UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-10351

Potash Corporation of Saskatchewan Inc.

(Exact name of registrant as specified in its charter)

| | |

| Canada | | N/A |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

122 — 1st Avenue South Saskatoon, Saskatchewan, Canada (Address of principal executive offices) | | S7K 7G3 (Zip Code) |

306-933-8500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer þ | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes ¨ No þ

As at April 10, 2014, Potash Corporation of Saskatchewan Inc. had 845,857,381 Common Shares outstanding.

Part I. Financial Information

Item 1. Financial Statements

Potash Corporation of Saskatchewan Inc.

Condensed Consolidated Statements of Financial Position

(in millions of US dollars)

(unaudited)

| | | | | | | | |

| As at | | March 31,

2014 | | | December 31,

2013 | |

Assets | | | | | | | | |

Current assets | | | | | | | | |

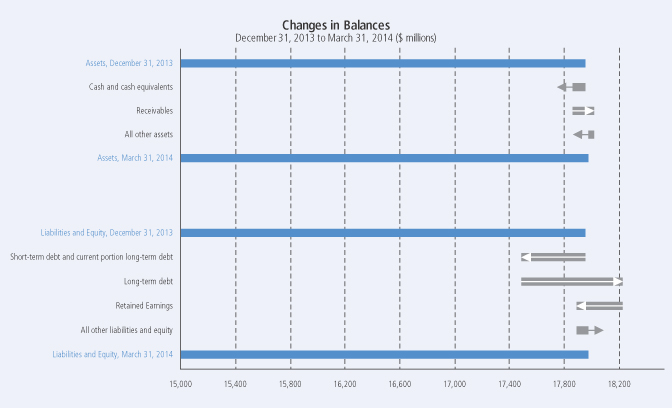

Cash and cash equivalents | | $ | 533 | | | $ | 628 | |

Receivables | | | 905 | | | | 752 | |

Inventories (Note 2) | | | 716 | | | | 728 | |

Prepaid expenses and other current assets | | | 60 | | | | 81 | |

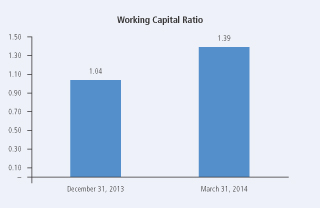

| | | 2,214 | | | | 2,189 | |

Non-current assets | | | | | | | | |

Property, plant and equipment | | | 12,209 | | | | 12,233 | |

Investments in equity-accounted investees | | | 1,310 | | | | 1,276 | |

Available-for-sale investments (Note 3) | | | 1,734 | | | | 1,722 | |

Other assets | | | 371 | | | | 401 | |

Intangible assets | | | 138 | | | | 137 | |

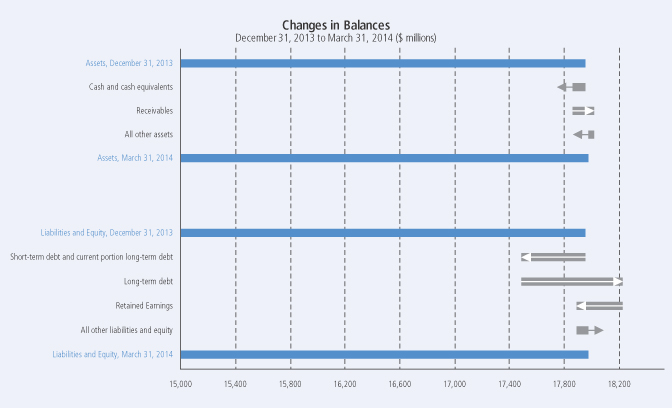

Total Assets | | $ | 17,976 | | | $ | 17,958 | |

Liabilities | | | | | | | | |

Current liabilities | | | | | | | | |

Short-term debt and current portion of long-term debt (Note 4) | | $ | 496 | | | $ | 967 | |

Payables and accrued charges | | | 1,054 | | | | 1,104 | |

Current portion of derivative instrument liabilities | | | 39 | | | | 42 | |

| | | 1,589 | | | | 2,113 | |

Non-current liabilities | | | | | | | | |

Long-term debt (Note 4) | | | 3,709 | | | | 2,970 | |

Derivative instrument liabilities | | | 123 | | | | 129 | |

Deferred income tax liabilities | | | 2,046 | | | | 2,013 | |

Pension and other post-retirement benefit liabilities | | | 415 | | | | 410 | |

Asset retirement obligations and accrued environmental costs | | | 583 | | | | 557 | |

Other non-current liabilities and deferred credits | | | 140 | | | | 138 | |

Total Liabilities | | | 8,605 | | | | 8,330 | |

Shareholders’ Equity | | | | | | | | |

Share capital (Note 5) | | | 1,611 | | | | 1,600 | |

Contributed surplus | | | 230 | | | | 219 | |

Accumulated other comprehensive income | | | 730 | | | | 673 | |

Retained earnings | | | 6,800 | | | | 7,136 | |

Total Shareholders’ Equity | | | 9,371 | | | | 9,628 | |

Total Liabilities and Shareholders’ Equity | | $ | 17,976 | | | $ | 17,958 | |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| 1 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

Potash Corporation of Saskatchewan Inc.

Condensed Consolidated Statements of Income

(in millions of US dollars except per-share amounts)

(unaudited)

| | | | | | | | |

| | | Three Months Ended March 31 | |

| | | 2014 | | | 2013 | |

Sales (Note 6) | | $ | 1,680 | | | $ | 2,100 | |

Freight, transportation and distribution | | | (166 | ) | | | (149 | ) |

Cost of goods sold | | | (949 | ) | | | (1,084 | ) |

Gross Margin | | | 565 | | | | 867 | |

Selling and administrative expenses | | | (68 | ) | | | (66 | ) |

Provincial mining and other taxes | | | (54 | ) | | | (63 | ) |

Share of earnings of equity-accounted investees | | | 33 | | | | 80 | |

Dividend income | | | 69 | | | | — | |

Impairment of available-for-sale investment (Note 3) | | | (38 | ) | | | — | |

Other income (expenses) | | | 24 | | | | (1 | ) |

Operating Income | | | 531 | | | | 817 | |

Finance costs | | | (47 | ) | | | (35 | ) |

Income Before Income Taxes | | | 484 | | | | 782 | |

Income taxes (Note 7) | | | (144 | ) | | | (226 | ) |

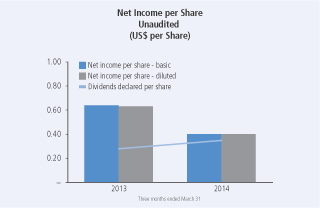

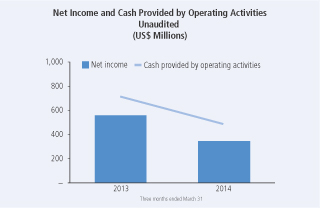

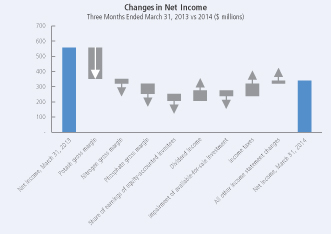

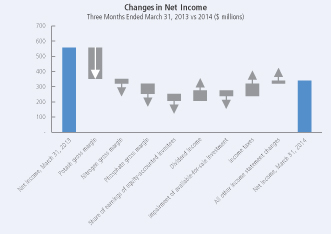

Net Income | | $ | 340 | | | $ | 556 | |

Net Income per Share (Note 8) | | | | | | | | |

Basic | | $ | 0.40 | | | $ | 0.64 | |

Diluted | | $ | 0.40 | | | $ | 0.63 | |

Dividends Declared per Share | | $ | 0.35 | | | $ | 0.28 | |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 2 |

Potash Corporation of Saskatchewan Inc.

Condensed Consolidated Statements of Comprehensive Income

(in millions of US dollars)

(unaudited)

| | | | | | | | |

| | | Three Months Ended March 31 | |

| (Net of related income taxes) | | 2014 | | | 2013 | |

Net Income | | $ | 340 | | | $ | 556 | |

Other comprehensive income | | | | | | | | |

Items that have been or may be subsequently reclassified to net income: | | | | | | | | |

Available-for-sale investments(1) | | | | | | | | |

Net fair value gain during the period | | | 50 | | | | 186 | |

Cash flow hedges | | | | | | | | |

Net fair value loss during the period(2) | | | (1 | ) | | | — | |

Reclassification to income of net loss(3) | | | 6 | | | | 11 | |

Other | | | 2 | | | | — | |

Other Comprehensive Income | | | 57 | | | | 197 | |

Comprehensive Income | | $ | 397 | | | $ | 753 | |

| (1) | Available-for-sale investments are comprised of shares in Israel Chemicals Ltd. and Sinofert Holdings Limited. |

| (2) | Cash flow hedges are comprised of natural gas derivative instruments and were net of income taxes of $1 (2013 — $NIL). |

| (3) | Net of income taxes of $(4) (2013 — $(6)). |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| 3 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

Potash Corporation of Saskatchewan Inc.

