Exhibit 99.1

Exhibit 99.1

March 1, 2005

Midwest Super-Community Bank Conference

Forward Looking Statement

This presentation contains forward-looking statements relating to the financial condition, results of operations and business of Sky Financial Group, Inc. Actual results could differ materially from those indicated. Among the important factors that could cause actual results to differ materially are interest rates, the success of the integration of acquisitions, changes in the mix of the company’s business, competitive pressures, general economic conditions and the risk factors detailed in the Company’s periodic reports and registration statements filed with the Securities and Exchange Commission. Sky Financial Group undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

This presentation contains financial information adjusted to exclude the results of certain significant transactions or events not representative of ongoing operations (“non-operating items”).

A reconciliation of these non-GAAP disclosures will be filed in a form 8-K. 2

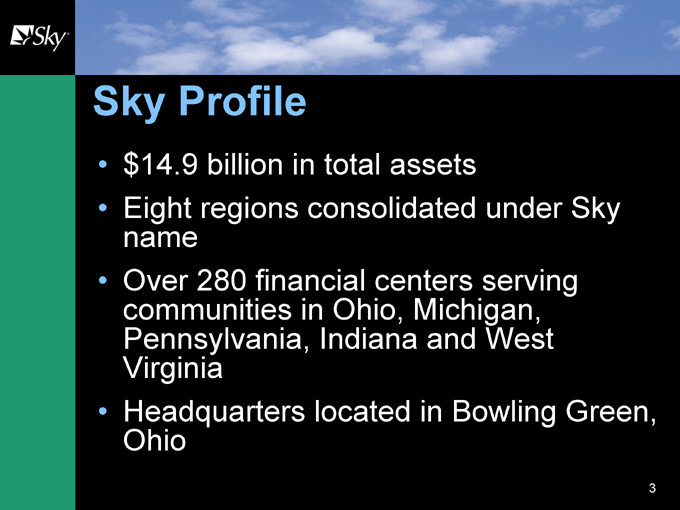

Sky Profile

$14.9 billion in total assets

Eight regions consolidated under Sky name

Over 280 financial centers serving communities in Ohio, Michigan, Pennsylvania, Indiana and West Virginia

Headquarters located in Bowling Green, Ohio

3

Sky Profile

38th largest publicly-owned holding company in U.S.

$2.9 billion market cap

Completed acquisition of Prospect Bancshares – December 2004

Pending Acquisition of Belmont Bancorp – Second Quarter 2005

4

Sky Profile - History

Built from Merger of Equals in 1998

Organic growth through sales and service process

Acquisition growth

– Ten bank acquisitions

– Nine insurance brokerage businesses

Divestiture of non-core businesses

Current focus on metro markets in footprint (Cleveland, Pittsburgh and Columbus)

