| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-5979 |

| |

| John Hancock California Tax-Free Income Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| Date of fiscal year end: | May 31 |

| |

| Date of reporting period: | November 30, 2011 |

Item 1. Schedule of Investments.

A look at performance

Total returns for the period ended November 30, 2011

| | | | | | | | | | | | |

| | | | | | | | | | | | | SEC 30-day |

| | Average annual total returns (%) | | Cumulative total returns (%) | | | SEC 30-day | | yield (%) |

| | with maximum sales charge | | with maximum sales charge | | | yield (%) | | unsubsidized1 |

|

| | | | | | | | | | | as of | | as of |

| | 1-year | 5-year | 10-year | | 6-months | 1-year | 5-year | 10-year | | 11-30-11 | | 11-30-11 |

|

| Class A | 2.32 | 2.63 | 3.78 | | 1.07 | 2.32 | 13.88 | 44.95 | | 3.85 | | 3.85 |

|

| Class B | 1.27 | 2.37 | 3.56 | | 0.37 | 1.27 | 12.44 | 41.89 | | 3.28 | | 3.18 |

|

| Class C | 5.27 | 2.71 | 3.39 | | 4.37 | 5.27 | 14.32 | 39.54 | | 3.28 | | 3.18 |

|

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 4.5% and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective 7-15-04. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectus for the Fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 9-30-12 for Class B and Class C shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | |

| | Class A | Class B | Class C | | | |

| Net (%) | 0.86 | 1.61 | 1.61 | | | |

| Gross (%) | 0.86 | 1.71 | 1.71 | | | |

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

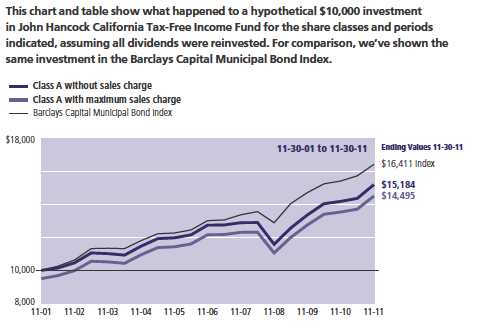

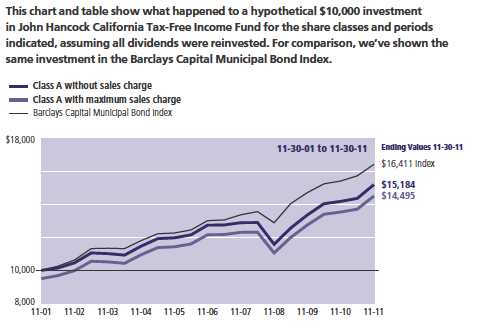

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. Please note that a portion of the Fund’s income may be subject to taxes, and some investors may be subject to the Alternative Minimum Tax (AMT). Also note that capital gains are taxable. The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| |

| 6 | California Tax-Free Income Fund | Semiannual report |

| | | | |

| | | Without | With maximum | |

| | Start date | sales charge | sales charge | Index |

|

| Class B2 | 11-30-01 | $14,189 | $14,189 | $16,411 |

|

| Class C2 | 11-30-01 | 13,954 | 13,954 | 16,411 |

|

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective 7-15-04.

Barclays Capital Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would have resulted in lower values if they did.

1 Unsubsidized yield reflects what the yield would have been without the effect of reimbursements and waivers.

2 No contingent deferred sales charge is applicable.

| |

| Semiannual report | California Tax-Free Income Fund | 7 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on June 1, 2011 with the same investment held until November 30, 2011.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 6-1-11 | on 11-30-11 | period ended 11-30-111 |

|

| Class A | $1,000.00 | $1,057.80 | $4.37 |

|

| Class B | 1,000.00 | 1,053.70 | 8.37 |

|

| Class C | 1,000.00 | 1,053.70 | 8.37 |

|

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at November 30, 2011, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | California Tax-Free Income Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on June 1, 2011, with the same investment held until November 30, 2011. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 6-1-11 | on 11-30-11 | period ended 11-30-111 |

|

| Class A | $1,000.00 | $1,020.80 | $4.29 |

|

| Class B | 1,000.00 | 1,016.90 | 8.22 |

|

| Class C | 1,000.00 | 1,016.90 | 8.22 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 0.85%, 1.63% and 1.63% for Class A, Class B and Class C shares, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

| |

| Semiannual report | California Tax-Free Income Fund | 9 |

Portfolio summary

| | | | |

| Top 10 Holdings (28.0% of Net Assets on 11-30-11)1,2 | |

|

| Golden State Tobacco Securitization Corp., 5.000%, 6-1-35 | 4.9% |

|

| Santa Ana Financing Authority, 6.250%, 7-1-24 | 4.2% |

|

| New Haven Unified School District, Zero Coupon, 8-1-22 | 3.1% |

|

| San Bernardino County, 5.500%, 8-1-17 | 2.8% |

|

| Commonwealth of Puerto Rico, 6.500%, 7-1-15 | 2.6% |

|

| State of California, 6.500%, 4-1-33 | 2.2% |

|

| Foothill Eastern Transportation Corridor Agency, Zero Coupon, 1-15-36 | 2.2% |

|

| California State Public Works Board, 5.000%, 12-1-19 | 2.0% |

|

| Inglewood Unified School District, 5.250%, 10-15-26 | 2.0% |

|

| California State Public Works Board, 5.500%, 6-1-18 | 2.0% |

|

| |

| Sector Composition1,3 | | | | |

|

| General Obligation Bonds | 19.9% | | Housing | 1.5% |

| |

|

| Revenue Bonds | | | Utilities | 1.3% |

| |

|

| Facilities | 19.6% | | Water & Sewer | 1.2% |

| |

|

| Tobacco | 11.6% | | Pollution | 0.8% |

| |

|

| Transportation | 11.5% | | Other Revenue | 17.1% |

| |

|

| Education | 7.3% | | Short-Term Investments & Other | 3.2% |

| |

|

| Health Care | 5.0% | | | |

| | | |

| | | | |

| Quality Composition1,4 | | | | |

| | | |

| AAA | 4.6% | | | |

| | | |

| AA | 19.3% | | | |

| | | |

| A | 30.2% | | | |

| | | |

| BBB | 25.4% | | | |

| | | |

| BB | 4.0% | | | |

| | | |

| B | 3.7% | | | |

| | | |

| Not Rated | 9.6% | | | |

| | | |

| Short-Term Investments & Other | 3.2% | | | |

| | | |

1 As a percentage of net assets on 11-30-11.

2 Cash and cash equivalents not included.

3 Investments focused on one sector may fluctuate more widely than investments diversified across sectors. Because the Fund may focus on particular sectors, its performance may depend on the performance of those sectors.

