- PTC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PTC (PTC) DEF 14ADefinitive proxy

Filed: 23 Dec 22, 4:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

PTC Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

NOTICE OF 2023 ANNUAL STOCKHOLDERS’ MEETING

| Thursday, February 16, 2023 |

| 9:00 a.m. Eastern Standard Time |

| PTC Inc. 121 Seaport Boulevard Boston, MA 02210 |

| HOW TO VOTE | |

| ONLINE at www.proxyvote.com |

| BY MAIL if you received a printed version of these proxy materials. |

| SCAN your proxy card or notice. |

| BY PHONE touch-tone if you received a printed version of these proxy materials. |

Important Notice of the Internet Availability of Proxy Materials The Proxy Statement and our 2022 Annual Report are available to stockholders at proxyvote.com. We made this proxy statement available to stockholders beginning on December 23, 2022. |

Matters to be Voted on at the Meeting

| Proposal 1 | |

| Elect nine directors to serve until the 2024 Annual Meeting of Stockholders. | |

| The Board of Directors recommends that you vote FOR the election of all director nominees. |

| Proposal 2 | |

| Approve an increase of 6,000,000 shares available for issuance under the 2000 Equity Incentive Plan. | |

| The Board of Directors recommends a vote FOR the share increase for the 2000 Equity Incentive Plan. |

| Proposal 3 | |

| Approve an increase of 2,000,000 shares under the 2016 Employee Stock Purchase Plan. | |

| The Board of Directors recommends a vote FOR the share increase for the 2016 Employee Stock Purchase Plan. |

| Proposal 4 | |

| Advisory vote to approve the compensation of our named executive officers (Say-on-Pay). | |

| The Board of Directors recommends a vote FOR the approval of the compensation of our named executive officers as disclosed in COMPENSATION DISCUSSION AND ANALYSIS and the tables and related disclosures contained in EXECUTIVE COMPENSATION. |

| Proposal 5 | |

| Advisory vote on the frequency of the Say-on-Pay vote. | |

| The Board of Directors recommends that you vote for ONE YEAR for the frequency of the Say-on-Pay Vote. |

| Proposal 6 | |

| Advisory vote to confirm the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023. | |

| The Board of Directors recommends that you vote FOR the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023. |

Other matters that are properly brought before the meeting may also be considered.

All stockholders as of the record date, December 9, 2022, have the right to attend and vote at the Annual Stockholders’ Meeting. In order to establish a quorum and facilitate the tabulation of votes, please vote before the meeting, even if you plan to attend the meeting. For more information, see “Additional Meeting Information.”

| 2023 PROXY STATEMENT | 3 |

We Enable Digital Transformation of Industrial Enterprises

Companies are facing disruption from everywhere—from supply chain issues to workforce attrition to competitors trying to take market share. PTC helps companies thrive in these conditions by enabling them to create more innovative products, solutions, and workforces.

Our portfolio of Computer-Aided Design, Product Lifecycle Management, Application Lifecycle Management, Service Lifecycle Management, IoT, and Augmented Reality technologies work together to create a powerful digital thread foundation that enables faster data continuity for better collaboration.

Companies from industries such as industrial equipment, high-tech, automotive, aerospace and defense, life sciences, and more use PTC’s world-class solutions to achieve their digital transformation goals and differentiate their business.

Our 2022 Business Performance Highlights

| +7% | +16% | +18% | +21% |

| ARR | ARR | Cash Flow from Operations | Free Cash Flow |

| Constant Currency | |||

| $1.6 Billion | $1.7 Billion | $435 Million | $416 Million |

| ARR | ARR | Cash Flow from Operations | Free Cash Flow |

| Constant Currency |

ARR (Annual Run Rate) is the value of our portfolio of recurring revenue contracts at the end of the period. Free cash flow is cash flow from operations net of capital expenditures. These measures are described and reconciled in Appendix C.

| Market Demand | Bottom Line | |

| Deliver technology solutions aligned with secular market trends including digital transformation, SaaS, and remote collaboration. | Increase free cash flow through continued operating discipline within a durable recurring business model. | |

| Top Line | CSR | |

| Drive sustainable ARR growth and maintain strong retention rates through our global field organization and partner ecosystem. | Empower our diverse workforce to create a better world through product innovation, sustainable operations, and supporting our global communities. | |

| 4 |  |

We recognize the close connection between our success and our ability to make a positive impact on our customers, our employees, and our communities. Our efforts help make us an employer of choice, differentiate our brand, and support profitable and sustainable growth. Our sustainability initiatives and programs include the environmental, social and governance initiatives and programs described below.

In 2022, we focused on building out our ESG program in its entirety to coordinate responsibilities and reporting to support a cohesive and informed approach.

ESG Governance Process and Structure Finalized Finalized Operating and Reporting Structure and Identified All Roles Required | ESG Governance and Structure Roles Filled Expanded Roles and Appointed People to New ESG Roles | |

Strategic ESG Assessment Completed Developed Action Plan for FY2023 ESG Initiatives | Environmental Sustainability Added as a FY2023 Corporate Initiative Conducted Product Strategy Assessment | |

The ESG council and designation of the ESG operating leads were added in 2022. The ESG Council is responsible for the strategic direction of ESG initiatives, oversight of progress of ESG initiatives, oversight of ESG reporting and alignment with applicable standards, and periodic reporting to the Board and appropriate committees on ESG initiatives.

| Board of Directors | ||||

| Audit Committee | Cybersecurity Committee | Corporate Governance Committee | Nominating Committee | Compensation and People Committee |

| Chief Executive Officer | ||||

| ESG Council | ||||

| ESG Operating Leads | ||||

| 2023 PROXY STATEMENT | 5 |

SUSTAINABILITY HIGHLIGHTS

The strategic ESG assessment canvased multiple stakeholders and sources to identify and prioritize our ESG focus areas. As a result, we plan to focus on the areas described below.

| ENVIRONMENTAL | SOCIAL | GOVERNANCE | ||||

|  |  | ||||

| GHG Emissions Environmental Product Offerings | Diversity, Equity & Inclusion Employee Compensation and Retention Community Engagement | Cybersecurity ESG Governance Ethical Conduct & Compliance Board Diversity |

| Align on Sustainability Reporting Frameworks | Align on Sustainability Metrics to be Tracked and Reported | Establish Diversity, Equity & Inclusion Metrics to be Tracked and Reported | ||

| Present Environmental Sustainability Track at LiveWorx 2023 | Measure and Be in a Position to Report 2023 GHG Emissions | Be in a Position to Evaluate Setting GHG Emission Reduction Targets in 2024 | ||

| Cybersecurity and Data Privacy |

Cybersecurity is a risk area with oversight at the highest levels of the organization, including the Executive level and Board. The Cybersecurity Committee of the Board receives regular reports (at least four times throughout the year) from our cybersecurity teams on the state of our cybersecurity and our initiatives to enhance our cybersecurity profile and that of our products.

As part of our program, we train our employees throughout the year on cybersecurity risks and our policies and practices designed to address to those risks.

| Diversity, Equity & Inclusion |

DEI is critical to how we think about our employee culture, our engagement with our customers and partners, and the communities in which we work and live.

Our definition of “diversity” is intentionally broad and includes many groups, united by purpose. Our common goal is to drive meaningful change and to create an environment where all employees can succeed personally and professionally. We are also committed to embedding equity into every part of the organization, promoting an innovative and inclusive forward-thinking culture, and building high-performing teams.

| 6 |  |

SUSTAINABILITY HIGHLIGHTS

We have a history of working to attract a wide diversity of people from different backgrounds, cultures, education experiences, and religions because we know that a workforce that reflects the diversity of our customers and communities will bring more innovative thinking and better ideas and solutions to our business. Our DEI team, led by our Chief Diversity Officer, focuses on underrepresented groups (URGs) in the tech industry, including people of color, women, and members of the LGBTQIAP+ community.

