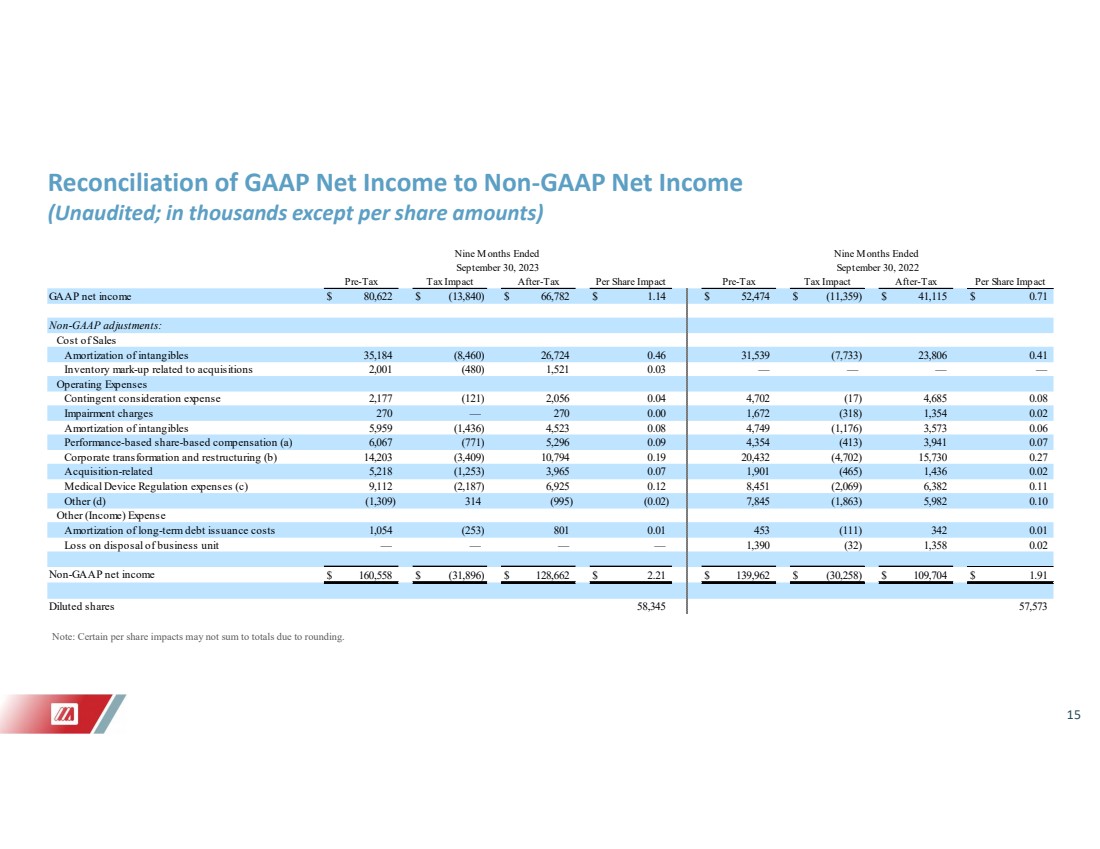

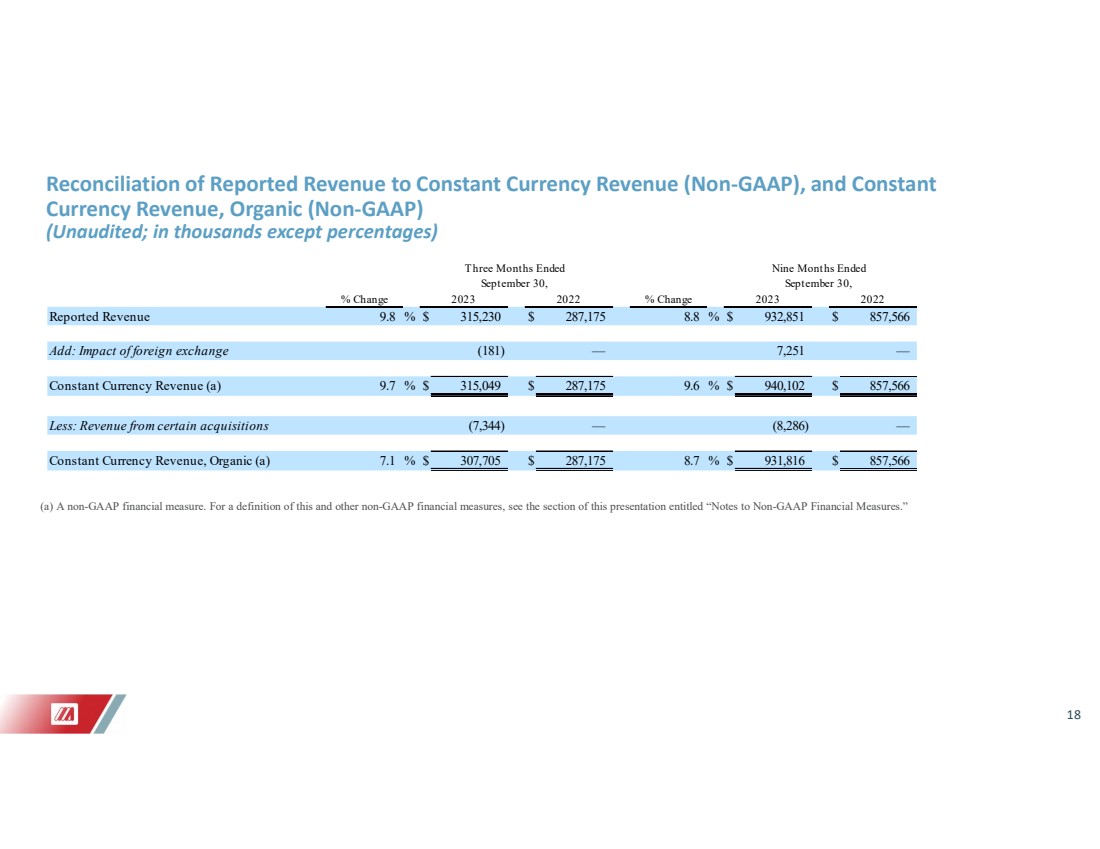

| 15 Reconciliation of GAAP Net Income to Non-GAAP Net Income (Unaudited; in thousands except per share amounts) Note: Certain per share impacts may not sum to totals due to rounding. GAAP net income $ 80,622 $ (13,840) $ 66,782 $ 1.14 $ 52,474 $ (11,359) $ 41,115 $ 0.71 Non-GAAP adjustments: Cost of Sales Amortization of intangibles 35,184 (8,460) 26,724 0.46 31,539 (7,733) 23,806 0.41 Inventory mark-up related to acquisitions 2,001 (480) 1,521 0.03 — — — — Operating Expenses Contingent consideration expense 2,177 (121) 2,056 0.04 4,702 (17) 4,685 0.08 Impairment charges 270 — 270 0.00 1,672 (318) 1,354 0.02 Amortization of intangibles 5,959 (1,436) 4,523 0.08 4,749 (1,176) 3,573 0.06 Performance-based share-based compensation (a) 6,067 (771) 5,296 0.09 4,354 (413) 3,941 0.07 Corporate transformation and restructuring (b) 14,203 (3,409) 10,794 0.19 20,432 (4,702) 15,730 0.27 Acquisition-related 5,218 (1,253) 3,965 0.07 1,901 (465) 1,436 0.02 Medical Device Regulation expenses (c) 9,112 (2,187) 6,925 0.12 8,451 (2,069) 6,382 0.11 Other (d) (1,309) 314 (995) (0.02) 7,845 (1,863) 5,982 0.10 Other (Income) Expense Amortization of long-term debt issuance costs 1,054 (253) 801 0.01 453 (111) 342 0.01 Loss on disposal of business unit — — — — 1,390 (32) 1,358 0.02 Non-GAAP net income $ 160,558 $ (31,896) $ 128,662 $ 2.21 $ 139,962 $ (30,258) $ 109,704 $ 1.91 Diluted shares 58,345 57,573 Pre-Tax Tax Impact After-Tax Per Share Impact Pre-Tax Tax Impact After-Tax Per Share Impact Nine Months Ended Nine Months Ended September 30, 2023 September 30, 2022 |