Exhibit 99.1

Ameriana Bancorp Annual Meeting May 16, 2013

CEO Presentation

1

Forward-Looking Statement

This presentation contains forward-looking statements, which include statements about Ameriana’s future financial performance, business plans and strategies. Forward-looking statements involve future risks and uncertainties, because of factors that could cause actual results to differ materially from those expressed or implied. Specific risk factors and other uncertainties that could affect the accuracy of forward-looking statements are included in Ameriana’s Form 10-K for the year ended December 31, 2012.

2

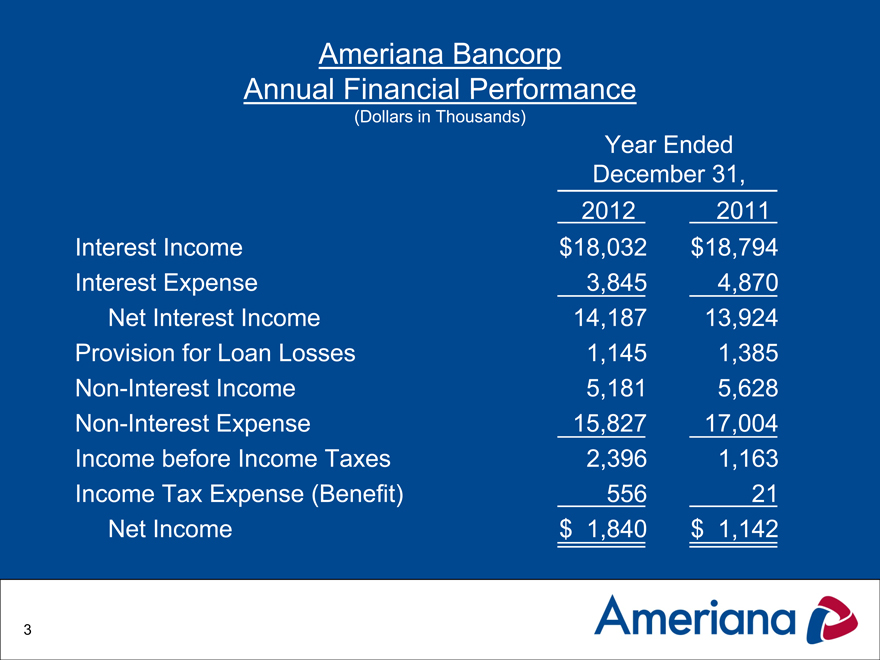

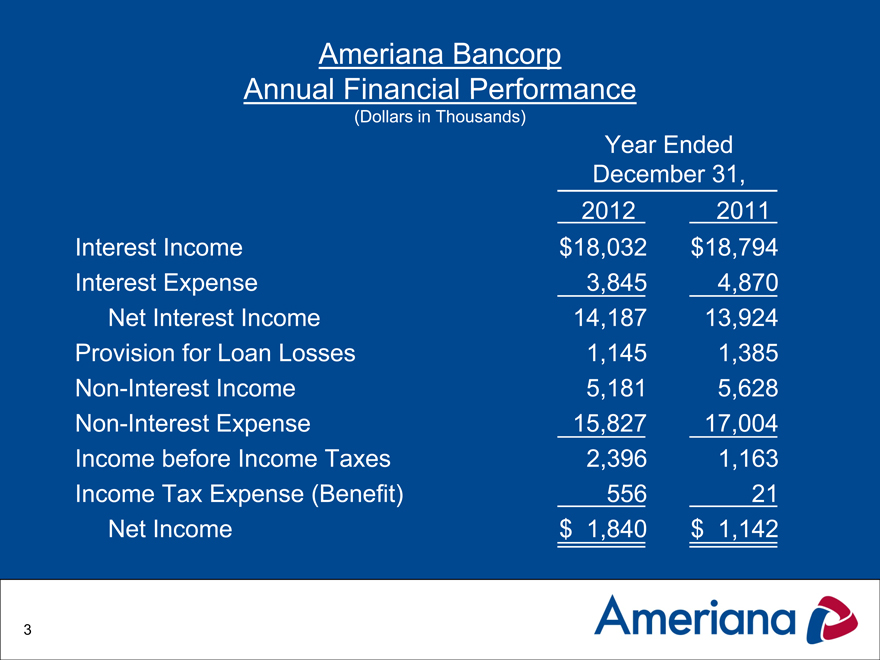

Ameriana Bancorp Annual Financial Performance

(Dollars in Thousands)

Year Ended

December 31,

2012 2011

Interest Income $ 18,032 $ 18,794

Interest Expense 3,845 4,870

Net Interest Income 14,187 13,924

Provision for Loan Losses 1,145 1,385

Non-Interest Income 5,181 5,628

Non-Interest Expense 15,827 17,004

Income before Income Taxes 2,396 1,163

Income Tax Expense (Benefit) 556 21

Net Income $ 1,840 $ 1,142

3

Ameriana Bancorp Quarterly Financial Performance

(Dollars in Thousands)

Three Months

Ended March 31,

2013 2012

Interest Income $ 4,291 $ 4,559

Interest Expense 762 1,042

Net Interest Income 3,529 3,517

Provision for Loan Losses 255 255

Non-Interest Income 1,512 1,280

Non-Interest Expense 3,960 4,119

Income before Income Taxes 826 423

Income Tax Expense 212 78

Net Income $ 614 $ 345

4

Ameriana Bank Capital

(as of 3/31/13)

Bank Peer

Tier 1 Leverage Capital 9.31% 9.79%

Tier 1 RBC/Risk Wtd. Assets 13.04 14.72

Total RBC/Risk Wtd. Assets 14.30 15.93

Source: FDIC UBPR 3/31/2013

5

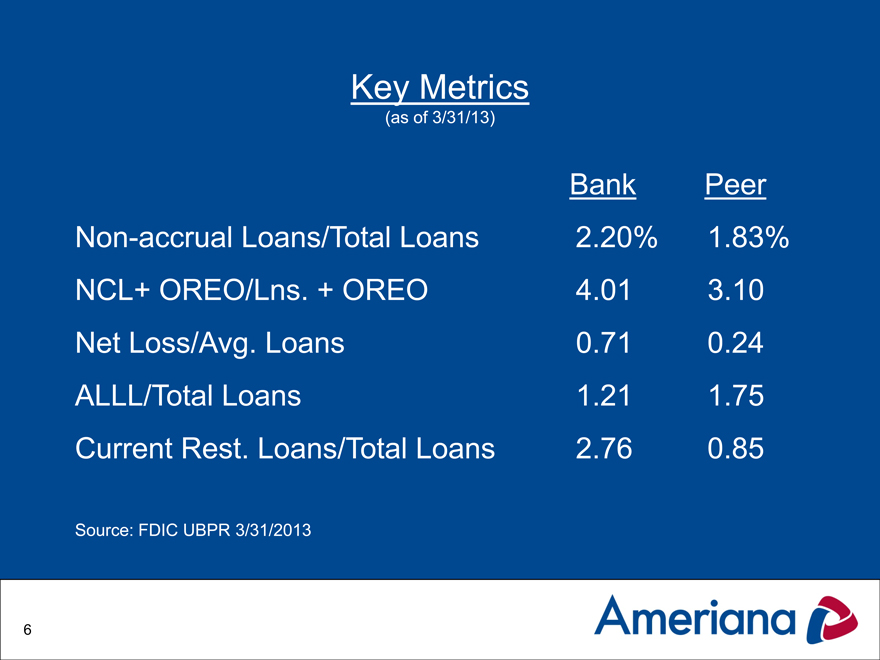

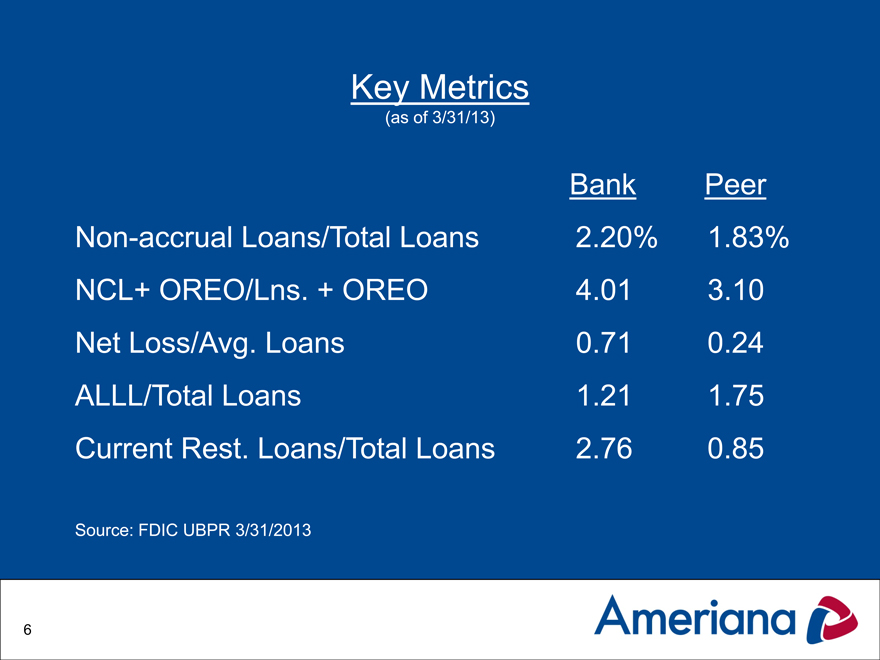

Key Metrics

(as of 3/31/13)

Bank Peer

Non-accrual Loans/Total Loans 2.20% 1.83%

NCL+ OREO/Lns. + OREO 4.01 3.10

Net Loss/Avg. Loans 0.71 0.24

ALLL/Total Loans 1.21 1.75

Current Rest. Loans/Total Loans 2.76 0.85

Source: FDIC UBPR 3/31/2013

6

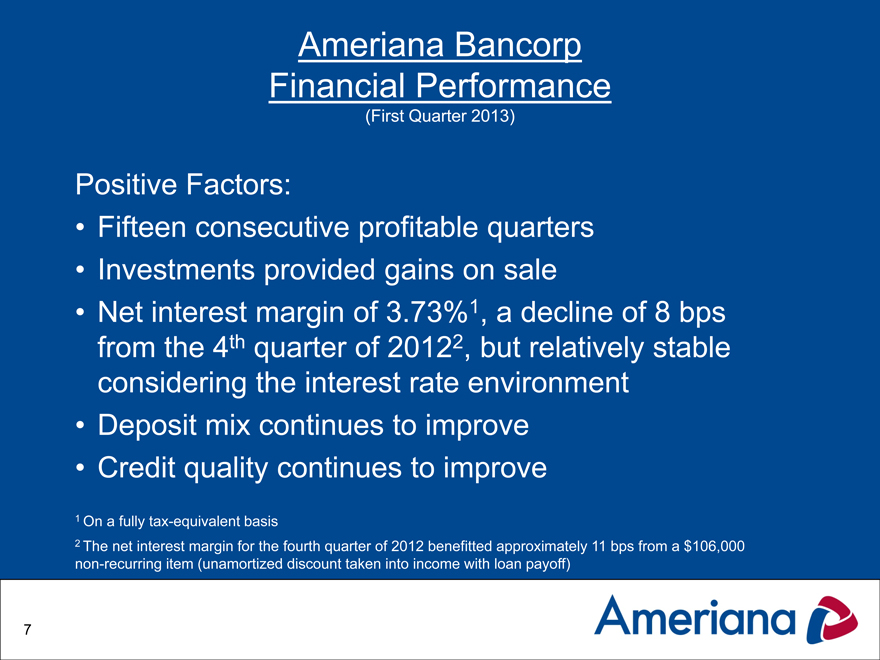

Ameriana Bancorp Financial Performance

(First Quarter 2013)

Positive Factors:

