Exhibit 99.(c) (8)

DRAFT BAIRD

PROJECT GIANT

Preliminary Discussion Materials

May 14, 2008

Preliminary Discussion Materials DRAFT BAIRD

Table of Contents

Review of M-Co Proposal 1

GIANT Financial Overview 2

Business Cycle Discussion 3

Preliminary Valuation Analysis 4

Selected Potential Strategic Partners 5

Appendix 6

A. Supplemental Information

For Confidential Use Of Board Of Directors Only And Not For Public Disclosure

PROJECT GIANT

1

Introduction DRAFT BAIRD

As discussed at the GIANT April Board meeting, and as prompted by the indicative offer letter sent by M-Co on May 5th (the “Proposal”), Baird has performed preliminary analyses regarding certain strategic and financial alternatives available to the Company, including:

Examined the summary terms and conditions of the Proposal

Conducted preliminary GIANT due diligence and reviewed certain historical and projected performance / plan information

Reviewed business cycle trends and valuation implications

Performed preliminary valuation analyses:

Selected company analysis

Discounted cash flow analysis

Selected transaction analysis

Other supplemental analyses as we deemed appropriate

Additionally, Baird identified other selected potential strategic partners that may have an interest in a transaction (if a decision were made to pursue that alternative) to assess their:

Recent merger and acquisition history

Likely rationale for a potential transaction with GIANT

Ability to finance / consummate an acquisition of GIANT

PROJECT GIANT

2

DRAFT BAIRD

Review of M-Co Proposal

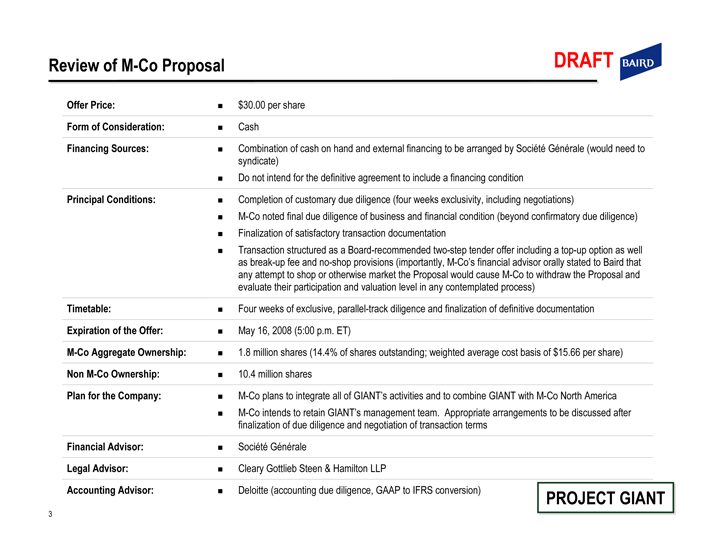

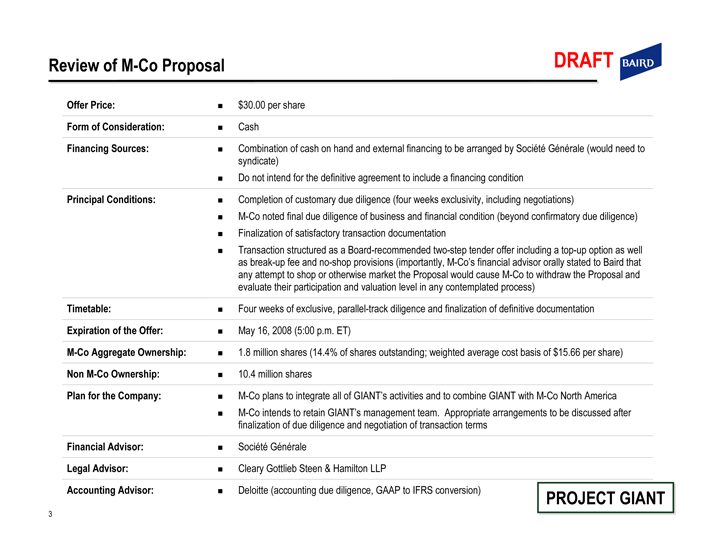

Review of M-Co Proposal DRAFT BAIRD

Offer Price: $30.00 per share

Form of Consideration: Cash

Financing Sources: Combination of cash on hand and external financing to be arranged by Société Générale (would need to syndicate)

Do not intend for the definitive agreement to include a financing condition

Principal Conditions: Completion of customary due diligence (four weeks exclusivity, including negotiations)

M-Co noted final due diligence of business and financial condition (beyond confirmatory due diligence)

Finalization of satisfactory transaction documentation

Transaction structured as a Board-recommended two-step tender offer including a top-up option as well as break-up fee and no-shop provisions (importantly, M-Co’s financial advisor orally stated to Baird that any attempt to shop or otherwise market the Proposal would cause M-Co to withdraw the Proposal and evaluate their participation and valuation level in any contemplated process) Timetable: Four weeks of exclusive, parallel-track diligence and finalization of definitive documentation

Expiration of the Offer: May 16, 2008 (5:00 p.m. ET)

M-Co Aggregate Ownership: 1.8 million shares (14.4% of shares outstanding; weighted average cost basis of $15.66 per share)

Non M-Co Ownership: 10.4 million shares

Plan for the Company: M-Co plans to integrate all of GIANT’s activities and to combine GIANT with M-Co North America

M-Co intends to retain GIANT’s management team. Appropriate arrangements to be discussed after finalization of due diligence and negotiation of transaction terms

Financial Advisor: Société Générale

Legal Advisor: Cleary Gottlieb Steen & Hamilton LLP

Accounting Advisor: Deloitte (accounting due diligence, GAAP to IFRS conversion)

PROJECT GIANT

3

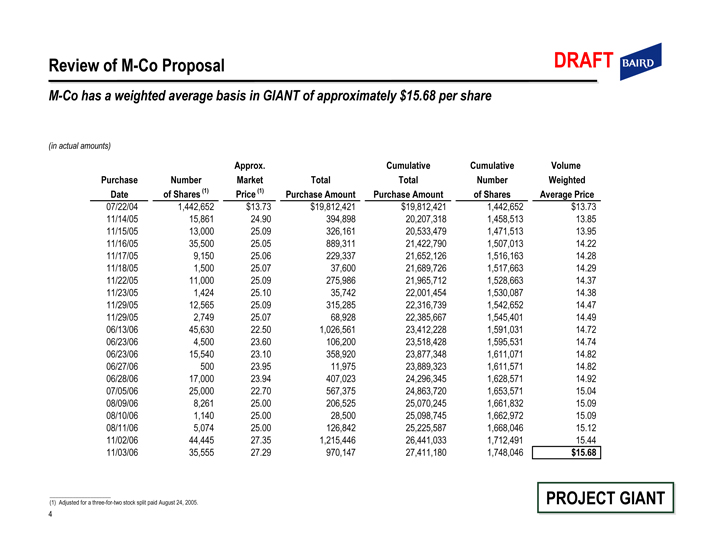

Review of M-Co Proposal DRAFT BAIRD

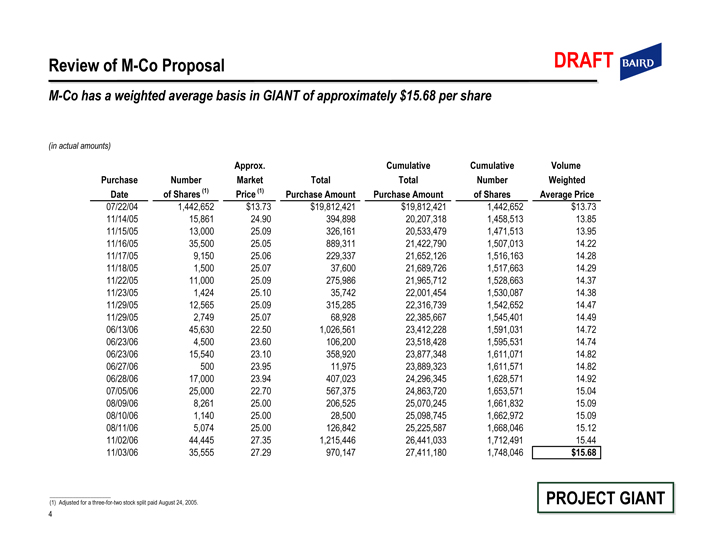

M-Co has a weighted average basis in GIANT of approximately $15.68 per share

(in actual amounts)

Approx. Cumulative Cumulative Volume

Purchase Number Market Total Total Number Weighted

Date of Shares (1) Price (1) Purchase Amount Purchase Amount of Shares Average Price

07/22/04 1,442,652 $13.73 $19,812,421 $19,812,421 1,442,652 $13.73

11/14/05 15,861 24.90 394,898 20,207,318 1,458,513 13.85

11/15/05 13,000 25.09 326,161 20,533,479 1,471,513 13.95

11/16/05 35,500 25.05 889,311 21,422,790 1,507,013 14.22

11/17/05 9,150 25.06 229,337 21,652,126 1,516,163 14.28

11/18/05 1,500 25.07 37,600 21,689,726 1,517,663 14.29

11/22/05 11,000 25.09 275,986 21,965,712 1,528,663 14.37

11/23/05 1,424 25.10 35,742 22,001,454 1,530,087 14.38

11/29/05 12,565 25.09 315,285 22,316,739 1,542,652 14.47

11/29/05 2,749 25.07 68,928 22,385,667 1,545,401 14.49

06/13/06 45,630 22.50 1,026,561 23,412,228 1,591,031 14.72

06/23/06 4,500 23.60 106,200 23,518,428 1,595,531 14.74

06/23/06 15,540 23.10 358,920 23,877,348 1,611,071 14.82

06/27/06 500 23.95 11,975 23,889,323 1,611,571 14.82

06/28/06 17,000 23.94 407,023 24,296,345 1,628,571 14.92

07/05/06 25,000 22.70 567,375 24,863,720 1,653,571 15.04

08/09/06 8,261 25.00 206,525 25,070,245 1,661,832 15.09

08/10/06 1,140 25.00 28,500 25,098,745 1,662,972 15.09

08/11/06 5,074 25.00 126,842 25,225,587 1,668,046 15.12

11/02/06 44,445 27.35 1,215,446 26,441,033 1,712,491 15.44

11/03/06 35,555 27.29 970,147 27,411,180 1,748,046 $15.68

(1) Adjusted for a three-for-two stock split paid August 24, 2005.

PROJECT GIANT

4

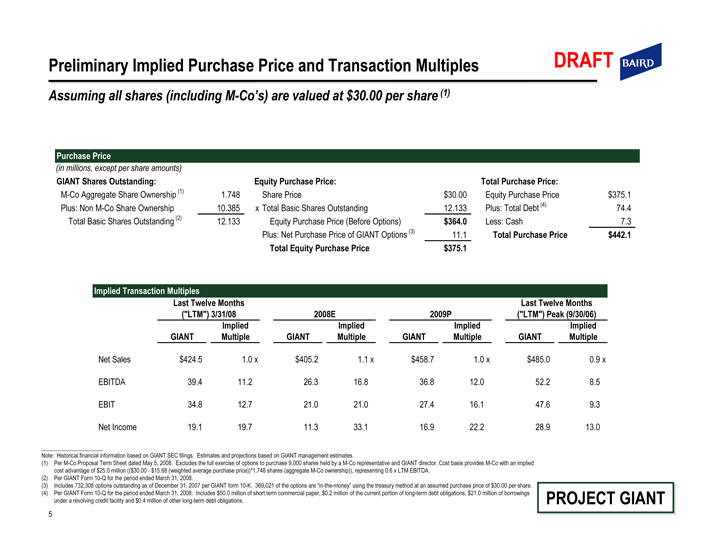

Preliminary Implied Purchase Price and Transaction Multiples DRAFT BAIRD

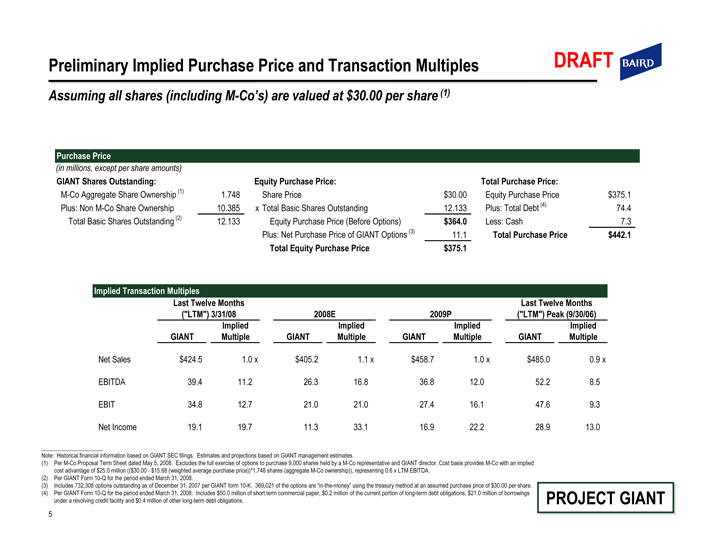

Assuming all shares (including M-Co’s) are valued at $30.00 per share (1)

Purchase Price

(in millions, except per share amounts)

GIANT Shares Outstanding:

M-Co Aggregate Share Ownership (1) 1.748

Plus: Non M-Co Share Ownership 10.385

Total Basic Shares Outstanding (2) 12.133

Equity Purchase Price:

Share Price $30.00

x Total Basic Shares Outstanding 12.133

Equity Purchase Price (Before Options) $364.0

Plus: Net Purchase Price of GIANT Options (3) 11.1

Total Equity Purchase Price $375.1

Total Purchase Price:

Equity Purchase Price $375.1

Plus: Total Debt (4) 74.4

Less: Cash 7.3

Total Purchase Price $442.1

Implied Transaction Multiples

Last Twelve Months (“LTM”) 3/31/08 2008E 2009P Last Twelve Months (“LTM”) Peak (9/30/06)

GIANT Implied Multiple GIANT Implied Multiple GIANT Implied Multiple GIANT Implied Multiple

Net Sales $424.5 1.0 x $405.2 1.1 x $458.7 1.0 x $485.0 0.9 x

EBITDA 39.4 11.2 26.3 16.8 36.8 12.0 52.2 8.5

EBIT 34.8 12.7 21.0 21.0 27.4 16.1 47.6 9.3

Net Income 19.1 19.7 11.3 33.1 16.9 22.2 28.9 13.0

Note: Historical financial information based on GIANT SEC filings. Estimates and projections based on GIANT management estimates.

(1) Per M-Co Proposal Term Sheet dated May 5, 2008. Excludes the full exercise of options to purchase 9,000 shares held by a M-Co representative and GIANT director. Cost basis provides M-Co with an implied cost advantage of $25.0 million (($30.00 - $15.68 (weighted average purchase price))*1.748 shares (aggregate M-Co ownership)), representing 0.6 x LTM EBITDA.

(2) Per GIANT Form 10-Q for the period ended March 31, 2008.

(3) Includes 732,308 options outstanding as of December 31, 2007 per GIANT form 10-K. 369,021 of the options are “in-the-money” using the treasury method at an assumed purchase price of $30.00 per share.

(4) Per GIANT Form 10-Q for the period ended March 31, 2008. Includes $50.0 million of short term commercial paper, $0.2 million of the current portion of long-term debt obligations, $21.0 million of borrowings under a revolving credit facility and $0.4 million of other long-term debt obligations.

