Filed by Sky Financial Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Sky Financial Group, Inc.

(Commission File No. 001-14473)

| Forward-looking Statement |

This filing contains certain forward-looking statements, including certain plans, expectations, goals, and projections, and including statements about the benefits of the merger between Huntington Bancshares Incorporated (“Huntington”) and Sky Financial Group, Inc. (“Sky Financial”), which are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements for a variety of factors including: the businesses of Huntington and Sky Financial may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the merger may not be fully realized within the expected timeframes; disruption from the merger may make it more difficult to maintain relatio nships with clients, associates, or suppliers; the required governmental approvals of the merger may not be obtained on the proposed terms and schedule; Huntington and/or Sky Financial’s stockholders may not approve the merger; changes in economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of other business strategies; the nature, extent, and timing of governmental actions and reforms; and extended disruption of vital infrastructure; and other factors described in Huntington’s 2005 Annual Report on Form 10-K/A, Sky Financial’s 2005 Annual Report on Form 10-K, and documents subsequently filed by Huntington and Sky Financial with the Securities and Exchange Commission. All forward-looking statements included in this filing are based on information available at the time of the filing. Neither Huntington nor Sky Financial assumes any obligation to update any forward-looking statement.

Additional Information About the Merger and Where to Find It

Huntington and Sky Financial will be filing relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S-4 which will include a proxy statement/prospectus. Stockholders will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about Huntington and Sky Financial, at the Securities and Exchange Commission’s internet site (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the Securities and Exchange Commission that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington, Huntington Center, 41 South High Street, Columbus, Ohio 43287, Attention: Investor Relations, 614-480-4060, or Sky Financial, 221 South Church Street, Bowling Green, Ohio, 43402. The fin al proxy statement/prospectus will be mailed to stockholders of Huntington and Sky Financial.

Stockholders are urged to read the proxy statement/prospectus, and other relevant documents filed with the Securities and Exchange Commission regarding the proposed transaction when they become available, because they will contain important information.

The directors and executive officers of Huntington and Sky Financial and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding Huntington’s directors and executive officers is available in its proxy statement filed with the SEC by Huntington on March 8, 2006. Information regarding Sky Financial’s directors and executive officers is available in its proxy statement filed with the SEC by Sky Financial on February 23, 2006. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

[Below is the Employee Call Script]

| | CONFIDENTIAL DRAFT | 12/2006 (12:00 PM ET) |

| |

| 1 | Script for Employee Call |

| 2 | |

| 3 | Good afternoon, everyone. This is Marty [Adams]. Thanks for taking time out of your day to join me on |

| 4 | this call. |

| 5 | |

| 6 | I am delighted to discuss with you the news we announced yesterday that Sky Financial Group has |

| 7 | agreed to merge with Huntington. The merger is comprised of stock and cash and is valued at |

| 8 | approximately $3.6 billion. While I’m sure most of you have read about the merger, I wanted to reach out |

| 9 | to you personally and give you some perspective on the strategic rationale behind this exciting |

| 10 | combination. |

| 11 | |

| 12 | As you know, the board, our executive team and I are extremely proud of Sky’s performance and the hard |

| 13 | work each of you do every day. We were not actively seeking a partner. Rather, up to now, we’ve |

| 14 | always been a buyer not a seller. However, given this point in our evolution and after carefully reviewing |

| 15 | this opportunity our Board determined that merging with Huntington was in Sky’s best interests. |

| 16 | |

| 17 | There has been a great deal of consolidation among companies like ours in the Midwest for some time |

| 18 | now, and Sky has been an active participant. Our success is due largely to your excellent performance |

| 19 | and commitment to our clients and the communities we serve. So, given our shared values, the |

| 20 | opportunity to merge with Huntington presents a great fit for Sky’s clients and the long-term future of our |

| 21 | organization. Given the markets Sky and Huntington serve and our lines of business, this transaction |

| 22 | makes great strategic sense. Huntington is an ideal merger partner to accelerate our continued growth |

| 23 | and success. As we look for ways to better compete, the combined resources of Huntington and Sky will |

| 24 | allow us to continue the tradition of client focus. |

| 25 | |

| 26 | Once completed, the company will be called Huntington Bancshares and will be headquartered in |

| 27 | Columbus, Ohio. The combined company will maintain regional headquarters in local markets close to its |

| 28 | clients. We will continue to have a substantial presence in Bowling Green and Salineville, as well as the |

| 29 | communities we currently serve. As a combined company, we will have a strong presence throughout the |

