December 31, 2020

Item 7.01. Regulation FD Disclosure

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank.

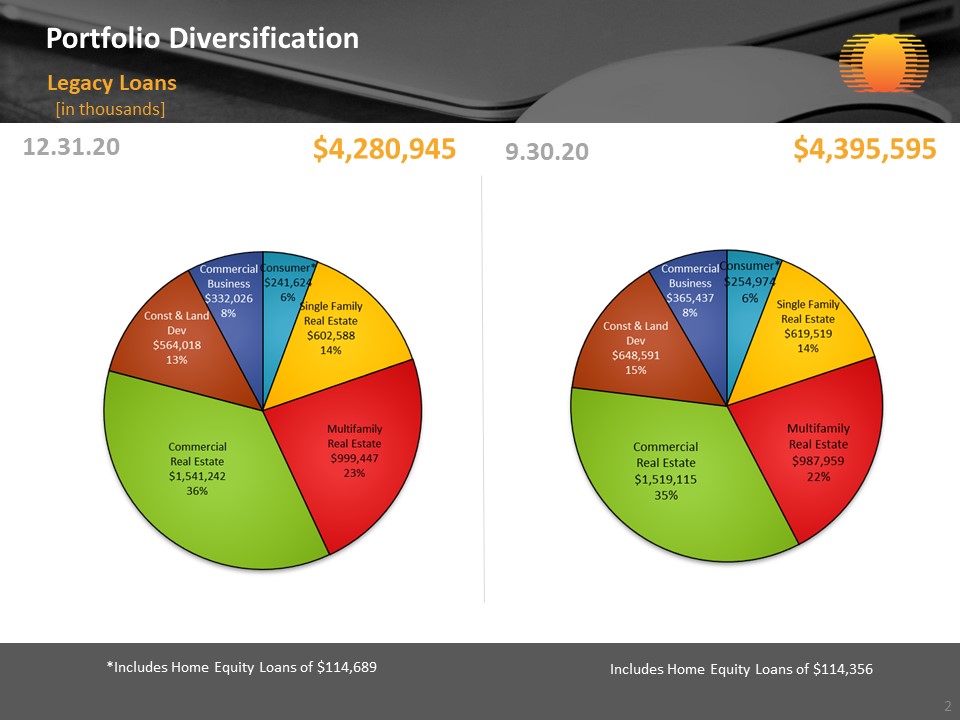

Portfolio Diversification Legacy Loans 12.31.20 $4,280,945 $4,395,595 9.30.20 *Includes Home Equity Loans of $114,689 Includes Home Equity Loans of $114,356 * [in thousands]

