UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2024

GREAT SOUTHERN BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Maryland | | 0-18082 | | 43-1524856 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 1451 East Battlefield, Springfield, Missouri | | | | 65804 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (417) 887-4400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | GSBC | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ |

Item 7.01 Regulation FD Disclosure.

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank.

December 31, 2023 1

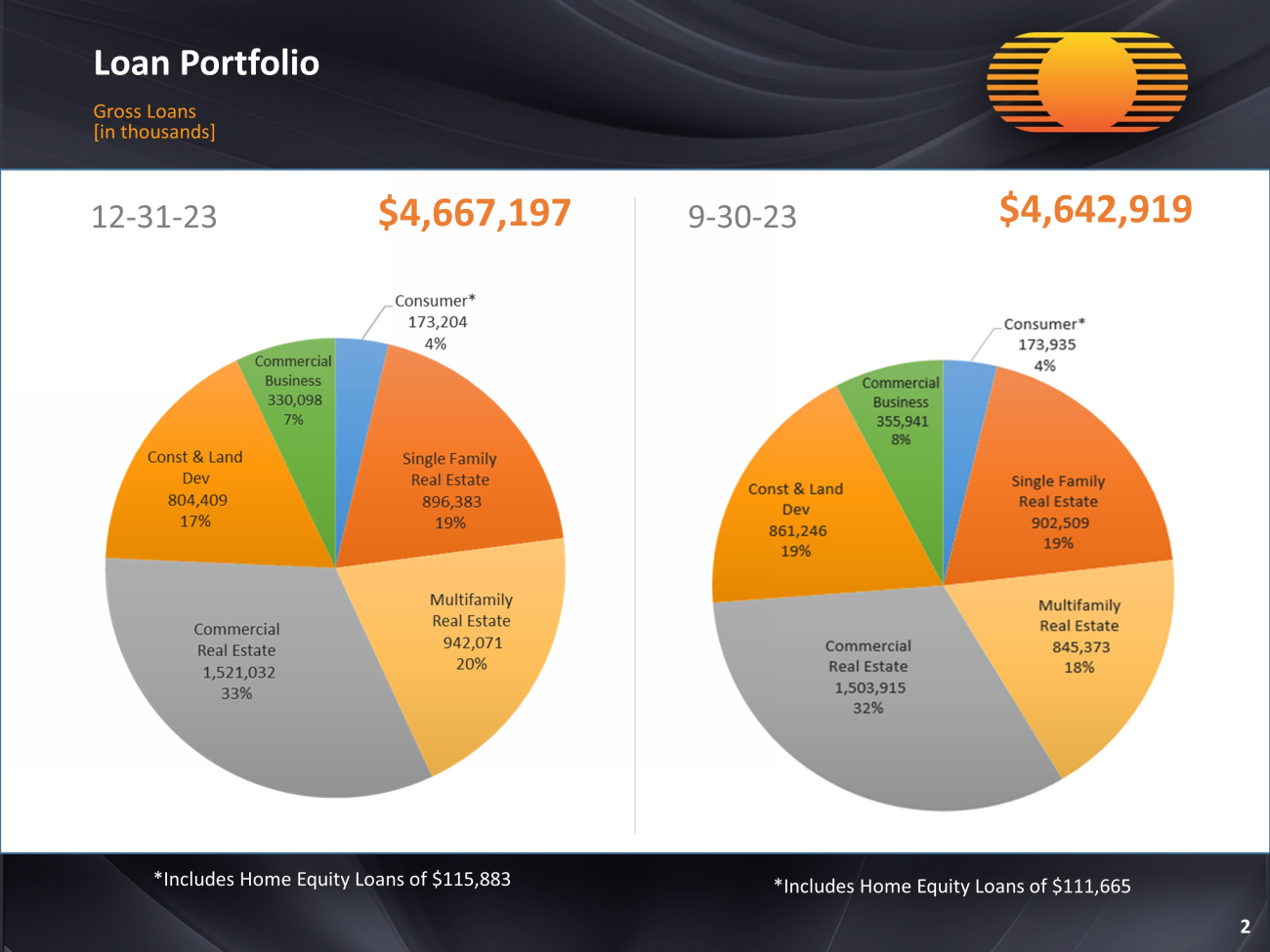

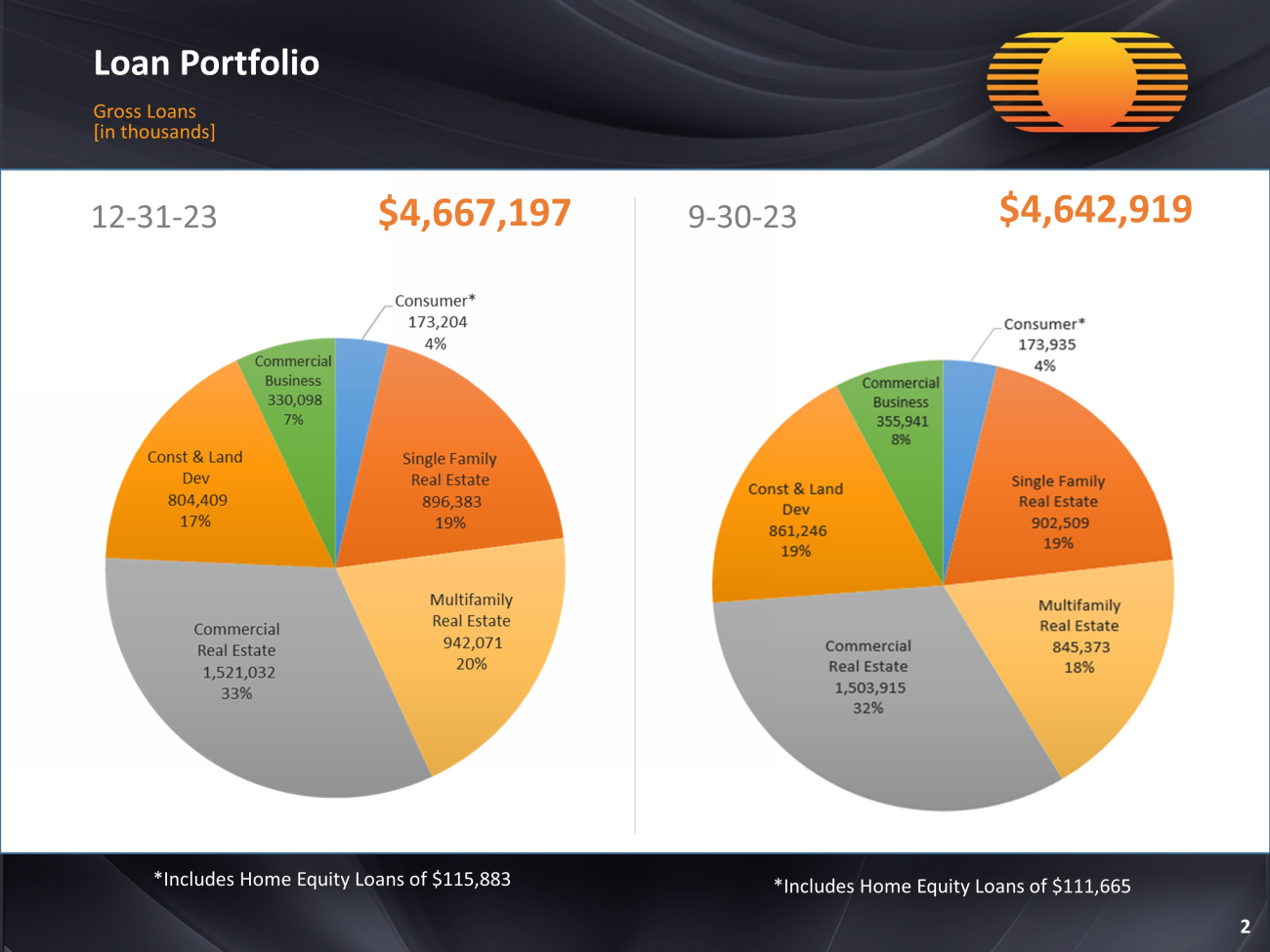

Loan Portfolio Gross Loans [in thousands] *Includes Home Equity Loans of $115,883 2 *Includes Home Equity Loans of $111,665 12 - 31 - 23 $4,667,197 9 - 30 - 23 $4,642,919