4 Ratings are from Moody’s Investors Service, Inc. If not available, we have used Standard & Poor’s Corporation ratings. In the absence of ratings from these agencies, we have used Fitch, Inc. ratings. “Not Rated” securities are those with no ratings available from these agencies. All ratings are as of 11-30-11 and do not reflect subsequent downgrades or upgrades, if any.

| |

| 10 | California Tax-Free Income Fund | Semiannual report |

Fund’s investments

As of 11-30-11 (unaudited)

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Municipal Bonds 96.85% | | | | | $252,270,579 |

|

| (Cost $244,643,541) | | | | | |

| |

| California 88.42% | | | | | 230,326,776 |

|

| ABAG Finance Authority for Nonprofit Corps. | | | | | |

| Institute on Aging (D) | 5.650 | | 08-15-38 | $1,000,000 | 998,536 |

|

| ABAG Finance Authority for Nonprofit Corps. | | | | | |

| Sharp Healthcare | 6.250 | | 08-01-39 | 1,000,000 | 1,072,810 |

|

| Anaheim Certificates of Participation | | | | | |

| Convention Center (D)(P) | 11.508 | | 07-16-23 | 2,000,000 | 2,016,280 |

|

| Anaheim Public Financing Authority | | | | | |

| Public Improvement Project, Series C (D)(Z) | Zero | | 09-01-18 | 3,000,000 | 2,242,410 |

|

| Antioch Public Financing Authority, Series B | 5.850 | | 09-02-15 | 1,130,000 | 1,131,842 |

|

| Belmont Community Facilities | | | | | |

| Library Project, Series A (D) | 5.750 | | 08-01-24 | 1,000,000 | 1,154,860 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Fresno County Funding Corp. | 6.000 | | 06-01-35 | 1,765,000 | 1,388,931 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Kern County Corp., Series A | 6.125 | | 06-01-43 | 5,000,000 | 3,862,500 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Public Improvements | 5.250 | | 06-01-21 | 4,590,000 | 4,224,636 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Stanislaus Funding, Series A | 5.500 | | 06-01-33 | 850,000 | 715,216 |

|

| California Educational Facilities Authority | | | | | |

| College and University Financing Project | 5.000 | | 02-01-26 | 4,525,000 | 4,045,033 |

|

| California Educational Facilities Authority | | | | | |

| Woodbury University | 5.000 | | 01-01-25 | 1,800,000 | 1,626,174 |

|

| California Educational Facilities Authority | | | | | |

| Woodbury University | 5.000 | | 01-01-30 | 2,000,000 | 1,711,960 |

|

| California Health Facilities Financing | | | | | |

| Kaiser Permanente, Series A | 5.250 | | 04-01-39 | 2,500,000 | 2,506,525 |

|

| California Health Facilities Financing Authority | | | | | |

| Catholic Healthcare West, Series G | 5.250 | | 07-01-23 | 1,000,000 | 1,055,990 |

|

| California Health Facilities Financing Authority | | | | | |

| Providence Health and Services, Series C | 6.500 | | 10-01-33 | 1,000,000 | 1,138,560 |

|

| California Health Facilities Financing Authority | | | | | |

| Scripps Health, Series A | 5.000 | | 11-15-36 | 1,000,000 | 1,006,500 |

| | |

| See notes to financial statements | Semiannual report | California Tax-Free Income Fund | 11 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| California (continued) | | | | | |

|

| California Infrastructure & Economic | | | | | |

| Development Bank California Independent | | | | | |

| System Operator, Series A | 6.250 | | 02-01-39 | $2,000,000 | $2,140,580 |

|

| California Infrastructure & Economic | | | | | |

| Development Bank Performing Arts Center | 5.000 | | 12-01-27 | 500,000 | 515,145 |

|

| California Pollution Control Financing Authority | | | | | |

| Waste Management Inc., Series C, AMT (P) | 5.125 | | 11-01-23 | 2,000,000 | 2,051,200 |

|

| California State Public Works Board | | | | | |

| Department of Corrections, Series A (D) | 5.000 | | 12-01-19 | 5,000,000 | 5,428,450 |

|

| California State Public Works Board | | | | | |

| Department of Corrections, Series C | 5.500 | | 06-01-18 | 5,000,000 | 5,273,450 |

|

| California State Public Works Board | | | | | |

| Trustees California State University, Series D | 6.250 | | 04-01-34 | 2,000,000 | 2,144,180 |

|

| California State University Revenue | | | | | |

| College and University Revenue, Series A | 5.250 | | 11-01-34 | 1,000,000 | 1,045,540 |

|

| California Statewide Communities | | | | | |

| Development Authority American Baptist | | | | | |

| Homes West | 6.250 | | 10-01-39 | 2,000,000 | 2,007,160 |

|

| California Statewide Communities | | | | | |

| Development Authority Senior Living of | | | | | |

| Southern California | 7.250 | | 11-15-41 | 1,700,000 | 1,819,544 |

|

| California Statewide Communities | | | | | |

| Development Authority Thomas Jefferson | | | | | |

| School of Law, Series A (S) | 7.250 | | 10-01-38 | 2,000,000 | 2,024,900 |

|

| California Statewide Communities | | | | | |

| Development Authority University | | | | | |

| of California — Irvine | 5.750 | | 05-15-32 | 1,230,000 | 1,232,583 |

|

| California Statewide Financing Authority | | | | | |

| Tobacco Settlement, Series A | 6.000 | | 05-01-37 | 2,500,000 | 1,939,975 |

|

| California Statewide Financing Authority | | | | | |

| Tobacco Settlement, Series B | 6.000 | | 05-01-37 | 4,000,000 | 3,103,960 |

|

| Capistrano Unified School District | | | | | |

| No. 90-2 Talega | 5.875 | | 09-01-23 | 500,000 | 507,880 |

|

| Capistrano Unified School District | | | | | |

| No. 90-2 Talega | 6.000 | | 09-01-33 | 750,000 | 753,375 |

|

| Center Unified School District, Series C (D)(Z) | Zero | | 09-01-16 | 2,145,000 | 1,829,385 |

|

| Cloverdale Community Development Agency | 5.500 | | 09-01-38 | 3,000,000 | 2,425,110 |

|

| Contra Costa County Public Financing | | | | | |

| Authority, Series A (D) | 5.000 | | 06-01-28 | 1,230,000 | 1,230,160 |

|

| Corona Community Facilities District No. 97-2 | 5.875 | | 09-01-23 | 1,035,000 | 1,036,490 |

|

| East Side Union High School District-Santa | | | | | |

| Clara County (D) | 5.250 | | 09-01-24 | 2,500,000 | 2,894,550 |

|

| Folsom Public Financing Authority, Series B | 5.125 | | 09-01-26 | 1,000,000 | 932,660 |

|

| Foothill Eastern Transportation Corridor Agency | | | | | |

| Highway Revenue Tolls (Z) | Zero | | 01-15-25 | 6,615,000 | 2,845,442 |

|

| Foothill Eastern Transportation Corridor Agency | | | | | |

| Highway Revenue Tolls (Z) | Zero | | 01-15-36 | 30,000,000 | 5,778,600 |

|

| Fresno Sewer Revenue, Series A–1 (D) | 5.250 | | 09-01-19 | 1,000,000 | 1,129,420 |

|

| Fullerton Community Facilities District No: 1 | 6.200 | | 09-01-32 | 1,000,000 | 1,011,840 |

|

| Golden State Tobacco Securitization Corp. | | | | | |

| Escrowed to Maturity, Series 2003 A–1 | 6.250 | | 06-01-33 | 1,850,000 | 1,983,996 |