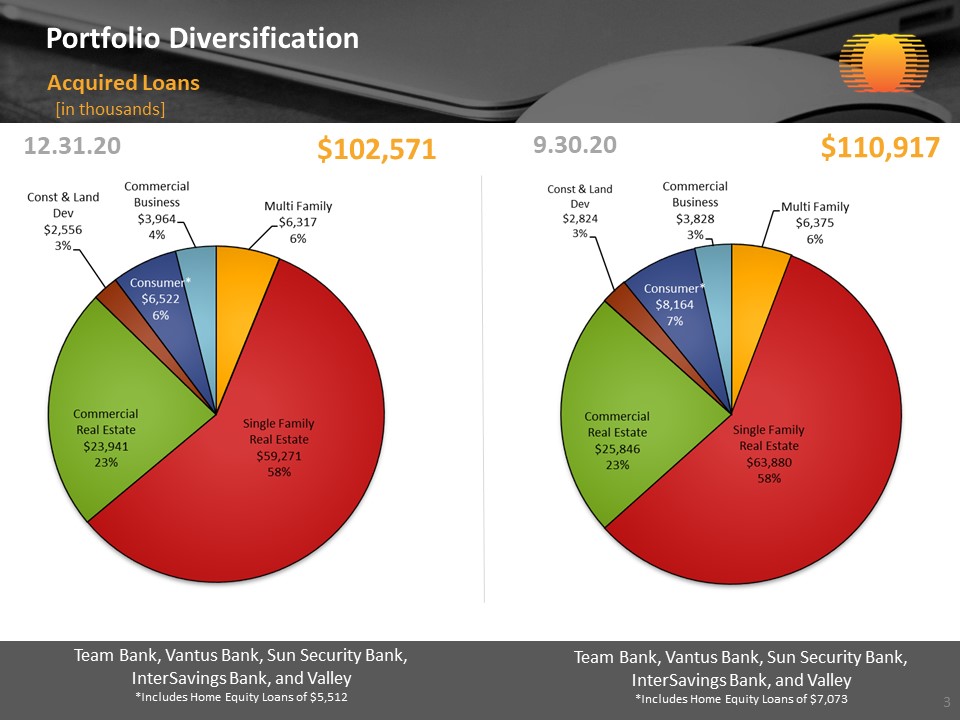

Portfolio Diversification Acquired Loans 12.31.20 $102,571 $110,917 9.30.20 Team Bank, Vantus Bank, Sun Security Bank, InterSavings Bank, and Valley*Includes Home Equity Loans of $5,512 Team Bank, Vantus Bank, Sun Security Bank, InterSavings Bank, and Valley*Includes Home Equity Loans of $7,073 * [in thousands]

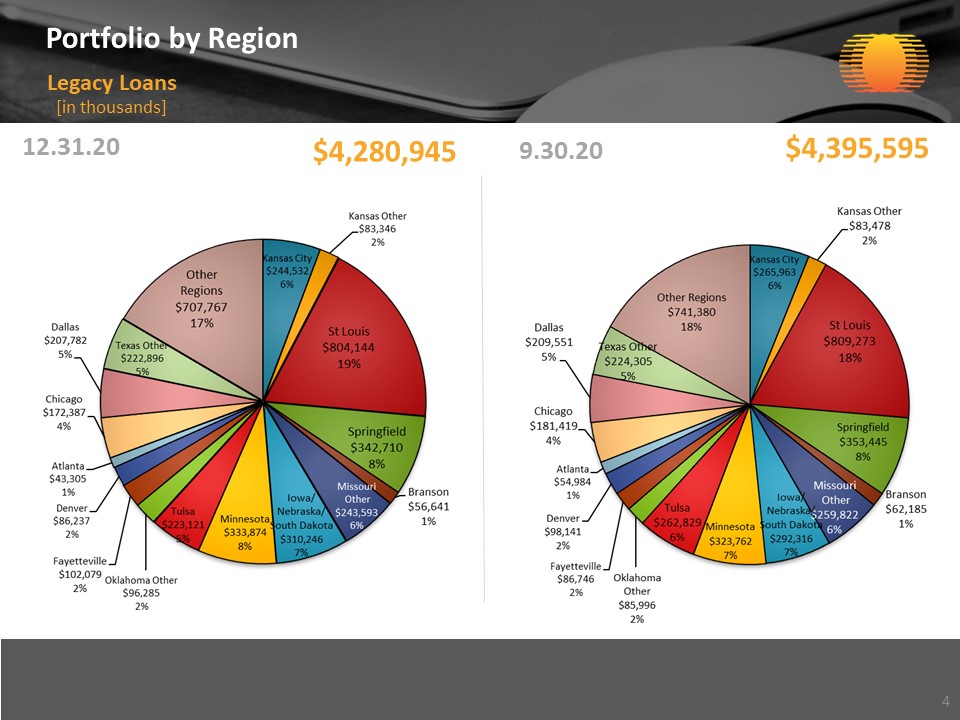

Portfolio by Region Legacy Loans 12.31.20 $4,280,945 $4,395,595 9.30.20 * [in thousands]