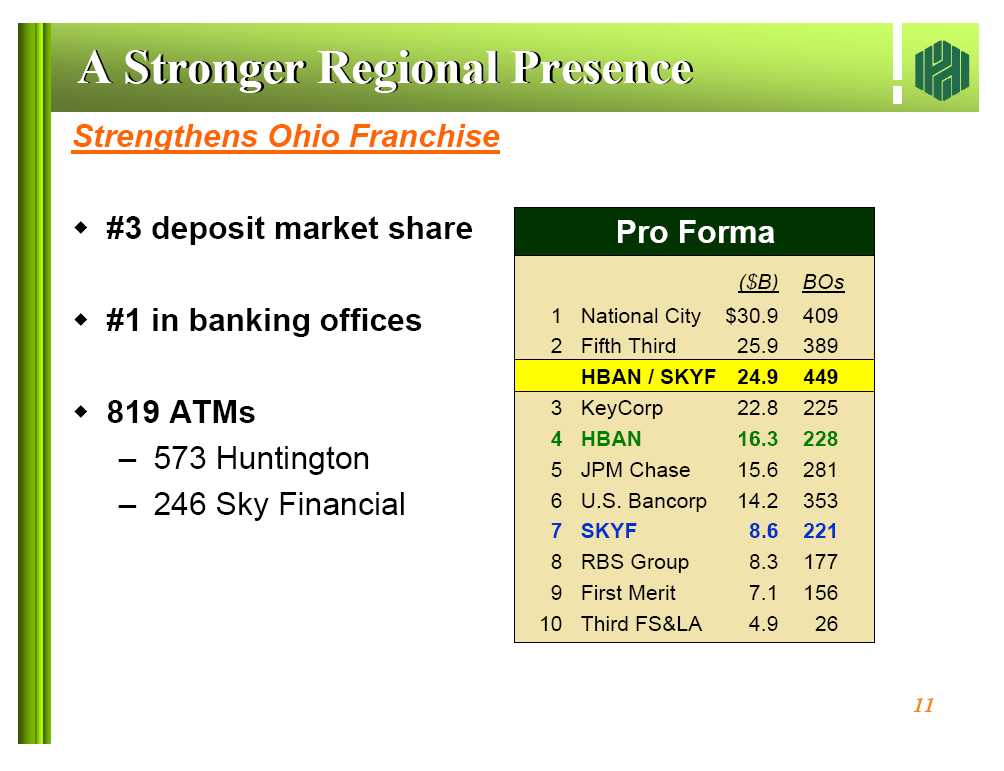

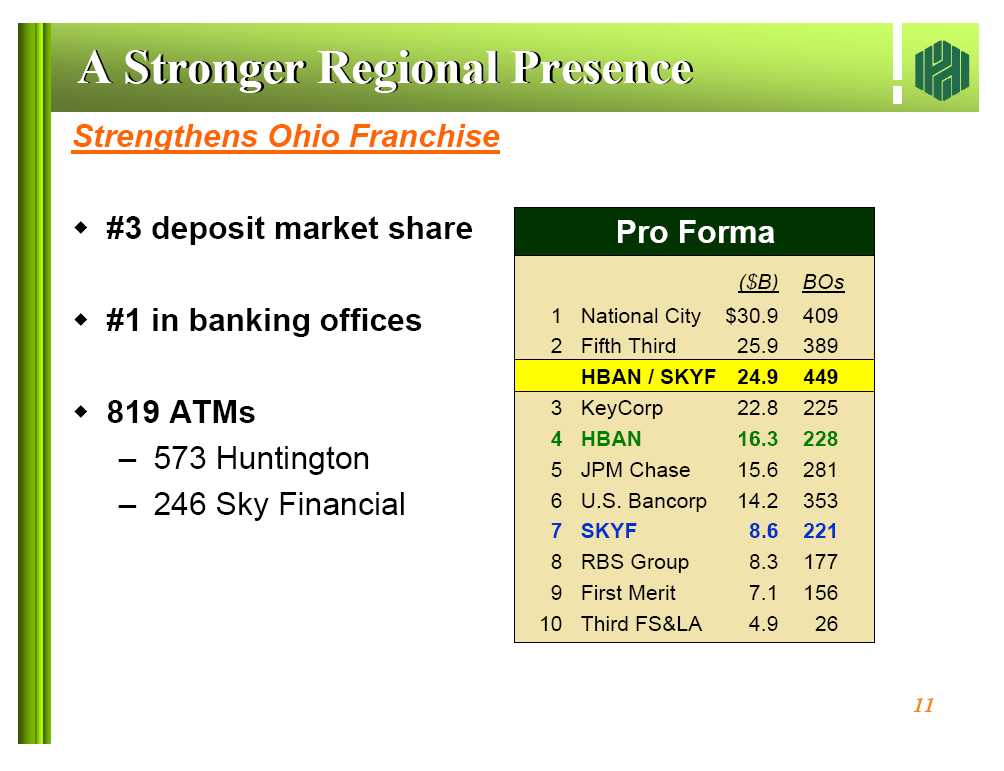

| 30 | Midwest, particularly in Ohio, where we will be the third largest bank in the state. Indianapolis will also |

| 31 | continue to be an important market for us after just completing the acquisition of Union Federal Bank of |

| 32 | Indianapolis. |

| 33 | |

| 34 | We expect the merger to close in the third quarter of 2007, subject to customary closing conditions |

| 35 | including the approval of Sky’s and Huntington’s shareholders and the receipt of regulatory approvals. |

| 36 | After the closing, I will become president and chief operating officer, reporting to Tom Hoaglin, |

| 37 | Huntington’s chairman and chief executive officer. However, as part of the merger agreement, by the end |

| |

| | CONFIDENTIAL DRAFT | 12/2006 (12:00 PM ET) |

| |

| 38 | of 2009, I will become chief executive officer and president of Huntington and Tom will remain Chairman |

| 39 | until early 2011. |

| 40 | |

| 41 | It is important to remember that Sky and Huntington remain separate companies until the merger is |

| 42 | complete – so it’s business as usual until then. In the interim, please visit Sky Central as we will be |

| 43 | making every effort to keep you informed of any developments in this process. If you have any questions, |

| 44 | don’t hesitate to email them to the Employee Question E-mail Box at asksky@skyfi.com. |

| 45 | |

| 46 | In our effort to provide a seamless merger for our employees and clients, both companies will initiate an |

| 47 | extensive communication outreach program. |

| 48 | |

| 49 | Although we don’t know all of the details at this time, I think you would agree that Sky has a history of |

