SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

AMERIANA BANCORP

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

[AMERIANA BANCORP LETTERHEAD]

April 15, 2005

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Ameriana Bancorp (the “Company”), to be held at the main office of Ameriana Bank and Trust, SB, 2118 Bundy Avenue, New Castle, Indiana, on Thursday, May 19, 2005 at 10:00 a.m.

The attached notice of the Annual Meeting and proxy statement describe the formal business to be transacted at the Annual Meeting. During the Annual Meeting, we will also report on the operations of the Company. Directors and officers of the Company as well as a representative of the Company’s auditors, BKD,LLP, will be present to respond to appropriate questions of shareholders.

Detailed information concerning our activities and operating performance during our fiscal year ended December 31, 2004 is contained in our annual report, which is also enclosed.

Please sign, date and promptly return the enclosed proxy card. If you attend the Annual Meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the Annual Meeting.

|

Sincerely, |

|

/s/ Harry J. Bailey |

Harry J. Bailey |

President and Chief Executive Officer |

AMERIANA BANCORP

2118 Bundy Avenue

New Castle, Indiana 47362

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 19, 2005

The Annual Meeting of Shareholders (the “Annual Meeting”) of Ameriana Bancorp (the “Company”) will be held at the main office of Ameriana Bank and Trust, SB, 2118 Bundy Avenue, New Castle, Indiana, on Thursday, May 19, 2005, at 10:00 a.m.

A Proxy Card and a Proxy Statement for the Annual Meeting are enclosed.

The Annual Meeting is for the purpose of considering and acting on:

| | 1. | The election of four directors of the Company; |

| | 2. | The ratification of the appointment of BKD,LLP as auditors for the Company for the fiscal year ending December 31, 2005; and |

| | 3. | Such other matters as may properly come before the Annual Meeting or any adjournments thereof. |

NOTE: The Board of Directors is not aware of any other business to come before the Annual Meeting.

Any action may be taken on any one of the foregoing proposals at the Annual Meeting on the date specified above, or on any date or dates to which, by original or later adjournment, the Annual Meeting may be adjourned. Shareholders of record at the close of business on April 1, 2005 are entitled to receive notice of and vote at the Annual Meeting and any adjournments thereof.

You are requested to fill in and sign the enclosed form of proxy, which is solicited by the Board of Directors and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend and vote at the Annual Meeting in person.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

/s/ Nancy A. Rogers |

Nancy A. Rogers |

Secretary |

New Castle, Indiana

April 15, 2005

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO INSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

PROXY STATEMENT

OF

AMERIANA BANCORP

2118 BUNDY AVENUE

NEW CASTLE, INDIANA 47362

ANNUAL MEETING OF SHAREHOLDERS

May 19, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Ameriana Bancorp (the “Company”) to be used at the Company’s Annual Meeting of Shareholders, which will be held at the main office of its wholly owned subsidiary, Ameriana Bank and Trust, SB (the “Bank”), 2118 Bundy Avenue, New Castle, Indiana, on Thursday, May 19, 2005 at 10:00 a.m. The accompanying notice of meeting and this proxy statement are being first mailed to shareholders on or about April 15, 2005.

VOTING AND REVOCABILITY OF PROXIES

Who Can Vote at the Meeting. You are entitled to vote your Ameriana Bancorp common stock if the records of the Company show that you held your shares as of the close of business on April 1, 2005. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker, bank or nominee. As the beneficial owner, you have the right to direct your broker on how to vote your shares. Your broker, bank or nominee has enclosed a voting instruction card for you to use in directing it on how to vote your shares.

As of the close of business on April 1, 2005, 3,155,204 shares of Company common stock were outstanding. Each share of Company common stock has one vote.

Attending the Meeting.If you are a shareholder as of the close of business on April 1, 2005, you may attend the meeting. However, if you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank, broker or other nominee are examples of proof of ownership. If you want to vote your shares of Ameriana Bancorp common stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Vote Required. The annual meeting will be held if at least a majority of the outstanding shares of Company common stock entitled to vote, constituting a quorum, is represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes for determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees or withhold votes as to any nominee. There is no cumulative voting for the election of directors. Directors shall be elected by a plurality of the votes cast by shareholders entitled to vote. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In voting on the ratification of the appointment of BKD,LLP as independent auditors, you may vote in favor of the proposal, against the proposal or abstain from voting. To be approved, this matter requires the affirmative vote of a majority of the votes cast at the annual meeting. Broker non-votes and abstentions will not be counted as votes cast and will have no effect on the voting on this proposal.

Voting by Proxy.This proxy statement is being sent to you by the Board of Directors of the Company to request that you allow your shares of Ameriana Bancorp common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Ameriana Bancorp common stock represented at the meeting by properly executed, dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.The Board of Directors recommends that you vote “FOR” each of the nominees for director and “FOR” ratification of BKD,LLP as independent auditors of the Company for the year ending December 31, 2005.

If any matter not described in this proxy statement is properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your Ameriana Bancorp common stock may also be voted by the persons named in the proxy card on the new meeting date, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the meeting.

Shareholders who execute proxies retain the right to revoke them at any time. Unless so revoked, the shares represented by such proxies will be voted at the annual meeting and all adjournments thereof. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company, by the filing of a later-dated proxy before a vote being taken on a particular proposal at the annual meeting or by attending the annual meeting and voting in person. The mere presence of a shareholder at the annual meeting will not in and of itself revoke such shareholder’s proxy.

If your Ameriana Bancorp common stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form provided by your broker, bank or other nominee that accompanies this proxy statement. If you wish to change your voting instructions after you have returned your voting instruction form to your broker, bank or other nominee, you must contact your broker, bank or other nominee.

