Ameriana Bancorp

Annual Meeting of

Shareholders

May 20, 2010

Forward-Looking Statement

This presentation contains forward-looking

statements, which include statements about

Ameriana’s future financial performance,

business plans and strategies. Forward-

looking statements involve future risks and

uncertainties, because of factors that could

cause actual results to differ materially from

those expressed or implied. Specific risk

factors and other uncertainties that could

affect the accuracy of forward-looking

statements are included in Ameriana’s Form

10-K for the year ended December 31, 2009.

Michael Kent

Chairman of the Board

Introduction of Directors:

Jerome J. Gassen – President and Chief Executive Officer – Ameriana

Bancorp

Ronald R. Pritzke – Vice Chairman of the Board, Ameriana Bancorp,

Partner - Pritzke & Davis

Donald C. Danielson – Vice Chairman of the Board – City Securities

Corporation

R. Scott Hayes – General Counsel, Senior Partner – Hayes Copenhaver

Crider

Charles M. (Kim) Drackett, Jr. – Chairman, President and General Manager

– Fairholme Farms Inc.

Richard E. Hennessey – Executive Vice President – Real Estate

Development – Shiel Sexton Company inc.

Michael E. Bosway – President and Chief Executive Officer – City

Securities Corporation

Paul W. Prior – Director Emeritus - Former President and Chairman of the

Board

Representing our Independent Auditor

BKD – Indianapolis Office

Troy Gilstorf

Partner - BKD

Steve Moore

Partner - BKD

Mike Ososki

Manager – BKD

Introduction of Senior Officers:

Timothy G. Clark – Executive Vice

President and Chief Operating Officer

John J. Letter – Senior Vice President –

Treasurer and Chief Financial Officer

Michael L. Wenstrup – Senior Vice

President and Chief Credit Officer

Nancy A. Rogers - - Senior Vice President –

Investor Relations and Corporate Secretary

Proxy Proposals

Election of Directors

Ratification of Appointment of

BKD, LLP as Independent

Auditor

Remarks of Mr. Kent:

Board is focused on two key objectives:

“Well Being” of the Company

Return on investment to shareholders

Long - term view

Well being of the Company

Bank’s financial condition – “Well Capitalized”

Approved for TARP

Strong Corporate Governance

The Company’s strategic plan and its goals and

objectives

Quality of Management

Remarks of Mr. Kent:

Corporate Governance

Disclosure Committee

Development, approval and implementation of

the long-range strategic plan

Independent Board Committees provide

oversight

Board education

Management Team Focus

Improving asset quality

Minimizing credit losses

Maintaining liquidity and capital

Comprehensive risk management approach

Jerome J. Gassen

President and CEO

Background Information

Headquarters – New Castle, Indiana

Henry County

15 Locations

- 13 Banking Centers

- 1 Loan Production Center

- 1 Insurance Office

# 1 Market Share in Henry County – 31.25%

- $213.8 Million in Deposits

# 4 Market Share in Hancock County – 10.83%

- $74.2 Million in Deposits

(FDIC summary of deposits 6/30/09)

Hamilton County

$25.0 Million in Deposits

(Source: FDIC)

Ameriana Bancorp - Profile

Line of Business Focus

Commercial/Business Lending

Mortgage Banking

Consumer Lending and Deposits

Ameriana Financial Services

Ameriana Insurance

Experienced Management Team

Enterprise Risk Management

Ameriana Bancorp Profile

“ Our mission and promise is to

engage every customer in

genuine and innovative ways, to

truly understand and embrace

their individual needs and

desires, so we can provide them

with the best financial solutions

and direction.”

Industry Challenges In 2009

Commercial

Deterioration of credit quality

Higher Industry NPAs

Higher provision expenses

Slowing absorption rates

Declining appraised values; higher cap rates

Industry Challenges In 2009

Residential

Record levels of residential foreclosures

nationwide

Decreased property values (20-40% declines in

appraised values)

Significantly increased sale times

Tightened secondary market and PMI standards

Government intervention is directing write-downs

on loans in foreclosure

Re-defaults

Industry Challenges In 2009

Bank failures

2008 – 25

2009 – 140

YTD – 72

Negative public opinion of bank

bailout/TARP

Regulatory expectations on capital and

liquidity

Ameriana – 2010 Key Objectives

Soundness – CAPITAL

Preserve and Build Capital

Reduce risk-based assets, if needed

Reduce expenses and pursue fee income

opportunities to increase net income

Evaluate raising capital from traditional capital

markets i.e.

