2005 Annual Report

Sky Financial Group, Inc.

Financial Highlights

(Dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | | 2005 | | | 2004 | | | Percent Change |

| | For the Year | | | | | | | | | | | | | | |

| | Income from continuing operations | | $ | 182,191 | | | $ | 175,200 | | | | 4.0% |

| | Net income | | | 182,563 | | | | 194,355 | | | | (6.1) |

| | From Continuing Operations | | | | | | | | | | |

| | Return on average assets | | | 1.20 | % | | | 1.31 | % | | | – |

| | Return on average common equity | | | 12.25 | % | | | 14.24 | % | | | – |

| | Per Common Share Data | | | | | | | | | | | | | | |

| | Basic | | | | | | | | | | | | | | |

| | Income from continuing operations | | $ | 1.71 | | | $ | 1.76 | | | | (2.8)% |

| | Net income | | | 1.71 | | | | 1.95 | | | | (12.3) |

| | Diluted | | | | | | | | | | |

| | Income from continuing operations | | $ | 1.69 | | | $ | 1.74 | | | | (2.9)% |

| | Net income | | | 1.69 | | | | 1.93 | | | | (12.4) |

| | Dividends | | | 0.89 | | | | 0.85 | | | | 4.7% |

| | Book value at year end | | | 14.35 | | | | 13.77 | | | | 4.2 |

| | At Year End | | | | | | | | | | | | | | |

| | Assets | | $ | 15,683,291 | | | $ | 14,944,423 | | | | 4.9% |

| | Loans | | | 11,149,222 | | | | 10,616,118 | | | | 5.0 |

| | Deposits | | | 10,755,676 | | | | 10,351,591 | | | | 3.9 |

| | Shareholders’ equity | | | 1,553,877 | | | | 1,470,955 | | | | 5.6 |

| | | | | | | | | | | | | |

| | Quarterly Financial Highlights | | | | | | | | | | | | | | |

| | | | | First | | | | Second | | | | Third | | | Fourth |

| | 2005 | | | | | | | | | | | | | | |

| | Net interest income | | $ | 124,007 | | | $ | 128,000 | | | $ | 130,419 | | $ | 132,226 |

| | Provision for credit losses | | | 30,823 | | | | 5,894 | | | | 8,725 | | | 6,807 |

| | Income from continuing operations | | | 30,719 | | | | 47,786 | | | | 50,345 | | | 53,341 |

| | Income from discontinuing operations | | | – | | | | – | | | | – | | | 372 |

| | Net income | | | 30,719 | | | | 47,786 | | | | 50,345 | | | 53,713 |

| | Basic per share | | | | | | | | | | | | | | |

| | Income from continuing operations | | | 0.29 | | | | 0.45 | | | | 0.47 | | | 0.49 |

| | Net income | | | 0.29 | | | | 0.45 | | | | 0.47 | | | 0.50 |

| | Diluted per share | | | | | | | | | | | | | | |

| | Income from continuing operations | | | 0.29 | | | | 0.45 | | | | 0.46 | | | 0.49 |

| | Net income | | | 0.29 | | | | 0.45 | | | | 0.46 | | | 0.49 |

| | 2004 | | | | | | | | | | | | | | |

| | Net interest income | | $ | 101,803 | | | $ | 102,687 | | | $ | 122,516 | | $ | 124,305 |

| | Provision for credit losses | | | 6,665 | | | | 11,020 | | | | 8,360 | | | 11,615 |

| | Income from continuing operations | | | 39,952 | | | | 40,201 | | | | 46,148 | | | 48,899 |

| | Net income | | | 58,677 | | | | 40,201 | | | | 46,148 | | | 49,329 |

| | Basic per share | | | | | | | | | | | | | | |

| | Income from continuing operations | | | 0.43 | | | | 0.43 | | | | 0.44 | | | 0.46 |

| | Net income | | | 0.63 | | | | 0.43 | | | | 0.44 | | | 0.47 |

| | Diluted per share | | | | | | | | | | | | | | |

| | Income from continuing operations | | | 0.42 | | | | 0.43 | | | | 0.43 | | | 0.46 |

| | Net income | | | 0.62 | | | | 0.43 | | | | 0.43 | | | 0.46 |

| | | | |

| | |  | | | | | | | | | | | |

| | |

| Dear Fellow Shareholder: |

| | n 2005, Sky Financial Group demonstrated its strength by rising to meet challenges. With our disciplined approach and focus on our strategic priorities, we again produced solid financial results, despite a rising interest rate environment and uncharacteristically higher credit costs. This was accomplished by emphasizing expense control and strengthening our credit management to supplement our revenue growth strategies. |

Looking toward our growth in 2006 and beyond, we are extremely excited about the opportunity to expand our franchise into the Indianapolis, Indiana, market with our pending acquisition of Union Federal Bank. Indianapolis is a growing city that fits well within our footprint and metro market strategy. As we expand into new markets, we further enhance the Sky franchise by upholding our proven model of regional decision making driven by our five strategic priorities: organic growth, fee-based income, organizational synergies, sound asset quality and prudent acquisitions. Using the Sky Trek sales and service process, our regionally-empowered professionals attract, cultivate and retain more clients than ever before, putting us in prime position to realize our vision of Sky becoming the premier financial institution in the Midwest. |

| | |

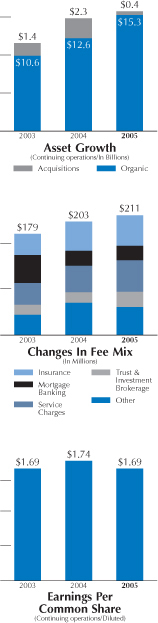

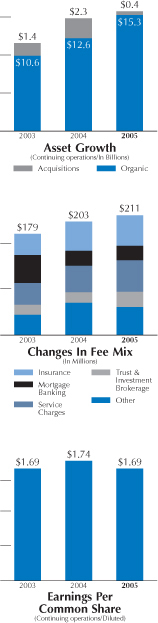

| | 2005 Performance Our commitment to profitable growth and high performance was clearly reflected in our 2005 results. Sky’s growth generated total revenues of $726 million for the year - up 11% - - with $11.1 billion in loans and $10.8 billion in deposits by year-end. Despite rising rates and a flat yield curve, our net interest margin improved to 3.73% for the year compared to 3.69% in 2004. As for our fee-based businesses, Sky Trust revenues grew 20%, and our investment sales gained 26%. Despite a soft insurance market, Sky Insurance had a solid year with commissions increasing by 5%. Mortgage banking revenues held steady on originations of $1.3 billion, despite continuing economic challenges on regional and national levels. |

| | |

| Even while growing, Sky upheld our disciplined practices surrounding efficiency and asset quality. Our operating efficiency ratio, including the integration costs of two bank mergers, remained superior to peers at 54.85%, demonstrating our strong expense control culture. While the ratio of net credit losses to average total loans rose to .57% in 2005 – versus .37% last year – the level of non-performing loans was significantly reduced during the year, declining from 1.35% of total loans to 1.07% at year-end 2005. |

1

| | |

| | ur 2005 net income was $1.69 per share, reflecting a strong finish to the year after the impact of atypical credit losses in the first quarter, but not reaching the level achieved in 2004, which was bolstered by a gain from Sky’s sale of its dental finance unit, Sky Financial Solutions. Importantly, our 2005 earnings results also included the first-time expense of stock options due to our adoption of the accounting standard FAS No. 123(R) Share-Based Payment. |