2

SECURITY OWNERSHIP

The following table sets forth information as of April 1, 2005 (1) with respect to any person who was known to the Company to be the beneficial owner of more than five percent (5%) of the Company common stock, and (2) as to the Company common stock beneficially owned by each director of the Company, by each executive officer of the Company named in the “Summary Compensation Table” and by all directors and executive officers of the Company as a group. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investing power.

| | | | | | | |

Beneficial Owner

| | Number of Shares Owned

(excluding options)

| | Number of

Shares That May

be Acquired

Within 60 Days

by Exercising

Options

| | Percent of

Common Stock (1)

| |

Harry J. Bailey | | 46,415 | | 28,051 | | 2.34 | % |

Timothy G. Clark | | 9,600 | | 24,500 | | 1.07 | |

Donald C. Danielson | | 101,331 | | 10,000 | | 3.52 | |

Charles M. Drackett, Jr. | | 9,680 | | 21,732 | | * | |

R. Scott Hayes | | 19,340 | | 20,732 | | 1.26 | |

Richard E. Hennessey | | — | | 11,732 | | * | |

Michael E. Kent | | 16,500 | | 21,732 | | 1.20 | |

Paul W. Prior | | 48,719 | | 21,182 | | 2.20 | |

Ronald R. Pritzke | | 13,322 | | 21,732 | | 1.10 | |

Bradley L. Smith | | — | | 8,000 | | * | |

All Directors and Executive Officers as a Group (16 persons) | | 290,918 | | 264,957 | | 16.25 | % |

| | | |

Jeffrey L. Gendell (2) Tontine Financial Partners, L.P. Tontine Management, L.L.C. 55 Railroad Avenue, 3rd Floor Greenwich, CT 06830 | | 230,148 | | — | | 7.23 | % |

| * | Less than 1% of shares outstanding. |

| (1) | Based upon 3,155,204 shares of Company common stock outstanding, plus, for each individual or group, the number of shares of Company common stock that each individual or group may acquire through the exercise of options within 60 days. |

| (2) | Jeffrey L. Gendell, Tontine Financial Partners, L.P. and Tontine Management, L.L.C. collectively reported shared or sole voting and dispositive power with respect to 230,148 shares of the Company’s common stock on a Schedule 13D/A dated as of July 28, 2004. |

3

PROPOSAL I — ELECTION OF DIRECTORS

The Board of Directors of the Company is comprised of eight members and is divided into three classes. Directors serve for staggered three-year terms with one class standing for election at each annual meeting. Each member of the Board of Directors is “independent” in accordance with the listing standards of the Nasdaq Stock Market (“Nasdaq”), except for Harry J. Bailey and R. Scott Hayes. Mr. Bailey is not independent because he is an employee of the Company and the Bank. Mr. Hayes is not independent because of the legal services he and his law firm provided for the Company and the Bank in fiscal 2004. See“Transactions with Management.”

At the annual meeting, four current directors will stand for election. The Board of Directors has nominated Harry J. Bailey, Charles M. Drackett, Jr., Richard E. Hennessey and Ronald R. Pritzke to serve as directors for three-year terms. Mr. Bailey informed the Board of Directors of his desire to retire as President and Chief Executive Officer of the Bank and the Company in 2005. The Board has hired an executive search firm to assist the Board of Directors with locating a replacement. The Board will consider outside candidates as well as members of management. The Board has not set a timetable to replace Mr. Bailey and Mr. Bailey has agreed to remain in office until a replacement has been found. It is anticipated that Mr. Bailey will remain a consultant to the Company and the Bank for three years after his retirement to assist the new president and chief executive officer in the transition process.

It is intended that the persons named in the proxies solicited by the Board will vote“FOR” the election of the named nominees. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute nominee as the Board of Directors may recommend. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board knows of no reason why any nominee might be unable to serve.

Information regarding the nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his current occupation for the last five years. The age indicated in each biography is as of December 31, 2004. There are no family relationships among the directors or executive officers.

NOMINEES FOR ELECTION OF DIRECTORS

The following nominees are standing for election for terms ending in 2008:

Harry J. Bailey has been President of the Company and the Bank since May 1990 and was appointed Chief Executive Officer in December 1990. Mr. Bailey had been the Executive Vice President and Chief Operating Officer of the Company since its formation in 1989 and of the Bank since February 1984. He has been a Director of the Bank since 1987 and a Director of the Company since its formation. From June 1983 to January 1984, Mr. Bailey, an attorney, acted as a consultant to financial institutions and for 15 years before, served in the legal department and as operations officer for thrift institutions in the Chicago area. He is a Trustee of the Henry County Memorial Hospital, Director of the New Castle/Henry County Economic Development Corporation, is a past member of the Board of Directors of the Federal Home Loan Bank of Indianapolis, past Chairman and Director of the Indiana Bankers Association, and past Director of the Henry County Community Foundation. Age 62.

Charles M. (Kim) Drackett, Jr. is Chairman, President and General Manager of Fairholme Farms Inc. in Lewisville, Indiana. He is a graduate of Dartmouth College, the Indiana Institute of Food and Nutrition in Indianapolis and the Purdue University Short Course in Agriculture. Mr. Drackett currently serves as a Trustee of the Indiana Pork Producers Association and just completed his term as a Director of The Cincinnati Nature Center where he was Chairman of its Agricultural Operations

4

Committee. He has been a Director of the Bank since 1989 and Director of the Company since its formation. Age 54.

Richard E. Hennesseyis Executive Vice President and Chief Financial Officer of Shiel Sexton Company, Inc. He is a graduate of Indiana University and is a Certified Public Accountant. Mr. Hennessey is a member of the American Institute of Certified Public Accountants and the Indiana CPA Society. He serves on the Executive Committee of the Indianapolis Tennis Championships. He also has served as Vice President of the Indiana University Student Foundation Board of Associates, on the Board of Directors of the Indianapolis Opera and United Cerebral Palsy of Central Indiana, as President of the Indiana/World Skating Academy and as a treasurer and member of the Executive Committee of the Indiana Sports Corporation. He was appointed as a Director of the Bank and of the Company in November 2004. Age 53.

Ronald R. Pritzke is a partner in the law firm Pritzke & Davis in Greenfield, Indiana. He is past President of the Greater Greenfield Chamber of Commerce. He is also a founding member, past President and served for twelve years on the Hancock County Community Foundation Board. In addition, he is a founding member and past President of Regreening Greenfield, Inc. and a co-founding member and Director of PARCS, Inc. (Park Advocacy Research and Conservation Society). Mr. Pritzke served as a member of the Greenfield Public Library Board for over ten years. He is a former member of the Board of the Hancock County Cancer Society. Mr. Pritzke has been a Director of the Company and the Bank since December 1992. Age 57.

