QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

WILLIAMS CONTROLS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

WILLIAMS CONTROLS, INC.

Notice of Annual Meeting to Be Held

on July 31, 2003

The annual shareholder meeting for 2003 of Williams Controls, Inc., a Delaware corporation (the "Company") will be held at the InterContinental Barclay Hotel located at 111 East 48th Street New York, New York on July 31, 2003, at 3:00 p.m. Eastern Daylight Time, for the following purposes:

- 1.

- To elect three (3) members of the Company's board of directors, two (2) of whom will be elected by holders of the Company's Series B Preferred Stock, 15% Redeemable Convertible Series voting as a separate class, to serve until the next annual shareholder meeting or until their respective successors are duly elected and qualified; and

- 2.

- To transact any other business that may properly come before the shareholder meeting.

The board of directors is not aware of any other business to come before the shareholder meeting.

Only shareholders of record on June 13, 2003, are entitled to notice of and to vote at the shareholder meeting or any adjournments of the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE SO THAT YOUR SHARES WILL BE VOTED. THE ENVELOPE REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. If you attend the meeting, you may revoke the proxy and vote personally on all matters brought before the meeting.

| | | By Order of the Board of Directors, |

|

|

|

|

|

Dennis E. Bunday

Executive Vice President, Chief Financial Officer and Secretary |

June 24, 2003

Portland, Oregon |

|

|

WILLIAMS CONTROLS, INC.

14100 SW 72nd Avenue

Portland, Oregon 97224

(503) 684-8600

PROXY STATEMENT

Purpose

The board of directors of Williams Controls, Inc., a Delaware corporation (the "Company"), is furnishing this Proxy Statement in connection with its solicitation of proxies to be voted at the annual meeting of the Company's shareholders for 2003. The shareholder meeting will be held at the InterContinental Barclay Hotel located at 111 East 48th Street New York, New York on July 31, 2003, at 3:00 p.m. Eastern Daylight Time. The accompanying Notice of the Annual Shareholder Meeting, this Proxy Statement, and the enclosed proxy card are first being mailed to shareholders on or about June 16, 2003.

Record Date; Outstanding Shares

The board of directors has fixed June 13, 2003 as the record date for determining the holders of the Company's common stock, $0.01 par value (the "Common Stock"), and the holders of the Company's Series A Preferred Stock, 71/2% Convertible Redeemable Series, $0.01 par value (the "Series A Preferred Stock"), Series A-1 Preferred Stock, Non-Redeemable Convertible Series, $0.01 par value (the "Series A-1 Preferred Stock") and Series B Preferred Stock, 15% Redeemable Convertible Series (the "Series B Preferred Stock" and collectively with the Series A Preferred Stock and the Series A-1 Preferred Stock, the "Preferred Stock") who, in each case, are entitled to receive notice of, and to vote at, the shareholder meeting. At the close of business on the record date, there were 20,195,492 shares of Common Stock, 650 shares of Series A Preferred Stock, 77,550 shares of Series A-1 Preferred Stock and 150,000 shares of Series B Preferred Stock outstanding. The 20,195,492 shares of Common Stock currently outstanding and the 34,182,800 shares of Common Stock into which the Preferred Stock can be converted as of the record date are collectively described in this Proxy Statement as the "Voting Shares."

Except as otherwise specifically set forth in this Proxy Statement, the holders of Common Stock will vote together with holders of the Preferred Stock on all matters submitted for shareholder approval at the shareholder meeting, with the Preferred Stock entitled to a number of votes equal to the number of shares of Common Stock into which the shares of Preferred Stock may be converted.

Proxies

The board of directors is soliciting the enclosed proxy for use at the annual shareholder meeting and any adjournments of that meeting. The proxy holders will not vote the proxy at any other meeting. All proxies that are properly executed, received by the Company prior to or at the shareholder meeting, and not properly revoked by the shareholder in accordance with the instructions below, will be voted at the shareholder meeting or any adjournments thereof in accordance with the instructions in the proxy.

2

The Voting Shares represented by each signed proxy will be voted in accordance with the instructions given on the proxy. If a signed proxy is received but no instructions are indicated, the proxy will be voted as follows:

- •

- FOR the three nominees to the Company's board of directors named in this Proxy Statement; and

- •

- at the discretion of the persons named in the proxy on any other business that may properly come before the shareholder meeting.

Revocation of Proxies

The person giving any proxy in response to this solicitation may revoke it at any time before the proxy is voted:

- •

- by filing with the Company's corporate secretary, at or before the taking of the vote at the shareholder meeting, a written notice of revocation bearing a later date than the date of the proxy; or

- •

- by signing and dating a subsequent proxy relating to the same Voting Shares and delivering it to the Company's corporate secretary before the shareholder meeting; or

- •

- by attending the shareholder meeting and voting in person.

However, attendance at the shareholder meeting without taking one of the foregoing measures will not constitute a revocation of a proxy.

Any written notice revoking a proxy should be sent to Williams Controls, Inc., 14100 SW 72nd Avenue, Portland, Oregon, 97224, Attention: Corporate Secretary, or hand delivered to the corporate secretary at the shareholder meeting, at or before the taking of the vote.

Quorum

The presence of the holders of a majority of Voting Shares is necessary to constitute a quorum at the shareholder meeting. In addition, for purposes of Proposal 1, the presence of the holders of a majority of the Series B Preferred Stock is necessary to constitute a quorum for the election of directors to be elected by the holders of the Series B Preferred Stock. Shareholders are counted as present at the meeting if they are present in person at the shareholder meeting or have properly submitted a proxy card. Under the General Corporation Law of the State of Delaware, an abstaining vote and a "broker non-vote" (which occur if a broker or other nominee does not have discretionary authority and has not received voting instructions from the beneficial owner with respect to a proposal) are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum of shares is present at a meeting.

Voting

Each shareholder will be entitled to one vote for each share of Common Stock, 79 votes for each share of Series A Preferred Stock, 179 votes for each share of Series A-1 Preferred Stock and 135 votes for each share of Series B Preferred Stock held of record by the shareholder on the record date on all matters submitted for shareholder approval at the shareholder meeting on which the shares are entitled to vote. For the Series A Preferred Stock, Series A-1 Preferred Stock and the Series B Preferred Stock, the number of votes per share exclude fractional votes per share. The shareholders will not be entitled to cumulate votes in the election of directors.

Abstentions and broker non-votes will not be counted as an affirmative or negative vote on any proposal.

3

Notice to Beneficial Owners of Voting Shares

Any Voting Shares held in the name of fiduciaries, custodians or brokerage houses for the benefit of their clients or otherwise held in "street name" may only be voted by the fiduciary, custodian or brokerage house itself. The beneficial owner may not directly vote or appoint a proxy to vote the shares and should instruct the person or entity in whose name the shares are held how to vote. Brokerage houses should provide beneficial owners with instructions that the beneficial owners must follow to direct the voting of their shares.

Solicitation of Proxies

We will bear the cost of preparing, printing, and mailing this Proxy Statement and of the solicitation of proxies by the board of directors. Solicitation will be made by mail and, in addition, may be made by our directors, officers, and employees personally, or by telephone or facsimile. None of those persons will be compensated for soliciting proxies. We will request brokers, custodians, nominees and other like parties to forward copies of proxy materials to the beneficial owners of the Voting Shares and will reimburse such parties for their reasonable and customary charges or expenses in this connection.

PROPOSAL 1—ELECTION OF DIRECTORS

General

The Company's Bylaws provide that the Company's board of directors will consist of seven members. Pursuant to the Company's Certificate of Incorporation, three of the directors are to be elected by the holders of shares of Common Stock and Preferred Stock voting together as a single class and four are to be elected solely by the holders of shares of Series B Preferred Stock voting as a separate class.

The directors are divided into three classes with staggered three-year terms, with each class consisting, as nearly as possible, of one-third of the total number of directors. The directors whose terms of office expire at this shareholders' meeting consist of three Class II Directors. One of the directors is to be elected by the holders of Common Stock and Preferred Stock voting together as a single class and the other two directors are to be elected by the holders of Series B Preferred Stock voting as a separate class.

