Second Quarter 2018 Results FRED LAMPROPOULOS Chairman & CEO RAUL PARRA CFO

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS This presentation and any accompanying management commentary include “forward-looking statements,” as defined within applicable securities laws and regulations. All statements in this presentation, other than statements of historical fact, are “forward-looking statements”, including projections of earnings, revenues or other financial items, statements regarding our plans and objectives for future operations, statements concerning proposed products or services, statements regarding the integration, development or commercialization of our business or any business, assets or operations we have acquired or may acquire, statements regarding future economic conditions or performance, statements regarding governmental inquiries, investigations or proceedings and statements of assumptions underlying any of the foregoing. All forward-looking statements, including financial projections, included in this presentation are made as of the date of this presentation, and are based on information available to us as of such date. We assume no obligation to update or disclose revisions to any forward-looking statement, except as required by law or regulation. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “likely,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “projects,” ”forecast,” “potential,” “plan,” or other comparable terminology. Forward-looking statements are based on our current beliefs, expectations and assumptions regarding our business, domestic and global economies, regulatory and competitive environments and other conditions. There can be no assurance that such beliefs, expectations or assumptions or any of the forward-looking statements will prove to be correct. Actual results will likely differ, and may differ materially, from those projected or assumed in the forward-looking statements. Our future financial and operating results and condition, as well as any forward-looking statements, are subject to inherent risks and uncertainties such as those described in our Annual Report on Form 10-K for the year ended December 31, 2017 and other filings with the U.S. Securities and Exchange Commission. Such risks and uncertainties include risks relating to our potential inability to successfully manage growth through acquisitions, including the inability to commercialize technology acquired through completed, proposed or future transactions; expenditures relating to research, development, testing and regulatory approvals of our products and risks that such products may not be developed successfully or approved for commercial use; governmental scrutiny and regulation of the medical device industry, including governmental inquiries, investigations or proceedings; restrictions on our liquidity or business operations resulting from our debt agreements; infringement of our technology or the assertion that our technology infringes the rights of other parties; product recalls and product liability claims; changes in customer purchasing patterns or the mix of products we sell; the potential of fines, penalties or other adverse consequences if our employees or agents violate the U.S. Foreign Corrupt Practices Act or other laws or regulations; laws and regulations targeting fraud and abuse in the healthcare industry; potential for significant adverse changes in governing regulations, including reforms to the procedures for approval or clearance of our products by the U.S. Food & Drug Administration or comparable regulatory authorities in other jurisdictions; changes in tax laws and regulations in the United States or other countries; increases in the prices of commodity components; negative changes in economic and industry conditions in the United States or other countries; termination or interruption of relationships with our suppliers, or failure of such suppliers to perform; fluctuations in exchange rates; concentration of a substantial portion of our revenues among a few products and procedures; development of new products and technology that could render our existing products obsolete; market acceptance of new products; volatility in the market price of our common stock; modification or limitation of governmental or private insurance reimbursement policies; changes in healthcare policies or markets related to healthcare reform initiatives; failure to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; introduction of products in a timely fashion; price and product competition; availability of labor and materials; and fluctuations in and obsolescence of inventory. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The financial projections set forth in this presentation are based on a number of assumptions, estimates and forecasts. The inaccuracy of any one of those assumptions, estimates or forecasts could materially impact our financial results. Inevitably, some of those assumptions, estimates or forecasts will not occur and unanticipated events and circumstances will occur subsequent to the date of this presentation. In addition to changes in the underlying assumptions, our future performance is subject to a number of risks and uncertainties with respect to our existing and proposed business and other factors that may cause our actual results or performance to be materially different from any predicted or implied. Although we have attempted to identify important assumptions in the financial projections, there may be other factors that could materially affect our actual financial performance, and no assurance can be given that all material factors have been considered in the preparation of the financial projections. Accordingly, you should not place undue reliance on such projections. Future operating results are, in fact, impossible to predict. 2