• Fifteen consecutive profitable quarters

• Investments provided gains on sale

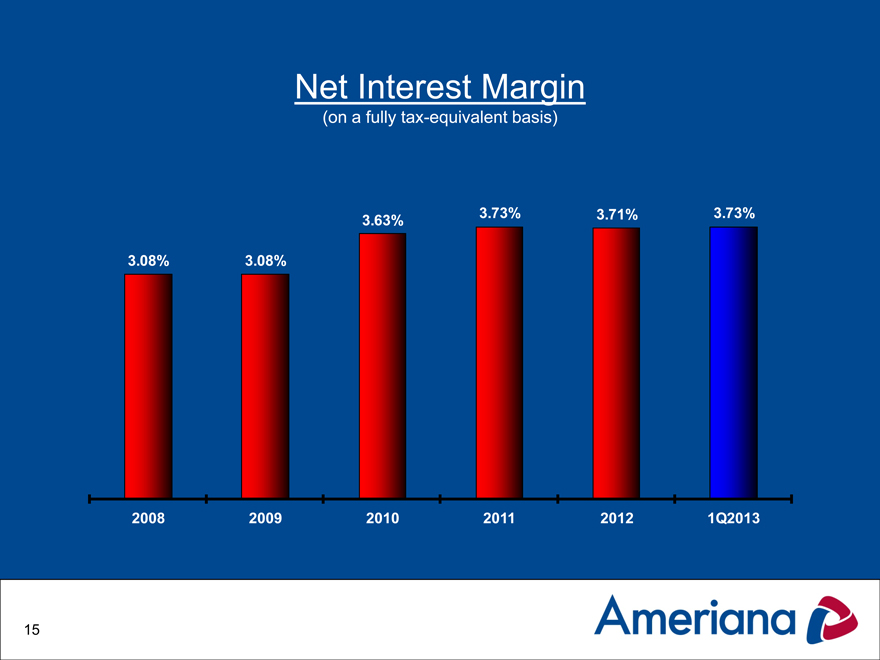

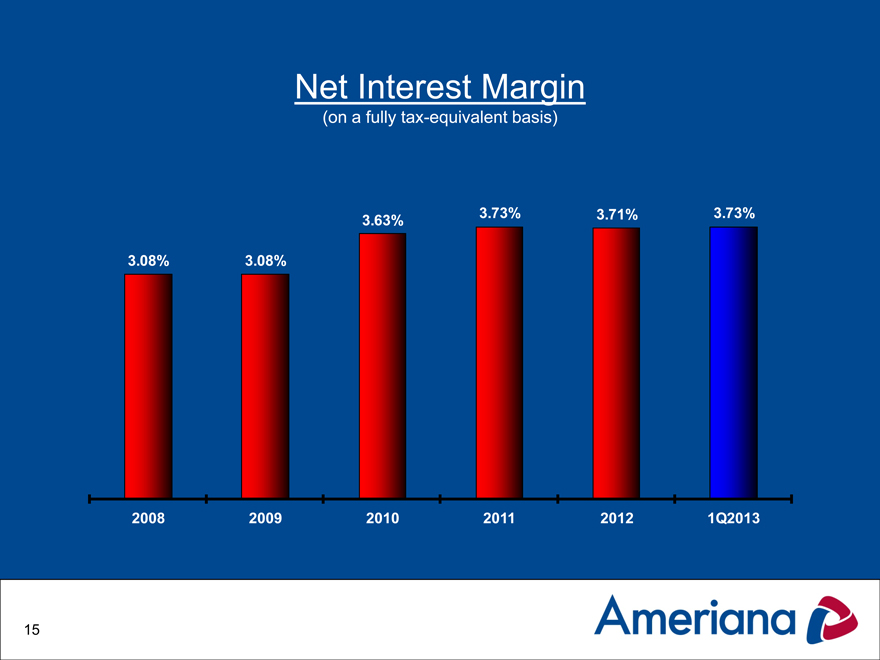

• Net interest margin of 3.73%1, a decline of 8 bps

from the 4th quarter of 20122, but relatively stable

considering the interest rate environment

• Deposit mix continues to improve

• Credit quality continues to improve

1 On a fully tax-equivalent basis

2 The net interest margin for the fourth quarter of 2012 benefitted approximately 11 bps from a $106,000

non-recurring item (unamortized discount taken into income with loan payoff)

7

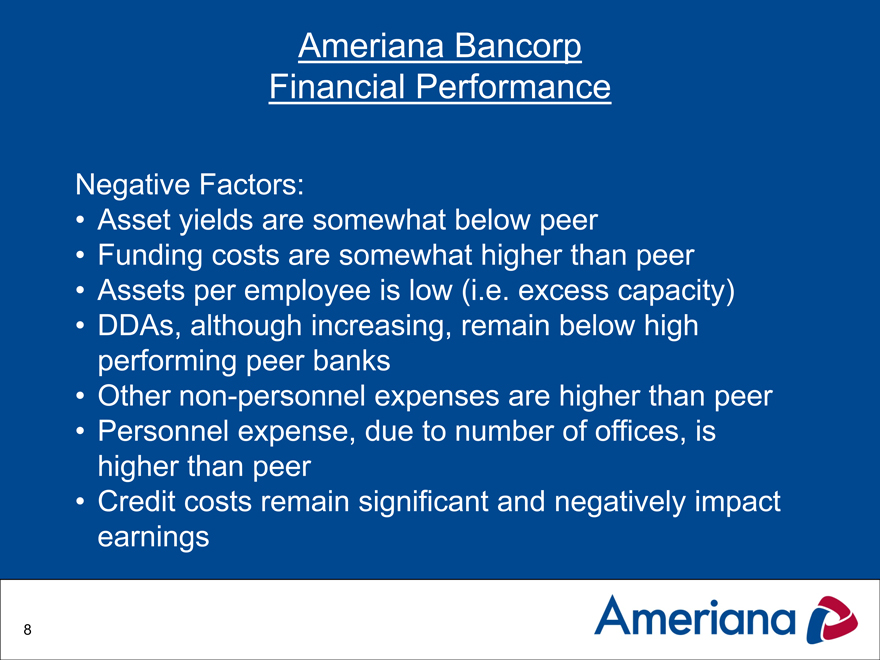

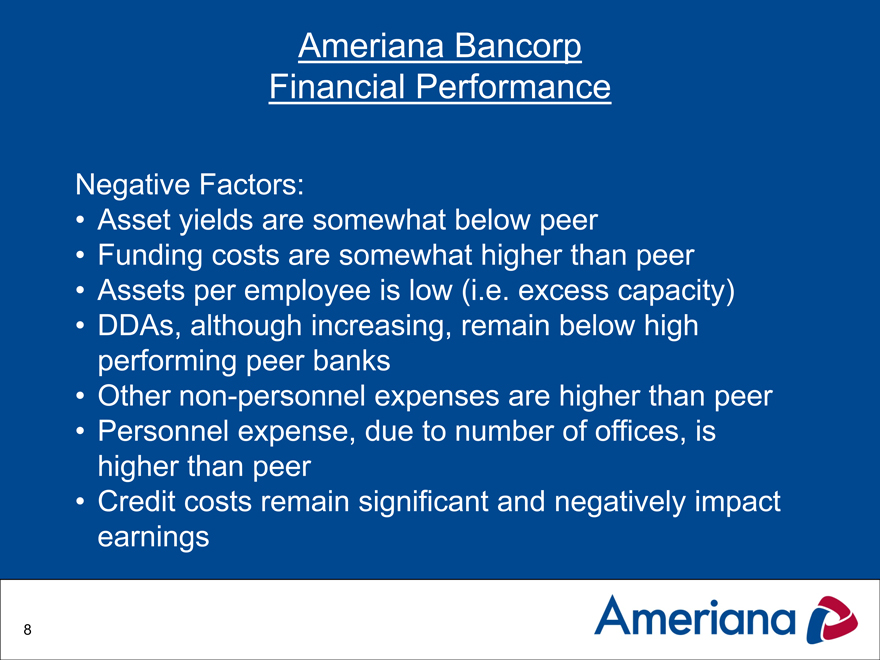

Ameriana Bancorp Financial Performance

Negative Factors:

• Asset yields are somewhat below peer

• Funding costs are somewhat higher than peer

• Assets per employee is low (i.e. excess capacity)

• DDAs, although increasing, remain below high performing peer banks

• Other non-personnel expenses are higher than peer

• Personnel expense, due to number of offices, is higher than peer

• Credit costs remain significant and negatively impact earnings

8

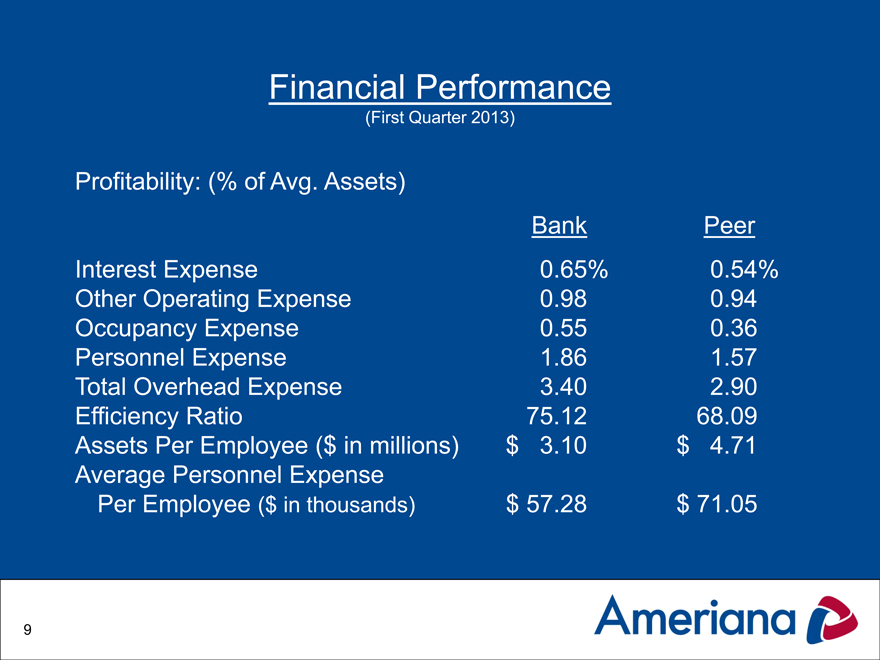

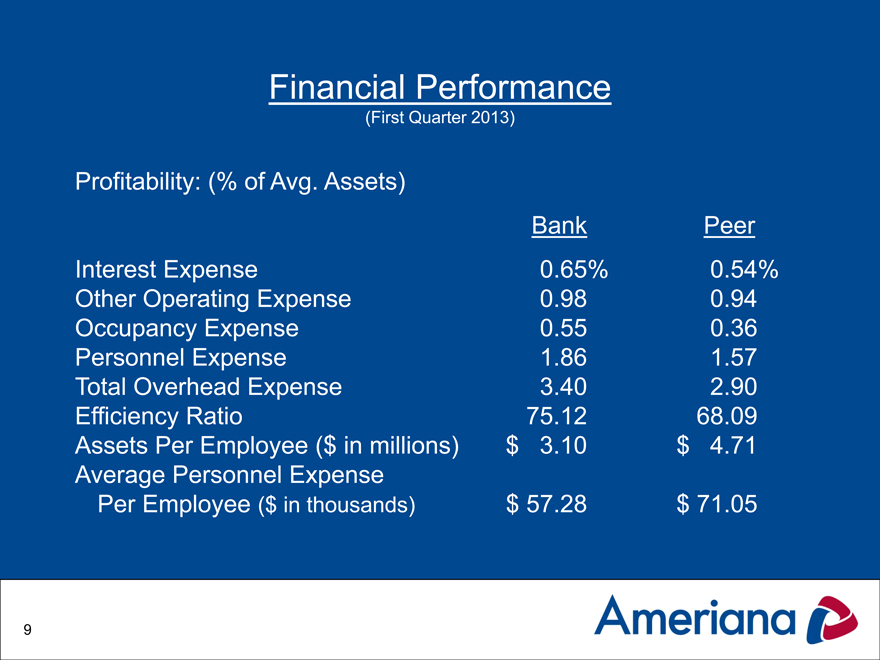

Financial Performance

(First Quarter 2013)

Profitability: (% of Avg. Assets)