Nominees for Directors to be elected by holders of Common Stock and Preferred Stock

The holders of the Common Stock and the Preferred Stock, voting as a single class, will elect one director. Unless the shareholders otherwise specify, the shares represented by the proxies received for the election of this director will be voted to elect Donn J. Viola as a Class II Director with a term expiring in 2006. The term of office of the person elected by the Common Stock and Preferred Stock will continue until their term expires or until their successor has been elected and qualified or until their earlier death, resignation or removal.

Nominees for Directors to be elected by holders of Series B Preferred Stock

At the shareholder meeting, the holders of Series B Preferred Stock, voting as a separate class, will elect two directors of the Company. Unless the holders of Series B Preferred Stock otherwise specify, the shares represented by the proxies received for the election of these two (2) directors will be voted in favor of the election of W. Richard Bingham and R. Eugene Goodson as Class II Directors with a term expiring in 2006. The terms of office of the persons elected by the Series B Preferred Stock will continue until their terms expire or until their successor has been elected and qualified or until their earlier death, resignation or removal.

4

Information Regarding Nominees and Other Directors

The following sets forth certain information about the nominees and other current directors based on information these individuals supplied to the Company, including their names, ages, principal occupations for the past five years, and their directorships with other corporations.

Each of the nominees has agreed to serve as a director if elected. If any director is unable to stand for election, the Voting Shares represented by all proxies in favor of the above slate will be voted for the election of the substitute nominee recommended by the board of directors. We are not aware that any director is or will be unable to stand for election.

Shares represented at the shareholder meeting by executed but unmarked proxies will be voted "FOR" the named nominees.

Nominees for Class II Directors for a Term Expiring in 2006

Name

| | Age

| | Occupation and Employment History

|

|---|

| W. Richard Bingham | | 67 | | Mr. Bingham has been a director since July 1, 2002, and is a member of the Executive Committee. Since 1989, Mr. Bingham has been a director and President of American Industrial Partners, which he co-founded in 1989. He is also a director of Great Lakes Carbon Corp., Bucyrus International, Inc., and Stanadyne Automotive Corp. |

R. Eugene Goodson |

|

67 |

|

Mr. Goodson has been our Chairman of the Board since July 1, 2002. He has also been our President and Chief Executive Officer since August 7, 2002. Mr. Goodson is the Chairman of the Executive Committee of the Board of Directors. Mr. Goodson has been an Adjunct Professor at the University of Michigan's School of Business since September 1998. From October 1997 to September 1998, he was a consultant with Oshkosh Truck Corporation, a manufacturer of specialized trucks and transport equipment. From 1990 until his retirement in October 1997, he was Chairman of the board of directors and Chief Executive Officer of Oshkosh Truck Corporation. |

Donn J. Viola |

|

58 |

|

Mr. Viola has been a director since December, 2002 when he was appointed to fill a vacancy in the Board created by the resignation on Mr. Timothy Itin. Mr. Viola served as Chief Operating Officer of Donnley Corporation, an automotive parts supplier, from 1996 until his retirement in 2002. Prior to that, from 1990 to 1996, Mr. Viola held positions as Senior Executive Vice President and Chief Operating officer with Mack Trucks, a heavy truck manufacturer. |

5

Class III Directors with a Term Expiring in 2005

Name

| | Age

| | Occupation and Employment History

|

|---|

| Nathan L. Belden | | 32 | | Mr. Belden has been a director since July 16, 2002 and is a member of the Audit Committee. Mr. Belden joined the San Francisco office of American Industrial Partners in 1995 and serves as a partner and Managing Director and Chief Financial Officer of that firm. Mr. Belden previously worked in the Mergers and Acquisitions Department of Kidder, Peabody & Co., Inc. in New York. Mr. Belden graduated from the University of Colorado, Boulder. |

Douglas E. Hailey |

|

41 |

|

Mr. Hailey has served as a director since March 2001 and is a member of the Executive and Compensation Committees. Since 1994, Mr. Hailey has been Vice President of the Investment Banking Division of Taglich Brothers, Inc., a New York-based full service brokerage firm that specializes in private equity placements for small public companies. Prior to joining Taglich Brothers, Mr. Hailey spent five years with Weatherly Financial Group, a small private equity firm that specialized in sponsoring leveraged buyouts. Mr. Hailey received a Bachelors degree in Business Administration from Eastern New Mexico University and an MBA in Finance from the University of Texas. |

Class I Directors with a Term Expiring in 2004

Name

| | Age

| | Occupation and Employment History

|

|---|

| Kirk R. Ferguson | | 35 | | Mr. Ferguson has been a director since July 1, 2002, a member of the Executive Committee and is the chairman of the Compensation Committee and a member of the Audit Committee. Mr. Ferguson joined the New York office of American Industrial Partners in 2001 and serves as a partner and Managing Director of that firm. Mr. Ferguson was previously a principal at Saratoga Partners, a private equity investment firm where he was employed from 1997 to 2001. Mr. Ferguson earned his AB from Stanford University and his MBA from Harvard Business School. Mr. Ferguson is also a director of Stanadyne Automotive Corp. |

| | | | | |

6

H. Samuel Greenawalt |

|

74 |

|

Mr. Greenawalt served as a director and a member of the Audit Committee from March 1994 to July 1, 2002 when he resigned in conjunction with the recapitalization transaction. Mr. Greenawalt was re-elected as a director at the Company's Annual Meeting on September 19, 2002. Mr. Greenawalt is chairman of the Audit Committee. From 1987 until his retirement in June 1994, Mr. Greenawalt served as Senior Vice President, Business Development, for Michigan National Bank in Detroit, Michigan. Since June 1993, Mr. Greenawalt has served as a director of Enercorp, Inc., a publicly traded business development company that formerly owned approximately ten percent of our common stock. Mr. Greenawalt received a Bachelor of Science degree from the Wharton School at the University of Pennsylvania, and is a graduate of the University of Wisconsin Banking School. |

There are no family relationships among the directors of the Company.

Meetings of the Board; Committees

Our board of directors has designated an Executive Committee, an Audit Committee, a Nominating Committee and a Compensation Committee. The Company had during fiscal 2002 a Special Review Committee to evaluate and manage collection of amounts owed to it by Ajay Sports, Inc. and guaranteed by Mr. Thomas Itin, a former Chief Executive Officer and Chairman of the Board. A settlement was reached in fiscal 2002 with Ajay and Mr. Itin and that committee was dissolved in fiscal 2002.

Executive Committee. When the board of directors is not in session, the Executive Committee may exercise all the powers and authority of the board except as limited by law and the Certificate of Incorporation. The Executive Committee was created in June 2002 and did not meet during fiscal 2002. The current members of the Executive Committee are Messrs. Bingham, Ferguson, Goodson and Hailey.

Audit Committee. The Audit Committee assists the Board of directors in its general oversight of the company's financial reporting, monitors the preparation of quarterly, annual and other financial reports; is responsible for other maters concerning the relationship between the Company and its independent accountants; and oversees management's implementation of effective systems of internal controls. The Audit Committee operates under a charter from the Board of Directors, which can be found as attached Appendix A. The Audit Committee held five meetings during our 2002 fiscal year. The members of the Audit Committee are Messrs. Belden, Ferguson and Greenawalt. Only Mr. Greenawalt is an independent directors under the meaning set forth in Rule 4200(a)(14) of the NASD's listing standards.

Compensation Committee. The Compensation Committee primarily reviews and sets compensation to be paid to our executive officers and directors and makes recommendations to the board regarding awards under the Company's stock option plans. The Compensation Committee was inactive during fiscal 2002. The members of the Compensation Committee are Messrs. Hailey and Ferguson.

Nominating Committee. The Nominating Committee is responsible for determining the persons to be nominated for election to the board of directors. The Nominating Committee did not meet during fiscal 2002, but rather nominations were considered by the Board as a whole. The Nominating Committee consists of Messrs. Belden, Ferguson and Hailey. The Nominating Committee will consider

7

nominees recommended by our shareholders, but has not established specific procedures for submission.

Meeting Attendance

The board of directors met eight times during fiscal 2002. Each incumbent director attended more than 75% of the meetings of the board of directors and each committee on which he served and which met during fiscal 2002.

