Exhibit 99.2

First Quarter 2015 Results October 30, 2014 SOLID PORTFOLIO. SOLID FUTURE.

2 Cautionary Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to : the production estimates from the operators of the Company’s properties ; the ramp - up of the Mt . Milligan mine ; construction progress at the Phoenix project ; CORE stockholder approval of the transaction contemplated by the Master Agreement between CORE and the Company ; development, permitting and exploration activity at Tetlin and Ilovitza ; anticipated growth in the volume of metals subject to the Company’s royalty interests ; and statements or estimates regarding projected steady, increasing or decreasing production ; and estimates of timing of commencement of production from operators of properties where we have royalty interests, including operator estimates . Factors that could cause actual results to differ materially from these forward-looking statements include, among others : the risks inherent in construction, development and operation of mining properties, including those specific to a new mine being developed and operated by a base metals company ; changes in gold, silver, copper, nickel and other metals prices ; performance of and production at the Company’s royalty properties ; decisions and activities of the Company’s management ; unexpected operating costs ; decisions and activities of the operators of the Company’s royalty and stream properties ; changes in operators’ mining and processing techniques or royalty calculation methodologies ; resolution of regulatory and legal proceedings (including with Vale regarding Voisey’s Bay) ; unanticipated grade, geological, metallurgical, environmental, processing or other problems at the properties ; inaccuracies in technical reports and reserve estimates ; revisions by operators of reserves, mineralization or production estimates ; changes in project parameters as plans of the operators are refined ; the results of current or planned exploration activities ; discontinuance of exploration activities by operators ; economic and market conditions ; operations on lands subject to First Nations or Native American jurisdiction in Canada and the United States ; the ability of operators to bring non-producing and not - yet - in development projects into production and operate in accordance with feasibility studies ; challenges to the Company’s royalty interests, or title and other defects in the Company’s royalty properties ; errors or disputes in calculating royalty payments, or payments not made in accordance with royalty agreements ; future financial needs of the Company ; the impact of future acquisitions and royalty and streaming financing transactions ; adverse changes in applicable laws and regulations ; litigation ; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments . These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission . Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date . The Company’s past performance is not necessarily indicative of its future performance . The Company disclaims any obligation to update any forward-looking statements . Endnotes located on page 15 . October 2014

Today’s Speakers October 2014 3 Tony Jensen President and CEO Bill Heissenbuttel VP Corporate Development Bill Zisch VP Operations

Financial Results Net income up 23% from a year ago despite a 3% decline in gold price Adjusted EBITDA of $0.86 per basic share, or 81% of revenue Fourth consecutive quarter of increased revenue from Mt Milligan $13.7 million in dividends paid New Business Tetlin project, Contango Ore (“CORE”) – Acquired a 2.0% NSR royalty and a 3.0% NSR royalty for $6.0 million in late September – Entered into a master agreement form a JV to advance exploration and development Ilovitza project, Euromax Resources Ltd – Entered into a gold stream transaction for 25 % 1 of the gold at the Ilovitza gold - copper project in Macedonia – Staged investment of $7.5 million upfront, $7.5 million in one year, and $160 million, subject to certain conditions First Quarter 2015 Highlights 4 October 2014

