| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| California Municipal Bond Fund (Class A/TACAX) | $80 | 0.78% |

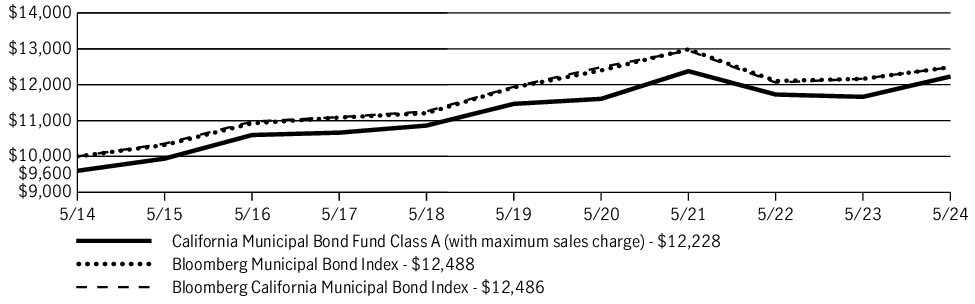

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| California Municipal Bond Fund (Class A/TACAX) | 0.62% | 0.47% | 2.03% |

| California Municipal Bond Fund (Class A/TACAX)—excluding sales charge | 4.86% | 1.30% | 2.45% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

| Bloomberg California Municipal Bond Index | 2.63% | 0.90% | 2.25% |

| The Fund has designated Bloomberg Municipal Bond Index as its broad-based securities market index in accordance with the revised definition for such an index. |

| Fund net assets | $377,888,540% |

| Total number of portfolio holdings | $347% |

| Total advisory fees paid (net) | $1,462,389% |

| Portfolio turnover rate | $44% |

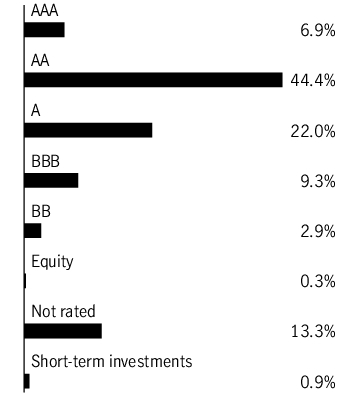

| General obligation bonds | 27.5% |

| Revenue bonds | 71.3% |

| Other revenue | 13.4% |

| Health care | 12.6% |

| Education | 8.6% |

| Facilities | 6.8% |

| Airport | 5.8% |

| Water and sewer | 5.8% |

| Utilities | 5.2% |

| Tobacco | 3.9% |

| Housing | 3.7% |

| Development | 2.8% |

| Transportation | 2.2% |

| Pollution | 0.5% |

| Closed-end funds | 0.3% |

| Short-term investments | 0.9% |

- Prospectus

- Financial information

- Fund holdings

- Proxy voting information

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| California Municipal Bond Fund (Class C/TCCAX) | $156 | 1.53% |

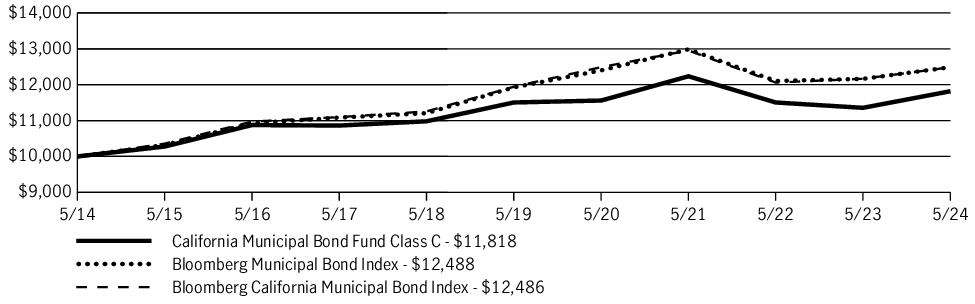

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| California Municipal Bond Fund (Class C/TCCAX) | 3.07% | 0.54% | 1.68% |

| California Municipal Bond Fund (Class C/TCCAX)—excluding sales charge | 4.07% | 0.54% | 1.68% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

| Bloomberg California Municipal Bond Index | 2.63% | 0.90% | 2.25% |

| The Fund has designated Bloomberg Municipal Bond Index as its broad-based securities market index in accordance with the revised definition for such an index. |

| Fund net assets | $377,888,540% |

| Total number of portfolio holdings | $347% |

| Total advisory fees paid (net) | $1,462,389% |

| Portfolio turnover rate | $44% |

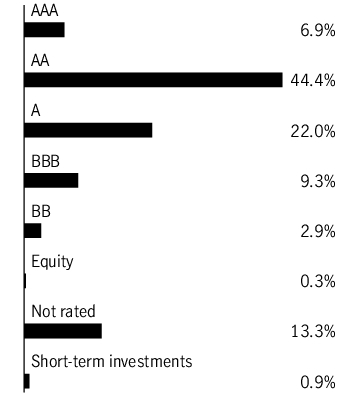

| General obligation bonds | 27.5% |

| Revenue bonds | 71.3% |

| Other revenue | 13.4% |

| Health care | 12.6% |

| Education | 8.6% |

| Facilities | 6.8% |

| Airport | 5.8% |

| Water and sewer | 5.8% |

| Utilities | 5.2% |

| Tobacco | 3.9% |

| Housing | 3.7% |

| Development | 2.8% |

| Transportation | 2.2% |

| Pollution | 0.5% |

| Closed-end funds | 0.3% |

| Short-term investments | 0.9% |

- Prospectus

- Financial information

- Fund holdings

- Proxy voting information

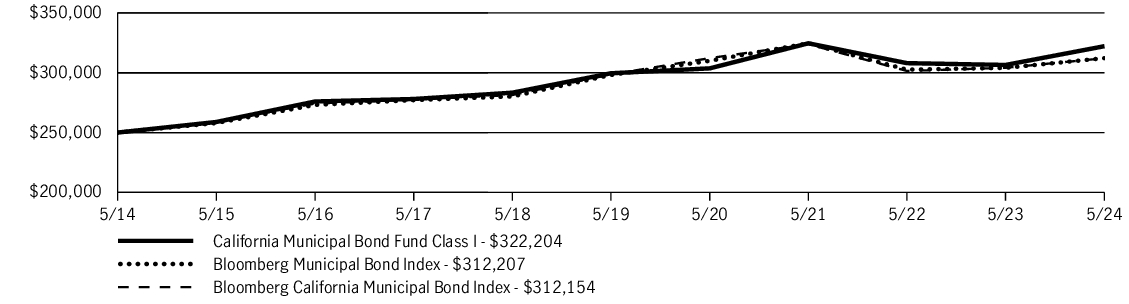

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| California Municipal Bond Fund (Class I/JCAFX) | $65 | 0.63% |

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| California Municipal Bond Fund (Class I/JCAFX) | 5.12% | 1.47% | 2.57% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

| Bloomberg California Municipal Bond Index | 2.63% | 0.90% | 2.25% |

| The Fund has designated Bloomberg Municipal Bond Index as its broad-based securities market index in accordance with the revised definition for such an index. | |

| Class I shares were first offered on 2-13-17. Returns prior to this date are those of Class A shares that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| Fund net assets | $377,888,540% |

| Total number of portfolio holdings | $347% |

| Total advisory fees paid (net) | $1,462,389% |

| Portfolio turnover rate | $44% |

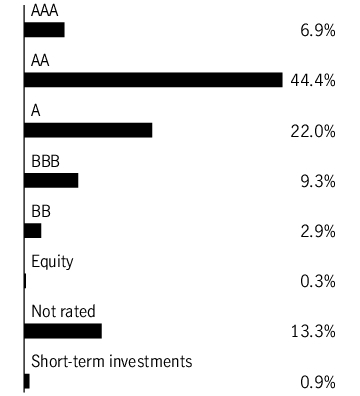

| General obligation bonds | 27.5% |

| Revenue bonds | 71.3% |

| Other revenue | 13.4% |

| Health care | 12.6% |

| Education | 8.6% |

| Facilities | 6.8% |

| Airport | 5.8% |

| Water and sewer | 5.8% |

| Utilities | 5.2% |

| Tobacco | 3.9% |

| Housing | 3.7% |

| Development | 2.8% |

| Transportation | 2.2% |

| Pollution | 0.5% |

| Closed-end funds | 0.3% |

| Short-term investments | 0.9% |

- Prospectus

- Financial information

- Fund holdings

- Proxy voting information

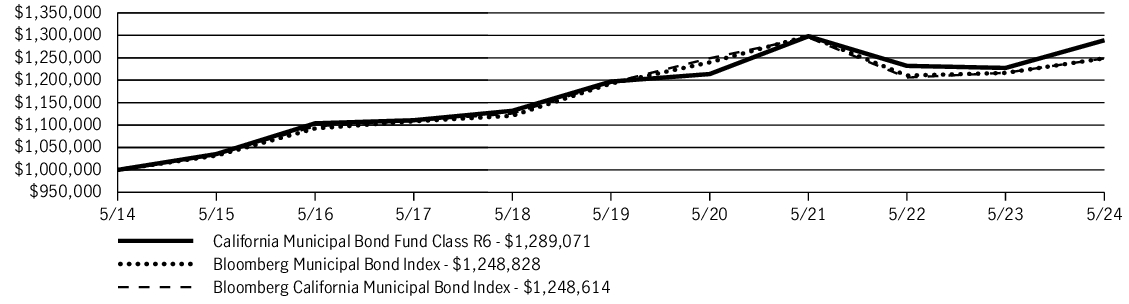

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| California Municipal Bond Fund (Class R6/JCSRX) | $64 | 0.62% |

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| California Municipal Bond Fund (Class R6/JCSRX) | 5.03% | 1.49% | 2.57% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 2.25% |

| Bloomberg California Municipal Bond Index | 2.63% | 0.90% | 2.25% |

| The Fund has designated Bloomberg Municipal Bond Index as its broad-based securities market index in accordance with the revised definition for such an index. | |

| Class R6 shares were first offered on 8-30-17. Returns prior to this date are those of Class A shares that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| Fund net assets | $377,888,540% |

| Total number of portfolio holdings | $347% |

| Total advisory fees paid (net) | $1,462,389% |

| Portfolio turnover rate | $44% |

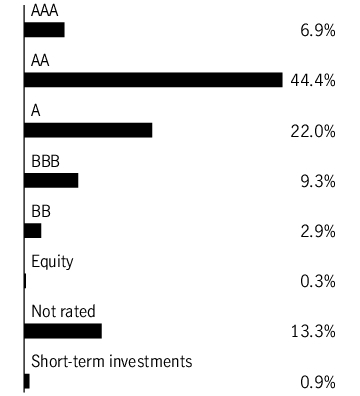

| General obligation bonds | 27.5% |

| Revenue bonds | 71.3% |

| Other revenue | 13.4% |

| Health care | 12.6% |

| Education | 8.6% |

| Facilities | 6.8% |

| Airport | 5.8% |

| Water and sewer | 5.8% |

| Utilities | 5.2% |

| Tobacco | 3.9% |

| Housing | 3.7% |

| Development | 2.8% |

| Transportation | 2.2% |

| Pollution | 0.5% |

| Closed-end funds | 0.3% |

| Short-term investments | 0.9% |

- Prospectus

- Financial information

- Fund holdings

- Proxy voting information

ITEM 2. CODE OF ETHICS.