PROJECT GIANT

5

DRAFT BAIRD

GIANT Financial Overview

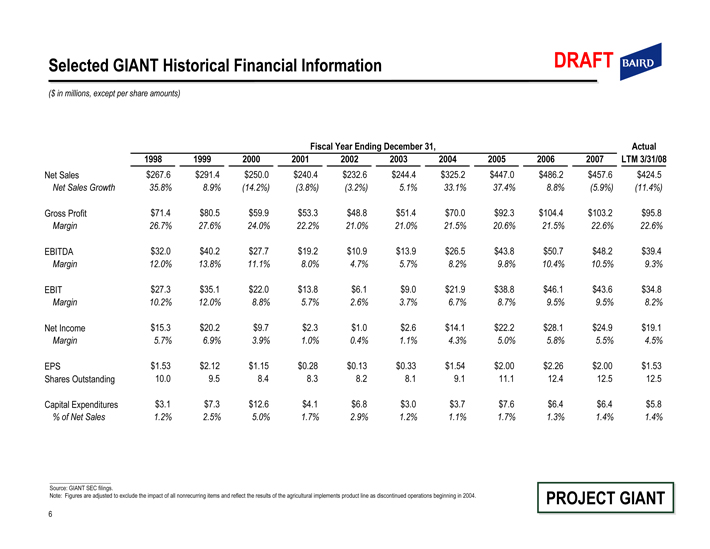

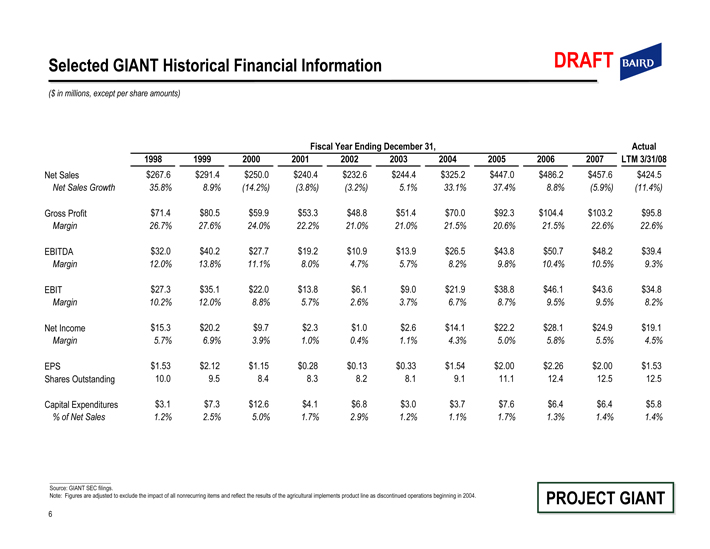

Selected GIANT Historical Financial Information

DRAFT BAIRD

($ in millions, except per share amounts)

Fiscal Year Ending December 31, Actual

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 LTM 3/31/08

Net Sales $267.6 $291.4 $250.0 $240.4 $232.6 $244.4 $325.2 $447.0 $486.2 $457.6 $424.5

Net Sales Growth 35.8% 8.9%(14.2%)(3.8%)(3.2%) 5.1% 33.1% 37.4% 8.8%(5.9%)(11.4%)

Gross Profit $71.4 $80.5 $59.9 $53.3 $48.8 $51.4 $70.0 $92.3 $104.4 $103.2 $95.8

Margin 26.7% 27.6% 24.0% 22.2% 21.0% 21.0% 21.5% 20.6% 21.5% 22.6% 22.6%

EBITDA $32.0 $40.2 $27.7 $19.2 $10.9 $13.9 $26.5 $43.8 $50.7 $48.2 $39.4

Margin 12.0% 13.8% 11.1% 8.0% 4.7% 5.7% 8.2% 9.8% 10.4% 10.5% 9.3%

EBIT $27.3 $35.1 $22.0 $13.8 $6.1 $9.0 $21.9 $38.8 $46.1 $43.6 $34.8

Margin 10.2% 12.0% 8.8% 5.7% 2.6% 3.7% 6.7% 8.7% 9.5% 9.5% 8.2%

Net Income $15.3 $20.2 $9.7 $2.3 $1.0 $2.6 $14.1 $22.2 $28.1 $24.9 $19.1

Margin 5.7% 6.9% 3.9% 1.0% 0.4% 1.1% 4.3% 5.0% 5.8% 5.5% 4.5%

EPS $1.53 $2.12 $1.15 $0.28 $0.13 $0.33 $1.54 $2.00 $2.26 $2.00 $1.53

Shares Outstanding 10.0 9.5 8.4 8.3 8.2 8.1 9.1 11.1 12.4 12.5 12.5

Capital Expenditures $3.1 $7.3 $12.6 $4.1 $6.8 $3.0 $3.7 $7.6 $6.4 $6.4 $5.8

% of Net Sales 1.2% 2.5% 5.0% 1.7% 2.9% 1.2% 1.1% 1.7% 1.3% 1.4% 1.4%

Source: GIANT SEC filings.

Note: Figures are adjusted to exclude the impact of all nonrecurring items and reflect the results of the agricultural implements product line as discontinued operations beginning in 2004.

PROJECT GIANT

6

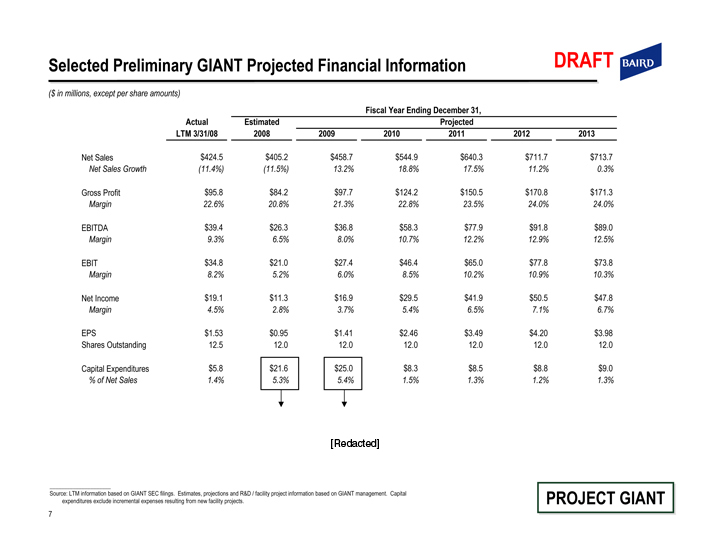

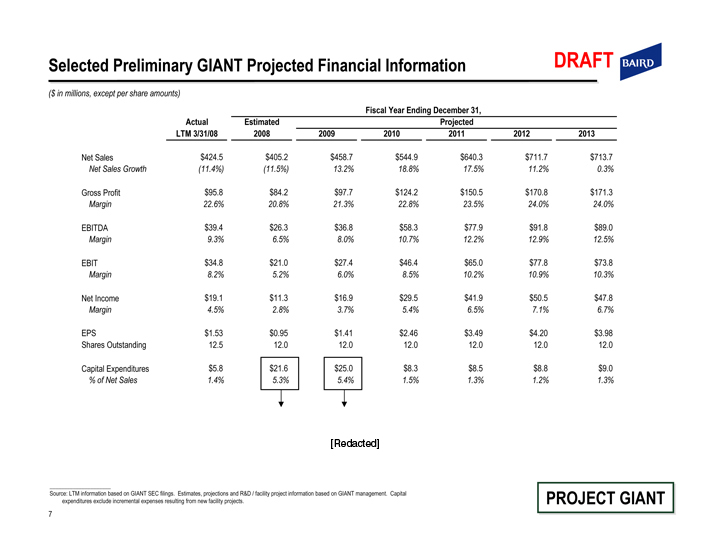

Selected Preliminary GIANT Projected Financial Information DRAFT BAIRD

($ in millions, except per share amounts)

Fiscal Year Ending December 31, Actual Estimated Projected

LTM 3/31/08 2008 2009 2010 2011 2012 2013

Net Sales $424.5 $405.2 $458.7 $544.9 $640.3 $711.7 $713.7

Net Sales Growth(11.4%)(11.5%) 13.2% 18.8% 17.5% 11.2% 0.3%

Gross Profit $95.8 $84.2 $97.7 $124.2 $150.5 $170.8 $171.3

Margin 22.6% 20.8% 21.3% 22.8% 23.5% 24.0% 24.0%

EBITDA $39.4 $26.3 $36.8 $58.3 $77.9 $91.8 $89.0

Margin 9.3% 6.5% 8.0% 10.7% 12.2% 12.9% 12.5%

EBIT $34.8 $21.0 $27.4 $46.4 $65.0 $77.8 $73.8

Margin 8.2% 5.2% 6.0% 8.5% 10.2% 10.9% 10.3%

Net Income $19.1 $11.3 $16.9 $29.5 $41.9 $50.5 $47.8

Margin 4.5% 2.8% 3.7% 5.4% 6.5% 7.1% 6.7%

EPS $1.53 $0.95 $1.41 $2.46 $3.49 $4.20 $3.98

Shares Outstanding 12.5 12.0 12.0 12.0 12.0 12.0 12.0

Capital Expenditures $5.8 $21.6 $25.0 $8.3 $8.5 $8.8 $9.0

% of Net Sales 1.4% 5.3% 5.4% 1.5% 1.3% 1.2% 1.3% [Redacted]

Source: LTM information based on GIANT SEC filings. Estimates, projections and R&D / facility project information based on GIANT management. Capital expenditures exclude incremental expenses resulting from new facility projects.

PROJECT GIANT

7

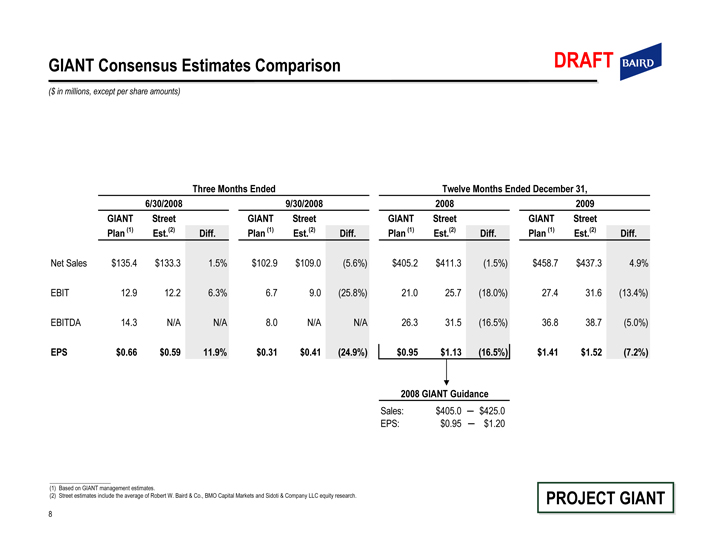

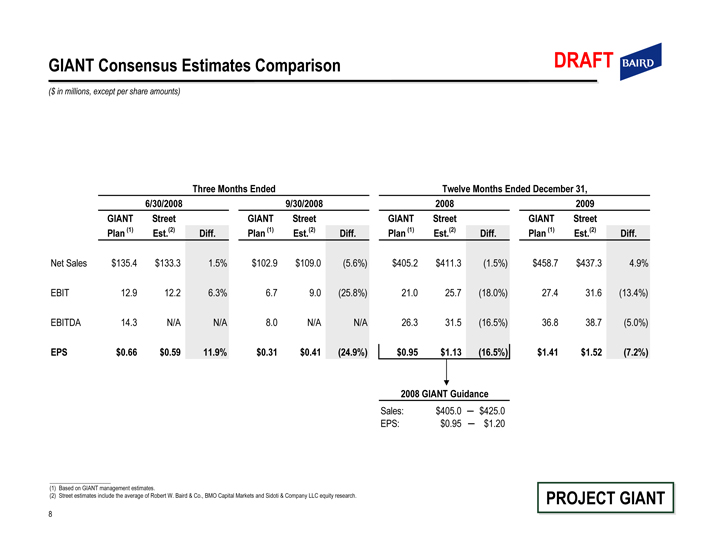

GIANT Consensus Estimates Comparison DRAFT BAIRD

($ in millions, except per share amounts)

Three Months Ended Twelve Months Ended December 31,

6/30/2008 9/30/2008 2008 2009

GIANT Plan(1) Street Est.(2) Diff. GIANT Plan(1) Street Est.(2) Diff. GIANT Plan(1) Street Est.(2) Diff. GIANT Plan(1) Street Est.(2) Diff.

Net Sales $135.4 $133.3 1.5% $102.9 $109.0 (5.6%) $405.2 $411.3 (1.5%) $458.7 $437.3 4.9%

EBIT 12.9 12.2 6.3% 6.7 9.0 (25.8%) 21.0 25.7 (18.0%) 27.4 31.6 (13.4%)

EBITDA 14.3 N/A N/A 8.0 N/A N/A 26.3 31.5 (16.5%) 36.8 38.7 (5.0%)

EPS $0.66 $0.59 11.9% $0.31 $0.41 (24.9%) $0.95 $1.13 (16.5%) $1.41 $1.52 (7.2%)

2008 GIANT Guidance

Sales: $405.0 - $425.0

EPS: $0.95 - $1.20

(1) Based on GIANT management estimates.

(2) Street estimates include the average of Robert W. Baird & Co., BMO Capital Markets and Sidoti & Company LLC equity research.

PROJECT GIANT

8

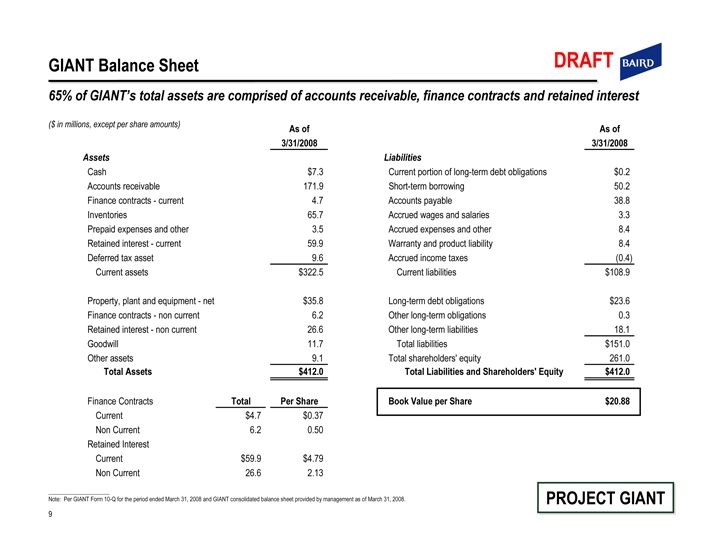

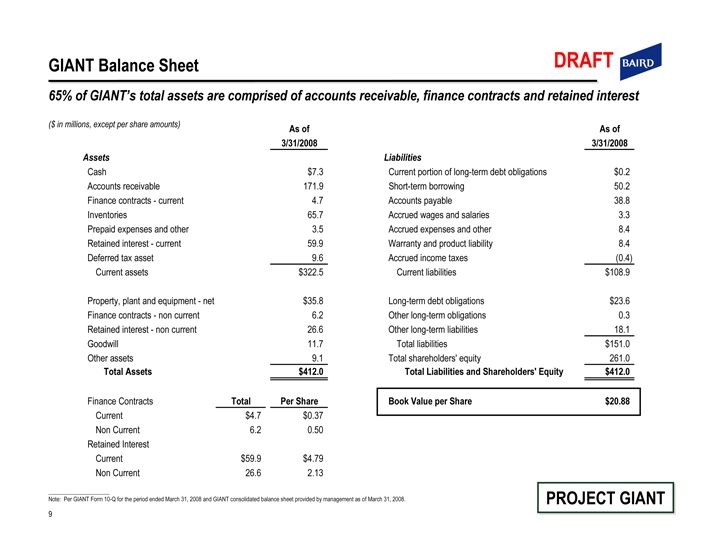

GIANT Balance Sheet DRAFT BAIRD

65% of GIANT’s total assets are comprised of accounts receivable, finance contracts and retained interest

($ in millions, except per share amounts)

As of 3/31/2008

Assets

Cash $7.3

Accounts receivable 171.9

Finance contracts - current 4.7

Inventories 65.7

Prepaid expenses and other 3.5

Retained interest - current 59.9

Deferred tax asset 9.6

Current assets $322.5

Property, plant and equipment - net $35.8

Finance contracts - non current 6.2

Retained interest - non current 26.6

Goodwill 11.7

Other assets 9.1

Total Assets $412.0

Finance Contracts Total Per Share

Current $4.7 $0.37

Non Current 6.2 0.50

Retained Interest

Current $59.9 $4.79

Non Current 26.6 2.13

As of 3/31/2008

Liabilities

Current portion of long-term debt obligations $0.2

Short-term borrowing 50.2

Accounts payable 38.8

Accrued wages and salaries 3.3

Accrued expenses and other 8.4

Warranty and product liability 8.4

Accrued income taxes (0.4)

Current liabilities $108.9

Long-term debt obligations $23.6

Other long-term obligations 0.3

Other long-term liabilities 18.1

Total liabilities $151.0

Total shareholders’ equity 261.0

Total Liabilities and Shareholders’ Equity $412.0

Book Value per Share $20.88

Note: Per GIANT Form 10-Q for the period ended March 31, 2008 and GIANT consolidated balance sheet provided by management as of March 31, 2008.