Bank Peer

Interest Expense 0.65% 0.54%

Other Operating Expense 0.98 0.94

Occupancy Expense 0.55 0.36

Personnel Expense 1.86 1.57

Total Overhead Expense 3.40 2.90

Efficiency Ratio 75.12 68.09

Assets Per Employee ($ in millions) $ 3.10 $ 4.71

Average Personnel Expense

Per Employee ($ in thousands) $ 57.28 $ 71.05

9

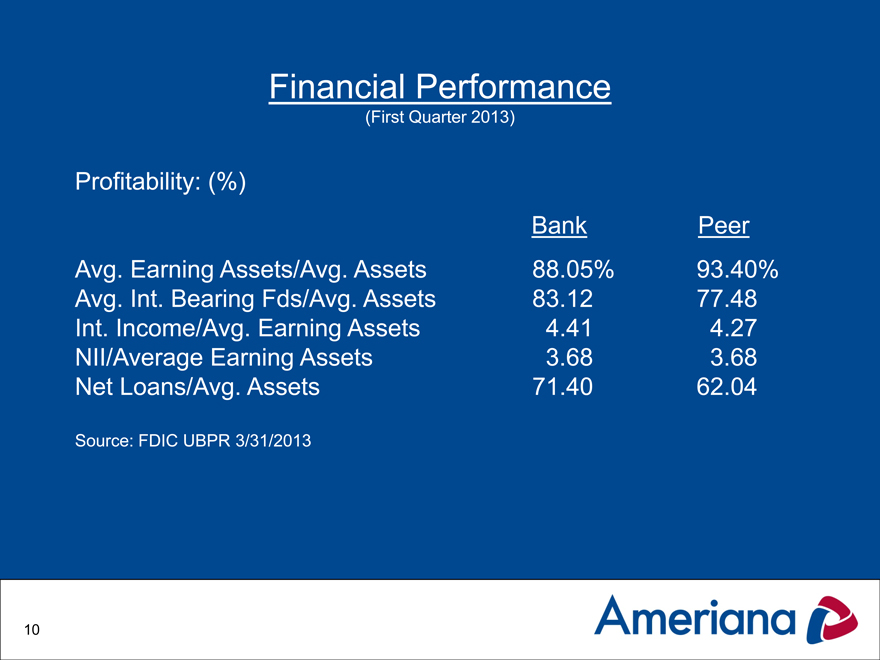

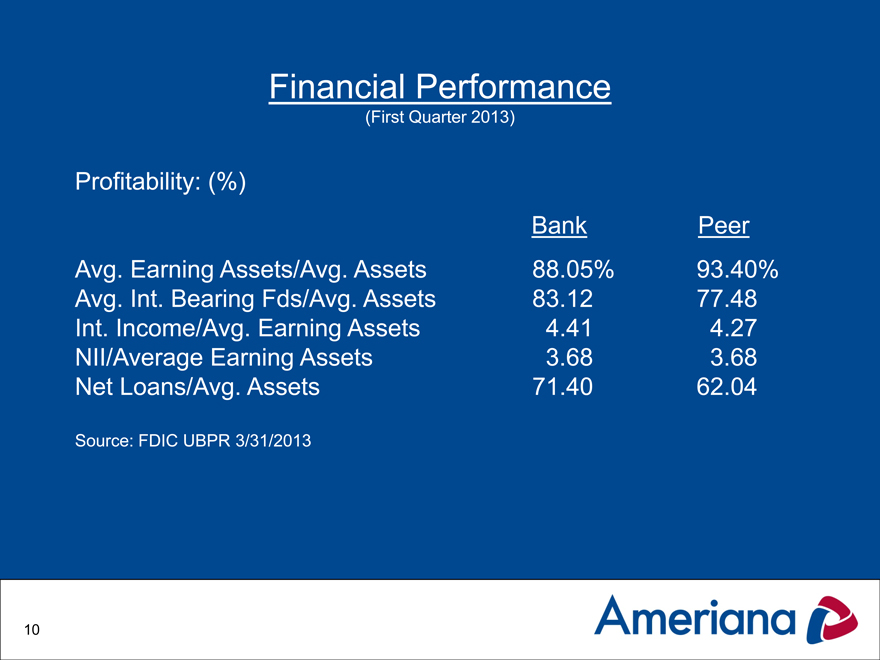

Financial Performance

(First Quarter 2013)

Profitability: (%)

Bank Peer

Avg. Earning Assets/Avg. Assets 88.05% 93.40%

Avg. Int. Bearing Fds/Avg. Assets 83.12 77.48

Int. Income/Avg. Earning Assets 4.41 4.27

NII/Average Earning Assets 3.68 3.68

Net Loans/Avg. Assets 71.40 62.04

Source: FDIC UBPR 3/31/2013

10

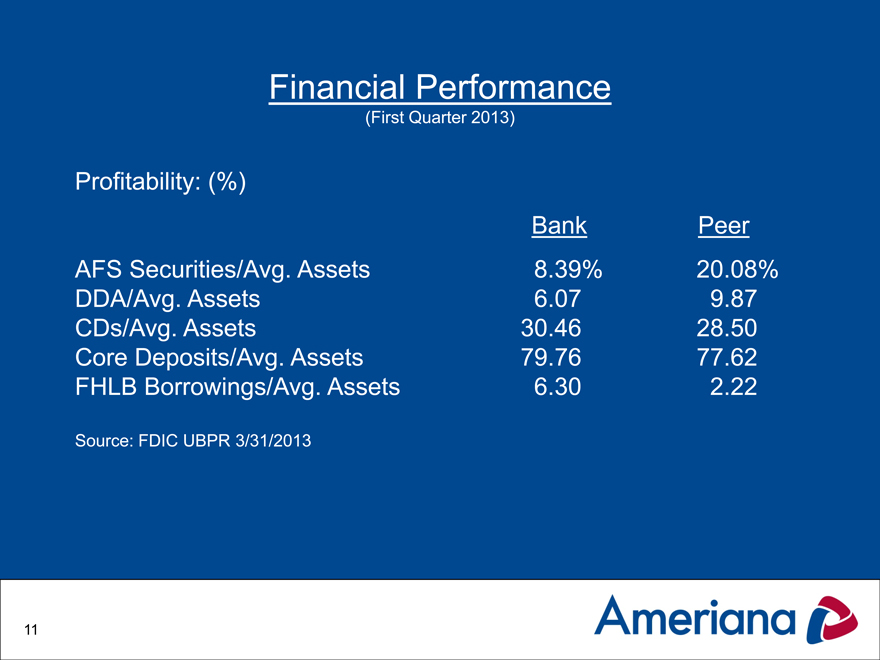

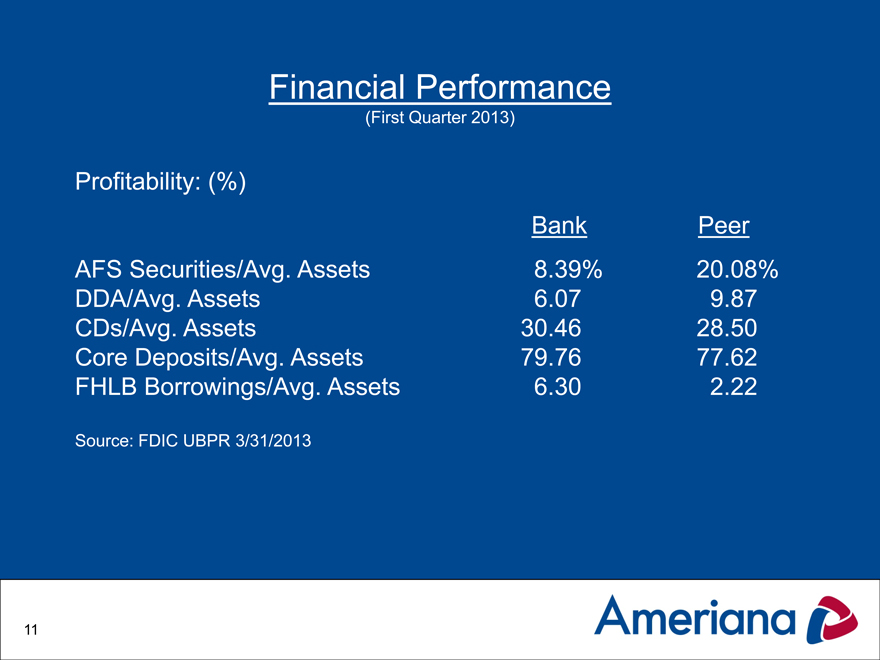

Financial Performance

(First Quarter 2013)

Profitability: (%)

Bank Peer

AFS Securities/Avg. Assets 8.39% 20.08%

DDA/Avg. Assets 6.07 9.87

CDs/Avg. Assets 30.46 28.50

Core Deposits/Avg. Assets 79.76 77.62

FHLB Borrowings/Avg. Assets 6.30 2.22

Source: FDIC UBPR 3/31/2013

11

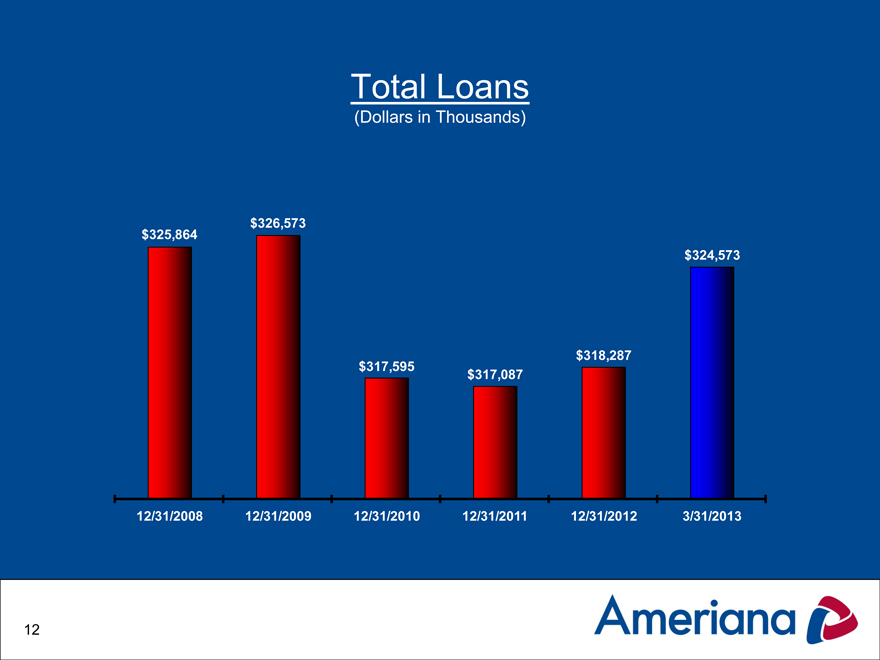

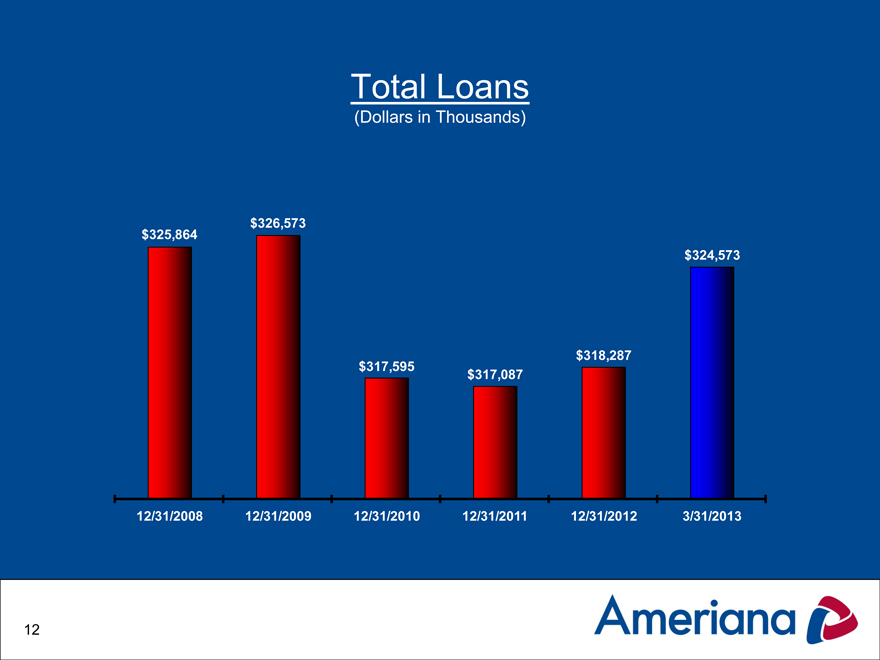

Total Loans

(Dollars in Thousands)