|

| Golden State Tobacco Securitization Corp. | | | | | |

| Series A (D) | 5.000 | | 06-01-35 | 13,750,000 | 12,866,425 |

| | |

| 12 | California Tax-Free Income Fund | Semiannual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| California (continued) | | | | | |

|

| Inglewood Unified School District | | | | | |

| School District (D) | 5.250 | | 10-15-26 | $5,000,000 | $5,284,350 |

|

| Irvine Mobile Home Park Revenue | | | | | |

| Meadow Mobile Home Park, Series A | 5.700 | | 03-01-28 | 3,975,000 | 3,831,900 |

|

| Kern County, Capital Improvements Project, | | | | | |

| Series A (D) | 5.750 | | 08-01-35 | 1,000,000 | 1,063,840 |

|

| Laguna-Salada Union School District, | | | | | |

| Series C (D)(Z) | Zero | | 08-01-26 | 1,000,000 | 457,650 |

|

| Lancaster School District | | | | | |

| School Improvements (D)(Z) | Zero | | 04-01-19 | 1,730,000 | 1,319,454 |

|

| Lancaster School District | | | | | |

| School Improvements (D)(Z) | Zero | | 04-01-22 | 1,380,000 | 836,542 |

|

| Lee Lake Water District Community Facilities | | | | | |

| District No: 2 Montecito Ranch | 6.125 | | 09-01-27 | 1,200,000 | 1,204,452 |

|

| Long Beach Harbor Revenue, Series A, AMT (D) | 6.000 | | 05-15-18 | 2,660,000 | 3,219,265 |

|

| Long Beach Special Tax Community | | | | | |

| Community Facilities, District 6 | 6.250 | | 10-01-26 | 2,500,000 | 2,499,925 |

|

| Los Angeles Community College District | | | | | |

| 2008 Election, Series A | 6.000 | | 08-01-33 | 4,000,000 | 4,532,120 |

|

| Los Angeles Community Facilities District No: 3 | | | | | |

| No. 3 Cascades Business Park | 6.400 | | 09-01-22 | 655,000 | 657,024 |

|

| M-S-R Energy Authority | | | | | |

| Natural Gas Revenue, Series B | 6.500 | | 11-01-39 | 2,500,000 | 2,740,425 |

|

| Modesto Community Facilities District No: 4-1 | 5.100 | | 09-01-26 | 3,000,000 | 2,716,020 |

|

| New Haven Unified School District, Series B (D)(Z) | Zero | | 08-01-22 | 14,200,000 | 8,119,844 |

|

| Northern California Power Agency | | | | | |

| California — Oregon Transportation Project, | | | | | |

| Series A (D) | 7.000 | | 05-01-13 | 70,000 | 73,492 |

|

| Orange County Improvement Bond Act 1915, | | | | | |

| Series B | 5.750 | | 09-02-33 | 1,365,000 | 1,367,798 |

|

| Oxnard Community Facilities District: No. 3 | | | | | |

| Seabridge | 5.000 | | 09-01-35 | 1,490,000 | 1,346,081 |

|

| Paramount Unified School District, Series B (D)(Z) | Zero | | 09-01-25 | 4,735,000 | 2,203,527 |

|

| Pasadena California Certificates Participation | | | | | |

| Refunding Old Pasadena Parking | | | | | |

| Facility Project | 6.250 | | 01-01-18 | 700,000 | 785,218 |

|

| Ripon Redevelopment Agency | | | | | |

| Ripon Community Redevelopment Project (D) | 4.750 | | 11-01-36 | 1,550,000 | 1,266,583 |

|

| Riverside County Asset Leasing Corp. | | | | | |

| Health, Hospital & Nursing Home | | | | | |

| Improvements, Series A | 6.500 | | 06-01-12 | 355,000 | 361,035 |

|

| San Bernardino County | | | | | |

| Capital Facilities Project, Escrowed to | | | | | |

| Maturity, Series B | 6.875 | | 08-01-24 | 350,000 | 474,359 |

|

| San Bernardino County | | | | | |

| Medical Center Financial Project, Series B (D) | 5.500 | | 08-01-17 | 6,910,000 | 7,195,038 |

|

| San Bruno Park School District | | | | | |

| School Improvements, Series B (D)(Z) | Zero | | 08-01-21 | 1,015,000 | 665,708 |

|

| San Diego Public Facilities Financing Authority | | | | | |

| Lease Revenue | 5.250 | | 03-01-40 | 1,000,000 | 989,740 |

|

| San Diego Redevelopment Agency | | | | | |

| City Heights, Series A | 5.750 | | 09-01-23 | 1,000,000 | 999,940 |

| | |

| See notes to financial statements | Semiannual report | California Tax-Free Income Fund | 13 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| California (continued) | | | | | |

|

| San Diego Redevelopment Agency | | | | | |

| City Heights, Series A | 5.800 | | 09-01-28 | $1,395,000 | $1,347,054 |

|

| San Diego Redevelopment Agency | | | | | |

| Public Improvements, Series B (Z) | Zero | | 09-01-17 | 1,600,000 | 1,187,536 |

|

| San Diego Redevelopment Agency | | | | | |

| Public Improvements, Series B (Z) | Zero | | 09-01-18 | 1,700,000 | 1,167,322 |

|

| San Diego Unified School District, Election | | | | | |

| of 1998, Series A (D)(Z) | Zero | | 07-01-21 | 2,500,000 | 1,647,200 |

|

| San Francisco City & County Redevelopment | | | | | |

| Agency Community Facilities, District No. 6, | | | | | |

| Series A | 6.000 | | 08-01-25 | 2,500,000 | 2,501,300 |

|

| San Francisco City & County Redevelopment | | | | | |

| Agency Department of General Services | | | | | |

| Lease, No. 6, Mission Bay South, Series A | 5.150 | | 08-01-35 | 1,250,000 | 1,064,750 |

|

| San Francisco City & County Redevelopment | | | | | |

| Agency Mission Bay South Redevelopment, | | | | | |

| Series D | 7.000 | | 08-01-41 | 1,000,000 | 1,052,340 |

|

| San Francisco City & County Redevelopment | | | | | |

| Financing Authority Mission Bay South | | | | | |

| Redevelopment, Series D | 6.625 | | 08-01-39 | 1,000,000 | 1,022,090 |

|

| San Francisco City & County Redevelopment | | | | | |

| Financing Authority San Francisco | | | | | |

| Redevelopment Projects, Series B | 6.625 | | 08-01-39 | 700,000 | 745,066 |

|

| San Francisco State Building Authority, Series A | 5.000 | | 10-01-13 | 925,000 | 952,972 |

|

| San Joaquin County | | | | | |

| County Administration Building (D) | 5.000 | | 11-15-29 | 2,965,000 | 2,987,712 |