PROJECT GIANT

9

DRAFT BAIRD

Business Cycle Discussion

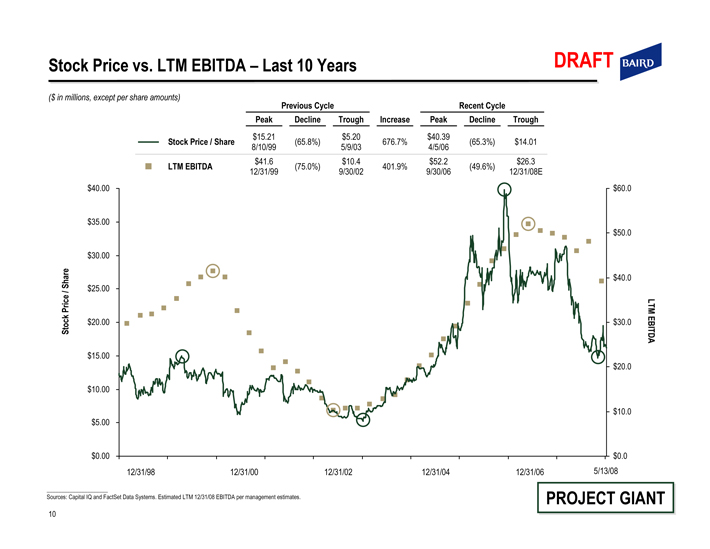

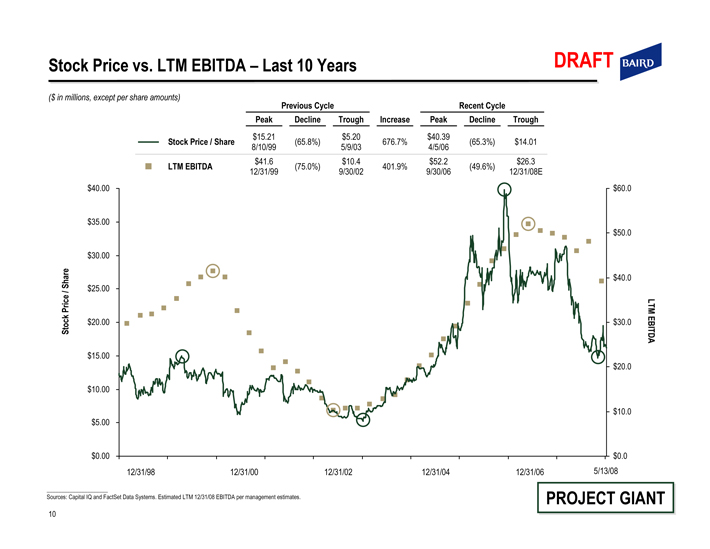

Stock Price vs. LTM EBITDA – Last 10 Years DRAFT BAIRD

($ in millions, except per share amounts)

Previous Cycle Recent Cycle

Peak Decline Trough Increase Peak Decline Trough

$15.21 $5.20 $40.39

Stock Price / Share (65.8%) 676.7%(65.3%) $14.01

8/10/99 5/9/03 4/5/06

$41.6 $10.4 $52.2 $26.3

LTM EBITDA (75.0%) 401.9%(49.6%)

12/31/99 9/30/02 9/30/06 12/31/08E

$40.00 $60.0

$35.00

$50.0

$30.00

Stock Price / Share $40.0

$25.00

LTM EBITDA

$20.00

$30.0

$15.00

$20.0

$10.00

$10.0

$5.00

$0.00 $0.0

12/31/98 12/31/00 12/31/02 12/31/04 12/31/06 5/13/08

Sources: Capital IQ and FactSet Data Systems. Estimated LTM 12/31/08 EBITDA per management estimates.

PROJECT GIANT

10

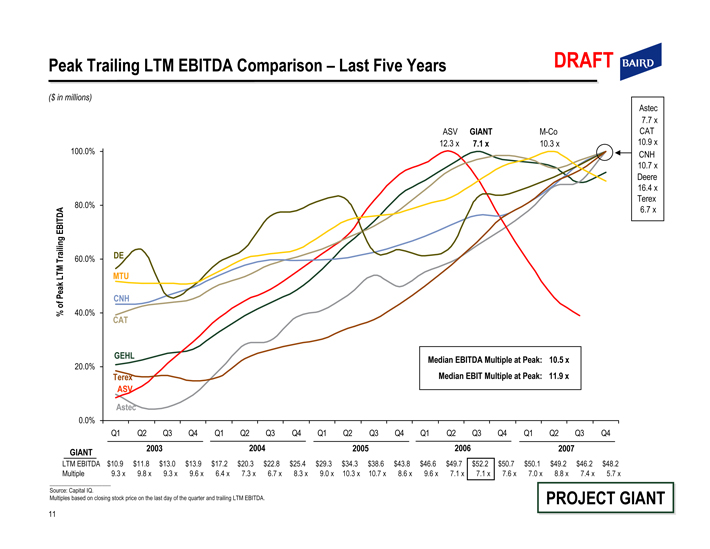

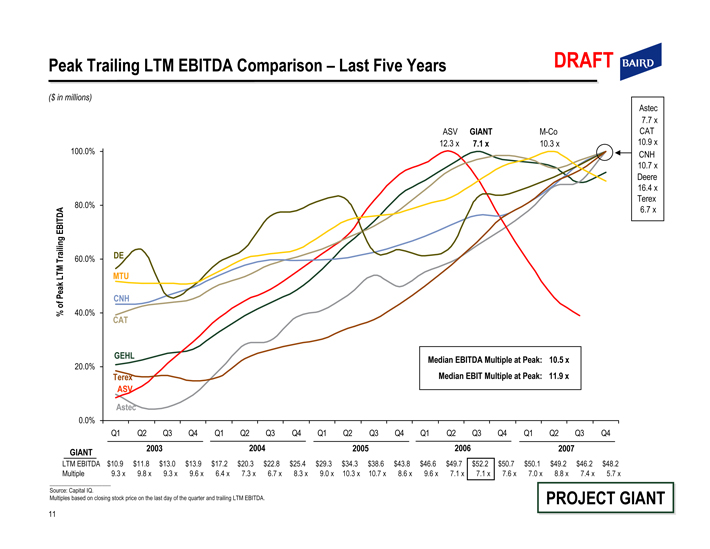

Peak Trailing LTM EBITDA Comparison – Last Five Years

DRAFT BAIRD

($ in millions)

% of Peak LTM Trailing EBITDA

100.0%

80.0%

60.0%

40.0%

20.0%

0.0%

DE

MTU

CNH

CAT

GEHL

Terex

ASV

Astec

ASV

12.3 x

GIANT

7.1 x

M-Co

10.3 x

Median EBITDA Multiple at Peak: 10.5 x

Median EBIT Multiple at Peak: 11.9 x

Astec

7.7 x

CAT

10.9 x

CNH

10.7 x

Deere

16.4 x

Terex

6.7 x

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2003 2004 2005 2006 2007

GIANT

LTM EBITDA $10.9 $11.8 $13.0 $13.9 $17.2 $20.3 $22.8 $25.4 $29.3 $34.3 $38.6 $43.8 $46.6 $49.7 $52.2 $50.7 $50.1 $49.2 $46.2 $48.2

Multiple 9.3 x 9.8 x 9.3 x 9.6 x 6.4 x 7.3 x 6.7 x 8.3 x 9.0 x 10.3 x 10.7 x 8.6 x 9.6 x 7.1 x 7.1 x 7.6 x 7.0 x 8.8 x 7.4 x 5.7 x

Source: Capital IQ.

Multiples based on closing stock price on the last day of the quarter and trailing LTM EBITDA.

PROJECT GIANT

11

DRAFT BAIRD

Preliminary Valuation Analysis

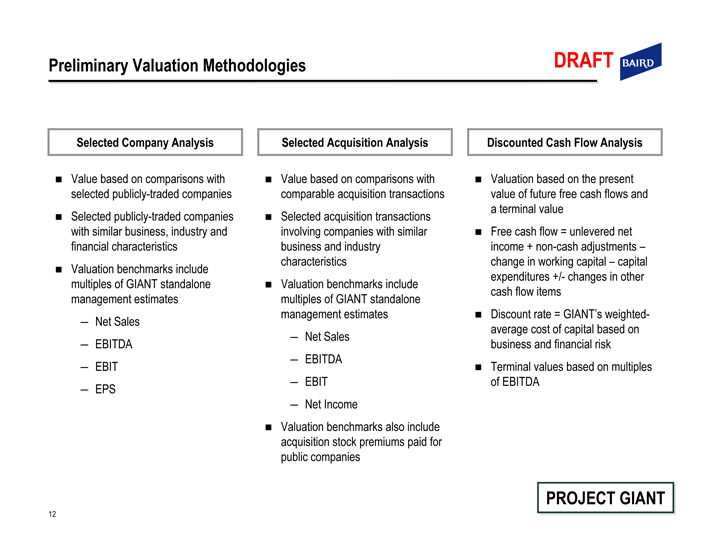

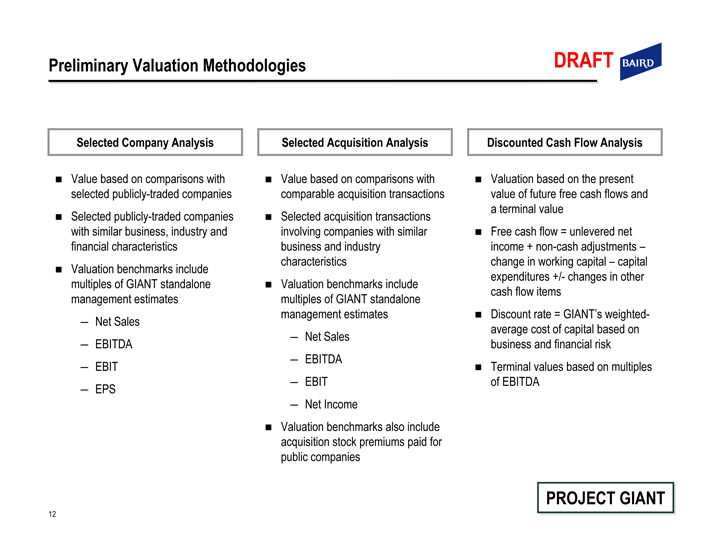

Preliminary Valuation Methodologies

DRAFT BAIRD

Selected Company Analysis

Value based on comparisons with selected publicly-traded companies

Selected publicly-traded companies with similar business, industry and financial characteristics

Valuation benchmarks include multiples of GIANT standalone management estimates

Net Sales

EBITDA

EBIT

EPS

Selected Acquisition Analysis

Value based on comparisons with comparable acquisition transactions

Selected acquisition transactions involving companies with similar business and industry characteristics

Valuation benchmarks include multiples of GIANT standalone management estimates

Net Sales

EBITDA

EBIT

Net Income

Valuation benchmarks also include acquisition stock premiums paid for public companies

Discounted Cash Flow Analysis

Valuation based on the present value of future free cash flows and a terminal value

Free cash flow = unlevered net income + non-cash adjustments – change in working capital – capital expenditures +/- changes in other cash flow items

Discount rate = GIANT’s weighted-average cost of capital based on business and financial risk

Terminal values based on multiples of EBITDA

PROJECT GIANT

12

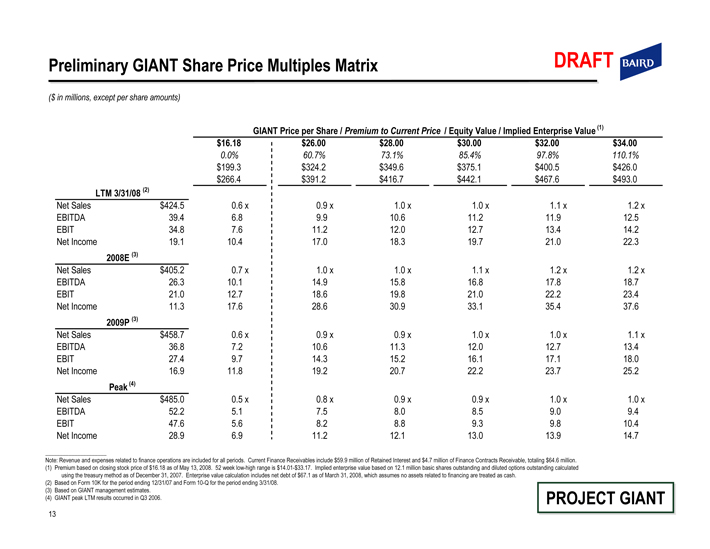

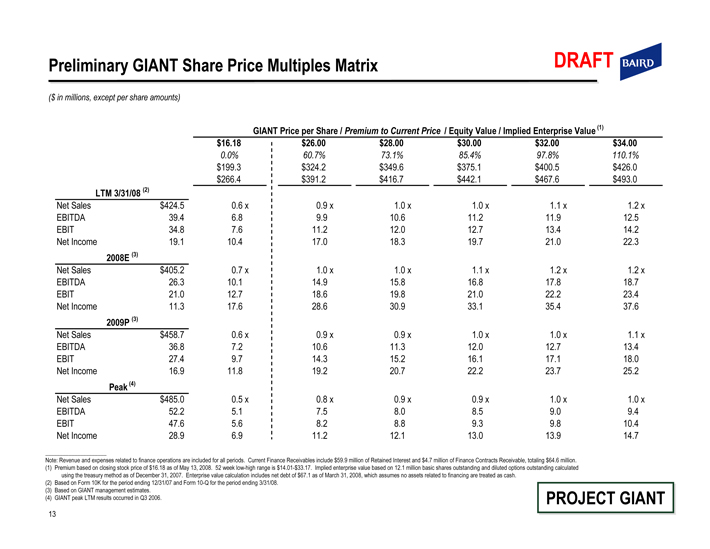

Preliminary GIANT Share Price Multiples Matrix DRAFT BAIRD

($ in millions, except per share amounts)

GIANT Price per Share / Premium to Current Price / Equity Value / Implied Enterprise Value (1)

$16.18 $26.00 $28.00 $30.00 $32.00 $34.00

0.0% 60.7% 73.1% 85.4% 97.8% 110.1%

$199.3 $324.2 $349.6 $375.1 $400.5 $426.0

$266.4 $391.2 $416.7 $442.1 $467.6 $493.0

LTM 3/31/08 (2)

Net Sales $424.5 0.6 x 0.9 x 1.0 x 1.0 x 1.1 x 1.2 x

EBITDA 39.4 6.8 9.9 10.6 11.2 11.9 12.5

EBIT 34.8 7.6 11.2 12.0 12.7 13.4 14.2

Net Income 19.1 10.4 17.0 18.3 19.7 21.0 22.3

2008E (3)

Net Sales $405.2 0.7 x 1.0 x 1.0 x 1.1 x 1.2 x 1.2 x

EBITDA 26.3 10.1 14.9 15.8 16.8 17.8 18.7

EBIT 21.0 12.7 18.6 19.8 21.0 22.2 23.4

Net Income 11.3 17.6 28.6 30.9 33.1 35.4 37.6

2009P (3)

Net Sales $458.7 0.6 x 0.9 x 0.9 x 1.0 x 1.0 x 1.1 x

EBITDA 36.8 7.2 10.6 11.3 12.0 12.7 13.4

EBIT 27.4 9.7 14.3 15.2 16.1 17.1 18.0

Net Income 16.9 11.8 19.2 20.7 22.2 23.7 25.2

Peak (4)

Net Sales $485.0 0.5 x 0.8 x 0.9 x 0.9 x 1.0 x 1.0 x

EBITDA 52.2 5.1 7.5 8.0 8.5 9.0 9.4

EBIT 47.6 5.6 8.2 8.8 9.3 9.8 10.4

Net Income 28.9 6.9 11.2 12.1 13.0 13.9 14.7

Note: Revenue and expenses related to finance operations are included for all periods. Current Finance Receivables include $59.9 million of Retained Interest and $4.7 million of Finance Contracts Receivable, totaling $64.6 million.

