UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

Cornerstone Realty Income Trust, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

CORNERSTONE REALTY INCOME TRUST, INC.

Notice of Annual Meeting of Shareholders

to be held on Tuesday, May 25, 2004

The Annual Meeting of Shareholders of Cornerstone Realty Income Trust, Inc. (the “Company”) will be held at The Woman’s Club, 211 East Franklin Street, Richmond, Virginia 23219 on Tuesday, May 25, 2004 at 2:00 p.m. for the following purposes:

1. To elect four (4) directors, each of whom will serve for a three-year term; and

2. To transact such other business as may properly come before the meeting.

If you were a holder of record of any common shares of the Company at the close of business on the record date of March 31, 2004, you are entitled to vote at the meeting. If you are present at the meeting, you may vote in person even though you have previously returned a proxy card.

A proxy card for voting your shares is located in the envelope in which these proxy materials were mailed. If you need a replacement proxy card, assistance may be obtained by calling Mr. Mark M. Murphy, Senior Vice President of Corporate Services, at (804) 643-1761.

By Order of the Board of Directors

J. Philip Hart

Secretary

April 7, 2004

|

|

| WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON. |

|

CORNERSTONE REALTY INCOME TRUST, INC.

PROXY STATEMENT

DATED

APRIL 7, 2004

Annual Meeting of Shareholders

To Be Held

May 25, 2004

General

The enclosed proxy is solicited by the management of Cornerstone Realty Income Trust, Inc. (the “Company”) for the Annual Meeting of Shareholders to be held at The Woman’s Club, 211 East Franklin Street, Richmond, Virginia 23219 on Tuesday, May 25, 2004 at 2:00 p.m. (the “Annual Meeting”). Your proxy may be revoked at any time before being voted at the Annual Meeting, either by a written notice of revocation that is received by the Company before the Annual Meeting or by conduct that is inconsistent with the continued effectiveness of the proxy, such as delivering another proxy with a later date or attending the Annual Meeting and voting in person.

Unless your proxy indicates otherwise, all shares represented by a proxy that you sign and return will be votedFORthe election of the persons named therein as directors.

This proxy statement and the enclosed proxy are being mailed to the common shareholders of record at the close of business on the record date of March 31, 2004 (the “Record Date”). The approximate date of such mailing is expected to be April 20, 2004 or sooner. Such mailing to shareholders also will contain the Company’s Annual Report, which includes audited consolidated financial statements for the year ended December 31, 2003 (the “Annual Report”).

At the close of business on the Record Date, a total of 55,663,735 common shares of the Company (the “Common Shares”) were outstanding and entitled to vote on all matters, including those to be acted upon at the Annual Meeting. The presence in person or by proxy of a majority of the Common Shares entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business.

Company Information

The mailing address of the Company is 306 East Main Street, Richmond, Virginia 23219. Notice of revocation of proxies should be sent to the Company, Attn: Mr. Mark M. Murphy, Senior Vice President of Corporate Services, at such address. The Company also can be contacted, and public information about the Company can be obtained, through its website atwww.cornerstonereit.com or by sending a written notice to the Senior Vice President of Corporate Services as described above. The Company is a real estate investment trust, or “REIT,” for federal income tax purposes. The Common Shares trade under the symbol “TCR” on the New York Stock Exchange.

The Company will be responsible for the costs of the solicitation set forth in this proxy statement. The Annual Report includes the Company’s Annual Report on Form 10-K (except for certain Exhibit material thereto) as filed with the Securities and Exchange Commission for the year ended December 31, 2003. The Company’s Annual Report on Form 10-K and its other public federal securities filings also may be obtained electronically through the EDGAR system of the Securities and Exchange Commission at http://www.sec.gov.

1

Ownership of Equity Securities

The determination of “beneficial ownership” for purposes of this proxy statement has been based on information reported to the Company and the rules and regulations of the Securities and Exchange Commission. References below to “beneficial ownership” by a particular person, and similar references, should not be construed as an admission or determination by the Company that Common Shares in fact are beneficially owned by such person.

On the Record Date, the Company had a total of 55,663,735 issued and outstanding Common Shares. There are no shareholders known to the Company who beneficially owned more than 5% of its outstanding voting securities on such date, except as shown in the table below:

| | | | |

Security Ownership of Certain Beneficial Owners |

Name and Address of Beneficial Owner(1)

| | Amount and Nature of Beneficial Ownership of Common Shares(2)

| | Percent of Class

|

Glade M. Knight 306 East Main Street Richmond, Virginia 23219 | | 3,361,965 | | 5.95% |

| (1) | | Individual named is a director and an executive officer. |

| (2) | | Includes 829,211 Common Shares that may be acquired upon the exercise of stock options. |

(Remainder of Page is Intentionally Blank)

2

On the Record Date, the following equity securities were beneficially owned by those individuals who currently are, or who were at the end of 2003, serving as directors and executive officers of the Company and by the nominees for election as directors at the Annual Meeting:

| | | | | |

Security Ownership of Management | |

Name of Beneficial Owner

| | Amount and Nature of Beneficial Ownership of Common Shares(1)

| | Percent of Class(2)

| |

| |

Directors (including any officers who are directors and each nominee as a director) | | | |

| | |

Glenn W. Bunting, Jr. | | 75,291 | | * | |

Kent W. Colton | | 26,418 | | * | |

Robert A. Gary, IV | | 5,324 | | * | |

Leslie A. Grandis | | 75,030 | | * | |

W. Tennent Houston | | 962,962 | | 1.73 | % |

Glade M. Knight | | 3,361,965 | | 5.95 | % |

Penelope W. Kyle | | 76,688 | | * | |

Stanley J. Olander, Jr. | | 538,877 | | * | |

Harry S. Taubenfeld | | 118,426 | | * | |

Martin Zuckerbrod | | 118,375 | | * | |

| | |

Individuals other than directors | | | | | |

| | |

Debra A. Jones | | 378,156 | | * | |

David L. Carneal | | 34,987 | | * | |

Gus G. Remppies | | 39,256 | | * | |

| | |

| |

|

|

Above directors and executive officers as a group | | 5,811,755 | | 10.12 | % |

* Less than one percent of outstanding Common Shares.

| (1) | | Amounts shown include the Common Shares that may be acquired upon the exercise of options, as follows: (a) Messrs. Bunting and Grandis and Ms. Kyle – 70,377 Common Shares each; (b) Mr. Knight – 829,211 Common Shares; (c) Mr. Olander – 304,310 Common Shares; (d) Ms. Jones – 144,310 Common Shares; (e) Messrs. Taubenfeld and Zuckerbrod – 96,461 Common Shares each; (f) Mr. Colton – 24,527 Common Shares; (g) Messrs. Gary and Houston – 5,000 Common Shares each; (h) Mr. Carneal – 31,000 Common Shares; and (i) Mr. Remppies – 25,400 Common Shares. Amounts shown in table reflect Common Shares as to which the named individual has sole voting and investment power, or joint power with his or her spouse or minor children, if any. All options for Ms. Jones were issued prior to March 31, 2004, when she ceased to serve as an officer and employee. |

| (2) | | Percentage for named person is computed (under rules of the Securities and Exchange Commission) to show the maximum potential ownership, based on the following assumptions: (a) the named person fully exercises all currently unexercised options; and (b) no other person exercises any currently unexercised options. Thus, the denominator for this calculation is the Common Shares on the Record Date plus the Common Shares available under options held by the applicable person (as specified in note 1 above). |

