Filed by Colonial Properties Trust Pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Cornerstone Realty Income Trust, Inc.

Commission File No.: 001-12875

| Smith Barney REIT CEO Conference March 2005 |

| Forward Looking Statements "Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: Except for the historical information contained herein, these supplemental financial highlights contain forward-looking statements regarding Company and property performance, and are based on the Company's current expectations and judgment. Actual results could vary materially depending on risks and uncertainties inherent to general and local real estate conditions, competitive factors specific to markets in which the Company operates, legislative or other regulatory decisions, future interest rate levels or capital markets conditions. The Company assumes no liability to update this information. For more details, please refer to the Company's SEC filings, including its most recent Annual Report on Form 10-K and quarterly reports on Form 10-Q. |

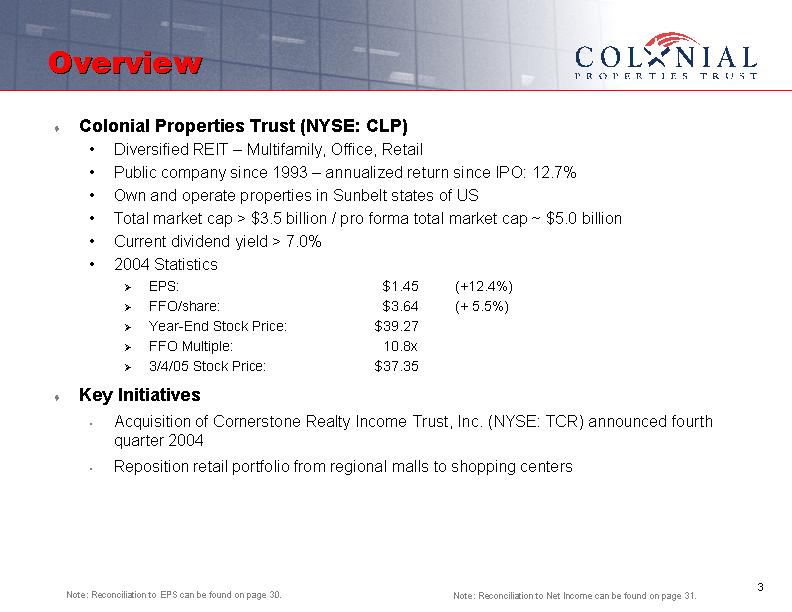

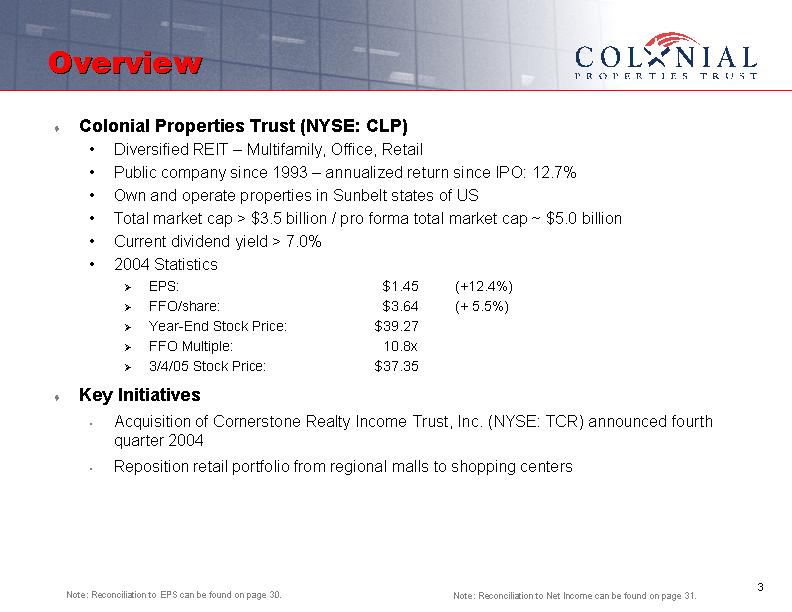

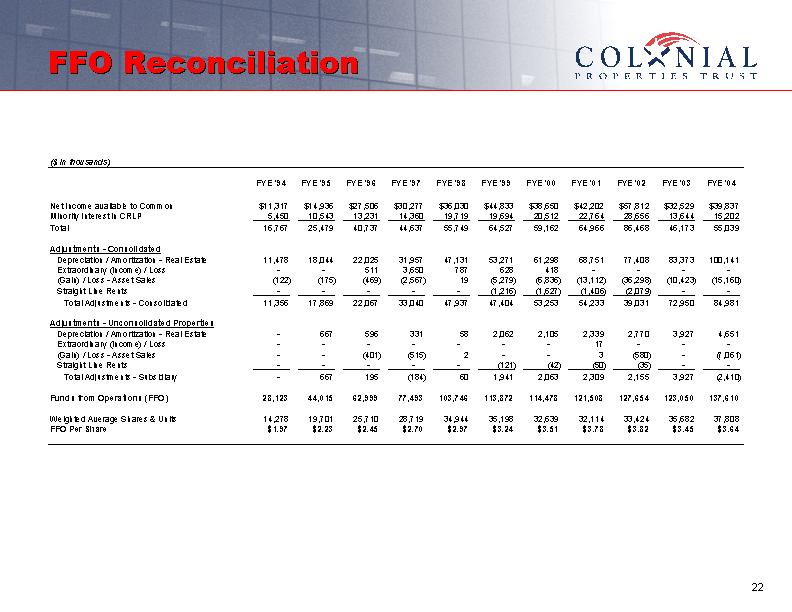

| Overview Colonial Properties Trust (NYSE: CLP) Diversified REIT - Multifamily, Office, Retail Public company since 1993 - annualized return since IPO: 12.7% Own and operate properties in Sunbelt states of US Total market cap > $3.5 billion / pro forma total market cap ~ $5.0 billion Current dividend yield > 7.0% 2004 Statistics EPS: $1.45 (+12.4%) FFO/share: $3.64 (+ 5.5%) Year-End Stock Price: $39.27 FFO Multiple: 10.8x 3/4/05 Stock Price: $37.35 Key Initiatives Acquisition of Cornerstone Realty Income Trust, Inc. (NYSE: TCR) announced fourth quarter 2004 Reposition retail portfolio from regional malls to shopping centers Note: Reconciliation to EPS can be found on page 30. Note: Reconciliation to Net Income can be found on page 31. |