We are improving our systems and processes to enable us to better track, manage and develop our employees. With these improvements, we are gaining a better understanding of our current demographic population and developing demographic goals, as we strive to create a more demographically diverse, inclusive, and equitable organization. Starting in 2022, our Self-Identification program invited U.S. employees to volunteer their personal information across categories such as race/ethnicity, sexual orientation, gender identity, pronouns, disability, veteran and military status, and more. By analyzing this information in aggregate, we can determine what we should adjust in terms of DEI programming, policies, and hiring practices.

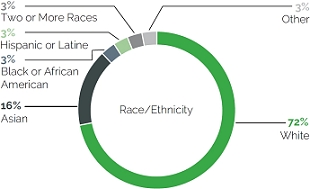

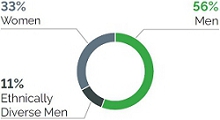

United States Employee Representation

| RACE/ETHNICITY | GENDER DIVERSITY | |||

|  | |||

| Environmental Sustainability |

We are committed to addressing our environmental impact and to providing solutions to our customers that enable them to transform their businesses and operations to reduce their environmental impact and that of their customers.

Governance Process and Oversight

Our environmental programs and initiatives are overseen by our ESG Council, which is comprised of a cross-functional team of internal PTC business leaders with executive oversight, including our Chief Strategy and Sustainability Officer.

Our Corporate Governance Committee oversees risks and opportunities related to climate change and other ESG risks and initiatives not addressed by other committees of the Board.

Addressing Our Direct Impacts

To help us and our stakeholders understand our environmental impact, we have undertaken an effort to measure and ultimately report our GHG emissions. Our goal is to begin reporting our Scope 1 and Scope 2 emissions in FY2023 and to introduce reduction targets thereafter.

| 2023 PROXY STATEMENT | 7 |

SUSTAINABILITY HIGHLIGHTS

As a software company, our environmental impact results mainly from our offices, employees, and leased data centers. Accordingly, as we open new offices or relocate offices, we seek to locate our offices in areas accessible by public transportation, to lease energy efficient buildings, and to organize our workspaces to reduce the physical and environmental footprint of those offices. As we refresh other offices, we implement energy efficient measures and reduce the footprint by organizing workspaces more efficiently. We also engage in other resource conservation efforts at our offices, including recycling programs, public transportation support programs, and, in India, water resource conservation programs.

As business travel by our employees and our customers can have a significant impact, we are reducing our business travel through adoption of policies and technology for remote meetings and collaboration and are leveraging technology and practices to reduce customer visits to our offices. We do not own or lease any corporate jets.

Support for Our Customers’ Digital Transformation Initiatives

We are committed to driving innovation and creating products that help our customers improve productivity and reduce costs and help them achieve their own sustainability goals and those of their customers.

Our software products enable companies to design, manufacture, and service their products in ways that lower their physical environmental impact by saving energy, reducing materials usage and waste, and increasing efficiency. Our augmented reality software enables our customers to remotely service their products and to train their employees more efficiently, including remotely, enabling them to make processes more efficient and to reduce travel. We are exploring ways to capture and report the efficiencies and reductions in environmental impact realized by our customers through the use of our software.

| Community Engagement |

We are committed to creating a better reality by providing financial grants to organizations with charitable and social missions and by supporting employees in their efforts to give back to the community.

The PTC Foundation focuses on charitable giving in STEM and Education and in the communities where PTC employees, partners and stakeholders are located. In 2022, we donated over $1 million to address the Ukraine Humanitarian Crisis.

Corporate Social Responsibility and Sustainability

We describe our sustainability initiatives and successes in our most recent Corporate Social Responsibility Report, including the December 2022 Information supplement to that report located on the Corporate Social Responsibility page on our website. The December 2022 Information supplement includes an update on our alignment with SASB standards.

Human Capital Management

Our Human Capital Management practices are described in 2022 Annual Report on Form 10-K, which accompanies this proxy statement. Our most recent EEO-1 data is included in the December 2022 Information supplement.

Cybersecurity and Data Privacy

We maintain a Trust Center on our website that describes our approach to cybersecurity and data privacy.

| 1 | The references to our Corporate Social Responsibility Report, the December 2022 Information supplement, the Trust Center, and our website are not intended to incorporate those resources or other information on our website into this Proxy Statement by reference. |

| 8 |  |

| Fall 2022 Engagement | |

| Investors Contacted | Discussions Held |

| 20 | 6 |

| Investors | Investors |

| 57.3% | 12.41% |

| Outstanding Shares | Outstanding Shares |

| Primary Topics Discussed | |

| ESG Governance and Oversight | Executive Compensation |

| Climate Goals and Targets | DEI Goals and Targets |

We engaged with stockholders in Fall 2022 to provide them with an opportunity to share their views and any concerns.

For our engagement, we targeted our 20 largest investors, each of which held at least 1% of our outstanding stock.

The results of our engagement and our stockholders’ perspectives on the items discussed will be shared with the Board of Directors and will inform future decisions with respect to those matters.

| 2023 PROXY STATEMENT | 9 |

This summary highlights information contained elsewhere in this proxy statement and does not contain all the information you should consider. You should read the entire proxy statement before voting.

All references to 2022 and 2021 refer to PTC’s fiscal years ended September 30, 2022 and 2021, respectively, unless otherwise indicated.

| Director Since | Committee Memberships | ||||||||

| Name and Primary Occupation | Age | AC | CPC | CGC | CC | NC | |||

| Mark Benjamin Independent Former CEO, Nuance Communications | 52 | 2021 |  |  | ||||

| Janice Chaffin Independent Former Group President, Consumer Business Unit, Symantec | 68 | 2013 |  |  |  |  | ||

| Amar Hanspal Independent Former CEO, Bright Machines | 58 | 2002 | ||||||

| James Heppelmann President and CEO, PTC Inc. | 58 | 2008 | ||||||

| Michal Katz Independent Head of Investment and Corporate Banking, Americas, Mizuho Financial Group | 54 | 2002 | ||||||

| Paul Lacy Independent Former President, Kronos Incorporated | 75 | 2009 |  |  |  |  | ||

| Corinna Lathan Independent CEO and Board Chair, AnthroTronix | 55 | 2017 |  |  | ||||

| Blake Moret Independent President and CEO, Rockwell Automation, Inc. | 60 | 2018 |  | |||||

| Robert Schechter Independent Former CEO, NMS Communications | 74 | 2009 |  |  | ||||

| KEY | |||||

| AC | Audit Committee | CGC | Corporate Governance Committee | NC Nominating Committee | |

| CPC | Compensation & People Committee | CC | Cybersecurity Committee |  Chair |

Member |

| 10 |  |

PROXY STATEMENT SUMMARY

Executive Compensation Highlights

Alignment of Executives and Stockholders

| RSUs TIED TO STRATEGIC GOALS | + | THREE-YEAR VESTING OF RSUs | + | SUBSTANTIAL STOCK OWNERSHIP REQUIREMENTS | + | CLAWBACK PROVISIONS | = | ALIGNED INTERESTS BETWEEN OUR EXECUTIVES AND STOCKHOLDERS |

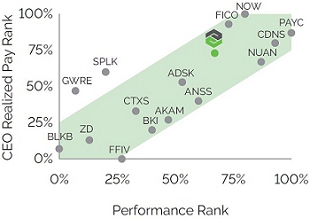

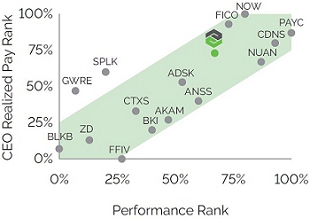

Alignment of Pay and Performance

| 5-YEAR CEO REALIZED PAY VS. TSR | 5-YEAR NEO REALIZED PAY VS. TSR | |||

|  | |||

| See Proposal 4, Compensation Discussion and Analysis, and Executive Compensation for more information about our executive compensation policies and practices. |

2022 PricewaterhouseCoopers LLP Services and Fees

$2,896,012 Audit + Audit-Related Fees | $754,417 Tax Preparation + Related Fees | $1,400,900 Other Tax + Reporting Software Fees | ||

| $5,051,329 Total Fees | ||||

| See Proposal 6 for more information about PricewaterhouseCoopers LLP’s services. |

| 2023 PROXY STATEMENT | 11 |

PROXY STATEMENT SUMMARY

Corporate Governance Highlights

Board Independence

| Board and Committee Practices

| |

Stockholder Rights

| Stock Governance

| |

Compensation Practices

|

|

| 12 |  |

Election of Directors The Board is elected by the stockholders to represent and protect their interest in PTC. The Board selects and oversees the members of senior management, who are responsible for conducting the business of PTC. All director nominees are current directors of the company. Information about each of the director nominees, including their qualifications, skills and experience that led the Nominating Committee and the Board to conclude that the director should serve as a director of the company, is discussed below. Information about their PTC stock ownership is set forth in INFORMATION ABOUT PTC COMMON STOCK OWNERSHIP – Stock Owned by Directors and Officers.

