UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

SKY FINANCIAL GROUP, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

[LOGO] Sky®

2006 Notice of Annual Meeting

and Proxy Statement

Sky Financial Group, Inc.

221 South Church Street

Bowling Green, Ohio 43402

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

March 6, 2006

To the Shareholders of Sky Financial Group, Inc.:

The Annual Meeting of Shareholders of Sky Financial Group, Inc. (the “Company”) will be held at the Cleveland Marriott East, 26300 Harvard Road, Warrensville Heights, Ohio, 44122, on April 19, 2006 at 10:00 a.m. (local time) for the purpose of considering and voting upon the following matters:

| | 1. | The election of five (5) Class II Directors to serve a three-year term until the Annual Meeting of Shareholders in 2009; and |

| | 2. | The transaction of such other business as may properly come before the meeting or any adjournment thereof. |

Shareholders of record at the close of business on February 21, 2006 are entitled to notice of and to vote at the Annual Meeting of Shareholders. The Proxy Statement and Annual Report of the Company, including financial statements for the year ended December 31, 2005, have been mailed to all shareholders with this Notice of Annual Meeting.

By Order of the Board of Directors,

W. Granger Souder, Jr.

Secretary

|

| |

| YOUR VOTE IS IMPORTANT. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED. |

Sky Financial Group, Inc.

221 South Church Street

Bowling Green, Ohio 43402

PROXY STATEMENT

GENERAL INFORMATION

The Board of Directors of Sky Financial Group, Inc. (the “Company”) is soliciting proxies to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on April 19, 2006, and any adjournments thereof.

The Company is a financial holding company headquartered in Bowling Green, Ohio. The mailing address of the principal executive offices of the Company is 221 S. Church Street, P.O. Box 428, Bowling Green, Ohio 43402, its telephone number is (419) 327-6300, and its website address is www.skyfi.com. Through its wholly-owned subsidiaries, the Company operates a commercial bank, a trust company and an insurance agency. Its market area includes Ohio, Pennsylvania, West Virginia, Michigan and Indiana.

Each of the 108,455,084 shares of common stock of the Company, without par value (“Common Stock”), outstanding on February 21, 2006, will be entitled to one vote on matters acted upon at the Annual Meeting, either in person or by proxy. The shares represented by all properly executed proxies sent to the Company or its designee will be voted as designated, and in the absence of instructions will be voted in the manner recommended by the Board of Directors of the Company. Any shareholder executing a proxy has the right to revoke it at any time prior to its exercise, by written notice delivered to the Secretary of the Company, by subsequently dated proxy or by voting in person at the Annual Meeting any time prior to its exercise.

All costs associated with the solicitation of proxies will be paid for by the Company. Proxies will be solicited primarily by mail, but certain officers and employees of the Company or its subsidiaries may personally solicit proxies without additional compensation. Banks, brokers and other holders of record will be asked to send proxies and proxy materials to the beneficial owners of Common Stock to obtain necessary voting instructions, and the Company will reimburse them for their reasonable expenses.

The proxy statement and form of proxy are first being mailed to shareholders on or about March 6, 2006.

PROPOSAL 1:

ELECTION OF DIRECTORS

Under the Code of Regulations of the Company, the Board of Directors is divided into three classes designated as Class I, Class II and Class III. Each class consists of approximately one-third of the total number of directors, as fixed from time to time by the Board of Directors. Directors serve staggered three-year terms so that directors of only one class are elected at each annual meeting of shareholders. As of the date of this Proxy Statement, no vacancies exist on the Company’s Board of Directors.

At the Annual Meeting, shareholders will be asked to elect five Class II Directors, as described below. If any of the Company’s nominees are unable to serve (which is not now contemplated), the proxies will be voted for such substitute nominee(s) as the Board of Directors recommends or the number of directors constituting the full Board of Directors may be reduced. In accordance with the Company’s

1

Code of Regulations and Ohio law, if a quorum is present at the Annual Meeting, the nominees for director who receive the greatest number of votes cast by the shares present in person or by proxy and entitled to vote at the Annual Meeting will be elected to serve as directors of the Company. Proxies will be voted in favor of the nominees named below or any substitutes unless otherwise instructed by the shareholder. Abstentions and shares of Common Stock not voted by brokers and other entities holding shares of Common Stock on behalf of beneficial owners will not affect the election of directors because such shares are not considered present for voting purposes.

Information as to Nominees

The following information is provided with respect to each nominee for election at the Annual Meeting. Each person listed below has been nominated for election to the Class and for the term indicated below. Nominations are made by the Board of Directors, upon the recommendation of the Governance and Nominating Committee of the Board. Unless otherwise indicated, the business experience and principal occupations indicated for each director has extended for five or more years.

Class II Directors—Term Expires 2009

| | |

Name, Age, and Certain Biographical Information | | Period of Service as a Director |

George N. Chandler II, 68 Retired Vice President, Cleveland-Cliffs, Inc., a producer of iron ore pellets and iron ore. Mr. Chandler is the uncle of Richard R. Hollington III, an executive officer of the Company. | | Director since 1998; Director of subsidiary or predecessor since 1997 |

| |

Robert C. Duvall, CPA, 63 Retired; formerly Vice President/Finance and Director of Wampum Hardware Co., an explosives distributor; formerly Director of Nobel Insurance LTD. | | Director since 1999; Director of subsidiary or predecessor since 1995 |

| |

D. James Hilliker, 58 Vice President, Better Food Systems, Inc., a company that owns and operates Wendy’s restaurant franchises. | | Director since 1998; Director of subsidiary or predecessor since 1995 |

| |

Gregory L. Ridler, 59 Retired Chairman, Mahoning Valley Region, Sky Bank; formerly President & CEO, Mahoning National Bank of Youngstown, which was acquired by the Company. | | Director since 1999; Director of subsidiary or predecessor since 1988 |

| |

Emerson J. Ross, Jr., 64 Retired Manager, Corporate Community Relations, Owens Corning, a manufacturer of building materials and composite products. | | Director since 1998; Director of subsidiary or predecessor since 1988 |

2

Information as to Directors Whose Terms of Office Continue

The following information is provided with respect to incumbent Class I and Class III Directors who are not nominees for election at the Annual Meeting. Unless otherwise indicated, the business experience and principal occupations indicated for each director has extended for five or more years.

