Exhibit 99.1

Key Drivers of Future Revenue Growth Annual Financial Institution Investors Conference

Ryan Beck & Co

October 27, 2004

Forward Looking Statement

This presentation contains forward-looking statements relating to the financial condition, results of operations and business of Sky Financial Group, Inc. Actual results could differ materially from those indicated. Among the important factors that could cause actual results to differ materially are interest rates, the success of the integration of acquisitions, changes in the mix of the company’s business, competitive pressures, general economic conditions and the risk factors detailed in the Company’s periodic reports and registration statements filed with the Securities and Exchange Commission. Sky Financial Group undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

This presentation contains financial information adjusted to exclude the results of certain significant transactions or events not representative of ongoing operations (“non-operating items”). A reconciliation of these non-GAAP disclosures will be filed in a form 8-K.

2

Sky Profile

$14.6 billion in total assets

Eight regions consolidated under Sky name

286 financial centers serving communities in Ohio, Michigan, Pennsylvania, Indiana and West Virginia

Headquarters located in Bowling Green, Ohio

40th largest publicly-owned holding company in U.S.

$2.7 billion market cap

www.skyfi.com

3

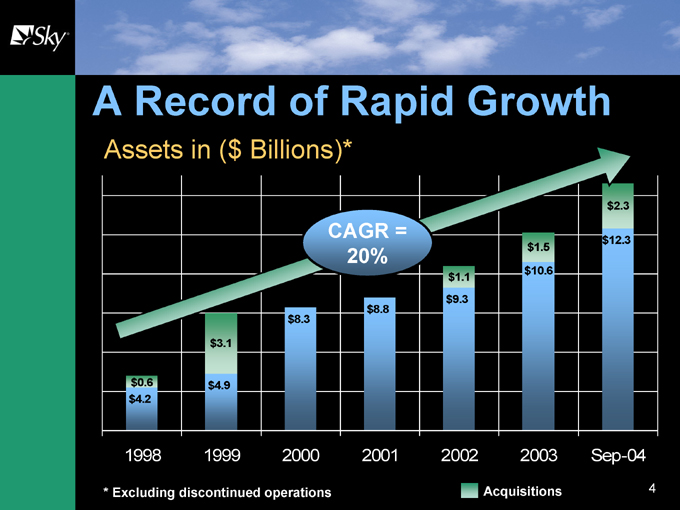

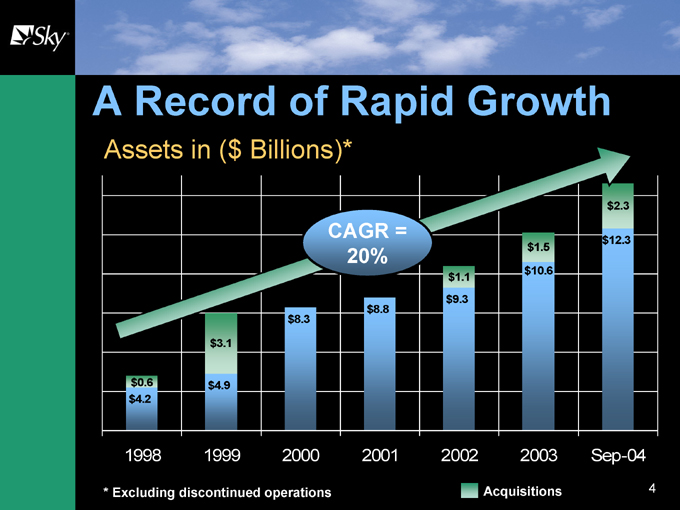

A Record of Rapid Growth

Assets in ($ Billions)*

CAGR = 20%

$4.2 $0.6

$4.9 $3.1

$8.3

$8.8

$9.3 $1.1

$12.3 $2.3

$10.6 $1.5

1998 1999 2000 2001 2002 2003 Sep-04

Acquisitions

* Excluding discontinued operations

4

Sky Performance Goals

Operating EPS growth of 10-12%

Committed to perform among the top 25% of the 100 largest banks in the U.S. in terms of:

ROE

ROA

Efficiency ratio

Sound asset quality

5

Sky Priorities

One Company ~ One Culture

Organic growth

Growth of fee-based businesses

Organizational synergies

Sound asset quality

Acquisitions

6

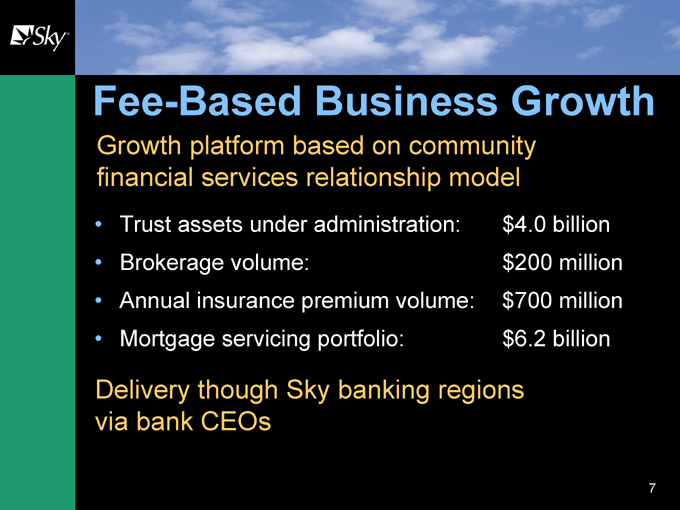

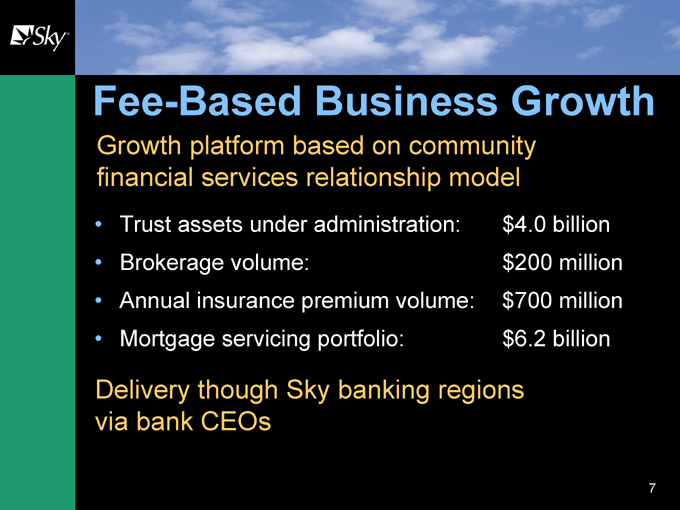

Fee-Based Business Growth

Trust assets under administration: $4.0 billion

Brokerage volume: $200 million

Annual insurance premium volume: $700 million

Mortgage servicing portfolio: $6.2 billion

Growth platform based on community financial services relationship model

Delivery though Sky banking regions

via bank CEOs

7

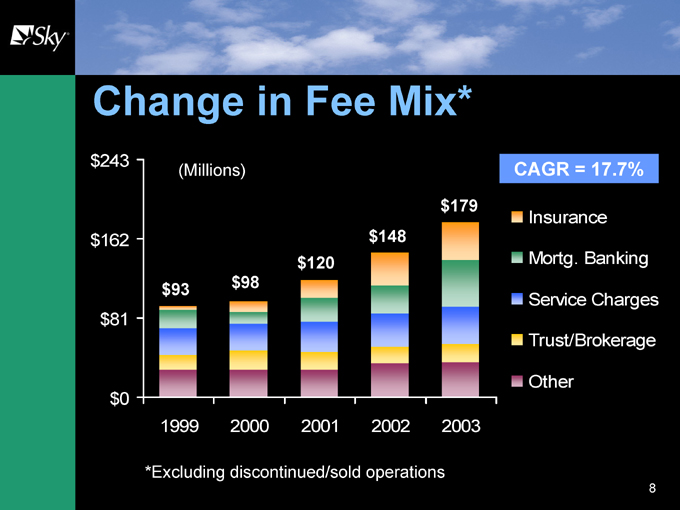

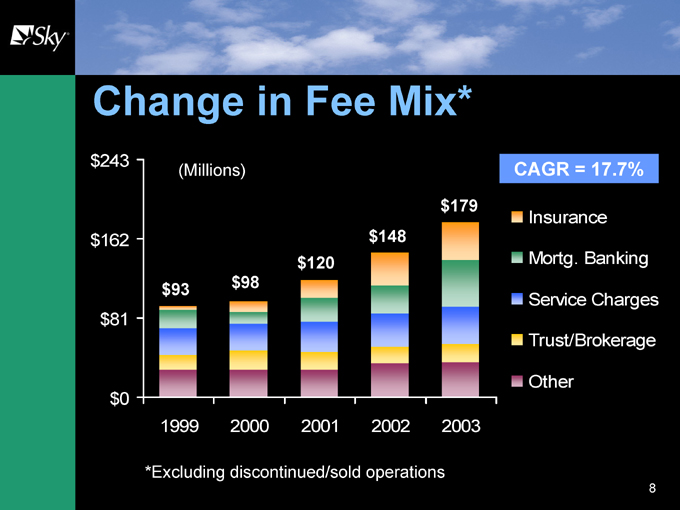

Change in Fee Mix*

(Millions)

