MAKINGPLENTIFUL POSSIBLE 2016 Annual Integrated Report

Contents

Financial data in this report are stated in US dollars unless

otherwise noted.

To learn more online, watch for the following icon:

WEB potashcorp.com

More than 1,000 people – including students and farmers – are welcomed annually at PotashCorp’s Model Farm in Trinidad, where visitors learn how fertilizers make bountiful crops possible.

Making Plentiful Possible

Food is essential for life. For nourishment and comfort. No matter which corner of the Earth we live in, whether we grow our own food, or buy it at a store, we all want enough to stay healthy and happy. It’s no surprise that when a country starts to grow and prosper, its people choose to eat more – and better – food.

But can the world produce the fruits, vegetables, grains and protein to feed everyone? This challenge drives demand for PotashCorp’s products – potash, nitrogen and phosphate – that help farmers grow healthier, more abundant crops.

By following our vision to play a key role in the global food solution while building long-term value for our stakeholders, PotashCorp is making plentiful possible.

| | |

| About this report: |

You can find this report and additional information about PotashCorp on our corporate website at www.potashcorp.com. While we include certain non-financial performance in this report, more detailed information on our sustainability performance is provided in our GRI content index available in our online Integrated Reporting Center. WEB potashcorp.com/irc | |  |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 1 |

WHY POTASHCORP?

| | |

1 | | FERTILIZER IS REQUIRED FOR PLENTIFUL FOOD PRODUCTION |

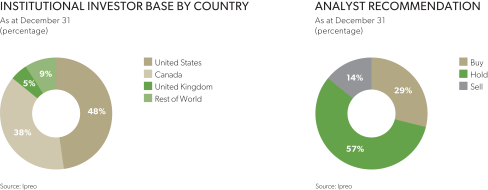

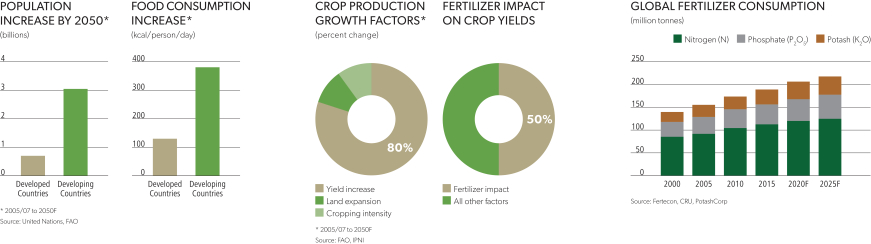

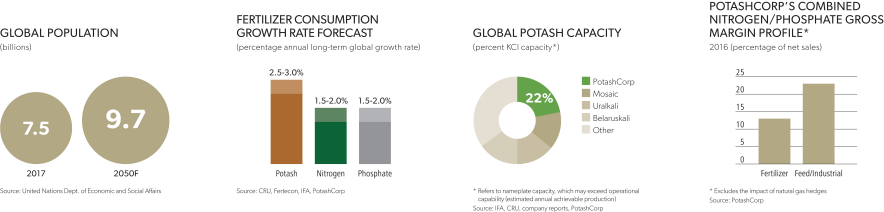

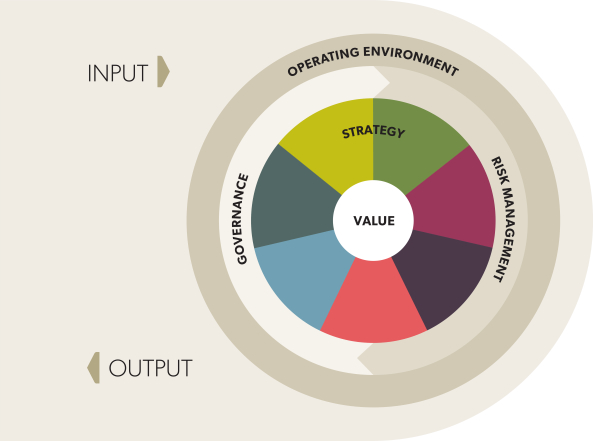

By 2050, the world’s population is expected to grow by 2.2 billion, to 9.7 billion. At the same time, diets are improving in many emerging regions. The result is greater demand for food. With limited arable land, only increased yields from the world’s farmers can make plentiful possible. Fertilizer is responsible for half of all crop yields; without it, we believe the world would be unable to feed itself.

| | |

| 2 | | THE POTASH BUSINESS HAS ADVANTAGES |

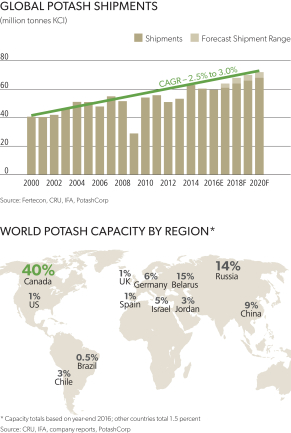

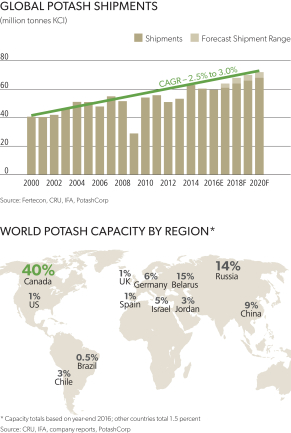

Of the three primary crop nutrients, potash has the greatest expected long-term rate of consumption growth, due to under-application in emerging markets, where crop yields lag behind those of the developed world.

Significant production occurs in only 11 countries, with approximately 40 percent of global capacity currently located in Canada. In addition, potash operations are very costly to develop and require long lead times.

| | |

3 | | WE HAVE AN EXCEPTIONAL POSITION IN

POTASH |

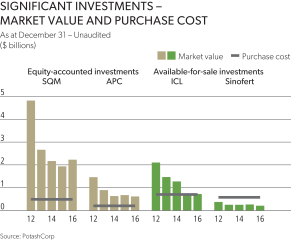

We are the largest potash company in the world by capacity, representing 22 percent of the global total. We also have investments in other potash-related companies that further enhance our exposure to this key nutrient.

With our multi-year expansion program completed, we can bring on morelow-cost potash capacity than any other producer to meet rising demand. Our focus is to retain operational flexibility while remaining a low-cost supplier into key markets.

| | |

4 | | WE HAVEHIGH-QUALITY NITROGEN AND PHOSPHATE ASSETS |

While potash is our primary nutrient and namesake, our portfolio includes all three essential crop nutrients.

We have nitrogen assets with access to lower-cost natural gas, proximity to key markets and a stable industrial customer base. In phosphate, we have the most diversified product offering in the industry, which has historically provided more favorable and stable returns.

| | |

| |

| 2 | | PotashCorp 2016 Annual Integrated Report |

FINANCIAL & OPERATIONAL HIGHLIGHTS

Years ended December 31

| | | | | | | | | | | | | | | | | | | | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | | | | | | |

| (millions unless otherwise noted) | | | | | | | | | | | | | | | | | | | | |

FINANCIAL | | | | | | | | | | | | | | | | | | | | |

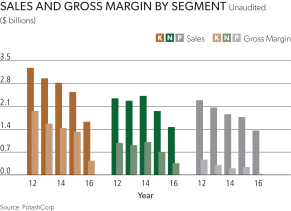

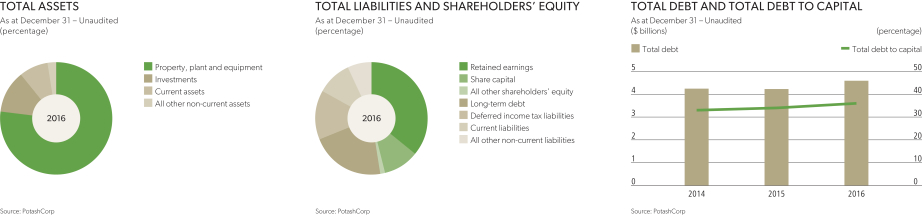

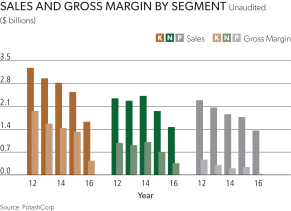

Sales | | | 4,456 | | | | 6,279 | | | | 7,115 | | | | 7,305 | | | | 7,927 | |

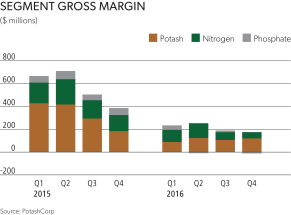

Gross Margin | | | 830 | | | | 2,269 | | | | 2,647 | | | | 2,790 | | | | 3,410 | |

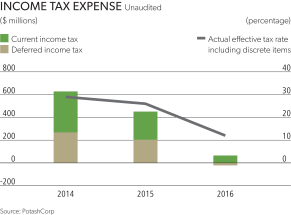

Net Income | | | 323 | | | | 1,270 | | | | 1,536 | | | | 1,785 | | | | 2,079 | |

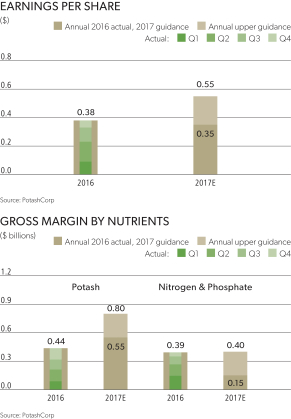

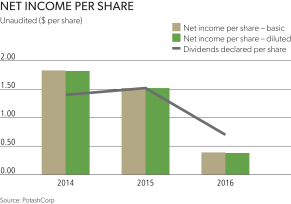

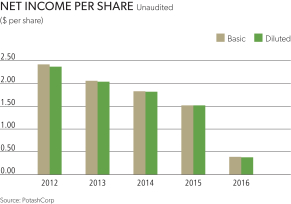

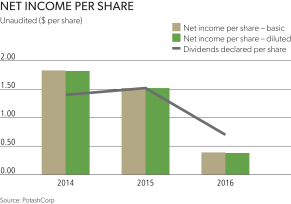

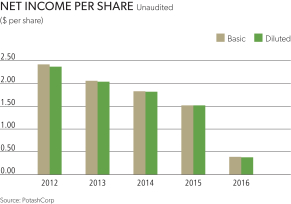

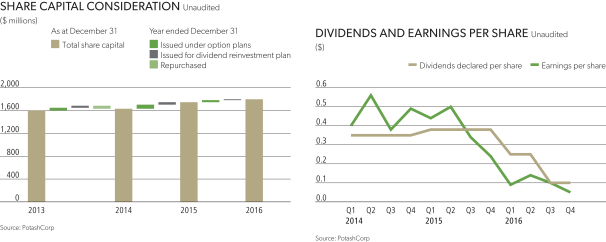

Net Income per Share – Diluted | | | 0.38 | | | | 1.52 | | | | 1.82 | | | | 2.04 | | | | 2.37 | |

Adjusted EBITDA 1 | | | 1,417 | | | | 2,598 | | | | 3,087 | | | | 3,342 | | | | 3,938 | |

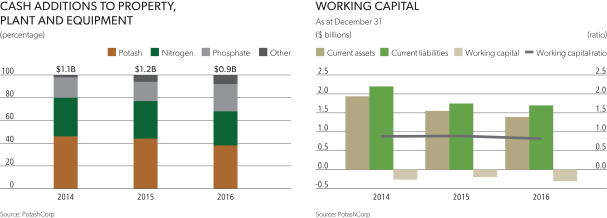

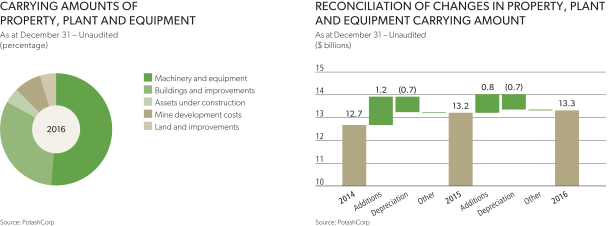

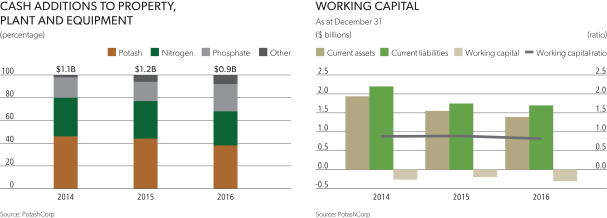

Cash Additions to Property, Plant and Equipment | | | (893 | ) | | | (1,217 | ) | | | (1,138 | ) | | | (1,624 | ) | | | (2,133 | ) |

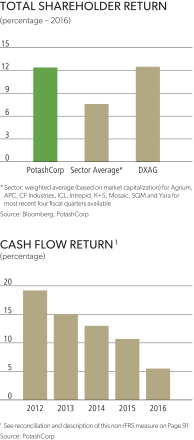

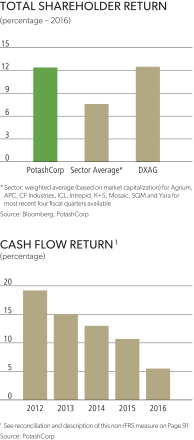

Cash Flow Return 2 | | | 5.5% | | | | 10.7% | | | | 13.0% | | | | 15.0% | | | | 19.2% | |

