Executive Summary

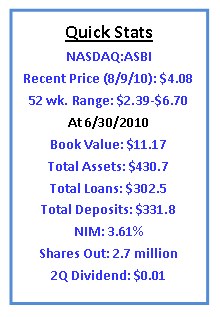

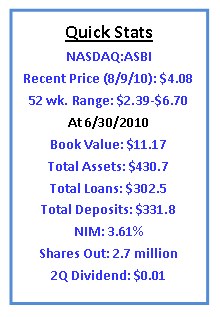

An expanded and experienced management team, in place since 2005, is working to turn Ameriana Bancorp (“the Company”) (NASDAQ GM: ASBI) into a premier community banking franchise in Central Indiana. With 13 banking centers and 15 total locations in and around the Indianapolis metropolitan area, the Company is positioned to leverage improved earnings performance and its well-capitalized position to capture market share through organic growth and potential acquisitions. Senior management, credit and lending teams have the expertise to effectively run a significantly larger organization. Ameriana’s management team and senior lenders have come to the franchise from larger successful Indiana and Midwestern-based community banks. With strong market share positions in counties surrounding Indianapolis that generate a base of core deposits and lending activity, Ameriana Bank (“the Bank”) has entered the competitive but highly fragmented Indianapolis Metropolitan Statistical Area (“MSA”) with lending offices and branches to deliver superior community banking services to retail, small- and mid-size business banking customers. Two wholly owned subsidiaries provide investment and insurance products and services to complement Ameriana’s full line of banking capabilities. Central Indiana has historically enjoyed a vibrant and diverse economy, and has experienced significant growth in business and population. In the past several years, the area demonstrated greater economic stability and resilience, and lower unemployment levels than national averages. The demographically balanced area has experienced steady growth in white-collar employment, which now exceeds 60% of total employment. The markets that Ameriana serves have national leadership positions in pharmaceuticals, information technology and life sciences. It is a hotbed for leading-edge development in alternative energy, telecommunications, new-era entrepreneurship and more, driven in part by strong support from the State of Indiana and educational institutions like Ball State University, Butler University, Indiana University, Purdue University and Rose Hulman Institute of Technology. Supporting the experienced management team is a Board of Directors comprised of business, financial and community leaders recognized and respected statewide, representing a balanced cross-section of capabilities and expertise. |  |

Investment Highlights

· | Following a significant restructuring and turnaround which started in 2005, the Company returned to profitability in 2009. |

· | Strong balance sheet management focused on reducing non-performing loans and stabilizing loan loss reserves. |

· | The Company has reduced and restructured its loan portfolio to build C&I lending as a percentage of total loans. |

· | Strong credit and risk management practices position the Company for commercial assets and loans to drive consistent year-over-year growth, backed by a strong retail operation. |

· | Well-capitalized by regulatory standards with strength to obtain capital for organic and inorganic growth. |

· | Premier brand recognition and market positioning to facilitate growth and expansion. |

· | Senior management team with expertise and experience building and managing significantly larger community banks. |

Positioned for Performance: The Ameriana Transformation

In five years and despite a nationwide economic slowdown, Ameriana Bancorp has emerged as a leading Central Indiana community bank holding company, well-positioned to be a winner through organic growth and potential merger and acquisition activity. When President and Chief Executive Officer (“CEO) Jerome J. Gassen joined the Company in 2005, the former thrift institution had struggled with a myriad of issues, including collateralized mortgage obligations gone sour, commercial real estate loan problems, an over-reliance on real estate based loans and high-interest CDs. The Company was operating under a regulatory memorandum of understanding, which was lifted soon after Gassen joined the Bank. Executive Vice President and Chief Operating Officer (“COO”) Timothy G. Clark, who joined the Bank in 1997 and has over 38 years of Indiana banking experience including t he position of CEO and President at other institutions, teamed with Gassen to revitalize operations and improve practices.