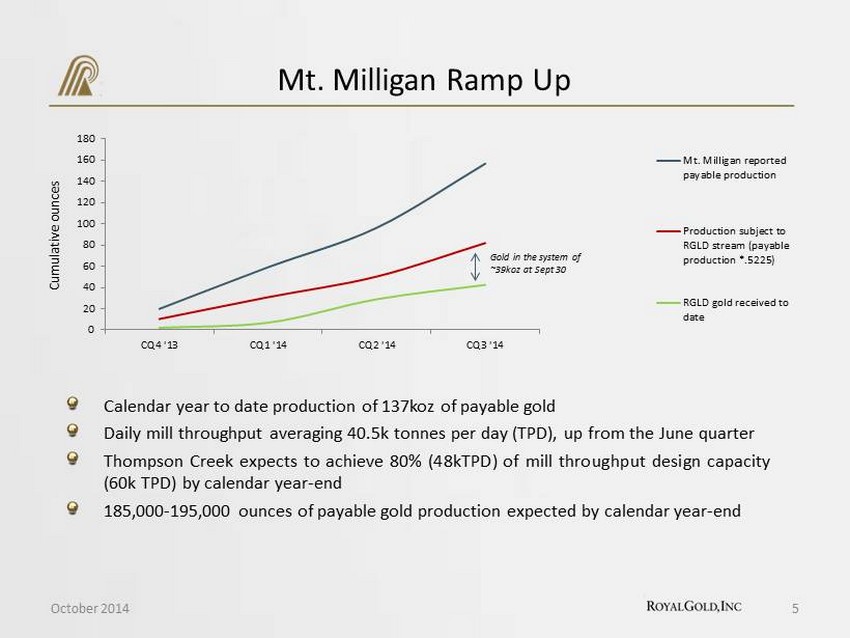

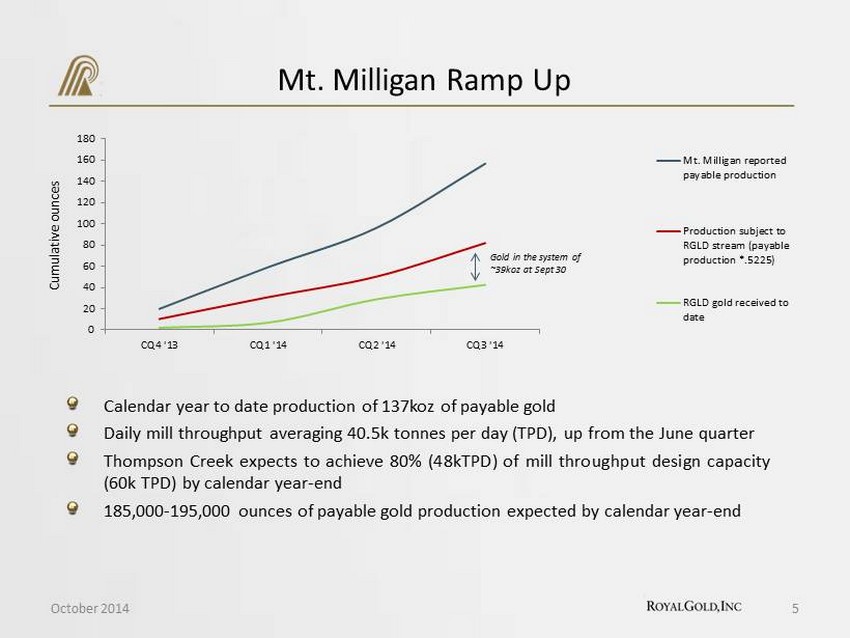

Calendar year to date production of 137 koz of payable gold Daily mill throughput averaging 40 . 5 k tonnes per day ( TPD), up from the June quarter Thompson Creek expects to achieve 80 % ( 48 kTPD) of mill throughput design capacity ( 60 k TPD ) by calendar year - end 185 , 000 - 195 , 000 ounces of payable gold production expected by calendar year - end Mt . Milligan Ramp Up 5 October 2014 0 20 40 60 80 100 120 140 160 180 CQ4 '13 CQ1 '14 CQ2 '14 CQ3 '14 Mt. Milligan reported payable production Production subject to RGLD stream (payable production *.5225) RGLD gold received to date Cumulative ounces Gold in the system of ~39koz at Sept 30