Total Shareholder Return | | | 12.4% | | | | (49.0% | ) | | | 11.6% | | | | (16.4% | ) | | | (0.2% | ) |

| | | | | | | | | | | | | | | | | | | | | |

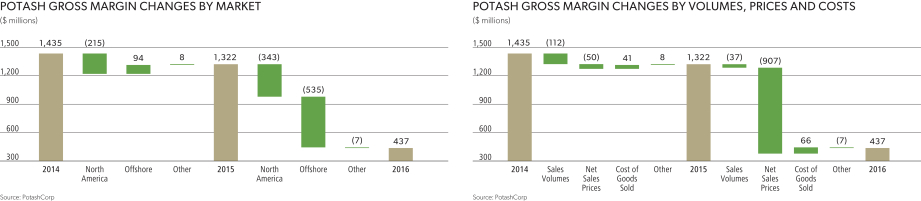

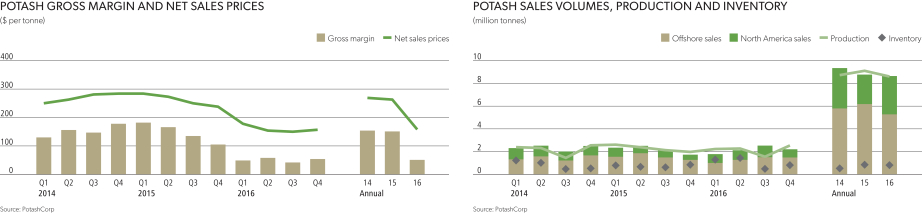

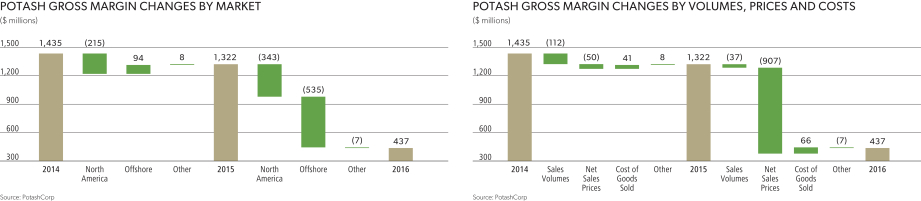

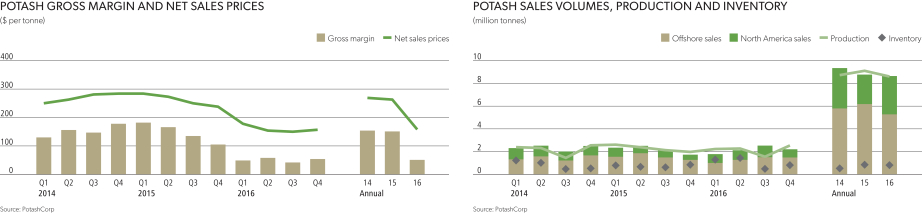

POTASH | | | | | | | | | | | | | | | | | | | | |

Sales Volumes (thousand tonnes product) | | | 8,644 | | | | 8,772 | | | | 9,346 | | | | 8,100 | | | | 7,230 | |

Average Realized Price (per tonne) | | | 158 | | | | 263 | | | | 269 | | | | 332 | | | | 424 | |

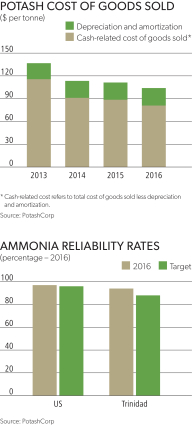

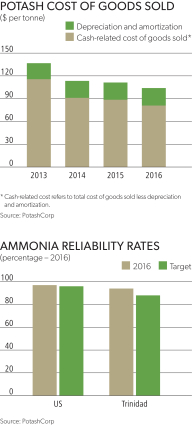

Cost of Goods Sold (per tonne) | | | (105 | ) | | | (111 | ) | | | (113 | ) | | | (136 | ) | | | (152 | ) |

Gross Margin (per tonne) | | | 53 | | | | 152 | | | | 156 | | | | 196 | | | | 272 | |

| | | | | | | | | | | | | | | | | | | | | |

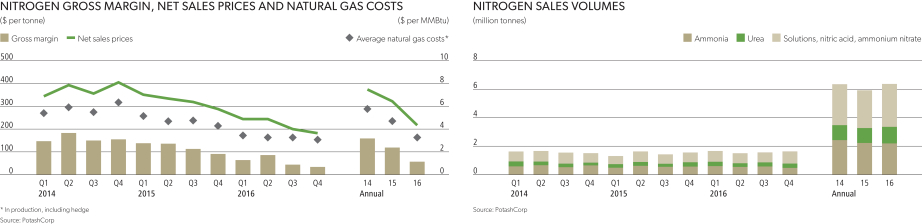

NITROGEN 3 | | | | | | | | | | | | | | | | | | | | |

Sales Volumes (thousand tonnes product) | | | 6,373 | | | | 5,926 | | | | 6,352 | | | | 5,896 | | | | 4,946 | |

Average Realized Price (per tonne) | | | 217 | | | | 322 | | | | 374 | | | | 377 | | | | 438 | |

Cost of Goods Sold (per tonne) | | | (163 | ) | | | (206 | ) | | | (218 | ) | | | (225 | ) | | | (254 | ) |

Gross Margin (per tonne) | | | 54 | | | | 116 | | | | 156 | | | | 152 | | | | 184 | |

| | | | | | | | | | | | | | | | | | | | | |

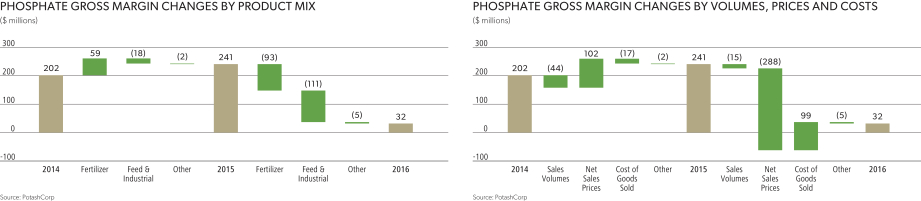

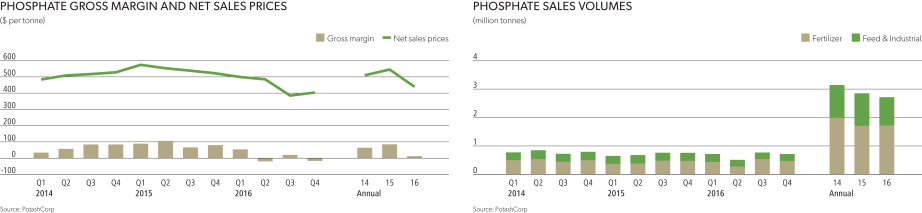

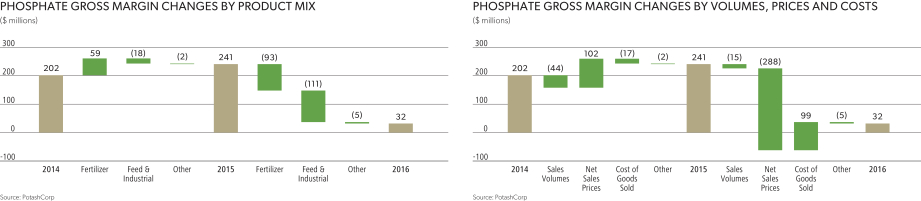

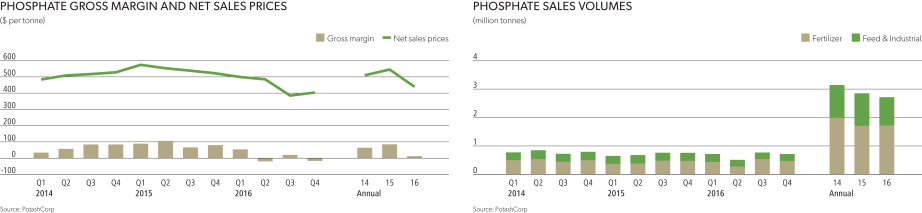

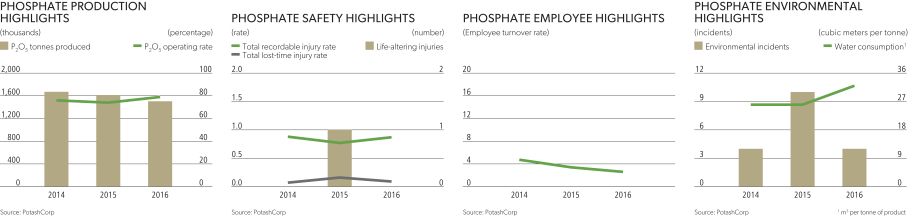

PHOSPHATE | | | | | | | | | | | | | | | | | | | | |

Sales Volumes (thousand tonnes product) | | | 2,713 | | | | 2,850 | | | | 3,142 | | | | 3,680 | | | | 3,643 | |

Average Realized Price (per tonne) | | | 439 | | | | 545 | | | | 510 | | | | 497 | | | | 568 | |

Cost of Goods Sold (per tonne) | | | (428 | ) | | | (463 | ) | | | (448 | ) | | | (415 | ) | | | (444 | ) |

Gross Margin (per tonne) | | | 11 | | | | 82 | | | | 62 | | | | 82 | | | | 124 | |

| | | | | | | | | | | | | | | | | | | | | |

1 See reconciliation and description of this non-IFRS measure on Page 95

2 See reconciliation and description of this non-IFRS measure on Page 91

3 Includes inter-segment ammonia sales

Note: all amounts listed under Potash, Nitrogen and Phosphate exclude the impact of other miscellaneous and purchased products

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 3 |

CEO LETTER

“2016 was a year

that charted a path

forward, one that

positions us to be

successful in any

market conditions.”

| | |

| |

| 4 | | PotashCorp 2016 Annual Integrated Report |

DEAR SHAREHOLDERS,

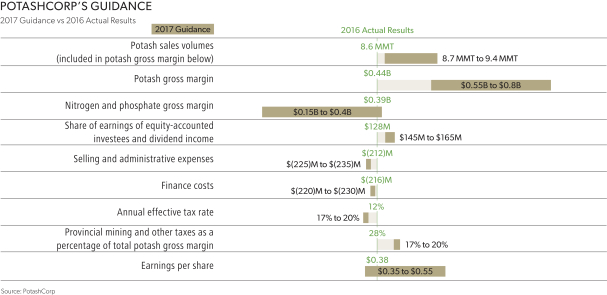

2016 was a transformative year for PotashCorp. Not only did we demonstrate how a market-responsive approach, commitment to operational excellence and focus on financial flexibility create resiliency amidst challenging market conditions, we also took important steps to strengthen ourbest-in-class assets and set a foundation for future success.

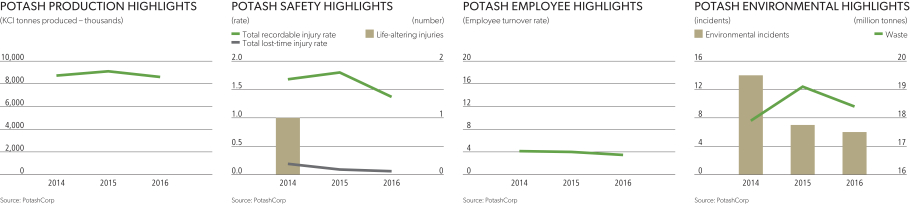

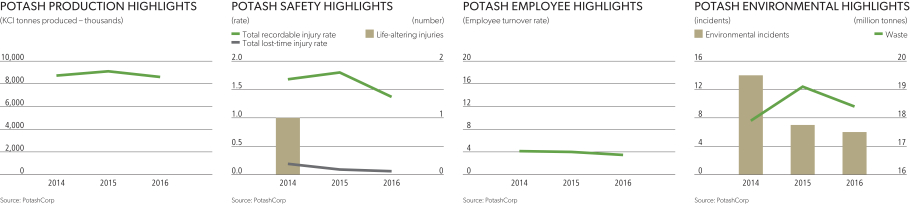

Strengthening our position can’t happen without ensuring the safety of our people. I’m proud to say that in 2016 we achieved the best safety results in our company’s history. We made significant progress in each of our safety priority areas and experienced no life-altering injuries. We introduced enhanced measures to help prevent serious injuries and fatalities and were recognized for a new program that empowers our front-line supervisors to be leaders in safety engagement. While our work to keep our employees safe is never done, our focus is making a difference.

During the year, we made the difficult but necessary move to optimize our potash portfolio by shifting capability to our lower-cost facilities. By suspending operations in New Brunswick and initiating operational changes at Cory, we will further reduce our cost profile in 2017 as we ramp up production at Rocanville, our lowest cost operation. At the same time, we reduced our dividend, with an aim to maintain strong credit ratings and enhance our financial flexibility.

We also announced a proposed Merger of Equals with Agrium, to create a highly synergistic, integrated nutrient production and retail distribution platform. We believe this opportunity will create tremendous value for our shareholders.

Importantly, 2016 was a year that charted a path forward, one that positions us to be successful in any market conditions, and enhances our ability to thrive as demand increases for our products – the building blocks of making plentiful possible.

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 5 |

OUR STRATEGY AND PERFORMANCE

Playing a key role in the global food solution and deliveringlong-term value for all our stakeholders requires strong performance in many areas. Our seven strategic priorities are vital to realizing our vision, and in 2016 we continued to deliver.

12.4%

total shareholder return

(Outperformed our peer group1)

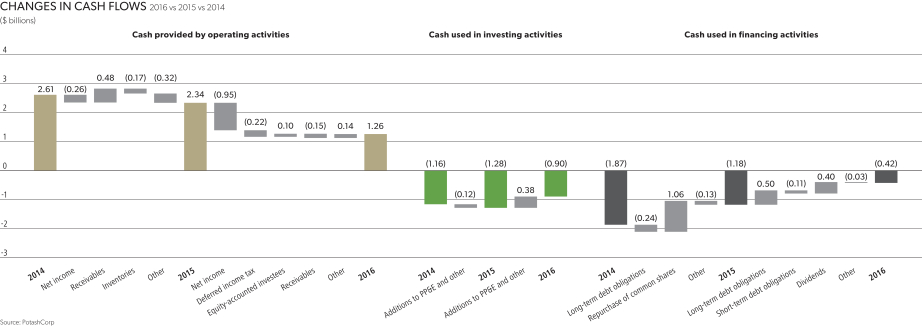

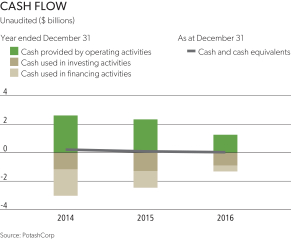

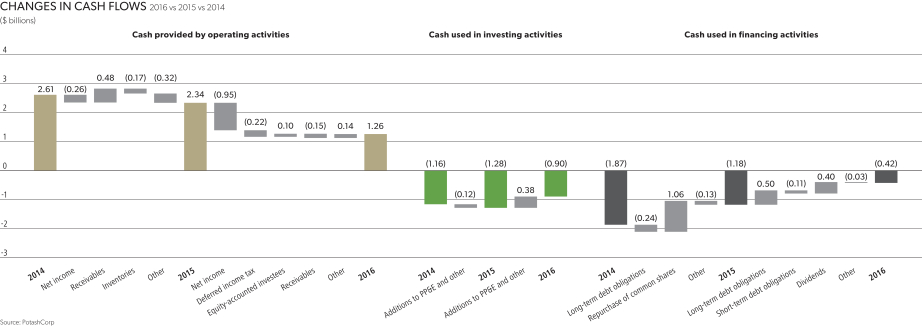

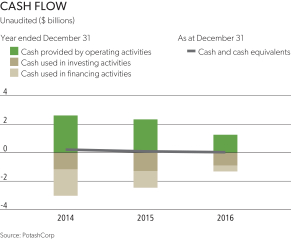

$1.3 billion

cash provided by

operating activities

PORTFOLIO & RETURN OPTIMIZATION

Outperformed

our competitors on customer surveys

in the areas of quality, reliability and service

57

educational seminars held

in the US and international markets, focused on the

benefits of our products and proper soil fertility

CUSTOMER & MARKET DEVELOPMENT

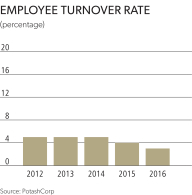

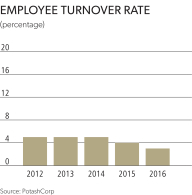

3%

annual employee turnover rate

demonstrating that our employees value

working at PotashCorp

Incentive plans

were enhanced

to better align pay and performance

with our strategic priorities

PEOPLE DEVELOPMENT

9%

reduction in our per-tonne cash

cost of goods sold in potash

(compared to 2015)