Condensed Consolidated Statements of Cash Flow

(in millions of US dollars)

(unaudited)

| | | | | | | | |

| | | Three Months Ended March 31 | |

| | | 2014 | | | 2013 | |

Operating Activities | | | | | | | | |

Net income | | $ | 340 | | | $ | 556 | |

Adjustments to reconcile net income to cash provided by operating activities | | | | | | | | |

Depreciation and amortization | | | 176 | | | | 154 | |

Share-based compensation | | | 15 | | | | 16 | |

Net undistributed earnings of equity-accounted investees | | | (31 | ) | | | (77 | ) |

Impairment of available-for-sale investment (Note 3) | | | 38 | | | | — | |

Provision for deferred income tax | | | 46 | | | | 102 | |

Pension and other post-retirement benefits | | | 9 | | | | (31 | ) |

Other long-term liabilities and miscellaneous | | | 9 | | | | 16 | |

Subtotal of adjustments | | | 262 | | | | 180 | |

Changes in non-cash operating working capital | | | | | | | | |

Receivables | | | (158 | ) | | | (104 | ) |

Inventories | | | 20 | | | | 47 | |

Prepaid expenses and other current assets | | | 18 | | | | 1 | |

Payables and accrued charges | | | 57 | | | | 58 | |

Subtotal of changes in non-cash operating working capital | | | (63 | ) | | | 2 | |

Cash provided by operating activities | | | 539 | | | | 738 | |

Investing Activities | | | | | | | | |

Additions to property, plant and equipment | | | (224 | ) | | | (496 | ) |

Other assets and intangible assets | | | (2 | ) | | | (5 | ) |

Cash used in investing activities | | | (226 | ) | | | (501 | ) |

Financing Activities | | | | | | | | |

Proceeds from long-term debt obligations | | | 737 | | | | — | |

Repayment of long-term debt obligations | | | — | | | | (250 | ) |

(Repayment of) proceeds from short-term debt obligations | | | (470 | ) | | | 211 | |

Dividends | | | (293 | ) | | | (177 | ) |

Repurchase of common shares | | | (396 | ) | | | — | |

Issuance of common shares | | | 14 | | | | 2 | |

Cash used in financing activities | | | (408 | ) | | | (214 | ) |

(Decrease) Increase in Cash and Cash Equivalents | | | (95 | ) | | | 23 | |

Cash and Cash Equivalents, Beginning of Period | | | 628 | | | | 562 | |

Cash and Cash Equivalents, End of Period | | $ | 533 | | | $ | 585 | |

Cash and cash equivalents comprised of: | | | | | | | | |

Cash | | $ | 134 | | | $ | 103 | |

Short-term investments | | | 399 | | | | 482 | |

| | | $ | 533 | | | $ | 585 | |

Supplemental cash flow disclosure | | | | | | | | |

Interest paid | | $ | 24 | | | $ | 9 | |

Income taxes paid | | $ | 50 | | | $ | 55 | |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 4 |

Potash Corporation of Saskatchewan Inc.

Condensed Consolidated Statements of Changes in Equity

(in millions of US dollars)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Accumulated Other Comprehensive Income | | | | | | | |

| | | Share

Capital | | | Contributed

Surplus | | | Net

unrealized

gain on

available-for-

sale

investments | | | Net loss on

derivatives

designated as

cash flow

hedges | | | Other | | | Total

Accumulated

Other

Comprehensive

Income | | | Retained

Earnings | | | Total

Equity(1) | |

Balance — December 31, 2013 | | $ | 1,600 | | | $ | 219 | | | $ | 780 | | | $ | (105 | ) | | $ | (2 | ) | | $ | 673 | | | $ | 7,136 | | | $ | 9,628 | |

Net income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 340 | | | | 340 | |

Other comprehensive income | | | — | | | | — | | | | 50 | | | | 5 | | | | 2 | | | | 57 | | | | — | | | | 57 | |

Share repurchase (Note 5) | | | (21 | ) | | | (1 | ) | | | — | | | | — | | | | — | | | | — | | | | (377 | ) | | | (399 | ) |

Dividends declared | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (299 | ) | | | (299 | ) |

Effect of share-based compensation including issuance of common shares | | | 22 | | | | 12 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 34 | |

Shares issued for dividend reinvestment plan | | | 10 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 10 | |

Balance — March 31, 2014 | | $ | 1,611 | | | $ | 230 | | | $ | 830 | | | $ | (100 | ) | | $ | — | | | $ | 730 | | | $ | 6,800 | | | $ | 9,371 | |

Balance — December 31, 2012 | | $ | 1,543 | | | $ | 299 | | | $ | 1,539 | | | $ | (138 | ) | | $ | (2 | ) | | $ | 1,399 | | | $ | 6,671 | | | $ | 9,912 | |

Net income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 556 | | | | 556 | |

Other comprehensive income | | | — | | | | — | | | | 186 | | | | 11 | | | | — | | | | 197 | | | | — | | | | 197 | |

Dividends declared | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (242 | ) | | | (242 | ) |

Effect of share-based compensation including issuance of common shares | | | 3 | | | | 12 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 15 | |

Shares issued for dividend reinvestment plan | | | 4 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4 | |

Balance — March 31, 2013 | | $ | 1,550 | | | $ | 311 | | | $ | 1,725 | | | $ | (127 | ) | | $ | (2 | ) | | $ | 1,596 | | | $ | 6,985 | | | $ | 10,442 | |

| (1) | All equity transactions were attributable to common shareholders. |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| 5 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

Potash Corporation of Saskatchewan Inc.

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2014

(in millions of US dollars except as otherwise noted)

(unaudited)

1. Significant Accounting Policies

Basis of Presentation

With its subsidiaries, Potash Corporation of Saskatchewan Inc. (“PCS”) — together known as “PotashCorp” or “the company” except to the extent the context otherwise requires — forms an integrated fertilizer and related industrial and feed products company. These unaudited interim condensed consolidated financial statements are based on International Financial Reporting Standards, as issued by the International Accounting Standards Board (“IFRS”), and have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim Financial Reporting.” The accounting policies used in preparing these unaudited interim condensed consolidated financial statements are consistent with those used in the preparation of the company’s 2013 annual consolidated financial statements, except as described below.

These unaudited interim condensed consolidated financial statements include the accounts of PCS and its subsidiaries; however, they do not include all disclosures normally provided in annual consolidated financial statements and should be read in conjunction with the company’s 2013 annual consolidated financial statements. In management’s opinion, the unaudited interim condensed consolidated financial statements include all adjustments necessary to fairly present such information. Interim results are not necessarily indicative of the results expected for the fiscal year.

These unaudited interim condensed consolidated financial statements were authorized by the audit committee of the Board of Directors for issue on April 29, 2014.

Standards, amendments and interpretations effective and applied

The International Accounting Standards Board (“IASB”) and International Financial Reporting Interpretations Committee (“IFRIC”) have issued the following standards and amendments or interpretations to existing standards that were effective and applied by the company.

| | | | |

| Standard | | Description | | Impact |

| Amendments to IAS 32, Offsetting Financial Assets and Financial Liabilities | | Issued as part of the IASB’s offsetting project, amendments clarify certain items regarding offsetting financial assets and financial liabilities. | | Adopted retrospectively effective January 1, 2014 with no change to the company’s consolidated financial statements. |

| Amendments to IAS 36, Recoverable Amount Disclosures for Non-Financial Assets | | Amendments were issued that clarify disclosure requirements for the recoverable amount of an asset or CGU. | | Adopted retrospectively effective January 1, 2014 with no change to the company’s consolidated financial statements. |

| IFRIC 21, Levies | | Provides guidance on when to recognize a liability for a levy imposed by a government. | | Adopted retrospectively effective January 1, 2014 with no change to the company’s consolidated financial statements. |

Standards, amendments and interpretations not yet effective and not applied

The IASB and IFRIC have issued the following standards and amendments or interpretations to existing standards that were not yet effective and not applied at March 31, 2014. The company does not anticipate early adoption of these standards at this time.

| | | | | | |

| Standard | | Description | | Impact | | Effective Date(1) |

| Amendments to IAS 19, Employee Benefits | | Issued to simplify the accounting for employee or third-party contributions to defined benefit plans that are independent of the number of years of employee service. | | The company is reviewing the standard to determine the potential impact, if any. | | July 1, 2014, applied retrospectively. |

| (1) | Effective date for annual periods beginning on or after the stated date. |

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 6 |

| | | | | | |

| Standard | | Description | | Impact | | Effective Date(1) |

| IFRS 9, Financial Instruments | | Initially issued guidance on the classification and measurement of financial assets. Additional guidance was issued on the classification and measurement of financial liabilities. Additional amendments were issued which introduce a new hedge accounting model and modify the requirements for transition from IAS 39 to IFRS 9. | | The company is reviewing the standard to determine the potential impact, if any. | | January 1, 2018 (tentative). |

| (1) | Effective date for annual periods beginning on or after the stated date. |

2. Inventories

| | | | | | | | |

| | | March 31,

2014 | | | December 31,

2013 | |

Finished products | | $ | 335 | | | $ | 340 | |

Intermediate products | | | 90 | | | | 85 | |

Raw materials | | | 81 | | | | 101 | |

Materials and supplies | | | 210 | | | | 202 | |

| | | $ | 716 | | | $ | 728 | |

3. Available-for-Sale Investments

The company assesses at the end of each reporting period whether there is objective evidence of impairment. A significant or prolonged decline in the fair value of the investment below its cost would be evidence that the asset is impaired. If objective evidence of impairment exists, the impaired amount (i.e., the unrealized loss) is recognized in net income; any subsequent reversals would be recognized in other comprehensive income (“OCI”) and would not flow back into net income. Any subsequent decline in fair value below the carrying amount at the impairment date would represent a further impairment to be recognized in net income.