Class I Directors—Term Expires 2008

| | |

Name, Age, and Certain Biographical Information | | Period of Service as a Director |

Marty E. Adams, 53 Chairman, President and CEO, Sky Financial Group, Inc. | | Director since 1998; Director of subsidiary or predecessor since 1984 |

| |

Jonathan A. Levy, 45 Partner, Redstone Investments, a real estate development, acquisition and management firm. Mr. Levy serves as the Company’s Lead Director. | | Director since 1999; Director of subsidiary or predecessor since 1996 |

| |

Thomas J. O’Shane, 58 Retired Senior Executive Vice President, Sky Financial Group, Inc.; formerly CEO of First Western Bancorp, Inc., which was acquired by the Company. | | Director since 1999; Director of subsidiary or predecessor since 1988 |

| |

C. Gregory Spangler, 65 Chairman, Spangler Candy Company, a manufacturer of candy products. | | Director since 1998; Director of subsidiary or predecessor since 1993 |

| |

Marylouise Fennell, RSM, 66 Partner, Higher Education Services, consultants to Presidents and Boards of Trustees of colleges and universities. | | Director since 2002; Director of subsidiary or predecessor since 1994 |

Class III Directors—Term Expires 2007

| | |

Name, Age, and Certain Biographical Information | | Period of Service as a Director |

Fred H. Johnson III, 44 President and CEO, Summitcrest, Inc., a company that operates Angus cattle farms. | | Director since 1998; Director of subsidiary or predecessor since 1987 |

| |

Gerard P. Mastroianni, 50 President, Alliance Ventures, a real estate holding company. | | Director since 1998; Director of subsidiary or predecessor since 1996 |

| |

Joseph N. Tosh II, 64 Retired Regional Chairman of Sky Bank, a subsidiary of the Company. | | Director since 1998; Director of subsidiary or predecessor since 1986 |

| |

R. John Wean, III, 57 Co-owner & President of Specialties la Cote Basque, a wholesale French bread bakery. Finance Committee, Grantmakers of Western Pennsylvania. | | Director since 2004; Director of subsidiary or predecessor since 1987 |

MEETINGS, COMMITTEES, COMPENSATION AND INDEPENDENCE

The Board of Directors of the Company held eleven regular meetings and one special meeting in 2005. Each incumbent director attended at least 75% of the aggregate of the total meetings of the Board of Directors and the total number of meetings held by all committees of the Board on which the directors served in 2005. The Board of Directors schedules regular executive sessions, at which management is not in attendance, following each regularly scheduled meeting of the Board. Although the Company does not have a formal policy with respect to Board member attendance at annual meetings of shareholders, each member is encouraged to attend. All Board members attended the 2005 annual meeting of shareholders.

3

To assist in carrying out its responsibilities, the Board of Directors has established five standing committees, which are described below:

Executive Committee

The members of the Executive Committee of the Board of Directors are Marty E. Adams, Gerard P. Mastroianni, Gregory L. Ridler, Emerson J. Ross, Jr., C. Gregory Spangler and Jonathan A. Levy, who serves as chairperson. The Executive Committee met four times in 2005. Under the terms of the Company’s Code of Regulations and the Executive Committee Charter, which are available on the Company’s website, the Executive Committee is authorized to act on behalf of the Board of Directors in the oversight of the business and affairs of the Company while the Board of Directors is not in session, subject to certain limitations.

Audit Committee

The Company has a standing Audit Committee as defined in Section 3(a)(58)(A) of the Securities and Exchange Act of 1934. The members of the Audit Committee of the Board of Directors are Robert C. Duvall, Fred H. Johnson III and C. Gregory Spangler, who serves as chairperson. The Audit Committee met nine times in 2005. Under the terms of the Audit Committee Charter, which is available on the Company’s website, the oversight functions of the Audit Committee include: (i) the appointment of the Company’s independent auditors; (ii) the review of the independent audit plan and the results of the auditing engagement; (iii) the review of the internal audit plan and results of the internal audits; (iv) the review of the adequacy of the Company’s financial reporting procedures; and (v) the review of the adequacy of the Company’s system of internal control. The Company’s securities are listed on the NASDAQ National Market, and all members of the Audit Committee have been deemed by the Board of Directors to meet the independence standards of Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. and Rule 10A-3 of the Securities Exchange Act. The Board of Directors has determined that Mr. Duvall, an independent director and licensed CPA, satisfies the requirements of a “Financial Expert” as defined in Item 401(h)(2) of Regulation S-K and satisfies the definition of “financially sophisticated” under Rule 4350(d) of the National Association of Securities Dealers, Inc.

Risk Management Committee

The members of the Risk Management Committee of the Board of Directors are George N. Chandler II, Thomas J. O’Shane and Gregory L. Ridler, who serves as chairperson. The Risk Management Committee met seven times in 2005. Under the terms of the Risk Management Committee Charter, which is available on the Company’s website, the Risk Management Committee is responsible for reviewing the adequacy of systems and procedures controlling risk throughout the Company and its subsidiaries, including credit risk, liquidity risk, market risk, legal risk, reputation risk and operational risk.

Governance and Nominating Committee

The members of the Governance and Nominating Committee of the Board of Directors are Joseph N. Tosh II, R. John Wean III and Emerson J. Ross, Jr., who serves as chairperson. The Governance and Nominating Committee met seven times in 2005. Under the terms of the Governance and Nominating Committee Charter, which is available on the Company’s website, the Committee is responsible for making independent recommendations to the Board of Directors as to best practices for Board governance, evaluation of Board performance and succession planning. The Committee further serves as the Company’s nominating committee, and is responsible for developing and implementing a process and guidelines for the selection of individuals for nomination to the Board of Directors and considering incumbent directors for nomination for re-election. The Governance and Nominating Committee considers shareholder nominations for directors in accordance with procedures contained in the Company’s Code of Regulations. The Board of Directors of the Company has determined that each member of the Governance and Nominating Committee meets the independence standards of Rule 4200(a)(15) of the National Association of Securities Dealers, Inc.

4

Process for Selection and Nomination of Directors

The Governance and Nominating Committee is responsible for the selection of the final slate of nominees for election to the Board of Directors. Those nominees recommended by the Committee are then submitted to the Board of Directors for approval. In making its annual recommendation, the Governance and Nominating Committee determines the appropriate qualifications, skills and characteristics necessary for the Board of Directors in the context of the strategic direction of the Company. Current directors are annually assessed through a Board self-assessment and peer evaluation process. The results of the assessment are used to determine Board member effectiveness, including whether to consider a member for re-nomination. In making its recommendations and selections, the Committee considers a variety of factors, including the candidate’s integrity, independence, qualifications, skills, experience (including experiences in finance and banking), familiarity with accounting rules and practices, and compatibility with existing members of the Board. Other than the foregoing, there are no stated minimum criteria for nominees, although the Committee may consider such other factors as it may deem are in the best interest of the Company and its shareholders, which may change from time-to-time. The Committee will consider candidates for nomination as a director, which are recommended by shareholders, directors and other sources, including the community and the Company’s subsidiary and regional boards. The Committee has the prerogative to employ and pay third-party search firms. For more information regarding the process for shareholders to nominate directors, see “Shareholder Nominations, Proposals and Communications – Shareholder Nominations.”