Required Vote

A plurality of the votes of the shares of Common Stock and Preferred Stock, voting together as a single class, present in person or represented by proxy, is required to elect Mr. Viola. For the election of Messrs. Bingham and Goodson, a plurality of the votes of the holders of Series B Preferred Stock, voting separately as a single class, is required to elect each nominee.

RECOMMENDATION OF THE BOARD:

THE BOARD OF DIRECTORS RECOMMENDS THE NOMINEES LISTED ABOVE FOR ELECTION AND URGES THE HOLDERS OF THE VOTING SHARES TO VOTE "FOR" MR. VIOLA AND THE HOLDERS OF THE SERIES B PREFERRED STOCK TO VOTE "FOR" MESSRS. BINGHAM AND GOODSON.

8

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Recapitalization Transaction

Messrs. Belden, Bingham, Ferguson and Goodson were appointed to the Company's board in connection with a restructuring of the Company (the "Recapitalization Transaction") which was consummated on July 1, 2002 (Mr. Belden was appointed effective July 16, 2002 by agreement of the parties to the Recapitalization Transaction.) In the Recapitalization Transaction, the Company sold a total of 150,000 shares of Series B Preferred Stock, having an aggregate purchase price of $15,000,000, or $100 per share, to American Industrial Partners Capital Fund III, L.P., a Delaware limited partnership ("AIP"), and Dolphin Offshore Partners L.P. ("Dolphin") purchasers. AIP purchased a total of 130,000 shares of the Series B Preferred Stock. AIP has informed the Company that it paid the purchase price from equity capital contributed by its partners. Dolphin purchased a total of 20,000 shares of the Series B Preferred Stock for a total purchase price of $2,000,000. Dolphin paid for the shares by tendering $2,000,000 in principal outstanding under a 12% Secured Subordinated Debenture, due March 1, 2002, issued by the Company to Dolphin. The net proceeds of the Recapitalization Transaction, after deducting AIP's and Dolphin's costs and expenses, were used to satisfy the Company's obligations under its outstanding 12% Secured Subordinated Debentures, due March 1, 2002. The Company used the balance of the net proceeds for working capital purposes.

Immediately prior to the closing of the Recapitalization Transaction, the board of directors increased the board composition to seven directors. At the closing of the Recapitalization Transaction, directors H. Samuel Greenawalt, David Eberly and Gary Arnold resigned, and W. Richard Bingham, R. Eugene Goodson and Kirk R. Ferguson were appointed to fill three of the vacancies on the board of directors. Nathan L. Belden was appointed to fill the remaining vacancy effective July 16, 2002, also in connection with the Recapitalization Transaction. Following the Recapitalization Transaction, as provided in our certificate of incorporation and the related Certificate to Provide for the Designation, Preferences, Rights, Qualifications, Limitations or Restrictions Thereof, of the Series B Preferred Stock filed on July 1, 2002 with the Delaware Secretary of State, the holders of Series B Preferred Stock, voting as a separate class, are entitled to elect a majority of our board of directors.

Also in connection with the Recapitalization Transaction, we entered into a Shareholders Agreement with AIP, Dolphin and Eubel, Brady & Suttman Asset Management, Inc. ("Brady"), an entity that has voting control over approximately 19% of the Series A-1 Preferred Stock. The Shareholders Agreement provides, among other things, that (a) until July 1, 2003, Dolphin and Brady will vote along with AIP on all matters related to the election of directors as to all of the shares of Series B Preferred Stock and any of the Series A-1 Preferred Stock over which Dolphin or Brady has voting control, (b) until July 1, 2004, Dolphin and Brady will vote along with AIP on all matters related to the election of directors as to all of the shares of Series B Preferred Stock over which Dolphin or Brady has voting control, and (c) until the date on which AIP no longer owns a majority of the Series B Preferred Stock, Dolphin and Brady will vote along with AIP on all other matters as to all of the Series B Preferred Stock over which over which Dolphin or Brady has voting control. To give effect to these voting provisions, Dolphin and Brady have granted AIP a power of attorney to vote in accordance with the Shareholders Agreement the shares over which Dolphin and Brady have voting control. The Shareholders Agreement thus effectively gives AIP voting control over all of the Series B Preferred Stock, which as of the record date represents approximately 35.3% of the Company's outstanding voting securities on an as-converted basis. Thus, the Shareholders Agreement, together with AIP's holdings of Series B Preferred Stock, gives AIP the right to elect a majority of the members of the board of directors.

9

Management Services Agreement

The Company has a Management Services Agreement with American Industrial Partners ("Advisor"), an affiliate of AIP. Under the terms of the Management Services Agreement, Advisor has agreed that it will provide advisory and management services to the Company and its subsidiaries as the Company may request and as Advisor agrees to provide from time to time. Advisor has the right, but not the obligation, to elect to act as sole advisor to the Company and its subsidiaries with respect to significant business transactions. The Company has agreed to pay to Advisor: (a) an advisory fee of $850,000 which was paid on July 1, 2002 in connection with the closing of the recapitalization; (b) an annual management fee, equal to $400,000 plus 3% of any debt outstanding (including accrued interest thereon) of the Company or its subsidiaries as of the first day of the applicable quarterly payment period which is owned or guaranteed by AIP or any of its affiliate, and (c) advisory and/or structuring fees in connection with significant business transactions of the Company (including, without limitation, acquisitions, investments and financings) in amounts comparable for similarly situated companies. The Annual Fee will be reduced by 50% beginning the first day of any quarterly period following the conversion of all shares of the AIP's Series B Preferred into the Company's common stock.

The Advisor may terminate the Management Services Agreement at any time by written notice to the Company, and the agreement will terminate automatically as of the earlier of July 1, 2009 or the end of the fiscal year in which AIP and its affiliates own, directly or indirectly, less than 5,000,000 shares of Common Stock on a fully diluted basis.

Taglich Financial Advisory Fees

The Company engaged Taglich Brothers, Inc. ("Taglich") pursuant to a retainer agreement dated August 14, 2001 as placement agent with respect to various financings, including private equity financings. The Company paid Taglich, a fee of $400,000 for assisting us in the recapitalization effort, specifically completing the Series B investment transaction with AIP and $200,000 for (a) obtaining commitments from persons to purchase additional shares of Series B Preferred Stock from investors other than AIP and its affiliates; (b) obtaining tenders from the holders of at least 90% of the Series A Preferred Stock in the Exchange Offer; and (c) obtaining commitments from at least 90% of the holders of our 7.5% Convertible Subordinated Debentures to extend the maturity date of such debentures to 24 months from the closing of the purchase of the Series B Preferred Stock under the Stock Purchase Agreement. Douglas E. Hailey, who is a director of the Company, is affiliated with Taglich. The $400,000 fee was paid as $280,000 in cash and 181,818 shares of the Company's common stock. The $200,000 fee was paid in cash.

Ziegler Lawsuit

On May 12, 2003, Mr. Ziegler, our former president and chief executive officer, filed suit against the Company, American Industrial Partners, L.P.; American Industrial Partners Fund III, L.P., and American Industrial Partners Fund III Corporation in the Circuit Court of the 15th Judicial Circuit in and for Palm Beach County, Florida. In the suit, Mr. Ziegler alleges that the Company breached an oral agreement with Mr. Ziegler to pay him additional compensation, including a bonus of "at least" $500,000, for certain tasks performed by Mr. Ziegler while he was the Company's president and chief executive officer and seeks additional compensation to which he claims he is entitled. The company disputes the existence of an agreement and any liability to Ziegler.

Investments in and Receivables From Ajay Sports, Inc.

Previously, the Company had notes and accounts receivable from Ajay Sports, Inc. ("Ajay") with a carrying value of $3,565,000. The Company's former chief executive officer and former Chairman of the

10

Board, Thomas W. Itin, is an officer and shareholder of Ajay. The investment in and certain loans of the Company to Ajay were guaranteed by Thomas W. Itin.

The Company evaluated the realization of its investment in and receivables from Ajay and based on the Company's collection efforts determined the investment in and receivables from Ajay were impaired and accordingly an impairment loss for the entire carrying value of $3,565,000 was recorded in the second quarter of fiscal 2002. Additionally, the Company evaluated the collectability of the guarantees of Mr. Itin, including the cost of collections and concluded that these guarantees were worthless.