DIRECTORS CONTINUING IN OFFICE

The following directors have terms ending in 2006:

R. Scott Hayesis a partner in Hayes Copenhaver Crider, New Castle, Indiana, the law firm which serves as General Counsel to the Company. He is President of the Henry County Redevelopment Commission. He is Director and past Chairman of the New Castle/Henry County Economic Development Corporation, President of the Board of Trustees of Wittenbraker YMCA and retired as a Director of BETA MU Chapter House Association, Inc. after 33 years. He has been a Director of the Bank since 1984 and Director of the Company since its formation. Age 57.

Michael E. Kent is a private investor. Prior to his retirement in January 1996, Mr. Kent was Chairman, President and Chief Executive Officer of Modernfold, Inc. He was past President and is currently an Advisory Director of the Alumni Board of the Department of Mechanical and Industrial Engineering at the University of Illinois. He has been a Director of the Bank since 1987 and Director of the Company since its formation. Age 64.

The following directors have terms ending in 2007:

Donald C. Danielson is Vice Chairman of City Securities Corporation of Indianapolis. He served on the Board of Trustees of Indiana University for 21 years and was Chairman of the Board for 11 years. He currently is a member of the James Whitcomb Riley Children’s Foundation Board of Governors, a Director of the Indiana University Foundation, Indiana Chamber of Commerce, National Fellowship of Christian Athletes, Indiana Basketball Hall of Fame, Henry County Community Foundation and Chairman of the Board for the Walther Cancer Foundation. He served as a member of President Bush’s Credit Standards Advisory Committee in 1991. He has been a Director of the Bank since 1971 and Director of the Company since its formation. Age 85.

5

Paul W. Prior is the Chairman of the Boards of the Company and the Bank. He joined the Bank as Chairman of the Board, President and Chief Executive Officer in January 1973, after having served another savings institution as Chief Executive Officer for 20 years. He became Chairman of the Board, President and Chief Executive Officer of the Company at the time of its formation in 1989. Mr. Prior served as National Chairman of the United States League of Savings Institutions in 1984. He is a life member of the Board of Directors of the Indiana Chamber of Commerce. Age 83.

Meetings and Committees of the Board of Directors

The Board of Directors of the Company conducts its business through meetings of the Board and its committees. During the fiscal year ended December 31, 2004, the Company’s Board of Directors held twelve regular meetings. No director of the Company attended fewer than 75% of the total meetings of the Board of Directors and committees on which such director served during this period.

The Company’s Board of Directors has an Audit Committee, which is responsible for the review and evaluation of the Company’s annual audit and related financial matters. Additionally, the Audit Committee selects the auditor and reviews their independence. This committee consists of Messrs. Kent (Chairman), Drackett, Hennessey and Pritzke, who are all “independent” as defined by Nasdaq listing standards. The Board has determined that Mr. Hennessey is an “audit committee financial expert” as defined under the rules and regulations of the Securities and Exchange Commission. The Company’s Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee met five times during fiscal 2004. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Audit Committee Report.”

The Company’s “nominating committee” is its Nominating and Governance Committee, which will generally be comprised of all of the directors of the Company who are “independent” as defined by Nasdaq listing standards and who are not nominees for a given year’s director elections. For this year’s annual meeting, the directors who are serving on the nominating committee are Messrs. Danielson, Kent and Prior. The Board of Directors has adopted a charter for the Nominating and Governance Committee, which is not available on the Company’s website but was included as an appendix to the Company’s proxy statement for the 2004 annual meeting of shareholders. In 2004, the Nominating and Governance Committee met one time in its capacity as a nominating committee.

In its deliberations, the nominating committee considers a candidate’s knowledge of the banking business, involvement in community, business and civic affairs and whether the candidate would provide for adequate representation of the Company’s market area. Any nominee for director made by the nominating committee must be highly qualified with regard to some or all the attributes listed in the preceding sentence. In searching for qualified director candidates to fill vacancies on the Board, the nominating committee solicits its then current directors for the names of potential qualified candidates. The nominating committee may also ask its directors to pursue their business contacts for the names of potentially qualified candidates. The nominating committee would then consider the potential pool of director candidates, select the top candidate based on the candidates’ qualifications and the Board’s needs, and conduct a thorough investigation of the proposed candidate’s background to ensure there is no past history that would cause the candidate not to be qualified to serve as a director of the Company. If a shareholder has submitted a proposed nominee, in accordance with the procedures in the Company’s Articles of Incorporation as described below, the nominating committee would consider the proposed nominee, along with any other proposed nominees recommended by individual directors, in the same manner in which the nominating committee would evaluate nominees for director recommended by the Board of Directors.

6

The nominating committee will consider recommendations for director submitted by shareholders. Shareholders who wish the nominating committee to consider their recommendations for nominees for director should submit their recommendations in writing to the nominating committee in care of the Secretary, Ameriana Bancorp, 2118 Bundy Avenue, New Castle, Indiana 47362. Each such written recommendation must set forth (1) the name of the recommended candidate, (2) the number of shares of stock of the Company that is beneficially owned by the shareholder making the recommendation and the recommended candidate, and (3) a detailed statement explaining why the shareholder believes the recommended candidate should be nominated for election as a director. In addition, the shareholder making such recommendation must promptly provide any other information reasonably requested by the nominating committee. To be considered by the nominating committee for nomination for election at an annual meeting of shareholders, the recommendation must be received by the January 1 preceding that annual meeting. Recommendations by shareholders that are made in accordance with these procedures will receive the same consideration given to other candidates recommended by directors or executive management.

The Company’s Board of Directors has also appointed a Committee on Compensation and Stock Options, which serves as the Company’s Compensation Committee and is responsible for administering the wage, salary and stock option plans of the Company and the Bank. This committee consists of Messrs. Danielson (Chairman), Hennessey and Kent, each of whom is “independent” as defined by Nasdaq listing standards. This committee met seven times during fiscal 2004. The report of the Compensation Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Report of Committee on Compensation and Stock Options.”