|

| San Joaquin Hills Transportation Corridor | | | | | |

| Agency Highway Revenue Tolls, Escrowed | | | | | |

| to Maturity (Z) | Zero | | 01-01-14 | 5,000,000 | 4,922,500 |

|

| San Joaquin Hills Transportation Corridor | | | | | |

| Agency Highway Revenue Tolls, Escrowed | | | | | |

| to Maturity (Z) | Zero | | 01-01-22 | 6,500,000 | 4,989,205 |

|

| San Joaquin Hills Transportation Corridor | | | | | |

| Agency Highway Revenue Tolls, Series A | 5.750 | | 01-15-21 | 5,000,000 | 4,570,650 |

|

| San Mateo County Joint Power Authority (D) | 5.000 | | 07-01-21 | 1,815,000 | 1,987,026 |

|

| Santa Ana Financing Authority | | | | | |

| Police Administration & Holdings Facility, | | | | | |

| Series A (D) | 6.250 | | 07-01-19 | 1,790,000 | 1,982,085 |

|

| Santa Ana Financing Authority | | | | | |

| Police Administration & Holdings Facility, | | | | | |

| Series A (D) | 6.250 | | 07-01-24 | 10,000,000 | 10,960,600 |

|

| Santa Fe Springs Community Development | | | | | |

| Commission Construction Redevelopment | | | | | |

| Project, Series A (D)(Z) | Zero | | 09-01-20 | 1,275,000 | 807,024 |

|

| Santaluz Community Facilities District No: 2 | | | | | |

| Improvement Area No. 1 | 6.375 | | 09-01-30 | 1,485,000 | 1,487,465 |

|

| Southern California Public Power Authority | | | | | |

| Natural Gas Revenue, Series A | 5.250 | | 11-01-26 | 2,000,000 | 1,949,460 |

|

| State of California (D) | 4.750 | | 04-01-29 | 2,920,000 | 2,920,380 |

|

| State of California | 5.000 | | 09-01-41 | 1,500,000 | 1,490,685 |

|

| State of California | 5.000 | | 10-01-41 | 2,000,000 | 1,987,580 |

|

| State of California Public Improvements | 5.125 | | 04-01-23 | 2,000,000 | 2,108,320 |

| | |

| 14 | California Tax-Free Income Fund | Semiannual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| California (continued) | | | | | |

|

| State of California Recreation Facilities | | | | | |

| and School Improvements | 6.500 | | 04-01-33 | $5,000,000 | $5,825,600 |

|

| State of California Water, Utility | | | | | |

| and Highway Improvements | 5.250 | | 03-01-30 | 2,000,000 | 2,106,540 |

|

| Torrance Hospital Revenue Torrance Memorial | | | | | |

| Medical Center, Series A | 5.500 | | 06-01-31 | 2,000,000 | 2,003,820 |

|

| Tuolumne Wind Project Authority | | | | | |

| Tuolumne County Project, Series A | 5.625 | | 01-01-29 | 1,000,000 | 1,091,640 |

|

| Vallejo Sanitation & Flood Control District (D) | 5.000 | | 07-01-19 | 1,945,000 | 1,990,941 |

|

| West Covina Redevelopment Agency | | | | | |

| Fashion Plaza | 6.000 | | 09-01-22 | 3,000,000 | 3,407,820 |

| | | | | | |

| Puerto Rico 8.43% | | | | | 21,943,803 |

|

| Commonwealth of Puerto Rico | 6.500 | | 07-01-15 | 6,000,000 | 6,710,040 |

|

| Commonwealth of Puerto Rico | | | | | |

| Public Improvement, Series A | 5.750 | | 07-01-41 | 5,000,000 | 5,136,900 |

|

| Commonwealth of Puerto Rico, Series A | 5.375 | | 07-01-33 | 1,250,000 | 1,256,475 |

|

| Puerto Rico Aqueduct & Sewer Authority | | | | | |

| Water Revenue, Series A | 6.125 | | 07-01-24 | 1,750,000 | 1,931,580 |

|

| Puerto Rico Highway & Transportation | | | | | |

| Authority Fuel Sales Tax Revenue, Series A (D) | 5.000 | | 07-01-38 | 80,000 | 75,723 |

|

| Puerto Rico Highway & Transportation | | | | | |

| Authority Prerefunded, Series Z (D) | 6.250 | | 07-01-14 | 3,250,000 | 3,617,630 |

|

| Puerto Rico Industrial Tourist Education | | | | | |

| Medical & Environment, Authority, | | | | | |

| Hospital de la Concepcion | 6.500 | | 11-15-20 | 500,000 | 501,865 |

|

| Puerto Rico Sales Tax Financing Corp. | | | | | |

| Sales Tax Revenue, Series A (Zero coupon | | | | | |

| steps up to 6.750% on 8-1-16) (Z) | Zero | | 08-01-32 | 3,000,000 | 2,713,590 |

| |

| | | | | Shares | Value |

| Short-Term Investments 1.98% | | | | | $5,165,000 |

|

| (Cost $5,165,000) | | | | | |

| | | | | | |

| Repurchase Agreement 1.98% | | | | | |

|

| Repurchase Agreement with State Street Corp. | | | | | |

| dated 11-30-11 at 0.010% to be repurchased | | | | | |

| at $5,165,001 on 12-1-11, collateralized by | | | | | |

| $5,265,000 Federal Home Loan Mortgage | | | | | |

| Corp., 0.500% due 8-23-13 (valued at | | | | | |

| $5,271,581, including interest) | | | | 5,165,000 | 5,165,000 |

| |

| Total investments (Cost $251,587,275)† 98.83% | | | | $257,435,579 |

|

| |

| Other assets and liabilities, net 1.17% | | | | $3,043,750 |

|

| |

| Total net assets 100.00% | | | | | $260,479,329 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

| | |

| See notes to financial statements | Semiannual report | California Tax-Free Income Fund | 15 |

Notes to Schedule of Investments

AMT Interest earned from these securities may be considered a tax preference item for purpose of the Federal Alternative Minimum Tax.

(D) Bond is insured by one of these companies:

| | |

| Insurance coverage | As a percentage of total investments | |

| |

| Ambac Financial Group, Inc. | 3.00% | |

| Assured Guarantee Corp. | 0.41% | |

| Assured Guaranty Municipal Corp. | 6.88% | |

| California Mortgage Insurance | 0.39% | |

| Financial Guaranty Insurance Corp. | 5.00% | |

| National Public Finance Guarantee Corp. | 20.25% | |

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(Z) Zero coupon bonds are issued at a discount from their principal amount in lieu of paying interest periodically.

† At 11-30-11, the aggregate cost of investment securities for federal income tax purposes was $249,808,541. Net unrealized appreciation aggregated $7,627,038, of which $15,451,904 related to appreciated investment securities and $7,824,866 related to depreciated investment securities.