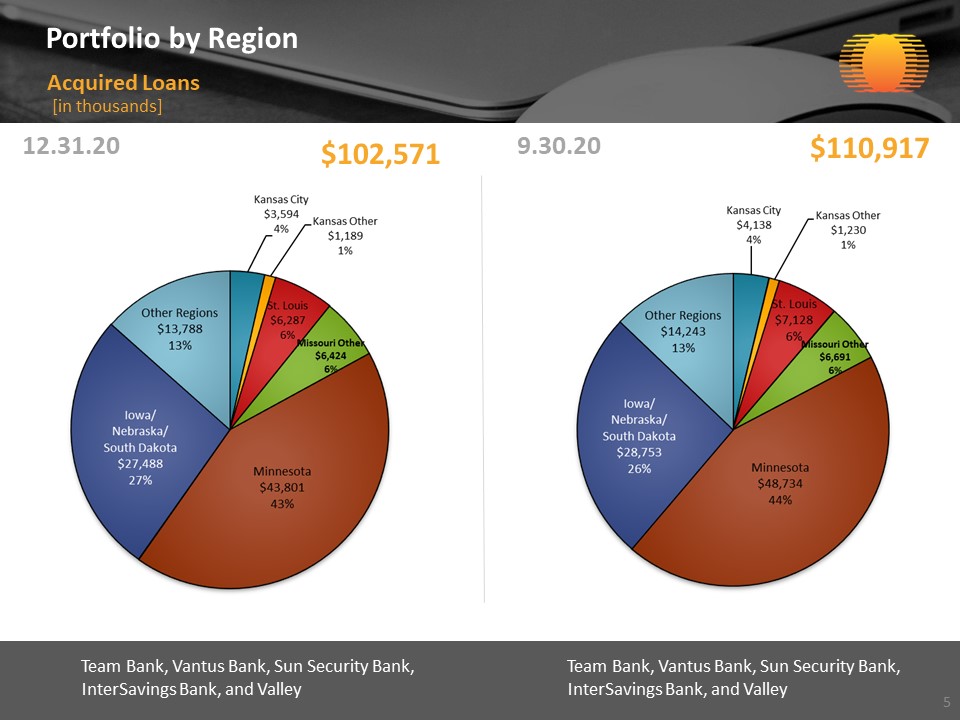

Portfolio by Region Acquired Loans 12.31.20 $102,571 $110,917 9.30.20 * [in thousands] Team Bank, Vantus Bank, Sun Security Bank, InterSavings Bank, and Valley Team Bank, Vantus Bank, Sun Security Bank, InterSavings Bank, and Valley

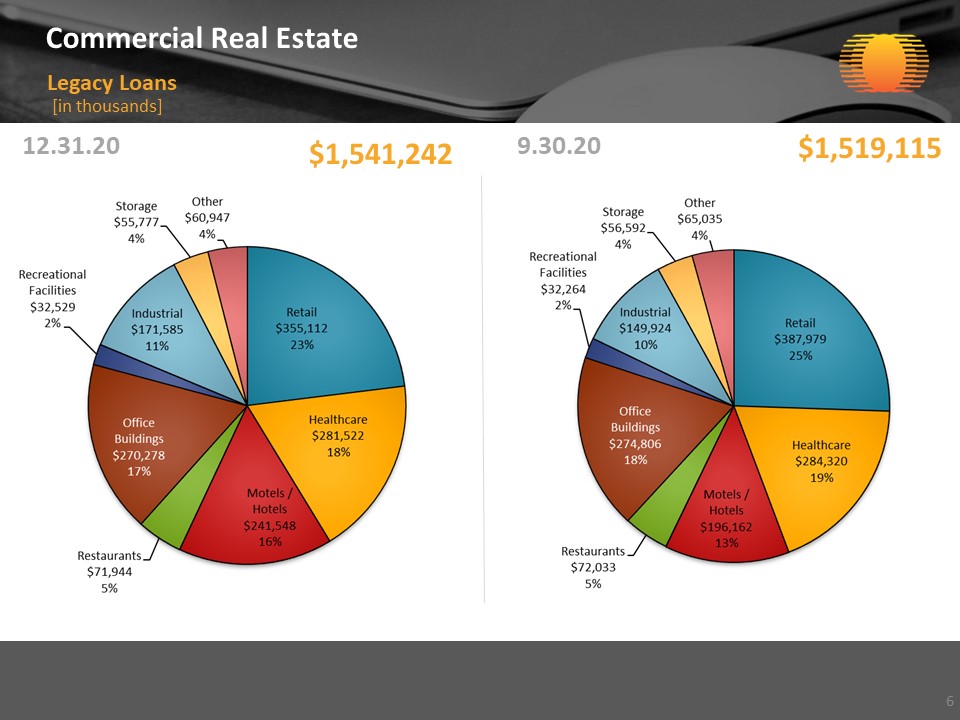

Commercial Real Estate Legacy Loans 12.31.20 $1,541,242 $1,519,115 9.30.20 * [in thousands]