During 2012, the company concluded its investment in Sinofert Holdings Limited (“Sinofert”) was impaired due to the significance by which fair value was below cost. As a result, an impairment loss of $341 was recognized in net income during 2012. At March 31, 2014, the company concluded its investment in Sinofert was further impaired due to the fair value declining below the carrying amount of $238 at the previous impairment date. As a result, an impairment loss of $38 was recognized in net income during the three months ended March 31, 2014. The fair value was determined through the market value of Sinofert shares on the Hong Kong Stock Exchange.

Changes in fair value, and related accounting, for the company’s investment in Sinofert since December 31, 2013 were as follows:

| | | | | | | | | | | | | | | | |

| | | | | | | | | Impact of Unrealized Loss on: | |

| | | Fair Value | | | Unrealized Loss | | | OCI and AOCI | | | Net Income and

Retained Earnings | |

Balance — December 31, 2013 | | $ | 254 | | | $ | (325 | ) | | $ | 16 | | | $ | (341 | ) |

Decrease in fair value and recognition of impairment | | | (54 | ) | | | (54 | ) | | | (16 | ) | | | (38 | ) |

Balance — March 31, 2014 | | $ | 200 | | | $ | (379 | ) | | $ | — | | | $ | (379 | ) |

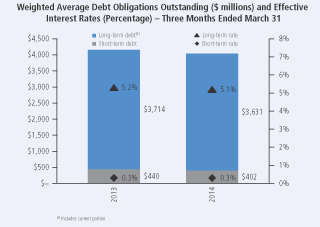

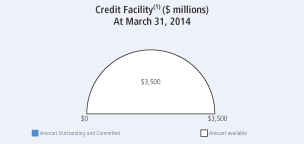

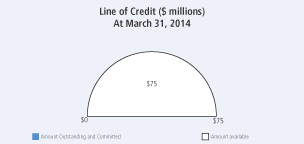

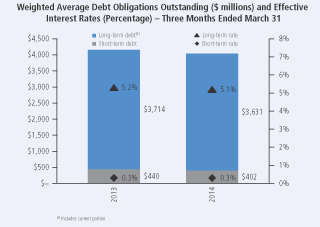

4. Long-Term Debt

On March 7, 2014, the company closed the issuance of $750 of 3.625 percent senior notes due March 15, 2024. The senior notes were issued under a US shelf registration statement.

On March 7, 2014, the company issued a notice of redemption for all of its outstanding $500 of 5.250 percent senior notes due May 15, 2014. On April 7, 2014, the company completed the redemption of all $500 of the senior notes at a redemption price of 100.497 percent of the principal amount of the notes redeemed plus accrued interest.

| | |

| 7 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

5. Share Capital

Authorized

The company is authorized to issue an unlimited number of common shares without par value and an unlimited number of first preferred shares. The common shares are not redeemable or convertible. The first preferred shares may be issued in one or more series with rights and conditions to be determined by the Board of Directors. No first preferred shares have been issued.

Issued

| | | | | | | | |

| | | Number of

Common Shares | | | Consideration | |

Balance — December 31, 2013 | | | 856,116,325 | | | $ | 1,600 | |

Issued under option plans | | | 1,140,850 | | | | 22 | |

Issued for dividend reinvestment plan | | | 321,006 | | | | 10 | |

Repurchased | | | (11,722,000 | ) | | | (21 | ) |

Balance — March 31, 2014 | | | 845,856,181 | | | $ | 1,611 | |

Share Repurchase Program

On July 24, 2013, the company’s Board of Directors authorized a share repurchase program of up to 5 percent of PotashCorp’s outstanding common shares (up to $2,000 of its outstanding common shares) through a normal course issuer bid. Shares may be repurchased from time to time on the open market commencing August 2, 2013 through August 1, 2014 at prevailing market prices. The timing and amount of purchases under the program are dependent upon the availability and alternative uses of capital, market conditions, applicable US and Canadian regulations and other factors.

Under this program, the company repurchased for cancellation 11,722,000 common shares during the three months ended March 31, 2014, at a cost of $399 and an average price per share of $34.00. The repurchase resulted in a reduction of share capital of $21, and the excess of net cost over the average book value of the shares was recorded as a reduction of contributed surplus of $1 and a reduction of retained earnings of $377.

6. Segment Information

The company has three reportable operating segments: potash, nitrogen and phosphate. These reportable operating segments are differentiated by the chemical nutrient contained in the product that each produces. Inter-segment sales are made under terms that approximate market value. The accounting policies of the segments are the same as those described in Note 1 and are measured in a manner consistent with that of the financial statements. The company’s operating segments have been determined based on reports reviewed by the Chief Executive Officer, its chief operating decision-maker, that are used to make strategic decisions.

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2014 | |

| | | Potash | | | Nitrogen | | | Phosphate | | | All Others | | | Consolidated | |

Sales — third party | | $ | 671 | | | $ | 581 | | | $ | 428 | | | $ | — | | | $ | 1,680 | |

Freight, transportation and distribution — third party | | | (86 | ) | | | (31 | ) | | | (49 | ) | | | — | | | | (166 | ) |

Net sales — third party | | | 585 | | | | 550 | | | | 379 | | | | — | | | | | |

Cost of goods sold — third party | | | (285 | ) | | | (323 | ) | | | (341 | ) | | | — | | | | (949 | ) |

Margin (cost) on inter-segment sales(1) | | | — | | | | 12 | | | | (12 | ) | | | — | | | | — | |

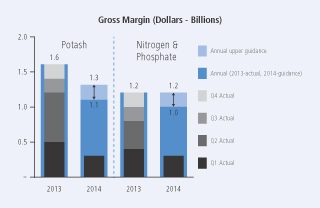

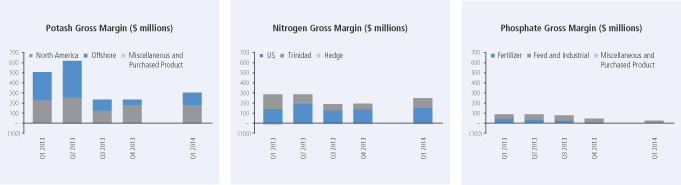

Gross margin | | | 300 | | | | 239 | | | | 26 | | | | — | | | | 565 | |

Depreciation and amortization | | | (52 | ) | | | (42 | ) | | | (78 | ) | | | (4 | ) | | | (176 | ) |

Assets | | | 9,365 | | | | 2,247 | | | | 2,444 | | | | 3,920 | | | | 17,976 | |

Cash flows for additions to property, plant and equipment | | | 124 | | | | 67 | | | | 31 | | | | 2 | | | | 224 | |

| (1) | Inter-segment net sales were $25. |

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 8 |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2013 | |

| | | Potash | | | Nitrogen | | | Phosphate | | | All Others | | | Consolidated | |

Sales — third party | | $ | 885 | | | $ | 659 | | | $ | 556 | | | $ | — | | | $ | 2,100 | |

Freight, transportation and distribution — third party | | | (71 | ) | | | (25 | ) | | | (53 | ) | | | — | | | | (149 | ) |

Net sales — third party | | | 814 | | | | 634 | | | | 503 | | | | — | | | | | |

Cost of goods sold — third party | | | (310 | ) | | | (381 | ) | | | (393 | ) | | | — | | | | (1,084 | ) |

Margin (cost) on inter-segment sales(1) | | | — | | | | 18 | | | | (18 | ) | | | — | | | | — | |

Gross margin | | | 504 | | | | 271 | | | | 92 | | | | — | | | | 867 | |

Depreciation and amortization | | | (41 | ) | | | (38 | ) | | | (71 | ) | | | (4 | ) | | | (154 | ) |

Assets | | | 8,826 | | | | 2,256 | | | | 2,546 | | | | 5,035 | | | | 18,663 | |

Cash flows for additions to property, plant and equipment | | | 349 | | | | 45 | | | | 65 | | | | 37 | | | | 496 | |

| (1) | Inter-segment net sales were $45. |

7. Income Taxes

A separate estimated average annual effective tax rate was determined for each taxing jurisdiction and applied individually to the interim period pre-tax income of each jurisdiction.

| | | | | | | | |

| | | Three Months Ended March 31 | |

| | | 2014 | | | 2013 | |

Income tax expense | | $ | 144 | | | $ | 226 | |

Actual effective tax rate on ordinary earnings | | | 27% | | | | 27% | |

Actual effective tax rate including discrete items | | | 30% | | | | 29% | |

Discrete tax adjustments that impacted the tax rate | | $ | 2 | | | $ | 19 | |

Significant items to note include the following:

| Ÿ | | In first-quarter 2014, a non-tax deductible impairment of the company’s available-for-sale investment in Sinofert was recorded. This increased the actual effective tax rate including discrete items by 2 percent. |

| Ÿ | | In first-quarter 2013, a tax expense of $15 was recorded to adjust the 2012 income tax provision. |