The Fund has the following sector composition as a percentage to total net assets on 11-30-11.

| | | |

| General Obligation Bonds | 19.9% | | |

| Revenue Bonds | | | |

| Facilities | 19.6% | | |

| Tobacco | 11.6% | | |

| Transportation | 11.5% | | |

| Education | 7.3% | | |

| Health Care | 5.0% | | |

| Housing | 1.5% | | |

| Utilities | 1.3% | | |

| Water & Sewer | 1.2% | | |

| Pollution | 0.8% | | |

| Other Revenue | 17.1% | | |

| Short-Term Investments & Other | 3.2% | | |

| | |

| 16 | California Tax-Free Income Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 11-30-11 (unaudited)

This Statement of assets and liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $251,587,275) | $257,435,579 |

| Cash | 418 |

| Receivable for fund shares sold | 291,199 |

| Interest receivable | 3,591,589 |

| Other receivables and prepaid expenses | 35,905 |

| | |

| Total assets | 261,354,690 |

|

| Liabilities | |

|

| Payable for fund shares repurchased | 324,635 |

| Distributions payable | 307,200 |

| Payable to affiliates | |

| Accounting and legal services fees | 4,854 |

| Transfer agent fees | 14,561 |

| Distribution and service fees | 28,283 |

| Trustees’ fees | 25,556 |

| Management fees | 117,202 |

| Other liabilities and accrued expenses | 53,070 |

| | |

| Total liabilities | 875,361 |

| |

| Net assets | |

|

| Paid-in capital | $254,750,403 |

| Undistributed net investment income | 272,899 |

| Accumulated net realized loss on investments | (392,277) |

| Net unrealized appreciation (depreciation) on investments | 5,848,304 |

| | |

| Net assets | $260,479,329 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($230,240,647 ÷ 22,115,063 shares) | $10.41 |

| Class B ($2,268,795 ÷ 217,882 shares)1 | $10.41 |

| Class C ($27,969,887 ÷ 2,686,597 shares)1 | $10.41 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95.5%)2 | $10.90 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On a single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced.

| | |

| See notes to financial statements | Semiannual report | California Tax-Free Income Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the six-month period ended 11-30-11

(unaudited)

This Statement of operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Interest | $7,136,463 |

| |

| Expenses | |

|

| Investment management fees (Note 4) | 707,563 |

| Distribution and service fees (Note 4) | 316,371 |

| Accounting and legal services fees (Note 4) | 16,998 |

| Transfer agent fees (Note 4) | 86,397 |

| Trustees’ fees (Note 4) | 10,051 |

| State registration fees | 7,228 |

| Printing and postage | 8,140 |

| Professional fees | 28,290 |

| Custodian fees | 17,733 |

| Registration and filing fees | 12,623 |

| Other | 7,188 |

| | |

| Total expenses | 1,218,582 |

| Less expense reductions (Note 4) | (9,797) |

| | |

| Net expenses | 1,208,785 |

| | |

| Net investment income | 5,927,678 |

|

| Realized and unrealized gain (loss) | |

| Net realized gain on Investments | 295,752 |

| Change in net unrealized appreciation (depreciation) of Investments | 8,271,527 |

| | |

| Net realized and unrealized gain | 8,567,279 |

| | |

| Increase in net assets from operations | $14,494,957 |

| | |

| 18 | California Tax-Free Income Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of changes in net assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Six months | |

| | ended | Year |

| | 11-30-11 | ended |

| | (Unaudited) | 5-31-11 |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $5,927,678 | $12,617,886 |

| Net realized gain (loss) | 295,752 | (433,348) |

| Change in net unrealized appreciation (depreciation) | 8,271,527 | (7,360,374) |

| | | |

| Increase in net assets resulting from operations | 14,494,957 | 4,824,164 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (5,270,139) | (11,303,196) |

| Class B | (42,750) | (116,974) |

| Class C | (513,573) | (996,182) |

| | | |

| Total distributions | (5,826,462) | (12,416,352) |

| | | |

| From Fund share transactions (Note 5) | (192,485) | (18,961,638) |

| | | |

| Total increase (decrease) | 8,476,010 | (26,553,826) |

| |

| Net assets | | |

|

| Beginning of period | 252,003,319 | 278,557,145 |

| | | |

| End of period | $260,479,329 | $252,003,319 |

| | | |

| Undistributed net investment income | $272,899 | $171,683 |

| | |

| See notes to financial statements | Semiannual report | California Tax-Free Income Fund | 19 |

Financial highlights

The Financial highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | | | |

| CLASS A SHARES Period ended | 11-30-111 | 5-31-11 | 5-31-10 | 5-31-092 | 8-31-08 | 8-31-07 | 8-31-06 |

| |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning | | | | | | | |

| of period | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 | $10.93 | $11.08 |

| Net investment income3 | 0.24 | 0.49 | 0.50 | 0.36 | 0.47 | 0.47 | 0.49 |

| Net realized and unrealized gain | | | | | | | |

| (loss) on investments | 0.34 | (0.26) | 0.61 | (0.65) | (0.25) | (0.32) | (0.15) |

| Total from investment operations | 0.58 | 0.23 | 1.11 | (0.29) | 0.22 | 0.15 | 0.34 |

| Less distributions | | | | | | | |

| From net investment income | (0.24) | (0.48) | (0.49) | (0.36) | (0.46) | (0.47) | (0.49) |

| From net realized gain | — | — | — | (0.01) | (0.01) | — | — |

| Total distributions | (0.24) | (0.48) | (0.49) | (0.37) | (0.47) | (0.47) | (0.49) |

| Net asset value, end of period | $10.41 | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 | $10.93 |

| Total return (%)4 | 5.785 | 2.29 | 11.696 | (2.63)5,6 | 2.186 | 1.346 | 3.196 |

| |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period | | | | | | | |

| (in millions) | $230 | $224 | $250 | $248 | $294 | $304 | $296 |

| Ratios (as a percentage of average | | | | | | | |

| net assets): | | | | | | | |

| Expenses before reductions | 0.857 | 0.86 | 0.85 | 0.917,8 | 0.81 | 0.81 | 0.82 |

| Expenses net of fee waivers | 0.857 | 0.86 | 0.85 | 0.917,8 | 0.81 | 0.81 | 0.82 |

| Net investment income | 4.707 | 4.79 | 4.97 | 5.107 | 4.45 | 4.33 | 4.53 |

| Portfolio turnover (%) | 6 | 2 | 9 | 26 | 22 | 41 | 33 |

1 Semiannual period from 6-1-11 to 11-30-11. Unaudited.

2 For the nine-month period ended 5-31-09. The Fund changed its fiscal year end from August 31 to May 31.

3 Based on the average daily shares outstanding.

4 Does not reflect the effect of sales charges, if any.

5 Not annualized.

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Annualized.