3

The following table summarizes the equity compensation plans of the Company:

| | | | | | | |

Equity Compensation Plan Information |

| | | (a)

| | (b)

| | (c)

|

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column(a))

|

Equity compensation plans approved by security holders | | (see following list) | | | | | |

| | | |

1992 Non-Employee Directors Stock Option Plan (as amended and restated) | | 372,601 | | $ | 10.20 | | 420,351 |

| | | |

1992 Incentive Plan (as amended and restated) | | 1,445,683 | | $ | 10.23 | | 269,483 |

| | | |

Equity compensation plans not approved by security holders | | n/a | | | n/a | | n/a |

| | | |

Total | | 1,818,284 | | $ | 10.23 | | 689,834 |

Election of Directors

Nominees. Four (4) individuals have been nominated for election at the Annual Meeting to the Company’s Board of Directors. If elected, the Board would continue to consist of ten directors. The following table lists the nominees for election to the Board of Directors and indicates the length of the terms they would have if elected:

| | |

Nominee for Election to Board of Directors

| | Length of Term, if Elected(1)

|

Robert A. Gary, IV | | Three-year term expiring in 2007 |

W. Tennent Houston | | Three-year term expiring in 2007 |

Penelope W. Kyle | | Three-year term expiring in 2007 |

Harry S. Taubenfeld | | Three-year term expiring in 2007 |

| (1) | | Term would extend until the Annual Meeting of Shareholders for the year shown, or until a successor is duly elected and qualified, except in the event of prior resignation, death or removal. |

Unless otherwise specified, all Common Shares represented by proxies will be votedFOR the election of the nominees listed. If any nominee ceases to be available for election as a director, discretionary authority may be exercised by each of the proxies named on the attached proxy card to vote for a substitute. No circumstances are presently known that would cause any nominee to be unavailable for election as a director. All of the nominees are now members of the Board of Directors and have been nominated by action of the Board of Directors. If a quorum is present, a total of four positions on the Board of Directors will be filled by the election of the four properly nominated candidates who receive the greatest number of votes at the Annual Meeting, even if the nominees do not receive a majority of all votes represented and entitled to be cast.

A shareholder who wishes to abstain from voting on the election of directors may do so by specifying, as provided on the enclosed proxy, that authority to vote for any or all of the nominees is to be withheld. By withholding authority in this manner, the Common Shares that otherwise could be voted by such shareholder will not be included in determining the number of Common Shares voted for such nominees. The Company will comply with instructions in a proxy executed by a broker or other nominee shareholder indicating that less than all of the Common Shares of the record shareholder on the Record Date are to be voted on a particular matter. All

4

Common Shares that are not voted will be treated as Common Shares as to which voting authority has been withheld.

Below is a list of the nominees, their ages and the respective years of their election to the Board of Directors of the Company, together with a brief description of their principal occupations and employment during at least the past five years and their directorships, if any, in public companies other than the Company.

Robert A. Gary, IV, 50, is a director of the Company. He is a co-founder of Keiter, Stephens, Hurst, Gary & Shreaves, which is an independent certified public accounting firm based in Richmond, Virginia. He holds a bachelor’s degree in accounting from Wake Forest University and a master’s degree in business administration from the University of Virginia’s Darden School. He is a member of the American Institute of Certified Public Accountants and the Virginia Society of Certified Public Accountants. He is the chairperson and financial expert for the Company’s Audit Committee (as indicated in a following section). Mr. Gary was first elected to the Company’s Board of Directors in 2003.

W. Tennent Houston,53, is a director of the Company. He is the managing member of Merry Land Properties, LLC, and formerly served as chairman and chief executive officer of Merry Land Properties, Inc., which merged into a subsidiary of the Company in May 2003. He previously served as president and chief executive officer of Merry Land & Investment Company, Inc., a New York Stock Exchange-listed apartment REIT, which he joined in 1981. He serves as a member of both the National Multi-Housing Council and the National Apartment Association. Mr. Houston was first elected to the Company’s Board of Directors in 2003.

Penelope W. Kyle, 56, is a director of the Company. She has been the director of the Virginia Lottery since September 1, 1994. Ms. Kyle worked in various capacities for CSX Corporation and its affiliated companies from 1981 until August 1994. She served as Vice President, Administration and Finance for CSX Realty, Inc. beginning in 1991, as Vice President, Administration for CSX Realty, Inc. from 1989 to 1991, and as Assistant Vice President and Assistant to the President for CSX Realty, Inc. from 1987 to 1989. She is a member of the Company’s Compensation Committee (as indicated in a following section). Ms. Kyle was first elected to the Company’s Board of Directors in 1993.

Harry S. Taubenfeld, 74, is a director of the Company. He has practiced law since 1956, and has been involved in mortgage and real estate investment activities in the firm of Zuckerbrod & Taubenfeld of Cedarhurst, New York since 1959. Mr. Taubenfeld concentrates on real estate and commercial law. Mr. Taubenfeld is a past President of the Nassau County Village Officials. He is a member of the Company’s Audit Committee and its Compensation Committee (as indicated in a following section). Mr. Taubenfeld was first elected to the Company’s Board of Directors in 1992.

MANAGEMENT RECOMMENDS A VOTE“FOR”

EACH OF THE ABOVE NOMINEES.

Other Directors and Officers. The following individuals constitute the directors of the Company whose terms expire after 2004 and the current executive officers of the Company.

Glenn W. Bunting, Jr., 59, has been President of American KB Properties, Inc., which develops and manages shopping centers, since 1985. He has been President of G.B. Realty Corporation, which brokers shopping centers and apartment communities, since 1980. He is the chairperson of the Company’s Nominating and Governance Committee, a member of its Executive Committee and its Audit Committee, and the presiding director for executive sessions of the Board (as indicated in following sections). Mr. Bunting was first elected to the Company’s Board of Directors in 1993. His current term as a director expires in 2005.

Kent W. Colton, 60, has been Senior Scholar of the Joint Center for Housing at Harvard University since 1999. He is president of KColton LLC, a consulting and housing research company in McLean, Virginia, and

5

serves as a member of the Millennial Housing Commission, which was established by Congress to examine national housing policy. From April 1984 through May 1999, he was executive vice president and chief executive officer of the National Association of Home Builders. He is the chairperson of the Company’s Compensation Committee and a member of its Nominating and Governance Committee (as indicated in a following section). Mr. Colton was first elected to the Company’s Board of Directors in 2001. His current term as a director expires in 2006.

Leslie A. Grandis, 59, has been a partner in the law firm of McGuireWoods LLP in Richmond, Virginia since 1974. His law practice concentrates on mergers and acquisitions, corporate finance and securities law. He is a director of Markel Corporation and CSX Trade Receivables Corporation. Mr. Grandis was first elected to the Company’s Board of Directors in 1993. His current term as a director expires in 2005.