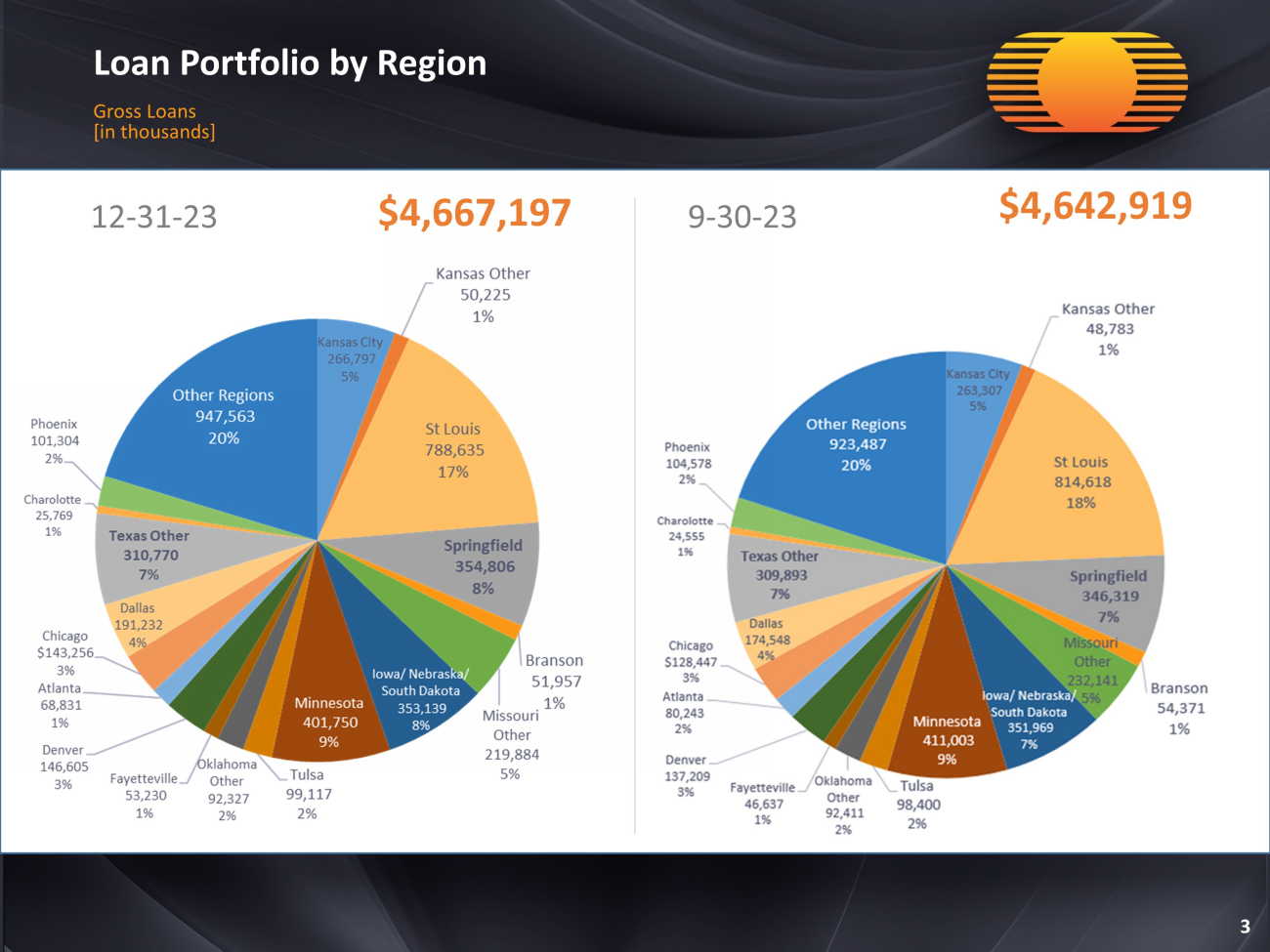

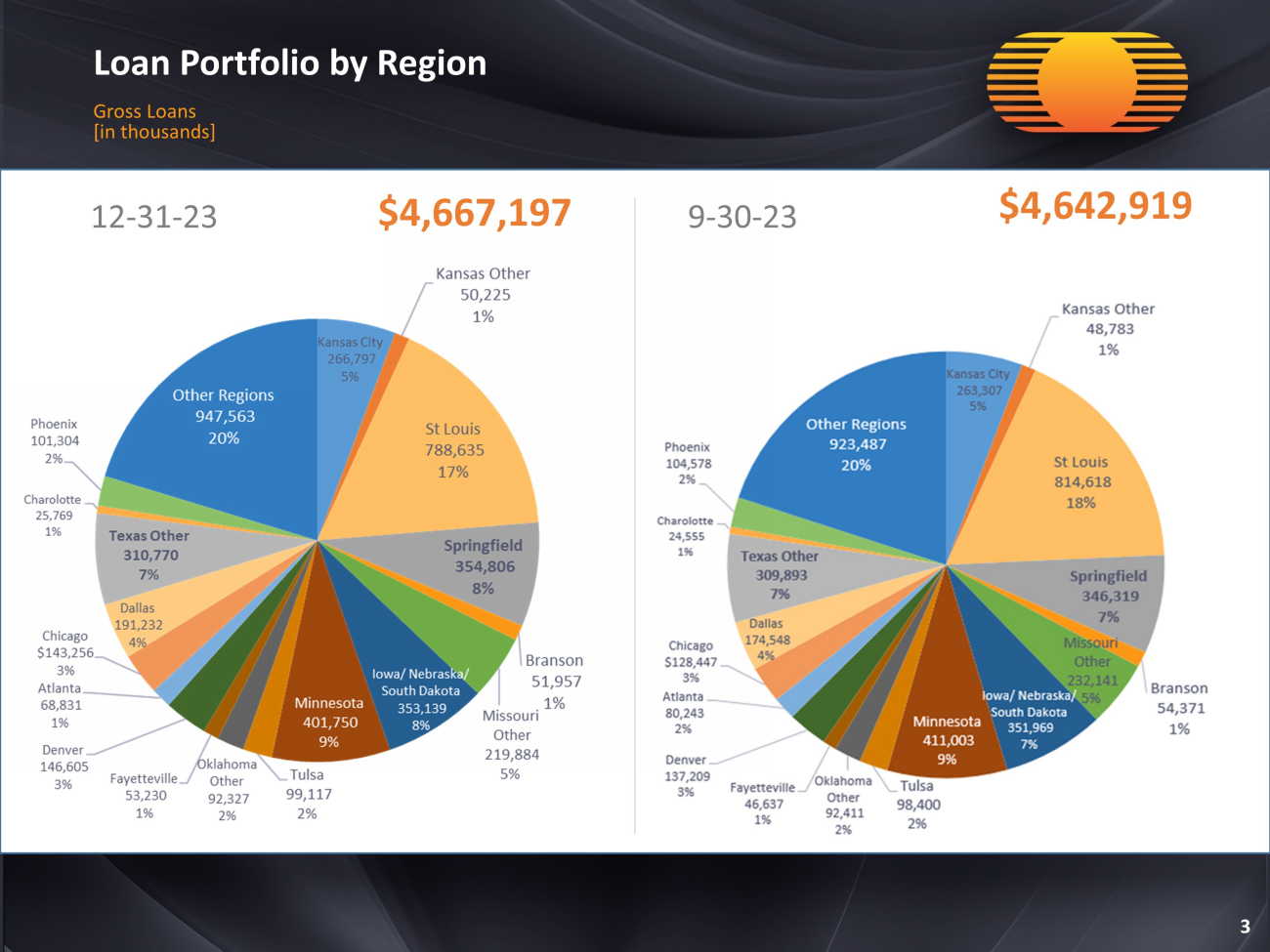

Loan Portfolio by Region Gross Loans [in thousands] 3 12 - 31 - 23 $4,667,197 9 - 30 - 23 $4,642,919

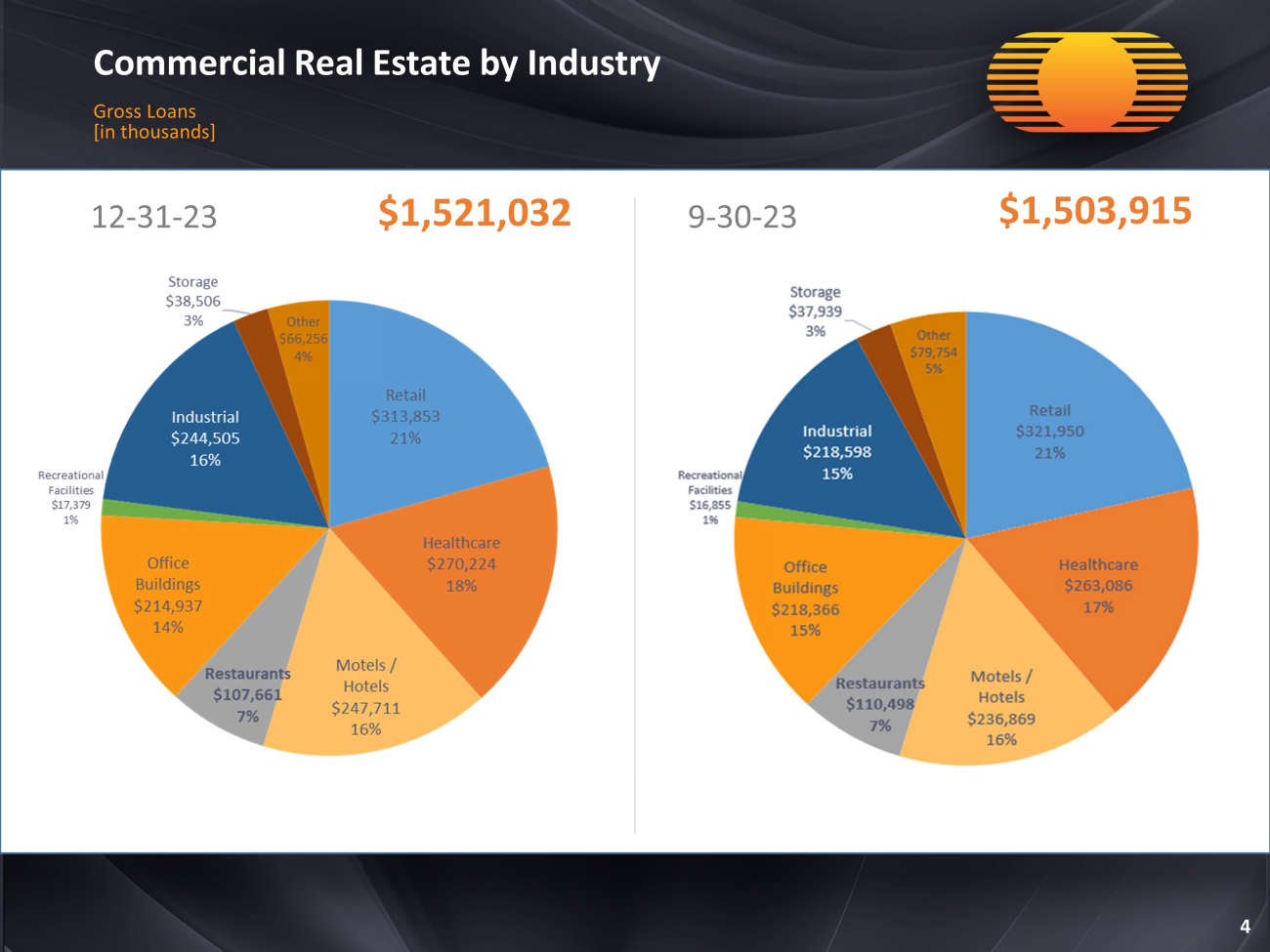

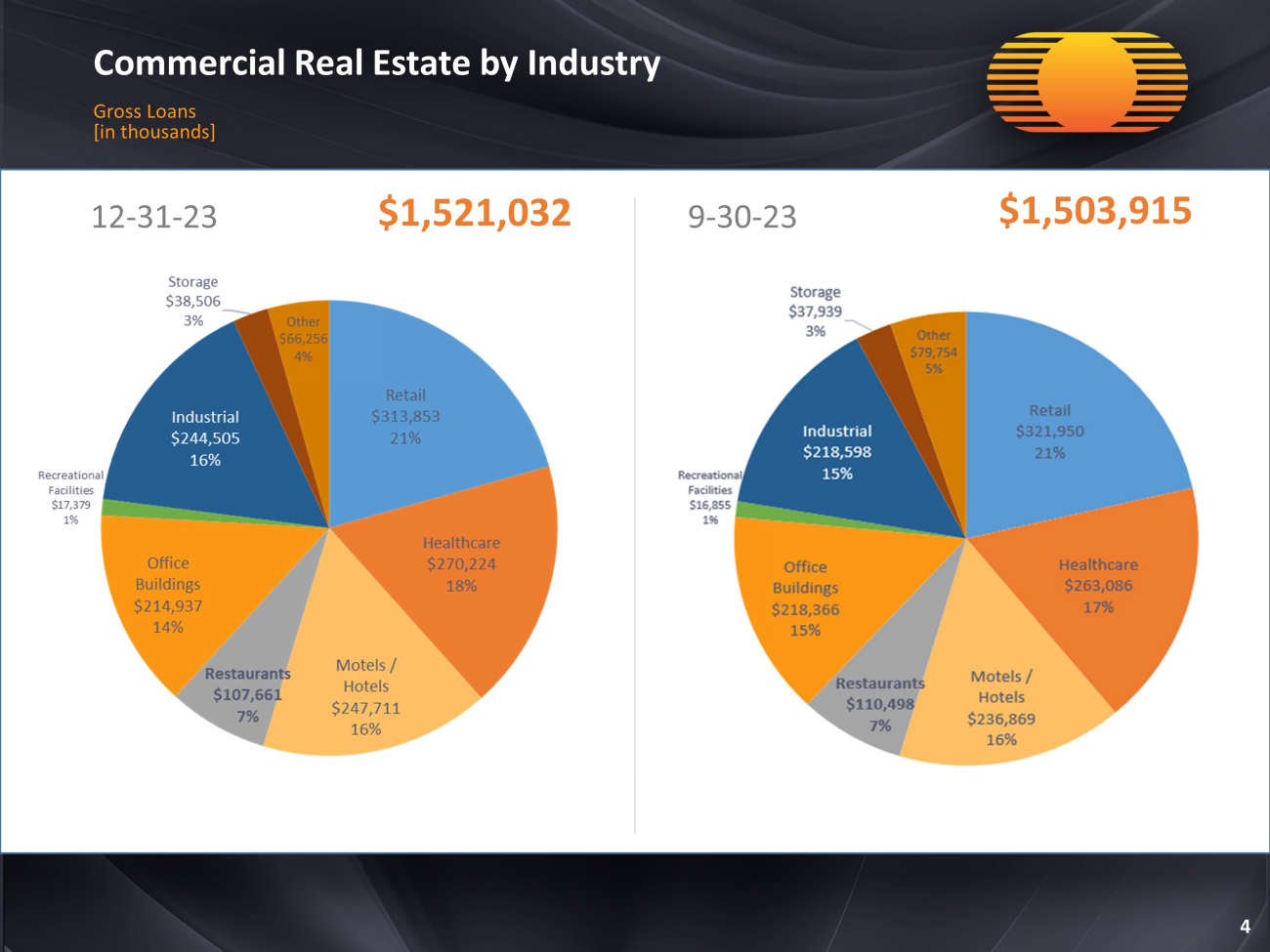

Commercial Real Estate by Industry Gross Loans [in thousands] 4 12 - 31 - 23 $1,521,032 9 - 30 - 23 $1,503,915

