UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 05979

John Hancock California Tax-Free Income Fund

(Exact name of registrant as specified in charter)

200 Berkeley Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: 617-663-4497

Date of fiscal year end: May 31

Date of reporting period: November 30, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS |

Dear shareholder,

Despite heightened fears over the coronavirus (COVID-19),most global financial markets delivered positive returns for the 6 months ended November 30, 2020.During the rampant sell-off earlier in the year,many investors reacted by exiting higher-risk assets and moving into cash,leading to a liquidity crunch in the fixed-income markets.In response to the sell-off,the U.S.Federal Reserve acted quickly,lowering interest rates to near zero and reinstating quantitative easing,as well as announcing its plans for broad support of debt markets.Many other nations followed suit and credit spreads rebounded off their highs as liquidity concerns eased.

As the year progressed,however,economic growth has slowed as the ongoing spread of COVID-19 continues to create uncertainty among businesses and investors.Lockdowns and curfews in certain areas have been reinstated,affecting the level of unemployment and the pace of hiring.Consumer spending also remains far below prepandemic levels.

Your financial professional can help position your portfolio so that it’s sufficiently diversified to seek to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management,I’d like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you’ve placed in us.

Sincerely,

Andrew G.Arnott

President and CEO,

John Hancock Investment Management

Head ofWealth and Asset Management,

United States and Europe

This commentary reflects the CEO’s views as of this report’s period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss.All investments entail risks,including the possible loss of principal.For more up-to-date information,you can visit our website at jhinvestments.com.

John Hancock

California Tax-Free Income Fund

| | |

| SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 1 |

INVESTMENT OBJECTIVE

The fund seeks a high level of current income, consistent with preservation of capital, that is exempt from federal and California personal income taxes.

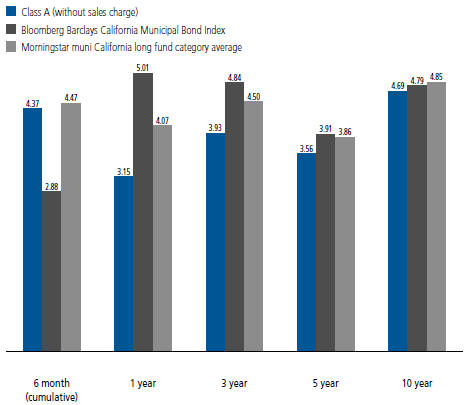

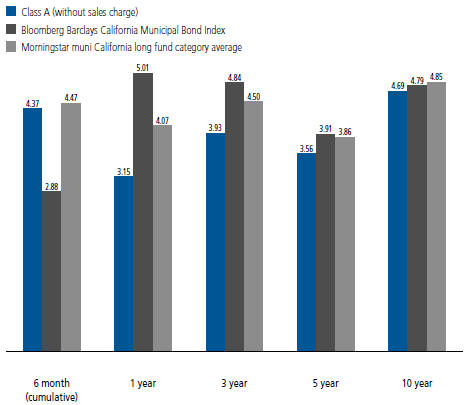

AVERAGE ANNUAL TOTAL RETURNS AS OF 11/30/2020 (%)

The Bloomberg Barclays California Municipal Bond Index is an unmanaged index comprising California investment-grade municipal bonds.

It is not possible to invest directly in an index.Index figures do not reflect expenses or sales charges, which would result in lower returns.

The fund’s Morningstar category average is a group of funds with similar investment objectives and strategies and is the equal-weighted return of all funds per category.Morningstar places funds in certain categories based on their historical portfolio holdings.Figures from Morningstar,Inc.include reinvested distributions and do not take into account sales charges.Actual load-adjusted performance is lower.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions,and does not guarantee future results.Performance of the other share classes will vary based on the difference in the fees and expenses of those classes.Shares will fluctuate in value and,when redeemed,may be worth more or less than their original cost.Current month-end performance may be lower or higher than the performance cited,and can be found at jhinvestments.com or by calling 800-225-5291.For further information on the fund’s objectives,risks, and strategy,see the fund’s prospectus.

| | |

| 2 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT |

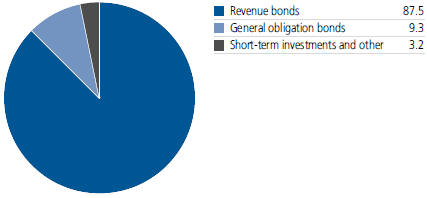

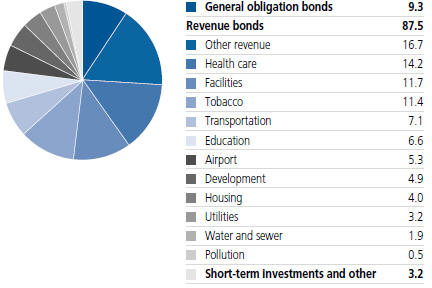

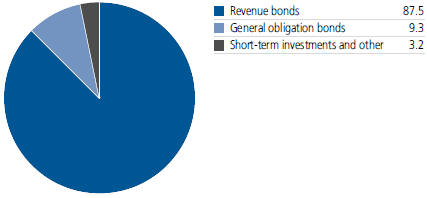

PORTFOLIO COMPOSITION AS OF 11/30/2020 (% of net assets)

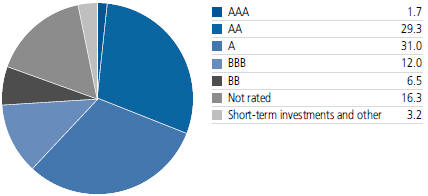

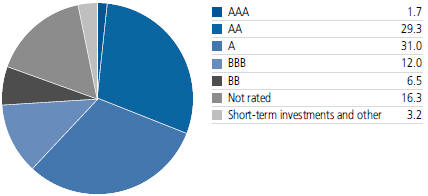

QUALITY COMPOSITION AS OF 11/30/2020 (% of net assets)

Ratings are from Moody’s Investors Service,Inc.If not available,we have used Standard & Poor’s Ratings Services.In the absence of ratings from these agencies,we have used Fitch Ratings,Inc. “Not rated”securities are those with no ratings available from these agencies.All ratings are as of 11-30-20 and do not reflect subsequent downgrades or upgrades,if any.

A note about risks

The fund is subject to various risks as described in the fund’s prospectus.A widespread health crisis such as a global pandemic could cause substantial market volatility,exchange trading suspensions and closures,impact the ability to complete redemptions,and affect fund performance.For example,the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future,could affect the global economy in ways that cannot necessarily be foreseen at the present time.A health crisis may exacerbate other pre-existing political,social,and economic risks.Any such impact could adversely affect the fund’s performance,resulting in losses to your investment.For more information, please refer to the “Principal risks”section of the prospectus.

| | |

| SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 3 |

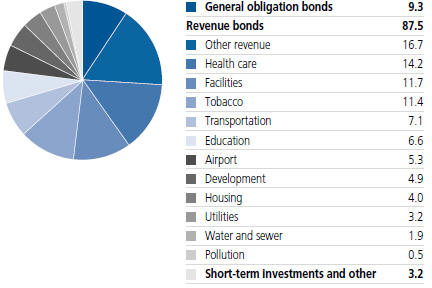

SECTOR COMPOSITION AS OF 11/30/2020 (% of net assets)

| | |

| 4 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT |

TOTAL RETURNS FOR THE PERIOD ENDED NOVEMBER 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average annual total returns (%) with maximum sales charge | | | | | Cumulative total returns (%) with maximum sales charge | | | | | SEC 30-day yield (%) subsidized | | | | | SEC 30-day yield (%) unsubsidized† | | | | | Tax-

equivalent

subsidized

yield (%)† | |

| | | | | 1-year | | | 5-year | | | 10-year | | | | | 6-month | | | 5-year | | | 10-year | | | | | as of

11-30-20 | | | | | as of 11-30-20 | | | | | as of

11-30-20 | |

Class A | | | | | -0.98 | | | | 2.71 | | | | 4.27 | | | | | | 0.23 | | | | 14.32 | | | | 51.92 | | | | | | 1.32 | | | | | | 1.31 | | | | | | 2.57 | |