(1) Premium based on closing stock price of $16.18 as of May 13, 2008. 52 week low-high range is $14.01-$33.17. Implied enterprise value based on 12.1 million basic shares outstanding and diluted options outstanding calculated using the treasury method as of December 31, 2007. Enterprise value calculation includes net debt of $67.1 as of March 31, 2008, which assumes no assets related to financing are treated as cash.

(2) Based on Form 10K for the period ending 12/31/07 and Form 10-Q for the period ending 3/31/08.

(3) Based on GIANT management estimates.

(4) GIANT peak LTM results occurred in Q3 2006.

PROJECT GIANT

13

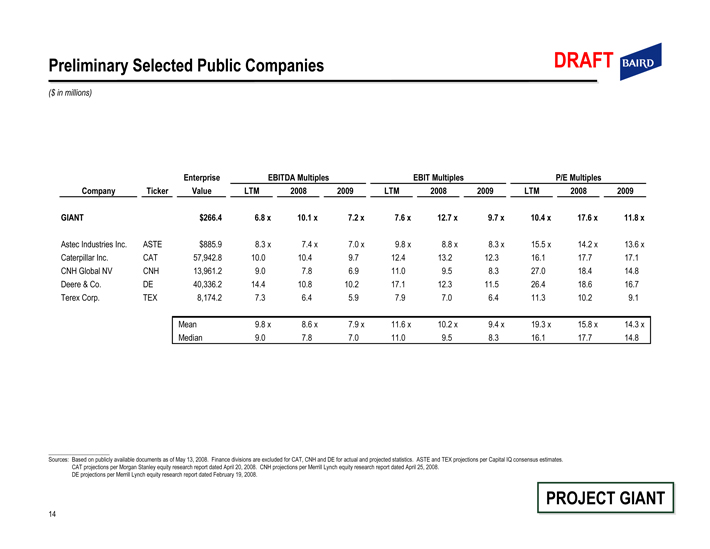

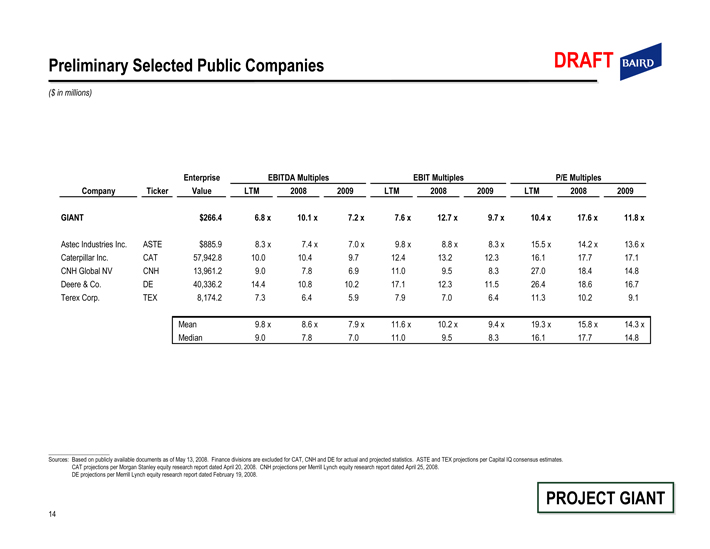

Preliminary Selected Public Companies DRAFT BAIRD

($ in millions)

EBITDA Multiples EBIT Multiples P/E Multiples

Company Ticker Enterprise Value LTM 2008 2009 LTM 2008 2009 LTM 2008 2009

GIANT $266.4 6.8 x 10.1 x 7.2 x 7.6 x 12.7 x 9.7 x 10.4 x 17.6 x 11.8 x

Astec Industries Inc. ASTE $885.9 8.3 x 7.4 x 7.0 x 9.8 x 8.8 x 8.3 x 15.5 x 14.2 x 13.6 x

Caterpillar Inc. CAT 57,942.8 10.0 10.4 9.7 12.4 13.2 12.3 16.1 17.7 17.1

CNH Global NV CNH 13,961.2 9.0 7.8 6.9 11.0 9.5 8.3 27.0 18.4 14.8

Deere & Co. DE 40,336.2 14.4 10.8 10.2 17.1 12.3 11.5 26.4 18.6 16.7

Terex Corp. TEX 8,174.2 7.3 6.4 5.9 7.9 7.0 6.4 11.3 10.2 9.1

Mean 9.8 x 8.6 x 7.9 x 11.6 x 10.2 x 9.4 x 19.3 x 15.8 x 14.3 x

Median 9.0 7.8 7.0 11.0 9.5 8.3 16.1 17.7 14.8

Sources: Based on publicly available documents as of May 13, 2008. Finance divisions are excluded for CAT, CNH and DE for actual and projected statistics. ASTE and TEX projections per Capital IQ consensus estimates.

CAT projections per Morgan Stanley equity research report dated April 20, 2008. CNH projections per Merrill Lynch equity research report dated April 25, 2008.

DE projections per Merrill Lynch equity research report dated February 19, 2008.

PROJECT GIANT

14

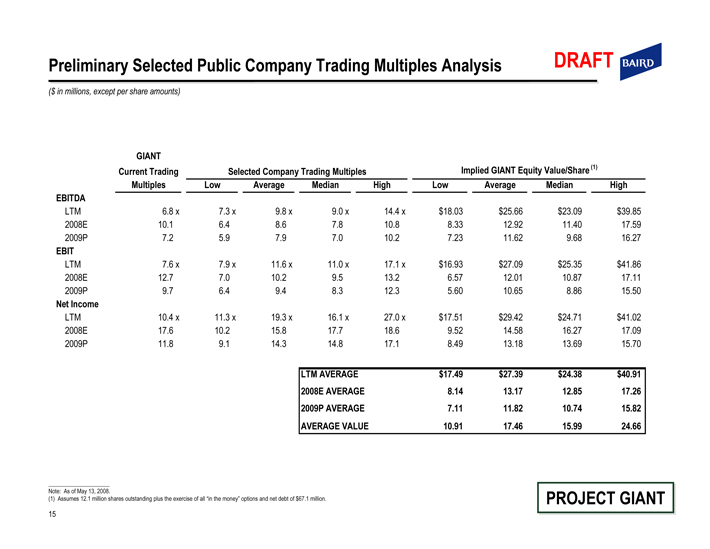

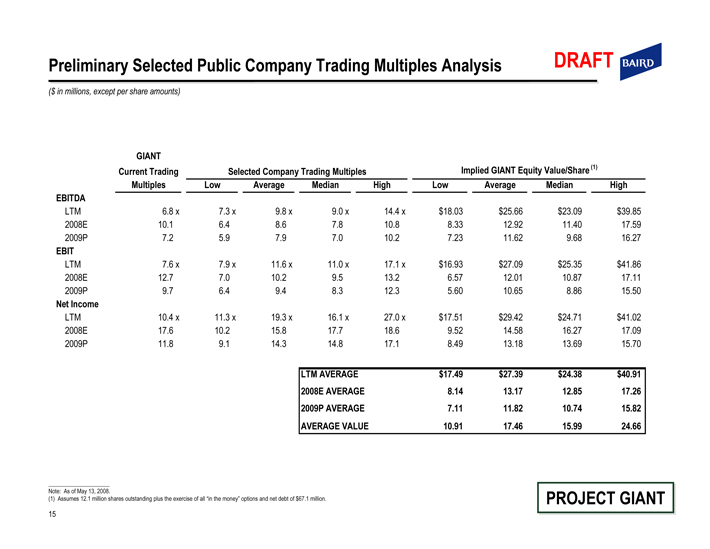

Preliminary Selected Public Company Trading Multiples Analysis DRAFT BAIRD

($ in millions, except per share amounts)

GIANT Current Trading Multiples Selected Company Trading Multiples Implied GIANT Equity Value/Share (1)

Low Average Median High Low Average Median High

EBITDA

LTM 6.8 x 7.3 x 9.8 x 9.0 x 14.4 x $18.03 $25.66 $23.09 $39.85

2008E 10.1 6.4 8.6 7.8 10.8 8.33 12.92 11.40 17.59

2009P 7.2 5.9 7.9 7.0 10.2 7.23 11.62 9.68 16.27

EBIT

LTM 7.6 x 7.9 x 11.6 x 11.0 x 17.1 x $16.93 $27.09 $25.35 $41.86

2008E 12.7 7.0 10.2 9.5 13.2 6.57 12.01 10.87 17.11

2009P 9.7 6.4 9.4 8.3 12.3 5.60 10.65 8.86 15.50

Net Income

LTM 10.4 x 11.3 x 19.3 x 16.1 x 27.0 x $17.51 $29.42 $24.71 $41.02

2008E 17.6 10.2 15.8 17.7 18.6 9.52 14.58 16.27 17.09

2009P 11.8 9.1 14.3 14.8 17.1 8.49 13.18 13.69 15.70

LTM AVERAGE $17.49 $27.39 $24.38 $40.91

2008E AVERAGE 8.14 13.17 12.85 17.26

2009P AVERAGE 7.11 11.82 10.74 15.82

AVERAGE VALUE 10.91 17.46 15.99 24.66

Note: As of May 13, 2008.

(1) Assumes 12.1 million shares outstanding plus the exercise of all “in the money” options and net debt of $67.1 million.

PROJECT GIANT

15

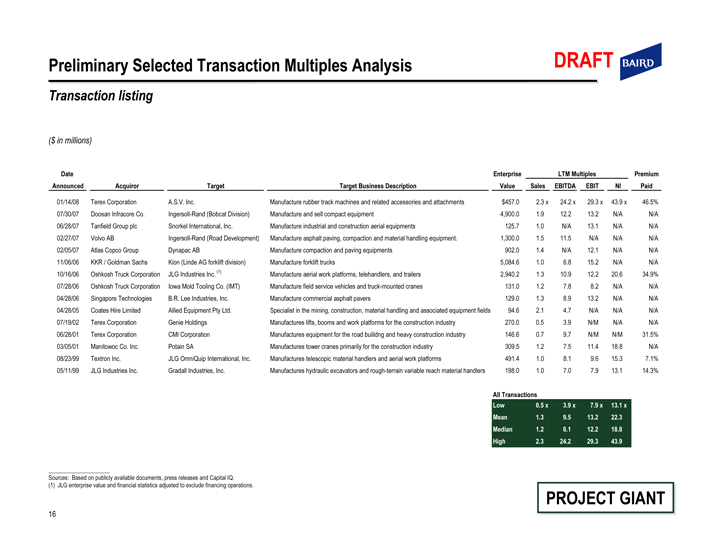

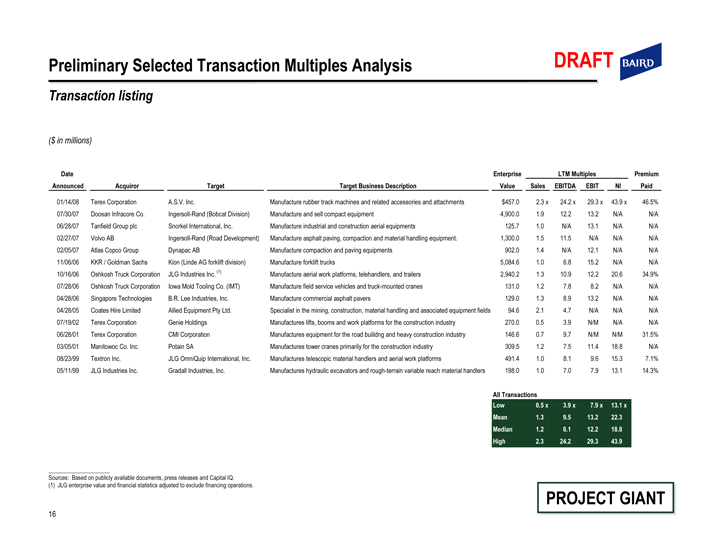

Preliminary Selected Transaction Multiples Analysis DRAFT BAIRD

Transaction listing

($ in millions)

Date Announced Acquiror Target Target Business Description Enterprise Value LTM Multiples Premium Sales EBITDA EBIT NI Paid

01/14/08 Terex Corporation A.S.V. Inc. Manufacture rubber track machines and related accessories and attachments $457.0 2.3 x 24.2 x 29.3 x 43.9 x 46.5%

07/30/07 Doosan Infracore Co. Ingersoll-Rand (Bobcat Division) Manufacture and sell compact equipment 4,900.0 1.9 12.2 13.2 N/A N/A

06/28/07 Tanfield Group plc Snorkel International, Inc. Manufacture industrial and construction aerial equipments 125.7 1.0 N/A 13.1 N/A N/A

02/27/07 Volvo AB Ingersoll-Rand (Road Development) Manufacture asphalt paving, compaction and material handling equipment. 1,300.0 1.5 11.5 N/A N/A N/A

02/05/07 Atlas Copco Group Dynapac AB Manufacture compaction and paving equipments 902.0 1.4 N/A 12.1 N/A N/A

11/06/06 KKR / Goldman Sachs Kion (Linde AG forklift division) Manufacture forklift trucks 5,084.6 1.0 6.8 15.2 N/A N/A

10/16/06 Oshkosh Truck Corporation JLG Industries Inc. (1) Manufacture aerial work platforms, telehandlers, and trailers 2,940.2 1.3 10.9 12.2 20.6 34.9%

07/28/06 Oshkosh Truck Corporation Iowa Mold Tooling Co. (IMT) Manufacture field service vehicles and truck-mounted cranes 131.0 1.2 7.8 8.2 N/A N/A

04/28/06 Singapore Technologies B.R. Lee Industries, Inc. Manufacture commercial asphalt pavers 129.0 1.3 8.9 13.2 N/A N/A

04/28/05 Coates Hire Limited Allied Equipment Pty Ltd. Specialist in the mining, construction, material handling and associated equipment fields 94.6 2.1 4.7 N/A N/A N/A

07/19/02 Terex Corporation Genie Holdings Manufactures lifts, booms and work platforms for the construction industry 270.0 0.5 3.9 N/M N/A N/A

06/28/01 Terex Corporation CMI Corporation Manufactures equipment for the road building and heavy construction industry 146.6 0.7 9.7 N/M N/M 31.5%

03/05/01 Manitowoc Co. Inc. Potain SA Manufactures tower cranes primarily for the construction industry 309.5 1.2 7.5 11.4 18.8 N/A

08/23/99 Textron Inc. JLG OmniQuip International, Inc. Manufactures telescopic material handlers and aerial work platforms 491.4 1.0 8.1 9.6 15.3 7.1%

05/11/99 JLG Industries Inc. Gradall Industries, Inc. Manufactures hydraulic excavators and rough-terrain variable reach material handlers 198.0 1.0 7.0 7.9 13.1 14.3%

All Transactions

Low 0.5 x 3.9 x 7.9 x 13.1 x

Mean 1.3 9.5 13.2 22.3

Median 1.2 8.1 12.2 18.8

High 2.3 24.2 29.3 43.9

Sources: Based on publicly available documents, press releases and Capital IQ.

(1) JLG enterprise value and financial statistics adjusted to exclude financing operations.

