Filed Pursuant to Rule 424(b)(5)

Registration No. 333-163454

The information in this prospectus supplement is not complete and may be changed. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated August 9, 2010

PROSPECTUS SUPPLEMENT

(To Prospectus dated January 26, 2010)

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

[ ] Shares of Common Stock

Warrants to Purchase up to [ ] Shares of Common Stock

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering [ ] units, consisting of (i) [ ] shares of our common stock, par value $0.001 per share, and (ii) warrants to purchase up to [ ] shares of common stock. Each unit consists of one share of our common stock and a warrant to purchase 0.5 shares of common stock at an initial exercise price of $[ ] per share. The sales price for each unit is $[ ]. The warrants will be exercisable during the period beginning six months after the date of issue and ending on the fifth anniversary of the date of issue. In this prospectus supplement, we refer to the shares and warrants collectively as the “units.” The shares of common stock and warrants comprising the units will be issued separately.

Our common stock trades on the NYSE Amex under the symbol “HQS.” The last reported sale price of our common stock on the NYSE Amex on August [ ], 2010 was $[ ] per share. There is no established public trading market for the offered warrants and we do not expect a market to develop. In addition, we do not intend to apply for listing of the warrants on any national securities exchange or automated quotation system.

Investing in our common stock involves risk. See “Risk Factors” beginning on page S-23 of this prospectus supplement and page 8 of the accompanying prospectus. You should carefully read this prospectus supplement and the accompanying prospectus, together with the documents we incorporate by reference, before you invest in any of our securities.

We will receive the proceeds from all securities sold in this offering less underwriting discounts and commissions, and less other expenses we incur in connection with the offering of the units.

| | | | | | |

| | | Per Unit | | Total |

Price to the public | | $ | [ ] | | $ | [ ] |

Underwriting discounts and commissions | | $ | [ ] | | $ | [ ] |

Proceeds, before expenses, to us | | $ | [ ] | | $ | [ ] |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the securities being offered pursuant to this prospectus supplement and the accompanying prospectus on or about August [ ], 2010.

Ladenburg Thalmann & Co. Inc.

The date of this prospectus supplement is August [ ], 2010.

TABLE OF CONTENTS

You should rely on the information contained in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where their offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement is accurate only at the date on the front cover of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or of any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since the date indicated on the front cover of this prospectus supplement.

This prospectus supplement contains summaries of certain provisions contained in some of the documents described herein, and reference is made to the actual documents filed with the United States Securities and Exchange Commission, or SEC, for complete information. Copies of some of the documents referred to herein have been filed or will be filed or incorporated by reference as exhibits to our SEC filings, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

Additional information, including our financial statements for the years ended December 31, 2009 and 2008 and the notes related thereto, is incorporated by reference to our periodic reports filed with the SEC.

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. You should read this entire prospectus supplement, as well as the accompanying prospectus and the documents incorporated by reference that are described under “Information Incorporated by Reference” in this prospectus supplement and the accompanying prospectus. In the event that the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus prepared by or on behalf of us, or information to which we have referred you. We have not, and the underwriter has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference is accurate only as of the respective dates of those documents in which the information is contained. Our business, financial condition, results of operations and prospects may have changed since those dates.

We obtained statistical data, market data and other industry data and forecasts used throughout, or incorporated by reference in, this prospectus supplement and the accompanying prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information.

Unless otherwise indicated or unless the context otherwise requires, all references in this prospectus supplement and the accompanying prospectus to “HQS,” the “Company”, “we,” “our” and “us” refer to HQ Sustainable Maritime Industries, Inc. and all of its subsidiaries and affiliated companies including Hainan Quebec Ocean Fishing Co. Ltd., or “HQOF,” and Jiahua Marine Bio-Product Company Limited, or “Jiahua Marine,” on a consolidated basis.

S-1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents we incorporate by reference in this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements involve known and unknown risks, uncertainties and other important factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| | • | | our marketing, sales and distribution initiatives in North America, Europe and China; |

| | • | | our estimates of production, market sizes and anticipated consumption of our marine bio and healthcare products and our aquaculture products; |

| | • | | our new organic feed mill and our current and future processing facilities; |

| | • | | our ability to enter into and maintain cooperative farming arrangements and other partnerships with respect to our marine bio products and the performance of our partners under such arrangements; |

| | • | | our relationship with local governments in Hainan Province and the potential support and financing they may provide to us; |

| | • | | our estimates of future performance and growth potential; |

| | • | | our ability to obtain sufficient capital to fund our operations and expansion plans; and |

| | • | | our operating income, future revenue, expenses, capital requirements and needs for additional financing. |

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Because of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus supplement and the accompanying prospectus may not transpire.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this document, any supplements to this document and the documents that we reference in this prospectus supplement and the accompanying prospectus with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this prospectus supplement and the accompanying prospectus, whether as a result of new information, future events or otherwise.

