UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: September 30, 2005

Commission File Number: 0-18059

PARAMETRIC TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Massachusetts | | 04-2866152 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

140 Kendrick Street, Needham, MA 02494

(Address of principal executive offices, including zip code)

(781) 370-5000

(Registrant’s telephone number, including area code)

| | |

Securities registered pursuant to Section 12(b) of the Act: | | Securities registered pursuant to Section 12(g) of the Act: |

| |

| None | | Common Stock, $.01 par value per share |

| |

| | | Series A Junior Participating Preferred Stock Purchase Rights |

| | | (Title of Class) |

Indicate by check mark whether the registrant (i) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (ii) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). YES x NO ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). YES ¨ NO x

The aggregate market value of our voting stock held by non-affiliates was approximately $1,532,173,156 on April 1, 2005 based on the last reported sale price of our common stock on the Nasdaq National Market on that day. There were 271,648,750 shares of our common stock outstanding on that day and 277,398,787 shares of our common stock outstanding on November 30, 2005.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement in connection with the 2006 Annual Meeting of Stockholders (2006 Proxy Statement) are incorporated by reference into Part III.

PARAMETRIC TECHNOLOGY CORPORATION

ANNUAL REPORT ON FORM 10-K FOR FISCAL YEAR 2005

Table of Contents

i

Forward-Looking Statements

Statements in this Annual Report on Form 10-K about our anticipated financial results and growth, as well as about the development of our products and markets, are forward looking statements that are based on our current plans and assumptions. Important information about the bases for these plans and assumptions and factors that may cause our actual results to differ materially from these statements are discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 9 below, and generally throughout this report.

Unless otherwise indicated, all references to a year reflect our fiscal year that ends on September 30.

PART I

Overview

Parametric Technology Corporation (PTC) develops, markets and supports product lifecycle management (PLM) and enterprise content management (ECM) software solutions and related services that help companies improve their processes for developing physical and information products.

The PLM market encompasses the mechanical computer-aided design, manufacturing and engineering (CAD, CAM and CAE) market and the collaboration and data management solutions market, as well as many previously isolated markets that address various other phases of the product lifecycle. These include product data management (PDM), component and supplier management, visualization and digital mockup, enterprise application integration, program and project management, after market service and portfolio management, requirements management, customer needs management, manufacturing planning, and technical and marketing publications.

The ECM market encompasses companies in multiple verticals and includes technologies for business process management, compliance management, document management, dynamic publishing, document archival and retrieval, knowledge management, records management and Web content management. Within the ECM market, PTC focuses its development on a subset of solutions that optimize the development of dynamic publications, such as those associated with technical manuals, service documents and regulatory and compliance data sets, as well as government and financial document publishing and content management.

Our software solutions include:

| • | | a suite of mechanical computer-aided design and XML-based document authoring tools (our Desktop Solutions); and |

| • | | a range of Internet-based collaboration, content and process management, and publishing technologies (our Enterprise Solutions). |

These software solutions enable companies to:

| • | | create digital product content as represented by product designs and component-based documents (collectively, “digital products”); |

| • | | collaborate globally on the development of content with cross-functional teams consisting of members within an organization and from the extended enterprise; |

| • | | control content and automate processes over the course of a product’s lifecycle; and |

| • | | communicate relevant product information across the extended enterprise and to customers through multiple channels using dynamic publications. |

Our software solutions historically focused on addressing the design engineering needs of manufacturing companies. Over time, we expanded our software solutions to enable customers to leverage engineering content across an extended enterprise and design chain. As part of this process, we diversified our product portfolio to include our Windchill content and process management

1

software and our recently acquired Arbortext dynamic publishing software. Our product development system for manufacturing companies, which is a combination of all of our solutions (Pro/ENGINEER®, Windchill® and Arbortext®), enables customers to meet a broad set of needs across the product development lifecycle. Additionally, the combination of Windchill and the Arbortext products will enable us to extend our product development system to address the content management and dynamic publishing needs of companies in vertical markets we previously have not served, such as the life sciences, publishing, government and financial services markets.

Our PLM solutions suite addresses significant challenges that manufacturing companies face in their product and documentation development processes: more frequent change, heterogeneity of systems, regulatory compliance, and increased communication inside and outside the manufacturing enterprise to support growing globalization and outsourcing of development activities, increasingly transparent supply chains, and growing services and maintenance strategies. With our PLM software solutions suite, we provide our manufacturing customers with a product development system that permits individuals—regardless of their roles in the commercialization of a product, the computer-based tools they use, or their location geographically or in the supply chain—to participate in and impact the product development process across the digital product value chain. We have devoted significant resources to our enterprise solutions and their integration with our design software and continue to integrate our products more tightly and make them easier to deploy. We believe this will create significant added value for our customers.

For customers in the life sciences, publishing, government and financial services markets, our combined Windchill and Arbortext solutions will enable us to address significant inefficiencies in cross-functional or complex documentation development processes. Today, most companies use traditional desktop publishing tools that involve a significant amount of manual work to maintain accurate documentation. This causes considerable additional work in environments where multiple authors contribute to the development of content, content changes frequently, multiple organizations within a company have specialized requirements but use similar content, or regulatory compliance drives the need for standardization across all information outputs. Our combination of Windchill and Arbortext solutions is the only single-vendor offering that fully addresses these problems. Our product development system for these vertical markets provides customers the ability to create compound documents from reusable content components, manage the content and processes to enable teams to work together, and configure and publish the information for a variety of uses and audiences, in a variety of formats.

Our solutions are complemented by our experienced services and technical support organizations, as well as resellers and other strategic partners. Our services and technical support organizations provide training, consulting, implementation and support services to customers worldwide. Our resellers supplement our direct sales force and provide greater geographic and small account coverage, primarily for our design solutions, and our strategic partners provide complementary product and/or service offerings.

Acquisitions

We completed four strategic acquisitions in 2004 and 2005:

| | | | |

Company

| | Technology

| | Date Acquired

|

Arbortext, Inc. | | Enterprise Publishing Software | | Fourth Quarter 2005 |

Polyplan Technologies, Inc. | | Manufacturing Process Planning | | Third Quarter 2005 |

Aptavis Technologies Corporation | | Windchill-based Solutions for the Retail, Footwear and Apparel Industry | | Third Quarter 2005 |

OHIO Design Automation, Inc. | | Electronic Design Collaboration Software | | Third Quarter 2004 |

Our acquisition of Arbortext enables us to provide solutions to create, manage and dynamically publish information concurrently with the development of related products or services, improving time-to-market and quality and reducing cost. The acquisition provides us with new opportunities within our existing markets and with increased access to new markets such as life sciences, publishing, government and financial services. Based in Ann Arbor, Michigan, Arbortext had approximately 250 employees in offices around the world and generated revenue of approximately $40 million for the twelve months ended June 30, 2005.

Our acquisition of Polyplan Technologies helps us enable concurrent development of products and related manufacturing process plans. We are focusing on providing an easy-to-use and affordable solution for use by mainstream manufacturing engineers who are not satisfied with the manufacturing process management tools available today. We do not expect the Polyplan acquisition to contribute revenue in the near term as we work to integrate the technology with our solutions.

2

Through our prior business relationship with Aptavis Technologies, we increased our penetration of the footwear and apparel market, and our solution for this market that uses the Aptavis technology has been adopted by leading footwear and apparel manufacturers and retailers. Our acquisition of Aptavis enables us to more fully integrate the Aptavis technology into our product offerings and to further develop the technology to address the requirements of international customers. Although we expect this business to continue to grow, the revenue contribution from the Aptavis technology historically has not been material and we do not expect this to change in the near term as a result of this acquisition.