$326,573 $325,864 $324,573

$318,287 $317,595 $317,087

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

12

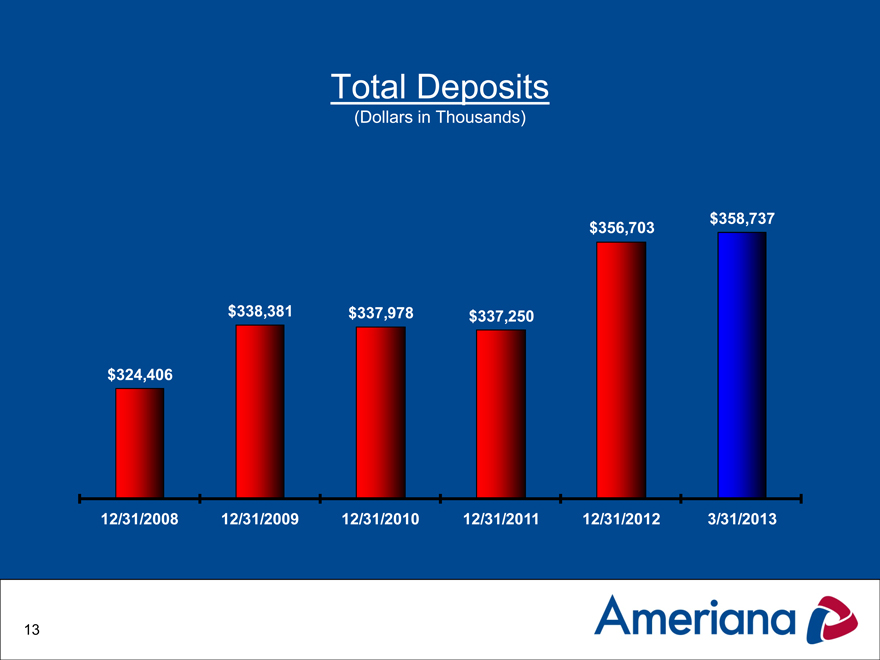

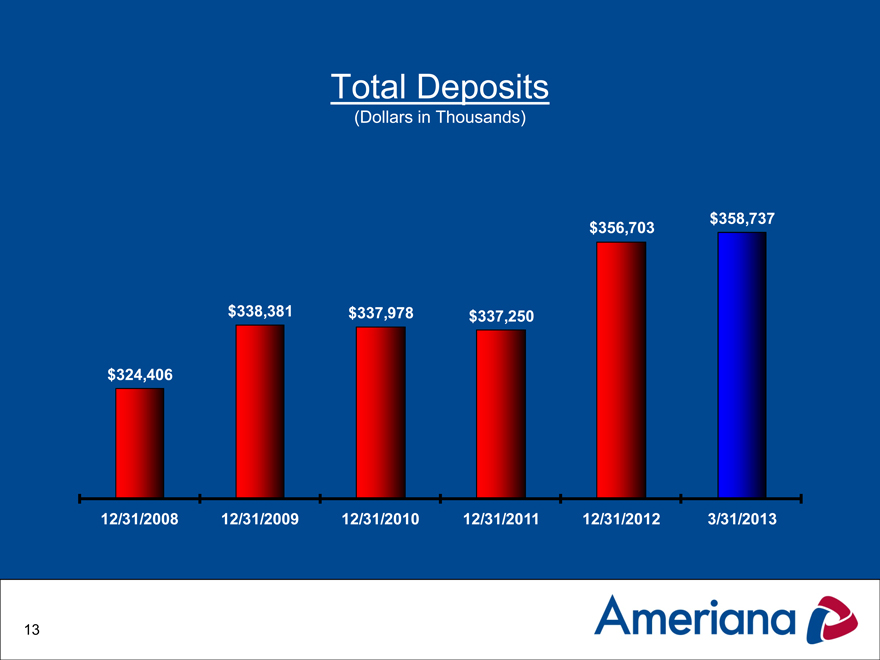

Total Deposits

(Dollars in Thousands)

$358,737 $356,703

$338,381 $337,978 $337,250

$324,406

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

13

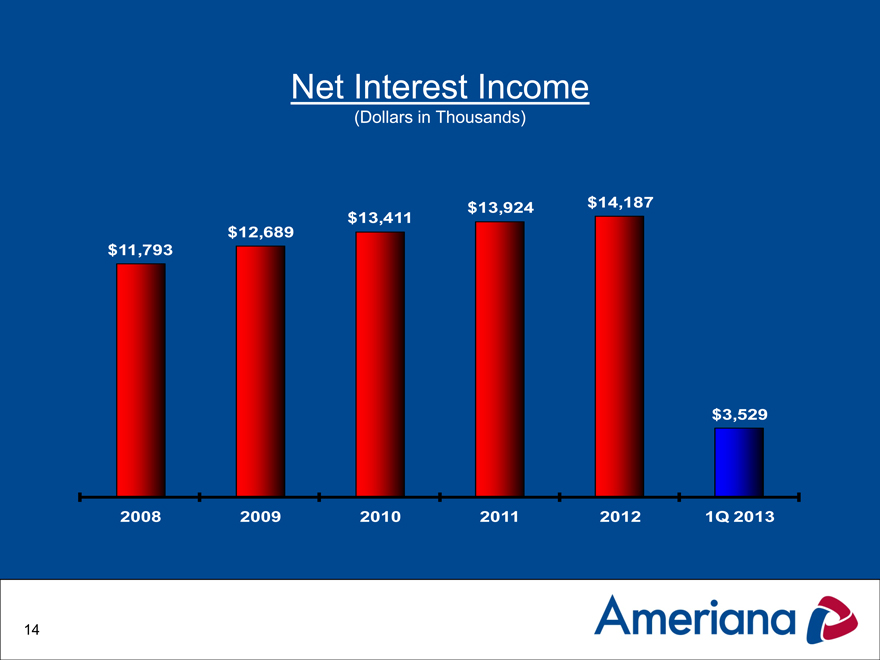

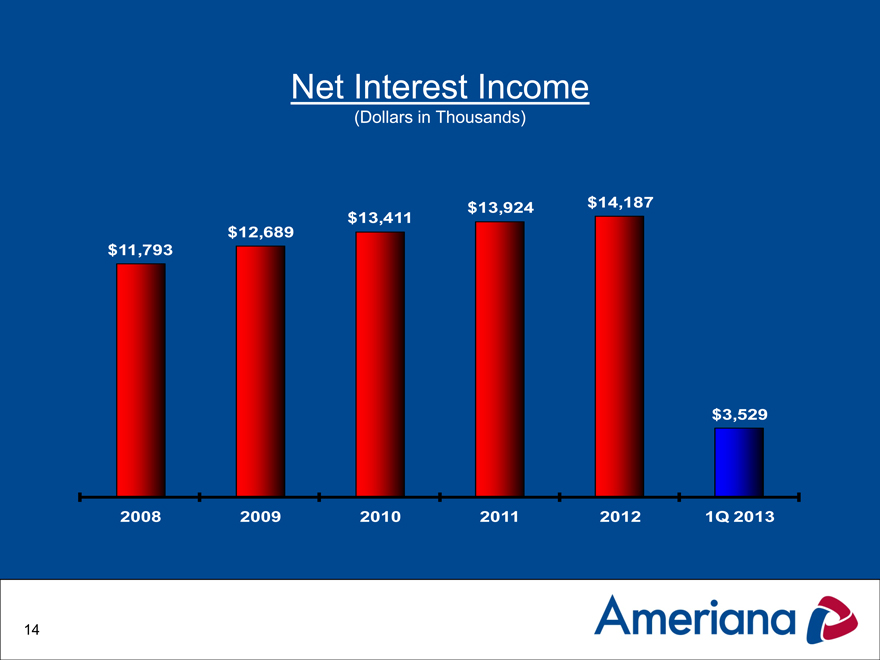

Net Interest Income

(Dollars in Thousands)

$13,924 $14,187 $13,411 $12,689 $11,793

$3,529

2008 2009 2010 2011 2012 1Q 2013

14

Net Interest Margin

(on a fully tax-equivalent basis)

3.73% 3.71% 3.73%

3.63%

3.08% 3.08%

2008 2009 2010 2011 2012 1Q2013

15

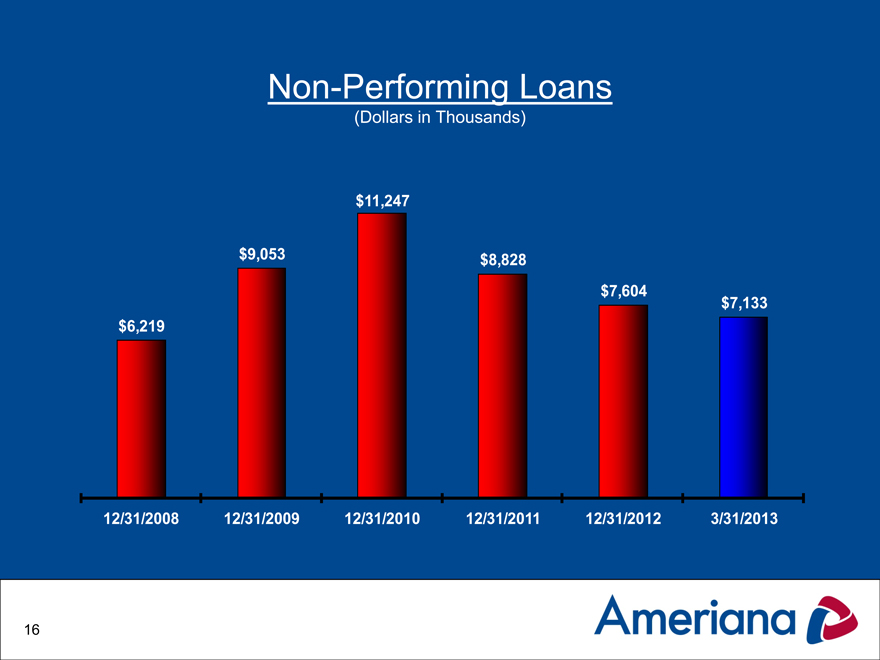

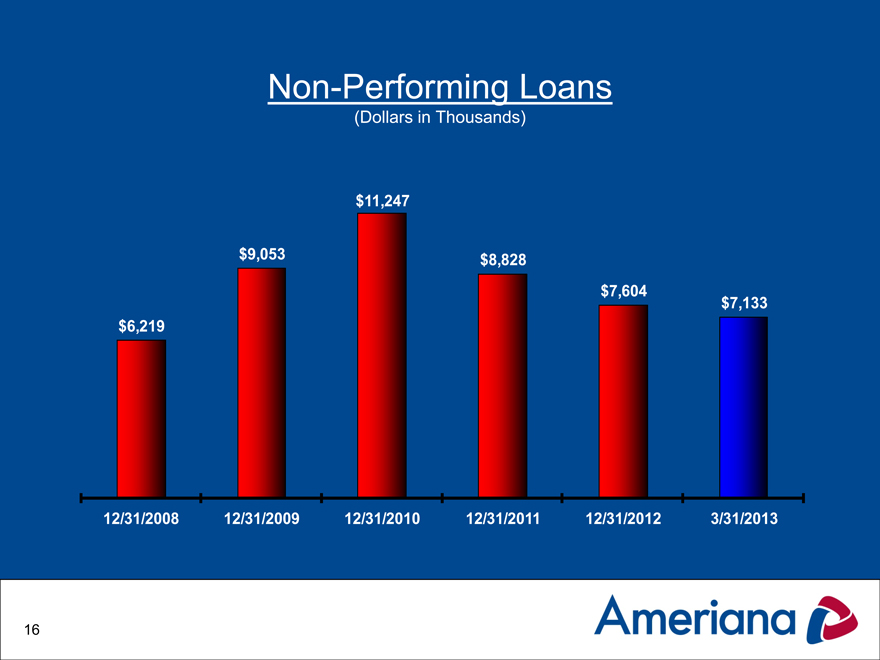

Non-Performing Loans

(Dollars in Thousands)