8 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.04%.

| | |

| 20 | California Tax-Free Income Fund | Semiannual report | See notes to financial statements |

| | | | | | | |

| CLASS B SHARES Period ended | 11-30-111 | 5-31-11 | 5-31-10 | 5-31-092 | 8-31-08 | 8-31-07 | 8-31-06 |

| |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning | | | | | | | |

| of period | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 | $10.93 | $11.08 |

| Net investment income3 | 0.20 | 0.40 | 0.41 | 0.30 | 0.38 | 0.38 | 0.40 |

| Net realized and unrealized gain | | | | | | | |

| (loss) on investments | 0.34 | (0.26) | 0.61 | (0.65) | (0.25) | (0.32) | (0.15) |

| Total from investment operations | 0.54 | 0.14 | 1.02 | (0.35) | 0.13 | 0.06 | 0.25 |

| Less distributions | | | | | | | |

| From net investment income | (0.20) | (0.39) | (0.40) | (0.30) | (0.37) | (0.38) | (0.40) |

| From net realized gain | — | — | — | (0.01) | (0.01) | — | — |

| Total distributions | (0.20) | (0.39) | (0.40) | (0.31) | (0.38) | (0.38) | (0.40) |

| Net asset value, end of period | $10.41 | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 | $10.93 |

| Total return (%)4 | 5.375,6 | 1.43 | 10.755 | (3.25)5,6 | 1.315 | 0.485 | 2.325 |

| |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period | | | | | | | |

| (in millions) | $2 | $2 | $4 | $7 | $10 | $15 | $24 |

| Ratios (as a percentage of average | | | | | | | |

| net assets): | | | | | | | |

| Expenses before reductions | 1.707 | 1.71 | 1.70 | 1.767,8 | 1.66 | 1.66 | 1.67 |

| Expenses net of fee waivers | 1.637 | 1.71 | 1.70 | 1.767,8 | 1.66 | 1.66 | 1.67 |

| Net investment income | 3.917 | 3.92 | 4.12 | 4.257 | 3.59 | 3.47 | 3.68 |

| Portfolio turnover (%) | 6 | 2 | 9 | 26 | 22 | 41 | 33 |

1 Semiannual period from 6-1-11 to 11-30-11. Unaudited.

2 For the nine-month period ended 5-31-09. The Fund changed its fiscal year end from August 31 to May 31.

3 Based on the average daily shares outstanding.

4 Does not reflect the effect of sales charges, if any.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Annualized.

8 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.04%.

| | |

| See notes to financial statements | Semiannual report | California Tax-Free Income Fund | 21 |

| | | | | | | |

| CLASS C SHARES Period ended | 11-30-111 | 5-31-11 | 5-31-10 | 5-31-092 | 8-31-08 | 8-31-07 | 8-31-06 |

| |

| Per share operating performance | | | | | | | |

|

| Net asset value, beginning | | | | | | | |

| of period | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 | $10.93 | $11.08 |

| Net investment income3 | 0.20 | 0.40 | 0.41 | 0.30 | 0.38 | 0.37 | 0.40 |

| Net realized and unrealized gain | | | | | | | |

| (loss) on investments | 0.34 | (0.26) | 0.61 | (0.65) | (0.25) | (0.31) | (0.15) |

| Total from investment operations | 0.54 | 0.14 | 1.02 | (0.35) | 0.13 | 0.06 | 0.25 |

| Less distributions | | | | | | | |

| From net investment income | (0.20) | (0.39) | (0.40) | (0.30) | (0.37) | (0.38) | (0.40) |

| From net realized gain | — | — | — | (0.01) | (0.01) | — | — |

| Total distributions | (0.20) | (0.39) | (0.40) | (0.31) | (0.38) | (0.38) | (0.40) |

| Net asset value, end of period | $10.41 | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 | $10.93 |

| Total return (%)4 | 5.375,6 | 1.43 | 10.765 | (3.25)5,6 | 1.315 | 0.485 | 2.325 |

| |

| Ratios and supplemental data | | | | | | | |

|

| Net assets, end of period | | | | | | | |

| (in millions) | $28 | $26 | $25 | $17 | $14 | $10 | $8 |

| Ratios (as a percentage of average | | | | | | | |

| net assets): | | | | | | | |

| Expenses before reductions | 1.707 | 1.71 | 1.70 | 1.767,8 | 1.66 | 1.66 | 1.67 |

| Expenses net of fee waivers | 1.637 | 1.71 | 1.70 | 1.767,8 | 1.66 | 1.66 | 1.67 |

| Net investment income | 3.917 | 3.95 | 4.11 | 4.227 | 3.60 | 3.47 | 3.68 |

| Portfolio turnover (%) | 6 | 2 | 9 | 26 | 22 | 41 | 33 |

1 Semiannual period from 6-1-11 to 11-30-11. Unaudited.

2 For the nine-month period ended 5-31-09. The Fund changed its fiscal year end from August 31 to May 31.

3 Based on the average daily shares outstanding.

4 Does not reflect the effect of sales charges, if any.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Annualized.

8 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.04%.

| | |

| 22 | California Tax-Free Income Fund | Semiannual report | See notes to financial statements |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock California Tax-Free Income Fund (the Fund) is a non-diversified open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek a high level of current income, consistent with preservation of capital, that is exempt from federal and California personal income taxes.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A, Class B and Class C shares are offered to all investors. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ. Class B shares convert to Class A shares eight years after purchase.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

As of November 30, 2011, all investments are categorized as Level 2 under the hierarchy described above. Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. During the six months ended November 30, 2011, there were no significant transfers into or out of Level 1, Level 2 or Level 3 assets.

In order to value the securities, the Fund uses the following valuation techniques. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, taking into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. Other portfolio

| |

| Semiannual report | California Tax-Free Income Fund | 23 |

securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

Repurchase agreements. The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement, it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. which enables them to participate in a $100 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. For the six months ended November 30, 2011, the Fund had no borrowings under the line of credit.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, and transfer agent fees, are calculated daily for each class, based on the net asset value of the class and the applicable specific expense rates.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

| |

| 24 | California Tax-Free Income Fund | Semiannual report |

For federal income tax purposes, the Fund has a capital loss carryforward of $1,774,965 available to offset future net realized capital gains as of May 31, 2011. The loss carryforward expires as follows: May 31, 2017 — $1,568,548 and May 31, 2018 — $206,417.

Under the Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

As of May 31, 2011, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares dividends daily and pays them monthly. Capital gain distributions, if any, are distributed annually.

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to accretion on debt securities and distributions payable.

New accounting pronouncement. In May 2011, Accounting Standards Update 2011-04 (ASU 2011-04), Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, was issued and is effective during interim and annual periods beginning after December 15, 2011. ASU 2011-04 amends Financial Accounting Standards Board (FASB) Topic 820, Fair Value Measurement. The amendments are the result of the work by the FASB and the International Accounting Standards Board to develop common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP. Management is currently evaluating the application of ASU 2011-04 and its impact, if any, on the Fund’s financial statement disclosure.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

| |

| Semiannual report | California Tax-Free Income Fund | 25 |

Note 4 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Adviser) serves as investment adviser for the Fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Fund. The Adviser and the Distributor are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management agreement with the Adviser under which the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.550% of the first $500,000,000 of the Fund’s average daily net assets, (b) 0.500% of the next $500,000,000, (c) 0.475% of the next $1,000,000,000 and (d) 0.450% of the Fund’s average daily net assets in excess of $2,000,000,000. The Adviser has a subadvisory agreement with John Hancock Asset Management a division of Manulife Asset Management (US) LLC, an indirectly owned subsidiary of MFC and an affiliate of the Adviser. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the six months ended November 30, 2011 were equivalent to an annual effective rate of 0.55% of the Fund’s average daily net assets.

Accounting and legal services. Pursuant to the Accounting and Legal Services Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the six months ended November 30, 2011 amounted to an annual rate of 0.01% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B and Class C shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. The Fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares.

| | | | |

| CLASS | 12b–1 FEE | | | |

| | | |

| Class A | 0.15% | | | |

| Class B | 1.00% | | | |

| Class C | 1.00% | | | |

Effective August 1, 2011, the Distributor has contractually agreed to limit the distribution and service fees on Class B and Class C shares to 0.90% of the average daily net assets of each class of shares, until at least September 30, 2012.