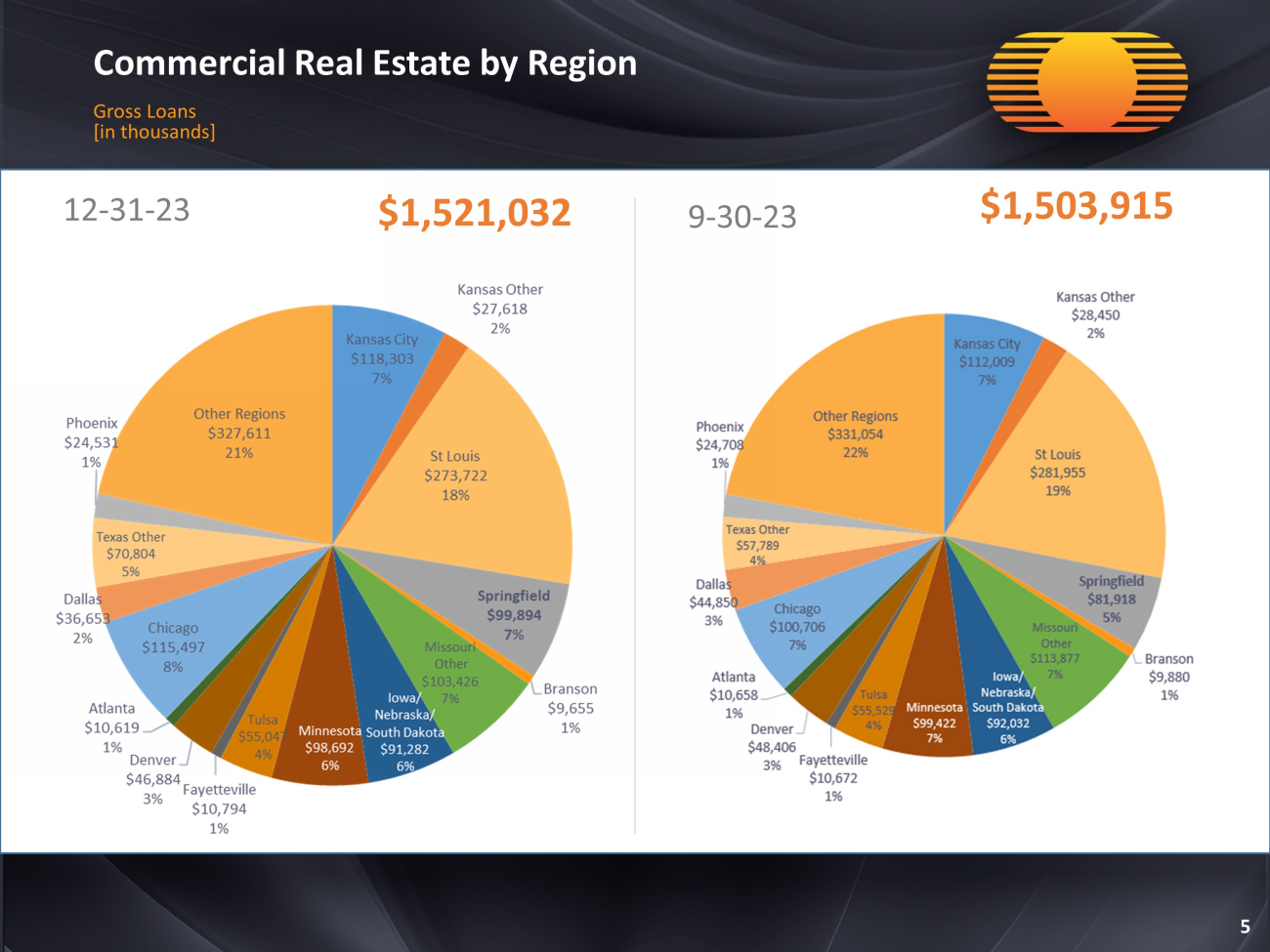

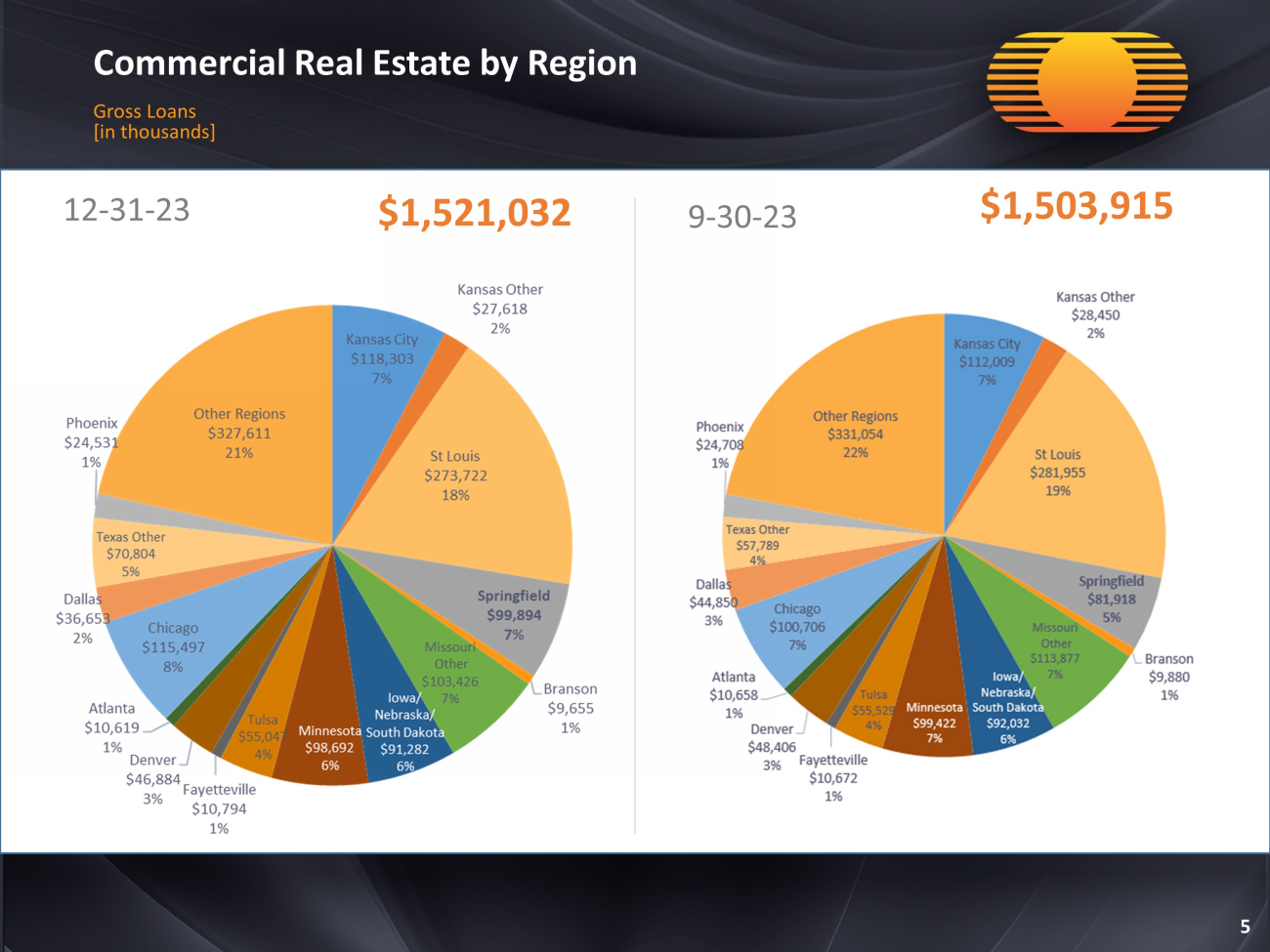

Commercial Real Estate by Region Gross Loans [in thousands] 5 12 - 31 - 23 $1,521,032 9 - 30 - 23 $1,503,915