$135 million

annualized captured

procurement savings

(compared to 2014 levels)

OPERATIONAL EXCELLENCE

4.2out of 5

on community surveys

in the areas of local investment,

safety and environmental performance

83%

rated our communications on par with or

better than other best-practice companies

as part of annual shareholder survey

STAKEHOLDER COMMUNICATIONS

& ENGAGEMENT

| 1 | Weighted average (based on market capitalization) for Agrium, APC, CF Industries, ICL, Intrepid, K+S, Mosaic, SQM and Yara |

| | |

| |

| 6 | | PotashCorp 2016 Annual Integrated Report |

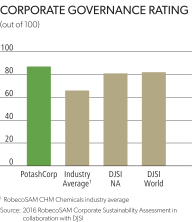

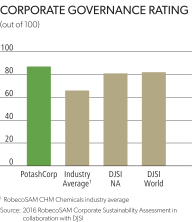

Exceeded rating

ofbest-in-class peers

on the Dow Jones Sustainability

World Index for corporate governance

Top quartile

ranking of governance practices

as determined by The Globe and Mail’s Board Games

GOOD GOVERNANCE

0

life-altering injuries

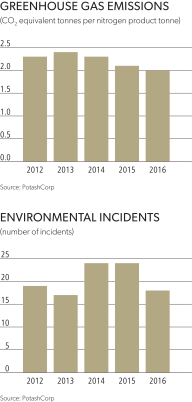

25%

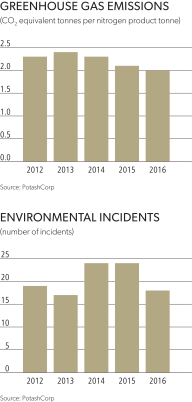

reduction in the number of

environmental incidents

(compared to 2015)

SAFETY, HEALTH &

ENVIRONMENTAL EXCELLENCE

POSITIONED FOR THE FUTURE

Throughout the year, we continued to focus on positioning our company for long-term success:

Completion and ramp-up of our largest and lowest cost potash mine is expected to reduce cost of goods sold by approximately $10 per tonne in 2017 and increase our Canpotex allocation and future offshore sales potential.

| • | | Production Optimization |

Optimization of our potash production from New Brunswick to our lower-cost Saskatchewan mines, along with operational changes at Cory, will reduce per-tonne cost of goods sold while ensuring we have adequate flexibility to meet rising customer needs.

Our Hammond Regional Distribution Center in Indiana was commissioned in May and offers 100,000 tonnes of additional potash storage capacity and space for up to 1,000 loaded railcars. We expect it to reduce rail cycle times and enhance our ability to serve our US customers.

| • | | Improved Financial Flexibility |

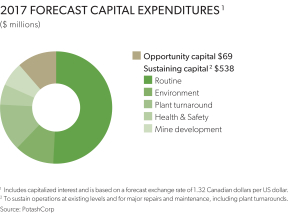

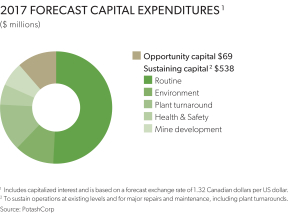

With capital expenditures reduced to approximately $600 million in 2017, and a realigned dividend, we have enhanced financial flexibility and our balance sheet and credit ratings are well positioned.

| • | | Merger of Equals with Agrium |

We expect our Merger of Equals with Agrium to create synergies of up to $500 million annually, greater earnings stability and new avenues for growth. With a broader range of high-quality products and more production locations, we will be better positioned to efficiently serve our customers.

Our company achieved a lot in 2016, and we are well positioned for the future. This couldn’t have happened without our employees. I offer my personal thanks for their valuable contributions to our company. I would also like to recognize the guidance and expertise provided by Jeffrey McCaig and Elena Viyella De Paliza, directors who are retiring from our Board after many years of service. At PotashCorp, we help nature provide, but it’s our people who ensure we can deliver the nutrients to feed a growing population.

Making plentiful possible is vital to more than 7 billion people around the world today, and by 2030 – only 13 years from now – it will be vital to another 1.2 billion. This is a significant challenge that makes clear the drivers of our business and our opportunity. As the largest producer of the nutrients that are responsible for half of all global crop yields, we are uniquely positioned to build value not only for our shareholders, but the countless others who depend on our enduring success.

Jochen Tilk

President and Chief Executive Officer

February 20, 2017

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 7 |

Management’s

Discussion &

Analysis

of Financial Condition and Results

of Operations (in US dollars)

| | |

| To learn more, watch for the following icons: |

| WEB | | potashcorp.com* |

A | | Annual Integrated Report |

10K | | Form10-K |

P | | Proxy Circular |

FS | | Financial Statements |

The following discussion and analysis is the responsibility of management and is as of February 20, 2017. The Board of Directors carries out its responsibility for review of this disclosure principally through its audit committee, comprised exclusively of independent directors. The audit committee reviews this disclosure and recommends its approval by the Board of Directors. The term “PCS” refers to Potash Corporation of Saskatchewan Inc. and the terms “we,” “us,” “our,” “PotashCorp” and “the company” refer to PCS and, as applicable, PCS and its direct and indirect subsidiaries as a group. Additional information relating to PotashCorp (which is not incorporated by reference herein) can be found in our regulatory filings on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

All references toper-share amounts pertain to diluted net income per share (EPS) as described in Note 9 to the consolidated financial statements.

* The information contained on or accessible from our website or any other website is not incorporated by reference into this “Management’s Discussion & Analysis of Financial Condition and Results of Operations” or any other report or document we file with or furnish to the US Securities and Exchange Commission or Canadian securities regulatory authorities.

Our nutrients help farmers produce thriving crops that sustain people across the globe.

WHO WE ARE AND WHAT WE DO

PotashCorp is the world’s largest crop nutrient company by capacity, producing potash (K), nitrogen (N) and phosphate (P). These primary crop nutrients are vital to maintain the healthy and productive soils that make plentiful possible.

| | | | | | | | | | | | |

| | | 2016 | | OUR OPERATIONS AND ASSETS | | OUR PRODUCTS AND MARKETS | | SHARE OF GLOBAL CAPACITY1 | | CONTRIBUTION TO GROSS MARGIN | | |

| | | | | | |

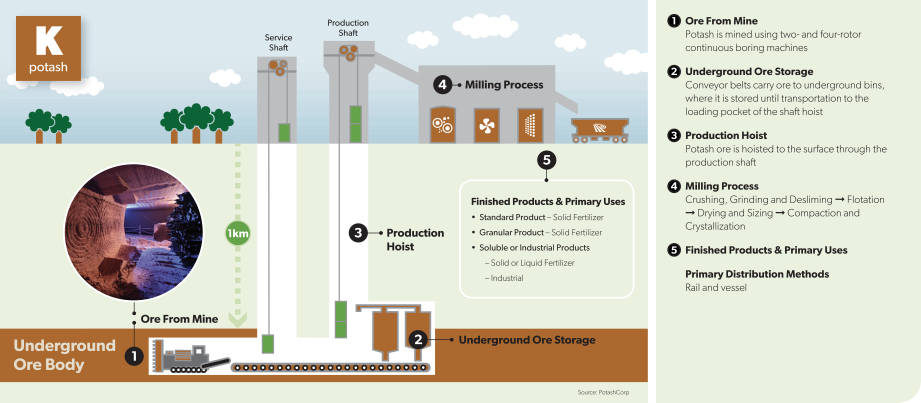

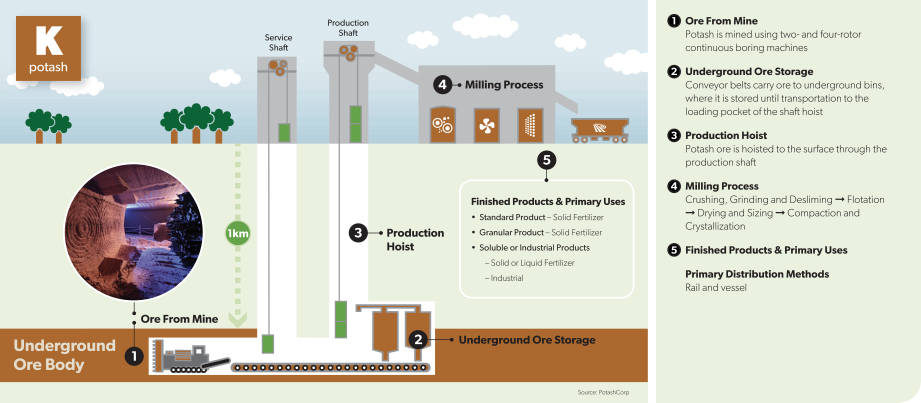

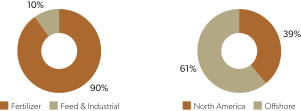

K | | POTASH | | • Five large-scale, lower-cost potash mines and several decades of high-quality reserves in Saskatchewan; positioned to remain one of the lowest cost producers globally • One potash mine in New Brunswick currently in care-and-maintenance mode • Four potash-related equity investments in Asia, Latin America and the Middle East • Investment in Canpotex, the world’s premier potash exporter | | • Produce nine different products; vast majority of production is granular and standard fertilizer • Product sold offshore by Canpotex, utilizing more than 5,000 railcars, three shipping terminals in British Columbia, Oregon and New Brunswick and a state-of-the-art railcar maintenance facility • Product sold within North America by PCS Sales, using 4,700 railcars and more than 200 owned or leased distribution points | | 22% | | 53% | | |

| | | | | | |

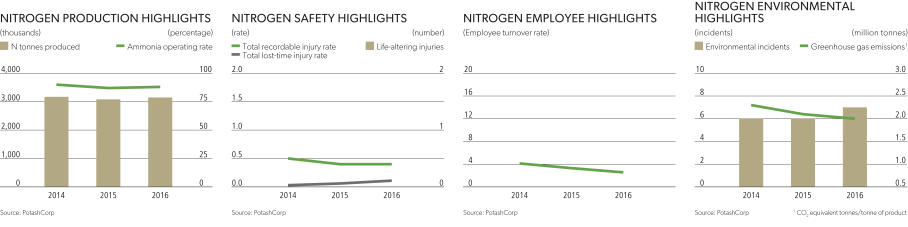

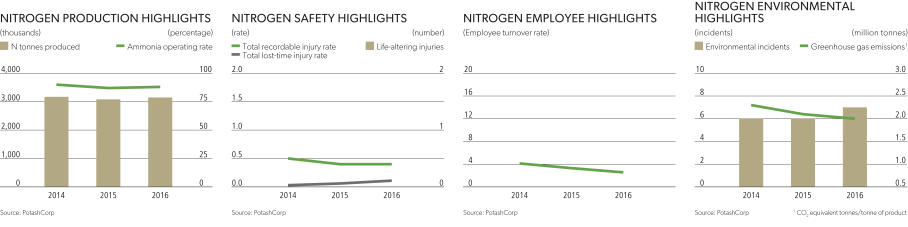

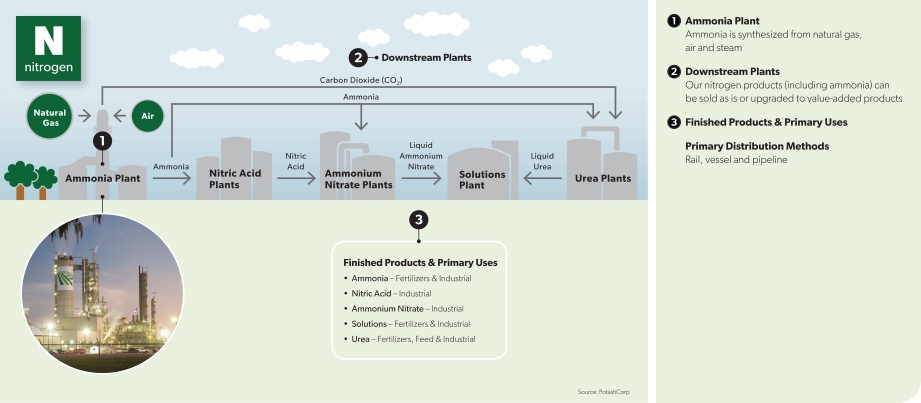

N | | NITROGEN | | • Three US production facilities, near key customers, with access to lower-cost natural gas • One large-scale production facility in Trinidad with four ammonia plants and one urea plant | | • Produce ammonia, urea, nitric acid, ammonium nitrate and nitrogen solutions, with a focus on industrial customers • Majority of product is sold in North America; offshore sales sourced primarily from Trinidad • Long-term, fixed-price ammonia vessel leases and access to six deepwater US ports enhance our flexibility and enable us to effectively manage transport costs | | 2% | | 43% | | |

| | | | | | |

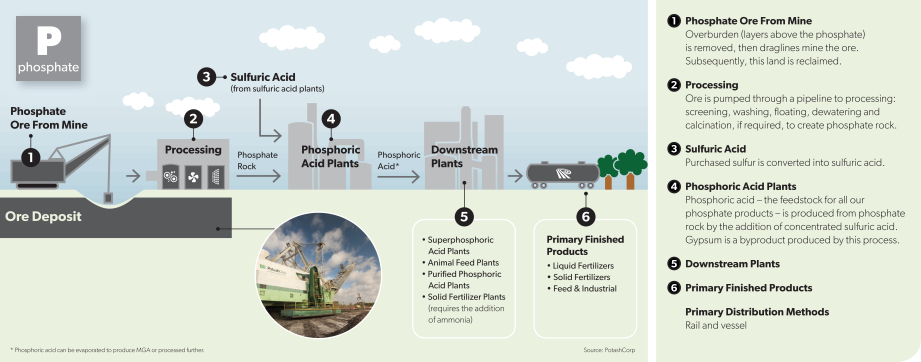

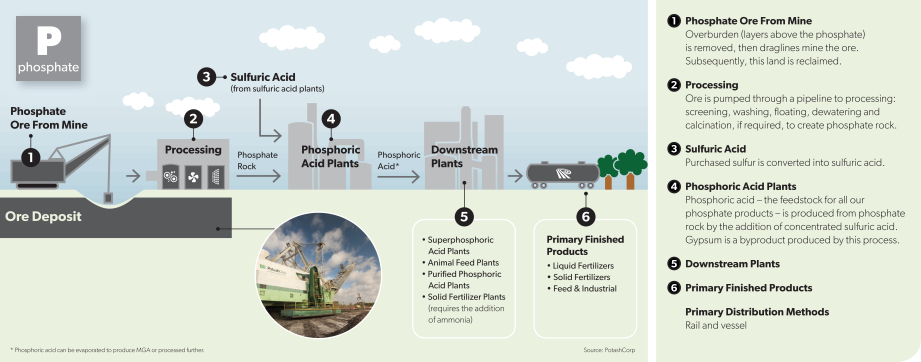

P | | PHOSPHATE | | • Two large, integrated mining and processing facilities and five smaller upgrading plants in the US • Long-term permits in place at Aurora for decades of mining; life-of-mine permit at White Springs | | • High-quality rock allows us to produce the most diversified portfolio of products among our peers, including feed, industrial and fertilizers • Majority of product is sold in North America; proximity to customers allows us to minimize freight costs | | 3% | | 4% | | |