In November 2002, the Company settled all claims related to Ajay and Mr. Itin, including previously filed suits in the Circuit Court for Oakland County, Michigan and the Multnomah Circuit Court for the State of Oregon. As part of the settlement, the Company retained a $2,500,000 interest in the notes receivable owed to the Company by Ajay; however, no amounts have been recorded on the financial statements for these interests. Additionally, as part of the settlement, although the Company believed the guarantees of Mr. Itin were enforceable, based on the Company's evaluation of the ultimate collectability of the guarantees, including the cost of collections, Mr. Itin was relieved of his guaranty obligation.

Employment Contracts

On January 10, 2003, the Company entered into employment agreements with Messrs. Bunday, Dunlap and Velat. Each contract is for a term of four years beginning on October 1, 2002 and specifies an initial base salary of $150,000 per year, plus bonus based on parameters established by the board of directors. The agreements also provide for a one-year severance payment under certain circumstances in the event the Company terminates the agreements prior to the end of the contract period.

11

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our Common Stock and each series of our Preferred Stock as of June 13, 2003 by (i) each shareholder who is known by the Company to own beneficially more than 5 percent of the outstanding shares of each class of our voting stock, (ii) each of our directors, (iii) our President and Chief Executive Officer and each of our other named executive officers, and (iv) all of our directors and executive officers as a group.

| | Common Stock

| |

| | Preferred Stock

| |

|

|---|

Name & Address of

Beneficial Owner

| | Amount

Beneficially

Owned

| | Percentage

of Class

Owned*

| | Preferred

Series

| | Amount

Beneficially

Owned

| | Percentage

of Class

Owned**

| | Percentage of

Total Voting

Stock***

|

|---|

R. Eugene Goodson(1)

14100 Southwest 72nd Ave.

Portland, OR 97224 | | 31,432 | | **** | | A

A-1

B | | 208

- -0-

- -0- | | 32.0

- -0-

- -0- | | **** |

W. Richard Bingham(2)

c/o American Industrial Partners

One Maritime Plaza, Suite 2525

San Francisco, CA 94111 |

|

20,359,618 |

|

50.3 |

|

A

A-1

B |

|

- -0-

- -0-

150,000 |

|

- -0-

- -0-

100 |

|

33.9 |

Nathan L. Belden(3)

c/o American Industrial Partners

One Maritime Plaza, Suite 2525

San Francisco, CA 94111 |

|

- -0- |

|

- -0- |

|

A

A-1

B |

|

- -0-

- -0-

- -0- |

|

- -0-

- -0-

- -0- |

|

- -0- |

Kirk R. Ferguson(4)

c/o American Industrial Partners

One Maritime Plaza, Suite 2525

San Francisco, CA 94111 |

|

- -0- |

|

- -0- |

|

A

A-1

B |

|

- -0-

- -0-

- -0- |

|

- -0-

- -0-

- -0- |

|

- -0- |

H. Samuel Greenawalt(5)

14100 Southwest 72nd Ave.

Portland, OR 97224 |

|

235,152 |

|

1.2 |

|

A

A-1

B |

|

- -0-

- -0-

- -0- |

|

- -0-

- -0-

- -0- |

|

**** |

Douglas E. Hailey(6)

1171 Maggies Way

Waterbury Center, VT 05677 |

|

313,146 |

|

1.5 |

|

A

A-1

B |

|

- -0-

250

- -0- |

|

- -0-

****

- -0- |

|

**** |

Donn J. Viola

14100 Southwest 72nd Ave.

Portland, OR 97224 |

|

- -0- |

|

- -0- |

|

A

A-1

B |

|

- -0-

- -0-

- -0- |

|

- -0-

- -0-

- -0- |

|

- -0- |

Dennis E. Bunday(7)

14100 Southwest 72nd Ave.

Portland, OR 97224 |

|

1,037,372 |

|

5.2 |

|

A

A-1

B |

|

42

- -0-

- -0- |

|

6.5

- -0-

- -0- |

|

1.7 |

Thomas F. Dunlap(8)

14100 Southwest 72nd Ave.

Portland, OR 97224 |

|

1,110,596 |

|

5.5 |

|

A

A-1

B |

|

208

- -0-

- -0- |

|

32.0

- -0-

- -0- |

|

1.8 |

Ronald J. Velat(9)

14100 Southwest 72nd Ave.

Portland, OR 97224 |

|

90,845 |

|

**** |

|

A

A-1

B |

|

42

- -0-

- -0- |

|

6.5

- -0-

- -0- |

|

**** |

Eubel Suttman & Brady Asset Management Inc.(10)

7777 Washington Village Drive

Suite 210

Dayton, OH 45459 |

|

1,861,923 |

|

8.7 |

|

A

A-1

B |

|

- -0-

11,000

- -0- |

|

- -0-

14.2

- -0- |

|

6.4 |

| | | | | | | | | | | | | |

12

Mark E. Brady(10)(11)

Eubel Suttman & Brady Asset Management Inc.

7777 Washington Village Drive

Suite 210

Dayton, OH 45459 |

|

2,013,409 |

|

9.3 |

|

A

A-1

B |

|

- -0-

14,000

- -0- |

|

- -0-

18.0

- -0- |

|

7.5 |

Robert J. Suttman, II(10)(12)

Eubel Suttman & Brady Asset Management Inc.

7777 Washington Village Drive

Suite 210

Dayton, OH 45459 |

|

2,020,739 |

|

9.4 |

|

A

A-1

B |

|

- -0-

14,000

- -0- |

|

- -0-

18.0

- -0- |

|

7.5 |

Ronald L. Eubel(10)(13)

Eubel Suttman & Brady Asset Management Inc.

7777 Washington Village Drive

Suite 210

Dayton, OH 45459 |

|

1,976,247 |

|

9.2 |

|

A

A-1

B |

|

- -0-

14,000

- -0- |

|

- -0-

18.0

- -0- |

|

7.5 |

Bernard J. Holtgreive(10)

Eubel Suttman & Brady Asset Management Inc.

7777 Washington Village Drive

Suite 210

Dayton, OH 45459 |

|

1,861,923 |

|

8.7 |

|

A

A-1

B |

|

- -0-

11,000

- -0- |

|

- -0-

14.2

- -0- |

|

6.4 |

William E. Hazel(10)

Eubel Suttman & Brady Asset Management Inc.

7777 Washington Village Drive

Suite 210

Dayton, OH 45459 |

|

1,861,923 |

|

8.7 |

|

A

A-1

B |

|

- -0-

11,000

- -0- |

|

- -0-

14.2

- -0- |

|

6.4 |

American Industrial Partners Capital Fund III, L.P.(14)

c/o American Industrial Partners

One Maritime Plaza, Suite 2525

San Francisco, CA 94111 |

|

20,359,618 |

|

50.3 |

|

A

A-1

B |

|

- -0-

- -0-

150,000 |

|

- -0-

- -0-

100 |

|

33.9 |

Comerica Bank(15)

500 Woodward Avenue

33rd Floor, One Detroit Center

Detroit, MI 48226 |

|

3,592,000 |

|

17.8 |

|

A

A-1

B |

|

- -0-

- -0-

- -0- |

|

- -0-

- -0-

- -0- |

|

6.0 |

Thomas W. Itin(16)

7001 Orchard Lake Rd., Suite 424

West Bloomfield, MI 48322-3608 |

|

3,898,719 |

|

19.4 |

|

A

A-1

B |

|

- -0-

- -0-

- -0- |

|

- -0-

- -0-

- -0- |

|

6.5 |

Dolphin Offshore Partners, L.P.(17)

c/o Dolphin Management Inc.

129 East 17th Street

New York, NY 10007 |

|

5,571,825 |

|

22.4 |

|

A

A-1

B |

|

- -0-

12,750

20,000 |

|

- -0-

16.4

13.3 |

|

13.1 |

E.H. Arnold

c/o Taglich Brothers

1370 Avenue of the Americas,

31st Floor

New York, NY 10019-4602 |

|

- -0- |

|

- -0- |

|

A

A-1

B |

|

- -0-

5,000

- -0- |

|

- -0-

6.4

- -0- |

|

1.5 |

All executive officers and directors as a group (10 persons) |

|

22,154,134 |

|

54.1 |

|

A

A-1

B |

|

500

250

150,000 |

|

76.9

****

100 |

|

36.9 |

- *

- The percentages of beneficial ownership of the Common Stock assumes the exercise or conversion of all shares of Series A and Series B Preferred Stock beneficially owned by such person or entity and all options, warrants and other securities

13

convertible into Common Stock beneficially owned by such person or entity currently exercisable on or before August 12, 2003. These percentages do not include the shares issuable upon conversion of the Series A-1 Preferred Stock, as the shares of Series A-1 Preferred Stock are not convertible into Common Stock on or before August 12, 2003.