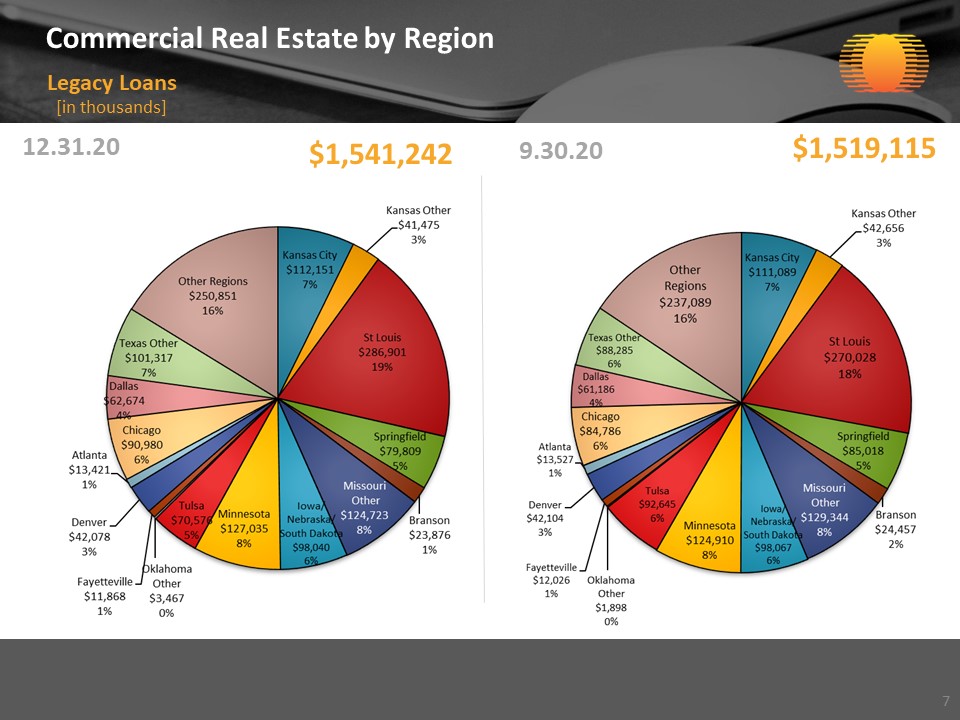

Commercial Real Estate by Region Legacy Loans 12.31.20 $1,519,115 9.30.20 * [in thousands] $1,541,242