Board Policies Regarding Communications With the Board of Directors and Attendance at Annual Meetings

The Board of Directors maintains a process for shareholders to communicate with the Board of Directors. Shareholders wishing to communicate with the Board of Directors should send any communication to the Secretary, Ameriana Bancorp, 2118 Bundy Avenue, New Castle, Indiana 47362. Any such communication must state the number of shares beneficially owned by the shareholder making the communication. The Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is addressed unless the communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

The Company does not have a policy regarding Board member attendance at annual meetings of shareholders. All of the Company’s directors attended the Company’s 2004 annual meeting of shareholders.

Director Compensation

Directors Fees.All of the members of the Company’s Board of Directors are also members of the Bank’s Board of Directors. The Company’s directors, except the Chairman, receive fees of $6,600 annually. The Company’s Chairman receives a fee of $12,600. The Bank’s non-employee directors, except the Chairman, receive annual fees of $6,000 in addition to $500 for each Board meeting attended. Non-employee directors of all Board committees, except for the Trust Committee, receive fees of $500 per meeting attended, with the Chairman of that committee receiving $750. Non-employee directors of the Trust Committee receive fees of $300 per meeting.

Option Grants. On May 18, 2004, non-employee directors each received stock options to acquire 10,000 shares of Company common stock, at an exercise price of $14.80, the fair market value of

7

the Company’s common stock on the date of grant. On December 22, 2004, Mr. Hennessey received stock options to acquire 11,732 shares of Company common stock, at an exercise price of $15.56, the fair market value of the Company’s common stock on the date of grant. All of the options were exercisable as of the date they were granted.

Director Supplemental Retirement Program. To provide retirement benefits for non-employee directors, the Bank maintains a director supplemental retirement program. Pursuant to the program, the Bank has established a pre-retirement account for the benefit of each non-employee director, which is increased or decreased each year by an amount equal to the difference between the after-tax earnings on specified adjustable life insurance contracts less that year’s premium expense and the Bank’s cost of funds expense on premiums paid to date (the “Index Retirement Benefit”). If the director continues in office until normal retirement age (the later of 65 or five years from the effective date of the program), he will be entitled to receive the balance in his pre-retirement account in ten equal annual installments, plus any additional Index Retirement Benefit accruing to his account for each year thereafter. In the event of disability, a director will become 100% vested and entitled to immediately begin receiving retirement benefits. If a director dies, the remaining unpaid balance of his account shall be paid in a lump sum to his designated beneficiaries. If a director resigns prior to normal retirement age, he will be entitled to receive a percentage of the balance in his pre-retirement account plus a percentage of the Index Retirement Benefit accruing thereafter. The applicable percentage will be equal to 10% times his number of years of service up to 100%. If his service is terminated following a change in control, he will be entitled to receive his benefits at normal retirement age as if he had been continuously serving until that time. For purposes of the Director Supplemental Retirement Program, a change in control will occur if any corporation, person or group acquires more than 25% of the voting stock of the Company or the Bank.

To fund the benefits payable under the Director Supplemental Retirement Program, the Bank has purchased life insurance policies on each director. The policies are designed to offset the program’s costs during the lifetime of the participant and to provide complete recovery of all the program’s costs at their death. The Bank has entered into split-dollar agreements with each of the directors pursuant to which their beneficiaries are entitled to a death benefit equal to 80% of the total policy proceeds less cash value of the policy if a director dies while serving on the Board or has retired or terminated service due to disability. If a director is otherwise not serving on the Board at his death, his beneficiaries will be entitled to a reduced death benefit.

8

Executive Compensation

Summary Compensation Table.The following table sets forth information regarding cash and noncash compensation for each of the last three fiscal years awarded to or earned by the Company’s Chief Executive Officer and each other executive officer of the Company and its subsidiaries whose total salary and bonus for the year exceeded $100,000 (the “Named Executive Officers”).

| | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | Stock Options

| | All Other Compensation (2)

|

| | | Salary

| | Bonus

| | Other Annual (1)

| | |

Harry J. Bailey President and Chief Executive Officer of the Company and the Bank | | 2004

2003

2002 | | $

| 267,000

267,000

267,000 | | $

| —

—

— | | $

| —

—

— | | 10,000

—

— | | $

| 6,202

2,548

2,094 |

| | | | | | |

Timothy G. Clark Executive Vice President and Chief Operating Officer of the Company and the Bank | | 2004

2003

2002 | | $

| 166,000

157,500

157,500 | | $

| —

—

— | | $

| —

—

— | | 7,500

—

5,000 | | $

| 4,488

635

569 |

| | | | | | |

Bradley L. Smith Senior Vice President – Treasurer and Chief Financial Officer of the Company and the Bank | | 2004

2003

2002 | | $

| 119,000

112,500

105,000 | | $

| —

—

— | | $

| —

—

— | | 5,000

—

8,000 | | $

| 2,682

—

— |

| (1) | The value of perquisites and personal benefits received by any named executive officer did not exceed the lesser of $50,000 or 10% of salary and bonus in 2004, 2003 or 2002. |

| (2) | Consists of income attributable to split-dollar plan agreement equal to $2,642, $775 and $0 for Messrs. Bailey, Clark and Smith, respectively, and employer contributions under the Ameriana Bank and Trust, SB 401(k) Plan of $3,560, $3,713 and $2,682 for Messrs. Bailey, Clark and Smith, respectively, in 2004. |

Option Grants in Fiscal Year 2004.The following table contains information concerning the grants of stock options during the year ended December 31, 2004 to the Named Executive Officers.

