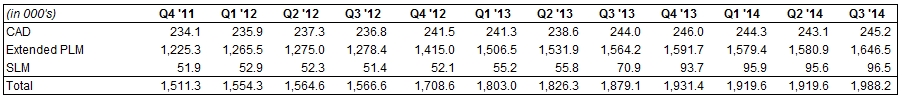

Q3 Extended PLM revenue, (our PLM, ALM and SCM solutions), compared to the prior year period, reflects double digit percentage license revenue growth in Europe, partially offset by a double digit percentage decline in license revenue in the Americas. Support revenue grew in all regions, with double digit percentage growth in Europe, Japan and the Pacific Rim and mid-single digit percentage growth in the Americas.

Q3 SLM revenue was up 3% year over year reflecting double digit growth in SLM support revenue, which includes contributions from Enigma (acquired in Q4’13) and ThingWorx (acquired in Q2’14). By region, SLM total revenue grew by double digit percentages in Europe, the Pac Rim and Japan, partially offset by a mid-single digit percentage decline in the Americas. Our SLM pipeline continues to build and we are optimistic about the growth opportunity

going forward. In addition, we continue to see bookings growth in our ThingWorx business. We also believe that the acquisition of Axeda, a leading provider of secure connectivity within the Internet of Things (IoT) space, when completed, will further PTC’s leadership position in the smart, connected products arena.”