As of the end of the year, May 31, 2024, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its Chief Executive Officer, Chief Financial Officer and Treasurer (respectively, the principal executive officer, the principal financial officer and the principal accounting officer, the "Covered Officers"). A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Frances G. Rathke is the audit committee financial expert and is "independent", pursuant to general instructions on Form N-CSR Item 3.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees billed for professional services rendered by the principal accountant for the audits of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements amounted to $49,393 and $47,591 for the fiscal years ended May 31, 2024 and May 31, 2023, respectively. These fees were billed to the registrant and were approved by the registrant's audit committee.

(b) Audit-Related Services

Audit-related fees for assurance and related services by the principal accountant are billed to the registrant or to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser ("control affiliates") that provides ongoing services to the registrant. The nature of the services provided was affiliated service provider internal controls reviews and a software licensing fee. Amounts billed to the registrant were $80 and $1,134 for fiscal years ended May 31, 2024 and May 31, 2023, respectively.

Amounts billed to control affiliates were $127,986 and $121,890 for the fiscal years ended May 31, 2024 and May 31, 2023, respectively.

(c) Tax Fees

The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning ("tax fees") amounted to $4,168 and $4,027 for the fiscal years ended May 31, 2024 and May 31, 2023, respectively. The nature of the services comprising the tax fees was the review of the registrant's tax returns and tax distribution requirements. These fees were billed to the registrant and were approved by the registrant's audit committee.

(d) All Other Fees

Other fees amounted to $369 and $57 for the fiscal years ended May 31, 2024 and May 31, 2023, respectively. The nature of the services comprising all other fees is advisory services provided to the investment manager. These fees were approved by the registrant's audit committee.

(e)(1) Audit Committee Pre-Approval Policies and Procedures

The registrant's Audit Committee must pre-approve all audit and non-audit services provided by the independent registered public accounting firm (the "Auditor") relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The registrant's Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee's consideration of audit-related and non-audit services by the Auditor. The policies and procedures require that any audit-related and non-audit service provided by the Auditor and any non-audit service provided by the Auditor to a fund service provider that relates directly to the operations and financial reporting of a fund are subject to approval by the Audit Committee before such service is provided. Audit-related services provided by the Auditor that are expected to exceed $25,000 per year/per fund are subject to specific pre-approval by the Audit Committee. Tax services provided by the Auditor that are expected to exceed $30,000 per year/per fund are subject to specific pre-approval by the Audit Committee.

All audit services, as well as the audit-related and non-audit services that are expected to exceed the amounts stated above, must be approved in advance of provision of the service by formal resolution of the Audit Committee. At the regularly scheduled Audit Committee meetings, the Committee reviews a report summarizing the services, including fees, provided by the Auditor.

(e)(2) Services approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X

Audit-Related Fees, Tax Fees and All Other Fees

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

(f) According to the registrant's principal accountant for the fiscal year ended May 31, 2024, the percentage of hours spent on the audit of the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons who were not full-time, permanent employees of principal accountant was less than 50%.

(g) The aggregate non-audit fees billed by the registrant's principal accountant for non-audit services rendered to the registrant and rendered to the registrant's control affiliates were $973,916 for the fiscal year ended May 31, 2024 and $1,236,793 for the fiscal year ended May 31, 2023.

(h) The audit committee of the registrant has considered the non-audit services provided by the registrant's principal accountant to the control affiliates and has determined that the services that were not pre-approved are compatible with maintaining the principal accountant's independence.

(i) Not applicable.

(j) Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The registrant has a separately-designated standing audit committee comprised of independent trustees. The members of the audit committee are as follows:

Frances G. Rathke – Chairperson

William H. Cunningham

Hassell H. McClellan

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Refer to information included in Item 7.

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

The Registrant prepared financial statements and financial highlights for the year ended May 31, 2024 for the following fund:

John Hancock California Municipal Bond Fund

| 1 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | |

| Rate (%) | Maturity date | Par value^ | Value | ||

| Municipal bonds 100.8% | $380,786,966 | ||||

| (Cost $382,824,107) | |||||

| California 94.2% | 355,755,023 | ||||

| Alameda Corridor Transportation Authority Series A, (0.000% to 10-1-37, then 5.400% thereafter) | 0.000 | 10-01-50 | 2,500,000 | 1,360,127 | |

| Alum Rock Union Elementary School District Election of 2022, Series A, GO (A) | 5.000 | 08-01-53 | 1,000,000 | 1,073,330 | |

| Alvord Unified School District Election of 2022, Series A, GO (A) | 5.000 | 08-01-52 | 1,750,000 | 1,903,234 | |

| Anaheim City School District Election of 2010, GO (A) | 5.000 | 08-01-51 | 2,150,000 | 2,328,043 | |

| Antelope Valley Community College District Election of 2016, Series B, GO | 4.000 | 08-01-45 | 65,000 | 64,478 | |

| Antelope Valley Community College District Election of 2016, Series C, GO (B) | 4.467 | 08-01-38 | 1,000,000 | 533,515 | |

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign Series B, AMT (A) | 4.125 | 07-01-41 | 1,000,000 | 973,746 | |

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign Series B, AMT (A) | 4.250 | 07-01-43 | 500,000 | 488,092 | |

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign Series B, AMT (A) | 4.375 | 07-01-49 | 1,000,000 | 972,487 | |

| Burlingame School District Election of 2020, Series B, GO | 5.000 | 08-01-52 | 3,460,000 | 3,754,093 | |

| California Community Choice Financing Authority Clean Energy Project, Series A | 4.000 | 10-01-52 | 1,250,000 | 1,249,323 | |

| California Community Choice Financing Authority Clean Energy Project, Series A-1 | 5.000 | 05-01-54 | 1,500,000 | 1,588,260 | |

| California Community Choice Financing Authority Clean Energy Project, Series B-1 | 4.000 | 02-01-52 | 1,000,000 | 992,169 | |

| California Community Choice Financing Authority Clean Energy Project, Series E1 | 5.000 | 02-01-54 | 1,000,000 | 1,053,731 | |

| California Community Choice Financing Authority Series D | 5.500 | 05-01-54 | 1,500,000 | 1,590,116 | |

| California Community College Financing Authority Napa Valley College Project, Series A (C) | 5.750 | 07-01-60 | 1,500,000 | 1,504,722 | |

| California Community Housing Agency Stoneridge Apartments, Series A (C) | 4.000 | 02-01-56 | 600,000 | 474,950 | |

| California County Tobacco Securitization Agency Fresno County Funding Corp. | 6.000 | 06-01-35 | 730,000 | 730,587 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 2 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| California County Tobacco Securitization Agency Kern County Tobacco Funding Corp. | 5.000 | 06-01-40 | 1,500,000 | $1,499,984 | |

| California County Tobacco Securitization Agency Louisiana County Securitization Corp. | 4.000 | 06-01-49 | 1,000,000 | 932,533 | |

| California County Tobacco Securitization Agency Merced County Tobacco Funding Corp. | 5.000 | 06-01-50 | 1,235,000 | 1,224,347 | |

| California County Tobacco Securitization Agency Series A | 5.000 | 06-01-29 | 400,000 | 429,716 | |

| California Educational Facilities Authority Stanford University, Series V-1 | 5.000 | 05-01-49 | 1,455,000 | 1,681,227 | |

| California Educational Facilities Authority Stanford University, Series V-2 | 5.000 | 04-01-51 | 3,500,000 | 4,047,358 | |

| California Educational Facilities Authority University of Redlands, Series A | 5.000 | 10-01-35 | 1,000,000 | 1,001,609 | |

| California Educational Facilities Authority University of the Pacific, Series A | 5.000 | 11-01-53 | 1,000,000 | 1,050,488 | |

| California Enterprise Development Authority Academy for Academic Excellence Project, Series A (C) | 5.000 | 07-01-40 | 430,000 | 430,515 | |

| California Enterprise Development Authority Academy for Academic Excellence Project, Series A (C) | 5.000 | 07-01-50 | 350,000 | 337,383 | |

| California Enterprise Development Authority Academy for Academic Excellence Project, Series A (C) | 5.000 | 07-01-55 | 240,000 | 228,195 | |

| California Enterprise Development Authority Curtis School Foundation Project | 4.000 | 06-01-49 | 350,000 | 334,390 | |

| California Enterprise Development Authority Curtis School Foundation Project | 4.000 | 06-01-53 | 40,000 | 37,698 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-37 | 100,000 | 110,662 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-38 | 125,000 | 137,066 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-39 | 100,000 | 108,964 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-40 | 150,000 | 162,377 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-41 | 125,000 | 134,589 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-42 | 200,000 | 214,296 | |

| California Enterprise Development Authority Curtis School Foundation Project | 5.000 | 06-01-43 | 110,000 | 117,137 | |

| California Enterprise Development Authority Pomona Properties LLC Project, Series A | 5.000 | 01-15-39 | 500,000 | 532,951 | |

| California Enterprise Development Authority Pomona Properties LLC Project, Series A | 5.000 | 01-15-45 | 1,000,000 | 1,040,665 |

