UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| x | Filed by the Registrant |

| | |

| o | Filed by a Party other than the Registrant |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

SUMMIT FINANCIAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(I)(1) and 0-11. |

| | 1. Title of each class of securities to which transaction applies:

|

| | 2. Aggregate number of securities to which transaction applies:

|

| | 3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | 4. Proposed maximum aggregate value of transaction:

|

| | 5. Total fee paid:

|

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. Amount Previously Paid:

|

| | 2. Form, Schedule or Registration No.:

|

| | 3. Filing Party:

|

| | 4. Date Filed:

|

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Summit Financial Corporation ("the Company"). The meeting will be held at Thornblade Club, 1275 Thornblade Boulevard, Greer, South Carolina on Tuesday, April 20, 2004, at 10:00 a.m.

The Notice of Annual Meeting and Proxy Statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as representatives of KPMG LLP, the Company’s independent auditors, will be present to respond to appropriate questions from shareholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

| | Sincerely, |

| | |

| |  |

| | |

| | J. Randolph Potter |

| | President and Chief Executive Officer |

SUMMIT FINANCIAL CORPORATION

Post Office Box 1087

937 North Pleasantburg Drive

Greenville, South Carolina 29602

(864) 242-2265

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held April 20, 2004

The Annual Meeting of shareholders of SUMMIT FINANCIAL CORPORATION will be held at Thornblade Club, 1275 Thornblade Boulevard, Greer, South Carolina on Tuesday, April 20, 2004, at 10:00 a.m. At the meeting, shareholders will consider and vote on the following matters:

1) The election of four directors to the Board of Directors of the Company, each for a three year term; and

2) Transaction of any other business that may properly come before the meeting.

The Board of Directors is not aware of any other business to come before the meeting.

Shareholders of record at the close of business on March 10, 2004 are entitled to receive notice of the meeting and to vote at the meeting and any adjournment or postponement of the meeting.

Please complete and sign the enclosed form of proxy, which is solicited by the Board of Directors, and mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING.Whether or not you plan to attend the Annual Meeting in person, please complete and return the enclosed proxy promptly in the envelope which has been provided so that your vote may be recorded.

Also enclosed is a copy of the Company’s 2003 Annual Report to Shareholders.

| | By Order of the Board of Directors, |

| | |

| |  |

| | J. Randolph Potter |

| | President and Chief Executive Officer |

| March 19, 2004 | |

| Greenville, South Carolina | |

SUMMIT FINANCIAL CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on April 20, 2004

This Proxy Statement contains information about the 2004 Annual Meeting of Shareholders of Summit Financial Corporation ("Summit Financial" or "the Company"). The Annual Meeting will be held at Thornblade Club, 1275 Thornblade Boulevard, Greer, South Carolina, on Tuesday, April 20, 2004, at 10:00 a.m. The Company is the parent holding company for Summit National Bank ("the Bank") and Freedom Finance, Inc. ("the Finance Company").

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of the Company to be used at the Annual Meeting and at any adjournment of that meeting. This Proxy Statement and the enclosed proxy card are being first mailed to shareholders on or about March 19, 2004.

VOTING AND PROXY PROCEDURE

Who Can Vote at the Meeting

To be able to vote your Summit Financial common stock, the records of the Company must have shown that you held your shares as of the close of business on March 10, 2004, the record date for the Annual Meeting. As of the close of business on March 10, 2004, there were 4,337,679 shares of Summit Financial common stock issued, outstanding, and entitled to vote at the Annual Meeting. Each share of our common stock that you owned on the record date entitles you to one vote on each matter that is to be voted on.

Attending the Meeting

All shareholders are invited to attend the Annual Meeting. If your Summit Financial common stock is held by a bank or brokerage firm, (i.e., in "street name"), you will need to bring a brokerage account statement or letter from your bank or brokerage firm showing that you are the beneficial owner of the shares in order to be admitted to the Annual Meeting. If you want to vote your shares of Summit Financial common stock held in "street name" in person at the meeting, you will have to get a written proxy in your name from the bank or brokerage firm which holds your shares.

What Constitutes a Quorum

In order for business to be conducted at the Annual Meeting, a quorum must be present. A quorum consists of a majority of the shares of common stock issued, outstanding and entitled to vote at the meeting, or at least 2,168,841 shares. Shares of common stock represented in person or by proxy at the meeting will be counted for the purpose of determining whether a quorum exists. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting.

Shares that reflect votes withheld for director nominees and "broker non-votes" will be counted for purposes of determining the existence of a quorum. "Broker non-votes" are shares that are held in "street name" by a bank or brokerage firm that does not vote on a particular proposal because it does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner of the shares.

What Vote is Required

Directors are elected by a plurality of the votes cast at the Annual Meeting. This means that the four nominees receiving the greatest number of votes cast at the meeting will be elected, regardless of whether that number represents a majority of the votes cast. In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

How You Can Vote

If you own your shares of record, you can vote in one of two ways. You can vote by mail, or you can vote in person at the meeting. You may vote by mail if you complete, sign, and date the enclosed proxy card that accompanies this Proxy Statement and promptly mail it in the envelope provided. You do not need to put a stamp on the enclosed envelope if you mail it in the United States.

If your Summit Financial common stock is held in "street name", by a bank or brokerage firm, you will receive instructions from your broker or other nominee on how to vote your shares. Your bank or brokerage firm, as the recordholder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your bank or brokerage firm provides you. If you do not give instructions to your bank or brokerage firm, it will still be able to vote your shares with respect to certain "discretionary" items, but will not be allowed to vote your shares with respect to certain "non-discretionary" items. In the case of non-discretionary items, the shares will be treated as "broker non-votes".

Your bank or brokerage firm may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instructions provided by your bank or brokerage firm that accompany this proxy statement for further information regarding telephone and Internet voting. If you wish to change your voting instructions after your have returned your voting instruction form to your broker or bank, you must contact your broker or bank.

Voting by Proxy

Your Board of Directors recommends that you vote "FOR" the election of all nominees to serve as Directors, each for a term of three years. All shares of Summit Financial common stock represented at the meeting by properly executed proxies will be voted in accordance with the instructions indicated on the proxy card. If you sign and return a proxy card without giving voting instructions, your shares will be voted "FOR" the election of all nominees for Director.

How You Can Change Your Vote

You can change your vote and revoke your proxy at any time before the vote is taken at the meeting by doing one of the following things:

If you own your shares of record, you may give the Secretary of the Company a written notice before your shares have been voted at the Annual Meeting that you want to revoke your proxy; or

Sign and submit another proxy with a later date; or

- Attend the meeting, and vote your shares in person.

Your attendance at the Annual Meeting alone will not revoke your proxy. If your shares are held in "street name" your should follow the instructions provided by your bank or brokerage firm.

STOCK OWNERSHIP

The following table sets forthinformation as to the shares of common stock beneficially owned, directly or indirectly, on February 27, 2004 by each director of the Company, by the Chief Executive Officer of the Company, by the Company’s other "Named Executive Officers", and by all executive officers and directors of the Company as a group. In addition, information with respect to persons known to the Company to be the beneficial owners of more than 5% of the Company’s outstanding common stock is presented. A person may be considered to beneficially own any share of common stock over which he or she has, directly or indirectly, sole or shared voting or investing power.