| Overview Colonial Properties Trust |

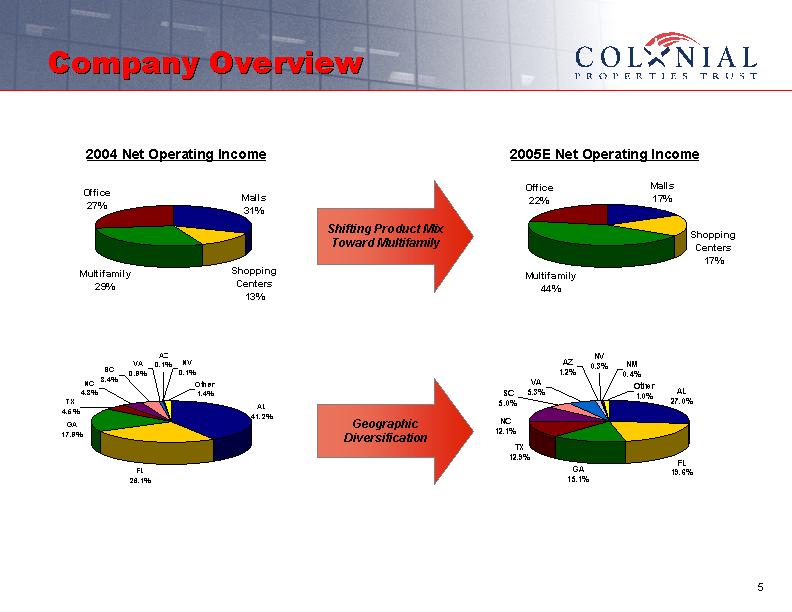

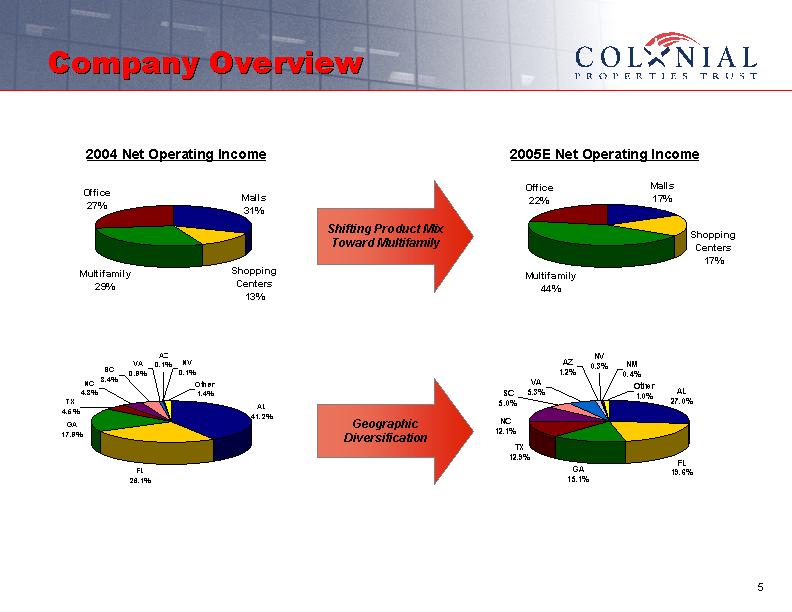

| Company Overview Shifting Product Mix Toward Multifamily 2004 Net Operating Income 2005E Net Operating Income Geographic Diversification |