NON-GAAP FINANCIAL MEASURES Although Merit’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), Merit’s management believes that certain non-GAAP financial measures provide investors with useful information regarding the underlying business trends and performance of Merit’s ongoing operations and can be useful for period-over-period comparisons of such operations. Certain financial measures included in this presentation, or which may be referenced in management’s discussion of Merit’s historical and future operations and financial results, have not been calculated in accordance with GAAP, and, therefore, are referenced as non-GAAP financial measures. Readers should consider non-GAAP measures used in this presentation in addition to, not as a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures generally exclude some, but not all, items that may affect Merit's net income. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded. Additionally, non-GAAP financial measures used in this presentation may not be comparable with similarly titled measures of other companies. Merit urges investors and potential investors to review the reconciliations of its non-GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate Merit’s business or results of operations. Please refer to “Notes to Non-GAAP Financial Measures” at the end of these materials for more information. TRADEMARKS Unless noted otherwise, trademarks used in this presentation are the property of Merit Medical Systems, Inc., in the United States and other jurisdictions. 3

Financial Summary GAAP Q2 2018 Q2 2017 YTD 2018 YTD 2017 Revenue $224.8M $186.5M $427.8M $357.6M Gross Margin 44.5% 45.1% 44.0% 44.8% Net Income $10.9M $9.5M $16.2M $24.3M EPS $0.21 $0.19 $0.31 $0.50 4

Financial Summary Non-GAAP Q2 2018 Q2 2017 YTD 2018 YTD 2017 Revenue (Constant Currency) $221.2M $186.5M $419.0M $357.6M Non-GAAP Gross Margin 48.9% 48.3% 48.2% 48.3% Non-GAAP Net Income $22.4M $18.3M $38.3M $31.0M Non-GAAP EPS $0.43 $0.36 $0.74 $0.64 5

Q2 2018 Revenue by Market (Non(GAAP(GAAP-GAAP 18.9%) 18.9%) 18.3%) (GAAP 25.7%) (GAAP(Non-GAAP 25.7%) 25.4%) (GAAP 55.4%) (Non(GAAP-GAAP 55.4%) 56.3%) 6

YTD 2018 Revenue by Market (Non(GAAP-GAAP 19.3%) 18.5%) (GAAP(Non-GAAP 25.9%) 25.5%) (Non(GAAP-GAAP 54.8%) 56.0%) 7

New Products in 2018 – FLO40XR™ Hemostasis Valve – PreludeSYNC™ DISTAL Radial Compression Device – Prelude Pursuit™ Splittable Sheath Introducer – Prelude IDeal™ Hydrophilic Sheath Introducer – Prelude Choice™ Hemostasis Valve Adapter 8

New Products in 2018 – CorVocet™ Biopsy Device – DiamondTOUCH™ Inflation Device – BasixTAU™ Inflation Device – Bone & Spine Biopsy Products – ReSolve CirQ™ Nephrostomy Catheter – FastBreak™ Breakaway Connector 9

New Products in 2018 – FirstChoice™ Ultra High Pressure PTA Balloon Catheters – Q50® PLUS Stent Graft Balloon Catheters Q50® PLUS is manufactured by and is a registered trademark of QXMédical. 10

Assets Purchased from Becton, Dickinson and Company – Achieve® Automatic Biopsy System – Pink Achieve™ Automatic Biopsy System – Original Temno™ Biopsy Device – Temno Evolution® Biopsy Device – Adjustable Coaxial Temno™ (ACT) Biopsy – Aspira® Drainage System 11

NvisionVLE® Imaging System – Breakthrough Design – High-Speed Optical Probe – Real-Time Image-Guided Tissue Marking ❖ NvisionVLE® Imaging System recently purchased by 4 major U.S. hospitals NvisionVLE ® is a registered trademark of NinePoint Medical, Inc. 12

Product Benefits from the Competitor Shortage SHEATH INTRODUCERS GUIDE WIRES – Prelude® – InQwire® – Prelude IDeal™ Hydrophilic – InQwire® Amplatz – PreludeEASE™ – Merit H20™ Hydrophilic – Prelude PRO™ – Merit Laureate® Hydrophilic 13

