UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 2)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

CHECK THE APPROPRIATE BOX:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to § 240.14a-12 |

PTC INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| | | | |

| |

| ☒ | | No fee required |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-(6)(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transactions applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, schedule or registration statement no.: |

| | (3) | | Filing party: |

| | (4) | | Date filed: |

Shareholder Engagement February 2021 NASDAQ: PTC J11567

On February 3, 2021, the Board of Directors of PTC established a separate Nominating Committee. The nominating responsibilities had previously been addressed by the Corporate Governance Committee. All the members of the Nominating Committee are independent under Nasdaq standards and as determined by the Board of Directors. Phillip Fernandez, Klaus Hoehn and Paul Lacy have been appointed to the Nominating Committee. Phillip Fernandez has been appointed Chair of the Nominating Committee. The Nominating Committee Charter and the revised Corporate Governance Committee Charter have been posted to the Investor Relations section of PTC’s website. Establishment of nominating committee

COMMITTEE COMPOSITION February 3, 2021 AUDIT COMPENSATION CORPORATE GOVERNANCE NOMINATING STRATEGIC PARTNERSHIPS OVERSIGHT Paul Lacy (Chair) Janice Chaffin (Chair) Phil Fernandez (Chair) Phil Fernandez (Chair) Bob Schechter (Chair) Phil Fernandez Paul Lacy Janice Chaffin Klaus Hoehn Janice Chaffin Cori Lathan Bob Schechter Klaus Hoehn Paul Lacy Blake Moret Bob Schechter Paul Lacy Blake Moret Board committee Composition