| 3 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| California Health Facilities Financing Authority Adventist Health System, Series A | 5.000 | 03-01-40 | 1,555,000 | $1,598,166 | |

| California Health Facilities Financing Authority Adventist Health System, Series A | 5.250 | 12-01-42 | 1,000,000 | 1,087,310 | |

| California Health Facilities Financing Authority Adventist Health System, Series A | 5.250 | 12-01-43 | 1,000,000 | 1,084,328 | |

| California Health Facilities Financing Authority Cedars Sinai Health System, Series A | 4.000 | 08-15-48 | 1,850,000 | 1,790,133 | |

| California Health Facilities Financing Authority Cedars Sinai Health System, Series A | 5.000 | 08-15-51 | 430,000 | 457,549 | |

| California Health Facilities Financing Authority Children’s Hospital of Orange County, Series A | 5.000 | 11-01-54 | 1,030,000 | 1,107,393 | |

| California Health Facilities Financing Authority Children’s Hospital, Series A | 5.000 | 08-15-47 | 575,000 | 581,668 | |

| California Health Facilities Financing Authority City of Hope Obligated Group | 4.000 | 11-15-45 | 1,160,000 | 1,094,853 | |

| California Health Facilities Financing Authority City of Hope Obligated Group | 5.000 | 11-15-49 | 750,000 | 757,778 | |

| California Health Facilities Financing Authority Commonspirit Health, Series A | 4.000 | 04-01-37 | 1,550,000 | 1,541,434 | |

| California Health Facilities Financing Authority Commonspirit Health, Series A | 5.000 | 12-01-40 | 850,000 | 932,147 | |

| California Health Facilities Financing Authority Commonspirit Health, Series A | 5.000 | 12-01-54 | 1,000,000 | 1,054,670 | |

| California Health Facilities Financing Authority El Camino Hospital | 5.000 | 02-01-42 | 1,000,000 | 1,027,744 | |

| California Health Facilities Financing Authority El Camino Hospital | 5.000 | 02-01-47 | 1,425,000 | 1,453,273 | |

| California Health Facilities Financing Authority Episcopal Communities & Services, Series B | 5.250 | 11-15-48 | 1,000,000 | 1,055,717 | |

| California Health Facilities Financing Authority Episcopal Communities & Services, Series B | 5.250 | 11-15-53 | 500,000 | 523,728 | |

| California Health Facilities Financing Authority Episcopal Communities & Services, Series B | 5.250 | 11-15-58 | 1,000,000 | 1,039,182 | |

| California Health Facilities Financing Authority Lucile Packard Children’s Hospital, Series A | 5.000 | 08-15-43 | 970,000 | 970,602 | |

| California Health Facilities Financing Authority Lucile Packard Children’s Hospital, Series B | 5.000 | 08-15-55 | 1,000,000 | 1,011,955 | |

| California Health Facilities Financing Authority Standford Health Care, Series A | 4.000 | 08-15-50 | 1,515,000 | 1,459,207 | |

| California Housing Finance Agency Series A | 4.250 | 01-15-35 | 926,407 | 899,070 | |

| California Infrastructure & Economic Development Bank Academy of Motion Picture Arts & Sciences, Series A | 4.000 | 11-01-41 | 1,000,000 | 1,019,105 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 4 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| California Infrastructure & Economic Development Bank Academy of Motion Picture Arts & Sciences, Series A | 4.000 | 11-01-45 | 25,000 | $23,813 | |

| California Infrastructure & Economic Development Bank Academy of Motion Picture Arts & Sciences, Series A | 5.000 | 11-01-40 | 300,000 | 334,856 | |

| California Infrastructure & Economic Development Bank California Academy of Sciences, Series A | 3.250 | 08-01-29 | 1,700,000 | 1,657,222 | |

| California Infrastructure & Economic Development Bank California Science Center | 4.000 | 05-01-46 | 1,190,000 | 1,139,724 | |

| California Infrastructure & Economic Development Bank California State Teachers Retirement System | 4.000 | 08-01-49 | 1,000,000 | 956,319 | |

| California Infrastructure & Economic Development Bank Clean Water and Drinking Water State Revolving Fund | 4.000 | 10-01-47 | 1,000,000 | 1,004,553 | |

| California Infrastructure & Economic Development Bank Equitable School Revolving Fund, Series B | 4.000 | 11-01-45 | 400,000 | 375,260 | |

| California Infrastructure & Economic Development Bank Los Angeles County Museum of Natural History Foundation | 4.000 | 07-01-50 | 445,000 | 429,756 | |

| California Municipal Finance Authority Caritas Project, Series A | 5.250 | 08-15-58 | 800,000 | 810,428 | |

| California Municipal Finance Authority Certificates of Participation, Palomar Health, Series A (A) | 5.250 | 11-01-52 | 725,000 | 759,438 | |

| California Municipal Finance Authority Channing House Project, Series A (A) | 4.000 | 05-15-40 | 1,500,000 | 1,477,621 | |

| California Municipal Finance Authority Community Facilities District No. 2020-6 | 5.000 | 09-01-42 | 500,000 | 497,966 | |

| California Municipal Finance Authority Community Facilities District No. 2023-7 | 5.000 | 09-01-54 | 750,000 | 745,605 | |

| California Municipal Finance Authority HumanGood Obligated Group | 4.000 | 10-01-46 | 2,020,000 | 1,866,439 | |

| California Municipal Finance Authority HumanGood Obligated Group | 5.000 | 10-01-35 | 350,000 | 373,543 | |

| California Municipal Finance Authority HumanGood Obligated Group, Series A | 5.000 | 10-01-44 | 1,000,000 | 1,013,479 | |

| California Municipal Finance Authority Kern Regional Center Project, Series A | 5.000 | 05-01-49 | 750,000 | 757,632 | |

| California Municipal Finance Authority Northbay Healthcare, Series A | 5.250 | 11-01-47 | 1,495,000 | 1,433,137 | |

| California Municipal Finance Authority Paradise Valley Estates Project, Series A (A) | 5.000 | 01-01-49 | 1,500,000 | 1,558,279 |

| 5 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| California Municipal Finance Authority Samuel Merritt University | 5.250 | 06-01-53 | 650,000 | $680,813 | |

| California Municipal Finance Authority Series B (D) | 5.000 | 09-01-54 | 1,000,000 | 994,147 | |

| California Municipal Finance Authority St. Mary’s School-Aliso Viejo, Series A (C) | 5.000 | 05-01-34 | 270,000 | 276,821 | |

| California Municipal Finance Authority St. Mary’s School-Aliso Viejo, Series A (C) | 5.500 | 05-01-44 | 275,000 | 277,906 | |

| California Municipal Finance Authority St. Mary’s School-Aliso Viejo, Series A (C) | 5.750 | 05-01-54 | 390,000 | 395,199 | |

| California Municipal Finance Authority St. Mary’s School-Aliso Viejo, Series A (C) | 5.875 | 05-01-59 | 395,000 | 401,937 | |

| California Municipal Finance Authority United Airlines, Inc. Project, AMT | 4.000 | 07-15-29 | 1,600,000 | 1,588,491 | |

| California Municipal Finance Authority Westside Neighborhood School Project (C) | 6.200 | 06-15-54 | 550,000 | 573,355 | |

| California Municipal Finance Authority Westside Neighborhood School Project (C) | 6.375 | 06-15-64 | 2,000,000 | 2,090,302 | |

| California Pollution Control Financing Authority American Water Capital Corp. Project | 3.700 | 08-01-40 | 1,000,000 | 979,501 | |

| California Pollution Control Financing Authority San Diego County Water Authority Desalination Project Pipeline (C) | 5.000 | 07-01-39 | 1,000,000 | 1,035,497 | |

| California Pollution Control Financing Authority San Diego County Water Authority Desalination Project Pipeline (C) | 5.000 | 11-21-45 | 3,000,000 | 3,056,355 | |

| California Pollution Control Financing Authority Waste Management, Inc., Series A1, AMT | 3.375 | 07-01-25 | 2,000,000 | 1,992,944 | |

| California Pollution Control Financing Authority Waste Management, Inc., Series A3, AMT | 4.300 | 07-01-40 | 4,675,000 | 4,681,687 | |

| California Public Finance Authority Enso Village Project, Series A (C) | 5.000 | 11-15-51 | 1,025,000 | 901,561 | |

| California Public Finance Authority Excelsior Charter Schools Project, Series A (C) | 5.000 | 06-15-50 | 400,000 | 373,258 | |

| California Public Finance Authority Excelsior Charter Schools Project, Series A (C) | 5.000 | 06-15-55 | 475,000 | 437,499 | |

| California Public Finance Authority Henry Mayo Newhall Hospital | 5.000 | 10-15-47 | 1,000,000 | 989,333 | |

| California Public Finance Authority Sharp Healthcare, Series A | 5.000 | 08-01-47 | 1,010,000 | 1,047,773 | |

| California Public Finance Authority Trinity Classical Academy, Series A (C) | 5.000 | 07-01-44 | 685,000 | 623,154 | |

| California Public Finance Authority Trinity Classical Academy, Series A (C) | 5.000 | 07-01-54 | 1,000,000 | 864,618 | |

| California School Finance Authority Aspire Public Schools (C) | 5.000 | 08-01-41 | 1,375,000 | 1,379,538 | |

| California School Finance Authority Camino Nuevo Charter Academy (C) | 5.000 | 06-01-43 | 820,000 | 801,235 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 6 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| California School Finance Authority Granada Hills Charter High School Obligated Group (C) | 5.000 | 07-01-43 | 750,000 | $752,303 | |

| California School Finance Authority Hawking Steam Charter School (C) | 5.250 | 07-01-52 | 500,000 | 504,738 | |

| California School Finance Authority John Adams Academies, Series A (C) | 5.125 | 07-01-62 | 1,000,000 | 932,125 | |

| California School Finance Authority KIPP LA Project, Series A (C) | 5.000 | 07-01-47 | 1,500,000 | 1,506,931 | |

| California School Finance Authority New Designs Charter School, Series A (C) | 5.000 | 06-01-54 | 200,000 | 199,222 | |

| California School Finance Authority New Designs Charter School, Series A (C) | 5.000 | 06-01-64 | 300,000 | 293,638 | |

| California School Finance Authority Sonoma County Junior College (C) | 4.000 | 11-01-41 | 1,000,000 | 898,616 | |