Our acquisition of OHIO Design Automation enables us to offer the InterComm™ suite of electronic design collaboration solutions to enable enterprise-wide visualization, verification, annotation, and automated comparison of electronic design content. These solutions are targeted toward high tech and electronics manufacturers and other manufacturers of products that contain electronic components. We offer the InterComm products both as stand alone solutions and as part of the Windchill product line.

We believe these acquisitions enhance the value and appeal of our product development system by adding capabilities that are valuable to both our existing customers and customers in new vertical industries. The new capabilities we are adding enable our customers to create more downstream deliverables, such as manufacturing process plans, and to address complex documentation requirements, such as maintenance instructions, operator manuals, promotional materials and regulatory filings. At the same time, these acquisitions provide increased access to new markets where we can offer configurations of our product development system that are targeted to these new markets.

Our Principal Products and Services

Our Desktop Solutions and our Enterprise Solutions are aligned under a unified product strategy using a common architecture. This strategy capitalizes on existing product synergies to offer integral product development solutions.

Our comprehensive product development system offers our customers the capabilities to improve their product development and documentation processes. These processes involve the entire enterprise and extend to supplier, partner, and customer participants. Our approach reduces complexity for our customers by ensuring that our solutions work together in a cohesive system. Our product development system enables our customers to create, collaborate, control and communicate digital product information across the extended enterprise and design chain. These capabilities are enabled by a system architecture that is built from the ground up to address the needs of the distributed product development environment. Our product development system architecture is:

| • | | integral, sharing a common database schema, common business objects and seamless user interface; |

| • | | internet-based, designed for the Web; it enables our product development system to deploy seamlessly across existing Intranet and Internet infrastructures to accommodate a distributed value chain; and |

| • | | interoperable, integrating easily with other systems using standard protocols and integration approaches. |

We describe our integrated portfolio of Desktop Solutions and Enterprise Solutions that address specific business challenges that occur in the product lifecycle below.

DESKTOP SOLUTIONS

Our Desktop Solutions include our integrated CAD/CAM/CAE software as well as document authoring tools added through our recent acquisition of Arbortext. Our principal Desktop Solutions are Pro/ENGINEER and Arbortext Editor. The family of Pro/ENGINEER software addresses a broad spectrum of engineering disciplines essential to the development of virtually all manufactured products, ranging from consumer products to jet aircraft. Manufacturers compete on the basis of cost, time to market and product performance criteria, which are significantly affected by the quality and length of the product development process. Pro/ENGINEER improves product quality and reduces time to market by enabling end-users easily to evaluate multiple design alternatives and to share data with bi-directional associativity. Our Arbortext document authoring solutions help companies create documents the same way Pro/ENGINEER helps them create product designs by allowing the creation of reusable content as components and as compound documents. Arbortext’s approach to document authoring helps companies reduce authoring and translation costs and improve the accuracy and consistency of the information they produce.

3

The key features of Pro/ENGINEER and Arbortext Editor are described below.

Pro/ENGINEER is a three-dimensional product design solution based on a parametric, feature-based solid modeler that enables changes made during the design process to be associatively updated throughout the design. Pro/ENGINEER consists of capabilities for detailed design (CAD), manufacturing/production (CAM), and simulation/analysis (CAE), as well as facilities for exchanging CAD data with a multitude of sources and in varied standard formats, allowing companies to create more innovative, differentiated and functional products quickly and easily.

Our offerings within the Pro/ENGINEER family include:

Pro/ENGINEER CAD solutions:foundational design capabilities for part and assembly modeling, basic surfacing, production drawing creation, welding, sheet metal design and photo rendering. Extended design capabilities include advanced styling and surfacing tools and solutions for electrical and mechanical systems design involving large assemblies, cable harnesses, and piping.

Pro/ENGINEER CAM solutions:solutions that enable designers to create downstream manufacturing deliverables such as molds and progressive dies, numerical control (NC) tool paths, and inspection programs. By directly referencing Pro/ENGINEER designs, production and tooling engineers can handle tooling design and detailing, NC process planning, NC programming, and inspection/verification, automatically responding to changes to the design with no data translation obstacles.

Pro/ENGINEER CAE solutions: solutions that allow engineers to test and optimize designs for structural, dynamic, thermal, and durability performance. These solutions provide benefits by minimizing physical prototyping, increasing engineering creativity, and helping deliver higher quality products in less time.

Arbortext Editor™ is an XML-based authoring tool that enables the creation of dynamic content for multiple output types with features that give authors control over content collection, personalization, assembly and publishing. Arbortext Editor looks and works like familiar word processing software, but is able to create components of content, aggregate those components into publications and customize those publications dynamically. The underlying principles of Arbortext Editor are similar to those of Pro/ENGINEER, with similar benefits – documents can be created by multiple contributors and the document components are reusable because we separate the content from its formatting and style. Consequently, when changes to content are made, those changes will be reflected wherever that content is used.

ENTERPRISE SOLUTIONS

Since their introduction in 1998, our Enterprise Solutions have evolved to address expanding customer needs. Our suite of Windchill and Arbortext solutions are designed to help companies manage the process of developing products and documentation across an extended enterprise. Windchill is a sophisticated, Internet-based content management system that specializes in the management of complex data and relationships, processes and publications. The other products in our Enterprise Solutions category use the Windchill content management system to leverage the content for use in other processes, such as manufacturing, procurement, technical publications and after market services. With our Enterprise Solutions, our customers can improve time to market, increase the number of new products they introduce, improve product quality, reduce product cost, reduce development cost, and improve content reuse.

Our principal Enterprise Solutions include:

Windchill PDMLink™: a product content management solution that is used to control information by facilitating data accessibility and automating and managing the product development process throughout the life of a product. Windchill PDMLink is fluent with workgroup level CAD content management as well as complete enterprise-wide product content management and enables document management, change management and configuration management. Optional modules of Windchill PDMLink include:

Windchill PartsLink™ Classification and Reuse: a solution that allows companies to organize internal design libraries and make them available to their engineering teams through flexible, easy-to-use searching mechanisms, maximizing part reuse. For example, with this module engineers can quickly and effectively select the “right” part by comparing important functional, supply chain, and environmental compliance characteristics.

Windchill Supplier Management: a solution that helps customers improve part and manufacturer source selection across multiple product lines and geographies. Approved manufacturer and vendor lists (AML, AVL) are developed based on a variety of characteristics, including environmental regulatory compliance, lifecycle status and end-of-life risk, and component and supplier preferences.

4

Windchill ProjectLink™: a collaborative project management solution that enables companies (including their employees, partners, suppliers, and customers) to work together on projects through Internet-based compartmentalized workspaces. Windchill ProjectLink also has capabilities for project plan development, milestone and deliverable tracking, activity assignment and management, and on-line discussion forums.

Pro/INTRALINK®: a Windchill-based Pro/ENGINEER workgroup data management solution that provides centralized vaulting and revision control of Pro/ENGINEER models, relationships, and capabilities for improved information security and accuracy. A subset of the capabilities found in Windchill PDMLink, Pro/INTRALINK is used for Pro/ENGINEER-only data management within the engineering department.

Visualization and Digital MockUp: visualization and digital mock-up solutions that support the integration of 2D and 3D product data, regardless of source. ProductView is a visualization solution designed to enable multiple parties to view, markup, and collaborate on all forms of digital product data. DIVISION® MockUp is a sophisticated visualization tool that enables real-time design collaboration, analysis, and simulation of an entire digital product model, regardless of CAD authoring tools or team location.