- **

- The percentages of beneficial ownership of each class of Preferred Stock is based upon 650 shares of Series A Preferred Stock, 77,550 shares of Series A-1 Preferred Stock and 150,000 shares of Series B Preferred Stock outstanding as of June 13, 2003, respectively.

- ***

- Subject to special voting rights in the election of directors, the holders of Preferred Stock are generally entitled to vote along with the holders of Common Stock in all matters in which holders of Common Stock are entitled to vote. In any such vote, the holders of Preferred Stock are entitled to a number of votes equal to the number of shares of Common Stock issuable upon conversion of their shares of Preferred Stock. Accordingly, the percentage of total voting stock beneficially owned is based upon: (i) 20,125,492 shares of Common Stock outstanding; (ii) 20,359,618 shares of Common Stock issuable upon conversion of the 150,000 shares of Series B Preferred Stock outstanding; (iii) 13,890,732 shares of Common Stock issuable upon conversion of the 77,550 shares of Series A-1 Preferred Stock outstanding; (iv) 51,781 shares of Common Stock issuable upon conversion of the 650 shares of Series A Preferred Stock outstanding; (v) 637,500 shares of Common Stock issuable upon exercise of outstanding stock options exercisable on or before August 12, 2003, and (vi) 5,079,772 shares of Common Stock issuable upon exercise of outstanding warrants exercisable on or before August 12, 2003.

- ****

- Less than one percent.

- (1)

- Information is based on the Form 4 filed with the Securities and Exchange Commission ("SEC") by Mr. Goodson on March 18, 2003. Includes (i) 15,000 shares of Common Stock; and (ii) 16,432 shares issuable upon conversion of the Series A Preferred Stock.

- (2)

- Information is based on the Form 3 filed with the SEC by Mr. Bingham on July 2, 2002, and the Schedule 13D filed with the SEC by Mr. Bingham on July 5, 2002. Common stock includes 20,359,618 shares of Common Stock issuable upon conversion of the Series B Preferred Stock. Series B Preferred Stock includes: (i) 130,000 shares held by American Industrial Partners Capital Fund III, L.P. ("AIP") over which Mr. Bingham has shared voting and dispositive power; and (ii) 20,000 shares held by Dolphin Offshore Partners, L.P. ("Dolphin") over which Mr. Bingham has shared voting power. American Industrial Partners III, L.P. ("AIP III") is the general partner of AIP. American Industrial Partners III Corporation ("AIP Corporation") is the general partner of AIP III, and Mr. Bingham is, or may be considered to be, a controlling stockholder of AIP Corporation. AIP holds the power to vote the shares held by Dolphin pursuant to a shareholders agreement. Mr. Bingham disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein.

- (3)

- Information is based on the Form 3 filed with the SEC by Mr. Belden on July 17, 2002, and the Schedule 13D filed with the SEC by AIP on July 5, 2002.

- (4)

- Information is based on the Form 3 filed with the SEC by Mr. Ferguson on July 2, 2002, and the Schedule 13D filed with the SEC by AIP on July 5, 2002.

- (5)

- Includes (i) 155,152 shares of Common Stock and (ii) 80,000 shares issuable upon exercise of stock options exercisable on or before August 12, 2003.

- (6)

- Information is partially based on the Form 4 filed with the SEC by Mr. Hailey in December, 2002. Common stock includes: (i) 123,193 shares of Common Stock; (ii) 84,643 shares issuable upon exercise of warrants relating to the Company's secured subordinated debt; (iii) 95,310 shares issuable upon the exercise of warrants issued in connection with the Company's July 1999 Common Stock offering; and (iv) 10,000 shares issuable upon exercise of stock options exercisable on or before August 12, 2003.

- (7)

- Information is partially based on the Form 4 filed with the SEC by Mr. Bunday on March 18, 2003. Includes (i) 10,000 shares of Common Stock; (ii) 1,024,027 shares owned by Williams Controls, Inc. employee benefit plans of which Mr. Bunday is a trustee and over which Mr. Bunday has shared voting and dispositive power; and (iii) 3,345 shares issuable upon conversion of the Series A Preferred Stock. Mr. Bunday disclaims beneficial ownership of shares held in the Company's employee benefit plans, except to the extent of his individual pecuniary interest therein.

- (8)

- Information is based on the Form 4 filed with the SEC by Mr. Dunlap on March 19, 2003. Includes (i) 20,000 shares of Common Stock; (ii) 1,024,027 shares owned by Williams Controls, Inc. employee benefit plans of which Mr. Dunlap is a trustee and over which Mr. Dunlap has shared voting and dispositive power; (iii) 50,000 shares issuable upon exercise of stock options exercisable on or before August 12, 2003; and (iv) 16,569 shares issuable upon conversion of the Series A Preferred Stock. Mr. Dunlap disclaims beneficial ownership of shares held in the Company's employee benefit plans, except to the extent of his individual pecuniary interest therein.

14

- (9)

- Information is based on the Form 4 filed with the SEC by Mr. Velat on March 18, 2003. Includes (i) 87,500 shares issuable upon exercise of stock options exercisable on or before August 12, 2003; and (ii) 3,345 shares issuable upon conversion of the Series A Preferred Stock.

- (10)

- Information is based on Form 4s filed with the SEC by Eubel Suttman & Brady Asset Management Inc. ("Eubel Suttman") on April 23, 2003. Common stock includes: (i) 565,102 shares of Common Stock; (ii) 89,051 shares issuable upon the exercise of warrants issued in connection with the Company's July 1999 Common Stock offering; and (iii) 1,207,770 shares issuable upon the exercise of warrants issued in connection with the Company's secured subordinated debt. According to its Form 4, Eubel Suttman is an investment manager and disclaims beneficial ownership of these securities except to the extent of its pecuniary interest therein. According to their Form 4s, Messrs. Brady, Suttman, Eubel, Holtgreive and Hazel are general partners or principals of Eubel Suttman and disclaim beneficial ownership of these securities except to the extent of their individual pecuniary interest therein.

- (11)

- Information is based on the Form 4 filed with the SEC by Mr. Brady on April 22, 2003. Common stock includes: (i) 40,000 shares of Common Stock; and (ii) 111,486 shares issuable upon the exercise of warrants issued in connection with the Company's secured subordinated debt. According to his Form 4, Mr. Brady is a general partner or principal of Eubel Suttman and disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein.

- (12)

- Information is based on the Form 4 filed with the SEC by Mr. Suttman on April 22, 2003. Common stock includes: (i) 47,330 shares of Common Stock; and (ii) 111,486 shares issuable upon the exercise of warrants issued in connection with the Company's secured subordinated debt. According to his Form 4, Mr. Suttman is a general partner or principal of Eubel Suttman and disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein.

- (13)

- Information is based on the Form 4 filed with the SEC by Mr. Eubel on October 10, 2002. Common stock includes: (i) 40,000 shares of Common Stock; and (ii) 74,324 shares issuable upon the exercise of warrants issued in connection with the Company's secured subordinated debt. According to his Form 4, Mr. Eubel is a general partner or principal of Eubel Suttman and disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein.

- (14)

- Common stock includes 20,359,618 shares of Common Stock issuable upon conversion of the Series B Preferred Stock. Series B Preferred Stock includes: (i) 130,000 shares held by AIP; and (ii) 20,000 shares held by Dolphin. AIP holds the power to vote the shares held by Dolphin pursuant to a shareholders agreement. AIP disclaims beneficial ownership in the shares held by Dolphin.

- (15)

- Information is based on the Schedule 13G filed with the SEC by Comerica Bank ("Comerica") and its parent, Comerica Incorporated, on August 12, 2002. According to information provided by the Company, Comerica has assigned the power to vote these shares to Thomas W. Itin, but Comerica retains sole dispositive power.