PROJECT GIANT

16

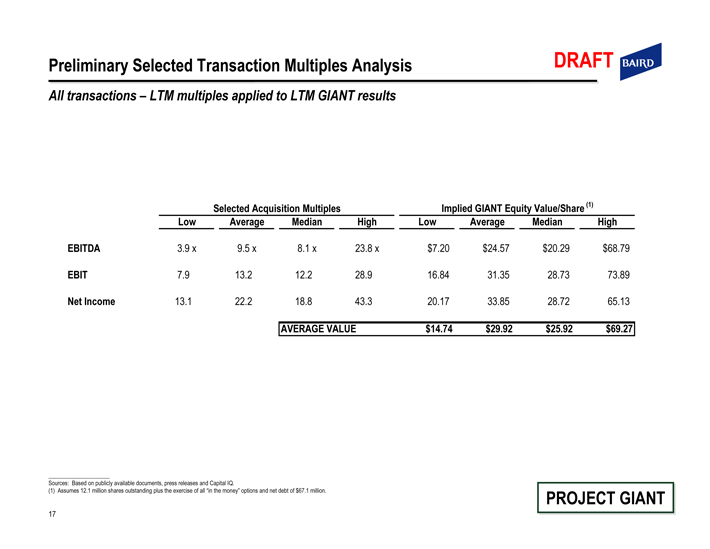

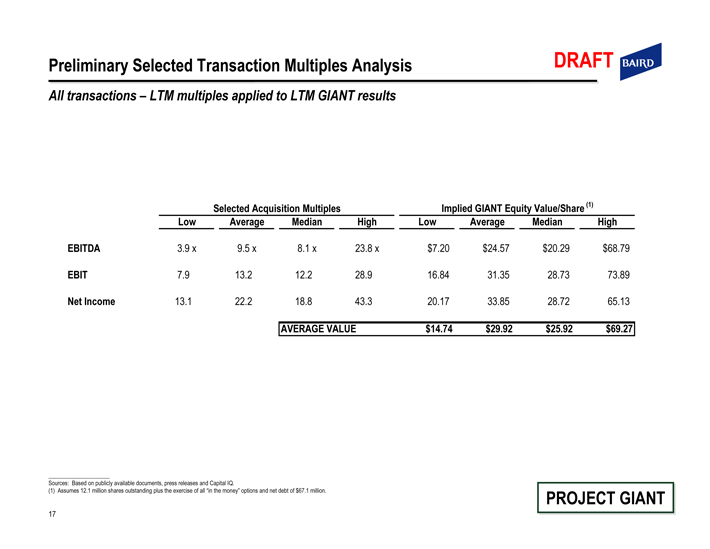

Preliminary Selected Transaction Multiples Analysis DRAFT BAIRD

All transactions – LTM multiples applied to LTM GIANT results

Selected Acquisition Multiples Implied GIANT Equity Value/Share (1)

Low Average Median High Low Average Median High

EBITDA 3.9 x 9.5 x 8.1 x 23.8 x $7.20 $24.57 $20.29 $68.79

EBIT 7.9 13.2 12.2 28.9 16.84 31.35 28.73 73.89

Net Income 13.1 22.2 18.8 43.3 20.17 33.85 28.72 65.13

AVERAGE VALUE $14.74 $29.92 $25.92 $69.27

Sources: Based on publicly available documents, press releases and Capital IQ.

(1) Assumes 12.1 million shares outstanding plus the exercise of all “in the money” options and net debt of $67.1 million. PROJECT GIANT

17

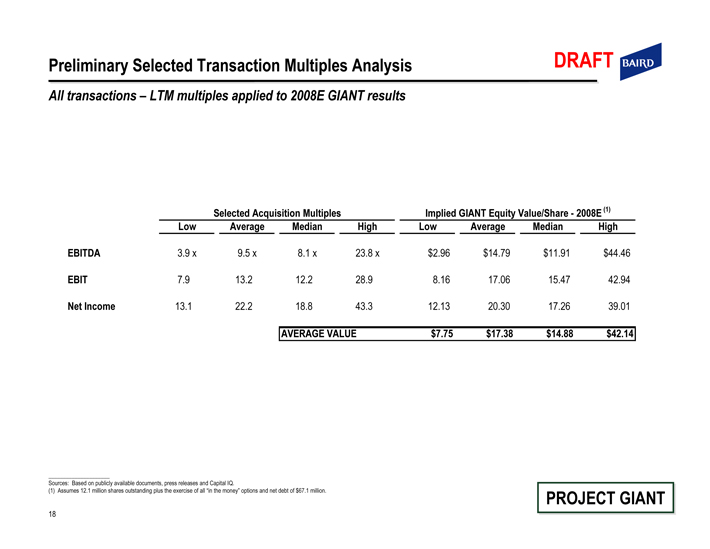

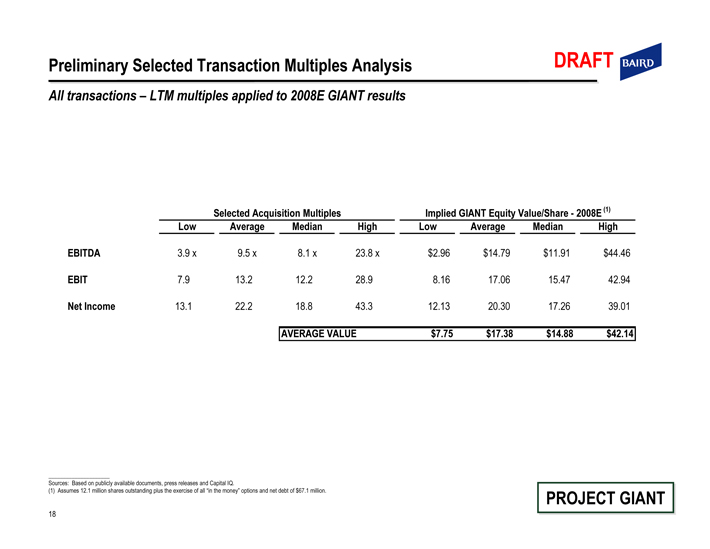

Preliminary Selected Transaction Multiples Analysis DRAFT BAIRD

All transactions – LTM multiples applied to 2008E GIANT results

Selected Acquisition Multiples Implied GIANT Equity Value/Share - 2008E (1)

Low Average Median High Low Average Median High

EBITDA 3.9 x 9.5 x 8.1 x 23.8 x $2.96 $14.79 $11.91 $44.46

EBIT 7.9 13.2 12.2 28.9 8.16 17.06 15.47 42.94

Net Income 13.1 22.2 18.8 43.3 12.13 20.30 17.26 39.01

AVERAGE VALUE $7.75 $17.38 $14.88 $42.14

Sources: Based on publicly available documents, press releases and Capital IQ.

(1) Assumes 12.1 million shares outstanding plus the exercise of all “in the money” options and net debt of $67.1 million. PROJECT GIANT

18

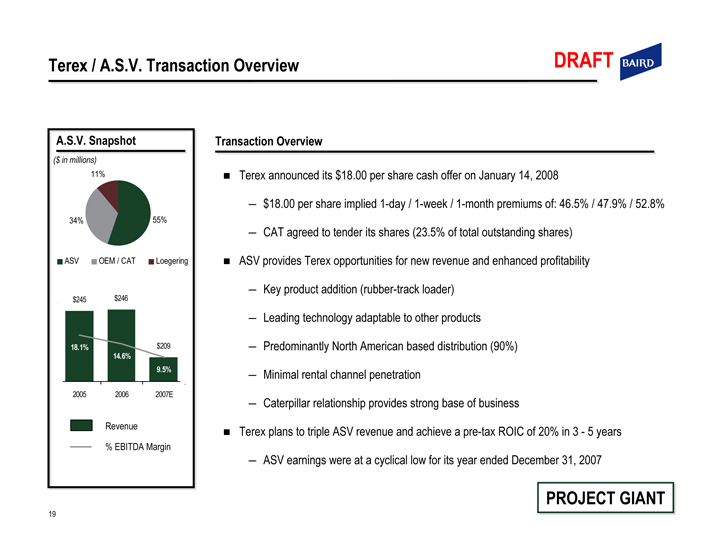

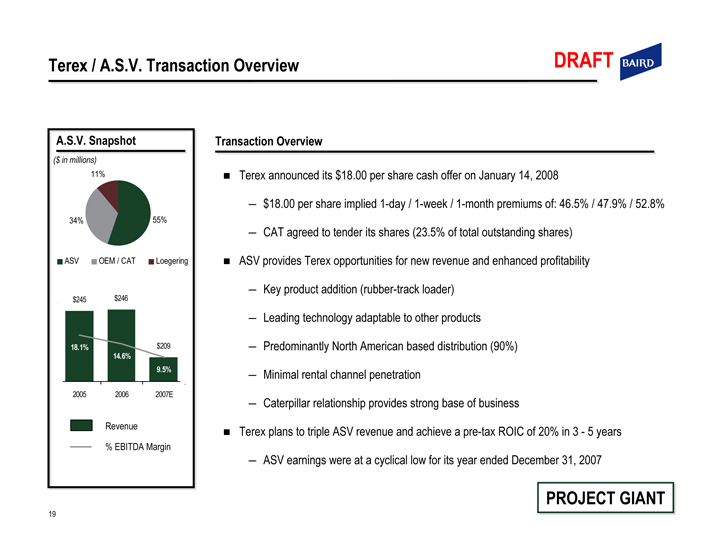

Terex / A.S.V. Transaction Overview DRAFT BAIRD

A.S.V. Snapshot

($ in millions)

11%

34% 55%

• ASV • OEM / CAT • Loegering

$245 $246

18.1% $209

14.6%

9.5%

2005 2006 2007E

Revenue

% EBITDA Margin

Transaction Overview

• Terex announced its $18.00 per share cash offer on January 14, 2008

– $18.00 per share implied 1-day / 1-week / 1-month premiums of: 46.5% / 47.9% / 52.8%

– CAT agreed to tender its shares (23.5% of total outstanding shares)

• ASV provides Terex opportunities for new revenue and enhanced profitability

– Key product addition (rubber-track loader)

– Leading technology adaptable to other products

– Predominantly North American based distribution (90%)

– Minimal rental channel penetration

– Caterpillar relationship provides strong base of business

• Terex plans to triple ASV revenue and achieve a pre-tax ROIC of 20% in 3 - 5 years

– ASV earnings were at a cyclical low for its year ended December 31, 2007

PROJECT GIANT

19

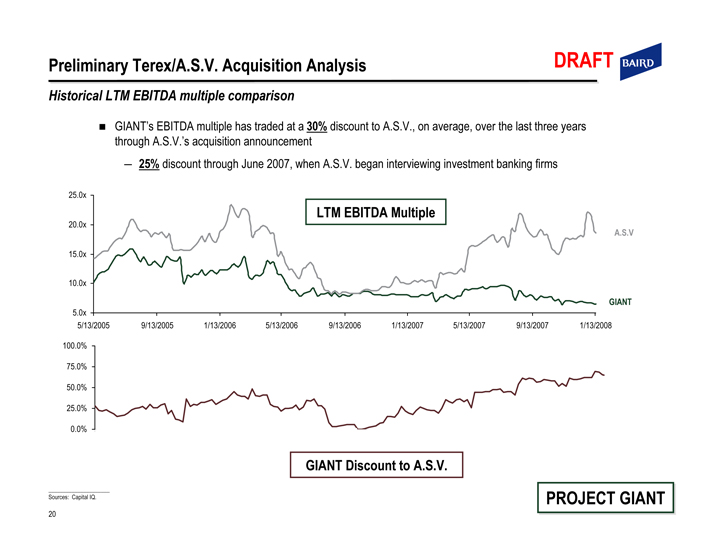

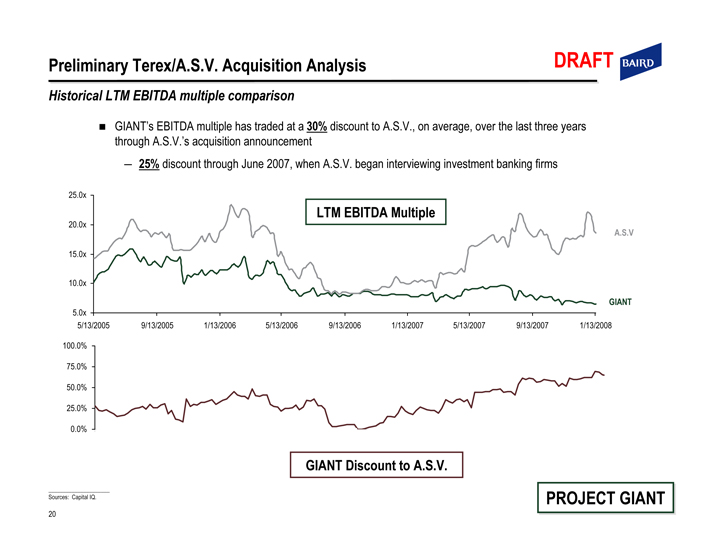

Preliminary Terex/A.S.V. Acquisition Analysis DRAFT BAIRD

Historical LTM EBITDA multiple comparison

• GIANT’s EBITDA multiple has traded at a 30% discount to A.S.V., on average, over the last three years through A.S.V.’s acquisition announcement

– 25% discount through June 2007, when A.S.V. began interviewing investment banking firms

25.0x

20.0x

15.0x

10.0x

5.0x

LTM EBITDA Multiple

A.S.V

GIANT

5/13/2005 9/13/2005 1/13/2006 5/13/2006 9/13/2006 1/13/2007 5/13/2007 9/13/2007 1/13/2008

100.0% 75.0% 50.0% 25.0% 0.0%

GIANT Discount to A.S.V.

Sources: Capital IQ. PROJECT GIANT

20

Preliminary Terex/A.S.V. Acquisition Analysis DRAFT BAIRD

Multiples analysis

($ in millions, except per share amounts)

LTM and 2008E Multiples

A.S.V. GIANT Statistics Implied Equity Value / Share (1)

LTM Multiples LTM 3/31/08 2008E LTM 3/31/08 2008E

EBITDA 24.2 x $39.4 $26.3 $69.82 $45.14

EBIT 29.3 34.8 21.0 74.89 43.54

Net Income 43.9 19.1 11.3 65.94 39.49

A.S.V. GIANT Statistics Implied Equity Value / Share (1)

2008E Multiples (2) LTM 3/31/08 2008E LTM 3/31/08 2008E

EBITDA 14.9 x $39.4 $26.3 $41.47 $26.14

EBIT 16.7 34.8 21.0 41.01 22.95

Net Income 26.9 19.1 11.3 40.73 24.43

(1) Assumes 12.1 million shares outstanding plus the exercise of all “in the money” options and net debt of $67.1 million.

(2) Based on A.S.V. estimated 2008 figures as of November 11, 2007 (Net Sales of $259.3 million, EBITDA of $30.6 million, EBIT of $27.3 million and Net Income of $18.4 million). Based on confidential numbers provided by A.S.V. management, subject to confidentiality agreement . Subsequent disclosures in A.S.V. SEC filings dated January 28, 2008 were consistent

(Net Sales of $243.8 million and EBIT of $26.7 million).