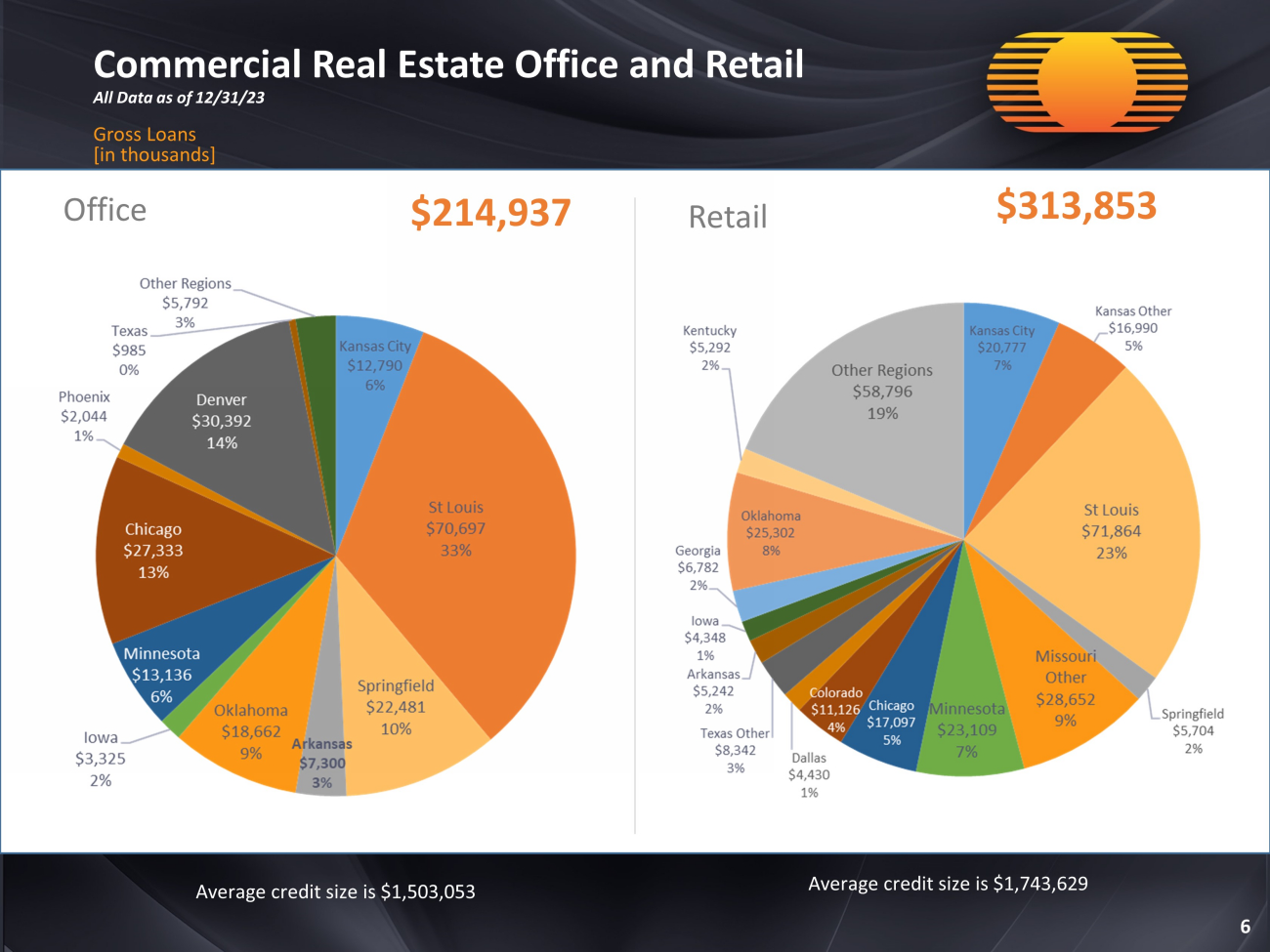

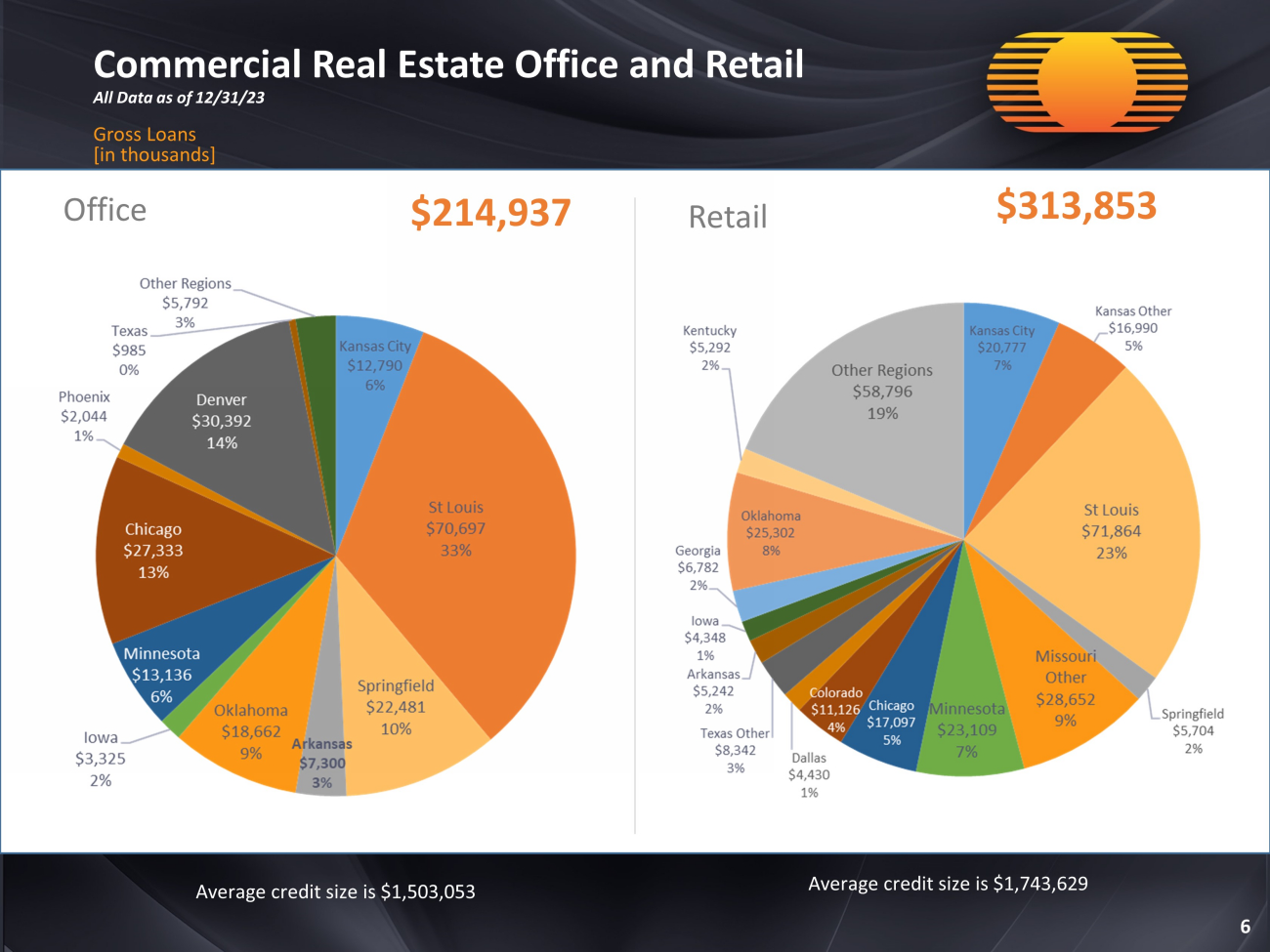

Commercial Real Estate Office and Retail All Data as of 12/31/23 Gross Loans [in thousands] 6 Office $214,937 Retail $313,853 Average credit size is $1,503,053 Average credit size is $1,743,629

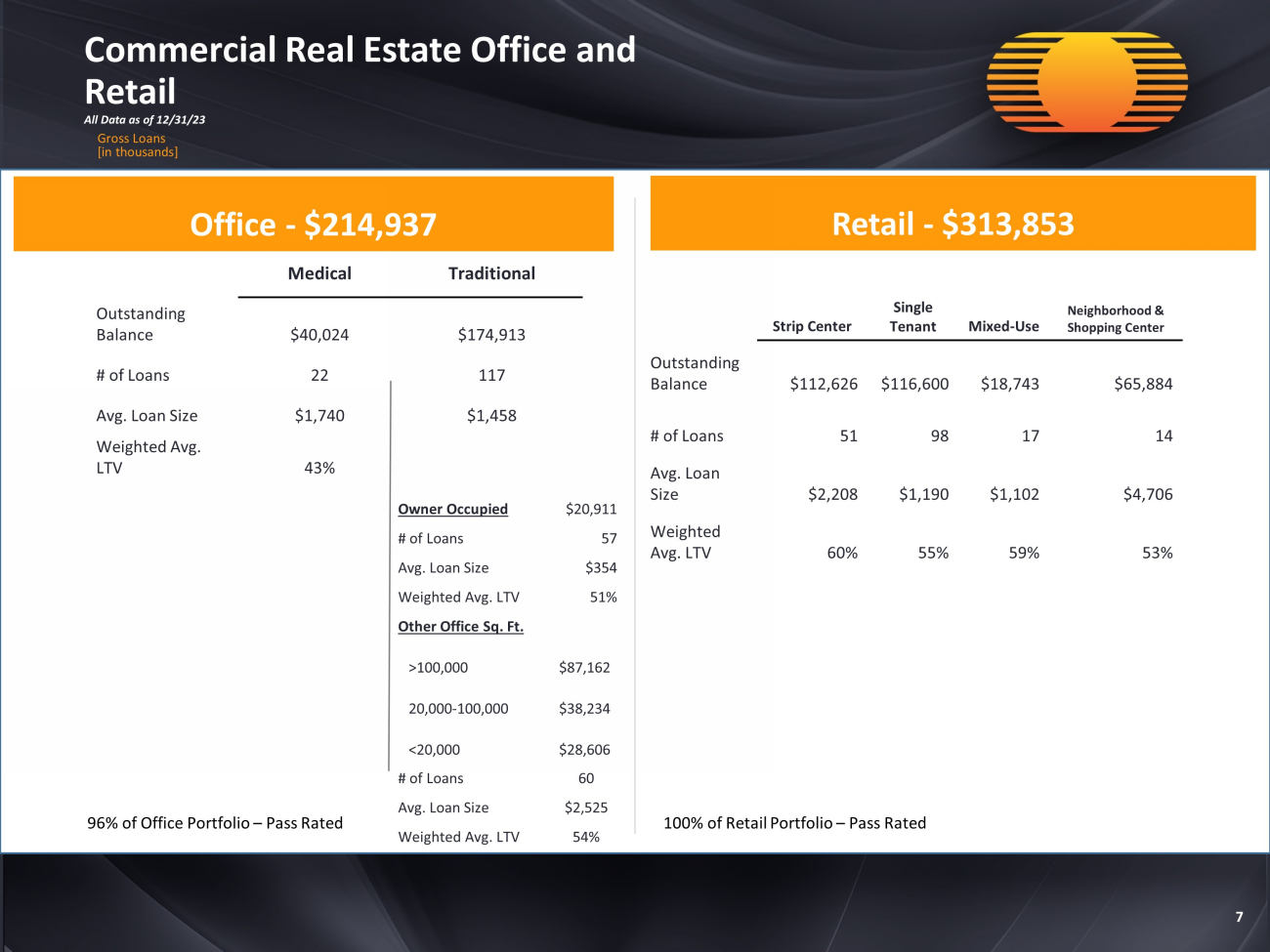

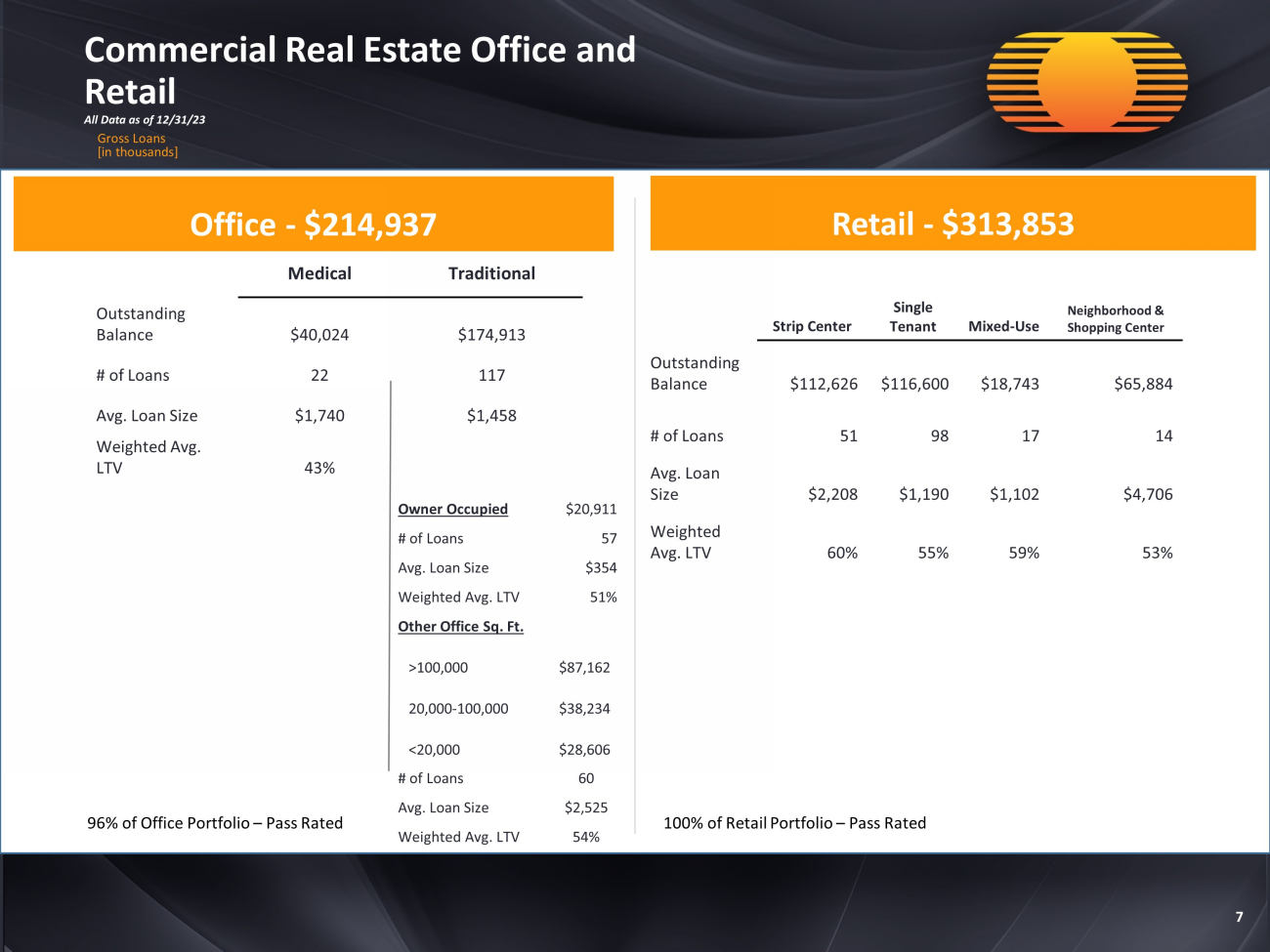

Commercial Real Estate Office and Retail All Data as of 12/31/23 Gross Loans [in thousands] 7 Office - $214,937 Retail - $313,853 Medical Traditional Outstanding Balance $40,024 $174,913 # of Loans 22 117 Avg. Loan Size $1,740 $1,458 Weighted Avg. LTV 43% 96% of Office Portfolio – Pass Rated Strip Center Single Tenant Mixed - Use Neighborhood & Shopping Center Outstanding Balance $112,626 $116,600 $18,743 $65,884 # of Loans 51 98 17 14 Avg. Loan Size $2,208 $1,190 $1,102 $4,706 Weighted Avg. LTV 60% 55% 59% 53% 100% of Retail Portfolio – Pass Rated Owner Occupied $20,911 # of Loans 57 Avg. Loan Size $354 Weighted Avg. LTV 51% Other Office Sq. Ft. >100,000 $87,162 20,000 - 100,000 $38,234 <20,000 $28,606 # of Loans 60 Avg. Loan Size $2,525 Weighted Avg. LTV 54%