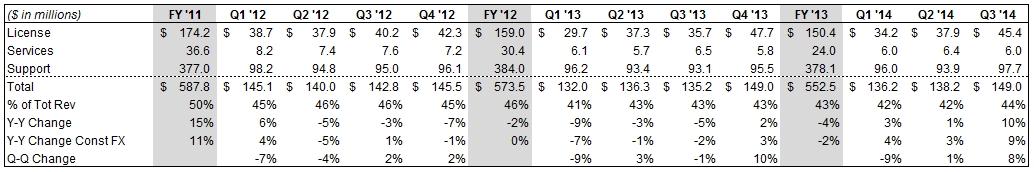

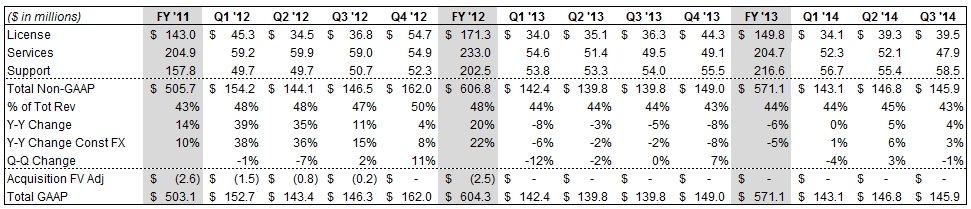

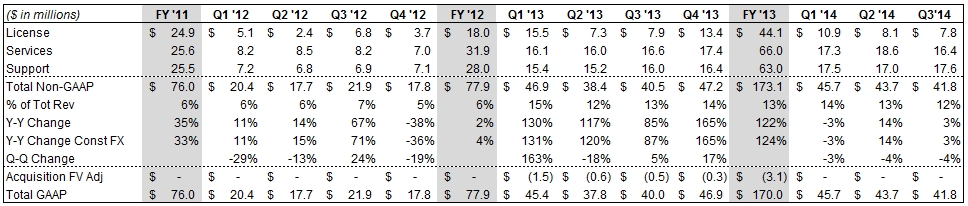

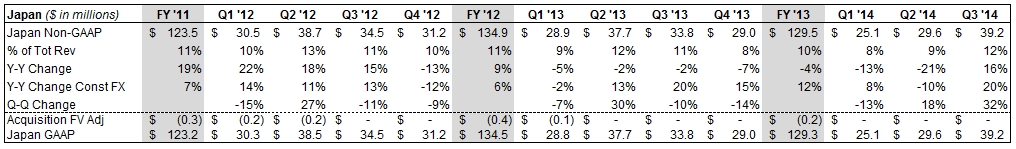

REVENUE BY REGION

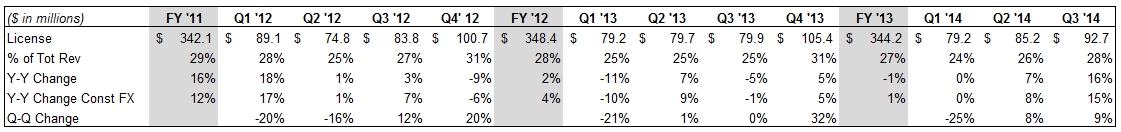

Americas license revenue in Q3 was down 17% year over year. Q3 license revenue in Europe was up 50% year over year (up 43% on a constant currency basis). Q3 license revenue in Japan was up 49% (up 53% on a constant currency basis) compared with last year. Q3 license revenue in the Pacific Rim was up 4% compared with last year.

CURRENCY IMPACT ON RESULTS COMPARED TO THE YEAR AGO PERIOD

We have a global business, with Europe and Asia historically representing approximately 60% of our revenue. We do not forecast currency movements; rather we provide detailed constant currency commentary. Currency can significantly impact our results. For example, in FY’13, currency was a headwind for PTC and negatively impacted non-GAAP revenue by $18 million and favorably impacted GAAP and non-GAAP expenses by $9 million. In FY’12 currency was also a headwind for us and negatively impacted non-GAAP revenue by $25 million while favorably impacting non-GAAP expenses by $19 million.

As a simple rule of thumb, based on current revenue and expense levels, a $0.10 move on the USD / EURO exchange rate will impact annualized revenue by approximately $35 to $40 million and EPS by approximately $0.08

to $0.10. Given recent fluctuation in the YEN / USD exchange rate, we also note that a 10 YEN move versus the USD will impact annualized revenue by approximately $13 to $17 million and expenses by approximately $6 to $8 million.

In Q3’14, currency was a tailwind for PTC and favorably impacted revenue by $4.8 million and unfavorably impacted GAAP expenses by $1.7 million and non-GAAP expenses by $1.4 million. Our actual simple average Q3’14 Fx rate was $1.38 USD / EURO and 102 YEN / USD.

Looking forward, the guidance we are providing assumes exchange rates of approximately 1.35 USD / EURO and 101 YEN / USD.

Q3 FY’14 EXPENSES COMMENTARY AND Q4 & FY’14 OUTLOOK

Q3 non-GAAP results exclude $12.5 million of stock-based compensation expense, $12.4 million of acquisition-related intangible asset amortization, and $1.5 million of acquisition-related and pension plan termination costs. The Q3 non-GAAP and GAAP results include a tax rate of 19% and 27%, respectively, and 119.9 million diluted shares outstanding.

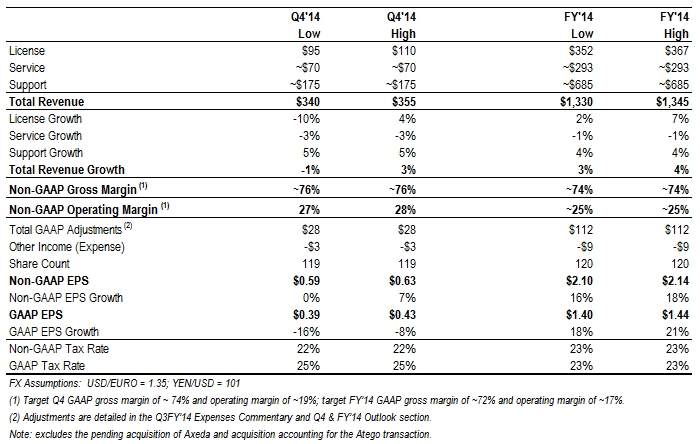

Q4’14 non-GAAP guidance excludes the following estimated expenses and their income tax effects, as well as any additional discrete tax items or restructuring costs |

| l | | Approximately $14 million of expense related to stock-based compensation |

| l | | Approximately $12 million of acquisition-related intangible asset amortization expense |

| l | | Approximately $2 million of acquisition-related and pension plan termination costs |

FY’14 non-GAAP guidance excludes the following full-year estimated expenses and their income tax effects, as well as any additional discrete tax items or restructuring costs |

| l | | Approximately $52 million of expense related to stock-based compensation |

| l | | Approximately $50 million of acquisition-related intangible asset amortization expense |

| l | | Approximately $2 million of restructuring charges |

| l | | Approximately $9 million of acquisition-related and pension plan termination costs |

Our Q4’14 and FY’14 guidance does not include the pending acquisition of Axeda or acquisition accounting for the Atego transaction.