- (16)

- Information is based on the Schedule 13G, filed by Mr. Itin with the SEC on February 14, 2003 and additional information provided by Mr. Itin to the Company. Includes: (i) 150,000 shares of Common Stock held by Acrodyne Corporation; (ii) 156,719 shares owned by Ajay Sports, Inc.; and (iii) 3,592,000 shares held by Comerica. According to information provided by the Company, Comerica has assigned the power to vote the shares held by Comerica to Mr. Itin, but Comerica retains sole dispositive power.

- (17)

- Information is based on the Schedule 13D/A dated February 23, 2001 filed with the SEC by this entity. Common stock ownership includes: (i) 792,273 shares of Common Stock; (ii) 2,714,615 shares issuable upon conversion of the Series B Preferred Stock; (iii) 1,481,690 shares issuable upon the exercise of warrants issued in connection with the Company's secured subordinated debt; and (iv) 583,247 shares issuable upon the exercise of warrants issued in connection with the Company's July 1999 Common Stock offering. AIP holds the power to vote the shares of Series B Preferred Stock held by Dolphin pursuant to a shareholders agreement.

15

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission ("SEC"). Officers, directors and greater than ten-percent shareholders are required by the SEC regulation to furnish the Company with copies of Section 16(a) forms they file. Based solely on review of the copies of such forms furnished to the Company, or written representations of the reporting persons, the Company believes that all required reports were timely filed during the year.

16

EXECUTIVE OFFICERS

The following table identifies the current executive officers of the Company, the positions in which they serve, and the year in which they began serving in their respective capacities. Officers of the Company are elected by the board at the meeting of the board of directors immediately following the annual meeting of the stockholders to hold office until their successors are elected and qualified.

Name

| | Age

| | Current Position

| | Position Held Since

|

|---|

| R. Eugene Goodson | | 67 | | Chairman of the Board, President and Chief Executive Officer | | 2002 |

Dennis E. Bunday |

|

52 |

|

Chief Financial Officer

Executive Vice President,

Secretary |

|

2001

2002 |

Thomas F. Dunlap |

|

54 |

|

Executive Vice President |

|

2002 |

Ronald J. Velat |

|

51 |

|

Executive Vice President |

|

2002 |

R. Eugene Goodson has been our Chairman of the Board since the consummation of the Recapitalization Transaction on July 1, 2002. He has also been our President and Chief Executive Officer since August 7, 2002. Mr. Goodson has been an Adjunct Professor at the University of Michigan's School of Business since September 1998. From October 1997 to September 1998, he was a consultant with Oshkosh Truck Corporation, a manufacturer of specialized trucks and transport equipment. From 1990 until his retirement in October 1997, he was Chairman of the board of directors and Chief Executive Officer of Oshkosh Truck Corporation.

Dennis E. Bunday has been Chief Financial Officer of the Company since January 2001. Until June 2002, he was Chief Financial Officer under an independent employment agreement. In conjunction with the Recapitalization Transaction, Mr. Bunday became employed by the Company as Executive Vice President, Chief Financial Officer and Secretary in July 2002. Prior to joining the Company, he served as Vice President—Financial and Chief Financial Officer from 1998 to 2001, for Babler Bros., Inc., a $40 million manufacturer of pre-cast concrete products. From 1996 until 1998, he held the same positions with Quality Veneer & Lumber, Inc., and its predecessor, the Morgan Company, a $75 million producer of forest products. Prior to 1996, he was Financial Controller and Treasurer of Pope & Talbot, Inc., a New York Stock Exchange company. Mr. Bunday received a Bachelors degree in Accounting from Washington State University.

Thomas F. Dunlap was appointed Executive Vice President in July 2002 in conjunction with the Recapitalization Transaction. Mr. Dunlap has been the General Manager of the Company's Portland, Oregon facility since 1999. Prior to joining the Company, Mr. Dunlap was Vice President and General Manager of the OEM business unit of Warn Industries, a powertrain component supplier to the auto industry. Mr. Dunlap was employed by Warn Industries for thirteen years. Mr. Dunlap has a Bachelor of Science degree in Aerospace Engineering from Iowa State University and a Masters in Business from the University of Michigan.

Ronald J. Velat was appointed Executive Vice President in July 2002 in conjunction with the Recapitalization Transaction. Mr. Velat has been the General Manager of the Company's Florida facility since 1998. From 1991 until joining the Company in 1998, Mr. Velat was general manager of the Sarasota Division of Hi-Stat Manufacturing. Mr. Velat has a Bachelor of Science degree from Michigan Technological University and a Masters in Business Administration from the University of Detroit.

There are no family relationships among the executive officers of the Company.

17

EXECUTIVE COMPENSATION

The table below sets forth the compensation received by the Chief Executive Officer of the Company and other named executive officers of the Company, for the past three fiscal years, who received compensation in excess of $100,000 during the fiscal year ended September 30, 2002. The Company has no restricted stock award or long-term incentive plans.

Executive Compensation

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation($)

| | Securities

Underlying

Options (#)

| | All Other

Compensation($)

| |

|---|

R. Eugene Goodson

Chairman of the Board, President and

Chief Executive Officer | | 2002

2001

2000 | | 30,000

—

— | (1)

| 25,000

—

— | | —

—

— | | —

—

— | | —

—

— | |

Thomas K. Ziegler

Former President, Chief Executive

Officer and Chief Operating Officer |

|

2002

2001

2000 |

|

187,833

128,340

127,000 |

(2)

|

66,917

—

— |

(3)

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

Dennis E. Bunday

Executive Vice President and

Chief Financial Officer |

|

2002

2001

2000 |

|

37,500

—

— |

(4)

|

25,000

—

— |

|

178,715

193,500

— |

(4)

(4)

|

—

—

— |

|

—

—

— |

|

Thomas F. Dunlap

Executive Vice President |

|

2002

2001

2000 |

|

123,750

115,000

115,000 |

(5)

|

100,000

29,000

46,000 |

(6)

|

—

—

— |

|

—

—

— |

|

1,200

2,250

2,200 |

(7)

(7)

(7) |

Ronald J. Velat

Executive Vice President |

|

2002

2001

2000 |

|

133,500

128,705

128,000 |

(8)

|

75,000

—

— |

(9)

|

—

—

— |

|

—

—

— |

|

10,000

6,000

6,000 |

(10)

(11)

(11) |

- (1)

- Mr. Goodson was appointed as Chairman of the Board on July 1, 2002 and on August 7, 2002 was appointed President and Chief Executive Officer in addition to Chairman of the Board.

- (2)

- Mr. Ziegler was President and Chief Executive Officer from January 8, 2001 until August 7, 2002. Prior to that, Mr. Ziegler was Vice President and General Counsel to the Company. Fiscal 2002 compensation includes amounts paid to Mr. Ziegler from August 7, 2002 until September 30, 2002 while he was an employee of the Company, but not an officer.

- (3)

- In fiscal 2002, Mr. Ziegler received a bonus equivalent to a retroactive salary increase to $200,000 per year from the time he became President, Chief Executive Officer and Chief Operating Officer.

- (4)

- Mr. Bunday was named Executive Vice President and Chief Financial Officer effective July 1, 2002 in conjunction with the Recapitalization Transaction. Prior to that, Mr. Bunday was Chief Financial Officer of the Company and provided services to the Company under an independent contractor agreement from January 22, 2001 to June 30, 2002. Contract payments amounts are included under "other compensation."

- (5)

- Mr. Dunlap was named Executive Vice President and General Manager of the Company's Oregon operations effective July 1, 2002 in conjunction with the Recapitalization Transaction. Prior to that, Mr. Dunlap was General Manager of the Company's Oregon operations. Compensation includes amounts prior to being named Executive Vice President.

- (6)

- Mr. Dunlap's bonus includes a $60,000 one-time retention bonus paid upon the successful completion of the Recapitalization Transaction.

- (7)

- Represents contributions from the Company to Mr. Dunlap's 401(k) account.

- (8)

- Mr. Velat was named Executive Vice President and General Manager of the Company's Florida operations effective July 1, 2002 in conjunction with the Recapitalization Transaction. Prior to that, Mr. Velat was General Manager of the Company's Florida operations. Compensation includes amounts prior to being named Executive Vice President.