$11,247

$9,053 $8,828 $7,604 $7,133 $6,219

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

16

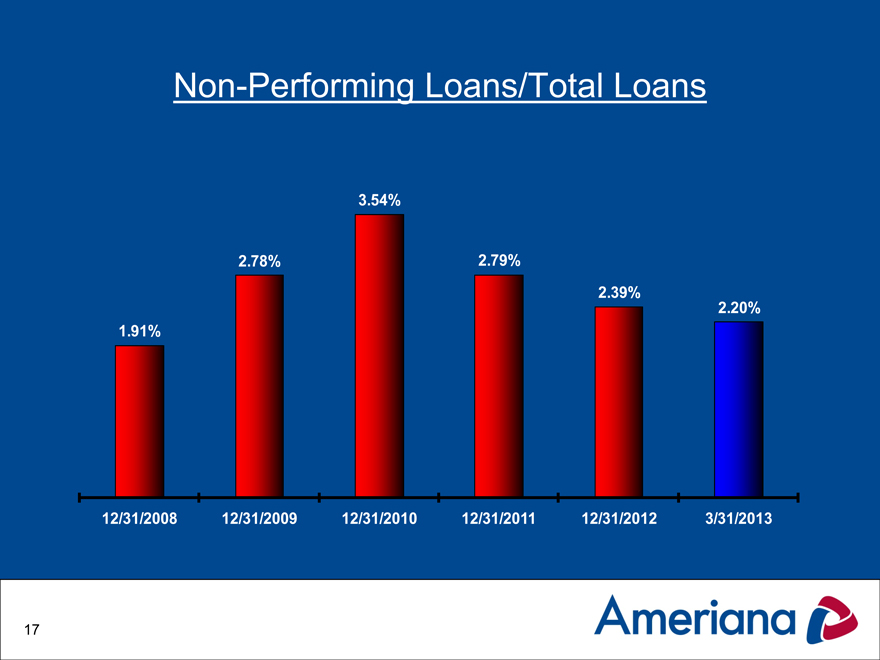

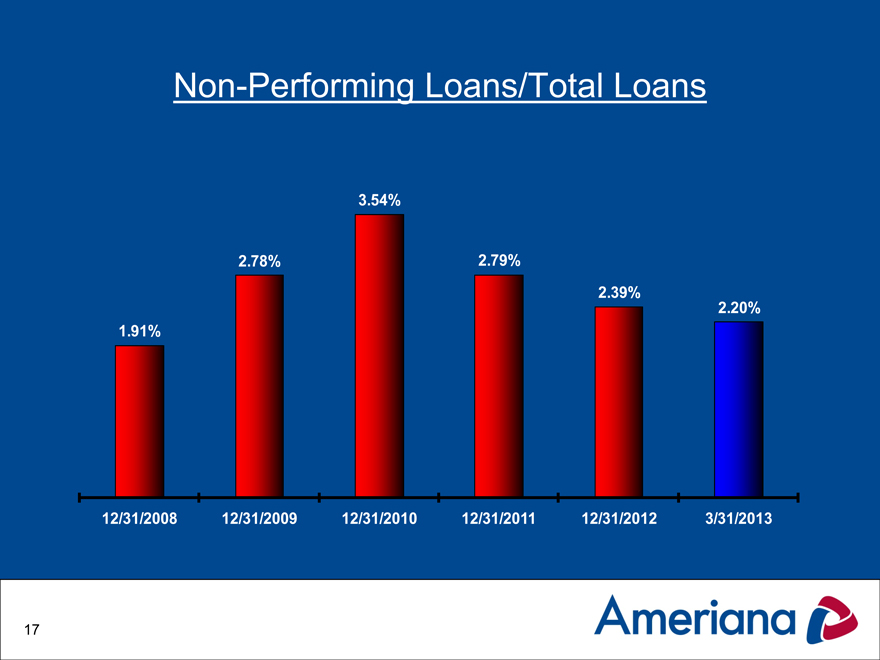

Non-Performing Loans/Total Loans

3.54%

2.78% 2.79%

2.39%

2.20%

1.91%

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

17

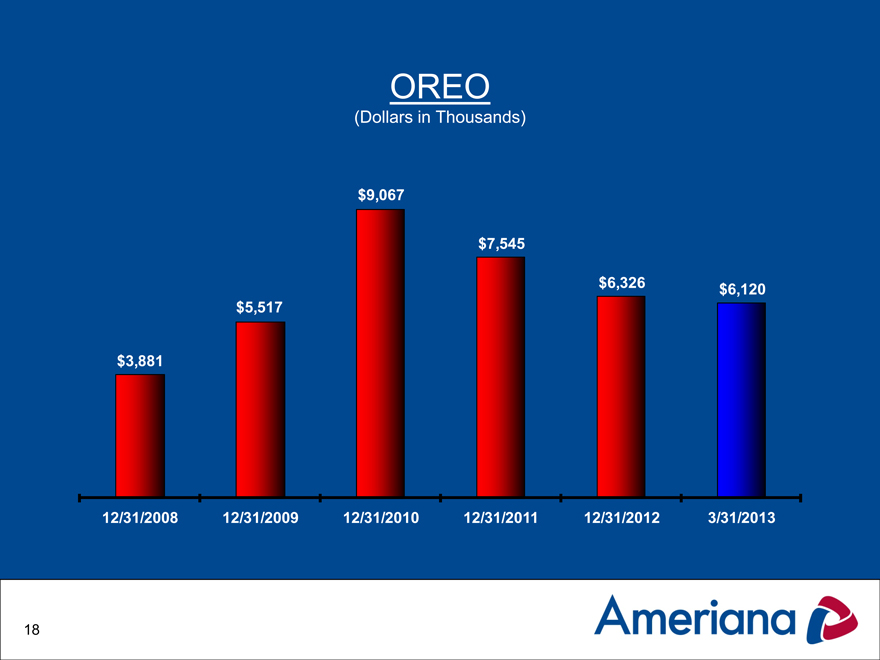

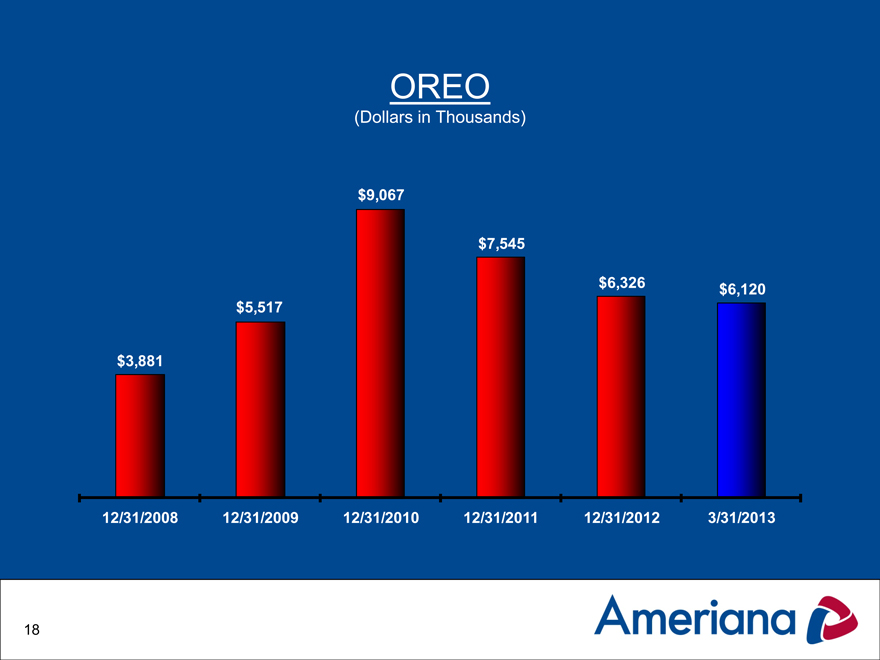

OREO

(Dollars in Thousands)

