UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

MAF Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

55th Street & Holmes Avenue

Clarendon Hills, Illinois 60514-1500

(630) 325-7300

April 4, 2006

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of MAF Bancorp, Inc., which will be held on Wednesday, May 10, 2006 at Marie’s Ashton Place, 341 W. 75th Street, Willowbrook, Illinois 60514, at 10:00 a.m.

The attached Notice of the Annual Meeting and proxy statement describe the formal business to be transacted at the meeting. Directors and officers of MAF Bancorp will be present at the meeting to respond to questions from our shareholders.

YOUR VOTE IS IMPORTANT. Please sign and return the enclosed proxy card promptly in the postage-paid envelope. Your cooperation is appreciated since a majority of the common stock must be represented, either in person or by proxy, to constitute a quorum for the conduct of business.

On behalf of the Board of Directors and all the employees of the Company and Mid America Bank, I wish to thank you for your continued support.

|

| Sincerely yours, |

|

/s/ Allen H. Koranda |

| Allen H. Koranda |

| Chairman of the Board and |

| Chief Executive Officer |

55th Street & Holmes Avenue

Clarendon Hills, Illinois 60514-1500

(630) 325-7300

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On May 10, 2006

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of MAF Bancorp, Inc. will be held at Marie’s Ashton Place, 341 W. 75th Street, Willowbrook, Illinois 60514 on Wednesday, May 10, 2006 at 10:00 a.m.

The meeting is for the purpose of considering and voting upon the following matters:

| | 1. | Election of four directors to serve for three-year terms or until their successors are elected and qualified; and |

| | 2. | Ratification of the selection of KPMG LLP, a registered public accounting firm, as independent auditors of MAF Bancorp, Inc. for the year ending December 31, 2006; and |

| | 3. | Such other matters as may properly come before the meeting or any adjournments thereof, including whether or not to adjourn the meeting. |

The Board of Directors has fixed March 17, 2006 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and at any adjournments thereof. In the event there are not sufficient shares represented for a quorum, the meeting may be adjourned in order to permit further solicitation of proxies by the Company. A list of shareholders entitled to vote at the meeting will be available at the Company’s offices located at Mid America Bank, 55th Street & Holmes Avenue, Clarendon Hills, Illinois 60514-1500, for a period of ten days prior to the meeting and will also be available at the meeting.

Whether or not you plan to attend the meeting, please sign, date and return the enclosed proxy card without delay in the enclosed postage-paid envelope. Any proxy given by you may be revoked at any time before it is exercised by filing with the Corporate Secretary of the Company a written revocation or a duly executed proxy bearing a later date, or by attending the meeting and voting in person on each matter brought before the meeting. However, if you are a shareholder whose shares are not registered in your own name, you will need additional documentation from your record holder to vote in person at the meeting.

| | | | |

| | | | By Order of the Board of Directors |

| | |

| | | | /s/ Carolyn Pihera |

| | | | Carolyn Pihera |

| | | | Corporate Secretary |

| | |

| Clarendon Hills, Illinois | | | | |

| April 4, 2006 | | | | |

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 10, 2006

Solicitation and Voting of Proxies

These proxy materials are being furnished to shareholders of MAF Bancorp, Inc. in connection with the solicitation by the Board of Directors of proxies to be used at the Annual Meeting of Shareholders to be held at Marie’s Ashton Place, 341 W. 75th Street, Willowbrook, Illinois 60514 on Wednesday, May 10, 2006 at 10:00 a.m., and at any adjournments thereof. The 2005 Annual Report to Shareholders and Form 10-K, including the audited consolidated financial statements as of and for the year ended December 31, 2005, accompanies this proxy statement. The proxy materials are first being mailed to shareholders on or about April 4, 2006.

Regardless of the number of shares of common stock owned, it is important that shareholders be represented by proxy or present in person at the meeting. Shareholders are requested to vote by completing the enclosed proxy card and returning it signed and dated in the enclosed postage-paid envelope. Shareholders are urged to indicate their vote in the spaces provided on the proxy card.Proxies solicited by the Board of Directors of MAF Bancorp will be voted in accordance with the directions given therein. Where no instructions are indicated, proxies will be voted “FOR” the election of the Board of Directors’ nominees and “FOR” the ratification of the selection of the independent auditors.

The Board of Directors knows of no additional matters that will be presented for consideration at the meeting. Execution of a proxy, however, confers on the designated proxy holders discretionary authority to vote the shares in accordance with their best judgment on such other business, if any, that may properly come before the meeting or any adjournments thereof, including whether or not to adjourn the meeting.

Shareholders of record may revoke a proxy at any time prior to its exercise by the filing of a written notice of revocation with the Corporate Secretary of the Company, by delivering to the Company a duly executed proxy bearing a later date, or by attending the meeting and voting in person. If you are a shareholder whose shares are not registered in your own name, you will need additional documentation from your record holder to vote personally at the meeting.

The cost of solicitation of proxies in the form enclosed herewith will be borne by the Company. In addition to the solicitation of proxies by mail, the Company has retained Georgeson Shareholder Communications, Inc. to assist with the solicitation of proxies for a fee of $6,500, plus reimbursement for out-of-pocket expenses. Proxies may also be solicited personally or by telephone or facsimile by directors, officers and regular employees of the Company and Mid America Bank, fsb (the “Bank”), without additional compensation. The Company will also request persons, firms and corporations holding shares in their names, or in the name of their nominees, which are beneficially owned by others, to send proxy material to, and obtain proxies from, such beneficial owners, and will reimburse such holders for their reasonable expenses in doing so.

1

The Board of Directors has fixed the close of business on March 17, 2006, as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournments of the meeting. The total number of shares of common stock outstanding on the record date was 34,076,342. Each share of common stock of the Company entitles its owner to one vote on all matters to be voted on at the meeting, except as described below. There is no cumulative voting for the election of directors.

As provided in Article Fourth of the Company’s Certificate of Incorporation, record holders of common stock who beneficially own in excess of 10% of the outstanding shares of common stock are not entitled to any vote in respect of the shares held in excess of this limit. A person or entity is deemed to beneficially own shares owned by an affiliate of, as well as by persons acting in concert with, such person or entity. The Company’s Certificate of Incorporation authorizes the Board of Directors (i) to make all determinations necessary to implement and apply the limit, including determining whether persons or entities are acting in concert, and (ii) to demand that any person who is reasonably believed to beneficially own stock in excess of the limit supply information to the Company to enable the Board of Directors to implement and apply the limit.

The presence, in person or by proxy, of at least a majority of the total number of shares of common stock entitled to vote (after subtracting from shares outstanding any shares held in excess of the 10% limit described in the preceding paragraph) is necessary to constitute a quorum at the meeting. Shares covered by broker non-votes, if any, will be considered votes cast for purposes of determining the presence of a quorum. In the event there are not sufficient shares represented for a quorum, the meeting may be adjourned in order to permit the further solicitation of proxies.

As to the election of directors, the proxy card being provided by the Board of Directors enables a shareholder of record to vote “FOR” election of the nominees proposed by the Board, or to “WITHHOLD” authority to vote for one or more of the nominees being proposed for election. Directors are elected by a plurality of votes cast. Therefore, neither (i) broker non-votes, nor (ii) proxies as to which authority to vote for one or more of the nominees being proposed is withheld, will affect the outcome of the election.

As to ratification of the selection of KPMG, LLP as the Company’s independent auditors as set forth in Proposal 2, such matter must be approved by a majority of the votes cast on this proposal. Abstentions and shares underlying broker non-votes or in excess of the 10% limit described above are not counted as votes cast and will not have the effect of a vote against ratification.

As to other matters, if any, that may properly come before the meeting, such matters would also require the affirmative vote of a majority of the votes cast as described above.