1 Based on nameplate capacity on December 31, 2016, which may exceed operational capability

| | |

| |

| 10 | | PotashCorp 2016 Annual Integrated Report |

Company

With operations and investments in seven countries, PotashCorp is an international enterprise and a key player in making plentiful possible to help feed the world.

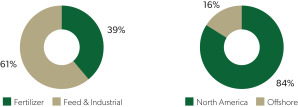

| | | | | | | | |

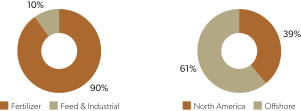

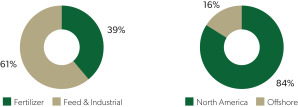

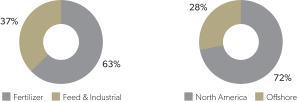

| | | NUMBER OF EMPLOYEES* | | SALES VOLUMES BY PRODUCT CATEGORY | | SALES VOLUMES BY REGION | | |

| | | |

| | 2,331 | |

| | |

| | | |

| | 823 | |

| | |

| | | |

| | 1,515 | |

| | |

| | * | Includes employees within individual nutrient segments on December 31, 2016 |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 11 |

KEY STAKEHOLDERS AND WHAT MATTERS MOST

Our Vision:To play a key role in the global food solution while building long-term value for all stakeholders

To achieve our vision and help make plentiful possible, we must not only be profitable for our shareholders but also understand and support the priorities of our other stakeholders. By helping our customers, employees, communities and suppliers prosper, we aim to ensure that everyone associated with our business can thrive. This is how we run our business, and this integrated report discusses how we create value for our stakeholders from both financial and non-financial standpoints.

| | |

| |

| 12 | | PotashCorp 2016 Annual Integrated Report |

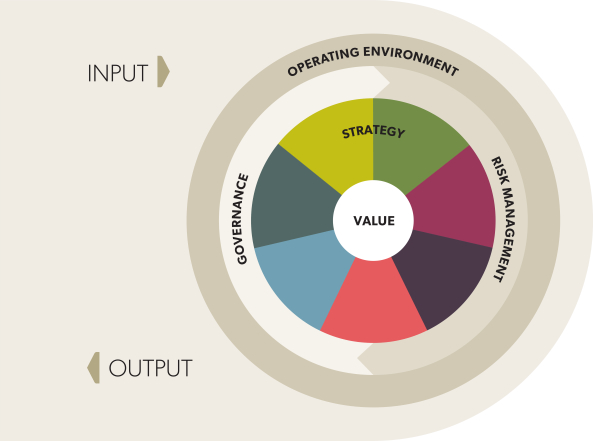

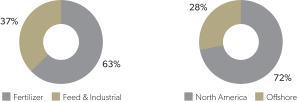

HOW WE CREATE VALUE AND WHAT WE REPORT

The priorities of our key stakeholders impact the way we approach value creation. As we consider the opportunities and challenges in our operating environment, these priorities shape our approach to setting strategy, managing risk and governing our actions. They also inform the depth and breadth of our reporting and the topics covered.

| | | | |

For more information on how we establish what matters most for reporting, refer to our Integrated Reporting Center. |

| | |

WEB | | potashcorp.com/irc/keytopics |

Operating Environment

We highlight the opportunities and challenges we face in each nutrient and our company’s competitive advantages.

Governance

We detail how PotashCorp is managed in a way that strives to build and protect value for all stakeholders.

Strategy and Performance

We describe where we direct our efforts and resources to ensure we createlong-term, sustainable value for our stakeholders. We discuss performance against targets and show what we are doing to achieve shared success.

Risk

We outline key risks to our company and the way we seek to manage them on an ongoing basis.

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 13 |

Our

Value Creation

Aaliyah Pacifique appreciates an abundant harvest at the PotashCorp Model Farm.

LONG-TERM OPPORTUNITY

OPERATING ENVIRONMENT

Our growth is tied closely to the need to produce nutritious food for a growing population. To determine how to best position the company for long-term success, we carefully monitor agricultural trends, macroeconomic factors and market opportunities and challenges in each nutrient.

| | | | | | |

POPULATION GROWTH AND DIETARY CHANGES IMPACT FOOD DEMAND | | WITH LESS ARABLE LAND PER CAPITA, FERTILIZERS ARE NEEDED FOR MORE PLENTIFUL YIELDS | | THE NEED FOR OUR PRODUCTS

IS GROWING |

| | |

| |

| 16 | | PotashCorp 2016 Annual Integrated Report |

NEAR-TERM FACTORS

| | | | | | |

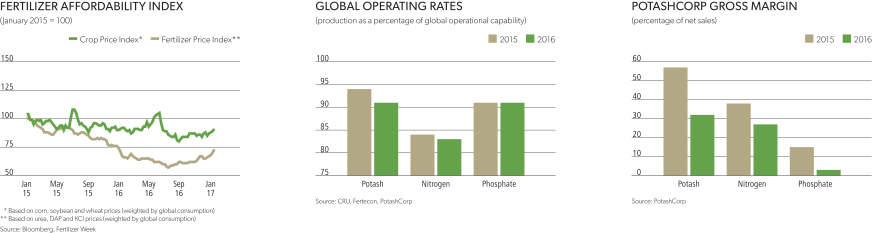

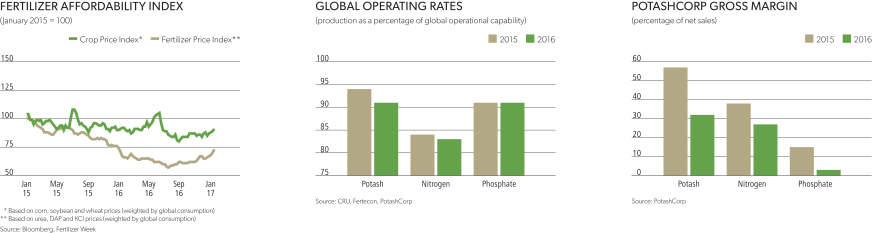

FERTILIZER AFFORDABILITY

FOR FARMERS AFFECTS DEMAND

FOR OUR PRODUCTS | | GLOBAL SUPPLY, DEMAND AND PRODUCTION COSTS IMPACT OUR MARKET ENVIRONMENT | | THESE FACTORS AFFECT MARGINS FOR OUR PRODUCTS |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 17 |

POTASH OPERATING ENVIRONMENT

| | | | | | | | |

| USES | | NUMBER OF MAJOR PRODUCING COUNTRIES* |

| | | |

Fertilizer Improves root and stem strength, water utilization and disease resistance; enhances taste, color and texture of food | | Feed Aids in animal growth and milk production | | Industrial Used in soaps, water softeners, de-icers, drilling muds

and food products | | 11 |

| | | |

* Countries producing more than 500,000 tonnes annually

INDUSTRY OVERVIEW

| | | | |

Economically mineable deposits are geographically concentrated | | Regions that have historically under-applied potash will drive growth in demand | | New capacity requires significant investment of time and money |

• Securing an economically mineable deposit in a country that has both political stability and available infrastructure presents significant challenges. • Producers in Canada and the FSU account for approximately 40 percent and 30 percent of capacity, respectively. | | • Crop production requirements and improving soil fertility practices – particularly in emerging markets where potash has been under-applied and crop yields lag – are expected to drive strong growth in potash demand. • Economic conditions and government policies in consuming regions can create variability in growth. | | • Entry into the potash business is challenging because building new capacity is costly and time-consuming. • Brownfield projects, especially those already completed, have a significant per-tonne capital cost advantage over greenfield projects. |

| | | | |

Our Competitive Advantage | | Our Competitive Advantage | | Our Competitive Advantage |

We have access to decades of high-quality, permitted potash reserves in a politically stable region withwell-established infrastructure. | | Canpotex is well positioned to efficiently supply its customers in approximately 35 countries around the world. With a lower fixed-cost profile, we can cost effectively reduce production to respond to variability in demand. | | With our expansions completed at a cost well below that of greenfield, we are the largest potash producer in the world by capacity, and have a lower-cost, growth platform that is paid for. |

| | |

| |

| 18 | | PotashCorp 2016 Annual Integrated Report |

| | | | | | |

| GLOBAL USE AS FERTILIZER | | ESTIMATED LONG-TERM GROWTH RATE | | GLOBAL PRODUCTION TRADED (KCI) | | AVERAGE GROSS MARGIN* |

| | | |

| ~90% | | 2.5-3.0% | | 76% | | 63% |

* PotashCorp 10-year percentage of net sales

Other key market facts

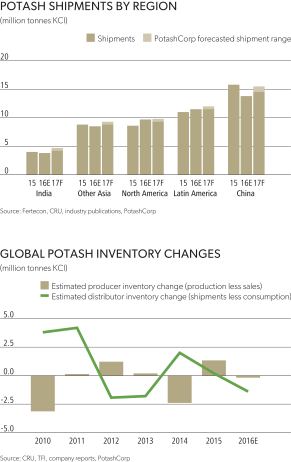

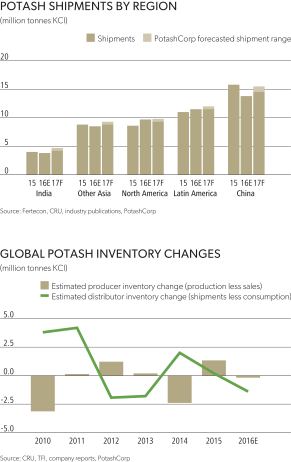

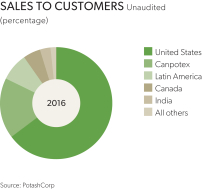

| • | | Asia and Latin America are the largest consuming regions, accounting for 48 percent and 20 percent, respectively. |

| • | | Asia is the largest consumer of standard product, using it as a direct application fertilizer and in compound fertilizers. |

| • | | Granular product is used in more advanced agricultural markets where it is typically blended with other crop nutrients. |

| • | | Most product is sold on a spot basis; customers in certain countries – like China and India – purchase under contracts. |

| • | | In offshore markets, Canpotex competes against producers such as APC, Belaruskali, ICL, K+S, SQM and Uralkali. |

| • | | In North America, our key competitors are Agrium, Belaruskali, ICL, Intrepid, K+S, Mosaic, SQM and Uralkali. |

PRIMARY POTASH MARKET PROFILE

| | | | | | | | |

Country/ Region | | Growth

Rate1 | | Offshore Imports 2

(MMT – 2016) | | Domestic Producer Sales

(MMT – 2016) | | Main Consuming Crops |

| China | | 4.1% | | 6.6 | | 7.2 | | Vegetables, rice, fruits, corn |

| India | | 0.1% | | 3.8 | | – | | Rice, wheat, vegetables, sugar crops |

| Other Asia | | 4.6% | | 8.2 | | 0.3 | | Oil palm, rice, sugar crops, fruits, vegetables |

| Latin America | | 4.2% | | 9.6 | | 1.9 | | Soybeans, sugar crops, corn |

| North America | | 0.2% | | 1.2 | | 8.5 | | Corn, soybeans |

1 10-year CAGR for consumption (2006-2016E) 2 Net imports; does not include product for re-export

| Source: | CRU, Fertecon, IFA, PotashCorp |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 19 |

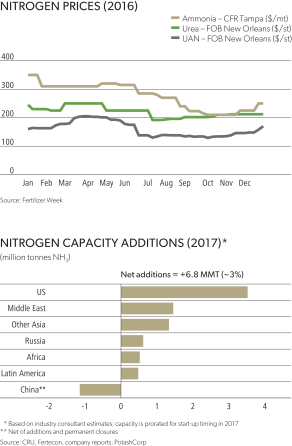

NITROGEN OPERATING ENVIRONMENT

| | | | | | | | |

| | | USES | | | | NUMBER OF MAJOR PRODUCING COUNTRIES |

| | | |

Fertilizer | | Feed | | Industrial | | ~65 |

Essential for protein synthesis; speeds plant growth | | Plays a key role in animal growth and development | | Used in plastics, resins, adhesives and emission controls | |

INDUSTRY OVERVIEW

| | | | |

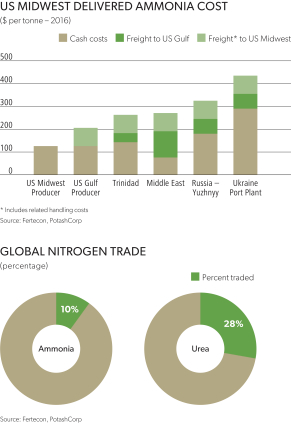

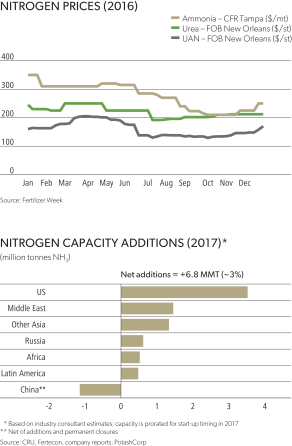

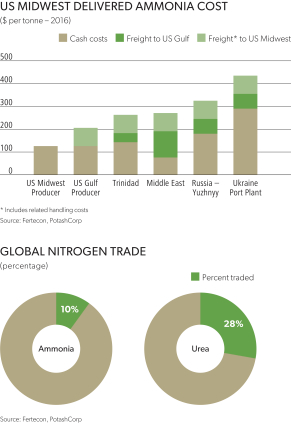

| Lower-cost energy is essential to success | | Proximity to end markets provides advantages | | Pricing can be volatile |

| | |

• Natural gas can make up 70-85 percent of the cash cost of producing a tonne of ammonia. • With lower-cost natural gas, the US, Russia, North Africa and the Middle East are major producing regions. • Producers in China and Europe are typicallyhigher-cost suppliers and play a significant role in determining global nitrogen prices. | | • The need for expensive, specialized transportation vessels is an obstacle to economical transportation of ammonia over long distances. • Global ammonia trade has historically been limited compared to urea, which can be more easily transported. | | • With natural gas feedstock widely available, the nitrogen industry is highly fragmented and regionalized. • Geopolitical events and the influence of Chinese urea exports can impact global trade. • These factors typically make nitrogen markets more volatile than other fertilizer markets. |

| | | | |

| Our Competitive Advantage | | Our Competitive Advantage | | Our Competitive Advantage |

| | |

Significant supply of lower-priced shale gas provides an advantaged cost position for our US nitrogen production.