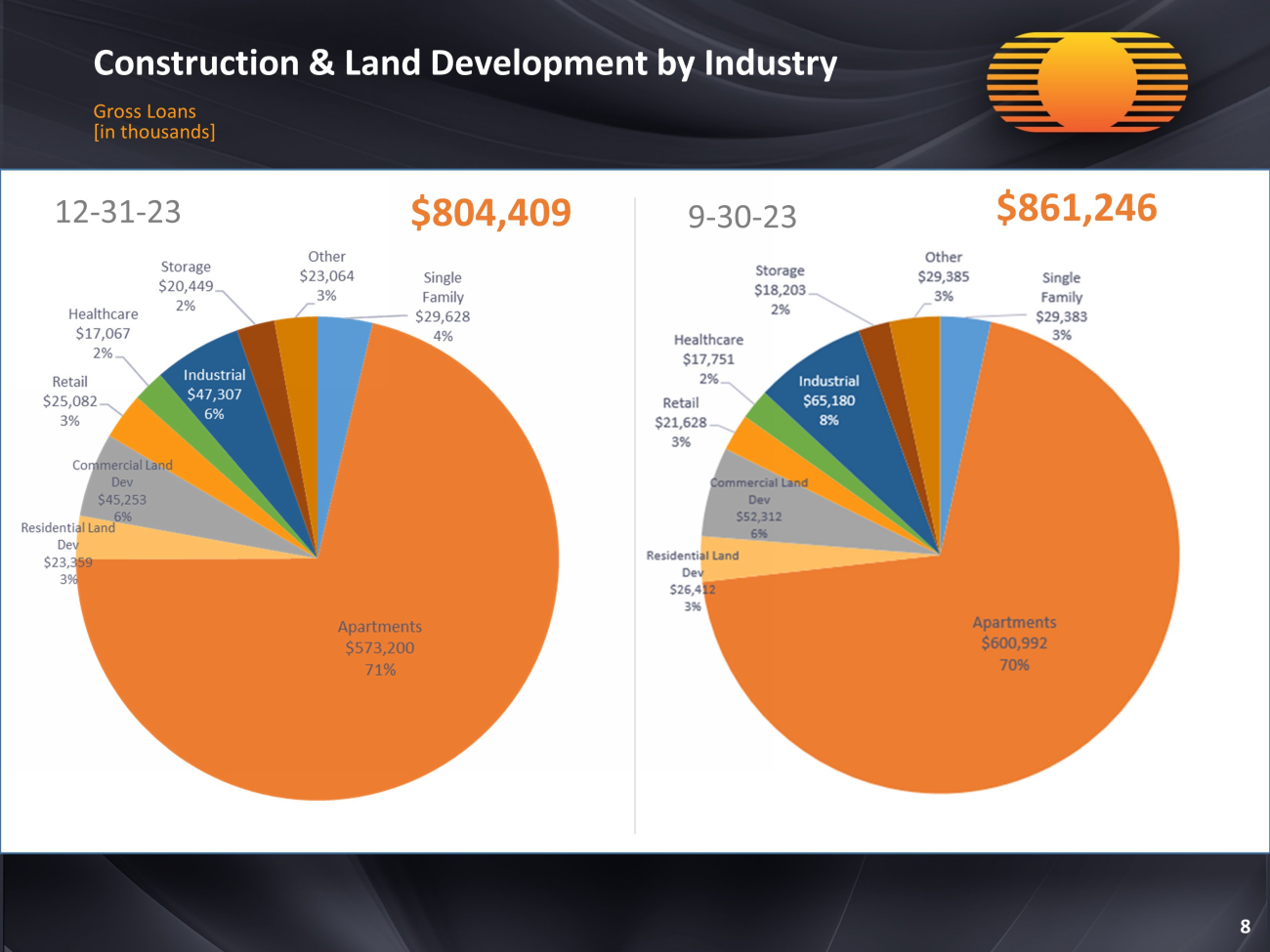

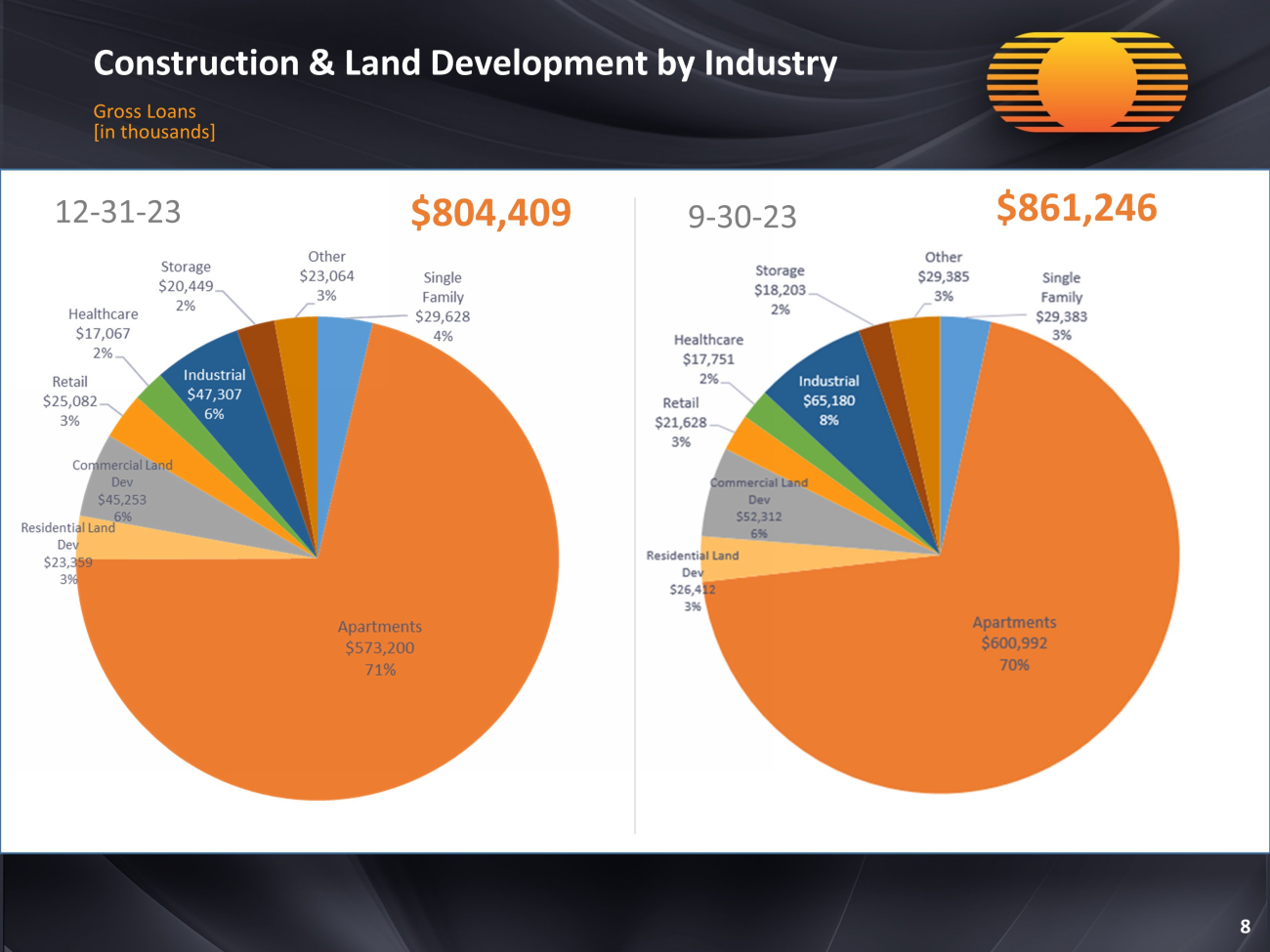

Construction & Land Development by Industry Gross Loans [in thousands] 8 12 - 31 - 23 $804,409 9 - 30 - 23 $861,246