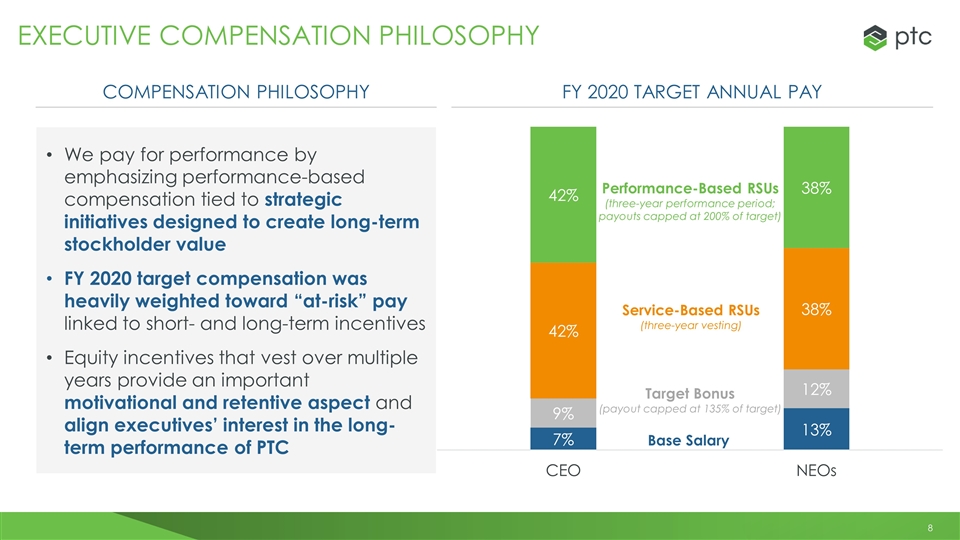

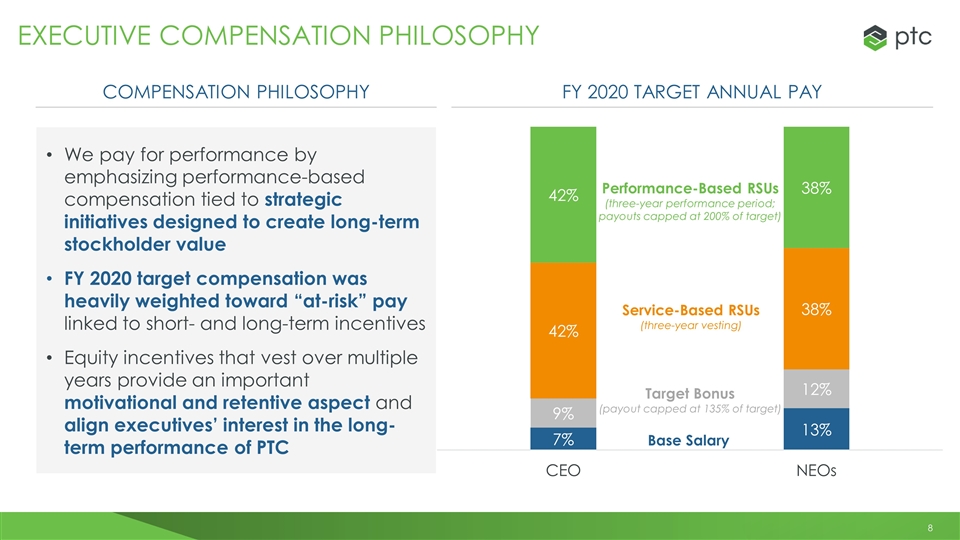

We pay for performance by emphasizing performance-based compensation tied to strategic initiatives designed to create long-term stockholder value FY 2020 target compensation was heavily weighted toward “at-risk” pay linked to short- and long-term incentives Equity incentives that vest over multiple years provide an important motivational and retentive aspect and align executives’ interest in the long-term performance of PTC Compensation Philosophy FY 2020 Target annual pay 8 Base Salary Target Bonus (payout capped at 135% of target) Service-Based RSUs (three-year vesting) Performance-Based RSUs (three-year performance period; payouts capped at 200% of target) Executive Compensation Philosophy