Product Benefits from the Competitor Shortage MICROCATHETERS COMPRESSION DEVICES CATHETERS – Merit Pursue™ – PreludeSYNC™ Radial – Impress® Hydrophilic – SwiftNINJA® Steerable – PreludeSYNC™ Distal – ConcierGE® Guiding – Merit Maestro® – Performa® Angiographic 14

Global Reach 15

NOTES TO NON-GAAP FINANCIAL MEASURES For additional details, please see the accompanying press release and forward-looking statement disclosure. These presentation materials and associated commentary from Merit’s management, as well as the press release issued today, use non-GAAP financial measures, including: • constant currency revenue; • core revenue; • core revenue on a constant currency basis; • non-GAAP gross margin; • non-GAAP net income; and • non-GAAP earnings per share. Merit’s management team uses these non-GAAP financial measures to evaluate Merit’s profitability and efficiency, to compare operating results to prior periods, to evaluate changes in the operating results of each segment, and to measure and allocate financial resources internally. However, Merit’s management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in accordance with GAAP. Readers should consider non-GAAP measures in addition to, not as a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures generally exclude some, but not all, items that may affect Merit's net income. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded. Merit believes it is useful to exclude such items in the calculation of non-GAAP net income, non-GAAP earnings per share and non-GAAP gross margin (in each case, as further illustrated in the reconciliation table below) because such amounts in any specific period may not directly correlate to the underlying performance of Merit’s business operations and can vary significantly between periods as a result of factors such as new acquisitions, non-cash expense related to amortization of previously acquired tangible and intangible assets, unusual compensation expenses or expenses resulting from non-ordinary course litigation or governmental proceedings. Merit may incur similar types of expenses in the future, and the non-GAAP financial information included in this presentation should not be viewed as a statement or indication that these types of expenses will not recur. Additionally, the non-GAAP financial measures used in this presentation may not be comparable with similarly titled measures of other companies. Merit urges investors and potential investors to review the reconciliations of its non-GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate Merit’s business or results of operations. 16

NOTES TO NON-GAAP FINANCIAL MEASURES (cont.) Constant Currency Revenue Merit’s revenue on a constant currency basis is prepared by translating the current-period reported sales of subsidiaries whose functional currency is other than the U.S. dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. The constant currency revenue adjustments of $(3.6) million and $(8.8) million for the three and six-month periods ended June 30, 2018 were calculated using the applicable average foreign exchange rates for the three and six-month periods ended June 30, 2017, respectively. Core Revenue and Core Revenue on a Constant Currency Basis Merit’s core revenue is defined (a) with respect to prior fiscal year periods, as GAAP revenue, and (b) with respect to current fiscal year periods, as GAAP revenue, less revenue from certain acquisitions and strategic transactions. For the three and six-month periods ended June 30, 2018, Merit’s core revenue excludes revenues from (i) the acquisition of (1) the assets of Catheter Connections, Inc. in January 2017 (excluded January 2018 only), (2) the critical care division of Argon Medical Devices, Inc. in January 2017 (excluded January 2018 only), (3) Osseon LLC in July 2017, (4) Laurane Medical S.A.S. in August 2017, (5) ITL Healthcare Pty. Ltd. in October 2017, and (6) certain divested assets of Becton, Dickinson and Company in February 2018, and (ii) a distribution arrangement with NinePoint Medical, Inc. in April 2018. Core revenue on a constant currency basis is defined as core revenue (as described in the first sentence of this paragraph) plus the foreign exchange impact related to those core sales, using the applicable foreign exchange rates in effect for the comparable prior-year periods presented. Non-GAAP Gross Margin Non-GAAP gross margin is calculated by reducing GAAP cost of sales by amounts recorded for amortization of intangible assets and inventory mark-up related to acquisitions. Non-GAAP Net Income Non-GAAP net income is calculated by reducing GAAP net income by certain items which are deemed by Merit’s management to be of a special or non-recurring nature, such as items related to new acquisitions, non-cash expense related to amortization of previously acquired tangible and intangible assets, unusual compensation expenses or expense resulting from non-ordinary courselitigation or governmental proceedings, as well as other items as set forth in the table below. Non-GAAP EPS Non-GAAP EPS is defined as non-GAAP net income divided by the diluted shares outstanding for the corresponding period. Other Non-GAAP Financial Measure Reconciliation The following table sets forth supplemental financial data and corresponding reconciliations of non-GAAP net income and non-GAAP earnings per share to Merit’s net income and earnings per share prepared in accordance with GAAP, in each case, for the three and six months ended June 30, 2018 and 2017. The non-GAAP income adjustments referenced in the following table do not reflect stock-based compensation expense of approximately $1.6 million and $1.1 million for the three-month periods ended June 30, 2018 and 2017, respectively, and approximately $2.8 million and $1.7 million for the six-month periods ended June 30, 2018 and 2017. 17