S-2

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus supplement, the accompanying prospectus or incorporated herein by reference. This summary does not contain all the information you should consider before investing in our common stock. You should read the entire prospectus supplement, the accompanying prospectus, any applicable free writing prospectus, as well as the information incorporated by reference carefully, especially the discussion of “Risk Factors” and our consolidated financial statements and the related notes, before deciding to invest in our securities. In this prospectus supplement and the accompanying prospectus, when we use phrases such as “we,” “us,” “our,” “HQS” or “our company,” we are referring to HQ Sustainable Maritime Industries, Inc. and all of its subsidiaries and affiliated companies as a whole, unless it is clear from the context that any of these terms refer only to HQ Sustainable Maritime Industries, Inc.

About Our Company

We are a multi-national company with our headquarters and primary sales offices based in Seattle, Washington. We are a vertically integrated aquatic product producer, processor, and farmer (e.g. through cooperative arrangements with pond farmers), with operations in the People’s Republic of China (“PRC”) of all natural tilapia, other aquatic products, and marine bio and healthcare products. We use state-of-the-art and environment-friendly technologies in our production, processing, and cooperative farm operations. Our facilities are currently certified according to the Hazard Analysis and Critical Control Point (“HACCP”) standards, currently assigned an European Union (“EU”) code required for exporting aquatic products to the EU, and are currently certified in accordance with the Aquaculture Certification Counsel (“ACC”) standards. Our products are sold principally to customers in North America, Europe and Asia. Our current sales activity is primarily directed to distributors within the PRC, rather than within the U.S.

Established in 1999, our aquatic farming and processing operations are in Hainan Province, an island in the South China Sea, which is situated within the most desirable latitude for raising tilapia. The Chinese government has designated Hainan Province in southern China a “green” province, where only environmentally friendly agri-food related industry and tourism are permitted. We purchase and process farm bred and farm raised tilapia through cooperative supply arrangements with local farmers and cooperatives. Our supply cooperatives, under our guidance, use feed formulated by us to optimize the all natural growth of farm raised tilapia. Starting in 2009, we began supplying the farmers and cooperatives with feed formulated from our feed processing mill. We believe our tilapia products have achieved such a high level of purity that we market these products as all natural tilapia. In addition, we purchase and process ocean-caught aquatic products through cooperative supply arrangements with local fisherman for our marine bio healthcare products.

In August 2004, the company acquired Hainan Jiahua Marine BioProducts Co. Ltd., or Jiahua Marine, which develops, produces and sells marine bio and healthcare products, including nutraceutical products for the enrichment of our feed formulas, exclusively in China. The principal products of Jiahua Marine are manufactured from fish by-products (tilapia and shark) that include shark cartilage capsules and shark liver oil products that are distributed exclusively in China. The products undergo substantial independent laboratory testing administered by the Ministry of Health in China, which has resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits. As part of HQS’s vertical integration plan with respect to tilapia, Jiahua Marine introduced new bio and healthcare products made from tilapia in 2009. Following changes in China legislation on food safety standards, which became effective on June 1, 2009, distribution of our health products have expanded and our sales have increased. We expect our health and bio-products business to continue to grow in the future as a result of this legislation. Further, Jiahua Marine’s health products recently have been rebranded to under the “Omojo” brand to celebrate its 10th anniversary.

S-3

In order to maintain the high quality of our products and to position ourselves for attaining completely organic production certification in the future, we have completed the construction of our own feed mill and processing plant for the production of floating feed formulations. We produce the feed using grains grown without chemical fertilizers, free of antibiotics and fishmeal, and use feed additives manufactured in our nutraceutical plant. We plan for this expanded production to satisfy our own demand through the 20,000 mu (or 3,294 acres) of production in Wenchang and Qionghai, as well as to manufacture feed for others’ farmed operations in Hainan, such as shrimp and other farmed species. We also are in the process of constructing a new re-processing plant and a new breeding and genetics facility, which are discussed in detail below.

From our headquarters in Seattle, Washington, we market and brand our high-quality, all natural tilapia products under the name TILOVEYA®. In early 2009, we introduced a new family of frozen tilapia meals under the brand name “Lillian’s Healthy Gourmet.” This new family of products includes an organic, natural and regular line of frozen tilapia meals.

We are incorporated in Delaware. The address of our Unites States headquarters is Melbourne Towers, 1511 Third Avenue, Suite 788, Seattle, Washington 98101 and our telephone number is (206) 621-9888. Our website is located atwww.hqfish.com. The information contained on our website or that can be accessed through our website does not constitute part of this prospectus supplement.