CAGR = 17.7%

$93 $120 $148 $179 $98

$0 $81 $162 $243

1999 2000 2001 2002 2003

Insurance

Mortg. Banking

Service Charges

Trust/Brokerage

Other

*Excluding discontinued/sold operations

8

Sky Insurance – Profile

One of the top 50 insurance agencies in the United States

Represent over $700 million in annualized premiums

350+ employees

19 office locations in Sky’s footprint

Client base of 10,000 and growing

Over $50 million in revenue

9

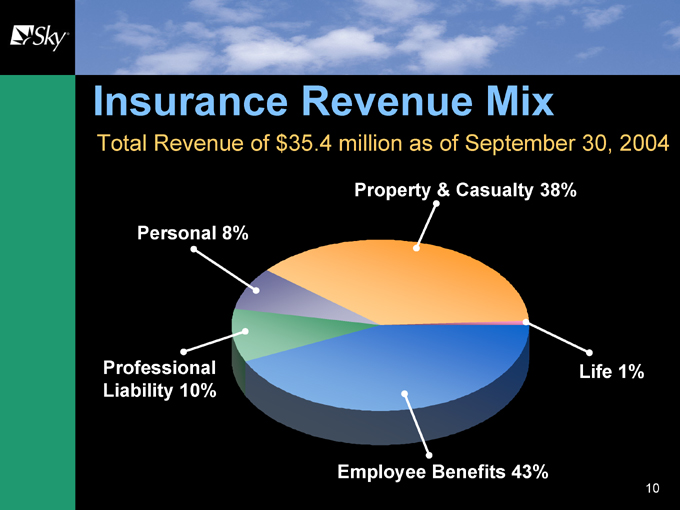

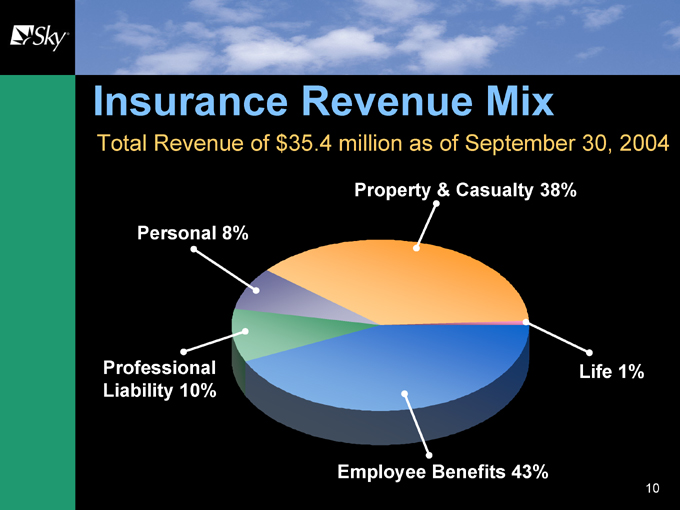

Insurance Revenue Mix

Total Revenue of $35.4 million as of September 30, 2004

Life 1%

Property & Casualty 38%

Professional Liability 10%

Employee Benefits 43%

Personal 8%

10

Sky Insurance – Growth Strategies

Aggressive acquisition strategy to consolidate multiple agencies under Sky Brand

Agency integration process to strengthen selling potential and operational efficiencies