BENEFICIAL OWNERSHIP TABLE

| Name and Address of Beneficial Owner | | Shares of Common Stock Beneficially Owned (1) | Percentage of Common Stock Outstanding (2) |

| |

|

|

Non-Employee Directors | | | | | | | |

| | | | | | | | |

| Ivan E. Block; Greenville, SC | | | 320,797 | (4) | | 6.6 | % (3) |

| C. Vincent Brown; Greenville, SC | | | 210,457 | (5) | | 4.4 | % |

| J. Earle Furman, Jr.; Greenville, SC | | | 98,129 | (6) | | 2.0 | % |

| John W. Houser; Greer, SC | | | 117,752 | (4) | | 2.4 | % |

| T. Wayne McDonald; Greenville, SC | | | 95,515 | (7) | | 2.0 | % |

| Allen H. McIntyre; Spartanburg, SC | | | 14,672 | | | < 1 | % |

| Larry A. McKinney; Greenville, SC | | | 140,690 | (4) | | 2.9 | % |

| David C. Poole; Greenville, SC | | | 201,967 | (4) | | 4.2 | % |

| | | | | | | | |

Employee Directors | | | | | | | |

| | | | | | | | |

| James G. Bagnal, III; Spartanburg, SC (11) | | | 67,875 | (8) | | 1.4 | % |

| J. Randolph Potter; Greenville, SC (11) | | | 136,018 | (8)(9) | | 2.8 | % |

| James B. Schwiers; Greenville, SC (11) | | | 168,512 | (8) | | 3.5 | % |

| | | | | | | | |

Named Executive Officer, Not a Director | | | | | | | |

| | | | | | | | |

| Blaise B. Bettendorf; Greenville, SC | | | 132,801 | (8) | | 2.7 | % |

| All Directors and executive officers as a group (12 persons) | | | 1,705,185 | (10) | | 35.3 | % |

| (1) - | Pursuant to Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of the Company’s common stock if he or she has voting and/or investment power with respect to such security or has a right to acquire beneficial ownership of such shares, through the exercise of outstanding options or otherwise, at any time within 60 days from February 27, 2004. The table includes certain shares owned by spouses, other immediate family members, closely-held companies, shares held in retirement accounts for the benefit of the named individuals, and other forms of ownership, over which shares the named persons possess sole or shared voting and/or investment power. |

| (2) - | Based on 4,337,679 shares of common stock of the Company outstanding and entitled to vote at the Annual Meeting, plus the number of shares that may be acquired within 60 days by each individual (or group of individuals) by exercising options. |

| (3) - | Mr. Block, residing at 210 League Street, Simpsonville, SC 29681, is the only person known to the Company to beneficially own more than 5% of the Company’s outstanding stock. |

| (4) - | Includes exercisable options to purchase 29,320 shares of common stock at from $3.61 - $4.83 per share granted under the 1995 Non-Employee Stock Option Plan. |

| (5) - | Includes exercisable options to purchase 58,641 shares of common stock at from $3.61 - $4.83 per share granted under the 1995 Non-Employee Stock Option Plan. |

| (6) - | Includes exercisable options to purchase 21,062 shares of common stock at $4.83 per share granted under the 1995 Non-Employee Stock Option Plan. |

| (7) - | Includes exercisable options to purchase 24,070 shares of common stock at $4.83 per share granted under the 1995 Non-Employee Stock Option Plan |

| (8) - | Includes exercisable options granted under the Incentive Stock Option Plans to purchase common stock at exercise prices from $3.61 - $7.82 per share as follows: Mr. Bagnal - 48,620 shares; Mr. Potter - 91,466 shares; Mr. Schwiers - 59,098 shares; and Ms. Bettendorf - 76,902 shares. |

| (9) - | Does not include 1,786 shares held by a related party as to which Mr. Potter disclaims beneficial ownership. |

| (10) - | Includes 497,139 shares of common stock subject to stock options exercisable within 60 days from February 27, 2004 held by the Directors and the executive officers of the Company as a group. |

| (11) - | Mr. Bagnal, Potter, and Schwiers are also Named Executive Officers of the Company. |

PROPOSAL 1 - ELECTION OF DIRECTORS

As provided in the Company’s Bylaws, the Board of Directors has fixed the number of directors at 11. Eight of the Directors are independent and three are members of management. The Board is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. Directors are nominated for election at the Annual Meeting to serve for a three-year term or until their respective successors have been elected and qualified. At the 2004 Annual Meeting, shareholders will have the opportunity to vote for the following nominees: James G. Bagnal, III, Ivan E. Block, J. Earle Furman, Jr., and T. Wayne McDonald, all of whom are currently directors of the Company. Each has consented to being named a nominee in this Proxy Statement and has agreed t o serve as a director if elected at the Annual Meeting. Each of these nominees for director were nominated by a majority of the independent directors of the Company in their role as nominating committee.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the nominees named above. If any nominee is unable to serve, the persons named in the proxy card would vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote "FOR" the election of all of the nominees.

The following table sets forth certain information regarding the nominees for election at the Annual Meeting as well as information regarding those directors continuing in office after the Annual Meeting.

NOMINEES AND CONTINUING DIRECTORS

Name | Age (1) | Position with Company | Year First Elected Director | Year Term Expires |

|

|

|

|

|

Board Nominees | | | | |

| James G. Bagnal, III (3) | 59 | Regional President of the Bank | 2000 | 2007 (2) |

| Ivan E. Block | 58 | Director (4) | 1989 | 2007 (2) |

| J. Earle Furman, Jr. (3) | 56 | Director (4) | 1989 | 2007 (2) |

| T. Wayne McDonald (3) | 65 | Director (4) | 1989 | 2007 (2) |

Directors Continuing in Office | | | | |

| John W. Houser (3) | 60 | Director (4) | 1989 | 2005 |

| Larry A. McKinney (3) | 62 | Director (4) | 1993 | 2005 |

| David C. Poole (3) | 65 | Secretary (4) | 1989 | 2005 |

| James B. Schwiers (3) | 45 | COO of the Bank | 2000 | 2005 |

| C. Vincent Brown (3) | 64 | Chairman (4) | 1989 | 2006 |

| Allen H. McIntyre (3) | 47 | Director (4) | 2000 | 2006 |

| J. Randolph Potter (3) | 57 | CEO and President | 1989 | 2006 |

(1) - As of March 19, 2004.

(2) - Each nominee has been nominated to serve for a three-year period or until their respective successors have been duly elected and qualified.

(3) - Also serves as Director of Summit National Bank.

(4) - Each director is "independent" as defined under the NASDAQ Corporate Governance rules.

Information regarding each nominee’s and continuing director’s principal occupation and business experience is provided below. Unless otherwise stated, each individual has held his current occupation for at least the last five years.

Nominees for Election as Directors for Terms Expiring in 2007

James G. Bagnal, IIIjoined Summit Financial Corporation as regional president of Summit National Bank in Spartanburg during 2000. He served as regional president in Spartanburg, South Carolina for Regions Bank from 1998 to 2000 and president of Spartanburg National Bank in Spartanburg, South Carolina prior to 1998.

Ivan E. Blockis president and CEO of Diversified Coatings Systems, Inc., which is engaged in the custom painting of exterior plastic parts for the automotive industry, and is president of Crown Metro Chemicals.