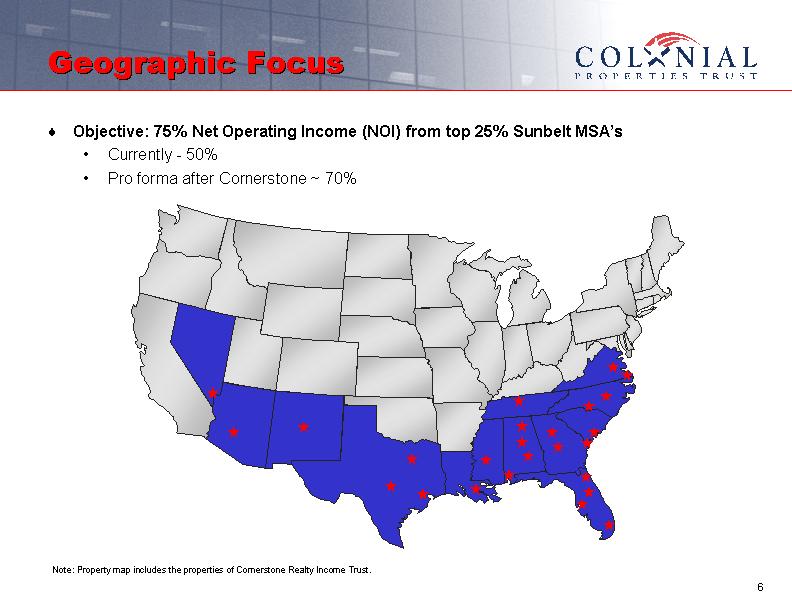

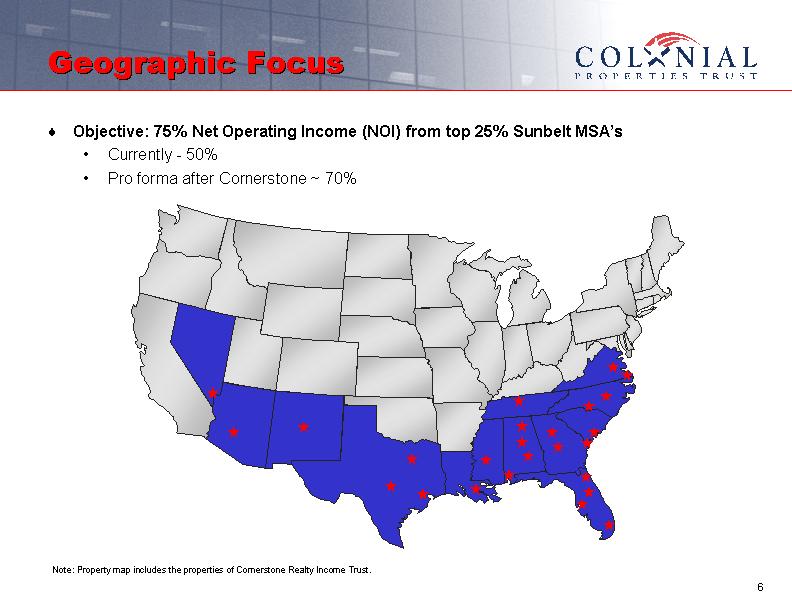

| Geographic Focus Objective: 75% Net Operating Income (NOI) from top 25% Sunbelt MSA's Currently - 50% Pro forma after Cornerstone ~ 70% Note: Property map includes the properties of Cornerstone Realty Income Trust. |

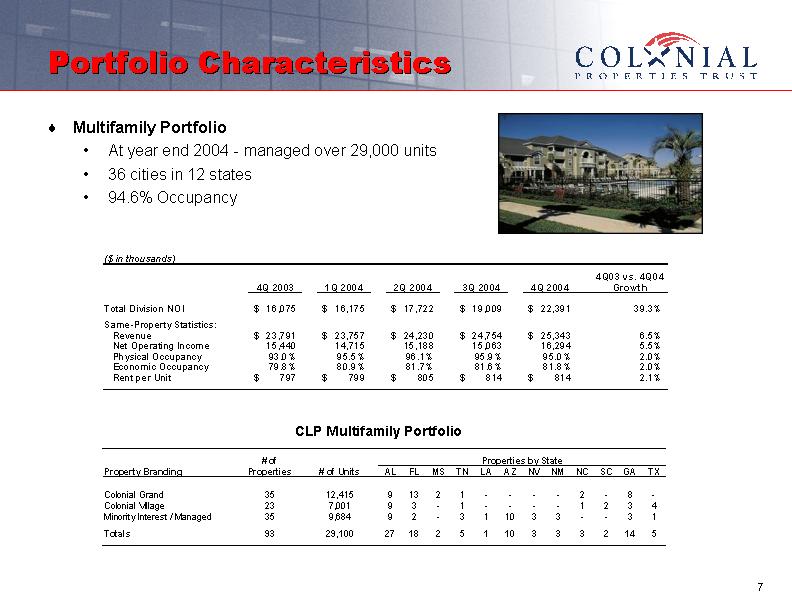

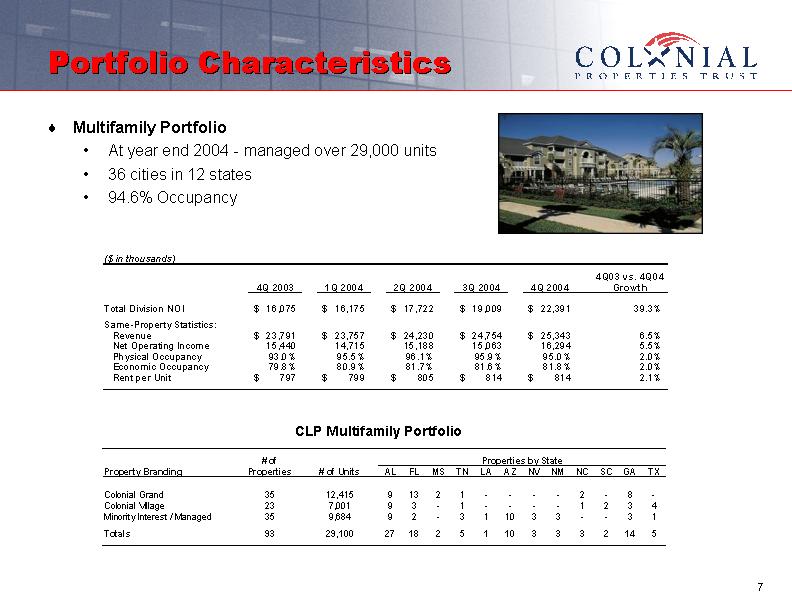

| Portfolio Characteristics Multifamily Portfolio At year end 2004 - managed over 29,000 units 36 cities in 12 states 94.6% Occupancy CLP Multifamily Portfolio |