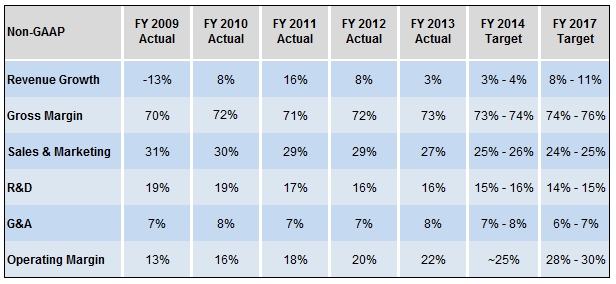

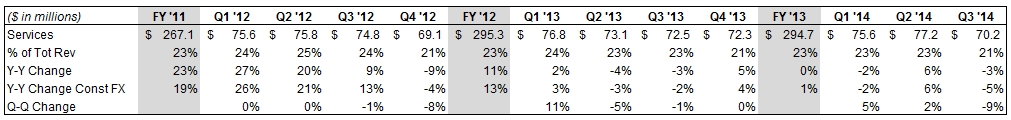

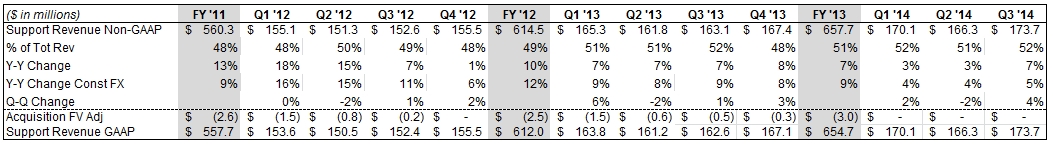

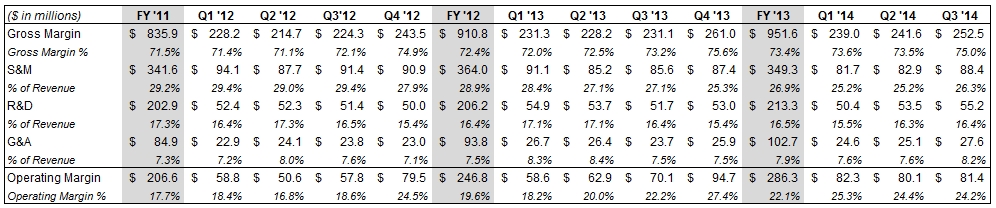

NON-GAAP GROSS MARGINS

Our Q3’14 non-GAAP gross margin percentage increased year over year primarily due to higher license margin, partially offset by lower services margins. Q3’14 GAAP gross margin was $246 million, or 72.9%, compared to $224 million, or 71.1%, in Q3‘13.

NON-GAAP OPERATING MARGINS

Our Q3’14 non-GAAP operating expenses were $171 million ($191 million on a GAAP basis), compared to $161 million in Q3’13 ($181 million on a GAAP basis). The higher year over year spending reflects workforce additions in our ThingWorx business, which we view as an important future growth opportunity for PTC, as well as expenditures for annual merit increases. This was partially offset by cost reduction actions taken during FY’13 and continued discipline on operating expenses.

From an operating performance perspective, we achieved 24.2% non-GAAP operating margin (23.5% on a constant currency basis) in Q3’14, compared to 22.2% in Q3’13. GAAP operating margin was 16.2% (15.5% on a constant currency basis) for Q3’14 compared to 13.7% in Q3’13.