The Board of Directors recommends that you vote FOR the election of all director nominees. |

Snapshot of Board Composition | Board Nominees

| SUPERMAJORITY IS INDEPENDENT | TENURE IS WELL-BALANCED | BOARD IS DIVERSE | ||||

|  |  | ||||

Stockholder Interests are Protected Eight of the nine director nominees, including our Board chairman, are independent. Our President and CEO is not independent. An independent board ensures that the directors exercise independent judgment, are willing to question management and are best suited to represent and protect the interests of stockholders. | Stockholders Benefit from Effective Board Refreshment The Board strives to achieve a balance of service on the Board through a mix of new members and perspectives and members with longer tenure with institutional knowledge. Our President and CEO has served on the Board for over 10 years. | Stockholders Benefit from Existence of Diverse Views Of the nine director nominees, three are women and one of the men is ethnically diverse. This composition provides a diverse set of viewpoints and experiences that we believe benefits stockholders. |

| 2023 PROXY STATEMENT | 13 |

Proposal 1: Election of Directors

Specific Qualifications, Skills, and Experience

The Nominating Committee believes that certain qualifications, skills, and experience should be represented on the Board, as described below, although not every member of the Board must possess all such qualifications, skills, and experience to be considered capable of making valuable contributions to the Board.

| Leadership Our business is complex and evolving rapidly. Individuals who have led companies or operating business units of significant size have proven leadership experience in developing and advancing a vision and making executive-level decisions. |

| Strategy Our success depends on successful development and execution of our corporate strategy, including successful selection and execution of strategic alliances and acquisitions. |

| Global We are a global company, with approximately 40% of our revenue coming from the Americas, 40% from Europe and 20% from the Asia-Pacific region. Global experience enhances understanding of the complexities and issues associated with running a global business and the challenges we face. |

| Financial Our business and financial model is complex and multinational. Individuals with financial expertise are able to identify and understand the issues associated with our business and financial model. |

| Software Industry We are an enterprise software company. Those with enterprise software experience are better able to understand the risks and opportunities facing our business. |

| Manufacturing We primarily serve companies in the manufacturing industry. Understanding of this industry enhances understanding of how we can best address the needs of our customers. |

| Marketing Our business depends on successfully creating awareness of our products and entering new markets. Persons with marketing experience can help us identify ways to do so successfully. |

| Research and Development Our business depends on the success of our research and development efforts to develop our products and expand our offerings. Experience in this area enhances understanding of the challenges we face and best practices. |

Board Nominees Have Balance of Qualifications, Skills, Experience, and Diversity

|  |  |  |  |  |  |  | ||

| Diverse | Leadership | Strategy | Global | Financial | Software Industry | Manufacturing | Marketing | R&D | |

| Mark Benjamin |  |  |  |  |  |  | |||

| Janice Chaffin |  |  |  |  |  |  |  | ||

| Amar Hanspal |  |  |  |  |  |  |  |  |  |

| James Heppelmann |  |  |  |  |  |  |  |  | |

| Michal Katz |  |  |  |  |  |  | |||

| Paul Lacy |  |  |  |  |  |  | |||

| Corinna Lathan |  |  |  |  |  |  |  | ||

| Blake Moret |  |  |  |  |  |  | |||

| Robert Schechter |  |  |  |  |  |  |  |  | |

| Total | 4 | 9 | 9 | 9 | 9 | 8 | 5 | 6 | 4 |

| 14 |  |

Proposal 1: Election of Directors

The Nominating Committee’s mandate is to create and maintain a Board with a diversity of skills and attributes that is aligned with PTC’s current and anticipated future strategic needs. The Board and Nominating Committee value diversity and believe that diversity among the directors as to personal and professional experiences, opinions, perspectives, and backgrounds, including diversity with respect to race, ethnicity, gender, age, cultural backgrounds, sexual identity, and gender orientation is desirable.

The Nominating Committee actively seeks diverse candidates by requiring that all slates of proposed candidates include at least two racially and/or ethnically diverse candidates and opening the aperture to identify candidates that might not otherwise be identified.

BOARD DIVERSITY MATRIX (AS OF DECEMBER 16, 2022)

Total Number of Directors 10

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

| Part I: Gender Identity | ||||||||

| Directors | 3 | 7 | — | — | ||||

| Part II: Demographic Background | ||||||||

| Asian | — | 1 | — | — | ||||

| White | 3 | 6 | — | — | ||||

| Did Not Disclose Demographic Background | — |

| 2023 PROXY STATEMENT | 15 |

Proposal 1: Election of Directors

Independence of Our Directors

Our Board of Directors has determined that all the director nominees, other than Mr. Heppelmann, our President and Chief Executive Officer, are independent under applicable Nasdaq rules. None of the independent directors, to our knowledge, has any business, financial, familial, or other type of relationship with PTC or its management that would impact the director’s independence.

| Mark Benjamin, 53 | ||

Director Since 2021

Board Committees Compensation & People (Chair) Cybersecurity

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Marketing

| |

| 16 |  |

Proposal 1: Election of Directors

| Janice Chaffin, 69 | ||

Director Since 2013

Board Committees Compensation & People Cybersecurity (Chair) Corporate Governance (Chair) Nominating (Chair)

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Marketing

| |

| Amar Hanspal, 58 | ||

Director Since 2022

Board Committees None

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Manufacturing  Marketing  Research and Development

| |

| 2023 PROXY STATEMENT | 17 |

Proposal 1: Election of Directors

| James Heppelmann, 58 | ||

Director Since 2008

Board Committees None

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Manufacturing  Marketing  Research and Development

| |

| Michal Katz, 58 | ||

Director Since 2022

Board Committees None

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry

| |

| 18 |  |

Proposal 1: Election of Directors

| Paul Lacy, 75 | ||

Director Since 2009

Board Committees Audit (Chair)

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Manufacturing

| |

| Corinna Lathan, 55 | ||

Director Since 2017

Board Committees Audit Cybersecurity

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Research and Development

| |

| 2023 PROXY STATEMENT | 19 |

Proposal 1: Election of Directors

| Blake Moret, 60 | ||

Director Since 2018

Board Committees Corporate Governance

Other Public Company Boards

| KEY QUALIFICATIONS:

INDEPENDENCE CONSIDERATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Manufacturing  Marketing

| |

| 20 |  |

Proposal 1: Election of Directors

| Robert Schechter, 74 | ||

Chairman of the Board

Director Since 2009

Board Committees Audit Compensation & People

Other Public Company Boards

| KEY QUALIFICATIONS:

CAREER HIGHLIGHTS:

EDUCATION:

SKILLS AND ATTRIBUTES:  Leadership  Strategy  Global  Financial

Software Industry  Manufacturing  Marketing  Research and Development | |

| 2023 PROXY STATEMENT | 21 |

Our Board is led by an independent Chairman, Mr. Schechter. We believe this Board leadership structure serves the company and our stockholders well by providing independent leadership of the Board. If we were to decide that combining the Chairman and CEO positions would better serve the company and our stockholders, our policy is to have a Lead Independent Director.

Board and Committee Meetings; Attendance at the Annual Meeting

The Board and committees hold regularly scheduled meetings over the course of the year and hold additional meetings as necessary. The Board met four times in 2022. All directors attended at least 100% of meetings of the Board and the committees on which the director served in 2022.

We expect that each director will attend the Annual Meeting of Stockholders each year. All outside directors attended the 2022 Annual Meeting of Stockholders.