Accordingly, these fee limitations amounted to $740 and $9,057 for Class B and Class C shares, respectively, for the six months ended November 30, 2011.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $75,817 for the six months ended November 30, 2011. Of this amount, $486 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $72,170 was paid as sales commissions to broker-dealers and $3,161 was paid as sales commissions to sales personnel of Signator Investors, Inc. a broker-dealer affiliate of the Adviser.

| |

| 26 | California Tax-Free Income Fund | Semiannual report |

Class B and Class C shares are subject to contingent deferred sales charges (CDSCs). Class B shares that are redeemed within six years of purchase are subject to CDSCs, at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC on the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the six months ended November 30, 2011, CDSCs received by the Distributor amounted to $2,442 and $783 for Class B and Class C shares, respectively.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Adviser. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the six months ended November 30, 2011 were:

| | | | |

| | DISTRIBUTION AND | TRANSFER | | |

| CLASS | SERVICE FEES | AGENT FEES | | |

| | |

| Class A | $171,196 | $76,642 | | |

| Class B | 11,160 | 749 | | |

| Class C | 134,015 | 9,006 | | |

| Total | $316,371 | $86,397 | | |

Trustee expenses. The Fund compensates each Trustee who is not an employee of the Adviser or its affiliates. These Trustees may, for tax purposes, elect to defer receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan (the Plan). Deferred amounts are invested in various John Hancock funds and remain in the fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting liability are included within Other receivables and prepaid expenses and Payable to affiliates — Trustees’ fees, respectively, in the accompanying Statement of assets and liabilities.

| |

| Semiannual report | California Tax-Free Income Fund | 27 |

Note 5 — Fund share transactions

Transactions in Fund shares for the six months ended November 30, 2011 and for the year ended May 31, 2011 were as follows:

| | | | |

| | Six months ended 11-30-11 | Year ended 5-31-11 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 979,487 | $10,054,328 | 2,511,173 | $25,711,750 |

| Distributions reinvested | 338,685 | 3,496,357 | 622,083 | 6,293,174 |

| Repurchased | (1,457,863) | (15,033,506) | (5,113,325) | (51,259,750) |

| | | | | |

| Net decrease | (139,691) | ($1,482,821) | (1,980,069) | ($19,254,826) |

| |

| Class B shares | | | | |

|

| Sold | 39,365 | $407,161 | 45,006 | $465,460 |

| Distributions reinvested | 2,469 | 25,485 | 6,262 | 63,492 |

| Repurchased | (48,523) | (499,203) | (205,460) | (2,089,449) |

| | | | | |

| Net decrease | (6,689) | ($66,557) | (154,192) | ($1,560,497) |

| |

| Class C shares | | | | |

|

| Sold | 252,836 | $2,610,933 | 613,432 | $6,278,004 |

| Distributions reinvested | 23,892 | 246,676 | 43,816 | 443,179 |

| Repurchased | (145,692) | (1,500,716) | (482,454) | (4,867,498) |

| | | | | |

| Net increase | 131,036 | $1,356,893 | 174,794 | $1,853,685 |

| |

| Net decrease | (15,344) | ($192,485) | (1,959,467) | ($18,961,638) |

|

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, aggregated $15,311,362 and $19,554,487, respectively, for the six months ended November 30, 2011.

| |

| 28 | California Tax-Free Income Fund | Semiannual report |

Board Consideration of and Continuation of Investment Advisory Agreement and Subadvisory Agreement

The Board of Trustees (the Board, the members of which are referred to as Trustees) of John Hancock California Tax-Free Income Fund (the Fund), the sole series of John Hancock California Tax-Free Income Fund (the Trust), met in-person on May 1–3 and June 5–7, 2011 to consider the approval of the Fund’s investment advisory agreement (the Advisory Agreement) with John Hancock Advisers, LLC (the Adviser), the Fund’s investment adviser. The Board also considered the approval of the investment subadvisory agreement (the Subadvisory Agreement) among the Adviser, Manulife Asset Management (US) LLC (the Subadviser) and the Trust on behalf of the Fund. The Advisory Agreement and the Subadvisory Agreement are referred to as the Agreements.

Activities and composition of the Board

The Board consists of eleven individuals, nine of whom are Independent Trustees. Independent Trustees are generally those individuals who are not employed by or have any significant business or professional relationship with the Adviser or the Subadviser. The Trustees are responsible for the oversight of operations of the Fund and perform various duties required of directors of investment companies by the Investment Company Act of 1940, as amended (the 1940 Act). The Independent Trustees have hired independent legal counsel to assist them in connection with their duties. The Board has appointed an Independent Trustee as Chairperson. The Board has established four standing committees that are composed entirely of Independent Trustees: the Audit Committee; the Compliance Committee; the Nominating, Governance and Administration Committee; and the Contracts/Operations Committee. Additionally, Investment Performance Committee A is a standing committee of the Board that is composed of Independent Trustees and one Trustee who is affiliated with the Adviser. Investment Performance Committee A oversees and monitors matters relating to the investment performance of the Fund. The Board has also designated an Independent Trustee as Vice Chairperson to serve in the absence of the Chairperson. The Board also designates working groups or ad hoc committees as it deems appropriate.

The approval process

Under the 1940 Act, the Board is required to consider the continuation of the Agreements each year. Throughout the year, the Board, acting directly and through its committees, regularly reviews and assesses the quality of the services that the Fund receives under these Agreements. The Board reviews reports of the Adviser at least quarterly, which include Fund performance reports and compliance reports. In addition, the Board meets with portfolio managers and senior investment officers at various times throughout the year. The Board considers at each of its meetings factors that are relevant to its annual consideration of the renewal of the Agreements, including the services and support provided by the Adviser and Subadviser to the Fund and its shareholders.

Prior to the May 1–3, 2011 meeting, the Board requested and received materials specifically relating to the Agreements. The materials provided in connection with the May meeting included information compiled and prepared by Morningstar, Inc. (Morningstar) on Fund fees and expenses, and the investment performance of the Fund. This Fund information is assembled in a format that permits comparison with similar information from a Category and a subset of the Category referred to as the Peer Group, each as determined by Morningstar, and with the Fund’s benchmark index. The Category includes all funds that invest similarly to the way the Fund invests. The Peer Group represents funds of similar size, excluding passively managed funds and funds-of-funds. The Fund’s benchmark index is an unmanaged index of securities that is provided as a basis for comparison with the Fund’s performance. Other material provided for the Fund review included (a) information on the profitability of the Agreements to the Adviser and a discussion of any additional benefits to the Adviser or Subadviser or their affiliates that result from being the Adviser or Subadviser to the Fund; (b) a general analysis provided by the Adviser and the Subadviser concerning investment advisory fees charged to other clients, such as institutional clients and other investment companies,

| |

| Semiannual report | California Tax-Free Income Fund | 29 |

having similar investment mandates, as well as the performance of those other clients and a comparison of the services provided to those other clients and the services provided to the Fund; (c) the impact of economies of scale; (d) a summary of aggregate amounts paid by the Fund to the Adviser; and (e) sales and redemption data regarding the Fund’s shares.