| | | | | | | | | | | | | | | | |

Name

| | Number of Securities

Underlying Options

Granted (1)

| | Percent of Total Options Grants to

Employees in

Fiscal Year

| | | Exercise Price

| | Expiration Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation

For Options (2)

|

| | | | | | 5%

| | 10%

|

Harry J. Bailey | | 10,000 | | 5.3 | % | | $ | 14.80 | | May 17, 2014 | | $ | 93,100 | | $ | 253,900 |

| | | | | | |

Timothy G. Clark | | 7,500 | | 4.0 | | | | 14.80 | | May 17, 2014 | | | 69,825 | | | 176,925 |

| | | | | | |

Bradley L. Smith | | 5,000 | | 2.6 | | | | 14.80 | | May 17, 2014 | | | 46,550 | | | 117,950 |

| (1) | Mr. Bailey’s stock options vest in four equal annual installments commencing on the date of grant. Messrs. Clark and Smith’s stock options vest in five equal annual installments beginning on the date of grant. |

| (2) | The dollar gains under these columns result from calculations required by the Securities and Exchange Commission’s rules and are not intended to forecast future price appreciation of the common stock. Options have value only if the stock price increases above the exercise price shown in the table during the effective option period. In order for the executive to realize the potential values set forth in the 5% and 10% columns in the table, the price per share of the Company’s common stock would be approximately $24.11 and $38.39, respectively, as of the expiration date of the options. |

9

Year-End Option Values.The following table sets forth information concerning exercises of stock options by the Named Executive Officers during fiscal 2004, as well as the number and value of options held by the Named Executive Officers at the end of 2004.

| | | | | | | | | | | | | | | |

Name

| | Shares Acquired On

Exercise

| | Value

Realized

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End

| | Value of Exercisable In-the-Money Options at Year End (1)

|

| | | | |

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Harry J. Bailey | | 800 | | $ | 3,001 | | 25,551 | | 7,500 | | $ | 44,629 | | $ | 9,300 |

Timothy G. Clark | | — | | | — | | 23,000 | | 6,000 | | | 10,810 | | | 7,440 |

Bradley L. Smith | | — | | | — | | 7,000 | | 6,000 | | | 11,980 | | | 8,540 |

| (1) | Options are considered in-the-money if the market value of the underlying securities exceeds the exercise price of the options. |

Employment and Other Agreements.The Bank has employment agreements with Messrs. Bailey, Clark and Smith, which currently provide for annual salaries of $277,000, $171,000 and $125,000, respectively. The current term of Mr. Bailey’s employment agreement is two years. The terms of the employment agreements for Messrs. Clark and Smith are three years. Each agreement provides for annual salary review by the Board of Directors, as well as any discretionary bonus plans, customary fringe benefits, vacation and sick leave. The agreements provide that the Bank may terminate the executives at any time. If an executive is terminated for a reason other than “cause” (as defined in the agreements), normal retirement or disability, the Bank will continue to pay the executive (or his beneficiary or estate) at his highest monthly salary rate for the remainder of the term of the agreement, provided that the total of such payments does not exceed three times his annual rate of salary as of the date of termination.

Each of these agreements provides that in the event of disability, the executive will continue to receive his full compensation for the first 18 months from the date of such disability, at which time the Bank may terminate the agreement and the executive shall receive 60% of his monthly salary at the time he became disabled until the earlier of his death or his normal retirement date under the Bank’s pension plan. The agreements provide that these amounts shall be offset by any amounts paid to the executives under any other disability program maintained by the Bank.

The agreements further provide that if: (a) after a change in control of the Bank or the Company, the Bank (1) terminates the employment of the executives for any reason other than cause, retirement or disability, (2) otherwise changes the present capacity or circumstances of their employment, or (3) reduces their responsibilities, authority, compensation or benefits (including, in the case of Mr. Bailey, the failure to elect or re-elect him to the Board of Directors of the Bank or the Company) without their written consent; (b) the executive voluntarily terminates their employment within 30 days following a change in control; or (c) during the period beginning six months before a change in control and ending on the later of one year after the change in control or the expiration date of the agreement, the Bank changes the present capacity or circumstances of the executives’ employment or reduces their responsibilities, authority, compensation or benefits (including, in the case of Mr. Bailey, the failure to elect or re-elect him to the Board of Directors of the Bank or the Company) without their written consent, the Bank shall promptly pay the executives a sum equal to 2.99 times the average annual compensation paid to them for the five most recent taxable years ending before the change in control, subject to such reduction as may be required to prevent the payment from being deemed an “excess parachute payment” under Section 280G of the Internal Revenue Code of 1986. “Change in control” generally refers to the acquisition by any person or entity of the ownership or power to vote more than 25% of the Company’s common stock,

10

the ability to control the election of a majority of the Bank’s or the Company’s directors, controlling influence over the management or policies of the Bank or the Company by any person or group or a change in the majority of the Board of Directors over any two-year period that was not approved by two-thirds of the incumbent directors.

Pension Plan.The Bank sponsors a tax-qualified defined benefit pension plan for its employees. However, the accrual of benefits under the pension plan was frozen as of June 30, 2004. The following table shows the estimated annual benefits payable under the pension plan based upon the respective years-of-service and compensation indicated below as calculated under the plan.

| | | | | | | | | | | | | | | | |

Average of High Five Years Compensation

| | Years of Service at Age 65

|

| |

| | 5

| | 10

| | 20

| | 30

| | 40

|

| $ | 50,000 | | $ | 3,800 | | $ | 7,500 | | $ | 15,000 | | $ | 22,500 | | $ | 30,000 |

| | 75,000 | | | 5,600 | | | 11,300 | | | 22,500 | | | 33,800 | | | 45,000 |

| | 100,000 | | | 7,500 | | | 15,000 | | | 30,000 | | | 45,000 | | | 60,000 |

| | 150,000 | | | 11,300 | | | 22,500 | | | 45,000 | | | 67,500 | | | 90,000 |

| | 200,000 | | | 15,000 | | | 30,000 | | | 60,000 | | | 90,000 | | | 120,000 |

The compensation covered by the plan consists of the employee’s salary and bonus (as set forth under “Annual Compensation” in the Summary Compensation Table above) up to applicable legal limits ($205,000 for the 2004 plan year and $210,000 for the 2005 plan year). As of December 31, 2004, Messrs. Bailey, Clark and Smith had 21, 7 and 2 years of service, respectively, under the plan. Participants are not eligible for benefits under the plan until they have completed five years of service. Benefits under the plan are computed on the basis of compensation and years of service and are not subject to any deduction for social security or other offset amounts.