Director Election Process and Voting Standard

All directors stand for election each year. Directors are elected by a plurality of votes received. We maintain a Majority Voting Policy for uncontested director elections that requires a director who does not receive a majority of the votes cast for his or her proposed election to promptly tender his or her resignation from the Board. The Corporate Governance Committee will consider the resignation and recommend to the Board whether to accept the resignation. The Board will use its best efforts to act on the resignation and publicly disclose its decision and its rationale within 90 days following certification of the election results. The director tendering the resignation may not participate in the decisions of the Corporate Governance Committee or the Board that concern the resignation.

The Board conducts an annual evaluation process, which is facilitated by a third-party once every three years.

Years 1 and 2 Self-Evaluation The Chairman of the Board meets with each director individually to discuss the Board’s performance and the Chair of the Corporate Governance Committee meets with each director individually to assess the Chairman of the Board’s performance. The results of the assessment are discussed with the full Board. | Year 3 Externally Facilitated Evaluation The external facilitator works with the Board to develop a list of discussion topics and then meets with each of the directors individually to discuss these topics and the Board’s performance. The results of the assessment are discussed with the full Board. |

As a result of its 2022 evaluation, the Board modified the cadence and agendas of Board and committee meetings.

| 22 |  |

CORPORATE GOVERNANCE

Director Nominations and Board Refreshment

The Nominating Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at each Annual Meeting of Stockholders. Candidates may be suggested by directors, management, stockholders, or a search firm retained by the Committee. Stockholders may nominate candidates in accordance with the procedures described in STOCKHOLDER PROPOSALS AND NOMINATIONS. Candidates properly nominated by stockholders will be given the same consideration as other proposed candidates.

The Nominating Committee considers the Board’s composition, including the alignment of the skills and professional experience of the directors with our long-term strategy and the Board’s gender, racial, ethnic, and LGBTQ+ diversity. The Nominating Committee evaluates candidates against the standards and qualifications set forth in our Corporate Governance Guidelines and the Nominating Committee Charter as well as other relevant factors.

Our typical search process involves the steps described below.

1 | 2 | 3 | 4 | 5 | 6 | 7 | ||||||

Assess Board’s Current Skills and Attributes Assess Board’s Current Skills and Attributes |  Identify Skills or Attributes that are needed or may be needed in the future Identify Skills or Attributes that are needed or may be needed in the future |  Develop Candidate Profile Develop Candidate Profile |  Identify and Retain Search Firm to Lead the Process Identify and Retain Search Firm to Lead the Process |  Screen Candidates Screen Candidates |  Chairman of the Board, CEO, Chair of Nominating Committee, and other directors meet with candidates Chairman of the Board, CEO, Chair of Nominating Committee, and other directors meet with candidates |  Decision and Nomination Decision and Nomination |

Commitment to Diversity

The Board and the Nominating Committee are committed to diversity on the Board. The Board initially focused on increasing gender diversity on the Board and successfully identified and recruited three women, all of whom serve on the Board today. The Board has now its attention to increasing other elements of diversity, including racial, ethnic, and LGBTQ+ diversity and in 2022 successfully recruited a seasoned enterprise software executive who is ethnically diverse. Our initiatives and efforts to increase diversity on the Board are described above in PROPOSAL 1: ELECTION OF DIRECTORS – Board Diversity.

| Janice Chaffin | Corinna Lathan | Michal Katz | Amar Hanspal | |||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

Qualifications Required of All Directors

The Nominating Committee considers each candidate’s character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, national and international experience and such other relevant skills and experience as may contribute to the Board’s effectiveness and PTC’s success. In addition, all candidates must be able to dedicate sufficient time and resources for the diligent performance of the duties required of a member of the Board and must not hold positions or interests that conflict with their responsibilities to PTC. Candidates must also comply with any other minimum qualifications for either individual directors or the Board under applicable laws or regulations. The Committee will also consider whether the candidate is independent of PTC as at least a majority of members of the Board must qualify as independent in accordance with Nasdaq independence rules.

| 2023 PROXY STATEMENT | 23 |

CORPORATE GOVERNANCE

The Board and the relevant committees review with PTC’s management the risk management practices for which they have oversight responsibility. Since overseeing risk is an ongoing process and inherent in PTC’s strategic decisions, the Board and the relevant committees do not view risk in isolation but discuss risk throughout the year in relation to ongoing operations and proposed actions and initiatives.

Board of Directors Ultimate responsibility for risk management oversight and oversight of risk | ||||||||||

| Risk or Focus | Audit | Compensation & People | Corporate Governance | Cybersecurity | Nominating | |||||

| Accounting & Financial Reporting | ● | |||||||||

| Financial Condition & Debt | ● | |||||||||

| Ethical Conduct & Compliance | ● | |||||||||

| Related Party Transactions | ● | |||||||||

| Executive Compensation | ● | |||||||||

| Equity Programs | ● | |||||||||

| Human Capital Management | ● | |||||||||

| Corporate Governance | ● | |||||||||

| Composition of Board Committees | ● | |||||||||

| CEO Succession Planning | ● | |||||||||

| Board and Director Evaluations | ● | |||||||||

| Director Compensation | ● | |||||||||

| ESG Governance, Reporting & Frameworks | ● | |||||||||

| Environmental Risks and Initiatives | ● | |||||||||

| Community Engagement Initiatives & Philanthropy | ● | |||||||||

| Cybersecurity | ● | |||||||||

| Data Privacy | ● | |||||||||

| Composition of the Board | ● | |||||||||

| Board Diversity | ● | |||||||||

| Board Refreshment | ● | |||||||||

| Director Nominations | ● | |||||||||

| 24 |  |

CORPORATE GOVERNANCE

The Board has five standing committees: Audit, Compensation & People, Corporate Governance, Cybersecurity, and Nominating. Each of the committees acts under a written charter, all of which are available on the Investor Relations page of our website at www.ptc.com. Mr. Heppelmann, our CEO, does not serve on any committee.

| Audit | Compensation & People | Corporate Governance | Cybersecurity | Nominating | |

| Mark Benjamin, Independent |  |  | |||

| Janice Chaffin, Independent |  |  |  |  | |

| Amar Hanspal, Independent | |||||

| Klaus Hoehn, Independent |  |  | |||

| Michal Katz, Independent | |||||

| Paul Lacy, Independent* |  |  |  |  | |

| Corinna Lathan, Independent |  |  | |||

| Blake Moret, Independent |  | ||||

| Robert Schechter, Independent* |  |  | |||

| Total Meetings in 2022 | 8 | 5 | 4 | 4 | 2 |

Chair

Chair  Member * Audit Committee Financial Expert

Member * Audit Committee Financial Expert

| Audit Committee | |||

| Committee Chair: Committee Members: |

RESPONSIBILITIES

| Assists our Board in fulfilling its oversight responsibilities for accounting and financial reporting compliance and oversees our compliance programs. |

| Reviews the financial information provided to stockholders and others, PTC’s accounting policies, disclosure controls and procedures, internal accounting and financial controls, and the audit process. |

| Meets with management and with our independent auditor to discuss our financial reporting policies and procedures, our internal control over financial reporting, the results of the independent auditor’s examinations, PTC’s critical accounting policies and the overall quality of PTC’s financial reporting, and reports on such matters to the Board. |

| Meets with the independent auditor, with and without PTC management present. |

| Appoints (and, if appropriate, replaces), evaluates, and establishes the compensation of, the independent auditor. |

| Reviews the independent auditor’s performance in conducting the annual financial statement audit and the audit of our internal control over financial reporting, assesses independence of the auditor, and reviews the auditor’s fees. |

| Reviews and pre-approves audit and non-audit related services that may be performed by the independent auditor. |

INDEPENDENCE AND FINANCIAL EXPERTISE

| All Committee members are “independent directors” under both SEC rules and the Nasdaq Stock Market listing requirements. |

| No Committee member has ever been an employee of PTC or any of its subsidiaries. |

| The Board of Directors has determined that Mr. Lacy and Mr. Schechter qualify as Audit Committee Financial Experts as defined by the SEC. |

| 2023 PROXY STATEMENT | 25 |

CORPORATE GOVERNANCE

| Compensation and People Committee | |||

| Committee Chair: Committee Members: |

RESPONSIBILITIES

| Establishes the compensation levels for our executive officers. |

| Sets performance goals for compensation of executive officers and evaluates performance against those goals. |

| Oversees our employee compensation programs, including the corporate bonus programs. |

| Oversees our equity compensation plans. |

| Oversees our people management programs and initiatives, including Diversity, Equity & Inclusion, corporate culture, pay equity, development, engagement, and retention. |

May engage compensation consultants or other advisors to provide information and advice to the Committee.