Reconciliation of GAAP Net Income to Non-GAAP Net Income (Unaudited, in thousands except per share amounts) Three Months Ended Three Months Ended June 30, 2018 June 30, 2017 Pre-Tax Tax Impact (a) After-Tax Per Share Impact Pre-Tax Tax Impact (a) After-Tax Per Share Impact GAAP net income $ 11,565 $ (624) $ 10,941 $ 0.21 $ 11,313 $ (1,830) $ 9,483 $ 0.19 Non-GAAP adjustments: Cost of Sales Amortization of intangibles 7,937 (2,061) 5,876 0.12 4,917 (1,840) 3,077 0.06 Inventory mark-up related to acquisitions 1,888 (485) 1,403 0.03 985 (383) 602 0.01 Operating Expenses Severance 163 (38) 125 0.00 128 (50) 78 0.00 Acquisition-related (b) 620 (159) 461 0.01 1,736 (552) 1,184 0.02 Fair value adjustment to contingent consideration (c) 178 (46) 132 0.00 (18) 7 (11) 0.00 Long-term asset impairment charge (d) 29 (7) 22 0.00 2 (1) 1 0.00 Acquired in-process research and development 306 (79) 227 0.00 75 (29) 46 0.00 Amortization of intangibles 2,466 (655) 1,811 0.03 1,329 (512) 817 0.02 Special legal expense (e) 1,646 (423) 1,223 0.02 3,657 (1,422) 2,235 0.04 Other (Income) Expense Gain on bargain purchase (f) — — — 0.00 669 — 669 0.01 Amortization of long-term debt issuance costs 201 (52) 149 0.00 171 (67) 104 0.00 Non-GAAP net income $ 26,999 $ (4,629) $ 22,370 $ 0.43 $ 24,964 $ (6,679) $ 18,285 $ 0.36 Diluted shares 52,154 51,188 (a) Reflects the tax effect associated with pre-tax income and the non-GAAP adjustments (b) Represents transaction costs related to acquisitions (c) Represents changes in the fair value of contingent consideration liabilities and contingent receivables as a result of acquisitions (d) Represents abandoned patents (e) Costs incurred in responding to an inquiry from the U.S. Department of Justice (f) Represents the gain on bargain purchase realized from the acquisition of the critical care division of Argon Medical Devices, Inc. 18