| California School Finance Authority Sonoma County Junior College (C) | 4.000 | 11-01-55 | 580,000 | 469,760 | |

| California School Finance Authority Stem Preparatory School (C) | 5.000 | 06-01-43 | 750,000 | 742,661 | |

| California School Finance Authority Value Schools, Series A (C) | 5.250 | 07-01-48 | 500,000 | 500,894 | |

| California State Public Works Board Air Resource Board, Series D | 4.000 | 05-01-44 | 1,000,000 | 989,918 | |

| California State Public Works Board May Lee State Office Complex, Series A | 5.000 | 04-01-39 | 800,000 | 899,246 | |

| California State Public Works Board May Lee State Office Complex, Series A | 5.000 | 04-01-49 | 1,300,000 | 1,420,481 | |

| California State Public Works Board Various Capital Projects, Series B | 4.000 | 03-01-45 | 1,520,000 | 1,502,494 | |

| California State University Series A | 3.000 | 11-01-52 | 575,000 | 422,501 | |

| California State University Series A | 5.250 | 11-01-48 | 1,000,000 | 1,114,597 | |

| California State University Series A | 5.250 | 11-01-53 | 350,000 | 387,032 | |

| California Statewide Communities Development Authority Adventist Health System, Series A | 5.000 | 03-01-48 | 1,785,000 | 1,790,279 | |

| California Statewide Communities Development Authority CHF Irvine LLC | 5.000 | 05-15-40 | 1,440,000 | 1,450,871 | |

| California Statewide Communities Development Authority Community Facilities District No. 2020-02 | 5.125 | 09-01-42 | 1,000,000 | 1,009,380 | |

| California Statewide Communities Development Authority Community Facilities District No. 2022-03 | 5.000 | 09-01-43 | 1,020,000 | 989,414 | |

| California Statewide Communities Development Authority Emanate Health, Series A | 4.000 | 04-01-45 | 1,880,000 | 1,754,270 |

| 7 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| California Statewide Communities Development Authority Enloe Medical Center, Series A (A) | 5.250 | 08-15-52 | 1,000,000 | $1,060,528 | |

| California Statewide Communities Development Authority Front Porch Communities & Services | 3.000 | 04-01-37 | 2,000,000 | 1,793,305 | |

| California Statewide Communities Development Authority Front Porch Communities & Services, Series A | 5.000 | 04-01-47 | 750,000 | 761,095 | |

| California Statewide Communities Development Authority Improvement Area No. 3 | 5.000 | 09-01-54 | 550,000 | 543,409 | |

| California Statewide Communities Development Authority Infrastructure Program, Series A | 4.000 | 09-02-51 | 970,000 | 806,954 | |

| California Statewide Communities Development Authority Infrastructure Program, Series B | 5.000 | 09-02-44 | 625,000 | 625,509 | |

| California Statewide Communities Development Authority John Muir Health, Series A | 4.000 | 08-15-46 | 770,000 | 731,473 | |

| California Statewide Communities Development Authority Redlands Community Hospital | 5.000 | 10-01-46 | 1,500,000 | 1,513,166 | |

| California Statewide Communities Development Authority Series 2021-A | 4.000 | 09-02-41 | 990,000 | 893,783 | |

| California Statewide Financing Authority Tobacco Securitization Program, Series C (B)(C) | 9.876 | 06-01-55 | 12,000,000 | 620,318 | |

| California Statewide Financing Authority Tobacco Settlement, Series A | 6.000 | 05-01-37 | 1,595,000 | 1,628,897 | |

| California Statewide Financing Authority Tobacco Settlement, Series B | 6.000 | 05-01-37 | 1,915,000 | 1,955,698 | |

| Campbell Union School District Series 2010-J and Series 2022-A, GO | 4.000 | 08-01-48 | 1,500,000 | 1,453,964 | |

| Campbell Union School District Series 2010-J and Series 2022-A, GO | 4.000 | 08-01-49 | 185,000 | 178,450 | |

| Campbell Union School District Series 2010-J and Series 2022-A, GO | 4.000 | 08-01-50 | 175,000 | 168,535 | |

| Center Joint Unified School District Election of 2008, Series C, GO (A) | 4.125 | 08-01-46 | 1,250,000 | 1,250,282 | |

| Chaffey Joint Union High School District Election of 2012, Series G, GO | 5.250 | 08-01-52 | 2,000,000 | 2,191,623 | |

| Chino Valley Unified School District Election of 2016, Series C, GO (B) | 3.990 | 08-01-36 | 250,000 | 154,220 | |

| Chino Valley Unified School District Election of 2016, Series C, GO (B) | 4.333 | 08-01-40 | 400,000 | 199,453 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 8 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| City & County of San Francisco Community Facilities District No. 2016-1 Improvement Area No. 2, Treasure Island, Series A (C) | 4.000 | 09-01-42 | 250,000 | $224,345 | |

| City & County of San Francisco Infrastructure & Revitalization Financing District No. 1 Series A (C) | 5.000 | 09-01-52 | 900,000 | 836,666 | |

| City of Burbank Water and Power Electric Revenue | 5.000 | 06-01-39 | 400,000 | 443,025 | |

| City of Burbank Water and Power Electric Revenue | 5.000 | 06-01-40 | 700,000 | 772,518 | |

| City of Emeryville Election of 2018, Series B, GO | 4.900 | 08-01-48 | 500,000 | 460,910 | |

| City of Fresno Airport Revenue Series A, AMT (A) | 4.000 | 07-01-42 | 1,000,000 | 952,729 | |

| City of Fresno Airport Revenue Series A, AMT (A) | 5.000 | 07-01-48 | 1,000,000 | 1,037,410 | |

| City of Irvine Community Facilities District No. 2013-3, Great Park | 5.000 | 09-01-49 | 1,730,000 | 1,731,417 | |

| City of Long Beach Alamitos Bay Marina Project | 5.000 | 05-15-45 | 280,000 | 277,324 | |

| City of Long Beach Community Facilities District 6-Pike Project | 6.250 | 10-01-26 | 975,000 | 976,551 | |

| City of Long Beach Water Revenue | 4.000 | 05-01-54 | 1,725,000 | 1,677,459 | |

| City of Long Beach Airport System Revenue Series C, AMT (A) | 5.000 | 06-01-42 | 450,000 | 472,951 | |

| City of Long Beach Harbor Revenue Series A | 5.000 | 05-15-44 | 500,000 | 529,683 | |

| City of Los Angeles Department of Airports Los Angeles International Airport, AMT | 4.125 | 05-15-43 | 1,885,000 | 1,838,662 | |

| City of Los Angeles Department of Airports Los Angeles International Airport, AMT | 5.250 | 05-15-48 | 900,000 | 962,038 | |

| City of Los Angeles Department of Airports Los Angeles International Airport, Series A, AMT | 4.000 | 05-15-44 | 1,400,000 | 1,323,080 | |

| City of Los Angeles Department of Airports Los Angeles International Airport, Series A, AMT | 4.000 | 05-15-49 | 1,500,000 | 1,373,465 | |

| City of Los Angeles Department of Airports Los Angeles International Airport, Series F, AMT | 3.000 | 05-15-49 | 1,000,000 | 735,571 | |

| City of Ontario Community Facilities District No. 56 | 5.250 | 09-01-43 | 900,000 | 924,554 | |

| City of Oroville Oroville Hospital | 5.250 | 04-01-54 | 1,000,000 | 681,886 | |

| City of Palm Desert Community Facilities District No. 2021-1 | 5.000 | 09-01-44 | 1,000,000 | 975,229 | |

| City of Palm Desert Community Facilities District No. 2021-1 | 5.000 | 09-01-53 | 525,000 | 497,878 |

| 9 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| City of Rocklin Community Facilities District No. 10 Whitney (A) | 4.000 | 09-01-43 | 1,950,000 | $1,945,557 | |

| City of Sacramento Greenbriar Community Facilities District No. 2018-3 | 4.000 | 09-01-50 | 500,000 | 419,180 | |

| City of San Francisco Public Utilities Commission Water Revenue Local Water, Series C | 4.000 | 11-01-50 | 1,000,000 | 971,488 | |

| City of San Francisco Public Utilities Commission Water Revenue Regional and Local Water, Series A | 5.250 | 11-01-48 | 2,000,000 | 2,225,845 | |

| City of San Francisco Public Utilities Commission Water Revenue Series A | 4.000 | 11-01-39 | 1,000,000 | 986,736 | |

| City of Vernon Electric System Revenue Series 2022-A | 5.000 | 08-01-41 | 775,000 | 807,688 | |

| City of Victorville Electric Revenue Series A | 5.000 | 05-01-34 | 500,000 | 553,677 | |

| City of Victorville Electric Revenue Series A | 5.000 | 05-01-35 | 540,000 | 597,134 | |

| City of Victorville Electric Revenue Series A | 5.000 | 05-01-36 | 500,000 | 550,896 | |

| Coachella Valley Water District Stormwater System Revenue Certificates of Participation, Series A | 5.000 | 08-01-35 | 920,000 | 1,052,244 | |

| Coachella Valley Water District Stormwater System Revenue Certificates of Participation, Series A | 5.000 | 08-01-36 | 975,000 | 1,112,119 | |

| Compton Community Redevelopment Agency Successor Agency Series A (A) | 5.000 | 08-01-42 | 1,215,000 | 1,299,930 | |

| Contra Costa Water District Water Revenue | 5.000 | 10-01-53 | 900,000 | 977,053 | |

| County of Sacramento Metro Air Park Community Facilities District No. 2000-1 | 5.000 | 09-01-47 | 1,000,000 | 963,713 | |

| CSCDA Community Improvement Authority 1818 Platinum Triangle Anaheim, Series A-2 (C) | 3.250 | 04-01-57 | 300,000 | 216,018 | |

| CSCDA Community Improvement Authority Altana Glendale, Series A-1 (C) | 3.500 | 10-01-46 | 500,000 | 397,478 | |

| CSCDA Community Improvement Authority Altana Glendale, Series A-2 (C) | 4.000 | 10-01-56 | 1,000,000 | 767,016 | |

| CSCDA Community Improvement Authority Monterey Station Apartments, Series A-2 (C) | 3.125 | 07-01-56 | 1,500,000 | 997,636 | |