INDEPENDENCE

| All Committee members are “independent directors” under The Nasdaq Stock Market listing rules. |

| Corporate Governance Committee | |||

| Committee Chair: Committee Members: |

RESPONSIBILITIES

| Develops and recommends policies and processes regarding corporate governance. |

| Maintains a CEO succession plan to ensure continuity of leadership for PTC. |

| Makes recommendations to the Board about the composition of committees of the Board. |

| Reviews and makes recommendations to the Board with respect to director compensation. |

| Facilitates Board and director evaluations. |

| Oversees ESG governance, frameworks, and reporting. |

| Oversees company management of environmental risks and initiatives. |

| Oversees company management of ESG risks and initiatives not addressed by other committees or the Board. |

| Oversees the company’s community engagement and philanthropy initiatives. |

INDEPENDENCE

| “All Committee members are “independent directors” under The Nasdaq Stock Market listing rules. |

| 26 |  |

CORPORATE GOVERNANCE

| Cybersecurity Committee | |||

| Committee Chair: Committee Members: |

RESPONSIBILITIES

| Oversees the Company’s cybersecurity and data privacy programs. |

INDEPENDENCE

| All Committee members are “independent directors” under The Nasdaq Stock Market listing rules. |

| Nominating Committee | |||

| Committee Chair: Committee Members: |

RESPONSIBILITIES

| ● | Oversees the director recruitment process, including the assessment of qualifications and skills sought in new directors and the retention of search firms to assist in the identification of potential candidates. |

| ● | Reviews the composition of the Board and makes recommendations regarding nominees for election to the Board. |

INDEPENDENCE

| ● | All Committee members are “independent directors” under The Nasdaq Stock Market listing rules. |

| 2023 PROXY STATEMENT | 27 |

CORPORATE GOVERNANCE

Director and Executive Officer Stock Ownership Requirements

Because we believe our directors’ and executives’ interests are more aligned with those of our stockholders if they are stockholders themselves, our directors and executive officers are required to hold a significant amount of our stock. Options and unvested equity are not counted toward the holding requirement.

5x Annual Board | CHIEF EXECUTIVE 6x Annual Salary | OTHER EXECUTIVE 3x Annual Salary | All our directors and officers meet their stock ownership requirements. | |||

|  |  |

Our Director Stock Ownership Policy and our Executive Officer Stock Ownership Policy are available on the Investor Relations page of our website at www.ptc.com.

No Hedging or Pledging of PTC Equity

In order to ensure members of the Board of Directors and our executives and employees are aligned with the interests of our stockholders, our Trading in Company Securities Policy prohibits the hedging of PTC stock or equity by directors, executives and employees and transactions in derivative securities whose value is tied to that of PTC stock (including puts, calls and listed options). The Policy also prohibits the pledging of PTC stock or equity by directors, executives and employees and short sales of PTC stock.

Stockholders may send communications to the Board of Directors at: Board of Directors, PTC Inc., c/o General Counsel and Secretary, 121 Seaport Boulevard, Boston, Massachusetts 02210.

| 28 |  |

We pay our non-employee directors a mix of cash and equity compensation. The amounts established for the annual Board and committee cash and equity retainers for the most recent year are shown in the table below. The retainers are the only compensation paid for service as a director; we do not pay meeting fees for attendance at board or committee meetings.

| Annual Cash Retainer | Annual Equity Retainer | Committee Chair Retainer | Committee Member Retainer | |||||||||||||

| Chairman of the Board | $ | 125,000 | $ | 300,000 | ||||||||||||

| Other Directors | $ | 60,000 | $ | 250,000 | ||||||||||||

| Audit Committee | $ | 30,000 | $ | 15,000 | ||||||||||||

| Compensation Committee | $ | 25,000 | $ | 12,500 | ||||||||||||

| Corporate Governance Committee | $ | 15,000 | $ | 7,500 | ||||||||||||

| Cybersecurity Committee | $ | 15,000 | $ | 7,500 | ||||||||||||

| Nominating Committee | $ | 5,000 | $ | 2,500 | ||||||||||||

Director Compensation Process and Decisions

The Board establishes the annual compensation for the directors at the meeting of the Board of Directors held directly after the Annual Meeting of Stockholders. In setting such compensation, the Board considers the recommendation of the Corporate Governance Committee. In making its recommendation for 2022, the Corporate Governance Committee considered a competitive assessment of the directors’ compensation with that of our compensation peer group (described in COMPENSATION DISCUSSION AND ANALYSIS) and reviewed each element of compensation to determine whether the compensation is competitive and reasonable for the services provided by the directors. Based on that review, no changes were made to our directors’ compensation for 2022.

We provide a higher annual retainer for service as the Chairman of the Board given the additional work required by that position, but do not pay a committee chair retainer to the Chairman of the Board for service as the Chair of any committee. We provide different retainers for the Chairs and members of the various committees based on the anticipated level of work required with respect to the position and the committee.

We also believe that providing a majority of our directors’ annual retainer compensation in the form of equity rather than cash serves to further align the interests of our directors with our stockholders as they become stockholders themselves. Accordingly, in accordance with our established practice, we made onboarding equity grants of Michal Katz and Amar Hanspal upon joining the Board. The onboarding grants are equal to 1.5x the annual equity retainer, and vest in two substantially equal installments on the first and second anniversaries of the date the director joined the Board.

| 2023 PROXY STATEMENT | 29 |

DIRECTOR COMPENSATION

The amounts shown in the Fees Earned or Paid in Cash column of the table are each director’s annual board and committee retainer fees. The amounts shown in the Stock Awards column of the table are the value of the equity awards (RSUs) made to the directors during the year.

| Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards (#) | Stock Awards ($)(4)(5) | Total ($) | ||||||||||||

| Robert Schechter Chairman of the Board | $ | 152,500 | 2,497 | $ | 299,915 | $ | 452,415 | |||||||||

| Mark Benjamin | $ | 90,832 | 2,081 | $ | 249,949 | $ | 340,781 | |||||||||

| Janice Chaffin | $ | 104,162 | 2,081 | $ | 249,949 | $ | 354,111 | |||||||||

| Amar Hanspal(2) | $ | 20,000 | 5,532 | $ | 590,652 | $ | 610,652 | |||||||||

| Klaus Hoehn | $ | 70,000 | 2,081 | $ | 249,949 | $ | 319,949 | |||||||||

| Michal Katz(3) | $ | 30,000 | 5,203 | $ | 624,932 | $ | 654,932 | |||||||||

| Paul Lacy | $ | 112,250 | 2,081 | $ | 249,949 | $ | 362,449 | |||||||||

| Corinna Lathan | $ | 80,832 | 2,081 | $ | 249,949 | $ | 330,781 | |||||||||

| Blake Moret | $ | 67,500 | 2,081 | $ | 249,949 | $ | 317,449 | |||||||||

| (1) | As an employee of PTC, Mr. Heppelmann, our President and Chief Executive Officer, receives no compensation for his service as a director, and accordingly, is not shown in the Director Compensation Table. |

| (2) | Mr. Hanspal joined the Board on April 1, 2022. His Stock Awards reflect a pro-rated annual equity grant of 2,020 RSUs and a new director grant of 3,512 RSUs. His new director grant vests in two equal installments on April 1, 2023 and April 1, 2024. |

| (3) | Ms. Katz joined the Board on February 8, 2022. Her Stock Awards reflect an annual equity grant of 2,081 RSUs and a new director grant of 3,122 RSUs. Her new director grant vests in two equal installments on February 15, 2023 and February 15, 2024. |

| (4) | Grant date fair value of restricted stock units granted on February 9, 2022, and, for Mr. Hanspal, April 1, 2022. The grant date fair value is equal to the number of RSUs granted multiplied by the closing price of our common stock on the NASDAQ Stock Market on the grant date, $120.11 per share, and, for Mr. Hanspal, $106.77 per share. |

| (5) | The number of outstanding RSUs held by each director as of September 30, 2022, is shown in the table below. No director held options. |

| Name | Restricted Stock Units | |

| Robert Schechter | 2,497 | |

| Mark Benjamin | 3,376 | |

| Janice Chaffin | 2,081 | |

| Amar Hanspal | 5,532 | |

| Klaus Hoehn | 2,081 | |

| Michal Katz | 5,203 | |

| Paul Lacy | 2,081 | |

| Corinna Lathan | 2,081 | |

| Blake Moret | 2,081 |

| 30 |  |

Approve an Increase in the Number of Shares Available under the 2000 Equity Incentive Plan The 2000 Equity Incentive Plan enables us to provide equity incentives to our employees and is essential for us to be able to continue to use equity incentives to attract, motivate and retain the employees necessary for our future success.