InterComm: a suite of electronic design collaboration solutions that enable enterprise-wide visualization, verification, annotation, and automated comparison of the electronic design intent. The InterComm solutions provide easy access to complex CAE and electronic computer aided design data created in leading electronic design automation tools.

PTC PLM On Demand: hosted by IBM, these solutions provide companies with flexibility to pursue their product lifecycle management initiatives in an “on demand” model and are provided in two service options:

Standard: hosted out-of-the-box versions of Windchill PDMLink and Windchill ProjectLink solutions for small- and medium-sized businesses. This deployment option reduces the typical barriers to entry, including cost and implementation time and risk, making our PLM solutions accessible to companies with limited resources.

Dedicated: an offering for companies that need robust PLM technology and process consulting with an on demand delivery model. This deployment option enables larger customers to take advantage of the full Windchill software suite and the IBM on demand infrastructure to maintain flexibility in fast-changing business environments.

Windchill Integrations: turn-key solutions that enable cross-application data compatibility and information exchange. These integrations are key to any enterprise environment and include robust support for MCAD, ECAD and software configuration management applications, major ERP systems, and a flexible standards-based application for other enterprise integrations.

Arbortext Publishing Engine™: a server-based system that assembles XML and SGML content and automatically publishes audience-specific content in both print and electronic forms, with high-quality layout and formatting. This system can reduce publishing costs, improve time-to-market and increase productivity.

SERVICES

Maintenance Services

We offer maintenance support plans for our software products. Customers who participate in our maintenance support plans receive periodic software updates and new releases. Active maintenance plan customers also have direct access to our global technical support team of certified engineers, an ISO 9001 accredited organization, for timely and accurate issue resolution. In addition, we provide self-service support tools that allow our customers quick, dynamic access at all times to an extensive amount of technical support information.

Consulting and Training Services

Our software solutions and maintenance support offerings are complemented by additional offerings from our services organization, as well as from third-party resellers and other strategic partners. We offer the following comprehensive portfolio of services to help customers select the “right” technology to support organizational and strategic goals:

Implementation Services: a wide range of technology installation, configuration, and migration services, from pre-packaged “quick start” deployments to full system integration.

5

Process and Technology Adoption Services: consulting services to facilitate widespread acceptance and use of our solutions within our customers’ organizations by addressing organizational challenges and competing priorities.

Training Services: an extensive curriculum of instructor-led courses and computer-based training resources to accelerate adoption of the product development system and realize value across the entire enterprise.

Product Development

For our products to remain competitive, we must provide our customers with new and innovative software solutions. As a result, we continue to spend on research and development, and we look for opportunities to acquire new technologies suited to our customers’ needs. We must also efficiently manage our development resources to ensure the appropriate balance among product lines, based on both product development plans and customer demand.

Our ability to rapidly develop new design products is facilitated by the modular structure of our software code. This structure enables functional capabilities of existing products to be used in new software applications or modules, thereby reducing the amount of new code required to develop additional products. Much of our Enterprise Solutions technology is Internet-centric, Java-based, object-oriented software and our products depend on these evolving technologies. We also license certain technologies from third parties to augment the functionality of our products. We generally pay these third parties either periodic royalties or fixed fees for the use of their technologies and rely on them for development and other support. We continually review the associated costs, development resource savings, support levels, and, if applicable, experience with the third party to determine whether the use of such technologies is beneficial.

Over the past few years, we have focused much of our research and development investment on integrating our products into a unified product development system. This strategy is supported by changes we have made to both our product planning and product testing processes. These planning and testing phase changes ensure that the products work together in a cohesive system across specific customer business processes.

We also work closely with our customers to define improvements and enhancements to our products. Customers become involved in the software design process to help validate feasibility and to provide feedback on functionality early in the development of our products. In addition, we maintain software and hardware partner programs designed to provide partners both with access to our products and with the mechanisms and environment to facilitate the integration of complementary products with our product lines. Through our open software toolkits, program members can build tightly integrated solutions that satisfy the various requirements of our customers.

Our fiscal year research and development expenses were $118.3 million in 2005, $108.0 million in 2004 and $128.4 million in 2003. Additional information about our research and development expenditures may be found in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Costs and Expenses—Research and Development” beginning on page 19 below.

Sales and Marketing

We derive most of our revenue from products and services distributed directly by our sales force to our end-user customers. We also offer products through third-party distributors. Our direct sales force focuses on large accounts, while our reseller channel provides a cost-effective means of covering the small- and medium-sized business market.

Within our direct sales force, we have both strategic accounts and general business accounts units. The strategic accounts unit is further divided into vertical groups, such as aerospace and defense, automotive, consumer products, electronics and high technology, footwear and apparel, industrial products and life sciences. This vertical orientation is mirrored in our services delivery organization and, increasingly, in the products we deliver to strategic accounts. In addition, we continue to broaden our indirect distribution channel through alliances with third-party resellers and other strategic partners who provide products and/or services that complement our offerings. Our resellers distribute our design products, including Pro/ENGINEER, and provide related services throughout North America, Europe and parts of Asia/Pacific; our other strategic partners help complement our product development system with ancillary offerings. We recently authorized some of our resellers to distribute our Windchill Link solutions and PLM On Demand to the small- and medium-sized business market.

6

Financial information about our international and domestic operations, including by segment and principal products, may be found in Note M of “Notes to Consolidated Financial Statements” and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 9 below.

Competition

We compete primarily in the PLM market, including the design solutions market, and the ECM market, including the document management market and the document publishing market.

We compete in the PLM market with a number of companies that offer solutions that address specific functional areas covered by our solutions, including: Dassault Systemes SA and UGS Corp. for traditional design solutions, PDM solutions, manufacturing planning solutions and visualization and digital mock-up solutions; Agile Software Corp. and MatrixOne Inc. for PDM solutions; and i2 Technologies, Inc. for part sourcing solutions. In addition, we compete with larger, better-known enterprise-solution companies with established customers that have entered the PLM market and offer solutions integrated with their other enterprise software applications. For example, SAP AG offers a solution that controls product data within the larger framework of its ERP solution. We believe our PLM solutions are more specifically targeted toward the product development processes within manufacturing companies and offer broader and deeper functionality in those processes.

We and our resellers compete with design products from companies such as Autodesk, Inc. and Solidworks, a subsidiary of Dassault Systemes, for sales to smaller manufacturing customers.

We compete in the ECM market with repository-based collaboration software solutions such as IBM Lotus Notes, Microsoft Sharepoint, and EMC’s Documentum eRoom.

We compete with EMC Documentum, FileNet, Hummingbird, and OpenText in the document management market and with EMC Documentum, Adobe Framemaker, and the Microsoft Office suite in the document publishing market.

Proprietary Rights

Our software products and our trademarks, including our company names, product names and logos, are proprietary. We protect our intellectual property rights in these items by relying on copyrights, trademarks, patents and common law safeguards, including trade secret protection, as well as restrictions on disclosures and transferability contained in our agreements with other parties.

We believe that, due to the rapid pace of innovation within our industry, the technological and creative skills of our personnel are as important to establishing and maintaining a technology leadership position within the industry as are the various legal protections surrounding our technology.

Our proprietary rights are subject to risks and uncertainties described under the subheading “Important Factors That May Affect Future Results” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below. You should read that discussion, which is incorporated into this section by reference.