Proxies solicited by this proxy statement will be returned to the proxy solicitor or the Company’s transfer agent. The Board has appointed the Company’s transfer agent to tabulate the proxies and serve as inspector of elections.

2

Security Ownership of Certain Beneficial Owners

Under Section 13(d) of the Securities Exchange Act of 1934, a beneficial owner of a security is any person who directly or indirectly has or shares voting power or investment power over such security. Such beneficial owner under this definition does not need to enjoy the economic benefits of such securities. The following is a list of those shareholders known to the Company to be beneficial owners of 5% or more of the common stock of the Company as of March 17, 2006, the record date for the Annual Meeting.

| | | | | | |

Name and Address of Owner | | Shares of

Common Stock | | | Percent of Class

Ownership1 | |

Advisory Research, Inc. 180 North Stetson Street Suite 5500 Chicago, IL 60601 | | 1,873,231 | 2 | | 5.50 | % |

| | |

Delaware Charter Guarantee & Trust Company DBA Principal Trust Company as successor Trustee for the Mid America Bank, fsb Employees’ Profit Sharing Plan and the Mid America Bank, fsb Employee Stock Ownership Plan 1013 Centre Road Wilmington, DE 19805 | | 1,773,502 | 3 | | 5.20 | % |

| 1 | Based on 34,076,342 shares of common stock outstanding on the record date. |

| 2 | Reflects information provided in Schedule 13-G filed by Advisory Research, Inc. on February 27, 2006. Based on such filing, the shareholder has sole investment and voting authority over the shares. |

| 3 | Reflects shares held in the Plans for the benefit of employees and former employees of the Bank as of March 17, 2006. As of March 17, 2006, the Profit Sharing Plan held 514,415 shares of the Company’s common stock and the ESOP Plan held 1,259,087 shares. Although the Trustee has disclosed in a Schedule 13-G/A filed on February 16, 2006 that it has sole investment and voting authority over the shares, it is subject to the terms of the plans and to fiduciary duties under ERISA. |

Interests of Certain Persons in Matters to be Acted Upon

Except as noted in “Transactions with Certain Related Persons and Other Matters,” no person being nominated as a director under Proposal 1, “Election of Directors,” is being proposed for election pursuant to any agreement or understanding between any person and MAF Bancorp.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (“Exchange Act”) requires the Company’s directors and executive officers, and certain persons who own more than 10% of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, all required Section 16(a) reports during the year ended December 31, 2005 were timely filed.

3

PROPOSAL 1. ELECTION OF DIRECTORS

Pursuant to the Company’s bylaws, the number of directors is set at twelve (12), unless otherwise designated by the Board. The current number of directors designated by the Board is sixteen (16), increased from fifteen (15) during the past year to accommodate the appointment to the Board of Leo M. Flanagan, Jr. as provided in the merger agreement with EFC Bancorp, Inc. Mr. Flanagan, former Chairman of the Board of EFC Bancorp, Inc., was appointed to the Board of Directors on February 1, 2006, the effective date of the acquisition of EFC by the Company. Mr. Flanagan serves as a member of the class of directors whose term of office expires in 2007. Directors are divided into three classes serving staggered three-year terms, with the term of office of only one of the three classes of directors expiring each year. Directors serve until their successors are elected and qualified.

Upon the recommendation of the Nominating and Corporate Governance Committee of the Board of Directors, the Board of Directors has named four nominees for election at the meeting to serve a three-year term of office and has taken action to reduce the number of directors to fourteen (14) effective on the date of the annual meeting. The nominees are Joe F. Hanauer, Kenneth R. Koranda, Raymond S. Stolarczyk and Andrew J. Zych. Two members of the class of directors whose terms are expiring at the 2006 Annual Meeting, Harris W. Fawell and F. William Trescott, will be retiring as directors of the Company and the Bank at the Annual Meeting due to the Company’s policy on age limits for directors.

The four nominees currently serve as directors of the Company and the Bank and, except for Kenneth R. Koranda, are being proposed for re-election when their current terms expire at the Annual Meeting. Kenneth R. Koranda is currently a member of the class of directors whose term expires in 2007. In order to balance the three classes of directors as evenly as possible, Mr. Koranda was slated for election at this annual meeting for a three-year term expiring in 2009. Upon his election, he will resign from the 2007 class of directors. If Kenneth Koranda is not re-elected as a director at the current annual meeting, he will continue to serve as a director with a term of office that will expire in 2007.

In the event that any nominee is unable to serve or declines to serve for any reason, it is intended that proxies will be voted for the election of the other nominees named and for such other persons as may be designated by the present Board of Directors upon the recommendation of the Nominating and Corporate Governance Committee. The Board of Directors has no reason to believe that any of the persons named will be unable or unwilling to serve.Unless authority to vote for any director is withheld, the shares represented by the enclosed proxy card, if executed, will be voted “FOR” election of each of the nominees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES NAMED IN THIS PROXY STATEMENT.

Information with respect to Nominees, Continuing Directors and Others

The table that begins on the following page sets forth the names of nominees, continuing directors, two retiring directors and “Named Executive Officers” as listed in “Executive Compensation–Summary Compensation Table,” their ages, a brief description of their recent business experience, including present occupations and employment, certain directorships held by each, the year in which each became a director of the Company, the year in which their terms (or in the case of nominees, their proposed terms) as directors of the Company expire, the number of shares of common stock beneficially owned, the number of shares subject to exercisable options and the percentage ownership for each individual and for all directors and executive officers as a group, as of the record date. Each of the members of the Board of Directors of MAF Bancorp also presently serves as a director of the Bank except for Mr. Flanagan who will be appointed to the Bank board of directors following the Annual Meeting.

4

| | | | | | | | | | | | |

Name, Age and Principal Occupation at Present and for the Past Five Years | | Director of the

Company

Since | | Shares of

Common

Stock

Beneficially

Owned1 | | Currently

Exercisable

Stock

Options2 | | Total

Beneficial

Ownership | | | Ownership

Percentage3 | |

NOMINEES TO SERVE UNTIL 2009 | | | | | | | | | | | | |

| | | | | |

Joe F. Hanauer (59)

Principal of Combined Investments, L.P. (private investment firm), Chairman and Director of Homestore, Inc. (an internet real estate company), trustee of Calamos Advisors Trust, Calamos Investment Trust and Calamos Convertible Opportunities and Income Fund (registered investment companies), former Chairman of the Board and director of Grubb and Ellis Co. (a real estate firm). | | 1990 | | 369,132 | | 18,000 | | 387,132 | 13 | | 1.14 | % |

| | | | | |

Kenneth R. Koranda (56)

President and Vice Chairman of the Company and President of the Bank. Mr. Koranda is the brother of Allen H. Koranda. | | 1989 | | 801,509 | | 423,702 | | 1,225,211 | 4,13 | | 3.55 | % |

| | | | | |

Raymond S. Stolarczyk (67)

Former Chairman of the Board and Chief Executive Officer, Fidelity Bancorp, Inc. | | 2003 | | 224,996 | | 4,500 | | 229,496 | 5,13 | | * | |

| | | | | |

Andrew J. Zych (64)

Former Director and Executive Vice President, N.S. Bancorp, Inc. | | 1996 | | 224,484 | | 25,875 | | 250,359 | 6,13 | | * | |

| | | | | |

CONTINUING DIRECTORS SERVING UNTIL 2007 | | | | | | | | | | | | |

| | | | | |

Terry A. Ekl (58)

Partner in the law firm of Connolly, Ekl & Williams, P.C. | | 1995 | | 9,237 | | 18,000 | | 27,237 | 13 | | * | |

| | | | | |

Leo M. Flanagan, Jr. (63)

Partner in the law firm of Brittain & Ketcham, P.C. Former Chairman of the Board, EFC Bancorp, Inc. | | 2006 | | 52,506 | | 28,238 | | 80,744 | 7,13 | | * | |

| | | | | |

Thomas R. Perz (61)

Managing Director of the Bank from December 2003 to December 2005. Former Chairman of the Board and Chief Executive Officer of St. Francis Capital Corporation. | | 2003 | | 220,600 | | 4,500 | | 225,100 | 8,13 | | * | |

| | | | | |

Lois B. Vasto (72)

Former Senior Vice President/Loan Operations of the Company and the Bank until her retirement in 1997. | | 1989 | | 17,079 | | 20,250 | | 37,329 | 13 | | * | |

| | | | | |

Jerry A. Weberling (54)

Executive Vice President and Chief Financial Officer of the Company and the Bank. | | 1998 | | 71,475 | | 239,597 | | 311,072 | | | * | |

See footnotes beginning on page 6.