Glade M. Knight, 60, is Chairman and Chief Executive Officer of the Company. He was first elected to the Company’s Board of Directors in 1989. Mr. Knight is the founder, Chairman of the Board and Chief Executive Officer of three extended-stay hotel REITs, consisting of Apple Hospitality Two, Inc., Apple Hospitality Five, Inc. and Apple Suites, Inc. (which was acquired by Apple Hospitality Two, Inc. during the first quarter of 2003). During the first quarter of 2004, Mr. Knight founded Apple REIT Six, Inc., a start-up company that plans to acquire hotels, residential apartment communities and other income-producing real estate in selected metropolitan areas in the United States. Mr. Knight has an employment agreement with the Company that is renewable annually for a fixed number of one-year terms, the last of which would expire on September 30, 2006. He is Chairman of the Board of Trustees of Southern Virginia University in Buena Vista, Virginia. He also is a member of the advisory board to the Graduate School of Real Estate and Urban Land Development at Virginia Commonwealth University. He has served on a National Advisory Council for Brigham Young University and is a founding member of the university’s Entrepreneurial Department of the Graduate School of Business Management. He is the co-chairperson of the Company’s Executive Committee (as indicated in a following section). His current term as a director expires in 2005.

Stanley J. Olander, Jr., 49, is a director, President and Chief Financial Officer of the Company. Mr. Olander has been the Company’s Chief Financial Officer since September 1, 1996, and serves in that capacity under an employment agreement which has a five-year term ending on September 30, 2006. Mr. Olander was first elected to the Company’s Board of Directors in 1992. His current term as a director expires in 2006.

Martin Zuckerbrod, 73, is a director of the Company. He has practiced law since 1956, and has been involved in mortgage and real estate investment activities in the firm of Zuckerbrod & Taubenfeld of Cedarhurst, New York since 1959. Mr. Zuckerbrod’s areas of professional concentration are real estate and commercial law. Mr. Zuckerbrod also serves as a judge in the Village of Cedarhurst, New York. He is the co-chairperson of the Company’s Executive Committee (as indicated in a following section). Mr. Zuckerbrod was first elected to the Company’s Board of Directors in 1992. His current term as a director expires in 2006.

David L. Carneal, 40, is the Chief Operating Officer and an Executive Vice President of the Company. He joined the Company in 1996 as a regional vice president of operations. Prior to joining the Company, he served in executive management positions with various property management companies, including Trammell Crow Residential. In 1998, he became senior vice president of Apple Residential, Inc., which the Company acquired in 1999. In December 2003, Mr. Carneal was promoted from senior vice president of operations for the Company to his current positions.

Gus G. Remppies, 43, is the Chief Investment Officer and an Executive Vice President of the Company. He joined the Company in 1995 as vice president of acquisitions. Prior to joining the Company, he served as an acquisition specialist for Richmond-based Knight-Austin Corp. and as a mortgage banker for various lending institutions in the Richmond area. In December 2003, Mr. Remppies was promoted from senior vice president of acquisitions to his current positions.

6

Corporate Governance and Procedures for Shareholder Communications

Board of Directors. The Company’s Board of Directors has determined that all of the Company’s directors, except Messrs. Knight, Olander, Grandis and Houston, are “independent” within the meaning of the rules of the New York Stock Exchange. In making this determination, the Board considered all relationships between the director and the Company, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships.

The Board has adopted a categorical standard that a director is not independent (a) if he or she receives any personal financial benefit from, on account of or in connection with a relationship between the Company and the director (excluding directors fees), (b) if he or she is a partner, officer, employee or managing member of an entity that has a business or professional relationship with, and that receives compensation from, the Company, or (c) if he or she is a non-managing member or shareholder of such an entity and owns 10% or more of the membership interests or common stock of that entity. The Board may determine that a director with a business or other relationship that does not fit within the categorical standard described in the immediately preceding sentence is nonetheless independent, but in that event, the Board is required to disclose the basis for its determination in the Company’s next annual proxy statement. In accordance with the rules of the New York Stock Exchange, certain conditions prevent a director from being considered independent while the condition lasts and then for three years thereafter (or one year during the first year of such rules).

Executive Sessions. The non-management directors, who are all those directors not serving as officers of the Company, schedule and hold regular executive session meetings without management participation and with a view, among other things, to foster better communications among such non-management directors. In executive sessions of the Board, which consist of the non-management directors, the designated presiding director is Glenn W. Bunting, Jr. Any shareholder communications to the presiding director for executive sessions should be sent as indicated below under the subheading entitled “Shareholder Communications.”

Code of Ethics and Governance Guidelines. The Board has adopted a Code of Business Conduct and Ethics for the Company’s officers, directors and employees and a separate document containing Corporate Governance Guidelines for the Company. These documents are available on the Company’s website,www.cornerstonereit.com, and copies may be obtained free of charge upon request to the Senior Vice President of Corporate Services (as described in the preceding section entitled “Company Information”).

The purpose of the Code of Business Conduct and Ethics is to promote (a) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest, (b) full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by the Company, and (c) compliance with all applicable rules and regulations that apply to the Company and its officers and directors. The purpose of the Corporate Governance Guidelines is to set forth general principles for the governance of the Company in conjunction with (and subject to) applicable laws, the rules of the New York Stock Exchange and the Company’s charter and bylaws.

Shareholder Communications. In addition, shareholders may send communications to the Board or its members. Such communications should indicate the intended recipient(s) and should be sent in care of J. Philip Hart, General Counsel, to the address given in the preceding section entitled “Company Information.” Any communication regarding nominees for directors should include a request for further distribution to the Nominating and Governance Committee, which is among the standing committees discussed below. Each shareholder communication will receive an initial evaluation to determine, based on the substance and nature of the communication, a suitable process for internal distribution, review and response or other appropriate treatment.

7

Committees of the Board

Summary. The Board of Directors has four standing committees, which are specified below and have the following functions:

| | • | | Executive Committee. The Executive Committee has, to the extent permitted by law, all powers vested in the Board of Directors, except powers specifically withheld from the Committee under the Company’s bylaws. |

| | • | | Audit Committee. The Audit Committee operates in accordance with a written charter (which was amended and restated in 2004, is attached asAppendix A to this proxy statement and is available on the Company’s website atwww.cornerstonereit.com). The Audit Committee has the functions and responsibilities set forth in its charter. A report by the Audit Committee appears in another section below. |

| | • | | Compensation Committee. The Compensation Committee operates in accordance with a written charter (available on the Company’s website atwww.cornerstonereit.com). The Compensation Committee administers the Company’s incentive and stock option plans, oversees the compensation and reimbursement of directors and executive officers of the Company and has the other functions and responsibilities set forth in its charter. A report by the Compensation Committee appears in another section below. |

| | • | | Nominating and Governance Committee. The Nominating and Governance Committee operates in accordance with a written charter (available on the Company’s website atwww.cornerstonereit.com). As necessary, the Nominating and Governance Committee identifies individuals with the qualifications to become members of the Board of Directors, recommends to the Board the nominees to be presented for election to the Board or to fill vacancies on the Board, develops and recommends to the Board the corporate governance principles applicable to the Company, and has the other functions and responsibilities set forth in its charter. The Nominating and Governance Committee will consider director nominees recommended by shareholders in accordance with the procedures set forth in its charter and the Company’s bylaws and applicable law. As part of the process for identifying and evaluating each nominee for director, the Nominating and Governance Committee considers various factors it deems appropriate, including judgment, skill, diversity, strength of character, experience with businesses and organizations comparable in size or scope to the Company, experience and skill relative to other Board members, and specialized knowledge or experience. Depending on the current needs of the Board, certain factors may be weighed more or less heavily by the Nominating and Governance Committee. |

Committee Independence. The Board of Directors determined in 2004 that each current member of the Audit Committee (as shown in the table on the following page) is “independent” under the applicable listing standards of the New York Stock Exchange. To be considered independent, a member of the Audit Committee must not (other than in his or her capacity as a director or committee member, and subject to certain other limited exceptions) either (a) accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company or any subsidiary, or (b) be an affiliate of the Company or any subsidiary. The Board also has determined that each Audit Committee member is “financially literate” and that at least one member has “accounting or related financial management expertise,” as all such terms are used for purposes of the rules of the New York Stock Exchange. In addition, the Board has determined that the Audit Committee has a “financial expert” (who is identified in the following table) within the meaning of regulations issued by the Securities and Exchange Commission.