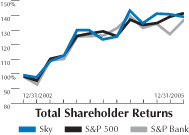

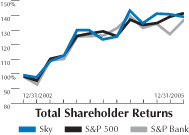

Most importantly, Sky’s three-year total return to shareholders of 54% has outperformed our peers and is a clear indicator of the validity of our goals, strategies and decisions. Cultivating Our Client Base At Sky, our highest priority remains that of organic growth. The catalyst for that growth lies in our sales and service model, Sky Trek, which empowers our professionals, tracks their progress and rewards their achievements. Regional management teams make lending decisions, set competitive pricing and implement service initiatives based upon the needs of their markets, while sales professionals make referrals for fee-based products and services. The result is superior client service by the most efficient means possible. It is this service excellence that enables us to retain and cultivate existing clients while attracting new business. The 2005 Sky Trek campaign “Under One Sky” emphasized internal referrals among sales and support units to match client needs with Sky’s products and services. This integration and partnership leveraged the full force of the Sky organization to deliver more than 762,000 referrals, representing a 12% increase from 2004. The success of “Under One Sky” was also driven by our increase in proactive sales and service techniques. During 2005, our regional sales force initiated and completed more than 738,000 tele-consulting contacts with clients – a 30% increase from the previous year. Sky professionals employed another proven sales tool, the financial needs analysis profile (FiNAP), to identify our clients’ current and future needs for Sky’s financial services. In 2005, our staff increased the number of completed FiNAPs by 26%. The Sky Trek philosophy stresses growth not only by serving more clients, but also by serving existing clients more. This year, the number of households new to Sky grew 17%, and the number of net, new checking accounts increased by 10%. Likewise, our sales team increased the number of households with 2 to 3 services by 7%, and the number of households with four or more services grew by more than 16%. “Under One Sky” also prompted fee-based growth in the areas of trust, investment sales and commercial fee revenue. Notably, Sky Trust reported $4.8 billion in assets in 2005 and a 20% annualized growth in revenue. In August 2005, John S. Gulas became president and CEO for Sky’s wealth management business. John and his team will be focused on increasing client relationships within private banking, asset management, trust administration, retirement planning and retail brokerage services in order to continue their growth. Sky Insurance products presented yet another area of organic growth opportunity, as referrals to and from our insurance and bank units alone posted an increase of more than 400% in 2005. Sky Insurance continues its targeted acquisition strategy to consolidate multiple agencies under the Sky brand and grow its franchise. During 2005, Sky Insurance earned $55 million in commissions and acquired three new agencies, which will support and expand this division’s expertise and marketability. |

2

|

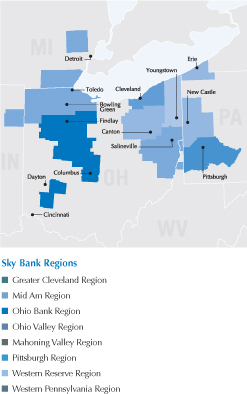

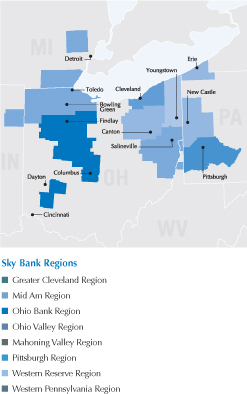

Driving Growth In 2005, Sky grew to $15.7 billion in assets and expanded our delivery channels to 290 financial centers and more than 300 ATMs in Ohio, Pennsylvania, Michigan, Indiana and West Virginia. In June, we completed the acquisition of Belmont Bancorp (Bridgeport, Ohio). This acquisition included Belmont National Bank, a $297 million commercial bank with 12 full-service branches located in Belmont, Harrison and Tuscarawas counties in Ohio and Ohio County in West Virginia. Belmont complemented our presence in the Ohio Valley Region and allowed Sky to expand in the Wheeling, West Virginia, market. In December, Sky acquired Falls Bank (Stow, Ohio), gaining $83.6 million in assets and adding two full-service branches to our Western Reserve Region. The acquisition of Falls Bank was strategically aligned with our expansion into the growth market of Akron/Canton. Falls Bank also enhanced our focus on superior client service and local decision-making. In early February 2006, Sky announced its pending acquisition of Union Federal Bank of Indianapolis and its parent company, Waterfield Mortgage Company, in Ft. Wayne, Indiana. Union Federal is the fourth largest bank in Indianapolis and operates 44 full-service banking centers. Sky will acquire only Waterfield’s retail and commercial banking business, which is conducted primarily through Union Federal Bank. Indianapolis - much like Columbus - is a growing Midwestern metropolitan market that offers a wealth of opportunity for our company. Union Federal fits well with Sky’s regional philosophy and culture of service. Upon completion of the merger, the Union Federal banking structure will become Sky’s ninth region with its own regional board, regional president and leadership team. Waterfield’s insurance affiliate, Waterfield Insurance Agency, will later be integrated with Sky Insurance. After the closing of this transaction, 40% of Sky’s deposits will be held in the major metro markets in our footprint. During 2005, Sky Insurance acquired three companies, adding to our presence in target markets, our expertise and our client base. In August, B.K.M.’s Benefit Design Agency of Ohio, Inc. (Findlay, Ohio) merged into Sky Insurance and added valuable expertise about employee benefits that complemented and enhanced our existing business in Northwest Ohio. In October, Sky Insurance acquired two agencies in Wooster, Ohio, both of which helped bolster our presence near the Akron/Canton market - a target growth area for Sky Insurance. Becker-McDowell Agency, Inc., a well respected employee benefits agency, was one of the region’s top insurers, and Steiner Insurance Agency’s expertise included property and casualty insurance, which coordinated with our expanding opportunities for commercial clients. In January 2006, Sky Insurance acquired the Peter B. Burke Insurance Agency in Pittsburgh, Pennsylvania, which added property, casualty and surety services to our existing presence in that metro market. Each of these acquisitions is a result of our established growth strategy. They have all met the high standards set forth to ensure a strong fit of philosophies and services. We will continue to build the Sky franchise by seeking similar opportunities in the growing metropolitan areas of the Midwest, while maintaining our financial discipline. |

3

| | |

| Maximizing Efficiencies |

| | ky is dedicated to providing the highest quality services and products to our clients, while maximizing our efficiency and profitability. Technological tools can help us accomplish both goals, and 2005 held several major technological consolidations and advancements for the company. The first of these was the establishment of a new processing platform for all of Sky’s Automated Teller Machines (ATMs). Not only did this consolidation reduce expenses in core information processing, but our ATMs now have a standard screen presentation and transaction processing capabilities for all clients. As a part of this installation, we also consolidated all ATM and CheckCard processing under one system. This provides enhanced fraud protection, management reporting improvements and improved client service capabilities. |

In the second quarter of 2005, Sky opened a centralized item processing facility in Brecksville, Ohio, which enhanced our client service and improved our processing efficiencies. Through the upgraded platform, we completely integrated item processing and image archive capabilities and improved our fraud detection features. Brecksville is now the primary site for our item and remittance processing services, which allows us to offer our clients a broader range of image-based services, including the new Check 21 check image technology. The facility also provides enhanced processing capabilities including positive pay, controlled disbursement, a more robust image archive to support client needs, and integrated wholesale and retail lockbox processing. In the summer of 2005, we introduced a new suite of business online banking products with extensive cash management features. With this new online platform, Sky is able to focus on new potential online commercial banking clients from small businesses to large corporations. For our small to mid-market business segment - our core commercial client base - our new online product provides real-time views of financial position, tools to maximize cash flow, online lockbox images, positive pay, bill pay and online ACH tax payments. For our larger corporate clients, we can now offer a powerful payment engine, advanced entitlements, an extended wire payments module and reporting tools for managing the cash position of even the most complex operation. These technology improvements were among Sky’s organizational synergy initiatives and expense control measures that were vital to improving our financial performance throughout the year. Helping to lead these technological implementations is our change management office. This area uses disciplined approaches and standard practices to assure the successful completion of our strategic initiatives. In addition, all employees at Sky are encouraged to provide process improvement plans and to examine areas in which their departments or offices can save money. This past year, literally hundreds of expense control initiatives were implemented throughout the company. Efforts at every level of the organization contributed to our superior efficiency ratio, even as we expanded through organic growth and acquisitions. Maintaining Asset Quality At Sky, strong asset quality has always been one of our strategic priorities and a characteristic strength of our company. While our net charge-offs for the year increased due to first quarter credit losses; primarily from two large commercial credits and the sale of a group of non-performing real estate loans; our credit management remains strong and focused. |