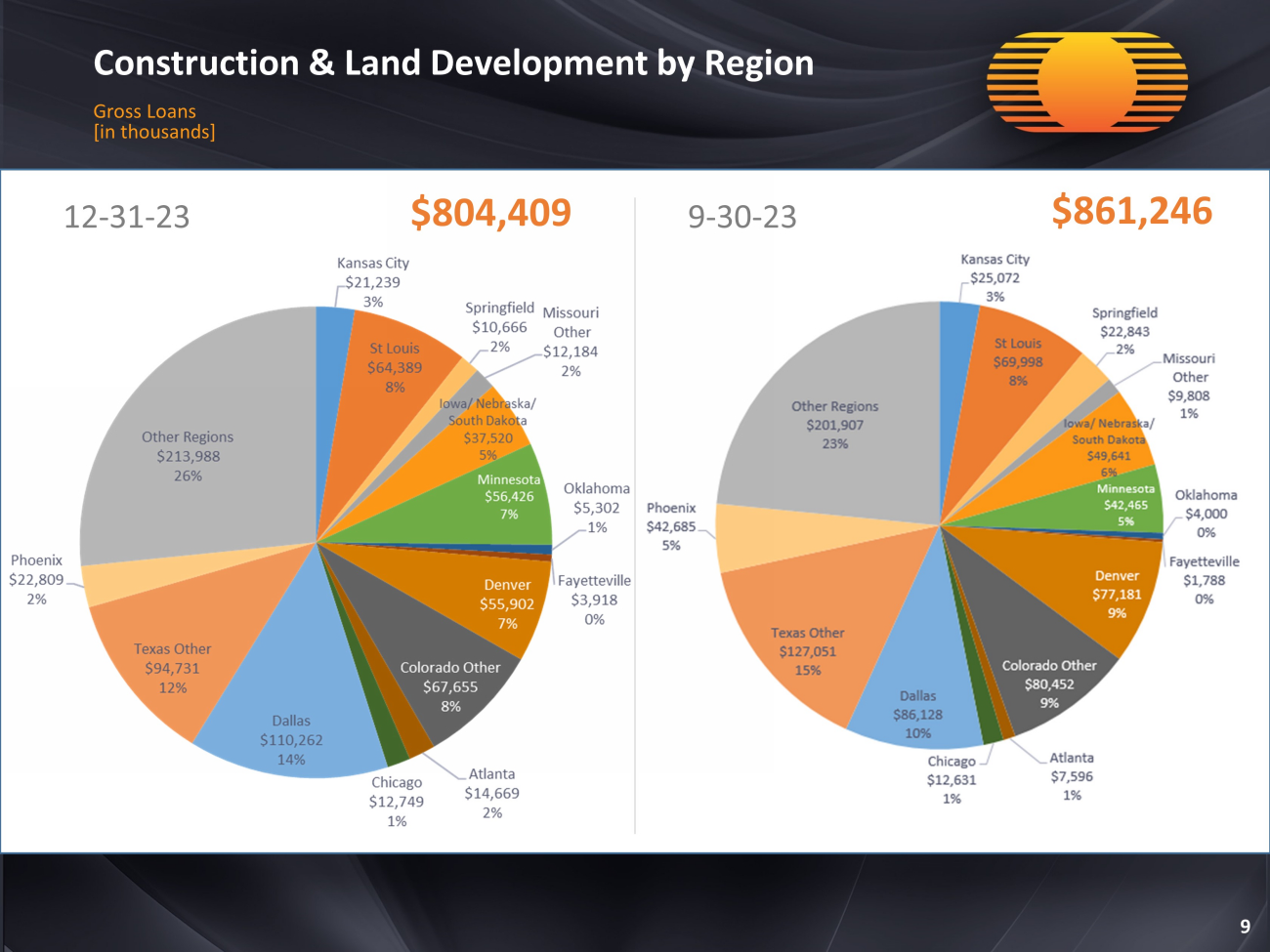

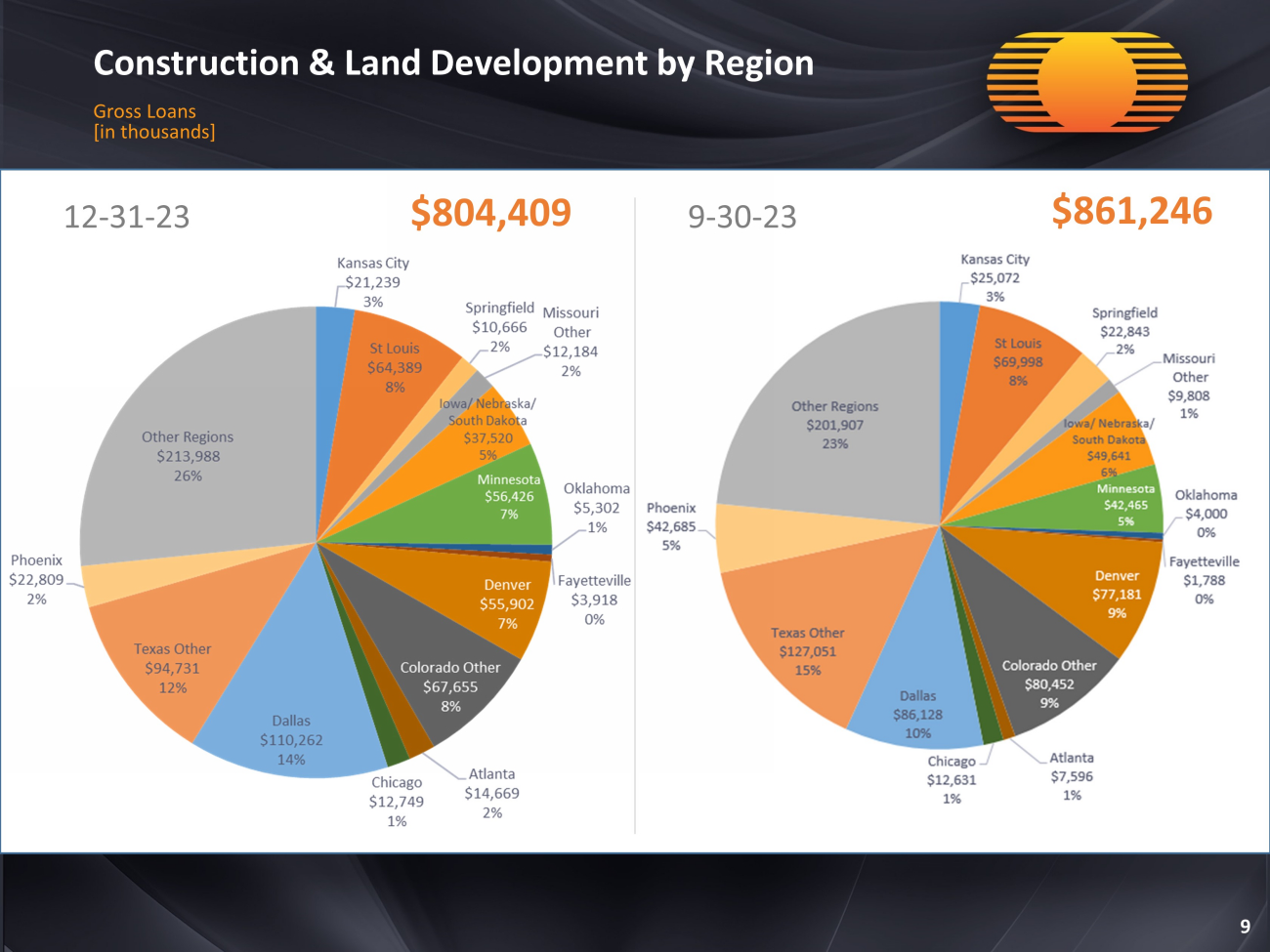

Construction & Land Development by Region Gross Loans [in thousands] 9 12 - 31 - 23 $804,409 9 - 30 - 23 $861,246

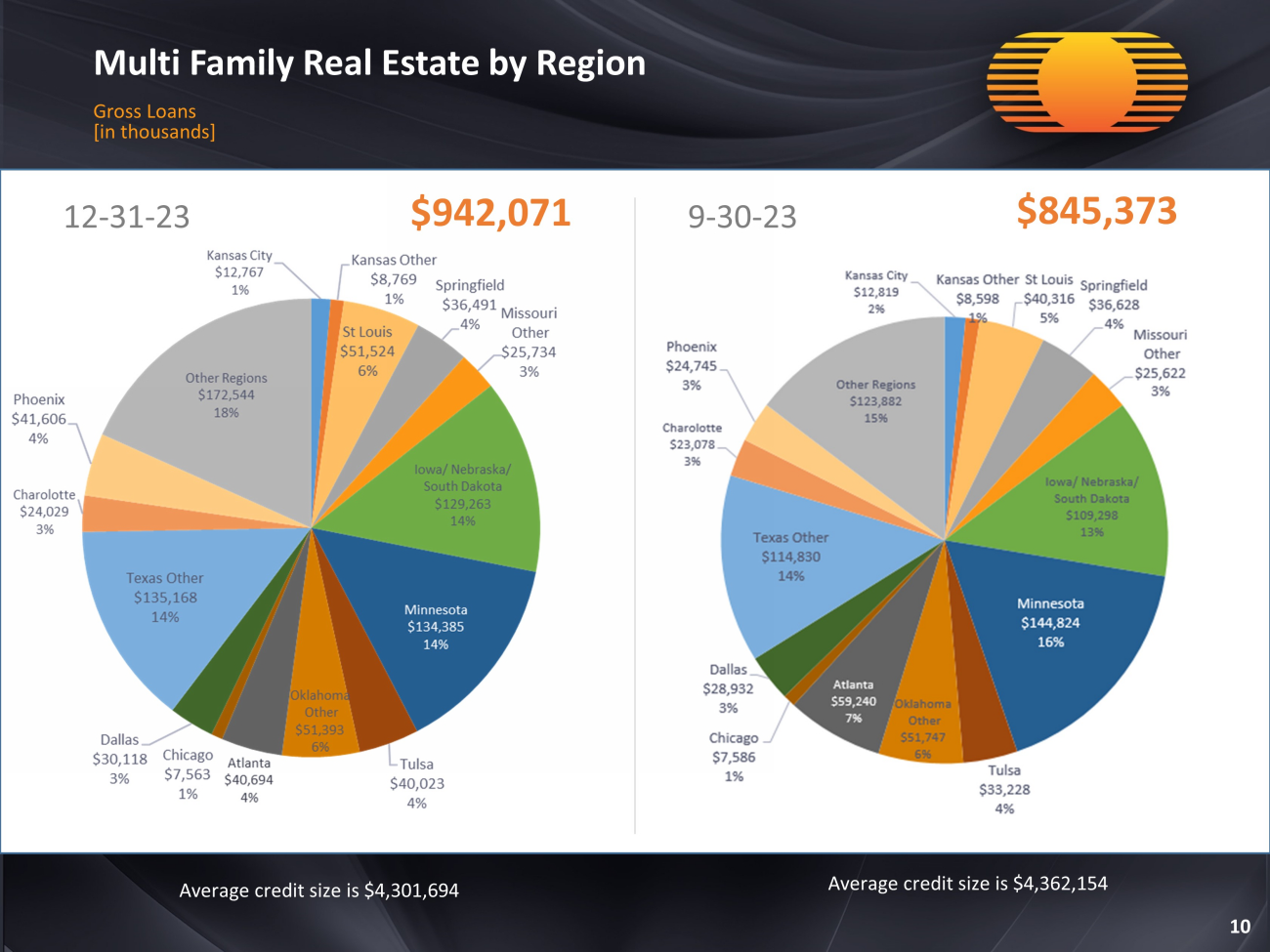

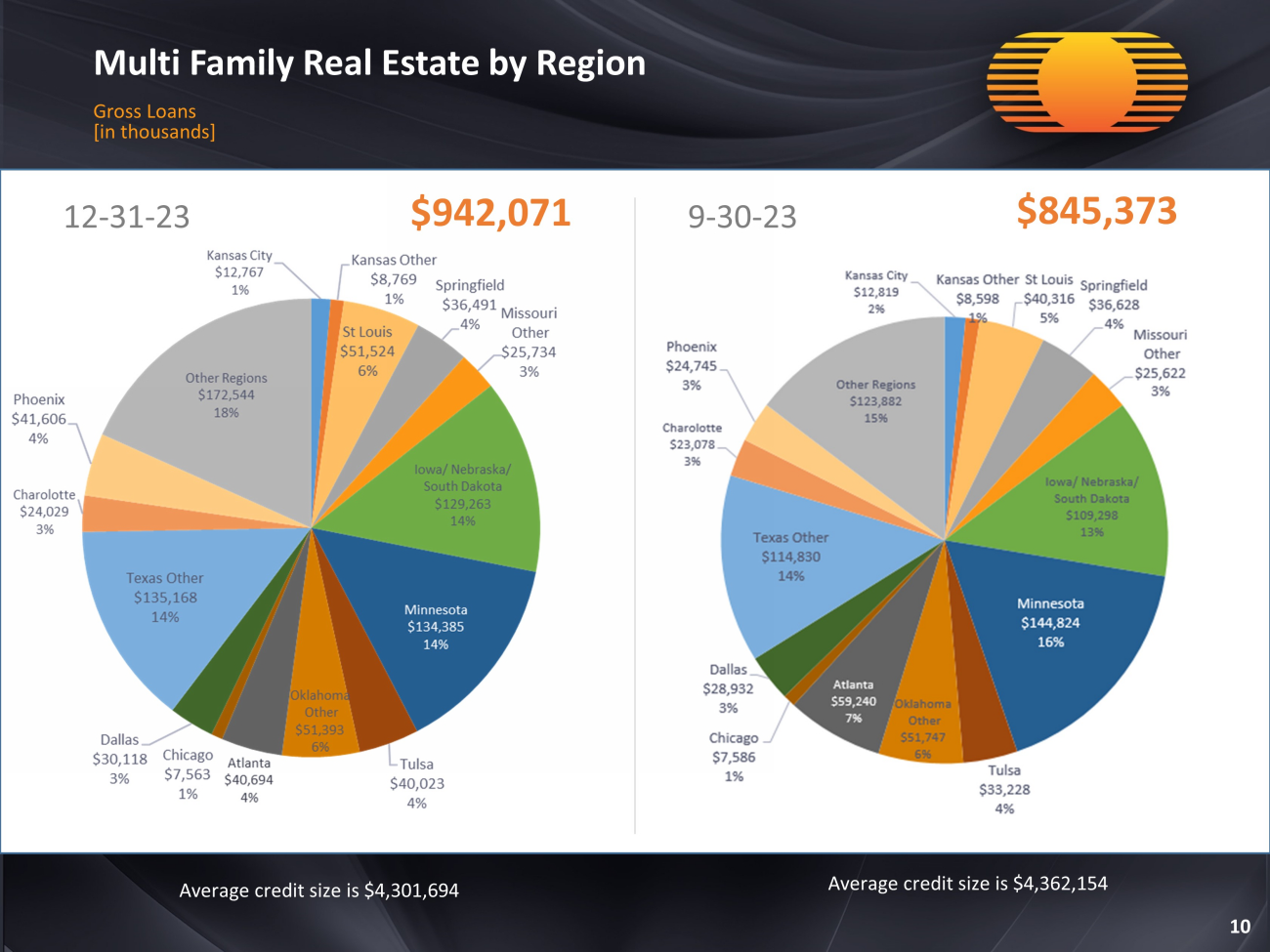

Multi Family Real Estate by Region Gross Loans [in thousands] 10 12 - 31 - 23 $942,071 9 - 30 - 23 $845,373 Average credit size is $4,301,694 Average credit size is $4,362,154