Speculative lending and investment practices were eliminated, out-of-state operations sold and credit and risk management practices were dramatically revised and improved. New senior finance executives focused on trimming operating costs, improving net interest margins and returning the Company to sustainable and growing profitability. A veteran commercial lending team was assembled to build a quality C&I loan portfolio, while business specialists focused on growing relationship banking with small and midsize companies.

Retail banking, a key driver of low-cost core deposits, was restructured and modernized to provide superior service and competitive products. Technology and Internet Banking upgrades and new products enabled the Bank to effectively compete in price and service against competitors.

While selling Ameriana’s title insurance business, management strengthened and expanded the Company’s successful Ameriana Insurance Agency and Ameriana Financial Services (Securities and Insurance products offered through LPL Financial and its affiliates - Member FINRA/SIPC).

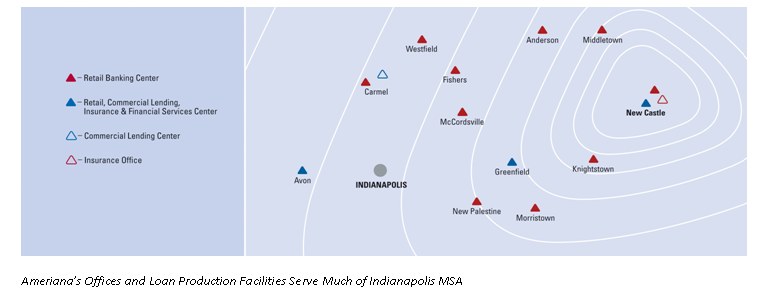

The Company has leveraged well-situated locations surrounding Indianapolis to generate new business opportunities and capture market share. A key strategic initiative has included expanding west toward the Indianapolis MSA, adding new full service offices in suburban Fishers, Westfield and Carmel during the past two years. While enhancing the Ameriana name and visibility in the Indianapolis market, these offices also position the Company to tap into new business and retail customers. These offices are focused on generating commercial lending and relationship business, where significant opportunities exist to win market share from small institutions lacking capital strength and resources, and large institutions that have concentrated on large business customers.

To differentiate itself from its competitors, Ameriana focuses on enhancing the customer experience with value-added services. In its new banking facilities, Ameriana has continued its commitment to customer interaction and demonstrates its community banking spirit by incorporating space for community meetings, business and financial planning seminars and small events. With Wi-Fi access and other amenities, these offices create a convenient and welcoming environment for customers. The banking center concept facilitates cross-selling opportunities, particularly with retail customers.

Ameriana’s 2010 Customer Satisfaction Survey, comprised of retail and business customers who opened a new account with Ameriana from January 1, 2010 through March 31, 2010, revealed a shift to a younger demographic group of customers compared to the 2008 survey results. In 2008, 45% of those surveyed were aged 65+, compared to only 15% in the 2010 survey. In addition, 95% of those surveyed indicated they are “Likely” or “Very Likely” to recommend Ameriana to friends and family, and 98% are “Likely” or “Very Likely” to continue to do business with the Bank. Management’s strategic repositioning has generated impressive results despite the weak economy.

In the second half of 2009, the Company returned to profitability through continuing net interest margin expansion and continued de-leveraging of the balance sheet by selling investment securities and purging non-core deposits. Management continues to focus on modifying the loan portfolio mix to incorporate a higher percentage of commercial lending, and has implemented steps to generate loan growth and build commercial lending and banking relationships.

Commercial Service Platform for the Future

The Bank has a strong retail banking business with a full range of banking products, as well as affiliated insurance, brokerage and asset management services. This will remain an integral part of Ameriana’s business. Management believes there is a significant opportunity to grow the Bank’s commercial banking business. The Company has the opportunity to add high quality larger lending relationships through its lending capacity.