4

|

We were pleased with the significant reduction in non-performing loans accomplished during the year, and we are confident that our conservative credit culture and prudent lending procedures that have historically led to sound asset quality will continue to support our growth strategies in 2006 and beyond. Refining Strategic Priorities While Sky’s focus on our five strategic priorities has been a proven catalyst for success since Sky’s formation, our vision and strategy requires regular review and refinement to help us improve and grow. In 2006, to enhance our strong position, we are committed to improving client satisfaction, organizational talent and internal efficiency. To maximize our client base, Sky must not only increase the number of clients who are satisfied with our service, but also decrease the number of clients who leave the organization. To achieve our goal of superior levels of client satisfaction, we will improve our already successful Sky Trek sales and service model. New initiatives will focus on extensive training and strong support for all Sky employees, as well as improved measurement tools. With Sky Trek, our staff will be more equipped and motivated to provide the excellent client service that attracts and retains clients, thus driving our organic growth. Highly talented employees at all levels of the organization are integral to achieving our strategic goals and performance commitments. In order to maintain excellence among our staff, we continue to develop a competitive, rewarding and effective work environment. This includes aggressive recruitment, internal advancement opportunities and effective staffing levels. These initiatives - in collaboration with our commitment to superior client service - make Sky distinctive among our peers. As we continue to grow and evolve as a Midwest financial services leader, we must constantly evaluate and advance our organizational structure and processes to optimize efficiency and growth. To meet these complex challenges, Sky is evaluating how organizational effectiveness can be improved through the clear definition of roles, responsibilities and accountabilities; through new risk management systems; and through the strategic allocation of resources and technologies. With these initiatives, we are striving to enhance revenue growth and profitability by establishing organizational consistency while maintaining the flexibility to respond to different market circumstances and opportunities. Moving Forward With a strong finish to 2005 and a new opportunity in a pivotal market, we are primed for new growth. In 2006, we look forward to expanding our successful regional financial services model by continuing to improve the things we do well and creating value for our clients, employees and shareholders. |

|

| Marty E. Adams |

| Chairman, President and CEO |

5

Sky Financial Group Board of Directors

| | | | | | |

| |  | |  | |  |

| | | |

Marty E. Adams1 Chairman, President & CEO Sky Financial Group, Inc. | | George N. Chandler II5 Retired VP Cleveland Cliffs, Inc. | | Robert C. Duvall2 Retired | | Marylouise Fennell, RSM4 Partner Higher Education Services |

| | | |

| |  | |  | |  |

| | | |

D. James Hilliker4 Vice President Better Food Systems, Inc. | | Fred H. “Sam” Johnson III2 President & CEO Summitcrest, Inc. Treasurer, Origen, Inc. | | Jonathan A. Levy1 Lead Director Sky Financial Group, Inc. Partner/Redstone Investments | | Gerard P. Mastroianni1, 4 President Alliance Ventures |

| | | |

| |  | |  | | |

| | | |

Thomas J. O’Shane5 Retired Senior Executive Vice President Sky Financial Group, Inc. | | Gregory L. Ridler1, 5 Retired Chairman Mahoning Valley Region of Sky Bank | | Emerson J. Ross, Jr.1, 3 Retired Manager, Corporate Community Relations Owens Corning | | |

| | | |

| |  | |  | | Committees 1 Executive 2 Audit 3 Governance &

Nominating 4 Compensation 5 Risk Management |

| | | |

C. Gregory Spangler1, 2 Chairman Spangler Candy Company | | Joseph N. Tosh II3 Retired Chairman Western Pennsylvania Region of Sky Bank | | R. John Wean III3 Co-owner & President of Specialties la Cote Basque Finance Committee, Grantmakers of Western Pennsylvania | | |

6

Sky Boards of Directors and Management

| | | | | | |

Sky Bank Regional Boards Greater Cleveland Region Robert M. Biggar Ralph M. Della Ratta, Jr. Richard R. Hollington III Norman J. Kotoch Bracy E. Lewis Richard M. Osborne, Jr. * Ernesto J. Poza Mahoning Valley Region Randall P. Baker William J. Bresnahan Raymond J. Briya Lee Burdman Rex A. Ferry * Frank Hierro Chander M. Kohli, M.D. Edward W. Muransky John L. Pogue Ben Z. Post Mid Am Region Joel S. Beren Paul C. Betz David A. Bryan Floyd D. Craft Ralph W. Gallagher Kathleen S. Hanley Patrick J. Johnson * G. Ray Medlin, Jr. Dane C. Nelson Sharon S. Speyer Ohio Bank Region Jon C. Ballinger Timothy R. Clark John A. Cole John C. Fergus II Ronald L. Geese Samuel J. Kiehl III * Thomas J. Weissling Doug E. Zimmerman Ohio Valley Region Keith D. Burgett * Paul P. Carapellotti David E. D’Anniballe Carl N. Frankovitch John H. Goodman Terrence A. Lee James C. McBane Carl M. Noretto Brian L. Schambach William C. Shivers Jayson M. Zatta | | Pittsburgh Region Paul F. Lackner Vincent W. Locher Demetrios (Jim) T. Patrinos * Mary Pat Soltis Charles A. Warden Robert T. Woodings III Western Reserve Region Louis M. Altman Dr. David A. Bitonte Fred J. Haupt * Rick L. Hull Paul T. Schumacher Lester S. Sherman Paul J. Testa Western Pennsylvania Region Del E. Goedeker Thomas E. Libeg Floyd H. McElwain * Barbara Bateman McNees Roger W. Richards Stephen R. Sant Steven C. Warner Sky Trust Board Marty E. Adams * John S. Gulas David L. Hayes Richard R. Hollington III Randall C. Hunt Harold F. Reed, Jr. Gregory L. Ridler Karl B. Schroedel II Patrick A. Sebastiano Richard E. White Sky Insurance Board Marty E. Adams Jerry J. Batt George N. Chandler II Charles I. Homan Edward J. Reiter George Rumman Samuel E. Smiley D.D.S. Scott C. Smith *Also serves on Sky Bank Corporate Board of Directors along with Thomas J. O’Shane. | | Sky Financial Group Executive Management Marty E. Adams Chairman, President & CEO Perry C. Atwood SVP/Director of Sales Caren L. Cantrell EVP/Chief Operations Officer of Sky Bank Phillip C. Clinard SVP/Director of Change

Management Office John S. Gulas President & CEO of Sky Trust Richard R. Hollington III Greater Cleveland Region

Regional President Frank J. Koch EVP/Senior Credit Officer Thomas A. Sciorilli SVP/Chief Human Resources Officer Curtis E. Shepherd SVP/Director of Marketing and Product Development W. Granger Souder, Jr. EVP/General Counsel Les Starr EVP/Operations and

Information Technology Kevin T. Thompson EVP/Chief Financial Officer | | Sky Bank Regional Presidents Frank Hierro Mahoning Valley Region Richard R. Hollington III Greater Cleveland Region Vincent W. Locher Pittsburgh Region Stephen R. Sant Western PA Region Sharon S. Speyer Mid Am Region Rick L. Hull Western Reserve Region Thomas J. Weissling Ohio Bank Region Jayson M. Zatta Ohio Valley Region Sky Insurance Jerry J. Batt President & CEO Edward D. Rawlings Regional President/Pennsylvania Sky Trust John S. Gulas President & CEO |

7

SEC FORM 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

Commission File No. 1-14473

Sky Financial Group, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Ohio | | 34-1372535 |

(State of Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification Number) |

| |

| 221 South Church Street, Bowling Green, Ohio | | 43402 |

| (Address of Principal Executive Office) | | (Zip Code) |

(419) 327-6300

(Registrant’s Telephone Number)

Securities registered pursuant to Section 12 (b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act:

Common Stock, without par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of

the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2005, the last business day of the registrant’s most recently completed second fiscal quarter: $2,759,260,424.

The number of shares outstanding of the Registrant’s common stock, without par value was 108,433,993 at February 10, 2006.