Class C | | | | | 1.39 | | | | 2.79 | | | | 4.06 | | | | | | 2.98 | | | | 14.74 | | | | 48.90 | | | | | | 0.64 | | | | | | 0.53 | | | | | | 1.25 | |

Class I1,2 | | | | | 3.31 | | | | 3.68 | | | | 4.75 | | | | | | 4.45 | | | | 19.78 | | | | 59.07 | | | | | | 1.53 | | | | | | 1.52 | | | | | | 2.98 | |

Class R61,2 | | | | | 3.34 | | | | 3.68 | | | | 4.75 | | | | | | 4.56 | | | | 19.82 | | | | 59.11 | | | | | | 1.56 | | | | | | 1.55 | | | | | | 3.04 | |

Index 1†† | | | | | 5.01 | | | | 3.91 | | | | 4.79 | | | | | | 2.88 | | | | 21.15 | | | | 59.61 | | | | | | — | | | | | | — | | | | | | — | |

Index 2†† | | | | | 4.89 | | | | 3.93 | | | | 4.36 | | | | | | 3.29 | | | | 21.25 | | | | 53.20 | | | | | | — | | | | | | — | | | | | | — | |

Performance figures assume all distributions have been reinvested.Figures reflect maximum sales charges on Class A shares of 4.0% and the applicable contingent deferred sales charge (CDSC) on Class C shares.The returns for Class A shares have been adjusted to reflect the reduction in the maximum sales charge from 4.5% to 4.0%, effective 2-3-14.Class C shares sold within one year of purchase are subject to a 1% CDSC.Sales charges are not applicable to Class I and Class R6 shares.

The expense ratios of the fund,both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations),are set forth according to the most recent publicly available prospectus for the fund and may differ from those disclosed in the Financial highlights tables in this report.Net expenses reflect contractual expense limitations in effect until September 30, 2021 and are subject to change.Had the contractual fee waivers and expense limitations not been in place,gross expenses would apply.The expense ratios are as follows:

| | | | | | | | | | |

| | | | Class A | | Class C | | Class I | | Class R6 |

| | Gross (%) | | 0.85 | | 1.70 | | 0.70 | | 0.67 |

| | Net (%) | | 0.84 | | 1.59 | | 0.69 | | 0.66 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800–225–5291 or visit the fund’s website at jhinvestments.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| | † | Unsubsidized yield reflects what the yield would have been without the effect of reimbursements and waivers. Tax-equivalent yield is based on the maximum federal income tax rate of 40.8% and a state tax rate of 13.3%. | |

| | †† | Index 1 is the Bloomberg Barclays California Municipal Bond Index; Index 2 is the Bloomberg Barclays Municipal Bond Index. | |

See the following page for footnotes.

| | |

| SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 5 |

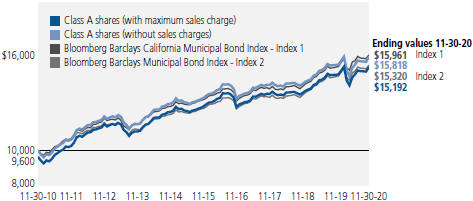

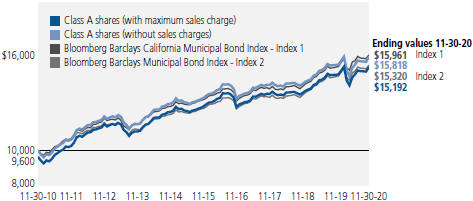

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock California Tax-Free Income Fund for the share classes and periods indicated,assuming all distributions were reinvested.For comparison,we’ve shown the same investment in two separate indexes.

| | | | | | | | | | |

| | | Start date | | With maximum

sales charge ($) | | Without

sales charge ($) | | Index 1 ($) | | Index 2 ($) |

Class C3 | | 11-30-10 | | 14,890 | | 14,890 | | 15,961 | | 15,320 |

Class I1,2 | | 11-30-10 | | 15,907 | | 15,907 | | 15,961 | | 15,320 |

Class R61,2 | | 11-30-10 | | 15,911 | | 15,911 | | 15,961 | | 15,320 |

The values shown in the chart for Class A shares with maximum sales charge have been adjusted to reflect the reduction in the Class A shares’ maximum sales charge from 4.5% to 4.0%, which became effective on 2-3-14.

The Bloomberg Barclays California Municipal Bond Index is an unmanaged index comprising California investment-grade municipal bonds.

The Bloomberg Barclays Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

It is not possible to invest directly in an index.Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| | 1 | Class I shares and Class R6 shares were first offered on 2-13-17 and 8-30-17,respectively.Returns prior to these dates are those of Class A shares that have not been adjusted for class-specific expenses; otherwise,returns would vary. | |

| | 2 | For certain types of investors,as described in the fund’s prospectus. | |

| | 3 | The contingent deferred sales charge is not applicable. | |

| | |

| 6 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT |

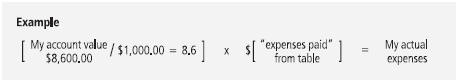

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund,you incur two types of costs:

| | ∎ | Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc. | |

| | ∎ | Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses. | |

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund’s actual ongoing operating expenses,and is based on the fund’s actual return.It assumes an account value of $1,000.00 on June 1, 2020, with the same investment held until November 30, 2020.

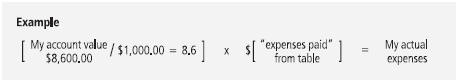

Together with the value of your account,you may use this information to estimate the operating expenses that you paid over the period.Simply divide your account value at November 30, 2020, by $1,000.00, then multiply it by the “expenses paid”for your share class from the table.For example,for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund’s ongoing operating expenses with those of any other fund.It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the class’s actual return).It assumes an account value of $1,000.00 on June 1, 2020, with the same investment held until November 30, 2020. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | |

| SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 7 |

Remember,these examples do not include any transaction costs,therefore,these examples will not help you to determine the relative total costs of owning different funds.If transaction costs were included,your expenses would have been higher. See the prospectus for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| | | | | | | | | | | | | | | | | | |

| | | | | Account value on 6-1-2020 | | | Ending value on 11-30-2020 | | | Expenses paid during period ended 11-30-20201 | | | Annualized expense ratio | |

Class A | | Actual expenses/actual returns | | | $1,000.00 | | | | $1,043.70 | | | | $4.35 | | | | 0.85 | % |

| | | Hypothetical example | | | 1,000.00 | | | | 1,020.80 | | | | 4.31 | | | | 0.85 | % |

Class C | | Actual expenses/actual returns | | | 1,000.00 | | | | 1,039.80 | | | | 8.18 | | | | 1.60 | % |

| | | Hypothetical example | | | 1,000.00 | | | | 1,017.00 | | | | 8.09 | | | | 1.60 | % |

Class I | | Actual expenses/actual returns | | | 1,000.00 | | | | 1,044.50 | | | | 3.59 | | | | 0.70 | % |

| | | Hypothetical example | | | 1,000.00 | | | | 1,021.60 | | | | 3.55 | | | | 0.70 | % |

Class R6 | | Actual expenses/actual returns | | | 1,000.00 | | | | 1,045.60 | | | | 3.38 | | | | 0.66 | % |

| | | Hypothetical example | | | 1,000.00 | | | | 1,021.80 | | | | 3.35 | | | | 0.66 | % |

| | 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| | |

| 8 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT |

AS OF 11-30-20 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

Municipal bonds 96.8% | | | | | | | | | | | | | | | $207,968,921 | |

| | | | |

(Cost $192,585,264) | | | | | | | | | | | | | | | | |

| | | | |

California 94.0% | | | | | | | | | | | | | | | 202,032,792 | |

| | | | |

ABAG Finance Authority for Nonprofit Corps.