5

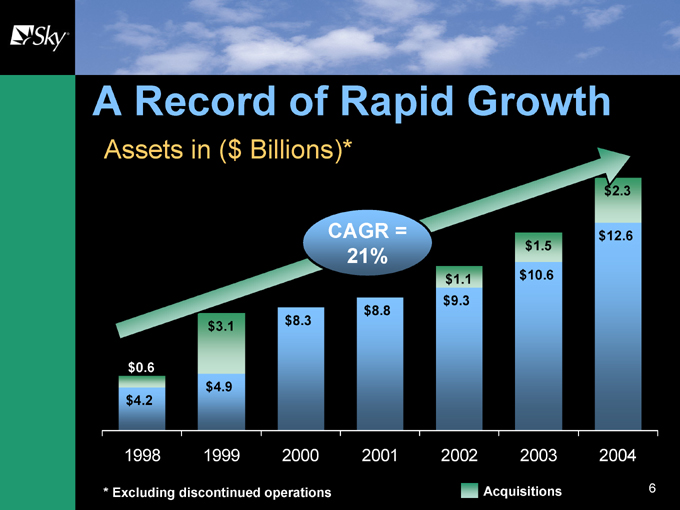

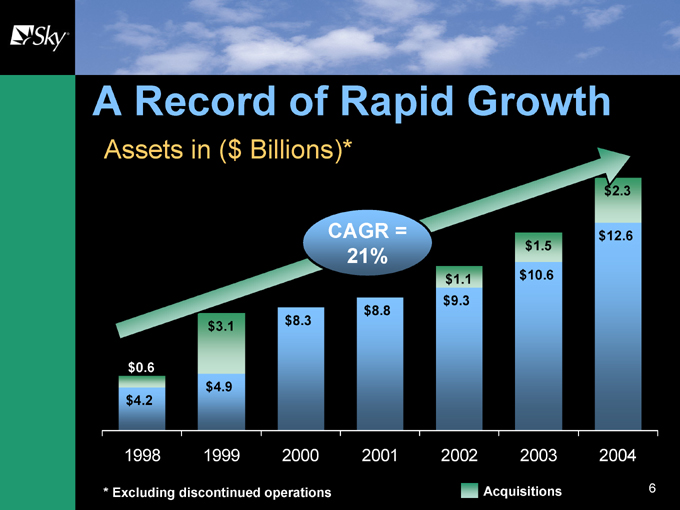

A Record of Rapid Growth

Assets in ($ Billions)*

CAGR = 21%

1998 1999 2000 2001 2002 2003 2004

$0.6 $4.2 $3.1 $4.9 $8.3 $8.8 $1.1 $9.3 $1.5 $10.6 $2.3 $12.6

* Excluding discontinued operations

Acquisitions

6

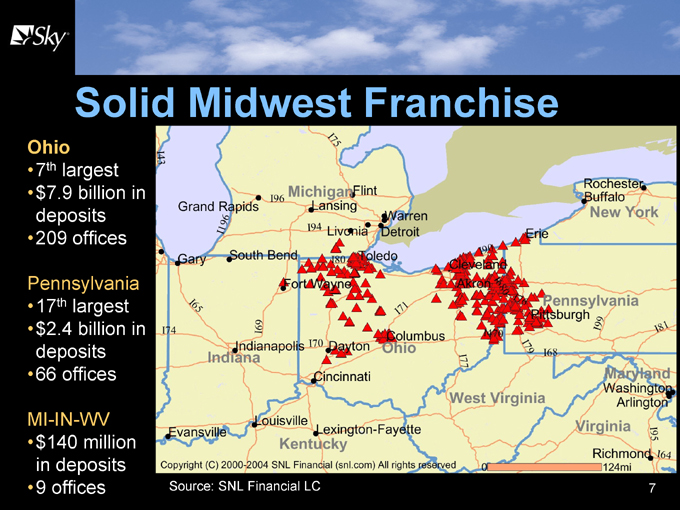

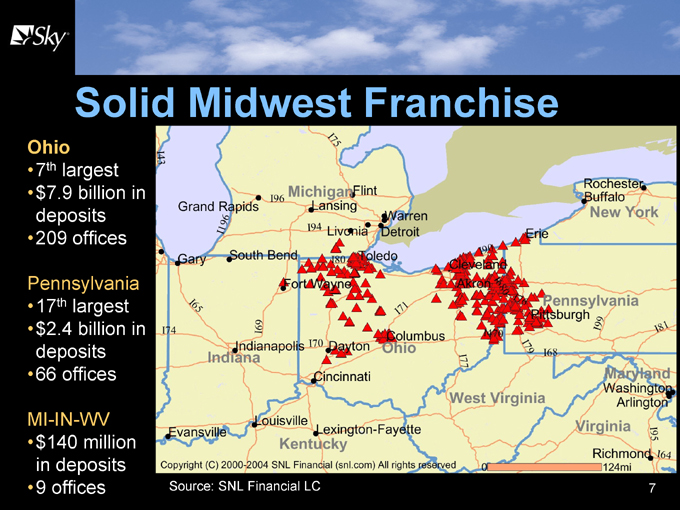

Solid Midwest Franchise

Ohio

7th largest

$7.9 billion in deposits

209 offices

Pennsylvania

17th largest

$2.4 billion in deposits

66 offices

MI-IN-WV

$140 million in deposits

9 offices

Grand Rapids Lansing Flint Rochester Buffalo Erie South Bend Fort Wavne Indianapolis Davton Columbus Cincinnati Evansville Louisville Lexington-Fayette West Virginia Pennsylvania Pittsburgh, Virginia Richmond

Copyright (C) 2000-2004 SNL Financial (snl.com) All rights reserved

Source: SNL Financial LC

0 124mi

7

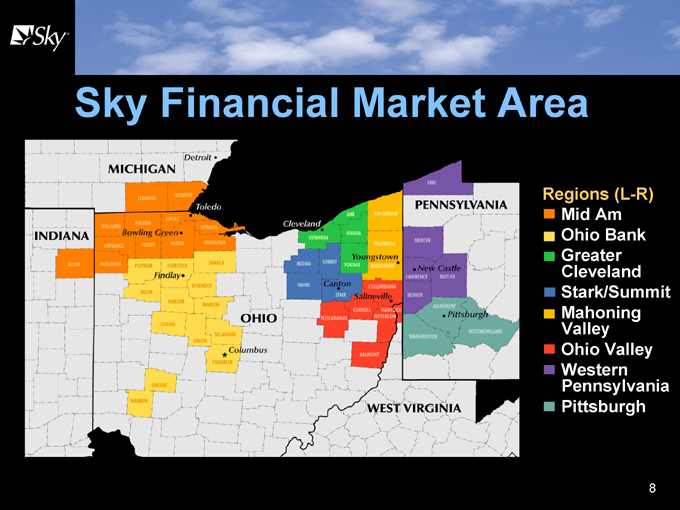

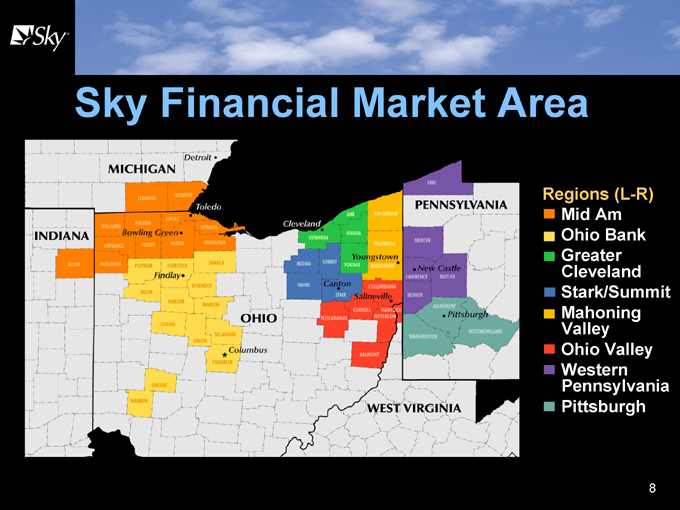

Sky Financial Market Area

MICHIGAN INDIANA OHIO PENNSYLVANIA WEST VIRGINIA Detroit Toledo Findlay Columbus Youngstown MERCER LAWRENCE BEAVER BUTLER New Castle Pittsburgh Canton LAKE

Regions (L-R) Mid Am Ohio Bank Greater Cleveland Stark/Summit Mahoning Valley Ohio Valley Western Pennsylvania Pittsburgh

8

Market Share

Deposit Rankings

By County Counties Deposits % of Sky Ranked #1 & #2 15 $5.4B 53% Ranked #3 & #4 9 $1.6B 16% Other #5 plus 24 $3.2B 31% By Metro Market Deposits % of Market Cleveland MSA $1.0B 1.6% Columbus MSA $0.5B 1.3% Pittsburgh MSA $1.7B 3.2%