Certain specifically designated portions of Sky Financial Group, Inc.’s definitive Proxy Statement dated March 6, 2006 for its 2006 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

2

PART I

Item 1.Business

Sky Financial Group, Inc. (Sky Financial) is a $15.7 billion financial holding company located in Bowling Green, Ohio that owns one commercial bank primarily engaged in commercial and consumer banking business at over 290 financial centers and 300 ATMs located in Ohio, western Pennsylvania, southern Michigan, eastern Indiana and northern West Virginia. Sky Financial also operates businesses relating to insurance, trust and other related financial services. Since 2004, Sky Financial completed the following acquisitions and divestitures and announced the following pending acquisition:

| n | | On February 3, 2006, Sky Financial announced the execution of a definitive agreement to acquire Union Federal Bank of Indianapolis (Union Federal) and its parent company, Waterfield Mortgage Company, Incorporated (Waterfield), Ft. Wayne, Indiana. |

| n | | On January 3, 2006, Sky Financial acquired the Peter B. Burke Agency, Inc. located in Pittsburgh, Pennsylvania. |

| n | | On November 29, 2005, Sky Financial acquired Falls Bank, an $80 million bank that operated two full-service branches in the Akron, Ohio market. |

| n | | On October 4, 2005, Sky Financial acquired Becker-McDowell Agency, Inc. and Steiner Insurance Agency, Inc., both located in Wooster, Ohio. |

| n | | On August 1, 2005, Sky acquired B.K.M.’s Benefit Design Agency of Ohio, Inc., located in Findlay, Ohio. |

| n | | On June 1, 2005, Sky Financial acquired Belmont Bancorp, a $297 million bank holding company headquartered in St. Clairsville, Ohio, and its wholly-owned subsidiary, Belmont National Bank. |

| n | | On November 30, 2004, Sky Financial acquired Prospect Bancshares and its wholly-owned subsidiary Prospect Bank, a $202 million savings bank located in Worthington, Ohio. |

| n | | On July 1, 2004, Sky Financial acquired Second Bancorp, Inc. and its wholly-owned subsidiaries, The Second National Bank of Warren and Stouffer-Herzog Insurance Agency, Inc. Second National Bank was a $2.0 billion commercial bank located in Warren, Ohio. |

| n | | On March 31, 2004, Sky Financial sold Sky Financial Solutions, Inc., its specialized medical/dental financing unit located in Columbus, Ohio. |

The Holding Company

Sky Financial’s corporate philosophy is to operate as a locally-oriented, community-based financial service organization, augmented by centralized support in select critical areas. This local market orientation is reflected in its financial centers and regional advisory boards comprised of local business persons, professionals and other community representatives that assist the bank in responding to local banking needs. Sky Financial’s bank subsidiary concentrates on client service and business development, while relying upon the support of Sky Financial for operational functions that are not readily visible to clients and those that are critical to risk management. Asset quality review, mortgage banking activities, financial reporting, investment activities, internal audit, compliance and funds management are among the functions that are overseen at the holding company level.

Sky Financial’s market area is economically diverse, with a base of manufacturing, service, transportation and agriculture industries, and thus Sky Financial is not dependent upon any single industry or employer. Similarly, Sky Financial’s client base is diverse, and Sky Financial and its subsidiaries are not dependent upon any single industry or upon any single client.

Sky Financial’s strategic plan includes organically growing loans and deposits from a focused sales and service culture, increasing fee-based income, strengthening organizational synergies to manage operating costs, maintaining strong asset quality and acquiring financial institutions, branches and financial service businesses. Sky Financial seeks acquisition partners, which have experienced management, and possess either significant market presence or have potential for improved profitability through financial management, economies of scale and expanded services.

There is significant competition among commercial banks in Sky Financial’s market area. As a result of the deregulation of the financial services industry, Sky Financial also competes with other providers of financial services such as savings and loan associations, credit unions, consumer finance companies, securities firms, insurance companies, insurance agencies, commercial finance and leasing companies, the mutual funds industry, full-service brokerage firms and discount brokerage firms. Some of Sky Financial’s competitors, including certain regional bank holding companies, which have made acquisitions in Sky Financial’s market area, have greater resources than those of Sky Financial, and as such, may have higher lending limits and may offer other services not available through Sky Financial’s bank and non-bank subsidiaries. The bank and non-bank subsidiaries compete on the basis of rates of interest charged on loans, the rates of interest paid for funds, the availability of services and the responsiveness to the needs of its clients.

Sky Financial’s executive offices are located at 221 South Church Street, P.O. Box 428, Bowling Green, Ohio, and its telephone number is 419-327-6300.

The Bank Subsidiary

Sky Bank, headquartered in Salineville, Ohio, had total assets of $15.5 billion at December 31, 2005, and operates financial centers in Ohio, western Pennsylvania, southern Michigan, eastern Indiana and northern West Virginia. Sky Bank engages in commercial and consumer banking, including the acceptance of a variety of demand, savings and time deposits and the extension of commercial and consumer loans. Falls Bank merged with Sky Bank on December 3, 2005, and Belmont National Bank was merged into Sky Bank on June 3, 2005.

The Financial Services Subsidiaries

Sky Trust, National Association (Sky Trust), a wholly-owned subsidiary of Sky Financial, is headquartered in Pepper Pike, Ohio, and provides a full range of trust and employee benefit services to its commercial and consumer clients.

Sky Insurance, Inc. (Sky Insurance), Maumee, Ohio, is Sky Financial’s full service insurance agency offering a variety of insurance products and services to its clients. On August 1, 2005, B.K.M.’s Benefit Design Agency of Ohio, Inc. was acquired and merged into Sky Insurance. On October 4, 2005, Becker-McDowell Agency, Inc. and Steiner Insurance Agency, Inc. were acquired and merged into Sky Insurance.

Sky Financial has various other subsidiaries that are not significant to the consolidated entity.

3

Competition

The financial services industry is highly competitive. Sky Financial and its subsidiaries compete with other local, regional and national financial service providers, such as other financial holding companies, commercial banks, savings associations, credit unions, finance companies, leasing companies, and brokerage and insurance firms. The financial services industry is likely to become more competitive as further technological advances enable more companies to provide financial services on a more efficient and convenient basis.

Supervision and Regulation

Introduction

Sky Financial, its banking subsidiary and many of its non-banking subsidiaries are subject to extensive regulation by federal and state agencies. The regulation of bank holding companies and their subsidiaries is intended primarily for the protection of depositors, federal deposit insurance funds and the banking system as a whole and not for the protection of security holders. Although Sky Financial is recognized as a financial holding company, most regulations pertaining to bank holding companies also apply to it. As discussed in more detail below, this regulatory environment, among other things, may restrict Sky Financial’s ability to diversify into certain areas of financial services, acquire depository institutions in certain states and pay dividends on its capital stock. It may also require Sky Financial to provide financial support to its banking subsidiary, maintain capital balances in excess of those desired by management and pay higher deposit insurance premiums as a result of the deterioration in the financial condition of depository institutions in general.

Regulatory Agencies

Holding Company. Sky Financial is a financial holding company subject to regulation under the Bank Holding Company Act of 1956 (BHCA), as amended, and to inspection, examination and supervision by the Board of Governors of the Federal Reserve System under the BHCA.

Subsidiary Bank. Sky Financial’s banking subsidiary is subject to regulation and examination primarily by the Ohio Division of Financial Institutions and the Federal Reserve Board and secondarily by the Federal Deposit Insurance Corporation (FDIC).

Financial Services Subsidiaries. Many of Sky Financial’s financial services subsidiaries also are subject to regulation by the Federal Reserve Board and other applicable federal and state agencies. Sky Financial’s insurance subsidiaries are subject to regulation by applicable state insurance regulatory agencies. Other non-bank subsidiaries of Sky Financial are subject to the laws and regulations of both the federal government and the various states in which they conduct business. Sky Trust, Sky Financial’s trust services affiliate, is regulated by the Office of the Comptroller of the Currency (OCC).

Securities and Exchange Commission (SEC) and NASDAQ. Sky Financial is also under the jurisdiction of the SEC and certain state securities commissions for matters relating to the offering and sale of its securities. Sky Financial is subject to the disclosure and regulatory requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, as administered by the SEC. Sky Financial is listed on the NASDAQ Stock Market under the trading symbol “SKYF,” and is subject to the rules of NASDAQ for listed companies.

Bank Holding Company Activities

Interstate Banking. Under the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (“Riegle-Neal Act”), as amended, a bank holding company may acquire banks in states other than its home state, subject to certain limitations. The Riegle-Neal Act also authorizes banks to merge across state lines, thereby creating interstate branches. Banks are also permitted to acquire and to establish de novo branches in other states where authorized under the laws of those states.