Sharp HealthCare, Series A | | | 5.000 | | | | 08-01-43 | | | | 2,000,000 | | | | 2,184,060 | |

| | | | |

Burbank Unified School District

Convertible Capital Appreciation Election

2013, GO (0.000% to 8-1-23, then 4.500% thereafter) | | | 0.000 | | | | 08-01-37 | | | | 1,770,000 | | | | 1,928,521 | |

| | | | |

California Community Housing Agency

Annadel Apartments, Series A (A) | | | 5.000 | | | | 04-01-49 | | | | 1,000,000 | | | | 1,119,260 | |

| | | | |

California Community Housing Agency

Serenity at Larkspur, Series A (A) | | | 5.000 | | | | 02-01-50 | | | | 1,000,000 | | | | 1,129,500 | |

| | | | |

California Community Housing Agency

Verdant at Green Valley Project, Series A (A) | | | 5.000 | | | | 08-01-49 | | | | 1,000,000 | | | | 1,108,070 | |

| | | | |

California County Tobacco Securitization Agency

Fresno County Funding Corp. | | | 6.000 | | | | 06-01-35 | | | | 1,570,000 | | | | 1,571,837 | |

| | | | |

California County Tobacco Securitization Agency

Kern County Tobacco Funding Corp. | | | 5.000 | | | | 06-01-40 | | | | 1,500,000 | | | | 1,579,020 | |

| | | | |

California County Tobacco Securitization Agency

Merced County Tobacco Funding Corp. | | | 5.000 | | | | 06-01-50 | | | | 500,000 | | | | 568,230 | |

| | | | |

California County Tobacco Securitization Agency

Sonoma County Securitization Corp. | | | 4.000 | | | | 06-01-49 | | | | 400,000 | | | | 453,920 | |

| | | | |

California County Tobacco Securitization Agency

Tobacco Settlement Revenue, Series A | | | 4.000 | | | | 06-01-49 | | | | 1,000,000 | | | | 1,137,890 | |

| | | | |

California County Tobacco Securitization Agency

Tobacco Settlement Revenue, Series B1 | | | 5.000 | | | | 06-01-49 | | | | 500,000 | | | | 591,175 | |

| | | | |

California Educational Facilities Authority

Pepperdine University | | | 5.000 | | | | 10-01-49 | | | | 1,500,000 | | | | 1,786,755 | |

| | | | |

California Educational Facilities Authority

University of Redlands, Series A | | | 5.000 | | | | 10-01-35 | | | | 1,000,000 | | | | 1,097,060 | |

| | | | |

California Enterprise Development Authority

Academy for Academic Excellence Project, Series A (A) | | | 5.000 | | | | 07-01-40 | | | | 430,000 | | | | 466,292 | |

| | | | |

California Enterprise Development Authority

Academy for Academic Excellence Project, Series A (A) | | | 5.000 | | | | 07-01-50 | | | | 350,000 | | | | 375,928 | |

| | | | |

California Enterprise Development Authority

Academy for Academic Excellence Project,

Series A (A) | | | 5.000 | | | | 07-01-55 | | | | 240,000 | | | | 256,622 | |

| | | | |

California Health Facilities Financing Authority

Children’s Hospital, Series A | | | 5.000 | | | | 08-15-47 | | | | 1,000,000 | | | | 1,160,900 | |

| | | | |

California Health Facilities Financing Authority

City of Hope Obligated Group | | | 4.000 | | | | 11-15-45 | | | | 1,000,000 | | | | 1,155,030 | |

| | | | |

California Health Facilities Financing Authority

CommonSpirit Health Obligated Group, Series A | | | 4.000 | | | | 04-01-40 | | | | 1,500,000 | | | | 1,748,625 | |

| | | | |

California Health Facilities Financing Authority

El Camino Hospital | | | 5.000 | | | | 02-01-42 | | | | 1,000,000 | | | | 1,182,340 | |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 9 |

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

California (continued) | | | | | | | | | | | | | | | | |

| | | | |

California Health Facilities Financing Authority

El Camino Hospital | | | 5.000 | | | | 02-01-47 | | | | 1,425,000 | | | | $1,671,824 | |

| | | | |

California Health Facilities Financing Authority

Lucile Packard Children’s Hospital, Series A | | | 5.000 | | | | 08-15-43 | | | | 1,000,000 | | | | 1,113,900 | |

| | | | |

California Health Facilities Financing Authority

Lucile Packard Children’s Hospital, Series B | | | 5.000 | | | | 08-15-55 | | | | 1,000,000 | | | | 1,162,010 | |

| | | | |

California Health Facilities Financing Authority

Standford Health Care, Series A | | | 4.000 | | | | 08-15-50 | | | | 1,000,000 | | | | 1,173,770 | |

| | | | |

California Housing Finance

Series A | | | 4.250 | | | | 01-15-35 | | | | 982,257 | | | | 1,125,549 | |

| | | | |

California Municipal Finance Authority

Channing House Project, Series A (B) | | | 4.000 | | | | 05-15-40 | | | | 1,500,000 | | | | 1,725,405 | |

| | | | |

California Municipal Finance Authority

HumanGood Obligated Group, Series A | | | 5.000 | | | | 10-01-44 | | | | 1,000,000 | | | | 1,158,340 | |

| | | | |

California Municipal Finance Authority

LINXS APM Project, AMT | | | 5.000 | | | | 12-31-43 | | | | 1,000,000 | | | | 1,172,590 | |

| | | | |

California Municipal Finance Authority

Paradise Valley Estates Project, Series A (B) | | | 5.000 | | | | 01-01-49 | | | | 1,500,000 | | | | 1,812,810 | |

| | | | |

California Municipal Finance Authority

Retirement Housing Foundation Obligation Group, Series A | | | 5.000 | | | | 11-15-31 | | | | 1,500,000 | | | | 1,810,980 | |

| | | | |

California Municipal Finance Authority

West Village Student Housing Project at UC Davis (B) | | | 4.000 | | | | 05-15-48 | | | | 1,365,000 | | | | 1,497,391 | |

| | | | |

California Municipal Finance Authority

Wineville School Project, Series A (B) | | | 5.000 | | | | 10-01-42 | | | | 2,000,000 | | | | 2,287,000 | |

| | | | |

California Pollution Control Financing Authority

San Diego County Water Authority Desalination Project Pipeline (A) | | | 5.000 | | | | 07-01-39 | | | | 1,000,000 | | | | 1,176,270 | |

| | | | |

California Pollution Control Financing Authority

San Diego County Water Authority Desalination Project Pipeline (A) | | | 5.000 | | | | 11-21-45 | | | | 1,500,000 | | | | 1,740,660 | |

| | | | |

California Pollution Control Financing Authority

Waste Management, Inc., Series A1, AMT | | | 3.375 | | | | 07-01-25 | | | | 1,000,000 | | | | 1,111,770 | |

| | | | |

California Pollution Control Financing Authority

Waste Management, Inc., Series A3, AMT | | | 4.300 | | | | 07-01-40 | | | | 4,675,000 | | | | 5,334,689 | |

| | | | |

California Public Finance Authority

Excelsior Charter Schools Project, Series A (A) | | | 5.000 | | | | 06-15-50 | | | | 500,000 | | | | 528,795 | |

| | | | |

California Public Finance Authority

Excelsior Charter Schools Project, Series A (A) | | | 5.000 | | | | 06-15-55 | | | | 500,000 | | | | 527,325 | |

| | | | |

California Public Finance Authority

Henry Mayo Newhall Hospital | | | 5.000 | | | | 10-15-47 | | | | 2,000,000 | | | | 2,231,960 | |

| | | | |

California Public Finance Authority

Trinity Classical Academy, Series A (A) | | | 5.000 | | | | 07-01-44 | | | | 110,000 | | | | 110,759 | |

| | | | |

California Public Finance Authority

Trinity Classical Academy, Series A (A) | | | 5.000 | | | | 07-01-54 | | | | 325,000 | | | | 322,956 | |

| | | | |

California School Finance Authority

Aspire Public Schools (A) | | | 5.000 | | | | 08-01-46 | | | | 1,275,000 | | | | 1,438,315 | |

| | | | |

| 10 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

California (continued) | | | | | | | | | | | | | | | | |

| | | | |

California School Finance Authority

Granada Hills Charter High School Obligated Group (A) | | | 5.000 | | | | 07-01-43 | | | | 1,000,000 | | | | $1,116,090 | |

| | | | |

California School Finance Authority

KIPP LA Project, Series A (A) | | | 5.000 | | | | 07-01-47 | | | | 1,500,000 | | | | 1,747,440 | |

| | | | |

California State Public Works Board

Various Capital Projects, Series C | | | 5.000 | | | | 11-01-44 | | | | 1,000,000 | | | | 1,287,210 | |