5

| | | | | | | | | | | | |

Name, Age and Principal Occupation at Present and for the Past Five Years | | Director of the

Company

Since | | Shares of

Common

Stock

Beneficially

Owned1 | | Currently

Exercisable

Stock Options2 | | Total Beneficial

Ownership | | | Ownership

Percentage3 | |

CONTINUING DIRECTORS SERVING UNTIL 2008 | | | | | | | | | | | | |

| | | | | |

Robert J. Bowles, MD (59)

Chairman of the Board of Physician Associates of Florida, Orlando, Florida, and practicing physician. | | 1989 | | 15,914 | | 9,000 | | 24,914 | 13 | | * | |

| | | | | |

David C. Burba (58)

Executive Vice President of the Company and the Bank from 1999-2003. Former Chairman of the Board and President, Westco Bancorp, Inc. | | 1999 | | 245,526 | | 24,341 | | 269,867 | 9,13 | | * | |

| | | | | |

Allen H. Koranda (60)

Chairman of the Board and Chief Executive Officer of the Company and the Bank. Mr. Koranda is the brother of Kenneth R. Koranda. | | 1989 | | 674,920 | | 424,614 | | 1,099,534 | 10 | | 3.19 | % |

| | | | | |

Barbara L. Lamb (51)

Chief Development Officer of Market Liquidity Network, LLC from 1999 to 2001. Senior Vice President and Chief Credit Officer - ABN AMRO, Incorporated from 1995 to 1998. | | 2003 | | 2,102 | | 4,500 | | 6,60213 | | | * | |

| | | | | |

Edward W. Mentzer (70)

President, Advance Fitting Corp., a privately held manufacturing business. Director of the Bank since 2003. Former director of St. Francis Capital Corporation. | | 2005 | | 39,827 | | 4,500 | | 44,327 | 11,13 | | * | |

| | | | | |

NAMED EXECUTIVE OFFICERS (who are not directors) | | | | | | | | | | | | |

| | | | | |

Kenneth B. Rusdal (64)

Senior Vice President-Operations and Information Systems. | | N/A | | 34,433 | | 105,639 | | 140,072 | 12 | | * | |

| | | | | |

Jennifer R. Evans (47)

Senior Vice President and General Counsel since June 2004. Prior thereto, partner in the law firm of Vedder, Price, Kaufman & Kammholz, P.C. | | N/A | | 1,179 | | 85,000 | | 86,179 | | | * | |

| | | | | |

Stock Ownership of all Directors and Executive Officers as a Group (26 persons) | | | | 3,236,131 | | 2,559,058 | | 5,795,189 | 13 | | 15.82 | % |

| * | Represents less than 1 % |

| 1 | “Shares of Common Stock Beneficially Owned” include shares held directly or indirectly, including: (a) shares held in joint tenancy or tenancy in common, and (b) shares allocated to the account of the individual through deferred compensation or employee benefit plans of the Company or Bank. Each person whose shares are included herein is deemed to have sole or shared voting and investment power as to the shares reported, except as otherwise indicated. |

Footnotes continued on next page.

6

| 2 | Represents shares subject to stock options granted under incentive or equity compensation plans of the Company or acquired companies and currently exercisable or exercisable within 60 days of March 17, 2006. |

| 3 | Based on shares outstanding at March 17, 2006. For purposes of calculating ownership percentages for an individual or the group, those shares of common stock issuable to such individual, or to all directors and executive officers as a group, upon exercise of currently exercisable stock options or stock options exercisable within 60 days of March 17, 2006, are deemed to be outstanding. |

| 4 | For Mr. Kenneth Koranda, includes 1,695 shares held by his wife, 142,183 shares held as trustee for Mr. Koranda’s children and 9,000 shares held in a charitable foundation. |

| 5 | For Mr. Stolarczyk, includes 105,783 shares held in trust, 7,234 shares held by his wife and 20,409 shares held in trust for which Mr. Stolarczyk’s wife is trustee. |

| 6 | For Mr. Zych, includes 29,584 shares held by his wife, 3,200 shares held as trustee for his children and 4,930 shares held as trustee for his grandchildren. |

| 7 | For Mr. Flanagan, includes 1,832 shares held by the law firm in which he is a partner and 3,884 shares held by his wife. |

| 8 | For Mr. Perz, includes 6,921 shares held in trust. |

| 9 | For Mr. Burba, includes 5,863 shares held in trust for which Mr. Burba’s wife is trustee and 7,860 shares held by his wife as custodian for the benefit of their son. |

| 10 | For Mr. Allen Koranda, includes 118,195 shares held in trust for Mr. Koranda’s children for which Mr. Koranda is trustee. |

| 11 | For Mr. Mentzer, includes 11,988 shares held in trust. |

| 12 | For Mr. Rusdal, includes 12,375 shares held by his wife. |

| 13 | Excludes 329 unallocated shares held by the Mid America Bank Management Recognition and Retention Plans and Trusts (the “MRPs”) which shares are reflected in the total stock ownership of directors and executive officers as a group. The voting of such shares is directed by the non-employee directors of the Bank. As a result of this shared voting authority, each non-employee director of the Bank may be deemed to be the beneficial owner of all such shares. |

7

Meetings of the Board and Committees of the Board

During the year ended December 31, 2005, the Board of Directors of the Company held eight regular meetings and one special meeting. The independent directors of the Board generally meet in executive session, without management present, in connection with each regularly scheduled board meeting. Lois B. Vasto, chairman of the Nominating and Corporate Governance Committee, serves as the lead director of the Board and presides at these sessions in accordance with the corporate governance guidelines adopted by the Board. During the year, all directors of the Company attended at least 75% of the aggregate of number of meetings of the Board and those committees of the Board on which such director served. The Board of Directors of the Company has five standing committees, which are described below.

Audit Committee. The Audit Committee consists of Barbara L. Lamb (Chairman), F. William Trescott (Vice Chairman), Joe F. Hanauer and Edward Mentzer, who was appointed to the Audit Committee in April 2005. Barbara L. Lamb has been designated by the Board as the “audit committee financial expert,” as defined by applicable rules of the SEC, based on her educational background in finance and accounting and her professional experience in investment banking where she was actively involved in the evaluation and analysis of financial statements of financial institutions and various other entities. The Audit Committee is responsible for selection of the Company’s independent registered public accounting firm, the oversight of the Company’s accounting, reporting and internal controls practices, and monitoring of legal and regulatory compliance. The Committee reports to the Board of Directors concerning audit and compliance activities and the results of regulatory examinations and any other related matters affecting the Company and the Bank. The Audit Committee met 15 times during 2005. All members of the Audit Committee meet the independence standards and have the accounting or financial management expertise required for Audit Committee members under the applicable Nasdaq Stock Market listing standards. The formal report of the Audit Committee with respect to the year 2005 is shown later in this proxy statement. The Audit Committee charter is available on the Company’s website atwww.mafbancorp.com and is attached hereto as Appendix A.