The Bank pursues a full service strategy when seeking new loan customers and focuses on bringing deposit relationships or cash management relationships with new commercial lending customers. The Bank’s average commercial credit size is approximately $350,000. It utilizes sophisticated analytical software for credit documentation, and has a formal risk management committee and both internal and independent analysts. The Bank’s credit analysts frequently accompany lending officers on sales calls, a practice that facilitates and speeds the loan review process. Management believes a key to successful community banking is the ability to be responsive to customers’ individual needs, while maintaining stringent underwriting practices. A focus on relationship banking, quality service and a full range of leading-edg e products enables the Bank to avoid the need to offer costly incentives to win and retain commercial banking clients.

Ameriana has developed a fully integrated, real-time information technology platform with capacity to accommodate significant growth. This platform is also designed to facilitate integration should the Company merge with or acquire other banks or branch locations.

Indianapolis and Central Indiana Offer Growth, Market

Share Opportunities in Retail and Commercial Banking

Central Indiana and the far-reaching Indianapolis MSA provides a wide variety of opportunities to serve retail and business customers. For three decades, there has been significant growth in businesses and population in the communities and counties surrounding the city, not only as suburban “bedroom” communities but as strong and self-sufficient centers for business and living. The revitalization of downtown Indianapolis in the past decade has spurred significant expansion of urban living as well as fast-growing convention and hospitality industries.

Because of its central physical location, its importance as the state capital and extensive transportation access, Indianapolis serves as the hub of a particularly large geographical area. By developing a physical presence in and surrounding the Indianapolis metro area, Ameriana is positioned to capitalize on the unique access to this large metro area.

Encompassing more than 4,000 square miles, the Indianapolis MSA market incorporates nine counties in what is sometimes described as the “Doughnut Counties,” which refers to the circular shape of the region with Marion County in the center. Highway design has facilitated this hub-like expansion, with the city encircled by the I-465 and I-865 bypasses, bisected by I-65 (a main north-south route from the Chicago area to the Gulf Coast), and intersecting a major north-south highway such as I-69 or east-west highways I-70 and I-74.

This relatively easy transportation access actually expands this nine-county region to include two additional counties and a number of cities, including New Castle, which is Ameriana’s corporate headquarters. New Castle is located 50 miles from downtown Indianapolis, yet only a 50 minute drive, and much closer to surrounding communities it serves.

A Great Place to Live and Work; Supportive Business Climate

Central Indiana has battled economic and unemployment issues similar to the rest of the country; however, the region is particularly well-positioned to rebound and grow. With a population of approximately two million, Indianapolis is the 13th largest U.S. city, yet consistently ranks as one of the nation’s most affordable. For instance, it rated third in Forbes Magazine’s 2008 list of "America’s Best Bang for the Buck Cities." In 2009, CNN Money listed Indianapolis among the nation’s top 50 places to launch a small business.

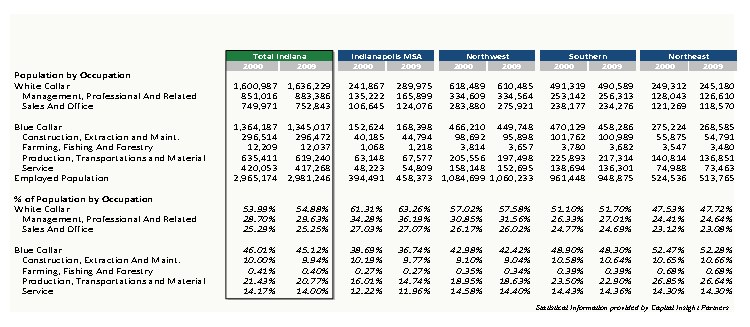

Since 2000, white collar employment in the region has increased and comprises nearly 64% of the area’s total employment. Average household income in the Indianapolis MSA grew from $61,452 in 2000 to nearly $71,000 in 2009. Area residents have access to a diverse housing market, with numerous location options. A great deal of affordable housing is available that provides convenient access to area workplaces. These characteristics all support Ameriana’s consumer lending, banking, insurance and financial advisory services and capabilities.