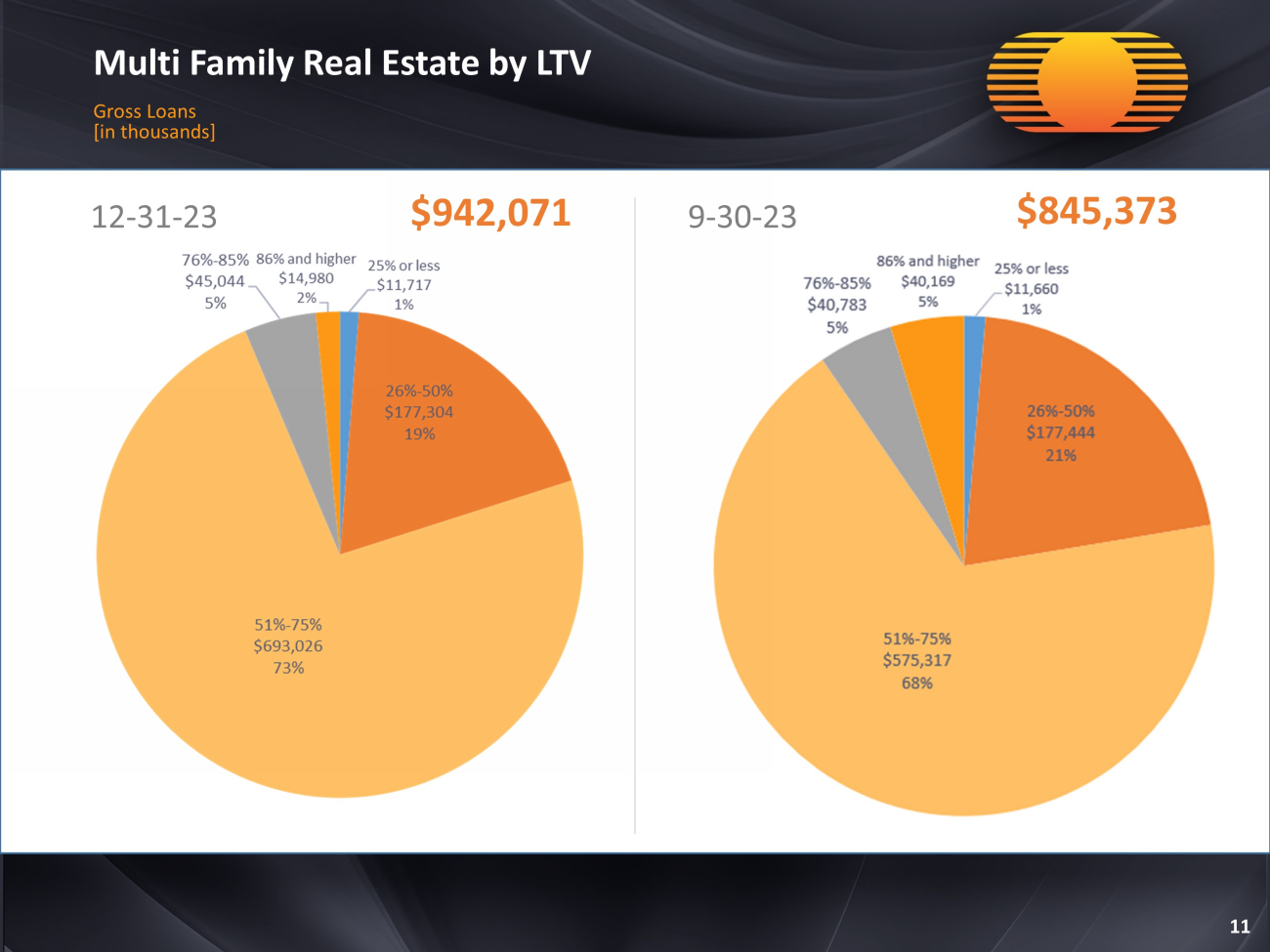

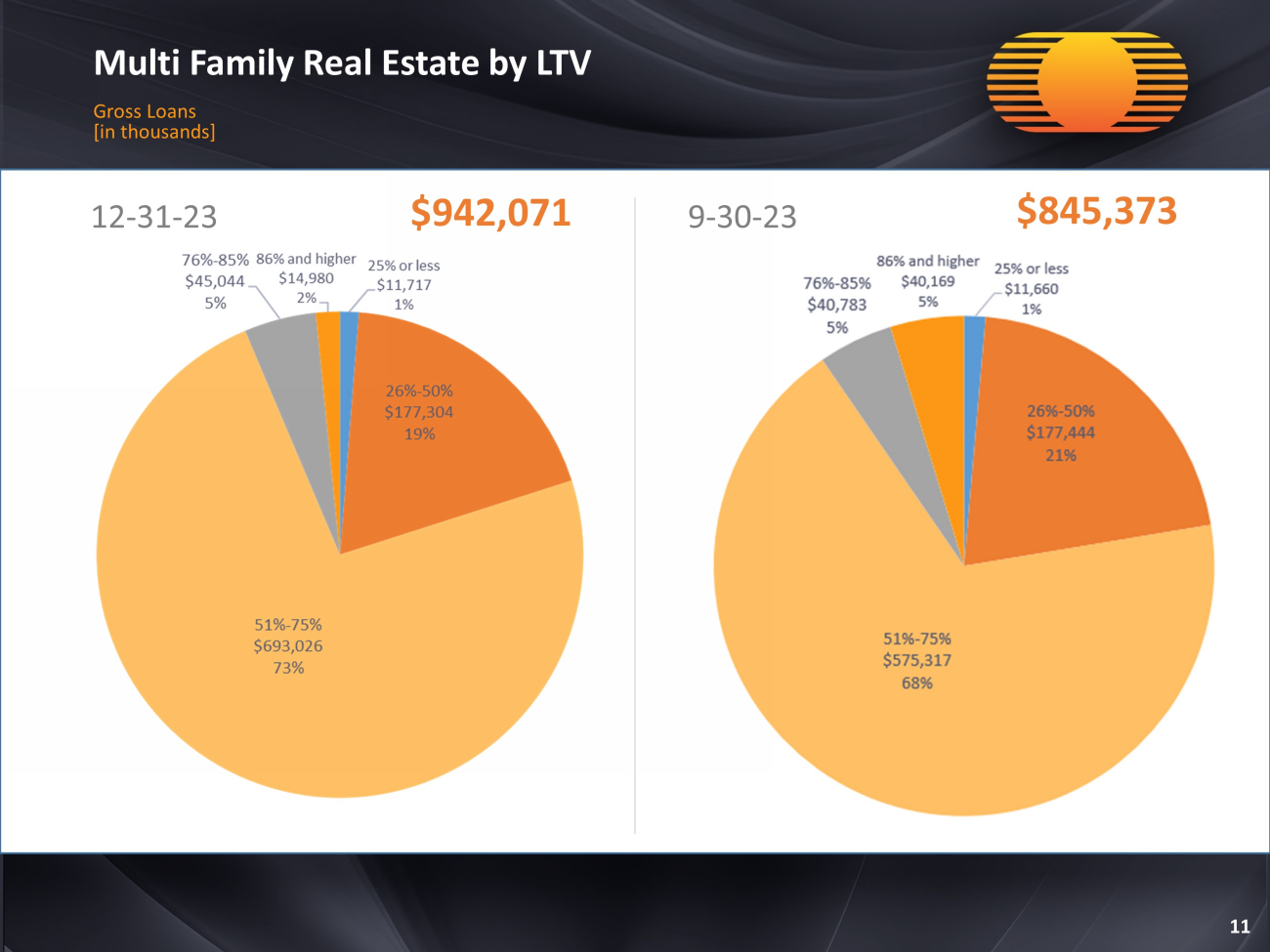

Multi Family Real Estate by LTV Gross Loans [in thousands] 11 12 - 31 - 23 $942,071 9 - 30 - 23 $845,373

