Exhibit 99.1

1 Parent of: Investor Presentation November 16, 2017

2 Certain statements contained in this communication may not be based on historical facts and are “forward - looking statements” wit hin the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward - looking statements include, without limitation, th ose relating to The Community Financial Corporation, Community Bank of the Chesapeake’s and County First Bank’s future growth and management’s outlook or expectations for revenue, assets, asset qualit y, profitability, business prospects, net interest margin, non - interest revenue, allowance for loan losses, the level of credit losses from lending, liquidity levels, capital levels, or other future financi al or business performance strategies or expectations. These forward looking statements may also include: management’s plan relating to the transaction; the expected completion of the transaction; the payment of any c ont ingent cash consideration in the transaction; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating t o t he transaction; any statement of expectation or belief; projections related to certain financial metrics; and any statement of assumptions underlying the foregoing. These forward - looking statements may be identified by reference to a future period(s) or by the use of forward - looking terminology, such as “anticipate,” “estimate,” “expect,” “foresee,” “may,” “might,” “will,” “would,” “could” or “intend,” future or condit ion al verb tenses, and variations or negatives of such terms. Forward - looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actua l results, performance or achievements to differ materially from our expectations of future results, performance or achievements, or industry results, expressed or implied by these forward - looking statements. In addition to factors previously disclosed in The Community Financial Corporation’s reports filed with the Securities and Ex cha nge Commission including those we file with the SEC, including in our Annual Report on Form 10 - K for the year ended December 31, 2016, and those identified elsewhere in this document, the following factors among others, could cause actual results to differ materially from forward - looking statements or historical performance: changes in The Community Financial Corporation’s and Community Bank of the Chesapeake’s op erating or expansion strategy; availability of and costs associated with obtaining adequate and timely sources of liquidity; the ability to maintain credit quality; the effects of future economic, bus iness and market conditions; weaker than anticipated market conditions in our primary market areas; changes in interest rates; governmental monetary and fiscal policies; changes in prices and values of real esta te; legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and their application by our regulators, including changes in the cost and scope of FDIC insurance; the fai lure of assumptions regarding the levels of non - performing assets and the adequacy of the allowance for loan losses; possible adverse rulings, judgments, settlements and other outcomes of pending litigation; th e ability of Community Bank of the Chesapeake and County First Bank to collect amounts due under loan agreements; changes in consumer preferences; liquidity risks through an inability to raise funds throu gh deposits, borrowings or other sources, or to maintain sufficient liquidity at the Company separate from the Bank’s liquidity; volatility in the capital and credit markets; effectiveness of Community Bank of the Chesapeake’s interest rate risk management strategies; the ability to obtain regulatory approvals and meet other closing conditions to the transaction, including approval by County First Bank’s sharehol der s on the expected terms and schedule; delay in closing the transaction; difficulties and delays in integrating the County First Bank’s business or fully realizing cost savings and other benefits of the transact ion in the expected timeframes, if at all; business disruption following the transaction; inflation; customer acceptance of Community Bank of the Chesapeake’s products and services; customer borrowing, repayment, in ves tment and deposit practices; customer disintermediation; and the introduction, withdrawal, success and timing of business initiatives. You are cautioned not to place undue reliance on the forward - looking statements contained in this document in that actual result s could differ materially from those indicated in such forward - looking statements, due to a variety of factors. Any forward - looking statement speaks only as of the date of this Report, and we undertake no obliga tion to update these forward - looking statements to reflect events or circumstances that occur after the date of this Report. Forward - looking statements regarding the transaction are based upon currently availabl e information. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts, and may not re flect actual results. Forward Looking Information

3 Acquisition of County First Bank

4 Transaction Rationale Leverages Existing Presence in Southern Maryland Markets County First Improves Core Funding & Liquidity Profile Lower Integration Risk x All 5 County First branch locations are within 1.5 miles of an existing TCFC branch location x Approximately $1.2 billion of combined deposits and #1 deposit market share position in Southern Maryland markets (Calvert, Charles and Saint Mary’s Counties) x County First adds $200 million of high quality, low cost deposits x Greater than 80% core deposits; 32% noninterest bearing deposits x 18 bps cost of funds (as of March 31, 2017) x Loan to deposit ratio of 75%; pro forma TCFC loan to deposit ratio reduced to approximately 100% from 105% x Extensive due diligence conducted – Greater than 55% of outstanding commercial portfolio x Familiarity with County First’s markets and customers x Significant and achievable opportunities for cost savings in the transaction Source: SNL Financial. Deposit market share data is as of 6/30/16.