| 50 | treating employees fairly and will communicate information as soon as possible. [Given the overlap in the |

| 51 | markets and communities we serve and our lines of business, we expect there will be some workforce |

| 52 | reductions after the merger closes. The company will be providing severance and outplacement services. |

| 53 | However, we expect that there will also be numerous opportunities for career growth and advancement |

| 54 | for Sky employees in the combined company. |

| 55 | |

| 56 | Finally, as you might expect, the media will have some interest in this news. Should you receive any calls, |

| 57 | please forward them to Tim Dirrim and Curtis Shepherd in corporate communications. Their numbers are |

| 58 | available in the FAQ posted on our intranet. |

| 59 | |

| 60 | This concludes my comments tonight. Let me again reiterate just how exciting a time this is in Sky’s |

| 61 | history, and how much we’re looking forward to the opportunities that the future holds. As always, I thank |

| 62 | you for your continued commitment to and focus on our clients and hope that you share in our optimism |

| 63 | for the future of Sky and Huntington. |

| |

[Below is the Sky Financial Employee FAQ]

| CONFIDENTIAL DRAFT | | | | | | | | | | 12/20/06 (12:00 PM ET) |

Frequently Asked Questions (FAQ) for Sky Employees

Sky and Huntington Sky Merger

December 2006

NOTE:This document is intended to answer some of the questions you may have regarding Sky’s merger with Huntington. As you could appreciate, we will not have answers to all of your questions at this early stage, but will update this document periodically with new information. In the meantime, if you have a question that is not listed on this document, please feel free to email it to our Employee Question E-mail Box at [ ].

