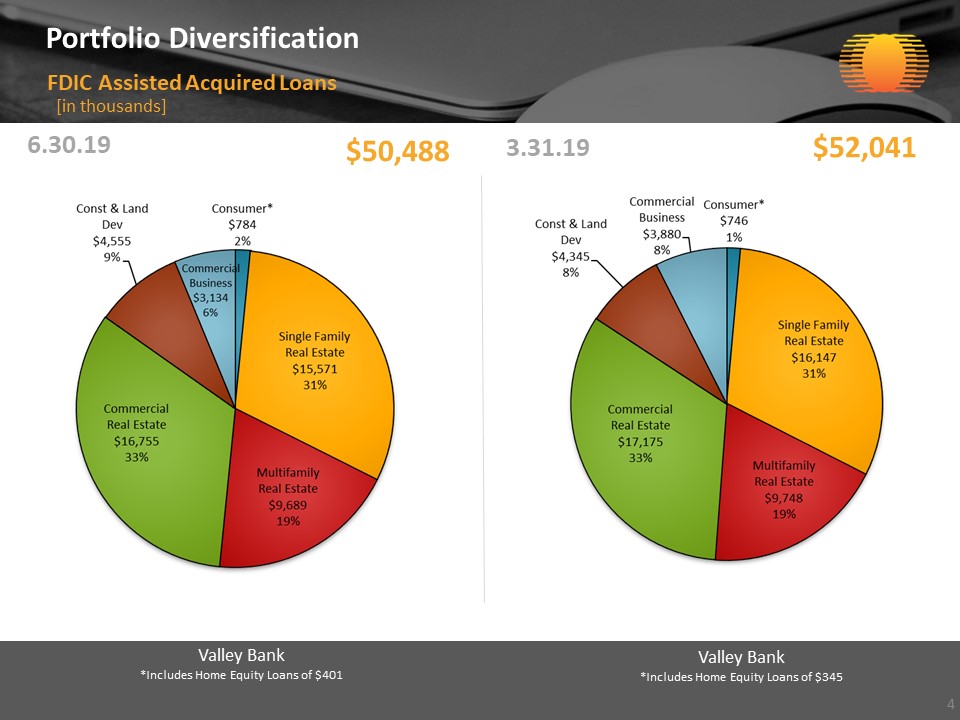

Portfolio Diversification FDIC Assisted Acquired Loans 6.30.19 $50,488 $52,041 3.31.19 Valley Bank*Includes Home Equity Loans of $401 Valley Bank*Includes Home Equity Loans of $345 * [in thousands]

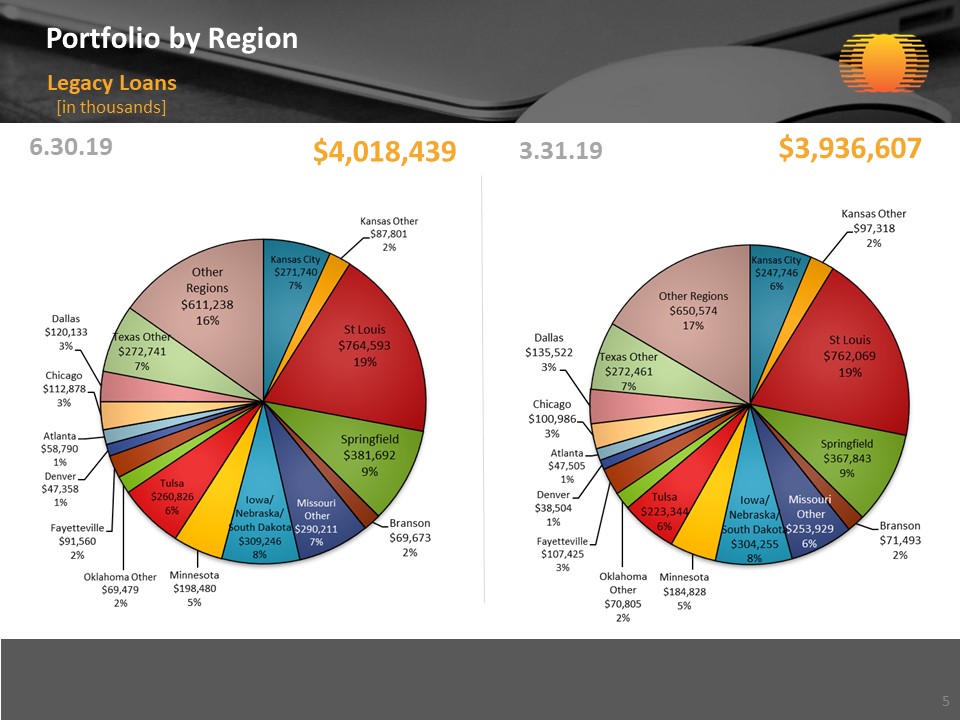

Portfolio by Region Legacy Loans 6.30.19 $4,018,439 $3,936,607 3.31.19 * [in thousands]