PROJECT GIANT

21

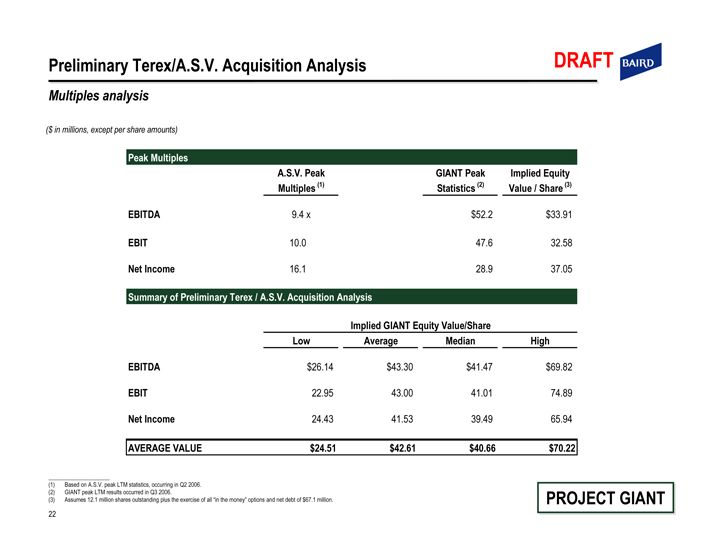

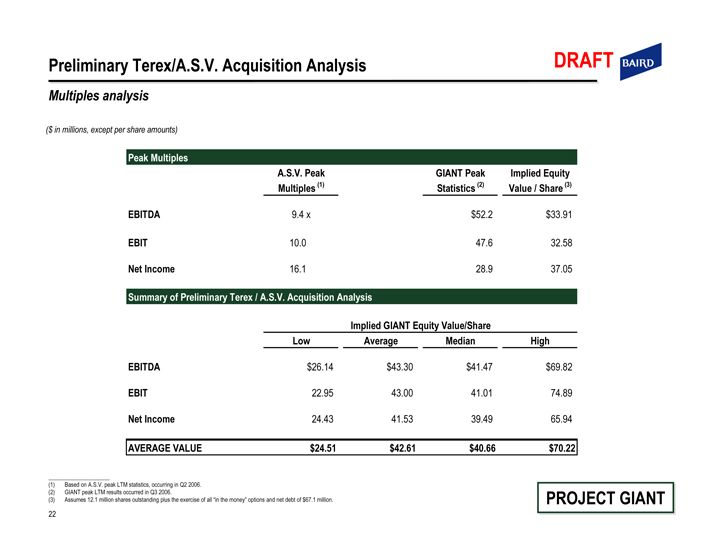

Preliminary Terex/A.S.V. Acquisition Analysis DRAFT BAIRD

Multiples analysis

($ in millions, except per share amounts)

Peak Multiples

A.S.V. Peak GIANT Peak Implied Equity

Multiples (1) Statistics (2) Value / Share (3)

EBITDA 9.4 x $52.2 $33.91

EBIT 10.0 47.6 32.58

Net Income 16.1 28.9 37.05

Summary of Preliminary Terex / A.S.V. Acquisition Analysis

Implied GIANT Equity Value/Share

Low Average Median High

EBITDA $26.14 $43.30 $41.47 $69.82

EBIT 22.95 43.00 41.01 74.89

Net Income 24.43 41.53 39.49 65.94

AVERAGE VALUE $24.51 $42.61 $40.66 $70.22

(1) Based on A.S.V. peak LTM statistics, occurring in Q2 2006.

(2) GIANT peak LTM results occurred in Q3 2006.

(3) Assumes 12.1 million shares outstanding plus the exercise of all “in the money” options and net debt of $67.1 million. PROJECT GIANT

22

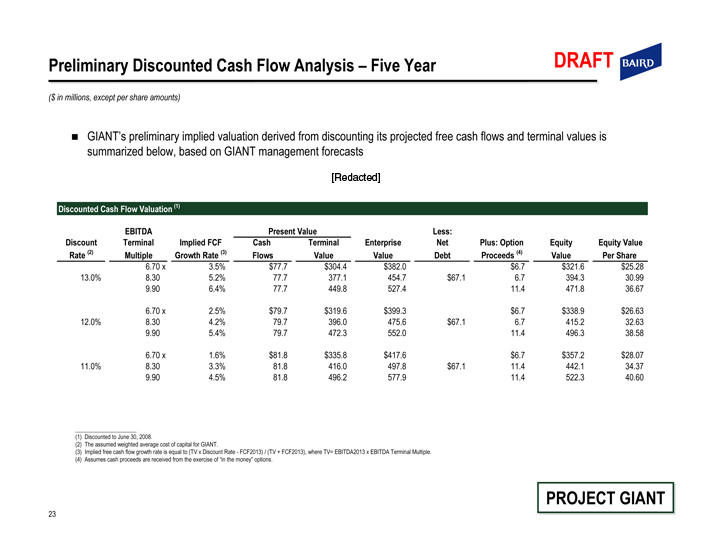

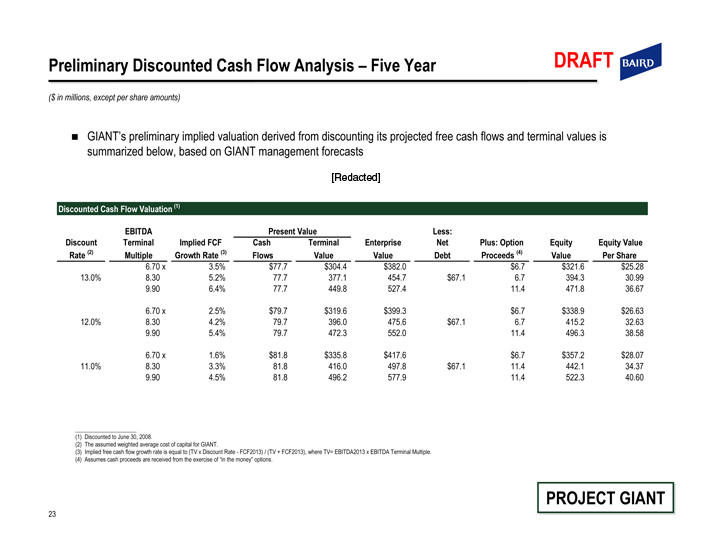

Preliminary Discounted Cash Flow Analysis – Five Year DRAFT BAIRD

($ in millions, except per share amounts)

• GIANT’s preliminary implied valuation derived from discounting its projected free cash flows and terminal values is

summarized below, based on GIANT management forecasts [Redacted]

Discounted Cash Flow Valuation (1) EBITDA Present Value Less:

Discount Terminal Implied FCF Cash Terminal Enterprise Net Plus: Option Equity Equity Value

Rate (2) Multiple Growth Rate (3) Flows Value Value Debt Proceeds (4) Value Per Share

6.70 x 3.5% $77.7 $304.4 $382.0 $6.7 $321.6 $25.28

13.0% 8.30 5.2% 77.7 377.1 454.7 $67.1 6.7 394.3 30.99

9.90 6.4% 77.7 449.8 527.4 11.4 471.8 36.67

6.70 x 2.5% $79.7 $319.6 $399.3 $6.7 $338.9 $26.63

12.0% 8.30 4.2% 79.7 396.0 475.6 $67.1 6.7 415.2 32.63

9.90 5.4% 79.7 472.3 552.0 11.4 496.3 38.58

6.70 x 1.6% $81.8 $335.8 $417.6 $6.7 $357.2 $28.07

11.0% 8.30 3.3% 81.8 416.0 497.8 $67.1 11.4 442.1 34.37

9.90 4.5% 81.8 496.2 577.9 11.4 522.3 40.60

(1) Discounted to June 30, 2008.

(2) The assumed weighted average cost of capital for GIANT.

(3) Implied free cash flow growth rate is equal to (TV x Discount Rate - FCF2013) / (TV + FCF2013), where TV= EBITDA2013 x EBITDA Terminal Multiple.

(4) Assumes cash proceeds are received from the exercise of “in the money” options.

PROJECT GIANT

23

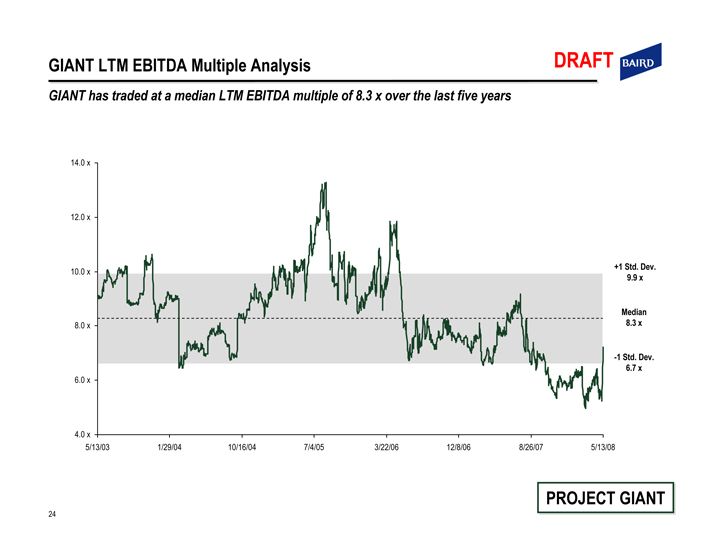

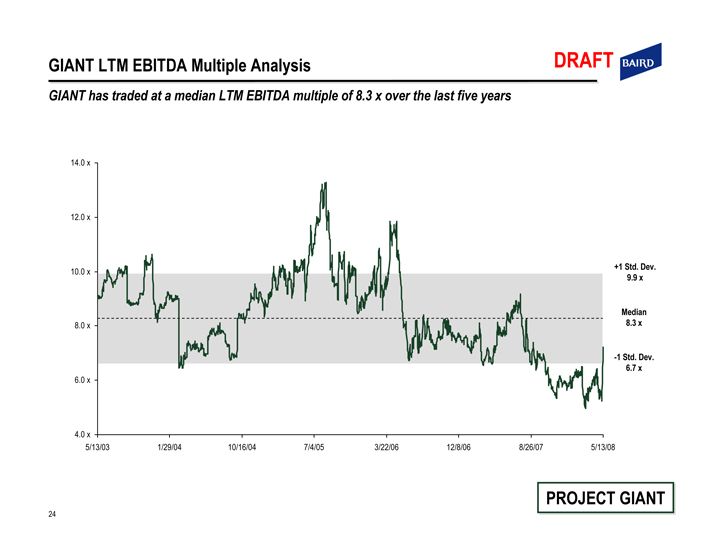

GIANT LTM EBITDA Multiple Analysis DRAFT BAIRD

GIANT has traded at a median LTM EBITDA multiple of 8.3 x over the last five years

14.0 x

12.0 x

10.0 x

8.0 x

6.0 x

4.0 x

+1 Std. Dev. 9.9 x

Median 8.3 x

-1 Std. Dev. 6.7 x

5/13/03 1/29/04 10/16/04 7/4/05 3/22/06 12/8/06 8/26/07 5/13/08

PROJECT GIANT

24

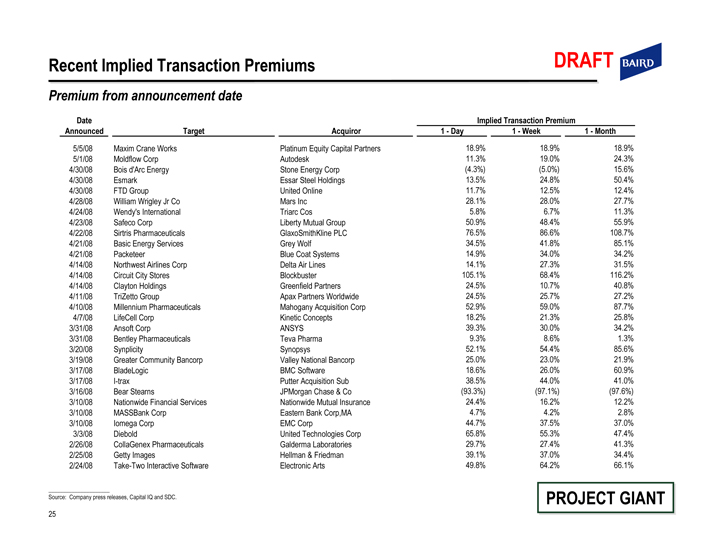

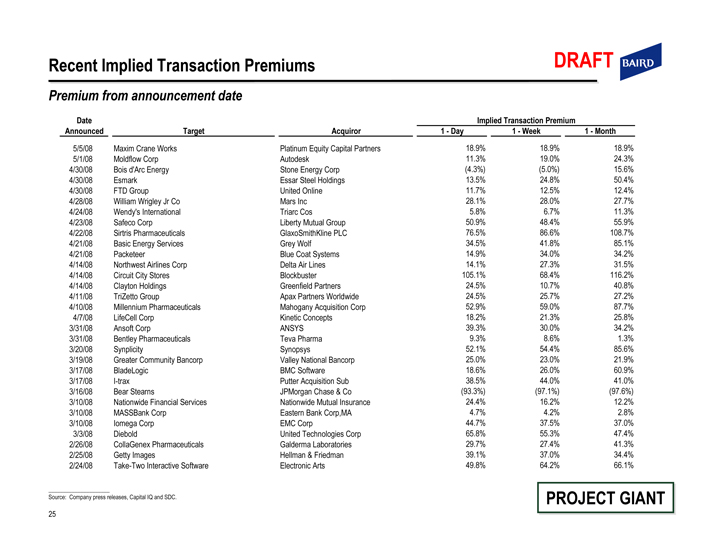

Recent Implied Transaction Premiums DRAFT BAIRD

Premium from announcement date

Date Implied Transaction Premium

Announced Target Acquiror 1 - Day 1 - Week 1 - Month

5/5/08 Maxim Crane Works Platinum Equity Capital Partners 18.9% 18.9% 18.9%

5/1/08 Moldflow Corp Autodesk 11.3% 19.0% 24.3%

4/30/08 Bois d’Arc Energy Stone Energy Corp (4.3%) (5.0%) 15.6%

4/30/08 Esmark Essar Steel Holdings 13.5% 24.8% 50.4%

4/30/08 FTD Group United Online 11.7% 12.5% 12.4%

4/28/08 William Wrigley Jr Co Mars Inc 28.1% 28.0% 27.7%

4/24/08 Wendy’s International Triarc Cos 5.8% 6.7% 11.3%

4/23/08 Safeco Corp Liberty Mutual Group 50.9% 48.4% 55.9%

4/22/08 Sirtris Pharmaceuticals GlaxoSmithKline PLC 76.5% 86.6% 108.7%

4/21/08 Basic Energy Services Grey Wolf 34.5% 41.8% 85.1%

4/21/08 Packeteer Blue Coat Systems 14.9% 34.0% 34.2%

4/14/08 Northwest Airlines Corp Delta Air Lines 14.1% 27.3% 31.5%

4/14/08 Circuit City Stores Blockbuster 105.1% 68.4% 116.2%

4/14/08 Clayton Holdings Greenfield Partners 24.5% 10.7% 40.8%

4/11/08 TriZetto Group Apax Partners Worldwide 24.5% 25.7% 27.2%

4/10/08 Millennium Pharmaceuticals Mahogany Acquisition Corp 52.9% 59.0% 87.7%

4/7/08 LifeCell Corp Kinetic Concepts 18.2% 21.3% 25.8%

3/31/08 Ansoft Corp ANSYS 39.3% 30.0% 34.2%

3/31/08 Bentley Pharmaceuticals Teva Pharma 9.3% 8.6% 1.3%

3/20/08 Synplicity Synopsys 52.1% 54.4% 85.6%

3/19/08 Greater Community Bancorp Valley National Bancorp 25.0% 23.0% 21.9%

3/17/08 BladeLogic BMC Software 18.6% 26.0% 60.9%

3/17/08 I-trax Putter Acquisition Sub 38.5% 44.0% 41.0%

3/16/08 Bear Stearns JPMorgan Chase & Co (93.3%) (97.1%) (97.6%)

3/10/08 Nationwide Financial Services Nationwide Mutual Insurance 24.4% 16.2% 12.2%