Administrative/Compensation Committee. The Administrative/Compensation Committee consists of Robert J. Bowles (Chairman), Harris W. Fawell, F. William Trescott and Andrew J. Zych. Each member of the committee is independent under the rules of the Nasdaq Stock Market. This committee is responsible for administering various benefit and compensation plans and for reviewing and making recommendations to the Board concerning compensation programs applicable to the Company’s executive officers and directors. The committee also has responsibility for conducting the annual performance review and determining the compensation of the Company’s chief executive officer and approving the compensation for all other executive officers. As part of the Company’s ongoing management succession planning process, the committee annually reviews the roles, structure and depth of the senior management team. The Administrative/Compensation Committee met 10 times during 2005.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Lois B. Vasto (Chairman), Robert J. Bowles and F. William Trescott. Each member of the committee is independent under the rules of the Nasdaq Stock Market.This committee makes recommendations to the Board regarding the size and composition of the Board and recommends to the Board of Directors the nominees to stand for election at the Company’s annual meeting of shareholders. The committee is also responsible for taking a leadership role in the oversight of the Company’s corporate governance policies and management succession planning. The Nominating and Corporate Governance Committee charter is available on the Company’s website atwww.mafbancorp.com. The Nominating and Corporate Governance Committee met six times during 2005.

8

Executive Committee. The Executive Committee consists of Allen H. Koranda (Chairman), Kenneth R. Koranda, Robert J. Bowles, Joe F. Hanauer and Lois B. Vasto. This committee meets only as needed. The Executive Committee has the power to exercise most of the powers of the Board of Directors in the intervals between meetings of the Board. The Executive Committee did not meet in 2005.

Asset/Liability Management Committee. The Asset/Liability Management Committee consists of Jerry A. Weberling (Chairman), Robert J. Bowles, Joe F. Hanauer, Allen H. Koranda, Kenneth R. Koranda and Thomas R. Perz. The Committee’s function is to assist the Board of Directors in monitoring and overseeing the Company’s interest rate risk and credit risk exposure. This committee is also responsible for implementation of the Company’s overall asset/liability management and credit policies and for overseeing and making recommendations to the Board concerning other financial areas of the business, including financing transactions, capital utilization and dividend policy. The Asset/Liability Management Committee met eight times in 2005.

Corporate Governance Matters

Director Independence. The Board of Directors has determined the following 10 directors to be “independent” under the rules of the Nasdaq Stock Market based on its conclusion that they have no material relationship with the Company that would interfere with their exercise of independent judgment: Robert J. Bowles, Barbara L. Lamb, Joe F. Hanauer, Harris W. Fawell, Leo M. Flanagan, Jr., Edward W. Mentzer, Raymond S. Stolarczyk, F. William Trescott, Lois B. Vasto and Andrew J. Zych. In the case of the other six directors, the Board is precluded under the Nasdaq rules from determining the individuals to be “independent” directors based on their current or former employment with the Company or business relationships with the Company. In determining Mr. Flanagan and Mr. Stolarczyk to be “independent” directors, the Board considered Mr. Flanagan’s service as Chairman of the Board of EFC Bancorp, Inc. (“EFC”) until its merger into the Company in February 2006 and Mr. Stolarczyk’s employment by Fidelity Bancorp, Inc. (“Fidelity”) until its merger into the Company in July 2003, and does not believe these former positions preclude a finding of independence, as Mr. Flanagan and Mr. Stolarczyk have never been employed by the Company or any subsidiary of the Company.

Qualifications for Board Nomination. As part of its annual nomination process, the Nominating and Corporate Governance Committee reviews the existing composition of the Board to evaluate the appropriate mix of disciplines, experience and other characteristics required of board candidates in the context of perceived needs of the Company. The Board believes a range of experience, knowledge and judgment and a diversity of perspectives on the Board enhances the effectiveness of the Board if each director has the personal characteristics, commitment and experience to participate actively in the board process. The Board also believes continuity in leadership and board tenure are important characteristics of an effective Board.

The Board has adopted a policy statement regarding director qualifications to identify the personal traits, skills and performance criteria it believes are critical to effective service as a director of the Company. Included among these traits are an ability and willingness to devote the necessary attention to Board matters and to exercise independent judgment. Board members are expected to have relevant business or managerial skills and offer insight and advice to management while acting in the best interests of shareholders and complying with the Company’s Code of Ethics (available on the Company’s website). In addition, directors should possess the following personal characteristics: mature wisdom; demonstrated leadership skills; comprehension of the Company’s business plans and strategies; ability to understand financial statements; ability to make informed judgments on a wide range of issues and willingness to express differing views even if unpopular; and collegial personality and non-confrontational manner.

9

As stated in the corporate governance guidelines of the Board, the Board’s policy is that no person will be nominated for election as a director if he or she reaches the age of 75 on the last day of the year immediately prior to the election. Under the corporate governance guidelines, each Board member is expected to limit his or her participation on other boards to no more than five other public companies or mutual fund complexes. In addition, each director is to provide notice in the event of a change in his or her employment status and offer to resign as a director upon the change if deemed necessary or appropriate by the Nominating and Corporate Governance Committee. The corporate governance guidelines are available on the Company’s website atwww.mafbancorp.com.

The corporate governance guidelines call for each director to establish a financial stake in the Company through meaningful ownership of common stock of the Company appropriate for the director’s personal financial circumstances, with a minimum investment of at least 1,000 shares over a reasonable period of time. Those directors who are executive officers are governed by the Company’s executive stock ownership guidelines established by the Board in 2005. These guidelines call for the chief executive officer and the president to maintain an investment in company stock valued at five times their annual base salaries, the executive vice president at three times annual base salary, and all senior vice presidents at one times their annual base salaries. The policy calls for executives to establish ownership stakes at these levels within five years with the expectation that the stock ownership will be achieved through equity compensation awards.

Board Nomination Process. As part of its nomination process, the Nominating and Corporate Governance Committee considers the diversity and mix of experience and expertise among Board members, as well as the perceived business needs of the Company and any legal or regulatory requirements. Under the committee’s procedures for identifying and evaluating director nominees, the committee will seek candidates to ensure that: (a) a majority of directors are “independent” in accordance with the rules of the Nasdaq Stock Market; (b) at least three members of the Board satisfy the SEC’s heightened standards for audit committee members; and (c) at least one member of the Board satisfies the criteria for being an “audit committee financial expert.” New director candidates are evaluated by the Nominating and Corporate Governance Committee relative to the director qualification criteria set forth in the Board-approved policy statement and the corporate governance guidelines. The committee generally considers re-nomination of incumbent directors provided they continue to meet the performance expectations and qualification criteria adopted by the Board of Directors.

The Nominating and Corporate Governance Committee may retain third party search firms to assist it in identifying potential Board nominees and may also seek input from other Board members and management. For new candidates, the committee will review background information provided by the candidate and may conduct background checks and interviews to the extent it considers it to be appropriate.

Stockholder Recommendations. The Committee will generally considerbona fide director nominee recommendations from shareholders if they are timely received in accordance with the procedures set forth below. Candidates recommended by shareholders will be evaluated using the same criteria applicable to other potential candidates, but the Committee is not obligated to include any shareholder recommended director candidates in the slate of nominees.

To be timely, a shareholder’s recommendation must be in writing and must be delivered or mailed to the Corporate Secretary and received at the principal executive office of the Company not later

10

than 120 days prior to the anniversary date of mailing of proxy solicitation materials relating to the prior year’s annual meeting, or in the event that the date of the meeting has changed more than 30 days from the anniversary date of the prior year’s annual meeting, such recommendation must be delivered or mailed to and received by the Company not later than 90 days in advance of such meeting. Any shareholder recommendation is required to set forth (1) as to each person whom such shareholder recommends as a nominee for election or re-election as a director, (A) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected) and (B) representations and/or references indicating that the recommended director candidate meets the minimum director qualifications described in the Company’s most recent annual meeting proxy statement; and (2) as to the shareholder making the recommendation, (A) the name and address, as they appear on the Company’s books, of such shareholder, (B) the number of shares of the Company’s common stock that are beneficially owned by such shareholder and (C) any material relationship, arrangement or understanding of such shareholder with the proposed nominee or any other interest in such nomination.