Looking forward, we are targeting Q4‘14 non-GAAP gross margin of approximately 76% (GAAP gross margin of approximately 74%) and non-GAAP operating margin of approximately 27% to 28% (GAAP operating margin of approximately 19%). For FY‘14, we are targeting non-GAAP gross margin of approximately 74% (GAAP gross margin of approximately 72%) and non-GAAP operating margin of approximately 25% (GAAP operating margin of approximately 17%).

Over the longer term we intend to increase our non-GAAP operating margin to the 28% to 30% range primarily through increased efficiencies in our global sales and marketing organizations and improved non-GAAP gross margin (74% to 76% range) due to improved non-GAAP services margin and a more favorable revenue mix.

TAX RATE

Our Q3 non-GAAP and GAAP tax rate was 19% and 27%, respectively.

Looking forward, we expect our Q4 non-GAAP tax rate will be 22% and FY’14 non-GAAP tax rate will be 23% given our current estimates for geographic mix of profits. We expect our non-GAAP tax rate to be approximately 22% in FY’15 and beyond. Our guidance assumes a Q4 GAAP tax rate of 25% and FY’14 GAAP tax rate of 23%.

STOCK-BASED COMPENSATION

For Q3’14, expenses related to stock-based compensation were 3.7% of non-GAAP revenue compared to 3.5% of non-GAAP revenue in Q3’13, in keeping with our longer-term objective for stock-based compensation as a percentage of revenue.

SHARE COUNT / SHARE REPURCHASE

We had 119.9 million fully diluted weighted average shares outstanding for Q3. We repurchased $60 million worth of shares during the quarter.

Looking forward, we expect to have approximately 119 million fully diluted shares outstanding for Q4’14 and 120 million for the full fiscal year, assuming no additional share repurchases in the fourth quarter. Through the third quarter of 2014, we had repurchased all of the $100 million authorized by our Board of Directors for share repurchases for FY’14. Our long-term philosophy is to repurchase shares to offset dilution.

BALANCE SHEET: Solid cash position

CASH / CASH FLOW FROM OPERATIONS

As of the end of Q3’14 our cash balance was $304 million, up from $270 million at the end of Q2’14. We generated $106 million in operating cash flow, used $6 million for capital expenditures, used $60 million to repurchase shares during the quarter, and used $3 million to repay a portion of the amounts outstanding under our credit facility.

DSO

We continue to have strong DSOs of 62 days in Q3’14 compared to 61 days in Q2’14 and 58 days in Q3’13.

OUTSTANDING DEBT

Our credit facility consists of a $750 million revolving line and a $250 million term loan. We expect to use our credit facility for general corporate purposes, including acquisitions of businesses and working capital requirements. We currently have borrowings outstanding under the credit facility of $315 million, reflecting payments of $3 million during the quarter.

MISCELLANEOUS COMMENTS

HEADCOUNT

Total headcount was 6,126 at the end of Q3’14, compared to 6,043 at the end of Q2’14 and 5,987 at the end of Q3’13.

M&A

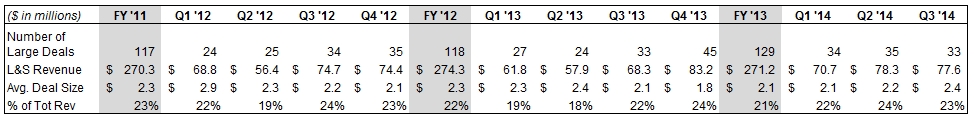

We view M&A primarily as a strategic vehicle to further enhance our product portfolio and growth opportunity. We intend to remain opportunistic as it relates to M&A. Over the last three years, we have undertaken small, strategic technology tuck-ins (e.g. the acquisitions of Enigma and NetIDEAS in Q4’13), as well as larger transactions, including MKS in Q3’11, Servigistics in Q1’13 and ThingWorx in Q2’14. On June 30, 2014 we acquired Atego, a developer of model-based systems and software engineering applications. At the time of the acquisition, Atego had approximately 110 employees, who are located primarily in Europe. The purchase price of Atego was $50 million. We expect Atego to contribute approximately $5 million in revenue during fiscal Q4’14. On July 23, 2014 we announced the signing of an agreement to acquire Axeda, a leading provider of connectivity solutions in the Internet of Things space, for $170 million. We expect to close the deal in Q4’14.