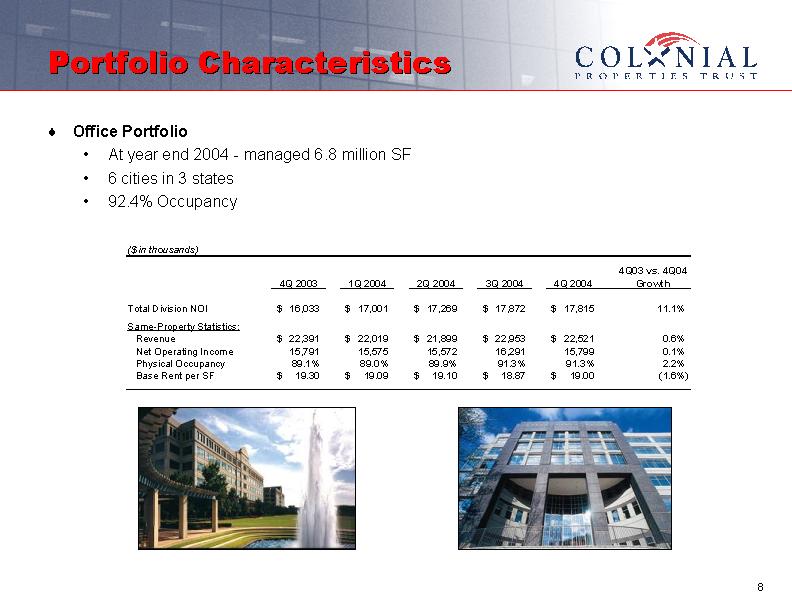

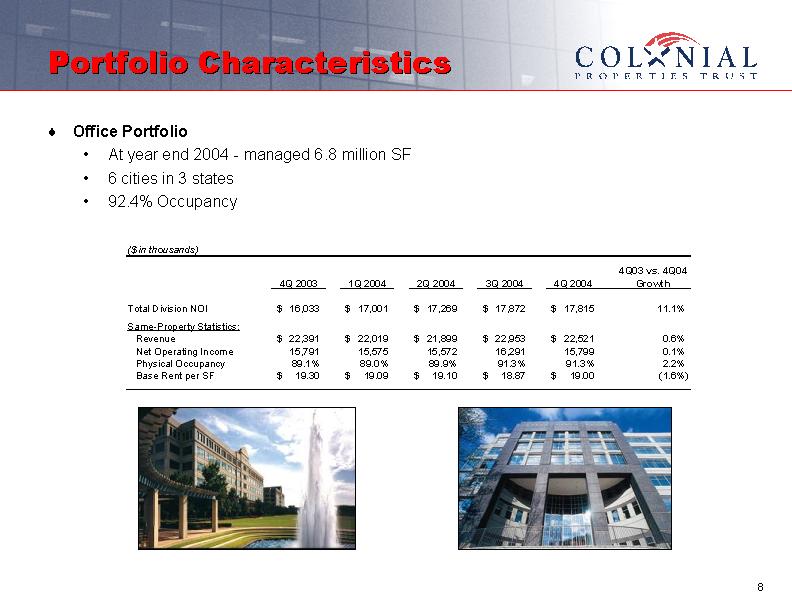

| Portfolio Characteristics Office Portfolio At year end 2004 - managed 6.8 million SF 6 cities in 3 states 92.4% Occupancy |

| Portfolio Characteristics Retail Portfolio Shopping Centers (38%) - manage 5.8 million sf Regional Malls (62%) - manage 9.5 million sf 30 cities in 8 states 91.4% Occupancy |