Directors’ Compensation

Directors’ Fees. All directors received annual director fees of $25,000 in 2005, and directors who are not also employees received an additional fee of $750 for each Board meeting and annual meeting attended. These fees are for service on the board of directors of the Company and the Bank. Directors also received $200 for each committee meeting they attended that was not held on the same day as a Board of Directors meeting. Directors’ fees earned by the three employee directors in 2005 are included in the salary amounts shown in “Executive Compensation–Summary Compensation Table” for the executives. The Chairman of the Audit Committee, Administrative/Compensation Committee and Nominating and Corporate Governance Committee also receive an additional annual fee for serving in such capacity of $4,000, $2,000 and $2,000, respectively.

Director Stock Options. During 2005, each non-employee director of the Company received a grant of 2,250 options at an exercise price of $39.73 per share, which was equal to 100% of the fair market value of the common stock on the date of grant.

Directors’ Deferred Compensation Plan. The Bank maintains the Mid America Bank, fsb Directors’ Deferred Compensation Plan. Under the plan, directors may annually elect to defer up to 100% of their annual directors’ fees. Directors may choose to earn a return on their deferred amounts based either on interest at 110% of the Moody’s Corporate Bond Rate (decreased from 130% beginning in 2005) or on an investment in MAF Bancorp common stock at the time of deferral.Generally, upon attaining the age of 65 (or, pursuant to an election made in advance by a director, at the later of termination of service or attaining the age of 65), directors are entitled to receive the deferred fees plus accrued interest, or in the case of amounts invested in common stock, the associated number of MAF Bancorp shares including assumed reinvestment of dividends. Such amounts are payable in a lump sum or in installments over a period of time not to exceed 15 years.Death benefits are provided to the beneficiaries of the plan participants. The shares purchased on behalf of directors through the plan and allocated to directors’ accounts are included in beneficial ownership shown in “Information with respect to Nominees, Continuing Directors and Others,” for each director and for all directors and executive officers as a group.

11

Health Insurance Plan. Non-employee directors and retired directors are eligible to participate in the Bank’s medical benefits plan, and those individuals electing to be covered under the plan pay a portion of the cost which is comparable to the cost paid by current employees.

Expense Reimbursement. Directors are entitled to reimbursement for reasonable travel expenses for meeting attendance and for the costs of attending approved director education programs.

EXECUTIVE COMPENSATION

The report of the Compensation Committee and the stock performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Compensation Committee Report

Under rules established by the Securities and Exchange Commission, the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company’s Chief Executive Officer and other executive officers of the Company. The disclosure requirements for the Chief Executive Officer and other executive officers include the use of tables and a report explaining the rationale and considerations that led to fundamental executive compensation decisions affecting those individuals. In fulfillment of this requirement, the Company’s Administrative/Compensation Committee (the “Compensation Committee”) provides the following report for inclusion in the 2006 proxy statement.

Committee Composition, Role and Process. The Compensation Committee is composed of four “independent” directors as defined under the rules of the Nasdaq Stock Market. The Board has delegated to the committee the responsibility for establishing the compensation of the Chief Executive Officer and other executive officers. Under the Compensation Committee charter, the committee is responsible for assuring that executive compensation is consistent with the compensation strategy, competitive practices, the performance of the Company, and the requirements of appropriate regulatory agencies.

Directors who do not sit on the Compensation Committee also participate in executive compensation matters through the review, discussion and ratification of Compensation Committee actions. On occasion, the committee has used compensation consultants to assist in assessing executive compensation plans and executive compensation levels relative to peer groups and survey results. In 2005, the committee engaged Watson Wyatt to assist it in reviewing executive compensation and to provide consulting services with respect to executive compensation matters.

Among other things, Watson Wyatt:

| | • | | assessed executive officers’ salary levels and reviewed and concluded that the salaries were within the range of competitive practice; |

| | • | | reviewed all components of the ongoing executive officer compensation program and gave the committee feedback regarding their fit within the range of competitive practice; |

12

| | • | | advised the committee on incorporation of individual performance metrics into the annual bonus program beginning in 2006; |

| | • | | reviewed and consulted with the committee on severance programs in place for executives in the context of involuntary departure or a change in-control; |

| | • | | reviewed the company’s “tally sheets” from 2004 which summarized all compensation and perquisites for the company’s executive officers, gave advice on modifying the tally sheet format for 2005 and reviewed the 2005 tally sheets as prepared by management, using this revised format; |

| | • | | reviewed and advised with respect to the formulation of the Company’s peer group; and |

| | • | | advised the committee on the use of various forms of equity incentive compensation. |

At meetings held in December 2005 and January 2006, the committee and the Board reviewed all components of the chief executive officer and the other executive officers’ 2005 compensation, using individual “tally sheets” prepared by management and reviewed by Watson Wyatt. The committee was also provided summaries of historical amounts of base salaries, proposed annual bonuses and stock-based compensation awards for purposes of the meeting. The committee reviewed compensation data taken from SNL Securities compilations to compare compensation levels of the Company’s top five highest paid executives (including the chief executive officer) with those of the selected peer group. The peer group used for this comparison included 34 companies with median total assets and return on equity results for 2004 of $11.5 billion and 12.8%, respectively. A representative from Watson Wyatt experienced in executive compensation matters was present at two of the three meetings to consult with the committee.

Executive Compensation Philosophy. The Compensation Committee has the following goals for the compensation programs relating to the executives of the Company and the Bank:

| | • | | to maintain the amount of “fixed” compensation costs at reasonable levels by targeting base salaries at or below average competitive levels; |

| | • | | to link a significant portion of total compensation to achievement of performance-based goals, including financial performance metrics, such as the Company’s earnings per share results as well as individual goals; |

| | • | | to provide motivation for the executive officers to enhance long-term shareholder value by linking a portion of their compensation opportunity to the future appreciation in the value of the Company’s common stock relative to a market index; |

| | • | | to align the interests of executive officers with the interests of shareholders by including in total compensation a significant component of equity-based pay, traditionally in the form of stock option awards but which may also be in the form of restricted stock, performance-based share awards, stock appreciation rights or other share-based payments; and |

| | • | | to retain quality executive officers and allow the Company to attract talented executives in the future. In pursuing this goal, the committee recognizes the need to address evolving executive compensation practices and to be competitive in responding to changing trends while promoting shareholders’ best interest. |

13

Executive officers’ compensation has consisted principally of salary, annual incentive bonus opportunities, grants of stock-based performance units, stock option awards and participation in the Company’s deferred compensation plan and supplemental executive retirement plan. In addition, executive officers receive various perquisites and are party to either an employment agreement or a change-in-control agreement providing certain severance benefits. Executives also participate in the Company’s various employee benefit plans generally under the same terms as are applicable to all employees.

The Committee pursues the goal of linking executive compensation to the Company’s financial performance by structuring financial performance goals into the eligibility criteria for annual bonuses and the goal of linking executive compensation to the Company’s stock price performance through performance unit awards and equity-based compensation such as stock option grants. The structure of bonus opportunities and awards are intended to motivate executives to take actions that will favorably impact the Company’s annual, as well as long-term, profitability.

Base Salaries. In establishing base salaries for 2005, the Committee met in December 2004 and reviewed the recommendations from the Chief Executive Officer. The median percentage increase in base salaries awarded at that time for the executive officers was 4.59%.

At its December 2005 meeting, the Committee determined to increase base salaries for the Company’s executive officers. The median percentage increase in base salaries awarded at that time for the executive officers was 3.11%.