- (9)

- Mr. Velat's bonus includes a $60,000 one-time retention bonus paid upon the successful completion of the Recapitalization Transaction.

- (10)

- Represents a one-time payment for elimination on Mr. Velat's monthly car allowance of $500.

- (11)

- Represents monthly car allowance of $500 per month.

18

Stock Option Grants

The Company did not grant any stock options to the named executives during the fiscal year ended September 30, 2002.

Aggregated Option Exercises and Fiscal Year-End Option Value Table

The Table below summarizes fiscal year-end option values of the executive officers named in the Summary Compensation Table. No named executive officer acquired any shares on exercise during the fiscal year ended September 30, 2002.

| |

| |

| | Securities Underlying

Unexercised Options

at Year End (#)

| | Value of In-the Money

Option at Year End ($)

|

|---|

| | Shares

acquired on

exercise

(#)

| |

|

|---|

Name

| | Value

realized

($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| R. Eugene Goodson | | — | | — | | — | | — | | — | | — |

| Thomas K. Ziegler | | — | | — | | 110,000 | | — | | — | | — |

| Dennis E. Bunday | | — | | — | | — | | — | | — | | — |

| Thomas K. Dunlap | | — | | — | | 50,000 | | — | | — | | — |

| Ronald J. Velat | | — | | — | | 87,500 | | — | | — | | — |

Equity Compensation Plan Information

The table below sets forth certain information as of the end of the Company's 2002 fiscal year for (i) all compensation plans previously approved by our shareholders and (ii) all compensation plans not previously approved by our shareholders.

Plan category

| | Number of securities

to be issued

upon exercise of

outstanding options,

warrants and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available

for future issuance

under equity compensation

plans (excluding securities

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 3,004,220 | | $ | 2.36 | | 1,825,280 |

| Equity compensation plans not approved by security holders | | — | | | — | | — |

| | |

| |

| |

|

| | Total | | 3,004,220 | | $ | 2.36 | | 1,825,280 |

| | |

| |

| |

|

Pension Plan

Under the Company's Pension Plan, the Company is required to contribute amounts sufficient to fund specified retirement benefits for covered employees. Benefits are calculated on the basis of an employee's final average pay and length of service. Final average pay generally means the average of the employee's three highest annual compensation amounts during the last ten calendar years of employment. Compensation means taxable compensation plus any salary deferrals allowable under the Internal Revenue Code Sections 125 or 402. Compensation is limited in accordance with Internal Revenue Code Section 401(a)(17). For the 2002 calendar year, compensation considered under the plan may not exceed $200,000. Benefits are payable under normal (age 65), early (age 55 with 10 years of service) or deferred (over age 65) retirement or death. Employees who are officers or directors of the Company participate in the Pension Plan on the same basis as other employees. In general, an employee retiring under the plan will receive an annuity payable for life without any offsets. The following table sets forth estimated annual benefits as retirement under the Pension Plan for covered employees of the Company at various assumed years of service and levels of final average pay. The

19

calculations are shown for an employee retiring at age 65 in the form of a level single life annuity to the employee. Mr. Ziegler is the only named executive officer eligible for pension benefits under the plan. The years of credited service as computed by William Mercer, the Company's actuary, for Pension Plan purposes as of September 30, 2002 for Mr. Ziegler is 8.03 years and his final average pay is $152,550.

Estimated Annual Retirement Benefits

(nearest $100)

| | Years of Service

|

|---|

Final Average Salary

|

|---|

| | 5

| | 10

| | 15

| | 20

| | 25

| | 30

| | 35

|

|---|

| $125,000 | | $ | 9,000 | | $ | 18,100 | | $ | 27,100 | | $ | 36,100 | | $ | 45,200 | | $ | 54,200 | | $ | 63,200 |

| $150,000 | | | 11,100 | | | 22,200 | | | 33,300 | | | 44,400 | | | 55,500 | | | 66,600 | | | 77,700 |

| $175,000 | | | 12,500 | | | 24,900 | | | 37,400 | | | 49,900 | | | 62,300 | | | 74,800 | | | 87,300 |

| $200,000 | | | 12,500 | | | 24,900 | | | 37,400 | | | 49,900 | | | 62,300 | | | 74,800 | | | 87,300 |

Compensation of Directors

The non-employee directors of the Company, other than the directors elected by the holders of the Series B Preferred Stock, are paid an annual retainer of $2,500. In addition, each non-employee director, other than the directors elected by the holders of the Series B Preferred Stock, receives an additional $1,500 for each regular Board meeting attended in person, $500 for each telephonic Board meeting attended and $500 for each Committee meeting attended, whether in person or telephonic. No fees are paid when action is taken by unanimous written consent. The Company reimburses its directors for reasonable costs incurred to attend Board and committee meetings.

In fiscal 2002, the Company paid to Mr. Greenawalt a fee of $50,000 for his assistance in the sale of the Company's global positioning system business, GeoFocus. The fee was paid as $40,000 cash and 15,151 shares of the Company's common stock, valued at $10,000.

We paid a financial advisory fee to Taglich. See "Certain Relationships and Related Party Transactions" above. Mr. Hailey is associated with Taglich.

The Company has a Stock Option Plan for the non-employee directors of the Company. For the fiscal year ended September 30, 2002, non-employee directors Mr. Greenawalt, and Mr. Hailey and former director Timothy Itin each received non-statutory stock options exercisable for ten years to purchase up to 10,000 shares of Common Stock at $1.27 per share and 10,000 shares each at $.49 per share. Additionally, former Directors Gary Arnold and David Eberly each received non-statutory stock options exercisable for ten years to purchase up to 10,000 shares of Common Stock at $.49 per share and former Director Charles G. McClure received non-statutory stock options exercisable for ten years to purchase up to 10,000 shares of Common Stock for $1.27 per share. With the resignations of Messrs. Arnold, Eberly, Timothy Itin and McClure, options outstanding, including those granted in fiscal 2002, to those former directors were cancelled.

Certain Tax Considerations Related to Executive Compensation

As a result of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), if we pay more that $1,000,000 in compensation to a "covered employee" (the chief executive officer and the next four highest paid employees) in a single year, our income tax deduction for such compensation could be limited to $1,000,000.

20

Employment Contracts, Termination of Employment and Change in Control Arrangements

On January 10, 2003, the Company entered into employment agreements with Messrs. Bunday, Dunlap and Velat. See "Certain Relationships and Related Party Transactions" above.

Compensation Committee Interlocks and Insider Participation

The Company has a Compensation Committee consisting of Mr. Ferguson and Mr. Hailey. Neither Mr. Ferguson nor Mr. Hailey is or ever was an executive officer of the Company. Mr. Hailey is a Vice President of the Investment Banking Division of Taglich, and Mr. Ferguson is a partner and Managing Director of American Industrial Partners, which is an affiliate AIP. See "Certain Relationships and Related Party Transactions" above for a description of the relationships between the Company and each of Taglich and AIP. This Committee makes the determinations for stock issuances pursuant to the Company's compensation plans. The Company has no retirement, pension or profit sharing plans covering its officers and directors, but has contemplated the implementation of such a plan in the future.

Board Compensation Committee Report on Executive Compensation

The Compensation Committee is composed of Messrs. Hailey and Ferguson. The Compensation Committee was inactive during the 18-month period before the Recapitalization Transaction. Due to the Recapitalization Transaction, the Company's executive compensation activities have been managed by the Board as a whole. Those activities included negotiating employment agreements with Messrs. Bunday, Dunlap and Velat.

Subsequent to fiscal 2002 year-end, the Compensation Committee assumed responsibility for establishing the Company's executive compensation programs. Those programs consist of base salary, annual incentives and long-term incentives.