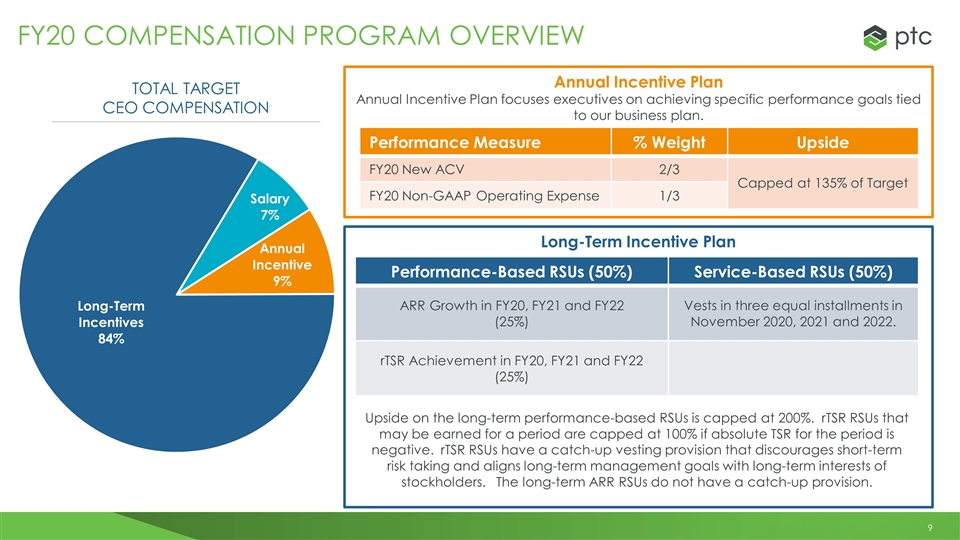

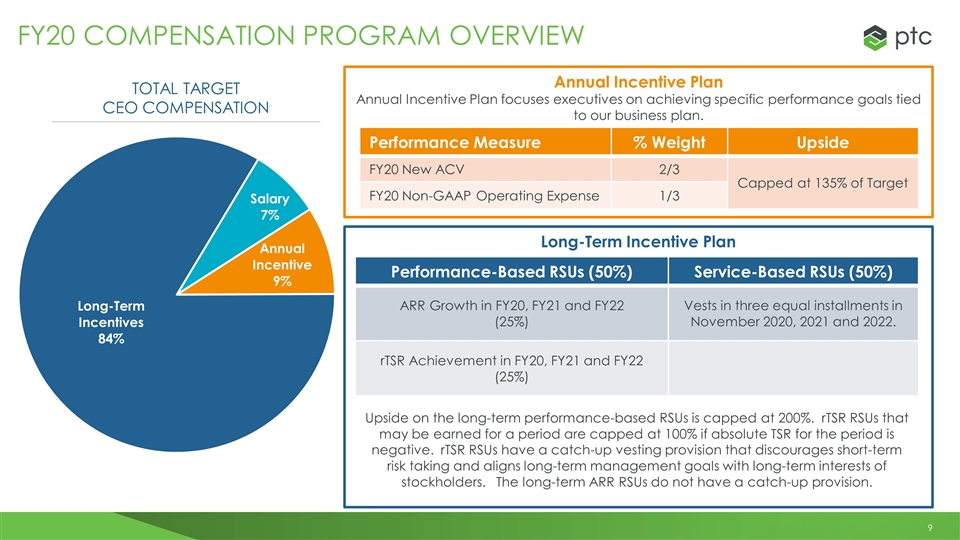

Annual Incentive Plan Annual Incentive Plan focuses executives on achieving specific performance goals tied to our business plan. Long-Term Incentive Plan 9 FY20 Compensation Program overview Total Target CEO Compensation Performance Measure % Weight Upside FY20 New ACV 2/3 Capped at 135% of Target FY20 Non-GAAP Operating Expense 1/3 Performance-Based RSUs (50%) Service-Based RSUs (50%) ARR Growth in FY20, FY21 and FY22 (25%) Vests in three equal installments in November 2020, 2021 and 2022. rTSR Achievement in FY20, FY21 and FY22 (25%) Upside on the long-term performance-based RSUs is capped at 200%. rTSR RSUs that may be earned for a period are capped at 100% if absolute TSR for the period is negative. rTSR RSUs have a catch-up vesting provision that discourages short-term risk taking and aligns long-term management goals with long-term interests of stockholders. The long-term ARR RSUs do not have a catch-up provision.

