UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811- 05901 )

Exact name of registrant as specified in charter: Putnam Investment Grade Municipal Trust

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| One Post Office Square | |

| Boston, Massachusetts 02109 | |

| Copy to: | John W. Gerstmayr, Esq. |

| Ropes & Gray LLP | |

| One International Place | |

| Boston, Massachusetts 02110 | |

Registrant’s telephone number, including area code: (617) 292-1000

Date of fiscal year end: November 30, 2006

Date of reporting period: December 1, 2005— May 31, 2006

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

We have stringent investor protections and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam

Investment Grade

Municipal Trust

5| 31| 06

Semiannual Report

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 13 |

| Your fund’s management | 16 |

| Terms and definitions | 19 |

| Trustee approval of management contract | 20 |

| Other information for shareholders | 25 |

| Financial statements | 26 |

Cover photograph: © Richard H. Johnson

Message from the Trustees

Dear Fellow Shareholder

Investors continue to keep a close watch on the course of the economy. Globally, it appears that, assuming economic growth exceeds 4% in 2006, we will have seen the strongest economic performance over a four-year period in over thirty years. Corporate profits have boomed around the world, business capacity utilization rates have moved up, and unemployment rates have come down. Given such a sustained period of robust growth, it is not surprising that prices have begun to rise, inflation rates have crept up, and central banks in many countries, particularly the Federal Reserve (the Fed) in the United States, have pushed interest rates higher.

In recent weeks, investors have worried that these higher rates could threaten the fundamentals of the global economy, prompting a widespread sell-off. However, we believe that today’s higher interest rates, far from being a threat to global economic fundamentals, are in fact an integral part of them. Higher interest rates are bringing business borrowing costs closer to the rate of return available from investments. In our view, this should help provide the basis for a longer and more durable business expansion and a continued healthy investment environment.

You can be assured that the investment professionals managing your fund are closely monitoring the factors that influence the performance of the securities in which your fund invests. Moreover, Putnam Investments’ management team, under the leadership of Chief Executive Officer Ed Haldeman, continues to focus on investment performance and remains committed to putting the interests of shareholders first.

2

In the following pages, members of your fund’s management team discuss the fund’s performance and strategies for the fiscal period ended May 31, 2006, and provide their outlook for the months ahead. As always, we thank you for your support of the Putnam funds.

Putnam Investment Grade Municipal Trust:

potential for income exempt from federal income tax

Municipal bonds finance important public projects such as schools, roads, and hospitals, and they can help investors keep more of their investment income. Putnam Investment Grade Municipal Trust offers another advantage — the flexibility to invest in municipal bonds issued by any state in the country.

Municipal bonds are typically issued by states and local municipalities to raise funds for building and maintaining public facilities. The income from a municipal bond is generally exempt from federal income tax. The bonds are backed by either the issuing city or town or by revenues collected from usage fees.

The fund’s management team can select bonds issued by a variety of state and local governments. The fund also combines bonds of differing quality levels to increase income potential. The portfolio focuses primarily on investment-grade bonds to seek a high level of overall credit quality. The team also allocates a portion of assets to lower-rated bonds, which may offer higher income in return for more risk. When deciding whether to invest in a bond, the team considers factors such as credit risk, interest-rate risk, and the risk that the bond will be prepaid. Once a bond has been purchased, the team continues to monitor developments that affect the bond market, the sector, and the issuer of the bond. Typically, lower-rated bonds are reviewed more often because of their greater potential risk.

Putnam Investment Grade Municipal Trust’s management team is backed by the resources of Putnam’s fixed-income organization, one of the largest in the investment industry. Putnam’s municipal bond analysts are grouped into sector teams and conduct ongoing, rigorous research.

The goal of the management team’s research and active management is to stay a step ahead of the industry and pinpoint opportunities to adjust the fund’s holdings — either by acquiring

Municipal bonds may finance a range of community projects

and thus play a key role in local development.

more of a particular bond or selling it — for the benefit of the fund and its shareholders.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. Please consult with your tax advisor for more information. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Leverage can mean higher returns, but adds risk and may increase share price volatility.

How do closed-end funds differ from open-end funds?

More assets at work While open-end funds must maintain a cash position to meet redemptions, closed-end funds have no such requirement and can keep more of their assets invested in the market.

Traded like stocks Closed-end fund shares are traded on stock exchanges, and their market prices fluctuate in response to supply and demand, among other factors.

Market price vs. net asset value

Like an open-end fund’s net asset value (NAV) per share, the NAV of a closed-end fund share equals the current value of the fund’s assets, minus its liabilities, divided by the number of shares outstanding. However, when buying or selling closed-end fund shares, the price you pay or receive is the market price. Market price reflects current market supply and demand and may be higher or lower than the NAV.

Strategies for higher income Closed-end funds have greater flexibility to use strategies such as “leverage” — for example, issuing preferred shares to raise capital, then seeking to invest that capital at higher rates to enhance return for common shareholders.

5

Putnam Investment Grade Municipal Trust is a leveraged fund that seeks as high a level of current income free from federal income tax as Putnam Management believes is consistent with preservation of capital by investing primarily in investment-grade municipal bonds. The fund may be suitable for investors seeking tax-exempt income who can accept a higher level of risk in exchange for the potentially higher level of income offered by a leveraged fund.

Highlights

* For the six months ended May 31, 2006, Putnam Investment Grade Municipal Trust returned 1.93% at net asset value (NAV) and 2.82% at market price.

* The fund’s benchmark, the Lehman Municipal Bond Index, returned 1.51% ..

* The average return for the fund’s Lipper category, General Municipal Debt Funds (leveraged closed-end) was 2.65% .

* Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 13.

Performance

It is important to note that a fund’s performance at market price may differ from its results at NAV. Although market price performance generally reflects investment results, it may also be influenced by several other factors, including changes in investor perceptions of the fund or its investment advisor, market conditions, fluctuations in supply and demand for the fund’s shares, and changes in fund distributions.

Total return for periods ended 5/31/06

Since the fund's inception (10/26/89), average annual return is 7.38% at NAV and 6.00% at market price.

| Average annual return | Cumulative return | |||

| NAV | Market price | NAV | Market price | |

| 10 years | 6.36% | 3.59% | 85.24% | 42.31% |

| 5 years | 6.25 | 3.65 | 35.38 | 19.61 |

| 3 years | 5.98 | -0.29 | 19.05 | -0.88 |

| 1 year | 2.49 | 1.04 | 2.49 | 1.04 |

| 6 months | — | — | 1.93 | 2.82 |

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes.

6

Report from the fund managers

The period in review

Solid economic growth and investors’ pursuit of income during the past six months drove credit spreads narrower for higher-yielding bonds. Your fund’s emphasis on tobacco settlement bonds, appreciation from a pre-refunded holding, and use of leverage enabled it to outperform its benchmark, the Lehman Municipal Bond Index, at NAV. The fund’s relatively short duration was also a positive factor as interest rates continued to rise, causing bond prices to fall. However, our yield curve strategy had its downside, as interest rates for bonds with shorter maturities increased more than rates for longer-term bonds. In addition, the overall quality of the fund’s portfolio was higher than that of other funds in its Lipper group. Lower-quality bonds continued to outperform higher-quality issues during the period, causing the fund’s results at NAV to lag the average for its Lipper category.

Market overview

Amid continuing signs of solid economic growth, and the potential for inflation that often accompanies such growth, the Fed increased the federal funds rate four times during the first half of the fund’s fiscal year, lifting this benchmark for overnight loans between banks from 4.00% to 5.00% . Bond yields rose across the maturity spectrum, leading to a convergence of shorter- and longer-term rates. As rates converged, the yield curve — a graphical representation of yields for bonds of comparable quality plotted from the shortest to the longest maturity — flattened.

During the period, tax-exempt bonds generally outperformed comparable Treasury bonds, as prices of tax-exempt bonds declined less than Treasury prices across all maturities. Municipal bonds typically perform better than Treasuries when interest rates are rising. However, the degree to which they outperformed Treasuries was greater than we expected.

A robust economy and rising corporate earnings contributed to the

7

strong relative performance of lower-rated bonds. Among uninsured bonds in general and especially bonds rated Baa and below, yield spreads tightened as lower-rated bonds performed better than higher-rated bonds. The superior performance of lower-rated bonds was primarily the result of strong demand by buyers searching for higher yields. Non-rated bonds also rallied. In addition, as a result of favorable legal rulings, tobacco settlement bonds generally outperformed the broader market. Also, airline-related industrial development bonds (IDBs) performed exceptionally well, in our view.