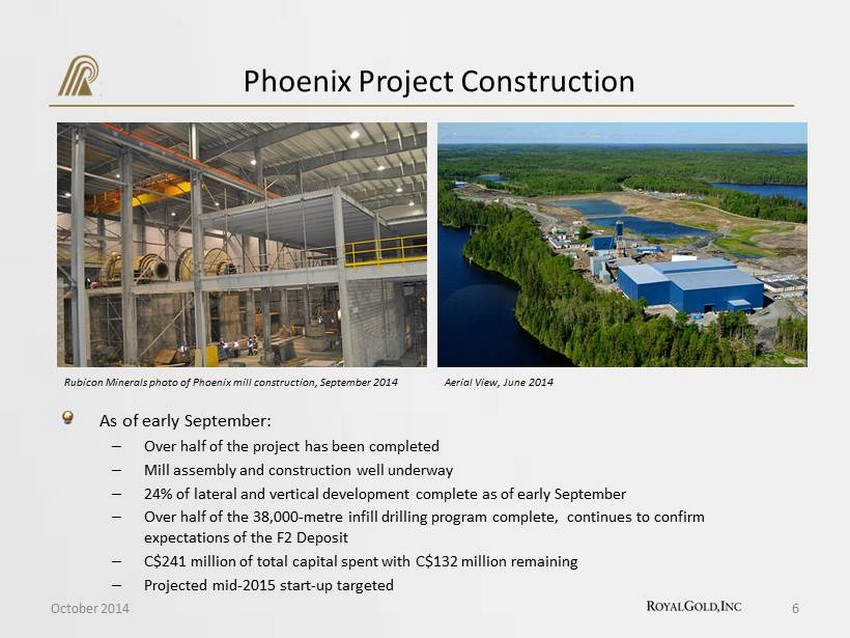

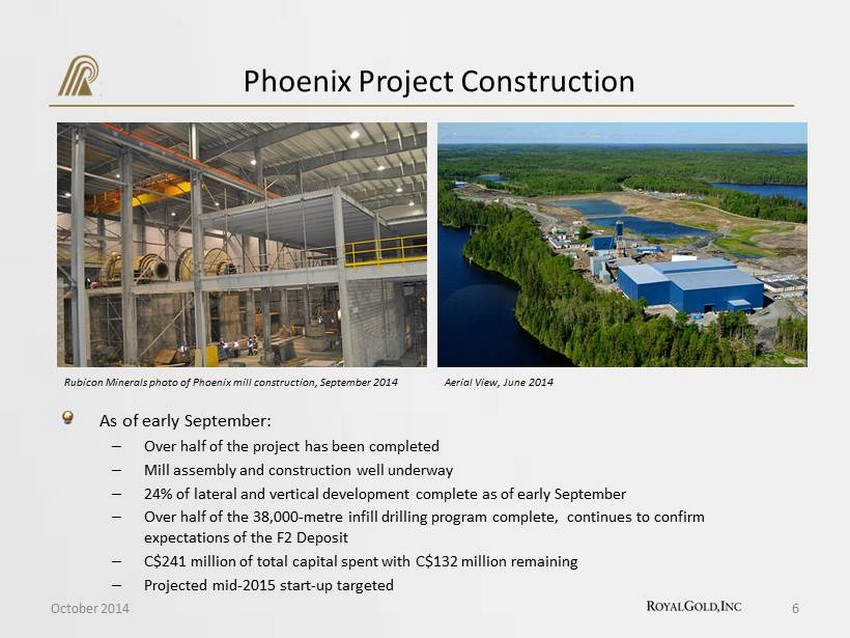

Phoenix P roject C onstruction October 2014 6 As of early September: – Over half of the project has been completed – Mill assembly and construction well underway – 24% of lateral and vertical development complete as of early September – Over half of the 38,000 - metre infill drilling program complete, continues to confirm expectations of the F2 Deposit – C$241 million of total capital spent with C$132 million remaining – Projected mid - 2015 start - up targeted Rubicon Minerals photo of Phoenix mill construction, September 2014 Aerial View, June 2014