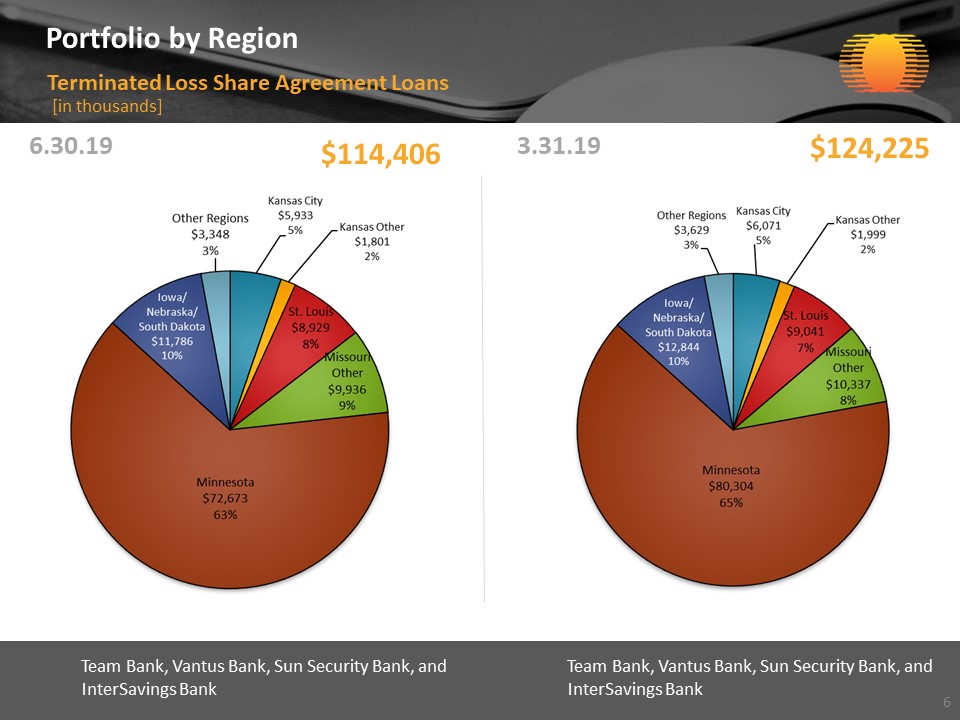

Portfolio by Region Terminated Loss Share Agreement Loans 6.30.19 $114,406 $124,225 3.31.19 * [in thousands] Team Bank, Vantus Bank, Sun Security Bank, and InterSavings Bank Team Bank, Vantus Bank, Sun Security Bank, and InterSavings Bank

Commercial Real Estate Legacy Loans 6.30.19 $1,418,458 $1,374,478 3.31.19 * [in thousands]

Commercial Real Estate by Region Legacy Loans 6.30.19 $1,374,478 3.31.19 * [in thousands] $1,418,458