PTC, the PTC Logo, Parametric Technology Corporation, The Product Development Company, Product First, The way to Product First, Create Collaborate Control Communicate, Simple Powerful Connected, Pro/ENGINEER, Wildfire, Pro/DESKTOP, Pro/INTRALINK, MECHANICA, GRANITE, Windchill, Windchill ProjectLink, Windchill PartsLink, Windchill DynamicDesignLink, Windchill PDMLink, InterComm, FlexPLM, Arbortext and all product names in the PTC product family are trademarks or registered trademarks of PTC or our subsidiaries in the United States and/or other countries.

Backlog

We generally ship our products within 30 days after acceptance of a customer order. A high percentage of our license revenue historically has been generated in the third month of each fiscal quarter, and this revenue tends to be concentrated in the later part of that month. Accordingly, orders may exist at the end of a quarter that have not been shipped and not been recognized as revenue. We do not believe that our backlog at any particular point in time is indicative of future sales levels.

7

Employees

As of September 30, 2005, we had 3,751 employees, including 1,087 in sales and marketing; 1,037 in customer support, training and consulting; 385 in general and administration; and 1,242 in product development. Of these employees, 1,702 were located in the United States and 2,049 were located outside the United States.

Website Access to Reports and Code of Business Conduct and Ethics

We make available free of charge on our website atwww.ptc.com the following reports as soon as reasonably practicable after electronically filing them with, or furnishing them to, the SEC: our Annual Report on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934. Our Proxy Statements for our Annual Meetings and our Section 16 trading reports on SEC Forms 3, 4 and 5 also are available on our website. The reference to our website is not intended to incorporate information on our website into this document by reference.

Our Code of Business Conduct and Ethics also is available on our website. Additional information about this code and amendments and waivers thereto can be found below in Part III, Item 10 of this Annual Report.

Executive Officers of the Registrant

Information about our executive officers is incorporated by reference from Part III, Item 10 of this Annual Report.

Other Information

PTC was incorporated in Massachusetts in 1985 and is headquartered in Needham, Massachusetts.

ITEM 2. Properties

We currently lease 114 offices used in operations in the United States and internationally through our non-U.S. subsidiaries, predominately as sales and/or support offices and for research and development work. Of our total of approximately 1,136,000 square feet of leased facilities used in operations, approximately 550,000 square feet are located in the U.S., including 316,000 square feet of our headquarters facility located in Needham, Massachusetts. The lease for our headquarters began in December 2000 and expires in December 2012, subject to certain renewal rights. We also lease space comprising approximately 415,000 square feet, which is not used for our current operations and is primarily subleased to third parties. As described in Notes B and G of “Notes to Consolidated Financial Statements,” lease commitments on unused facilities in excess of expected sublease income have been included in our restructuring provisions. We continue to engage in subleasing and early lease termination initiatives to employ alternate uses for these excess facilities. We believe that our facilities are adequate for our present needs.

ITEM 3. Legal Proceedings

On May 30, 2003, a lawsuit was filed against us in the U.S. District Court for the District of Massachusetts by Rand A Technology Corporation and Rand Technologies Limited (together, “Rand”). Rand historically had been our largest distributor. The complaint alleges various breaches of a revised one-year distribution agreement entered into in December 2002, as well as other agreements between Rand and us, and also asserts certain non-contract claims. The complaint, as amended, seeks equitable relief and substantial damages. On November 24, 2003, we filed our substantive response to Rand’s complaint and asserted counterclaims against Rand. During the second quarter of 2005, Rand quantified its claimed actual damages as being in excess of $50 million and Rand asserts that this amount should be trebled by the court. As a result of several recent rulings by the court, some of Rand’s claims have been dismissed and Rand’s possible maximum recovery in the lawsuit may have been reduced. In addition, the court has excluded the testimony of the damages expert hired by Rand to substantiate Rand’s damages quantification. The court has also issued a ruling granting PTC summary judgment on one of PTC’s counterclaims against Rand. Despite these rulings, several of Rand’s claims, as well as certain of our counterclaims, remain to be tried before a jury. We believe Rand’s claims and its damages assessment associated with those claims are without merit and will continue to contest them vigorously. We also intend diligently to prosecute our counterclaims. We cannot predict the ultimate resolution of this action at this time, and we cannot assure you that this action, if determined adversely to us, will not have a material adverse impact on our financial condition or results of operations.

8

We also are subject to various legal proceedings and claims that arise in the ordinary course of business. We currently believe that resolving these other matters will not have a material adverse impact on our financial condition or results of operations.

ITEM 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders during the last quarter of 2005.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Information with respect to this item may be found in the section captioned “Quarterly Financial Information” on page F-38 below.

On September 30, 2005, the close of our fiscal year, our common stock was held by 5,372 shareholders of record. As of November 30, 2005, our common stock was held by 5,330 shareholders of record. We do not pay cash dividends on our common stock and retain earnings for use in our business. We review our dividend policy periodically, but we cannot assure you that our review will cause us to pay any dividends in the future.

ITEM 6. Selected Financial Data

Information with respect to this item may be found in the section captioned “Five-Year Summary of Selected Financial Data” on page F-38 below.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Statements in this Annual Report on Form 10-K about our anticipated financial results and growth, as well as about the development of our products and markets, are forward-looking statements that are based on our current plans and assumptions. Important information about the bases for these plans and assumptions and factors that may cause our actual results to differ materially from these statements are contained below and in “Important Factors That May Affect Future Results” beginning on page 31.

Unless otherwise indicated, all references to a year reflect our fiscal year that ends on September 30.

9

Executive Overview

In 2004, we focused on and achieved a significant turnaround in profitability. In 2005, we focused on increasing revenue and profitability with a view towards our longer-term goal of achieving $1 billion in revenue in 2008. As we discuss in detail below, for 2005, we achieved 9% year-over-year revenue growth and net income more than double that of the prior year. We achieved these results through organic growth in revenue from our core solutions and through strategic acquisitions.

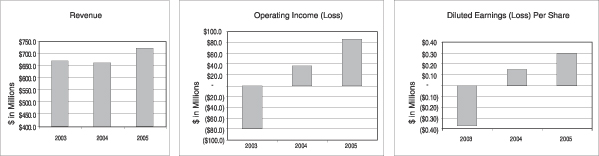

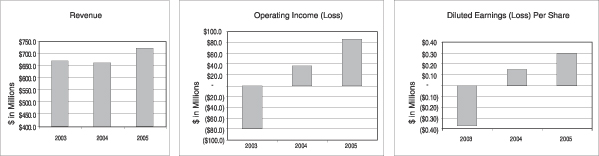

The following graphs for the prior three years illustrate two consecutive years of improved revenue, operating income and earnings per share:

We believe our operating results in 2005 reflect successful execution of our strategic initiatives, which focused on improving our product and service offerings, our distribution model, our competitive position and our marketing message, and are also attributable to the results of our restructuring program completed in 2004. Revenue increased in both Enterprise Solutions and Desktop Solutions, primarily due to increased sales of consulting and training and maintenance services. We increased sales of our services and solutions through expansion of our services delivery organization and our reseller channel, increased adoption of Pro/ENGINEER Wildfire and implementation of Windchill, and the addition of Arbortext products. Our operating expenses were below 2003 levels due to our restructuring program, but increased over 2004 due to incremental expenditures we made to support our revenue growth in 2005 and to support anticipated future revenue growth. In 2006, we intend to continue to grow revenue and earnings through organic growth of our core solutions and through strategic acquisitions.