5 Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) Pro Forma - TCFC 15 1,172 25.7 1 Community Financial Corp. 10 973 21.4 2 PNC Financial Services Group Inc. 15 915 20.1 3 Bank of America Corp. 8 870 19.1 4 Old Line Bancshares Inc. 7 455 10.0 5 SunTrust Banks Inc. 7 367 8.0 6 BB&T Corp. 8 357 7.8 7 M&T Bank Corp. 4 200 4.4 8 County First Bank 5 198 4.3 9 Capital One Financial Corp. 1 102 2.2 10 Wells Fargo & Co. 2 68 1.5 Expanding Market Share Position in Southern Maryland Source: SNL Financial. (1) Includes Calvert, Charles and Saint Mary’s Counties. Deposit market share data as of 6/30/16. (2) Includes only counties with overlap between TCFC and County First Bank; dollars in thousands. Median HH Income by County (2) Deposit Market Share – MD Markets (1) $90 $87 $95 $57 Charles Saint Mary's Calvert US Pro Forma Franchise TCFC CUMD

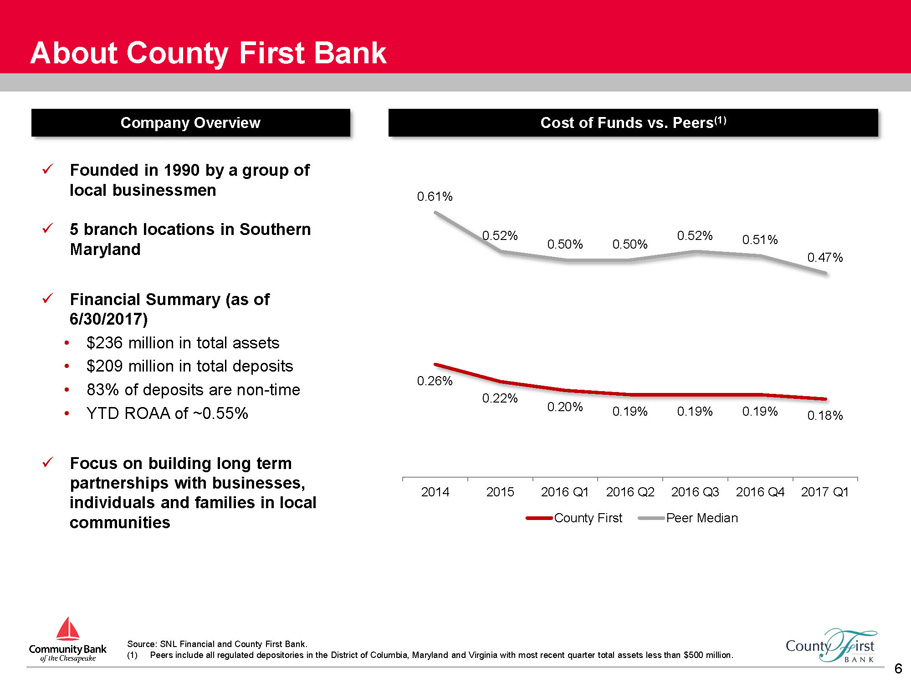

6 About County First Bank Source: SNL Financial and County First Bank. (1) Peers include all regulated depositories in the District of Columbia, Maryland and Virginia with most recent quarter total as set s less than $500 million. Cost of Funds vs. Peers (1) x Founded in 1990 by a group of local businessmen x 5 branch locations in Southern Maryland x Financial Summary (as of 6/30/2017) • $236 million in total assets • $209 million in total deposits • 83% of deposits are non - time • YTD ROAA of ~0.55% x Focus on building long term partnerships with businesses, individuals and families in local communities 0.26% 0.22% 0.20% 0.19% 0.19% 0.19% 0.18% 0.61% 0.52% 0.50% 0.50% 0.52% 0.51% 0.47% 2014 2015 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 County First Peer Median Company Overview

7 Cons A&D 3% Residential R.E. 24% Commercial R.E. 62% Commercial & Industrial 8% Consumer & Other 3% NIB Demand Deposits 17% NOW & Other Trans. Accts 16% MMDA & Other Savings 30% Time Deposits 37% Cons A&D 3% Residential R.E. 25% Commercial R.E. 62% Commercial & Industrial 8% Consumer & Other 2% Loan and Deposit Portfolios Loan Portfolio Deposit Mix Total loans: $1,143 million Average yield: 4.42% TCFC Total deposits: $1,088 million Cost of Deposits = 0.53% Loan/deposit ratio of 105% TCFC Total loans: $156 million Average yield: 4.61% County First Total deposits: $209 million Cost of Deposits = 0.18% Loan/deposit ratio of 75% Total loans: $1,300 million Pro Forma Total deposits: $1,296 million Loan/deposit ratio of 101% Pro Forma County First Cons A&D 8% Residential R.E. 15% Commercial R.E. 56% Commercial & Industrial 6% Consumer & Other 15% Source: SNL Financial and County First Bank. County First loan and deposit mixes as of 6/30/17. NIB Demand Deposits 14% NOW & Other Trans. Accts 18% MMDA & Other Savings 27% Time Deposits 41% NIB Demand Deposits 32% NOW & Other Trans. Accts 8% MMDA & Other Savings 43% Time Deposits 17%