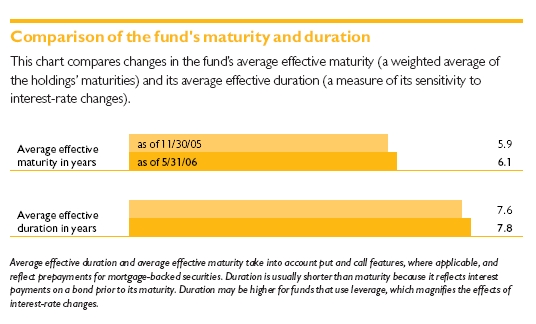

Strategy overview

Given our expectation for rising interest rates, we maintained a short (defensive) portfolio duration relative to the fund’s Lipper peer group, a strategy that contributed positively to results for the period as rates rose. Duration is a measure of a fund’s sensitivity to changes in interest rates. Having a shorter-duration portfolio may help protect principal when interest rates rise, but it can reduce appreciation potential when rates fall.

The fund’s yield curve positioning, or the maturity profile of its holdings, detracted from performance during the period but did not negate the positive contribution provided by our duration strategy. In order to keep the fund’s duration short, we limited

| Market sector performance | |

| These indexes provide an overview of performance in different market sectors for the | |

| six months ended 5/31/06. | |

| Bonds | |

| Lehman Municipal Bond Index (tax-exempt bonds) | 1.51% |

| Lehman Aggregate Bond Index (broad bond market) | 0.01% |

| Lehman Government Bond Index (U.S. Treasury and agency securities) | –0.25% |

| JP Morgan Global High Yield Index (global high-yield corporate bonds) | 4.56% |

| Equities | |

| S&P 500 Index (broad stock market) | 2.60% |

| Russell 1000 Index (large-company stocks) | 2.77% |

| Russell 2000 Index (small-company stocks) | 7.03% |

8

exposure to longer-maturity bonds, favoring intermediate-maturity securities instead. However, as the yield curve flattened and shorter- and longer-term yields converged, bonds with longer maturities performed better than their intermediate-maturity counterparts.

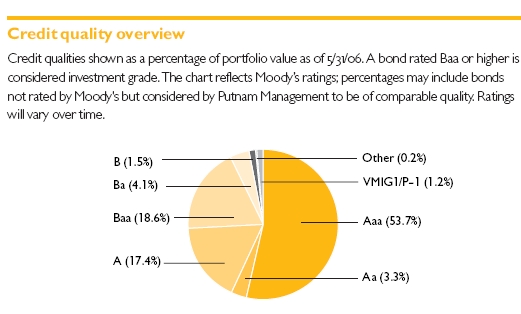

The fund’s underweight position in the lowest-rated bonds (i.e., those rated Ba and below), compared to other funds in its peer group, detracted from results as securities in this area of the market rallied. This underweight was based on our analysis of lower-rated bonds, which concluded that better relative value existed in bonds rated Baa and higher at this point in the credit cycle. In recent months, the continued narrowing of credit spreads — or the reduced premium investors stand to receive by investing in lower-rated issues — has not been supported by credit fundamentals, in our view. The fund’s overweight position in Baa-rated bonds, compared to other funds in its peer group, boosted results as securities in this area of the market continued to perform well.

The fund’s underweight position in airline-related IDBs (industrial development bonds) modestly detracted from performance as this sector posted strong results for the period. An overweight position in tobacco settlement bonds contributed positively to results, as these bonds continued to strengthen during the period.

9

Your fund’s holdings

While tobacco settlement bonds gener ally carry investment-grade ratings, they are secured by the income stream from tobacco companies’ settlement obligations to the states and generally offer higher yields than bonds of comparable quality. An improving litigation environment has led to higher prices for these bonds, and your fund’s holdings in this sector of the municipal bond market contributed favorably to results. We also think tobacco settlement bonds provide additional diversification, since their performance is not as closely tied to economic growth as other holdings. The fund owns or owned tobacco settlement bonds issued in six states during the period: California, New Jersey, South Carolina, South Dakota, Washington, and Wisconsin.

Among the fund’s best-performing individual issues were Illinois Development Finance Authority Hospital revenue bonds issued for Adventist Health System, which were pre-refunded in December 2005. Pre-refunding occurs when an issuer refinances an older, higher-coupon bond by issuing new bonds at current, lower interest rates. The proceeds are then invested in a secure investment — usually U.S. Treasury securities — that matures at the original bond’s first call date, effectively raising its perceived credit rating, but shortening its effective maturity. The effective maturity of the Adventist Health System bonds moved from 2024 to 2009.

10

The fund had only a small exposure to airline-related industrial development bonds (IDBs), which rebounded during the period. IDBs are issued by municipalities but backed by the credit of the company or institution benefiting from the financing. Investor perceptions about the backing company’s health, or that of its industry, affect the prices of these bonds more than the rating of the issuing municipality. The airline industry has been struggling ever since the terrorist attacks of September 2001, and rising fuel prices made a bad situation worse. However, a gradual rise in passenger counts and the recent rise in ticket prices helped improve airlines’ balance sheets, and many investors rushed to buy airline-related bonds. Your fund’s modest position in IDBs issued in New York City for British Airways — which have been in the portfolio for a long time — benefited from the rally, but other funds in the peer group with larger positions in this sector were able to participate more fully. Although we believe airlines are showing signs of stabilization and we are watching the situation carefully, we prefer to wait for more attractive opportunities before increasing the fund’s exposure.

Finally, to help broaden the fund’s diversification, we have been looking for opportunities in single-family housing bonds, where rising interest rates and declining mortgage prepayments make the sector seem increasingly attractive. We recently purchased some high-quality, single-family mortgage bonds issued in New Mexico.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

11

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

We believe that the Fed’s tightening cycle is nearing an end but expect that rates will continue to rise over the near term. Consequently, we currently plan to maintain the fund’s defensive duration because we believe that the municipal bond market may be susceptible to weaker returns in the coming months. A key reason for this belief is the market’s unusually strong performance versus taxable equivalents for the fiscal period. In our view, the municipal market’s exceptional results can be attributed primarily to a combination of robust demand and limited new-issue supply.

It appears to us that the extended rally among lower-rated, higher-yielding bonds may be in its final stages. We base this view, in part, on the fact that the difference in yields between Aaa-rated bonds and Baa-rated bonds — the lowest investment-grade rating — is at its narrowest point since late 1999. In other words, the reward in terms of higher yields for assuming additional credit risk has diminished substantially. Therefore, we remain cautious with respect to securities at the lower end of the credit spectrum.

We continue to have a positive view of defensive sectors such as single-family housing bonds, which performed well over most of the fiscal period.

Finally, our view on tobacco settlement bonds remains positive as we believe that they represent good investment opportunities relative to the inherent risks associated with the sector.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. The fund’s shares trade on a stock exchange at market prices, which may be higher or lower than the fund’s net asset value. The fund uses leverage, which involves risk and may increase the volatility of the fund’s net asset value.

12

Your fund’s performance

This section shows your fund’s performance for periods ended May 31, 2006, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

Fund performance

Total return and comparative index results for periods ended 5/31/06

| Lipper General | ||||

| Lehman | Municipal Debt | |||

| Municipal | Funds (leveraged | |||

| Market | Bond | closed-end) | ||

| NAV | price | Index | category average* | |

| Annual average | ||||

| Life of fund | ||||

| (since 10/26/89) | 7.38% | 6.00% | 6.73% | 7.29% |

| 10 years | 85.24 | 42.31 | 78.16 | 91.68 |

| Annual average | 6.36 | 3.59 | 5.95 | 6.71 |

| 5 years | 35.38 | 19.61 | 29.26 | 41.38 |

| Annual average | 6.25 | 3.65 | 5.27 | 7.14 |

| 3 years | 19.05 | -0.88 | 9.97 | 17.66 |

| Annual average | 5.98 | -0.29 | 3.22 | 5.54 |

| 1 year | 2.49 | 1.04 | 1.88 | 3.29 |

| 6 months | 1.93 | 2.82 | 1.51 | 2.65 |

Performance assumes reinvestment of distributions and does not account for taxes.