$9,067

$7,545

$6,326 $6,120 $5,517

$3,881

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

18

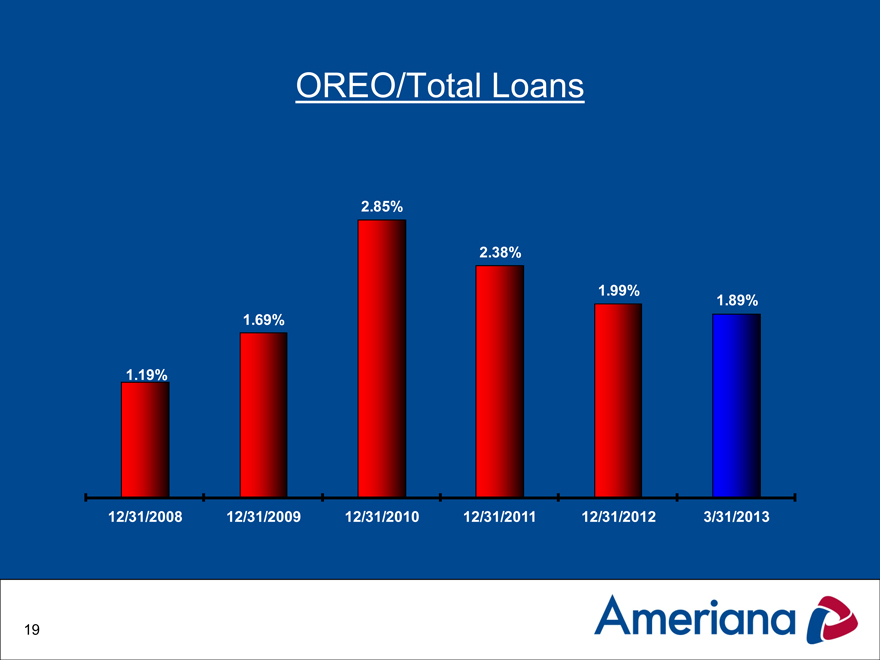

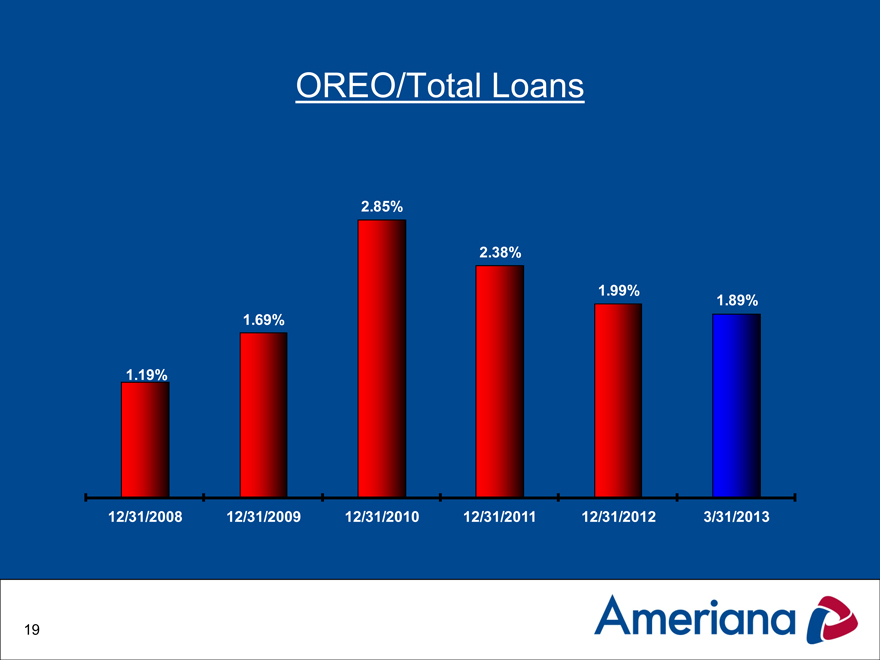

OREO/Total Loans

2.85%

2.38%

1.99%

1.89%

1.69%

1.19%

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

19

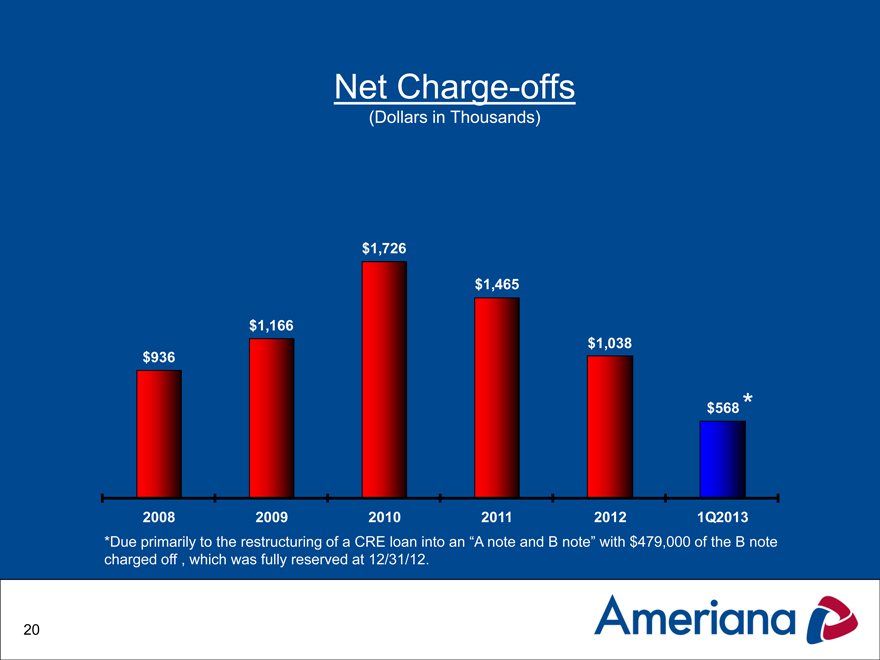

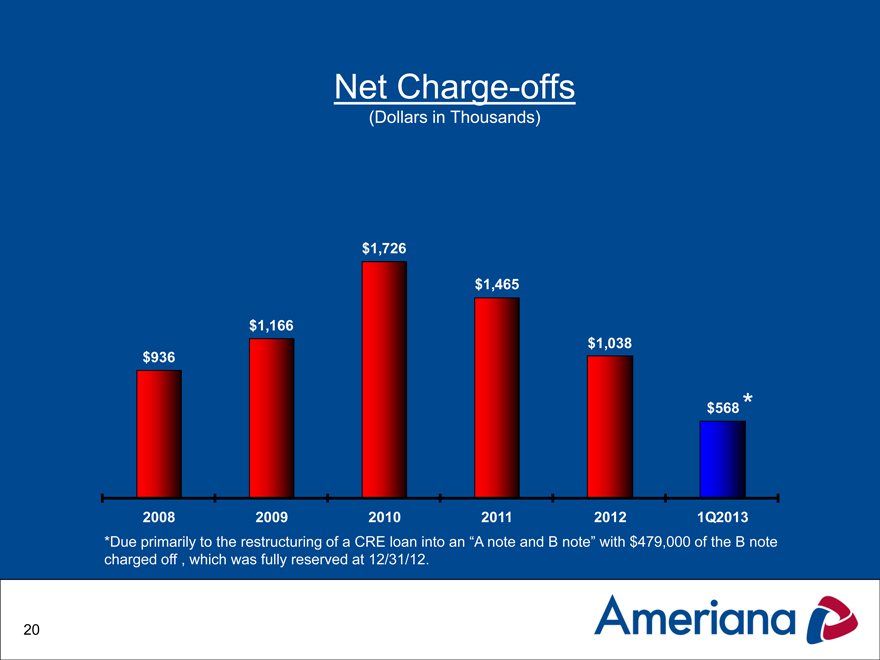

Net Charge-offs

(Dollars in Thousands)

$1,726

$1,465

$1,166 $1,038 $936

$568 *

2008 2009 2010 2011 2012 1Q2013

*Due primarily to the restructuring of a CRE loan into an “A note and B note” with $479,000 of the B note charged off , which was fully reserved at 12/31/12.

20

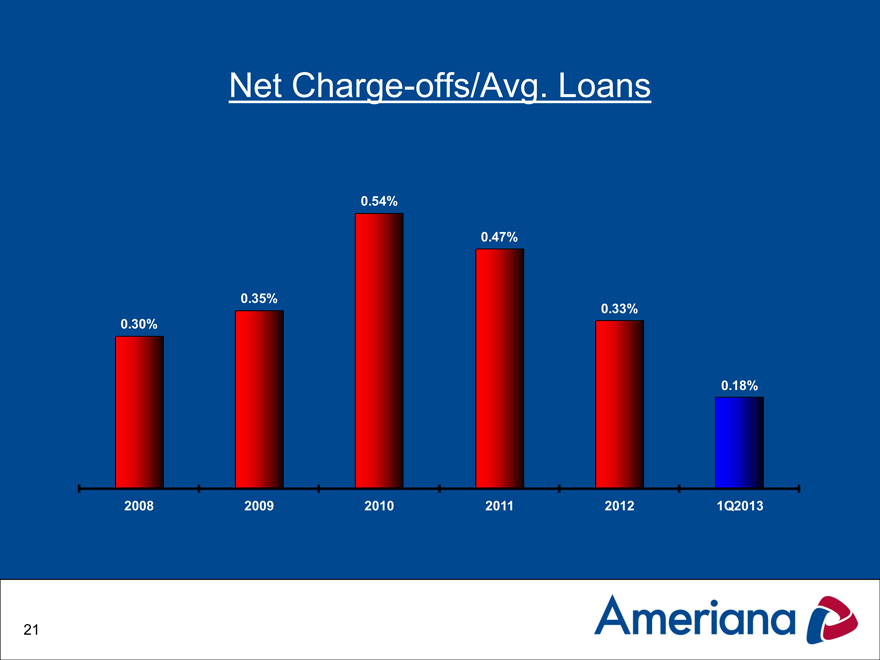

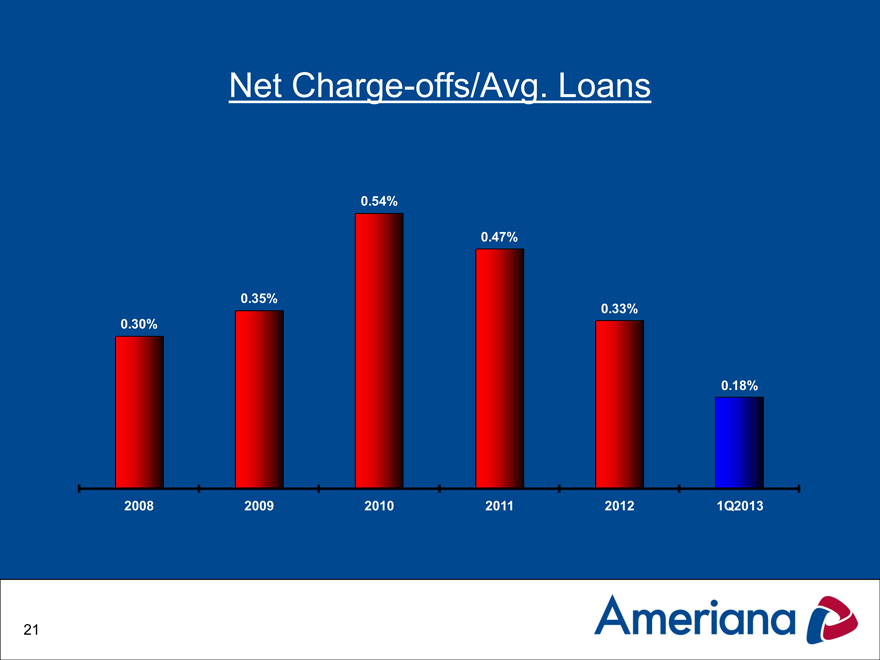

Net Charge-offs/Avg. Loans

0.54%

0.47%

0.35%

0.33%

0.30%

0.18%

2008 2009 2010 2011 2012 1Q2013

21

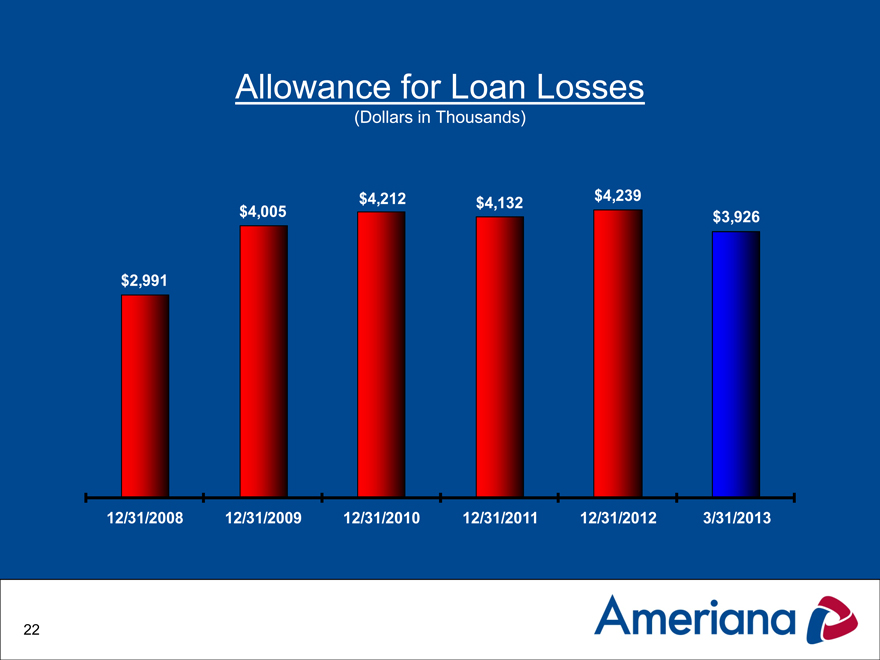

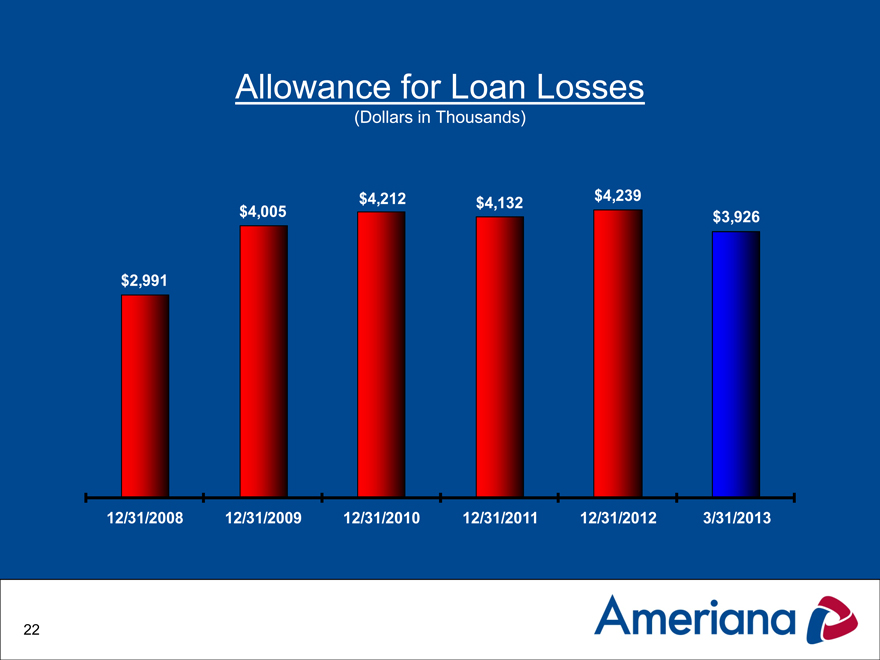

Allowance for Loan Losses

(Dollars in Thousands)