J. Earle Furman, Jr.is president of NAI Earle Furman, LLC, a commercial and industrial real estate brokerage firm which he formed in 1986.

T. Wayne McDonaldis a physician specializing in gynecology. He is currently associated with the Highlands Center for Women.

Directors Continuing in Office with Terms Expiring in 2005

John W. Houseris the president of Piedmont Management of Fairforest, Inc., a consulting firm. He is a partner in Piedmont Brokerage and Universal Packaging, which are involved in the manufacturing and sales of corrugated boxes.

Larry A. McKinneyis chief executive officer of ElDeCo, Inc., an electrical contracting firm.

David C. Pooleis president of David C. Poole Co., Inc., a dealer in synthetic fibers and polymers. Mr. Poole is Secretary of the Company.

James B. Schwiersis the executive vice president and chief operating officer of Summit National Bank and has been with the Bank since its inception in 1990.

Directors Continuing in Office with Terms Expiring in 2006

C. Vincent Brownis an attorney and is president of Brown, Massey, Evans, McLeod and Haynsworth, Attorneys at Law, P.A., where he has practiced tax and corporate law for over 30 years. Mr. Brown is the Chairman of the Company and Summit National Bank.

Allen H. McIntyreis president of ChemPro, Inc., a company in the consumer packaged goods industry.

J. Randolph Potteris president and chief executive officer of the Company and its two subsidiaries, Summit National Bank, and Freedom Finance, Inc. He has been in this role since the Company’s inception in 1989.

Meetings and Committees of the Board of Directors

The Board of Directors of the Company and Summit National Bank conduct their business through meetings of the Boards and through their committees. During the year ended December 31, 2003, the Board of Directors of the Company held four meetings and the Board of Summit National Bank held 12 meetings. In 2003, all directors of the Company attended more than 75% of the aggregate meetings of the Board and committees on which they served during this period. Directors are encouraged to attend the Annual Meeting, absent extenuating circumstances. All directors were in attendance at the 2003 Annual Meeting of Shareholders.

Executive Committee

The Executive Committee of the Board of Directors, currently consisting of Directors Brown, Poole, Block, Potter, and McDonald, generally meets monthly and met 11 times during 2003. The members of the Executive Committee, exclusive of Mr. Block, are also members of the Executive Committee of Summit National Bank and their meetings are held jointly.

Compensation Committee

The Compensation Committee, which consisted of Directors Brown, Poole, Block, and McDonald during 2003, is responsible for all matters regarding the Company’s and the Bank’s employee compensation and benefit programs, including stock option and restricted stock grant approvals. The Compensation Committee is responsible for approval of compensation arrangements of senior management, adoption of compensation plans, and granting options or other benefits under compensation plans. The Committee met two times during 2003.

Audit Committee

The Board of Directors of the Company has an Audit Committee which consisted of Directors Block, Houser, McDonald and McKinney in 2003. The Audit Committee is responsible for developing and monitoring the Company’s audit program and providing independent, objective oversight of the Company’s accounting functions and internal controls. The Committee oversees the scope of the Company’s internal audit program, the adequacy of the Company’s systems of internal controls and procedures, and the adequacy of management’s action with respect to recommendations arising from auditing activities. The Audit Committee selects the Company’s outside auditors, monitors the independence of the outside auditors, and meets privately, outside the presence of management, with the ou tside auditors to discuss the results of the annual audit, quarterly reviews, internal controls and procedures, and any related matters. The Audit Committee also oversees the Company’s regulatory compliance program. The members of the Audit Committee, exclusive of Mr. Block, are also members of the Audit Committee of the Bank and customarily hold joint meetings of both Committees. The Board of Directors has determined that all of the members of the Audit Committee are independent, as independence for audit committee members is defined by the NASDAQ Corporate Governance Rules. The Audit Committee met four times during the year ended December 31, 2003. The Audit Committee’s report is included later in this proxy statement under "Audit Committee Matters".

Nominating Process

The Board currently has no standing nominating committee and there is no formal nominating committee charter. The Company believes that the use of non-management directors as a nominating body accomplishes the same goals as having a standing nominating committee. Nevertheless, the Company is considering establishing a standing nominating committee and, if such a committee is established, the Board will adopt a written charter for the committee. The non-management members of the Board of Directors of the Company acted as a nominating committee for selecting the nominees for recommendation to the shareholders for election as directors at the Annual Meeting. Each of such non-management directors (Directors Block, Brown, Furman, Houser, McDonald, Mc Intyre, McKinney, and Poole) is independent, as independence for nominating committees is defined by the NASDAQ Corporate Governance Rules. The non-management directors met one time in their capacity as the nominating committee during the year ended December 31, 2003.

Any shareholder may recommend to the non-management directors persons for nomination for director by writing to the Secretary of the Company at 937 North Pleasantburg Drive, Greenville, South Carolina, 29607. Any such correspondence should include the candidate’s name and address, the reason the shareholder believes the candidate should be nominated and biographical data regarding the candidate similar to that included in this proxy with respect to nominees and continuing directors. Candidates recommended by shareholders will be evaluated in the manner as are other candidates.

There are no minimum requirements that must be met by non-management director nominees for Board positions. Non-management directors seek candidates with significant business management experience and high ethical standards whose experience and expertise, when added to the experience and expertise of the other members of the Board, will result in the Board as a whole having experience and expertise in the various areas within which the Board is called to operate.

Communication with the Board of Directors

If a shareholder desires to communicate with the Board of Directors, or any individual director, he may write to the Board of Directors (or to the particular director) at 937 North Pleasantburg Drive, Greenville, South Carolina 29607. All communications will be relayed promptly to the Chairman, or in the case of communications to a particular director, to that director.

Directors’ Compensation

During 2003, members of the Board of Directors of Summit Financial, who are not officers of the Company or of its subsidiaries, received a fee of $1,200 for each board meeting attended, and from $150 to $400 for each committee meeting attended, depending on the committee. The Chairman receives two times the standard attendance fees. Total fees paid to Directors of Summit Financial Corporation during 2003 was $138,500. There were no stock options granted to Directors during 2003 under the 1995 Summit Financial Corporation Non-Employee Stock Option Plan.

Reportof the Audit Committee

The Audit Committee of the Board of Directors is composed of four independent directors. The Committee operates under a written charter adopted by the Board on March 20, 2000, and amended on November 5, 2003, a copy of which is attached to this proxy statement as Appendix A.

The Board of Directors has determined that the Audit Committee of the Company does not have an "audit committee financial expert" as that term is defined by applicable SEC rules. However, the Board believes that the current members of the Audit Committee, as a whole based on their experiences and backgrounds, are qualified to effectively carry out the duties and responsibilities of the Audit Committee. Each Audit Committee member has significant experience in accounting and audit functions, internal controls and budget preparation. All four Audit Committee members serve or have served as president, chief executive officer, or in a similar role with significant financial oversight responsibilities and have an understanding of generally accepted accounting principles and financial statements. All four Audit Committee members have served several terms on the Audit Committee of the Company and the Bank.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibilities include the following:

Review annual and quarterly financial statements prior to filing or distribution and discuss the results of the annual audit;

Review quarterly CEO/CFO certifications;

Review the qualifications, independence and performance of the external auditors;

Review the operation, organizational structure and qualifications of the internal audit department;

Review significant reports regarding the Company prepared by the internal audit department;

Review the Company’s legal compliance with applicable laws and regulations; and

Review employee and shareholder complaints regarding accounting, audit or internal control issues.