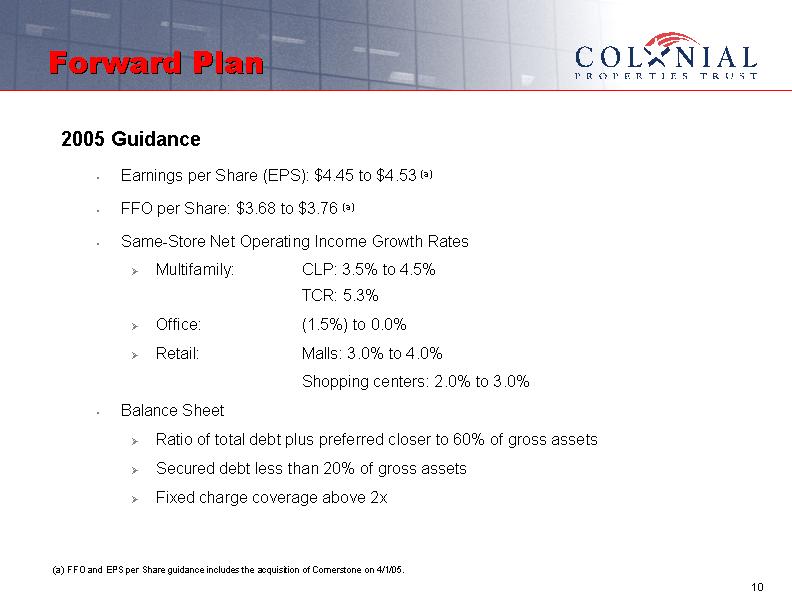

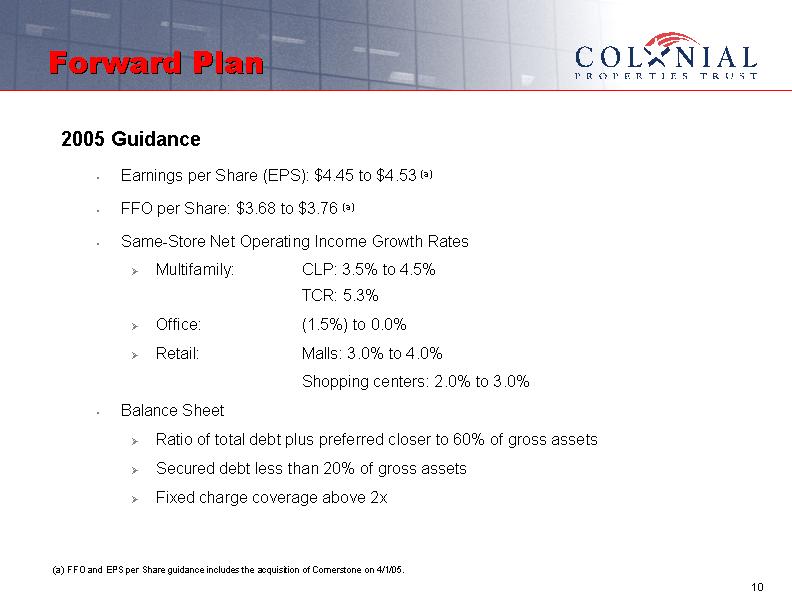

| Forward Plan 2005 Guidance Earnings per Share (EPS): $4.45 to $4.53 (a) FFO per Share: $3.68 to $3.76 (a) Same-Store Net Operating Income Growth Rates Multifamily: CLP: 3.5% to 4.5% TCR: 5.3% Office: (1.5%) to 0.0% Retail: Malls: 3.0% to 4.0% Shopping centers: 2.0% to 3.0% Balance Sheet Ratio of total debt plus preferred closer to 60% of gross assets Secured debt less than 20% of gross assets Fixed charge coverage above 2x (a) FFO and EPS per Share guidance includes the acquisition of Cornerstone on 4/1/05. |

| Key Plan Drivers Multifamily Cornerstone portfolio Close Transaction April 1, 2005 Successfully integrate Cornerstone and Colonial Properties multifamily operations Achieve 5.3% projected NOI growth CLP portfolio - 5 consecutive quarters of year-over-year growth Office Manage renewals in challenging environment Retail Reduce regional mall exposure through planned dispositions Increased focus on retail development |

| Nearly 50% of Cornerstone's assets are in Dallas, Charlotte and Raleigh - markets starting to see signs of recovery Multifamily Occupancy Source: Mueller, 2004 (3Q report) Note: The 10 largest multifamily markets make up 50% of the total square footage of multifamily space that we monitor. Thus, the 10 largest multifamily markets are in boldface italics to help distinguish how the weighted national average is affected. +1 indicates the number of positions the market has moved since the previous quarter. |

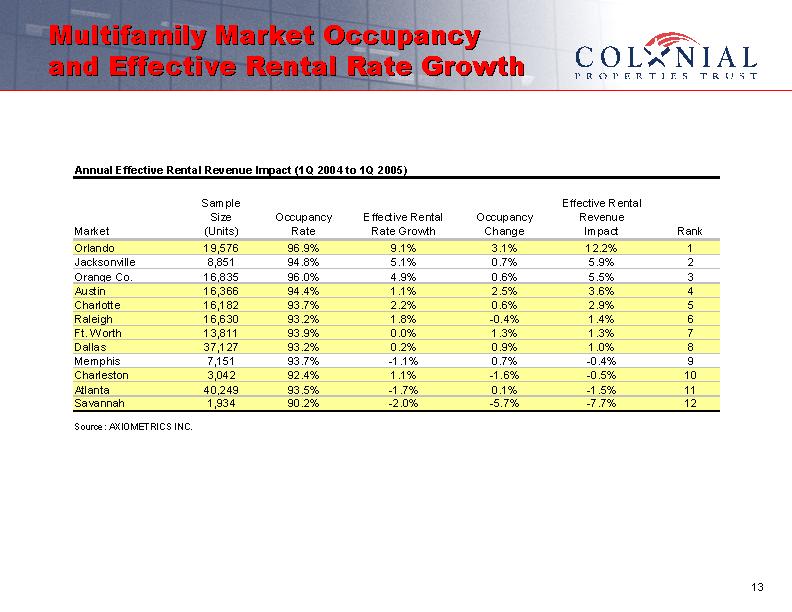

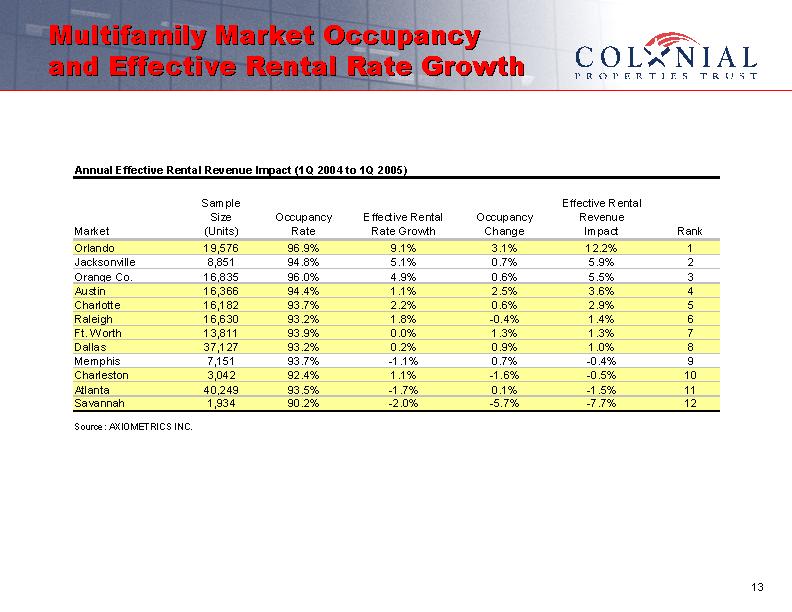

| Multifamily Market Occupancy and Effective Rental Rate Growth |

| Job Growth & Multifamily Permitting Trends Source: AXIOMetrics, Inc. Job Growth and Permitting Trends (All CLP and TCR Markets) |