$4,212 $4,239 $4,132 $4,005 $3,926

$2,991

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

22

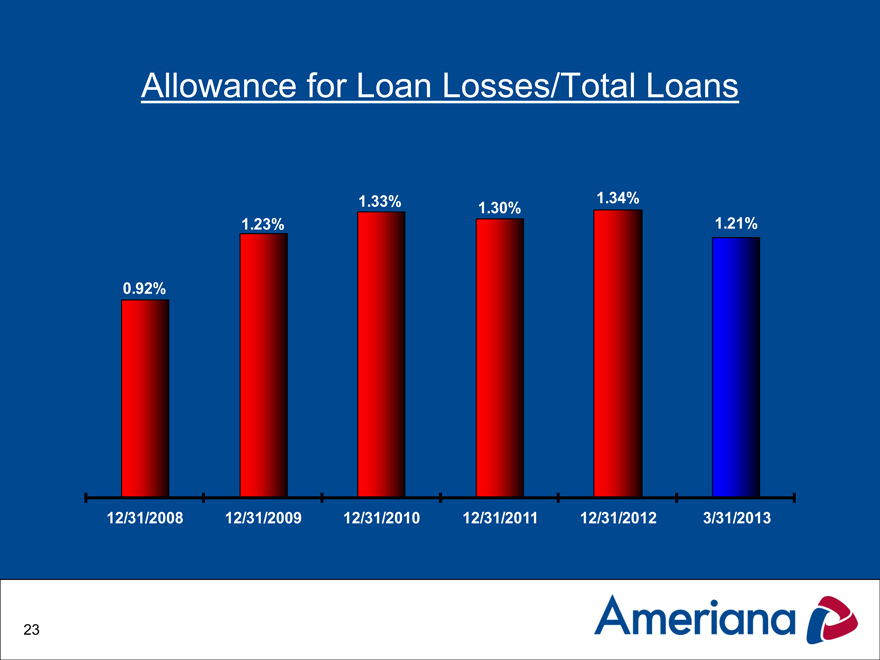

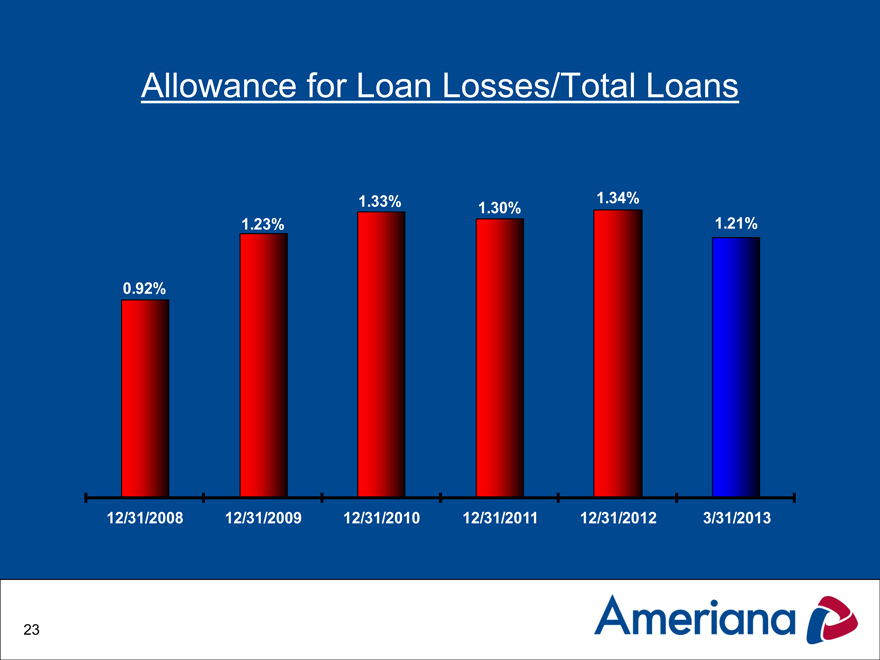

Allowance for Loan Losses/Total Loans

1.33% 1.34%

1.30%

1.23% 1.21%

0.92%

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

23

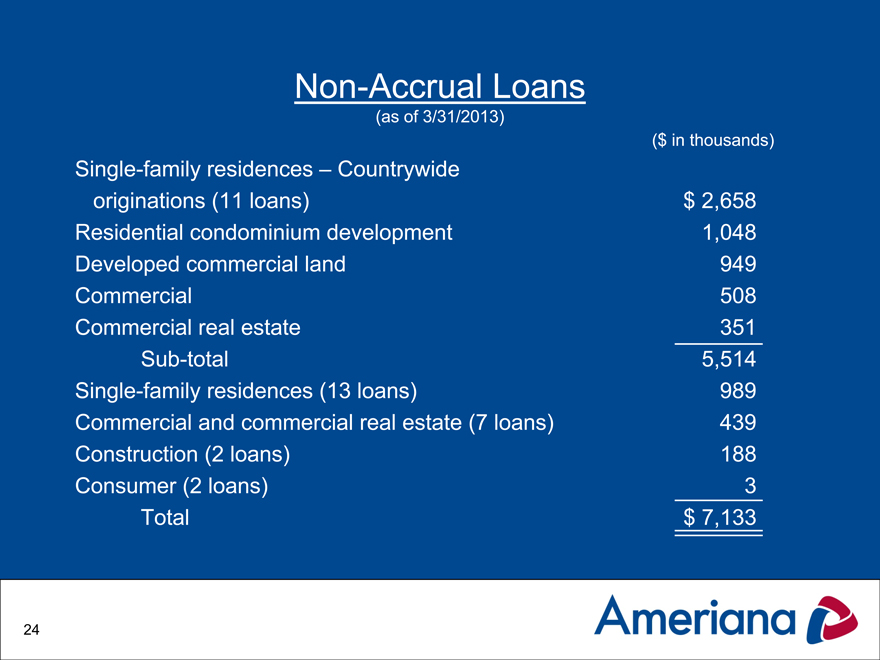

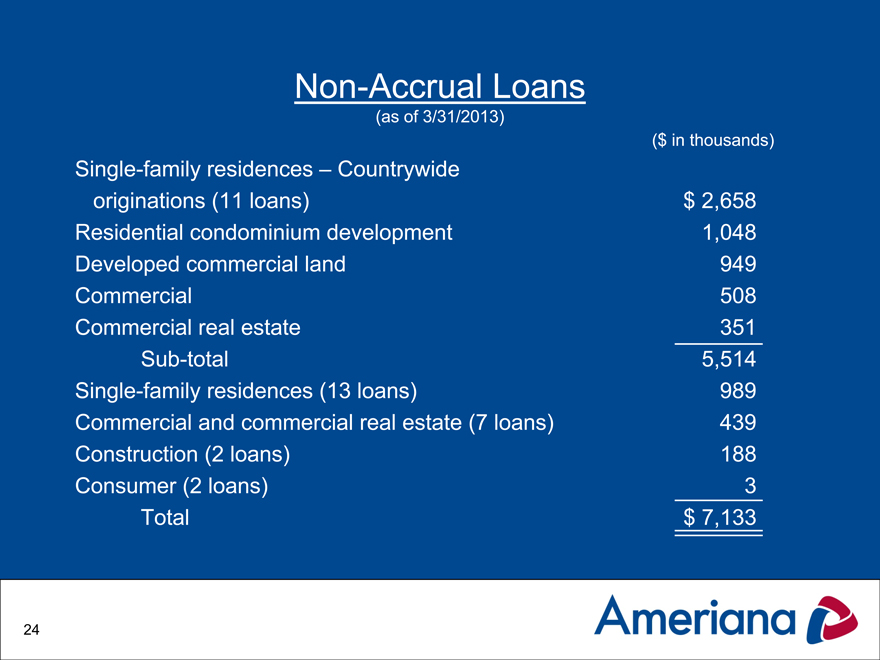

Non-Accrual Loans

(as of 3/31/2013)

($ in thousands)

Single-family residences – Countrywide

originations (11 loans)

$ 2,658

Residential condominium development

1,048

Developed commercial land

949

Commercial

508

Commercial real estate

351

Sub-total

5,514

Single-family residences (13 loans)

989

Commercial and commercial real estate (7 loans)

439

Construction (2 loans)

188

Consumer (2 loans)

Total

$ 7,133

24

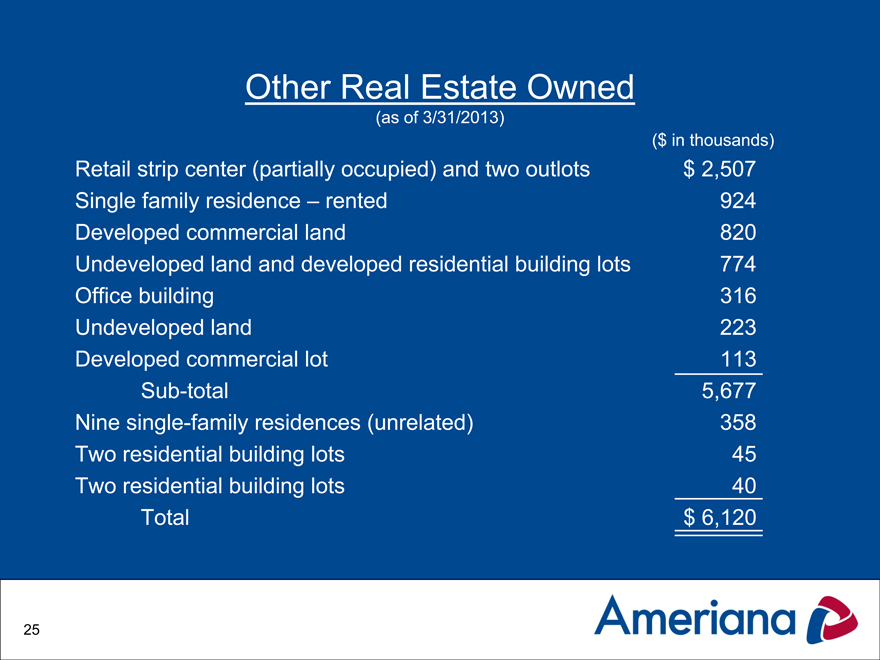

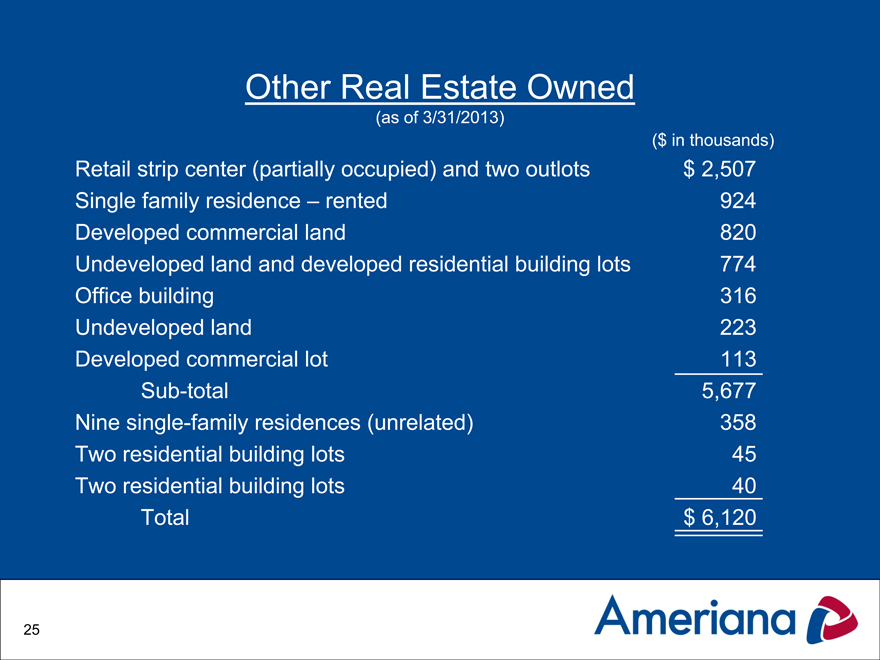

Other Real Estate Owned

(as of 3/31/2013)

($ in thousands)

Retail strip center (partially occupied) and two outlots $ 2,507

Single family residence – rented 924

Developed commercial land 820

Undeveloped land and developed residential building lots 774

Office building 316

Undeveloped land 223

Developed commercial lot 113

Sub-total 5,677

Nine single-family residences (unrelated) 358

Two residential building lots 45

Two residential building lots 40

Total $ 6,120

25

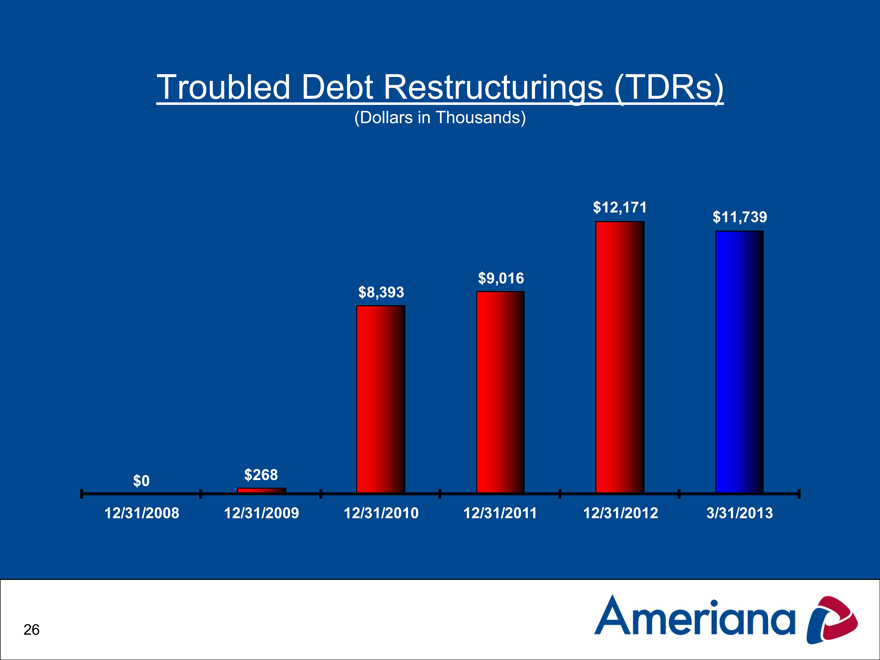

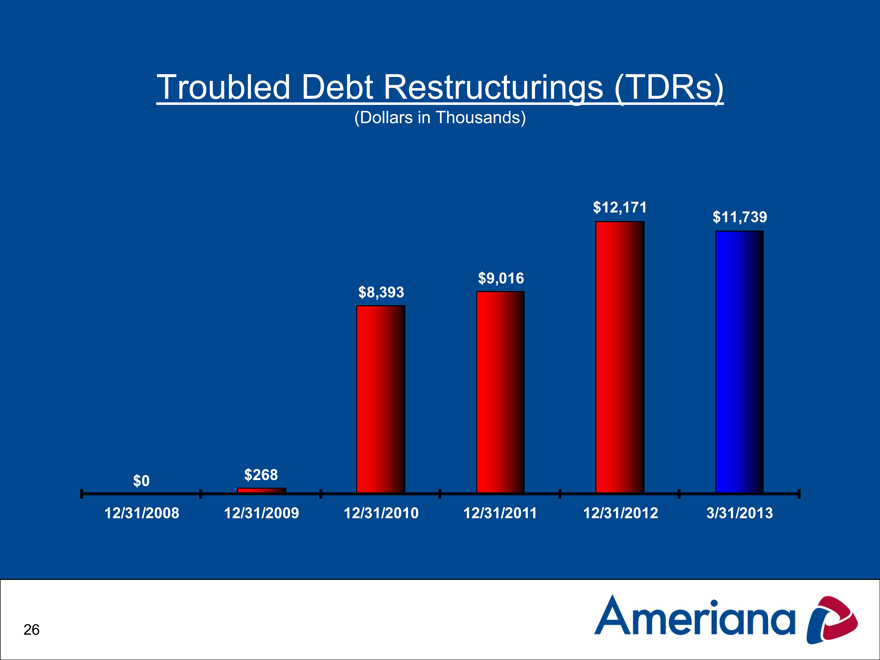

Troubled Debt Restructurings (TDRs)