In this context, the Audit Committee has met and held discussions with management and the independent accountants regarding the financial statements for the year ended December 31, 2003. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement of Auditing Standards ("SAS") No. 61, "Communication with Audit Committees", as amended by SAS No. 90, "Audit Committee Communications".

The Company’s independent accountants also provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees", and the Audit Committee discussed with the independent accountants that firm’s independence.

Based on the Audit Committee’s review and discussions detailed above, the Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE:

| T. Wayne McDonald, Chairman | Ivan E. Block |

| John W. Houser | Larry A. McKinney |

Independent Auditors’ Fees

KPMG LLP has significant experience in bank accounting and auditing and has served as the independent accountants of the Company since its organization in 1989. KPMG LLP has advised the Company that they are independent, within the meaning of the rules and guidelines of the SEC, the American Institute of Certified Public Accountants, and the Independence Standards Board. Representatives of KPMG LLP are expected to be present at the Annual Meeting, will be available to respond to appropriate questions, and will have the opportunity to make a statement if they desire to do so. The Audit Committee has selected KPMG LLP as the independent public accountants for the Company for the year ending December 31, 2004.

The following table presents the aggregate fees, billed or accrued, for the years ended December 31, 2003 and 2002 for professional audit services rendered by KPMG LLP for the audit of the Company’s annual financial statements for those years. Also presented are fees billed for other services rendered by KPMG LLP.

| | | 2003 | 2002 |

| | |

| |

| |

| Audit fees | | $ | 41,000 | | $ | 38,000 | |

| Audit related fees (1) | | | - | | | 1,500 | |

| | |

| |

| |

| Total audit and audit related fees | | | 41,000 | | | 39,500 | |

| Tax fees (2) | | | - | | | 7,300 | |

| All other fees (3) | | | 2,800 | | | 3,500 | |

| | |

| |

| |

| Total fees | | $ | 43,800 | | $ | 50,300 | |

| | |

| |

| |

(1) - Audit related fees consisted of fees paid in conjunction with an S-8 registration filing.

(2) - Tax fees consisted principally of fees for tax consultation and planning for certain Named Executive Officers.

(3) - All other fees paid consisted of fees for professional services rendered for collateral verification audits for the FHLB.

The Audit Committee implemented a policy in 2002 to have all auditing services and permitted non-audit services of KPMG LLP pre-approved by the Audit Committee, including fees and terms. The Audit Committee pre-approved 100% of the engagements for the audit of the Company, audit related engagements and tax engagements paid during 2003. The Audit Committee pre-approved 100% of the engagements for audit fees, audit related fees, and all other fees paid during 2002. Prior to the implementation of the policy, the Board of Directors of the Company pre-approved the remaining engagements for tax consulting services which were paid in 2002.

The Audit Committee has considered whether the provision of services after the audit services (as specified above) is compatible with maintaining KPMG LLP independence and has determined that provision of such services has not adversely affected KPMG LLP’s independence.

EXECUTIVE OFFICERS AND COMPENSATION

Set forth below are the names, ages, titles, and business experience of the executive officers of the Company.

J. Randolph Potter, age 57, has been President and Chief Executive Officer of the Company since 1989.

James B. Schwiers, age 45, has been Chief Operating Officer of Summit National Bank, a wholly-owned subsidiary of the Company since 1997. He has been Executive Vice President of the Bank since 1990.

Blaise B. Bettendorf, age 41, is a certified public accountant and has been Senior Vice President and Chief Financial Officer, and Assistant Secretary/Treasurer of the Company since 1990.

James G. Bagnal, III,age 59, has been Regional President of Summit National Bank since joining the Company in April 2000. He served as regional president in Spartanburg, South Carolina for Regions Bank from 1998 to 2000.

Compensation of Executive Officers

The following table sets forth, for the years ended December 31, 2003, 2002 and 2001, the cash compensation paid by the Company and its subsidiaries, as well as other compensation paid or accrued for each of these years, to the chief executive officer and to each of the other most highly compensated executive officers (collectively the "Named Executive Officers") for services rendered in all capacities to the Company and its subsidiaries.

SUMMARY COMPENSATION TABLE

| | | | Annual Compensation | Long-Term Compensation | |

| | |

|

| |

Name and Principal Position | | Year | Salary ($)(1) | Bonus ($)(2) | Other Annual Compen-sation ($) | AWARDS Restricted Stock Awards ($) | AWARDS Securities Underlying Options/ SARS (#) | All Other Compensation ($) |

| |

| |

| |

| |

| |

| |

| |

| |

J. Randolph Potter,President and CEO | | | 2003 | | $ | 247,000 | | $ | 61,000 | | | (3) | | $ | 36,400 | (8) | | - | | $ | 12,442 | (4) |

| | | | 2002 | | $ | 242,000 | | $ | 48,000 | | | (3) | | | - | | | - | | $ | 12,562 | |

| | | | 2001 | | $ | 235,000 | | $ | 23,000 | | | (3) | | | - | | | - | | $ | 10,861 | |

| | | | | | | | | | | | | | | | | | | | | | | |

James B. Schwiers,Executive Vice Presidentand COO of the Bank | | | 2003 | | $ | 178,000 | | $ | 44,000 | | | (3) | | $ | 36,400 | (8) | | - | | $ | 11,122 | (5) |

| | | | 2002 | | $ | 173,000 | | $ | 31,000 | | | (3) | | | - | | | - | | $ | 11,527 | |

| | | | 2001 | | $ | 165,000 | | $ | 16,000 | | | (3) | | | - | | | - | | $ | 10,961 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Blaise B. Bettendorf,Senior Vice Presidentand CFO | | | 2003 | | $ | 148,000 | | $ | 37,000 | | | (3) | | $ | 36,400 | (8) | | - | | $ | 9,288 | (6 ) |

| | | | 2002 | | $ | 144,000 | | $ | 28,000 | | | (3) | | | - | | | - | | $ | 9,077 | |

| | | | 2001 | | $ | 137,000 | | $ | 14,000 | | | (3) | | | - | | | - | | $ | 8,451 | |

| | | | | | | | | | | | | | | | | | | | | | | |

James G. Bagnal, III,Regional President of the Bank | | | 2003 | | $ | 151,500 | | $ | 21,000 | | | (3) | | | - | | | - | | $ | 10,016 | (7) |

| | | | 2002 | | $ | 147,000 | | $ | 14,000 | | | (3) | | | - | | | - | | $ | 9,677 | |

| | | | 2001 | | $ | 140,000 | | $ | 30,000 | | | (3) | | | - | | | - | | $ | 9,091 | |

| (1) - | All compensation and benefits are paid by Summit National Bank. |

| (2) - | Includes bonuses awarded for the current year which may be paid in the subsequent year. |

| (3) - | Certain amounts may have been expended by the Company which may have had value as a personal benefit to the Named Executive Officer. However, the total value of such perquisites and other personal benefits for any year presented did not exceed, in the aggregate, 10% of the annual salary and bonus of such executive officer. |

| (4) - | The amount for 2003 is comprised of (i) $12,000 contributed by the Company to the Summit Financial Corporation 401(k) Plan to match fiscal 2003 pre-tax deferral contributions, all of which was vested; and (ii) $442 of term life insurance premiums, not generally available to other employees, paid by the Company on behalf of Mr. Potter. |