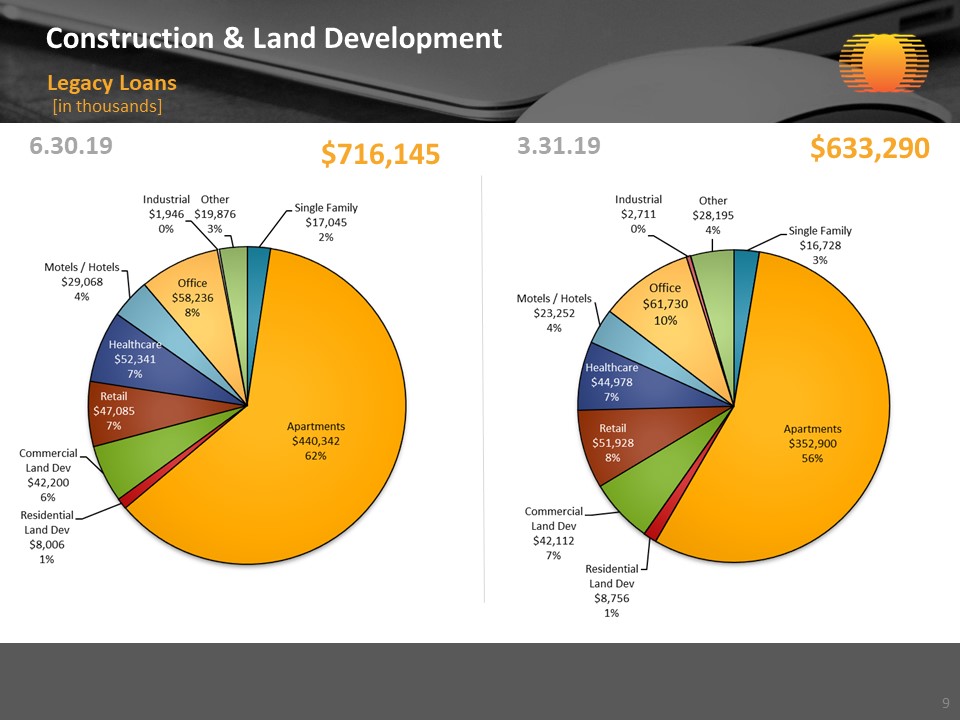

Construction & Land Development Legacy Loans 6.30.19 $716,145 $633,290 3.31.19 * [in thousands]

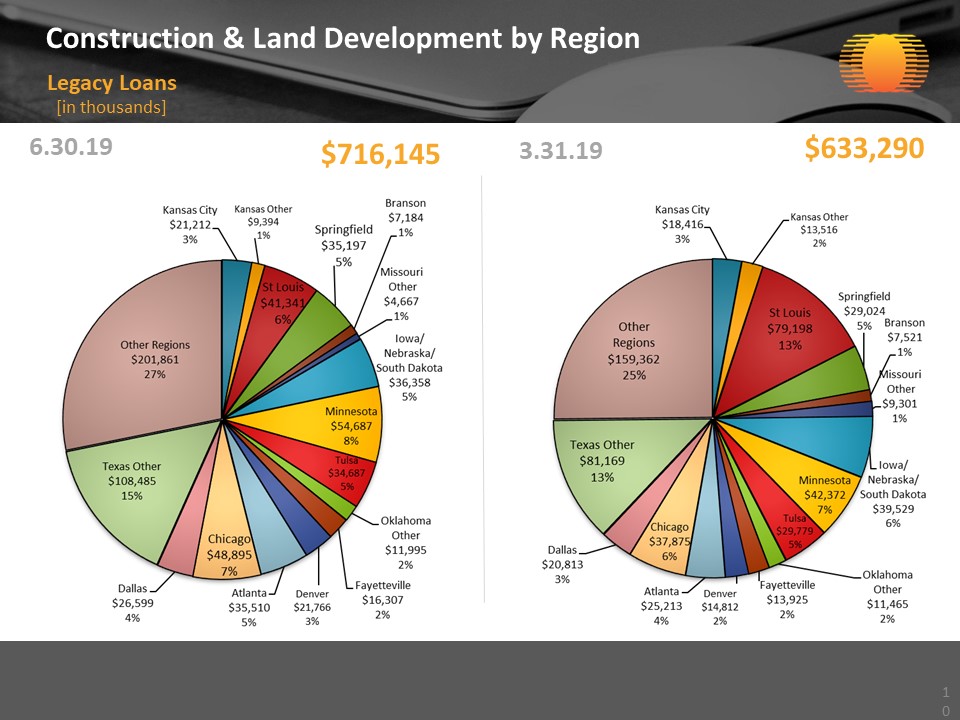

Construction & Land Development by Region Legacy Loans 6.30.19 $633,290 3.31.19 * [in thousands] $716,145