In Trinidad, our gas costs are indexed to Tampa ammonia prices, sheltering margins. | | Our production facilities in the US and Trinidad are well- positioned to serve the key consuming regions of North America and Latin America. | | We produce a broad range of nitrogen products and have a relatively stable industrial customer base. Sales to industrial customers make up approximately two-thirds of our total nitrogen sales volumes. |

| | |

| |

| 20 | | PotashCorp 2016 Annual Integrated Report |

| | | | | | |

| GLOBAL USE AS FERTILIZER | | ESTIMATEDLONG-TERM GROWTH RATE | | GLOBAL PRODUCTION TRADED (NH3) | | AVERAGE GROSS MARGIN* |

| | | |

~80% | | 1.5-2.0% | | 10% | | 36% |

* PotashCorp 10-year percentage of net sales

Other key market facts

| • | | China and India are the largest-consuming countries, accounting for almost half of world consumption. |

| • | | Capacity has recently expanded significantly in the US, reducing the need for offshore imports. |

| • | | Volume of Chinese exports is an important factor for global urea pricing. |

| • | | We compete in the US market with Agrium, CF Industries, CVR, Koch, LSB and OCI, along with offshore suppliers. |

| • | | We compete in offshore markets with a wide range of offshore and domestic producers. |

US NITROGEN MARKET PROFILE

| | | | | | | | | | |

| Product | | Fertilizer Use 1 | | Non-Fertilizer Use | | Production 2

(MMT – 2016) | | Imports

(MMT – 2016) | | Key Supplying Countries/Regions |

| Ammonia | | 70% | | 30% | | 12.9 | | 4.6 | | Canada, Russia, Trinidad |

| Urea | | 75% | | 25% | | 7.5 | | 6.6 | | Africa, Canada, Middle East |

| UAN | | 99% | | 1% | | 11.3 | | 2.7 | | Canada, Russia, Trinidad |

1 Includes production upgraded into other fertilizer products

2 Includes urea liquor used to produce nitrogen solutions and diesel emission fluid (DEF)

| Source: | USDOC, Blue Johnson, Fertecon, CRU, PotashCorp |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 21 |

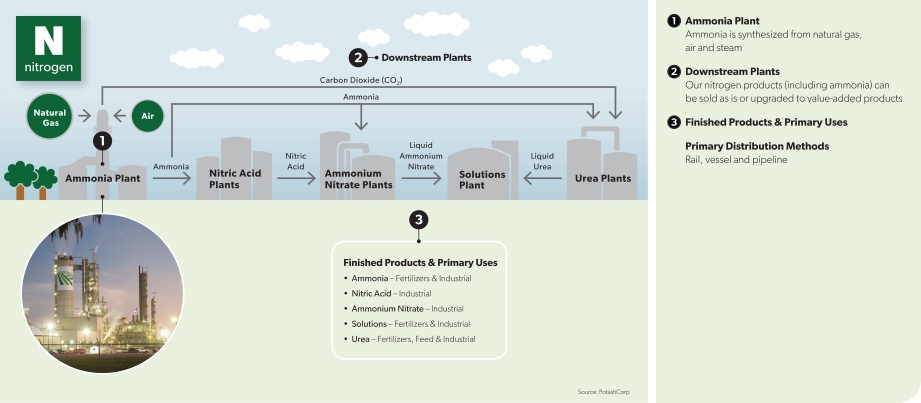

PHOSPHATE OPERATING ENVIRONMENT

| | | | | | | | |

USES | | NUMBER OF MAJOR PRODUCING COUNTRIES | | |

| | | | |

| | | | | | | | |

Fertilizer Required for energy storage and transfer; speeds crop maturity | | Feed Assists in muscle repair and skeletal development of animals | | Industrial Used in soft drinks, food additives

and metal treatments | | ~40 | |

| | | | | |

| | | | | | | |

| | | | | | | |

INDUSTRY OVERVIEW

| | | | |

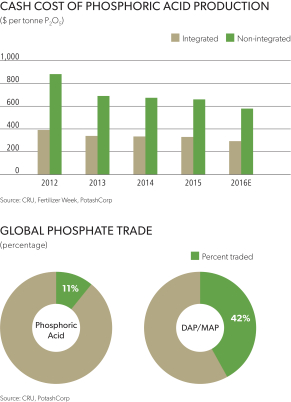

High-quality, lower-cost rock is critical

tolong-term success | | Raw material cost changes

affect profitability | | Changes in global trade impact

market fundamentals |

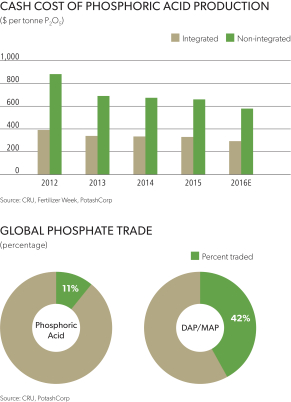

• Phosphate rock is geographically concentrated: China, Morocco and the US together produce 67 percent of the world’s supply. • Approximately one-third of global producers arenon-integrated and rely on purchased rock; those with direct access to a high-quality,lower-cost supply have a significant competitive advantage. | | • Changing prices for raw material inputs – sulfur and ammonia – have historically resulted in production-cost volatility. • Phosphate prices have historically reflected changes in the costs of these inputs, along with rock costs. | | • With limited indigenous rock supply, India is the largest importer of phosphate in the world, and its demand can have a significant impact on global markets. • Increased export supply from Morocco, Saudi Arabia and China has lowered US exports of solid fertilizers. • US producers rely more on trade with Latin America and production of specialty phosphate products. |

| | | | |

Our Competitive Advantage | | Our Competitive Advantage | | Our Competitive Advantage |

We are an integrated producer with access to many years ofhigh-quality, permitted phosphate reserves. | | We sell feed and industrial phosphate products that require minimal ammonia as a raw material input. | | We have the most diversified product offering in the industry and make more than 70 percent of our sales in

North America. |

| | |

| |

| 22 | | PotashCorp 2016 Annual Integrated Report |

| | | | | | | | | | |

| GLOBAL USE AS FERTILIZER | | ESTIMATED LONG-TERM GROWTH RATE | | GLOBAL PRODUCTION TRADED (P2O5) | | | AVERAGE GROSS MARGIN* | |

| | | | | | | | | | |

| ~90% | | 1.5-2.0% | | | 11% | | | | 21% | |

* PotashCorp 10-year percentage of net sales

Other key market facts

| • | | China and India account for more than 40 percent of global consumption. |

| • | | With large deposits in Africa and the Middle East, geopolitical instability can affect investment and operating decisions. |

| • | | Volume of Chinese exports is an important factor in global phosphate pricing. |

| • | | We compete in fertilizer markets with Agrium, Mosaic and Simplot, and imports primarily from China, Morocco and Russia. |

| • | | For feed and industrial sales, our major competitors are ICL, Innophos, Mosaic and producers from China and Russia. |

KEY DAP/MAP MARKET PROFILE

| | | | | | | | |

| Country/Region | | Growth Rate 1 | | DAP/MAP Production (MMT – 2016) | | DAP/MAP Imports (MMT – 2016) | | Main Crops |

| | | | | | | | | |

| China | | 0.5% | | 26.4 | | 0.3 | | Vegetables, corn, wheat |

| India | | 1.7% | | 4.4 | | 4.3 | | Rice, wheat, oilseeds |

| Other Asia | | 2.4% | | 0.9 | | 4.8 | | Rice, wheat, oil palm |

| Latin America | | 4.8% | | 1.9 | | 5.9 | | Soybeans, corn, sugar crops |

| North America | | 0.5% | | 9.1 | | 1.4 | | Corn, wheat, soybeans |

1 10-year CAGR for consumption (2006-2016E)

| Source: | CRU, IFA, PotashCorp |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 23 |

GOVERNANCE

In fulfilling its oversight responsibilities, our Board of Directors’ commitment to excellence in governance permeates our overall approach to business. Whether it’s shaping the Core Values that guide our actions or ensuring we have the right value-enhancing strategies and risk processes, the Board fosters a culture that encourages us to uphold the highest ethical standards and strive for excellence in our business practices in order to build long-term value for all our stakeholders.

FOCUSING ON GOOD GOVERNANCE

In 2016, we continued to advance our governance practices. Some of these are highlighted below:

| | | | |

| | Our Core Values are the principles that guide the behavior and actions of our people as we seek to achieve our corporate goals. They articulate the expectation that we will hold ourselves to the highest standards and consider factors beyond financial performance when evaluating our opportunities and success. | | During the year, we updated our Core Values to better reflect our focus in the areas of: • Safety, health, environment and security, particularly to proactively encourage

healthy lifestyle choices by our employees • Innovation, including technology, reliability and productivity • Diversity, training and leadership development |

| | | | | | | | | | |

INTEGRITY We do the

right thing. | | SAFETY, HEALTH & ENVIRONMENT We put people and the environment first. | | PERFORMANCE We strive for

superior results. | | IMPROVEMENT & INNOVATION We get better

every day. | | GROWTH

& DIVERSITY We help each employee succeed. | | COMMUNICATION & COLLABORATION We connect

with others. |

For additional information on our Core Values, visit WEB potashcorp.com/corevalues_codeofconduct

| | |

| |

| 24 | | PotashCorp 2016 Annual Integrated Report |

DIVERSITY & INCLUSION

We believe that diversity brings broader perspectives and experiences that enhance decision-making within the company and contribute tolong- term success.

We reframed our Board diversity objectives in 2015 to maintain at least 30 percent representation by women and ensure that at least half the qualified candidates considered for open Board positions are female. We continued this direction in 2016 and adopted a company-wide Diversity and Inclusion Policy. It includeslong-term targets for gender and Aboriginal representation within our workforce.

APage 41

BOARD EVALUATION

Beyond internal evaluation processes, which are described in our Management Proxy Circular, the Board commissioned an external evaluation of its practices and performance by a corporate governance expert in 2016. The primary objective was to independently assess current practices and performance to identify areas of strength and opportunities for improvement.

The evaluation – conducted by the National Association of Corporate Directors – reinforced that PotashCorp’s Board continues to perform at a very high level. Detailed findings were discussed with the Board and management late in 2016, and recommendations were subsequently evaluated and implemented by the Board and its committees.

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 25 |

ENSURING EFFECTIVE OVERSIGHT OF STRATEGY AND RISK

One of the key responsibilities of the Board is overseeing the successful execution of strategy and management of risk. In 2016, significant strides were made in advancing the company’s defined strategy.

99%

PotashCorp shares

voted in favor

of Merger of Equals

with Agrium

| | |

Launching Merger of Equals with Agrium As part of their continuing mandate to strengthen the company and enhance value for shareholders, the Board and senior management assess strategic opportunities on an

ongoing basis. In early 2016, the Board, with input from management and external advisors, reviewed

the strategic rationale of a business combination with Agrium, reaching consensus that

work on a potential transaction should continue. In September, holding a shared view that the combination would unlock significant shareholder value, the Board unanimously approved the transaction. In November, PotashCorp shareholders overwhelmingly approved the proposed Merger of Equals with Agrium, with more than 99 percent of shares voted at the meeting voting in favor of the transaction. | | Enhancing our employee compensation program Following an extensive review, the human resources and compensation committee of the Board – together with input from its independent compensation consultant and management – implemented a number of compensation program changes in 2016. These were designed to create an incentive compensation program that is more competitive, engaging, cost-effective and aligned with the company’s corporate strategy. In addition, a new performance management system was adopted to better facilitate and track progress against corporate and individual objectives. P Proxy Circular |

Advancing our innovation platform During the year, an internal review was conducted to identify opportunities to drive a more standardized approach to innovation across the organization. As part of this process, the Board and management aligned their understanding of the potential role of innovation, established key focus areas and defined a path and timeline to improve capabilities. | |

| |

| | |

| |

| 26 | | PotashCorp 2016 Annual Integrated Report |

COMMITTED TO EXCELLENCE

A LONG-STANDING COMMITMENT TO GOOD GOVERNANCE

For the benefit of all stakeholders, we proactively pursue excellence in corporate governance. This means that when we identify practices that add value for the company and our stakeholders, we often go beyond common standards and legal requirements. Some of our long-standing best practices include:

| • | | Say on Pay vote on executive compensation held annually since 2010, with highly supportive shareholder approvals since inception | |

| • | | Majority voting policy to elect Board members (since 2006) | |

| • | | Voluntary compliance with the more rigorous Board independence provisions of the New York Stock Exchange governance standards | |

| • | | Commitment to conducting periodic external Board evaluations |

| • | | Early adoption of integrated reporting, extending discussion beyond financial performance to include a more holistic discussion of value creation | |

| | |

For a comprehensive discussion of PotashCorp’s corporate governance practices, refer to our Management Proxy Circular and our Integrated Reporting Center. P Proxy Circular WEB potashcorp.com/irc/governance | | |