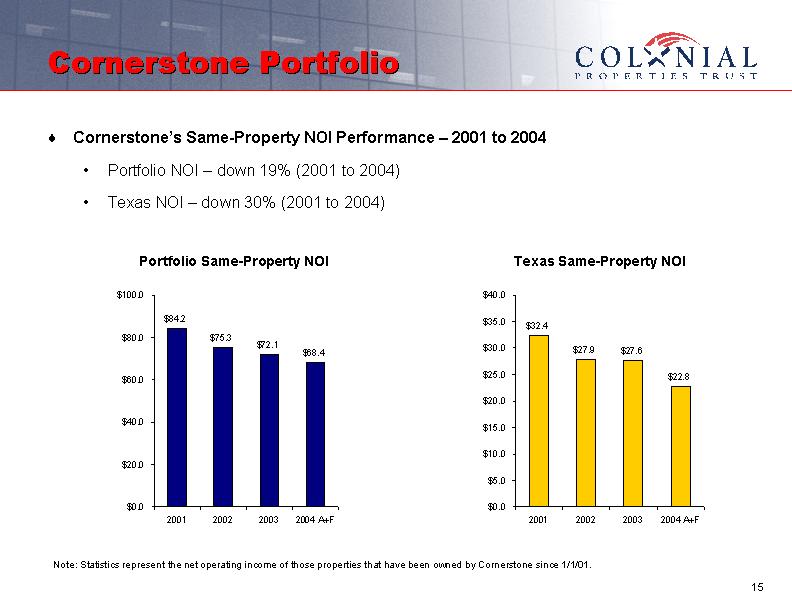

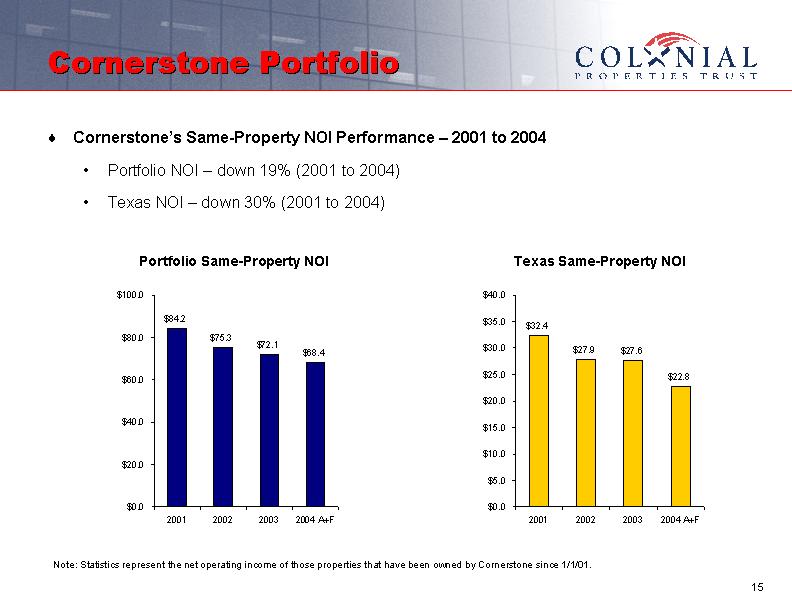

| Cornerstone's Same-Property NOI Performance - 2001 to 2004 Portfolio NOI - down 19% (2001 to 2004) Texas NOI - down 30% (2001 to 2004) Cornerstone Portfolio Portfolio Same-Property NOI Texas Same-Property NOI Note: Statistics represent the net operating income of those properties that have been owned by Cornerstone since 1/1/01. |