Income tax balances within the condensed consolidated statements of financial position were comprised of the following:

| | | | | | | | | | |

| Income Tax Assets (Liabilities) | | Statements of Financial Position Location | | March 31,

2014 | | | December 31,

2013 | |

Current income tax assets | | | | | | | | | | |

Current | | Receivables | | $ | 86 | | | $ | 90 | |

Non-current | | Other assets | | | 125 | | | | 126 | |

Deferred income tax assets | | Other assets | | | 8 | | | | 21 | |

Total income tax assets | | | | $ | 219 | | | $ | 237 | |

Current income tax liabilities | | | | | | | | | | |

Current | | Payables and accrued charges | | $ | (38 | ) | | $ | (3 | ) |

Non-current | | Other non-current liabilities and deferred credits | | | (137 | ) | | | (135 | ) |

Deferred income tax liabilities | | Deferred income tax liabilities | | | (2,046 | ) | | | (2,013 | ) |

Total income tax liabilities | | | | $ | (2,221 | ) | | $ | (2,151 | ) |

| | |

| 9 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

8. Net Income per Share

Net income per share was calculated on the following weighted average number of shares:

| | | | | | | | |

| | | Three Months Ended

March 31 | |

| | | 2014 | | | 2013 | |

Basic | | | 852,919,000 | | | | 865,056,000 | |

Diluted | | | 859,675,000 | | | | 876,672,000 | |

Diluted net income per share was calculated based on the weighted average number of shares issued and outstanding during the period, incorporating the following adjustments. The denominator was: (1) increased by the total of the additional common shares that would have been issued assuming exercise of all stock options with exercise prices at or below the average market price for the period; and (2) decreased by the number of shares that the company could have repurchased if it had used the assumed proceeds from the exercise of stock options to repurchase them on the open market at the average share price for the period. For performance-based stock option plans, the number of contingently issuable common shares included in the calculation was based on the number of shares, if any, that would be issuable if the end of the reporting period were the end of the performance period and the effect were dilutive.

Options excluded from the calculation of diluted net income per share due to the options’ exercise prices being greater than the average market price of common shares were as follows:

| | |

| | | Three Months Ended March 31, 2014 |

Weighted average number of options | | 5,030,350 |

Performance Option Plan years excluded, in whole or in part | | 2008 through 2012 |

9. Financial Instruments

Fair Value

Estimated fair values for financial instruments are designed to approximate amounts at which the instruments could be exchanged in a current arm’s-length transaction between knowledgeable willing parties. The valuation policies and procedures for financial reporting purposes are determined by the company’s finance department.

Due to their short-term nature, the fair value of cash and cash equivalents, receivables, short-term debt, and payables and accrued charges was assumed to approximate carrying value. The company’s derivative instruments and investments in Israel Chemicals Ltd. (“ICL”) and Sinofert were carried at fair value. The fair value of derivative instruments that are not traded in an active market (such as natural gas swaps and foreign currency derivatives) was determined using valuation techniques. The company used a variety of methods and made assumptions that were based on market conditions existing at each reporting date.

The fair value of foreign currency derivatives was determined using quoted forward exchange rates (Level 2) at the statements of financial position dates.

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 10 |

Natural gas swap valuations were based on a discounted cash flow model. The inputs used in the model included contractual cash flows based on prices for natural gas futures contracts, fixed prices and notional volumes specified by the swap contracts, the time value of money, liquidity risk, the company’s own credit risk (related to instruments in a liability position) and counterparty credit risk (related to instruments in an asset position). Certain of the futures contract prices used as inputs in the model were supported by prices quoted in an active market and others were not based on observable market data.

For valuations that included both observable and unobservable data, if the unobservable input was determined to be significant to the overall inputs, the entire valuation was categorized in Level 3. For natural gas swaps, the primary input into the valuation model

was natural gas futures prices, which were based on delivery at the Henry Hub and were observable only for up to three years in the future. The unobservable futures price range at March 31, 2014 was $4.11 to $4.75 per MMBtu (December 31, 2013 — $4.00 to $4.54 per MMBtu). Changes in the unobservable natural gas futures prices would not result in significantly higher or lower fair values as any price change would be counterbalanced by offsetting derivative positions for virtually all of the company’s derivatives. Interest rates used to discount estimated cash flows at March 31, 2014 were between 0.15 percent and 3.46 percent (December 31, 2013 — between 0.17 percent and 3.59 percent) depending on the settlement date.

Fair value of investments designated as available-for-sale was based on the closing bid price of the common shares (Level 1) as of the statements of financial position dates.

The fair value of the company’s senior notes at March 31, 2014 reflected the yield valuation based on observed market prices (Level 1), which ranged from 0.62 percent to 4.74 percent (December 31, 2013 — 0.50 percent to 5.25 percent). The fair value of the company’s other long-term debt instruments approximated carrying value. Presented below is a comparison of the fair value of the company’s senior notes to their carrying values.

| | | | | | | | | | | | | | | | |

| | | March 31, 2014 | | | December 31, 2013 | |

| | | Carrying Amount of Liability | | | Fair Value of Liability | | | Carrying Amount of Liability | | | Fair Value of Liability | |

Long-term debt senior notes | | $ | 4,250 | | | $ | 4,605 | | | $ | 3,500 | | | $ | 3,791 | |

The following table presents the company’s fair value hierarchy for financial assets and financial liabilities carried at fair value on a recurring basis.

| | | | | | | | | | | | | | | | |

| | | | | | Fair Value Measurements at Reporting Date Using: | |

| | | Carrying Amount

of Asset

(Liability) | | | Quoted Prices in

Active Markets for

Identical Assets

(Level 1)(1) | | | Significant Other

Observable

Inputs (Level 2)(1,2) | | | Significant

Unobservable

Inputs (Level 3)(2) | |

March 31, 2014 | | | | | | | | | | | | | | | | |

Derivative instrument assets | | | | | | | | | | | | | | | | |

Natural gas derivatives | | $ | 10 | | | $ | — | | | $ | (1 | ) | | $ | 11 | |

Investments in ICL and Sinofert | | | 1,734 | | | | 1,734 | | | | — | | | | — | |

Derivative instrument liabilities | | | | | | | | | | | | | | | | |

Natural gas derivatives | | | (162 | ) | | | — | | | | (17 | ) | | | (145 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

December 31, 2013 | | | | | | | | | | | | | | | | |

Derivative instrument assets | | | | | | | | | | | | | | | | |

Natural gas derivatives | | $ | 8 | | | $ | — | | | $ | — | | | $ | 8 | |

Investments in ICL and Sinofert | | | 1,722 | | | | 1,722 | | | | — | | | | — | |

Derivative instrument liabilities | | | | | | | | | | | | | | | | |

Natural gas derivatives | | | (170 | ) | | | — | | | | (21 | ) | | | (149 | ) |

Foreign currency derivatives | | | (1 | ) | | | — | | | | (1 | ) | | | — | |

| (1) | During the three months ended March 31, 2014 and twelve months ended December 31, 2013, there were no transfers between Level 1 and Level 2. |

| (2) | During the three months ended March 31, 2014, there were no transfers into or out of Level 3. During the twelve months ended December 31, 2013, there were no transfers into Level 3 and $14 of losses was transferred out of Level 3 into Level 2 as (due to the passage of time) the terms of certain natural gas derivatives now matured within 36 months. The company’s policy is to recognize transfers at the end of the reporting period. |

| | |

| 11 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

The following table presents a reconciliation of the beginning and ending balances of the company’s fair value measurements using significant unobservable inputs (Level 3):

| | | | | | | | |

| | | Natural Gas Derivatives | |

| | | Three Months Ended

March 31, 2014 | | | Twelve Months Ended

December 31, 2013 | |

Balance, beginning of period | | $ | (141 | ) | | $ | (191 | ) |

Total (losses) gains (realized and unrealized) before income taxes | | | | | | | | |

Included in net income (cost of goods sold) | | | (5 | ) | | | (27 | ) |

Included in other comprehensive income | | | 4 | | | | 27 | |

Purchases | | | — | | | | — | |

Sales | | | — | | | | — | |

Issues | | | — | | | | — | |

Settlements | | | 8 | | | | 36 | |

Transfers of losses out of Level 3 | | | — | | | | 14 | |

Balance, end of period | | $ | (134 | ) | | $ | (141 | ) |

Gains (losses) for the period included in net income (cost of goods sold) were: | | | | | | | | |

Change in unrealized gains (losses) relating to instruments still held at the reporting date | | $ | — | | | $ | — | |

Total losses (realized and unrealized) | | | (5 | ) | | | (27 | ) |

10. Seasonality

The company’s sales of fertilizer can be seasonal. Typically, fertilizer sales are highest in the second quarter of the year, due to the North American spring planting season. However, planting conditions and the timing of customer purchases will vary each year and sales can be expected to shift from one quarter to another.

11. Contingencies and Other Matters

Canpotex

PCS is a shareholder in Canpotex Limited (“Canpotex”), which markets Saskatchewan potash offshore. Should any operating losses or other liabilities be incurred by Canpotex, the shareholders have contractually agreed to reimburse it for such losses or liabilities in proportion to each shareholder’s productive capacity. Through March 31, 2014, there were no such operating losses or other liabilities.