Compensation Committee

The members of the Compensation Committee of the Board of Directors are Marylouise Fennell, D. James Hilliker, and Gerard P. Mastroianni, who serves as chairperson. The Compensation Committee met six times in 2005. Under the terms of the Compensation Committee Charter, which is available on the Company’s website, the Compensation Committee is responsible for the oversight and administration of the compensation and benefit plans of the Company and its subsidiaries. The Compensation Committee oversees (i) the Company’s compensation strategy, policies and programs; (ii) the compensation levels of directors and executive management; and (iii) administration of the Company’s employee benefit plans. The Board of Directors of the Company has determined that each member of the Compensation Committee meets the independence standards of Rule 4200(a)(15) of the National Association of Securities Dealers, Inc.

Compensation Committee Interlocks and Insider Participation

Members of the Compensation Committee, or their associates, were clients of or had transactions with the Company or the Company’s banking or other subsidiaries in the ordinary course of business during 2005, and additional transactions may be expected to take place in the future. All outstanding loans to directors and their associates were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral where applicable, as those prevailing at the time for comparable transactions with other persons, and did not involve more than normal risk of collectibility.

Compensation of Directors

Each director of the Company receives an annual cash retainer of $12,600. In addition, non-employee directors receive a fee of $1,050 for each Board of Directors meeting attended ($525 for teleconference meetings) and a fee of $1,000 for each committee meeting attended ($500 for teleconference meetings). Committee chairpersons receive an additional fee of $600 for each committee meeting attended ($300 for teleconference meetings). In 2005, each non-employee director was granted a long-term equity award comprised of a mix of stock options and restricted stock under the 2002 Stock Option and Stock

5

Appreciation Rights Plan and the 2004 Restricted Stock Plan. The 2005 grant and award permitted the director to elect to receive one of the three alternatives detailed below:

| | | | | | | | | | | | | | | | | | |

| | | Directors | | Committee Chairpersons | | Lead Director |

Elective Alternative | | 1 | | 2 | | 3 | | 1 | | 2 | | 3 | | 1 | | 2 | | 3 |

Stock Options | | 7,500 | | 5,000 | | 2,500 | | 7,950 | | 5,300 | | 2,650 | | 13,950 | | 9,300 | | 4,650 |

Restricted Stock | | 500 | | 1,000 | | 1,500 | | 530 | | 1,060 | | 1,590 | | 930 | | 1,860 | | 2,790 |

Independence of Directors

The Company’s Governance and Nominating Committee has established criteria for the determination of the independence of members of the Board of Directors and its committees. The Committee has utilized the definitional criteria of the National Association of Securities Dealers, Inc. and the Securities and Exchange Commission in their respective rulemakings promulgated under certain provisions of the Sarbanes Oxley Act of 2002. The Board of Directors of the Company has determined that a majority of the members of the Board are “independent” and that the membership of the Audit, Compensation and Governance Committees is comprised solely of “independent” directors. Directors deemed independent by the Board include directors: Chandler, Duvall, Fennell, Hilliker, Johnson, Levy, Mastroianni, Ridler, Ross, Spangler, Tosh and Wean.

6

BENEFICIAL OWNERSHIP OF THE COMPANY’S COMMON STOCK

Generally, under the rules of the Securities and Exchange Commission, a person is deemed to be the beneficial owner of a security with respect to which such person, through any contract, arrangement, understanding, relationship or otherwise, has or shares voting power (which includes power to vote or direct the voting of, such security) or investment power (which includes power to dispose of or direct the disposition of such security). In addition, a person is deemed to be the beneficial owner of a security if he or she has the right to acquire such voting or investment power over the security within 60 days, for example, through the exercise of a stock option.

The following table shows the beneficial ownership of the Company’s common stock as of December 31, 2005, by (i) each person who is the beneficial owner of more than five percent of the outstanding shares of the Company’s common stock; (ii) each director of the Company; (iii) each executive officer named in the Summary Compensation Table and (iv) all directors and named executive officers as a group.

| | | | | | |

Five Percent Holders | | Amount and Nature of Beneficial Ownership as of December 31, 2005(1), (2) | | | Percent of Class (if 1% or Greater) | |

Sky Trust, National Association | | 8,850,061 | (3) | | 8.79 | % |

30050 Chagrin Blvd. | | | | | | |

Suite 150 | | | | | | |

Pepper Pike, Ohio 44124 | | | | | | |

| | |

Ariel Capital Management, L.L.C. | | 7,999,484 | | | 7.26 | % |

200 E. Randolf Drive | | | | | | |

Chicago, Illinois 60601 | | | | | | |

| | |

Directors and Named Executive Officers | | | | | | |

Marty E. Adams | | 754,386 | | | | |

George N. Chandler II | | 689,357 | (4) | | | |

Robert C. Duvall | | 153,039 | | | | |

Marylouise Fennell | | 21,853 | | | | |

D. James Hilliker | | 162,703 | | | | |

Fred H. Johnson III | | 222,390 | | | | |

Frank J. Koch | | 101,243 | | | | |

Jonathan A. Levy | | 130,783 | | | | |

Gerard P. Mastroianni | | 109,399 | | | | |

Thomas J. O’Shane | | 265,257 | | | | |

Gregory L. Ridler | | 100,587 | | | | |

Emerson J. Ross, Jr. | | 83,304 | | | | |

W. Granger Souder, Jr. | | 106,808 | | | | |

C. Gregory Spangler | | 95,078 | | | | |

Les V. Starr | | 16,683 | | | | |

Kevin T. Thompson | | 128,130 | | | | |

Joseph N. Tosh II | | 322,688 | (5) | | | |

R. John Wean III | | 16,919 | | | | |

All directors and executive officers as a group | | 3,480,605 | | | 3.16 | % |

| (1) | Includes shares held in the name of spouses, minor children, certain relatives, trusts, estates and certain affiliated companies as to which beneficial ownership may be disclaimed. |