| (5) - | The amount for 2003 is comprised of (i) $10,680 contributed by the Company to the Summit Financial Corporation 401(k) Plan to match fiscal 2003 pre-tax deferral contributions, all of which was vested; and (ii) $442 in term life insurance premiums, not generally available to other employees, paid by the Company on behalf of Mr. Schwiers. |

| (6) - | The amount for 2003 is comprised of (i) $8,880 contributed by the Company to the Summit Financial Corporation 401(k) Plan to match fiscal 2003 pre-tax deferral contributions, all of which was vested; and (ii) $408 in term life insurance premiums, not generally available to other employees, paid by the Company on behalf of Ms. Bettendorf. |

| (7) - | The amount for 2003 is comprised of (i) $9,007 contributed by the Company to the Summit Financial Corporation 401(k) Plan to match fiscal 2003 pre-tax deferral contributions, which was partially vested; (ii) $417 in term life insurance premiums, not generally available to other employees, paid by the Company on behalf of Mr. Bagnal; and (iii) $592 imputed income on the term portion of split-dollar life insurance coverage paid by the Company on behalf of Mr. Bagnal. |

| (8) - | In February 2004, pursuant to the Company’s Restricted Stock Plan, Mr. Potter, Mr. Schwiers, and Ms. Bettendorf were awarded 2,000 shares each of the Company’s common stock. The awards were granted for nominal consideration and restrictions lapse 20% each year over a period of 5 years from the date of the award. The amount (adjusted for stock dividends) and 2003 year end value (based on the closing market price of $18.00 at December 31, 2003) of all restricted stock held by the Named Executive Officers at December 31, 2003 are: Mr. Potter held 24,945 shares of restricted stock, of which 23,973 shares had vested, with a market value of $449,000; Mr. Schwiers held 19,316 shares of restricted stock, of which 18,344 shares had vested, with a market value of $347,700; and, Ms. Bettendorf h eld 16,502 shares of restricted stock, of which 15,530 shares had vested, with a market value of $297,000. Dividends are payable on the restricted stock to the extent paid on the Company’s common stock generally. If a change in control of the Company (as defined in the plan) were to occur, the restricted stock would immediately vest in full. |

Stock Options

The Corporation maintains several stock option plans, which provide discretionary awards of options to purchase common stock to officers and employees as determined by the Board of Directors. There were no stock option grants made to any Named Executive Officer during 2003.

Option Exercise And Fiscal Year End Option Value Table

The following table shows stock option exercises by the Named Executive Officers during the year ended December 31, 2003. In addition, this table includes the number of shares (adjusted for stock dividends) covered by both exercisable and non-exercisable options as of December 31, 2003. Also reported are the values for "in-the-money" options, which represent the positive spread between the exercise price of any such existing options and the year-end market price of Summit Financial Corporation common stock.

AGGREGATED OPTION/SAR EXERCISES IN THE LAST FISCAL YEAR,

AND FISCAL YEAR-END OPTION/SAR VALUES

| | | | | Number of Securities Underlying Unexercised Options/SARs at FY-End (#)(2) | Value of Unexercised In-the-Money Options/SARs at FY-End ($)(3) (4) |

| | | |

|

|

| Name | | Number of Shares Acquired on Exercise (#) | Value Realized ($) (1) | Exercisable | Unexercisable | Exercisable | Unexercisable |

| |

| |

| |

| |

| |

| |

| |

| J. Randolph Potter | | | - | | | - | | | 91,466 | | | - | | $ | 1,215,000 | | | - | |

| James B. Schwiers | | | 24,178 | | $ | 292,554 | | | 59,098 | | | - | | $ | 748,000 | | | - | |

| Blaise B. Bettendorf | | | - | | | - | | | 76,902 | | | - | | $ | 1,030,000 | | | - | |

| James G. Bagnal, III | | | - | | | - | | | 34,465 | | | 24,310 | | $ | 31,000 | | $ | 247,000 | |

| (1) - | Value realized is calculated as the spread between the fair market value of the underlying common stock as quoted on the NASDAQ Small Cap Market as of the exercise date, minus the grant price. |

| (2) - | The number of exercisable and unexercisable options has been adjusted for all 5% stock dividends issued. |

| (3) - | Values are based on the fair market value, determined as the closing price of the common stock on December 31, 2003 ($18.00 as quoted on the NASDAQ Small Cap Market), minus the grant price. |

| (4) - | The value of unexercised in-the-money stock options at December 31, 2003 is presented to comply with SEC regulations. The actual amount realized upon any exercise of stock options will depend upon the excess of the fair market value of the common stock over the grant price at the time the stock option is exercised. There is no assurance that the values of unexercised stock options reflected in this table will be realized. |

Defined Benefit Plan

During 1998, the Company established a salary continuation plan pursuant to agreements with certain executives of the Company and the Bank. Under the Salary Continuation Agreements, an executive will be entitled to a stated annual benefit for a period of 20 years either, (i) upon retirement from the Company after attaining the normal retirement age defined in the plan as age 65, or (ii) upon the executive’s disability or death, in which case the benefits would be payable immediately to the executive or to the executive’s beneficiary. If the executive’s employment is terminated voluntarily or is terminated as a result of a change in control of the Company as defined in the agreement, a reduced annual benefit will be payable at the age of 65 pursuant to the early termination te rms of the agreement. Mr. Potter, Mr. Schwiers and Ms. Bettendorf have entered into Salary Continuation Agreements with the Company that currently provide annual benefits at age 65 of $130,000, $48,500 and $45,000, respectively.

Employee Agreements

The Company has entered into substantially similar noncompetition, severance, and employment agreements (each individually the "Agreement") with J. Randolph Potter, James B. Schwiers, Blaise B. Bettendorf, and James G. Bagnal, III (each an "Executive"). The terms of each Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Agreement itself.

Under each Agreement, the applicable Executive is given duties and authority typical of similar executives and the Company is obligated to pay the Executive an annual salary determined by the Board, such incentive compensation as may become payable to the Executive under the Company’s bonus plans, and certain other typical executive benefits. The provisions of the Agreement are to continue until such time as the Executive’s employment is terminated as provided for in the Agreement. In the event the Executive voluntarily terminates his employment with the Company, the Company’s obligations under the Agreement cease as of the date of such termination and the Executive is subject to a 12 month non-competition provision as defined in the Agreement. In the event that the Company s hall terminate the Executive’s employment without cause (as defined in the Agreement), the Company is obligated to continue monthly salary payments for a minimum period of one year up to a maximum of three years. The Executive is subject to a non-competition provision as defined in the Agreement for the entire period severance payments are made. In the event of termination associated with a change in control as defined by the Agreement, the Executive is entitled to an amount equal to three times his annual base pay amount computed and paid over a three-year period as provided for in the Agreement. The Executive is subject to a non-competition provision as defined in the Agreement for a period of up to three years while he/she is receiving payments following a change in control.

COMPENSATION COMMITTEE MATTERS

Compensation Committee Report

The Compensation Committee of the Board of Directors is composed entirely of independent directors. This Committee is responsible for establishing, implementing and monitoring all compensation policies of the Company and its primary operating subsidiary, Summit National Bank. The Committee is also responsible for evaluating the performance of the Chief Executive Officer of the Company and recommending appropriate compensation levels. The Chief Executive Officer evaluates the performance of other executive officers of the Company and recommends individual compensation levels to the Compensation Committee for their approval.