We continue to evaluate strategic acquisition opportunities of varying size as they arise. Our forecasted financial, cash and debt positions for FY’14 described above are exclusive of the effects of any acquisitions that we may complete.

Important Information About Non-GAAP References

PTC provides non-GAAP supplemental information to its financial results. Non-GAAP revenue, operating expenses, margin and EPS exclude the effect of purchase accounting on the fair value of acquired deferred revenue of Servigistics, Inc. and MKS, Inc., stock-based compensation expense, amortization of acquired intangible assets, restructuring charges, acquisition-related expenses, costs associated with terminating a U.S. pension plan, certain identified non-operating gains and losses, and the related tax effects of the preceding items and discrete tax items. We use these non-GAAP measures, and we believe that they assist our investors, to make period-to-period comparisons of our operational performance because they provide a view of our operating results without items that are not, in our view, indicative of our core operating results. We believe that these non-GAAP measures help illustrate underlying trends in our business, and we use the measures to establish budgets and operational goals, communicated internally and externally, for managing our business and evaluating our performance. We believe that providing non-GAAP measures affords investors a view of our operating results that may be more easily compared to the results of peer companies. In addition, compensation of our executives is based in part on the performance of our business based on these non-GAAP measures. However, non-GAAP information should not be construed as an alternative to GAAP information as the items excluded from the non-GAAP measures often have a material impact on PTC’s financial results. Management uses, and investors should consider, non-GAAP measures in conjunction with our GAAP results. PTC also provides results on a constant currency basis to provide a year-over-year view of our results excluding the effect of currency translation. Our constant currency disclosures are calculated by multiplying the actual results for the third quarter of 2014 by the exchange rates in effect for the comparable period in 2013.

Forward-Looking Statements

Statements in these prepared remarks that are not historic facts, including statements about our fourth quarter and full fiscal 2014 and other future financial and growth expectations, anticipated tax rates, expected market growth rates and the long-term prospects for PTC, are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the possibility that the macroeconomic and/or manufacturing climates may not improve or may deteriorate, the possibility that customers may not purchase our solutions when or at the rates we expect, the possibility that our pipeline of opportunities may not convert or generate the revenue we expect, the possibility that we will be unable to achieve planned services margins and operating margin improvements, the possibility that foreign currency exchange rates may vary from our expectations and thereby affect our reported revenue and expense, the possibility that we may not achieve the license, services or support revenue that we expect, which could result in a different mix of revenue between license, service and support and could impact our EPS results, the possibility that our restructurings and cost containment measures may not generate the operating margin improvements we expect and could adversely affect our revenue, the possibility that we may be unable to achieve our profitability targets with lower license revenue or without additional restructuring or cost containment measures, the possibility that our businesses, including the SLM business and the ThingWorx/Internet of Things/Smart, Connected Products business, may not expand and/or generate the revenue we expect, the possibility that we may not complete the acquisition of Axeda Corporation when or as we expect, the possibility that sales personnel productivity may not increase as we expect and generate the additional sales pipeline and revenue that we expect, the possibility that we may be unable to expand our services partner ecosystem or improve services margins as we expect, the possibility that we may be unable to attain or maintain a technology leadership position or that any such leadership position may not generate the revenue we expect, the possibility that the markets in which we participate may not grow at the rates we expect or that we may not be able to grow at rates exceeding the market growth rates, and the possibility that remedial actions relating to our previously announced investigation in China could adversely affect our revenue and that fines and penalties may be assessed against PTC in connection with the China matter. In addition, our assumptions concerning our future GAAP and non-GAAP effective income tax rates are based on estimates and other factors that could change, including the geographic mix of our revenue, expenses and profits and loans and cash repatriations from foreign subsidiaries. Other risks and uncertainties that could cause actual results to differ materially from those projected are detailed from time to time in reports we file with the Securities and Exchange Commission, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q.