8 Summary of Terms Source: SNL Financial. (1) Based upon TCFC’s closing share price of $36.27 as of 7/28/17. (2) Based upon TCFC’s closing share price of $36.27 as of 7/28/17 and County First’s 6/30/17 tangible book value per share of $26 .87 . (3) Represents the median price to tangible book value for nationwide depository transactions since 11/8/2016 with targets betwee n $ 100 million and $500 million of total assets and announced deal values greater than $10 million. x Acquisition of 100% of the common stock of County First Bank x Shares of County First will be exchanged for 0.9543 shares of TCFC common stock and $1.00 of cash x Implied Price per Share: $35.61 (1) x Transaction Value: $34.3 million (1) x Price / Tangible Book Value: 1.33x (2) (vs. 1.51x for recent nationwide transactions (3) ) x Consideration Mix: 97% stock / 3% cash (excluding contingent cash) x Contingent Cash Consideration: Up to a maximum of $2.24 per share • Contingent cash consideration to be based upon the resolution of certain identified assets prior to the closing of the transaction x County First Bank legacy shareholders to own approximately 16.5% of the combined entity x One current County First board member to be appointed to the boards of TCFC and Community Bank of the Chesapeake x County First Bank shareholder approval x Customary regulatory approvals Transaction Summary Board Seats Required Approvals

9 Summary of Assumptions and Transaction Impacts (1) Includes the cumulative interest rate marks on securities, loans and deposits. (2) Estimated based on consensus earnings estimates for The Community Financial Corporation plus assumed transaction adjustments. Th e Community Financial Corporation does not endorse consensus earnings estimates or publish financial guidance. Actual results may differ from conse nsu s earnings estimates. (3) Estimated tangible book value per share impact and capital ratios assume a 12/31/17 closing date. (4) Using the crossover method. x Identified cost savings of approximately $4.4 million when fully phased - in • ~60% phased - in during 2018 and 100% thereafter • Cost savings phase - in assumes closing of overlapping branches by June 30, 2018 x No revenue enhancements assumed x Gross credit mark of approximately 3.5% of County First’s loan portfolio (~$5.6 million; 2.1x the current reserve balance) x Cumulative estimated interest rate marks of approximately $323,000 (1) x After - tax deal - related charges of $3.8 million x ~$2.5 million core deposit intangible (1.4% of non - time deposits) x Estimated closing early first quarter of 2018 Impact to TCFC Shareholders Pro Forma Capital x Estimated pro forma capital ratios in excess of well - capitalized at close (3) x TCE Ratio: 7.9% x Tier 1 Leverage Ratio: 8.8% x CET1 Ratio: 10.0% x Total RBC Ratio: 13.4% x 2018 EPS: ~4% accretive (2) x 2019 EPS: ~12% accretive (2) x TBV Impact: ~2.7% dilutive (3) x TBV Earnback: ~2.4 years (4) x IRR: ~20% Assumptions Transaction Impacts

10 Comprehensive Due Diligence Completed x Comprehensive due diligence encompassing all areas of County First Bank’s operations and financial results x Senior executives from across both organizations involved in the due diligence process x Management’s credit due diligence efforts were supplemented by third party credit review experts x Loan review encompassed: • Greater than 55% of the outstanding commercial portfolio • 100% of all NPAs and OREO