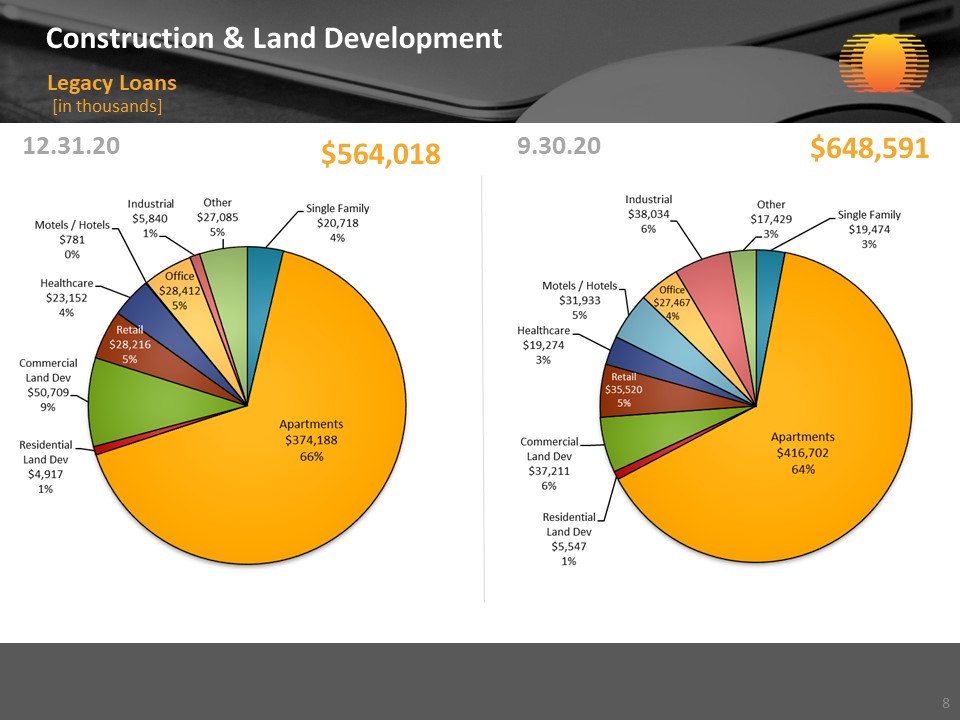

Construction & Land Development Legacy Loans 12.31.20 $564,018 $648,591 9.30.20 * [in thousands]

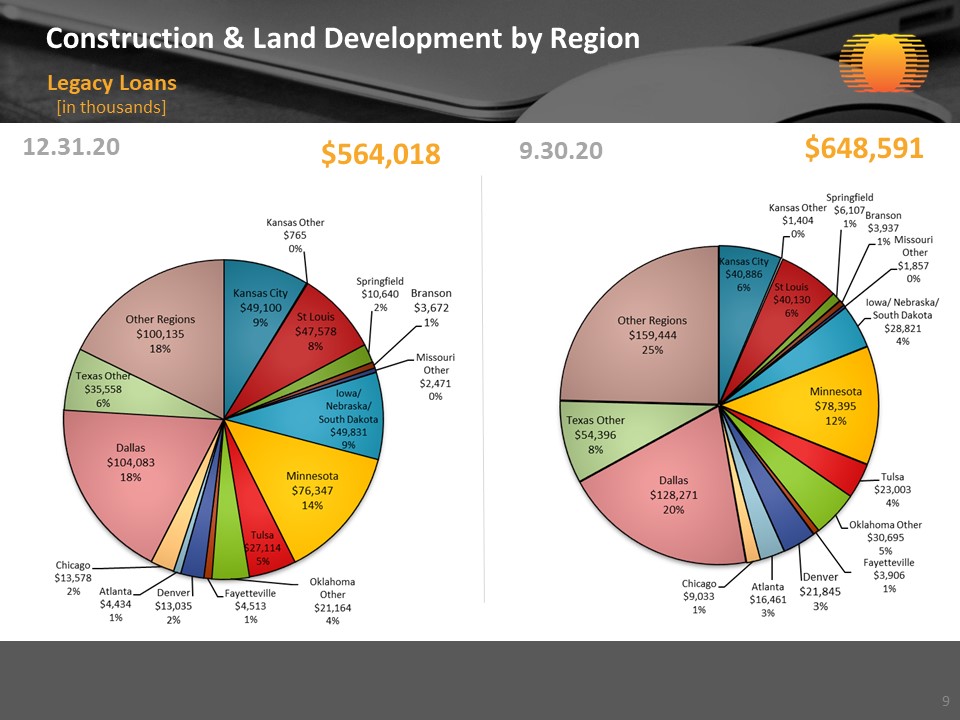

Construction & Land Development by Region Legacy Loans 12.31.20 $648,591 9.30.20 * [in thousands] $564,018

Multi Family Real Estate by Region Legacy Loans 12.31.20 $999,447 $987,959 9.30.20 * [in thousands] Average credit size is $3,621,184 Average credit size is $3,466,522