Acquisitions

We completed four acquisitions in 2004 and 2005 that we believe will help accelerate our long-term growth. We purchased Arbortext, Inc., a provider of enterprise publishing software, in the fourth quarter of 2005; Polyplan Technologies, Inc., a provider of manufacturing process planning technology, in the third quarter of 2005; Aptavis Technologies Corporation, a provider of Windchill-based solutions for the retail, footwear and apparel industry, in the third quarter of 2005; and OHIO Design Automation, Inc., a provider of electronic design collaboration software, in the third quarter of 2004. We believe Arbortext will contribute significantly to our planned growth in 2006 as its solutions facilitate timely, accurate and product-specific technical publications, solving a problem faced by our traditional installed base of discrete manufacturing customers. It also provides us entry into vertical markets we previously have not served, including the life sciences, publishing, government and financial services markets. As a stand-alone company, Arbortext generated revenue of approximately $40 million for the twelve months ended June 30, 2005. Our acquisitions of Polyplan, Aptavis and OHIO Design are important because they provide increased access to new markets where we can provide different configurations of our product development system, although we do not expect these acquisitions to contribute significant revenue in the near term. You can find more information about these acquisitions under the subheading “Acquisitions” of the “Business” section of this report, which begins on page 2.

Market Opportunities

We believe demand for our traditional CAD/CAM/CAE solutions has begun to grow again modestly and that the broader PLM market continues to present an opportunity for more meaningful growth. We believe the overall market for PLM solutions is evolving as manufacturers seek to improve their total product development processes instead of focusing on individual productivity in engineering or manufacturing. These product development processes have become increasingly complex as companies develop and manufacture products across geographic and corporate boundaries (a trend referred to as “global product development”).

10

Additionally, we believe there is a growing opportunity in the small- and medium-sized business market as these manufacturers migrate from two-dimensional design tools to entry-level three-dimensional design tools. We believe these smaller manufacturers have a need for and will invest in collaboration and data management solutions over the next several years.

Finally, we recently entered the ECM market as the result of our acquisition of Arbortext. We believe potential for significant growth exists in the portion of the ECM market that Arbortext addressed as a stand-alone solution. In addition, we believe we have an incremental opportunity to sell our Windchill solutions into vertical markets beyond our core manufacturing base as a result of the combination of Windchill and Arbortext into a dynamic publishing and related content management solution.

Fiscal Year 2006

In support of our goal to increase revenue and earnings in 2006, while remaining focused on profitability, we plan to continue:

| • | | improving our product and service offerings; |

| • | | maintaining and growing revenue from our traditional vertical market segments; |

| • | | leveraging and optimizing our distribution model, including, when appropriate, making measured increases to our direct sales force, reseller channel and services organization; |

| • | | making additional strategic investments in solutions for vertical market segments outside our traditional market segments as demand for our products dictate, including those serviced by newly acquired companies; |

| • | | enhancing our relationships with strategic accounts; |

| • | | implementing strategic initiatives in the Asia-Pacific market; and |

| • | | pursuing corporate development opportunities, including mergers and acquisitions and strategic partnerships. |

Our success will depend on, among other factors, our ability to:

| • | | optimize our sales and services coverage and productivity through, among other means, effective use and management of our internal resources in combination with our resellers and other strategic partners and appropriate investment in our distribution channel; |

| • | | integrate newly acquired businesses into our operations and execute future corporate development initiatives while remaining focused on organic growth opportunities, including penetration of strategic vertical markets; |

| • | | differentiate our products and services from those of our competitors to effectively pursue opportunities within the small- and medium-sized business market and with strategic larger accounts; |

| • | | manage the development and enhancement of our expanding product line using our geographically dispersed development resources; and |

| • | | help our customers expand their product development technology infrastructure to a more robust PLM product development system in order to further their global product development initiatives. |

We discuss additional factors affecting our revenue and operating results under Important Factors That May Affect Future Results beginning on page 31.

11

Results of Operations

Overview

The following is a summary of our results of operations for the last three years, which includes the results of operations of companies we acquired beginning on their acquisition date. A detailed discussion of these results follows the table below:

| | | | | | | | | | | | | | | | | |

| | | 2005

| | Percent Change

| | | 2004

| | | Percent Change

| | | 2003

| |

| | | (Dollar amounts in millions) | |

Total revenue | | $ | 720.7 | | 9 | % | | $ | 660.0 | | | (2 | )% | | $ | 671.9 | |

Total costs and expenses | | | 634.9 | | 2 | % | | | 622.6 | | | (17 | )% | | | 751.6 | |

| | |

|

| | | | |

|

|

| | | | |

|

|

|

Operating income (loss) | | | 85.8 | | 129 | % | | | 37.4 | | | 147 | % | | | (79.7 | ) |

Other income (expense), net | | | 5.5 | | | | | | (0.4 | ) | | | | | | (2.8 | ) |

| | |

|

| | | | |

|

|

| | | | |

|

|

|

Income (loss) before income taxes | | | 91.3 | | | | | | 37.0 | | | | | | | (82.5 | ) |

Provision for income taxes | | | 7.7 | | | | | | 2.2 | | | | | | | 15.8 | |

| | |

|

| | | | |

|

|

| | | | |

|

|

|

Net income (loss) | | $ | 83.6 | | 140 | % | | $ | 34.8 | | | 135 | % | | $ | (98.3 | ) |

| | |

|

| | | | |

|

|

| | | | |

|

|

|

| • | | License revenue was $209.7 million in 2005, $198.9 million in 2004 and $205.3 million in 2003. |

| • | | Service revenue was $511.0 million in 2005, $461.1 million in 2004 and $466.6 million in 2003. |

| • | | Enterprise Solutions revenue was $217.6 million in 2005, $179.3 million in 2004 and $173.5 million in 2003. |

| • | | Desktop Solutions revenue was $503.1 million in 2005, $480.7 million in 2004 and $498.4 million in 2003. |

| • | | Total costs and expenses, including restructuring and other charges (credits) and stock-based compensation expense, was $634.9 million in 2005, $622.6 million in 2004 and $751.6 million in 2003. |

| • | | Restructuring and other charges (credits) were $(1.3) million in 2005, $42.9 million in 2004 and $30.9 million in 2003. |

| • | | We adopted SFAS No. 123(R), “Share-Based Payment,” at the beginning of the fourth quarter of 2005. Stock-based compensation expense was $15.5 million in 2005, $0.4 million in 2004 and $0.5 million in 2003. |

| • | | The provision for income taxes in 2005 is net of tax benefits totaling $12.1 million due to favorable resolutions of tax audits in a non-US jurisdiction. In 2004, the provision for income taxes is net of a one-time benefit of $18.9 million due to a favorable resolution of prior-year tax audits with the Internal Revenue Service. |

| • | | Net income (loss) was $83.6 million in 2005, $34.8 million in 2004 and $(98.3) million in 2003. The improvement in our 2005 results compared to 2004 is primarily attributable to higher revenues and lower restructuring charges, partially offset by measured increases in our operating cost structure and the adoption of stock-based compensation expensing in 2005. The improvement in 2004 results compared to 2003 is primarily attributable to reductions in our operating cost structure. |