11 Third Quarter 2017 Financial Update

12 Financial Highlights Source:, Company regulatory and SEC filings. TCFC has had no intangible assets in all presented periods. Gross loans presente d n et of deferred loan fees. (1) Non - GAAP financial measures. Refer to Appendix to this presentation for a reconciliation. (2) Tier 1 capital in 2015 was impacted by the redemption of $20 million of SBLF in February 2015 with proceeds of $23 million su bor dinated debt offering. (3) NPLs include nonaccrual loans, loans 90+ days past due and accruing TDRs. NPAs include NPLs and OREO. x Year over year loan growth of ~9% x Asset quality improvement has accelerated. Net charge offs remain low. x Capital position remains strong x Efficiency Ratio of 59.84% included $494,000 of County First merger related costs through 9/30/2017. x Merger costs reduced EPS by $0.03 and $0.07 for the three and nine months ended 9/30/17. YTD Highlights 2014 FY 2015 FY 2016 FY YTD (dollars in thousands, except share data) 12/31/2014 12/31/2015 12/31/2016 9/30/2016 9/30/2017 Balance Sheet Total Assets 1,082,878$ 1,143,332$ 1,334,257$ 1,281,874$ 1,402,172$ Total Gross Loans 870,890 917,740 1,089,379 1,051,573 1,146,439 Total Deposits 869,384 906,899 1,038,825 1,011,575 1,098,001 Tangible Common Equity (1) 96,559 99,783 104,426 103,983 110,885 Consolidated Capital (%) Tier 1 Risk Based Ratio (2) 14.26% 11.38% 10.62% 10.87% 10.87% Risk Based Capital Ratio 15.21% 14.58% 13.60% 13.94% 13.81% Tangible Common Equity/Tang. Assets 8.92% 8.73% 7.83% 8.11% 7.91% TBV Per Share (1) 20.53$ 21.48$ 22.54$ 22.33$ 23.85$ Asset Quality (%) NPAs/Assets (3) 2.71% 2.98% 1.99% 2.16% 1.63% NCOs/Avg Loans 0.28% 0.16% 0.11% 0.08% 0.05% Reserves/NPLs (3) 36.1% 34.8% 52.4% 50.7% 79.8% Profitability Net Income 6,490$ 6,343$ 7,331$ 5,309$ 7,667$ Net Income to Common 6,290$ 6,320$ 7,331$ 5,309$ 7,667$ ROAA 0.63% 0.58% 0.60% 0.59% 0.75% ROACE 6.7% 6.3% 7.1% 6.9% 9.4% Net Interest Margin 3.68% 3.60% 3.48% 3.50% 3.39% Efficiency Ratio (1) 66.61% 67.97% 64.82% 65.74% 59.84% Efficiency Ratio (Reported) (1) 67.00% 71.35% 67.40% 68.47% 62.61% Non-Interest Exp/Avg Assets (Reported) (1) 2.56% 2.60% 2.37% 2.41% 2.18% Net Operating Exp/Avg Assets (Reported) (1) 2.16% 2.30% 2.10% 2.14% 1.88% Diluted EPS 1.35$ 1.35$ 1.59$ 1.15$ 1.65$