Source: SNL Financial LC – 2004 Deposit Market Share Data

9

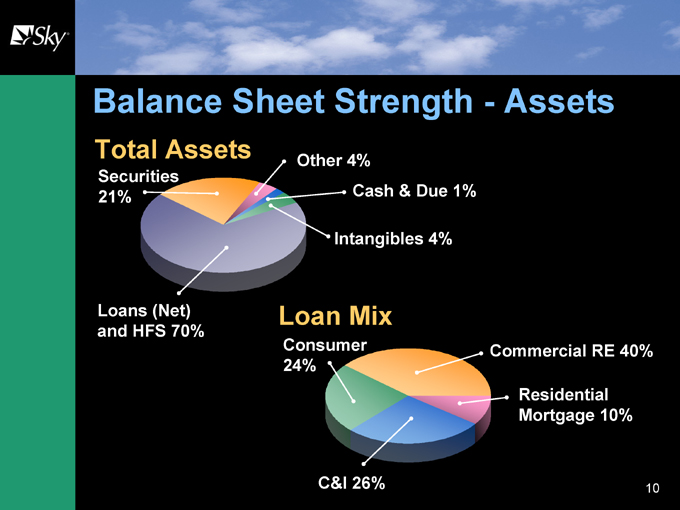

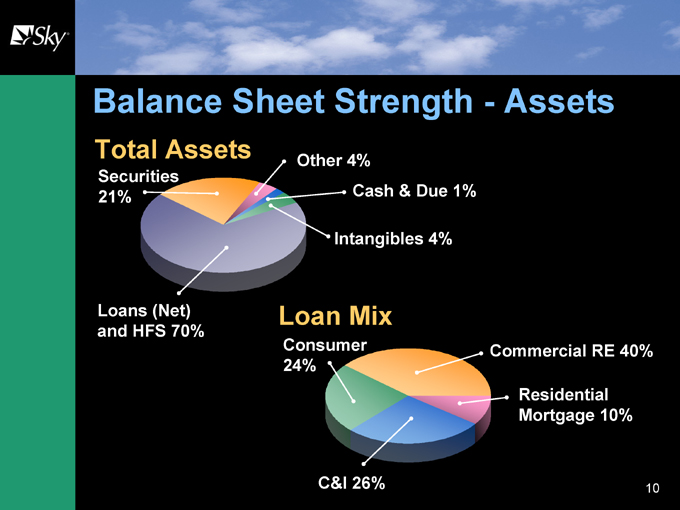

Balance Sheet Strength - Assets

Total Assets

Other 4% Securities

21% Cash & Due 1% Intangibles 4%

Loans (Net) Loan Mix and HFS 70%

Consumer Commercial RE 40% 24% Residential Mortgage 10%

C&I 26% 10

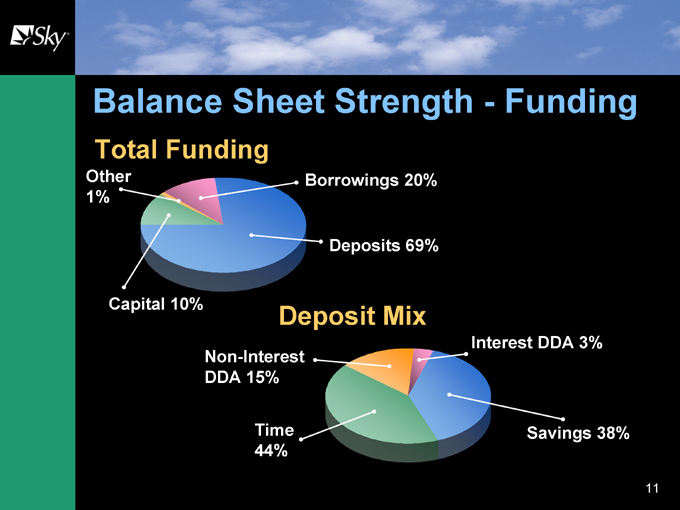

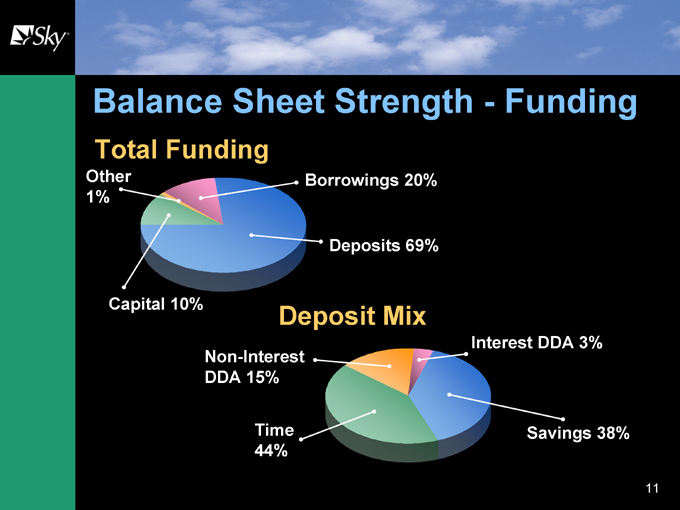

Balance Sheet Strength - Funding

Total Funding

Other Borrowings 20% 1%

Deposits 69%

Capital 10% Deposit Mix

Interest DDA 3% Non-Interest DDA 15%

Time Savings 38% 44%

11

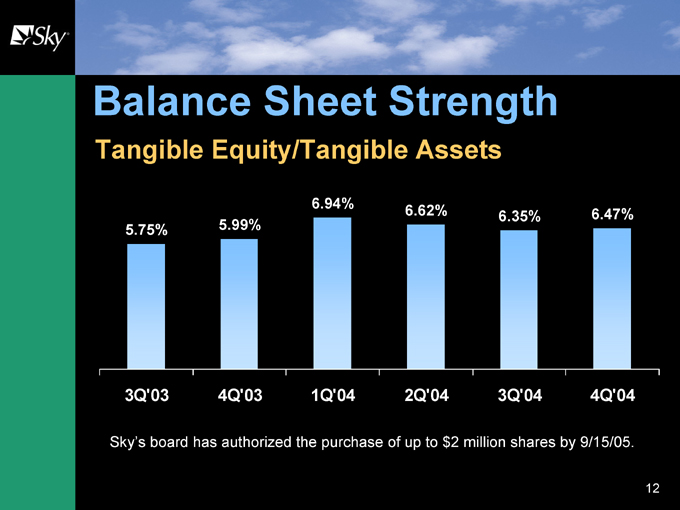

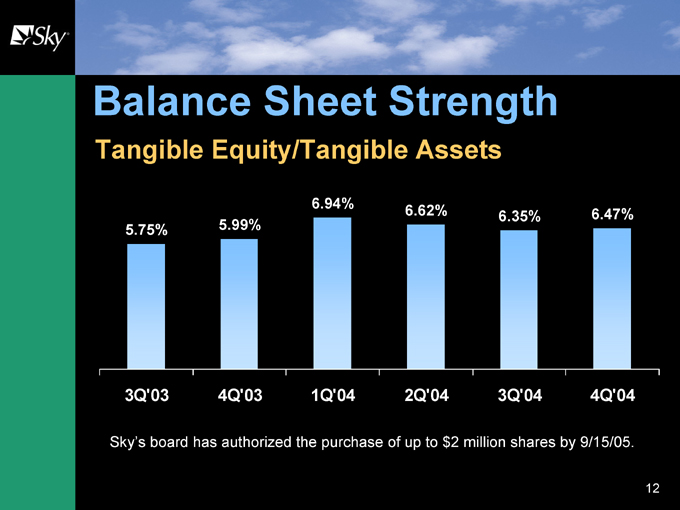

Balance Sheet Strength

Tangible Equity/Tangible Assets

6.94%

6.62% 6.35% 6.47% 5.75% 5.99%

3Q’03 4Q’03 1Q’04 2Q’04 3Q’04 4Q’04

Sky’s board has authorized the purchase of up to $2 million shares by 9/15/05.

12

A community-based, integrated financial services company Led by strong regional presidents who “own” the delivery channels Driven by aggressive sales and service process Characterized by high-quality operations/ technology and product/business line experts

13

Strategic Vision

Regional Accountabilities

Decentralized, local empowerment

Majority of lending decisions made at financial center or within region

Establish pricing for loans and deposits

Hiring and personnel management

Sky encourages local volunteerism and community leadership

Local boards provide community input

14

Central Support Capabilities

Risk Management

– Credit standards

– Large credit evaluation

– Interest rate risk and liquidity

– Legal and compliance department

Technology

– One core data platform –

Common network, data communications and technology support

Sales Support Operations

– Call center, deposit and loan operations,marketing, finance, human resources, etc.