Ability to cross-sell insurance products through bank delivery channel

Market clout – provides for better pricing to clients

Talented team with strong knowledge base

Additional specialized talent added through acquisitions

Represent the industry’s best A-rated insurance companies

11

Sky Insurance – Growth

Acquisitions

Picton Cavanaugh – May 1999

Meyer & Eckenrode – July 2000

Celaris Group – January 2002

Value Added Benefits – April 2002

Insurance Buyers Service Agency – July 2003

Spencer Patterson Insurance – January 2004

EOB, Inc. – April 2004

Stouffer-Herzog – July 2004

12

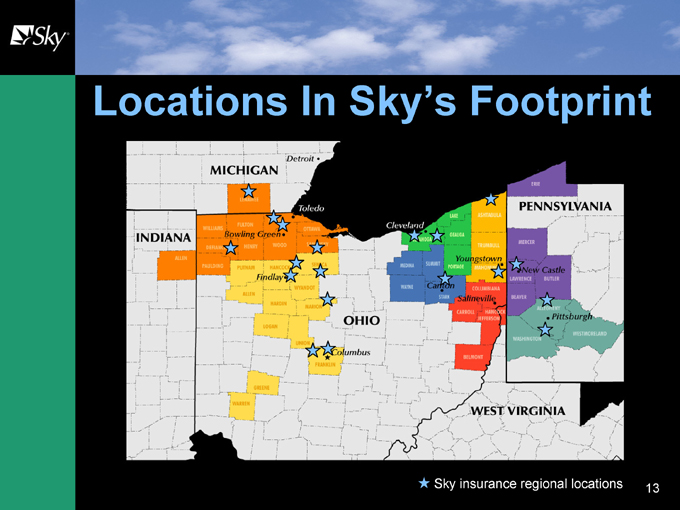

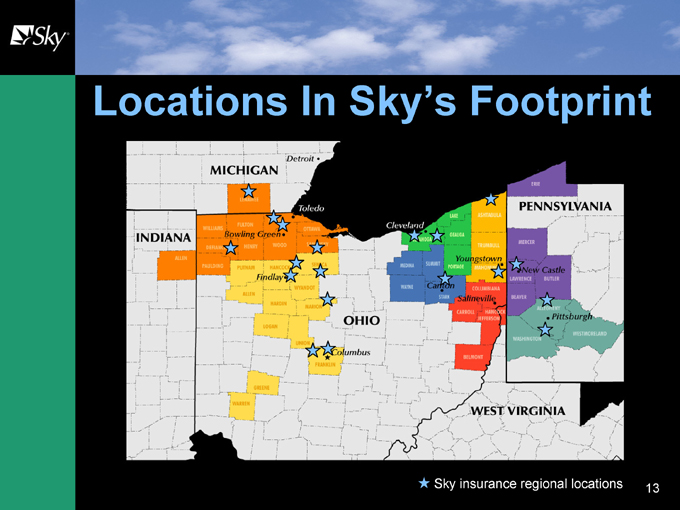

Locations In Sky’s Footprint

Sky insurance regional locations

13

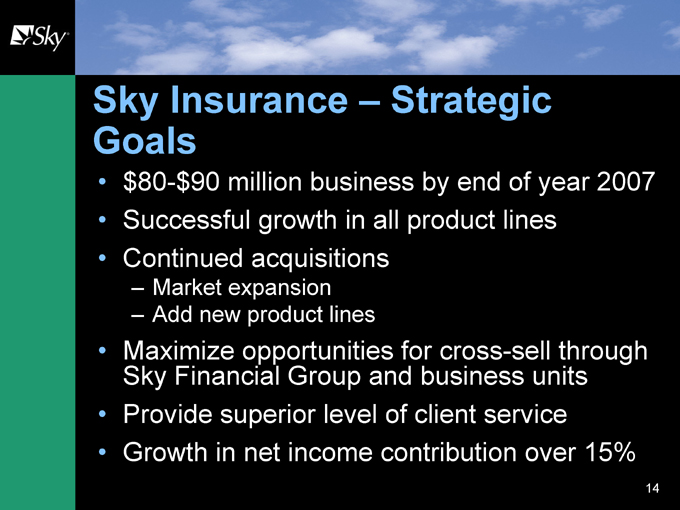

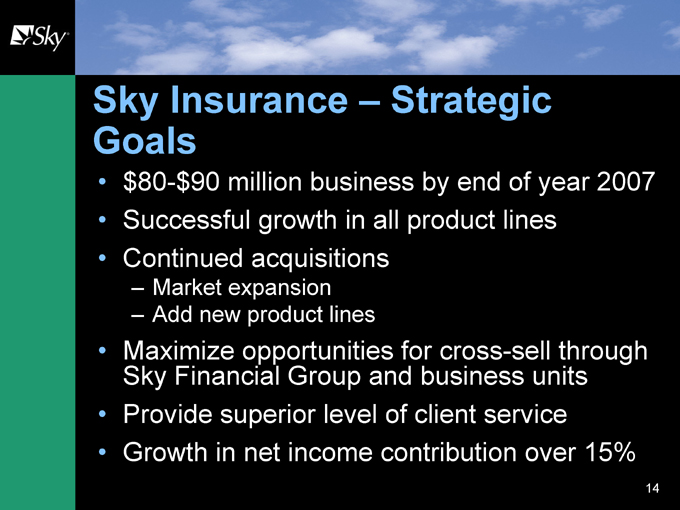

Sky Insurance – Strategic Goals

$80-$90 million business by end of year 2007

Successful growth in all product lines

Continued acquisitions

Market expansion

Add new product lines

Maximize opportunities for cross-sell through Sky Financial Group and business units