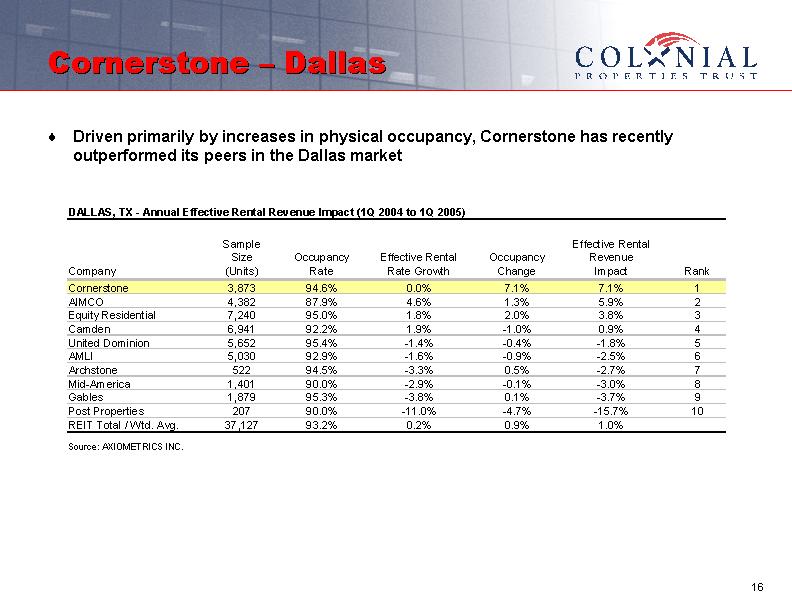

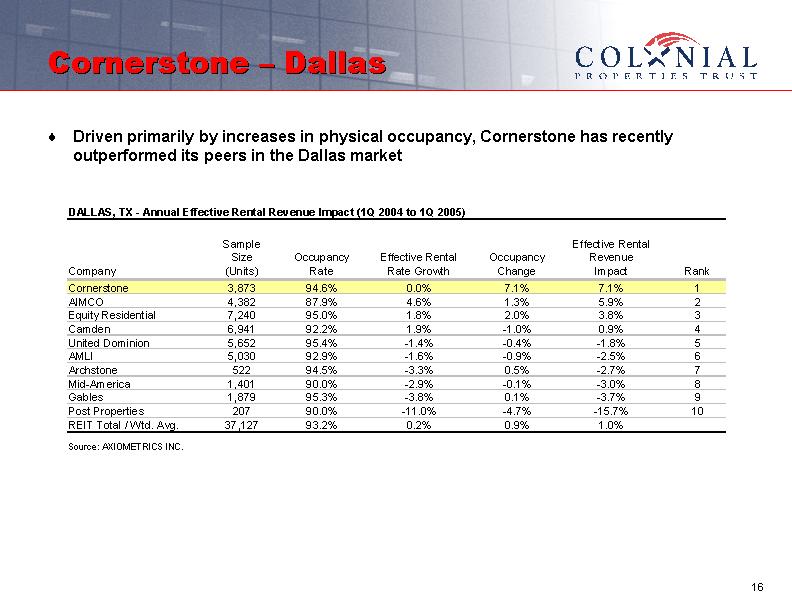

| Driven primarily by increases in physical occupancy, Cornerstone has recently outperformed its peers in the Dallas market Cornerstone - Dallas |

| Integration Combined Company Legal / Insurance Recruiting Capital Projects Residents Purchasing Operating Policies / Procedures Training Development IT Strategic Accounting Bonus / Recognition Third Party / Joint Ventures Marketing / Branding Human Resources Ancillary Income Acquisitions / Dispositions Audit Sarbanes- Oxley |

| Integration Integration Process 18 Teams ? team leaders: 50% CLP / 50% TCR Operations Identify best practices Weekly conference calls Monthly in-person meetings Combined company Key Performance Indicators (KPI's) NOI expense management physical occupancy economic occupancy delinquency rate March 15 is kick-off for integration roll-out to off-property leadership team April 1 - first day of combined company operations |

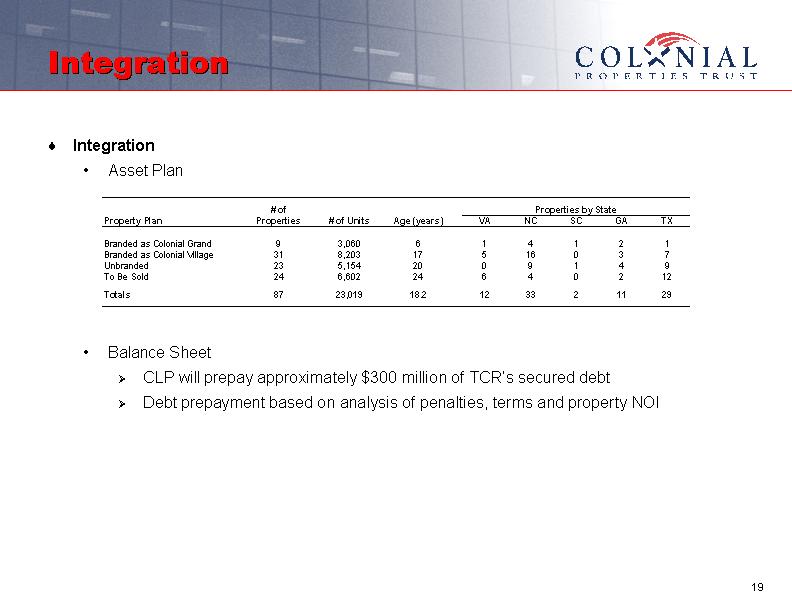

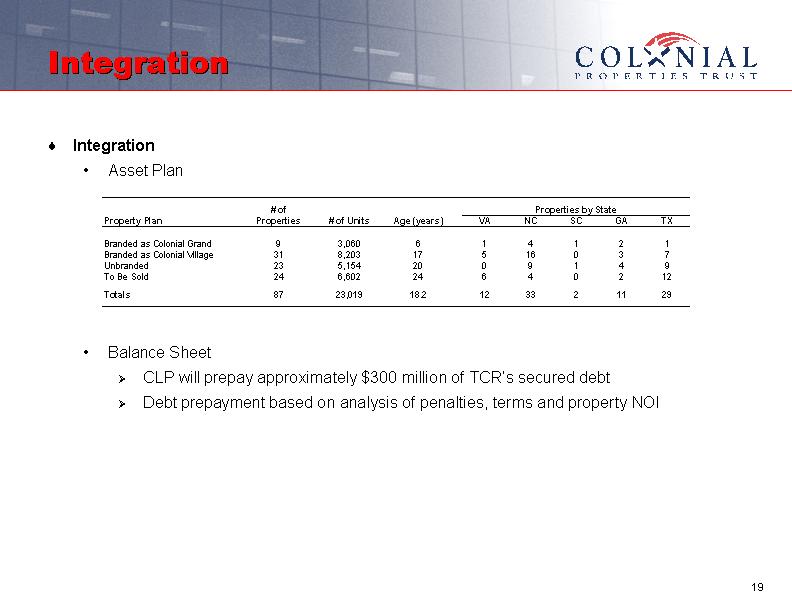

| Integration Integration Asset Plan Balance Sheet CLP will prepay approximately $300 million of TCR's secured debt Debt prepayment based on analysis of penalties, terms and property NOI |

