Exhibit 99.1

EXECUTIVE VARIABLE COMPENSATION PLAN

2008

1. Plan Objectives

| | • | | Reward management for achieving stated business objectives |

| | • | | Build shareholder value |

| | • | | Provide competitive compensation for senior management |

2. Administration

The Compensation Committee will administer the Executive Variable Compensation Plan.

3. Eligibility

Senior management as nominated by the CEO and approved by the Compensation Committee. Participation in the Plan in one year does not imply continued Plan participation in any subsequent year. Participants must be employed at the time of payment to receive payment under the Plan.

Eligible senior management hired during the Plan year will have their Target Incentive Percentage and Maximum Incentive Percentage set based upon their level in the organization (see item 5 below). The incentive payout will be pro-rated from the day they are eligible to participate. Employees hired after September 30, 2008 are not eligible for incentive payout for the 2008 Plan year.

4. Term

Lattice fiscal year 2008, commencing on December 30, 2007 and ending on January 3, 2009.

5. Target Incentive Payout

The Compensation Committee will approve a Target Incentive Percentage and a Maximum Incentive Percentage for each participant. The incentives will be expressed as a percentage of annual base salary (ABS) as of the first day of the Plan year.

6. Incentive Determination

Company Performance (CP): the target payout will be based on achievement of the 2008 Revenue and non-GAAP Operating Income (“OI”) performance goals of the Company as approved by the Board prior to the Plan year. Non-GAAP Operating Income is defined as GAAP Operating Income less: Intangible Asset Amortization, Restructuring Charges and any other board approved, extraordinary expense items. The Revenue goal and the non-GAAP Operating Income goal will each comprise 50% of the Incentive Award. The following formula will determine the Incentive Award for Company performance:

- 1 -

| | | | | | |

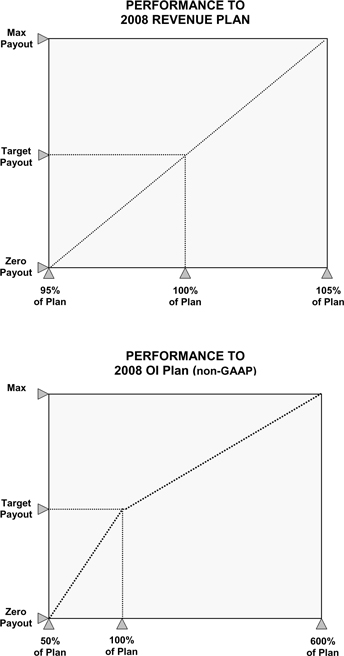

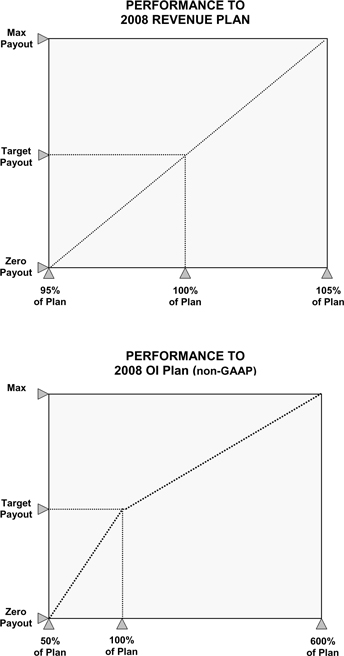

Revenue % of Annual Plan | | CP-R Incentive Award | | OI (non-GAAP) % of Annual Plan | | CP-OI (non-GAAP) Incentive Award |

| Less than 95% | | No payout | | Less than 50% | | No payout |

| 95%-100% | | 0 – Target | | 50%-100% | | 0 - Target |

| 100%-105% | | Target - Max. | | 100%-600% | | Target - Max. |

| Above 105% | | Max. | | Above 600% | | Max. |

The following two graphs illustrate the calculation of the Incentive Award as a function of performance to the 2008 Revenue Plan and to the non-GAAP Operating Income Plan:

- 2 -

Individual Performance (IP): the variable compensation payout will further be based on individual performance. The total variable compensation pool for Plan participants will be determined by the above calculation.

The variable compensation to each Plan participants will further be adjusted based on Individual Performance. The adjustment for Individual performance can be in the range of 0.67 to 1.33 of the variable compensation payout as determined by achievement of Revenue and Operating Income Plan above. However, the sum of all variable compensation amounts for all Plan participants cannot exceed the total amount based on Revenue and Operating performance to Plan as determined above.

The Compensation Committee will determine the performance of the CEO, while the CEO will determine the performance of the other participants in the Plan. The determination of individual performance is discretionary.

Total payment for each participant under the Plan will be calculated as follows:

(CP-R + CP-OI) x IP = Total Incentive Award (TIA)

The sum of all TIAs for all participants cannot exceed (CP-R + CP-OI).

If, during 2008, the Company is not profitable on an operating basis (non-GAAP excluding intangible asset amortization and other board approved, extraordinary expense items), there will be no payout under this plan.

7. Payment

Payments under the Plan will be made as soon as possible following the approval of the annual audited statements. The Compensation Committee must approve all executive officer incentive awards prior to payment.

- 3 -