Annual Incentive Bonuses. Annual incentive bonuses are awarded to eligible officers pursuant to the MAF Incentive Compensation Plan (“Incentive Plan”). For 2005, officers were classified in one of three different bonus pools, based on their position within the Company, which determined their bonus opportunity level. In early 2005, the Committee established a performance goal based on 2005 diluted earnings per share results and approved a bonus matrix comprised of bonus opportunity amounts (defined as percentages of 2005 base salary) that were dependent on achieving minimum and incrementally increasing earnings per share amounts. The bonus matrix for 2005 is set forth below:

2005 Annual Bonus Opportunities

(% of base salary)

| | | | | | | | | | | | |

Performance Level | | 2005 EPS

Results | | Tier 1 | | | Tier 2 | | | Tier 3 | |

Threshold | | $ | 2.98 | | 30.0 | % | | 25.0 | % | | 22.5 | % |

Target | | | 3.31 | | 60.0 | % | | 50.0 | % | | 45.0 | % |

Superior | | | 3.81 | | 105.0 | % | | 87.5 | % | | 78.8 | % |

For 2005, Messrs. A. Koranda and K. Koranda participated in Tier 1 of the bonus pool. Messrs. Weberling and Rusdal participated in Tier 2 of the bonus pool. Ms. Evans, along with other executive officers, participated in Tier 3 of the bonus pool.

The Committee also set forth four safety and soundness standards that the Company needed to satisfy in order for annual bonuses to be paid for 2005. These included: (a) a minimum 5% Bank tangible capital ratio; (b) a minimum 10% Bank risk-based capital ratio; (c) a maximum 2% non-performing assets to total assets ratio; and (d) a one-year cumulative interest sensitivity gap within the range of plus or minus 15%.

14

In 2005, all of the safety soundness standards were met and diluted EPS equaled $3.13 per share. This represented a performance level between the Threshold and Target levels. Bonuses equal to 43.7%, 36.4% and 32.8% of 2005 base salary amounts were paid to Tier 1, 2 and 3 participants, respectively. This resulted in annual bonus payments of $183,920, $183,920, $105,940, $93,560 and $85,190 to Messrs. A. Koranda, K. Koranda, Weberling, Rusdal and Ms. Evans, respectively.

For 2006, the committee has incorporated individual performance goals into the annual bonus program. Annual bonuses will continue to be determined based on the executive’s base salary, classification into one of three bonus tiers and the Company’s earnings per share performance relative to goals established at the beginning of the year, and bonus amounts will be reduced by up to 50% if individual goals established for the year have not been adequately achieved. In the event the threshold earnings per share level for payouts under the bonus program is not attained, executives will be eligible to receive other cash incentive pay in an amount up to one-half of the opportunity the executive had at the “threshold” level of performance, based on the assessment of the extent to which an executive’s individual goals have been adequately achieved. For 2006, all Senior Vice Presidents participating in the annual bonus program who were not already included in Tier 2, were moved into this tier.

Stock-Based Performance Unit Grants. Performance unit awards have been granted annually to executive officers with a three-year performance period. The Committee has broad discretion under the Incentive Plan in determining how the long-term incentive program operates and may redesign the structure of future awards as it deems appropriate. Under the current program, the number of units granted to each participant is dependent on the executive’s base salary and classification in one of three different tiers. The value of performance units, if any, which is paid in cash, is determined at the end of a three-year performance period based on the stock price performance of MAF Bancorp (including reinvested dividends) relative to companies included in the S&P 500 Index.

In order for the performance units to be worth their targeted value, the stock price performance of MAF Bancorp must be in the 60th percentile of the S&P 500 Index (target performance) at the end of the three-year measurement period. If the stock price performance ranks in the 50th percentile of the S&P 500 Index, the performance units will be worth 50% of their targeted value, while performance in the 90th percentile of the S&P 500 Index will result in the performance units being worth 200% of their targeted value. If the Company’s stock price performance does not rank at least in the 50th percentile of the S&P 500 Index for the three-year measurement period, or if MAF Bancorp’s stock price appreciation, including reinvested dividends, does not exceed a specified total shareholder return hurdle for the three-year period, the performance units will have no value.

The matrix below sets forth the potential value of performance units awarded for the three-year period that ended on December 31, 2005, based on: (a) a participant’s base salary in the year prior to the year in which the performance period begins; (b) a participant’s classification into one of three tiers; and (c) the percentile stock performance ranking of MAF Bancorp at the end of the three-year measurement period relative to the 500 companies included in the S&P 500 Index.

15

Value of Performance Units

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Tier 1 | | Tier 2 | | Tier 3 |

| | Threshold

(50th ) | | Target

(60th) | | Superior

(90th) | | Threshold

(50th ) | | Target

(60th) | | Superior

(90th) | | Threshold

(50th) | | Target

(60th) | | Superior

(90th) |

| Base Salary | | | | | | | | | | | | | | | | | | | | | | | | | | | |

$150,000 | | $ | 22,500 | | $ | 45,000 | | $ | 90,000 | | $ | 18,750 | | $ | 37,500 | | $ | 75,000 | | $ | 16,875 | | $ | 33,750 | | $ | 67,500 |

$250,000 | | | 37,500 | | | 75,000 | | | 150,000 | | | 31,250 | | | 62,500 | | | 125,000 | | | 28,125 | | | 56,250 | | | 112,500 |

$350,000 | | | 52,500 | | | 105,000 | | | 210,000 | | | 43,750 | | | 87,500 | | | 175,000 | | | 39,375 | | | 78,750 | | | 157,500 |

$450,000 | | | 67,500 | | | 135,000 | | | 270,000 | | | 56,250 | | | 112,500 | | | 225,000 | | | 50,625 | | | 101,250 | | | 202,500 |

For the performance period that ended on December 31, 2005, Messrs. A. Koranda and K. Koranda were classified in Tier 1, Messrs. Weberling and Rusdal were classified in Tier 2 and Ms. Evans was classified in Tier 3 along with other senior officers. Performance units for the performance period beginning January 1, 2003 were valued at the end of their three-year performance period on December 31, 2005. The total return on MAF Bancorp Common Stock was 29.2% during this performance period and ranked in the 27th percentile when compared to companies in the S&P 500 Index. As a result, for the performance period ended on December 31, 2005, there were no payouts for the long-term incentive plan units.

At its meeting in December 2004, the committee granted performance units to executive officers for the performance period that began on January 1, 2005 and ends on December 31, 2007. At its meeting in January 2006, the committee granted performance units to executive officers for the performance period that began on January 1, 2006 and ends on December 31, 2008. The structure of these awards is similar to that shown in the table above. For 2006, all senior vice presidents participating in the long-term incentive program were moved into Tier 2.

Stock Options. The committee believes it is in the best interests of shareholders to have a significant portion of executives’ compensation comprised of stock-based compensation to closely align executives’ interests with those of shareholders. Historically, the committee has generally awarded stock-based compensation to executives in the form of stock options. The Incentive Plan provides the committee with the authority to grant discretionary stock option awards (at an exercise price of not less than 100% of the fair market value of the common stock on the date of grant) to executives, directors and employees.

In determining individual option grant amounts, the committee took into account each executive officer’s individual performance, level of responsibility and position within the Company. The committee considered the estimated value of such individual awards under a Black Scholes pricing model, together with the summary of all components of each executive officer’s compensation packages as set forth on individual tally sheets. The committee also assessed the aggregate number of stock option and restricted stock awards for 2005 relative to total outstanding shares. The aggregate number of shares covered by stock options and restricted stock awards granted in 2005 was 352,600, or 1.10% of outstanding shares at December 31, 2005.

The committee also considered the number of shares that remained available for grant under the Incentive Plan and the impact of the pending change in accounting rules that will require the mandatory expensing of stock options that vest after December 31, 2005. All stock options granted at the December 14, 2005 meeting were granted at an exercise price of $42.73 per share and vested 100% on the date of grant.