50

Corporate reporting awards

received from CPA Canada

over the past 24 years

4

Consecutive years

recognized as one of the best annual

reports in the world by reportwatch.com

9times

Over the past 10 years

recognized as one of the top 10

Canadian companies by The Globe and

Mail’s annual Board Games rankings

87

Governance score

vs best-in-class peers score of 82 on the

Dow Jones Sustainability World Index

(score out of 100)

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 27 |

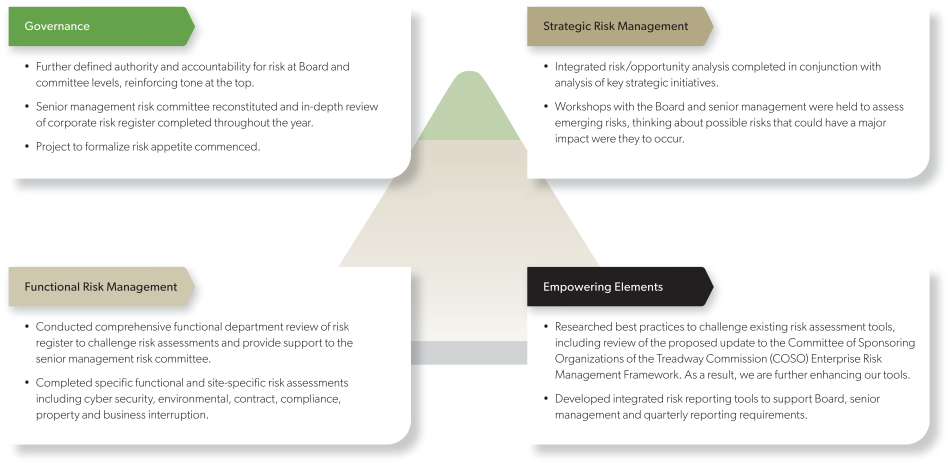

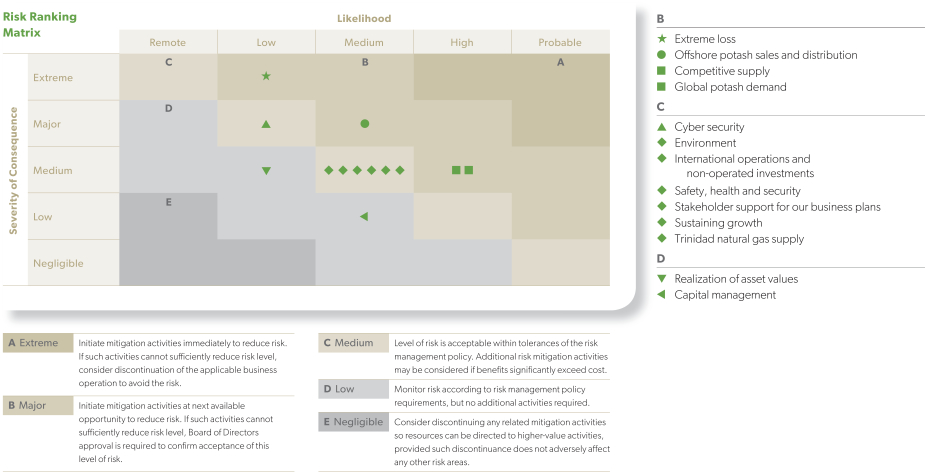

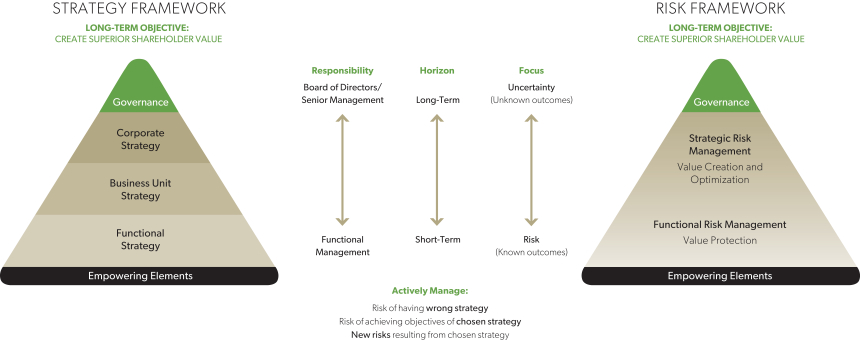

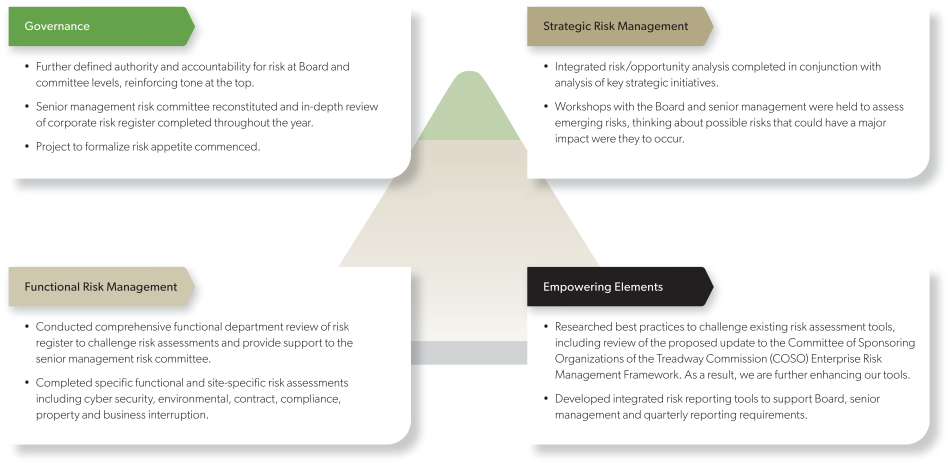

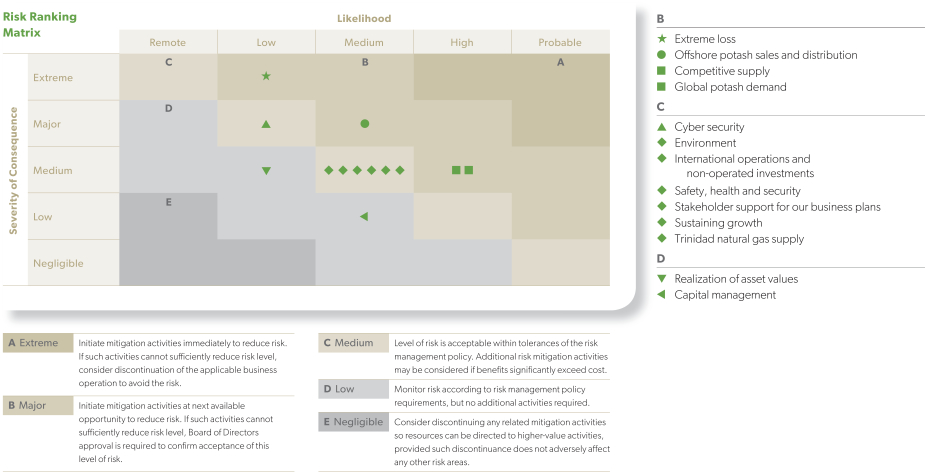

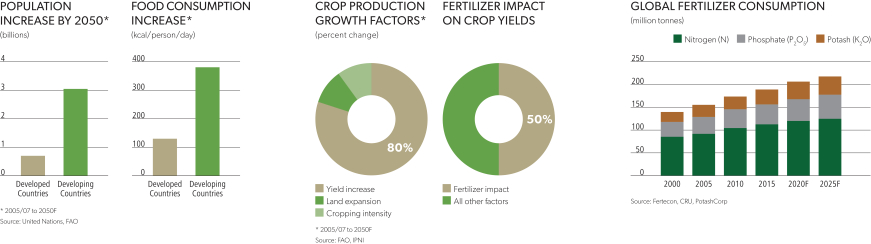

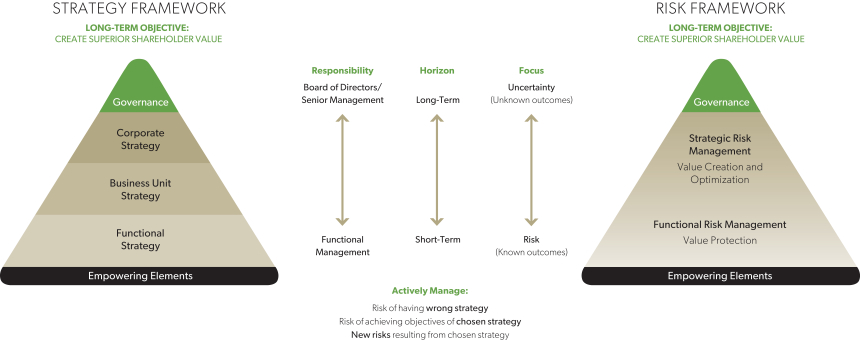

INTEGRATED APPROACH TO STRATEGY AND RISK

In a complex business environment, it is critical that we understand the interconnection of strategy, risk and value creation. At PotashCorp, this link is formalized through purposeful alignment of our strategy and risk management processes – which ensures we are always striving to provide meaningful returns to those who depend on us.

Our strategy and risk frameworks are integrated and enable us to anticipate and adapt to opportunities and risks in a volatile and uncertain global marketplace. Our long-term objectives and strategic priorities – and associated risk mitigation plans – are aligned throughout the organization, from our corporate actions to those of our functional areas.

| | |

| |

| 28 | | PotashCorp 2016 Annual Integrated Report |

STRATEGY FRAMEWORK

Governance

Our Board of Directors provides guidance and oversight, while management defines and executes strategy. It begins with devising and executing ideas that use, or redeploy as necessary, our capital and resources in the most value-enhancing manner at each level of the organization.

Corporate Strategy

From a corporate strategy perspective, we continually evaluate our existing businesses and new opportunities, allocating capital toward those that we believe create the greatest long-term value.

Business Unit Strategy

Our business units devise and execute plans that seek to extract the maximum value from our potash, nitrogen and phosphate assets.

Functional Strategy

Our functional strategies – guided by seven strategic priorities designed to deliver value for all stakeholders – support our broader corporate and business unit strategies by ensuring we have the right processes, people and plans in place for sustainable success.

For further details on strategy, see A Page 30

RISK FRAMEWORK

Governance

Our integrated approach to managing risk recognizes the need for clear, timely direction and support from our Board and senior management, as well as business unit and functional management. Risks are monitored and challenged. Where necessary or prudent, we take on additional risk or reduce our risk exposure to achieve our objectives.

Strategic Risk Management

Our starting point for managing risk is our strategic planning process. Our risk framework ensures that we evaluate and consider ways to create or optimize value for the company by continually testing our strategy: observing, analyzing and anticipating macroeconomic, industry-specific, regional and local developments. Importantly, we also consider what we do not know – whether it is a risk that could disrupt the assumptions at the core of our strategy or other conditions

we cannot readily observe, such as our competitors’ actions, innovations or customer preferences. Consideration of these uncertainties, risks and opportunities allows us to evolve our strategy to continually respond to or navigate through them.

Functional Risk Management

Functional risk management processes are focused on value protection by managing risks we face in achieving the objectives of our chosen strategy and new risks resulting from that strategy. We continually identify, measure, assess, respond to and monitor risks and uncertainties that could impact value. We seek to proactively mitigate risks that exceed our appetite and tolerance, and accept risks we believe are manageable and appropriate in relation to expected opportunities. These risks and opportunities are regularly monitored for changes and further action is taken if necessary.

For further details on risk, see A Page 48

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 29 |

STRATEGYAND PERFORMANCE

Creating superior shareholder value is essential to ensure we can make plentiful possible for all our stakeholders. Strong and sustainable earnings growth – coupled with a premium valuation multiple – rewards our shareholders and, at the same time, allows us to focus on our broader social and environmental responsibilities. Our seven strategic priorities determine where we focus our efforts to create long-term value for all those associated with our business.

OUR LONG-TERM OBJECTIVE

Create superior shareholder value by:

| | | | |

GROWING EARNINGS AND CASH FLOW

WHILE MINIMIZING VOLATILITY | | PROTECTING AND ENHANCING A

PREMIUM VALUATION MULTIPLE | | MAINTAINING

THE TRUST AND SUPPORT OF OUR STAKEHOLDERS |

Financially, we prioritize earnings growth and investment opportunities in potash while complementing that business with other best-in-class assets. |

|

| For additional information on our sustainability performance, refer to our GRI content index in our Integrated Reporting Center. |

| WEB potashcorp.com/irc/gri | |

| | |

| |

| 30 | | PotashCorp 2016 Annual Integrated Report |

| | | | | | | | | | |

| SUMMARY SCORECARD | | |  Achieved Achieved | | | |  Not achieved Not achieved | | |  On track On track |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TARGET METRIC | | RESULT | | | | | | | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | | | | | |

PORTFOLIO & RETURN OPTIMIZATION | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholder return (TSR) vs peers | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | | A | Page 32 | |

TSR vs DAXglobal Agribusiness Index (DXAG) | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | |

Cash flow return (CFR) vs sector | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | |

OPERATIONAL EXCELLENCE | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Potashper-tonne cash cost savings | | |  | | | |  | | | |  | | | | – | | | | – | | | | | | | A | Page 34 | |

Procurement savings | | |  | | | | – | | | | – | | | | – | | | | – | | | | | | |

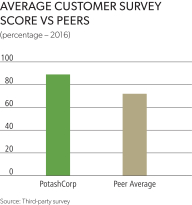

Ammonia reliability rate | | |  | | | | – | | | | – | | | | – | | | | – | | | | | | |

CUSTOMER & MARKET DEVELOPMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

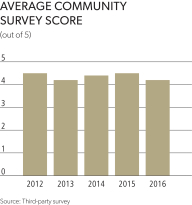

Customer survey score | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | | A | Page 36 | |

Enhance market development initiatives | | |  | | | |  | | | | – | | | | – | | | | – | | | | | | |

STAKEHOLDER COMMUNICATIONS & ENGAGEMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Community investment | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | | A | Page 38 | |

Community survey score | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | |

Shareholder survey score | | |  | | | | – | | | | – | | | | – | | | | – | | | | | | |

PEOPLE DEVELOPMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Employee engagement score | | |  | | | | – | | | |  | | | | – | | | |  | | | | | | | A | Page 40 | |

Annual employee turnover rate | | |  | | | | – | | | | – | | | |  | | | |  | | | | | | |

Implement Diversity and Inclusion Policy | | |  | | | |  | | | | – | | | | – | | | | – | | | | | | |

GOOD GOVERNANCE | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Top quartile of governance practices | | |  | | | |  | | | | – | | | | – | | | |  | | | | | | | A | Page 42 | |

SAFETY, HEALTH & ENVIRONMENTAL EXCELLENCE | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Life-altering injuries at our sites | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | | | | |

Total recordable injury rate | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | | A | Page 44 | |

Total lost-time injury rate | | |  | | | |  | | | | – | | | | – | | | | – | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Greenhouse gas emissions per tonne of nitrogen product | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | | A | Page 46 | |

Environmental incidents | | |  | | | |  | | | |  | | | |  | | | |  | | | | | | |

Water consumption per tonne of phosphate product | | |  | | | |  | | | |  | | | | – | | | |  | | | | | | |

Note: Historical financial and non-financial data available in 11 year data on Page 92.