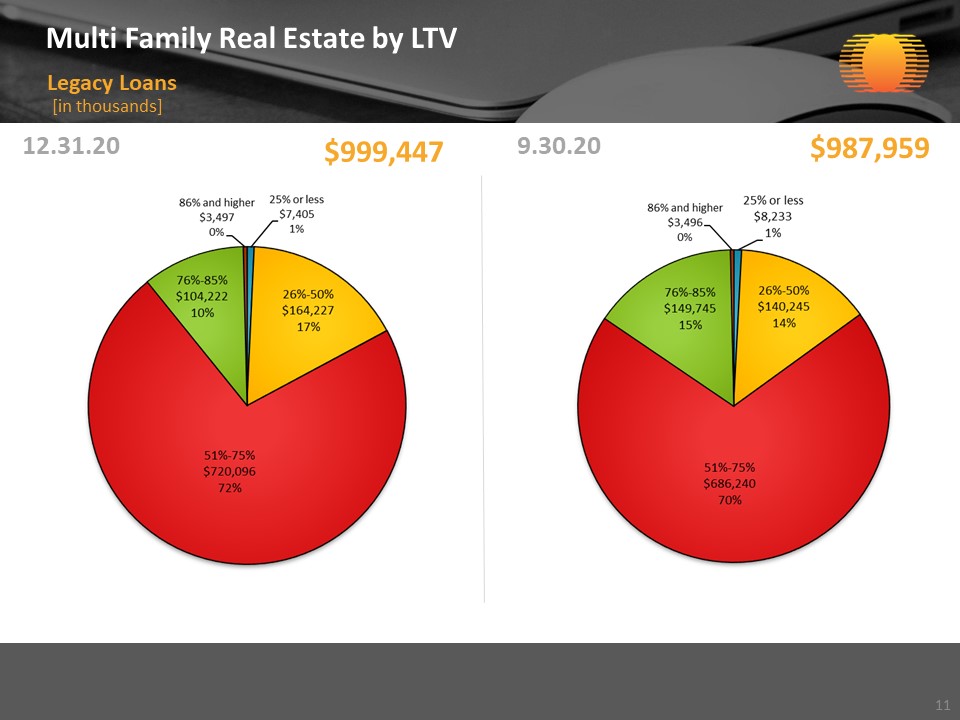

Multi Family Real Estate by LTV Legacy Loans 12.31.20 $999,447 $987,959 9.30.20 * [in thousands]