Compensation Philosophy

The Compensation Committee believes that a compensation plan for executive officers should take into account management skills, long-term performance results, shareholder returns, operating results, asset quality, asset-liability management, regulatory compliance, and unusual accomplishments as well as economic conditions and other external events that affect the operations of the Company. Compensation policies must be maintained to promote: 1) the attraction and retention of highly qualified executives; 2) motivation of executives that is related to the performance of the individual and the Company; 3) compensation opportunities that are comparable to those offered by peer organizations; 4) current and long-term performance; and 5) a financial interest in the success of the Company similar to the interest of its shareholders. The Company’s current compensation plan involves a combination of salary and bonus to reward short-term performance, retirement benefits pursuant to salary continuation agreements with certain officers, and in some years, grants of stock options or restricted stock, both of which vest over five-year periods, to encourage long-term performance. The Committee believes that these key elements provide a competitive, well-balanced total compensation program that is supportive of the Company’s strategies and goals.

The base salary levels and annual bonus incentives of the executive officers are designed to be competitive within the financial services industry and are intended to reflect individual performance and responsibility, as well as annual corporate performance and results. When granted, awards of stock options or restricted stock are intended to provide executives with increased motivation and incentive to exert their best efforts on behalf of the Company by enlarging their personal stake in its success through the opportunity to increase their stock ownership in the Company. The Committee believes that stock ownership by management and stock-based performance compensation arrangements are beneficial in aligning managements’ and shareholders’ interest in the enhancement of shareholde r value and focusing on long-term results.

Compensation Paid in 2003

The Company’s policy as to compensation of its executive officers, including the CEO, is based upon the level of performance in relation to the responsibilities and accomplishments incident to the individual’s job description. In determining compensation, the Committee considers the progress made by the Company in laying a foundation for future revenue enhancements, income improvements, growth of the Company, quality of the loan portfolio, and growth of shareholder value.

Compensation paid J. Randolph Potter, Chief Executive Officer and President of the Company, and the other Named Executive Officers in 2003 consisted of the following elements: (1) a base salary; (2) a cash bonus; (3) restricted stock grants for Mr. Potter, Mr. Schwiers, and Ms. Bettendorf; (4) certain perquisites, the total of all which did not exceed 10% of base salary and bonus amounts; (5) premiums paid by the Company on behalf of the executives with respect to insurance not generally available to all employees; (6) vested amounts of retirement benefits pursuant to the nonqualified salary continuation agreement for certain officers; and (7) the other compensation set forth in the Summary Compensation Table previously presented.

During 2003, the Company reported an 11% increase in earnings to $3.8 million and total assets of $344 million, which represents a 14% growth rate from the prior year. Average earning assets grew 12%, contributing to the 6% increase in net interest income. Return on average assets ("ROA") and return on average equity ("ROE") both decreased somewhat from the prior year as the asset growth rate exceeded the increase in net income. ROA was 1.18% and ROE was 12.46% for the year ended December 31, 2003. The market value of the Company’s stock increased 23% to close the year at $18.00. The Company’s nonperforming assets, past due loans, and net charge-off ratios increased somewhat from the prior year, however, all remained low in 2003 in comparison to peers.

During the year 2003, the base compensation for Mr. Potter was $247,000. For 2004, Mr. Potter’s base compensation was increased 1% to $250,000. Mr. Potter was also awarded a cash bonus (determined on a subjective basis) of $61,000, or 25% of his salary, for the year ended 2003 based primarily on the Company’s performance. In addition, the Compensation Committee awarded Mr. Potter 2,000 shares of the Company’s common stock under the Restricted Stock Plan which vest over a five year period to provide additional incentive for long-term increases in growth and profitability. The Committee assessed that Mr. Potter continues to provide the Company with strong leadership in overseeing growth, asset quality, profitability improvements, and strategic positioning for both Summit Nation al Bank and Freedom Finance, Inc. Based upon the factors discussed above, the Compensation Committee continues to believe that Mr. Potter’s compensation package as Chief Executive Officer and President of the Company appropriately reflects the Company’s short-term and long-term performance goals.

COMPENSATION COMMITTEE:

| C. Vincent Brown | David C. Poole |

| Ivan E. Block | T. Wayne McDonald |

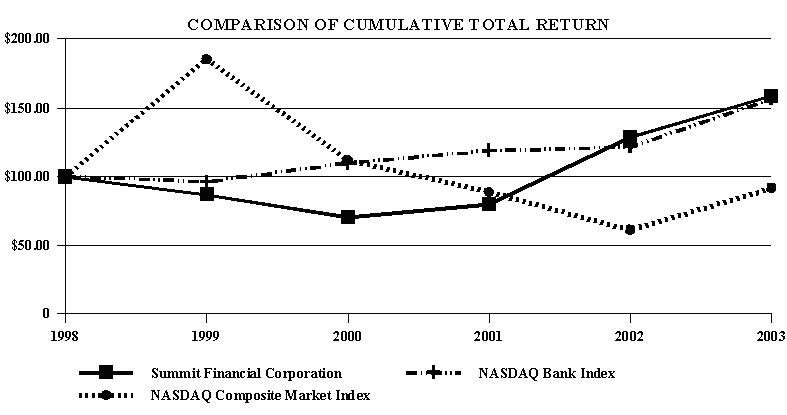

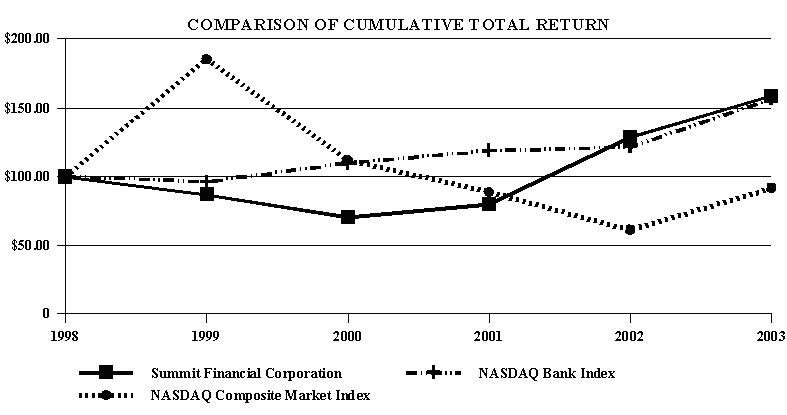

Stock Performance Graph

The following graph compares the cumulative total shareholder return (calculated based upon the stock appreciation) of the common stock of the Company for the five year period from December 31, 1998 through December 31, 2003, with the cumulative total return on the NASDAQ Composite Market Index and the NASDAQ Bank Index, the Company’s peer group, over the same period. All cumulative returns assume an initial investment of $100 on December 31, 1998 in each of the Company’s shares, the NASDAQ Market Index, and the NASDAQ Bank Index, and the reinvestment of all dividends.

| | | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 |

| |

| |

| |

| |

| |

| |

| |

| Summit Financial Corporation | | $ | 100.00 | | $ | 87.00 | | $ | 70.39 | | $ | 79.87 | | $ | 128.78 | | $ | 158.56 | |

| NASDAQ Bank Index | | $ | 100.00 | | $ | 96.15 | | $ | 109.84 | | $ | 118.92 | | $ | 121.74 | | $ | 156.62 | |

| NASDAQ Composite Market Index | | $ | 100.00 | | $ | 185.43 | | $ | 111.83 | | $ | 88.76 | | $ | 61.37 | | $ | 91.75 | |

Compensation Committee Interlocks and Insider Participation

During 2003, the following persons served on the Compensation Committee: Mr. C. Vincent Brown (Chairman), Mr. David C. Poole (Secretary), Mr. Ivan Block and Dr. T. Wayne McDonald.