“–” indicates no stated target in noted year

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 31 |

Portfolio & Return Optimization

Maximize returns for our assets and explore other value creation opportunities

2016 PERFORMANCE

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | | | | | | | | | |

| TARGET | | | | | RESULT | | | | | | DISCUSSION | | | |

| | | | | | | | | | | | | | | | | | | |

Exceed TSR performance for our sector* and the DXAG | | | | | | |   | | | | | | | • PotashCorp’s TSR of 12.4 percent exceeded the sector return of 7.6 percent due primarily to improving potash fundamentals in the second half of 2016. • Despite exceeding the sector return, our TSR was slightly below the DXAG return of 12.5 percent. | | | | |

| | | | | | | | | | | | | | | | | | | |

Exceed CFR1 for our sector* | | | | | | |  | | | | | | | • Our 2016 CFR of 5.5 percent was below the sector average, driven primarily by weaker cash flow generation. | | | | |

| | | | | | | | | | | | | | | | | | | |

Expand and further develop innovation teams for each nutrient | | | | | | |  | | | | | | | • In 2016, we conducted an evaluation to benchmark our corporate innovation practices to best-in-class peers. We are internalizing what we’ve learned from this process as we seek to improve our approach to innovation and further develop our capabilities. | | | | |

| | | | | | | | | | | | | | | | | | | |

* Sector: weighted average (based on market capitalization) for Agrium, APC, CF Industries, ICL, Intrepid, K+S, Mosaic, SQM and Yara for most recent four fiscal quarters available

1 See reconciliation and description of thisnon-IFRS measure on Page 91

2017 TARGETS

| • | | Exceed TSR performance for our sector and the DXAG |

| • | | Exceed CFR for our sector |

| | |

| |

| 32 | | PotashCorp 2016 Annual Integrated Report |

TAKING ACTION

Market-responsive potash approach

We produce to meet the needs of our customers as we believe this approach to the market provides the best opportunity to generate the greatest long-term value for our shareholders. In 2016, we responded to challenging market conditions by indefinitely suspending production at our Picadilly, New Brunswick operations and initiating operational changes at Cory. We also took temporary shutdowns at a number of our Saskatchewan operations to manage inventories during the year.

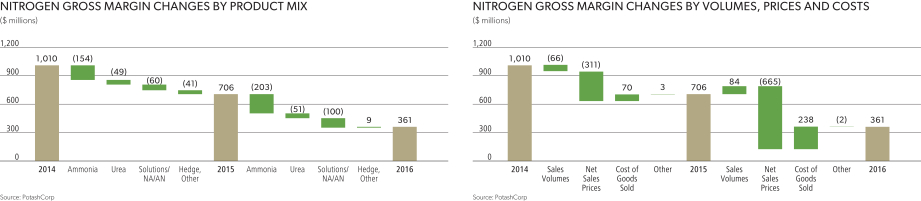

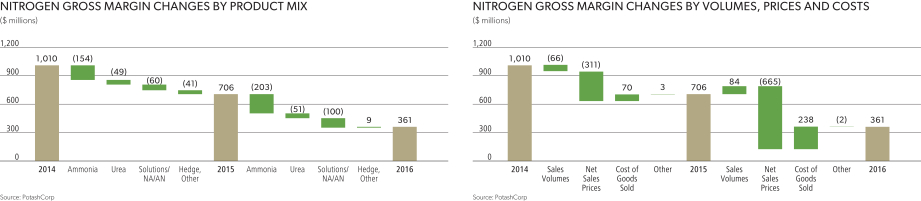

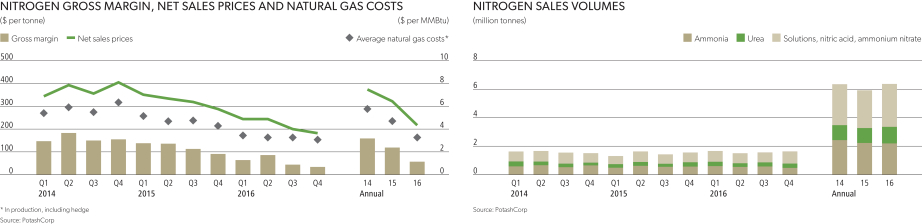

Nitrogen and phosphate optimization

We strive to allocate our production toward the combination of products that provides the greatest gross margin with the least volatility. In nitrogen, our focus is on industrial markets and ensuring that product can be reliably and competitively supplied under long-term contracts. In phosphate, we focus on specialized feed and industrial products and niche liquid fertilizers.

Merger of Equals with Agrium

During the third quarter of 2016, the company entered into an Arrangement Agreement with Agrium to combine businesses in the Proposed Transaction, which is designed to:

Bring together world-class nutrient production assets and retail distribution, providing an integrated platform with multiple paths for growth;

Create up to $500 million of annual run-rate operating synergies within 24 months of closing;

Enhance financial flexibility through the use of a strong balance sheet and improved cash flows, enabling the support of growth initiatives and shareholder returns; and

Leverage best-in-class leadership and governance through the combination of two experienced teams that are focused on creatinglong-term value.

During the fourth quarter, shareholders of both companies overwhelmingly approved the Proposed Transaction and the Ontario Superior Court of Justice issued a final order approving it.

From a regulatory standpoint, we continue to cooperate with the various enforcement agencies in their reviews. We have received clearances in Brazil and Russia, and continue to work on obtaining approval from China, India, Canada and the US.

Upon closing of the Proposed Transaction – which is anticipated mid-2017 – PotashCorp and Agrium will become indirect, wholly owned subsidiaries of a new parent company. PotashCorp shareholders will own approximately 52 percent of the new company and Agrium shareholders will own approximately 48 percent.

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 33 |

Operational Excellence

Improve our competitive position through reliability, productivity and flexibility

2016 PERFORMANCE

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | | | | | | | |

| TARGET | | | | | RESULT | | | | | DISCUSSION | | | |

| | | | | | | | | | | | | | | | | |

Achieve potash cash cost savings

of$20-$30 per tonne from 2013 levels by 2017 (excluding the impacts of foreign exchange

and royalties) | | | | | |  | | | | | | • We expect to achieve our target in 2017 as we ramp up our Rocanville expansion, which was completed in 2016. | | | | |

| | | | | | | | | | | | | | | | | |

Track procurement effectiveness and capture cumulative savings of $125 million from 2014 levels by the end of 2016 | | | | | |  | | | | | | • We have captured $213 million in cumulative procurement savings since 2014. | | | | |

| | | | | | | | | | | | | | | | | |

| Achieve 96 percent operating rate 1 for all US nitrogen plants and 88 percent in Trinidad | | | | | |  | | | | | | • Our ammonia reliability rate was 97 percent in the US and 94 percent in Trinidad for 2016. | | | | |

| | | | | | | | | | | | | | | | | |

| 1 | The company has clarified that the target refers to ammonia reliability rate, its focus in the nitrogen segment. Operating rate is defined as actual production divided by capacity. Reliability rate is defined as actual production divided by capacity, lessnon-reliability downtime. | |

2017 TARGETS

| • | | Achieve potash cash cost savings of$20-$30 per tonne from 2013 levels by 2017 (excluding foreign exchange and royalties) |

| • | | Capture direct and indirect annualized procurement savings of $170 million from 2014 levels by the end of 2017 |

| • | | Achieve a 95 percent ammonia reliability rate for our nitrogen division |

| | |

| |

| 34 | | PotashCorp 2016 Annual Integrated Report |

TAKING ACTION

Optimizing potash production

Our cash cost of goods sold decreased compared to 2015 due primarily to the shift of production to our lower-cost Saskatchewan mines and the impact of foreign exchange, which more than offset closure-related costs at our Picadilly mine.

Capital expenditures under our multi-year potash expansion program are complete and Rocanville is in the final stages of ramp-up. It will provide additionallow-cost production flexibility to meet future customer needs and allow us to increase our Canpotex allocation. We expect cash cost of goods sold to decline further in 2017 as we source a greater proportion of production from Rocanville.

In 2017, we expect to have 10.1 million tonnes of operational capability, maintaining flexibility to meet demand should it exceed our current sales volumes estimate. With the ability to restart idled capacity if market conditions warrant, we believe we are best positioned to meet long-term growth in global demand.

Increasing efficiencies and productivity

In nitrogen, a key focus is to improve our cost position by achieving energy and labor efficiencies through innovation and process improvements. In phosphate, at our Aurora facility we continue to benefit from initiatives to lower rock mining costs and refine our mining and recovery techniques. Across all three nutrients, we are working to better share and standardize maintenance processes to strengthen the reliability of our operations.

In addition, we have transformed the way PotashCorp sources goods and services. Establishing a newcenter-led approach to procurement has enabled us to improve our supplier relationships, leverage our size and scale to generate significant cost savings, create connections to improve the way we operate and provide our operating sites with new capabilities.

~$10

Estimated reduction in potashper-tonne

cost of goods

sold in 2017

(compared to 2016)

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 35 |

Customer & Market Development

Encourage product demand and support customer growth

2016 PERFORMANCE

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | |

| TARGET | | | | RESULT | | | | DISCUSSION | | |

| | | | | | | | | | | |

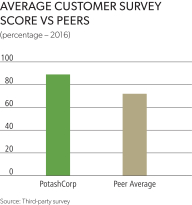

| Outperform competitor groups on quality, reliability and service as measured by customer surveys | | | |  | | | | • We outperformed our competitors in quality, reliability and service in 2016. Our average customer survey score was 89 percent compared to 72 percent for our peers. • Our sales team continued to rank higher than competitors in service and knowledge of products, customers and the industry. | | |

| | | | | | | | | | | |

Support development of existing and new markets with initiatives in education, sales and supply chain enhancements | | | |  | | | | • Our sales and agronomy teams held 57 seminars in the US and international locations, communicating the benefits of our products and proper soil fertility. • Our eKonomics ROI calculator was named one of the top apps in CropLife’s list of ‘Agriculture apps that will help you farm smarter in 2017.’ | | |

| | | | | | | | | | | |

Successfully integrate Hammond, Indiana distribution facility into our North American marketing strategy | | | |  | | | | • In 2016, we completed construction of our Hammond distribution facility and we are using it to more efficiently deliver potash to our US customers. | | |

| | | | | | | | | | | |

2017 TARGETS

| • | | Outperform competitor groups on quality, reliability and service as measured by customer surveys |

| • | | Support development of existing and new markets with enhancements in education, sales and the supply chain |

25%

Reduction in net potash

railcar transit time to the

Chicago interchange

due to our Hammond

facility

| | |

| |

| 36 | | PotashCorp 2016 Annual Integrated Report |

TAKING ACTION

Encouraging potash consumption growth

We explore and invest in market development opportunities primarily through Canpotex and our membership in the International Plant Nutrition Institute to encourage consumption growth in places that have historically under-applied potash, such as Africa, China and India.

Optimizing potash infrastructure

In North America, we added 700 new railcars to our domestic potash fleet and now own approximately 3,000 custom-built high-capacity cars, which increases volumes per trainload. With construction of our regional distribution center in Hammond now complete, we can serve key markets in the US more efficiently.

Our offshore sales are made through Canpotex where our current sales allocation is 51.6 percent. This allocation is expected to grow in the second half of 2017 following the completion of our Rocanville capacity audit. Canpotex currently has export capability of approximately 19 million tonnes annually, which is projected to increase to 20 million tonnes with the expansion of its Portland terminal, expected to be complete in 2017.

Capitalizing on future nitrogen opportunities and maximizing returns

We seek opportunities to enter new market segments where we have a competitive advantage. We have been expanding in the diesel emission fluid (DEF) market, leveraging our ability to produce high-quality products in

an area with strong demand. Our expanded Lima facility is expected to further enhance our ability to serve this profitable and growing market.

Evaluating new fertilizer products to meet customer needs

We continue to explore opportunities to differentiate our products in response to changing needs of our customers. In 2016, we evaluated opportunities to integrate new product offerings into our portfolio through investment and partnerships and are working to leverage such opportunities in 2017.

| | |

Farmers value business analysis.Our user-friendly eKonomics website features concise summaries of the latest crop nutrition research, tips and tools for more productive soils, industry news, commodity futures prices, rainfall data, as well as our Nutrient ROI Calculator and Nationwide Nutrient Balance Analysis – both industry firsts exclusive to PotashCorp. | |  |

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 37 |

Stakeholder Communications & Engagement

Earn stakeholder trust through strong communications and engagement

2016 PERFORMANCE

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | | | | | | | |

| TARGET | | | | | RESULT | | | | | DISCUSSION | | | |

| | | | | | | | | | | | | | | | | |

| Invest 1 percent of consolidated income before income taxes (on afive-year rolling average) in community initiatives | | | | | |

| | | | | | • We invested $15 million in community initiatives, representing more than 1 percent of 2016 pre-tax income, but fell short of our five-year rolling average target after realigning our spending with current market conditions during the year. • We refined our community investment objectives to better match our business priorities of community building, education and training, and food solutions. | | | | |

| | | | | | | | | | | | | | | | | |

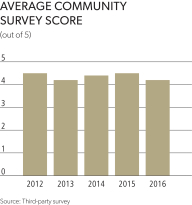

| Achieve 4 (performing well) out of 5 on surveys of community leaders | | | | | |

| | | | | | • We achieved an average score of 4.2 out of 5 among surveyed communities. • Our communities continue to acknowledge us as a key contributor to their local economies and appreciate our commitment to employment, safety and environmental stewardship. | | | | |

| | | | | | | | | | | | | | | | | |

Achieve rating on third-party annual shareholder survey that exceeds 2015 results for quality of communications | | | | | |

| | | | | | • We achieved an average score of 8 out of 10 on quality of communications with the investment community, an improvement from our 2015 results. • 83 percent of respondents rated our communications on par with or better than other best-practice companies. | | | | |

| | | | | | | | | | | | | | | | | |

2017 TARGETS

| • | | Achieve 4 (performing well) out of 5 on surveys of community leaders |

| • | | Outperform competitor group on quality of communications and responsiveness as measured by investor surveys |

8

Quality of shareholder

communications as

determined by 2016

annual survey

(average score out of 10)

| | |

| |

| 38 | | PotashCorp 2016 Annual Integrated Report |

TAKING ACTION

Building relationships with our communities

Our stakeholders are critical to our long-term success, and we support them by improving the quality of life in our communities. In 2016, we continued our support of school nutrition programs, food banks, our Trinidad Model Farm and other initiatives related to food security. We also supported a number of Aboriginal initiatives, community-building events and funded scholarships that help develop the workforce of the future.