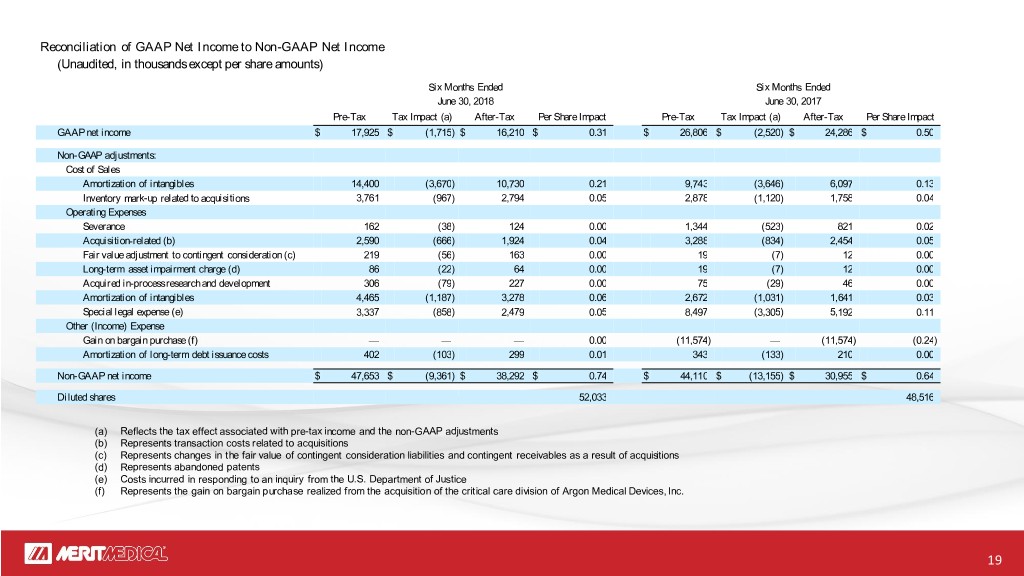

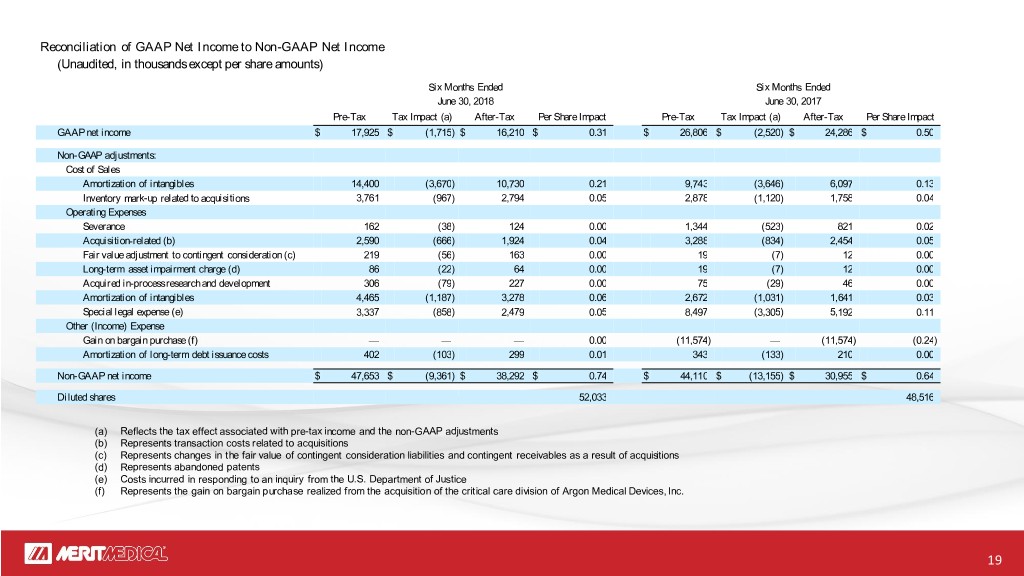

Reconciliation of GAAP Net Income to Non-GAAP Net Income (Unaudited, in thousands except per share amounts) Six Months Ended Six Months Ended June 30, 2018 June 30, 2017 Pre-Tax Tax Impact (a) After-Tax Per Share Impact Pre-Tax Tax Impact (a) After-Tax Per Share Impact GAAP net income $ 17,925 $ (1,715) $ 16,210 $ 0.31 $ 26,806 $ (2,520) $ 24,286 $ 0.50 Non-GAAP adjustments: Cost of Sales Amortization of intangibles 14,400 (3,670) 10,730 0.21 9,743 (3,646) 6,097 0.13 Inventory mark-up related to acquisitions 3,761 (967) 2,794 0.05 2,878 (1,120) 1,758 0.04 Operating Expenses Severance 162 (38) 124 0.00 1,344 (523) 821 0.02 Acquisition-related (b) 2,590 (666) 1,924 0.04 3,288 (834) 2,454 0.05 Fair value adjustment to contingent consideration (c) 219 (56) 163 0.00 19 (7) 12 0.00 Long-term asset impairment charge (d) 86 (22) 64 0.00 19 (7) 12 0.00 Acquired in-process research and development 306 (79) 227 0.00 75 (29) 46 0.00 Amortization of intangibles 4,465 (1,187) 3,278 0.06 2,672 (1,031) 1,641 0.03 Special legal expense (e) 3,337 (858) 2,479 0.05 8,497 (3,305) 5,192 0.11 Other (Income) Expense Gain on bargain purchase (f) — — — 0.00 (11,574) — (11,574) (0.24) Amortization of long-term debt issuance costs 402 (103) 299 0.01 343 (133) 210 0.00 Non-GAAP net income $ 47,653 $ (9,361) $ 38,292 $ 0.74 $ 44,110 $ (13,155) $ 30,955 $ 0.64 Diluted shares 52,033 48,516 (a) Reflects the tax effect associated with pre-tax income and the non-GAAP adjustments (b) Represents transaction costs related to acquisitions (c) Represents changes in the fair value of contingent consideration liabilities and contingent receivables as a result of acquisitions (d) Represents abandoned patents (e) Costs incurred in responding to an inquiry from the U.S. Department of Justice (f) Represents the gain on bargain purchase realized from the acquisition of the critical care division of Argon Medical Devices, Inc. 19