The state offers a positive tax environment for businesses and residents, and an array of funding and tax-related initiatives to promote across-the-board business development. There is considerable support in the public and private sectors for business innovation and advancement. Purdue University, Indiana Uni-versity, Ball State University and other institutions are active not only in training and education, but in collaborative support to further new businesses.

Indiana’s $69 billion life sciences industry represents 18% of the state’s economic output, according to Indiana-based BioCrossroads. The Battelle Institute has reported that the number of bioscience jobs in Indiana has grown 17% since 2001, outpacing the national average. Indianapolis is ranked second in the U.S. for employment concentration in drugs and pharmaceu-ticals. Many small and large corporations including those involved with healthcare, life sciences and technology, are headquartered in Central Indiana, including Eli Lilly & Co., Clarian Health Partners, AT&T, Rolls Royce, and Community Health Network. Dow AgroSciences announced it is adding nearly 600 jobs and investing $340 million in its Indianapolis headquarters – the company's largest-ever expansion.

Initiatives like the Indiana University Emerging Technologies Center, an incubator supporting 22 ventures, the Purdue University Center for Advanced Manufacturing, and one of the nation’s largest ambitious wind farms have helped to establish Indiana as a leader in “new economy” business development.

The state capital also moved up four spots from the 2008 report and is now ranked fourth in the Agricultural Feedstock and Chemicals subsector, and jumped one spot from 2008 to number fifteen in the Medical Devices and Equipment category.

The area’s balanced and diversified business profile includes significant employment related to institutions of higher learning, manufacturing, advanced medical devices, communications, computer systems design and software development.

As a major regional hub with easy highway access and geographic proximity to population centers like Chicago, Cincinnati, St. Louis, and Nashville, Indianapolis is home to many businesses serving the transportation, distribution and logistics sectors. Indianapolis has a new state-of-the-art $1.1 billion dollar airport terminal which opened in November 2008. In 2010, it was ranked by Air Cargo World magazine as one of the top four North American airports handling one million or more tons of cargo.

Ameriana’s Competitive Edge in a Fragmented Market

Central Indiana presents an attractive opportunity for Ameriana to capture market share and potentially capitalize on the need for smaller community banks to consolidate to remain competitive. The region hosts a number of national megabanks including Chase, Fifth Third, Huntington, Regions, PNC (formerly National City) and Marshall & Isley.

Ameriana management believes many of these banks are vulnerable to losing market share to a strong community bank, particularly small and midsize business clients and retail customers requiring a less formulaic approach to banking than megabanks provide. Management feels acquisitions and asset quality issues have led to significant dissatisfaction among the customers of megabanks and large regional institutions.

In the 1980s and 1990s, the Indianapolis area was a major market for Bank One Corp., which was acquired by J.P. Morgan Chase in 2004 to create one of the nation’s largest banking entities. Although headquartered in Chicago, Bank One had a dominating presence in Indianapolis. The departure of this “hometown bank,” which was later mirrored in Charlotte, North Carolina when Wachovia was acquired by Wells Fargo, led many loyal customers to reconsider their banking alternatives. National City has been a strong midsize competitor in the Indianapolis market. Ameriana management believes its 2009 acquisition by PNC may lead to the same customer satisfaction and service issues related to megabanks.

The Indiana banking market is home to 116 small community banks, creating a potential for increased consolidation. Many of these institutions are well-capitalized, but lack the size to have any prospect for meaningful growth. Ameriana believes this situation represents an opportunity to grow through M&A activity.

Strong Leadership and Corporate Culture

With a community banking history stretching back 120 years, Ameriana has built on its traditionally strong reputation for community involvement and being a workplace of choice. The Company seeks to be a center of community activity, which enhances customer loyalty and generates exposure, particularly in smaller communities. The Company and its employees participate in numerous community-outreach activities.