Regulatory Approval. Under the BHCA, prior approval of the Federal Reserve Board is required for the acquisition of more than 5% of the voting stock of any bank. In determining whether to approve a proposed bank acquisition, federal banking regulators will consider, among other factors, the effect of the acquisition on competition, the public benefits expected to be received from the acquisition, the projected capital ratios and levels on a post-acquisition basis, and the acquiring institution’s record of addressing the credit needs of the communities it serves, including the needs of low and moderate income neighborhoods, consistent with the safe and sound operation of the bank, under the Community Reinvestment Act of 1977.

Dividend Restrictions

Sky Financial is a legal entity separate and distinct from its subsidiary bank and other subsidiaries. Its principal source of funds to pay dividends on its common stock and service its debt is from dividends from its subsidiaries, primarily Sky Bank. Various federal and state statutory provisions and regulations limit the amount of dividends that Sky Bank may pay without regulatory approval. Dividends payable by a state chartered bank are limited to the lesser of the bank’s undivided profits and the bank’s retained net income for the current year plus its retained net income for the preceding two years (less any required transfers to capital surplus) up to the date of any dividend declaration in the current calendar year. As of December 31, 2005, $227,309 was available for distribution to Sky Financial as dividends without prior regulatory approval.

Federal bank regulatory agencies have the authority to prohibit Sky Bank from engaging in unsafe or unsound practices in conducting its business. The payment of dividends, depending on the financial condition of the bank, could be deemed an unsafe or unsound practice. The ability of Sky Bank to pay dividends in the future is currently influenced, and could be further influenced, by bank regulatory policies and capital guidelines.

Holding Company Structure

Transfer of Funds from Banking Subsidiary. Sky Financial’s banking subsidiary is subject to restrictions under federal law that limit the transfer of funds or other items of value from this subsidiary to Sky Financial and its non-banking subsidiaries, including affiliates, whether in the form of loans and other extensions of credit, investments and asset purchases or as other transactions involving the transfer of value from a

4

subsidiary to an affiliate or for the benefit of an affiliate. Unless an exemption applies, these transactions by a banking subsidiary with a single affiliate are limited to 10% of the subsidiary bank’s capital and surplus and, with respect to all covered transactions with affiliates in the aggregate, to 20% of the subsidiary bank’s capital and surplus. Moreover, loans and extensions of credit to affiliates generally are required to be secured in specified amounts. A bank’s transactions with its non-bank affiliates are also generally required to be on arm’s-length terms.

Source of Strength Doctrine. Under current Federal Reserve Board policy, Sky Financial is expected to act as a source of financial and managerial strength to its subsidiary bank and, under appropriate circumstances, to commit resources to support such subsidiary bank. This support could be required at times when Sky Financial might not have the resources to provide it.

Capital loans from Sky Financial to its subsidiary bank are subordinate in right of payment to deposits and certain other indebtedness of the subsidiary bank. In the event of Sky Financial’s bankruptcy, any commitment by Sky Financial to a federal bank regulatory agency to maintain the capital of a subsidiary bank will be assumed by the bankruptcy trustee and entitled to a priority of payment.

Depositor Preference. The Federal Deposit Insurance Act provides that, in the event of the “liquidation or other resolution” of an insured depository institution, the claims of depositors of the institution, including the claims of the FDIC as subrogee of insured depositors, and certain claims for administrative expenses of the FDIC as a receiver, will have priority over other general unsecured claims against the institution. If an insured depository institution fails, insured and uninsured depositors, along with the FDIC, will have priority in payment ahead of unsecured, non-deposit creditors, including Sky Financial, with respect to any extensions of credit they have made to such insured depository institution.

Liability of Commonly Controlled Institutions. The deposits of Sky Bank are insured by the FDIC. FDIC-insured depository institutions can be held liable for any loss incurred, or reasonably expected to be incurred, by the FDIC due to the default of an FDIC-insured depository institution controlled by the same bank holding company, or for any assistance provided by the FDIC to an FDIC-insured depository institution controlled by the same bank holding company that is in danger of default. “Default” means generally the appointment of a conservator or receiver. “In danger of default” means generally the existence of certain conditions indicating that a default is likely to occur in the absence of regulatory assistance.

Capital Requirements

Sky Financial is subject to risk-based capital requirements and guidelines imposed by the Federal Reserve Board. These are substantially similar to the capital requirements and guidelines imposed by the OCC and the FDIC on the depository institutions under their jurisdictions. For this purpose, a depository institution’s or holding company’s assets, and some of its specified off-balance sheet commitments and obligations, are assigned to various risk categories. A depository institution’s or holding company’s capital, in turn, is classified in one of three depending on type:

| | | | |

| Core (“Tier 1”) Capital tiers, | | Supplementary (“Tier 2”) Capital | | Market Risk (“Tier 3”) Capital |

| | |

- Common equity - Retained earnings | | - Perpetual preferred stock not meeting the Tier 1 definition | | - Qualifying unsecured subordinated debt |

- Qualifying non-cumulative perpetual | | - Qualifying mandatory convertible | | |

preferred stock | | Securities | | |

- A limited amount of qualifying | | - Qualifying subordinated debt | | |

cumulative perpetual stock at the holding company level | | - Allowances for loan and lease losses, subject to limitations | | |

- Minority interests in equity accounts of | | - Recourse obligation on sold loan | | |

consolidated subsidiaries | | portfolios | | |

- Less goodwill, most intangible assets and certain other assets | | | | |

Sky Financial, like other bank holding companies, currently is required to maintain Tier 1 capital and “total capital” (the sum of Tier 1, Tier 2 and Tier 3 capital) equal to at least 4% and 8%, respectively, of its total risk-weighted assets (including various off-balance-sheet items, such as standby letters of credit). For a holding company to be considered “well capitalized” for regulatory purposes, its Tier 1 and total capital ratios must be 6% and 10% on a risk-adjusted basis, respectively. At December 31, 2005, Sky Financial met both requirements, with Tier 1 and total capital equal to 9.3% and 11.5% of its respective total risk-weighted assets.

Federal Reserve Board, FDIC and state rules require Sky Financial to incorporate market and interest rate risk components into its risk-based capital standards. Under these market risk requirements, capital is allocated to support the amount of market risk related to a financial institution’s ongoing trading activities.

The Federal Reserve Board also requires bank holding companies to maintain a minimum “leverage ratio” (Tier 1 capital to adjusted total assets) of 3% if the holding company has the highest regulatory rating and meets other requirements, or of 3% plus an additional “cushion” of at least 100 to 200 basis points (one to two percentage points) if the holding company does not meet these requirements. Sky Financial’s leverage ratio at December 31, 2005 was 8.0%.

The Federal Reserve Board may set capital requirements higher than the minimums described above for holding companies whose circumstances warrant it. For example, holding companies experiencing or anticipating significant growth may be expected to maintain capital positions substantially above the minimum supervisory levels without significant reliance on intangible assets. The Federal Reserve Board has also indicated that it will consider a “tangible Tier 1 capital leverage ratio” (deducting all intangibles) and other indications of capital strength in evaluating proposals for expansion or new activities.

Sky Bank is subject to similar risk-based and leverage capital requirements adopted by the Federal Reserve Board. Sky Financial’s management believes that Sky Bank meets all capital requirements to which it is subject.

Failure to meet capital requirements could subject a bank to a variety of enforcement remedies, including the termination of deposit insurance by the FDIC, and to restrictions on its business, which are described under the next paragraph.

Federal Deposit Insurance Corporation Improvement Act of 1991. The Federal Deposit Insurance Corporation Improvement Act of 1991 (the “FDICIA”), among other things, identifies five capital categories for insured depository institutions: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. It requires U.S. federal bank regulatory agencies to implement systems for “prompt corrective action” for insured depository institutions that do not meet minimum capital requirements based on these categories. The FDICIA imposes progressively more restrictive constraints on operations, management and capital distributions, depending on the category in which an institution is classified. Unless a bank is well capitalized, it is subject to restrictions on its

5

ability to offer brokered deposits and on other aspects of its operations. The FDICIA generally prohibits a bank from paying any dividend or making any capital distribution or paying any management fee to its holding company if the bank would thereafter be undercapitalized. An undercapitalized bank must develop a capital restoration plan, and its parent holding company must guarantee the bank’s compliance with the plan up to the lesser of 5% of the bank’s assets at the time it became undercapitalized and the amount needed to comply with the plan.