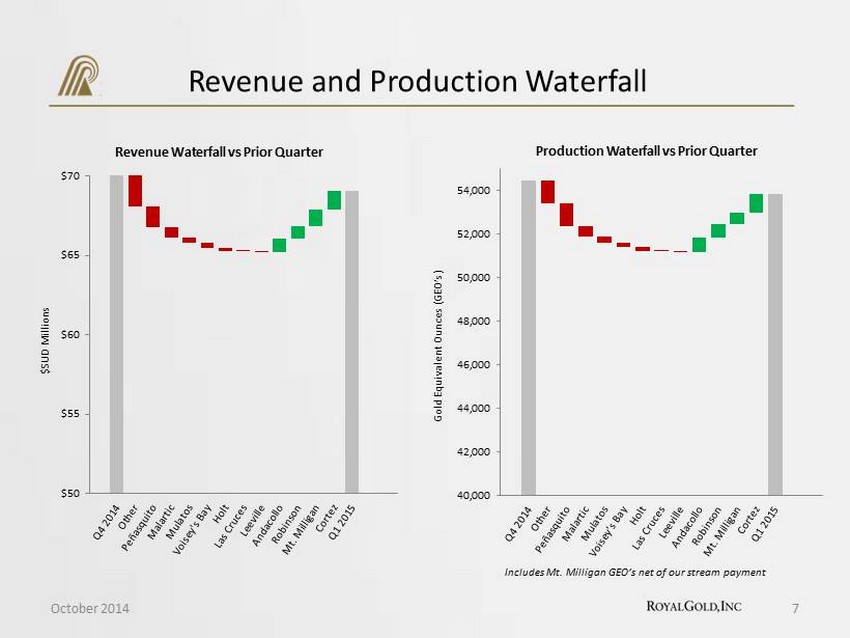

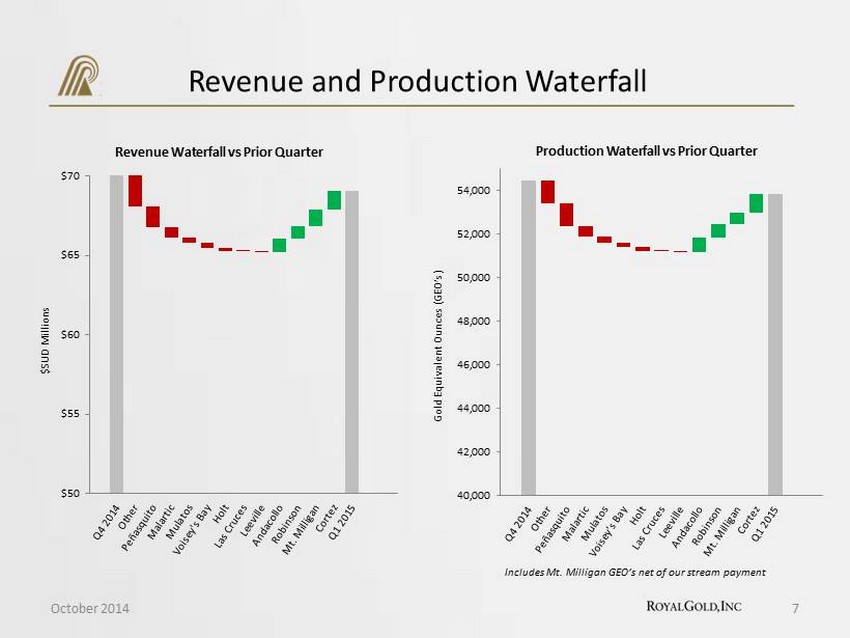

Revenue and Production Waterfall 7 Gold Equivalent Ounces (GEO’s) October 2014 $50 $55 $60 $65 $70 $SUD Millions Revenue Waterfall vs Prior Quarter 40,000 42,000 44,000 46,000 48,000 50,000 52,000 54,000 Production Waterfall vs Prior Quarter Includes Mt. Milligan GEO’s net of our stream payment