| | | | |

California State Public Works Board

Various Correctional Facilities, Series A | | | 5.000 | | | | 09-01-39 | | | | 2,500,000 | | | | 2,881,925 | |

| | | | |

California Statewide Communities Development Authority

Adventist Health System, Series A | | | 5.000 | | | | 03-01-48 | | | | 1,885,000 | | | | 2,266,618 | |

| | | | |

California Statewide Communities Development Authority

CHF Irvine LLC | | | 5.000 | | | | 05-15-40 | | | | 1,485,000 | | | | 1,634,139 | |

| | | | |

California Statewide Communities Development Authority

Emanate Health, Series A | | | 4.000 | | | | 04-01-45 | | | | 250,000 | | | | 287,930 | |

| | | | |

California Statewide Communities Development Authority

Front Porch Communities and Services, Series A | | | 5.000 | | | | 04-01-47 | | | | 500,000 | | | | 563,965 | |

| | | | |

California Statewide Communities Development Authority

Infrastructure Program Revenue, Series B | | | 5.000 | | | | 09-02-44 | | | | 1,000,000 | | | | 1,065,160 | |

| | | | |

California Statewide Communities Development Authority

Redlands Community Hospital | | | 5.000 | | | | 10-01-46 | | | | 2,000,000 | | | | 2,266,860 | |

| | | | |

California Statewide Communities Development Authority

Redwoods Project (B) | | | 5.375 | | | | 11-15-44 | | | | 1,500,000 | | | | 1,688,085 | |

| | | | |

California Statewide Financing Authority

Tobacco Settlement, Series A | | | 6.000 | | | | 05-01-37 | | | | 2,500,000 | | | | 2,509,750 | |

| | | | |

California Statewide Financing Authority

Tobacco Settlement, Series B | | | 6.000 | | | | 05-01-37 | | | | 3,000,000 | | | | 3,011,700 | |

| | | | |

City of Belmont

Library Project, Series A (B) | | | 5.750 | | | | 08-01-24 | | | | 825,000 | | | | 927,135 | |

| | | | |

City of Irvine

Community Facilities District, No. 2013-3 Great Park | | | 5.000 | | | | 09-01-49 | | | | 2,000,000 | | | | 2,228,420 | |

| | | | |

City of La Verne

Brethren Hillcrest Homes | | | 5.000 | | | | 05-15-36 | | | | 750,000 | | | | 808,988 | |

| | | | |

City of Long Beach

Alamitos Bay Marina Project | | | 5.000 | | | | 05-15-45 | | | | 1,000,000 | | | | 1,104,420 | |

| | | | |

City of Long Beach

Community Facilities District 6-Pike Project | | | 6.250 | | | | 10-01-26 | | | | 1,795,000 | | | | 1,799,900 | |

| | | | |

City of Long Beach

Harbor Revenue, Series A | | | 5.000 | | | | 05-15-49 | | | | 2,000,000 | | | | 2,473,820 | |

| | | | |

City of Los Angeles Department of Airports

Airport Revenue, Series C, AMT | | | 5.000 | | | | 05-15-35 | | | | 1,000,000 | | | | 1,294,300 | |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 11 |

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

California (continued) | | | | | | | | | | | | | | | | |

| | | | |

City of Los Angeles Department of Airports

Los Angeles International Airport, Series D, AMT | | | 4.000 | | | | 05-15-44 | | | | 2,000,000 | | | | $2,286,200 | |

| | | | |

City of San Clemente

Community Facilities District, No. 2006-1 | | | 5.000 | | | | 09-01-46 | | | | 1,965,000 | | | | 2,194,473 | |

| | | | |

City of San Francisco Public Utilities Commission Water Revenue

Green Bonds, Series A | | | 5.000 | | | | 11-01-45 | | | | 1,500,000 | | | | 1,755,705 | |

| | | | |

City of San Mateo

Community Facilities District, No. 2008-1 Bay Meadows | | | 5.500 | | | | 09-01-44 | | | | 2,000,000 | | | | 2,112,340 | |

| | | | |

College of the Sequoias Tulare Area

Improvement District No. 3

Election of 2008, Series B, GO (B)(C) | | | 2.291 | | | | 08-01-40 | | | | 2,890,000 | | | | 1,839,138 | |

| | | | |

Foothill-Eastern Transportation Corridor Agency

Highway Revenue Tolls, Series A | | | 5.750 | | | | 01-15-46 | | | | 5,000,000 | | | | 5,618,300 | |

| | | | |

Golden State Tobacco Securitization Corp.

Series A | | | 5.000 | | | | 06-01-40 | | | | 5,000,000 | | | | 5,818,499 | |

| | | | |

Golden State Tobacco Securitization Corp.

Series A | | | 5.000 | | | | 06-01-45 | | | | 3,250,000 | | | | 3,753,945 | |

| | | | |

Golden State Tobacco Securitization Corp.

Series A-1 | | | 3.500 | | | | 06-01-36 | | | | 1,785,000 | | | | 1,818,005 | |

| | | | |

Golden State Tobacco Securitization Corp.

Series A-1 | | | 5.000 | | | | 06-01-47 | | | | 1,610,000 | | | | 1,661,456 | |

| | | | |

Hastings Campus Housing Finance Authority

California Campus Housing Revenue, Series A | | | 5.000 | | | | 07-01-45 | | | | 1,000,000 | | | | 1,061,320 | |

| | | | |

Inland Valley Development Agency

Series A | | | 5.000 | | | | 09-01-44 | | | | 2,500,000 | | | | 2,761,775 | |

| | | | |

Los Angeles Community Facilities District

Cascades Business Park | | | 6.400 | | | | 09-01-22 | | | | 165,000 | | | | 166,176 | |

| | | | |

Los Angeles County Metropolitan Transportation Authority

Sales Tax Revenue, Series A | | | 4.000 | | | | 06-01-35 | | | | 250,000 | | | | 312,398 | |

| | | | |

Los Angeles County Public Works Financing Authority

Series D | | | 5.000 | | | | 12-01-45 | | | | 3,000,000 | | | | 3,514,230 | |

| | | | |

Los Angeles County Regional Financing Authority

Montecedro, Inc. Project, Series A (B) | | | 5.000 | | | | 11-15-44 | | | | 1,355,000 | | | | 1,457,330 | |

| | | | |

Los Angeles Department of Water

Power Waterworks Revenue, Series A | | | 5.000 | | | | 07-01-50 | | | | 1,000,000 | | | | 1,313,700 | |

| | | | |

Los Angeles Department of Water & Power

Power Systems, Series D | | | 5.000 | | | | 07-01-44 | | | | 1,000,000 | | | | 1,143,830 | |

| | | | |

Los Angeles Unified School District

Series RYQ, GO | | | 4.000 | | | | 07-01-44 | | | | 1,500,000 | | | | 1,795,560 | |

| | | | |

Marin Healthcare District

Election of 2013, GO | | | 4.000 | | | | 08-01-45 | | | | 1,000,000 | | | | 1,104,910 | |

| | | | |

Metropolitan Water District of Southern California

Series A | | | 5.000 | | | | 10-01-49 | | | | 1,500,000 | | | | 1,959,660 | |

| | | | |

Morgan Hill Redevelopment Successor Agency

Series A | | | 5.000 | | | | 09-01-33 | | | | 1,750,000 | | | | 1,974,858 | |

| | | | |

| 12 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

California (continued) | | | | | | | | | | | | | | | | |

| | | | |

M-S-R Energy Authority

Natural Gas Revenue, Series B | | | 6.500 | | | | 11-01-39 | | | | 1,500,000 | | | | $2,482,050 | |

| | | | |

Norman Y. Mineta San Jose International Airport SJC

Series A, AMT | | | 5.000 | | | | 03-01-47 | | | | 3,000,000 | | | | 3,510,600 | |

| | | | |

Oakland Unified School District

Series A, GO | | | 5.000 | | | | 08-01-40 | | | | 1,500,000 | | | | 1,740,615 | |

| | | | |

Orange County Community Facilities District

2017-1 Esencia Village, Series A | | | 5.000 | | | | 08-15-47 | | | | 2,000,000 | | | | 2,337,980 | |