The Board further determined in 2004 that each current member (as shown in the following table) of the Compensation Committee and the Nominating and Governance Committee is “independent” under the applicable listing standards of the New York Stock Exchange.

Meetings and Membership. The Board held a total of seven meetings during 2003 (including regularly scheduled and special meetings). The following table shows both the membership of the Company’s standing

8

committees during 2003, the number of meetings held during 2003, and the current membership as of the Record Date:

| | | | | | |

Standing Committee

| | Members of Committee During 2003

| | Number of Committee

Meetings During 2003

| | Members of Committee as of Record Date

|

Executive | | Glade M. Knight*

Martin Zuckerbrod*

Glenn W. Bunting, Jr.

Harry S. Taubenfeld | | 2 | | Glade M. Knight*

Martin Zuckerbrod*

Glenn W. Bunting, Jr. |

| | | |

Audit | | Penelope W. Kyle*

Glenn W. Bunting, Jr.

Leslie A. Grandis | | 7 | | Robert A. Gary, IV*†

Glenn W. Bunting, Jr.

Harry S. Taubenfeld |

| | | |

Compensation | | Leslie A. Grandis*

Kent W. Colton

Penelope W. Kyle | | 3 | | Kent W. Colton*

Penelope W. Kyle

Harry S. Taubenfeld |

| | | |

Nominating and Governance | | Kent W. Colton*

Glenn W. Bunting, Jr. | | 4 | | Glenn W. Bunting, Jr.*

Kent W. Colton |

| * | | Indicates Chairperson (or co-chair, as applicable). |

| † | | Financial expert, as determined by the Board, within the meaning of regulations issued by the Securities and Exchange Commission. (As set forth in such regulations, such financial expert is not deemed an expert for any other purpose.) |

Attendance and Related Information. It is the policy of the Company that directors should attend each annual meeting of shareholders. The Company also expects directors to attend each regularly scheduled and special meeting of the Board, but recognizes that, from time to time, other commitments may preclude full attendance. In 2003, each director attended at least 75% of the total number of those meetings of the Board of Directors that were held during the period in which he or she was a director. All directors attended the 2003 annual meeting of shareholders. In addition, each director who served on a committee of the Board attended at least 75% of the total number of those meetings that were held by each applicable committee during the period of such service.

Compensation Committee Interlocks and Insider Participation

During 2003, the membership of the Company’s Compensation Committee and Audit Committee included Leslie A. Grandis, who is a partner in the law firm of McGuireWoods LLP, which serves as counsel to the Company. The representation of the Company by McGuireWoods LLP is expected to continue in 2004. Mr. Grandis no longer serves on any of the Company’s standing committees. The membership of the Compensation Committee included in 2003, and continues to include, Penelope W. Kyle, whose husband is also a partner in McGuireWoods LLP.

Compensation of Directors

During 2003, the directors of the Company were compensated as follows:

All Directors in 2003. All directors were reimbursed by the Company for travel and other out-of-pocket expenses incurred by them to attend meetings of the directors or a committee and in conducting the business of the Company.

Non-Employee Directors in 2003. The non-employee directors (classified by the Company as all directors other than Messrs. Knight and Olander) received annual directors’ fees of $12,000, with $6,000 payable in cash and the balance payable in Common Shares (valued at the current market price at the time of issuance), plus $1,000 for each meeting of the Board and $100 for each committee meeting attended. Non-employee directors

9

received an additional $1,000 for serving on the Executive Committee. Under the Company’s 1992 Non-Employee Directors Stock Option Plan (as amended and restated), each non-employee director received options to purchase 9,925 Common Shares, exercisable at $7.41 per Common Share (except for directors Gary and Houston, who each received upon joining the Board options for 5,000 Common Shares, exercisable (respectively) at $9.26 and $8.39 per Common Share).

Employee Directors in 2003. The directors who are also employees of the Company (Messrs. Knight and Olander) received no compensation from the Company for their services as directors.

Executive Officers

The Company currently has four executive officers. They are Glade M. Knight, Stanley J. Olander, Jr., David L. Carneal and Gus G. Remppies. Information about them is set forth above in the section “Election of Directors.”

Compensation of Executive Officers

General. The following table sets forth the compensation paid by the Company for each of the last three completed fiscal years to its Chief Executive Officer and to all executive officers of the Company whose total salary and bonus, by dollar-value, exceeded $100,000 during the last completed fiscal year (collectively, the “Named Executive Officers”):

Summary Compensation Table

| | | | | | | | | | | | |

| | | Annual Compensation (1)

| | Long-Term Compensation Awards

|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus ($)

| | Other Annual Com- pensation ($)

| | Restricted

Share Awards ($) (2)

| | Securities

Underlying

Options

|

Glade M. Knight,

Chairman and

Chief Executive Officer | | 2003

2002

2001 | | 250,000

250,000

220,000 | | —

—

105,000 | | —

—

— | | —

—

250,000 | | —

—

— |

| | | | | | |

Stanley J. Olander, Jr.,

President and

Chief Financial Officer | | 2003

2002

2001 | | 190,000

190,000

137,500 | | 142,050

—

60,000 | | —

—

— | | —

—

220,000 | | —

—

— |

| | | | | | |

Debra A. Jones,

Chief Operating Officer | | 2003

2002

2001 | | 190,000

190,000

137,500 | | —

—

60,000 | | —

—

— | | —

—

220,000 | | —

—

— |

| | | | | | |

David L. Carneal

Chief Operating Officer

(see note 1) | | 2003

2002

2001 | | 119,998

119,998

115,832 | | 16,233

541

510 | | —

—

— | | —

18,001

— | | —

—

— |

| | | | | | |

Gus G. Remppies

Chief Investment Officer (see note 1) | | 2003

2002

2001 | | 115,000

115,000

112,500 | | 31,083

2,807

48,710 | | —

—

— | | 84,250

17,252

— | | —

—

— |

| | (1) | | Messrs. Carneal and Remppies became executive officers on December 9, 2003. Ms. Jones ceased to serve as an officer and employee effective as of March 31, 2004. From December 9, 2003 until March 31, 2004 Ms. Jones and Mr. Carneal were Co-Chief Operating Officers. Bonuses may be awarded in 2004 and in future years in the discretion of the Board of Directors or its Compensation Committee. The Company provides each of the Named Executive Officers with the use of a Company automobile, and pays premiums for their term life, disability and health insurance. The value of such items was below the lesser of either (a) $50,000 or (b) 10% of the total salary and bonus of the Named Executive Officer in 2003. |