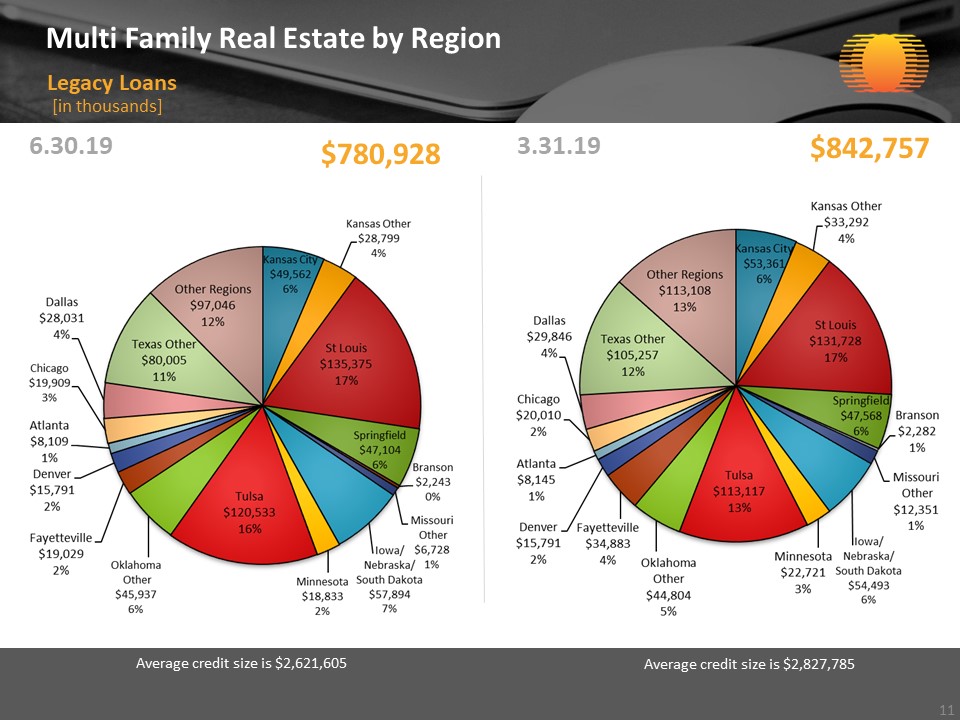

Multi Family Real Estate by Region Legacy Loans 6.30.19 $780,928 $842,757 3.31.19 * [in thousands] Average credit size is $2,621,605 Average credit size is $2,827,785

Multi Family Real Estate by LTV Legacy Loans 6.30.19 $780,928 $842,757 3.31.19 * [in thousands]