Preferred stock

Subordinated debentures

Rights offering

Evaluate securitization of mortgage assets

Ameriana – 2010 Key Objectives

Soundness – Resolution of Problem Assets

Reduce NPAs and OREO

Minimize losses

Work with borrowers in distress if possible

Utilize skills of Special Assets Manager and Chief

Credit Officer to manage criticized and classified

assets

Ensure adequacy of ALLL

Ameriana – 2010 Key Objectives

Profitability

Maintain or improve Net Interest Margin

Increase Net Interest Income by increasing

earning assets and margin

Manage expenses

Grow other income from Ameriana Financial

Services and Ameriana Insurance

Ameriana – 2010 Key Objectives

Growth

Due to current economic conditions additional

significant growth initiatives have been placed on

hold

Ameriana Bancorp – Profile

(as of 12/31/2009)

Ameriana Bancorp – Consolidated ($ in 000s)

- Total Assets - $441,563

- Total Loans – Net of allowance - $321,544

- Total Deposits - $338,381

Ameriana Financial

- Assets under Management - $ 39.1 million

Ameriana Insurance

- Total Customers - 4,700

- P & C Revenues - - $779,000

2009 Financial Results

Net loss of $264,000 compared to $741,000 net income in

2008

Net interest income increased $896M or 7.6%

Interest rate spread improved by 55 basis points to 3.6%

at 12/31/09

Increased deposits by 4.3% to $338.4 million

Shrank the Investment Portfolio by 52.4% to 8.1% of total

assets

Sold 16.67% interest in Family Financial Holdings, Inc.

2009 Financial Results

2009 Earnings impacted by:

$930,000 increase in provision for loan losses

$797,000 increase in FDIC premiums

$255,000 increase in OREO expense

$149,000 increase in pension expense

Capital Ratios

(As of 3/31/10)

Ameriana Bank Actual Well-Capitalized

TIER 1 Leverage Ratio 8.54% 5.00%

TIER 1 Risk-Based Capital Ratio 11.58% 6.00%

Total Risk-Based Capital Ratio 12.83% 10.00%

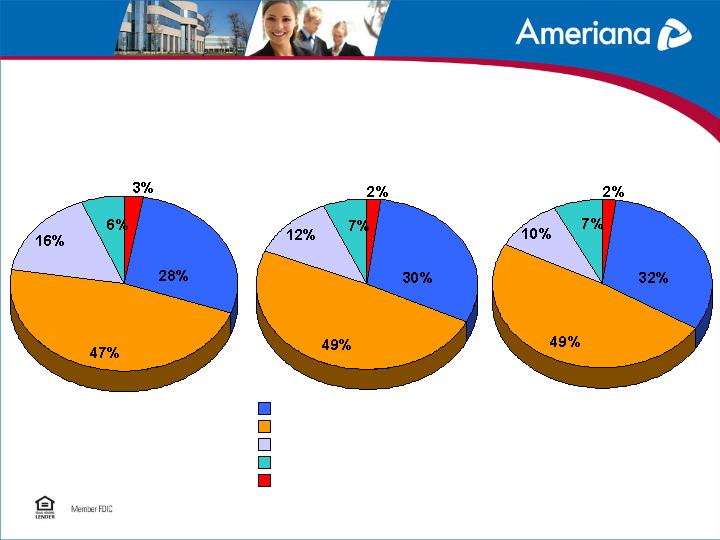

($ in thousands)

(as of 12/31)

Total Loans

Loan Mix

(as of 12/31)

(% of total loans)