As of December 31, 2005, Sky Financial believes that its bank subsidiary was well capitalized, based on the prompt corrective action ratios and guidelines described above. A bank’s capital category is determined solely for the purpose of applying the prompt corrective action regulations, and the capital category may not constitute an accurate representation of the bank’s overall financial condition or prospects for other purposes.

Deposit Insurance Assessments

The FDIC insures the deposits of Sky Financial’s depository institution subsidiary up to prescribed limits for each depositor. The amount of FDIC assessments paid by each Bank Insurance Fund (BIF) member institution is based on its relative risk of default as measured by regulatory capital ratios and other factors. Specifically, the assessment rate is based on the institution’s capitalization risk category and supervisory subgroup category. An institution’s capitalization risk category is based on the FDIC’s determination of whether the institution is well capitalized, adequately capitalized or less than adequately capitalized. An institution’s supervisory subgroup category is based on the FDIC’s assessment of the financial condition of the institution and the probability that FDIC intervention or other corrective action will be required.

The FDIC may increase or decrease the assessment rate schedule on a semi-annual basis. An increase in the assessment rate could have a material adverse effect on Sky Financial’s earnings, depending on the amount of the increase. The FDIC is authorized to terminate a depository institution’s deposit insurance upon a finding by the FDIC that the institution’s financial condition is unsafe or unsound or that the institution has engaged in unsafe or unsound practices or has violated any applicable rule, regulation, order or condition enacted or imposed by the institution’s regulatory agency. The termination of deposit insurance for Sky Bank could have a material adverse effect on Sky Financial’s earnings.

Fiscal and Monetary Policies

Sky Financial’s business and earnings are affected significantly by the fiscal and monetary policies of the federal government and its agencies. Sky Financial is particularly affected by the policies of the Federal Reserve Board, which regulates the supply of money and credit in the United States. Among the instruments of monetary policy available to the Federal Reserve are (a) conducting open market operations in United States government securities, (b) changing the discount rates of borrowings of depository institutions, (c) imposing or changing reserve requirements against depository institutions’ deposits, and (d) imposing or changing reserve requirements against certain borrowing by banks and their affiliates. These methods are used in varying degrees and combinations to affect directly the availability of bank loans and deposits, as well as the interest rates charged on loans and paid on deposits. For that reason alone, the policies of the Federal Reserve Board have a material effect on the earnings of Sky Financial.

Privacy Provisions of Gramm-Leach-Bliley Act

Under Gramm-Leach-Bliley Act (GLB Act), federal banking regulators adopted rules that limit the ability of banks and other financial institutions to disclose non-public information about consumers to non-affiliated third parties. These limitations require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to non-affiliated third parties. The privacy provisions of the GLB Act affect how consumer information is transmitted through diversified financial companies and conveyed to outside vendors.

Sarbanes-Oxley Act of 2002

The Sarbanes-Oxley Act of 2002 contains important requirements for public companies in the area of financial disclosure and corporate governance. In accordance with section 302(a) of the Sarbanes-Oxley Act, written certifications by Sky Financial’s chief executive officer and chief financial officer are required. These certifications attest that Sky Financial’s quarterly and annual reports filed with the SEC do not contain any untrue statement of a material fact. Sky Financial has also implemented a program designed to comply with Section 404 of the Sarbanes-Oxley Act, which includes the identification of significant processes and accounts, documentation of the design of control effectiveness over process and entity level controls, and testing of the operating effectiveness of key controls. Also, in response to the Sarbanes-Oxley Act, Sky Financial adopted a series of procedures to improve its corporate governance practices. One of these actions included the formation of a Financial Disclosure Committee whose members include the chief executive officer, the chief financial officer and other Sky Financial officers. Sky Financial also requires signed certifications from managers who are responsible for internal controls throughout Sky Financial as to the integrity of the information they prepare. These procedures supplement Sky Financial’s Code of Ethics policies and procedures that have previously been in place. See Item 9A “Controls and Procedures” for Sky Financial’s evaluation of its disclosure controls and procedures.

Future Legislation

Various legislation, including proposals to change substantially the financial institution regulatory system and to expand or contract the powers of banking institutions and bank holding companies, is from time to time introduced in Congress. This legislation may change banking statutes and the operating environment of Sky Financial and its subsidiaries in substantial and unpredictable ways. If enacted, such legislation could increase or decrease the cost of doing business, limit or expand permissible activities or affect the competitive balance among banks, savings associations, credit unions and other financial institutions. Sky Financial cannot predict whether any of this potential legislation will be enacted, and if enacted, the effect that it, or any implemented regulations, would have on the financial condition or results of operations of Sky Financial or any of its subsidiaries.

To the extent that the previous information describes statutory and regulatory provisions, it is qualified in its entirety by reference to the full text of those provisions. Also, such statutes, regulations and policies are continually under review by Congress and state legislatures and federal and state regulatory agencies. A change in statutes, regulations or regulatory policies applicable to Sky Financial could have a material effect on the business of Sky Financial.

In addition, see the information contained in Note 21 “Regulatory Matters” in this Form 10-K.

6

Employees

As of December 31, 2005, Sky Financial and its subsidiaries had approximately 4,117 full-time equivalent employees. Sky Financial and its subsidiaries consider their employee relations to be good. None of the employees are covered by a collective bargaining agreement.

Available Information

Sky Financials’ Internet address is www.skyfi.com. We have made available free of charge on or through our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such material was electronically filed with, or furnished to the SEC. Materials that Sky Financial files with the SEC may be read and copied at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, D.C. 20549. This information may also be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. Sky Financial will provide a copy of any of the foregoing documents to stockholders upon request.

Certain Statistical Information Regarding Sky Financial

Certain financial and statistical information relative to Sky Financial as required under the SEC’s Industry Guide 3, “Statistical Disclosure By Bank Holding Companies,” and related discussion is incorporated by specific references from the indicated pages of this Form 10-K.

Item 1A.Risk Factors

Interest Rate Risk

Changes in interest rates could adversely affect our earnings and financial condition.

Our earnings and financial condition are dependent to a large degree upon net interest income, which is the difference between interest earned from loans and investments and interest paid on deposits and borrowings. The narrowing of interest-rate spreads, meaning the difference between the interest rates earned on loans and investments and the interest rates paid on deposits and borrowings, could adversely affect our earnings and financial condition.

Interest rates are highly sensitive to many factors, including:

| n | | The rate of economic growth; |

| n | | Instability in domestic and foreign financial markets. |

Changes in market interest rates will also affect the level of voluntary prepayments on our loans and the receipt of payments on our mortgage-backed securities resulting in the receipt of proceeds that may be reinvested at a lower rate than the loan or mortgage-backed security being prepaid.

We originate residential loans for sale and for our portfolio. The origination of loans for sale is designed to meet client financing needs and earn fee income. The origination of loans for sale is highly dependent upon the local real estate market and the level and trend of interest rates. Increasing interest rates may reduce the origination of loans for sale and consequently the fee income we earn. While our commercial banking, construction and income property business lines are an increasing portion of our activities, high interest rates may reduce our mortgage-banking activities and thereby our income. In contrast, decreasing interest rates have the effect of causing clients to refinance mortgage loans faster than anticipated. This causes the value of assets related to the servicing rights on loans sold to be lower than originally anticipated. If this happens, we may need to write down our servicing assets faster, which would accelerate our expense and lower our earnings.

Government Policies

Our business may be adversely affected by changes in government policies.

The earnings of banks and bank holding companies such as Sky Financial are affected by the policies of regulatory authorities, including the Federal Reserve Board, which regulates the money supply. Among the methods employed by the Federal Reserve Board are open market operations in U.S. Government securities, changes in the discount rate on member bank borrowings, and changes in reserve requirements against member bank deposits. These methods are used in varying combinations to influence overall growth and distribution of bank loans, investments and deposits, and their use may also affect interest rates charged on loans or paid on deposits. The monetary policies of the Federal Reserve Board have had a significant effect on the operating results of commercial and savings banks in the past and are expected to continue to do so in the future.