To foster employees’ community involvement, the Bank sponsors a volunteer program offering eight hours of paid leave per quarter for non-exempt employees to perform community service. Senior managers are required to perform 12 hours of community and charitable service per quarter and serve on the board of at least one charitable or business organization. Ameriana sponsors numerous community partnerships, financial education programs, seminars and other activities to serve the community and enhance the Bank’s visibility.

Senior management and members of the Board of Directors are well-recognized in Ameriana’s com-munities, participating in a variety of charitable and business organizations. Many members of Ameriana’s executive team have been in Indiana community banking for decades.

Experienced Management Team Positioned to Guide Larger Institution

Jerome J. Gassen, President and Chief Executive Officer, joined Ameriana in 2005, and was tasked with building a skilled senior management team and positioning the Company for profitability and growth. A veteran of Indiana and Midwestern banking, he had previously served as Executive Vice President of Old National Bank, headquartered in Evansville, Indiana, managing 130 offices in six states, 1,700 employees and over $9.5 billion in assets. He also held several CEO positions with Old National’s regional operations. Prior to joining Old National, he was President and CEO of American National Bank of Muncie, Indiana, where he repositioned the bank, implemented new credit and risk management policies, and integrated assets and branches from a bank acquisition. Under his leadership, total assets grew 75% in three years. From 1985-1995, he held numerous executive positions with Firstar Bank in Wisconsin and Iowa and was named CEO and Chairman of Firstar Bank Ottumwa, Iowa in 1993. He holds a bachelor’s and master’s degree from the University of Wisconsin-Milwaukee, an MBA from Marquette University and completed the Graduate School of Banking course at the University of Wisconsin-Madison. He is active in the community and has held numerous directorships at charitable organizations, corporations and educational institutions.

Timothy G. Clark, Executive Vice President and Chief Operating Officer, has served in his current position with Ameriana Bank since 1997. Previously, he held executive positions with Indiana community banks, including President and CEO of Seymour National Bank and Central National Bank. He is a 38-year veteran of community banking in Indiana. He is active in numerous community organizations and is currently serving as Chairman of the Board of Trustees, Hancock Regional Hospital in Greenfield, Indiana. He received a bachelor’s degree from Ball State University, Muncie, Indiana and completed the University of Wisconsin’s Graduate School of Banking.

John J. Letter, Senior Vice President, Treasurer and Chief Financial Officer (“CFO”) joined the Ameriana team in 2007, bringing more than 30 years of experience in bank financial management. Previously, he served in a number of senior executive positions with Old National Bancorp (NYSE:ONB) in Evansville, Indiana, including Regional President, District President and Regional CFO with Old National Bank. Prior to Old National, he served as CFO and Controller with American National Bank in Muncie, Indiana; CFO of Muncie Federal Savings Bank; and CFO of Pioneer Savings Bank in Racine, Wisconsin. He served in the US Army, achieving the rank of Captain. Letter, a Certified Public Accountant, received his bachelor’s in business administrat ion from the University of Wisconsin – Whitewater.

Michael L. Wenstrup, Senior Vice President and Chief Credit Officer, joined Ameriana in 2010 following a 27 year executive career in credit, commercial lending and portfolio management at Parkway Bank and Trust in Phoenix and Harwood Heights, Illinois; LaSalle National Bank, Chicago; and Standard Bank and Trust in Hickory Hills, Illinois. He received a BA in accounting from North Central College in Naperville, Illinois.