21

PERFORMANCE INFORMATION

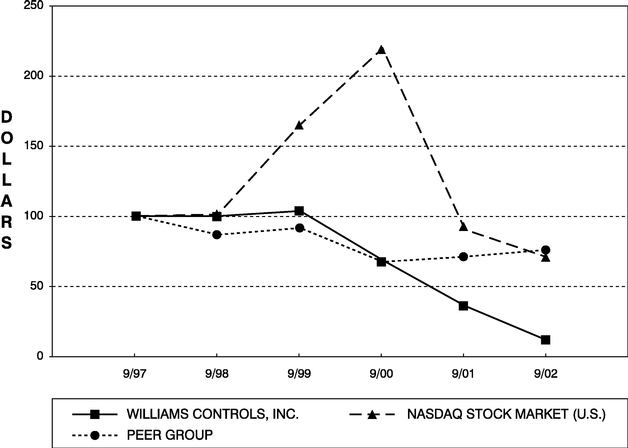

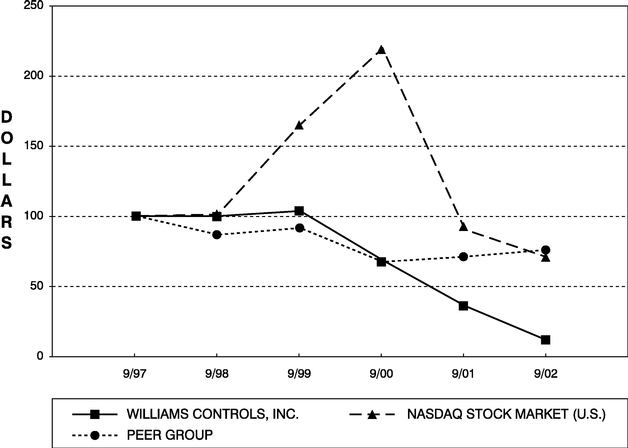

The following graph sets forth the percentage changes in the Company's cumulative stockholder return on its Common Stock for the five-year period ended September 30, 2002, with the cumulative total return of the NASDAQ Stock Market (US Companies) and a peer index of the NASDAQ Stocks—Motor Vehicles and Motor Vehicle Equipment companies.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG WILLIAMS CONTROLS, INC.,

THE NASDAQ STOCK MARKET (U.S.) INDEX AND A PEER GROUP

* $100 invested on 9/30/97 in stock or index-

including reinvestment of dividends.

Fiscal year ending September 30.

22

AUDIT COMMITTEE REPORT

The Audit Committee held five meetings during our 2002 fiscal year. The independent certified public accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

With respect to the Company's audited financial statements for the Company's fiscal year ended September 30, 2002, management of the Company represented to the Committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America and the Committee reviewed and discussed those financial statement with management. The Audit Committee also discussed with the Company's independent certified public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as modified or supplemented.

The Audit Committee received the written disclosures from the Company's independent certified public accountants required by Independent Standards Board Standard No. 1 (Independent Standards Board Standard No. 1, Independent Discussions With Audit Committees), as modified or supplemented, and discussed with the Company's independent certified public accountants their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements for the fiscal year ended September 30, 2002, be included in the Company's Annual Report on Form 10-K for that fiscal year.

The Audit Committee members for fiscal 2002 were:

H. Samuel Greenawalt

Timothy Itin

Douglas Hailey

Chip McClure

The current members of the Audit Committee are:

Kirk Ferguson

Nathan L. Belden

H. Samuel Greenawalt

23

INDEPENDENT PUBLIC ACCOUNTANTS

Independent Public Accountants

KPMG LLP was the auditor for the year ended September 30, 2002. A representative of KPMG LLP is expected to be present at the shareholder meeting, will be given the opportunity to make a statement if they so desire, and be available to respond to appropriate questions.

Arthur Andersen LLP performed the audit of the Company's financial statements for fiscal 2001, but was replaced by KPMG LLP effective July 22, 2002 with the recommendation and approval of the Audit Committee and the Board as a whole. The audit reports of Arthur Andersen LLP on the consolidated financial statements of Williams Controls, Inc. and subsidiaries as of and for the years ended September 30, 2001 and 2000, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles, except as follows:

Arthur Andersen LLP's report on the consolidated financial statements of Williams Controls, Inc. and subsidiaries as of and for the years end September 30, 2001 and 2000, contained a separate paragraph stating "the Company has suffered recurring losses from operations, is out of compliance with its debt covenants, is in default on payment of certain debt and has significant negative working capital. These matters raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result should the Company be unable to continue as a going concern."

In connection with the audits of the two fiscal years ended September 30, 2001 and the subsequent interim period through July 22, 2002, there were no disagreements with Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to their satisfaction would have caused them to make reference in connection with their opinion to the subject matter of the disagreement.

In addition, during the Company's two most recent fiscal years and any subsequent interim period, Arthur Andersen LLP did not advise the Company that: (a) the internal controls necessary to develop reliable financial statements did not exist; (b) information had come to the attention of Arthur Andersen LLP which made it no longer able or unwilling to rely on management's representation, or unwilling to be associated with the financial statements prepared by management; (c) the scope of the audit should have been expanded significantly; (d) information had come to Arthur Andersen's attention that it had concluded would, or if further investigated might have, materially impacted the fairness or reliability of a previously issued audit report or the underlying financial statements, or the financial statements issued or to be issued covering the fiscal period(s) subsequent to the date of the most recent audited financial statements, or (e) information has come to its attention that it concluded materially impacts the fairness or reliability of either (i) a previously issued audit report or the underlying financial statements or (ii) the financial statements issued or to be issued covering the fiscal periods subsequent to September 30, 2001, that would prevent it from rendering an unqualified audit report, and such issue had not been resolved to Arthur Andersen's satisfaction.

The Company requested, but have not been able to obtain a letter from Arthur Andersen LLP on whether they agree on the Company's position regarding the change in the Company's independent auditor. Arthur Andersen LLP has indicated that they are no longer in a position to provide such a letter.

During the two most recent fiscal years of the Company ended September 30, 2001, and the subsequent interim period through July 22, 2002, the Company did not consult with KPMG LLP regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

24

Fees Billed to the Company by KPMG LLP During Fiscal Year Ended September 30, 2002

The Company was billed for professional services provided during fiscal year 2002 by KPMG LLP in the amounts set out in the following table.

Services Provided

| | Fee Amount

|

|---|

| Audit Fees(1) | | $ | 212,971 |

| Audit Related Fees(2) | | $ | 58,000 |

| Tax Fees | | $ | 43,295 |

| All Other Fees (3) | | $ | 17,985 |

| | Total | | $ | 332,251 |

- (1)

- Fees in connection with the audit of the Company's annual financial statements for the fiscal year ended September 30, 2002 and reviews of the financial statements included in the Company's quarterly reports on Form 10-Q after July 22, 2002 during the 2002 fiscal year.

- (2)

- Fees include audit of benefit plans.

- (3)

- Fees include assistance with benefit plan compliance.

The Audit Committee of the Board of Directors has considered each of the services rendered by KPMG LLP for services other than the audit of the Company's financial statements and has determined that the provision of each of these services is compatible with maintaining the firm's independence.

25

SHAREHOLDER PROPOSALS FOR 2004 ANNUAL MEETING

Any shareholder proposal intended for inclusion in proxy materials for the Company's next annual shareholder meeting must be received in proper form by the Company at its principal office at least 120 days prior to the date of the Company's next annual meeting.

OTHER MATTERS

The board of directors is not aware of any business other than the proposals discussed above that will be presented for consideration at the shareholder meeting. If other matters properly come before the shareholder meeting, it is the intention of the persons named in the enclosed proxy to vote on such matters in accordance with their best judgment.

ANNUAL REPORT ON FORM 10-K

The Company has arranged for a copy of its annual report on Form 10-K for fiscal 2002, to be mailed to each record shareholder and each beneficial owner with this Proxy Statement. A RECORD SHAREHOLDER OR BENEFICIAL SHAREHOLDER MAY ALSO OBTAIN A COPY OF THE ANNUAL REPORT ON FORM 10-K AT NO CHARGE, OR A COPY OF EXHIBITS THERETO FOR A REASONABLE CHARGE, BY WRITING TO WILLIAMS CONTROLS, INC., INVESTOR RELATIONS, 14100 SW 72ND AVENUE, PORTLAND, OREGON 97224.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, THE COMPANY HOPES THAT YOU WILL HAVE YOUR STOCK REPRESENTED BY COMPLETING, SIGNING, DATING AND RETURNING YOUR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE AS SOON AS POSSIBLE.

| | | By Order of the Board of Directors, |

|

|

|

|

|