Executive Supplemental Retirement Plan. To supplement the retirement benefits to which executive officers are entitled under the Bank’s pension plan, the Bank maintains executive supplemental retirement plan agreements with Messrs. Bailey and Clark. The agreements establish pre-retirement accounts similar to those established under the Director Supplemental Retirement Program agreements described in “Director Compensation.” If the executives remain employed by the Bank until age 65, they will be entitled to receive the balance in their pre-retirement account in ten equal annual installments plus any additional Index Retirement Benefits accruing each year thereafter. In the event of disability, the executives will become 100% vested in their accounts and entitled to immediately begin receiving their retirement benefits. If the executive dies, the remaining unpaid balance of his account shall be paid in a lump sum to his designated beneficiaries. If the executive voluntarily resigns, he will be entitled to receive 5% times the number of full years that he served the Bank from February 23, 2004 (to a maximum of 100%) times the balance in his pre-retirement account payable over ten years in equal installments commencing when the executive attains 65 years of age. In addition to these payments, the executive will be entitled to receive each year for the period, beginning in the year he attains age 65 until his death, 5% times the number of full years that he served the Bank since February 23, 2004 (to a maximum of 100%) times the Index Retirement Benefit for each year. If the executive is terminated without cause prior to age 65, he will be entitled to receive 10% times the number of full years that he served the Bank (to a maximum of 100%) times the balance in his pre-retirement account payable in equal installments over the course of ten years, commencing when the executive attains 65 years of age. In addition to these payments, the executive is entitled to receive, each year beginning in the year in which he attains age 65 until his death, 10% times the number of full years that he served the Bank (to a maximum of 100%) times the Index Retirement Benefit for each year. If the executive is terminated following a change in

11

control, he will be entitled to receive his benefits at age 65 as if he had been continuously employed until age 65. For purposes of the agreements, a change in control will occur if any corporation, person or group acquires more than 25% of the voting stock of the Company or the Bank. If an executive is discharged at any time for cause, he will forfeit all benefits under the agreements.

To fund the benefits payable under the Executive Supplemental Retirement Plan, the Bank has purchased variable life insurance policies on Messrs. Bailey and Clark. The policies are designed to offset the program’s costs during the lifetime of the participant and to provide complete recovery of all the program’s costs at their death. The Bank is the sole owner of these policies and has exclusive rights to the cash surrender value. The Company has entered into split-dollar agreements with the executives similar to those entered into with directors.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the reports of the Committee on Compensation and Stock Options and the Audit Committee and the Stock Performance Graph shall not be incorporated by reference into any such filings.

Report of Committee on Compensation and Stock Options

The Committee on Compensation and Stock Options (the “Compensation Committee”) of the Board of Directors is composed entirely of directors who are independent in accordance with Nasdaq listing standards. It has overall responsibility to review and recommend compensation plans and structure to the Board with respect to the Company’s executive compensation policies. In addition, the Compensation Committee recommends on an annual basis the compensation to be paid to the Chief Executive Officer and each of the other executive officers of the Company. The Committee also reviews and makes recommendations on annual cash bonus programs, long-term incentive programs, grants of stock options and other executive benefits. The Committee has available to it access to independent compensation data.

The Compensation Committee’s executive compensation philosophy is to provide competitive levels of compensation, integrate management’s pay with the achievement of the Company’s annual and long-term performance goals, reward exceptional corporate performance, recognize individual initiative and achievement and assist the Company in attracting and retaining qualified management. Management compensation is intended to be set at levels that the Compensation Committee believes is consistent with others in the Company’s industry, with attention given to rewarding management based upon the Company’s level of performance.

The Compensation Committee endorses the position that equity ownership by management is beneficial in aligning management’s and shareholders’ interests in the enhancement of shareholder value.

Base salaries for all employees are determined by evaluating the responsibilities of the position held and by reference to the competitive marketplace for talent, including a comparison of base salaries for comparable positions at comparable companies within the banking industry. Minimum, midpoint and maximum levels are then established within the base salary ranges that are used to recognize the performance of an individual.

Annual salary adjustments are determined by evaluating changes in compensation in the marketplace, the performance of the Company, the performance of the executive and any increased responsibilities assumed by the executive. Above-average performance is recognized and rewarded by placing an executive at a higher level in the salary range. Based on the Company’s performance this year,

12

Mr. Bailey, Chief Executive Officer, informed the Compensation Committee that he would not accept a raise.

The Company has an annual incentive plan for executive officers under which executives can receive annual cash bonuses if the Company’s annual goals relating to net income and return on equity are met. Threshold, target and maximum performance goals are set by the Board of Directors at the beginning of each fiscal year, as well as the maximum percentage of base salary that can be earned. Individual performance is taken into account in determining a portion of the bonus, but no bonus is paid unless predetermined threshold levels of net income and return on equity are met.

A stock option program is the Company’s long-term incentive plan for executive officers and key employees. The objectives of the program are to align executive and shareholder long-term interests by creating a strong and direct link to shareholder return and to enable executives to develop and maintain a significant, long-term ownership position in the Company’s common stock.

The base salary of the Chief Executive Officer is established by the terms of the employment agreement entered into between Mr. Bailey and the Bank. The Chief Executive Officer’s base salary under the agreement was determined on the basis of the Committee’s review and evaluation of the compensation of chief executives of other financial institutions similar in size to the company. The Chief Executive Officer’s bonus is determined under the same criteria used for all executive officers as a group.