(Dollars in Thousands)

$12,171 $11,739

$9,016

$8,393

$0 $268

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 3/31/2013

26

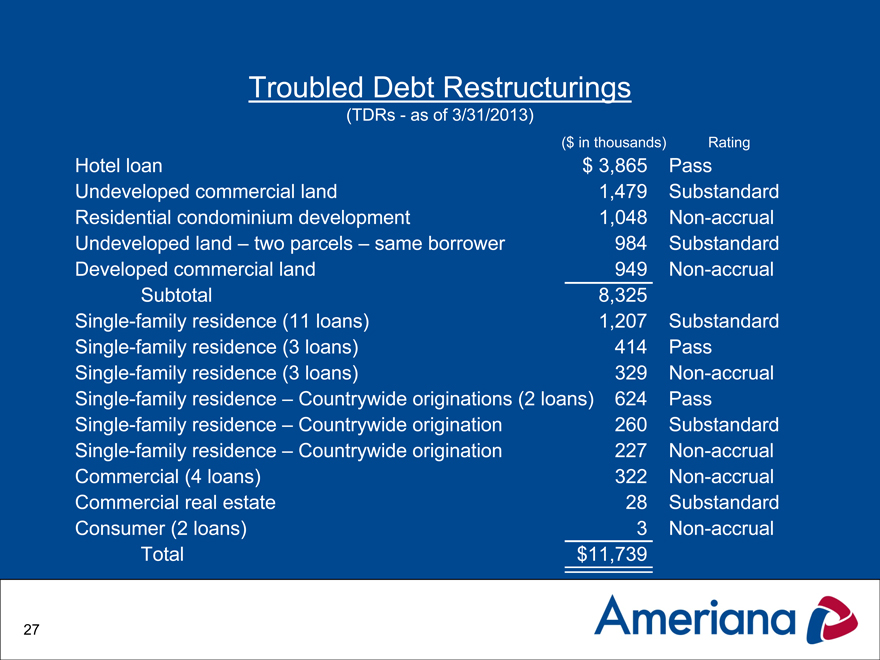

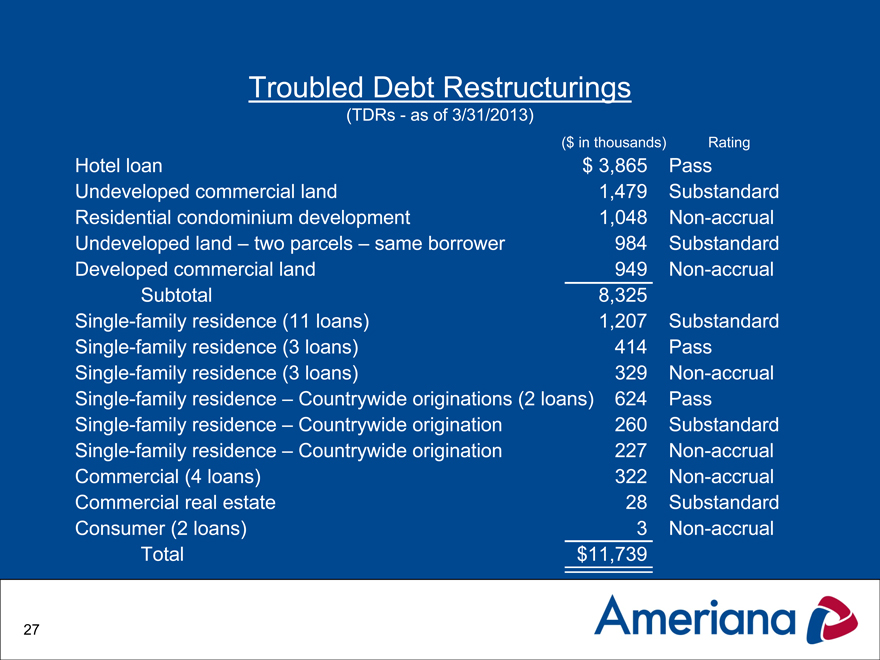

Troubled Debt Restructurings

(TDRs—as of 3/31/2013)

($ in thousands) Rating

Hotel loan $ 3,865 Pass

Undeveloped commercial land 1,479 Substandard

Residential condominium development 1,048 Non-accrual

Undeveloped land – two parcels – same borrower 984 Substandard

Developed commercial land 949 Non-accrual

Subtotal 8,325

Single-family residence(11 loans) 1,207 Substandard

Single-family residence(3 loans) 414 Pass

Single-family residence(3 loans) 329 Non-accrual

Single-family residence – Countrywide originations (2 loans) 624 Pass

Single-family residence – Countrywide origination 260 Substandard

Single-family residence – Countrywide origination 227 Non-accrual

Commercial (4 loans) 322 Non-accrual

Commercial real estate 28 Substandard

Consumer (2 loans) 3 Non-accrual

Total $11,739

27

Key Challenges for 2013

Margin Compression is likely

Low short-term interest rates, steep yield curve

Lack of viable investment alternatives

Deposit pricing is at all-time lows

Extremely competitive loan pricing

Consumers preference for short-term money market accounts

Regulatory and accounting environment

Dodd—Frank

Basel III

FASB pronouncements

28

Industry Challenges for 2013

Economic Conditions

Current economic conditions slowly improving

Resurgent U.S. auto industry and regional impact

Gradual price increase in residential housing market

Residential foreclosures decreasing

Unemployment levels slowly decreasing

Uncertainty of the future of the GSEs

Competition

Capital

Liquidity

Global unrest and sovereign risk

29

Key Objectives for 2013

Asset Quality

Earnings

Capital

Liquidity

People

30

Asset Quality Objectives for 2013

Reduce the level of criticized and classified credits to $8.0 million

Reduce OREO to $4.7 million

Maintain an adequate ALLL

Obtain risk-adjusted pricing for loans

Improve regulatory rating for asset quality

Stress test loan portfolios to ensure adequate capital and provision for loan losses

31

Earnings Objectives for 2013

Achieve net income of $2,970,000 for Bank and $2,410,000 for Ameriana Bancorp on a consolidated basis

Limit impact of low interest rate environment on net interest margin

Reduce credit losses and OREO expenses

Increase fee income from AFS and AIA

Increase new checking accounts and demand deposit balances

Ensure continued growth of our new banking centers

32

Capital Objectives for 2013

Maintain well-capitalized status: minimum of 9.0% Tier 1 Capital and 13.0% Total Risk Based Capital

Continue to evaluate other strategies for raising capital to mitigate exposure to loan losses

Build or acquire capital for acquisition or expansion purposes

Stress test capital under a variety of scenarios

33

Liquidity Objectives for 2013

Maintain adequate on balance sheet liquidity

Meet or exceed all board established minimums and regulatory standards

Monitor and adjust to changes in sources of liquidity due to changing collateral requirements

Increase low cost deposit balances

Stress test liquidity under a variety of scenarios

34

People Plan for 2013

Improve career pathing

Be an employer of choice and be recognized as a “best place” to work

Implement on-line time card record keeping system

Implement new LMS training systems

Implement wellness program

35

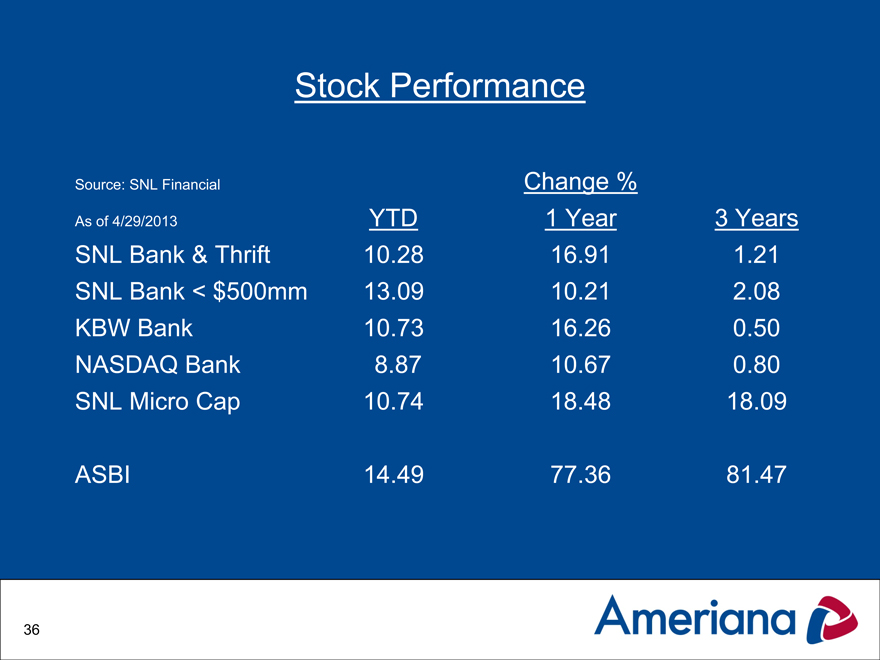

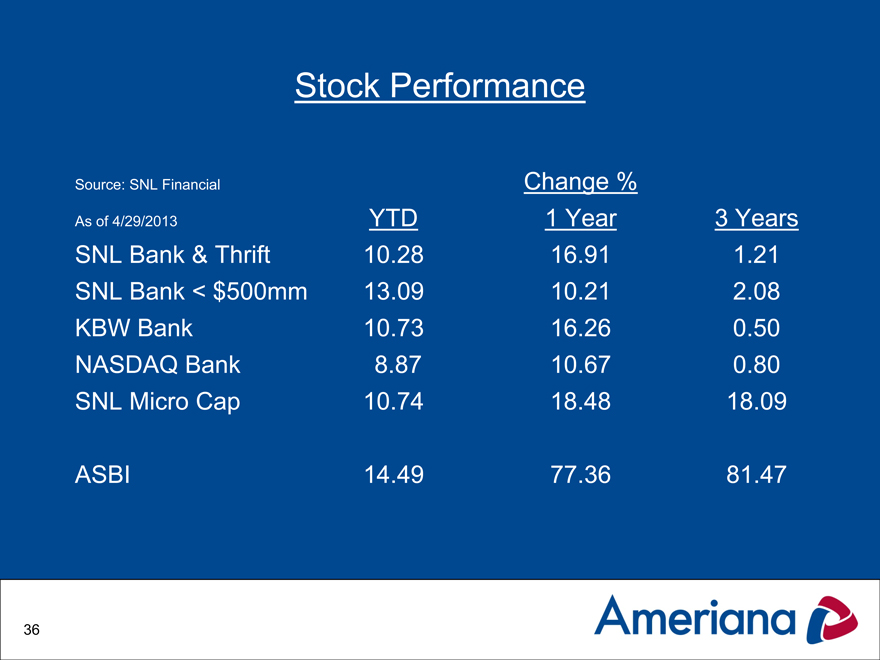

Stock Performance

Source: SNL Financial Change %

As of 4/29/2013 YTD 1 Year 3 Years

SNL Bank & Thrift 10.28 16.91 1.21

SNL Bank < $500mm 13.09 10.21 2.08

KBW Bank 10.73 16.26 0.50

NASDAQ Bank 8.87 10.67 0.80

SNL Micro Cap 10.74 18.48 18.09

ASBI 14.49 77.36 81.47

36

Questions?

37