Commercial Real Estate Loans

Residential Real Estate Loans

Construction Real Estate Loans

Commercial Loans and Leases

Consumer & Municipal Loans

2007

2008

2009

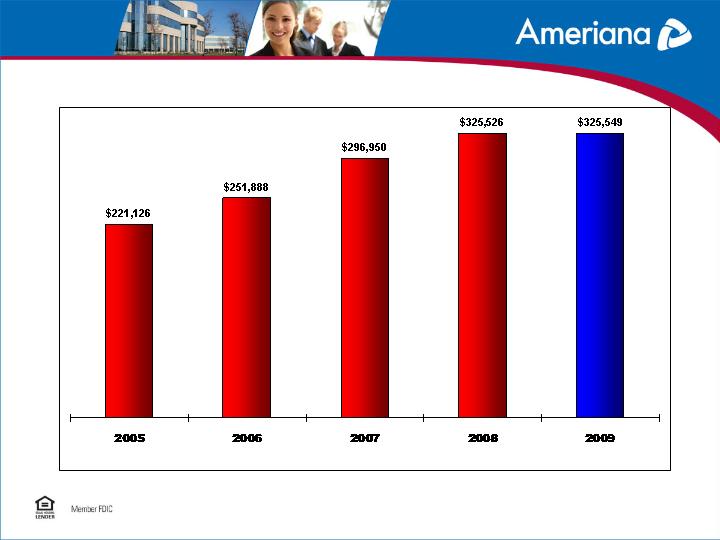

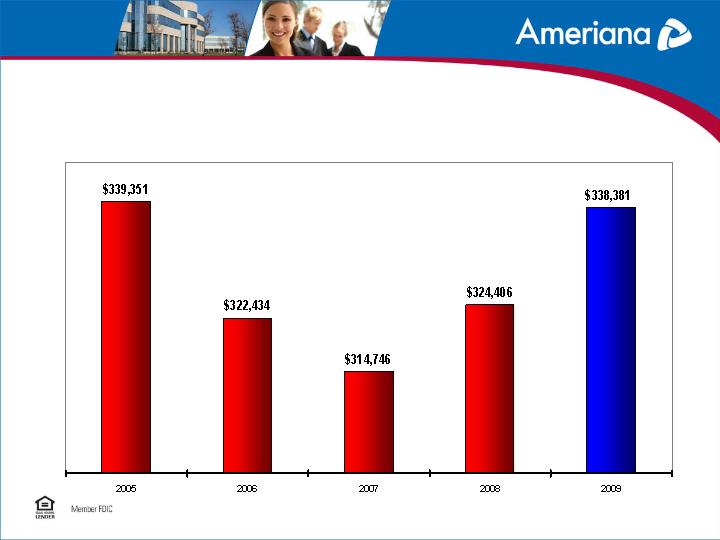

Total Deposits

(as of 12/31)

($ in thousands)

(*2005 includes brokered CD’s of $9,977,000)

*

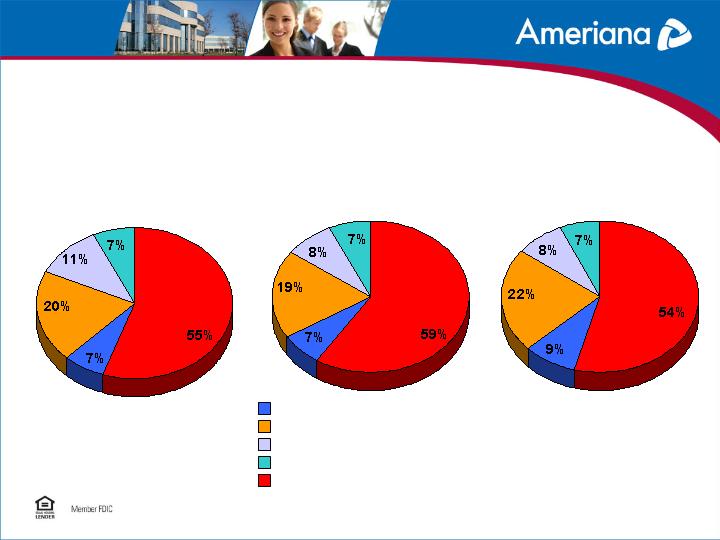

Deposit Mix

(as of 12/31)