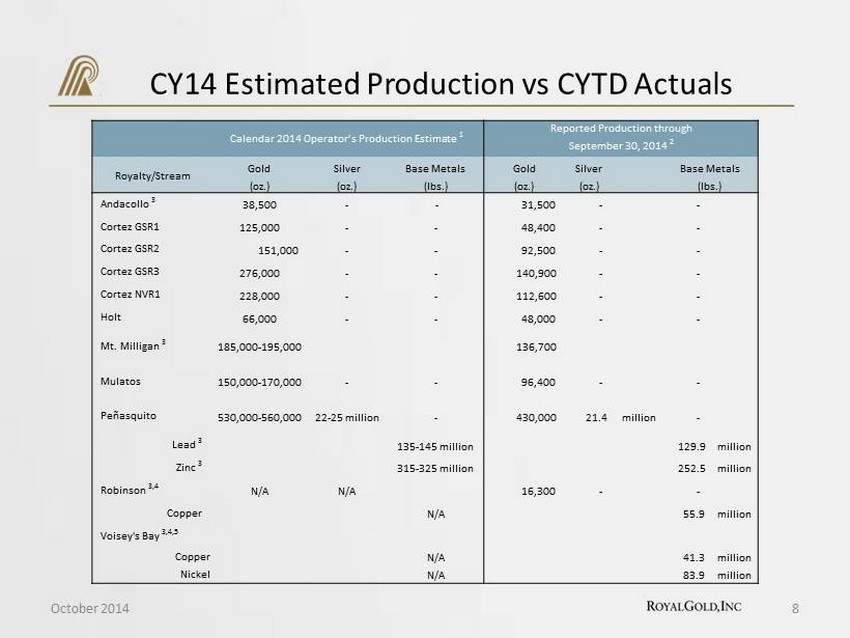

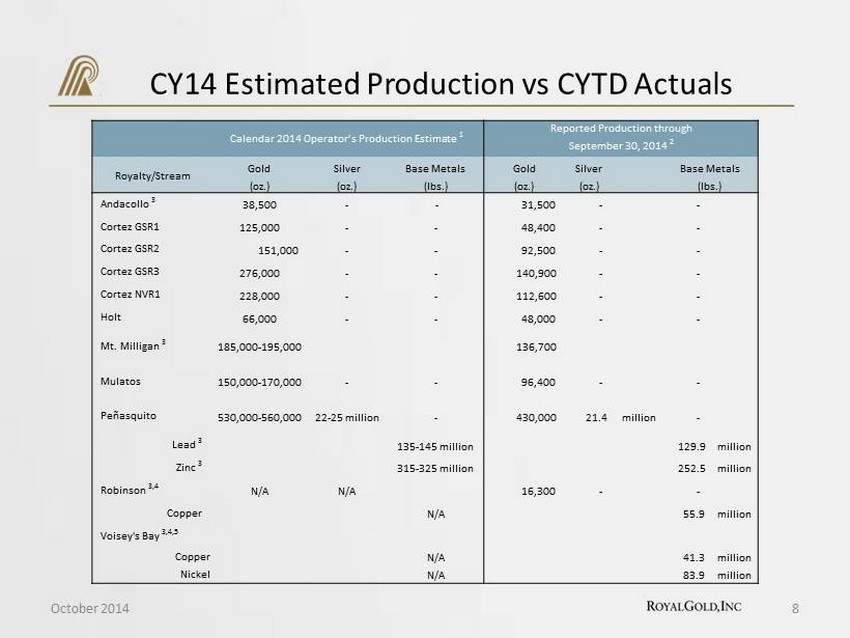

CY14 Estimated Production vs CYTD Actuals 8 October 2014 Calendar 2014 Operator’s Production Estimate 1 Reported Production through September 30, 2014 2 Royalty/Stream Gold Silver Base Metals Gold Silver Base Metals (oz.) (oz.) (lbs.) (oz.) (oz.) (lbs.) Andacollo 3 38,500 - - 31,500 - - Cortez GSR 1 125,000 - - 48,400 - - Cortez GSR 2 151,000 - - 92,500 - - Cortez GSR 3 276,000 - - 140,900 - - Cortez NVR 1 228,000 - - 112,600 - - Holt 66,000 - - 48,000 - - Mt . Milligan 3 185,000 - 195,000 136,700 Mulatos 150,000 - 170,000 - - 96,400 - - Peñasquito 530,000 - 560,000 22 - 25 million - 430,000 21.4 million - Lead 3 135 - 145 million 129.9 million Zinc 3 315 - 325 million 252.5 million Robinson 3 , 4 N/A N/A 16,300 - - Copper N/A 55.9 million Voisey's Bay 3 , 4 , 5 Copper N/A 41.3 million Nickel N/A 83.9 million

Portfolio Quality 9 October 2014 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Cash Margin by Operating Property, First Half 2014 The operators of our royalties and streams recognized an average 57%, or $576 per gold equivalent ounce, gross margin in the first half of 2014 on properties subject to our interest 57% average

New Business – Ilovitza project, Macedonia October 2014 10 Pre - feasibility study envisions a conventional open pit mine using large scale fleet for a planned 10 million tonne per year mill operation Current reserve of 2.45 million ounces of gold and 905 million pounds of copper, 23 year mine life Low planned strip of 0.7:1 waste to ore Initial capex of $501 million, p roduction startup planned for 2018 Royal Gold will make two advance payments totaling $15 million towards completion of the definitive feasibility study and permitting on the Ilovitza project, followed by payments aggregating $160 million towards project construction, subject, in each case, to certain conditions In return, Euromax will deliver physical gold equal to 25% of gold produced from the Ilovitza project until 525,000 ounces have been delivered, and 12.5% thereafter. Royal Gold’s purchase price per ounce will be 25% of the spot price at time of delivery View towards Ilovitza village Core shed, Ilovitza