10

| | (2) | | The restricted Common Shares issued in 2001 were approved for issuance under the Company’s 1992 Incentive Plan in late 2000, based on 1999 performance. During 2001, such issuances were as follows: (a) Mr. Knight – 23,536 restricted Common Shares; and (b) each of Ms. Jones and Mr. Olander – 20,712 restricted Common shares. Dividends are paid on all restricted Common Shares issued to the Named Executive Officers. Pursuant to the terms of the issuance, the shares vest over four years, with one-fifth vesting at issuance and one-fifth vesting on each of the next four anniversaries (except with respect to Ms. Jones, whose restricted Common Shares became fully vested on March 31, 2004 in connection with her separation from the Company). Generally, if the holder of such restricted Common Shares ceases to be an employee of the Company for any reason other than death or permanent disability, the unvested portion of the restricted Common Shares will revert to the Company. |

Options. The Company did not grant any options for the purchase of Common Shares to the Named Executive Officers in 2003. The following table sets forth information with respect to those Named Executive Officers holding options for the purchase of Common Shares during 2003:

Aggregated Option Exercises In 2003

And 2003 Year-End Option Values

| | | | | | | | |

| | | | | | | Number of Securities

Underlying

Unexercised Options

at Year-End

| | Value of Unexercised

In-the-Money

Options at Year End

|

Name

| | Shares Acquired on Exercise

| | Value Realized ($)

| | Exercisable/ Unexercisable (1)

| | Exercisable/ Unexercisable ($)

|

Glade M. Knight (2) | | 0 | | 0 | | 829,211 | | n/a |

David L. Carneal | | 0 | | 0 | | 31,000 | | n/a |

Debra A. Jones (3) | | 0 | | 0 | | 144,310 | | n/a |

Stanley J. Olander, Jr. | | 0 | | 0 | | 304,310 | | n/a |

Gus G. Remppies | | 0 | | 0 | | 25,400 | | n/a |

| (1) | | All options held by the named individuals were exercisable at December 31, 2003. On such date, the closing price per Common Share was $8.76. Such options were granted in various amounts on different dates and at different exercise prices. The exercise prices range from a minimum of $9.63 to a maximum of $12.06, except in the case of the Award Options (see note (2) below). |

| (2) | | In 1999, Mr. Knight was granted options (“Award Options”) to purchase 348,771 of the Company’s Common Shares at an exercise price of $10.125. These options represent a “rollover” of certain options previously held by Mr. Knight with respect to common shares in Apple Residential Income Trust, Inc. (which the Company acquired by merger in 1999). If a triggering event occurs, the exercise price will be $1.00 per common share for 180 days following the triggering event. A triggering event means the occurrence of certain events, defined in the option agreement, reflecting a change or prospective change in control of the Company. If a triggering event occurs, and Mr. Knight either elects not to, or otherwise fails to, exercise any exercisable Award Options, then the Company must pay to Mr. Knight the difference between the exercise price and the value of the common shares that would be obtained upon exercise. If the exercise or the receipt of payment in lieu of such exercise subjects the holder to an additional penalty tax under the Internal Revenue Code, the Company will pay to the holder an additional amount to offset the penalty tax. |

| (3) | | Ms. Jones ceased to serve as an officer and employee effective as of March 31, 2004. |

Employment Agreements. Each of Glade M. Knight and Stanley J. Olander, Jr. has entered into an employment agreement with the Company, effective October 1, 2001. Neither Mr. Carneal nor Mr. Remppies has an employment agreement with the Company.

Mr. Knight’s employment agreement is renewable annually for a fixed number of one-year terms, the last of which would expire on September 30, 2006. The employment agreement with Mr. Olander has a five-year term

11

ending on September 30, 2006. Mr. Olander is obligated to devote all of his business time to the Company. Mr. Knight is not similarly restricted, although he has agreed to devote as much of his attention and energies to the business of the Company as is reasonably required in his judgment and that of the Board of Directors.

Mr. Knight’s employment agreement contains a limited covenant not to compete or interfere. His agreement provides that, during the term of his employment (and for a period of one year thereafter if he terminates his employment), he will not own, be employed by, or be connected in any manner with, a business that owns, operates or manages multi-family residential real property in the states in which the Company is engaged in such operations at such time. Furthermore, he has agreed not to solicit any person employed by the Company to leave such employment for employment with a competing business. Notwithstanding the foregoing, Mr. Knight is permitted to pursue other ventures, including real estate ventures, except as expressly prohibited by the covenant not to compete. The employment agreement for Mr. Olander contains a similar covenant not to solicit employees of the Company, but does not contain the anti-competition covenant described above.

Each employment agreement terminates automatically upon the officer’s death. The Company is obligated to pay to the decedent’s personal representative an amount equal to the decedent’s current annual salary in a one-time lump sum payment.

The Company may terminate the officer’s employment and the Company’s obligations under the employment agreement in the event of the “disability” of the officer or for “cause,” as defined in the agreement. “Disability” means inability to perform the essential functions of the position, after reasonable accommodation in accordance with the Americans with Disabilities Act, if such a disability results from a physical or mental impairment which can be expected to result in death or to continue for at least six consecutive months. In the event of termination for disability, the Company must pay the officer or his representative an amount equal to the officer’s current annual salary in a one-time lump sum payment. “Cause” is defined in the employment agreement as including continued or deliberate neglect of duties, willful misconduct of the officer injurious to the Company, violation of any code or standard of ethics applicable to Company employees, active disloyalty to the Company, conviction of a felony, habitual drunkenness or drug abuse, excessive absenteeism unrelated to a disability, or breach by the officer of the employment agreement. If the Company terminates the officer for “cause,” it will have no further obligation to the officer except under any applicable benefits policy or as otherwise provided by law.

Effective March 31, 2004, Ms. Jones ceased to serve as an officer and employee of the Company and her employment agreement with the Company was terminated. The Company has agreed to make payments to Ms. Jones in an amount equal to her salary under her previous employment agreement through September 30, 2006 (the termination date of such previous agreement). Ms. Jones is no longer eligible to receive from the Company any share awards or options, any bonuses, or any pension or retirement benefits, and will not receive any special “parachute” payments.

Change in Control Agreements. Effective August 1, 2000, the Company entered into separate Change in Control Agreements with each of Glade M. Knight and Stanley J. Olander, Jr. (each of whom is defined as an “Executive” thereunder). These Change in Control Agreements provide for certain payments in the event that the Company terminates an Executive’s employment other than for Cause (as defined therein) or an Executive terminates employment for Good Reason (as defined in therein). Such payments from the Company to the Executive would be follows:

(a) the Executive’s salary and any accrued paid time off through the date of the change in control;

(b) the Executive’s annual bonus for the calendar year immediately preceding the calendar year in which the change in control occurs multiplied by a fraction in which the numerator is the number of days employed by the Company during the change of control year and the denominator is 365;

(c) all amounts previously deferred by the Executive under any nonqualified compensation plan sponsored by the Company together with any accrued earnings thereon; and

12

(d) for Stanley J. Olander, the greater of $1,250,000, or three times the sum of the annual base salary and the annual bonus (as such amounts are defined therein) or for Glade M. Knight, the greater of $2,525,000, or three times the sum of the annual base salary and the annual bonus. The Change of Control Agreements define annual base salary as twelve times the Executive’s highest monthly base salary and define annual bonus as the largest annual bonus paid to the Executive during the 36-month period immediately preceding the month of the effective date of the change in control.