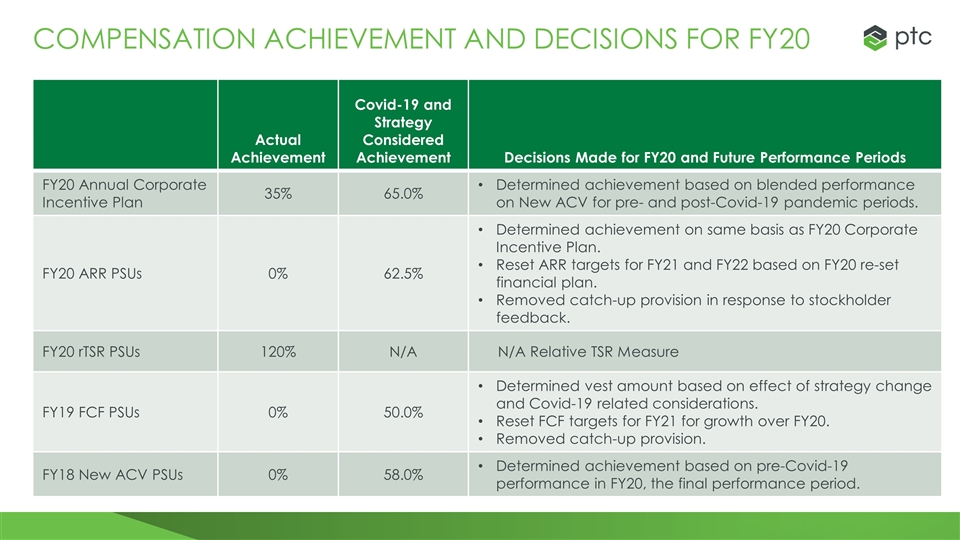

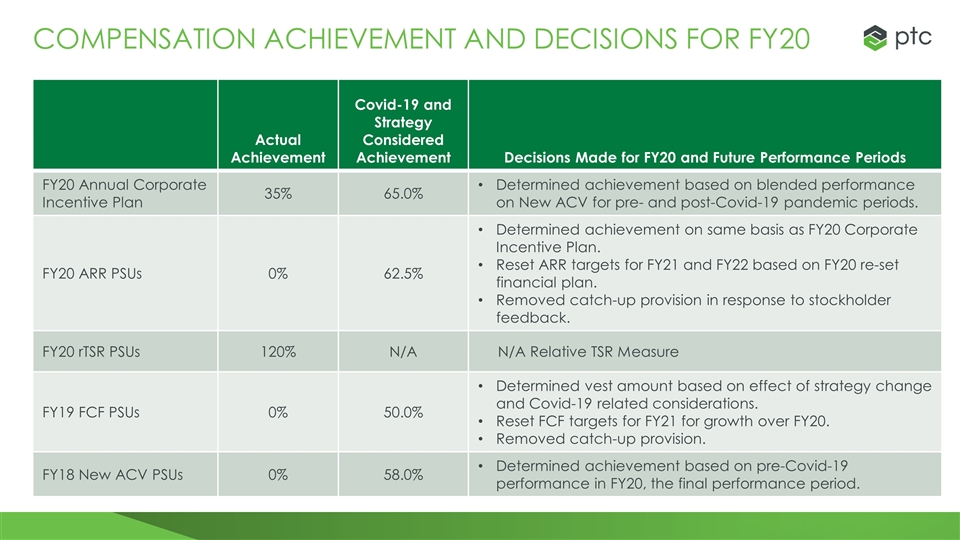

Actual Achievement Covid-19 and Strategy Considered Achievement Decisions Made for FY20 and Future Performance Periods FY20 Annual Corporate Incentive Plan 35% 65.0% Determined achievement based on blended performance on New ACV for pre- and post-Covid-19 pandemic periods. FY20 ARR PSUs 0% 62.5% Determined achievement on same basis as FY20 Corporate Incentive Plan. Reset ARR targets for FY21 and FY22 based on FY20 re-set financial plan. Removed catch-up provision in response to stockholder feedback. FY20 rTSR PSUs 120% N/A N/A Relative TSR Measure FY19 FCF PSUs 0% 50.0% Determined vest amount based on effect of strategy change and Covid-19 related considerations. Reset FCF targets for FY21 for growth over FY20. Removed catch-up provision. FY18 New ACV PSUs 0% 58.0% Determined achievement based on pre-Covid-19 performance in FY20, the final performance period. Compensation Achievement and decisions for FY20