7

The banking industry is highly regulated and changes in federal and state banking regulations as well as policies and administration guidelines may affect Sky Financial’s practices and growth prospects.

Credit Risk

Our earnings and reputation may be adversely affected if we fail to effectively manage our credit risk.

Originating and underwriting loans are integral to the success of our business. This business requires us to take “credit risk,” which is the risk of losing principal and interest income because borrowers fail to repay loans.

Collateral values and the ability of borrowers to repay their loans may be affected at any time by factors such as:

| n | | A downturn in the local economies in which we operate or the national economy; |

| n | | A downturn in one or more of the business sectors in which our customers operate; or |

| n | | A rapid increase in interest rates. |

Competition

Strong competition within our market area may reduce our ability to attract and retain deposits and originate loans.

We face competition both in originating loans and in attracting deposits. Competition in the financial services industry is intense. We compete for clients by offering excellent service and competitive rates on our loans and deposit products. The type of institutions we compete with include commercial banks, savings institutions, mortgage banking firms, credit unions, finance companies, mutual funds, insurance companies and brokerage and investment banking firms. As a result of their size and ability to achieve economies of scale, certain of our competitors offer a broader range of products and services than we offer. In addition, to stay competitive in our markets we may need to adjust the interest rates on our products to match the rates offered by our competitors, which could adversely affect our net interest margin. As a result, our profitability depends upon our continued ability to successfully compete in our market areas while achieving our investment objectives.

Economy

Our business may be adversely affected by downturns in the local economies on which we depend.

Our loan portfolio is concentrated primarily in the northern and central Ohio regions, the southeast Michigan region, the eastern Indiana region, the western Pennsylvania region and the northern West Virginia region. Our profits depend on providing products and services to clients in these local regions. An increase in unemployment, a decrease in real estate values or continued increases in interest rates could weaken the local economies in which we operate. Weakness in our market area could depress our earnings and consequently our financial condition because:

| n | | Clients may not want or need our products and services; |

| n | | Borrowers may not be able to repay their loans; |

| n | | The value of the collateral securing our loans to borrowers may decline; and |

| n | | The quality of our loan portfolio may decline. |

Integration Risk

We may not be able to achieve the expected integration and cost savings from our ongoing bank acquisition activities.

We have a long history of acquiring financial institutions and we expect this acquisition activity to continue in the future. Difficulties may arise in the integration of the business and operations of the financial institutions that agree to merge with and into Sky Financial and its affiliates and, as a result, we may not be able to achieve the cost savings and synergies that we expect will result from the merger activities. Achieving cost savings is dependent on consolidating certain operational and functional areas, eliminating duplicative positions and terminating certain agreements for outside services. Additional operational savings are dependent upon the integration of the banking businesses of the acquired financial institution with that of Sky Financial, including the conversion of the acquired entity’s core operating systems, data systems and products to those of Sky Financial and the standardization of business practices. Complications or difficulties in the conversion of the core operating systems, data systems and products of these other banks to those of Sky Financial may result in the loss of clients, damage to our reputation within the financial services industry, operational problems, one-time costs currently not anticipated by us and/or reduced cost savings resulting from the merger activities.

Acquisition Risk

We may have difficulty in the future to continue to grow through acquisitions.

Any future acquisitions or mergers by Sky Financial or its banking subsidiaries are subject to approval by the appropriate federal and state banking regulators. The banking regulators evaluate a number of criteria in making their approval decisions, such as:

| n | | Safety and soundness guidelines; |

| n | | Compliance with all laws including the USA Patriot Act of 2001, the International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, the Sarbanes-Oxley Act of 2002 and the related rules and regulations promulgated under such Act or the Exchange Act, the Equal Credit Opportunity Act, the Fair Housing Act, the Community Reinvestment Act, the Home Mortgage Disclosure Act and all other applicable fair lending laws and other laws relating to discriminatory business practices; and |

| n | | Anti-competitive concerns with the proposed transaction. |

8

If the banking regulators or a commenter on our regulatory application raise concerns about any of these criteria at the time a regulatory application is filed, the banking regulators may deny, delay or condition their approval of a proposed transaction.

We have grown, and intend to continue to grow, through acquisitions of banks and other financial institutions. After these acquisitions, we may experience adverse changes in results of operations of acquired entities, unforeseen liabilities, asset quality problems of acquired entities, loss of key personnel, loss of clients because of change of identity, difficulties in integrating data processing and operational procedures and deterioration in local economic conditions. These various acquisition risks can be heightened in larger transactions.

Item 1B.Unresolved Staff Comments

None.

Item 2.Properties

Sky Financial’s executive offices are located in Bowling Green, Ohio. Sky Bank operates over 290 financial centers, of which substantially all are owned. Also, the information contained in Note 5 “Premises and Equipment” on page 45 of this Form 10-K is incorporated herein by reference in response to this item.

Item 3.Legal Proceedings

In re Commercial Money Center, Inc. Equipment Lease Litigation in the U. S. District Court for the Northern District of Ohio, Eastern Division, MDL Case No. 1:02-CV-16000

Between August 2000 and December 2001, Sky Bank and two of its predecessor banks provided financing to a commercial borrower and its affiliated entities for the purchase of six separate portfolios of commercial lease pools, and a warehouse line of credit to finance lease pools. These loans are secured by assignments of the payment streams from the underlying leases, surety bonds or insurance policies, and a limited guarantee from the sole member of the commercial borrower.

Upon default of these commercial loans, Sky Bank (and its predecessors) made demand for payment from Illinois Union Insurance Company (“IU”), RLI Insurance Company (“RLI”), and Royal Indemnity Company (“Royal”) under the relevant surety bonds and insurance policies. IU, RLI, and Royal (collectively, the “Sureties”) have failed to make the payments required under the surety bonds and insurance policies. As a result, in the spring of 2002, Sky and its predecessors filed suit against each of the Sureties seeking to enforce Sky Bank’s rights under the surety bonds and insurance policies issued by the Sureties in connection with the commercial lease pools. Sky’s complaints claim breach of contract, bad faith and allege that the Sureties are liable for the payments due to Sky under the terms of the bonds and are estopped from asserting fraud as a defense to paying any claims under the bonds. In October, 2002, the suits were consolidated for pretrial purposes with more than 35 other lawsuits involving similar claims in the United States District Court for the Northern District of Ohio, Eastern Division, under the Federal Multi-district Litigation (“MDL”) Rules.

The key defense of the Sureties in denying Sky Bank’s claims under the surety bonds is that they were fraudulently induced by the originator of the commercial leases to issue the surety bonds in the first instance. The Sureties have also asserted related defenses that the underlying equipment leases are invalid, usurious, or otherwise unenforceable. Sky Bank believes that none of these defenses can defeat Sky Bank’s claims under the surety bonds, which, in the view of Sky Bank, provide for absolute and unconditional guarantees of payment. Moreover, Sky Bank believes that the Sureties are responsible to Sky Bank, as the Obligee or Named Insured under the bonds, for the underwriting of the lessees and leases, including all issues of fraud, and that the Sureties waived any defense of fraud to claims under the bonds.

On January 31, 2003, Sky Bank and the other Claimants in the MDL Proceeding (MDL 02CV16000, Docket No. 1490) filed a consolidated Motion for Judgment on the Pleadings (the “Motion”) seeking a determination that the Sureties are liable, as a matter of law, under the relevant surety bonds and insurance policies. On August 19, 2005, the MDL Court issued two orders relating to the Motions. The first order granted the Motion with respect to Sky Bank’s insurance policies with IU, finding that the bank is the obligee under the contracts and that IU is precluded from asserting the defense of fraudulent inducement. The second order denied the banks Motion with respect to the surety bonds issued by Royal and RLI, indicating that the resolution of the claims requires examination of evidence beyond the limited materials the MDL Court is permitted to consider in the Motion.

On December 21, 2005, Sky sold and assigned to a third party, without recourse, all of its rights and interests in three loans secured by commercial lease pools and surety bonds issued by Royal. On January 24, 2006, in conjunction with mediation proceedings ordered by the MDL court, Sky and IU agreed to settle its litigation pertaining to two loans secured by pools of leases and insurance policies issued by IU. The aggregate principal balance of the three loans sold to a third party and the two loans, which were settled, was $14.2 million, and the aggregate proceeds received by Sky in the sale and settlement was $14.9 million. Sky considers the matter with Royal as concluded, and has no further litigation pending against Royal relating to these loans.