| CSCDA Community Improvement Authority Orange City Portfolio, Series A-2 (C) | 3.000 | 03-01-57 | 1,200,000 | 815,227 | |

| CSCDA Community Improvement Authority Parallel Apartments Anaheim, Series A (C) | 4.000 | 08-01-56 | 995,000 | 837,993 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 10 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| CSCDA Community Improvement Authority The Link-Glendale, Series A-2 (C) | 4.000 | 07-01-56 | 600,000 | $438,035 | |

| Del Mar Union School District Election of 2018, Series B, GO | 4.000 | 08-01-46 | 1,000,000 | 1,005,947 | |

| Downey Unified School District Series C, GO | 3.000 | 08-01-45 | 1,840,000 | 1,459,159 | |

| Duarte Unified School District Election of 2020, Series B, GO (A) | 4.250 | 08-01-48 | 1,285,000 | 1,298,267 | |

| El Monte City School District Election of 2008, Series C, GO (A) | 4.000 | 08-01-47 | 100,000 | 98,060 | |

| El Monte Union High School District Election of 2018, Series C, GO (D) | 4.000 | 06-01-53 | 750,000 | 727,958 | |

| Encinitas Public Financing Authority | 4.000 | 10-01-49 | 1,010,000 | 978,839 | |

| Encinitas Public Financing Authority | 4.000 | 10-01-54 | 1,000,000 | 960,479 | |

| Encinitas Public Financing Authority | 5.000 | 10-01-39 | 175,000 | 196,219 | |

| Encinitas Public Financing Authority | 5.000 | 10-01-40 | 180,000 | 200,300 | |

| Encinitas Public Financing Authority | 5.000 | 10-01-41 | 190,000 | 209,463 | |

| Foothill-Eastern Transportation Corridor Agency Series B-2 (A) | 3.500 | 01-15-53 | 2,280,000 | 1,953,057 | |

| Golden State Tobacco Securitization Corp. Series B-2 (B) | 5.341 | 06-01-66 | 15,650,000 | 1,704,535 | |

| Golden State Tobacco Securitization Corp. Tobacco Settlement, Series A-1 | 5.000 | 06-01-51 | 1,000,000 | 1,028,048 | |

| Imperial Community College District Election of 2022, Series A, GO (A) | 5.250 | 08-01-53 | 255,000 | 277,522 | |

| Imperial Community College District Election of 2022, Series B, GO (A) | 5.000 | 08-01-54 | 1,000,000 | 1,077,372 | |

| Independent Cities Finance Authority Union City Tropics | 3.250 | 05-15-39 | 1,260,000 | 1,075,846 | |

| Independent Cities Finance Authority Union City Tropics | 4.000 | 05-15-32 | 760,000 | 755,152 | |

| Inland Valley Development Agency Series A | 5.000 | 09-01-44 | 375,000 | 376,755 | |

| Irvine Facilities Financing Authority Great Park Infrastructure Project (A) | 4.000 | 09-01-58 | 1,750,000 | 1,658,573 | |

| Jefferson Union High School District Measure Z, Series A, GO | 5.000 | 08-01-43 | 400,000 | 442,259 | |

| Jefferson Union High School District Measure Z, Series A, GO | 5.000 | 08-01-44 | 570,000 | 627,375 | |

| Jurupa Community Services District Community Facilities District No. 31 Eastvale Project (A) | 4.000 | 09-01-38 | 1,015,000 | 1,021,435 | |

| Jurupa Community Services District Community Facilities District No. 31 Eastvale Project (A) | 4.000 | 09-01-42 | 1,325,000 | 1,313,440 | |

| Kaweah Delta Health Care District Guild Series B | 4.000 | 06-01-37 | 50,000 | 43,191 | |

| La Mesa-Spring Valley School District Election of 2020, Series B, GO | 4.000 | 08-01-42 | 200,000 | 199,798 |

| 11 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| La Mesa-Spring Valley School District Election of 2020, Series B, GO | 4.000 | 08-01-43 | 290,000 | $288,509 | |

| La Mesa-Spring Valley School District Election of 2020, Series B, GO | 4.000 | 08-01-51 | 750,000 | 727,087 | |

| Long Beach Bond Finance Authority Lease Revenue | 5.000 | 08-01-31 | 325,000 | 365,121 | |

| Long Beach Bond Finance Authority Lease Revenue | 5.000 | 08-01-46 | 1,000,000 | 1,062,855 | |

| Long Beach Community College District Election of 2016, Series C, GO | 4.000 | 08-01-45 | 15,000 | 14,901 | |

| Los Angeles Community College District Election of 2008, Series K, GO | 3.000 | 08-01-39 | 1,080,000 | 945,304 | |

| Los Angeles Department of Water & Power Series A | 5.000 | 07-01-43 | 2,500,000 | 2,776,375 | |

| Los Angeles Department of Water & Power Series C | 5.000 | 07-01-51 | 2,000,000 | 2,140,029 | |

| Los Angeles Department of Water & Power Series D | 5.000 | 07-01-52 | 1,000,000 | 1,078,611 | |

| Los Angeles Unified School District Series A, GO | 5.000 | 07-01-34 | 3,500,000 | 4,047,967 | |

| Los Angeles Unified School District Series QRR, GO | 5.250 | 07-01-47 | 2,500,000 | 2,753,601 | |

| Los Angeles Unified School District Series RYQ, GO | 4.000 | 07-01-44 | 1,825,000 | 1,786,497 | |

| Menlo Park City School District, GO | 4.000 | 07-01-38 | 300,000 | 321,067 | |

| Menlo Park City School District, GO | 4.000 | 07-01-39 | 300,000 | 316,405 | |

| Menlo Park City School District, GO | 4.000 | 07-01-40 | 600,000 | 626,075 | |

| Menlo Park City School District, GO | 4.000 | 07-01-41 | 1,000,000 | 1,034,644 | |

| Miracosta Community College District Certificates of Participation, 2023 School Financing Project | 4.500 | 07-01-53 | 1,000,000 | 1,024,220 | |

| Moreno Valley Unified School District Election of 2014, Series C, GO (A) | 3.000 | 08-01-46 | 1,945,000 | 1,526,538 | |

| Moreno Valley Unified School District Election of 2014, Series D, GO (A) | 4.000 | 08-01-45 | 1,000,000 | 981,976 | |

| Mount San Antonio Community College District Election of 2008, Series E, GO (B) | 4.460 | 08-01-45 | 3,010,000 | 1,179,180 | |

| Mountain View School District Election of 2020, Series B, GO (A) | 5.000 | 08-01-49 | 395,000 | 418,973 | |

| M-S-R Energy Authority Series B | 6.500 | 11-01-39 | 1,500,000 | 1,854,375 | |

| M-S-R Energy Authority Series B | 7.000 | 11-01-34 | 10,000 | 12,039 | |

| Norman Y. Mineta San Jose International Airport SJC Series A, AMT | 5.000 | 03-01-47 | 1,500,000 | 1,509,064 | |

| Northern California Energy Authority Commodity Supply Revenue | 5.000 | 12-01-54 | 1,500,000 | 1,586,029 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 12 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| Oak Grove School District Election of 2022, Series A-2, GO | 4.000 | 08-01-49 | 2,000,000 | $1,917,725 | |

| Ontario Public Financing Authority Civic Center Improvements, Series A (A) | 5.000 | 11-01-52 | 1,195,000 | 1,259,041 | |

| Orange County Community Facilities District 2017-1 Esencia Village Improvement Area No. 1, Series A | 5.000 | 08-15-47 | 1,565,000 | 1,578,323 | |

| Orange County Community Facilities District No. 2021-1 Rienda, Series A | 5.000 | 08-15-52 | 500,000 | 496,768 | |

| Orange County Community Facilities District Rienda Phase 2B | 5.500 | 08-15-53 | 700,000 | 712,024 | |

| Pacifica School District Series C, GO (A)(B) | 3.806 | 08-01-26 | 1,000,000 | 921,102 | |

| Palmdale Water District Public Financing Authority Series A (A) | 4.000 | 10-01-49 | 2,500,000 | 2,432,228 | |

| Palmdale Water District Public Financing Authority Series A (A) | 4.125 | 10-01-50 | 1,000,000 | 989,171 | |

| Poway Public Financing Authority Series A (A) | 5.250 | 06-01-53 | 2,000,000 | 2,175,357 | |

| Redwood City Public Facilities & Infrastructure Authority Veterans Memorial Building Senior Center | 3.000 | 06-01-51 | 1,795,000 | 1,332,776 | |

| Regents of the University of California Medical Center Pooled Revenue Series P | 4.000 | 05-15-43 | 1,500,000 | 1,470,914 | |

| Rialto Public Financing Authority Police Station Project, Series A | 5.250 | 06-01-53 | 1,000,000 | 1,073,986 | |

| River Islands Public Financing Authority Community Facilities District No. 2003-1, Series A | 5.000 | 09-01-48 | 1,000,000 | 983,976 | |

| River Islands Public Financing Authority Community Facilities District No. 2016-1 (A) | 4.250 | 09-01-42 | 1,000,000 | 1,000,270 | |

| River Islands Public Financing Authority Community Facilities District No. 2016-1 (A) | 5.250 | 09-01-52 | 500,000 | 536,683 | |

| River Islands Public Financing Authority Lathrop Irrigation District (A) | 4.000 | 09-01-35 | 1,125,000 | 1,153,728 | |

| Riverside County Transportation Commission Route 91 Express Lanes, Series C | 4.000 | 06-01-47 | 1,665,000 | 1,565,773 | |

| Sacramento City Unified School District Series B, GO (A) | 5.000 | 08-01-43 | 1,000,000 | 1,087,989 | |

| Sacramento Municipal Utility District Series H | 4.000 | 08-15-45 | 750,000 | 744,924 | |

| Sacramento Municipal Utility District Series M | 5.000 | 11-15-39 | 1,000,000 | 1,139,812 | |

| Sacramento Municipal Utility District Series M | 5.000 | 11-15-54 | 1,000,000 | 1,092,362 | |

| Salinas City Elementary School District Election of 2022, Measure G, Series A, GO (A) | 4.000 | 08-01-53 | 95,000 | 90,971 |

| 13 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| Salinas Union High School District Certificates of Participation, Workforce Housing Project (A) | 4.125 | 06-01-42 | 125,000 | $125,431 | |