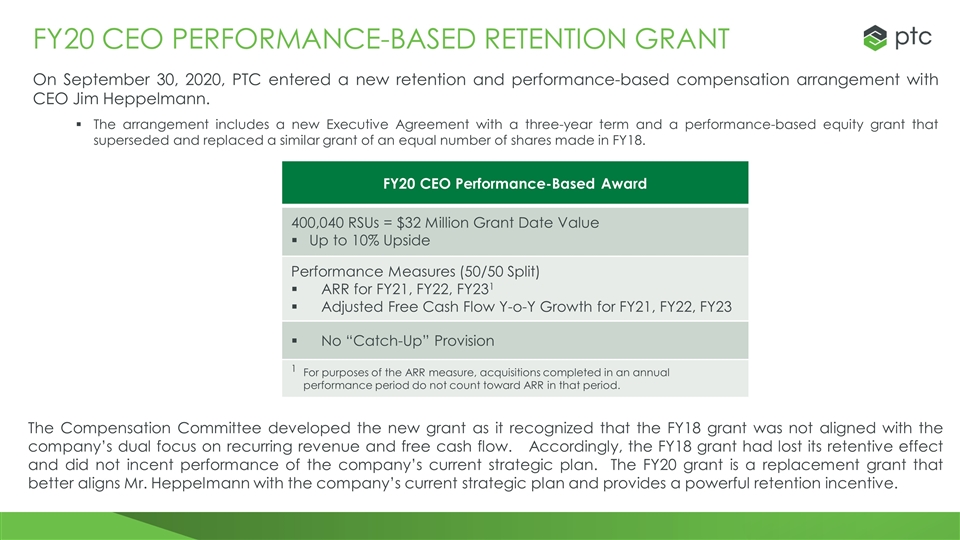

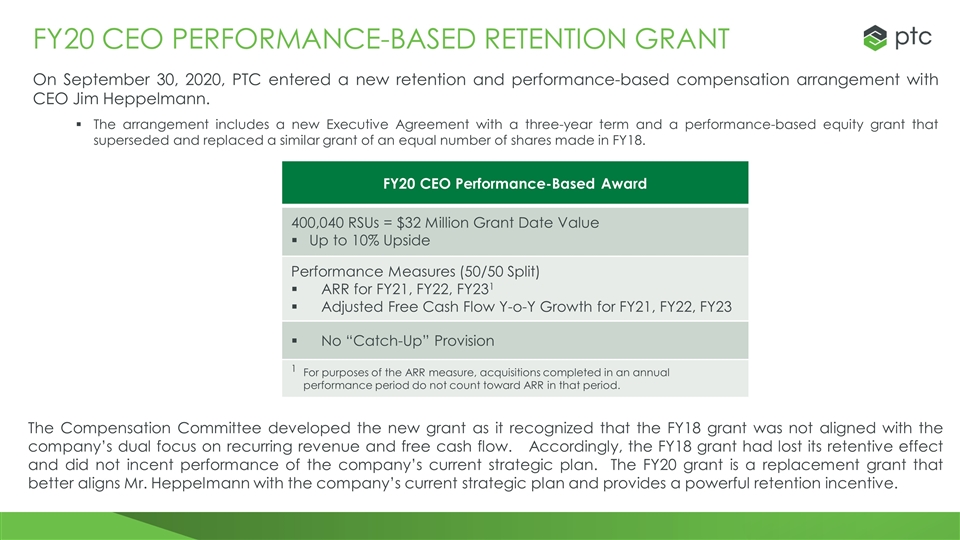

FY20 CEO Performance-Based Award 400,040 RSUs = $32 Million Grant Date Value Up to 10% Upside Performance Measures (50/50 Split) ARR for FY21, FY22, FY231 Adjusted Free Cash Flow Y-o-Y Growth for FY21, FY22, FY23 No “Catch-Up” Provision 1For purposes of the ARR measure, acquisitions completed in an annual performance period do not count toward ARR in that period. FY20 ceo performance-based retention grant On September 30, 2020, PTC entered a new retention and performance-based compensation arrangement with CEO Jim Heppelmann. The arrangement includes a new Executive Agreement with a three-year term and a performance-based equity grant that superseded and replaced a similar grant of an equal number of shares made in FY18. The Compensation Committee developed the new grant as it recognized that the FY18 grant was not aligned with the company’s dual focus on recurring revenue and free cash flow. Accordingly, the FY18 grant had lost its retentive effect and did not incent performance of the company’s current strategic plan. The FY20 grant is a replacement grant that better aligns Mr. Heppelmann with the company’s current strategic plan and provides a powerful retention incentive.

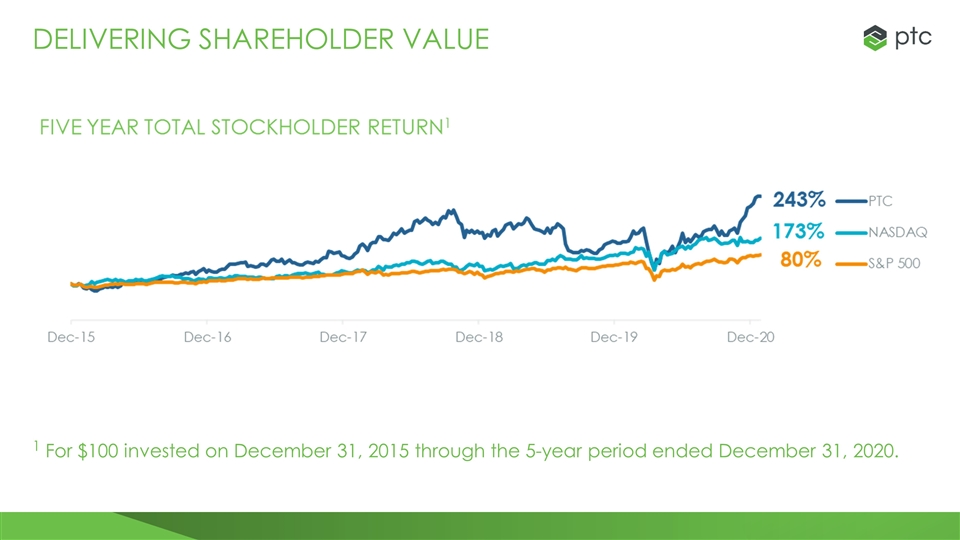

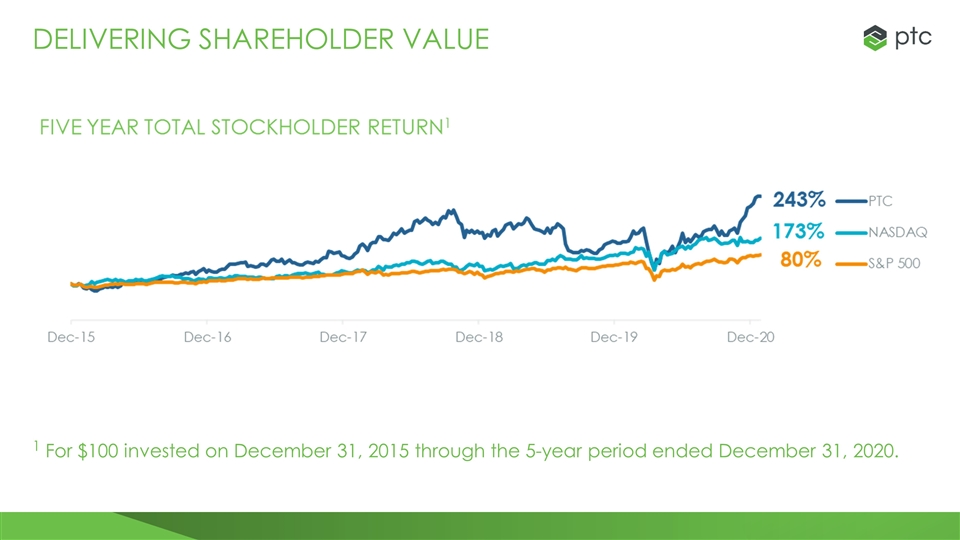

Delivering shareholder value 1 For $100 invested on December 31, 2015 through the 5-year period ended December 31, 2020.