The Change of Control Agreements also provide for a gross-up payment to each Executive. This payment is intended to compensate the Executive for any and all taxes due under Section 4999 of the Internal Revenue Code or any other federal, state and local tax payable by the Executives as a result any payment received under the Change in Control Agreements.

Compensation Committee Report

The Compensation Committee determines compensation arrangements for the Company’s executive officers and administers the Company’s 1992 Incentive Plan, as amended, under which options for Common Shares and restricted Common Shares may be issued to eligible officers and employees.

In 2001, the Company entered into new employment agreements (as described above) with Mr. Knight, Ms. Jones and Mr. Olander, with the approval of the Compensation Committee. Under the employment agreements, the Company is required to review the performance of the executive officer at the end of each fiscal year of the Company and, in its sole discretion and based on the executive officer’s performance and the financial condition of the Company, may either maintain or increase the executive officer’s salary. Each employment agreement provides that the executive officer is eligible for an annual bonus and for an award of options for Common Share and a grant of restricted Common Shares. Mr. Knight’s employment agreement is renewable annually for a fixed number of one-year terms, the last of which would expire on September 30, 2006. Effective October 1, 2003, the Company extended the term of his employment agreement until September 30, 2004.

The Compensation Committee determined that the annual salaries for Mr. Knight, Ms. Jones and Mr. Olander for 2003 would be maintained at the same level that was in effect beginning October 1, 2001, which was the effective date of the new employment agreements with these executive officers. The Compensation Committee also determined that the Company would not pay bonuses or issue options for Common Shares or restricted Common Shares to the three executive officers for the year 2003.

As in past years, in determining compensation payable to the executive officers, the Compensation Committee considered a variety of factors, including the performance of such executive officers and the Company, the tenure of such executive officers and a review of comparable industry compensation. The Compensation Committee annually reviews the criteria to be used in determining salary increases and other compensation. The Compensation Committee generally seeks to establish and maintain criteria to help the Company achieve its business objectives by: (a) designing performance-based compensation standards that align the interests of management with the interests of shareholders; (b) providing compensation increases and incentive compensation that vary directly with both Company financial performance and individual contributions to that performance by the executive officer; and (c) linking executive officer compensation to elements that affect both short-and long-term common share price performance. As appropriate, the Compensation Committee will also consider whether compensation levels are sufficient to attract and retain superior executive officers in a competitive environment.

At its meeting on February 12, 2004, the Board of Directors appointed the undersigned board members to the Compensation Committee, all of whom the Board of Directors had previously determined to be independent in accordance with the Company’s independence standard. At that same meeting, the Board of Directors also approved and adopted a charter for the Compensation Committee.

April 7, 2004

Kent W. Colton, Chairperson

Penelope W. Kyle

Harry S. Taubenfeld

13

Audit Committee Report

The Audit Committee of the Board of Directors is composed of three directors. It operates under a written charter that was adopted by the Board of Directors on February 12, 2004, which is annually reassessed and updated, as needed, in accordance with applicable rules of the Securities and Exchange Commission. The Committee’s primary function is to assist the Board of Directors in its oversight of the Company’s financial reporting process. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements; accounting and financial reporting principles; internal controls; and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors, Ernst & Young LLP, are responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards.

In performing its oversight role, the Audit Committee has reviewed and discussed the audited financial statements with senior management and with the independent auditors. The Audit Committee also has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, and has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. The Audit Committee has considered whether the provision of non-audit services (none of which related to financial information systems design and implementation) by the independent auditors is permitted by applicable laws and is compatible with maintaining the auditors’ independence, and has discussed with the auditors the auditors’ independence. Based on the review and discussions described in this Report, and subject to the limitations on its role and responsibilities described below and in its charter, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003.

The activities of the Audit Committee during 2003 included receiving and discussing reports by senior management and by the independent auditors pertaining to certain financial reporting requirements imposed by, or that would in the future become effective under, the Sarbanes-Oxley Act of 2002. During the fourth quarter of 2003, Company management summarized for the Audit Committee steps it had undertaken to formalize its disclosure controls and procedures. At its meeting on February 12, 2004, the Board of Directors determined that (a) the Audit Committee would consist of the members identified below, (b) each such member meets the criteria for independence set forth in applicable rules of the Securities and Exchange Commission, (c) each member is “financially literate” and at least one member has “accounting or related financial experience,” as such terms are used for purposes of the relevant rules of the New York Stock Exchange, and (d) Robert A. Gary, IV is an “audit committee expert” within the meaning of applicable regulations of the Securities and Exchange Commission. At such meeting, the Audit Committee Charter was amended, restated and adopted by the Board.

The members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that the Company’s financial statements have been prepared in accordance with generally accepted accounting principles or that the audit of the Company’s financial statements by Ernst & Young LLP has been carried out in accordance with generally accepted auditing standards.

April 7, 2004

Robert A. Gary, IV, Chairperson

Glenn W. Bunting, Jr.

Harry S. Taubenfeld

14

Performance Graph

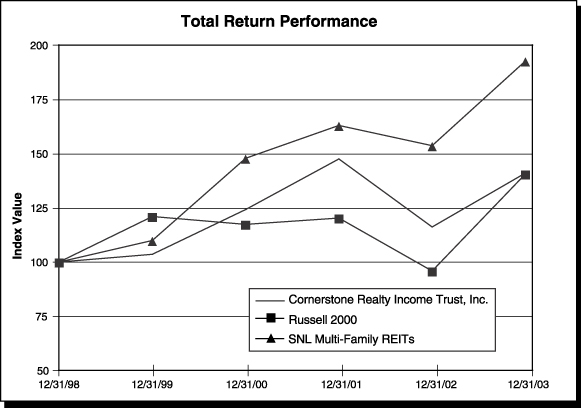

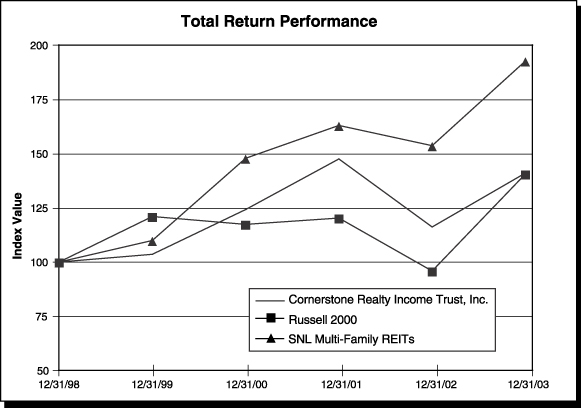

The following graph compares the cumulative total shareholder returns on the Common Shares, for the periods presented and with 1998 as the baseline year, to each of the Russell 2000 Index and the SNL Multi-Family REITs Index (which is an index of 22 other REITs). The indicated values are based on share price appreciation plus dividends, which are assumed to be reinvested. The historical information that follows is not necessarily an indication of future performance.

| | | | | | | | | | | | |

| | | Period Ending

|

Index

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

Cornerstone Realty Income Trust, Inc. | | 100.00 | | 103.63 | | 124.49 | | 148.10 | | 116.35 | | 141.54 |

Russell 2000 | | 100.00 | | 121.26 | | 117.59 | | 120.52 | | 95.83 | | 141.11 |

SNL Multi-Family REITs | | 100.00 | | 110.08 | | 148.43 | | 163.76 | | 154.32 | | 193.82 |

Certain Relationships and Agreements

Messrs. Zuckerbrod and Taubenfeld, who are directors of the Company, are principals in the law firm of Zuckerbrod & Taubenfeld of Cedarhurst, New York. This firm previously acted as counsel to the Company in connection with the Company’s acquisition of certain of its real properties and also rendered services on behalf of the Company in 2003 in exchange for the Company’s payment of fees in the amount of $70,000. In 2003, the Company discontinued its professional relationship with this firm for corporate governance reasons, and the Company made a determination that it will not use the firm for professional legal services in 2004 or thereafter.