James A. Freeman, Senior Vice President and Chief Commercial Lending Officer, joined Ameriana in 2005 and established a commercial loan division that entailed the hiring of eight commercial lending officers and four administrative assistants. Responsible for the day-to-day supervision of all associates assigned to the commercial loan division, and for overall loan generation, he has established individual loan officer goals and provided coaching support for all staff members. He has also been active in developing leading-edge cash management and other products for the Bank’s commercial clients. Previously, he held executive credit management positions at National City Bank in Indianapolis and also served as Small Business Sales Director. He previously held positions in credit, commercial lending and finance at Fifth Third Bank, Irwin Union Bank and Trust, First American Capital Bank and Mitsubishi Bank. He is a veteran of the US Air Force and has attended numerous continuing education classes related to finance and credit risk. He received the Risk Management Association’s Credit Risk Certification in 2004 and has been an active member of local educational and business organizations.

Deborah A. Bell, Senior Vice President and Chief Information Officer, has been with Ameriana since 1976. She has guided the Bank’s information technology since 1988. Under her leadership, the Company has built a sophisticated IT platform rivaling those of large financial institutions in functionality and security. She attended Ball State University, Muncie, Indiana.

Nancy A. Rogers, Senior Vice President - Investor Relations and Corporate Secretary, oversees the Company’s public market-related compliance and reporting issues, shareholder relations, Board of Directors communications and activities, and numerous internal management committees. She joined Ameriana in 1964 and in 1973 assumed the responsibility of planning, directing and evaluating the overall marketing activities of the Bank. In 1995 she was named Senior Vice President-Marketing Services and in 1998 assumed the additional responsibilities as Corporate Secretary of the Bank and the Company. In 2008 she was named Senior Vice President-Investor Relations and Corporate Secretary. She has served on various community boards an d committees which also included serving as President and a Director of the Henry County Chamber of Commerce. She attended Ball State University, Muncie, Indiana.

Deborah C. Robinson, Senior Vice President - Retail Banking and Chief Marketing Officer, joined Ameriana in 2008 to lead the Bank’s growth and expansion initiatives in Central Indiana. She spearheads the development and execution of marketing strategies to support the Ameriana brand. Previously, she served as Vice President of Marketing, Old National Bank, Indianapolis, Indiana and as Vice President of Marketing at American National Bank, Muncie, Indiana. She received a Bachelor’s degree from Ball State University and has won numerous marketing awards at the state and regional level from the American Bankers Association and the American Advertising Federation. Robinson is attending the University of Wisconsin’s Graduate S chool of Banking.

Janice L. Brehm, Senior Vice President - Mortgage Banking, joined Ameriana in 2004 to oversee the Bank’s mortgage operations which includes origination, secondary market, sales and mortgage servicing. Previously she served as processing and servicing manager at First Bank Richmond, NA, Richmond, Indiana.

Board of Directors

Michael E. Kent, Chairman of the Boards of Ameriana Bancorp and Ameriana Bank, a private investor, was Chairman, President and Chief Executive Officer of Modernfold, Inc. until retiring in 1996. He was past President and is currently an Advisory Director of the Alumni Board of the Department of Mechanical Science and Engineering at the University of Illinois. He has been a Director of Ameriana Bank since 1987 and Director of Ameriana Bancorp since its formation.

Ronald R. Pritzke, Vice Chairman of the Boards of Ameriana Bancorp and Ameriana Bank, and is a partner in the law firm of Pritzke & Davis, LLP in Greenfield, Indiana. He currently serves on the Board of Hancock Community Education Alliance, and is a founding member, past President and board member of Regreening Greenfield, Inc. and a co-founding member and Director of PARCS, Inc. (Park Advocacy Research and Conservation Society). He is past President of the Greater Greenfield Chamber of Commerce and also a founding member, past President and served for the past 12 years on the Hancock County Community Foundation Board. He has been a Director of Ameriana Bancorp and Ameriana Bank since 1992.