| Salinas Union High School District Series A, GO | 4.000 | 08-01-47 | 1,200,000 | 1,188,757 | |

| Salinas Union High School District Series B, GO | 4.000 | 08-01-49 | 1,200,000 | 1,190,595 | |

| San Bernardino Community College District Election of 2002, Series D, GO (B) | 3.540 | 08-01-33 | 2,000,000 | 1,447,033 | |

| San Bernardino Community College District Election of 2008, Series B, GO (B) | 4.558 | 08-01-44 | 1,530,000 | 614,513 | |

| San Diego County Regional Airport Authority Series A | 4.000 | 07-01-46 | 2,000,000 | 1,931,695 | |

| San Diego County Regional Airport Authority Series A | 4.000 | 07-01-51 | 2,000,000 | 1,909,972 | |

| San Diego County Regional Airport Authority Series B, AMT | 4.000 | 07-01-39 | 1,000,000 | 968,029 | |

| San Diego Unified School District Election of 2008, Series K-2, GO (B) | 4.009 | 07-01-33 | 205,000 | 142,696 | |

| San Diego Unified School District Election of 2012, Series O-2, GO | 4.250 | 07-01-47 | 1,460,000 | 1,477,925 | |

| San Diego Unified School District Election of 2012, Series ZR-5C, GO (D) | 5.000 | 07-01-39 | 1,000,000 | 1,103,944 | |

| San Diego Unified School District Election of 2022, Series A-3, GO | 4.000 | 07-01-53 | 2,700,000 | 2,606,983 | |

| San Francisco Bay Area Rapid Transit District Election of 2016, Series D1, GO (E) | 4.000 | 08-01-37 | 2,810,000 | 2,852,700 | |

| San Francisco Bay Area Rapid Transit District Election of 2016, Series D1, GO (E) | 4.250 | 08-01-52 | 7,305,000 | 7,313,839 | |

| San Francisco Bay Area Rapid Transit District Sales Tax Revenue Series A | 3.000 | 07-01-44 | 2,000,000 | 1,590,560 | |

| San Francisco City & County Airport Commission Series A, AMT | 4.000 | 05-01-49 | 10,000 | 10,006 | |

| San Francisco City & County Airport Commission Series A, AMT | 4.000 | 05-01-49 | 780,000 | 703,042 | |

| San Francisco City & County Airport Commission Series A, AMT | 5.000 | 05-01-38 | 1,000,000 | 1,070,691 | |

| San Francisco City & County Airport Commission Series A, AMT | 5.000 | 05-01-49 | 1,470,000 | 1,495,523 | |

| San Francisco City & County Airport Commission Series E, AMT | 5.000 | 05-01-50 | 1,705,000 | 1,733,525 | |

| San Francisco City & County Airport Commission SFO Fuel Company, AMT | 5.000 | 01-01-47 | 2,000,000 | 2,040,085 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 14 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| San Francisco City & County Public Utilities Commission Power Revenue Series A | 5.000 | 11-01-45 | 1,500,000 | $1,513,337 | |

| San Francisco City & County Public Utilities Commission Wastewater Revenue Series A | 4.000 | 10-01-51 | 1,155,000 | 1,121,487 | |

| San Francisco City & County Redevelopment Successor Agency Mission Bay Project, Series A | 5.000 | 08-01-43 | 375,000 | 375,252 | |

| San Joaquin Hills Transportation Corridor Agency Series A | 4.000 | 01-15-50 | 1,000,000 | 941,794 | |

| San Joaquin Hills Transportation Corridor Agency Toll Road Revenue, Series A | 5.000 | 01-15-33 | 1,500,000 | 1,648,641 | |

| San Jose Evergreen Community College District Election of 2016, Series C, GO | 4.000 | 09-01-43 | 1,000,000 | 1,010,390 | |

| San Jose Financing Authority Series B | 5.000 | 11-01-52 | 1,000,000 | 1,087,535 | |

| San Luis Obispo Public Financing Authority Cultural Arts District Parking Project | 5.000 | 12-01-53 | 1,490,000 | 1,614,609 | |

| San Mateo Foster City School District Election of 2020, Series B, GO | 4.000 | 08-01-42 | 1,000,000 | 1,016,043 | |

| San Ysidro School District Series A, GO (A) | 4.000 | 08-01-43 | 2,000,000 | 1,938,132 | |

| Santa Ana Financing Authority Police Administration & Holding Facility, Series A (A) | 6.250 | 07-01-24 | 1,125,000 | 1,126,916 | |

| Santa Ana Financing Authority Prerefunded, Police Administration & Holding Facility, Series A (A) | 6.250 | 07-01-24 | 1,130,000 | 1,131,878 | |

| Santa Ana Unified School District Election of 2018, Series C, GO | 4.000 | 08-01-44 | 2,000,000 | 2,004,195 | |

| Santa Clara Valley Water District Safe Clean Water Revenue Series A | 5.000 | 08-01-47 | 1,000,000 | 1,081,107 | |

| Santa Cruz County Capital Financing Authority Green Bond | 4.125 | 06-01-48 | 1,005,000 | 1,001,145 | |

| Santa Maria Joint Union High School District Election of 2016, GO | 3.000 | 08-01-41 | 1,000,000 | 822,128 | |

| Santa Maria Joint Union High School District Election of 2016, GO | 3.000 | 08-01-42 | 1,670,000 | 1,359,958 | |

| Santa Monica Community College District Series B, GO | 4.000 | 08-01-45 | 1,155,000 | 1,160,691 | |

| Sebastopol Union School District Series B, GO | 5.000 | 08-01-53 | 2,530,000 | 2,719,155 | |

| Shasta Union High School District Election of 2016, GO | 4.000 | 08-01-50 | 1,500,000 | 1,446,888 | |

| Southern California Public Power Authority Apex Power Project, Series A | 5.000 | 07-01-38 | 1,000,000 | 1,002,938 |

| 15 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| Southern California Public Power Authority Natural Gas Project, Series A | 5.250 | 11-01-26 | 2,000,000 | $2,037,890 | |

| Southern California Public Power Authority Southern Transmission System Renewal Project, Series 2024-1 | 5.000 | 07-01-53 | 1,750,000 | 1,911,263 | |

| State of California Various Purpose, GO | 5.000 | 10-01-42 | 2,000,000 | 2,202,388 | |

| State of California Various Purpose, GO | 5.000 | 10-01-45 | 1,100,000 | 1,203,986 | |

| State of California, GO | 4.000 | 09-01-52 | 2,000,000 | 1,941,320 | |

| State of California, GO | 5.000 | 09-01-53 | 2,000,000 | 2,172,453 | |

| Stockton Community Facilities District Imporvement Area No. 3, Westlake Villages | 5.000 | 09-01-54 | 625,000 | 611,835 | |

| Stockton Unified School District, GO (A) | 5.000 | 08-01-38 | 905,000 | 1,034,192 | |

| Stockton Unified School District, GO (A) | 5.000 | 08-01-41 | 500,000 | 560,406 | |

| Sweetwater Union High School District Election of 2018, Series A-1, GO | 5.000 | 08-01-52 | 2,000,000 | 2,139,855 | |

| Three Rivers Levee Improvement Authority Community Facilities District No. 2006-1, Series A | 4.000 | 09-01-51 | 1,000,000 | 819,278 | |

| Tobacco Securitization Authority of Southern California Tobacco Settlement, Series B1-2 | 5.000 | 06-01-48 | 1,960,000 | 1,965,592 | |

| Transbay Joint Powers Authority Series A | 5.000 | 10-01-32 | 345,000 | 357,052 | |

| Union Elementary School District Election of 2022, Series A, GO | 4.000 | 09-01-52 | 1,000,000 | 968,319 | |

| University of California Series AZ | 5.000 | 05-15-48 | 1,500,000 | 1,563,715 | |

| University of California Series BK | 5.000 | 05-15-52 | 1,720,000 | 1,840,026 | |

| University of California Series BM | 5.000 | 05-15-39 | 1,000,000 | 1,123,632 | |

| University of California Series BV | 5.000 | 05-15-43 | 1,000,000 | 1,113,252 | |

| University of California Series BV | 5.000 | 05-15-44 | 500,000 | 554,821 | |

| Val Verde Unified School District Election of 2020, Series B, GO (A) | 4.000 | 08-01-51 | 1,345,000 | 1,289,554 | |

| Vista Unified School District Series B, GO (A) | 4.250 | 08-01-44 | 1,500,000 | 1,529,067 | |

| Vista Unified School District Series B, GO (A) | 5.000 | 08-01-42 | 1,000,000 | 1,103,206 | |

| West Hollywood Public Financing Authority Series A | 3.000 | 04-01-42 | 2,000,000 | 1,617,922 | |

| William S. Hart Union High School District Community Facilities District No. 2015-1 | 5.000 | 09-01-47 | 1,000,000 | 1,007,264 | |

| Windsor Unified School District Election of 2016, GO (A) | 4.000 | 08-01-46 | 2,100,000 | 2,101,973 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 16 |

| Rate (%) | Maturity date | Par value^ | Value | ||

| California (continued) | |||||

| Yorba Linda Water District Public Financing Corp. Series A | 4.000 | 10-01-52 | 190,000 | $186,399 | |

| Connecticut 0.1% | 448,213 | ||||

| Town of Hamden Whitney Center Project | 5.000 | 01-01-50 | 500,000 | 448,213 | |

| Indiana 0.2% | 792,990 | ||||

| Kokomo Redevelopment Authority (A) | 4.000 | 08-01-42 | 820,000 | 792,990 | |

| Massachusetts 0.2% | 822,867 | ||||

| Town of Maynard, GO | 4.000 | 04-15-50 | 870,000 | 822,867 | |

| New Hampshire 0.8% | 2,907,786 | ||||

| New Hampshire Business Finance Authority Wheeling Power Company Project, Series A (C) | 6.890 | 04-01-34 | 2,850,000 | 2,907,786 | |

| Ohio 0.7% | 2,795,024 | ||||

| Buckeye Tobacco Settlement Financing Authority Series B-2, Class 2 | 5.000 | 06-01-55 | 1,495,000 | 1,337,595 | |

| Port of Greater Cincinnati Development Authority Duke Energy Convention Center Project, Series B (A) | 4.375 | 12-01-58 | 1,500,000 | 1,457,429 | |

| Puerto Rico 2.1% | 8,041,259 | ||||

| Puerto Rico Commonwealth CW Guarantee Bond Claims, GO (B) | 2.456 | 11-01-43 | 4,705,015 | 2,917,109 | |

| Puerto Rico Commonwealth Series A-1, GO | 4.000 | 07-01-46 | 2,500,000 | 2,251,542 | |