New Business – Tetlin Exploration Project, Alaska October 2014 11 700,000 acre property located within the Tintina Gold Belt Located near Tok , Alaska, on the Alcan highway, via an all - weather gravel road Royal Gold purchased a 2.0% NSR and a 3.0% NSR on the property in late September Royal Gold signed a master agreement to enter into a JV with Contango Ore for exploration and development of the project – Subject to Contango Ore shareholder approval – $5 million upfront, option to earn up to 40% interest by investing up to $30 million (including initial $5 million) 130 drill holes and 28,000 meters of drilling focused on a 60 acre portion of the property known as the Peak zone , which is one target within the larger Chief Danny prospect Peak zone resources. Source: Contango Ore Note to US Investors: The US Securities and Exchange Commission permits US listed mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or product. Contango ORE uses certain terms, such as inferred resources, indicated resources, which the SEC guidelines strictly prohibit US registered companies from including in their filings with the SEC. US Investors are urged to consider closely the disclosure in Contango Ore’s Form 10 - K which may be obtained from the SEC website. Inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources exist or will ever be upgraded to a higher resource category.

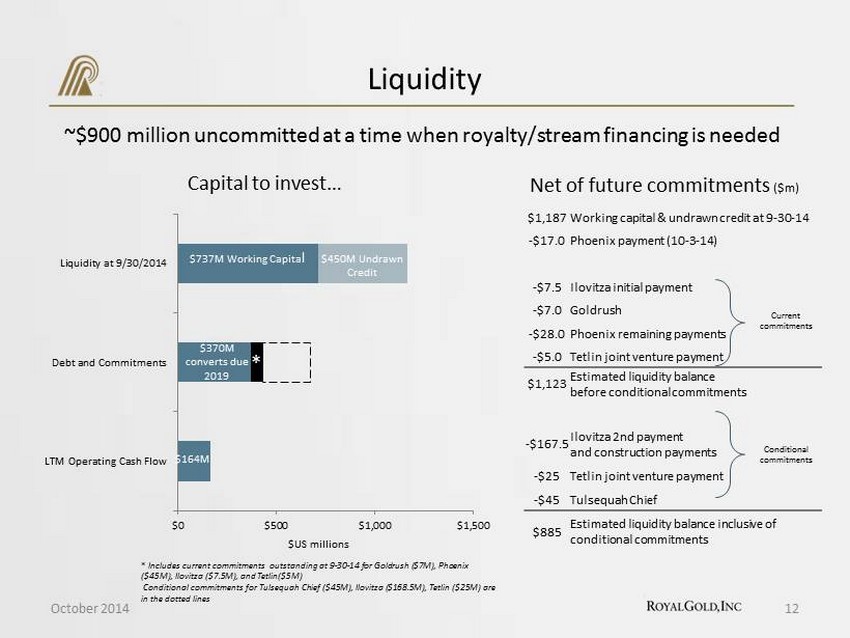

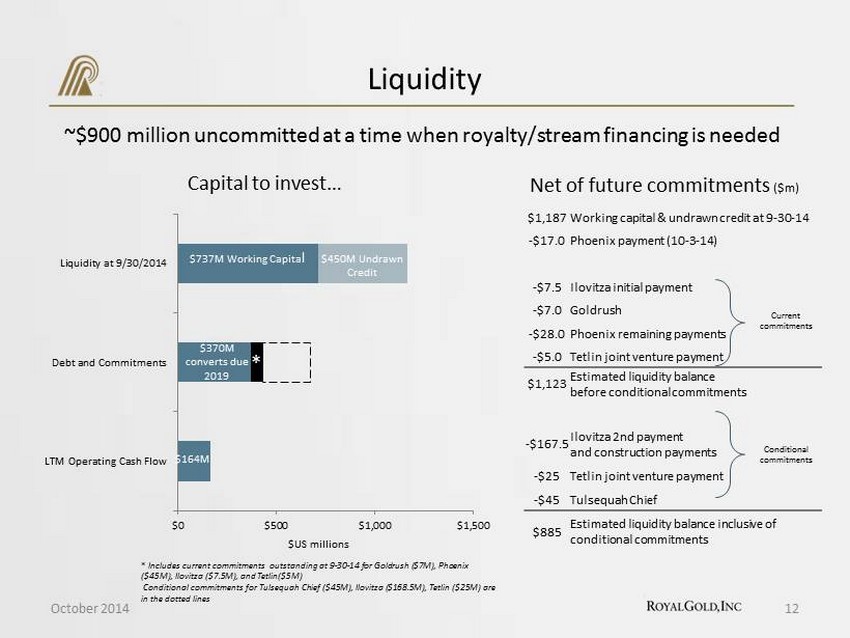

12 October 2014 Capital to invest… ~$900 million uncommitted at a time when royalty/stream financing is needed * Includes current commitments outstanding at 9 - 30 - 14 for Goldrush ($ 7M), Phoenix ($ 45M), Ilovitza ($7.5M), and Tetlin ($5M) Conditional commitments for Tulsequah Chief ($45M), Ilovitza ($ 168.5M), Tetlin ($25M) are in the dotted lines Liquidity $US millions $0 $500 $1,000 $1,500 Liquidity at 9/30/2014 Debt and Commitments LTM Operating Cash Flow $ 164M $370M converts due 2019 * $ 737M Working Capita l $450M Undrawn Credit $ 1,187 Working capital & undrawn credit at 9 - 30 - 14 - $17.0 Phoenix payment (10 - 3 - 14) - $7.5 Ilovitza initial payment - $7.0 Goldrush - $28.0 Phoenix remaining payments - $5.0 Tetlin joint venture payment $1,123 Estimated liquidity balance before conditional commitments - $ 167.5 Ilovitza 2nd payment and construction payments - $25 Tetlin joint venture payment - $45 Tulsequah Chief $ 885 Estimated l iquidity b alance inclusive of conditional commitments Net of future commitments ($m) Current commitments Conditional commitments