The Board of Directors recommends a vote FOR the share increase for the 2000 Equity Incentive Plan. |

We are seeking stockholder approval of an amendment to our 2000 Equity Incentive Plan (the Plan) to increase the number of shares authorized by 6,000,000 shares. Of the shares previously authorized, only 2,142,543 remained available for grant as of December 16, 2022. If approved, we expect to use the additional shares for continued equity grants to employees – including our executive officers and directors.

Why the 2000 Equity Incentive Plan is Important

| ATTRACT | MOTIVATE | RETAIN |

Our ability to attract, motivate and retain high-performing employees is vital to our ability to compete successfully in the competitive market for employees. We believe our ability to grant equity incentives as an element of employee compensation is essential for us to remain competitive in attracting and retaining such employees. We believe equity incentives motivate performance and provide an effective means of recognizing employee contributions to the success of PTC. Moreover, equity incentives align the interests of the employees with the interests of our stockholders. Accordingly, our equity program is broad and deep – reaching approximately 75.7% of employees worldwide. Because the Plan is the only plan under which we can grant equity incentives, maintaining its viability by increasing the number of shares available for grant is essential for us to be able to continue to use equity incentives to attract, motivate and retain the employees necessary for our future success.

Effective Practices to Balance Our Goals with Stockholder Interests

We are committed to maintaining an equity incentive program that accomplishes our incentive and retention goals while being sensitive to our stockholders’ concerns about the prudent use of equity.

| We Use RSUs as Our Primary Equity Award. We use restricted stock units (RSUs) as our principal equity award because they enable us to issue fewer shares than stock options to deliver comparable value, which reduces overhang and stockholder dilution. They also have a better retentive effect because they retain value even if the stock price declines. |

| We Use Value to Determine the Number of RSUs to Award. We use an intended dollar value to be delivered to determine the number of shares to be awarded, rather than a fixed number of shares. |

| Awards Generally Vest over Three Years. Annual equity awards to employees, including our executive officers, generally vest over three years, with one-third of the award vesting at the end of each one-year period. |

| rTSR RSUs Have One Three-Year Term. Our relative TSR equity awards have one three-year performance period, with cliff vesting at the end of the third year to the extent the rTSR performance measure is achieved. |

| 2023 PROXY STATEMENT | 31 |

PROPOSAL 2: APPROVE AN INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE 2000 EQUITY INCENTIVE PLAN

| Half Our Executives’ Annual RSUs are Performance-Based. Annual equity awards to our executive team, including our executive officers, are 50% service-based and 50% performance-based, with shares not earned for a period being forfeited. |

| We Net Shares for Taxes; Net Shares are not Recycled. We net shares for taxes to reduce the dilution associated with the program. Such “netted” shares are not returned to the share pool under the Plan. |

| We Repurchase Shares to Reduce Dilution. We repurchase shares to reduce the dilution associated with our equity incentive program. |

| No Liberal Change in Control Definition. The Plan includes a definition of a change in control that is tied to consummation of the applicable change in control events. |

| No Dividends on Unvested Awards. The Plan provides that no dividends or dividend equivalents may accumulate or be paid with respect to any unvested portion of an award or with respect to any stock option, whether vested or unvested. |

| No Option Repricing or Cash Buyouts. The Plan provides that we may not, without stockholder approval, amend any outstanding option to reduce the exercise price or replace it with an option at a lower exercise price or exchange it for cash. |

| No Discounted Options or SARs. The Plan requires that option or SAR exercise prices must be not less than 100% of the fair market value of a share of common stock on the date of grant. |

| No Transfer of Unvested Equity or of Options. The Plan prohibits the transfer of unvested awards and the transfer of stock options, whether vested or unvested. |

| No “Evergreen” Provision. The Plan does not include an “evergreen” provision; accordingly, we must periodically ask for stockholder approval to increase the number of shares available under the Plan. |

| We Manage Expense and Dilution. We routinely benchmark the equity program’s expense and share dilution (burn rate) against those of our compensation peer group. |

Benchmark of Dilution and Expense

Our burn rates for the past three completed years were below 40th percentile relative to our compensation peer companies. For 2022, the expense as a percentage of market capitalization associated with our equity program was between the 40th and 60th percentile relative to our compensation peer companies.

Value Burn Rate for the Three Most Recent Completed Fiscal Years

(All Awards Counted in Year Granted)

| Year | Weighted Average Grant Date Fair Value | Service- Based RSUs Granted | Performance- Based RSUs Granted | Total RSUs Granted | Value of Total Granted | Weighted Average Common Shares Outstanding | Value of Weighted Average Common Shares Outstanding | Burn Rate | ||||||||||||||||||||||||

| FY22 | $ | 115.54 | 1,353,405 | 181,274 | 1,534,679 | $ | 177,315,344 | 117,194,128 | $ | 13,540,497,458 | 1.31 | % | ||||||||||||||||||||

| FY21 | $ | 110.27 | 1,267,693 | 179,062 | 1,446,755 | $ | 159,530,207 | 116,835,560 | $ | 12,883,177,207 | 1.24 | % | ||||||||||||||||||||

| FY20 | $ | 76.38 | 2,168,416 | 602,282 | 2,770,698 | $ | 211,639,325 | 115,663,241 | $ | 8,834,918,216 | 2.40 | % | ||||||||||||||||||||

| Three-Year Average | 1.65 | % | ||||||||||||||||||||||||||||||

| 32 |  |

PROPOSAL 2: APPROVE AN INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE 2000 EQUITY INCENTIVE PLAN

Value Burn Rate for the Three Most Recent Completed Fiscal Years

(Performance-Based Awards Counted in Year Earned)

| Year | Weighted Average Grant Date Fair Value | Service- Based RSUs Granted | Performance- Based RSUs Earned | Total RSUs Granted | Value of Total Granted | Weighted Average Common Shares Outstanding | Value of Weighted Average Common Shares Outstanding | Burn Rate | ||||||||||||||||||||||||

| FY22 | $ | 115.54 | 1,353,405 | 396,192 | 1,749,597 | $ | 202,146,764 | 117,194,128 | $ | 13,540,497,458 | 1.49 | % | ||||||||||||||||||||

| FY21 | $ | 110.27 | 1,267,693 | 118,871 | 1,386,564 | $ | 152,893,089 | 116,835,560 | $ | 12,883,177,207 | 1.19 | % | ||||||||||||||||||||

| FY20 | $ | 76.38 | 2,168,416 | 179,528 | 2,347,944 | $ | 179,347,328 | 115,663,241 | $ | 8,834,918,216 | 2.03 | % | ||||||||||||||||||||

| Three-Year Average | 1.57 | % | ||||||||||||||||||||||||||||||

Outstanding Equity Awards and Shares Available to Grant

The table below shows the number of shares under outstanding awards and the number of shares available for future grants under our 2000 Equity Incentive Plan, which is our only equity incentive plan, as of December 16, 2022.