15

Sky Priorities

One Company ~ One Culture

Organic growth

Growth of fee-based businesses Organizational synergies Sound asset quality Acquisitions

16

A Platform for Organic Growth

Our goal is to be the premier sales and service organization in our regions

A focus on:

Regional delivery structure

Sky Trek process

Incentive compensation

17

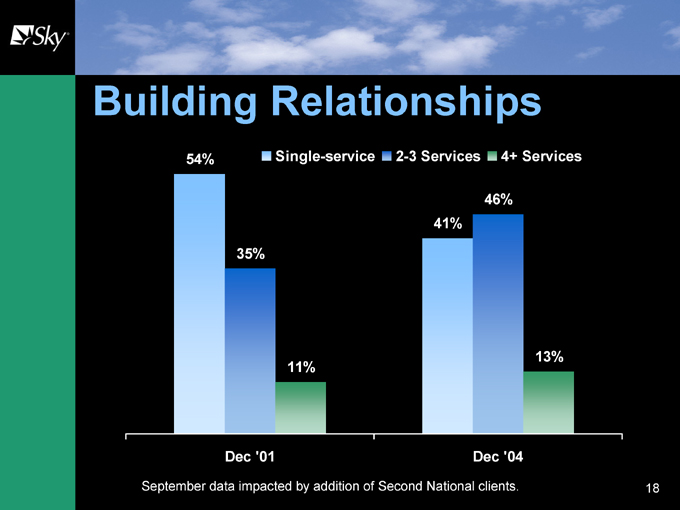

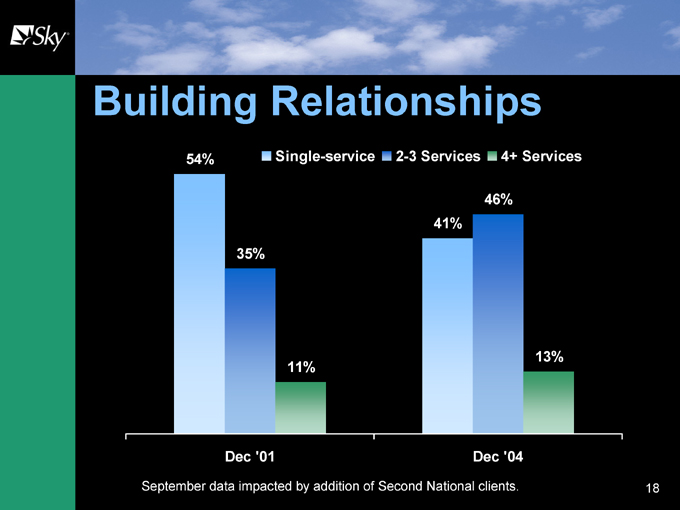

Building Relationships

54% Single-service 2-3 Services 4+ Services

46% 41%

35%

13% 11%

Dec ‘01 Dec ‘04

September data impacted by addition of Second National clients. 18

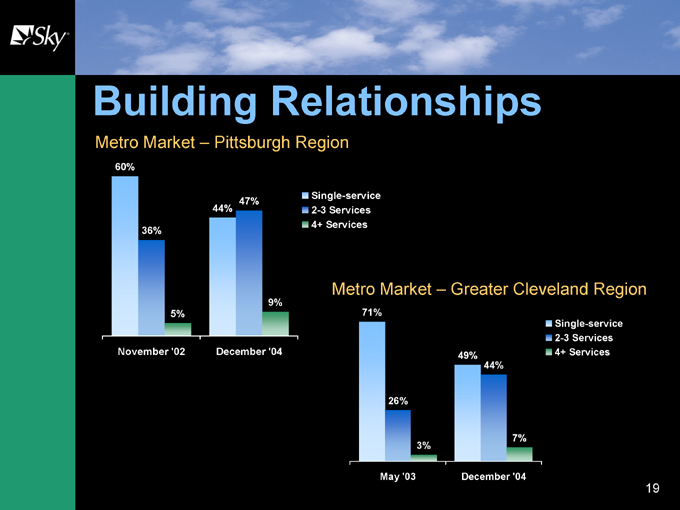

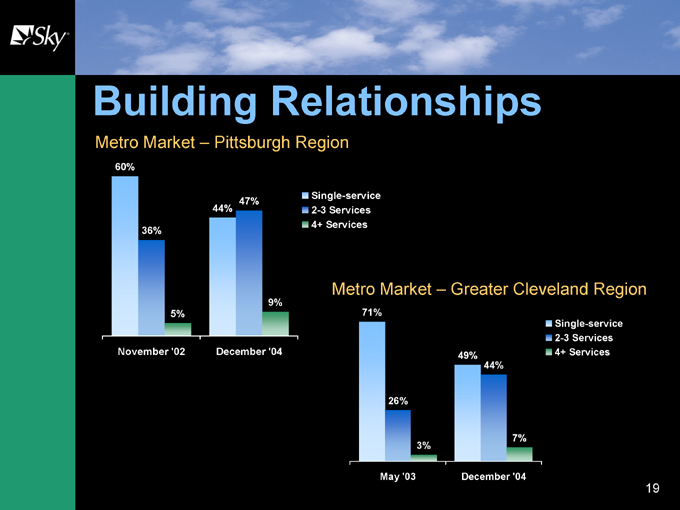

Building Relationships

Metro Market – Pittsburgh Region

60%

Single-service 47% 44% 2-3 Services 4+ Services 36%

Metro Market – Greater Cleveland Region

9%

5% 71%

Single-service 2-3 Services November ‘02 December ‘04 49% 4+ Services 44%

26%

7% 3%

May ‘03 December ‘04

19

Incentive Compensation Drives Performance

Every employee included in plan All have goals in four categories:

Profitability Growth Asset quality Client service

All receive monthly scorecards on performance Variable pay comprised 21% of total 2004 compensation

20

Fee-Based Business Growth

Trust, Investments, Insurance and Mortgages Growth platform based on community financial services relationship model Delivery through Sky banking regions via bank CEOs Significant organic growth via cross-sell opportunities to banking clients

21

Sky Trust/Investments $4.3 billion in trust assets under administration Centralized infrastructure supporting all regional relationship and sales teams 15-20% annualized revenue growth $200 million in investment brokerage volume

22

Sky Insurance $54 million in annual commissions

Aggressive acquisition strategy to consolidate multiple agencies under Sky brand Agency integration process to strengthen selling potential and operational efficiencies Ability to cross-sell insurance products through bank delivery channel

– 17% cross-sold to date in mature regions

Market clout – provides for better pricing to clients Represent the best A-rated insurance companies