7

| (2) | The amounts shown represent the total shares owned outright by such individuals, shares issuable upon the exercise of currently vested but unexercised stock options, and shares of Restricted Stock. Specifically, vested but unexercised options entitle the following individuals to acquire the indicated number of shares: Mr. Adams, 540,138; Mr. Chandler, 49,703; Mr. Duvall, 63,336; Ms. Fennell, 18,500; Mr. Hilliker, 73,147; Mr. Johnson, 51,821; Mr. Koch, 83,432; Mr. Levy, 88,416; Mr. Mastroianni, 74,737; Mr. O’Shane, 155,486; Mr. Ridler, 56,239; Mr. Ross, 58,467; Mr. Souder, 87,604; Mr. Spangler, 75,168; Mr. Starr, 15,240; Mr. Thompson, 109,134; Mr. Tosh, 73,507; Mr. Wean, 5,000; and all directors and named executive officers as a group, 1,679,075. Furthermore, the amounts shown reflect unvested shares of Restricted Stock, to which the holders are entitled to dividend and voting rights, in the following amounts: Mr. Adams, 23,250; Mr. Chandler, 500; Mr. Duvall, 500; Ms. Fennell, 1,500; Mr. Hilliker, 1,000; Mr. Johnson, 500; Mr. Koch, 780; Mr. Levy, 930; Mr. Mastroianni, 530; Mr. O’Shane, 500; Mr. Ridler, 1,060; Mr. Ross, 1,590; Mr. Souder, 2,340; Mr. Spangler, 1,060; Mr. Starr, 780; Mr. Thompson, 2,190; Mr. Tosh, 1,000; Mr. Wean, 1,000; and all directors and named executive officers as a group, 41,010. |

| (3) | Sky Trust, National Association, the Company’s trust company subsidiary, was deemed beneficial owner of portions of the referenced number of shares based upon its sole or shared voting or investment power over the shares. Sky Trust holds the shares solely in a fiduciary or custodial capacity under numerous trust relationships, none of which represents more than five percent of the Company’s outstanding shares. The Company disclaims beneficial ownership of the shares that may be deemed to be beneficially owned by Sky Trust. |

| (4) | The number of shares of common stock shown as beneficially owned by Mr. Chandler includes 1,700 shares owned by his wife, for which Mr. Chandler disclaims beneficial ownership. |

| (5) | The number of shares of common stock shown as beneficially owned by Mr. Tosh includes 53,871 shares owned by a trust, for which Mr. Tosh disclaims beneficial ownership. |

8

EXECUTIVE COMPENSATION

The following table is a summary of certain compensation awarded, paid to, or earned by the Company’s chief executive officer and its other four most highly compensated executive officers (the “Named Executives”).

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long Term Compensation | | |

Name/Title | | Year | | Salary | | Bonus | | Restricted

Stock

Awards (1) | | Securities

Underlying

Options/SARs | | All Other

Compensation (2) |

Marty E. Adams | | 2005 | | $ | 760,251 | | $ | 193,863 | | 23,250 | | 38,750 | | $137,000 |

Chairman, President and CEO | | 2004 | | | 720,741 | | | 603,115 | | | | 133,000 | | 157,494 |

Sky Financial Group, Inc. | | 2003 | | | 691,417 | | | 488,314 | | | | 75,000 | | 144,212 |

| | | | | | |

Kevin T. Thompson | | 2005 | | $ | 279,474 | | $ | 75,093 | | 2,190 | | 10,950 | | $ 47,076 |

EVP, Chief Financial Officer | | 2004 | | | 258,280 | | | 172,802 | | | | 21,900 | | 50,886 |

Sky Financial Group, Inc. | | 2003 | | | 247,342 | | | 139,748 | | | | 21,900 | | 47,645 |

| | | | | | |

Frank J. Koch | | 2005 | | $ | 227,154 | | $ | 10,093 | | 780 | | 11,700 | | $ 38,338 |

EVP, Senior Credit Officer | | 2004 | | | 217,763 | | | 90,590 | | | | 15,600 | | 35,727 |

Sky Financial Group, Inc. | | 2003 | | | 209,800 | | | 97,347 | | | | 15,600 | | 39,175 |

| | | | | | |

W. Granger Souder, Jr. | | 2005 | | $ | 219,834 | | $ | 55,094 | | 2,340 | | 3,900 | | $ 37,123 |

EVP, General Counsel & Secretary Sky Financial Group, Inc. | | 2004

2003 | |

| 209,067

201,422 | |

| 123,663

109,171 | | | | 15,600

15,600 | | 38,644

37,441 |

| | | | | | |

Les V. Starr | | 2005 | | $ | 209,477 | | $ | 41,993 | | 780 | | 11,700 | | $ 35,541 |

EVP, Operations and Information Technology Sky Financial Group, Inc. | | 2004

2003 | |

| 199,140

191,410 | |

| 85,233

100,681 | | | | 15,600

15,600 | | 31,544

33,930 |

| (1) | Restricted Stock awards under the 2004 Restricted Stock Plan vest over five years in the following increments: 40% on the second anniversary of the award date, and an additional 20% on each successive anniversary of the award date. Dividends are paid on shares of unvested and vested Restricted Stock. The aggregate numbers of shares of Restricted Stock held by each of the Named Executives at December 31, 2005 (and the aggregate value thereof, assuming fully vested as of that date) are as follows: Mr. Adams, 23,250 shares ($646,815); Mr. Thompson, 2,190 shares ($60,925); Mr. Koch, 780 shares ($21,700); Mr. Souder, 2,340 shares ($65,099); and Mr. Starr, 780 shares ($21,700). |

| (2) | In 2005, All Other Compensation for Messrs. Adams, Thompson, Koch, Souder and Starr consists of contributions under the Company’s ESOP Pension Plan, Profit Sharing Plan and 401(k) Plan ($24,150 for each of the Named Executives). Also included are amounts accrued under the Company’s supplemental retirement plan (Mr. Adams, $109,280; Mr. Thompson, $21,188; Mr. Koch, $12,401; Mr. Souder, $11,913; and Mr. Starr, $9,753); group term life insurance or bank-owned life insurance premiums paid by the Company (Mr. Adams, $2,692; Mr. Thompson, $909; Mr. Koch, $1,117; Mr. Souder, $412; and Mr. Starr, $1,020); dividends paid on unvested restricted stock (Mr. Adams, $15,345; Mr. Thompson, $1,445; Mr. Koch, $515; Mr. Souder; $1,544; and Mr. Starr, $515); and premiums for long-term disability insurance (Mr. Adams, $878; Mr. Thompson, $829; Mr. Koch, $669; Mr. Souder, $648; and Mr. Starr, $618). |

9

Stock Options

The following table sets forth information concerning 2005 grants to the Named Executives of options to purchase common stock under the Company’s Amended and Restated 1998 Stock Option Plan for Directors and the 1998 Stock Option Plan for Employees.