% of total deposits

Noninterest-bearing Deposits

NOW Deposits

Money Market Deposits

Savings Deposits

2007

2008

2009

Certificates of Deposits

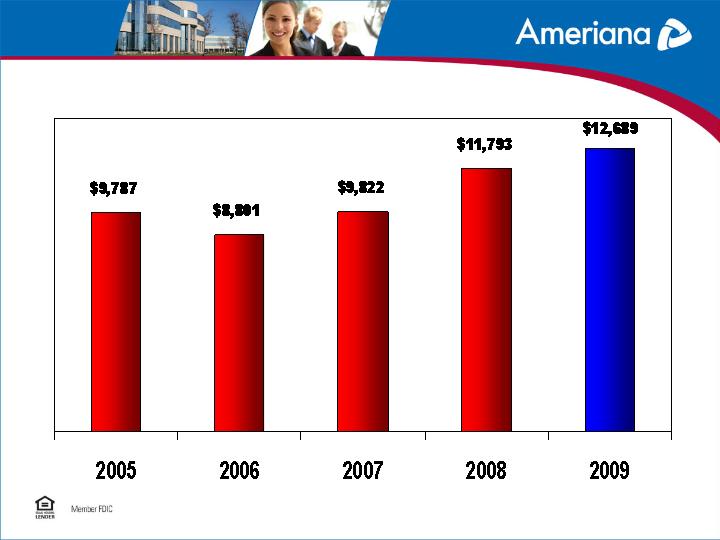

($ in thousands)

(as of 12/31)

Net Interest Income

Net Interest Margin

(as of 12/31)

(Net Interest Margin is Net Interest Income presented on a tax

equivalent basis as a % of average interest - earning assets)

Credit Quality

(as of 12/31)

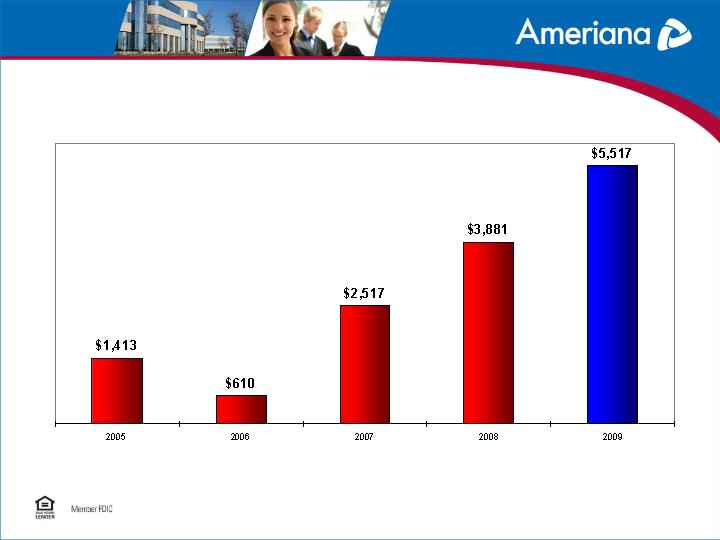

Classified and Criticized Loans

($ in thousands)

Credit Quality

(as of 12/31)

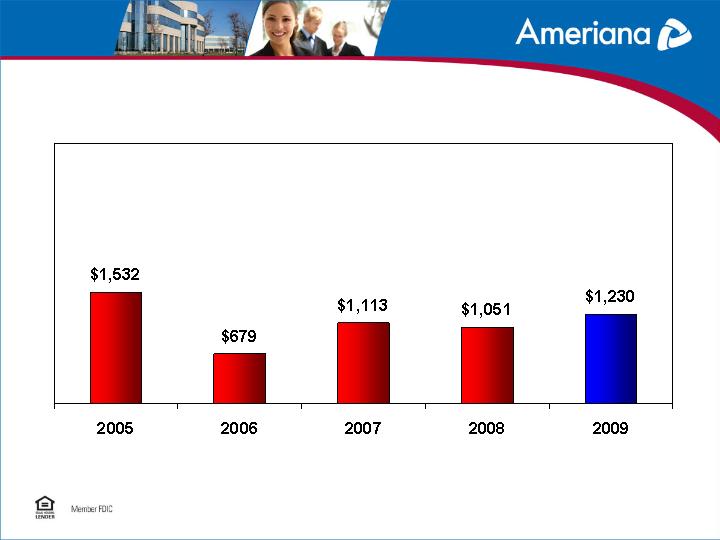

Non-Performing Loans

($ in thousands)

Credit Quality

(as of 12/31)

Non-Performing Loans/Total Loans

(% of total loans)

Credit Quality

(as of 12/31)

OREO

($ in thousands)

Credit Quality

(as of 12/31)