Certain of the Directors who were members of the Compensation Committee during 2003, and members of the immediate family and affiliates of such Directors, have from time to time engaged in banking transactions with the Company’s subsidiary bank and are expected to continue such relationships in the future. All loans or other extensions of credit made by the Company’s subsidiary bank to such individuals were made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unaffiliated third parties and did not involve more than the normal risk of collectibility or present other unfavorable features.

Certain of the executive officers and Directors of the Company, and members of the immediate family and affiliates of such persons, have from time to time engaged in banking transactions with the Company’s subsidiary bank and are expected to continue such relationships in the future. All loans or other extensions of credit made by the Company’s subsidiary bank to such individuals are regulated and limited by national banking laws. Such loans are made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unaffiliated third parties and did not involve more than the normal risk of collectibilit y or present other unfavorable features.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, executive officers, and persons who own more than 10% of the Company’s common stock, to file with the Securities and Exchange Commission (the "SEC") reports of ownership and changes in ownership of the common stock. Directors, executive officers, and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of the reports it received and written representations provided to the Company from the individuals required to file the reports, the Company believes that, for the year ended December 31, 2003, each of the Company’s Directors and executive officers has complied with applicable reporting requirements for transactions in Summit Financial Corporation common stock.

SHAREHOLDER PROPOSALS AND NOMINATIONS

Any shareholder may offer proposals for inclusion in the proxy statement. Pursuant to Rule 14a-8 under the Exchange Act, shareholders of the Company may present proposals for inclusion in the Company’s Proxy Statement and for consideration at the next annual meeting by submitting their proposals to the Company in a timely manner.

In order to be considered for inclusion in the Company’s Proxy Statement and Proxy Card for its 2005 Annual Meeting of shareholders, a shareholder proposal must be received in writing by the Secretary of the Company at the principal office of the Company, Summit Financial Corporation, 937 North Pleasantburg Drive, Greenville, South Carolina, 29607 by November 19, 2004. Securities and Exchange Commission rules contain standards for determining whether a shareholder proposal is required to be included in a proxy statement.

Under the Company’s bylaws, any shareholder who intends to present a proposal, or nominate an individual to serve as a director at the 2005 Annual Meeting, must notify the Company no later than November 19, 2004 of his intention to present the proposal or make the nomination. The shareholder also must comply with other requirements in the bylaws. Any shareholder may request a copy of the relevant bylaw provision by writing to the Secretary of the Company at Summit Financial Corporation, 937 North Pleasantburg Drive, Greenville, South Carolina, 29607.

ANNUAL REPORT TO SHAREHOLDERS

The Company’s 2003 Annual Report to Shareholders and 2003 Annual Report on Form 10-K, without exhibits, for the year ended December 31, 2003, as filed with the Securities and Exchange Commission, is included with this Proxy Statement and is being mailed to shareholders of record as of the close of business on March 10, 2004. Any shareholder who has not received a copy of the Annual Report and Form 10-K may obtain a copy by writing to the Secretary of the Company.

The Company has delivered only one Annual Report, Form 10-K and Proxy Statement to multiple shareholders of record located at a shared address, unless the Company received contrary instructions from one or more of the shareholders prior to the mailing date. The Company will furnish, upon written or verbal request, a separate copy of the Annual Report, Form 10-K, or Proxy Statement, or all, to a shareholder of record located at a shared address to which a single copy was sent. To request a separate copy of the document, or to request delivery of a single copy of documents for shareholders with a shared address, contact the Secretary of the Company at Summit Financial Corporation, 937 North Pleasantburg Drive, Greenville, South Carolina, 29607, or call the Corporate Secretary at 864-242-2265.

OTHER MATTERS

The Board of Directors and management of the Company know of no matters other than those stated above that are to be brought before the 2004 Annual Meeting. However, if any other matter should be presented for consideration and voting at the 2004 Annual Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the proxy in accordance with their judgment of what is in the best interest of the Company.

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of Summit Financial Corporation common stock. In addition to soliciting proxies by mail, directors, officers and employees of the Company or Summit National Bank may solicit proxies personally or by telephone. None of these persons will receive additional compensation for these activities.

| By Order of the Board of Directors, |

| | |

| |  |

| | J. Randolph Potter |

| | President and Chief Executive Officer |

| March 19, 2004 | |

| Greenville, South Carolina | |

APPENDIX A

SUMMIT FINANCIAL CORPORATION

AUDIT COMMITTEE CHARTER

Purpose

The purpose of the Audit Committee (the "Committee") is to oversee the accounting and financial reporting processes of Summit Financial Corporation ("the Company") and the audits of its financial statements and to monitor the Company’s compliance with legal and regulatory requirements.

The Committee shall prepare the "Audit Committee Report" required by the rules of the Securities and Exchange Commission (the "SEC") to be included in the Company’s annual proxy statement.

Committee Membership

The Committee shall consist of no fewer than three members of the Board of Directors (the "Board"). Each of the members of the Committee shall meet the criteria for independence under the Securities Exchange Act of 1934 (the "Exchange Act") and the rules and regulations promulgated thereunder and the independence requirements of the NASDAQ Stock Market. All members of the Committee shall be financially literate and have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements. At least one member of the Committee shall have the experience or background which results in the individual’s financial sophistication. The Board shall determine whether members of the Audit Committee are audit committee financial experts as defined by th e rules of the SEC. Further, Committee members shall not have participated in the preparation of the financial statements of the Company or any of its subsidiaries at any time during the past three years.

Committee members shall not simultaneously serve on the audit committees of more than two other public companies. The members of the Committee shall be appointed by the Board. Committee members may be replaced by the Board at any time or from time to time. The Board will designate a Committee Chairman; however, if the Committee Chairman is not present at a meeting, the members of the Committee may designate a member to serve as Chairman for that meeting by majority vote of the Committee members present.

Meetings

The Committee shall meet as often as it determines, but not less frequently than quarterly. The Committee shall invite members of management, auditors and others to attend the meetings and provide pertinent information as necessary. The Committee shall meet periodically separately with each of management, the internal auditors, and the independent auditors. The Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. Meeting agendas will be prepared and provided in advance to Committee members, along with appropriate briefing materials.

Committee Authority and Responsibilities

The Audit Committee has authority to conduct or authorize investigations into any matters within its scope of responsibility.

The Committee shall have the sole authority to appoint (subject, if applicable, to shareholder ratification) or replace the independent auditor. The Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services or related work for the Company and each such accounting firm shall report directly to the Committee. The Committee shall be responsible for resolving any disagreements between management and the independent auditors regarding financial reporting.