Option/SAR Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Individual Grants | | | | Potential Realizable Value at Assumed Rates of Stock Price Appreciation for Option Term (1) |

| | | Number of Securities Underlying Options Granted (2) | | % of Total Options Granted to Employees in Fiscal Year | | | Exercise Price Per Share | | Expiration Date | |

Name | | | | | | 5% | | 10% |

Marty E. Adams | | 38,750 | | 6.18 | % | | $ | 27.80 | | 2/16/15 | | $ | 677,477 | | $ | 1,716,859 |

Kevin T. Thompson | | 10,950 | | 1.75 | | | | 27.80 | | 2/16/15 | | | 191,442 | | | 485,151 |

Frank J. Koch | | 11,700 | | 1.87 | | | | 27.80 | | 2/16/15 | | | 204,554 | | | 518,381 |

W. Granger Souder, Jr. | | 3,900 | | 0.62 | | | | 27.80 | | 2/16/15 | | | 68,185 | | | 172,794 |

Les V. Starr | | 11,700 | | 1.87 | | | | 27.80 | | 2/16/15 | | | 204,554 | | | 518,381 |

| (1) | The dollar amounts under these columns are the result of calculations at the 5% and 10% rates set by the Securities and Exchange Commission and are not intended to forecast possible future appreciation, if any, in the market value of the common stock. |

| (2) | Options were granted as 2005 compensation under the Company’s Amended and Restated 1998 Stock Option Plan for Directors (Mr. Adams), 1998 Stock Option Plan for Employees (Mr. Thompson, Mr. Koch, Mr. Souder and Mr. Starr) on February 16, 2005. Options Granted to Mr. Adams under the Directors Plan vested fully on the grant date, whereas options granted to Mr. Thompson, Mr. Koch, Mr. Souder and Mr. Starr vest over five years in the following increments: 40% on the second anniversary of the grant date and an additional 20% on each successive anniversary of the grant date. The option exercise price is not adjustable except for stock splits, stock dividends and similar occurrences affecting all outstanding shares. |

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values

| | | | | | | | | | | | |

| | | Shares Acquired on Exercise(#) | | Value Realized($) | | Number of Securities Underlying Unexercised Options/SARs at 12/31/05 | | Value of Unexercised In-the- Money Options/SARS at 12/31/05 |

Name | | | | Exercisable(#) | | Unexercisable(#) | | Exercisable($) | | Unexercisable($) |

Marty E. Adams | | 0 | | 0 | | 540,138 | | 0 | | 3,290,365 | | 0 |

Kevin T. Thompson | | 0 | | 0 | | 109,134 | | 58,250 | | 877,620 | | 246,883 |

Frank J. Koch | | 0 | | 0 | | 83,432 | | 45,402 | | 692,296 | | 176,071 |

W. Granger Souder, Jr. | | 2,229 | | 33,586 | | 87,604 | | 37,602 | | 765,941 | | 175,915 |

Les V. Starr | | 0 | | 0 | | 15,240 | | 42,660 | | 99,690 | | 145,266 |

10

Employment Contracts

Employment agreements are in effect between the Company and each of the Executives identified in the Summary Compensation Table.

The Company entered into an employment agreement with Mr. Adams on March 1, 2004 in replacement of an employment agreement from 1998. The agreement is for an initial three-year term and automatically renews for an additional one year upon each anniversary of the agreement commencing with the first such anniversary, unless either party gives the other advance notice that it does not intend to renew the agreement. The agreement provides for an initial base salary of $725,000 for Mr. Adams, which may not be reduced during the term of the agreement. Mr. Adams is eligible to receive an annual target bonus under the Company’s management incentive program equal to at least 50% of such base salary. The agreement also provides for long-term incentive equity-based compensation equal to at least 50% of such base salary. Long-term incentive equity-based compensation in excess of that level shall vary based upon the Company’s and Mr. Adams’ annual performance. The agreement also provides for the participation in certain benefit plans and programs on a basis no less favorable than any other senior executive of the Company.

The agreement provides that, in the event of termination of employment for any reason, the Company shall pay Mr. Adams in lump sum an amount equal to the unpaid base salary, any short term and long term incentive compensation payable and any benefit payments due Mr. Adams through the date of termination. The agreement also provides for the payment upon the executive’s termination for any reason other than for “cause” or without “good reason” (each as defined in the agreement), of an amount equal to the targeted annual bonus prorated for the remainder of the year in which termination occurs.

In addition to those payments, in the event that Mr. Adams’ employment is terminated either prior to or after two years following a “change in control” of the Company (as defined in the agreement), either by the Company without “cause” or by the executive for “good reason,” the Company shall pay Mr. Adams an amount equal to the greater of (i) the sum of Mr. Adams’ annual base salary plus targeted annual bonus (“Annual Cash Compensation”) multiplied by the number of whole and partial years remaining in the employment term as it existed immediately preceding termination, or (ii) three times Annual Cash Compensation. Welfare benefit continuation will be provided for the remainder of the term, or if longer, three years. If such termination occurs during the two-year period following a “change in control,” Mr. Adams would receive the greater of the termination payment described above, or three times the sum of (x) his highest annual rate of base salary, (y) his highest supplemental matching contributions and (z) his highest annual bonus and long-term compensation paid or awarded during the three-year period immediately prior to the date of termination, and continued welfare benefits for the longer of three years or the remaining period of the term as it existed immediately prior to termination. Upon any such termination, all stock options granted after the effective time shall vest and become immediately exercisable in full.

If any payments pursuant to the agreement or otherwise would be subject to any excise tax under the Internal Revenue Code, the Company will provide an additional payment such that the executive retains a net amount equal to the payments he would have retained if such excise tax had not applied.

The agreement contains a covenant not to compete and related provisions that restrict Mr. Adams’ ability to compete with the Company during the term of the agreement and for a period of one year following termination under certain circumstances.

Citizens Bancshares, Inc., the Company’s predecessor, entered into an employment agreement with Mr. Koch, which was assumed by the Company as a result of the 1998 merger that formed Sky Financial.