In fiscal 2004, the Company did not exceed the targeted performance objectives under the incentive bonus plan and no bonuses were awarded.

|

| Compensation and Stock Options Committee |

|

Donald C. Danielson (Chairman) |

R. Scott Hayes |

Michael E. Kent |

13

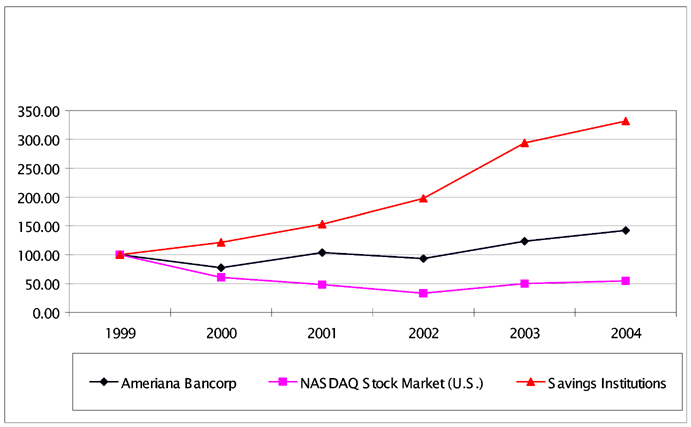

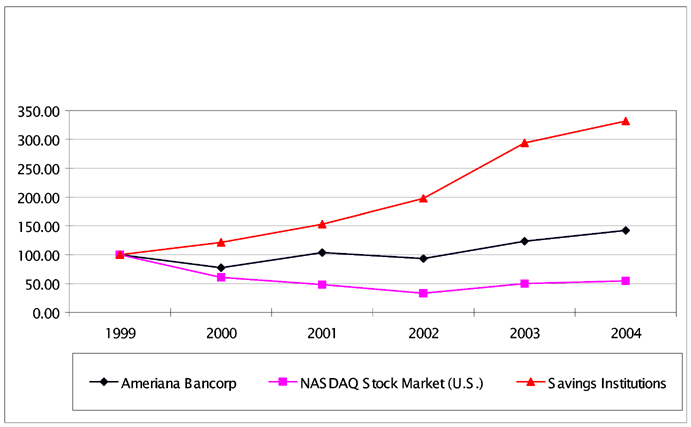

Stock Performance Graph

The following graph compares the cumulative total return of the Company common stock with the cumulative total return of the Nasdaq index for stocks of savings institutions (U.S. Companies, SIC 6030-39) and the Index for the Nasdaq Stock Market (U.S. Companies, all SIC). The graph assumes that $100 was invested on December 31, 1999. Cumulative total return assumes reinvestment of all dividends.

CUMULATIVE TOTAL SHAREHOLDER RETURN

COMPARED WITH PERFORMANCE OF SELECTED INDEXES

December 31, 1999 through December 31, 2004

| | | | | | | | | | | | | | | | | | |

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

Ameriana Bancorp | | $ | 100.00 | | $ | 77.60 | | $ | 103.93 | | $ | 93.38 | | $ | 123.43 | | $ | 142.17 |

Nasdaq Stock Market US | | | 100.00 | | | 60.82 | | | 48.18 | | | 33.13 | | | 49.95 | | | 54.53 |

Savings Institutions Index | | | 100.00 | | | 121.54 | | | 153.12 | | | 197.49 | | | 293.96 | | | 331.74 |

14

TRANSACTIONS WITH MANAGEMENT

The Bank offers mortgage and consumer loans to its directors, officers and employees. These loans do not involve more than the normal risk of collectibility or present other unfavorable features and are made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons.

The law firm of Hayes Copenhaver Crider, of which R. Scott Hayes is a partner, serves as General Counsel to the Company and performs legal services to the Company and the Bank on a regular basis. Estimated legal fees for services rendered to the Company and its subsidiaries by the law firm of Hayes Copenhaver Crider during 2004 were $225,500.

PROPOSAL II — RATIFICATION OF APPOINTMENT OF AUDITORS

BKD,LLP, which was the Company’s independent auditing firm for 2004, has been retained by the Audit Committee of the Board of Directors to be the Company’s auditors for 2005, subject to ratification by the Company’s shareholders. A representative of BKD,LLP is expected to be present at the annual meeting and will have the opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

The appointment of the auditors must be ratified by a majority of the votes cast by the shareholders of the Company at the annual meeting.The Board of Directors recommends that shareholders vote “FOR” the ratification of the appointment of auditors.

The following table sets forth the fees billed to the Company for the fiscal years ending December 31, 2004 and 2003.

| | | | | | | | |

| | | 2004

| | 2003

| | |

Audit Fees | | $ | 86,072 | | $ | 79,569 | | |

Audit Related Fees (1) | | | 9,839 | | | 10,233 | | |

Tax Fees (2) | | | 13,850 | | | 29,950 | | |

All Other Fees (3) | | | 12,602 | | | 26,510 | | |

| (1) | Consists of quarterly reviews of the consolidated condensed financial statements included in Forms 10-Q. |

| (2) | Consists of preparation of tax returns, assistance with quarterly estimates and consultation on various tax matters. |

| (3) | Consists of $3,713 for a loan review and $8,979 for information systems and fiduciary control consulting. |

The Audit Committee’s charter provides that the Audit Committee will pre-approve all audit and non-audit services to be provided by the independent auditor (subject to any exceptions permitted by the Securities and Exchange Commission), review the independent auditor’s proposed audit scope and approach and disclose to investors in periodic reports filed with the Securities and Exchange Commission all non-audit services and all reportable fees paid to the independent auditor. The authority to grant pre-approvals may be delegated to one or more members of the Committee, so long as any decision of such designated director is presented to the full Committee for its approval at its next scheduled meeting. During fiscal years ended December 31, 2003 and 2004, the Audit Committee approved all of “audit-related,” “tax” and “other fees.”

15

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is responsible for developing and monitoring the Company’s audit program. Additionally, the Audit Committee selects the auditors and reviews their independence and their annual audit. The Audit Committee also receives and reviews the reports and findings and other information presented to them by the Company’s officers regarding financial reporting and practices. The Audit Committee is comprised of three directors, each of whom is independent under the Nasdaq Stock Market listing standards. The Audit Committee acts under a written charter adopted by the Board of Directors.