Charge - offs

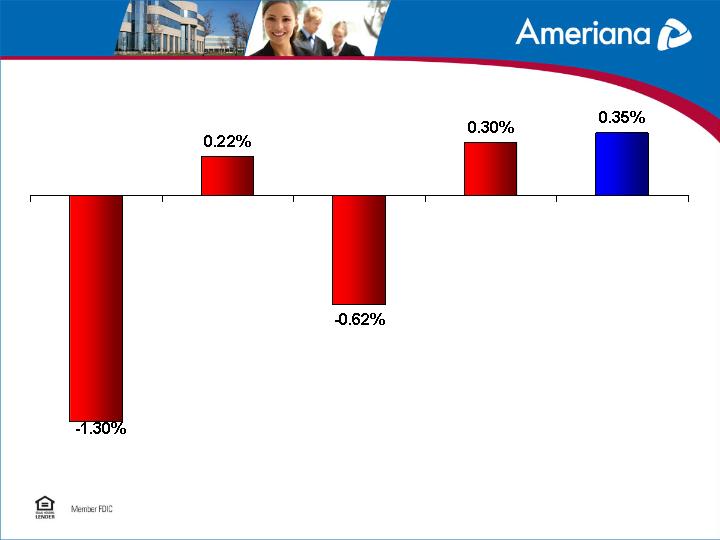

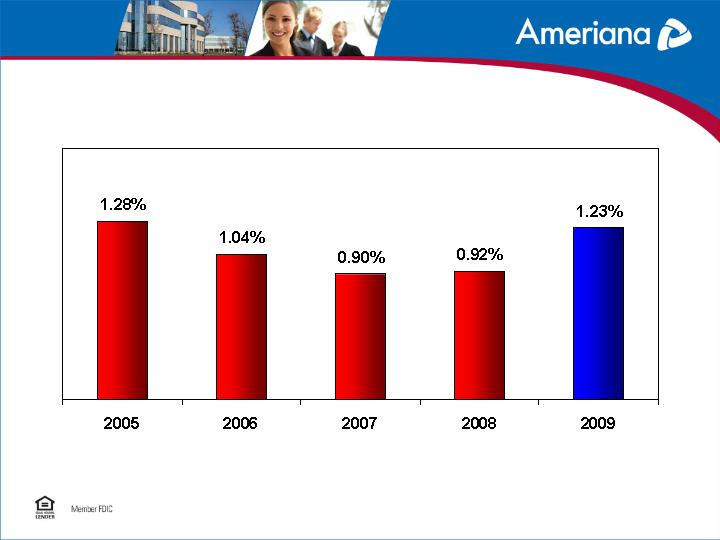

Credit Quality

Net Charge – offs / Total Loans

(as of 12/31)

2005

2006

2007

2008

2009

Credit Quality

(as of 12/31)

Allowance for Loan Losses

($ in thousands)

$2,835

$2,616

$2,677

$2,991

$4,005

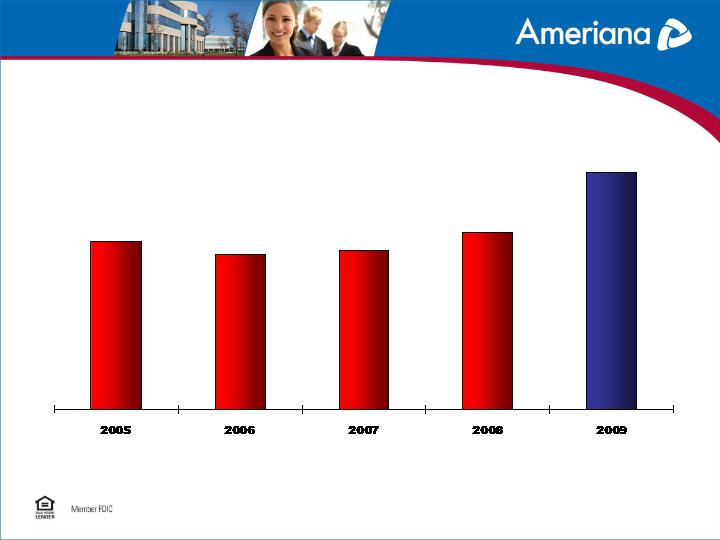

Credit Quality

(as of 12/31)

Allowance for Loan Losses

(% of total loans)