11

The agreement is automatically extended for additional two-year periods on each anniversary of the agreement, unless the Company gives notice of non-renewal. The agreement provides for a base salary at least equal to the annual salary paid in the preceding year, a bonus at the discretion of the Company, and participation in the Company’s profit sharing, health and welfare plans on a basis consistent with other Company executives. In the event of the termination of the executive’s employment by the Company without “cause” (as defined in the agreement), the officer is entitled to the continuation of base salary and discretionary bonus compensation for the remainder of the term of the agreement, in addition to the continuation of participation in the Company’s profit sharing and health and welfare benefit plans on a basis consistent with other Company executives for the remainder of the term. The agreement further contains non-competition and confidentiality provisions.

The Company has entered into employment agreements with Messrs. Thompson, Souder and Starr, which are identical in all material respects. The agreements provide for at-will employment with no specified term. They provide for a specified minimum base salary, which may not be reduced during the period of employment, and for incentive compensation, benefits and perquisites consistent with those to which similarly situated officers are entitled under the Company’s benefit plans. In the event of the termination of the executive officers’ employment without “cause” or for “good reason” (each as defined in the agreements), the officer is entitled to payments equal to the sum of: (i) 18 months of base salary; (ii) the targeted level of incentive compensation; (iii) 18 months of health benefits; and (iv) outplacement services. In the event of the termination of the executive officers’ employment “without cause” or for “good reason” (each as defined in the agreements) within six months of a “Change in Control” of the Company, the officer is entitled to payments equal to the sum of: (i) 2.99 times the base salary; (ii) 2.99 times the targeted level of incentive compensation; (iii) 18 months of health benefits; and (iv) outplacement services. The agreements further contain non-competition and confidentiality provisions.

12

COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is comprised of three independent directors who are not eligible to participate in management compensation programs. The Board of Directors has delegated to the Committee responsibility for the oversight and administration of all compensation and benefit plans of the Company. The Committee utilized independent compensation consulting firms to advise the Company on matters of short-term and long-term compensation for 2005.

Compensation Policies

The Committee has adopted a performance-driven compensation philosophy, which seeks to directly link pay to individual results as well as contributions toward team and organizational results. Organizational results are measured in terms of achieving both current and long-term strategic objectives, as established by the Board of Directors from time to time. The intended result of this linkage is the alignment of management’s interests with those of the Company’s shareholders.

The Company’s compensation program includes three core components: base salary, annual cash incentive, and long-term incentive compensation. The Committee manages all three components on an integrated basis to achieve the following objectives: to attract and retain highly qualified management; to provide short-term incentive compensation that varies directly with the Company’s financial performance; and to link long-term compensation directly with long-term stock price performance.

Base Salary

Base salaries for executive management are established annually by the Committee. The Committee also considers the recommendations of the chief executive officer as to the parameters for annual salary adjustments for all employees, to assure that salaries are competitively established. Salary ranges are determined for each executive position, based upon peer group survey data comprised of reasonably comparable financial services holding companies. For 2005, the Committee considered, among other things, its objective of targeting executive management base salaries at the 50th percentile of the salary range for the specific position, adjusted for individual performance.

Annual Incentive Compensation

Corporate-wide incentive compensation awards play a key role in implementing the Company’s strategy of attracting and retaining qualified executive officers by rewarding quality performance. The Company’s annual cash incentive compensation is based on the Company’s short-term performance as measured by certain financial ratios tied to the Company’s strategic objectives. Specifically, rewards under the plan are tied to four key performance measures: client service quality; balance sheet quality/risk management; profitability; and growth. These measures may relate to the Company’s consolidated results or the results of a subsidiary, region or departmental group. The relative weighting of each measurement criteria is weighted for each plan participant depending upon the participant’s position and ability to affect the financial performance of the Company or the participant’s subsidiary. For each category, the Company establishes a “Threshold” point, below which no incentive compensation is paid, a “Target” point, which represents the achievement of budgeted financial performance, and a “Maximum” point, which represents the highest level of payout for each measurement category. Linkage exists between performance measures, inasmuch as performance below the Threshold point for any category will reduce the aggregate incentive payout in other categories. Incentive compensation for each of the Executive Officers identified in the Summary Compensation Table is weighted to include factors such as corporate earnings per share and credit quality ratios.

The range of awards under the incentive plan is determined on the basis of the participant’s level of responsibility and are paid as a function of the participant’s base salary. For 2005, Target and Maximum

13

bonus percentages for Mr. Adams were 50% and 100% of base salary, respectively. Target and Maximum bonus percentages for Messrs. Thompson, Koch, Souder and Starr were 40% and 80% of base salary, respectively, for 2005.

Long-Term Incentive Compensation

The Committee considers long-term, stock-based compensation as an essential tool in aligning the interests of management with that of the Company’s shareholders. Tools available to the Committee to encourage executive officers to manage the Company in a manner that would increase long-term shareholder value include the 1998 Stock Option Plan (the “1998 Plan”), the 2002 Stock Option and Stock Appreciation Rights Plan (the “2002 Plan”) and the 2004 Restricted Stock Plan (the “2004 Plan”). In its evaluation of the appropriate level of long-term stock-based compensation, the Committee considers industry peer group data, the Company’s prior long-term incentive compensation practice and the level of stock options and restricted stock outstanding relative to the number of shares of the Company’s common stock outstanding. Options granted under the 2002 Plan are non-qualified stock options, are granted at an exercise price of 100% of the common stock’s market value on the grant date, vest in increments over five years and will generally expire 10 years from the date of grant unless the optionee no longer serves as an employee or director of the Company or a subsidiary. Awards of restricted stock under the 2004 Plan similarly vest in increments over five years and are subject to certain transferability and forfeiture restrictions. Options are granted and restricted stock is awarded by the Board of Directors, at the recommendation of the Committee, using the Black-Scholes option valuation model, and the Committee takes into consideration other factors such as dilution, the number of shares of the Company’s common stock outstanding, the number of stock options and shares of restricted stock remaining under the respective plans, the Company’s financial performance and the officer’s individual performance. In 2005, the Committee decided to provide senior officers with a choice to elect the mix of stock options and restricted stock, to account for variances in time horizons and investment objectives amongst the Company’s officers. In establishing the election methodology, the Committee set the stock option value at 20% of the value of restricted stock, based in part upon the Black-Scholes option valuation model. Officers were entitled to elect a mix of stock options and restricted stock, with no less than 25% of the value of the aggregate grant in either stock options or restricted stock.