23

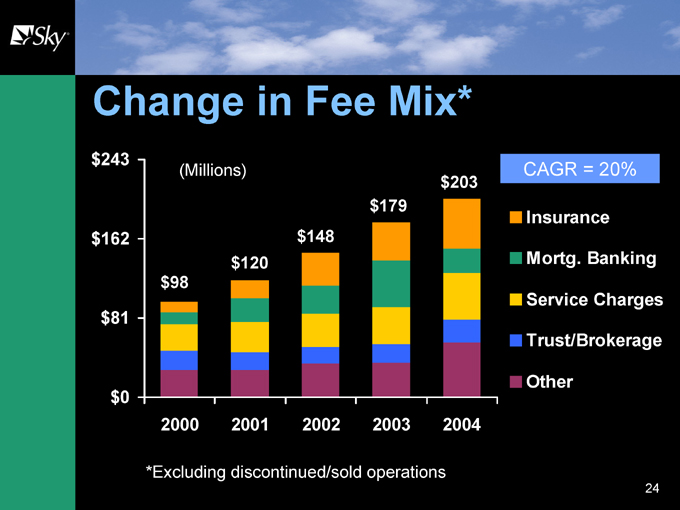

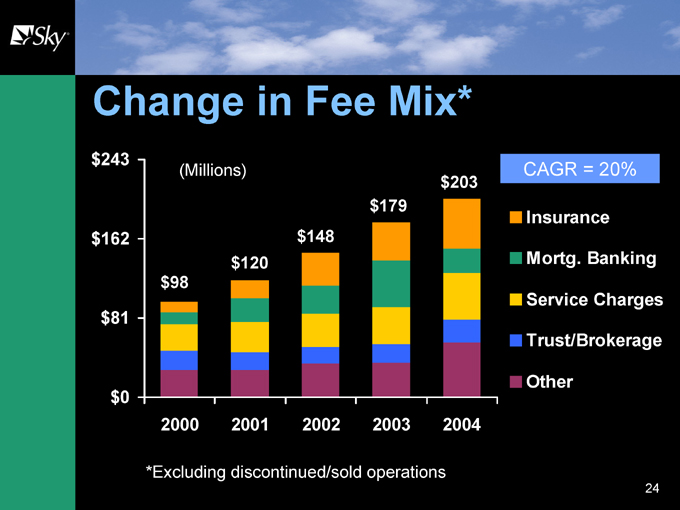

Change in Fee Mix* $243 $162 $81 $0

2000 2001 2002 2003 2004

(Millions) $98 $120 $148 $179 $203

CAGR = 20%

Insurance Mortg. Banking Service Charges Trust/Brokerage Other

*Excluding discontinued/sold operations

24

Organization Synergies

Scalable Common Processes

Investment in technology:

Merger-related system conversions completed within 30 days New browser-based client transaction system in place 2005 Plans: upgrade ATM, item processing and commercial online banking systems

Investment in people

– Sky Trek implementations completed within 60 days

Investment in process upgrades

– Improved small business lending model

– Consolidated insurance businesses under Sky name

Dedicated change-management team in place

25

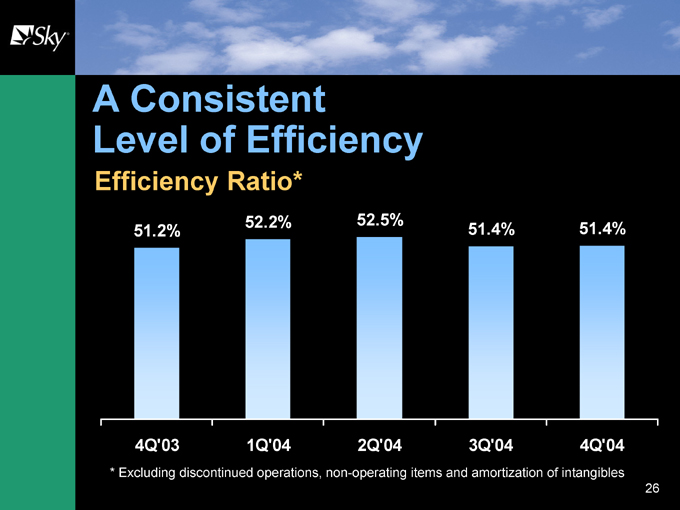

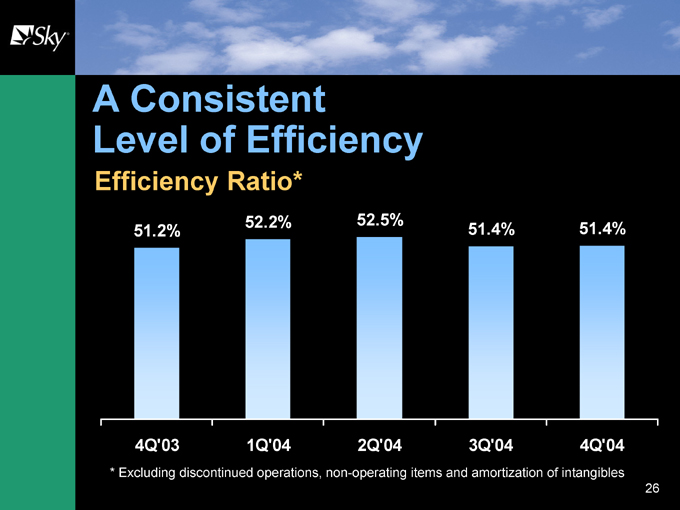

A Consistent Level of Efficiency

Efficiency Ratio*

52.2% 52.5%

51.2% 51.4% 51.4%

4Q’03 1Q’04 2Q’04 3Q’04 4Q’04

* Excluding discontinued operations, non-operating items and amortization of intangibles 26

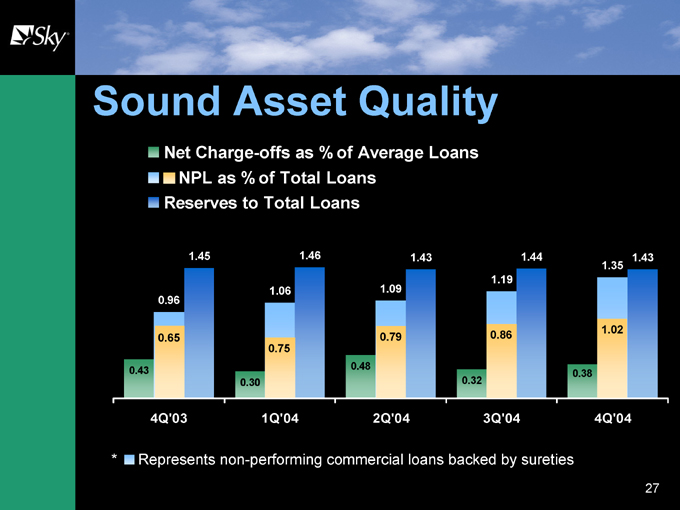

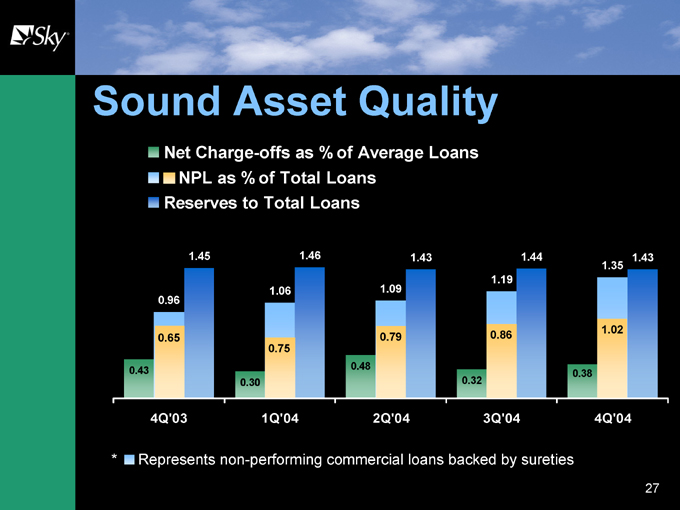

Sound Asset Quality

Net Charge-offs as % of Average Loans NPL as % of Total Loans Reserves to Total Loans