Index and Lipper results should be compared to fund performance at net asset value. Lipper calculations for reinvested dividends may differ from actual performance.

* Over the 6-month and 1-, 3-, 5-, and 10-year periods ended 5/31/06, there were 56, 56, 55, 45, and 39 funds, respectively, in this Lipper category.

13

| Fund price and distribution information | ||

| For the six-month period ended 5/31/06 | ||

| Distributions* — common shares | ||

| Number | 6 | |

| Income1 | $0.246400 | |

| Capital gains2 | — | |

| Total | $0.246400 | |

| Series A | ||

| Distributions* — preferred shares | (1,400 shares) | |

| Income1 | $1,606.62 | |

| Capital gains2 | — | |

| Total | $1,606.62 | |

| Common share value: | NAV | Market price |

| 11/30/05 | $10.81 | $9.34 |

| 5/31/06 | 10.74 | 9.36 |

| Current yield (common shares, end of period) | ||

| Current dividend rate3 | 4.57% | 5.24% |

| Taxable equivalent4 | 7.03 | 8.06 |

| * | Dividend sources are estimated and may vary based on final tax calculations after the fund's fiscal year-end. |

| 1 | For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. |

| 2 | Capital gains, if any, are taxable for federal and, in most cases, state purposes. |

| 3 | Most recent distribution, excluding capital gains, annualized and divided by NAV or market price at end of period. |

| 4 | Assumes maximum 35% federal tax rate for 2006. Results for investors subject to lower tax rates would not be as advantageous. |

14

Fund performance for most recent calendar quarter

Total return for periods ended 6/30/06

| NAV | Market price | |

| Annual average | ||

| Life of fund (since 10/26/89) | 7.31% | 6.04% |

| 10 years | 82.55 | 43.10 |

| Annual average | 6.20 | 3.65 |

| 5 years | 33.28 | 14.53 |

| Annual average | 5.91 | 2.75 |

| 3 years | 18.03 | –3.05 |

| Annual average | 5.68 | –1.03 |

| 1 year | 0.99 | 2.33 |

| 6 months | 0.15 | 2.70 |

15

Your fund’s management

Your fund is managed by the members of the Putnam Tax Exempt Fixed-Income Team. David Hamlin is the Portfolio Leader, and Paul Drury, Susan McCormack, and James St. John are Portfolio Members of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Tax Exempt Fixed-Income Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Fund ownership by the Portfolio Leader and Portfolio Members

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund (in dollar ranges). Information shown is as of May 31, 2006, and May 31, 2005.

| $1 – | $10,001 – | $50,001 – | $100,001 – | $500,001 – | $1,000,001 | |||

| Year | $0 | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | and over | |

| David Hamlin | 2006 | * | ||||||

| Portfolio Leader | 2005 | * | ||||||

| Paul Drury | 2006 | * | ||||||

| Portfolio Member | 2005 | * | ||||||

| Susan McCormack | 2006 | * | ||||||

| Portfolio Member | 2005 | * | ||||||

| James St. John | 2006 | * | ||||||

| Portfolio Member | 2005 | * | ||||||

16

Fund manager compensation

The total 2005 fund manager compensation that is attributable to your fund is approximately $170,000. This amount includes a portion of 2005 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2005 compensation paid to the Chief Investment Officer of the team and the Group Chief Investment Officer of the fund’s broader investment category for their oversight responsibilities, calculated based on the fund assets they oversee taken as a percentage of the total assets they oversee. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2005, the calculation reflects annualized 2005 compensation or an estimate of 2006 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

David Hamlin is the Portfolio Leader and Paul Drury, Susan McCormack, and James St. John are Portfolio Members for Putnam’s tax-exempt funds for the following states: Arizona, California, Florida, Massachusetts, Michigan, Minnesota, New Jersey, New York, Ohio, and Pennsylvania. The same group also manages Putnam AMT-Free Insured Municipal Fund, Putnam California Investment Grade Municipal Trust, Putnam High Yield Municipal Trust, Putnam Managed Municipal Income Trust, Putnam Municipal Bond Fund, Putnam Municipal Opportunities Trust, Putnam New York Investment Grade Municipal Trust, Putnam Tax Exempt Income Fund, Putnam Tax-Free Health Care Fund, and Putnam Tax-Free High Yield Fund.

David Hamlin, Paul Drury, Susan McCormack, and James St. John may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

Your fund’s Portfolio Leader and Portfolio Members did not change during the year ended May 31, 2006.

17

Fund ownership by Putnam’s Executive Board

The table below shows how much the members of Putnam’s Executive Board have invested in the fund (in dollar ranges). Information shown is as of May 31, 2006, and May 31, 2005.

| $1 – | $10,001 – | $50,001– | $100,001 | |||

| Year | $0 | $10,000 | $50,000 | $100,000 | and over | |

| Philippe Bibi | 2006 | * | ||||

| Chief Technology Officer | 2005 | * | ||||

| Joshua Brooks | 2006 | * | ||||

| Deputy Head of Investments | 2005 | * | ||||

| William Connolly | 2006 | * | ||||

| Head of Retail Management | N/A | |||||

| Kevin Cronin | 2006 | * | ||||

| Head of Investments | 2005 | * | ||||

| Charles Haldeman, Jr. | 2006 | * | ||||

| President and CEO | 2005 | * | ||||

| Amrit Kanwal | 2006 | * | ||||

| Chief Financial Officer | 2005 | * | ||||

| Steven Krichmar | 2006 | * | ||||

| Chief of Operations | 2005 | * | ||||

| Francis McNamara, III | 2006 | * | ||||

| General Counsel | 2005 | * | ||||

| Richard Robie, III | 2006 | * | ||||

| Chief Administrative Officer | 2005 | * | ||||

| Edward Shadek | 2006 | * | ||||

| Deputy Head of Investments | 2005 | * | ||||

| Sandra Whiston | 2006 | * | ||||

| Head of Institutional Management | N/A | |||||

N/A indicates the individual was not a member of Putnam's Executive Board as of 5/31/05.

18

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the value of all your fund’s assets, minus any liabilities and the net assets allocated to any outstanding preferred shares, divided by the number of outstanding common shares.

Market price is the current trading price of one share of the fund. Market prices are set by transactions between buyers and sellers on exchanges such as the New York Stock Exchange and the American Stock Exchange.

Comparative indexes

JP Morgan Global High Yield Index is an unmanaged index of global high-yield fixed-income securities.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Government Bond Index is an unmanaged index of U.S. Treasury and agency securities.

Lehman Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Russell 1000 Index is an unmanaged index of the 1,000 largest companies in the Russell 3000 Index.

Russell 2000 Index is an unmanaged index of the 2,000 smallest companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

19

Trustee approval of

management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months beginning in March and ending in June 2005, the Contract Committee met five times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. Upon completion of this review, the Contract Committee recommended and the Independent Trustees approved the continuance of your fund’s management contract, effective July 1, 2005.

This approval was based on the following conclusions:

* That the fee schedule currently in effect for your fund, subject to certain changes noted below, represents reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

* That such fee schedule represents an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

20

Model fee schedules and categories; total expenses

The Trustees’ review of the management fees and total expenses of the Putnam funds focused on three major themes:

* Consistency. The Trustees, working in cooperation with Putnam Management, have developed and implemented a series of model fee schedules for the Putnam funds designed to ensure that each fund’s management fee is consistent with the fees for similar funds in the Putnam family of funds and compares favorably with fees paid by competitive funds sponsored by other investment advisors. Under this approach, each Putnam fund is assigned to one of several fee categories based on a combination of factors, including competitive fees and perceived difficulty of management, and a common fee schedule is implemented for all funds in a given fee category. The Trustees reviewed the model fee schedules then in effect for the Putnam funds, including fee levels and breakpoints, and the assignment of each fund to a particular fee category under this structure. (“Breakpoints” refer to reductions in fee rates that apply to additional assets once specified asset levels are reached.)