Reconciliation of Reported Revenue to Core Revenue (Non-GAAP), Constant Currency Revenue (Non- GAAP), and Core Revenue on a Constant Currency Basis (Non-GAAP) (Unaudited, in thousands) Three Months Ended Six Months Ended June 30, June 30, % Change 2018 2017 % Change 2018 2017 Reported Revenue 20.5% $ 224,810 $ 186,549 19.6% $ 427,844 $ 357,618 Add: Impact of foreign exchange (a) (3,645) — (8,798) — Constant Currency Revenue 18.6% $ 221,165 $ 186,549 17.2% $ 419,046 $ 357,618 Three Months Ended Six Months Ended June 30, June 30, % Change 2018 2017 % Change 2018 2017 Reported Revenue 20.5% $ 224,810 $ 186,549 19.6% $ 427,844 $ 357,618 Less: Revenue from certain acquisitions (b) (16,364) — (30,998) — Core Revenue 11.7% $ 208,446 $ 186,549 11.0% $ 396,846 $ 357,618 Add: Impact of foreign exchange on core revenue (a) (3,645) — (8,798) — Core Revenue on a Constant Currency Basis 9.8% $ 204,801 $ 186,549 8.5% $ 388,048 $ 357,618 (a) The constant currency revenue adjustments of $(3.6) million and $(8.8) million to reported revenue and to core revenue for the three and six-months ended June 30, 2018, respectively were calculated using the applicable average foreign exchange rates for the three and six-months ended June 30, 2017, respectively. (b) Merit’s core revenue is defined (a) with respect to prior fiscal year periods, as GAAP revenue, and (b) with respect to current fiscal year periods, as GAAP revenue, less revenue from certain acquisitions and strategic transactions. For the three and six-month periods ended June 30, 2018, Merit’s core revenue excludes revenues from (i) the acquisitions of (1) the assets of Catheter Connections, Inc. in January 2017 (excluded January 2018 only), (2) the critical care division of Argon Medical Devices, Inc. in January 2017 (excluded January 2018 only), (3) Osseon LLC in July 2017, (4) Laurane Medical S.A.S. in August 2017, (5) ITL Healthcare Pty. Ltd. in October 2017, and (6) certain divested assets of Becton, Dickinson and Company in February 2018, and (ii) the distribution arrangement with NinePoint Medical, Inc. in April 2018. 20

Reconciliation of Reported Gross Margin to Non-GAAP Gross Margin (Non-GAAP) (Unaudited, as a percentage of reported revenue) Three Months Ended Six Months Ended June 30, June 30, 2018 2017 2018 2017 Reported Gross Margin 44.5% 45.1% 44.0% 44.8% Add back impact of: Amortization of intangibles 3.5% 2.7% 3.3% 2.7% Inventory mark-up related to acquisitions 0.9% 0.5% 0.9% 0.8% Non-GAAP Gross Margin 48.9% 48.3% 48.2% 48.3% 21