Other long-term compensation includes Company contributions under the Profit Sharing, 401(k) and Employee Stock Ownership Pension Plan (ESOP), which represents the Company’s qualified retirement plan. SERP contributions are made to the Company’s Non-Qualified Retirement Plan to the extent that contributions to the qualified plan are limited. At the discretion of the Board of Directors, Profit Sharing Plan contributions are made by the Company if corporate earnings targets established by the Company are achieved. Contributions under the ESOP are a function of annual cash compensation and are invested in the Company’s common stock. The Company also provides safe harbor matching contributions under its 401(k) Plan.

Chief Executive Officer’s Compensation

The Committee established Mr. Adams’ base salary for 2005 at $767,000, to be effective March 1, 2005, after considering factors such as the Company’s financial performance (as measured by return on average shareholders’ equity, net interest margin, balance sheet growth, credit quality and earnings per share), the achievement of the Company’s strategic objectives and comparative compensation data. Using similar criteria, the Committee established Mr. Adams’ annual cash incentive opportunity at a range of 50% to 100% of base salary, based upon weighted criteria of earnings per share (55%), demand deposit growth (15%), loan growth (10%), asset quality (10%), and services per household (10%). Mr. Adams’ 2005 annual cash incentive payout was $193,863. Taking into account the long term stock-based equity compensation mix election of Mr. Adams, the Committee granted to Mr. Adams a non-qualified stock option under the 1998 Plan to acquire 38,750 shares of Company common stock at $27.80, the market

14

price as of February 16, 2005, the date of grant, and an award of 23,250 shares of restricted stock under the 2004 Plan. The salary, incentive and long-term compensation levels established by the Committee for Mr. Adams represent the Committee’s satisfaction with Mr. Adams’ performance in the leadership of the Company and the effective discharge of his duties as chairman, president and chief executive officer.

Respectfully submitted,

The Compensation Committee

Gerard P. Mastroianni, Chairperson

D. James Hilliker

Marylouise Fennell

15

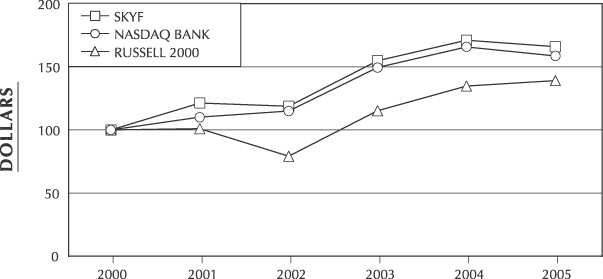

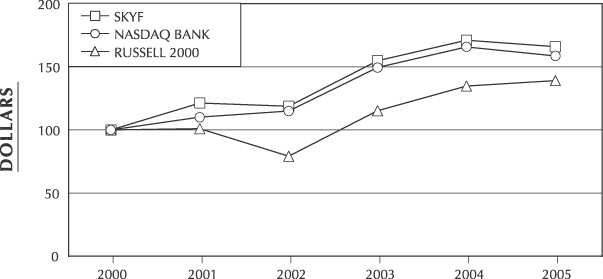

PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total shareholder returns for the Company, the NASDAQ Bank Index, and the Russell 2000 Index for the five-year period ended December 31, 2005. The total shareholder return assumes a $100 investment in the common stock of the Company and each index on December 31, 2000, and assumes that all dividends were reinvested.

CERTAIN TRANSACTIONS AND RELATIONSHIPS

Directors and executive officers of the Company and their associates were clients of, or had transactions with, the Company or the Company’s banking or other subsidiaries in the ordinary course of business during 2005. Additional transactions may be expected to take place in the future. All outstanding loans to directors and executive officers and their associates were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral where applicable, as those prevailing at the time for comparable transactions with other persons, and did not involve more than normal risk of collectibility or present other unfavorable features.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934, members of the Board of Directors, certain executive officers of the Company and its subsidiaries and holders of more than 10% of the Company’s common stock file periodic reports with the Securities and Exchange Commission disclosing their beneficial ownership of common stock. During 2005, and based solely upon a review of such reports, the Company believes that all filing requirements under Section 16(a) were complied with on a timely basis.

16

AUDITORS

During 2005, the Company engaged Deloitte & Touche LLP (“Deloitte & Touche”) to provide independent audit services for the Company and its subsidiaries. Pursuant to the recommendation of the Audit Committee, the Board of Directors has retained Deloitte & Touche as its independent auditors for 2006. Representatives of Deloitte & Touche will be in attendance at the Annual Meeting, and such representatives will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The audit reports issued to the Company by Deloitte & Touche for 2005 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty or audit scope. Moreover, there were no disagreements between the Company and Deloitte & Touche on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to Deloitte & Touche’s satisfaction, would have caused Deloitte & Touche to make reference to the subject matter of the disagreement in connection with its reports on the Company’s consolidated financial statements.

17

AUDIT COMMITTEE REPORT

The Company’s Audit Committee has reviewed and discussed with management the audited financial statements of the Company for the year ended December 31, 2005. In addition, the Committee has discussed with Deloitte & Touche, the independent registered public auditing firm for the Company, the matters required by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, and Rule 2-07,Communication with Audit Committees, of Regulation S-X.

The Committee also has received the written disclosures from Deloitte & Touche required by Independence Standards Board Standard No. 1, and have discussed with Deloitte & Touche its independence from the Company.

Based on the foregoing discussions and reviews, the Committee has recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission.

In accordance with rules related to auditor independence, the table below sets forth the aggregate fees billed by Deloitte & Touche for services rendered to the Company and its affiliates during 2004 and 2005.

| | | | | | |

| | | 2004 | | 2005 |

Audit Fees | | $ | 781,368 | | $ | 834,317 |

Audit-Related Fees (1) | | | 166,480 | | | 143,782 |

Tax Fees | | | 45,490 | | | 22,449 |

All Other Fees (2) | | | 0 | | | 0 |

| | (1) | Audit-Related services provided by Deloitte & Touche in 2005 included: SAS 70 service auditors report; audits of common trust funds; audits of employee benefit plans; and other accounting consultations. |

| | (2) | No Other Fees were paid to Deloitte & Touche in 2004 or 2005. |

The Committee has reviewed the services provided by Deloitte & Touche and has considered the compatibility of such services with maintaining the auditors’ independence. The Company did not retain Deloitte & Touche in 2005 for internal audit services or information technology consulting services relating to financial information systems design and implementation.

In accordance with the requirements of the Audit Committee Charter, the Committee has established written procedures for the pre-approval of all services provided by the Company’s independent auditor. The procedures identify specific permitted audit services, other permitted services and prohibited services. All services provided by the Company’s independent auditor must be approved in advance by the Audit Committee or a designated member of the Audit Committee. During 2005, approximately 2.2% of the total fees paid to Deloitte & Touche related to non-audit services approved by the Audit Committee pursuant to Rule 2-01(c)(7) of Regulation S-X.