Since their inception, Putnam’s closed-end funds have generally had management fees that are higher than those of Putnam’s open-end funds pursuing comparable investment strategies. These differences ranged from five to 20 basis points. The Trustees have reexamined this matter and recommended that these differences be conformed to a uniform five basis points. At a meeting on January 13, 2006, the Trustees approved an amended management contract for your fund to memorialize the arrangements agreed to in June 2005. Under the new fee schedule, which went into effect January 1, 2006, the fund pays a quarterly fee to Putnam Management at the lower of the following rates:

(a) 0.55% of the fund’s average net assets (including assets attributable to both common and preferred shares) or

(b) 0.65% of the first $500 million of the fund’s average net assets (including assets attributable to both common and preferred shares);

0.55% of the next $500 million;

0.50% of the next $500 million;

0.45% of the next $5 billion;

0.425% of the next $5 billion;

0.405% of the next $5 billion;

0.39% of the next $5 billion; and

0.38% thereafter.

The new fee schedule for your fund has resulted in lower management fees paid by common shareholders. The Trustees approved the new fee schedules for the funds effective as of January 1, 2006, in order to provide Putnam Management an opportunity to accommodate the impact on revenues in its budget process for the coming year.

21

* Competitiveness. The Trustees also reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 53rd percentile in management fees and in the 53rd percentile in total expenses as of December 31, 2004 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). The Trustees expressed their intention to monitor this information closely to ensure that fees and expenses of the Putnam funds continue to meet evolving competitive standards.

* Economies of scale. The Trustees concluded that the fee schedule currently in effect for your fund, which as of January 1, 2006, reflects the changes noted above, represents an appropriate sharing of economies of scale at current asset levels. The Trustees examined the existing breakpoint structure of the Putnam funds’ management fees in light of competitive industry practices. The Trustees considered various possible modifications to the Putnam funds’ current breakpoint structure, but ultimately concluded that the current breakpoint structure continues to serve the interests of fund shareholders. Accordingly, the Trustees continue to believe that the fee schedules currently in effect for the funds, taking into account the changes noted above, represent an appropriate sharing of economies of scale at current asset levels.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the funds’ investment process and performance by the work of the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing the fund’s performance with various benchmarks and with the performance of competitive funds. The

22

Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and continued to discuss with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of under-performance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional remedial changes are warranted.

In the case of your fund, the Trustees considered that your fund’s common share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper General Municipal Debt Funds (leveraged closed-end); compared using tax-adjusted performance to recognize the different federal income tax treatment for capital gains distributions and exempt-interest distributions) for the one-, three-, and five-year periods ended December 31, 2004 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| One-year period | Three-year period | Five-year period |

| 25th | 29th | 51st |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three-, and five-year periods ended December 31, 2004, there were 65, 56, and 51 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future performance.)

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees believe that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees believe that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment advisor for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

* The percentile rankings for your fund’s common share annualized total return performance in the Lipper General Municipal Debt Funds (leveraged closed-end) category for the one-, five-, and ten-year periods ended June 30, 2006, were 67%, 83%, and 53%, respectively. Over the one-, five-, and ten-year periods ended June 30, 2006, the fund ranked 38th out of 56, 39th out of 46, and 21st out of 39 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

23

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment advisor, subject to the obligation to seek best execution. The Trustees believe that soft-dollar credits and other potential benefits associated with the allocation of fund brokerage, which pertains mainly to funds investing in equity securities, represent assets of the funds that should be used for the benefit of fund shareholders. This area has been marked by significant change in recent years. In July 2003, acting upon the Contract Committee’s recommendation, the Trustees directed that allocations of brokerage to reward firms that sell fund shares be discontinued no later than December 31, 2003. In addition, commencing in 2004, the allocation of brokerage commissions by Putnam Management to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash. The Trustees will continue to monitor the allocation of the funds’ brokerage to ensure that the principle of “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of your fund’s custodian and investor servicing agreements with Putnam Fiduciary Trust Company, which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but have not relied on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

24

Other information

for shareholders

Important notice regarding share repurchase program

In October 2005, the Trustees of your fund authorized Putnam Investments to implement a repurchase program on behalf of your fund, which would allow your fund to repurchase up to 5% of its outstanding shares over the 12 months ending October 6, 2006. In March 2006, the Trustees approved an increase in this repurchase program to allow the fund to repurchase a total of up to 10% of its outstanding shares over the same period.

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2005, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

25

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

26

The fund’s portfolio 5/31/06 (Unaudited)

| Key to abbreviations | |

| AMBAC AMBAC Indemnity Corporation | GNMA Coll. Government National Mortgage |

| COP Certificate of Participation | Association Collateralized |

| FGIC Financial Guaranty Insurance Company | G.O. Bonds General Obligation Bonds |

| FHA Insd. Federal Housing Administration Insured | MBIA MBIA Insurance Company |

| FHLMC Coll. Federal Home Loan Mortgage | PSFG Permanent School Fund Guaranteed |

| Corporation Collateralized | U.S. Govt. Coll. U.S. Government Collateralized |

| FNMA Coll. Federal National Mortgage | VRDN Variable Rate Demand Notes |

| Association Collateralized | XLCA XL Capital Assurance |

| FSA Financial Security Assurance |

| MUNICIPAL BONDS AND NOTES (162.3%)* | |||||

| Rating ** | Principal amount | Value | |||

| Alabama (0.2%) | |||||

| Sylacauga, Hlth. Care Auth. Rev. Bonds | |||||

| (Coosa Valley Med. Ctr.), Ser. A, 6s, 8/1/25 | B/P | $ | 400,000 | $ | 410,152 |

| Arizona (1.5%) | |||||

| AZ Hlth. Fac. Auth. Hosp. Syst. Rev. Bonds | |||||

| (John C. Lincoln Hlth. Network), 6 3/8s, | |||||

| 12/1/37 (Prerefunded) | BBB | 500,000 | 572,995 | ||

| Casa Grande, Indl. Dev. Auth. Rev. Bonds | |||||

| (Casa Grande Regl. Med. Ctr.), Ser. A, | |||||

| 7 5/8s, 12/1/29 | B+/P | 1,175,000 | 1,297,165 | ||

| Pima Cnty., Indl Dev. Auth. Rev. Bonds | |||||

| (Horizon Cmnty. Learning Ctr.), 5.05s, 6/1/25 | BBB- | 525,000 | 500,346 | ||

| Scottsdale, Indl. Dev. Auth. Hosp. Rev. | |||||

| Bonds (Scottsdale Hlth. Care), 5.8s, 12/1/31 | A3 | 1,000,000 | 1,060,420 | ||

| 3,430,926 | |||||

| Arkansas (2.1%) | |||||

| AR State Hosp. Dev. Fin. Auth. Rev. Bonds | |||||

| (Washington Regl. Med. Ctr.), 7 3/8s, | |||||

| 2/1/29 (Prerefunded) | Baa2 | 3,000,000 | 3,364,800 | ||

| Independence Cnty., Poll. Control Rev. | |||||

| Bonds (Entergy, Inc.), 5s, 1/1/21 | A- | 500,000 | 502,725 | ||

| Little Rock, G.O. Bonds (Cap. Impt.), FSA, | |||||

| 3.95s, 4/1/19 | Aaa | 760,000 | 748,167 | ||

| 4,615,692 | |||||

27

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| California (20.3%) | |||||