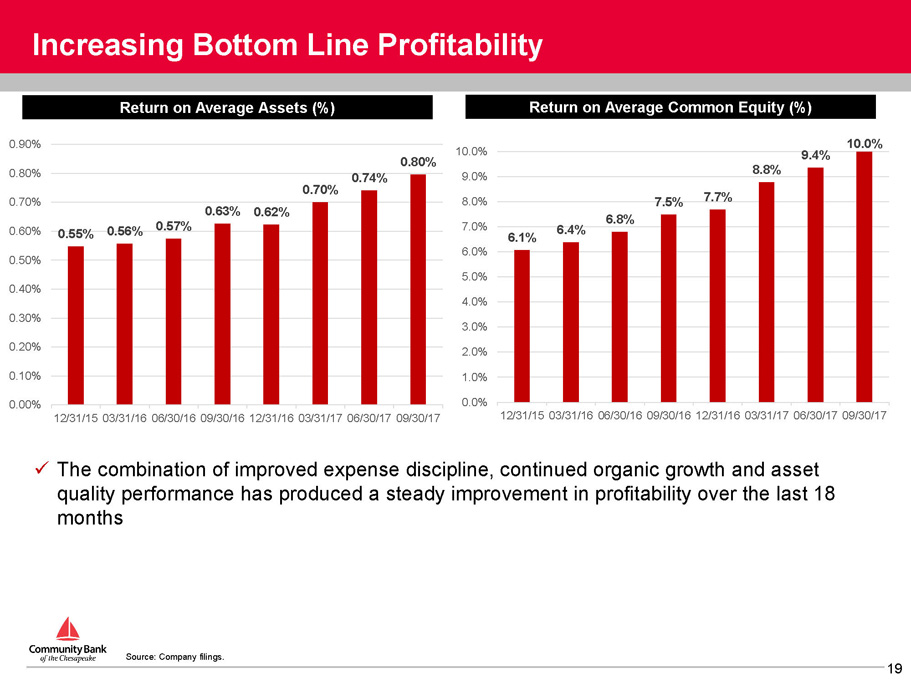

13 Financial Highlights (Last 5 Quarters) x $95.0 million in loan growth since Q3 2016 x Steady EPS growth - $0.60 per share for Q3 2017 was $0.18 greater than Q3 2016. x Asset quality improvement in each quarter. x Improved Operating Leverage due to controlling expenses and interest - earning asset growth. x 10% ROACE and 0.80% ROAA in Q3 2017. 5 Quarter Highlights 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3 (dollars in thousands, except share data) 9/30/2016 12/31/2016 3/31/2017 6/30/2017 9/30/2017 Balance Sheet Total Assets 1,281,874$ 1,334,257$ 1,356,073$ 1,392,688$ 1,402,172$ Total Gross Loans 1,051,573 1,089,379 1,114,478 1,142,863 1,146,439 Total Deposits 1,011,575 1,038,825 1,051,789 1,087,806 1,098,001 Tangible Common Equity 103,983 104,426 106,566 109,293 110,885 Consolidated Capital (%) Tier 1 Risk Based Ratio 10.87% 10.62% 10.69% 10.77% 10.87% Risk Based Capital Ratio 13.94% 13.60% 13.66% 13.72% 13.81% Tangible Common Equity/Tang. Assets 8.11% 7.83% 7.86% 7.85% 7.91% TBV Per Share 22.33$ 22.54$ 22.96$ 23.51$ 23.85$ Asset Quality (%) NPAs/Assets 2.16% 1.99% 1.83% 1.71% 1.63% NCOs/Avg Loans 0.06% 0.18% 0.05% 0.02% 0.08% Reserves/NPLs 50.7% 52.4% 55.9% 71.1% 79.8% Profitability Net Income to Common 1,963$ 2,022$ 2,342$ 2,543$ 2,782$ ROAA 0.63% 0.62% 0.70% 0.74% 0.80% ROACE 7.5% 7.7% 8.8% 9.4% 10.0% Net Interest Margin 3.47% 3.45% 3.40% 3.39% 3.38% Efficiency Ratio (Reported) 66.55% 64.38% 63.89% 62.83% 61.18% Non-Interest Exp/Avg Assets (Reported) 2.33% 2.26% 2.21% 2.19% 2.13% Net Operating Exp/Avg Assets (Reported) 2.06% 1.98% 1.94% 1.89% 1.80% Diluted EPS 0.42$ 0.44$ 0.51$ 0.55$ 0.60$

14 Residential & Consumer 57% Residential Construction 10% CRE & C&I 33% Organic Migration into a True Commercial Bank Loan Composition (12/31/2000) $174 Million Loan Composition (9/30/2017) Source: Management and company filings. Gross loans presented net of deferred loan fees. $1.1 Billion 57% 1 - 4 family real estate and consumer loans 80% commercial real estate, residential rentals and commercial & industrial loans Yield: 4.49% Owner Occupied CRE was $320 million at 9/30/17 Owner Occ. CRE and C&I , 33% Residential Rentals , 10% Commercial Real Estate , 37% Residential Construction , 3% Residential & Consumer , 17%

15 Asset Quality Trends NPAs & 90+PD / Assets (1) Allowance for Loan Losses / Loans Allowance for Loan Losses / NPLs (2) NCOs / Avg. Loans Source: : Company filings .. (1) Nonperforming Assets = Nonaccrual + accruing TDRs + 90 day past due + OREO. (2) Nonperforming Loans = Nonaccrual + accruing TDRs + 90 day past due. 1.48% 2.04% 2.17% 1.49% 1.83% 1.21% 0.91% 2.61% 2.50% 2.60% 2.71% 2.98% 1.99% 1.63% 0.00% 1.00% 2.00% 3.00% 4.00% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD TCFC Excl. TDRs TCFC 80.5% 62.8% 52.7% 82.6% 74.7% 117.7% 346.4% 37.1% 46.7% 41.1% 36.1% 34.8% 52.4% 79.8% 0.0% 50.0% 100.0% 150.0% 200.0% 250.0% 300.0% 350.0% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD TCFC Excl. TDRs TCFC 1.07% 1.09% 1.01% 0.97% 0.93% 0.91% 0.91% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD 0.61% 0.27% 0.14% 0.28% 0.16% 0.11% 0.05% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD

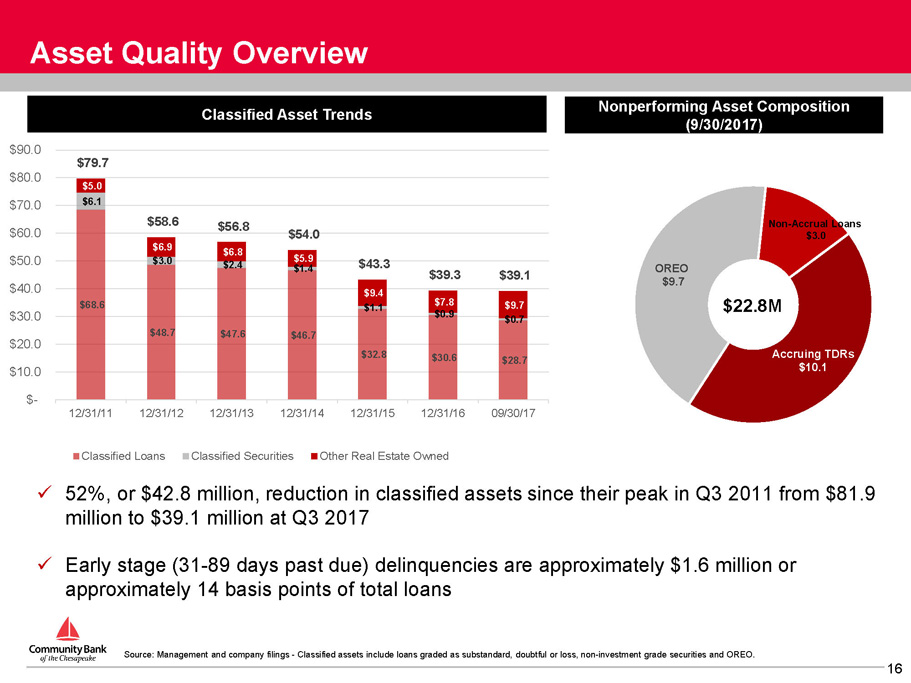

16 Asset Quality Overview Source: Management and company filings - Classified assets include loans graded as substandard, doubtful or loss, non - investment grade securities and OREO. Classified Asset Trends Nonperforming Asset Composition (9/30/2017) x 52%, or $42.8 million, reduction in classified assets since their peak in Q3 2011 from $81.9 million to $39.1 million at Q3 2017 x Early stage (31 - 89 days past due) delinquencies are approximately $1.6 million or approximately 14 basis points of total loans $68.6 $48.7 $47.6 $46.7 $32.8 $30.6 $28.7 $6.1 $3.0 $2.4 $1.4 $1.1 $0.9 $0.7 $5.0 $6.9 $6.8 $5.9 $9.4 $7.8 $9.7 $79.7 $58.6 $56.8 $54.0 $43.3 $39.3 $39.1 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 09/30/17 Classified Loans Classified Securities Other Real Estate Owned Non - Accrual Loans $3.0 Accruing TDRs $10.1 OREO $9.7 $22.8M

17 Deposit Franchise Cost of Funding x At September 30, 2016 the Bank’s deposit funding consisted of approximately 58% transaction accounts compared to less than 45% at December 31, 2011 x Increased average balance of transaction accounts by $46.3 million, or 7.8%, over last twelve months (1) x Success in increasing transaction deposits, including noninterest bearing deposits, has slowed the growth in cost of funds during 2017. x Average transaction deposits increased $22.7 million during Q3 2017 to $641.7 million compared to 619.0 million during Q2 2017. Source: Management and company filings. Data as of 6/30/17. (1) Comparison reflects three month average balance as of 6/30/17 as compared to three month average balance as of 6/30/16. Deposit Composition (9/30/2017) $1.1 Billion IB Transaction 44% NIB Transaction 14% Time Deposits 42% 1.43% 1.05% 0.71% 0.56% 0.48% 0.48% 0.53% 1.59% 1.21% 0.88% 0.74% 0.75% 0.73% 0.79% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD Cost of Deposits Cost of Funds

18 Focus on Efficiency & Expenses Efficiency Ratio – Adjusted and Reported Reported Noninterest Exp / Avg. Assets and Net Operating Exp/ Avg. Assets Source: Company filings. TCFC data as of 9/30/17. Efficiency ratio , noninterest expense to average assets and net operating exp ense to average assets are Non - GAAP financial measures; refer to Appendix to this presentation for a reconciliation. x Historically maintained our efficiency ratio below peer institutions x Expense discipline continued through recent growth history, including expansion into Fredericksburg, VA and Anne Arundel County, MD markets x Review operating expense base for specific savings initiatives, including closure of underperforming branches x Third Quarter 2017 non - interest expense and net operating expense to average assets was 2.13% and 1.80% x Year over year operating expenses increased approximately 2.3% vs. net interest income growth of 10.8% 64.8% 67.7% 66.8% 66.6% 68.0% 64.8% 59.8% 71.7% 69.8% 68.6% 67.0% 71.4% 67.4% 62.6% 40.0% 50.0% 60.0% 70.0% 80.0% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD Efficiency Ratio Efficiency Ratio (Reported) 2.46% 2.47% 2.56% 2.56% 2.60% 2.37% 2.18% 1.99% 2.01% 2.13% 2.16% 2.30% 2.10% 1.88% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 2.80% 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017YTD Non-Interest Expense Net Operating Expense

19 Increasing Bottom Line Profitability Return on Average Assets (%) Source: Company filings. x The combination of improved expense discipline, continued organic growth and asset quality performance has produced a steady improvement in profitability over the last 18 months Return on Average Common Equity (%) 0.55% 0.56% 0.57% 0.63% 0.62% 0.70% 0.74% 0.80% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 12/31/15 03/31/16 06/30/16 09/30/16 12/31/16 03/31/17 06/30/17 09/30/17 6.1% 6.4% 6.8% 7.5% 7.7% 8.8% 9.4% 10.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 12/31/15 03/31/16 06/30/16 09/30/16 12/31/16 03/31/17 06/30/17 09/30/17