As noted above, under “Compensation Committee Interlocks and Insider Participation,” Mr. Grandis, who is a director of the Company, is also a partner in the law firm of McGuireWoods LLP, which serves as counsel to

15

the Company and certain of its affiliates and which received legal fees for its services. Such representation is expected to continue in 2004. The husband of Penelope W. Kyle, a director of the Company, is also a partner in McGuireWoods LLP.

During 2003, Mr. Knight served as Chairman and Chief Executive Officer of three extended-stay hotel REITs, Apple Hospitality Two, Inc. (formed in 2001), Apple Hospitality Five, Inc. (formed in 2002) and Apple Suites, Inc. (formed in 1999 and acquired by Apple Hospitality Two, Inc. in a merger transaction during the first quarter of 2003). Mr. Knight continues to serve in such capacities on behalf of these other REITs. Mr. Knight also owns companies which provide services to these extended-stay hotel REITS. During 2003, the Company provided services to these other REITs (for real estate acquisitions and securities offerings, among other services) and received a total payment from them in the amount of approximately $200,000. During the first quarter of 2004, Mr. Knight formed Apple REIT Six, Inc., a start-up company that plans to acquire hotels, residential apartment communities and other income-producing real estate in selected metropolitan areas in the United States.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company’s directors and executive officers, and any persons holding more than 10% of the outstanding Common Shares, are required to file reports with the Securities and Exchange Commission with respect to their initial ownership of Common Shares and any subsequent changes in that ownership. The Company believes that during 2003 each of its executive officers and directors complied with all such filing requirements.

In making this statement, the Company has relied solely on written representations of its directors and executive officers and copies of reports that they have filed with the Securities and Exchange Commission. In 2003, and in 2004 through the Record Date, no person held more than 10% of the outstanding Common Shares.

Independent Public Accountants

The firm of Ernst & Young LLP served as independent auditors for the Company in 2003. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting. The representative will have an opportunity to make a statement if he or she so desires and will be available to answer appropriate questions from shareholders. The Board of Directors has approved the retention of Ernst & Young LLP as the Company’s independent auditors for 2004, based on the recommendation of the Audit Committee. Independent accounting fees for each of the last two fiscal years are shown in the table below:

| | | | | | | | |

Year

| | Audit Fees

| | Audit- Related Fees

| | Tax Fees

| | All Other Fees

|

2002 | | $233,200 | | — | | — | | — |

2003 | | $360,680 | | $52,000 | | — | | — |

All services rendered by Ernst & Young LLP are permissible under applicable laws and regulations and were pre-approved by the Audit Committee, as required by law. The nature of the services categorized above are described below:

Audit Fees. These are fees for professional services rendered for the audit of the Company’s annual financial statements, reviews of the financial statements included in the Company’s Form 10-Q filings or services normally provided by the independent auditor in connection with statutory or regulatory filings or engagements.

Audit-Related Fees. These are fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. In 2003, such services included accounting consultations in connection with acquisitions and access to the auditor’s accounting research service.

16

Tax Fees. Such services, while not provided to the Company by its auditors, Ernst & Young LLP, include tax compliance, tax advice and tax planning.

All Other Fees. These are fees for other permissible work that does not meet the above category descriptions. Such services include information technology and technical assistance provided to the Company.

These accounting services are actively monitored (as to both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence in the core area of accounting work by Ernst & Young LLP, which is the audit of the Company’s consolidated financial statements.

Pre-Approval Policy for Audit and Non-Audit Services. In accordance with the Sarbanes-Oxley Act of 2002, all audit and non-audit services provided to the Company by its independent auditors must be pre-approved by the Audit Committee. All services reported in the fees table shown above for fiscal years 2002 and 2003 were pre-approved by the full Audit Committee, as required by then applicable law.

Matters to be Presented Next Year at the 2005 Annual Meeting of Shareholders

Any qualified shareholder who wishes to make a proposal to be acted upon next year at the 2005 Annual Meeting of Shareholders must submit such proposal for inclusion in the Proxy Statement and Proxy Card to the Company at its principal office in Richmond, Virginia, by no later than December 21, 2004.

For shareholder proposals not included in the Company’s proxy statement for the 2005 Annual Meeting of Shareholders, the persons named by the Board of Directors proxy will be entitled to exercise discretionary voting power under the circumstances set forth in Rule 14a-4(c) under the Securities Exchange Act of 1934, unless the shareholder making the proposal both notifies the Secretary of the Company of the proposal by March 6, 2005, and otherwise follows the procedures specified in such Rule.

Other Matters for the 2004 Annual Meeting of Shareholders

Management knows of no matters, other than those stated above, that are likely to be brought before the Annual Meeting. However, if any matters that are not currently known come before the Annual Meeting, the persons named in the enclosed proxy are expected to vote the Common Shares represented by such proxy on such matters in accordance with their best judgment.

By Order of the Board of Directors

J. Philip Hart

Secretary

April 7, 2004

THE COMPANY DEPENDS UPON ALL SHAREHOLDERS PROMPTLY SIGNING AND RETURNING THE ENCLOSED PROXY CARD TO AVOID COSTLY SOLICITATION. YOU CAN SAVE THE COMPANY CONSIDERABLE EXPENSE BY SIGNING AND RETURNING YOUR PROXY CARD IMMEDIATELY.

17

Appendix A

CORNERSTONE REALTY INCOME TRUST, INC.

AUDIT COMMITTEE CHARTER

(Amended and Restated as of February 12, 2004)

Organization

| 1. | | The Audit Committee is a committee of the Board of Directors. The members and chair of the committee will be elected by the full Board and will serve at the pleasure of the Board. The Audit Committee must have a minimum of three members. |

| 2. | | All members of the committee must meet the independence requirements for audit committee members under the listing standards of the New York Stock Exchange and Securities and Exchange Commission Rule 10A-3. Each member of the committee must be financially literate and at least one member of the committee must have accounting or related financial management expertise, as the Board interprets such qualifications in its business judgment. If an audit committee member simultaneously serves on the audit committees of more than three public companies, the Board must determine that such simultaneous service would not impair his or her ability to serve on the audit committee and must disclose this determination in the annual proxy statement. |

| 3. | | The committee may not delegate any of its functions to a subcommittee without the authorization of the Board. |

| 4. | | The committee will regularly report on actions taken by it to the full Board. |

| 5. | | The committee is authorized to obtain advice and assistance as it believes necessary from corporate personnel and to engage independent counsel and other advisers, as it determines necessary to carry out its duties. |

| 6. | | The committee will maintain, with the assistance of management, a calendar incorporating regular reporting items it requires from the independent auditor, the internal audit function and management during the year. |

| 7. | | The Company will provide for adequate funding, as determined by the Audit Committee, in its capacity as a committee of the Board of Directors, for payment of (i) compensation of the independent auditor for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company, (ii) compensation of any advisers employed by the Audit Committee in accordance with paragraph 5 and (iii) ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its duties. |