Deferred Compensation. Executive officers, along with certain other corporate officers, may elect to participate in a deferred compensation plan under which they can defer up to 25% of their salary

16

and bonuses. Participants are unsecured creditors of the Company with respect to deferred amounts, which earn interest credits (unless a participant elects to earn a total return based on an investment in the Company’s common stock) at a rate equal to 110% of the Moody’s Corporate Bond Rate (decreased from 130% beginning in 2005). For 2005, this rate was equal to 6.68%. The committee and the Board have established the interest rate paid on deferred amounts at a level that is modestly higher than prevailing rates for comparable investments and to that extent, it represents a component of executives’ compensation packages and is reflected in the Summary Compensation Table below.

At its December 2005 meeting, the committee reviewed the balances of executive officers’ deferred compensation accounts and an estimation of the excess of the actual interest paid during 2005 over the interest calculated using a rate equal to 120% of an applicable federal rate.

In addition to the deferred compensation plan described above, the Company maintained a stock option gain deferral plan under which participants were permitted to defer receipt of shares otherwise deliverable upon the exercise of stock options. In light of the financial statement expense associated with dividends credited on shares deferred under such plan and one-time transition relief available during 2005 from the more stringent rules of then recently-enacted Code Section 409A relating to deferred compensation plans, the Company terminated the stock option gain deferral plan in February 2005. As a result, 49,318 and 197,318 shares of common stock, representing 44,690 and 178,763 shares deferred when stock options were exercised in 1999 and 4,628 and 18,555 shares attributable to dividend credits, were distributed to the plan’s two participants, Messrs A. Koranda and K. Koranda, respectively.

Supplemental Executive Retirement Plan. Executive officers, along with certain other corporate officers, also participate in a supplemental executive retirement plan (“SERP”). At its December 2005 meeting, the committee reviewed the benefits earned under this plan for each of its executive officers based on service through December 31, 2005. As part of a separate analysis of payments due to executives under various termination and change in control scenarios, the committee also reviewed enhanced SERP payouts that would be made in connection with a change in control of the Company (in which case participants receive up to ten additional years of service credit under the SERP). In January 2006, the committee acted to eliminate the automatic granting of enhanced SERP benefits to new SERP participants. The committee believes providing a SERP for executives is appropriate given the limitations on providing retirement benefits to a company’s more highly paid employees under qualified plans.

Severance Payments.The Company is a party to employment agreements with Messrs. A. Koranda, K. Koranda and Weberling that provide for severance payments in the event of an involuntary termination, other than for cause. The agreements also provide for severance payments under certain “good reason” voluntary terminations. In the event of termination following a change in control, these agreements provide for severance payments to the executives, as do various special termination agreements that the Company and the Bank are parties to with other executive officers.

At its December 2005 meeting, the committee reviewed the estimated aggregate costs of these severance payments under various termination scenarios, along with estimated costs relating to enhanced SERP benefits, continuing insurance coverage obligations, tax gross-up payments (if any) and accelerated vesting of stock options and restricted stock. The committee compared these costs to similar costs incurred by banks that the company has acquired, using total estimated costs as a percentage of the company’s value as the comparison statistic.

The Company also consulted with Watson Wyatt on various severance and change-in-control related terms contained in employment agreements, special termination agreements and other plans.

17

Based on these discussions and analyses, the committee believes that the aggregate severance and change-in-control related costs for its executive officer group are reasonable and the severance and change-in-control terms contained in these agreements and plans are not inconsistent with what is generally found in the financial institutions industry.

Chief Executive Officer’s Compensation. In establishing Allen H. Koranda’s compensation for 2005, the committee considered individual performance, peer group comparisons, and the committee’s philosophy regarding CEO compensation.

At its December 2005 meeting, the committee discussed Mr. Koranda’s performance and compensation without any members of management, including Mr. Koranda, present. While the earnings results for 2005 were below the targeted level the Company had set at the beginning of the year, the committee believes that the difficult operating environment that the Company and all financial institutions faced in 2005, along with delays experienced in the Company’s real estate operations that were outside the Company’s control, were significant contributing factors impacting these results. The Committee recognized that Mr. Koranda has been instrumental in guiding the Company on a successful growth and market expansion strategy over the past few years.

Based on this review, Mr. Koranda’s compensation package, the components of which are described below or elsewhere in this proxy statement, for 2005 may be summarized as follows:

| | | |

Base Salary | | $ | 421,000 |

Directors Fees | | | 25,000 |

Annual incentive bonus | | | 183,920 |

Black Scholes value of stock option grant | | | 454,875 |

LTIP Payment (2003-2005 cycle) | | | — |

SERP value increase | | | 133,439 |

Profit Sharing/401(k)/ESOP | | | 11,411 |

Excess interest on deferred compensation | | | 25,530 |

Perks (value of car; club dues) | | | 18,829 |

| | | |

Total | | $ | 1,274,004 |

| | | |

Mr. Koranda’s compensation package reflects the philosophy that compensation for the chief executive officer at MAF should not be multiple times greater than that of other senior MAF executive officers, who also have been important in shaping and leading MAF’s strategy and performance. The committee has historically maintained a relatively tight spread between the chief executive officer’s compensation and that of Kenneth Koranda, the Company’s President and Vice Chairman, and that of other senior executive officers, compared to what may exist at other companies.

Mr. Koranda’s base salary for 2005 was $421,000, which represented a 4.0% increase over his base salary rate for 2004. Mr. Koranda also receives an annual retainer for his service as a director of the Company and the Bank which totaled $25,000 for 2005, a 4.2% increase from 2004. These fees are considered part of his base compensation and are reflected in the Summary Compensation Table. For 2006, Mr. Koranda’s base salary has been increased by 3.7% to $436,500.

As discussed above, Mr. Koranda received a cash payout of $183,920 in February 2006 relating to his 2005 annual incentive bonus. He did not receive any payment relating to previously-granted performance units with a three-year performance period which ended on December 31, 2005 because the stock price performance over this period was below the “threshold” level of performance. At its meeting in January 2006, the Committee awarded Mr. Koranda long-term performance units that could result in a

18

cash payment to him in the range of $63,150-$252,600 depending on how MAF’s stock price performance ranks relative to the stock price performance of S&P 500 Index companies for the three-year period that ends on December 31, 2008. The chief executive officer was also awarded a discretionary stock option grant covering 37,500 shares for 2005 on the basis of the factors described above with a Black Scholes value of $454,875. Based upon the recommendation of the Committee, the Board acted to extend Mr. Koranda’s three-year employment agreement for an additional year to December 31, 2008 in accordance with the annual extension provision in the contract.

Section 162(m). The Compensation Committee does not currently believe that the provisions of Section 162(m) of the Internal Revenue Code of 1986, as amended, relating to the deductibility of compensation paid to the chief executive officer and the four other most highly compensated executive officers, will materially limit the deductibility of executive compensation. The Compensation Committee will continue to evaluate the impact, if any, of such provisions and take such actions as it deems appropriate.

The Committee’s Conclusion. Based on this review, the committee believes the chief executive officer’s and four other most highly compensated executive officers’ total compensation is reasonable and consistent with the Company’s compensation philosophy.

Submitted by the Administrative/Compensation Committee of the Company’s Board of Directors.

Robert J. Bowles, MD (Chairman)

Harris W. Fawell

F. William Trescott

Andrew J. Zych

Compensation Committee Interlocks and Insider Participation

Three individuals, Messrs. A. Koranda, K. Koranda, and J. Weberling, who are executive officers of the Company serve on the board of directors of the Bank. These same individuals are also executive officers of the Bank and serve as directors of the Company. None of them serves as a member of the Compensation Committee of the Company.