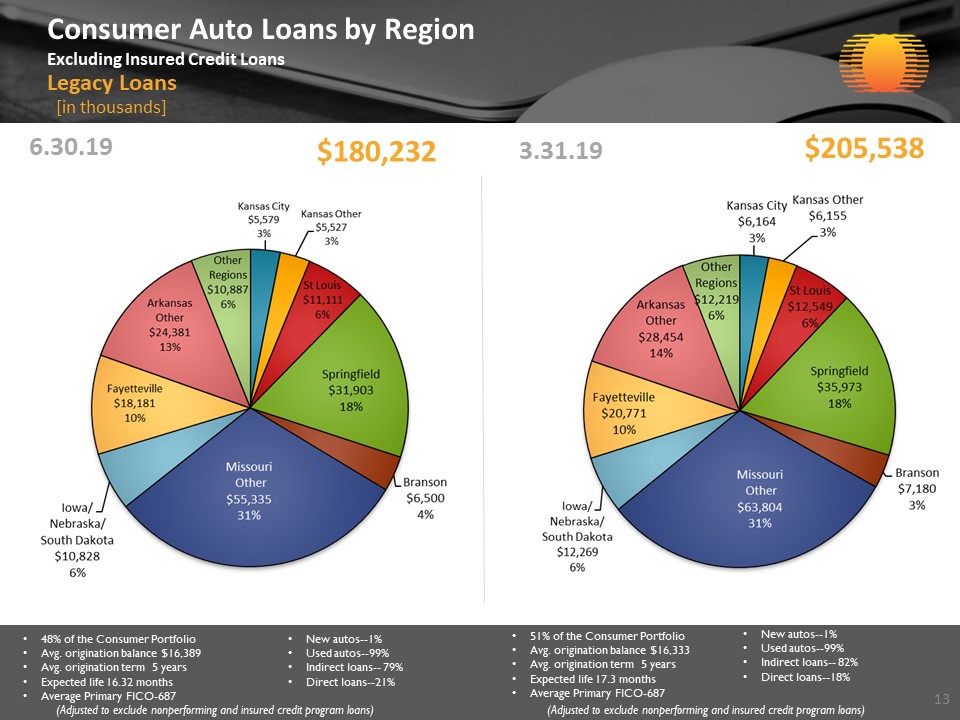

Consumer Auto Loans by RegionExcluding Insured Credit Loans Legacy Loans 6.30.19 $180,232 $205,538 3.31.19 * [in thousands] 48% of the Consumer PortfolioAvg. origination balance $16,389Avg. origination term 5 yearsExpected life 16.32 months Average Primary FICO-687 New autos--1% Used autos--99% Indirect loans-- 79%Direct loans--21% 51% of the Consumer PortfolioAvg. origination balance $16,333Avg. origination term 5 yearsExpected life 17.3 months Average Primary FICO-687 New autos--1% Used autos--99% Indirect loans-- 82%Direct loans--18% (Adjusted to exclude nonperforming and insured credit program loans) (Adjusted to exclude nonperforming and insured credit program loans)

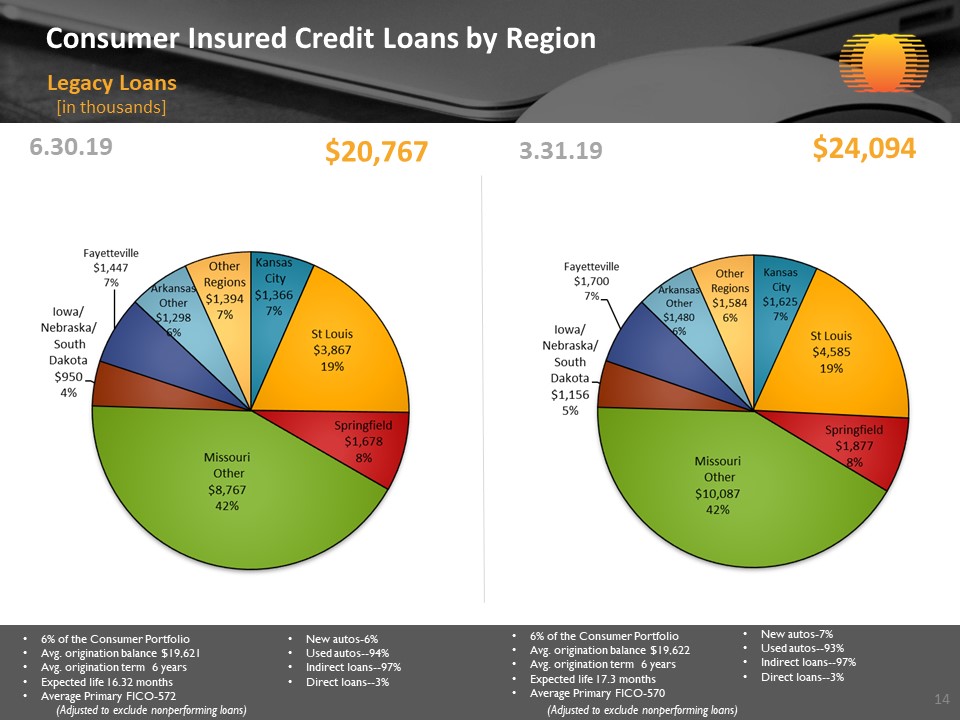

Consumer Insured Credit Loans by Region Legacy Loans 6.30.19 $20,767 $24,094 3.31.19 * [in thousands] 6% of the Consumer PortfolioAvg. origination balance $19,621Avg. origination term 6 yearsExpected life 16.32 months Average Primary FICO-572 New autos-6% Used autos--94% Indirect loans--97%Direct loans--3% 6% of the Consumer PortfolioAvg. origination balance $19,622Avg. origination term 6 yearsExpected life 17.3 months Average Primary FICO-570 New autos-7% Used autos--93% Indirect loans--97%Direct loans--3% (Adjusted to exclude nonperforming loans) (Adjusted to exclude nonperforming loans)