| | | | |

Pacifica School District

Series C, GO (B)(C) | | | 0.826 | | | | 08-01-26 | | | | 1,000,000 | | | | 953,810 | |

| | | | |

Port of Los Angeles

Series A, AMT | | | 5.000 | | | | 08-01-44 | | | | 2,000,000 | | | | 2,244,080 | |

| | | | |

River Islands Public Financing Authority

Community Facilities District, No. 2003-1 | | | 5.500 | | | | 09-01-45 | | | | 750,000 | | | | 796,080 | |

| | | | |

River Islands Public Financing Authority

Community Facilities District, No. 2003-1, Series A | | | 5.000 | | | | 09-01-48 | | | | 1,250,000 | | | | 1,399,538 | |

| | | | |

River Islands Public Financing Authority

Lathrop Irrigation District Electric Revenue (B) | | | 4.000 | | | | 09-01-35 | | | | 1,125,000 | | | | 1,346,254 | |

| | | | |

Riverside County Transportation Commission

Series A | | | 5.750 | | | | 06-01-48 | | | | 1,000,000 | | | | 1,085,030 | |

| | | | |

Sacramento Municipal Utility District

Electric Revenue, Series H | | | 4.000 | | | | 08-15-45 | | | | 1,500,000 | | | | 1,811,190 | |

| | | | |

San Diego Public Facilities Financing Authority

Capital Improvement Projects, Series A | | | 5.000 | | | | 10-15-44 | | | | 1,000,000 | | | | 1,170,560 | |

| | | | |

San Diego Public Facilities Financing Authority

Series A | | | 3.000 | | | | 08-01-49 | | | | 1,500,000 | | | | 1,642,215 | |

| | | | |

San Diego Public Facilities Financing Authority

Series A | | | 4.000 | | | | 08-01-45 | | | | 500,000 | | | | 609,385 | |

| | | | |

San Diego Unified School District

Series I, GO (C) | | | 3.538 | | | | 07-01-39 | | | | 1,250,000 | | | | 649,025 | |

| | | | |

San Francisco Bay Area Rapid Transit District

Election 2016, Series C1, GO | | | 3.000 | | | | 08-01-50 | | | | 1,500,000 | | | | 1,615,290 | |

| | | | |

San Francisco City & County Airport Commission

International Airport Revenue, Second Series 2020-B | | | 4.000 | | | | 05-01-37 | | | | 1,000,000 | | | | 1,197,800 | |

| | | | |

San Francisco City & County Airport Commission

Series E, AMT | | | 5.000 | | | | 05-01-50 | | | | 1,500,000 | | | | 1,837,305 | |

| | | | |

San Francisco City & County Airport Commission

Special Facilities Lease, SFO Fuel Company LLC, Series A, AMT | | | 5.000 | | | | 01-01-47 | | | | 2,000,000 | | | | 2,416,180 | |

| | | | |

San Francisco City & County Redevelopment Successor Agency

Department of General Services Lease, No. 6, Mission Bay South, Series A | | | 5.150 | | | | 08-01-35 | | | | 1,250,000 | | | | 1,256,950 | |

| | | | |

San Francisco City & County Redevelopment Successor Agency

Mission Bay Project, Series A | | | 5.000 | | | | 08-01-43 | | | | 1,000,000 | | | | 1,119,210 | |

| | | | |

San Joaquin Hills Transportation Corridor Agency

Highway Revenue Tolls, Series A | | | 5.000 | | | | 01-15-44 | | | | 2,500,000 | | | | 2,775,400 | |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 13 |

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

California (continued) | | | | | | | | | | | | | | | | |

| | | | |

San Mateo Joint Powers Financing Authority

Capital Projects Program (B) | | | 5.000 | | | | 07-01-21 | | | | 925,000 | | | | $950,697 | |

| | | | |

Santa Ana Financing Authority

Police Administration & Holding Facility, Series A (B) | | | 6.250 | | | | 07-01-24 | | | | 4,115,000 | | | | 4,635,794 | |

| | | | |

Santa Ana Financing Authority

Prerefunded, Police Administration & Holding Facility, Series A (B) | | | 6.250 | | | | 07-01-24 | | | | 4,115,000 | | | | 4,620,363 | |

| | | | |

Santa Margarita Water District

Community Facilities District, No. 2013-1 | | | 5.625 | | | | 09-01-43 | | | | 745,000 | | | | 815,216 | |

| | | | |

Santee School District

Election of 2006, Series E, GO (B)(C) | | | 2.741 | | | | 05-01-51 | | | | 1,530,000 | | | | 664,158 | |

| | | | |

South Orange County Public Financing Authority

Series A | | | 5.000 | | | | 08-15-33 | | | | 1,000,000 | | | | 1,047,210 | |

| | | | |

South Orange County Public Financing Authority

Series A | | | 5.000 | | | | 08-15-34 | | | | 450,000 | | | | 470,943 | |

| | | | |

Southern California Public Power Authority

Apex Power Project, Series A | | | 5.000 | | | | 07-01-38 | | | | 1,000,000 | | | | 1,143,830 | |

| | | | |

Southern California Public Power Authority

Natural Gas Project Revenue, Series A | | | 5.250 | | | | 11-01-26 | | | | 2,000,000 | | | | 2,500,540 | |

| | | | |

State of California

Construction Bonds, GO | | | 5.000 | | | | 10-01-49 | | | | 1,000,000 | | | | 1,279,580 | |

| | | | |

State of California

Various Purpose, GO | | | 3.000 | | | | 03-01-50 | | | | 1,500,000 | | | | 1,603,710 | |

| | | | |

State of California

Various Purpose, GO | | | 5.000 | | | | 04-01-32 | | | | 2,000,000 | | | | 2,827,900 | |

| | | | |

State of California

Various Purpose-Bid Group B, GO | | | 5.000 | | | | 08-01-36 | | | | 1,000,000 | | | | 1,288,880 | |

| | | | |

Sweetwater Union High School District

Ad Valorem Property Tax, GO | | | 4.000 | | | | 08-01-42 | | | | 500,000 | | | | 544,880 | |

| | | | |

Transbay Joint Powers Authority

Tax Allocation, Series A | | | 5.000 | | | | 10-01-32 | | | | 345,000 | | | | 448,824 | |

| | | | |

Turlock Irrigation District

Electricity, Power & Light Revenues | | | 5.000 | | | | 01-01-41 | | | | 1,000,000 | | | | 1,311,200 | |

| | | | |

University of California

Series AZ | | | 5.000 | | | | 05-15-48 | | | | 1,500,000 | | | | 1,867,710 | |

| | | | |

West Covina Community Development

Commission Successor Agency Fashion Plaza | | | 6.000 | | | | 09-01-22 | | | | 1,565,000 | | | | 1,672,124 | |

| | | | |

William S. Hart Union High School District

Community Facilities District, No. 2015-1 | | | 5.000 | | | | 09-01-47 | | | | 1,000,000 | | | | 1,118,920 | |

| | | | |

Puerto Rico 2.8% | | | | | | | | | | | | | | | 5,936,129 | |

| | | | |

Puerto Rico Sales Tax Financing Corp.

Series A-1 (C) | | | 2.546 | | | | 07-01-31 | | | | 1,500,000 | | | | 1,145,190 | |

| | | | |

Puerto Rico Sales Tax Financing Corp.

Series A-1 | | | 4.750 | | | | 07-01-53 | | | | 1,500,000 | | | | 1,625,895 | |

| | | | |

Puerto Rico Sales Tax Financing Corp.

Series A-1 (C) | | | 4.763 | | | | 07-01-46 | | | | 7,500,000 | | | | 2,241,825 | |

| | | | |

| 14 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | | | | | | | | | | | | |

| | | Rate (%) | | | Maturity date | | | Par value^ | | | Value | |

| | | | |

Puerto Rico (continued) | | | | | | | | | | | | | | | | |

| | | | |

Puerto Rico Sales Tax Financing Corp.