12

The following table shows certain consolidated financial data as a percentage of our total revenue for the last three years:

| | | | | | | | | |

| | | September 30,

| |

| | | 2005

| | | 2004

| | | 2003

| |

Revenue: | | | | | | | | | |

License | | 29 | % | | 30 | % | | 31 | % |

Service | | 71 | | | 70 | | | 69 | |

| | |

|

| |

|

| |

|

|

Total revenue | | 100 | | | 100 | | | 100 | |

| | |

|

| |

|

| |

|

|

Costs and expenses: | | | | | | | | | |

Cost of license revenue | | 1 | | | 1 | | | 2 | |

Cost of service revenue | | 28 | | | 26 | | | 31 | |

Sales and marketing | | 34 | | | 34 | | | 44 | |

Research and development | | 16 | | | 16 | | | 19 | |

General and administrative | | 9 | | | 9 | | | 10 | |

Amortization of acquired intangible assets | | — | | | 1 | | | 1 | |

In-process research and development | | — | | | — | | | — | |

Restructuring and other charges (credits) | | — | | | 7 | | | 5 | |

| | |

|

| |

|

| |

|

|

Total costs and expenses | | 88 | | | 94 | | | 112 | |

| | |

|

| |

|

| |

|

|

Operating income (loss) | | 12 | | | 6 | | | (12 | ) |

Interest income | | 1 | | | — | | | — | |

Other expense, net | | — | | | (1 | ) | | (1 | ) |

| | |

|

| |

|

| |

|

|

Income (loss) before income taxes | | 13 | | | 5 | | | (13 | ) |

Provision for income taxes | | 1 | | | — | | | 2 | |

| | |

|

| |

|

| |

|

|

Net income (loss) | | 12 | % | | 5 | % | | (15 | )% |

| | |

|

| |

|

| |

|

|

Revenue

Our revenue consists of software license revenue and service revenue, which includes software maintenance as well as consulting, implementation, training and other technical support revenue.

We report our revenue in two product categories:

| • | | Enterprise Solutions, which includes Windchill, Pro/INTRALINK 8.0, Arbortext Publishing Engine and all other solutions that help companies collaborate, manage and publish information across an extended enterprise; and |

| • | | Desktop Solutions, which includes Pro/ENGINEER, Arbortext Editor and all other solutions that help companies create content and improve desktop productivity. |

We previously reported our revenue in the following two categories: Design Solutions and Collaboration and Control Solutions. In the fourth quarter of 2005, as a result of the Arbortext acquisition, we redefined our product categories. This redefinition required no reclassifications of prior reported revenues between our two product categories. Revenue historically reported as Design Solutions is now reported as Desktop Solutions, and revenue historically reported as Collaboration and Control Solutions is now reported as Enterprise Solutions.

We recently launched Pro/INTRALINK 8.0, which is based on our Windchill technology. Our prior Pro/INTRALINK product was not Windchill-based and was either used as a stand-alone product or together with Windchill. In previous periods, half of Pro/INTRALINK revenue was allocated to Design Solutions and half was allocated to Collaboration and Control Solutions. As a result of the new technology configuration of Pro/INTRALINK 8.0, beginning in the fourth quarter of 2005, all Pro/INTRALINK revenue is fully classified as Enterprise Solutions.

13

Total Revenue

The following table illustrates trends from 2003 to 2005 in our software license and in our service revenues, as well as by product category and geography:

| | | | | | | | | | | | | | | |

| | | 2005

| | Percent Change

| | | 2004

| | Percent Change

| | | 2003

|

| | | (Dollar amounts in millions) |

License revenue | | $ | 209.7 | | 5 | % | | $ | 198.9 | | (3 | )% | | $ | 205.3 |

Service revenue: | | | | | | | | | | | | | | | |

Maintenance revenue | | | 342.6 | | 6 | % | | | 323.4 | | 5 | % | | | 309.1 |

Consulting and training service revenue | | | 168.4 | | 22 | % | | | 137.7 | | (13 | )% | | | 157.5 |

| | |

|

| | | | |

|

| | | | |

|

|

Total service revenue | | | 511.0 | | 11 | % | | | 461.1 | | (1 | )% | | | 466.6 |

| | |

|

| | | | |

|

| | | | |

|

|

Total revenue | | $ | 720.7 | | 9 | %* | | $ | 660.0 | | (2 | )%* | | $ | 671.9 |

| | |

|

| | | | |

|

| | | | |

|

|

Revenue by product category: | | | | | | | | | | | | | | | |

Enterprise Solutions revenue | | $ | 217.6 | | 21 | % | | $ | 179.3 | | 3 | % | | $ | 173.5 |

Desktop Solutions revenue | | | 503.1 | | 5 | % | | | 480.7 | | (4 | )% | | | 498.4 |

Revenue by geography: | | | | | | | | | | | | | | | |

North America | | $ | 272.0 | | 17 | % | | $ | 232.9 | | (7 | )% | | $ | 249.4 |

Europe | | | 254.2 | | 6 | %* | | | 240.2 | | — | %* | | | 239.8 |

Asia Pacific | | | 194.5 | | 4 | %* | | | 186.9 | | 2 | %* | | | 182.7 |

| * | On a consistent foreign currency basis from the prior period, total revenue increased 7% in 2005 compared to 2004 and decreased 7% in 2004 compared to 2003; revenue in Europe increased 1% in 2005 compared to 2004 and decreased 10% in 2004 compared to 2003; and revenue in Asia-Pacific increased 2% in 2005 compared to 2004 and decreased 3% in 2004 compared to 2003. |

In 2005, we had year-over-year revenue growth in both Desktop Solutions and Enterprise Solutions. This growth reflects increases in consulting and training services and in maintenance, as well as an increase in the number of new seats sold in both product categories. We attribute this growth to execution of our strategic initiatives described above as well as increased technology spending by our customers, particularly in North America. The improvements reflect both organic growth as well as revenue from sales of newly acquired products, particularly Arbortext products. Historically, Arbortext generated revenue for the twelve months ended June 30, 2005 of approximately $40 million, which is not included in our results for 2005. Since the acquisition date (July 19, 2005), Arbortext has been included in our 2005 results of operations. License revenue accounted for 29%, 30% and 31% of total revenue in 2005, 2004 and 2003, respectively, while consulting and training service revenue, which has a lower gross profit margin, accounted for 23%, 21% and 23% of total revenue in 2005, 2004 and 2003, respectively. We enter into customer contracts that may result in revenue being recognized over multiple reporting periods. License and/or consulting and training services revenue of $1 million or more within a quarter recognized from such contracts was $85.1 million, $77.0 million and $71.5 million in 2005, 2004 and 2003, respectively. Increases in consulting and training services revenue are due primarily to the emphasis we have placed on providing customers with process consulting, training and adoption services that help customers improve their product development processes and adoption of our solutions. As we have increased our service revenues and expanded our service product offerings, including computer-based training products that have a higher margin than other service products, we have also improved our service margins, an important part of our overall strategy. Maintenance revenue represented 48%, 49% and 46% of total revenues in 2005, 2004 and 2003, respectively.

We attribute the total revenue declines from 2003 to 2004 to a number of factors, including the relative saturation and increased competitiveness of the North American and European markets for design solutions, economic factors resulting in reluctance of our customers to consummate large software purchases, our reduced delivery capacity caused by headcount reductions in our services business, the weakness in technology spending in the global manufacturing economy during that period and the relative infancy of the PLM market. The increase in maintenance revenue in 2004 over 2003 was primarily attributable to customers’ adoption of Pro/ENGINEER Wildfire and prior period growth in Windchill-based solutions license revenue.

14

We derived 62%, 65% and 63% of our total revenue from sales to customers outside of North America in 2005, 2004 and 2003, respectively. We believe the improvements in our 2005 revenue in North America are attributable to implementation of our strategic initiatives and also indicate that the economy in that region, where the manufacturing sector and related technology spending had been weak over the past several years, improved over 2004. In addition to our organic growth in North America, the acquisition of Arbortext, whose revenues were concentrated in that region, also contributed to our growth there. The increase in European revenue in 2005 compared to 2004 is due primarily to improving sales and services performance in strategic accounts and favorable foreign currency exchange as noted above. Revenue performance in Asia-Pacific in 2005 compared to 2004 reflects a 12% increase in revenues in the Pacific Rim, partially offset by a 1% decrease in revenues in Japan. Japan experienced a decline in license revenue from large deals, partially offset by an increase in consulting and training revenue. We believe the Asia-Pacific region continues to present an important growth opportunity because global manufacturing companies have continued to invest in that region and the market in that region for both our Desktop Solutions and Enterprise Solutions is relatively unsaturated.