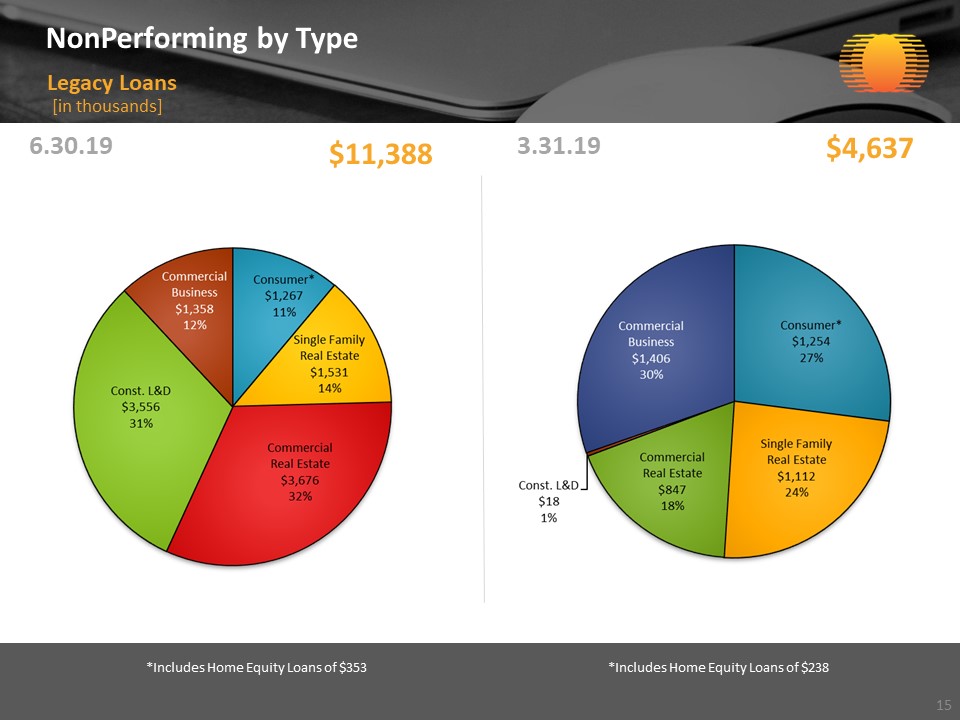

NonPerforming by Type Legacy Loans 6.30.19 $11,388 $4,637 3.31.19 * [in thousands] *Includes Home Equity Loans of $238 *Includes Home Equity Loans of $353

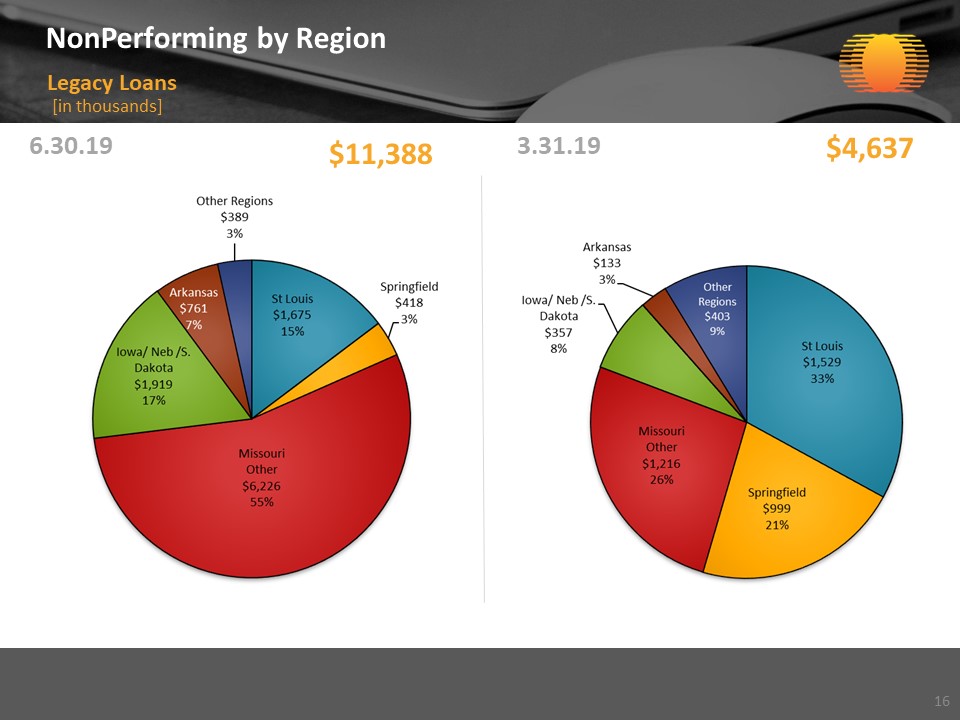

NonPerforming by Region Legacy Loans 6.30.19 $11,388 $4,637 3.31.19 * [in thousands]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| | GREAT SOUTHERN BANCORP, INC. | |

| | | | |

| Date July 17, 2019 | By: | /s/ Joseph W. Turner | |

| | | Joseph W. Turner | |

| | | President and Chief Executive Officer | |

| | | | |