20 Concluding Remarks

21 Concluding Remarks x Increased Momentum: • Profitability • Loan and Deposit Growth • Asset Quality Improvement x Positioned in Demographically Attractive Markets x Strong Market Share Position in Core Market x Strong, Experienced Management Team The Community Financial Corporation Acquisition of County First Bank x Financially attractive x Achievable cost savings opportunities x Enhances positioning within attractive Southern Maryland markets x Acquisition of low cost, stable core deposit base x Comprehensive due diligence conducted x Low integration risk

22 Appendix

23 Executive Leadership Team William J. Pasenelli x EVP and Chief Risk Officer x Joined in 2005 x Former EVP and Senior Loan Officer at Mercantile Southern Maryland Bank x President and Chief Executive Officer x Joined in 2000 x Former CFO of Acacia Federal Savings Bank (1987 - 2000) James M. Burke Todd L. Capitani x EVP and Chief Financial Officer x Joined in 2009 x Former Senior Finance Manager with Deloitte Consulting and CFO of Ruesch International, Inc. Christy M. Lombardi x EVP and Chief Administrative Officer x Joined in 1998 x Oversees human resources and shareholder relations Gregory Cockerham x EVP and Chief Lending Officer x Joined in 1988 x Former Executive with Maryland National Bank James F. Di Misa x EVP and Chief Operating Officer x Joined in 2005 x Former EVP at Mercantile Southern Maryland Bank

24 Investment Highlights x Strong Fundamental Operating Trends • More than 30 consecutive years of profitability • Net interest margin improvement driven by stable loan yields and improving funding costs x Robust Lending Pipeline x Strong Market Share and Brand Recognition • Top community bank aggregate deposit market share in operating counties in Southern Maryland • Successful results in new markets through local hiring, community outreach and grassroots marketing x Excellent Regional Demographics Driven by Proximity to Department of Defense (“DoD”) Headquarters, Homeland Security and Other Federal Agencies x Experienced Senior Management Team with Strong Track Record • Average of more than 30 years in banking and 18 years with the Company • Proven ability to grow organically through recent economic cycle

25 Significant In - Market Federal Agency Presence x Department of Defense in - market presence: • National Energetics Center – Naval Support Facility at Indian Head (Charles County) • Naval Surface Warfare – Naval Support Facility at Dahlgren (King George County) • Air Force One – Andrews AFB (Prince Georges County) • US Marines – Quantico (Prince William County) • Defense Intelligence Agency & Defense Intelligence Analysis Center – Joint Base Anacostia - Bolling (Prince Georges County) • Naval Air Station Patuxent River (St. Mary’s County) x Additional major in - market Federal Agency presence: • Federal Aviation Administration (FAA) Unmanned Aerial Vehicle (UAV) Drones Program • Homeland Security • FBI & DEA – Quantico (Prince William County)

26 Non - GAAP Reconciliation Tangible Book Value Per Share & Tangible Common Equity / Tangible Assets ‘‘Tangible book value per share’’ is defined as tangible stockholders’ equity less preferred equity and intangible assets divided by total common shares outstanding . We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in intangible assets . Source: Management and company filings. 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY YTD (dollars in thousands, except share data) 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 9/30/2016 9/30/2017 Stockholders Equity 75,454$ 79,047$ 110,730$ 116,559$ 99,783$ 104,426$ 103,983$ 110,885$ Intangible Assets - - - - - - - - Preferred Equity (20,000) (20,000) (20,000) (20,000) - - - - Tangible Common Equity 55,454$ 59,047$ 90,730$ 96,559$ 99,783$ 104,426$ 103,983$ 110,885$ Total Assets 983,480$ 981,639$ 1,023,824$ 1,082,878$ 1,143,332$ 1,334,257$ 1,281,874$ 1,402,172$ Intangible Assets - - - - - - - - Tangible Assets 983,480$ 981,639$ 1,023,824$ 1,082,878$ 1,143,332$ 1,334,257$ 1,281,874$ 1,402,172$ Shares Outstanding 3,026,557 3,052,416 4,647,407 4,702,715 4,645,429 4,633,868 4,656,989 4,649,302 Tangible Book Value per Share 18.32$ 19.34$ 19.52$ 20.53$ 21.48$ 22.54$ 22.33$ 23.85$ Tangible Common Equity/Tang. Assets 5.64% 6.02% 8.86% 8.92% 8.73% 7.83% 8.11% 7.91%