The Committee shall pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor, subject to the de minimus exception for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act which are approved by the Committee prior to the completion of the audit. The Committee may establish pre-approval policies and procedures, as permitted by the Exchange Act and the rules and regulations promulgated thereunder, for the engagement of independent auditors to render services to the Company, including but not limited to policies that would allow the delegation of pre-approval authority to one or more members of the Committee, provided that any pre-approvals delegated to one or more memb ers of the Committee are reported to the Committee at its next scheduled meeting.

The Committee shall seek any information it requires from employees, all of whom are directed to cooperate with the Committee’s requests, or external parties. Members may meet with Company officers, independent auditors, or outside counsel as necessary.

The Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting, or other advisors. The Company shall provide for appropriate funding, as determined by the Committee, for payment of compensation to any public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services or related work for the Company and to any advisors employed by the Committee and for the administrative expenses of the Committee that are necessary or appropriate in carrying out its duties.

The Committee shall make regular reports to the Board. The Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. The Committee shall annually review the Committee’s own performance.

In carrying out its responsibilities, the Committee believes its policies and procedures should remain flexible in order to best react to changing circumstances. Subject to this, in carrying out its mission, the Committee shall have the following authorities and responsibilities:

Financial Statement and Disclosure Matters

1. Review and discuss with management and the independent auditor the annual audited financial statements, including disclosures made in management’s discussion and analysis, and recommend to the Board whether the audited financial statements should be included in the Company’s Form 10-K.

2. Review and discuss with management and the independent auditor the Company’s quarterly financial statements, including disclosures made in management’s discussion and analysis, prior to the filing of the Company’s Form 10-Q, including the results of the independent auditor’s review of the quarterly financial statements.

3. Review and discuss with management and the independent auditor significant financial accounting and reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including their impact on the financial statements, any significant changes in the Company’s selection or application of accounting principles, any major issues as to the adequacy of the Company’s internal controls and any special steps adopted in light of material control deficiencies.

4. Review and discuss annual and quarterly reports from the independent auditors on:

(a) All critical accounting policies and practices to be used, complex or unusual transactions, and highly judgmental areas.

(b) Major issues regarding accounting principles and financial statement presentation, including any significant changes in the Company’s selection or application of accounting principles.

(c) All alternative treatments within generally accepted accounting principles for policies and practices related to material items that have been discussed with management, including ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor.

(d) Other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences.

5. Discuss with management the Company’s earnings press releases, including the use of "pro forma" or "adjusted" non-GAAP information, as well as financial information and earnings guidance provided to analysts and rating agencies. Such discussion may be done generally (consisting of discussing the types of information to be disclosed and the types of presentations to be made).

6. Discuss with management and the independent auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Company’s financial statements.

7. Discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies.

8. Discuss with management and the independent auditor the results of the audit and the matters required to be discussed by Statement of Auditing Standards No. 61 relating to the conduct of the audit, including any difficulties encountered in the course of the audit work, any restrictions on the scope of activities or access to requested information, and any significant disagreements with management.

9. Review disclosures made to the Committee by the Company’s CEO and CFO during their certification process for the Form 10-K and Form 10-Q about any significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting and any fraud involving management or other employees who have a significant role in the Company’s internal control over financial reporting.

Oversight of the Company’s Relationship with the Independent Auditor

10. Review and evaluate the lead partner of the independent auditor team and the performance of the independent auditors, and exercise final approval on the appointment or discharge of the independent auditors.

11. Obtain and review a report from the independent auditor at least annually regarding (a) the independent auditor’s internal quality-control procedures; (b) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm; (c) any steps taken to deal with any such issues; and (d) all relationships between the independent auditor and the Company. Evaluate the qualifications, performance and independence of the independent auditor, including considering whether the auditor’s quality controls are adequate and the provision of permitted non-audit services is compatible with maintaining the auditor’s independence, taking into acco unt the opinions of management and internal auditors. The Committee shall present its conclusions with respect to the independent auditor to the Board.

12. Ensure rotation of the lead or concurring audit partner every five years, and the other audit partners every seven years, or as otherwise required by law. Consider whether, in order to assure continuing auditor independence, it is appropriate to adopt a policy of rotating the independent auditing firm on a regular basis.

13. Ensure there are policies approved by the Board for the Company’s hiring of employees or former employees of the independent auditor who participated in any capacity in the audit of the Company.

14. Discuss with the national office of the independent auditor issues on which the Company’s audit team consulted them and matters of audit quality and consistency.

15. Meet with the independent auditor prior to the audit to discuss the planning, proposed audit scope and approach, including coordination of the audit effort with internal audit, and staffing of the audit.

16. Review internal accounting control reports and management letters submitted by the independent auditor which relate to the Company.

17. On a regular basis, meet separately with independent auditors to discuss any matters that the Committee or auditors believe should be discussed privately.

Oversight of the Company’s Internal Audit Function

18. Ensure there are no unjustified restrictions or limitations on the internal audit function, and review and concur in the appointment, replacement, or dismissal of the Director of Internal Audit.

19. Review the significant reports to management prepared by the internal auditing department and management’s responses.

20. Discuss with management and the Director of Internal Audit, the internal audit department’s responsibilities, charter, plan, activities, budget, staffing, organizational structure, and any recommended changes in the planned scope of the internal audit.

21. Review the effectiveness of the internal audit function and on a regular basis, meet separately with the Director of Internal Audit to discuss any matters that the Committee or internal audit believes should be discussed separately.

Compliance Oversight Responsibilities

22. Review the effectiveness of the system for monitoring compliance with laws and regulations and the results of management’s investigation and follow-up (including disciplinary action) of any instances of noncompliance.

23. Obtain reports from management, the Company’s senior internal auditing executive and the independent auditor that the Company and its subsidiaries are in conformity with applicable legal requirements and the Company’s Code of Ethics. Review and approve all related party transactions and review reports and disclosures of insiders and affiliated party transactions. Advise the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations and with the Company’s Code of Ethics. Review the process for communicating the Code of Ethics to Company personnel and for monitoring compliance training.

24. Establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

25. Receive communications and presentations from management summarizing the suspicious activity reports (SAR) filed by Summit National Bank with regulatory and law enforcement agencies.

26. Discuss with management and the independent auditor any correspondence with regulators or governmental agencies, any published reports that raise material issues regarding the Company’s compliance policies, and the findings of any examination by regulatory agencies.

Internal Control

27. Consider the effectiveness of the Company’s internal control systems, including information technology security and control.

28. Understand the scope of internal and external auditors’ review of internal controls over financial reporting, and obtain reports on significant findings and recommendations, together with management’s responses.

29. Receive, when needed, presentations from management and the independent auditor on the identification and resolution status of material weaknesses and reportable conditions in the internal control environment, including computerized information system controls and security, if any, and on any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal controls.

Reporting Responsibilities

30. Report regularly to the Board about Committee activities and issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the performance and independence of the Company’s independent auditors, and the performance of the internal audit function.

31. Provide an open avenue of communication between internal audit, independent auditors, and the Board.

32. Report annually to the shareholders, describing the Committee’s composition, responsibilities and how they were discharged, and other information required by law, including approval of non-audit services.

33. Review any other reports the Company issues that relate to Committee responsibilities.

34. Maintain minutes and other relevant documentation of all meetings held.

Limitation of Committee’s Role

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements and disclosures are complete and accurate and in accordance with generally accepted accounting principles and applicable rules and regulations. These are the responsibilities of management and the independent auditor.