Respectfully submitted,

The Audit Committee

C. Gregory Spangler, Chairperson

Robert C. Duvall

Fred H. Johnson III

18

SHAREHOLDER NOMINATIONS, PROPOSALS AND COMMUNICATIONS

Shareholder Nominations

Under its Process for Selection and Nomination, the Governance and Nominating Committee of the Board will consider recommendations for nominations received by shareholders in accordance with the Company’s Code of Regulations. Shareholder recommendations for nomination should be submitted in writing to the Company at its principal office in Bowling Green, Ohio, and must include the shareholder’s name, address and the number of shares of the Company owned by the shareholder. The recommendation must be provided to the Company in writing not less than 60 nor more than 90 days prior to the meeting; provided, however, that if less than 75 days notice or prior public disclosure of the date of the meeting is given to shareholders, notice by the shareholder must be received not later than the close of business on the fifteenth day following the earlier of the day on which such notice of the date of the meeting was mailed or such public disclosure was made. The recommendation should also include the name, age, business address, residence address, principal occupation of and number of shares of the Company owned by the recommended candidate for nomination. Shareholder recommendations must also include the information that would be required to be disclosed in the solicitation of proxies for the election of directors under federal securities laws, including the candidate’s consent to be elected and to serve. The Company may also require any nominee to furnish additional information regarding the eligibility and qualifications of the recommended candidate.

Shareholder Proposals

To be considered eligible for inclusion in the Company’s Proxy Statement for the 2007 Annual Meeting, a proposal must be made by a qualified shareholder and received by the Company at its principal office in Bowling Green, Ohio, prior to November 6, 2006. Any shareholder who intends to propose any other matter to be acted upon at the 2007 Annual Meeting must inform the Company in writing not less than 60 nor more than 90 days prior to the meeting; provided, however, that if less than 75 days notice or prior public disclosure of the date of the meeting is given to shareholders, notice by the shareholder must be received not later than the close of business on the fifteenth day following the earlier of the day on which such notice of the date of the meeting was mailed or such public disclosure was made. If notice is not provided by that date, the persons named in the Company’s proxy for the 2007 Annual Meeting will be allowed to exercise their discretionary authority to vote upon any such proposal without the matter having been discussed in the proxy statement for the 2007 Annual Meeting.

Shareholder Communications

Shareholders of the Company may send communications to the Board of Directors through the Company’s office of Corporate Secretary, Sky Financial Group, Inc., 221 S. Church St., P.O. Box 428, Bowling Green, Ohio 43402. Communications sent by qualified shareholders for proper, non-commercial purposes will be transmitted to the Board of Directors or the appropriate committee, as soon as practicable. Shareholders may also send communications to the presiding non-management director of the Board by sending correspondence to Lead Director, Sky Financial Group, Inc., 221 S. Church St., P.O. Box 428, Bowling Green, Ohio 43402. More information regarding the Company’s shareholder communication process may be found in the Corporate Governance section of the Company’s website, at www.skyfi.com.

OTHER BUSINESS

The Board of Directors of the Company is not aware of any other matters that may come before the Annual Meeting. However, the enclosed proxy will confer discretionary authority with respect to matters that are not now known to the Board of Directors and that may properly come before the meeting.

| | | | | | | | |

March 6, 2006 | | | | By Order of the Board of Directors, |

| | | |

|

| | | | | | W. Granger Souder, Jr. Secretary |

19

Annex 1

SKY FINANCIAL GROUP, INC.

PROXY VOTING INSTRUCTION CARD

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE

ANNUAL MEETING OF SHAREHOLDERS ON APRIL 19, 2006

The undersigned hereby appoints Joseph N. Tosh II and R. John Wean III, each of them, proxies, with the powers the undersigned would possess if present and with full power of substitution, to vote all common shares of the undersigned in Sky Financial Group, Inc., at the Annual Meeting and at any adjournments or postponements thereof, upon all subjects that may properly come before the Annual Meeting, including the matters described in the Proxy Statement furnished herewith, subject to any directions indicated on this card. If no directions are given, the proxies will vote for the election of all listed nominees, and at their discretion, on any other matter that may properly come before the Annual Meeting.

(Continued, and to be signed and dated, on the reverse side.)

SKY FINANCIAL GROUP, INC.

P.O. BOX 11486

NEW YORK, N.Y. 10203-0486

Directors recommend a vote FOR Proposal 1.

| | | | | | | | | | | | |

1. Election of all Nominees

for Director in Class II: | | FOR all nominees

listed below | | ¨ | | WITHHOLD AUTHORITY to vote

for all nominees listed below | | ¨ | | *EXCEPTIONS | | ¨ |

Nominees for Director in Class II: George N. Chandler II, Robert C. Duvall, D. James Hilliker, Gregory L. Ridler and Emerson J. Ross, Jr.

(INSTRUCTIONS: To withhold authorization to vote for any individual nominee, mark the “Exceptions” box and write that nominee’s name in the space provided below.)

*Exceptions: .

| | | |

| Please check the box to the right if | | | |

| you wish to attend the Annual Meeting. | | ¨ | |

| PLEASE SEE LETTER TO SHARE- | | | |

| HOLDERS FOR DETAILS. | | | |

| |

| Address Change and/or | | | |

| Comments Mark Here | | ¨ | |

|

| Please be sure to sign and date this Proxy Voting Instruction Card. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If more than one owner, all should sign. |

|

| Dated: , 2006 |

|

|

Share Owner sign here |

|

|

Co-Owner sign here |

Dear Shareholder,

Enclosed is your Notice of Annual Meeting of Shareholders and related Proxy Statement for our 2006 Annual Meeting. Also enclosed is the Company’s Annual Report for 2005.

The business of the 2006 Annual Meeting including the matters to be voted upon as described in the Notice and Proxy Statement, will be conducted on April 19, 2006 at 10:00 a.m. at the Marriott Cleveland East, 26300 Harvard Rd., Warrensville Heights, Ohio 44122. You are welcome to attend this Annual Meeting of Shareholders.

The matters to be acted upon at the meeting are important to you as a shareholder. Therefore, whether or not you plan to attend, we urge you to complete and return the proxy card at your earliest convenience.

We look forward to seeing you at our Annual Meeting.

Sincerely,

Marty E. Adams

Chairman, President and CEO

www.skyfi.com