| Anaheim, Pub. Fin. Auth. Tax Alloc. Rev. | |||||

| Bonds, MBIA, 6.45s, 12/28/18 | Aaa | $ | 4,000,000 | $ | 4,242,960 |

| CA Edl. Fac. Auth. Rev. Bonds (U. of the | |||||

| Pacific), 5s, 11/1/21 | A2 | 525,000 | 540,461 | ||

| CA Hlth. Fac. Auth. Rev. Bonds (Sutter | |||||

| Hlth.), Ser. A, MBIA, 5 3/8s, 8/15/30 | Aaa | 2,500,000 | 2,584,700 | ||

| CA State G.O. Bonds | |||||

| 5 1/8s, 4/1/23 | A1 | 500,000 | 521,050 | ||

| 5.1s, 2/1/34 | A1 | 750,000 | 759,075 | ||

| CA State Dept. of Wtr. Resources Rev. | |||||

| Bonds, Ser. A | |||||

| 6s, 5/1/15 (Prerefunded) | Aaa | 1,500,000 | 1,693,545 | ||

| AMBAC, 5 1/2s, 5/1/13 # | Aaa | 13,000,000 | 14,212,250 | ||

| 5 1/2s, 5/1/11 | A2 | 1,500,000 | 1,610,310 | ||

| CA State Econ. Recvy. G.O. Bonds, Ser. A, | |||||

| 5s, 7/1/16 | Aa3 | 1,000,000 | 1,042,200 | ||

| CA Statewide Cmnty. Dev. Auth. COP (The | |||||

| Internext Group), 5 3/8s, 4/1/30 | BBB | 1,750,000 | 1,746,360 | ||

| Cathedral City, Impt. Board Act of 1915 | |||||

| Special Assmt. Bonds (Cove Impt. Dist.), | |||||

| Ser. 04-02, 5.05s, 9/2/35 | BB+/P | 270,000 | 267,130 | ||

| Chula Vista, Indl. Dev. Rev. Bonds (San | |||||

| Diego Gas), Ser. B, 5s, 12/1/27 | A1 | 640,000 | 652,902 | ||

| Gilroy, Rev. Bonds (Bonfante Gardens | |||||

| Park), 8s, 11/1/25 | B-/P | 576,000 | 480,436 | ||

| Golden State Tobacco Securitization Corp. | |||||

| Rev. Bonds | |||||

| Ser. 03 A-1, 6 1/4s, 6/1/33 | BBB | 1,000,000 | 1,088,320 | ||

| Ser. B, 5 5/8s, FHLMC Coll., 6/1/38 | |||||

| (Prerefunded) | AAA | 1,500,000 | 1,653,090 | ||

| Ser. 03 A-1, 5s, 6/1/21 | BBB | 420,000 | 422,369 | ||

| Orange Cnty., Cmnty. Fac. Dist. Special | |||||

| Tax Rev. Bonds (Ladera Ranch - No. 02-1), | |||||

| Ser. A, 5.55s, 8/15/33 | BBB/P | 450,000 | 458,451 | ||

| Riverside Cnty., Redev. Agcy. Tax Alloc., | |||||

| Ser. A, XLCA, 5s, 10/1/29 | Aaa | 4,700,000 | 4,808,899 | ||

| Roseville, Cmnty. Fac. Special Tax Bonds | |||||

| (Dist. No. 1 - Westpark), 5 1/4s, 9/1/19 | BB/P | 875,000 | 894,206 | ||

| Sacramento, Special Tax Bonds (North | |||||

| Natomas Cmnty. Fac.), 5s, 9/1/18 | BB/P | 1,040,000 | 1,051,118 | ||

| Santa Clara Cnty., Fin. Auth. Lease Rev. | |||||

| Bonds (Multiple Fac.), Ser. I, AMBAC, | |||||

| 5s, 5/15/20 | Aaa | 3,000,000 | 3,160,950 | ||

| Vallejo, COP (Marine World Foundation), | |||||

| 7.2s, 2/1/26 | BBB-/P | 1,400,000 | 1,449,378 | ||

| 45,340,160 | |||||

28

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Colorado (4.6%) | |||||

| CO Hlth. Fac. Auth. Rev. Bonds (Hlth. Fac. - | |||||

| Evangelical Lutheran), 3.35s, 10/1/06 | A3 | $ | 2,500,000 | $ | 2,489,025 |

| CO Springs, Hosp. Rev. Bonds | |||||

| 6 3/8s, 12/15/30 (Prerefunded) | A3 | 1,485,000 | 1,656,503 | ||

| 6 3/8s, 12/15/30 | A3 | 1,515,000 | 1,645,139 | ||

| CO State Hsg. Fin. Auth. Rev. Bonds | |||||

| (Single Fam.) | |||||

| Ser. B-2 , 7s, 5/1/26 | Aa2 | 95,000 | 96,154 | ||

| Ser. B-3, 6.8s, 11/1/28 | Aa2 | 50,000 | 50,451 | ||

| Denver, City & Cnty. Arpt. Rev. Bonds, | |||||

| MBIA, 5 1/2s, 11/15/25 | Aaa | 2,500,000 | 2,543,475 | ||

| U. of CO. Enterprise Syst. Rev. Bonds, | |||||

| FGIC, 5s, 6/1/26 | Aaa | 1,650,000 | 1,714,152 | ||

| 10,194,899 | |||||

| Delaware (0.7%) | |||||

| GMAC Muni. Mtge. Trust 144A sub. notes | |||||

| Ser. A1-3, 5.3s, 10/31/39 | A3 | 500,000 | 514,500 | ||

| Ser. A1-2, 4.9s, 10/31/39 | A3 | 1,000,000 | 1,010,250 | ||

| 1,524,750 | |||||

| District of Columbia (1.9%) | |||||

| DC, G.O. Bonds, Ser. B, FSA, 5 1/4s, 6/1/26 | Aaa | 4,000,000 | 4,148,760 | ||

| Florida (3.2%) | |||||

| Escambia Cnty., Hlth. Fac. Auth. Rev. | |||||

| Bonds (Baptist Hosp. & Baptist Manor), | |||||

| 5 1/8s, 10/1/19 | Baa1 | 1,895,000 | 1,920,128 | ||

| Lee Cnty., Indl. Dev. Auth. Rev. Bonds | |||||

| (Alliance Cmnty.), Ser. C, 5 1/2s, 11/15/29 | BBB- | 1,000,000 | 993,580 | ||

| Miami Beach, Hlth. Fac. Auth. Hosp. Rev. | |||||

| Bonds (Mount Sinai Med. Ctr.), | |||||

| 5 3/8s, 11/15/28 | BB+ | 2,000,000 | 1,987,560 | ||

| Okeechobee Cnty., Solid Waste Mandatory | |||||

| Put Bonds (Waste Mgt./Landfill), Ser. A, | |||||

| 4.2s, 7/1/09 | BBB | 375,000 | 373,601 | ||

| Reunion West, Cmnty. Dev. Dist. Special | |||||

| Assmt. Bonds, 6 1/4s, 5/1/36 | BB-/P | 850,000 | 887,655 | ||

| Tern Bay, Cmnty. Dev. Dist. Rev. Bonds, | |||||

| Ser. B, 5s, 5/1/15 | BB-/P | 450,000 | 449,595 | ||

| Tolomato, Cmnty. Dev. Dist. Special Assmt. | |||||

| Bonds, 5.4s, 5/1/37 | BB-/P | 175,000 | 175,224 | ||

| Wentworth Estates Cmnty., Dev. Dist. | |||||

| Special Assmt. Bonds, Ser. B, 5 1/8s, 11/1/12 | BB-/P | 465,000 | 466,460 | ||

| 7,253,803 | |||||

29

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Georgia (5.4%) | |||||

| Atlanta, Arpt. Rev. Bonds, Ser. B, FGIC, | |||||

| 5 5/8s, 1/1/30 | Aaa | $ | 1,500,000 | $ | 1,565,325 |

| Atlanta, Wtr. & Waste Wtr. Rev. Bonds, | |||||

| Ser. A, FGIC, 5s, 11/1/38 (Prerefunded) | Aaa | 1,045,000 | 1,089,695 | ||

| Burke Cnty., Poll. Control Dev. Auth. | |||||

| Mandatory Put Bonds (GA Power Co.), | |||||

| 4.45s, 12/1/08 | A2 | 2,300,000 | 2,331,349 | ||

| Cobb Cnty., Dev. Auth. U. Fac. Rev. Bonds | |||||

| (Kennesaw State U. Hsg.), Ser. A, MBIA, | |||||

| 5s, 7/15/29 | Aaa | 5,215,000 | 5,361,750 | ||

| GA Med. Ctr. Hosp. Auth. Rev. Bonds, MBIA, | |||||

| 6.367s, 8/1/10 | Aaa | 600,000 | 600,984 | ||

| Rockdale Cnty., Dev. Auth. Solid Waste | |||||

| Disp. Rev. Bonds (Visay Paper, Inc.), | |||||

| 7.4s, 1/1/16 | B+/P | 1,200,000 | 1,200,576 | ||

| 12,149,679 | |||||

| Hawaii (0.4%) | |||||

| HI State Hsg. & Cmnty. Dev. Corp. Rev. | |||||

| Bonds (Single Fam. Mtge.), Ser. B, 3.7s, 1/1/22 | Aaa | 900,000 | 889,344 | ||

| Idaho (0.2%) | |||||

| ID Hsg. & Fin. Assn. Rev. Bonds (Single | |||||

| Fam. Mtge.), Ser. C-2, FHA Insd., 5.15s, 7/1/29 | Aaa | 500,000 | 507,585 | ||

| Illinois (11.5%) | |||||

| Chicago, G.O. Bonds, Ser. A, FSA, 5s, 1/1/27 | Aaa | 4,270,000 | 4,389,005 | ||