3/10/08 MASSBank Corp Eastern Bank Corp,MA 4.7% 4.2% 2.8%

3/10/08 Iomega Corp EMC Corp 44.7% 37.5% 37.0%

3/3/08 Diebold United Technologies Corp 65.8% 55.3% 47.4%

2/26/08 CollaGenex Pharmaceuticals Galderma Laboratories 29.7% 27.4% 41.3%

2/25/08 Getty Images Hellman & Friedman 39.1% 37.0% 34.4%

2/24/08 Take-Two Interactive Software Electronic Arts 49.8% 64.2% 66.1%

Source: Company press releases, Capital IQ and SDC. PROJECT GIANT

25

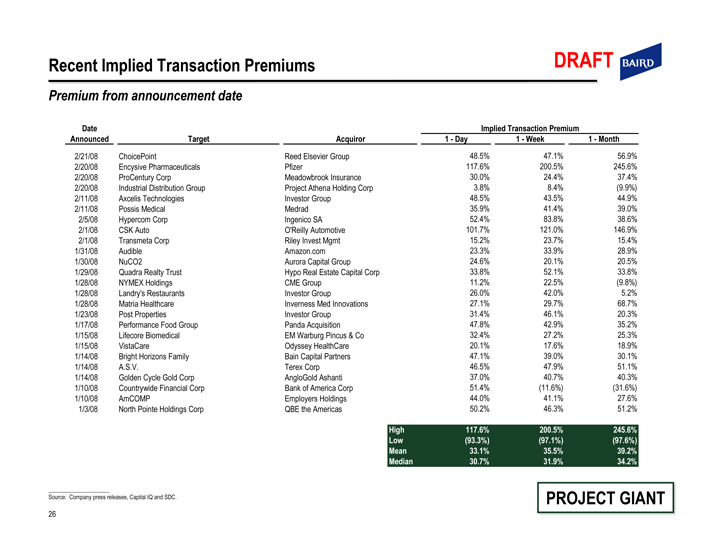

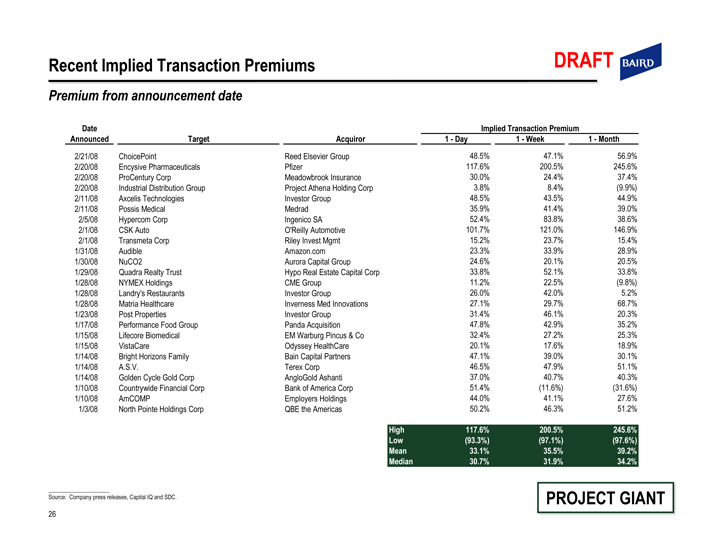

Recent Implied Transaction Premiums DRAFT BAIRD

Premium from announcement date

Date Implied Transaction Premium

Announced Target Acquiror 1-Day 1-Week 1-Month

2/21/08 ChoicePoint Reed Elsevier Group 48.5% 47.1% 56.9%

2/20/08 Encysive Pharmaceuticals Pfizer 117.6% 200.5% 245.6%

2/20/08 ProCentury Corp Meadowbrook Insurance 30.0% 24.4% 37.4%

2/20/08 Industrial Distribution Group Project Athena Holding Corp 3.8% 8.4%(9.9%)

2/11/08 Axcelis Technologies Investor Group 48.5% 43.5% 44.9%

2/11/08 Possis Medical Medrad 35.9% 41.4% 39.0%

2/5/08 Hypercom Corp Ingenico SA 52.4% 83.8% 38.6%

2/1/08 CSK Auto O’Reilly Automotive 101.7% 121.0% 146.9%

2/1/08 Transmeta Corp Riley Invest Mgmt 15.2% 23.7% 15.4%

1/31/08 Audible Amazon.com 23.3% 33.9% 28.9%

1/30/08 NuCO2 Aurora Capital Group 24.6% 20.1% 20.5%

1/29/08 Quadra Realty Trust Hypo Real Estate Capital Corp 33.8% 52.1% 33.8%

1/28/08 NYMEX Holdings CME Group 11.2% 22.5%(9.8%)

1/28/08 Landry’s Restaurants Investor Group 26.0% 42.0% 5.2%

1/28/08 Matria Healthcare Inverness Med Innovations 27.1% 29.7% 68.7%

1/23/08 Post Properties Investor Group 31.4% 46.1% 20.3%

1/17/08 Performance Food Group Panda Acquisition 47.8% 42.9% 35.2%

1/15/08 Lifecore Biomedical EM Warburg Pincus & Co 32.4% 27.2% 25.3%

1/15/08 VistaCare Odyssey HealthCare 20.1% 17.6% 18.9%

1/14/08 Bright Horizons Family Bain Capital Partners 47.1% 39.0% 30.1%

1/14/08 A.S.V. Terex Corp 46.5% 47.9% 51.1%

1/14/08 Golden Cycle Gold Corp AngloGold Ashanti 37.0% 40.7% 40.3%

1/10/08 Countrywide Financial Corp Bank of America Corp 51.4%(11.6%)(31.6%)

1/10/08 AmCOMP Employers Holdings 44.0% 41.1% 27.6%

1/3/08 North Pointe Holdings Corp QBE the Americas 50.2% 46.3% 51.2%

High 117.6% 200.5% 245.6%

Low(93.3%)(97.1%)(97.6%)

Mean 33.1% 35.5% 39.2%

Median 30.7% 31.9% 34.2%

Source: Company press releases, Capital IQ and SDC.

26 PROJECT GIANT

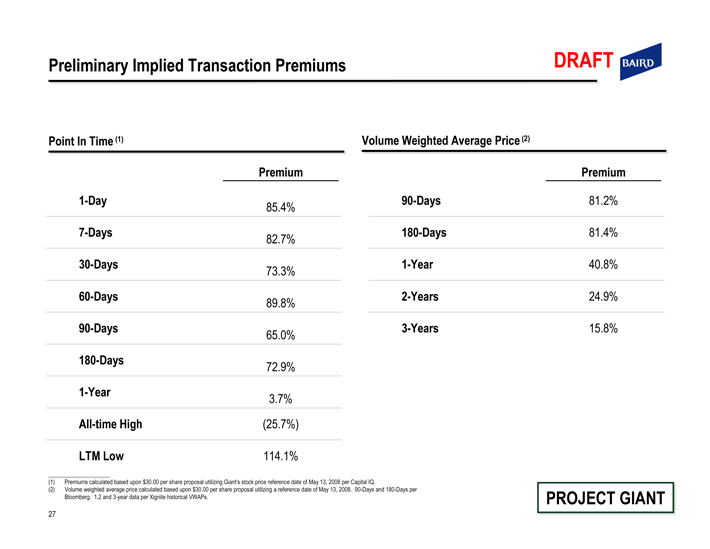

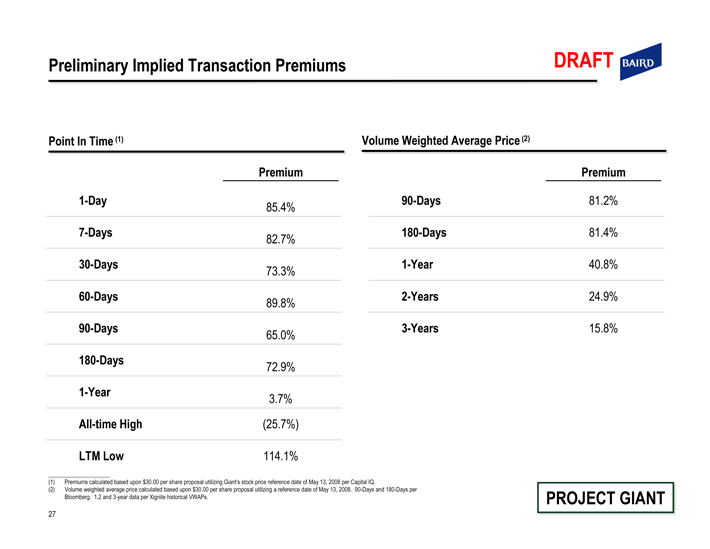

Preliminary Implied Transaction Premiums

DRAFT BAIRD

Point In Time (1) Volume Weighted Average Price (2)

Premium Premium

1-Day 85.4% 90-Days 81.2%

7-Days 82.7% 180-Days 81.4%

30-Days 73.3% 1-Year 40.8%

60-Days 89.8% 2-Years 24.9%

90-Days 65.0% 3-Years 15.8%

180-Days 72.9%

1-Year 3.7%

All-time High (25.7%)

LTM Low 114.1%

(1) Premiums calculated based upon $30.00 per share proposal utilizing Giant’s stock price reference date of May 13, 2008 per Capital IQ.

(2) Volume weighted average price calculated based upon $30.00 per share proposal utilizing a reference date of May 13, 2008. 90-Days and 180-Days per Bloomberg. 1,2 and 3-year data per Xignite historical VWAPs.

27 PROJECT GIANT

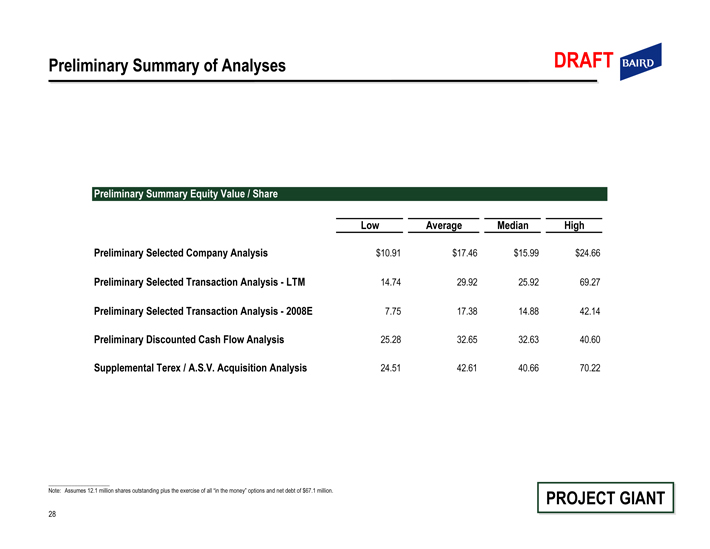

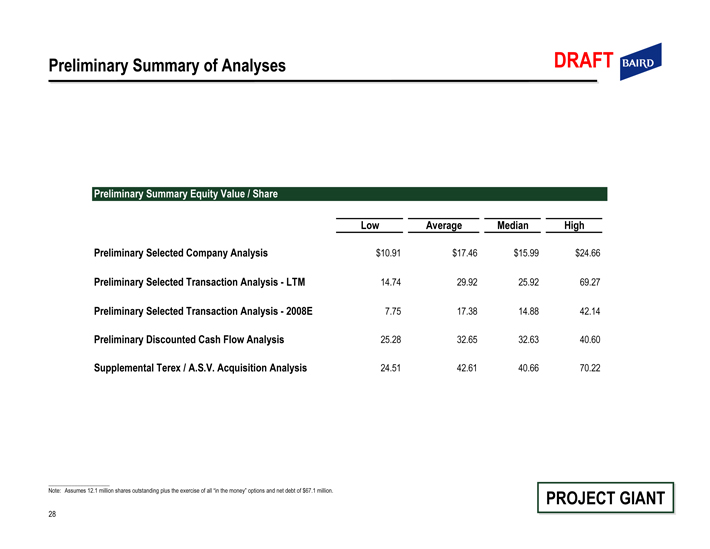

Preliminary Summary of Analyses

DRAFT BAIRD

Preliminary Summary Equity Value / Share

Low Average Median High

Preliminary Selected Company Analysis $10.91 $17.46 $15.99 $24.66

Preliminary Selected Transaction Analysis - LTM 14.74 29.92 25.92 69.27

Preliminary Selected Transaction Analysis - 2008E 7.75 17.38 14.88 42.14

Preliminary Discounted Cash Flow Analysis 25.28 32.65 32.63 40.60

Supplemental Terex / A.S.V. Acquisition Analysis 24.51 42.61 40.66 70.22

Note: Assumes 12.1 million shares outstanding plus the exercise of all “in the money” options and net debt of $67.1 million.

28 PROJECT GIANT

DRAFT BAIRD

Selected Potential Strategic Partners

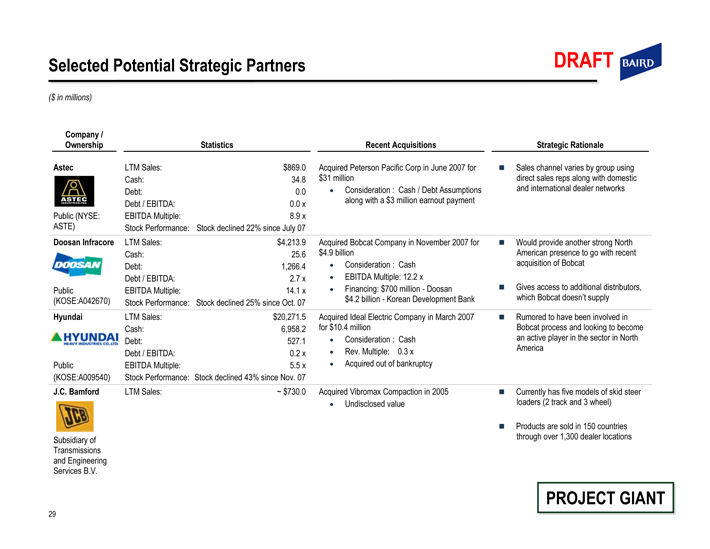

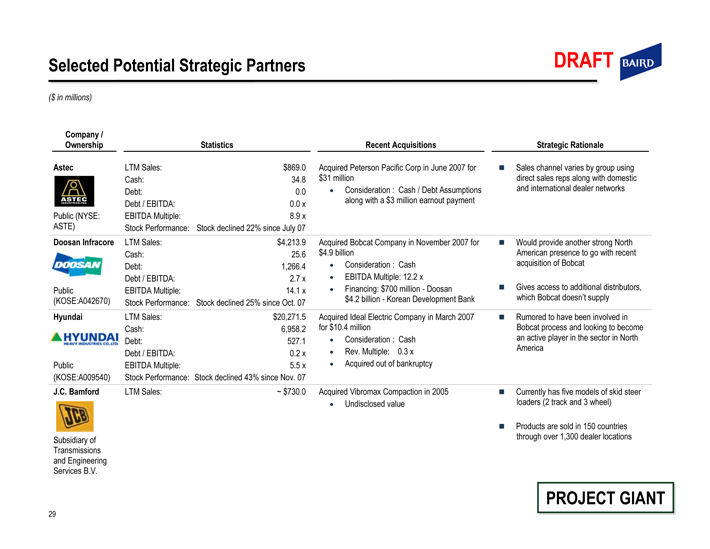

Selected Potential Strategic Partners

($ in millions)

DRAFT BAIRD

Company / Ownership

Astec

ASTEC

Public (NYSE: ASTE)

Doosan Infracore

DOOSAN

Public

(KOSE:A042670)

Hyundai

HYUNDAI

HEAVY INDUSTRIES CO., LTD.

Public

(KOSE:A009540)

J.C. Bamford

JCB

Subsidiary of Transmissions and Engineering Services B.V.