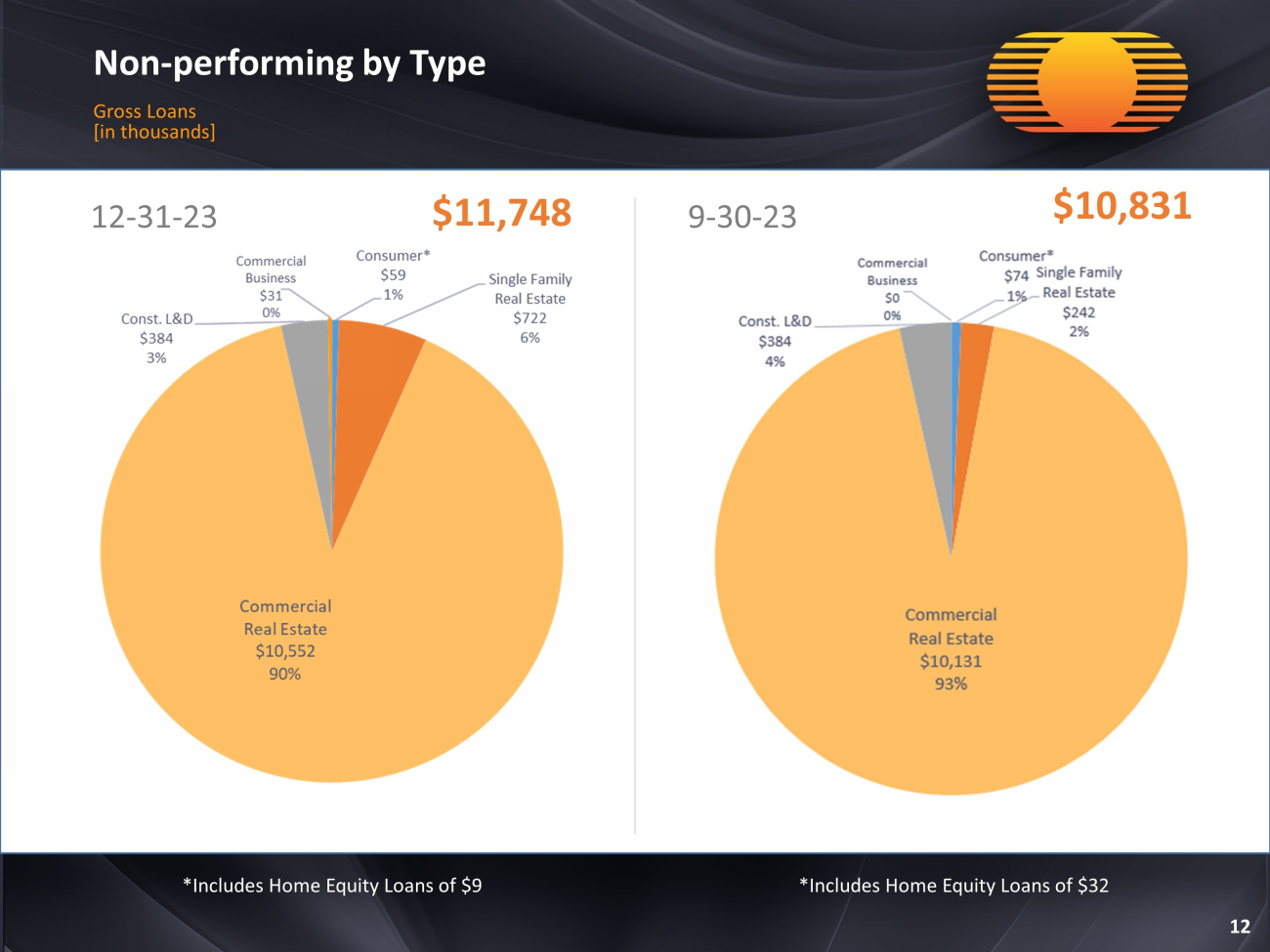

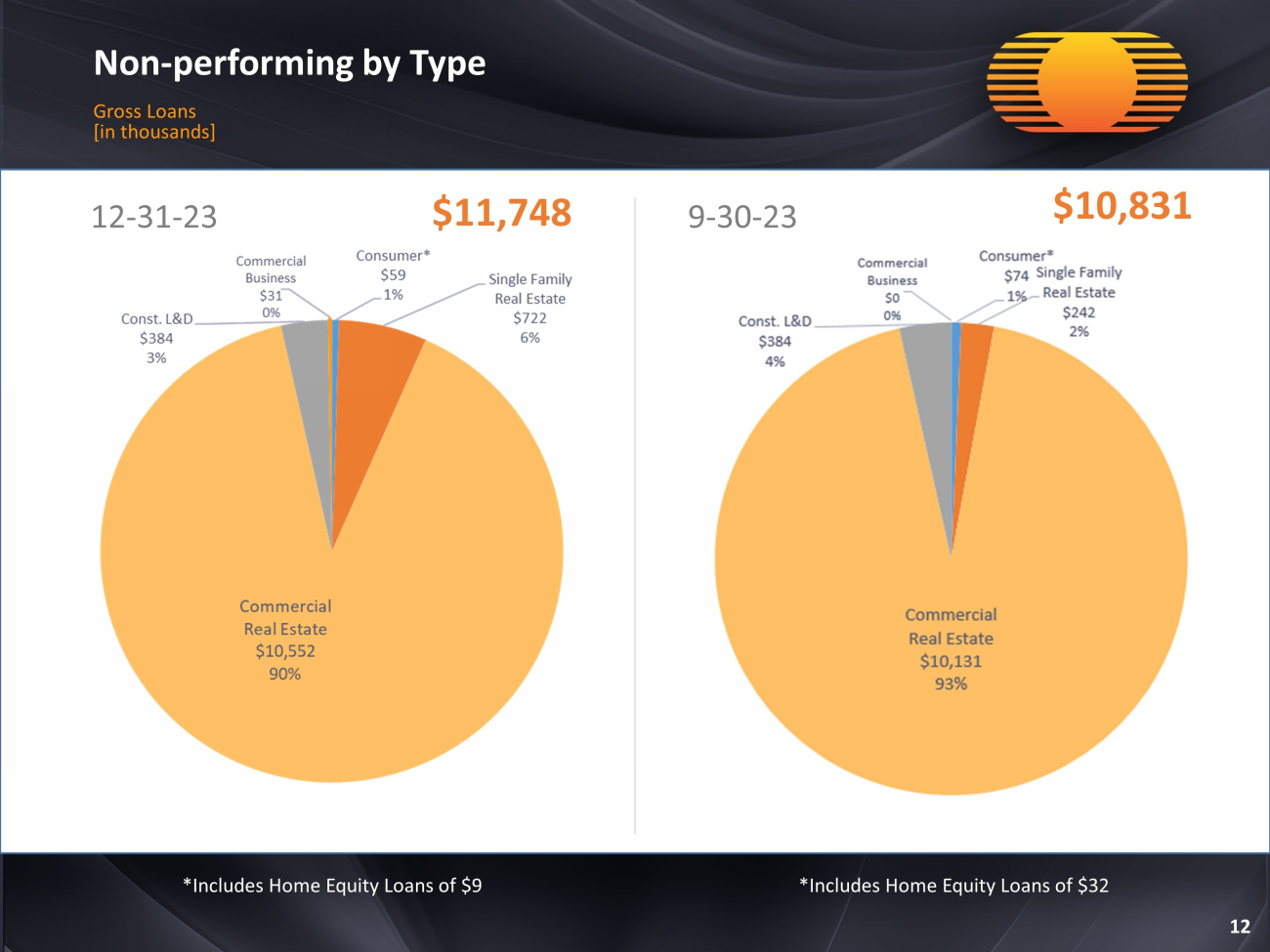

Non - performing by Type Gross Loans [in thousands] 12 12 - 31 - 23 $11,748 9 - 30 - 23 $10,831 *Includes Home Equity Loans of $9 *Includes Home Equity Loans of $32

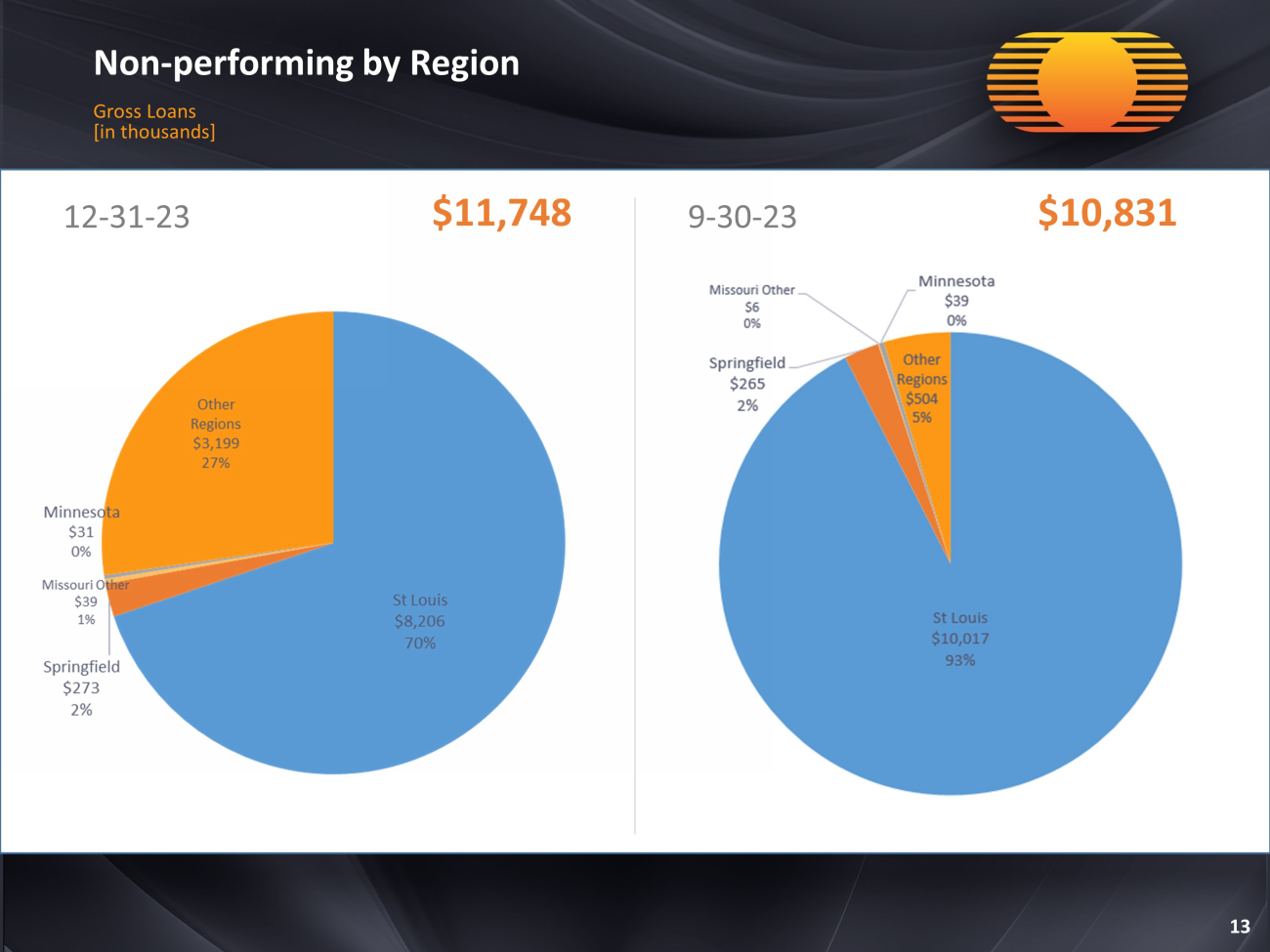

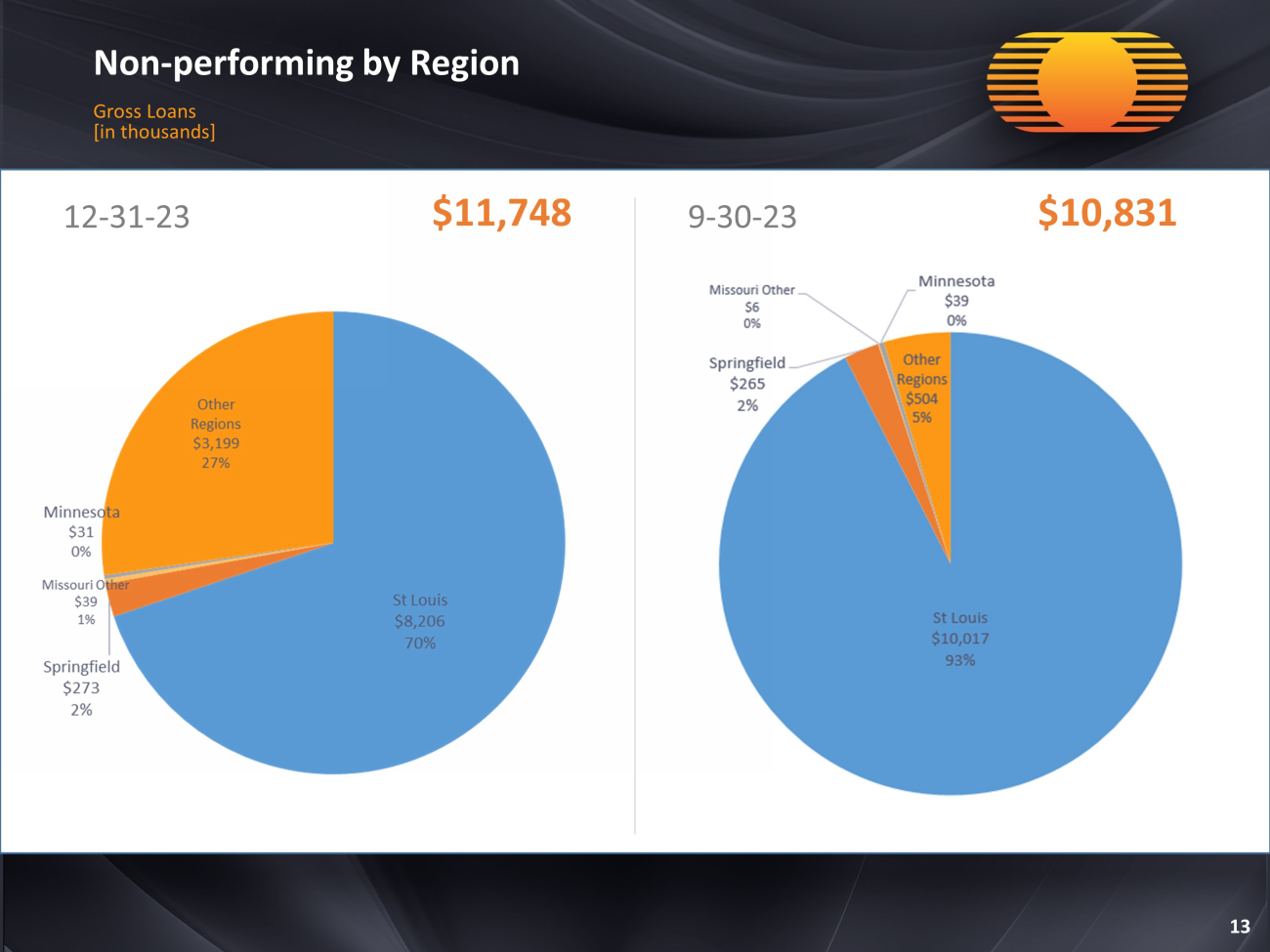

Non - performing by Region Gross Loans [in thousands] 13 12 - 31 - 23 $11,748 9 - 30 - 23 $10,831

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | GREAT SOUTHERN BANCORP, INC. |

| | |

| Date: January 22, 2024 | By: | /s/ Joseph W. Turner |

| | | Joseph W. Turner, President and Chief Executive Officer |