Purpose

The purpose of the committee is to:

| | • | | Assist Board oversight of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications and independence and (iv) the performance of the Company’s internal audit function and independent auditor; and |

| | • | | Prepare the committee report to be included in the Company’s proxy statement in accordance with applicable rules and regulations. |

A-1

Duties and Responsibilities

The committee’s duties and responsibilities will be to:

| 1. | | In its capacity as a committee of the Board of Directors, be directly responsible for the appointment, compensation, retention and oversight of the work of the independent auditor. Each independent audit firm retained by the Company for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company will report directly to the committee. |

| 2. | | Approve all audit engagement fees and terms and all non-audit engagements with the independent auditor. |

| 3. | | On an annual basis, obtain and review a report by the independent auditor describing (i) all relationships the independent auditor has with the Company, including any management consulting services and related fees provided to the auditor (so that the committee may assess the auditor’s independence); (ii) the firm’s internal quality-control procedures; and (iii) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues. In connection with its evaluation of the independent auditor, the committee should, in addition to assuring the regular rotation of the lead audit partner as required by law, consider whether, in order to assure continuing auditor independence, there should be regular rotation of the audit firm itself. |

| 4. | | Review and approve the committee’s report to be included in the proxy statement and the Company’s response to any comments of the Securities and Exchange Commission on the report. |

| 5. | | Review and discuss with management and the independent auditor the Company’s annual and quarterly financial statements, including the Company’s critical accounting estimates underlying the financial statements and other disclosures discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operation”; the effect of regulatory and accounting initiatives and any off-balance sheet structures on the Company’s financial statements; and any certification, report, opinion or review rendered by the independent auditor. |

| 6. | | Resolve any disagreements between management and the independent auditor regarding financial reporting. |

| 7. | | Discuss with management the Company’s earnings press releases before their release. In addition, discuss the types of financial information and earnings guidance provided to analysts and rating agencies. In connection with these discussions, management should identify and explain the use of any “pro forma” or “adjustment” information presented on a basis other than that prescribed by generally accepted accounting principles. |

| 8. | | Periodically consult with the independent auditor, outside the presence of management, about internal controls and the quality of the Company’s financial statements. As part of this review, the committee will receive regular reports from the Company’s counsel on significant litigation in which the Company is involved and the anticipated impact of such litigation. |

| 9. | | Meet separately, at least quarterly, with management, the personnel responsible for the internal auditing function and the independent auditor to review the integrity of the Company’s financial reporting processes, both internal and external. |

| 10. | | Discuss with management significant risks or exposures that the Company may have and the steps management has taken to monitor and control such risks or exposures. |

| 11. | | Review and discuss with management and the independent auditor (i) major issues regarding accounting principles and financial statement presentation, including any significant changes in the Company’s selection or application of accounting principles or adoption of new accounting principles; (ii) major issues as to the adequacy of the Company’s internal controls and any special audit steps adopted in light of material control deficiencies; and (iii) analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection the preparation of the |

A-2

| | financial statements, including analyses prepared by management and the independent auditor of the effects of applying alternative accounting principles on the financial statements. |

| 12. | | Consider, in consultation with the independent auditor, the personnel responsible for the internal auditing function and the chief financial officer, the audit scope and plan. Review with the independent auditor, the personnel responsible for the internal auditing function and the chief financial officer the coordination of the audit effort with respect to completeness of coverage, reduction of redundant efforts, and the effective use of audit resources. |

| 13. | | Review with the independent auditor any audit problems or difficulties and management’s response. This review must include any restrictions on the scope of the independent auditor’s activities or on access to requested information and discussion of any disagreements with management. It should also include accounting adjustments proposed by the independent auditor but not adopted; communications between the audit team and the audit firm’s national office with regard to auditing or accounting issues presented by the engagement; and any management or internal control letter issued or proposed to be issued by the independent auditor. |

| 14. | | Receive any reports from the independent auditor under the provisions of Section 10A of the Securities Exchange Act of 1934 and review with management and recommend to the Board appropriate remedial action to be taken by the Company. |

| 15. | | Establish hiring policies with respect to employees or former employees of the independent auditor. |

| 16. | | Review legal and regulatory matters that may have a material impact on the Company’s financial statements. |

| 17. | | Perform such other functions as may be assigned by the Board of Directors or as specified in policies adopted or approved by the Board of Directors. |

| 18. | | Establish procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls or auditing matters, and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. Receive reports regarding any violations of the Company’s Code of Business Conduct and Ethics relating to accounting, financial reporting or internal controls. |

| 19. | | Evaluate the committee’s own performance annually and report the results of the evaluation to the Board. |

| 20. | | Review this charter at least annually and update as necessary (with any amendments subject to approval by the Board). |

Role of the Audit Committee

This charter assigns oversight responsibilities to the audit committee. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements; accounting and financial reporting principles; internal controls; and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditor is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards

The members of the audit committee are not acting as experts in accounting or auditing and rely without independent verification on the information provided to them and on the representations made by management and the independent auditor. Accordingly, the audit committee’s oversight does not provide an independent basis to determine that the Company’s financial statements have been prepared in accordance with generally accepted accounting principles or that the audit of the Company’s financial statements by the independent auditor has been carried out in accordance with generally accepted auditing standards.

A-3

PROXY

CORNERSTONE REALTY INCOME TRUST, INC.

306 East Main Street

Richmond, VA 23219

This Proxy is solicited on behalf of Management

The undersigned hereby appoints J. Philip Hart, Mark M. Murphy and Martin B. Richards as Proxies, each with the power to appoint his substitute, and hereby authorizes each of them to represent and to vote, as designated below, all common shares of Cornerstone Realty Income Trust, Inc. held by the undersigned on March 31, 2004, at the Annual Meeting of Shareholders to be held on May 25, 2004, or any adjournment thereof. If a director nominee specified below ceases to be available for election as a director, discretionary authority may be exercised by each of the proxies named herein to vote for a substitute.

Management recommends a vote of“FOR” in item 1.

| | | | |

1. ELECTION OF DIRECTORS | | ¨ FOR all nominees listed below (except as marked to the contrary below) | | ¨ WITHHOLD AUTHORITY to vote for all nominees listed below |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, write that nominee’s name on the space provided below.)

Robert A. Gary, IV W. Tennent Houston Penelope W. Kyle Harry S. Taubenfeld

(Continued on reverse side)

(Continued from reverse side)

2. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTEDFOR THE NOMINEES LISTED ABOVE.

Please indicate whether you plan to attend the Annual Meeting in person: r Yes r No

Please print exact name(s) in which shares are registered, and sign exactly as name appears. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership or other entity, please sign in partnership or other entity name by authorized person.

Dated: , 2004

Printed Name

Signature

Signature if held jointly

Title of Signing Person (if applicable)

Please mark, sign, date and return the Proxy

Card promptly using the enclosed envelope.