Provide superior level of client service

Growth in net income contribution over 15%

14

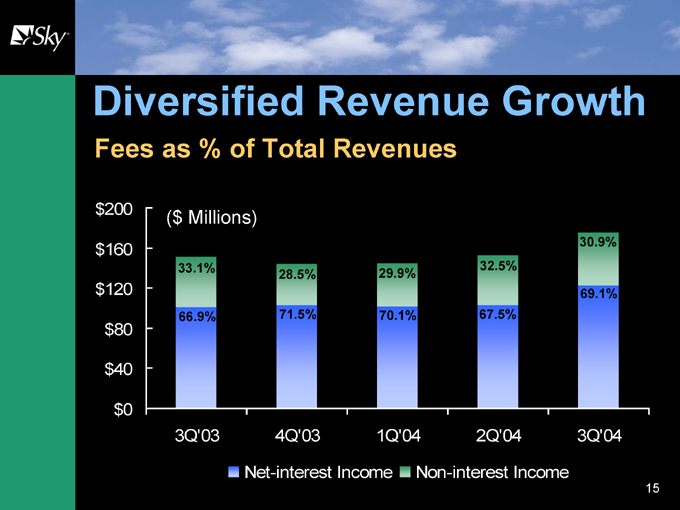

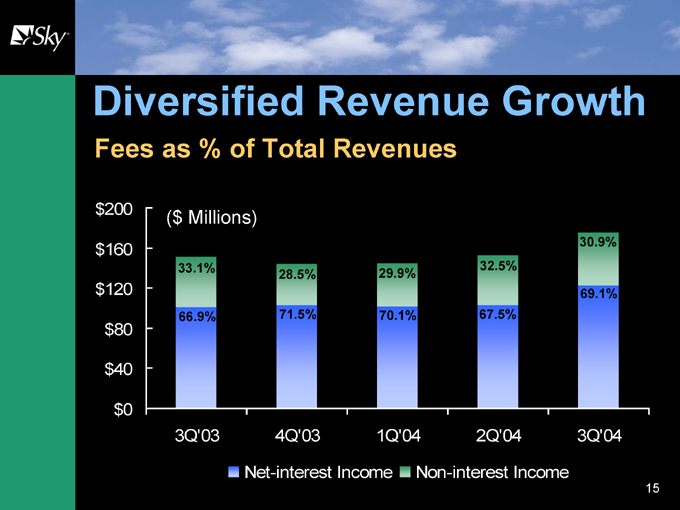

Diversified Revenue Growth

Fees as % of Total Revenues

($ Millions)