Mining Risk

The risk of underground water inflows, as with other underground risks, is currently not insured.

Legal and Other Matters

The company is engaged in ongoing site assessment and/or remediation activities at a number of facilities and sites, and anticipated costs associated with these matters are added to accrued environmental costs in the manner previously described in Note 14 to the company’s 2013 annual consolidated financial statements. This includes matters related to investigation of potential brine migration at certain of the potash sites. The following environmental site assessment and/or remediation

matters have uncertainties that may not be fully reflected in the amounts accrued for those matters:

Nitrogen and phosphate

| Ÿ | | The US Environmental Protection Agency (“USEPA”) has identified PCS Nitrogen, Inc. (“PCS Nitrogen”) as a potentially responsible party at the Planters Property or Columbia Nitrogen site in Charleston, South Carolina. The current owner of the Planters Property filed a complaint against PCS Nitrogen in the US District Court for the District of South Carolina seeking environmental response costs. The district court allocated 30 percent of the liability for response costs at the site to PCS Nitrogen, as well as a proportional share of any costs that cannot be recovered from another responsible party. The district court’s judgment is now final as all appeals have been exhausted. In December 2013, the USEPA issued an order to PCS Nitrogen and four other respondents requiring them jointly and severally to conduct certain cleanup work at the site and reimburse the USEPA’s costs for overseeing that work. The USEPA also has requested reimbursement of $4 of previously incurred response costs. The ultimate amount of liability for PCS Nitrogen depends upon the final outcome of separate litigation to impose liability on additional parties, the amount needed for remedial activities, the ability of other parties to pay and the availability of insurance. |

| Ÿ | | PCS Phosphate Company, Inc. (“PCS Phosphate”) has agreed to participate, on a non-joint and several basis, with parties to an Administrative Settlement Agreement with the USEPA (“Settling Parties”) in a removal action and the payment of certain other costs associated with PCB soil contamination at the Ward Transformer Superfund Site in Raleigh, North Carolina (“Site”), including reimbursement of past USEPA costs. The removal |

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 12 |

| | | activities commenced in August 2007 and are believed to be nearly complete. In September 2013, PCS Phosphate and other parties entered into an Administrative Order on Consent with the USEPA, pursuant to which a supplemental remedial investigation and focused feasibility study will be performed on the portion of the Site that was subject to the removal action. The completed and anticipated work on the Site is estimated to cost a total of $75. PCS Phosphate is a party to ongoing Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) contribution and cost recovery litigation for the recovery of costs of the removal activities. The USEPA has also issued an order to a number of entities requiring remediation downstream of the area subject to the removal action (“Operable Unit 1”). PCS Phosphate did not receive this order. At this time, the company is unable to evaluate the extent of any exposure that it may have for the matters addressed in the CERCLA litigation or for Operable Unit 1. |

| Ÿ | | In 1996, PCS Nitrogen Fertilizer, L.P. (“PCS Nitrogen Fertilizer”), then known as Arcadian Fertilizer, L.P., entered into a Consent Order (the “Order”) with the Georgia Environmental Protection Division (“GEPD”) in conjunction with PCS Nitrogen Fertilizer’s acquisition of real property in Augusta, Georgia. Under the Order, PCS Nitrogen Fertilizer is required to perform certain activities to investigate and, if necessary, implement corrective measures for substances in soil and groundwater. The investigation has proceeded and the results have been presented to GEPD. Two interim corrective measures for substances in groundwater have been proposed by PCS Nitrogen Fertilizer and approved by GEPD. PCS Nitrogen Fertilizer is implementing the approved interim corrective measures but it is unable to estimate with reasonable certainty the total cost of its corrective action obligations under the Order at this time. |

Based on current information and except for the uncertainties described in the preceding paragraphs, the company does not believe that its future obligations with respect to these facilities and sites are reasonably likely to have a material adverse effect on its consolidated financial position or results of operations.

Other legal matters with significant uncertainties include the following:

Nitrogen and phosphate

| Ÿ | | The USEPA has an ongoing initiative to evaluate implementation within the phosphate industry of a particular exemption for mineral processing wastes under the hazardous waste program. In connection with this industry-wide initiative, the USEPA conducted inspections at numerous phosphate operations and notified the company of alleged violations of the US Resource Conservation and Recovery Act (“RCRA”) at its plants in Aurora, North Carolina; Geismar, Louisiana; and White Springs, Florida; and one alleged Clean Air Act (“CAA”) violation at its Geismar, |

| | | Louisiana plant. The company has entered into RCRA 3013 Administrative Orders on Consent and has performed certain site assessment activities at all of these plants. At this time, the company does not know the scope of action, if any, that may be required. As to the alleged RCRA violations, the company continues to participate in settlement discussions with the USEPA but is uncertain if any resolution will be possible without litigation, or, if litigation occurs, what the outcome would be. |

| Ÿ | | The USEPA has pursued an initiative to evaluate compliance with the CAA at sulfuric acid and nitric acid plants. In connection with this industry-wide initiative, it has sent requests for information to numerous facilities, including the company’s plants in Augusta, Georgia; Aurora, North Carolina; Geismar, Louisiana; Lima, Ohio; and White Springs, Florida. The USEPA and the Louisiana Department of Environmental Quality have notified the company of various alleged violations of the CAA at its Geismar, Louisiana plant. In May 2012, the USEPA issued to the company’s White Springs, Florida plant a Notice of Violation alleging that certain specified projects at the sulfuric acid plants were undertaken in violation of the CAA. While the company disputes the alleged violations, in May 2013, the company reached a tentative agreement to resolve the alleged violations without admitting any liability. The tentative agreement is subject to a variety of conditions, including the approval of the company’s Board of Directors and the negotiation of acceptable final agreements. The tentative agreement involves capital improvements, process changes and penalties for the company’s sulfuric acid plants in Aurora, North Carolina; Geismar, Louisiana; and White Springs, Florida that are currently estimated to cost at least $51, but the company is uncertain if a final agreement can be concluded. If a final agreement cannot be concluded and litigation subsequently occurs, the company is uncertain what the outcome would be. |

| Ÿ | | In December 2010, the USEPA issued a final rule to restrict nutrient concentrations in surface waters in Florida to levels below those currently permitted to be discharged from the company’s White Springs, Florida plant. In November 2012, the USEPA approved numeric nutrient criteria rules in their entirety which had been adopted by the State of Florida. These state rules could ultimately substitute for the federal rules. In March 2013, the USEPA and the State of Florida announced an Agreement in Principle and Path Forward with the goal being to make the promulgation of federal water quality standards no longer necessary in Florida. The USEPA is now expected to take steps to repeal its rule on numeric nutrient criteria which would allow the adopted and approved state rule to take legal effect. In the meantime, the company continues to monitor and evaluate actions related to both the federal and state rules. Due to the possibility of additional legal challenges, the prospects for implementation of either the federal or the state rules and the availability of the site-specific relief mechanisms under either rule |

| | |

| 13 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

| | | remain uncertain. However, if the state rules become the governing rules, the company believes White Springs meets the criteria for site-specific relief and expects to apply for relief that would, if granted by the state, obviate the need for the expenditure of some or all of the capital costs previously projected for controls under the USEPA rule. |

General

| Ÿ | | There is no certainty as to the scope or timing of any final, effective requirements to control greenhouse gas emissions in the US or Canada. Canada has withdrawn from participation in the Kyoto Protocol, and the Canadian government has announced its intention to coordinate greenhouse gas policies with the US. Although the US Congress has not passed any greenhouse gas emission control laws, the USEPA has adopted several rules to control such emissions using authority under existing environmental laws. Some Canadian provinces and US states are considering the adoption of greenhouse gas emission control requirements. In Saskatchewan, provincial regulations pursuant to the Management and Reduction of Greenhouse Gases Act, which impose a type of carbon tax to achieve a goal of a 20 percent reduction in greenhouse gas emissions by 2020 compared to 2006 levels, may become effective in 2014. None of these regulations has resulted in material limitations on greenhouse gas emissions at the company’s facilities. The company is monitoring these developments and their future effect on its operations cannot be determined with certainty at this time. |

In addition, various other claims and lawsuits are pending against the company in the ordinary course of business. While it is not possible to determine the ultimate outcome of such actions at this time, and inherent uncertainties exist in predicting such outcomes, it is the company’s belief that the ultimate resolution of such actions is not reasonably likely to have a material adverse effect on its consolidated financial position or results of operations.

The breadth of the company’s operations and the global complexity of tax regulations require assessments of uncertainties and judgments in estimating the taxes it will ultimately pay. The final taxes paid are dependent upon many factors, including

negotiations with taxing authorities in various jurisdictions, outcomes of tax litigation and resolution of disputes arising from federal, provincial, state and local tax audits. The resolution of these uncertainties and the associated final taxes may result in adjustments to the company’s tax assets and tax liabilities.

The company owns facilities that have been either permanently or indefinitely shut down. It expects to incur nominal annual expenditures for site security and other maintenance costs at certain of these facilities. Should the facilities be dismantled, certain other shutdown-related costs may be incurred. Such costs are not expected to have a material adverse effect on the company’s consolidated financial position or results of operations and would be recognized and recorded in the period in which they are incurred.