Series A-2 | | | 4.784 | | | | 07-01-58 | | | | 850,000 | | | | $923,219 | |

| | | | |

| | | | | | | | | Par value^ | | | Value | |

| | | | |

Short-term investments 2.3% | | | | | | | | | | | | | | | $4,902,000 | |

| | | | |

(Cost $4,902,000) | | | | | | | | | | | | | | | | |

| | | | |

Repurchase agreement 2.3% | | | | | | | | | | | | | | | $4,902,000 | |

| | | | |

Barclays Tri-Party Repurchase Agreement dated 11-30-20 at 0.070% to be repurchased at $3,381,007 on 12-1-20, collateralized by $2,890,100 U.S. Treasury Bonds, 2.375% due 11-15-49 (valued at $3,448,725) | | | | | | | | | | | 3,381,000 | | | | 3,381,000 | |

| | | | |

Repurchase Agreement with State Street Corp. dated 11-30-20 at 0.000% to be repurchased at $1,521,000 on 12-1-20, collateralized by $1,511,000 U.S. Treasury Notes, 1.875% due 1-31-22 (valued at $1,551,439) | | | | | | | | | | | 1,521,000 | | | | 1,521,000 | |

| |

Total investments (Cost $197,487,264) 99.1% | | | | $212,870,921 | |

| |

| | | | | |

| |

Other assets and liabilities, net 0.9% | | | | 2,000,556 | |

| |

| | | | | |

| |

Total net assets 100.0% | | | | $214,871,477 | |

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund.

^All par values are denominated in U.S.dollars unless otherwise indicated.

Security Abbreviations and Legend

| | |

| AMT | | Interest earned from these securities may be considered a tax preference item for purpose of the Federal Alternative Minimum Tax. |

| |

| GO | | General Obligation |

| |

| (A) | | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. |

| |

| (B) | | Bond is insured by one or more of the companies listed in the insurance coverage table below. |

| |

| (C) | | Zero coupon bonds are issued at a discount from their principal amount in lieu of paying interest periodically. Rate shown is the effective yield at period end. |

At 11-30-20,the aggregate cost of investments for federal income tax purposes was $195,916,139.Net unrealized appreciation aggregated to $16,954,782,of which $17,074,003 related to gross unrealized appreciation and $119,221 related to gross unrealized depreciation.

| | | | |

| Insurance coverage | | As a % of total investments | |

| |

National Public Finance Guarantee Corp. | | | 5.2 | |

| |

California Mortgage Insurance | | | 3.2 | |

| |

Assured Guaranty Municipal Corp. | | | 1.8 | |

| |

Build America Mutual Assurance Company | | | 1.8 | |

| |

Ambac Financial Group, Inc. | | | 0.4 | |

| |

TOTAL | | | 12.4 | |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 15 |

| | | | |

|

| STATEMENT OF ASSETS AND LIABILITIES 11-30-20 (unaudited) | |

| |

| | | | |

| |

Assets | | | | |

| |

Unaffiliated investments, at value (Cost $197,487,264) | | | $212,870,921 | |

| |

Cash | | | 129 | |

| |

Interest receivable | | | 2,448,949 | |

| |

Receivable for fund shares sold | | | 138,847 | |

| |

Other assets | | | 16,072 | |

| |

Total assets | | | 215,474,918 | |

| |

Liabilities | | | | |

| |

Distributions payable | | | 53,221 | |

| |

Payable for fund shares repurchased | | | 333,481 | |

| |

Payable to affiliates | | | | |

| |

Investment management fees | | | 96,324 | |

| |

Accounting and legal services fees | | | 6,392 | |

| |

Transfer agent fees | | | 7,228 | |

| |

Distribution and service fees | | | 22,159 | |

| |

Trustees’ fees | | | 230 | |

| |

Other liabilities and accrued expenses | | | 84,406 | |

| |

Total liabilities | | | 603,441 | |

| |

Net assets | | | $214,871,477 | |

| |

Net assets consist of | | | | |

| |

Paid-in capital | | | $197,794,850 | |

| |

Total distributable earnings (loss) | | | 17,076,627 | |

| |

Net assets | | | $214,871,477 | |

| | | | |

| |

Net asset value per share | | | | |

| |

Based on net asset value and shares outstanding - the fund has an unlimited number of shares authorized with no par value | | | | |

| |

Class A ($182,003,695 ÷ 16,594,671 shares)1 | | | $10.97 | |

| |

Class C ($13,293,975 ÷ 1,212,144 shares)1 | | | $10.97 | |

| |

Class I ($12,452,520 ÷ 1,134,761 shares) | | | $10.97 | |

| |

Class R6 ($7,121,287 ÷ 648,706 shares) | | | $10.98 | |

| |

Maximum offering price per share | | | | |

| |

Class A (net asset value per share ÷ 96%)2 | | | $11.43 | |

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| 2 | On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced. |

| | | | |

| 16 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | |

|

| STATEMENT OF OPERATIONS For the six months ended 11-30-20 (unaudited) | |

| |

| | | | |

| |

Investment income | | | | |

Interest | | $ | 3,911,224 | |

Expenses | | | | |

Investment management fees | | | 583,751 | |

Distribution and service fees | | | 207,902 | |

Accounting and legal services fees | | | 20,389 | |

Transfer agent fees | | | 45,048 | |

Trustees’ fees | | | 1,840 | |

Custodian fees | | | 26,997 | |

State registration fees | | | 6,971 | |

Printing and postage | | | 18,717 | |

Professional fees | | | 29,841 | |

Other | | | 11,285 | |

Total expenses | | | 952,741 | |

Less expense reductions | | | (15,232 | ) |

Net expenses | | | 937,509 | |

Net investment income | | | 2,973,715 | |

Realized and unrealized gain (loss) | | | | |

Net realized gain (loss) on | | | | |

Unaffiliated investments | | | 1,169,155 | |

| | | | 1,169,155 | |

Change in net unrealized appreciation (depreciation) of | | | | |

Unaffiliated investments | | | 4,961,461 | |

| | | | 4,961,461 | |

Net realized and unrealized gain | | | 6,130,616 | |

Increase in net assets from operations | | $ | 9,104,331 | |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 17 |

| | | | | | | | |

|

STATEMENTS OF CHANGES IN NET ASSETS | |

| | |

| | | | | | | | |

| | | Six months ended

11-30-20

(unaudited) | | | Year ended

5-31-20 | |

Increase (decrease) in net assets | | | | | | | | |

From operations | | | | | | | | |

Net investment income | | | $2,973,715 | | | | $6,569,649 | |

Net realized gain (loss) | | | 1,169,155 | | | | (845,679) | |

Change in net unrealized appreciation (depreciation) | | | 4,961,461 | | | | (3,587,750) | |

Increase in net assets resulting from operations | | | 9,104,331 | | | | 2,136,220 | |

Distributions to shareholders | | | | | | | | |

From earnings | | | | | | | | |

Class A | | | (2,492,228) | | | | (6,845,190) | |

Class B1 | | | (2,166) | | | | (11,003) | |

Class C | | | (154,039) | | | | (537,072) | |

Class I | | | (191,858) | | | | (483,472) | |

Class R6 | | | (113,264) | | | | (204,555) | |

Total distributions | | | (2,953,555) | | | | (8,081,292) | |

From fund share transactions | | | (2,423,602) | | | | 7,406,442 | |

Total increase | | | 3,727,174 | | | | 1,461,370 | |

Net assets | | | | | | | | |

Beginning of period | | | 211,144,303 | | | | 209,682,933 | |

End of period | | | $214,871,477 | | | | $211,144,303 | |

| 1 | Share class was redesignated during the period. Refer to Note 5 for further details. |

| | | | |

| 18 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| CLASS A SHARES Period ended | | 11-30-201 | | | 5-31-20 | | | 5-31-19 | | | 5-31-18 | | | 5-31-17 | | | 5-31-16 | |

| | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.90 | | | | $11.22 | | | | $10.91 | |

| | | | | | |

Net investment income2 | | | 0.15 | | | | 0.34 | | | | 0.36 | | | | 0.36 | | | | 0.37 | | | | 0.39 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | 0.31 | | | | (0.20 | ) | | | 0.22 | | | | (0.16 | ) | | | (0.30 | ) | | | 0.32 | |

| | | | | | |

Total from investment operations | | | 0.46 | | | | 0.14 | | | | 0.58 | | | | 0.20 | | | | 0.07 | | | | 0.71 | |

| | | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

From net investment income | | | (0.15 | ) | | | (0.34 | ) | | | (0.36 | ) | | | (0.37 | ) | | | (0.39 | ) | | | (0.40 | ) |

| | | | | | |

From net realized gain | | | — | | | | (0.08 | ) | | | (0.01 | ) | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | (0.15 | ) | | | (0.42 | ) | | | (0.37 | ) | | | (0.37 | ) | | | (0.39 | ) | | | (0.40 | ) |

| | | | | | |

Net asset value, end of period | | | $10.97 | | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.90 | | | | $11.22 | |

| | | | | | |

Total return (%)3,4 | | | 4.375 | | | | 1.22 | | | | 5.57 | | | | 1.85 | | | | 0.63 | | | | 6.63 | |

| | | | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (in millions) | | | $182 | | | | $173 | | | | $176 | | | | $181 | | | | $213 | | | | $254 | |

| | | | | | |

Ratios (as a percentage of average net assets): | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before reductions | | | 0.85 | 6 | | | 0.85 | | | | 0.86 | | | | 0.85 | | | | 0.83 | | | | 0.84 | |

| | | | | | |

Expenses including reductions | | | 0.85 | 6 | | | 0.84 | | | | 0.85 | | | | 0.84 | | | | 0.83 | | | | 0.83 | |

| | | | | | |

Net investment income | | | 2.84 | 6 | | | 3.12 | | | | 3.42 | | | | 3.37 | | | | 3.35 | | | | 3.53 | |

| | | | | | |

Portfolio turnover (%) | | | 9 | | | | 22 | | | | 22 | | | | 9 | | | | 17 | | | | 20 | |

| 1 | Six months ended 11-30-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Does not reflect the effect of sales charges, if any. |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 19 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

CLASS C SHARES Period ended | | | 11-30-20 | 1 | | | 5-31-20 | | | | 5-31-19 | | | | 5-31-18 | | | | 5-31-17 | | | | 5-31-16 | |

| | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.90 | | | | $11.22 | | | | $10.91 | |

| | | | | | |

Net investment income2 | | | 0.11 | | | | 0.26 | | | | 0.28 | | | | 0.28 | | | | 0.29 | | | | 0.31 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | 0.31 | | | | (0.20 | ) | | | 0.22 | | | | (0.16 | ) | | | (0.31 | ) | | | 0.32 | |

| | | | | | |

Total from investment operations | | | 0.42 | | | | 0.06 | | | | 0.50 | | | | 0.12 | | | | (0.02 | ) | | | 0.63 | |

| | | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

From net investment income | | | (0.11 | ) | | | (0.26 | ) | | | (0.28 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.32 | ) |

| | | | | | |

From net realized gain | | | — | | | | (0.08 | ) | | | (0.01 | ) | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | (0.11 | ) | | | (0.34 | ) | | | (0.29 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.32 | ) |

| | | | | | |

Net asset value, end of period | | | $10.97 | | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.90 | | | | $11.22 | |

| | | | | | |

Total return (%)3,4 | | | 3.985 | | | | 0.47 | | | | 4.78 | | | | 1.09 | | | | (0.13 | ) | | | 5.83 | |

| | | | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (in millions) | | | $13 | | | | $16 | | | | $19 | | | | $21 | | | | $30 | | | | $36 | |

| | | | | | |

Ratios (as a percentage of average net assets): | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before reductions | | | 1.70 | 6 | | | 1.70 | | | | 1.71 | | | | 1.70 | | | | 1.68 | | | | 1.69 | |

| | | | | | |

Expenses including reductions | | | 1.60 | 6 | | | 1.59 | | | | 1.60 | | | | 1.59 | | | | 1.58 | | | | 1.58 | |

| | | | | | |

Net investment income | | | 2.09 | 6 | | | 2.37 | | | | 2.67 | | | | 2.62 | | | | 2.60 | | | | 2.78 | |

| | | | | | |

Portfolio turnover (%) | | | 9 | | | | 22 | | | | 22 | | | | 9 | | | | 17 | | | | 20 | |

| 1 | Six months ended 11-30-20. Unaudited. |

| 2 | Based on average daily shares outstanding. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Does not reflect the effect of sales charges, if any. |

| | | | |

| 20 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

CLASS I SHARES Period ended | | | 11-30-20 | 1 | | | 5-31-20 | | | | 5-31-19 | | | | 5-31-18 | | | | 5-31-17 | 2 |

| | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of period | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.91 | | | | $10.70 | |

| | | | | |

Net investment income3 | | | 0.16 | | | | 0.35 | | | | 0.38 | | | | 0.38 | | | | 0.12 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 0.31 | | | | (0.20 | ) | | | 0.22 | | | | (0.17 | ) | | | 0.21 | |

| | | | | |

Total from investment operations | | | 0.47 | | | | 0.15 | | | | 0.60 | | | | 0.21 | | | | 0.33 | |

| | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | | (0.16 | ) | | | (0.35 | ) | | | (0.38 | ) | | | (0.39 | ) | | | (0.12 | ) |

| | | | | |

From net realized gain | | | — | | | | (0.08 | ) | | | (0.01 | ) | | | — | | | | — | |

| | | | | |

Total distributions | | | (0.16 | ) | | | (0.43 | ) | | | (0.39 | ) | | | (0.39 | ) | | | (0.12 | ) |

| | | | | |

Net asset value, end of period | | | $10.97 | | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.91 | |

| | | | | |

Total return (%)4 | | | 4.455 | | | | 1.37 | | | | 5.72 | | | | 1.91 | | | | 3.095 | |

| | | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (in millions) | | | $12 | | | | $15 | | | | $10 | | | | $10 | | | | $5 | |

| | | | | |

Ratios (as a percentage of average net assets): | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before reductions | | | 0.70 | 6 | | | 0.70 | | | | 0.71 | | | | 0.70 | | | | 0.67 | 6 |

| | | | | |

Expenses including reductions | | | 0.70 | 6 | | | 0.69 | | | | 0.70 | | | | 0.69 | | | | 0.66 | 6 |

| | | | | |

Net investment income | | | 2.98 | 6 | | | 3.25 | | | | 3.58 | | | | 3.53 | | | | 3.76 | 6 |

| | | | | |

Portfolio turnover (%) | | | 9 | | | | 22 | | | | 22 | | | | 9 | | | | 17 | 7 |

| 1 | Six months ended 11-30-20. Unaudited. |

| 2 | The inception date for Class I shares is 2-13-17. |

| 3 | Based on average daily shares outstanding. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 7 | Portfolio turnover is shown for the period from 6-1-16 to 5-31-17. |

| | | | |

| SEE NOTES TO FINANCIAL STATEMENTS | | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 21 |

| | | | | | | | | | | | | | | | |

| | | | |

CLASS R6 SHARES Period ended | | | 11-30-20 | 1 | | | 5-31-20 | | | | 5-31-19 | | | | 5-31-18 | 2 |

| | | | |

Per share operating performance | | | | | | | | | | | | | | | | |

| | | | |

Net asset value, beginning of period | | | $10.66 | | | | $10.94 | | | | $10.73 | | | | $10.95 | |

| | | | |

Net investment income3 | | | 0.16 | | | | 0.36 | | | | 0.38 | | | | 0.29 | |

| | | | |

Net realized and unrealized gain (loss) on investments | | | 0.32 | | | | (0.20 | ) | | | 0.22 | | | | (0.22 | ) |

| | | | |

Total from investment operations | | | 0.48 | | | | 0.16 | | | | 0.60 | | | | 0.07 | |

| | | | |

Less distributions | | | | | | | | | | | | | | | | |

| | | | |

From net investment income | | | (0.16 | ) | | | (0.36 | ) | | | (0.38 | ) | | | (0.29 | ) |

| | | | |

From net realized gain | | | — | | | | (0.08 | ) | | | (0.01 | ) | | | — | |

| | | | |

Total distributions | | | (0.16 | ) | | | (0.44 | ) | | | (0.39 | ) | | | (0.29 | ) |

| | | | |

Net asset value, end of period | | | $10.98 | | | | $10.66 | | | | $10.94 | | | | $10.73 | |