33.1% 66.9%

28.5% 71.5%

29.9% 70.1%

32.5% 67.5%

30.9% 69.1%

$0 $40 $80 $120 $160 $200 3Q’03 4Q’03 1Q’04 2Q’04 3Q’04

Net-interest Income

Non-interest Income

15

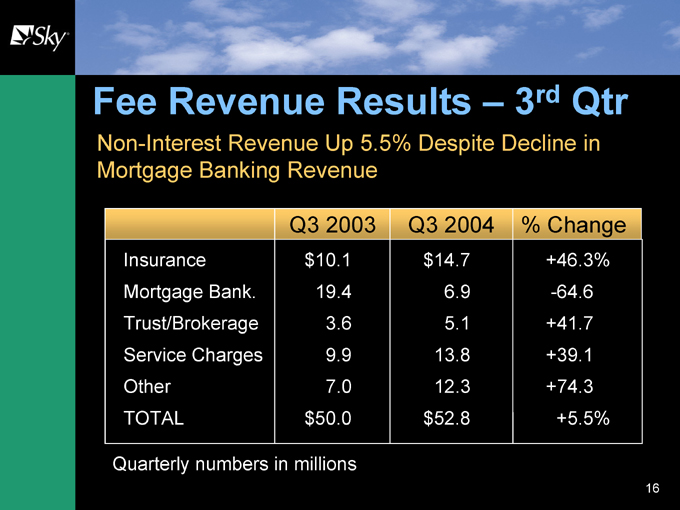

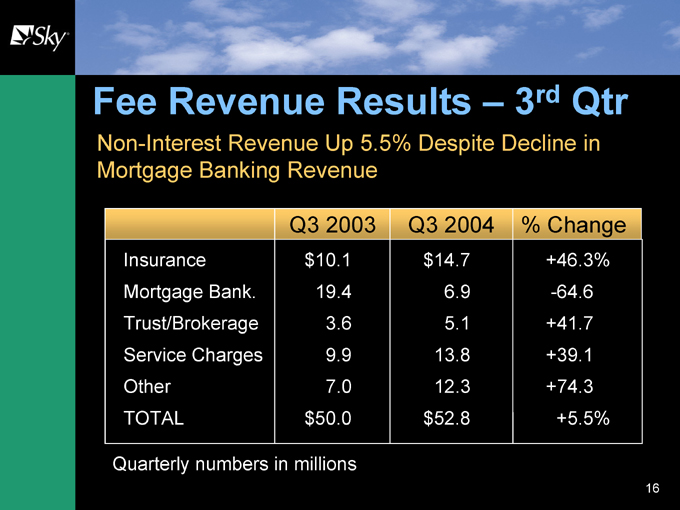

Fee Revenue Results – 3rd Qtr

Non-Interest Revenue Up 5.5% Despite Decline in Mortgage Banking Revenue

Q3 2003 Q3 2004 % Change

Insurance $10.1 $14.7 +46.3%

Mortgage Bank. 19.4 6.9 -64.6

Trust/Brokerage 3.6 5.1 +41.7

Service Charges 9.9 13.8 +39.1

Other 7.0 12.3 +74.3

TOTAL $50.0 $52.8 +5.5%

Quarterly numbers in millions

16

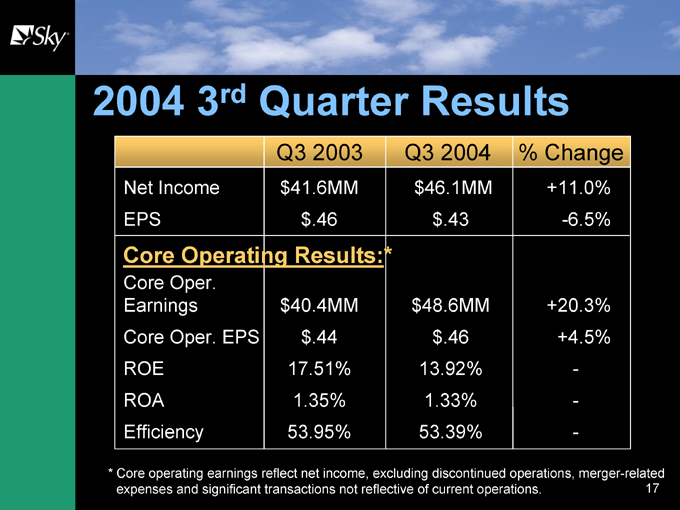

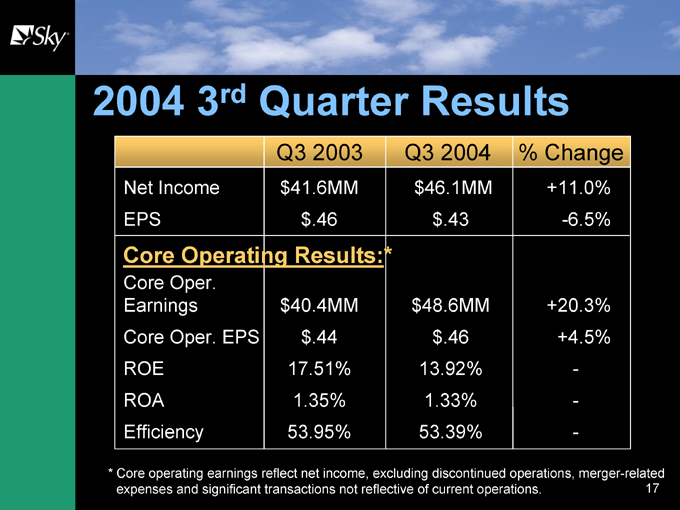

2004 3rd Quarter Results

Q3 2003 Q3 2004 % Change

Net Income $41.6MM $46.1MM +11.0%

EPS $.46 $.43 -6.5%

Core Operating Results:*

Core Oper. Earnings $40.4MM $48.6MM +20.3%

Core Oper. EPS $.44 $.46 +4.5%

ROE 17.51% 13.92% -

ROA 1.35% 1.33% -

Efficiency 53.95% 53.39% -

* Core operating earnings reflect net income, excluding discontinued operations, merger-related expenses and significant transactions not reflective of current operations.

17

SKYF: An Attractive Investment Opportunity*

P/E 2004 2005

SKYF 14.6x 13.0x

100 Largest Banks 16.2x 14.6x

Banks $10-20 billion 16.4x 14.6x

Price/Book: 193%

Dividend yield: 3.2%

* Based on closing stock prices as of 10/18/04

18

Why Buy Sky

Solid operating performance

Balance sheet strength

Aggressive performance goals

Strong growth profile

19

Under One Sky

www.skyfi.com