Donald C. Danielson, Director, is Vice Chairman of City Securities Corporation of Indianapolis. He served on the Board of Trustees of Indiana University for 21 years and was Chairman of the Board for 11 years. He currently is a member of the James Whitcomb Riley Children's Foundation Board of Governors, a Director of the Indiana University Foundation, Indiana Chamber of Commerce, National Fellowship of Christian Athletes, Walther Cancer Institute Foundation, Inc, Indiana Basketball Hall of Fame and Henry County Community Foundation. He served as a member of President Bush’s Credit Standards Advisory Committee in 1991. Danielson was inducted into the Junior Achievement of Central Indiana Business Hall of Fame and Governor Mitch Daniels named Mr. Danielson the 2009 Sachem, the highest award given by the State of Indiana. He has been a Director of Ameriana Bank since 1971 and Director of Ameriana Bancorp since its formation.

R. Scott Hayes, Director, is a partner in Hayes Copenhaver Crider, New Castle, Indiana, the law firm which serves as General Counsel to Ameriana Bancorp. He is a Director and past Chairman of the New Castle/Henry County Economic Development Corporation, is currently President of the Henry County Redevelopment Commission and is also President of the Board of Trustees of the Henry County YMCA. He has been a Director of Ameriana Bank since 1984 and Director of Ameriana Bancorp since its formation.

Charles M. (Kim) Drackett, Jr., Director, is Chairman, President and General Manager of Fairholme Farms Inc. in Lewisville, Indiana. He is a graduate of Dartmouth College, the Indiana Institute of Food and Nutrition in Indianapolis and the Purdue University Short Course in Agriculture. Mr. Drackett has served as a Trustee of the Indiana Pork Producers Association and as a Director of The Cincinnati Nature Center where he was Chairman of its Agricultural Operations Committee. He has been a Director of Ameriana Bank since 1989 and Director of Ameriana Bancorp since its formation.

Richard E. Hennessey, Director, is Executive Vice President Real Estate Development of Shiel Sexton Company, Inc., one of Indiana's largest construction companies and one of America's Top 400 contractors. He is a Certified Public Accountant (“CPA”) and a member of the American Institute of Certified Public Accountants and the Indiana CPA Society. Hennessey serves on the Executive committee of the Indianapolis Tennis Championships, and has held executive positions with numerous not-for-profit organizations. He has been a Director of Ameriana Bancorp and Ameriana Bank since 2004.

Michael E. Bosway, Director, is President and Chief Executive Officer of City Securities Corporation in Indianapolis and has served on the boards of directors of City Securities Corporation since 1998 and City Financial Corporation since 2006. He currently serves on the board of directors of the Indianapolis Chamber of Commerce, is a member of the Securities Industry and Financial Markets Association (“SIFMA”) Regional Firms Committee and SIFMA CEO Roundtable and is a member of the Indianapolis Chamber of Commerce’s Fiscal Policy Council. He served as Chairman of the Financial Industry Regulatory Authority (“FINRA”) Advisory Council in 2007 and Chairman of the FINRA District 8 Committee in 2006. He also serves in leadership positions for numerous charitable, philanthropic and private organizations. He has been a Director of Ameriana Bancorp and Ameriana Bank since July 2009.

Jerome J. Gassen, Ameriana Bancorp and Ameriana Bank President and Chief Executive Officer, has been a Director of Ameriana Bancorp and Ameriana Bank since 2005.

Member FDIC

This document contains forward-looking statements within the meaning of the federal securities laws. Statements in this release that are not strictly historical are forward-looking and are based upon current expectations that may differ materially from actual results. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by the statements made herein. These risks and uncertainties involve general economic trends, changes in interest rates, loss of deposits and loan demand to other financial institutions, substantial changes in financial markets, changes in real estate value and the real estate market, regulatory changes, possibility of unforeseen events affecting the industry generally, the uncertainties associated with newly developed or acquired op erations, the outcome of pending litigation, and market disruptions and other effects of terrorist activities. For discussion of these and other risks that may cause actual results to differ from expectations, refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2009, on file with the Securities and Exchange Commission, including the section entitled "Risk Factors." The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required under the rules and regulations of the Securities and Exchange Commission.