1.45 0.96 0.65

0.43

1.46

1.06

0.75

0.30

1.43

1.09

0.79

0.48

1.44 1.19

0.86

0.32

1.35 1.43

1.02

0.38

4Q’03 1Q’04 2Q’04 3Q’04 4Q’04

* Represents non-performing commercial loans backed by sureties

27

A Successful Acquisition Strategy

Bank expansion of geography into contiguous markets

Three Rivers – closed October 2002 Metropolitan Bancorp – closed May 2003 Great Lakes Bancorp – closed December 2003 Second National Bancorp – closed July 2004 Prospect Bancshares – closed December 2004 Belmont Bancorp – pending Second Quarter 2005

Enhancement of financial services product lines – primarily insurance brokerage businesses

Nine acquisitions since 1999

28

Acquisitions: A Core Competency

Experienced team to manage processes Conservative discipline

Accretive in year one – cost saves only Must meet financial expectations Proven integration tactics

All Sky acquisitions have met financial expectations

29

Sky Performance Goals

Operating EPS growth of 10-12%

Committed to perform among the top 25% of the 100 largest banks in the U.S. in terms of:

ROTE ROTA

Efficiency ratio Sound asset quality

30

Record Operating Earnings

Core Operating Earnings Per Share $1.72 $1.77 $1.65 $1.56 $1.39 $1.45 $1.13

1998 1999 2000 2001 2002 2003 2004

31

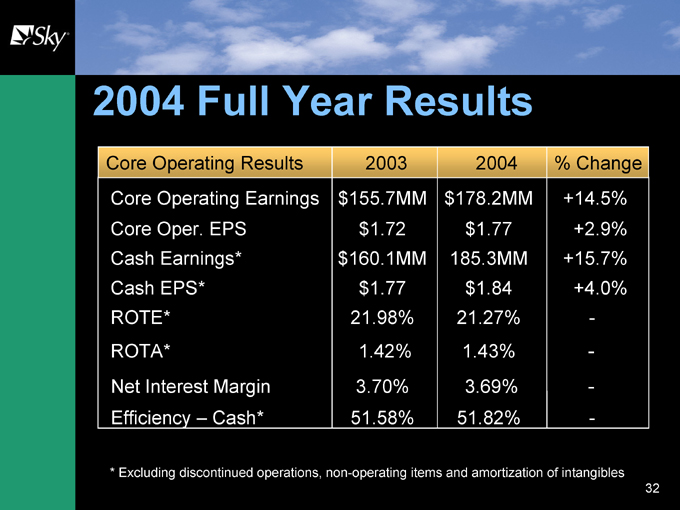

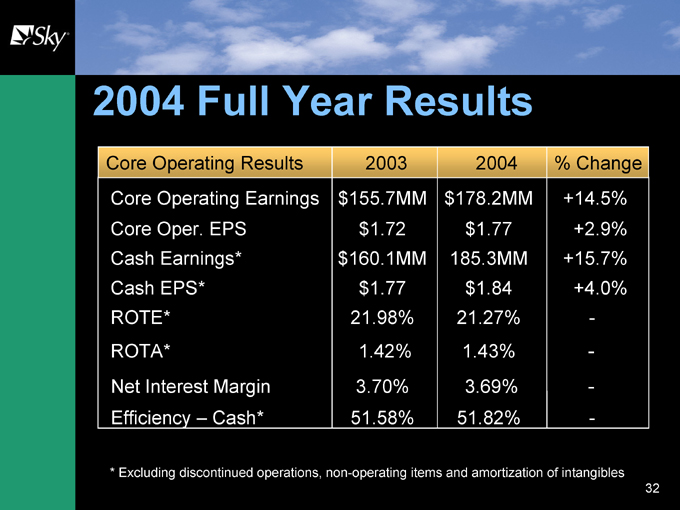

2004 Full Year Results

Core Operating Results 2003 2004 % Change Core Operating Earnings $155.7MM $178.2MM +14.5% Core Oper. EPS $1.72 $1.77 +2.9% Cash Earnings* $160.1MM 185.3MM +15.7% Cash EPS* $1.77 $1.84 +4.0% ROTE* 21.98% 21.27% -ROTA* 1.42% 1.43% -Net Interest Margin 3.70% 3.69% -Efficiency – Cash* 51.58% 51.82% -

* Excluding discontinued operations, non-operating items and amortization of intangibles 32

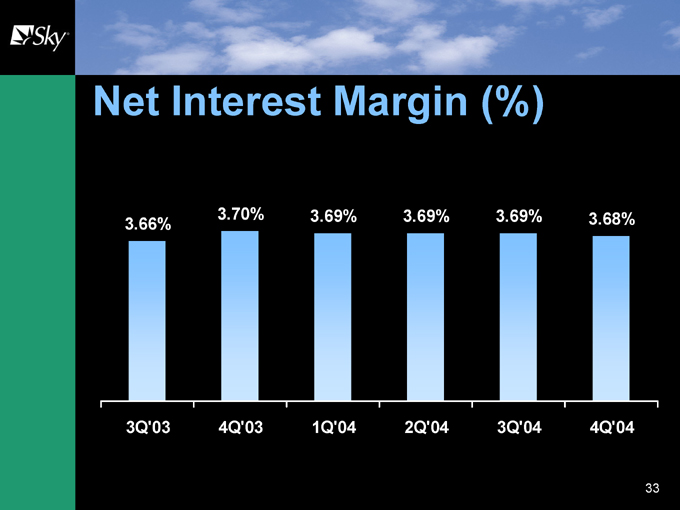

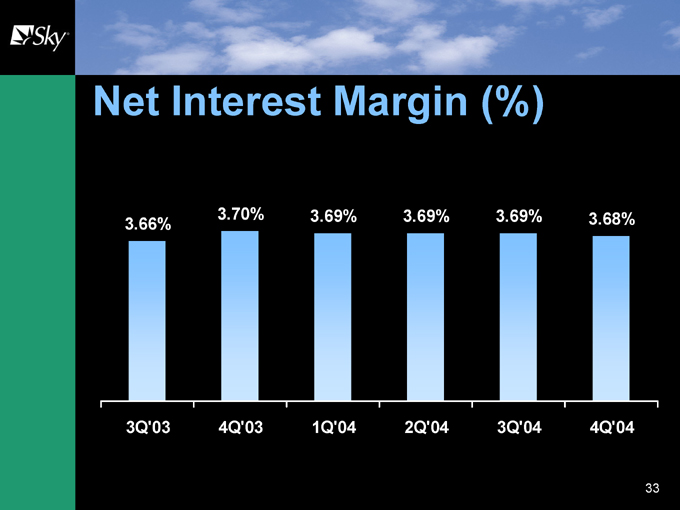

Net Interest Margin (%)