With respect to the remaining pool and the warehouse line of credit secured by surety bonds issued by RLI, which has a remaining principal balance of $15.4 million, Sky expects to proceed with amending its complaint and preparing for trial.

Sky Financial has reviewed the relevant matters of fact and law with its special counsel and believes that it has substantial and meritorious claims against the Sureties. Sky Financial has and will continue to vigorously assert all the rights and remedies available to it to obtain payment under the bonds. While the ultimate outcome of this matter cannot be determined at this time, Sky Financial management does not believe that the outcome of these pending legal proceedings will materially affect the consolidated financial position or results of operations of Sky Financial.

9

Item 4.Submission of Matters to a Vote of Security Holders

None

Executive Officers of the Registrant

The following table sets forth the names and ages and business experience of each of the executive officers of Sky Financial. Each executive officer of Sky Financial is appointed by the Board of Directors on an annual basis and serves at the pleasure of the Board.

| | | | | | |

Executive Officer | | Age | | Position With Company or Subsidiary and Experience | | Officer Since* |

| | | |

Marty E. Adams | | 53 | | Chairman, President and Chief Executive Officer of Sky Financial; formerly President and Chief Operating Officer of Sky Financial and President and Chief Executive Officer of Sky Bank. | | 1977 |

| | | |

Frank J. Koch | | 52 | | Executive Vice President and Senior Credit Officer of Sky Financial, and Senior Credit Officer of Sky Bank. | | 1988 |

| | | |

W. Granger Souder, Jr. | | 45 | | Executive Vice President, General Counsel and Secretary of Sky Financial and Secretary of Sky Bank. | | 1989 |

| | | |

Les Starr | | 54 | | Executive Vice President/Operations and Information Technology; formerly Senior Vice President and Director/Information Technology for Michigan National Bank. | | 2002 |

| | | |

Kevin T. Thompson | | 52 | | Executive Vice President and Chief Financial Officer of Sky Financial and Treasurer of Sky Bank. | | 1998 |

| | | |

Caren L. Cantrell | | 50 | | Division Executive Vice President and Chief Operations Officer; formerly Senior Vice President of Operations and Information Technology at Commercial Federal Bank; formerly Division EVP/Financial Services Operations of Sky Bank. | | 2005 |

| | | |

Perry C. Atwood | | 51 | | Senior Vice President, Director of Sales of Sky Financial; formerly Director of Sales of Sky Bank. | | 2000 |

| | | |

Phillip C. Clinard | | 56 | | Senior Vice President/Change Management Officer of Sky Financial; formerly Senior Vice President of Mid Am Bank. | | 1975 |

| | | |

Thomas A. Sciorilli | | 58 | | Chief Human Resources Officer of Sky Financial; formerly Senior Vice | | 2001 |

| | | | | President/Human Resources and Administration of Penn National Insurance. | | |

| | | |

Curtis E. Shepherd | | 40 | | Senior Vice President/Marketing and Product Development of Sky Financial; formerly Executive Vice President, Retail and Marketing of Sky Bank–Ohio Bank Region; formerly Senior Vice President of Marketing of Ohio Bank. | | 1997 |

| | | |

Richard R. Hollington III | | 42 | | Regional President, Greater Cleveland Region; formerly Executive Vice President, Chief Executive Officer of Sky Trust and Corporate Director of Financial Services; formerly Senior Vice President/Integration Manager of Sky Financial. | | 1996 |

| | | |

John S. Gulas | | 47 | | President and Chief Executive Officer of Sky Trust; formerly Executive Vice President with UMB Financial Corporation; formerly Regional Managing Director of First Union Corporation. | | 2005 |

| * | Includes period in which executive officer was an officer of a subsidiary or acquired company. |

10

PART II

Item 5.Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The information contained in Note 2 on page 41 and Note 18 “Stock Options” on page 56 of this Form 10-K is incorporated herein by reference in response to this item. There were no repurchases of shares of Sky Financial stock during the fourth quarter of 2005.

Quarterly Common Stock Prices, Dividends and Yields

| | | | | | | | | | | |

| | | High | | Low | | Book

Value per

Share | | Dividend

per

Share | | Dividend

Yield* | |

2005 | | | | | | | | | | | |

Fourth quarter | | $29.87 | | $26.05 | | $14.35 | | $0.23 | | 3.26 | % |

Third quarter | | 29.20 | | 27.38 | | 14.12 | | 0.22 | | 3.10 | |

Second quarter | | 29.06 | | 25.45 | | 13.97 | | 0.22 | | 3.19 | |

First quarter | | 28.95 | | 25.50 | | 13.31 | | 0.22 | | 3.17 | |

2004 | | | | | | | | | | | |

Fourth quarter | | $29.25 | | $24.90 | | $13.77 | | $0.22 | | 3.21 | % |

Third quarter | | 25.55 | | 23.13 | | 13.44 | | 0.21 | | 3.43 | |

Second quarter | | 26.23 | | 23.00 | | 11.13 | | 0.21 | | 3.40 | |

First quarter | | 27.81 | | 24.35 | | 11.46 | | 0.21 | | 3.16 | |

Stock Information at December 31, 2005

| | |

| | | Common Stock |

| |

Shares authorized | | 350,000,000 |

Shares issued | | 110,206,647 |

Treasury shares | | 1,899,046 |

Number of shareholders of record | | 20,599 |

Closing market price per share | | $27.82 |

Book value per share | | $14.35 |

Stock exchange | | NASDAQ |

Stock symbol | | SKYF |

* Calculated on average traded price for the quarter.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

| | | | | | | | |

| | | Total Number

of Shares

Purchased | | Average Price

Paid Per share | | Total Number of

Shares Purchased as

Part of Publicly

Announced Plans

or Programs* | | Maximum Number of Shares that

May Yet Be Purchased

Under the Plans or Programs |

February 1, 2005 - February 28, 2005 | | 998,300 | | $27.57 | | 998,300 | | 1,001,700 |

March 1, 2005 - March 31, 2005 | | 373,700 | | 27.46 | | 373,700 | | 628,000 |

April 1, 2005 - April 30, 2005 | | 538,500 | | 27.15 | | 538,500 | | 89,500 |

Total | | 1,910,500 | | $27.43 | | 1,910,500 | | – |

* During September 2004, the Board of Directors of Sky Financial Group, Inc. authorized the company to purchase up to two million shares of common stock in the open market for a period of twelve months.

Dividend Restrictions

Sky Financial is a legal entity separate and distinct from its subsidiary bank and other subsidiaries. Its principal source of funds to pay dividends on its common stock and service its debt is from dividends from its subsidiaries, primarily Sky Bank. Various federal and state statutory provisions and regulations limit the amount of dividends that Sky Bank may pay without regulatory approval. Dividends payable by a state chartered bank are limited to the lesser of the bank’s undivided profits and the bank’s retained net income for the current year plus its retained net income for the preceding two years (less any required transfers to capital surplus) up to the date of any dividend declaration in the current calendar year. As of December 31, 2005, $227,309 was available for distribution to Sky Financial as dividends without prior regulatory approval.

11

Item 6.Selected Financial Data

(Dollars and shares in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| December 31, | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Consolidated Statements of Income(1) | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 830,224 | | | $ | 661,943 | | | $ | 594,063 | | | $ | 576,397 | | | $ | 619,873 | |

Interest expense | | | 315,572 | | | | 210,632 | | | | 202,820 | | | | 235,162 | | | | 302,988 | |

Net interest income | | | 514,652 | | | | 451,311 | | | | 391,243 | | | | 341,235 | | | | 316,885 | |

Provision for credit losses | | | 52,249 | | | | 37,660 | | | | 34,125 | | | | 37,659 | | | | 27,384 | |

Net interest income after provision for credit losses | | | 426,403 | | | | 413,651 | | | | 357,118 | | | | 303,576 | | | | 289,501 | |

Non-interest income | | | 211,382 | | | | 203,417 | | | | 178,898 | | | | 147,984 | | | | 124,388 | |