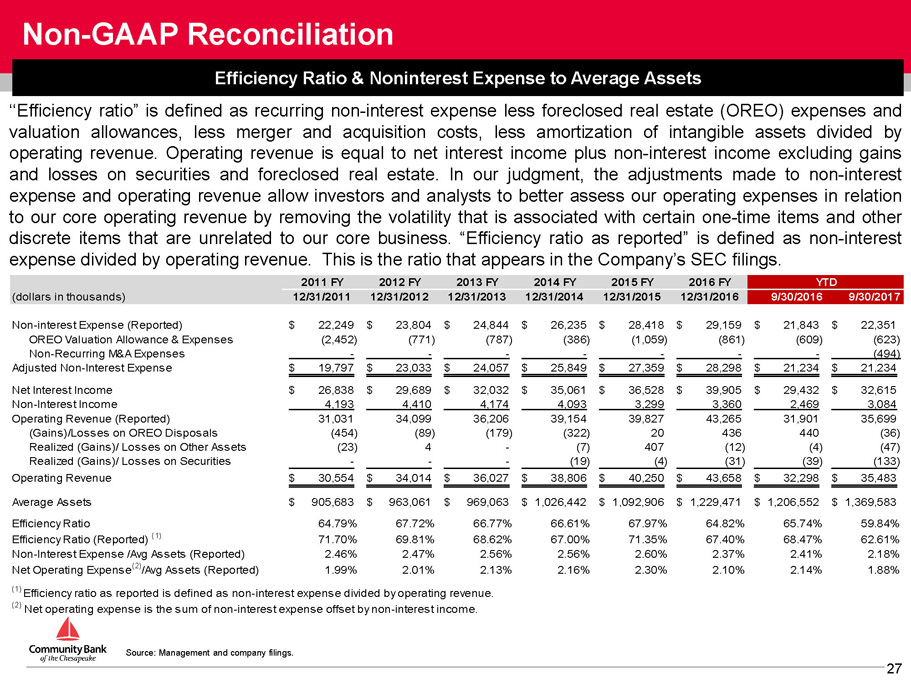

27 Non - GAAP Reconciliation Efficiency Ratio & Noninterest Expense to Average Assets ‘‘Efficiency ratio” is defined as recurring non - interest expense less foreclosed real estate (OREO) expenses and valuation allowances, less merger and acquisition costs, less amortization of intangible assets divided by operating revenue . Operating revenue is equal to net interest income plus non - interest income excluding gains and losses on securities and foreclosed real estate . In our judgment, the adjustments made to non - interest expense and operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain one - time items and other discrete items that are unrelated to our core business . “Efficiency ratio as reported” is defined as non - interest expense divided by operating revenue . This is the ratio that appears in the Company’s SEC filings . Source: Management and company filings. 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY YTD (dollars in thousands) 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 9/30/2016 9/30/2017 Non-interest Expense (Reported) 22,249$ 23,804$ 24,844$ 26,235$ 28,418$ 29,159$ 21,843$ 22,351$ OREO Valuation Allowance & Expenses (2,452) (771) (787) (386) (1,059) (861) (609) (623) Non-Recurring M&A Expenses - - - - - - - (494) Adjusted Non-Interest Expense 19,797$ 23,033$ 24,057$ 25,849$ 27,359$ 28,298$ 21,234$ 21,234$ Net Interest Income 26,838$ 29,689$ 32,032$ 35,061$ 36,528$ 39,905$ 29,432$ 32,615$ Non-Interest Income 4,193 4,410 4,174 4,093 3,299 3,360 2,469 3,084 Operating Revenue (Reported) 31,031 34,099 36,206 39,154 39,827 43,265 31,901 35,699 (Gains)/Losses on OREO Disposals (454) (89) (179) (322) 20 436 440 (36) Realized (Gains)/ Losses on Other Assets (23) 4 - (7) 407 (12) (4) (47) Realized (Gains)/ Losses on Securities - - - (19) (4) (31) (39) (133) Operating Revenue 30,554$ 34,014$ 36,027$ 38,806$ 40,250$ 43,658$ 32,298$ 35,483$ Average Assets 905,683$ 963,061$ 969,063$ 1,026,442$ 1,092,906$ 1,229,471$ 1,206,552$ 1,369,583$ Efficiency Ratio 64.79% 67.72% 66.77% 66.61% 67.97% 64.82% 65.74% 59.84% Efficiency Ratio (Reported) (1) 71.70% 69.81% 68.62% 67.00% 71.35% 67.40% 68.47% 62.61% Non-Interest Expense /Avg Assets (Reported) 2.46% 2.47% 2.56% 2.56% 2.60% 2.37% 2.41% 2.18% Net Operating Expense (2) /Avg Assets (Reported) 1.99% 2.01% 2.13% 2.16% 2.30% 2.10% 2.14% 1.88% (1) Efficiency ratio as reported is defined as non-interest expense divided by operating revenue. (2) Net operating expense is the sum of non-interest expense offset by non-interest income.