| 1. | Who is Huntington Bank? |

| | Huntington Bancshares Incorporated is a regional bank holding company headquartered in Columbus, Ohio. Huntington has more than 380 banking offices and nearly 1,000 ATMs in five states: Ohio, Michigan, West Virginia, Indiana and Kentucky. Huntington has a rich banking history dating back to over 140 years. Huntington is traded on Nasdaq under the ticker “HBAN.” To learn more, visit [ ]. |

| |

| | Huntington is an ideal fit for Sky. Huntington has been a strong competitor that reflects and shares our culture, understands our values, our markets and our clients. |

| |

| 2. | When will the merger be completed? |

| | We expect that the merger of Sky Financial Group and Huntington Bancshares will close in the third quarter of 2007. |

| |

| 3. | What happens between now and closing? |

| | Huntington and Sky will operate as separate companies until closing, and there will be very few changes. A joint integration team is currently being organized and we will keep you updated as major developments unfold. |

| |

| 4. | Why is this good for clients? |

| | The merger will provide Sky clients with new capabilities, locations, ATMs and even more services and products. In addition they will continue to receive great service and a commitment to their local communities. |

| |

| 5. | How should I communicate to clients during this time? |

| | Please continue to work with your clients just like you normally would today. During this period of transition, it will be business as usual – so continue to respond to clients quickly if they have questions or concerns about their everyday banking or this merger. Your manager/supervisor will assist you with answers to any questions you are unable to address with the tools you have been provided. |

| |

| 6. | What should I do if the media contacts me? |

| | During this time, it is important that we speak with one voice. All media inquiries should be directed to Tim Dirrim at [ ] or Curtis Shepherd at [ ]. |

| |

1

| CONFIDENTIAL DRAFT | | 12/20/06 (12:00 PM ET) |

| |

| |

| 7. | | What should I tell my clients? | | |

| | | Huntington’s structure drives decision-making to the local level, closest to the client. You will continue |

| | | to work with the same people you see every day at your local office. Huntington and Sky have similar |

| | | approaches to client service, including the ability to make as many decisions as possible at the local |

| | | level. | | |

| |

| | | In addition, by being part of a larger bank, your clients will now have access to financial centers and |

| | | ATMs in Ohio, Michigan, West Virginia and Indiana. Additionally, Huntington offers clients access to |

| | | highly-rated Internet banking services. | | |

| |

| | | Huntington offers a broad array of sophisticated products and services for businesses and individuals, |

| | | including treasury management, investment management, equipment finance, 401(K), retail securities |

| | | and interest rate swaps. If clients have questions that you cannot answer as we go through the |

| | | process, be sure to let your manager know. We are all committed to making the transition as smooth |

| | | as possible. | | |

8. How will my employment be affected by the merger?

Employees are critical to making this merger a success. Decisions about the combined company, including staffing decisions, will be made as we work through the

integration process. Sky and Huntington have a history of treating employees fairly and will communicate information as soon as possible to all affected employees.

It is clear that there is some overlap of operations, however no decisions have been made with regard to office consolidations or duplicated functions. Our management

team will work closely with Huntington to evaluate the options and determine the best possible solution. We will share those decisions with you as they are made.

| 9. | Will the Bank’s name change? |

| | Yes. After the merger closes, the combined company will be named Huntington. |

| |

| 10. | Will any branch offices be consolidated? |

| | Given the overlap in the markets and communities we serve and our lines of business, we expect that some branch offices will be consolidated. We are just beginning the process of identifying these specific locations. However, our objective is to maximize our collective resources to determine which facilities best meet the needs or both our clients. |

| |

| 11. | What will happen to Sky Insurance and its employees? |

| | Sky Insurance and their employees will be merged into Huntington as well. |

| |

| 12. | What will happen to Sky Trust and its employees? |

| | Sky Trust and their employees will be merged into Huntington as well. |

| |

| 13. | When will I learn more information? |

| | An integration team is currently being put in place and a detailed project plan will be instituted very soon. As a part of this plan, the desire is to communicate as frequently as possible with accurate information. We will communicate via the most appropriate mechanism for the information. These may include Sky Central stories, communicator e-mails, conference calls, one-on-one meetings and any other form appropriate. |

| |

| 14. | When Sky becomes part of Huntington, will it continue to be a community-based bank with local decision-making? |