3.70% 3.69% 3.69% 3.69% 3.68% 3.66%

3Q’03 4Q’03 1Q’04 2Q’04 3Q’04 4Q’04

33

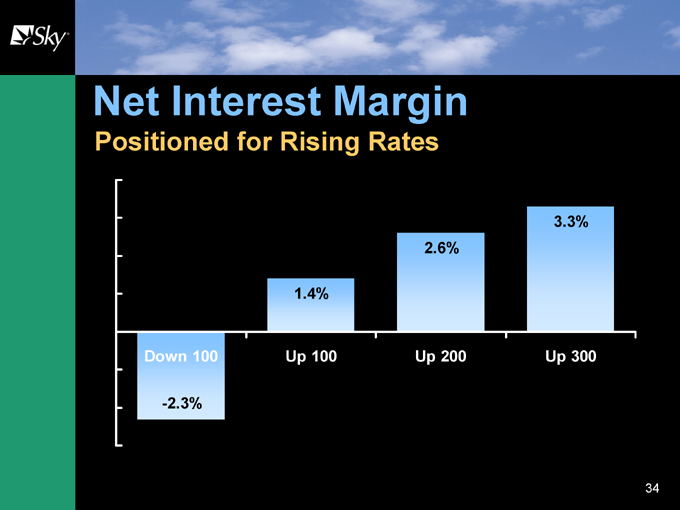

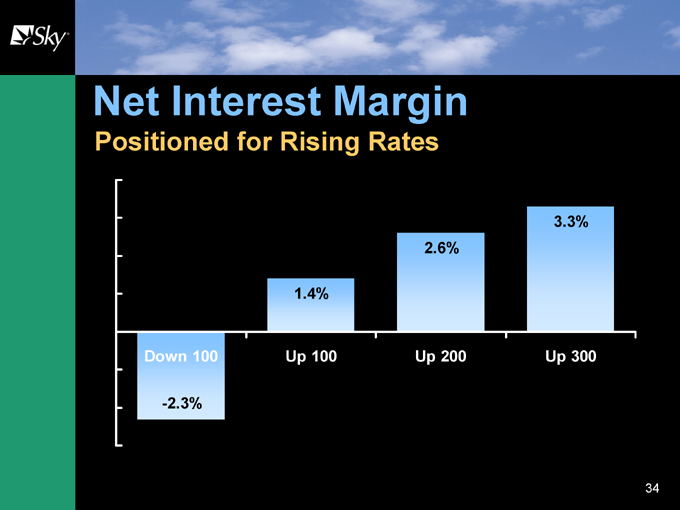

Net Interest Margin

Positioned for Rising Rates

1.4%

2.6%

3.3%

Down 100

-2.3%

Up 100

Up 200

Up 300

34

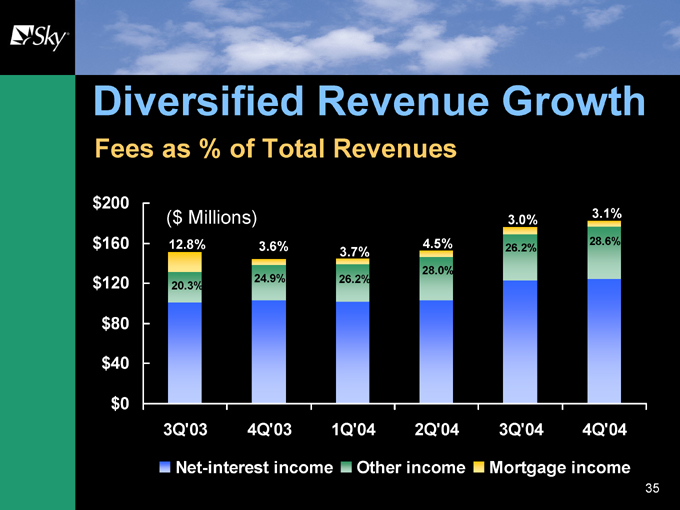

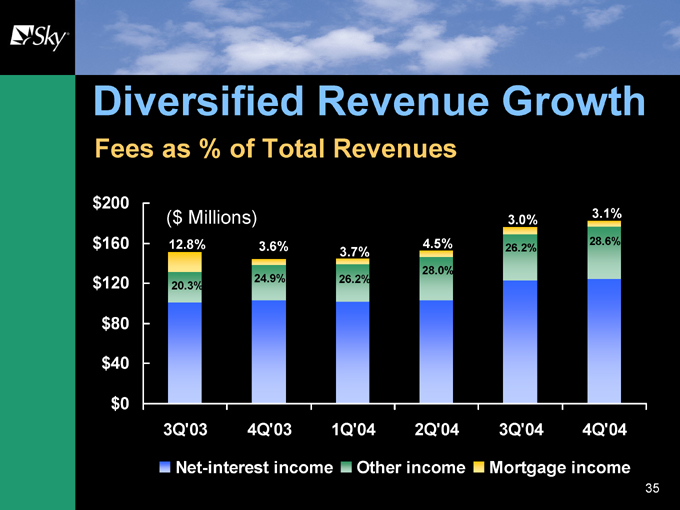

Diversified Revenue Growth

Fees as % of Total Revenues $200 $160 $120 $80 $40 $0

($ Millions)

12.8%

20.3%

3.6%

24.9%

3.7%

26.2%

4.5%

28.0%

3.0%

26.2%

3.1%

28.6%

3Q’03 4Q’03 1Q’04 2Q’04 3Q’04 4Q’04

Net-interest income Other income Mortgage income

35

Earnings Outlook

Future Performance Driven by:

– Solid core growth

– Exceptional DDA Growth

– Margin improvement from rising rates

– Accelerating fee businesses

– Net charge-offs being well controlled

– Disciplined expense control

36

SKYF: An Attractive Investment Opportunity*

100 Largest Banks

SKYF Median Top Quartile P/E 2005 15.0x 14.6x 16.0x P/E 2006 13.7x 13.3x 14.3x Price/Book 203% 221% 277% Price/Tangible Book 324% 324% 386% Dividend Yield 3.14% 2.66% 3.29%

*Book information based on the 12/31/04 financial report. Stock prices as of 2/18/05. 37

Why Buy Sky

Solid operating performance Balance sheet strength Aggressive performance goals Strong growth profile

38

Non-GAAP Financial Measures

In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. Sky believes that providing certain non-GAAP financial measures provides investors with information useful in understanding Sky’s financial performance, its performance trends and financial position. Specifically, Sky provides measures based on “core operating earnings,” which excludes discontinued operations and merger, integration and restructuring expenses, that are not reflective of on-going operations or not expected to recur. In addition, Sky provides measures based on “cash operating earnings,” which further adjusts core operating earnings to exclude the effect of amortization of intangibles. These non-GAAP measures should not be considered a substitute for GAAP basis measures and results. A reconciliation of these non-GAAP measures to the most comparable GAAP equivalent can be found in the financial tables attached to our most recent earnings release available on our website www.skyfi.com.