At an in-person meeting held on May 1–3, 2011, the Board reviewed materials relevant to its consideration of the Agreements. As a result of the discussions that occurred during the May 1–3, 2011 meeting, the Board asked the Adviser for additional information on certain matters. The Adviser provided the additional information and the Board also considered this information as part of its consideration of the Agreements.

At an in-person meeting held on June 5–7, 2011, the Board, including the Independent Trustees, formally considered the continuation of the Advisory Agreement between the Adviser and the Fund and the Subadvisory Agreement among the Fund, the Adviser and the Subadviser, each for an additional one-year term. The Board considered what it believed were key relevant factors that are described under separate headings presented below.

The Board also considered other matters important to the approval process, such as payments made to and by the Adviser or its affiliates relating to the distribution of Fund shares and other services. The Board reviewed services related to the valuation and pricing of Fund portfolio holdings. Other important matters considered by the Board were the direct and indirect benefits to the Adviser, the Subadviser and their affiliates from their relationship with the Fund and advice from independent legal counsel with respect to the review process and materials submitted for the Board’s review.

Nature, extent and quality of services

The Board reviewed the nature, extent and quality of services provided by the Adviser and the Subadviser, including the investment advisory services and the resulting performance of the Fund.

The Board considered the ability of the Adviser and the Subadviser, based on their resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory and supervisory personnel. It considered the background and experience of senior management and investment professionals responsible for managing the Fund. The Board considered the investment philosophy, research and investment decision-making processes of the Adviser and the Subadviser responsible for the daily investment activities of the Fund, including, among other things, portfolio trading capabilities, use of technology, commitment to compliance and approach to training and retaining portfolio managers and other research, advisory and management personnel.

The Board considered the Subadviser’s history and experience providing investment services to the Fund. The Board considered the Adviser’s execution of its oversight responsibilities. The Board further considered the culture of compliance, resources dedicated to compliance, compliance programs, record of compliance with applicable laws and regulation, with the Fund’s investment policies and restrictions and with the applicable Code of Ethics, and the responsibilities of the Adviser’s and Subadviser’s compliance departments.

In addition to advisory services, the Board considered the quality of the administrative and non-investment advisory services provided to the Fund by the Adviser under separate agreements. The Board noted that the Adviser and its affiliates provide the Fund with certain administrative, transfer agency, shareholder and other services (in addition to any such services provided to the Fund by third parties) and officers and other personnel as are necessary for the operations of the Fund. The Board reviewed the structure and duties of the Adviser’s administration, accounting, legal and compliance departments and its affiliate’s transfer agency operations and considered the Adviser’s and its affiliate’s policies and procedures for assuring compliance with applicable laws and regulations.

| |

| 30 | California Tax-Free Income Fund | Semiannual report |

The Board also received information about the nature, extent and quality of services provided by and fee rates charged by the Adviser and Subadviser to their other clients, including other registered investment companies, institutional investors and separate accounts. The Board reviewed a general analysis provided by the Adviser and the Subadviser concerning investment advisory fees charged to other clients having similar investment mandates, the services provided to those other clients as compared to the services provided to the Fund, the performance of those other clients as compared to the performance by the Fund and other factors relating to those other clients. The Board considered the significant differences between the Adviser’s and Subadviser’s services to the Fund and the services they provide to other clients. For other clients that are not mutual funds, the differences in services relate to the greater share purchase and redemption activity in a mutual fund, the generally higher turnover of mutual fund portfolio holdings, the more burdensome regulatory and legal obligations of mutual funds and the higher marketing costs for mutual funds. When compared to all clients including mutual funds, the Adviser has greater oversight and supervisory responsibility for the Fund and undertakes greater entrepreneurial risk as the sponsor of the Fund.

Fund performance

The Board was provided with reports, independently prepared by Morningstar, which included a comprehensive analysis of the Fund’s performance. The Board also examined materials provided by the Fund’s portfolio management team discussing Fund performance and the Fund’s investment objective, strategies and outlook. The Board also reviewed a narrative and statistical analysis of the Morningstar data that was prepared by the Adviser, which analyzed various factors that may affect the Morningstar rankings. The Board reviewed information regarding the investment performance of the Fund as compared to its Morningstar Category as well as its benchmark index (see chart below). The Board was provided with a description of the methodology used by Morningstar to select the funds in the Category. The Board also considered updated performance information provided by the Adviser at its May and June 2011 meetings. The Board regularly reviews the performance of the Fund throughout the year and attaches more importance to performance over relatively longer periods of time, typically three to five years.

Set forth below is the performance of the Fund over certain time periods ended December 31, 2010 and that of its Category average and benchmark index over the same periods:

| | | | |

| | 1 YEAR | 3 YEAR | 5 YEAR | 10 YEAR |

|

| California Tax-Free Income Fund Class A | 3.23% | 2.43% | 2.73% | 3.79% |

| Muni CA Long Category Average | 2.15% | 2.35% | 2.69% | 3.89% |

| BarCap Municipal TR Index | 2.38% | 4.08% | 4.09% | 4.83% |

The Board noted that the Fund’s performance compared favorably to its Category’s average performance over multiple periods shown. The Board also noted that, although the Fund had underperformed its benchmark index’s performance over the three longer comparison periods, the index was not specifically for California tax-exempt securities. The Board concluded that the Adviser and Subadviser were taking steps to address the underperformance which the Board would continue to monitor.

Expenses and fees

The Board, including the Independent Trustees, reviewed the Fund’s contractual advisory fee rate payable by the Fund to the Adviser as compared with the other funds in its Peer Group. The Board also received information about the investment subadvisory fee rate payable by the Adviser to the Subadviser for investment subadvisory services. The Board considered the services provided and the fees charged by the Adviser and the Subadviser to other clients with similar investment mandates, including separately managed institutional accounts.

In addition, the Board considered the cost of the services provided to the Fund by the Adviser. The Board received and considered expense information regarding the Fund’s various components,

| |

| Semiannual report | California Tax-Free Income Fund | 31 |

including advisory fees, distribution fees and fees other than advisory and distribution fees, including transfer agent fees, custodian fees, administration fees and other miscellaneous fees (e.g., fees for accounting and legal services). The Board considered comparisons of these expenses to the Peer Group median. The Board also considered expense information regarding the Fund’s total operating expense ratio (Gross Expense Ratio). The Board considered information comparing the Gross Expense Ratio and Net Expense Ratio of the Fund to that of the Peer Group median. As part of its analysis, the Board reviewed the Adviser’s methodology in allocating its costs to the management of the Fund and the Fund complex.

The Board noted that the Fund’s advisory fee ratio was seven basis points above the Peer Group median advisory fee ratio. The Board noted the following information about the Fund’s Gross and Net Expense Ratios for Class A shares contained in the Fund’s financial statements in relation with the Fund’s Peer Group median provided by Morningstar in April 2011:

| | |

| | FUND (CLASS A) | PEER GROUP MEDIAN |

|

| Advisory Fee Ratio | 0.55% | 0.48% |