| | Yes. This is one of the reasons we believe that Huntington is the right partner for Sky. Huntington’s structure drives decision-making to the local level, closest to the client. |

| |

2

| CONFIDENTIAL DRAFT | | | | | | 12/20/06 (12:00 PM ET) |

| | | | | | |

| COMPENSATION AND BENEFITS | | | | | | |

| 15. | What will happen to our benefits programs after the merger? |

| | Huntington offers a comprehensive and competitive benefits program designed to meet the individual and family needs of its employees. Benefits are an important aspect of an employee’s total compensation package at Huntington and Huntington is committed to keeping its total compensation package competitive when compared to its peers. Benefits packages vary from employer to employer. As you will see, while there are some differences in benefits, Huntington’s benefits package is similar to the benefits package offered at Sky. Highlights of the benefits package offered by Huntington to its eligible employees include: |

| |

| | 9 | Medical and prescription drug benefits through Anthem Blue Cross Blue Shield in all markets and Aultcare in certain Ohio markets |

| | 9 | Dental benefits through CIGNA |

| | 9 | Vision benefits through Vision Services Plan (“VSP”) |

| | 9 | Health and dependent care spending accounts |

| | 9 | Company paid short-term and long-term disability benefits |

| | 9 | Company paid term life and business travel insurance |

| | 9 | Employee paid accidental death and dismemberment, optional term and dependent term life insurance |

| | 9 | Paid time off as well as nine paid holidays |

| | 9 | 401(k) plan with the same employer matching contribution formula as Sky’s 401(k) plan |

| | 9 | Final average pay defined benefit pension plan |

| | 9 | Retiree medical and life insurance |

| | 9 | Tuition assistance |

| | 9 | Employee assistance plan |

| | 9 | Transition pay plan that provides severance pay to employees whose positions are eliminated |

| | 9 | Free checking and other free or reduced fee banking, mortgage and investment services |

| |

| | For more information about Huntington’s benefit package, a brochure entitled “Your Benefits at Huntington,” will be placed on Sky’s intranet in the near future.Importantly, following the merger, Sky employees who become Huntington employees will be offered benefits that are as favorable as the benefits offered to similarly situated Huntington employees. |

| |

| | Your service with Sky, Sky’s subsidiaries and employers acquired by Sky will count towards eligibility and vesting of benefits under Huntington’s programs to the same extent your service was counted for these purposes by Sky. While your service with Sky, its subsidiaries and employers acquired by Sky will count for eligibility and vesting in Huntington’s defined benefit pension plan, your prior service willnotcount when determining the amount of your benefit under this plan. This is because eligible Sky employees have received contributions under Sky’s profit sharing and ESOP during their employment with Sky. |

| |

| | During the first quarter of 2007, the benefits teams at Huntington and Sky will meet to determine the best course of action for transitioning Sky employees to Huntington’s payroll and benefits. This transition will occur after the merger closes (expected in the third quarter 2007). Employees will be updated once these decisions have been made. |

| |

| | We hope the information provided, along with information on the Sky intranet, has given you a basic understanding of Huntington’s current benefits program. We appreciate your patience while the details of the benefits and payroll transition are worked out. |

| |

3

| CONFIDENTIAL DRAFT | | | | | | | | | | 12/20/06 (12:00 PM ET) |

| 16. | What is Huntington’s Compensation Philosophy? Does Huntington have an employee incentive compensation plan? |

| |

| | The Huntington Compensation Program recognizes employees for their contributions toward achievement of our company’s goals. These contributions vary in type and scope, depending on the requirements of the job, the skills and knowledge one brings to a particular job and the quality of the work performed. The overall objective is to identify, recognize and reward these different contributions in a fair and equitable way. |

| |

| | For most employees the compensation programs consist of incentive pay and base pay. Base pay is designed to 1) ensure competitive compensation, 2) support our business strategy 3) reward diverse skill levels, 4) be simple to use and understand and 4) be flexible to accommodate rapid change. |

| |

| | Under our incentive pay programs, every employee is eligible to participate in a bonus or incentive program. |

| |

| 17. | What changes will be made to the Sky management structure? |

| | Marty Adams, Sky’s Chairman, President, and CEO will become the President and Chief Operating Officer for the combined company and 1/3 of the Board of Directors will be comprised of former Sky Directors. No other specific decisions have been made at this time. |

| |

4

[Below is a letter to Sky Employees]

| To: | | All Sky Employees |

| | |

| From: | | Marty E. Adams, Chairman, President and CEO |

| | |

| Date: | | December 20, 2006 |

| | |

| Re: | | Huntington Bancshares and Sky Financial Group Announce $3.6 Billion Merger Agreement |

At Sky, our clients and employees have always come first. With that unchanging philosophy as our cornerstone, it is with great excitement that Sky today has announced that we will be merging with Huntington Bancshares in a stock and cash merger valued at approximately $3.6 billion. A copy of the press release issued today is available in a related story on Sky Central.