We have been building and diversifying our reseller channel to become less dependent on a small number of resellers and to provide the resources necessary for more effective distribution of our products. Although we typically receive lower revenue per seat for an indirect sale versus a direct sale, we believe that using diverse and geographically dispersed resellers that focus on smaller businesses provides an efficient and cost effective means to reach these customers and allows our direct sales force to focus on larger sales opportunities. Total sales from our reseller channel, which are primarily for our CAD/CAM/CAE design solutions, were $138.6 million (19% of total revenue) in 2005, $135.9 million (21% of total revenue) in 2004 and $106.0 million (16% of total revenue) in 2003. We attribute this performance to our efforts to expand our reseller channel and to the success of Pro/ENGINEER Wildfire among small- and medium-sized businesses as Pro/ENGINEER Wildfire has become increasingly competitive in this market, both relative to our historic offerings as well as to competitive offerings in this market segment. We continue to see growth in reseller channel revenue in North America and Europe. While reseller channel performance in Asia-Pacific was not as strong as in our other regions in 2005, we recently made organizational and infrastructure changes to our reseller channel in that region that we expect will result in higher revenue growth in Asia-Pacific in 2006.

Enterprise Solutions Revenue

The following table illustrates trends from 2003 to 2005 in our Enterprise Solutions software license revenue and service revenue:

| | | | | | | | | | | | | | | |

| | | 2005

| | Percent Change

| | | 2004

| | Percent Change

| | | 2003

|

| | | (Dollar amounts in millions) |

Enterprise Solutions: | | | | | | | | | | | | | | | |

License revenue | | $ | 71.1 | | 19 | % | | $ | 59.6 | | 3 | % | | $ | 57.7 |

Service revenue: | | | | | | | | | | | | | | | |

Maintenance revenue | | | 56.3 | | 19 | % | | | 47.4 | | 37 | % | | | 34.5 |

Consulting and training service revenue | | | 90.2 | | 25 | % | | | 72.3 | | (11 | )% | | | 81.3 |

| | |

|

| | | | |

|

| | | | |

|

|

Total service revenue | | | 146.5 | | 22 | % | | | 119.7 | | 3 | % | | | 115.8 |

| | |

|

| | | | |

|

| | | | |

|

|

Total revenue | | $ | 217.6 | | 21 | % | | $ | 179.3 | | 3 | % | | $ | 173.5 |

| | |

|

| | | | |

|

| | | | |

|

|

Total revenue from our Enterprise Solutions software and related services was 30%, 27% and 26% of our total revenue in 2005, 2004 and 2003, respectively.

The increase in Enterprise Solutions revenue in 2005 compared to 2004 was due to:

| • | | stronger sales of software licenses, maintenance and consulting and training services, which reflects our success in marketing incremental adoption of our solutions; |

| • | | more wide-spread adoption of our solutions by both our existing and new customers; |

| • | | revenue contribution, particularly license revenue, from the acquisition of Arbortext; and |

| • | | the recent launch of Pro/INTRALINK (which is now Windchill-based). |

15

Enterprise Solutions license revenue grew 19% and 3% in 2005 and 2004, respectively, compared to the previous periods. The number of new Windchill seats added during the year was 42% higher in 2005 than in 2004, compared to a decline of 12% in 2004 from 2003. Increases in our Enterprise Solutions maintenance revenue and consulting and training service revenue are due primarily to an increase in the number of new users of our enterprise solutions as new customers are added and existing customers expand their implementation to additional users. The increase in 2005 reflects organic growth as well as growth from the acquisition of Arbortext. Consulting and training service revenue growth is also attributable to our focus on new process consulting offerings. Consulting and training service revenues in 2004 were adversely affected by our reduced services delivery capacity due to our 2004 headcount reductions.

We believe our success in growing Enterprise Solutions revenue is attributable in large part to our targeted Windchill-based solutions (including our Windchill Link solutions) and related services packages. These solutions can be implemented in incremental fashion in accordance with our product development system adoption roadmap, which provides customers with a suggested approach for purchasing and implementing our solutions in stages, and reduce customers’ initial required investments.

We believe we can increase our Enterprise Solutions revenue by improving our ability to sell enterprise solutions to small- and medium-sized businesses. To achieve this, we are expanding our distribution of PLM solutions by offering qualified resellers the ability to sell our Windchill Link solutions as well as related services. In addition, during 2005, we began to offer on demand versions of several Windchill Link solutions that help minimize customers’ cost of ownership and reduce implementation time. We describe these on demand solutions under “Item 1. Business – Our Principal Products and Services – Enterprise Solutions” beginning on page 4. The revenue contribution from these initiatives was not material in 2005.

Desktop Solutions Revenue

The following table illustrates trends from 2003 to 2005 in our Desktop Solutions software license revenue and service revenue:

| | | | | | | | | | | | | | | |

| | | 2005

| | Percent

Change

| | | 2004

| | Percent

Change

| | | 2003

|

| | | (Dollar amounts in millions) |

Desktop Solutions: | | | | | | | | | | | | | | | |

License revenue | | $ | 138.6 | | (1 | )% | | $ | 139.3 | | (6 | )% | | $ | 147.6 |

Service revenue: | | | | | | | | | | | | | | | |

Maintenance revenue | | | 286.3 | | 4 | % | | | 276.0 | | 1 | % | | | 274.6 |

Consulting and training service revenue | | | 78.2 | | 20 | % | | | 65.4 | | (14 | )% | | | 76.2 |

| | |

|

| | | | |

|

| | | | |

|

|

Total service revenue | | | 364.5 | | 7 | % | | | 341.4 | | (3 | )% | | | 350.8 |

| | |

|

| | | | |

|

| | | | |

|

|

Total revenue | | $ | 503.1 | | 5 | % | | $ | 480.7 | | (4 | )% | | $ | 498.4 |

| | |

|

| | | | |

|

| | | | |

|

|

Total revenue from our Desktop Solutions and related services was 70%, 73% and 74% of our total revenue in 2005, 2004 and 2003, respectively. The year-over-year decline in license revenue in 2005 and 2004 was primarily due to lower revenue from high-end packages, particularly from large deals in Japan in 2004 not replicated in 2005. Despite lower revenue from high-end packages, sales of our low-end and mid-range packages within our installed base and to new customers increased and we experienced a 12% increase in the total number of new Pro/ENGINEER seats added during each of 2005 and 2004 compared to new seats added in the previous periods. We believe such sales provide the foundation for long-term relationships and repeat business, as well as for potential sales of services and our overall product development system within these accounts. Increases in our Desktop Solutions maintenance and consulting and training revenue are due primarily to the increase in new seats over the past two years and improvements in our renewal rates. We believe these trends are a reflection of further customer adoption of Pro/ENGINEER Wildfire. The increase in Desktop Solutions consulting and training service revenue is also due to higher revenue from sales of consulting services and training packages, including computer-based training products, that help our customers improve user proficiency and engineering productivity. The decrease in Desktop Solutions total service revenue in 2004 was due in large part to license revenue declines in prior periods as well as our reduced services delivery capacity caused by our 2004 headcount reductions.