| Chicago, Board of Ed. G.O. Bonds | |||||

| (School Reform), Ser. A | |||||

| AMBAC, 5 1/4s, 12/1/27 | Aaa | 2,500,000 | 2,596,675 | ||

| FGIC, zero %, 12/1/18 | Aaa | 5,440,000 | 3,008,374 | ||

| Cook Cnty., Cmnty. G.O. Bonds (Cons. | |||||

| School Dist. No. 64 Pk. Ridge), FSA, | |||||

| 5 1/2s, 12/1/16 | Aaa | 1,580,000 | 1,757,055 | ||

| IL Dev. Fin. Auth. Rev. Bonds (Midwestern | |||||

| U.), Ser. B, 6s, 5/15/26 | A- | 1,600,000 | 1,727,728 | ||

| IL Dev. Fin. Auth. Hosp. Rev. Bonds | |||||

| (Adventist Hlth. Syst./Sunbelt | |||||

| Obligation), 5.65s, 11/15/24 | |||||

| (Prerefunded) | A2 | 2,500,000 | 2,669,075 | ||

| IL State Toll Hwy. Auth. Rev. Bonds, FSA, | |||||

| Ser. A-1, 5s, 1/1/23 | Aaa | 2,250,000 | 2,349,495 | ||

| IL U. Rev. Bonds (Auxiliary Fac. Syst.), | |||||

| Ser. A, AMBAC, 5 1/4s, 4/1/19 | Aaa | 1,945,000 | 2,135,629 | ||

| Schaumburg, G.O. Bonds, Ser. B, FGIC, 5s, | |||||

| 12/1/27 | Aaa | 5,000,000 | 5,153,400 | ||

| 25,786,436 | |||||

30

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Indiana (1.6%) | |||||

| IN State Dev. Fin. Auth. Env. Impt. Rev. | |||||

| Bonds (USX Corp.), 5.6s, 12/1/32 | Baa1 | $ | 2,600,000 | $ | 2,671,942 |

| Rockport, Poll. Control Rev. Bonds | |||||

| (Indiana-Michigan Pwr.), Ser. A, 4.9s, 6/1/25 | Baa2 | 1,000,000 | 1,005,550 | ||