There has been considerable consolidation activity among financial services companies in the Midwest and Sky has been one of the most active participants. Our success in the marketplace is due largely to your excellent performance, which consistently is above and beyond what I and the Board ask of you. Our success is what attracted Huntington to Sky. Because of your efforts, Sky has grown through acquisitions, organic growth and a consistent focus on our five strategic priorities. Given the markets Sky and Huntington serve and our lines of business, this merger makes great strategic sense and Huntington is an ideal merger partner to accelerate our continued growth and success.

As part of the agreement, the combined company, which will be called Huntington, will be headquartered in Columbus, Ohio. Huntington will maintain regional headquarters in local markets close to its clients. We will also continue to have a substantial presence in Bowling Green and Salineville, as well as the other communities Sky currently serves. As a combined company, we will have a strong presence throughout the Midwest.

We expect the merger to close in the third quarter of 2007, subject to customary closing conditions including approval by both companies’ shareholders and receipt of regulatory approvals. Upon closing of the merger, I will become president and chief operating officer of the combined company, reporting to Tom Hoaglin, who will remain chairman and chief executive officer. I will then become chief executive officer and president by the end of 2009, and Tom will remain as chairman until early 2011. It is important to note that employees are critical to making this merger a success. Decisions about the combined company, including staffing decisions, will be made as we work through the integration process. Sky and Huntington have a history of treating employees fairly and will communicate information as soon as possible to all affected employees.

Until the merger closes, Sky and Huntington remain separate companies, and it is important for us all to remember that it is business as usual. I know I can count on you to remain focused on our objectives. We will make every effort to keep you up to date on all developments and progress throughout this process. Please feel free to visit Sky Central for updates on the merger, and as always, should you have any questions in the interim, you could email them to our Employee Question E-mail Box at [ ].

We are committed to a seamless transition for both employees and Sky’s clients. Huntington and Sky will initiate an extensive communication outreach program to ensure that all clients are informed prior to any changes resulting from the merger.

This combination is likely to attract interest from the media and other external audiences, and it is important we be clear and consistent in our communications to other interested parties. If you receive any calls from the media or other outside parties, please forward them to Tim Dirrim at [ ] or Curtis Shepherd at [ ].

We will have an “All Employee Call” on Thursday, December 21 at 4:30 PM ET. Please be on the lookout for a Sky Communicator e-mail Thursday before noon that will have the call information.

This is an exciting time in our organization’s history, and we’re looking forward to the opportunities that the future holds. As always, I want to thank you and ask for your continued commitment and focus on our clients.

Forward-looking Statement

This communication contains certain forward-looking statements, including certain plans, expectations, goals, and projections, and including statements about the benefits of the merger between Huntington and Sky Financial Group, which are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements.

Additional Information About the Merger and Where to Find It

Huntington and Sky Financial will be filing relevant documents concerning the merger with the Securities and Exchange Commission, including a registration statement on Form S-4 which will include a proxy statement/prospectus. Stockholders will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about Huntington and Sky Financial Group, at the Securities and Exchange Commission’s internet site (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the Securities and Exchange Commission that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Bancshares Incorporated, Huntington Center, 41 South High Street, Columbus, Ohio 43287, Attention: Investor Relations, [ ], or Sky Financial Group., 221 South C hurch Street, Bowling Green, Ohio, 43402.

Stockholders are urged to read the proxy statement/prospectus, and other relevant documents filed with the Securities and Exchange Commission regarding the proposed merger when they become available, because they will contain important information.