16

We believe that our decision to offer Pro/ENGINEER packages with differing price points and functionality will continue to contribute to adoption of these solutions. We designed these packages to address our customers’ purchasing patterns and to better compete in the small- and medium-sized business segment of our market. Because our low- and high-end offerings are based on the same architecture, our solutions are scalable between different types of users or as customer needs grow, which differentiates our products from others in the marketplace. Our Desktop Solutions are now more competitive with lower-end modeling tools on the market that are known for ease of use, while maintaining the functionality for which Pro/ENGINEER is known.

Despite recent signs of improvement, Desktop Solutions revenue continues to be adversely affected by the relative maturity and saturation of the North American and European CAD/CAM/CAE markets, the difficulty associated with displacing incumbent product design systems in the discrete market for computer-aided design solutions, and increased competition and price pressure from products offering more limited functionality at lower cost. However, despite declines in 2005 Desktop Solutions revenue in Japan compared to the comparable prior period, we believe the Asia-Pacific region continues to present an opportunity for growth because the market is relatively unsaturated, the number of mechanical engineers is growing, and companies are continuing to migrate from two-dimensional to three-dimensional design tools. To address this, we have made recent organizational and infrastructure changes in our reseller channel in that region that we expect will result in higher revenue growth in Asia-Pacific in 2006.

Costs and Expenses

Over the past several years, we have made significant investments necessary to transform our business from providing a single line of technical software with a largely direct distribution model supplemented by a small number of channel partners to providing a family of enterprise solutions with an expanded channel and partner-involved distribution model. In 2003, after completing a significant portion of this transformation, we implemented a restructuring plan to reduce our cost structure, which we completed in the fourth quarter of 2004. All cost and expense categories in 2004 and 2003 were impacted by restructuring actions taken in those periods. The following table illustrates trends from 2003 to 2005 in our costs and expenses:

| | | | | | | | | | | | | | | | |

| | | 2005

| | | Percent Change

| | | 2004

| | Percent Change

| | | 2003

|

| | | (Dollar amounts in millions) |

Costs and Expenses | | | | | | | | | | | | | | | | |

Cost of license revenue | | $ | 8.4 | | | 3 | % | | $ | 8.2 | | (25 | )% | | $ | 11.0 |

Cost of service revenue | | | 199.8 | | | 15 | % | | | 173.9 | | (16 | )% | | | 207.5 |

Sales and marketing | | | 243.8 | | | 8 | % | | | 226.1 | | (24 | )% | | | 298.5 |

Research and development | | | 118.3 | | | 10 | % | | | 108.0 | | (16 | )% | | | 128.4 |

General and administrative | | | 63.6 | | | 9 | % | | | 58.3 | | (16 | )% | | | 69.4 |

Amortization of acquired intangible assets | | | 1.6 | | | (68 | )% | | | 5.2 | | (12 | )% | | | 5.9 |

In-process research and development | | | 0.7 | | | 100 | % | | | — | | — | % | | | — |

Restructuring and other charges (credits) | | | (1.3 | ) | | (103 | )% | | | 42.9 | | 39 | % | | | 30.9 |

| | |

|

|

| | | | |

|

| | | | |

|

|

Total costs and expenses | | $ | 634.9 | | | 2 | %* | | $ | 622.6 | | (17 | )%* | | $ | 751.6 |

| | |

|

|

| | | | |

|

| | | | |

|

|

| * | On a consistent foreign currency basis from the prior period, total costs and expenses were flat from 2004 to 2005 and decreased 20% in 2004 compared to 2003. |

As described in Note A of “Notes to Consolidated Financial Statements,” effective July 3, 2005, we adopted SFAS No. 123(R), “Share-Based Payment.” Accordingly, for the three months ended September 30, 2005, stock-based compensation was accounted for under SFAS No. 123(R), which requires the expensing of the fair value of stock-based awards in our consolidated statement of operations, while for the nine months ended July 2, 2005 and for 2004 and 2003, stock-based compensation was accounted for under APB No. 25, “Accounting for Stock Issued to Employees,” which required only the expensing of the intrinsic value of stock-based awards. In the fourth quarter of fiscal 2005, we granted to our employees, directors, and officers an aggregate of 1,928,000 shares of restricted stock (809,000 shares of which were performance-based awards that could be earned in whole or in part (subject to further time-based vesting) upon achievement of 2005 performance criteria) and 3,390,007 restricted stock units, each of which represents the right to receive one share of our common stock. Also, in the fourth quarter of 2005, we offered eligible

17

employees the opportunity to exchange eligible stock options for a cash payment. Employees holding approximately 18.3 million eligible stock options elected to participate in the stock option exchange. Accounting for the stock option exchange was recorded in our consolidated financial statements in the fourth quarter of 2005. The aggregate amount of the cash payments made to employees in exchange for their eligible options was $12.7 million and was paid in the fourth quarter. Of the total cash payments made in connection with the stock option exchange, $0.5 million was recorded as compensation expense and $12.2 million was recorded as a charge to stockholders’ equity, in accordance with the provisions of SFAS No. 123(R). The amounts in the table above include stock-based compensation expense from our stock-based awards and completing the stock option exchange as follows:

| | | | | | | | | |

| | | Year ended September 30,

|

| | | 2005

| | 2004

| | 2003

|

| | | (in millions) |

Cost of license revenue | | $ | 0.1 | | $ | — | | $ | — |

Cost of service revenue | | | 2.6 | | | — | | | — |

Sales and marketing | | | 5.1 | | | — | | | — |

Research and development | | | 3.8 | | | 0.4 | | | 0.5 |

General and administrative | | | 3.9 | | | — | | | — |

| | |

|

| |

|

| |

|

|

Total stock-based compensation expense | | $ | 15.5 | | $ | 0.4 | | $ | 0.5 |

| | |

|

| |

|

| |

|

|

Total costs and expenses increased to $634.9 million in 2005 compared to $622.6 million in 2004. Headcount increased to 3,751 at the end of 2005 from 3,042 at the end of 2004. Our increase in costs and expenses, including headcount, was primarily due to the following:

| • | | we made measured increases in our sales organization by adding direct sales representatives to support our strategic accounts and by adding other personnel to support our indirect distribution channel; |

| • | | we added services delivery capacity to address customer demand; |

| • | | we adopted SFAS No. 123(R) and revised our stock-based compensation program; |

| • | | we completed three acquisitions in the second half of 2005 that added operating costs and increased headcount by over 250 employees; |

| • | | we invested in research and development programs aimed at adding vertical functionality to our products; and |

| • | | we invested in strategic corporate development initiatives and in ongoing Sarbanes-Oxley compliance work in the general and administrative area. |

These increases were partially offset by a decrease in restructuring and other charges.

We anticipate that we will make additional measured increases to operating expenses to support our base business and to fund the revenue-generating initiatives described above and inExecutive Overview beginning on page 10.

Total costs and expenses decreased to $622.6 million in 2004 compared to $751.6 million in 2003, primarily as a result of our restructuring plan initiated in 2003 and completed in the fourth quarter of 2004. In 2004, to achieve our objective of restoring profitability, we implemented cost cutting measures that reduced our headcount, resulting in lower aggregate salaries, benefits and related costs. As a result, our headcount decreased to 3,042 at the end of 2004 from 3,500 at the end of 2003. In addition, our cost reduction initiatives resulted in reduced facility charges, including rent and related overhead costs. Primarily as a result of headcount reductions and lease costs related to excess facilities, we recorded restructuring and other charges of $42.9 million and $30.9 million in 2004 and 2003, respectively. SeeRestructuring and Other Charges (Credits) below and Note B of “Notes to Consolidated Financial Statements” for further discussion.

18

Cost of License Revenue