12. Related Party Transactions

The company sells potash from its Saskatchewan mines for use outside Canada and the US exclusively to Canpotex, a potash export, sales and marketing company owned in equal shares by the three producers in Saskatchewan. Sales are at prevailing market prices and are settled on normal trade terms. Sales to Canpotex for the three months ended March 31, 2014 were $249 (2013 — $375). At March 31, 2014, $144 (December 31, 2013 — $166) was owing from Canpotex.

13. Comparative Figures

Prior periods’ figures within Note 6 have been reclassified to disclose the impact of the margin (cost) on inter-segment sales separate from third-party transactions. Previously, these amounts were included as additions or reductions to cost of goods sold in each segment. There was no change in gross margin, by segment or in total. The company believes these reclassifications provide more succinct information. Additionally, comparative figures related to nitrogen inter-segment sales in Note 6 have been reduced by $26 for the three months ended March 31, 2013, to exclude sales within the same operating segment. These adjustments had no effect on any other amounts within the consolidated financial statements.

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 14 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis is the responsibility of management and is as of April 29, 2014. The Board of Directors carries out its responsibility for review of this disclosure principally through its audit committee, comprised exclusively of independent directors. The audit committee reviews and, prior to its publication, approves this disclosure, pursuant to the authority delegated to it by the Board of Directors. The term “PCS” refers to Potash Corporation of Saskatchewan Inc. and the terms “we,” “us,” “our,” “PotashCorp” and “the company” refer to PCS and, as applicable, PCS and its direct and indirect subsidiaries as a group. Additional information relating to PotashCorp, including our Annual Report on Form 10-K for the year ended December 31, 2013 (Form 10-K), can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. The company is a foreign private issuer under the rules and regulations of the US Securities and Exchange Commission (the SEC); however, it currently files voluntarily on the SEC’s domestic forms.

PotashCorp and Our Business Environment

PotashCorp is an integrated producer of fertilizer, industrial and animal feed products. We are the world’s largest fertilizer company by capacity, producing the three primary crop nutrients: potash (K), nitrogen (N) and phosphate (P). As the world’s largest potash producer by capacity, we are responsible for nearly one-fifth of global capacity through our Canadian operations. To enhance our global footprint, we have investments in four potash-related businesses in South America, the Middle East and Asia. We complement our potash assets with focused positions in nitrogen and phosphate.

A detailed description of our market and customers can be found on pages 54 and 55 (potash), 65 (nitrogen) and 73 (phosphate) in our 2013 Annual Integrated Report.

PotashCorp Strategy

Our business strategy is detailed on pages 20 to 23 in our 2013 Annual Integrated Report. Key strategies, risks and mitigation are outlined for each of our nutrients on pages 52 (potash), 63 (nitrogen) and 71 (phosphate) in our 2013 Annual Integrated Report.

Key Performance Drivers — Performance Compared to Targets

Through our integrated value model, we set, evaluate and refine our goals and priorities to drive improvements that benefit all those impacted by our business. We demonstrate our accountability by tracking and reporting our progress against targets related to each goal. Our long-term goals and 2014 targets are set out on pages 40 to 50 of our 2013 Annual Integrated Report. A summary of our progress against selected goals and representative annual targets is set out below.

| | | | |

| Goal | | Representative 2014 Annual Target | | Performance to March 31, 2014 |

| Create superior long-term shareholder value. | | Exceed total shareholder return performance for our sector and the DAXglobal Agribusiness Index. | | PotashCorp’s total shareholder return was 11 percent in the first three months of 2014 compared to our sector’s weighted average return (based on market capitalization) of 6 percent and the DAXglobal Agribusiness Index weighted average return (based on market capitalization) of 1 percent. |

| Be the supplier of choice to the markets we serve. | | Reduce domestic potash net rail cycle time through the Chicago corridor by 10 percent in 2014, compared to 2011 levels. | | Severe and prolonged winter weather throughout Canada and the United States, combined with increased rail shipments for grain and other commodities, impacted service for all rail customers. Our first quarter 2014 net rail cycle time through the Chicago corridor was 49 percent above the benchmark 2011 first quarter and 48 percent above the average of the prior three first quarter periods. We are seeing service improvements in the second quarter but backlogs persist for all rail shippers and we do not anticipate a quick return to historical net cycle times. |

| Attract and retain talented, motivated and productive employees who are committed to our long-term goals. | | Fill 75 percent of senior staff openings with qualified internal candidates. | | The percentage of senior staff positions filled internally in the first three months of 2014 was 100 percent. |

| Achieve no harm to people. | | Achieve zero life-altering injuries at our sites. | | Tragically, we had a fatality at our Cory potash facility during the first quarter of 2014. |

| | | Reduce total site recordable injury rate to 0.95 (per 200,000 hours worked) or lower. | | During the first three months of 2014, total site recordable injury rate was 1.06. |

| Achieve no damage to the environment. | | Reduce total reportable incidents (releases, permit excursions and spills) by 15 percent from 2013 levels. | | Annualized total reportable incidents were up 18 percent during the first three months of 2014 compared to 2013 annual levels. Compared to the first three months of 2013, total reportable incidents were down 29 percent. |

| | |

| 15 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

Performance Overview

This discussion and analysis are based on the company’s unaudited interim condensed consolidated financial statements included in Item 1 of this Quarterly Report on Form 10-Q (financial statements in this Form 10-Q) based on International Financial Reporting Standards, as issued by the International Accounting Standards

Board (IFRS), unless otherwise stated. All references to per-share amounts pertain to diluted net income per share.

For an understanding of trends, events, uncertainties and the effect of critical accounting estimates on our results and financial condition, this Form 10-Q should be read carefully, together with our 2013 Annual Integrated Report.

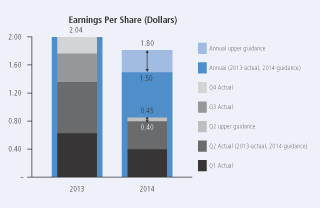

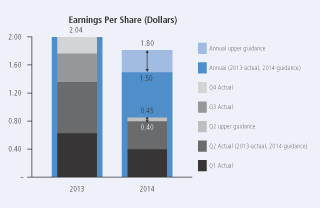

Earnings Guidance — First Quarter 2014

| | | | | | |

| | | Company Guidance | | Actual Results | |

Earnings per share | | $ 0.30 – $ 0.35 | | $ | 0.40 | |

Overview of Actual Results

| | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31 | |

| Dollars (millions) — except per-share amounts | | 2014 | | | 2013 | | | Change | | | % Change | |

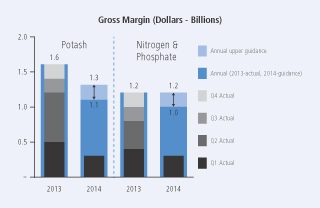

Sales | | $ | 1,680 | | | $ | 2,100 | | | $ | (420 | ) | | | (20 | ) |

Gross margin | | | 565 | | | | 867 | | | | (302 | ) | | | (35 | ) |

Operating income | | | 531 | | | | 817 | | | | (286 | ) | | | (35 | ) |

Net income | | | 340 | | | | 556 | | | | (216 | ) | | | (39 | ) |

Net income per share — diluted | | | 0.40 | | | | 0.63 | | | | (0.23 | ) | | | (37 | ) |

Other comprehensive income | | | 57 | | | | 197 | | | | (140 | ) | | | (71 | ) |

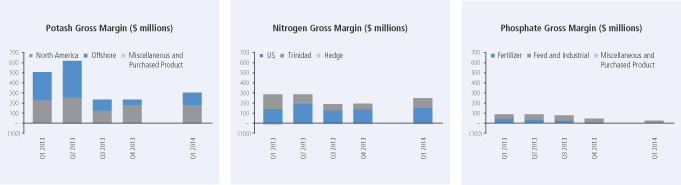

Earnings in the first quarter of 2014 were lower than the first quarter of 2013 due mostly to lower potash prices. Lower sales prices in nitrogen more than offset higher sales volumes. Phosphate was impacted by both lower prices and sales volumes.

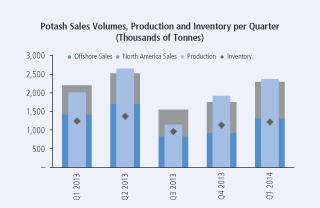

Potash demand and spot market pricing strengthened throughout the first quarter. In North America, demand was robust as fertilizer distributors worked to position product ahead of the spring planting season. Even as shipments from domestic producers climbed 48 percent above those during the same period last year, ongoing rail constraints — precipitated by difficult winter conditions and a record grain harvest in Canada — kept dealer supplies tight. Although demand from Brazil and Southeast Asian countries strengthened, North American producers’ offshore shipments fell slightly below those of the same period last year as

logistical challenges constrained their abilities to satisfy all demands for product. Offshore sales were further impacted by delayed supply contracts with Chinese and Indian buyers relative to 2013. Amidst strengthening market fundamentals, potash prices in all spot markets increased from the beginning of 2014 — most notably for granular product — but remained well below those of the comparative period in 2013.