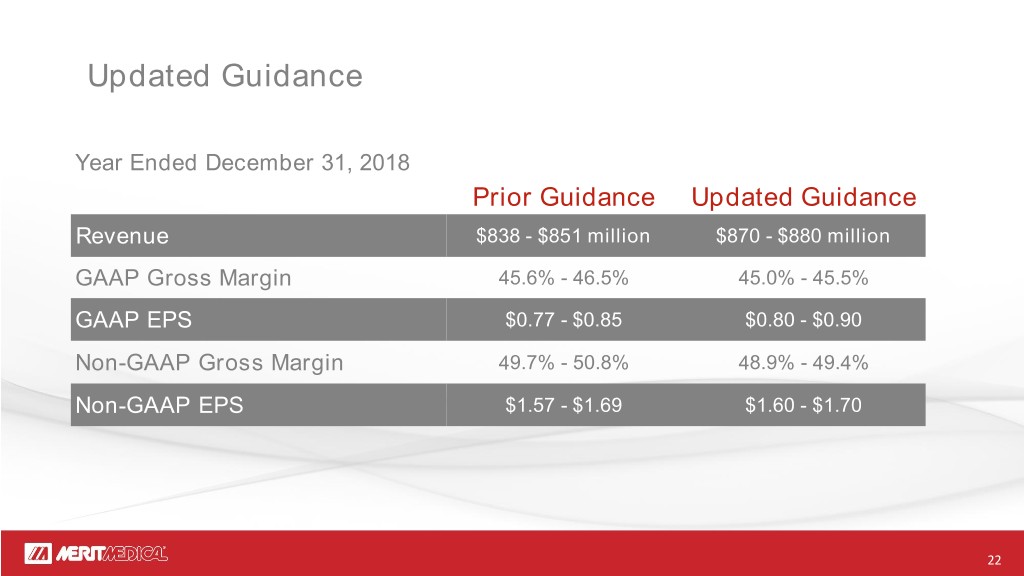

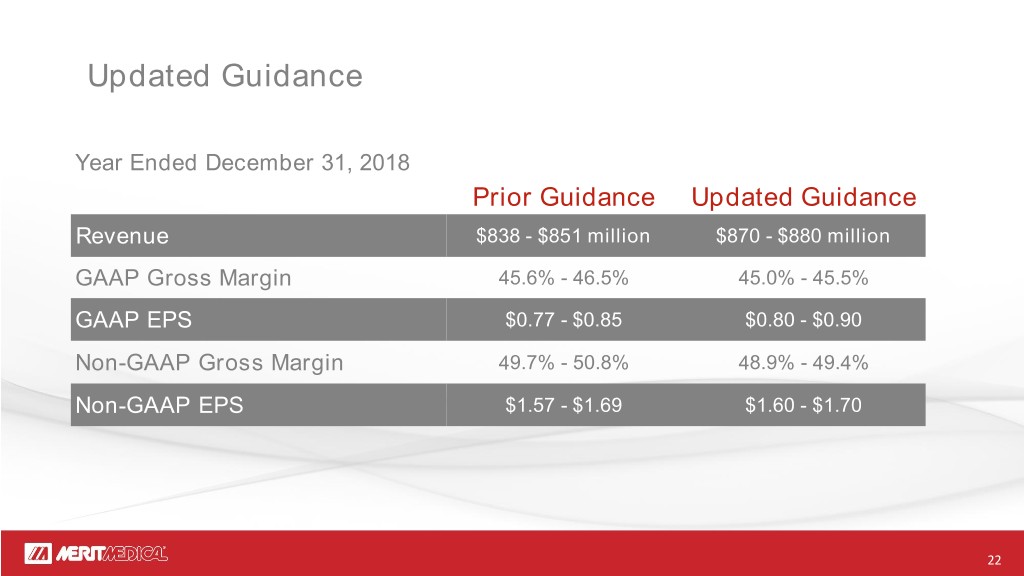

Updated Guidance Year Ended December 31, 2018 Prior Guidance Updated Guidance Revenue $838 - $851 million $870 - $880 million GAAP Gross Margin 45.6% - 46.5% 45.0% - 45.5% GAAP EPS $0.77 - $0.85 $0.80 - $0.90 Non-GAAP Gross Margin 49.7% - 50.8% 48.9% - 49.4% Non-GAAP EPS $1.57 - $1.69 $1.60 - $1.70 22