39

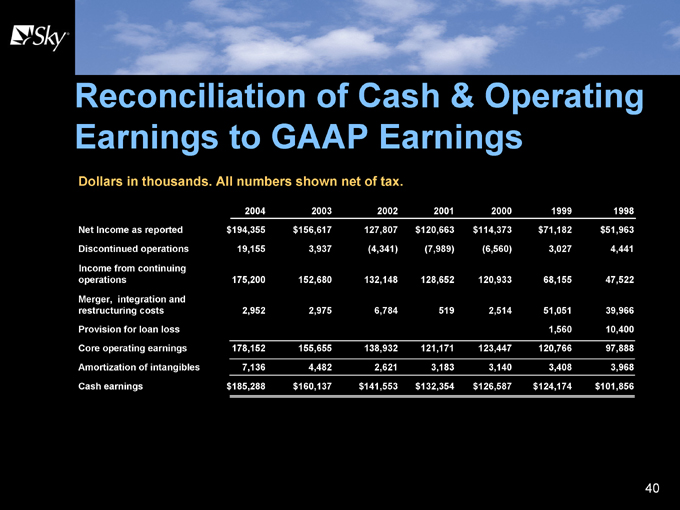

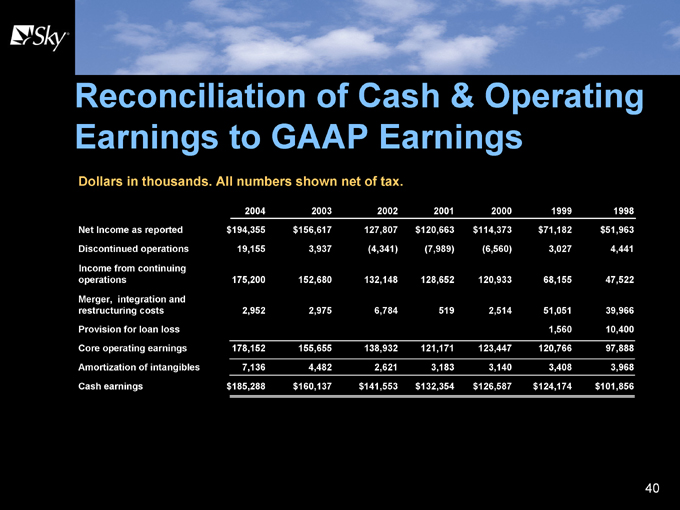

Reconciliation of Cash & Operating Earnings to GAAP Earnings

Dollars in thousands. All numbers shown net of tax.

2004 2003 2002 2001 2000 1999 1998 Net Income as reported $194,355 $156,617 127,807 $120,663 $114,373 $71,182 $51,963 Discontinued operations 19,155 3,937 (4,341) (7,989) (6,560) 3,027 4,441

Income from continuing operations 175,200 152,680 132,148 128,652 120,933 68,155 47,522

Merger, integration and restructuring costs 2,952 2,975 6,784 519 2,514 51,051 39,966 Provision for loan loss 1,560 10,400 Core operating earnings 178,152 155,655 138,932 121,171 123,447 120,766 97,888 Amortization of intangibles 7,136 4,482 2,621 3,183 3,140 3,408 3,968 Cash earnings $185,288 $160,137 $141,553 $132,354 $126,587 $124,174 $101,856

40

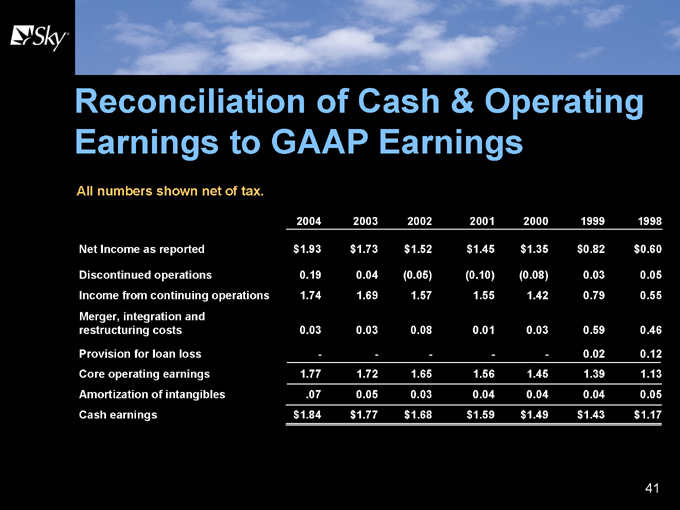

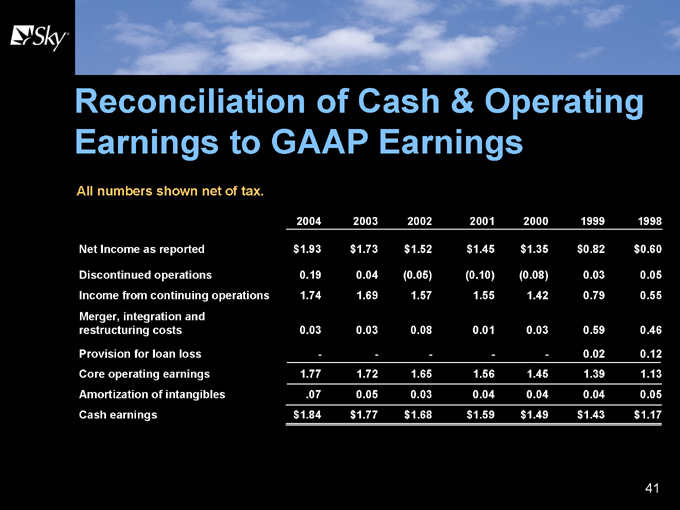

Reconciliation of Cash & Operating Earnings to GAAP Earnings

All numbers shown net of tax.

2004 2003 2002 2001 2000 1999 1998

Net Income as reported $1.93 $1.73 $1.52 $1.45 $1.35 $0.82 $0.60

Discontinued operations 0.19 0.04 (0.05) (0.10) (0.08) 0.03 0.05 Income from continuing operations 1.74 1.69 1.57 1.55 1.42 0.79 0.55 Merger, integration and restructuring costs 0.03 0.03 0.08 0.01 0.03 0.59 0.46

Provision for loan loss - - - - - 0.02 0.12 Core operating earnings 1.77 1.72 1.65 1.56 1.45 1.39 1.13 Amortization of intangibles .07 0.05 0.03 0.04 0.04 0.04 0.05 Cash earnings $1.84 $1.77 $1.68 $1.59 $1.49 $1.43 $1.17

41

Under One Sky

www.skyfi.com