2000 Equity Incentive Plan

(as of December 16, 2022)

| Options Outstanding | RSUs Outstanding | Other Equity Awards Outstanding | Shares Available to Grant | |||||

| 2000 Equity Incentive Plan | — | 2,438,338 | — | 2,142,543 |

Effect of the Share Increase on Dilution

Our model yielded a fully-diluted share overhang of 8.28% and a shareholder value transfer of 9.0%. We believe these measures indicate that our equity incentive program is appropriate and fair to stockholders while enabling us to provide the equity compensation incentives necessary to attract, motivate, and retain the employees necessary for our future success.

Effects of the Proposed Amendment

The only material change to the Plan as a result of the proposed amendment is to make an additional 6,000,000 shares available for issuance under the Plan. In addition to this material change, the amended plan reflects the addition of a definition of change in control to the Plan and certain other housekeeping changes to the Plan that did not require stockholder approval.

The terms of the 2000 Equity Incentive Plan, as amended, are described below. The summary below is qualified in its entirety by reference to the copy of the 2000 Equity Incentive Plan included as Appendix A to this proxy statement, which includes the effects of amendments and which is incorporated herein by reference.

| 2023 PROXY STATEMENT | 33 |

PROPOSAL 2: APPROVE AN INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE 2000 EQUITY INCENTIVE PLAN

| Administration | The Plan is administered by the Compensation Committee of the Board of Directors. The Committee is composed of at least two members of our Board who meet certain tests under the U.S. securities laws for independence from PTC management. If there are not at least two such members, then the entire Board serves as the Committee for purposes of the Plan. | |

| Types of Awards | The Committee may award restricted and unrestricted shares of common stock, restricted stock units, stock options and stock appreciation rights. | |

| Eligibility | The Committee may make awards to employees, directors and consultants of PTC and its subsidiaries based upon their past or anticipated contributions to the achievement of our objectives and other relevant matters. As of December 15, 2022, nine non-employee directors and approximately 6,500 employees were eligible for awards under the Plan. | |

| Restricted Stock Units (RSUs) | The Committee may grant RSUs, which are rights to receive shares of common stock in the future. The Committee determines the period during which, and the conditions under which, the award may be forfeited and the other terms and conditions of such awards. RSUs may be settled in shares of common stock or cash, as determined by the Committee at the time of grant or thereafter. RSUs represent unfunded and unsecured obligations of PTC. | |

| Restricted and Unrestricted Stock | The Committee may make awards of common stock subject to forfeiture. The participant generally will forfeit the shares if specified conditions, such as the participant’s continued service with PTC or achievement of certain company performance goals, are not met. The participant is entitled to vote the shares during the restricted period. The Committee may also award common stock without restrictions. The Committee determines what, if anything, the participant must pay to receive a stock award. | |

| Stock Options | The Committee may award incentive stock options and nonstatutory stock options. The Committee determines the terms of the option awards, including the amount, exercise price, vesting schedule and term, which may not exceed ten years for incentive stock options. The exercise price of an option may not be less than the fair market value of a share of common stock on the date of grant. A participant may pay the exercise price of an option in cash or, if permitted by the Committee, other consideration, including by surrender of common stock the participant holds. | |

| Stock Appreciation Rights | The Committee may grant stock appreciation rights, which are rights to receive any excess in value of shares of common stock over the exercise price. The exercise price may not be less than the fair market value of a share of common stock on the date of grant. The Committee determines at or after the time of grant whether stock appreciation rights are settled in cash, common stock or other securities of PTC, awards or other property and may define the manner of determining the excess in value of the shares of common stock. | |

| Performance Goals | In addition to service and service-related conditions, the Committee may establish performance goals, criteria, and measures with respect to the grant, vesting, and/or forfeiture of Awards. | |

| Limitations on Individual Grants | In any fiscal year, the Committee may not grant to any participant options or stock appreciation rights or restricted stock units, restricted stock or unrestricted stock Awards with respect to which performance goals apply for more than 800,000 shares of common stock. This limit is subject to adjustment for changes in our structure or capitalization that affect the number of shares of common stock outstanding. | |

| No Repricing of Outstanding Awards | The Committee may not, without stockholder approval, amend any outstanding option to reduce the exercise price or replace it with an option at a lower exercise price or exchange it for cash. |

| 34 |  |

PROPOSAL 2: APPROVE AN INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE 2000 EQUITY INCENTIVE PLAN

| No Payment or Accumulation of Dividends on Unvested Awards or Outstanding Options | No dividends or dividend equivalents may accumulate or be paid with respect to any unvested portion of an award or with respect to any stock option, whether vested or unvested. This Plan provision may be amended only with the approval of the stockholders of the Company. | |

| No Transfer | Participants may not transfer unvested awards and may not transfer stock options, whether vested or unvested. | |

| Change in Control | The Plan defines a Change in Control to occur when or upon: | |

|

A director whose election or nomination was approved by a vote of at least a majority of the directors then comprising the Incumbent Board is considered a member of the Incumbent Board;

| |

| The Committee may act to preserve a participant’s rights under an award in the event of a Change in Control by, among other things, accelerating any time period relating to the exercise or payment of the award, causing the award to be assumed by another entity, or providing for compensating payments to the participant. | ||

| Amendment of Outstanding Awards | The Committee may otherwise amend, modify or terminate any outstanding award, provided that the participant’s consent to such action is required if such action (1) would terminate or reduce the number of shares issuable under an option and the participant does not have the opportunity to exercise the option or be compensated for the lost shares, or (2) taking into account any related action, would materially and adversely affect the participant. | |

| Number of Shares Issuable; Change in Capitalization | There are currently 44,300,000 shares of common stock authorized for issuance under the Plan. If and as amended, there will be 50,300,000 shares authorized for issuance under the Plan – an increase of 6,000,000 shares over the 2,142,543 shares that remained available on December 16, 2022. If there is a change in our equity structure that affects the outstanding common stock, the aggregate number of shares that are reserved for issuance under the Plan, as well as the number of shares subject to outstanding awards, together with exercise prices with respect to any of the foregoing, will be adjusted by the Committee to preserve the benefits intended to be provided under the Plan. | |

| Amendments | The Board of Directors may amend, suspend, or terminate the Plan, subject to any stockholder approval it deems necessary or appropriate. Under NASDAQ Stock Market rules, the Board may not increase the number of shares of common stock issuable under the Plan (except in the case of a recapitalization, stock split or similar event) without stockholder approval. |

| 2023 PROXY STATEMENT | 35 |

PROPOSAL 2: APPROVE AN INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE 2000 EQUITY INCENTIVE PLAN

Certain U.S. Federal Tax Consequences

Below is a summary of the material U.S. federal income tax consequences for participants and PTC with respect to awards under the 2000 Equity Incentive Plan.

Restricted Stock Units. A participant will generally realize ordinary income in an amount equal to the fair market value of the shares (or the amount of cash) distributed to settle the restricted stock units at the time of settlement, which is generally upon vesting of the restricted stock units. In certain limited circumstances, a settlement date may be later than the vesting date, in which case the settlement would be made in a manner intended to comply with the rules governing non-qualified deferred compensation arrangements. In either case, we would receive a corresponding tax deduction at the time of settlement. If the restricted stock units are settled in shares, then upon sale of those shares, any subsequent appreciation or depreciation would be treated as short-term or long-term capital gain or loss to the participant and would not result in any further tax deduction by us.

Restricted Stock. Generally, a participant will be taxed at the time the restrictions on the shares lapse. The excess of the fair market value of the shares at that time over the amount paid, if any, by the participant for the shares will be treated as ordinary income. The participant may instead elect at the time of grant to be taxed (as ordinary income) on the excess of the then fair market value of the shares over the amount paid, if any, for the shares. In either case, we would receive a tax deduction for the amount reported as ordinary income to the participant. Upon the participant’s disposition of the shares, any subsequent appreciation or depreciation is treated as a short or long-term capital gain or loss and would not result in any further tax deduction by us.