The Audit Committee reviewed and discussed the annual financial statements with management and the independent auditors. As part of this process, management represented to the Audit Committee that the financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee also received and reviewed written disclosures and a letter from the auditors concerning their independence as required under applicable standards for auditors of public companies. The Audit Committee discussed with the auditors the contents of such materials, the auditors’ independence and the additional matters required under Statement on Auditing Standards No. 61. Based on such review and discussions, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission.

The Audit Committee’s responsibility is to monitor and review the Company’s financial reporting process, including its system of internal controls and the preparation of consolidated financial statements. It is not the duty or the responsibility of the Audit Committee to conduct auditing or accounting reviews. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent accountants are in fact “independent.”

|

| Audit Committee |

|

Michael E. Kent |

Charles M. Drackett, Jr. |

Richard E. Hennessey |

Ronald R. Pritzke |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to regulations promulgated under the Securities Exchange Act, the Company’s officers and directors and all persons who own more than 10% of the Company common stock (“Reporting Persons”) are required to file reports detailing their ownership and changes of ownership in the Company common stock and to furnish the Company with copies of all such ownership reports that are filed. Based solely on the Company’s review of the copies of such ownership reports that it has received in the past fiscal year or with respect to the past fiscal year, or written representations that no annual report of changes in beneficial ownership were required, the Company believes that during fiscal year 2004 all Reporting Persons have complied with these reporting requirements.

16

MISCELLANEOUS

The cost of solicitation of proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Company’s common stock. In addition to solicitations by mail, directors and officers of the Company may solicit proxies personally or by telegraph or telephone without additional compensation.

The Company’s Annual Report to Shareholders for 2004 accompanies this proxy statement. Such Annual Report is not to be treated as a part of the proxy solicitation materials nor as having been incorporated herein by reference.

SHAREHOLDER PROPOSALS AND NOMINATIONS

To be eligible for inclusion in the Company’s proxy materials for next year’s annual meeting of shareholders, any shareholder proposal to take action at such meeting must be received at the Company’s headquarters, 2118 Bundy Avenue, New Castle, Indiana 47362, no later than December 16, 2005. If next year’s annual meeting is held on a date more than 30 calendar days from May 19, 2006, a stockholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation materials. Any such proposals shall be subject to the requirements of the proxy rules adopted by the Securities and Exchange Commission.

Shareholder nominations for the election of directors and shareholder proposals, other than those submitted pursuant for inclusion in proxy materials as described above, must be delivered or mailed in writing, in the form prescribed by the Company’s Articles of Incorporation, to the Secretary of the Company at the address given in the preceding paragraph not less than thirty days nor more than sixty days prior to any such meeting; provided, however, that if less than thirty-one days’ notice of the meeting is given to shareholders, such written notice shall be delivered or mailed, as prescribed, to the Secretary of the Company not later than the close of the tenth day following the day on which notice of the meeting was mailed to shareholders.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

/s/ Nancy A. Rogers |

Nancy A. Rogers |

Secretary |

New Castle, Indiana

April 15, 2005

17

| | | | |

| PLEASE MARK VOTES | | REVOCABLE PROXY | | |

| | |

| AS IN THIS EXAMPLE | | AMERIANA BANCORP | | |

| | | | | | | | | | | | | | |

| | | | | | | | | WITH- | | |

ANNUAL MEETING OF SHAREHOLDERS May 19, 2005 | | I. The election as director of all nominees listed below (except as marked to the contrary below): | | FOR ¨ | | HOLD ¨ | | EXCEPT ¨ |

| | | | |

| The undersigned hereby appoints Harry J. Bailey, Charles M. Drackett, Jr., Ronald R. Pritzke, Donald C. Danielson, Paul W. Prior, R. Scott Hayes, Richard E. Hennessey and Michael E. Kent with full powers of substitution in each, to act as attorneys and proxies for the undersigned, and to vote all shares of common stock of the Company which the undersigned is entitled to vote at the Annual Meeting of Shareholders, to be held at the main office of Ameriana Bank and Trust, SB, 2118 Bundy Avenue, New Castle, Indiana, Thursday, May 19, 2005 at 10:00 a.m. and at any and all adjournments thereof, as follows: | | Harry J. Bailey Charles M. Drackett, Jr. Richard E. Hennessey Ronald R. Pritzke | | | | | | |

| | | | | INSTRUCTION: To withhold authority to vote for any individual nominee, mark “Except” and write that nominee’s name in the space provided below. |

| | | | |

|

| | | | | | | FOR | | AGAINST | | ABSTAIN |

| | | | | II. The ratification of the appointment of BKD,LLP as auditors for the fiscal year ending December 31, 2005 | | ¨ | | ¨ | | ¨ |

| | | |

| | | | | | | The Board of Directors recommends a vote “FOR” each nominee and the listed proposition. THIS PROXY WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR EACH OF THE NOMINEES AND THE PROPOSITION STATED. IF ANY OTHER BUSINESS IS PRESENTED AT SUCH ANNUAL MEETING, THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE DETERMINATION OF A MAJORITY OF THE BOARD OF DIRECTORS. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE ANNUAL MEETING. THIS PROXY ALSO CONFERS DISCRETIONARY AUTHORITY ON THE BOARD OF DIRECTORS TO VOTE WITH RESPECT TO APPROVAL OF THE MINUTES OF THE PRIOR ANNUAL MEETING OF SHAREHOLDERS, THE ELECTION OF ANY PERSON AS DIRECTOR WHERE THE NOMINEE IS UNABLE TO SERVE OR FOR GOOD CAUSE WILL NOT SERVE, AND MATTERS INCIDENT TO THE CONDUCT OF THE 2005 ANNUAL MEETING. |

| | | |

Please be sure to sign and date this proxy in the box below | | | | Date | | The undersigned acknowledges receipt from the Company before the execution of this proxy of notice of the annual meeting, a proxy statement for the annual meeting and the Company’s 2004 Annual Report. |

Shareholder sign above. | | Co-holder (if any) sign above | |

Detach above card, date, sign and mail in postage-paid envelope provided.

AMERIANA BANCORP

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

PLEASE COMPLETE, DATE, SIGN AND MAIL THIS PROXY PROMPTLY

IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.

________________________________________

________________________________________