In nitrogen, first-quarter ammonia production in the US reached its highest level in more than a decade as additional capacity came online and producers responded to strong agricultural and industrial demand. While ammonia prices trailed the historically high levels of 2013 — a period characterized by especially strong demand and supply challenges in key producing regions — they moved up sharply as the quarter came to a close. Demand for

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 16 |

urea was also robust ahead of the North American spring planting season. With imports lower than those of the previous year, North American supply tightened and urea prices strengthened over the course of the quarter, although key benchmarks remained below those of the same period in 2013.

Production and logistical challenges also impacted global phosphate markets. This was especially true in North America where a combination of supply disruptions and an improved demand environment caused prices for all phosphate fertilizer products to strengthen during the quarter. Despite this move upward, weak market fundamentals through the second half of 2013 kept pricing levels for the quarter below those of the comparative period last year.

Other significant factors that affected earnings quarter over quarter were lower income taxes (due to decreased ordinary earnings before taxes and fewer discrete tax adjustments), a special dividend received from Israel Chemicals Ltd. (ICL) (none in the first three months of 2013) and a non-tax deductible charge related to the impairment of our investment in Sinofert Holdings Limited (Sinofert) in first-quarter 2014. Other comprehensive income mainly consisted of an increase in the fair value of our investment in ICL. Other comprehensive income for the first quarter of 2013 was mainly the result of an increase in the fair value of our investments in ICL and Sinofert.

Statement of Financial Position

The most significant contributors to the changes in our statements of financial position were as follows(1):

| (1) | Direction of arrows refers to increase or decrease. |

| | |

Liabilities | | Equity |

i Short-term debt and current portion of long-term debt declined due to a decrease in our outstanding commercial paper. h Long-term debt was higher as a result of the issuance of $750 million in senior notes in the first quarter of 2014. | | h Equity was impacted by net income and other comprehensive income (both discussed in more detail above), dividends declared and common shares repurchased for cancellation (see Note 5 to the financial statements in this Form 10-Q) during the first three months of 2014. |

Cash and cash equivalents held in certain foreign subsidiaries were $13 million at March 31, 2014, down from $480 million at December 31, 2013 as a result of a repatriation of funds in the first quarter of 2014. There are no current plans to repatriate the funds at March 31, 2014 in a taxable manner.

| | |

| 17 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

Operating Segment Review

We report our results (including gross margin) in three business segments: potash, nitrogen and phosphate as described in Note 6 to the financial statements in this Form 10-Q. Our reporting structure reflects how we manage our business and how we classify our operations for planning and measuring performance. We include net sales in segment disclosures in the financial statements in this Form 10-Q pursuant to IFRS, which require segmentation based upon our internal organization and reporting of revenue and profit measures. As a component of gross margin, net sales (and the related per-tonne amounts) are the primary revenue measures we use and review in making decisions about operating matters on a business segment basis.

These decisions include assessments about potash, nitrogen and phosphate performance and the resources to be allocated to these segments. We also use net sales (and the related per-tonne amounts) for business planning and monthly forecasting. Net sales are calculated as sales revenues less freight, transportation and distribution expenses. Realized prices refer to net sales prices. Certain of the prior years’ figures within the nitrogen segment have been reclassified to conform with the current year’s presentation as disclosed in Note 13 to the financial statements in this Form 10-Q.

Our discussion of segment operating performance is set out below and includes nutrient product and/or market performance results, where applicable, to give further insight into these results.

Potash

Potash Financial Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31 | |

| | | Dollars (millions) | | | Tonnes (thousands) | | | Average per Tonne(1) | |

| | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | |

Manufactured product | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

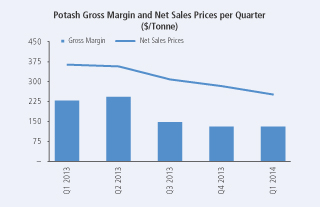

North America | | $ | 291 | | | $ | 331 | | | | (12 | ) | | | 988 | | | | 794 | | | | 24 | | | $ | 295 | | | $ | 417 | | | | (29 | ) |

Offshore | | | 287 | | | | 477 | | | | (40 | ) | | | 1,323 | | | | 1,432 | | | | (8 | ) | | $ | 217 | | | $ | 333 | | | | (35 | ) |

| | | 578 | | | | 808 | | | | (28 | ) | | | 2,311 | | | | 2,226 | | | | 4 | | | $ | 250 | | | $ | 363 | | | | (31 | ) |

Cost of goods sold | | | (274 | ) | | | (304 | ) | | | (10 | ) | | | | | | | | | | | | | | $ | (119 | ) | | $ | (136 | ) | | | (13 | ) |

Gross margin | | | 304 | | | | 504 | | | | (40 | ) | | | | | | | | | | | | | | $ | 131 | | | $ | 227 | | | | (42 | ) |

Other miscellaneous and purchased product gross margin(2) | | | (4 | ) | | | — | | | | n/m | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Margin | | $ | 300 | | | $ | 504 | | | | (40 | ) | | | | | | | | | | | | | | $ | 130 | | | $ | 227 | | | | (43 | ) |

| (1) | Rounding differences may occur due to the use of whole dollars in per-tonne calculations. |

| (2) | Comprised of net sales of $7 million (2013 — $6 million) less cost of goods sold of $11 million (2013 — $6 million). |

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 18 |

Potash gross margin variance attributable to:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31

2014 vs. 2013 | |

| | | | | | Change in

Prices/Costs | | | | |

| Dollars (millions) | | Change in Sales Volumes | | | Net Sales | | | Cost of Goods Sold | | | Total | |

Manufactured product | | | | | | | | | | | | | | | | |

North America | | $ | 64 | | | $ | (121 | ) | | $ | 11 | | | $ | (46 | ) |

Offshore | | | (27 | ) | | | (152 | ) | | | 25 | | | | (154 | ) |

Change in market mix | | | (13 | ) | | | 12 | | | | 1 | | | | — | |

Total manufactured product | | $ | 24 | | | $ | (261 | ) | | $ | 37 | | | | (200 | ) |

Other miscellaneous and purchased product | | | | | | | | | | | | | | | (4 | ) |

Total | | | | | | | | | | | | | | $ | (204 | ) |

Offshore sales to major markets, by percentage of sales volumes, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31 | |

| | | By Canpotex | | | From New Brunswick | |

| | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | |

Other Asian countries(1) | | | 47 | | | | 39 | | | | 21 | | | | — | | | | — | | | | — | |

Latin America | | | 27 | | | | 27 | | | | — | | | | 100 | | | | 100 | | | | — | |

China | | | 16 | | | | 25 | | | | (36 | ) | | | — | | | | — | | | | — | |

India | | | 3 | | | | 3 | | | | — | | | | — | | | | — | | | | — | |

Oceania, Europe and Other | | | 7 | | | | 6 | | | | 17 | | | | — | | | | — | | | | — | |

| | | | 100 | | | | 100 | | | | | | | | 100 | | | | 100 | | | | | |

| (1) | All Asian countries except China and India. |

| | |

| 19 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

The most significant contributors to the change in total gross margin quarter over quarter were as follows(1):

| (1) | Direction of arrows refers to impact on gross margin. |

| | | | |

| Net Sales Prices | | Sales Volumes | | Cost of Goods Sold |

i Potash prices began to trend upward in key markets as the quarter progressed, but the sharp decline during the second half of 2013 weighed on realizations. As a result, our first-quarter average realized potash price was well below the same period last year. | | h North American totals were higher as we leveraged our extensive warehousing and distribution capabilities to meet strong demand. i Our offshore sales volumes fell as delayed Chinese and Indian contracts and rail constraints limited shipments. | | h Two shutdown weeks were taken in 2014 as a result of the fatality at Cory while 16 shutdown weeks were taken in 2013 to match production with demand and for expansion-related activities. h The Canadian dollar weakened relative to the US dollar, reducing cost of goods sold. |

Potash Non-Financial Performance

| | | | | | | | | | | | | | |

| | | | | Three Months Ended March 31 | |

| | | | | 2014 | | | 2013 | | | % Change | |

Production | | KCl tonnes produced (thousands) | | | 2,395 | | | | 2,025 | | | | 18 | |

Safety | | Total site recordable injury rate | | | 1.34 | | | | 1.43 | | | | (6 | ) |

| | Life-altering injuries | | | 1 | | | | — | | | | n/m | |

Employee | | Percentage of senior staff positions filled internally | | | 100% | | | | —% | | | | n/m | |

Environmental | | Waste (000’s tonnes) | | | 4,500 | | | | 4,504 | | | | — | |

| | | Environmental incidents | | | 4 | | | | 6 | | | | (33 | ) |

Production

Potash production increased due to the reduction in shutdown weeks as discussed above.

Safety

Tragically, we had a fatality at our Cory potash facility during the first quarter of 2014.

Employee

Three senior staff positions were filled in the first quarter of 2014. In the same period in 2013 there were no relevant transfers or hires.

Environmental

Environmental incidents in the first three months of 2014 included brine and slurry pipeline failures resulting in brine spills. Environmental incidents in the first three months of 2013 were due largely to several failures of refrigerant lines in new HVAC units installed at New Brunswick.