Engaging with our shareholders

Each year we engage a third party to survey a sample of current and potential shareholders to gain additional insight into perceptions of our company, industry and quality of communications. While we proactively ask for feedback over the course of the year, this annual process allows us to formally benchmark shareholder perceptions so we can address their concerns and improve our performance. We monitor changes over time and ensure investor views are communicated to our management team and the Board.

In 2016, we also asked shareholders to rank key topics in all seven of our strategic priorities to better understand what is most important to them. This information will be combined with similar input from other key stakeholders to give us a holistic picture of what matters most to those who depend on our company, allowing us to improve our communications and reporting.

Partnering with our suppliers

We continue to explore opportunities to connect with our suppliers in new and meaningful ways. This helps us improve performance while focusing on safety, the environment and our other core values.

Our procurement strategy is strongly aligned with our diversity and inclusion objectives. We have an objective to allocate 30 percent of our local purchasing in Canada to Aboriginal suppliers by 2020.

$9M

Invested annually in

food security-related

initiatives

(3-year average)

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 39 |

People Development

Attract, develop and retain engaged employees

2016 PERFORMANCE

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | | On track | | |

| | | | | | | | | | | | | | | | | | |

| TARGET | | | | | RESULT | | | | | | DISCUSSION | | | |

| | | | | | | | | | | | | | | | | | | |

| Achieve an average employee engagement score of 75 percent on the company-wide biennial survey | | | | | | |  | | | | | | | • We achieved our target with an average employee engagement score of 75 percent on our 2016 survey, which represents a 12 percent increase from our 2014 results. • We have made strides over the past two years to improve our internal communications and will review our 2016 results to look for areas of further improvement. | | | | |

| | | | | | | | | | | | | | | | | | | |

| Maintain an annual employee turnover rate of 5 percent or less | | | | | | |  | | | | | | | • Our 2016 annual employee turnover was 3 percent, which demonstrates that our employees value working at PotashCorp. | | | | |

| | | | | | | | | | | | | | | | | | | |

| Implement Diversity and Inclusion Policy through training and communication initiatives | | | | | | |  | | | | | | | • In 2016, we began advancing our diversity and inclusion priorities through focused communication and training initiatives, and we will continue our work in this area. | | | | |

| | | | | | | | | | | | | | | | | | | |

2017 TARGETS

| • | | Have 95 percent of salaried staff submit and review business goals and individual development plans through our new performance management process |

| • | | Maintain an annual employee turnover rate of 5 percent or less |

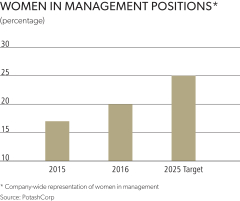

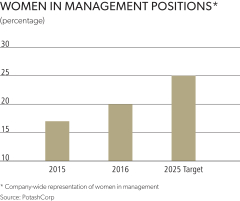

| • | | Achieve progress toward our diversity priorities of increasing the representation of women in management to 25 percent or more by 2025 and becoming representative of Aboriginal people in our Canadian operations by 2020 |

12%

Increase in company-

wide employee

engagement score

(compared to 2014)

| | |

| |

| 40 | | PotashCorp 2016 Annual Integrated Report |

Value Creation

TAKING ACTION

Managing performance

In 2016, we designed and implemented a new global performance management process, along with a supporting talent management system. This will help us design performance plans for our staff employees, including business goals and an individual development plan, by the end of 2017. Our goal is to provide clarity for performance and behavioral expectations, with an increased focus on coaching and guided development to support employee growth.

Enhancing employee communications

Based on feedback from our employees, we have taken steps to enhance our internal communications. This includes keeping employees informed of events and changes in our company in a timely and interactive manner through in-person meetings, videos and written communications. We also provide employees with updates on performance, development and compensation.

Growing our diverse workforce

We recognize that having a diverse workforce enhances our organizational strength and better reflects our stakeholders. In 2016, we adopted our global Diversity and Inclusion Policy, which includes long-term initiatives to increase representation of women in management across our operations and increase the representation of Aboriginal people in all our Canadian operations.

Developing our employees

In 2016, PotashCorp introduced a new global leadership development framework so employees at all levels could develop skills in this area. Activities include formal learning opportunities, such as classroom training and development, along with self-directed learning, which allows employees to take ownership of their own professional development.

22%

Increase in management positions held by women

(compared to 2015)

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 41 |

Good Governance

Foster a culture of accountability, fairness and transparency

2016 PERFORMANCE

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | | | | | | | |

| TARGET | | | | | RESULT | | | | | DISCUSSION | | | |

| | | | | | | | | | | | | | | | | |

| Remain in the top quartile of governance practices as measured by external reviews | | | | | |

| | | | | | • We ranked in the top quartile of governance practices in The Globe and Mail’s annual Board Games. • Our governance practices were highly ranked by the Dow Jones Sustainability Index (DJSI) and the FTSE4Good Index. • Our 2015 Annual Integrated Report was ranked fifth globally by reportwatch.com and received the Award of Excellence in Financial Reporting from CPA Canada. | | | | |

| | | | | | | | | | | | | | | | | |

2017 TARGETS

| • | | Remain in the top quartile of governance practices as measured by external reviews |

2015 Annual

Integrated Report

ranked fifth in the world

| | |

| |

| 42 | | PotashCorp 2016 Annual Integrated Report |

Value Creation

TAKING ACTION

Leading governance practices

Our governance score from our 2016 RobecoSAM Corporate Sustainability Assessment far exceeded both the average for our industry and the average score of Dow Jones Sustainability World Index members, a best-in-class benchmark representing approximately 250 of the top companies globally. The areas where we are most progressive are related to Board composition, diversity and disclosure.

Focusing on Board composition and education

The PotashCorp Board and management team bring a broad range of complementary skills and perspectives that allow us to better identify areas of value creation and potential challenges. To ensure our Board members have the best information available to them regarding our company and industry, we provide and support internal and external education opportunities.

We value diversity and believe it enhances our organization by bringing new perspectives and skills. In 2016, women represented 31 percent of our Board and 20 percent of our management positions. To further our efforts in this area, we adopted a company-wide Diversity and Inclusion Policy in 2016 with the aim of developing a more representative workforce, including enhancing female and Indigenous representation across our organization.

Aligning compensation with stakeholder interests

To ensure alignment with the interests of shareholders, our Board members are required to own shares or deferred share units (DSUs) with a value equal to at least five times their annual retainer. We believe an ownership mentality is important for management as well, and have a similar stipulation for our executives – with higher share ownership requirements for more senior roles – including our CEO, whose requirement is five times base salary.

For a comprehensive picture of PotashCorp’s corporate governance practices, refer to our Management Proxy Circular and our Integrated Reporting Center.

P Proxy Circular WEB potashcorp.com/irc

93

Score (out of 100) on The Globe and Mail’s annual Board Games

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 43 |

Safety, Health & Environmental Excellence

Be relentless in pursuit of the safety of our people and protection of the environment

2016 PERFORMANCE – SAFETY AND HEALTH

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | | | |

| TARGET | | | | | RESULT | | | | | DISCUSSION |

| | | | | | | | | | | | | |

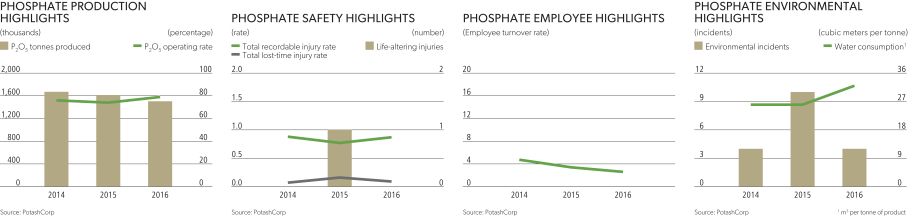

Achieve zero life-altering injuries at our sites | | | | | |

| | | | | | • There were no life-altering injuries at any of our sites in 2016. As safety is our top priority, we continue to increase our efforts to prevent serious injuries and fatalities (SIF) at our sites so our employees and contractors can return home safe every day. |

| | | | | | | | | | | | | |

Reduce total recordable injury rate to 0.85 (or lower) and total lost-time injury rate to 0.09 (or lower) | | | | | |

| | | | | | • Our total recordable injury rate was 0.87. Although we narrowly missed our target, the rate decreased 14 percent from 2015 and is our lowest on record. • We achieved our total lost-time injury rate target with a rate of 0.08, our second-lowest on record. • During the year we focused on four key priorities: leadership training, SIF prevention,pre-job hazard assessments and work pausing. |

| | | | | | | | | | | | | |

| By 2018, become one of the safest resource companies in the world by achieving recordable injury and lost- time injury rates in the lowest quartile of abest-in-class peer group* | | | | | |

| | | | | | • We continue to achieve improvements in our total recordable injury rate while our total lost-time injury rate is one of the lowest in the industry. • While we maintain our overarching objective to be one of the safest resource companies in the world, our primary focus going forward will be on SIF prevention, with targets aimed at continually improving our injury rates and avoiding life-altering injuries. |

| | | | | | | | | | | | | |

| * | Simple average based on most recent publicly available data from a sample of 16 leading global resource companies |

2017 TARGETS – SAFETY AND HEALTH

| • | | Achieve zero life-altering injuries at our sites |

| • | | Reduce total recordable injury rate to 0.75 or lower |

| • | | Reduce total lost-time injury rate to 0.07 or lower |

| | |

| |

| 44 | | PotashCorp 2016 Annual Integrated Report |

Value Creation

TAKING ACTION

Driving change on serious injuries and fatalities

To ensure our safety program remainsbest-in-class, we introduced an enhanced SIF prevention program focused on proactive and reactive processes. Our reactive prevention program helps ensure thatin-depth investigations are performed on all potential SIF incidents and that the strongest possible controls are put in place to prevent them from recurring. Our proactive prevention program is focused on discovering potential occurrences in routine work and mitigating them before something happens.

While our aim is preventing all injuries, no matter how minor, we are increasingly focused on SIF prevention.

Highlighting the “H” in SH&E

In 2016, we undertook an initiative to enhance our corporate health and wellness program, which included reviewing health and wellness best practices at our sites for inclusion in our program. We also established a corporate steering committee and increased education through our new health and wellness website for employees and their families.

WEB potashcorphealth.com

Coaching for safety engagement

A cornerstone of our safety program and one of our four key safety priorities is leadership. For our safety culture to evolve, we have to influence what happens at the worker level – where the majority of our safety exposures exist. We recognize that front-line supervisors have the largest influence on what happens at this critical grassroots level. Our objective is to enable each front-line supervisor in our company to become an expert in safety engagement.

We are proud that this program won the Queen’s University Industrial Relations Center Professional Development Award at the 2016 Canadian HR Awards.

33%

Decrease in our

total recordable

injury rate

(since 2012)

| | |

| |

| PotashCorp 2016 Annual Integrated Report | | 45 |

Safety, Health & Environmental Excellence

Be relentless in pursuit of the safety of our people and protection of the environment

2016 PERFORMANCE – ENVIRONMENT

| | | | | | | | |

| | |  Achieved Achieved | |  Not achieved Not achieved | |  On track On track | | |

| | | | | | | | | | | | | | |

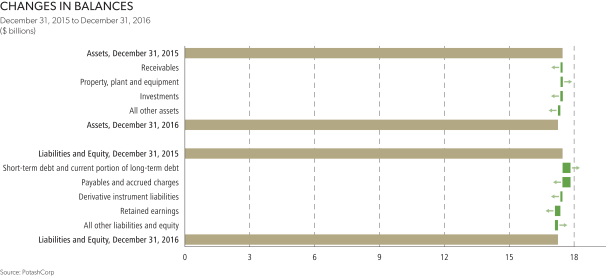

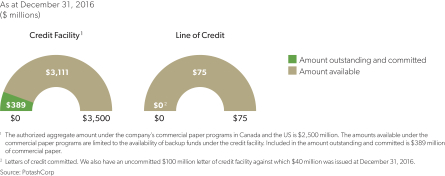

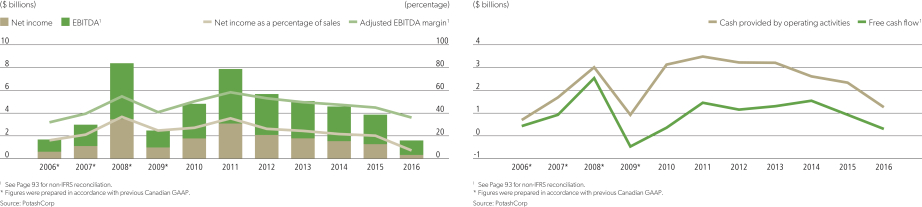

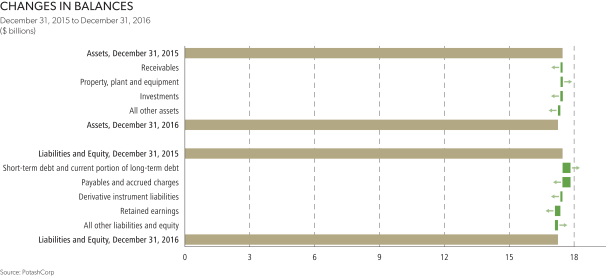

| TARGET | | | | RESULT | | | | | | DISCUSSION | | |