19

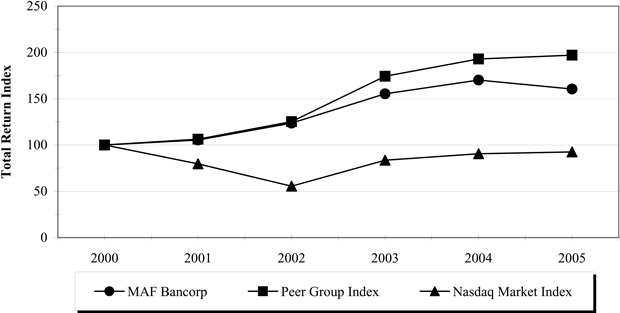

Stock Performance Graph

The following graph shows a comparison of cumulative total shareholder return (including reinvested dividends) on the Company’s common stock, with the cumulative total returns of both a broad-market index and a peer group index for the period December 29, 2000 through December 30, 2005. The broad-market index chosen was the Nasdaq Market Index, and the peer group index chosen was the Hemscott Industry Group, comprised of savings and loan institutions, which is the same peer group index used in past years. The data was provided by Hemscott, Inc. (formerly known as Core Data, Inc.). The shareholder returns are measured based on an assumed investment of $100 on December 29, 2000.

Comparison Of Cumulative Total Return Among Maf Bancorp,

Peer Group Index and Nasdaq Market Index

| | | | | | | | | | | | |

| | | 12/29/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/30/05 |

MAF Bancorp | | 100.00 | | 105.47 | | 123.67 | | 155.34 | | 170.10 | | 160.48 |

Peer Group Index | | 100.00 | | 106.31 | | 125.28 | | 174.25 | | 192.99 | | 197.16 |

Nasdaq Market Index | | 100.00 | | 79.71 | | 55.60 | | 83.60 | | 90.63 | | 92.62 |

| | A. | The lines represent yearly index levels derived from compounded returns that include all dividends. |

| | B. | If the fiscal year end is not a trading day, the preceding day is used. |

| | C. | The Index level for all series was set to $100.00 on 12/29/00. |

20

Summary Compensation Table

The following table shows, for the years ended December 31, 2005, 2004 and 2003, the cash compensation paid, as well as certain other compensation paid or accrued for those periods, to the Chief Executive Officer and the other four highest paid executive officers (“Named Executive Officers”) of the Company based on annual cash compensation.

| | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long Term Compensation | | |

| | | | | | | Awards | | Payouts | | |

Name and Principal Position | | Year | | Salary ($)1 | | Bonus ($)2 | | Other

Annual

Compen-

sation($)3 | | Restricted

Stock

Awards($) | | Securities

Underlying

Options/

SARs#4 | | LTIP

Payouts

($) | | All Other

Compen-

sation ($)5 |

Allen H. Koranda; Chairman of the Board & Chief Executive Officer | | 2005

2004

2003 | | $

| 445,385

443,923

398,772 | | $

| 183,920

—

205,704 | | —

—

— | | —

—

— | | 37,500

50,000

39,000 | |

$

| —

142,992

159,705 | | $

| 35,972

58,379

77,845 |

| | | | | | | | |

Kenneth R. Koranda; President and Vice Chairman of the Board | | 2005

2004

2003 | |

| 445,385

443,923

398,772 | |

| 183,920

—

205,704 | | —

—

— | | —

—

— | | 37,500

50,000

39,000 | |

| —

142,992

159,705 | |

| 57,496

95,138

123,297 |

| | | | | | | | |

Jerry A. Weberling; Executive Vice President and Chief Financial Officer | | 2005

2004

2003 | |

| 315,577

314,269

278,000 | |

| 105,940

—

116,434 | | —

—

— | | —

—

— | | 22,500

30,000

25,000 | |

| —

79,920

88,725 | |

| 16,222

21,767

26,630 |

| | | | | | | | |

Kenneth B. Rusdal; Senior Vice President - Operations and Information Systems | | 2005

2004

2003 | |

| 256,616

256,077

224,038 | |

| 93,560

—

102,334 | | —

—

— | | —

—

— | | —

25,000

22,000 | |

| —

69,120

76,050 | |

| 16,890

22,870

27,360 |

| | | | | | | | |

Jennifer R. Evans; Senior Vice President and General Counsel6 | | 2005

2004

2003 | |

| 259,615

144,231

— | |

| 85,190

—

— | | —

—

— | | —

—

— | | 15,000

70,000

— | |

| —

81,072

— | |

| 11,477

201

— |

| 1 | Includes amounts deferred at the election of the officer, under the Bank’s deferred compensation plans and profit sharing/401(k) plan and includes directors’ fees earned by Messrs. A. Koranda, K. Koranda and Weberling. |

| 2 | Includes bonuses earned pursuant to the Bank’s annual incentive program, which bases bonuses upon percentages of officers’ salaries if the Bank meets certain financial performance goals. |

| 3 | For 2005, 2004 and 2003, excludes the value of perquisites where the aggregate value does not exceed the lesser of $50,000, or 10% of the individual’s total salary and bonus for the years. Perquisites include use of company-owned automobile, payment for unused vacation, club dues and other miscellaneous benefits. |

| 4 | Option grants listed in the table were made pursuant to the MAF Bancorp Incentive Compensation Plan. Options granted to the Named Executive Officers in 2005 and 2004 were exercisable immediately and options granted to the Named Executive Officers in 2003 were exercisable over a two-year period. Options are granted at an exercise price equal to 100% of the fair market value of the common stock on the date of grant. Options granted to Messrs. A. Koranda, K. Koranda, Weberling and Rusdal for 2005, 2004 and 2003 have exercise prices of $42.73 per share, $44.87 per share and $42.22 per share, respectively. Options granted to Ms. Evans in 2005 have an exercise price of $42.73 per share. Ms. Evans received a 2004 option grant covering 20,000 shares at an exercise price of $44.87 per share and a separate grant covering 50,000 shares at an exercise price of $43.85 per share in connection with her hiring. |

| 5 | Includes for 2005: (1) contributions to the Company’s employee stock ownership plan valued at $2,276 for each of Messrs. A. Koranda, K. Koranda, Weberling, Rusdal and Ms. Evans; (2) contributions to the Bank’s profit sharing plan, representing discretionary employer contributions, 401(k) employer-matching contributions and forfeiture allocations, of$8,166 eachfor Messrs. A. Koranda, K. Koranda, Weberling, Rusdal and Ms. Evans; and (3) amounts accrued in the deferred compensation plan relating to the excess of the plan’s interest rates over 120% of the applicable federal long-term interest rates, of $25,530, $47,054, $5,780, $6,448 and $1,035 for Messrs. A. Koranda, K. Koranda, Weberling, Rusdal and Ms. Evans, respectively. |

| 6 | Ms. Evans was hired on June 1, 2004. |

21

Employment and Special Termination Agreements

The Company and the Bank have entered into employment agreements with Allen H. Koranda, Kenneth R. Koranda and Jerry A. Weberling. The Company and the Bank have also entered into special termination agreements with certain executive officers of the Company and the Bank, including Kenneth B. Rusdal and Jennifer R. Evans. Such employment and special termination agreements are designed to ensure that the Company and the Bank will be able to maintain a stable and experienced management base.

Employment Agreements. The employment agreements with Messrs. A. Koranda, K. Koranda and Weberling provide for three-year terms. Prior to each anniversary date, the Board of Directors of the Company or the Bank may extend the term of the agreements by an additional year so that the remaining terms are approximately three years. The current term of each of the agreements expires on December 31, 2008. The agreements provide for an annual base salary, which is reviewed annually, to be paid by the Bank, or the Company in lieu of the Bank. Base salary amounts for calendar 2006 for Messrs. A. Koranda, K. Koranda and Weberling are $436,500, $436,500 and $300,000, respectively. In addition to base salary, each agreement provides, among other things, for participation in benefit plans and other fringe benefits applicable to executive officers.