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Series A-1 (B) | 5.239 | 07-01-46 | 3,825,000 | 1,218,344 | |

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Series A-1 (B) | 5.387 | 07-01-51 | 3,450,000 | 815,976 | |

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Series A-2 | 4.784 | 07-01-58 | 850,000 | 838,288 | |

| South Carolina 0.4% | 1,589,185 | ||||

| Spartanburg County School District No. 5, GO | 3.000 | 03-01-35 | 1,750,000 | 1,589,185 | |

| South Dakota 0.7% | 2,759,270 | ||||

| South Dakota Health & Educational Facilities Authority Avera Health, Series A | 4.000 | 07-01-44 | 2,900,000 | 2,759,270 | |

| Texas 0.8% | 2,803,902 | ||||

| New Caney Independent School District, GO (D) | 4.000 | 02-15-49 | 1,000,000 | 944,965 | |

| New Caney Independent School District, GO (D) | 4.000 | 02-15-54 | 1,000,000 | 926,008 |

| 17 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Rate (%) | Maturity date | Par value^ | Value | ||

| Texas (continued) | |||||

| Waxahachie Independent School District, GO (D) | 4.000 | 02-15-53 | 1,000,000 | $932,929 | |

| Virgin Islands 0.6% | 2,071,447 | ||||

| Matching Fund Special Purpose Securitization Corp. Series A | 5.000 | 10-01-39 | 2,000,000 | 2,071,447 | |

| Shares | Value | ||||

| Closed-end funds 0.3% | $1,158,050 | ||||

| (Cost $1,039,842) | |||||

| Invesco California Value Municipal Income Trust | 115,000 | 1,158,050 | |||

| Yield (%) | Shares | Value | |||

| Short-term investments 0.9% | $3,328,510 | ||||

| (Cost $3,328,409) | |||||

| Short-term funds 0.9% | |||||

| John Hancock Collateral Trust (F) | 5.2280(G) | 332,961 | 3,328,510 | ||

| Total investments (Cost $387,192,358) 102.0% | $385,273,526 | ||||

| Other assets and liabilities, net (2.0%) | (7,384,986) | ||||

| Total net assets 100.0% | $377,888,540 | ||||

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. | |

| ^All par values are denominated in U.S. dollars unless otherwise indicated. | |

| Security Abbreviations and Legend | |

| AMT | Interest earned from these securities may be considered a tax preference item for purpose of the Federal Alternative Minimum Tax. |

| GO | General Obligation |

| (A) | Bond is insured by one or more of the companies listed in the insurance coverage table below. |

| (B) | Zero coupon bonds are issued at a discount from their principal amount in lieu of paying interest periodically. Rate shown is the effective yield at period end. |

| (C) | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. |

| (D) | Security purchased or sold on a when-issued or delayed delivery basis. |

| (E) | All or a portion of this security represents the municipal bond held by a trust that issues residual inverse floating rate interests. See Note 2 for more information. |

| (F) | Investment is an affiliate of the fund, the advisor and/or subadvisor. |

| (G) | The rate shown is the annualized seven-day yield as of 5-31-24. |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 18 |

| Insurance coverage | As a % of total investments |

| Assured Guaranty Municipal Corp. | 7.0 |

| Build America Mutual Assurance Company | 6.4 |

| National Public Finance Guarantee Corp. | 0.8 |

| California Mortgage Insurance | 0.8 |

| TOTAL | 15.0 |

| 19 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | | SEE NOTES TO FINANCIAL STATEMENTS |

| Assets | |

| Unaffiliated investments, at value (Cost $383,863,949) | $381,945,016 |

| Affiliated investments, at value (Cost $3,328,409) | 3,328,510 |

| Total investments, at value (Cost $387,192,358) | 385,273,526 |

| Interest receivable | 3,995,747 |

| Receivable for fund shares sold | 697,208 |

| Receivable for investments sold | 248,284 |

| Other assets | 39,434 |

| Total assets | 390,254,199 |

| Liabilities | |

| Payable for floating rate interests issued | 5,095,000 |

| Distributions payable | 39,163 |

| Payable for investments purchased | 487,674 |

| Payable for delayed delivery securities purchased | 5,736,622 |

| Payable for fund shares repurchased | 727,230 |

| Payable to affiliates | |

| Investment management fees | 148,089 |

| Accounting and legal services fees | 16,867 |

| Transfer agent fees | 4,712 |

| Distribution and service fees | 28,418 |

| Trustees’ fees | 212 |

| Other liabilities and accrued expenses | 81,672 |

| Total liabilities | 12,365,659 |

| Net assets | $377,888,540 |

| Net assets consist of | |

| Paid-in capital | $384,162,639 |

| Total distributable earnings (loss) | (6,274,099) |

| Net assets | $377,888,540 |

| Net asset value per share | |

| Based on net asset value and shares outstanding - the fund has an unlimited number of shares authorized with no par value | |

| Class A ($224,938,089 ÷ 22,806,020 shares)1 | $9.86 |

| Class C ($3,886,547 ÷ 394,075 shares)1 | $9.86 |

| Class I ($99,483,193 ÷ 10,080,596 shares) | $9.87 |

| Class R6 ($49,580,711 ÷ 5,021,987 shares) | $9.87 |

| Maximum offering price per share | |

| Class A (net asset value per share ÷ 96%)2 | $10.27 |

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| 2 | On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced. |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK California Municipal Bond Fund | 20 |

| Investment income | |

| Interest | $13,151,106 |

| Dividends from affiliated investments | 527,512 |

| Dividends | 46,794 |

| Total investment income | 13,725,412 |

| Expenses | |

| Investment management fees | 1,630,973 |

| Distribution and service fees | 344,091 |

| Interest expense | 191,867 |

| Accounting and legal services fees | 64,435 |

| Transfer agent fees | 50,897 |

| Trustees’ fees | 7,634 |

| Custodian fees | 60,903 |

| State registration fees | 48,648 |

| Printing and postage | 23,637 |

| Professional fees | 69,103 |

| Other | 25,710 |

| Total expenses | 2,517,898 |

| Less expense reductions | (172,580) |

| Net expenses | 2,345,318 |

| Net investment income | 11,380,094 |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Unaffiliated investments | (4,726,174) |

| Affiliated investments | (7,941) |

| (4,734,115) | |

| Change in net unrealized appreciation (depreciation) of | |

| Unaffiliated investments | 6,350,003 |

| Affiliated investments | 39 |

| 6,350,042 | |

| Net realized and unrealized gain | 1,615,927 |

| Increase in net assets from operations | $12,996,021 |

| 21 | JOHN HANCOCK California Municipal Bond Fund | | SEE NOTES TO FINANCIAL STATEMENTS |

| Year ended 5-31-24 | Year ended 5-31-23 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment income | $11,380,094 | $8,232,542 |

| Net realized loss | (4,734,115) | (1,467,255) |

| Change in net unrealized appreciation (depreciation) | 6,350,042 | (7,307,629) |

| Increase (decrease) in net assets resulting from operations | 12,996,021 | (542,342) |

| Distributions to shareholders | ||

| From earnings | ||

| Class A | (6,919,615) | (6,357,879) |

| Class C | (106,175) | (162,323) |

| Class I | (2,654,619) | (1,708,294) |

| Class R6 | (1,374,654) | (792,549) |

| Total distributions | (11,055,063) | (9,021,045) |

| From fund share transactions | 89,668,546 | 76,174,163 |

| Total increase | 91,609,504 | 66,610,776 |

| Net assets | ||

| Beginning of year | 286,279,036 | 219,668,260 |

| End of year | $377,888,540 | $286,279,036 |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK California Municipal Bond Fund | 22 |

| CLASS A SHARES Period ended | 5-31-24 | 5-31-23 | 5-31-22 | 5-31-21 | 5-31-20 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $9.73 | $10.14 | $11.06 | $10.66 | $10.94 |

| Net investment income1 | 0.34 | 0.32 | 0.27 | 0.30 | 0.34 |

| Net realized and unrealized gain (loss) on investments | 0.12 | (0.39) | (0.84) | 0.40 | (0.20) |

| Total from investment operations | 0.46 | (0.07) | (0.57) | 0.70 | 0.14 |

| Less distributions | |||||

| From net investment income | (0.33) | (0.31) | (0.28) | (0.30) | (0.34) |

| From net realized gain | — | (0.03) | (0.07) | — | (0.08) |

| Total distributions | (0.33) | (0.34) | (0.35) | (0.30) | (0.42) |

| Net asset value, end of period | $9.86 | $9.73 | $10.14 | $11.06 | $10.66 |

| Total return (%)2,3 | 4.86 | (0.55) | (5.26) | 6.64 | 1.22 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $225 | $188 | $181 | $181 | $173 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions4 | 0.83 | 0.85 | 0.82 | 0.85 | 0.85 |

| Expenses including reductions4 | 0.78 | 0.79 | 0.81 | 0.84 | 0.84 |

| Net investment income | 3.51 | 3.26 | 2.53 | 2.76 | 3.12 |

| Portfolio turnover (%) | 44 | 23 | 17 | 23 | 22 |

| 1 | Based on average daily shares outstanding. |

| 2 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 3 | Does not reflect the effect of sales charges, if any. |

| 4 | Includes interest expense of 0.06% and 0.04% for the periods ended 5-31-24 and 5-31-23, respectively. |

| 23 | JOHN HANCOCK California Municipal Bond Fund | | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS C SHARES Period ended | 5-31-24 | 5-31-23 | 5-31-22 | 5-31-21 | 5-31-20 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $9.73 | $10.14 | $11.06 | $10.66 | $10.94 |

| Net investment income1 | 0.27 | 0.24 | 0.19 | 0.22 | 0.26 |

| Net realized and unrealized gain (loss) on investments | 0.12 | (0.38) | (0.84) | 0.40 | (0.20) |