| | | | |

Total return (%)4 | | | 4.565 | | | | 1.40 | | | | 5.76 | | | | 0.665 | |

| | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

| | | | |

Net assets, end of period (in millions) | | | $7 | | | | $7 | | | | $4 | | | | $2 | |

| | | | |

Ratios (as a percentage of average net assets): | | | | | | | | | | | | | | | | |

| | | | |

Expenses before reductions | | | 0.67 | 6 | | | 0.67 | | | | 0.68 | | | | 0.68 | 6 |

| | | | |

Expenses including reductions | | | 0.66 | 6 | | | 0.66 | | | | 0.67 | | | | 0.67 | 6 |

| | | | |

Net investment income | | | 3.00 | 6 | | | 3.28 | | | | 3.58 | | | | 3.56 | 6 |

| | | | |

Portfolio turnover (%) | | | 9 | | | | 22 | | | | 22 | | | | 9 | 7 |

| 1 | Six months ended 11-30-20. Unaudited. |

| 2 | The inception date for Class R6 shares is 8-30-17. |

| 3 | Based on average daily shares outstanding. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 7 | Portfolio turnover is shown for the period from 6-1-17 to 5-31-18. |

| | | | |

| 22 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS |

|

Notes to financial statements (unaudited) |

Note 1 — Organization

John Hancock California Tax-Free Income Fund (the fund) is a series of John Hancock California Tax-Free Income Fund (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek a high level of current income, consistent with preservation of capital, that is exempt from federal and California personal income taxes.

The fund may offer multiple classes of shares. The shares currently outstanding are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R6 shares are only available to certain retirement plans, institutions and other investors. Class C shares convert to Class A shares eight years after purchase (certain exclusions may apply). Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the fund’s Valuation Policies and Procedures.

In order to value the securities, the fund uses the following valuation techniques: Debt obligations are typically valued based on evaluated prices provided by an independent pricing vendor. Independent pricing vendors utilize matrix pricing, which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker supplied prices.

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund’s Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities, including registered investment companies. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or

| | | | |

| | SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 23 |

methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

As of November 30, 2020, all investments are categorized as Level 2 under the hierarchy described above.

Repurchase agreements. The fund may enter into repurchase agreements. When the fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the fund’s custodian, or for tri-party repurchase agreements, collateral is held at a third-party custodian bank in a segregated account for the benefit of the fund. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. Collateral received by the fund for repurchase agreements is disclosed in the Fund’s investments as part of the caption related to the repurchase agreement.

Repurchase agreements are typically governed by the terms and conditions of the Master Repurchase Agreement and/or Global Master Repurchase Agreement (collectively, MRA). Upon an event of default, the non-defaulting party may close out all transactions traded under the MRA and net amounts owed. Absent an event of default, assets and liabilities resulting from repurchase agreements are not offset in the Statement of assets and liabilities. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline or the counterparty may have insufficient assets to pay claims resulting from close-out of the transactions.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Overdraft. The fund may have the ability to borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund’s custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the extent of any overdraft, and to the maximum extent permitted by law.

Line of credit. Effective June 25, 2020, the fund and other affiliated funds have entered into a syndicated line of credit agreement with Citibank, N.A. as the administrative agent that enables them to participate in a $1 billion unsecured committed line of credit. Excluding commitments designated for a certain fund and subject to the needs of all other affiliated funds, the fund can borrow up to an aggregate commitment amount of $850 million, subject to asset coverage and other limitations as specified in the agreement. Each participating fund paid an upfront fee in connection with this line of credit agreement, which is charged based on a combination of fixed and asset-based allocations and amortized over 365 days. Prior to June 25, 2020, the fund and other affiliated funds had a similar agreement that enabled them to participate in a $750 million unsecured committed line of credit. A commitment fee payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund based on a combination of fixed and asset-based allocations and is reflected in Other expenses on the Statement of operations. For the six months ended November 30, 2020, the fund had no borrowings under the line of credit. Commitment fees, including upfront fees, for the six months ended November 30, 2020 were $3,145.

| | | | |

| 24 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT | | |

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, and transfer agent fees, for all classes, are charged daily at the class level based on the net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of May 31, 2020, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares dividends daily and pays them monthly. Capital gain distributions, if any, are typically distributed annually.

Distributions paid by the fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP. The final determination of tax characteristics of the fund’s distribution will occur at the end of the year and will subsequently be reported to shareholders.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to accretion on debt securities.

Note 3 — Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management LLC (the Advisor) serves as investment advisor for the fund. John Hancock Investment Management Distributors LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the fund. The Advisor and the Distributor are indirect, principally owned subsidiaries of Manulife Financial Corporation.

Management fee. The fund has an investment management agreement with the Advisor under which the fund pays a monthly management fee to the Advisor, equivalent on an annual basis, to the sum of: (a) 0.550% of the first $500 million of the fund’s average daily net assets, (b) 0.500% of the next $500 million of the fund’s average daily net assets, (c) 0.475% of the next $1 billion of the fund’s average daily net assets; and (d) 0.450% of the

| | |

| SEMIANNUAL REPORT | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | | 25 |

fund’s average daily net assets in excess of $2 billion. The Advisor has a subadvisory agreement with Manulife Investment Management (US) LLC, an indirectly owned subsidiary of Manulife Financial Corporation and an affiliate of the Advisor. The fund is not responsible for payment of the subadvisory fees.

The Advisor has contractually agreed to waive a portion of its management fee and/or reimburse expenses for certain funds of the John Hancock group of funds complex, including the fund (the participating portfolios). This waiver is based upon aggregate net assets of all the participating portfolios. The amount of the reimbursement is calculated daily and allocated among all the participating portfolios in proportion to the daily net assets of each fund. During the six months ended November 30, 2020, this waiver amounted to 0.01% of the fund’s average daily net assets, on an annualized basis. This arrangement expires on July 31, 2022, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time.

For the six months ended November 30, 2020, the expense reductions described above amounted to the following:

| | | | |

| Class | | Expense reduction | |

Class A | | | $6,406 | |

Class B | | | 7 | |

Class C | | | 538 | |

| | | | |

| Class | | Expense reduction | |

Class I | | | $467 | |

Class R6 | | | 273 | |

Total | | | $7,691 | |

Expenses waived or reimbursed in the current fiscal period are not subject to recapture in future fiscal periods.

The investment management fees, including the impact of the waivers and reimbursements as described above, incurred for the six months ended November 30, 2020, were equivalent to a net annual effective rate of 0.54% of the fund’s average daily net assets.

Accounting and legal services. Pursuant to the Accounting and Legal Services Agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, compliance, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred, for the six months ended November 30, 2020, amounted to an annual rate of 0.02% of the fund’s average daily net assets.

Distribution and service plans. The fund has a distribution agreement with the Distributor. The fund has adopted distribution and service plans for certain classes as detailed below pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the fund. The fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the fund’s shares:

| | | | |

| Class | | Rule 12b-1 Fee | |

Class A | | | 0.15% | |

Class B | | | 1.00% | |

Class C | | | 1.00% | |

Class B was redesignated during the period. Refer to Note 5 for further details.

The fund’s Distributor has contractually agreed to waive 0.10% of Rule12b-1 fees for Class C shares. The current waiver agreement expires on September 30, 2021, unless renewed by mutual agreement of the fund and the Distributor based upon a determination that this is appropriate under the circumstances at the time. This contractual waiver amounted to $7,438 for Class C shares for the six months ended November 30, 2020.

| | |

| 26 | | JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND | SEMIANNUAL REPORT |

Prior to October 14, 2020, the fund’s distributor contractually agreed to waive 0.10% of Rule 12b-1 fees for Class B. This contractual waiver amounted to $103 for the six months ended November 30, 2020.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $58,053 for the six months ended November 30, 2020. Of this amount, $8,307 was retained and used for printing prospectuses, advertising, sales literature and other purposes and $49,746 was paid as sales commissions to broker-dealers.

Class A and Class C shares may be subject to contingent deferred sales charges (CDSCs). Certain Class A shares that are acquired through purchases of $1 million or more and are redeemed within one year of purchase are subject to a 1.00% sales charge. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC. CDSCs are applied to the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the six months ended November 30, 2020, CDSCs received by the Distributor amounted to $2,302 and $1,211 for Class A and Class C shares, respectively.