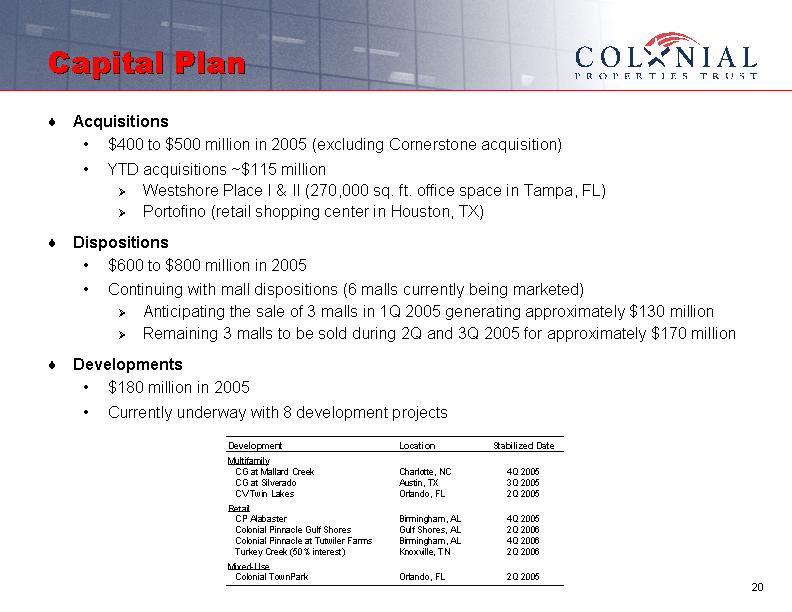

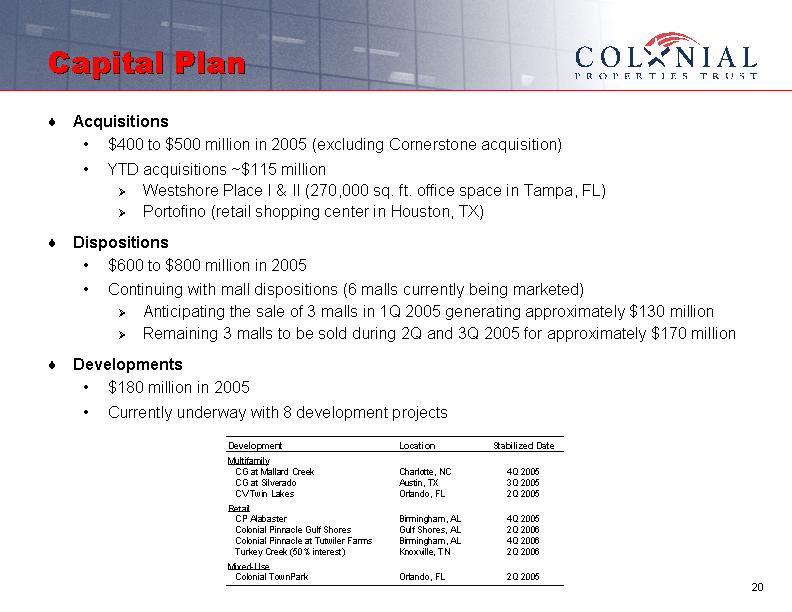

| Acquisitions $400 to $500 million in 2005 (excluding Cornerstone acquisition) YTD acquisitions ~$115 million Westshore Place I & II (270,000 sq. ft. office space in Tampa, FL) Portofino (retail shopping center in Houston, TX) Dispositions $600 to $800 million in 2005 Continuing with mall dispositions (6 malls currently being marketed) Anticipating the sale of 3 malls in 1Q 2005 generating approximately $130 million Remaining 3 malls to be sold during 2Q and 3Q 2005 for approximately $170 million Developments $180 million in 2005 Currently underway with 8 development projects Capital Plan |

| Additional Information about the Merger and Where to Find It In connection with the proposed merger of Cornerstone Realty Income Trust, Inc. with and into Colonial Properties Trust, Cornerstone and Colonial have filed relevant materials with the Securities and Exchange Commission, including a registration statement on Form S-4 that contains a prospectus and a joint proxy statement. INVESTORS AND SECURITY HOLDERS OF CORNERSTONE AND COLONIAL ARE URGED TO READ THE MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT CORNERSTONE, COLONIAL AND THE MERGER. The proxy statement, prospectus and other relevant materials, and any other documents filed by Cornerstone and Colonial with the SEC, may be obtained free of charge at the SEC's web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Colonial by directing a written request to Colonial Properties Trust, 2101 Sixth Avenue North, Suite 750, Birmingham, Alabama 35203, Attention: Investor Relations, and free copies of the documents filed with the SEC by Cornerstone by directing a written request to Cornerstone Realty Income Trust, Inc., 306 East Main Street, Richmond, Virginia 23219, Attention: Investor Relations. Investors and security holders are urged to read the proxy statement, prospectus and the other relevant materials before making any voting or investment decision with respect to the merger. Cornerstone, Colonial and their respective executive officers, trustees and directors may be deemed to be participants in the solicitation of proxies from the security holders of Cornerstone and Colonial in connection with the merger. Information about those executive officers and directors of Cornerstone and their ownership of Cornerstone common shares is set forth in the proxy statement for Cornerstone's 2004 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2004. Information about the executive officers and trustees of Colonial and their ownership of Colonial common stock and limited partnership units in Colonial Realty Limited Partnership is set forth in the proxy statement for Colonial's 2004 Annual Meeting of Shareholders, which was filed with the SEC on March 22, 2004. Investors and security holders may obtain additional information regarding the direct and indirect interests of Cornerstone, Colonial and their respective executive officers, trustees and directors in the merger by reading the proxy statement and prospectus regarding the merger when they become available. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. |