| 3,677,492 | |||||

| Iowa (0.9%) | |||||

| IA Fin. Auth. Hlth. Care Fac. Rev. Bonds | |||||

| (Care Initiatives), 9 1/4s, 7/1/25 | BBB-/P | 1,695,000 | 2,007,439 | ||

| Kansas (0.1%) | |||||

| Salina, Hosp. Rev. Bonds (Salina Regl. | |||||

| Hlth.), 5s, 10/1/23 | A1 | 300,000 | 306,759 | ||

| Louisiana (0.9%) | |||||

| Ernest N. Morial-New Orleans, Exhibit Hall | |||||

| Auth. Special Tax Bonds, Ser. A, AMBAC, | |||||

| 5 1/4s, 7/15/21 | Aaa | 1,500,000 | 1,555,725 | ||

| LA Pub. Fac. Auth. Rev. Bonds (Pennington | |||||

| Med. Foundation), 5s, 7/1/16 | A3 | 400,000 | 414,076 | ||

| 1,969,801 | |||||

| Maine (0.5%) | |||||

| ME State Hsg. Auth. Rev. Bonds, | |||||

| Ser. D-2-AMT, 5s, 11/15/27 | Aa1 | 1,185,000 | 1,204,647 | ||

| Massachusetts (11.3%) | |||||

| MA State Dev. Fin. Agcy. Rev. Bonds (MA | |||||

| Biomedical Research), Ser. C, 6 3/8s, 8/1/17 | A1 | 2,785,000 | 3,017,074 | ||

| MA State Hlth. & Edl. Fac. Auth. Rev. Bonds | |||||

| (Civic Investments/HPHC), | |||||

| Ser. A, 9s, 12/15/15 | BBB-/P | 1,000,000 | 1,206,250 | ||

| (Jordan Hosp.), Ser. E, 6 3/4s, 10/1/33 | BBB- | 750,000 | 814,365 | ||

| (Med. Ctr. of Central MA), AMBAC, | |||||

| 6.55s, 6/23/22 | Aaa | 16,400,000 | 17,214,579 | ||

| (UMass Memorial), Ser. D, 5s, 7/1/33 | Baa2 | 500,000 | 496,315 | ||

| MA State Hsg. Fin. Agcy. Rev. Bonds | |||||

| (Rental Mtge.), Ser. C, AMBAC, | |||||

| 5 5/8s, 7/1/40 | Aaa | 2,500,000 | 2,542,350 | ||

| 25,290,933 | |||||

| Michigan (4.0%) | |||||

| Detroit, Swr. Disp. VRDN, Ser. B, FSA, | |||||

| 3.21s, 7/1/33 | VMIG1 | 3,150,000 | 3,150,000 | ||

| Dickinson Cnty., Econ. Dev. Corp. Poll. | |||||

| Control Rev. Bonds (Intl. Paper Co.), | |||||

| Ser. A, 4.8s, 11/1/18 | BBB | 900,000 | 876,168 | ||

| Flint, Hosp. Bldg. Auth. Rev. Bonds | |||||

| (Hurley Med. Ctr.), 6s, 7/1/20 | Baa3 | 75,000 | 77,346 | ||

31

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Michigan continued | |||||

| MI State Hosp. Fin. Auth. Rev. Bonds | |||||

| (Oakwood Hosp.), Ser. A, 5 3/4s, 4/1/32 | A2 | $ | 1,000,000 | $ | 1,044,000 |

| (Holland Cmnty. Hosp.), Ser. A, FGIC, | |||||

| 5 3/4s, 1/1/21 | A2 | 1,250,000 | 1,333,588 | ||

| MI State Hsg. Dev. Auth. Rev. Bonds, | |||||

| Ser. A, 3.9s, 6/1/30 | Aaa | 1,200,000 | 1,192,176 | ||

| Saginaw Cnty., G.O. Bonds (Healthsource | |||||

| Saginaw, Inc.), MBIA, 5s, 5/1/26 | Aaa | 1,210,000 | 1,260,251 | ||

| 8,933,529 | |||||

| Minnesota (2.3%) | |||||

| Cohasset, Poll. Control Rev. Bonds | |||||

| (Allete, Inc.), 4.95s, 7/1/22 | A | 2,500,000 | 2,504,850 | ||

| Minneapolis, Cmnty. Dev. Agcy. Supported | |||||

| Dev. Rev. Bonds, Ser. G-3, 5.45s, 12/1/31 | A+ | 1,705,000 | 1,841,434 | ||

| Minneapolis, Hlth. Care Syst. VRDN | |||||

| (Fairview Hlth. Svcs.), Ser. C, MBIA, | |||||

| 3.21s, 11/15/26 | VMIG1 | 500,000 | 500,000 | ||

| St. Paul, Hsg. & Redev. Auth. Hosp. Rev. | |||||

| Bonds (Hlth. East), 6s, 11/15/25 | Baa3 | 350,000 | 377,720 | ||

| 5,224,004 | |||||

| Mississippi (2.4%) | |||||

| Lowndes Cnty., Solid Waste Disp. & Poll. | |||||

| Control Rev. Bonds (Weyerhaeuser Co.) | |||||

| Ser. A, 6.8s, 4/1/22 | Baa2 | 500,000 | 590,290 | ||

| Ser. B, 6.7s, 4/1/22 | Baa2 | 525,000 | 614,156 | ||

| MS Bus. Fin. Corp. Poll. Control Rev. | |||||

| Bonds (Syst. Energy Resources, Inc.), | |||||

| 5 7/8s, 4/1/22 | BBB- | 1,750,000 | 1,760,885 | ||

| MS Dev. Bk. Special Obligation Rev. Bonds | |||||

| (Jackson, MS), FSA, 5 1/4s, 3/1/21 | Aaa | 1,385,000 | 1,516,326 | ||

| MS Home Corp. Rev. Bonds (Single Fam. | |||||

| Mtge.), Ser. B-2, GNMA Coll., FNMA Coll., | |||||

| 6.45s, 12/1/33 | Aaa | 740,000 | 773,263 | ||

| 5,254,920 | |||||

| Missouri (2.3%) | |||||

| Cape Girardeau Cnty., Indl. Dev. Auth. | |||||

| Hlth. Care Fac. Rev. Bonds (St. Francis | |||||

| Med. Ctr.), Ser. A, 5 1/2s, 6/1/16 | A+ | 1,250,000 | 1,328,863 | ||

| MO Hsg. Dev. Comm. Rev. Bonds | |||||

| (Home Ownership), Ser. D, GNMA Coll., | |||||

| FNMA Coll., 5.55s, 9/1/34 | Aaa | 1,120,000 | 1,152,032 | ||

| MO State Hlth. & Edl. Fac. Auth. Rev. | |||||

| Bonds (BJC Hlth. Syst.), 5 1/4s, 5/15/32 | Aa2 | 1,000,000 | 1,034,030 | ||

32

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Missouri continued | |||||

| MO State Hsg. Dev. Comm. Mtge. Rev. Bonds | |||||

| (Single Fam. Homeowner Loan) | |||||

| Ser. A-2, GNMA Coll., 6.3s, 3/1/30 | AAA | $ | 850,000 | $ | 883,108 |

| Ser. C, GNMA Coll., FNMA Coll., | |||||

| 5.6s, 9/1/35 | AAA | 700,000 | 740,691 | ||

| 5,138,724 | |||||

| Nevada (3.7%) | |||||

| Clark Cnty., Arpt. Rev. Bonds, Ser. A-2, | |||||

| FGIC, 5 1/8s, 7/1/26 | Aaa | 5,105,000 | 5,311,804 | ||

| Clark Cnty., Impt. Dist. Special Assmt. | |||||

| Bonds (Summerlin No. 151), 5s, 8/1/25 | BB/P | 700,000 | 683,928 | ||

| Henderson, Local Impt. Dist. Special | |||||

| Assmt. Bonds | |||||

| (No. T-16), 5.1s, 3/1/21 | BB-/P | 1,000,000 | 995,820 | ||

| (No. T-17), 5s, 9/1/25 | BB/P | 225,000 | 221,432 | ||

| (No. T-14), 4 3/4s, 3/1/10 | BB/P | 1,135,000 | 1,144,205 | ||

| 8,357,189 | |||||

| New Hampshire (0.4%) | |||||

| NH State Bus. Fin. Auth. Poll. Control | |||||

| Rev. Bonds, 3 1/2s, 7/1/27 | Baa2 | 950,000 | 919,154 | ||

| New Jersey (6.9%) | |||||

| NJ Econ. Dev. Auth. Rev. Bonds | |||||

| (Cedar Crest Vlg., Inc.), Ser. A, | |||||

| 7 1/4s, 11/15/31 | BB-/P | 650,000 | 701,981 | ||

| (Cigarette Tax), 5 3/4s, 6/15/29 | Baa2 | 1,750,000 | 1,857,258 | ||

| (Motor Vehicle), Ser. A, MBIA, 5s, 7/1/27 | Aaa | 5,000,000 | 5,184,600 | ||

| NJ State G.O. Bonds, Ser. F, MBIA, | |||||

| 5 1/2s, 8/1/11 | AAA | 3,100,000 | 3,350,511 | ||

| NJ State Rev. Bonds (Trans. Syst.), | |||||

| Ser. C, AMBAC, zero %, 12/15/24 | Aaa | 4,800,000 | 1,961,088 | ||

| NJ State Edl. Fac. Auth. Rev. Bonds | |||||

| (Fairleigh Dickinson), Ser. C, 6s, 7/1/20 | BBB-/F | 750,000 | 823,815 | ||

| Tobacco Settlement Fin. Corp. Rev. Bonds | |||||

| 6 3/4s, 6/1/39 | BBB | 500,000 | 557,310 | ||

| 6s, 6/1/37 | BBB | 1,000,000 | 1,048,570 | ||

| 15,485,133 | |||||

| New Mexico (0.6%) | |||||

| NM Fin. Auth. Rev. Bonds, Ser. A, MBIA, | |||||

| 5s, 6/15/22 | Aaa | 750,000 | 784,305 | ||

| NM Mtge. Fin. Auth. Rev. Bonds (Single | |||||

| Fam. Mtge.), Ser. D-2, GNMA Coll., FNMA | |||||

| Coll., FHLMC Coll., 5.64s, 9/1/33 | AAA | 440,000 | 455,176 | ||

| 1,239,481 | |||||

33

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| New York (20.1%) | |||||

| NY City, G.O. Bonds, Ser. B, 5 1/4s, 12/1/09 | AA- | $ | 7,780,000 | $ | 8,142,704 |

| NY City, Hsg. Dev. Corp. Rev. Bonds, | |||||

| Ser. A, FGIC, 5s, 7/1/25 | Aaa | 500,000 | 518,060 | ||

| NY City, Indl. Dev. Agcy. Rev. Bonds | |||||

| (Liberty-7 World Trade Ctr.), Ser. A, | |||||

| 6 1/4s, 3/1/15 | B-/P | 500,000 | 527,150 | ||

| (Brooklyn Navy Yard Cogen. Partners), | |||||

| Ser. G, 5 3/4s, 10/1/36 | BBB- | 2,000,000 | 2,005,880 | ||

| NY City, Indl. Dev. Agcy. Special Fac. | |||||

| Rev. Bonds (British Airways PLC), | |||||

| 5 1/4s, 12/1/32 | Ba2 | 750,000 | 701,235 | ||

| NY City, Muni. Wtr. & Swr. Fin. Auth. | |||||

| Rev. Bonds | |||||

| Ser. B, 5 3/4s, 6/15/26 (Prerefunded) | AA+ | 4,100,000 | 4,226,813 | ||

| Ser. D, 5s, 6/15/37 | AA+ | 7,500,000 | 7,691,625 | ||

| NY State Energy Research & Dev. Auth. Gas | |||||

| Fac. Rev. Bonds (Brooklyn Union Gas), | |||||

| 6.952s, 7/1/26 | A+ | 2,000,000 | 2,044,100 | ||

| NY State Env. Fac. Corp. Rev. Bonds, | |||||

| 5s, 6/15/32 | Aaa | 4,000,000 | 4,124,160 | ||

| NY State Hwy. Auth. Rev. Bonds (Hwy. & | |||||

| Bridge Trust Fund), Ser. B, FGIC, 5s, 4/1/17 | Aaa | 3,000,000 | 3,192,900 | ||

| Port. Auth. NY & NJ Special Oblig. Rev. | |||||

| Bonds (JFK Intl. Air Term. - 6), MBIA, | |||||

| 5.9s, 12/1/17 | Aaa | 10,500,000 | 11,005,365 | ||

| Suffolk Cnty., Indl. Dev. Agcy. Rev. Bonds | |||||

| (Peconic Landing), Ser. A, 8s, 10/1/30 | B+/P | 650,000 | 711,906 | ||

| 44,891,898 | |||||

| North Carolina (3.4%) | |||||

| NC Eastern Muni. Pwr. Agcy. Syst. | |||||

| Rev. Bonds | |||||

| Ser. D, 6 3/4s, 1/1/26 | Baa2 | 1,000,000 | 1,091,660 | ||

| Ser. A, 5 3/4s, 1/1/26 | Baa2 | 2,000,000 | 2,112,220 | ||

| NC State Muni. Pwr. Agcy. Rev. Bonds (No. 1, | |||||

| Catawba Elec.), Ser. B, 6 1/2s, 1/1/20 | A3 | 3,500,000 | 3,811,500 | ||

| U. of NC Chapel Hill Hosp. Rev. Bonds, | |||||

| Ser. A, 5s, 2/1/11 | AA- | 500,000 | 520,375 | ||

| 7,535,755 | |||||

| North Dakota (0.4%) | |||||

| ND State Board of Higher Ed. Rev. Bonds | |||||

| (U. of ND Hsg. & Auxillary Fac.), FSA | |||||

| 5s, 4/1/21 | Aaa | 400,000 | 417,976 | ||

| 5s, 4/1/19 | Aaa | 500,000 | 524,910 | ||

| 942,886 | |||||

34

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Ohio (2.8%) | |||||

| Brookville, Local School Dist. G.O. Bonds, | |||||

| FSA, 5s, 12/1/31 | Aaa | $ | 1,000,000 | $ | 1,029,560 |

| Coshocton Cnty., Env. Rev. Bonds | |||||

| (Smurfit-Stone Container Corp.), | |||||

| 5 1/8s, 8/1/13 | CCC+ | 600,000 | 577,524 | ||

| OH State Air Quality Dev. Auth. Rev. Bonds | |||||

| (Toledo Poll. Control), Ser. A, 6.1s, 8/1/27 | Baa2 | 2,000,000 | 2,082,740 | ||