Statistics

LTM Sales: $869.0

Cash: 34.8

Debt: 0.0

Debt / EBITDA: 0.0 x

EBITDA Multiple: 8.9 x

Stock Performance: Stock declined 22% since July 07

LTM Sales: $4,213.9

Cash: 25.6

Debt: 1,266.4

Debt / EBITDA: 2.7 x

EBITDA Multiple: 14.1 x

Stock Performance: Stock declined 25% since Oct. 07

LTM Sales: $20,271.5

Cash: 6,958.2

Debt: 527.1

Debt / EBITDA: 0.2 x

EBITDA Multiple: 5.5 x

Stock Performance: Stock declined 43% since Nov. 07

LTM Sales: ~ $730.0

Recent Acquisitions

Acquired Peterson Pacific Corp in June 2007 for

$31 million

• Consideration : Cash / Debt Assumptions along with a $3 million earnout payment

Acquired Bobcat Company in November 2007 for $4.9 billion

• Consideration : Cash

• EBITDA Multiple: 12.2 x

• Financing: $700 million—Doosan

$4.2 billion—Korean Development Bank Acquired Ideal Electric Company in March 2007 for $10.4 million

• Consideration : Cash

• Rev. Multiple: 0.3 x

• Acquired out of bankruptcy Acquired Vibromax Compaction in 2005

• Undisclosed value

Strategic Rationale

• Sales channel varies by group using direct sales reps along with domestic and international dealer networks

• Would provide another strong North American presence to go with recent acquisition of Bobcat

• Gives access to additional distributors, which Bobcat doesn’t supply

• Rumored to have been involved in Bobcat process and looking to become an active player in the sector in North America

• Currently has five models of skid steer loaders (2 track and 3 wheel)

• Products are sold in 150 countries through over 1,300 dealer locations

29 PROJECT GIANT

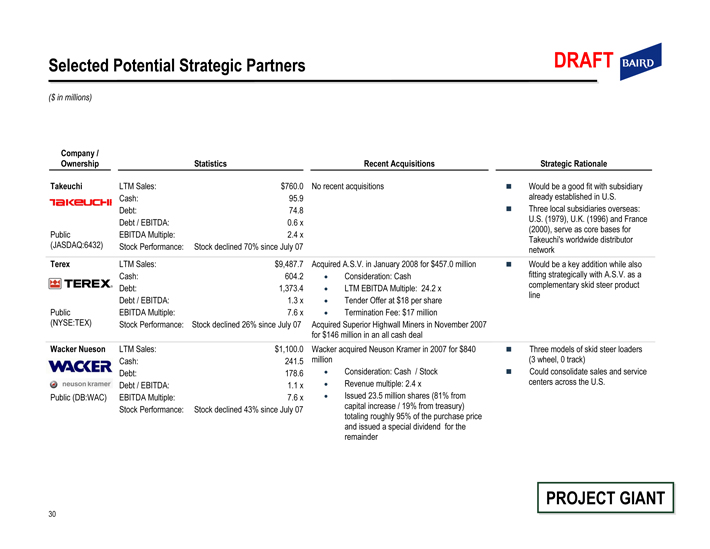

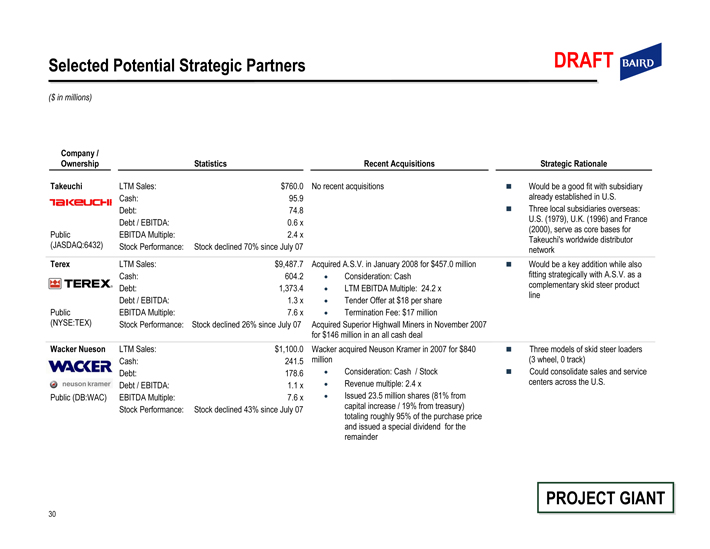

Selected Potential Strategic Partners DRAFT Baird

($ in millions)

Company / Ownership

Takeuchi

Public

(JASDAQ:6432)

Terex

Public (NYSE:TEX)

Wacker Nueson

Public (DB:WAC)

Statistics

LTM Sales: $760.0

Cash: 95.9

Debt: 74.8

Debt / EBITDA: 0.6 x

EBITDA Multiple: 2.4 x

Stock Performance: Stock declined 70% since July 07

LTM Sales: $9,487.7

Cash: 604.2

Debt: 1,373.4

Debt / EBITDA: 1.3 x

EBITDA Multiple: 7.6 x

Stock Performance: Stock declined 26% since July 07

LTM Sales: $1,100.0

Cash: 241.5

Debt: 178.6

Debt / EBITDA: 1.1 x

EBITDA Multiple: 7.6 x

Stock Performance: Stock declined 43% since July 07

Recent Acquisitions

No recent acquisitions

Acquired A.S.V. in January 2008 for $457.0 million

•Consideration: Cash

•LTM EBITDA Multiple: 24.2 x

•Tender Offer at $18 per share

•Termination Fee: $17 million

Acquired Superior Highwall Miners in November 2007 for $146 million in an all cash deal

Wacker acquired Neuson Kramer in 2007 for $840 million

•Consideration: Cash / Stock

•Revenue multiple: 2.4 x

•Issued 23.5 million shares (81% from capital increase / 19% from treasury) totaling roughly 95% of the purchase price and issued aspecial dividend for the remainder

Strategic Rationale

•Would be a good fit with subsidiary already established in U.S.

•Three local subsidiaries overseas: U.S. (1979), U.K. (1996) and France (2000), serve as core bases for Takeuchi’s worldwide distributor network

•Would be a key addition while also fitting strategically with A.S.V. as a complementary skid steer product line

•Three models of skid steer loaders (3 wheel, 0 track)

•Could consolidate sales and service centers across the U.S.

PROJECT GIANT

30

DRAFT Baird

Appendix

DRAFT Baird

Supplemental Information

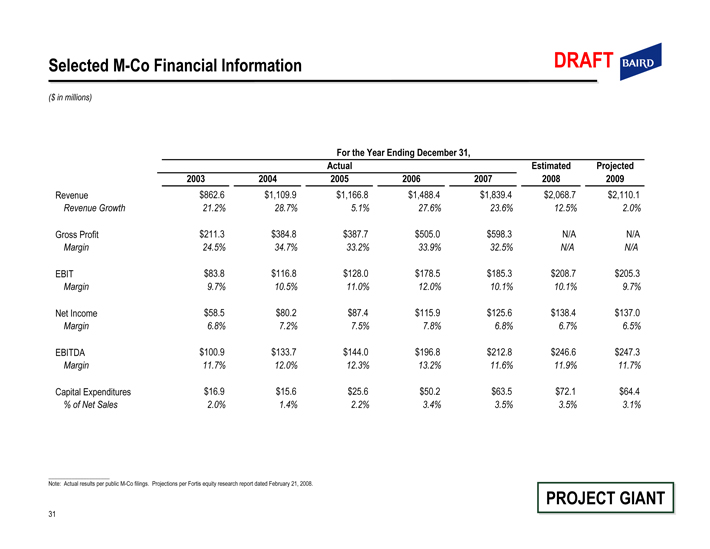

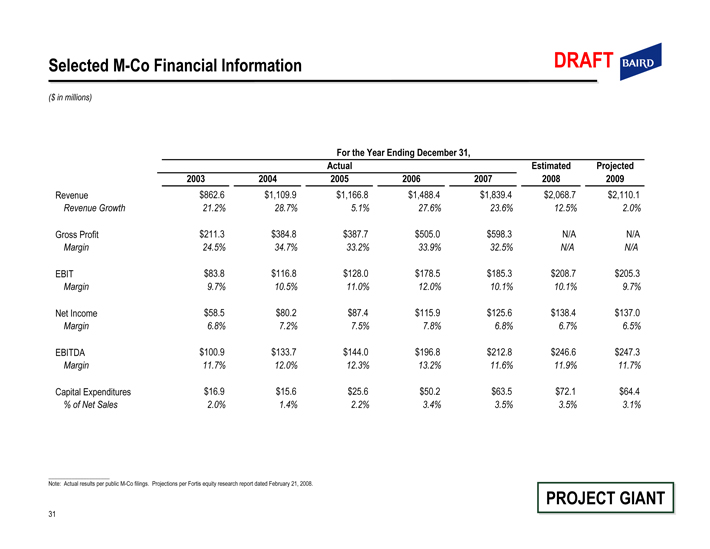

Selected M-Co Financial Information DRAFT Baird

($ in millions)

For the Year Ending December 31,

Actual Estimated Projected

2003 2004 2005 2006 2007 2008 2009

Revenue $862.6 $1,109.9 $1,166.8 $1,488.4 $1,839.4 $2,068.7 $2,110.1

Revenue Growth 21.2% 28.7% 5.1% 27.6% 23.6% 12.5% 2.0%

Gross Profit $211.3 $384.8 $387.7 $505.0 $598.3 N/A N/A

Margin 24.5% 34.7% 33.2% 33.9% 32.5% N/A N/A

EBIT $83.8 $116.8 $128.0 $178.5 $185.3 $208.7 $205.3

Margin 9.7% 10.5% 11.0% 12.0% 10.1% 10.1% 9.7%

Net Income $58.5 $80.2 $87.4 $115.9 $125.6 $138.4 $137.0

Margin 6.8% 7.2% 7.5% 7.8% 6.8% 6.7% 6.5%

EBITDA $100.9 $133.7 $144.0 $196.8 $212.8 $246.6 $247.3

Margin 11.7% 12.0% 12.3% 13.2% 11.6% 11.9% 11.7%

Capital Expenditures $16.9 $15.6 $25.6 $50.2 $63.5 $72.1 $64.4

% of Net Sales 2.0% 1.4% 2.2% 3.4% 3.5% 3.5% 3.1%

Note: Actual results per public M-Co filings. Projections per Fortis equity research report dated February 21, 2008.

PROJECT GIANT

31

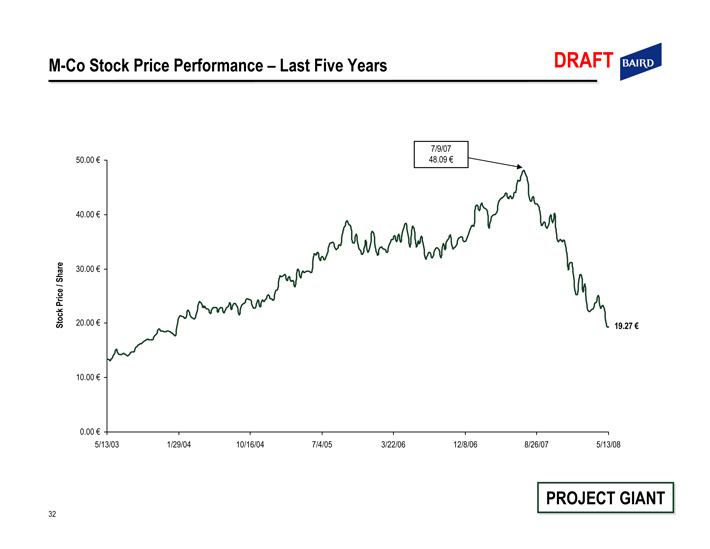

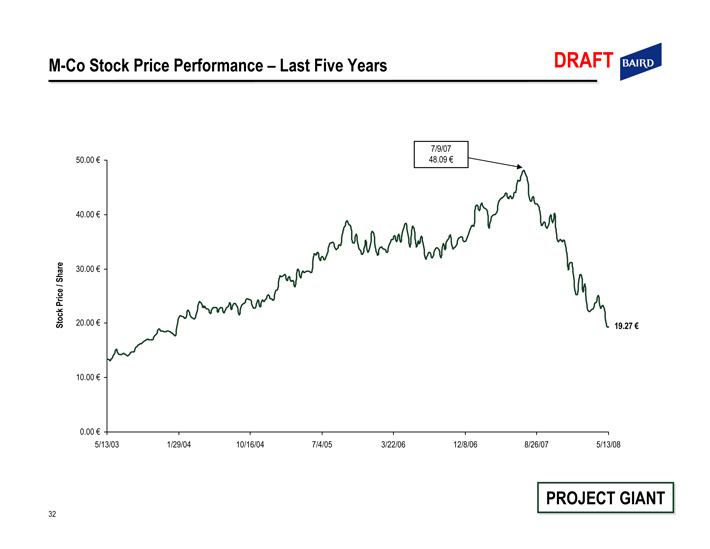

M-Co Stock Price Performance – Last Five Years DRAFT Baird

7/9/07

48.09 €

50.00 €

40.00 €

Stock Price / Share

30.00 €

20.00 €

19.27 €

10.00 €

0.00 €

5/13/03 1/29/04 10/16/04 7/4/05 3/22/06 12/8/06 8/26/07 5/13/08

PROJECT GIANT

32

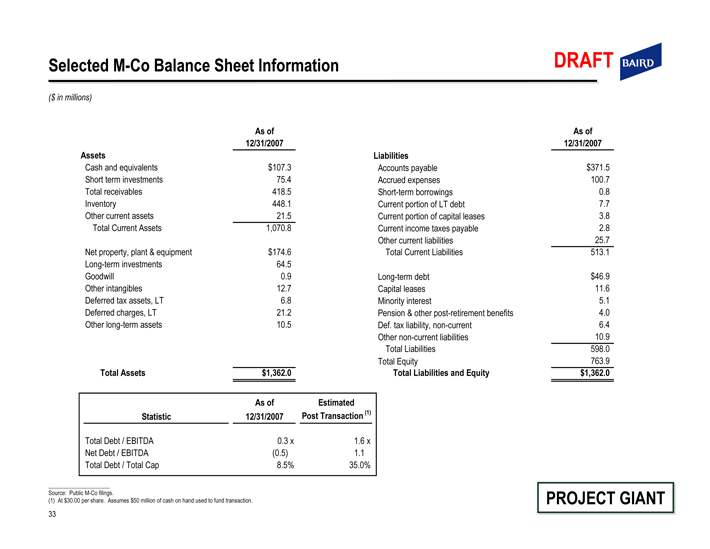

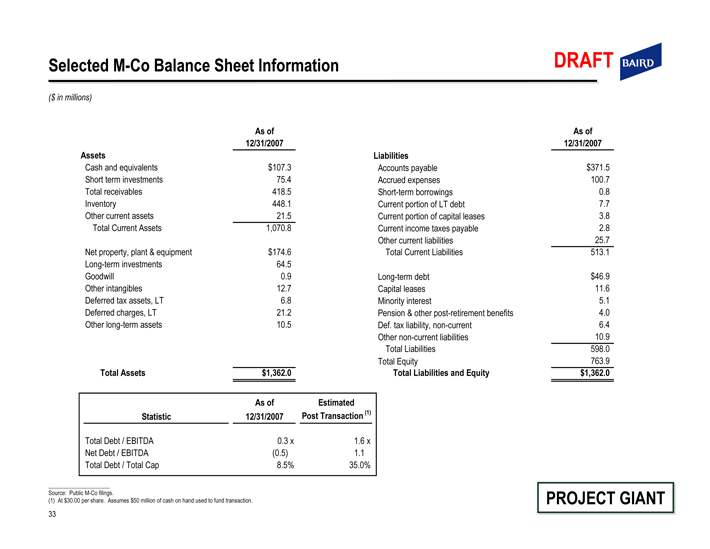

Selected M-Co Balance Sheet Information

($ in millions)

DRAFT Baird

As of

12/31/2007

Assets

Cash and equivalents $107.3

Short term investments 75.4

Total receivables 418.5

Inventory 448.1

Other current assets 21.5

Total Current Assets 1,070.8

Net property, plant & equipment $174.6

Long-term investments 64.5

Goodwill 0.9

Other intangibles 12.7

Deferred tax assets, LT 6.8

Deferred charges, LT 21.2

Other long-term assets 10.5

Total Assets $1,362.0

As of Estimated

Statistic 12/31/2007 Post Transaction (1)

Total Debt / EBITDA 0.3 x 1.6 x

Net Debt / EBITDA(0.5) 1.1

Total Debt / Total Cap 8.5% 35.0%

As of

12/31/2007

Liabilities

Accounts payable $371.5

Accrued expenses 100.7

Short-term borrowings 0.8

Current portion of LT debt 7.7

Current portion of capital leases 3.8

Current income taxes payable 2.8

Other current liabilities 25.7

Total Current Liabilities 513.1

Long-term debt $46.9

Capital leases 11.6

Minority interest 5.1

Pension & other post-retirement benefits 4.0

Def. tax liability, non-current 6.4

Other non-current liabilities 10.9

Total Liabilities 598.0

Total Equity 763.9

Total Liabilities and Equity $1,362.0

Source: Public M-Co filings.

(1) At $30.00 per share. Assumes $50 million of cash on hand used to fund transaction. PROJECT GIANT 33

Robert W. Baird Ltd. and Baird Capital Partners Europe are authorized and regulated in the UK by the Financial Services Authority.