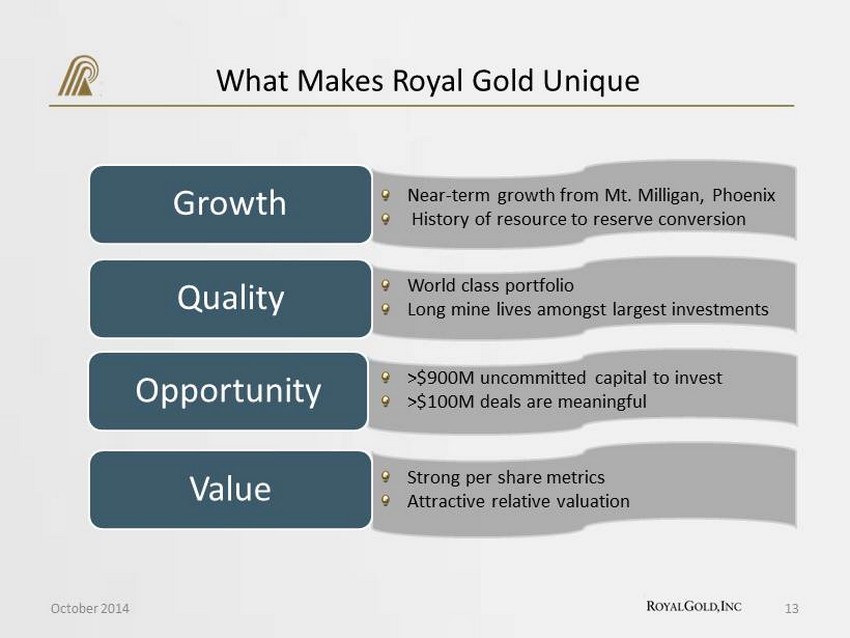

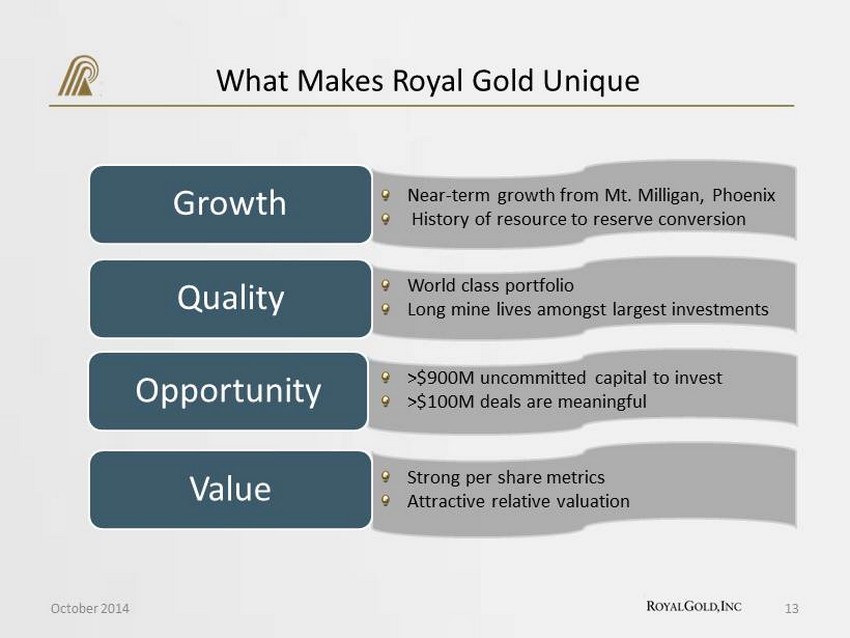

What Makes Royal Gold Unique 13 October 2014 Growth Quality Opportunity Value Near - term growth from Mt. Milligan, Phoenix History of resource to reserve conversion World class portfolio Long mine lives amongst largest investments >$900M uncommitted capital to invest >$100M deals are meaningful Strong per share metrics Attractive relative valuation

Endnotes SOLID PORTFOLIO. SOLID FUTURE.

Many of the matters in these endnotes and the accompanying slides constitute forward looking statements and are subject to numerous risks, which could cause actual results to differ . See complete Cautionary Statement on page 2 . Endnotes PAGE 4 First Quarter 2015 Highlights 1. Initial stream percentage is 25 % of the gold, until 525 , 000 ounces have been delivered, and 12 . 5 % thereafter . Royal Gold’s purchase price will be 25 % of spot . PAGE 8 CY 14 Estimated Production vs CYTD Actuals 1. There can be no assurance that production estimates received from our operators will be achieved . Please refer to our cautionary language regarding forward - looking statements on page 2 , as well as the Risk Factors identified in Part I, Item 1 A, of our Fiscal 2014 10 - K for information regarding factors that could affect actual results . 2. Reported production relates to the amount of metal sales, subject to our royalty interests, for the period January 1 , 2014 through September 30 , 2014 , as reported to us by the operators of the mines . For our streaming interest at Mt . Milligan, reported production represents payable gold shipped, subject to our stream interest, during the January 1 , 2014 through September 30 , 2014 period . 3. Payable metal and deliveries are subject to shipping and settlement schedules . 4. The operator did not release public production guidance for calendar 2014 . 5. In anticipation of the transition from processing Voisey’s Bay nickel concentrates at Vale’s Sudbury and Thompson smelters to processing at the Long Harbour hydrometallurgical plant, the Company engaged in discussions with Vale concerning calculation of the royalty once Voisey’s Bay nickel concentrates are processed at Long Harbour . Vale proposed a calculation of the royalty that the Company estimates could result in the substantial reduction of royalty payable to the Company on Voisey’s Bay nickel concentrates processed at Long Harbour . While the Company may continue to engage in discussions concerning calculation of the royalty on nickel concentrates processed at Long Harbour , there is no guaranty that the Company and Vale will reach agreement on the proper calculation under the terms of the royalty agreement . If no agreement is reached, the Company intends to vigorously pursue all legal remedies to ensure the appropriate calculation of the royalty and to enforce our royalty interests at Voisey’s Bay .

Property Portfolio 16 October 2014

1660 Wynkoop Street Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com SOLID PORTFOLIO. SOLID FUTURE.