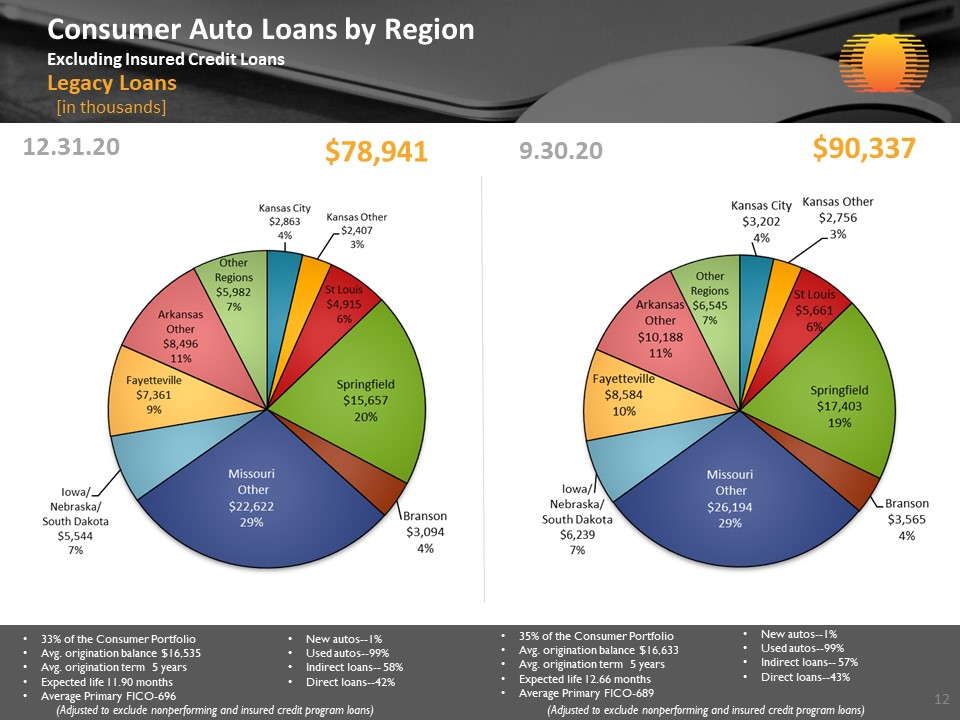

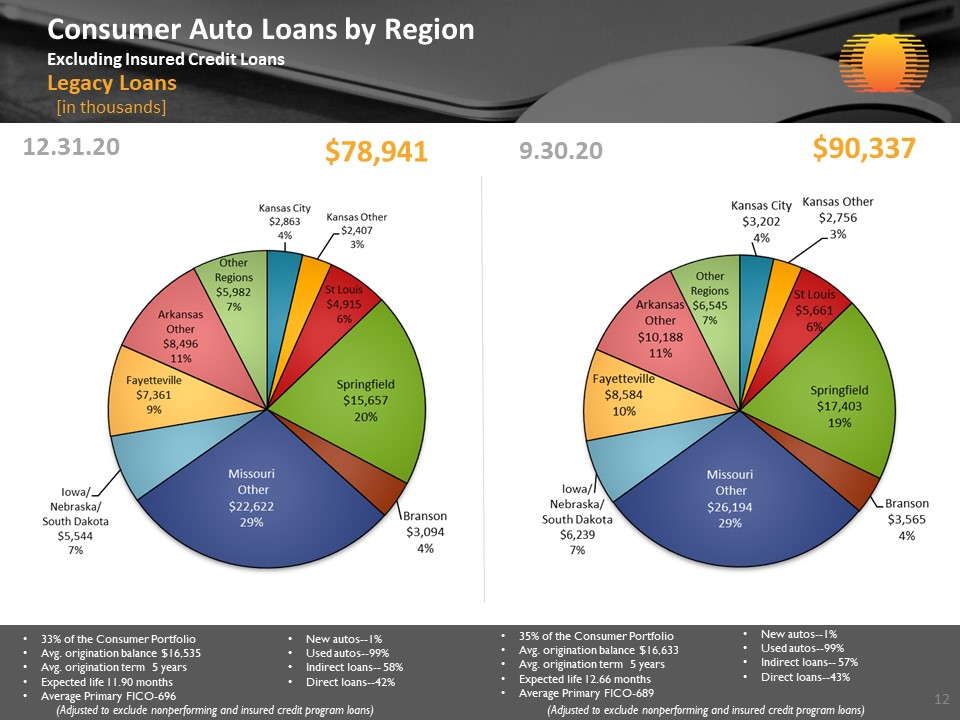

Consumer Auto Loans by RegionExcluding Insured Credit Loans Legacy Loans 12.31.20 $78,941 $90,337 9.30.20 * [in thousands] 33% of the Consumer PortfolioAvg. origination balance $16,535Avg. origination term 5 yearsExpected life 11.90 months Average Primary FICO-696 New autos--1% Used autos--99% Indirect loans-- 58%Direct loans--42% 35% of the Consumer PortfolioAvg. origination balance $16,633Avg. origination term 5 yearsExpected life 12.66 months Average Primary FICO-689 New autos--1% Used autos--99% Indirect loans-- 57%Direct loans--43% (Adjusted to exclude nonperforming and insured credit program loans) (Adjusted to exclude nonperforming and insured credit program loans)

Consumer Insured Credit Loans by Region Legacy Loans 12.31.20 $7,232 $8,865 9.30.20 * [in thousands] 3% of the Consumer PortfolioAvg. origination balance $19,580Avg. origination term 6 yearsExpected life 11.90 months Average Primary FICO-586 New autos-6% Used autos--94% Indirect loans--97%Direct loans--3% 3% of the Consumer PortfolioAvg. origination balance $19,523Avg. origination term 6 yearsExpected life 12.66 months Average Primary FICO-572 New autos-7% Used autos--93% Indirect loans--97%Direct loans--3% (Adjusted to exclude nonperforming loans) (Adjusted to exclude nonperforming loans)