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 20 |

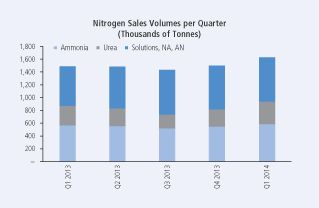

Nitrogen

Nitrogen Financial Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31 | |

| | | Dollars (millions) | | | Tonnes (thousands) | | | Average per Tonne(1) | |

| | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | |

Manufactured product(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

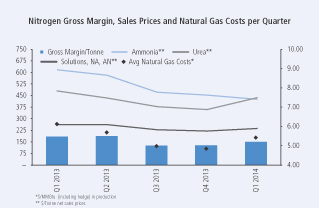

Ammonia | | $ | 246 | | | $ | 342 | | | | (28 | ) | | | 583 | | | | 559 | | | | 4 | | | $ | 422 | | | $ | 613 | | | | (31 | ) |

Urea | | | 150 | | | | 145 | | | | 3 | | | | 348 | | | | 305 | | | | 14 | | | $ | 433 | | | $ | 476 | | | | (9 | ) |

Solutions, Nitric acid, Ammonium nitrate | | | 164 | | | | 161 | | | | 2 | | | | 698 | | | | 622 | | | | 12 | | | $ | 234 | | | $ | 259 | | | | (10 | ) |

| | | 560 | | | | 648 | | | | (14 | ) | | | 1,629 | | | | 1,486 | | | | 10 | | | $ | 344 | | | $ | 436 | | | | (21 | ) |

Cost of goods sold | | | (324 | ) | | | (380 | ) | | | (15 | ) | | | | | | | | | | | | | | $ | (199 | ) | | $ | (255 | ) | | | (22 | ) |

Gross margin | | | 236 | | | | 268 | | | | (12 | ) | | | | | | | | | | | | | | $ | 145 | | | $ | 181 | | | | (20 | ) |

Other miscellaneous and purchased product gross margin(3) | | | 3 | | | | 3 | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Margin | | $ | 239 | | | $ | 271 | | | | (12 | ) | | | | | | | | | | | | | | $ | 147 | | | $ | 182 | | | | (19 | ) |

| (1) | Rounding differences may occur due to the use of whole dollars in per-tonne calculations. |

| (2) | Includes inter-segment ammonia sales, comprised of: net sales $25 million, cost of goods sold $12 million and 48,000 sales tonnes (2013 — net sales $31 million, cost of goods sold $13 million and 46,000 sales tonnes). Inter-segment profits are eliminated on consolidation. |

| (3) | Comprised of third-party and inter-segment sales, including: third-party net sales $15 million less cost of goods sold $11 million (2013 — net sales $17 million less cost of goods sold $14 million) and inter-segment net sales $NIL less cost of goods sold $1 million (2013 — net sales $14 million less cost of goods sold $14 million). Inter-segment profits are eliminated on consolidation. |

Nitrogen gross margin variance attributable to:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31

2014 vs. 2013 | |

| | | | | | Change in

Prices/Costs | | | | |

| Dollars (millions) | | Change in Sales Volumes | | | Net Sales | | | Cost of Goods Sold | | | Total | |

Manufactured product | | | | | | | | | | | | | | | | |

Ammonia | | $ | 13 | | | $ | (111 | ) | | $ | 33 | | | $ | (65 | ) |

Urea | | | 12 | | | | (15 | ) | | | 4 | | | | 1 | |

Solutions, NA, AN | | | — | | | | (17 | ) | | | 42 | | | | 25 | |

Hedge | | | — | | | | — | | | | 7 | | | | 7 | |

Change in product mix | | | 7 | | | | (7 | ) | | | — | | | | — | |

Total manufactured product | | $ | 32 | | | $ | (150 | ) | | $ | 86 | | | | (32 | ) |

Other miscellaneous and purchased product | | | | | | | | | | | | | | | — | |

Total | | | | | | | | | | | | | | $ | (32 | ) |

| | |

| 21 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

| | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31 | |

| | | Sales Tonnes

(thousands) | | | Price per Tonne | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Fertilizer | | | 577 | | | | 410 | | | $ | 370 | | | $ | 453 | |

Industrial and Feed | | | 1,052 | | | | 1,076 | | | $ | 330 | | | $ | 430 | |

| | | | 1,629 | | | | 1,486 | | | $ | 344 | | | $ | 436 | |

The most significant contributors to the change in total gross margin quarter over quarter were as follows(1):

| (1) | Direction of arrows refers to impact on gross margin. |

| | |

| Net Sales Prices | | Cost of Goods Sold |

i Ammonia prices fell from historically high levels in the first quarter of 2013, which was affected by strong demand and supply challenges in key producing regions. | | h Average costs, including our hedge position, for natural gas used as feedstock in production decreased 11 percent. Costs for natural gas used as feedstock in Trinidad production fell 29 percent (contract price indexed, in part, to Tampa ammonia prices) while our US spot costs for natural gas increased 40 percent. Including losses on our hedge position, US gas prices rose 22 percent. h The cost of goods sold variance for ammonia and urea mainly reflected decreased costs for natural gas used as feedstock in Trinidad production exceeding increased US natural gas costs, but to a greater extent in ammonia than in urea. h The cost of goods sold variance was better for solutions, nitric acid and ammonium nitrate due mainly to the impact of costs associated with Geismar in 2013 that did not repeat in 2014. |

Nitrogen Non-Financial Performance

| | | | | | | | | | | | | | |

| | | | | Three Months Ended March 31 | |

| | | | | 2014 | | | 2013 | | | % Change | |

Production | | N tonnes produced (thousands) | | | 833 | | | | 723 | | | | 15 | |

Safety | | Total site recordable injury rate | | | 0.49 | | | | 0.50 | | | | (2 | ) |

Employee | | Percentage of senior staff positions filled internally | | | 100% | | | | 100% | | | | — | |

Environmental | | Greenhouse gas emissions (CO2 equivalent tonnes/tonne of product) | | | 2.2 | | | | 2.2 | | | | — | |

| | | Environmental incidents | | | 1 | | | | 1 | | | | — | |

Production

The increase in production was mainly due to the restart of ammonia production at Geismar late in the first quarter of 2013.

| | |

| PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q | | 22 |

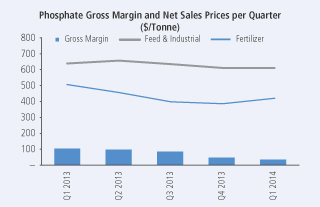

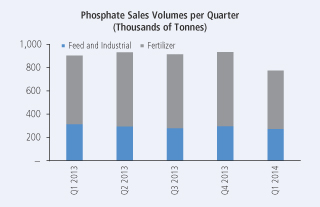

Phosphate

Phosphate Financial Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31 | |

| | | Dollars (millions) | | | Tonnes (thousands) | | | Average per Tonne(1) | |

| | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | | | 2014 | | | 2013 | | | % Change | |

Manufactured product | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fertilizer | | $ | 210 | | | $ | 297 | | | | (29 | ) | | | 502 | | | | 590 | | | | (15 | ) | | $ | 417 | | | $ | 503 | | | | (17 | ) |

Feed and Industrial | | | 165 | | | | 199 | | | | (17 | ) | | | 272 | | | | 313 | | | | (13 | ) | | $ | 608 | | | $ | 635 | | | | (4 | ) |

| | | 375 | | | | 496 | | | | (24 | ) | | | 774 | | | | 903 | | | | (14 | ) | | $ | 484 | | | $ | 549 | | | | (12 | ) |

Cost of goods sold | | | (351 | ) | | | (407 | ) | | | (14 | ) | | | | | | | | | | | | | | $ | (453 | ) | | $ | (451 | ) | | | — | |

Gross margin | | | 24 | | | | 89 | | | | (73 | ) | | | | | | | | | | | | | | $ | 31 | | | $ | 98 | | | | (68 | ) |

Other miscellaneous and purchased product gross margin(2) | | | 2 | | | | 3 | | | | (33 | ) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Margin | | $ | 26 | | | $ | 92 | | | | (72 | ) | | | | | | | | | | | | | | $ | 34 | | | $ | 102 | | | | (67 | ) |

| (1) | Rounding differences may occur due to the use of whole dollars in per-tonne calculations. |

| (2) | Comprised of net sales of $4 million (2013 — $7 million) less cost of goods sold of $2 million (2013 — $4 million). |

Phosphate gross margin variance attributable to:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31

2014 vs. 2013 | |

| | | | | | Change in

Prices/Costs | | | | |

| Dollars (millions) | | Change in Sales Volumes | | | Net Sales | | | Cost of Goods Sold | | | Total | |

Manufactured product | | | | | | | | | | | | | | | | |

Fertilizer | | $ | (25 | ) | | $ | (44 | ) | | $ | 23 | | | $ | (46 | ) |

Feed and Industrial | | | (18 | ) | | | (8 | ) | | | 7 | | | | (19 | ) |

Change in product mix | | | (2 | ) | | | 2 | | | | — | | | | — | |

Total manufactured product | | $ | (45 | ) | | $ | (50 | ) | | $ | 30 | | | | (65 | ) |

Other miscellaneous and purchased product | | | | | | | | | | | | | | | (1 | ) |

Total | | | | | | | | | | | | | | $ | (66 | ) |

| | |

| 23 | | PotashCorp 2014 First Quarter Quarterly Report on Form 10-Q |

The most significant contributors to the change in total gross margin quarter over quarter were as follows(1):