The directors and executive officers of Huntington and Sky Financial Group and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding Huntington’s directors and executive officers is available in its proxy statement filed with the SEC by Huntington on March 8, 2006. Information regarding Sky Financial Group’s directors and executive officers is available in its proxy statement filed with the SEC by Sky Financial Group on February 23, 2006. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

[Below is a Sky Central Announcement of the Merger]

| CONFIDENTIAL DRAFT | | | | | | | | 12/20/06 (12:15 PM ET) |

| Sky Central Announcement | | | | | | | | |

| 1 | HUNTINGTON BANCSHARES AND SKY FINANCIAL GROUP ANNOUNCE $3.6 BILLION |

| 2 | MERGER AGREEMENT |

| 3 | |

| 4 | On December 20, Sky Financial announced that it will be merging with Huntington |

| 5 | Bancshares in a stock (90%) and cash transaction (10%) valued at approximately $3.6 billion. |

| 6 | |

| 7 | This is an exciting development for Sky and one that is expected to generate many questions |

| 8 | from employees and clients. Sky employees have been sent an email from Marty Adams that |

| 9 | provides some information about the rationale behind the transaction and what to expect going |

| 10 | forward. Marty will also be hosting an “All Employee Call” on Thursday, December 21 at 4:30 PM |

| 11 | ET for Sky employees to give some more perspective about the merger. A Sky Communicator e- |

| 12 | mail will be distributed Thursday before noon that will have the call information. |

| 13 | |

| 14 | Additionally, an employee FAQ is available atINSERT URLand a client FAQ is available at |

| 15 | INSERT URL. These documents will be updated periodically as Sky’s and Huntington’s |

| 16 | integration teams work through the merger process, so be sure to check back for new |

| 17 | information. Our clients should not expect any changes straight away, as the merger is expected |

| 18 | to close in the third quarter of 2007. Both Sky and Huntington are committed to a seamless |

| 19 | transition for our clients and will initiate an extensive communication outreach program to ensure |

| 20 | that all clients are informed prior to any changes resulting from the merger. |

| 21 | |

| 22 | To read the complete press release Sky and Huntington issued today, please clickHERE. |

| 23 | |

| 24 | |

| 25 | 12/20/06 |

| 26 | |

| 27 | |

| |

| Forward-looking Statement |

This filing contains certain forward-looking statements, including certain plans, expectations, goals, and projections, and including statements about the benefits of the merger between Huntington Bancshares Incorporated (“Huntington”) and Sky Financial Group, Inc. (“Sky Financial”), which are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements for a variety of factors including: the businesses of Huntington and Sky Financial may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the merger may not be fully realized within the expected timeframes; disruption from the merger may make it more difficult to maintain relationships with clients, associates, or suppliers; the required governmental a pprovals of the merger may not be obtained on the proposed terms and schedule; Huntington and/or Sky Financial’s stockholders may not approve the merger; changes in economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of other business strategies; the nature, extent, and timing of governmental actions and reforms; and extended disruption of vital infrastructure; and other factors described in Huntington’s 2005 Annual Report on Form 10-K/A, Sky Financial’s 2005 Annual Report on Form 10-K, and documents subsequently filed by Huntington and Sky Financial with the Securities and Exchange Commission. All forward-looking statements included in this filing are based on information available at the time of the filing. Neither Huntington nor Sky Financial assumes any obligation to update any forward-looking statement.

Additional Information About the Merger and Where to Find It

Huntington and Sky Financial will be filing relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S-4 which will include a proxy statement/prospectus. Stockholders will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about Huntington and Sky Financial, at the Securities and Exchange Commission’s internet site (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the Securities and Exchange Commission that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington, Huntington Center, 41 South High Street, Columbus, Ohio 43287, Attention: Investor Relations, 614-480-4060, or Sky Financial, 221 South Church Street, Bowling Green, Ohio, 43402. The fina l proxy statement/prospectus will be mailed to stockholders of Huntington and Sky Financial.

Stockholders are urged to read the proxy statement/prospectus, and other relevant documents filed with the Securities and Exchange Commission regarding the proposed transaction when they become available, because they will contain important information.

The directors and executive officers of Huntington and Sky Financial and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding Huntington’s directors and executive officers is available in its proxy statement filed with the SEC by Huntington on March 8, 2006. Information regarding Sky Financial’s directors and executive officers is available in its proxy statement filed with the SEC by Sky Financial on February 23, 2006. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.