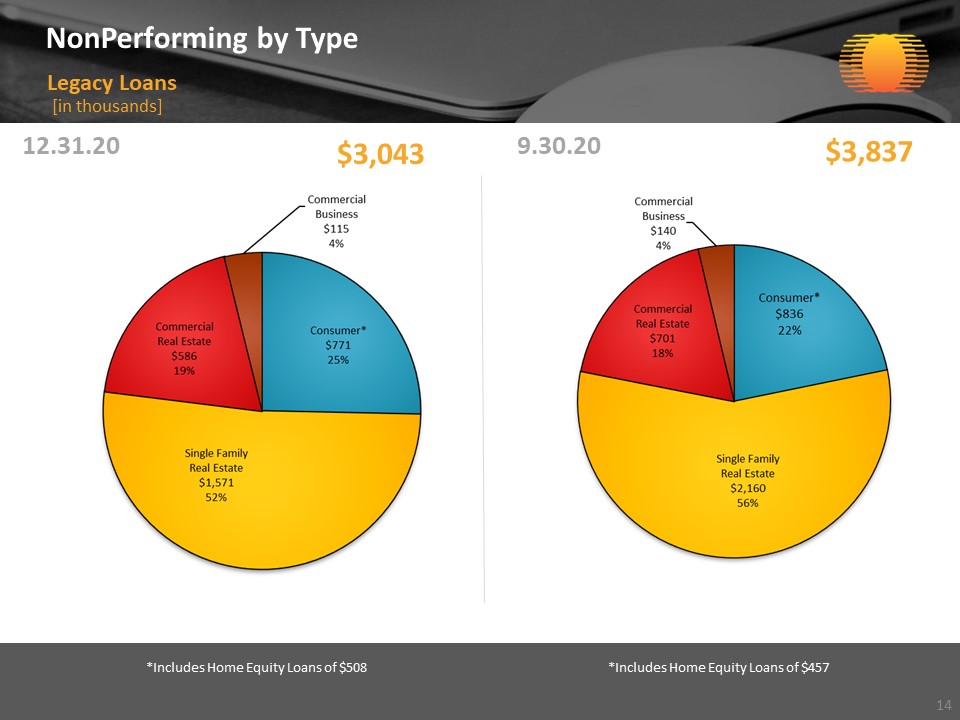

NonPerforming by Type Legacy Loans 12.31.20 $3,043 $3,837 9.30.20 * [in thousands] *Includes Home Equity Loans of $457 *Includes Home Equity Loans of $508

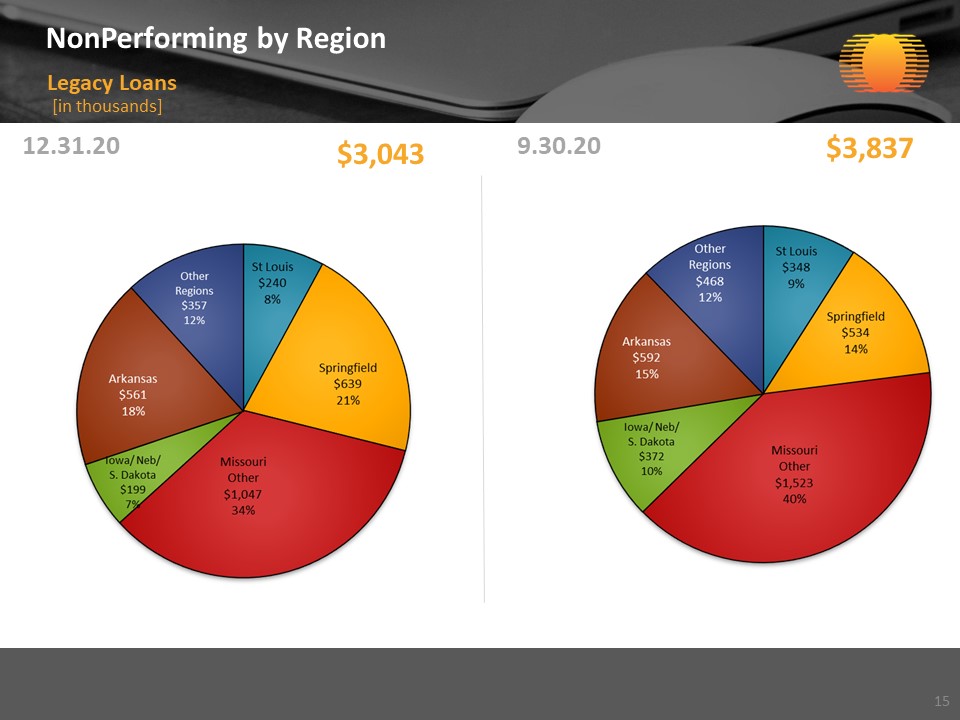

NonPerforming by Region Legacy Loans 12.31.20 $3,043 $3,837 9.30.20 * [in thousands]

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | GREAT SOUTHERN BANCORP, INC. |

| | | | |

| Date: | January 25, 2021 | By: | /s/ Joseph W. Turner |

| | | | Joseph W. Turner, President |

| | | | and Chief Executive Officer |