Incentive Stock Options. A participant does not realize taxable income upon the grant or exercise of an ISO under the 2000 EIP. If a participant does not dispose of shares received upon exercise of an ISO for at least two years from the date of grant and one year from the date of exercise, then (1) upon sale of the shares, any amount realized in excess of the exercise price is taxed to the participant as long-term capital gain and any loss sustained will be a long-term capital loss and (2) we may not take a deduction for Federal income tax purposes. The exercise of ISOs gives rise to an adjustment in computing alternative minimum taxable income that may result in alternative minimum tax liability for the participant.

If shares of common stock acquired upon the exercise of an ISO are disposed of before the end of the one and two-year periods described above (a “disqualifying disposition”), the participant would recognize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares at exercise (or, if less, the amount realized on a sale of such shares) over the exercise price. We would be entitled to a tax deduction for the same amount. Any further gain realized by the participant would be taxed as a short-term or long-term capital gain and would not result in any deduction for us. A disqualifying disposition in the year of exercise will generally avoid the alternative minimum tax consequences of the exercise of an ISO.

Nonstatutory Stock Options. No income is realized by the participant at the time a nonstatutory option is granted. Upon exercise, the participant will recognize ordinary income in an amount equal to the difference between the exercise price and the fair market value of the shares on the date of exercise. We would receive a tax deduction for the same amount. Upon disposition of the shares, appreciation or depreciation after the date of exercise is treated as a short-term or long-term capital gain or loss to the participant and would not result in any further tax deduction by us.

| 36 |  |

Approve an Increase in the Number of Shares under the 2016 Employee Stock Purchase Plan The Board of Directors believes that the 2016 Employee Stock Purchase Plan serves important objectives for PTC, including providing a compensation element that will further enable PTC to compete for talented employees, increase employee engagement, and align employees’ interests with those of other stockholders as they become stockowners themselves. |

| The Board of Directors recommends a vote FOR the share increase for the 2016 Employee Stock Purchase Plan. |

We are seeking stockholder approval of an amendment to our 2016 Employee Stock Purchase Plan (ESPP) to increase the number of shares authorized by 2,000,000 shares. Of the shares previously authorized, only 420,142 remained available for purchase as of December 16, 2022.

Why the 2016 Employee Stock Purchase Plan is Important

The ESPP gives our employees the opportunity and incentive to invest in PTC by purchasing shares of our common stock, including through convenient payroll deductions. The plan is intended to promote stock ownership among PTC employees, which will further align our employees’ interests with those of our stockholders. The plan also serves an important compensation function.

Our practice is to extend participation to eligible employees in most countries in which we operate. We offer two consecutive six-month offering periods a year, with the purchase price per share in any offering being 85% of the lower of the fair market value of the common stock on the first day or the last day of the offering period.

Although these are our current practices, our practices may change as permitted by the ESPP and applicable law. A full copy of the ESPP is included as Appendix B to this Proxy Statement.

Effects of the Proposed Amendment

The only material change to the ESPP as a result of the proposed amendment will be to make an additional 2,000,000 shares available for purchase under the ESPP.

| 2023 PROXY STATEMENT | 37 |

PROPOSAL 3: APPROVE AN INCREASE IN THE NUMBER OF SHARES UNDER THE 2016 EMPLOYEE STOCK PURCHASE PLAN

The terms of the ESPP are described below. The summary below is qualified in its entirety by reference to the copy of the 2016 Employee Stock Purchase Plan included as Appendix B to this proxy statement, which includes the effect of the proposed amendment and which is incorporated herein by reference.

| Administration | The ESPP is administered by the Compensation Committee of the Board of Directors (the “Committee”). The Committee may delegate day-to-day administration of the ESPP to an officer or other person charged with the day-to-day supervision of the ESPP as appointed by the Board or Committee. | |

| Employee Participation | All employees of PTC and its subsidiaries who are customarily employed for more than 20 hours per week and more than five months in the calendar year are eligible to participate in the ESPP. | |

| Offering Periods | The ESPP has consecutive offering periods, and the Committee determines the frequency and duration of individual offering periods and the date(s) on which stock may be purchased. Offering periods may last up to 27 months. Each offering period to date has been six months. | |

| Purchase Limits | ESPP participants may make contributions through payroll deductions of up to ten percent (10%) of eligible compensation, which are used to purchase shares of our common stock at the end of each offering period. A participant may not purchase more than 1,500 shares in any offering period, and his or her right to purchase shares under the ESPP may not accrue at a rate that exceeds $25,000 of the fair market value of the common stock for each calendar year. | |

| Purchase Price | The purchase price per share in any offering is 85% of the lower of the fair market value of the common stock on the first day or the last day of the offering period. | |

| Participant Withdrawal | Participants may withdraw from any offering at any time before stock is purchased. Participation terminates automatically upon termination of the participant’s employment for any reason. Upon termination of a participant’s participation in the ESPP, all payroll deductions credited to the participant’s account or amounts paid that were not used to purchase shares of our common stock are refunded. | |

| Modification and Termination of the ESPP | The Board may amend, modify, or terminate the Plan at any time without notice, subject to any stockholder approval the Board determines to be necessary or advisable. The ESPP will continue until no more shares remain available for issuance under the ESPP or if earlier terminated at the discretion of the Board. |

| 38 |  |

EQUITY COMPENSATION PLAN INFORMATION

The table below shows the awards outstanding and that could be made under our equity plans as of September 30, 2022.

Equity Compensation Plan Information

(as of September 30, 2022)

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options warrants and rights | Number of securities remaining available for future issuance under equity compensation plans | ||||||

| Equity compensation plans approved by security holders: | |||||||||

| 2000 Equity Incentive Plan | 2,751,388 | (1) | $— | (2) | 2,833,421 | ||||

| 2016 Employee Stock Purchase Plan | — | — | 420,142 | (3) | |||||

| Total | 2,751,388 | (1) | $— | (2) | 3,253,563 | (3) | |||

| (1) | All of the shares are issuable upon vesting of outstanding restricted stock units. Outstanding RSUs are counted at the maximum number of RSUs that can be issued under an award. |

| (2) | Outstanding restricted stock units have no exercise price. |

| (3) | This amount represents the total number of shares remaining available under the Plan, of which 106,033 shares are subject to purchase for the current offering period ending January 31, 2023. |

| 2023 PROXY STATEMENT | 39 |

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

| JAMES HEPPELMANN President and Chief Executive Officer Age 58 Additional Information about Jim Heppelmann is provided in “Director Nominees.” | |

| KRISTIAN TALVITIE Executive Vice President, Chief Financial Officer Age 52 Kristian joined PTC as our Chief Financial Officer in May 2019. Before that, Kristian was the Chief Financial Officer of Syncsort Incorporated, a private software company specializing in Big Data, high speed sorting products and data integration software and services from October 2018 through May 2019. He served as Chief Financial Officer of Sovos Compliance, LLC, a private SaaS software company specializing in tax compliance software from July 2016 to October 2018, and served as the Corporate Vice President, Finance of PTC from July 2013 to July 2016 and as the Senior Vice President, Financial Planning and Analysis and Investor Relations of PTC from November 2010 to July 2013. | |

| MICHAEL DITULLIO President, Digital Thread Business Age 55 Mike has been the President, Digital Thread Business since May 2022. Before that, he was the President, Velocity Business, from January 2021 to May 2022. Prior to that Mike served in various positions in our Sales organization, including as Executive Vice President, Global Sales from November 2015 to January 2021. Mike joined PTC in 1999. | |

| CATHERINE KNIKER Executive Vice President, Chief Strategy and Sustainability Officer Age 56 Catherine has been Executive Vice President, Chief Strategy and Sustainability Officer since May 2022. Before that, she was Executive Vice President, Chief Strategy Officer from April 2021 to May 2022, and DVP, Global Head of Corporate Development from January 2020 to April 2021. Prior to that Catherine served in various positions at PTC, including Divisional Vice President, Head of Global Strategic Alliances from October 2018 to January 2020 and Chief Revenue Officer, IoT and AR from September 2016 to October 2018. Catherine joined PTC in 2016. | |

| AARON VON STAATS Executive Vice President, General Counsel and Secretary Age 57 Aaron has served as our General Counsel and Secretary since 2003. Before that, he served in other roles in the company’s Legal group. Aaron joined PTC in 1997. |

| 40 |  |