| Rickenbacker, Port Auth. Rev. Bonds (OASBO | |||||

| Expanded Asset Pooled), Ser. A, 5 3/8s, 1/1/32 | A2 | 2,500,000 | 2,679,575 | ||

| 6,369,399 | |||||

| Oklahoma (0.5%) | |||||

| OK Dev. Fin. Auth. Rev. Bonds (Hillcrest | |||||

| Hlth. Care Syst.), Ser. A, U.S. Govt. | |||||

| Coll., 5 5/8s, 8/15/29 (Prerefunded) | Aaa | 1,050,000 | 1,117,683 | ||

| Oregon (0.4%) | |||||

| OR State Hsg. & Cmnty. Svcs. Dept. Rev. | |||||

| Bonds (Single Family Mtge.), Ser. K, | |||||

| 5 5/8s, 7/1/29 | Aa2 | 845,000 | 870,908 | ||

| Pennsylvania (5.4%) | |||||

| Bucks Cnty., Indl. Dev. Auth. Retirement | |||||

| Cmnty. Rev. Bonds (Ann’s Choice, Inc.), | |||||

| Ser. A, 5.4s, 1/1/15 | BB/P | 530,000 | 527,467 | ||

| Carbon Cnty., Indl. Dev. Auth. Rev. Bonds | |||||

| (Panther Creek Partners), 6.65s, 5/1/10 | BBB- | 870,000 | 913,448 | ||

| Lancaster Cnty., Hosp. Auth. Rev. Bonds | |||||

| (Gen. Hosp.), 5 1/2s, 3/15/26 | A1 | 1,500,000 | 1,575,015 | ||

| Lehigh Cnty., Gen. Purpose Auth. Rev. | |||||

| Bonds (Lehigh Valley Hosp. Hlth. | |||||

| Network), Ser. A, 5 1/4s, 7/1/32 | A1 | 1,000,000 | 1,022,410 | ||

| PA State Econ. Dev. Fin. Auth. Resource | |||||

| Recvy. Rev. Bonds | |||||

| (Northampton Generating), Ser. A, 6.6s, 1/1/19 | B+ | 750,000 | 737,963 | ||

| PA State Higher Edl. Fac. Auth. Rev. Bonds | |||||

| (Philadelphia College of Osteopathic | |||||

| Med.), 5s, 12/1/08 | A | 1,045,000 | 1,069,265 | ||

| Philadelphia, School Dist. G.O. Bonds, | |||||

| Ser. D, FGIC, 5s, 6/1/27 | Aaa | 5,000,000 | 5,179,750 | ||

| Sayre, Hlth. Care Fac. Auth. Rev. Bonds | |||||

| (Guthrie Hlth.), Ser. A, 5 7/8s, 12/1/31 | A- | 1,000,000 | 1,062,020 | ||

| 12,087,338 | |||||

| Puerto Rico (2.6%) | |||||

| Cmnwlth. of PR, Govt. Dev. Bank Rev. | |||||

| Bonds, Ser. AA, 5s, 12/1/16 | BBB | 250,000 | 259,510 | ||

| Cmnwlth. of PR, Hwy. & Trans. Auth. Rev. | |||||

| Bonds, Ser. B, 6s, 7/1/39 (Prerefunded) | BBB+ | 5,000,000 | 5,481,900 | ||

| 5,741,410 | |||||

35

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| South Carolina (3.2%) | |||||

| Florence Cnty., Hosp. Rev. Bonds (McLeod | |||||

| Regl. Med. Ctr.), Ser. A, FSA, 5 1/4s, 11/1/23 | Aaa | $ | 2,515,000 | $ | 2,667,384 |

| Greenwood Cnty., Hosp. Rev. Bonds | |||||

| (Memorial Hosp.), 5 1/2s, 10/1/26 | A2 | 750,000 | 782,213 | ||

| SC Hosp. Auth. Rev. Bonds (Med. U.), | |||||

| Ser. A, 6 1/2s, 8/15/32 (Prerefunded) | AAA | 1,000,000 | 1,142,380 | ||

| SC Jobs Econ. Dev. Auth. Hosp. Fac. Rev. | |||||

| Bonds (Palmetto Hlth. Alliance), Ser. A, | |||||

| 7 3/8s, 12/15/21 (Prerefunded) | BBB+/F | 600,000 | 696,384 | ||

| SC Tobacco Settlement Rev. Mgt. Rev. | |||||

| Bonds, Ser. B, 6 3/8s, 5/15/28 | BBB | 1,750,000 | 1,869,490 | ||

| 7,157,851 | |||||

| South Dakota (1.0%) | |||||

| SD Edl. Enhancement Funding Corp. Rev. | |||||

| Bonds, Ser. B, 6 1/2s, 6/1/32 | BBB | 2,000,000 | 2,169,560 | ||

| Tennessee (4.4%) | |||||

| Johnson City, Hlth. & Edl. Fac. Board | |||||

| Hosp. Rev. Bonds | |||||

| (Mountain States Hlth.), Ser. A, | |||||

| 7 1/2s, 7/1/25 | BBB+ | 2,000,000 | 2,318,680 | ||

| (First Mtge. - Mountain States Hlth.), | |||||

| Ser. A, MBIA, 6s, 7/1/21 | Aaa | 7,000,000 | 7,523,250 | ||

| 9,841,930 | |||||

| Texas (9.2%) | |||||

| Alliance, Arpt. Auth. Rev. Bonds (Federal | |||||

| Express Corp.), 4.85s, 4/1/21 | Baa2 | 1,750,000 | 1,733,463 | ||

| Columbus, Indpt. School Dist. G.O. Bonds, | |||||

| PSFG, 5 1/8s, 8/15/29 | Aaa | 4,525,000 | 4,704,145 | ||

| Conroe, Indpt. School Dist. G.O. Bonds | |||||

| (School House), PSFG, 5s, 2/15/26 | Aaa | 2,905,000 | 2,994,590 | ||

| Gateway, Pub. Fac. Corp. Rev. Bonds | |||||

| (Stonegate Villas Apt.), FNMA Coll., | |||||

| 4.55s, 7/1/34 | Aaa | 750,000 | 764,700 | ||

| Harris Cnty., Hlth. Fac. Rev. Bonds | |||||

| (Memorial Hermann Hlth. Care), Ser. A, | |||||

| 6 3/8s, 6/1/29 (Prerefunded) | A2 | 1,500,000 | 1,688,640 | ||

| Montgomery Cnty., G.O. Bonds (Library), | |||||

| Ser. B, AMBAC, 5s, 3/1/26 | Aaa | 1,335,000 | 1,375,691 | ||

| Sam Rayburn Muni. Pwr. Agcy. Rev. Bonds, | |||||

| 6s, 10/1/21 | Baa2 | 1,500,000 | 1,572,870 | ||

| Snyder, Indpt. School Dist. G.O. Bonds | |||||

| (School Bldg.), AMBAC | |||||

| 5 1/4s, 2/15/24 | AAA | 1,215,000 | 1,292,481 | ||

| 5 1/4s, 2/15/23 | AAA | 1,150,000 | 1,225,900 | ||

36

| MUNICIPAL BONDS AND NOTES (162.3%)* continued | |||||

| Rating ** | Principal amount | Value | |||

| Texas continued | |||||

| Socorro, Indpt. School Dist. G.O. Bonds, | |||||

| PSFG, 5s, 8/15/29 | A | $ | 1,360,000 | $ | 1,397,631 |

| Tomball, Hosp. Auth. Rev. Bonds (Tomball | |||||

| Regl. Hosp.), 6s, 7/1/19 | Baa3 | 1,700,000 | 1,789,165 | ||

| 20,539,276 | |||||

| Utah (6.3%) | |||||

| UT Cnty., Env. Impt. Rev. Bonds | |||||