| Total from investment operations | 0.39 | (0.14) | (0.65) | 0.62 | 0.06 |

| Less distributions | |||||

| From net investment income | (0.26) | (0.24) | (0.20) | (0.22) | (0.26) |

| From net realized gain | — | (0.03) | (0.07) | — | (0.08) |

| Total distributions | (0.26) | (0.27) | (0.27) | (0.22) | (0.34) |

| Net asset value, end of period | $9.86 | $9.73 | $10.14 | $11.06 | $10.66 |

| Total return (%)2,3 | 4.07 | (1.29) | (5.97) | 5.85 | 0.47 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $4 | $5 | $8 | $11 | $16 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions4 | 1.68 | 1.71 | 1.67 | 1.70 | 1.70 |

| Expenses including reductions4 | 1.53 | 1.55 | 1.56 | 1.59 | 1.59 |

| Net investment income | 2.76 | 2.51 | 1.78 | 2.02 | 2.37 |

| Portfolio turnover (%) | 44 | 23 | 17 | 23 | 22 |

| 1 | Based on average daily shares outstanding. |

| 2 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 3 | Does not reflect the effect of sales charges, if any. |

| 4 | Includes interest expense of 0.06% and 0.04% for the periods ended 5-31-24 and 5-31-23, respectively. |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK California Municipal Bond Fund | 24 |

| CLASS I SHARES Period ended | 5-31-24 | 5-31-23 | 5-31-22 | 5-31-21 | 5-31-20 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $9.73 | $10.15 | $11.07 | $10.66 | $10.94 |

| Net investment income1 | 0.36 | 0.33 | 0.29 | 0.32 | 0.35 |

| Net realized and unrealized gain (loss) on investments | 0.13 | (0.39) | (0.84) | 0.41 | (0.20) |

| Total from investment operations | 0.49 | (0.06) | (0.55) | 0.73 | 0.15 |

| Less distributions | |||||

| From net investment income | (0.35) | (0.33) | (0.30) | (0.32) | (0.35) |

| From net realized gain | — | (0.03) | (0.07) | — | (0.08) |

| Total distributions | (0.35) | (0.36) | (0.37) | (0.32) | (0.43) |

| Net asset value, end of period | $9.87 | $9.73 | $10.15 | $11.07 | $10.66 |

| Total return (%)2 | 5.12 | (0.50) | (5.11) | 6.90 | 1.37 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $99 | $64 | $19 | $13 | $15 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions3 | 0.68 | 0.70 | 0.67 | 0.70 | 0.70 |

| Expenses including reductions3 | 0.63 | 0.64 | 0.66 | 0.69 | 0.69 |

| Net investment income | 3.66 | 3.41 | 2.68 | 2.90 | 3.25 |

| Portfolio turnover (%) | 44 | 23 | 17 | 23 | 22 |

| 1 | Based on average daily shares outstanding. |

| 2 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 3 | Includes interest expense of 0.06% and 0.04% for the periods ended 5-31-24 and 5-31-23, respectively. |

| 25 | JOHN HANCOCK California Municipal Bond Fund | | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS R6 SHARES Period ended | 5-31-24 | 5-31-23 | 5-31-22 | 5-31-21 | 5-31-20 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $9.74 | $10.15 | $11.07 | $10.66 | $10.94 |

| Net investment income1 | 0.36 | 0.33 | 0.29 | 0.32 | 0.36 |

| Net realized and unrealized gain (loss) on investments | 0.12 | (0.38) | (0.83) | 0.41 | (0.20) |

| Total from investment operations | 0.48 | (0.05) | (0.54) | 0.73 | 0.16 |

| Less distributions | |||||

| From net investment income | (0.35) | (0.33) | (0.31) | (0.32) | (0.36) |

| From net realized gain | — | (0.03) | (0.07) | — | (0.08) |

| Total distributions | (0.35) | (0.36) | (0.38) | (0.32) | (0.44) |

| Net asset value, end of period | $9.87 | $9.74 | $10.15 | $11.07 | $10.66 |

| Total return (%)2 | 5.03 | (0.38) | (5.08) | 6.93 | 1.40 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $50 | $30 | $12 | $9 | $7 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions3 | 0.67 | 0.69 | 0.63 | 0.66 | 0.67 |

| Expenses including reductions3 | 0.62 | 0.63 | 0.63 | 0.65 | 0.66 |

| Net investment income | 3.67 | 3.41 | 2.70 | 2.93 | 3.28 |

| Portfolio turnover (%) | 44 | 23 | 17 | 23 | 22 |

| 1 | Based on average daily shares outstanding. |

| 2 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 3 | Includes interest expense of 0.06% and 0.04% for the periods ended 5-31-24 and 5-31-23, respectively. |

| SEE NOTES TO FINANCIAL STATEMENTS | | JOHN HANCOCK California Municipal Bond Fund | 26 |

| 27 | JOHN HANCOCK California Municipal Bond Fund | |

| Total value at 5-31-24 | Level 1 quoted price | Level 2 significant observable inputs | Level 3 significant unobservable inputs | |

| Investments in securities: | ||||

| Assets | ||||

| Municipal bonds | $380,786,966 | — | $380,786,966 | — |

| Closed-end funds | 1,158,050 | $1,158,050 | — | — |

| Short-term investments | 3,328,510 | 3,328,510 | — | — |

| Total investments in securities | $385,273,526 | $4,486,560 | $380,786,966 | — |

| | JOHN HANCOCK California Municipal Bond Fund | 28 |

| TOB floaters outstanding | $5,095,000 |

| Interest rate (%) | 3.37% |

| Collateral for TOB floaters outstanding | $7,703,563 |

| Average TOB floaters outstanding | $4,696,708 |

| Average interest rate (%) | 4.09% |

| 29 | JOHN HANCOCK California Municipal Bond Fund | |

| | JOHN HANCOCK California Municipal Bond Fund | 30 |

| May 31, 2024 | May 31, 2023 | |

| Ordinary income | $159,489 | $153,777 |

| Exempt Income | 10,895,574 | 8,077,742 |

| Long-term capital gains | — | 789,526 |

| Total | $11,055,063 | $9,021,045 |

| 31 | JOHN HANCOCK California Municipal Bond Fund | |

| Class | Expense reduction |

| Class A | $106,940 |

| Class C | 2,108 |

| Class I | 39,249 |

| Class | Expense reduction |

| Class R6 | $20,287 |

| Total | $168,584 |

| Class | Rule 12b-1 Fee |

| Class A | 0.15% |

| Class C | 1.00% |

| | JOHN HANCOCK California Municipal Bond Fund | 32 |

| Class | Distribution and service fees | Transfer agent fees |

| Class A | $304,132 | $35,415 |

| Class C | 39,959 | 696 |

| Class I | — | 13,010 |

| Class R6 | — | 1,776 |

| Total | $344,091 | $50,897 |

| Year Ended 5-31-24 | Year Ended 5-31-23 | |||

| Shares | Amount | Shares | Amount | |

| Class A shares | ||||

| Sold | 7,071,539 | $69,444,023 | 5,346,401 | $52,160,877 |

| Distributions reinvested | 659,203 | 6,447,436 | 596,376 | 5,808,527 |

| Repurchased | (4,245,390) | (40,711,927) | (4,447,616) | (43,216,692) |

| Net increase | 3,485,352 | $35,179,532 | 1,495,161 | $14,752,712 |

| Class C shares | ||||

| Sold | 108,159 | $1,065,374 | 90,279 | $886,250 |

| Distributions reinvested | 9,676 | 94,596 | 14,246 | 138,718 |

| Repurchased | (205,130) | (2,005,565) | (372,372) | (3,634,831) |

| Net decrease | (87,295) | $(845,595) | (267,847) | $(2,609,863) |

| 33 | JOHN HANCOCK California Municipal Bond Fund | |

| Year Ended 5-31-24 | Year Ended 5-31-23 | |||

| Shares | Amount | Shares | Amount | |

| Class I shares | ||||

| Sold | 7,041,273 | $69,464,336 | 6,480,980 | $63,457,049 |

| Distributions reinvested | 270,049 | 2,642,512 | 173,875 | 1,693,883 |

| Repurchased | (3,766,362) | (35,954,443) | (1,970,598) | (19,157,990) |

| Net increase | 3,544,960 | $36,152,405 | 4,684,257 | $45,992,942 |

| Class R6 shares | ||||

| Sold | 2,969,223 | $29,049,171 | 2,712,508 | $26,429,221 |

| Distributions reinvested | 140,256 | 1,374,565 | 81,253 | 792,535 |

| Repurchased | (1,167,899) | (11,241,532) | (943,750) | (9,183,384) |

| Net increase | 1,941,580 | $19,182,204 | 1,850,011 | $18,038,372 |

| Total net increase | 8,884,597 | $89,668,546 | 7,761,582 | $76,174,163 |

| Dividends and distributions | |||||||||

| Affiliate | Ending share amount | Beginning value | Cost of purchases | Proceeds from shares sold | Realized gain (loss) | Change in unrealized appreciation (depreciation) | Income distributions received | Capital gain distributions received | Ending value |

| John Hancock Collateral Trust | 332,961 | $3,774,313 | $122,362,012 | $(122,799,913) | $(7,941) | $39 | $527,512 | — | $3,328,510 |

| | JOHN HANCOCK California Municipal Bond Fund | 34 |

| 35 | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | |

| | JOHN HANCOCK CALIFORNIA MUNICIPAL BOND FUND | 36 |

200 Berkeley Street, Boston, MA 02116, 800-225-5291, jhinvestments.com

| MF3619752 | 53A 5/24 |

ITEM 8. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PROXY DISCLOSURE FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Information included in Item 7, if applicable.

ITEM 10. REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Refer to information included in Item 7.

ITEM 11. STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT.

Information included in Item 7, if applicable.

ITEM 12. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 13. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 14. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATE PURCHASERS.

Not applicable.

ITEM 15. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The registrant has adopted procedures by which shareholders may recommend nominees to the registrant's Board of Trustees. A copy of the procedures is filed as an exhibit to this Form N-CSR. See attached "John Hancock Funds – Nominating, Governance and Administration Committee Charter".

ITEM 16. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 17. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 18. RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION.

Not applicable.

ITEM 19. EXHIBITS.