Industry Overview

Aquaculture Industry

Aquaculture is the farming of aquatic animals or plants. Aquaculture is the fastest growing segment in the food production system and has been for the past two decades. According to a recent study by the World Food and Agriculture Organization (“FAO”) published March 2, 2009, world fisheries production reached a new high of 143.6 million metric tonnes in 2006, including farmed and ocean caught product. The contribution of aquaculture to the world fisheries production in 2006 was 51.7 million tonnes of fish, which is 36% of world fisheries production, up from 3.6% in 1970. Global aquaculture accounted for 6% of the fish available for human consumption in 1970. In 2006 global aquaculture accounted for 47% of the fish available for human consumption according to the FAO. The FAO report also describes that over half of the global aquaculture in 2006 was freshwater finfish. Based on the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach in excess of 80 million tonnes of fish by 2050.

As the availability of sites for aquaculture is becoming increasingly limited and the ability to develop non-agricultural land is often restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increases, the demand for institutional support, services and skilled persons is anticipated to increase, along with the demand for more knowledge-based aquaculture education and training as aquaculture becomes more important worldwide. China remains the largest producer of aquaculture products throughout the world with fisheries in China reportedly producing approximately 41.3 million tonnes of fish in 2004. Within the global aquaculture industry, China accounted for 71.0% of the world’s supply of fish for direct human consumption and 29.9% of the total production by live weight in 2002.

Tilapia Industry

In 2005, according to the American Tilapia Association (ATA), tilapia production worldwide was second in volume to carp, and it is projected by the ATA that tilapia will become the most important aquaculture crop in this century, potentially reaching $5.0 billion in global sales by 2010. Commercial production of tilapia has become popular in many countries around the world. Touted as the new white fish to replace the depleted ocean

S-4

stocks of cod, pollock, and hake, world tilapia production continues to rise and at least 100 countries currently raise tilapia, with the PRC being the largest producer. The American Tilapia Association further reports that world production of tilapia products reached approximately 2.5 million metric tonnes in 2007, of which China produced the dominant share of 45.0%.

One of the major outlets for Chinese-produced tilapia has been, and should continue to be, the United States. The following chart reflects the increase in per-capita consumption of tilapia in pounds in the United States in relation to other traditional types of seafood.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Consumer Consumption Per Capita (lbs) |

| 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 (est.) |

| Tuna | | 3.5 | | Shrimp | | 3.4 | | Shrimp | | 3.7 | | Shrimp | | 4.0 | | Shrimp | | 4.2 | | Shrimp | | 4.1 | | Shrimp | | 4.4 | | Shrimp | | 4.1 | | Shrimp | | 4.0 |

| Shrimp | | 3.2 | | Tuna | | 2.9 | | Tuna | | 3.1 | | Tuna | | 3.4 | | Tuna | | 3.4 | | Tuna | | 3.1 | | Tuna | | 2.9 | | Tuna | | 2.7 | | Tuna | | 2.6 |

| Pollock | | 1.6 | | Salmon | | 2.0 | | Salmon | | 2.0 | | Salmon | | 2.2 | | Salmon | | 2.2 | | Salmon | | 2.4 | | Salmon | | 2.0 | | Salmon | | 2.3 | | Salmon | | 2.2 |

| Salmon | | 1.5 | | Pollock | | 1.2 | | Pollock | | 1.1 | | Pollock | | 1.7 | | Pollock | | 1.7 | | Pollock | | 1.5 | | Pollock | | 1.6 | | Pollock | | 1.7 | | Pollock | | 1.6 |

| Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.0 | | Tilapia | | 1.0 | | Tilapia | | 1.1 | | Tilapia | | 1.2 |

| Cod | | 0.8 | | Cod | | 0.6 | | Cod | | 0.7 | | Cod | | 0.6 | | Tilapia | | 0.7 | | Tilapia | | 0.8 | | Catfish | | 1.0 | | Catfish | | 1.0 | | Catfish | | 1.0 |

| Clams | | 0.5 | | Clams | | 0.5 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Cod | | 0.6 | | Cod | | 0.6 | | Crabs | | 0.7 | | Crabs | | 0.7 | | Crabs | | 0.7 |

| Crabs | | 0.4 | | Crabs | | 0.4 | | Clams | | 0.5 | | Tilapia | | 0.5 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Cod | | 0.5 | | Cod | | 0.5 | | Clams | | 0.4 |

| Flatfish | | 0.4 | | Flatfish | | 0.4 | | Tilapia | | 0.4 | | Clams | | 0.5 | | Clams | | 0.5 | | Clams | | 0.4 | | Clams | | 0.4 | | Clams | | 0.4 | | Cod | | 0.4 |

| Scallops | | 0.3 | | Tilapia | | 0.4 | | Flatfish | | 0.4 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 |

| Tilapia | | 0.3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

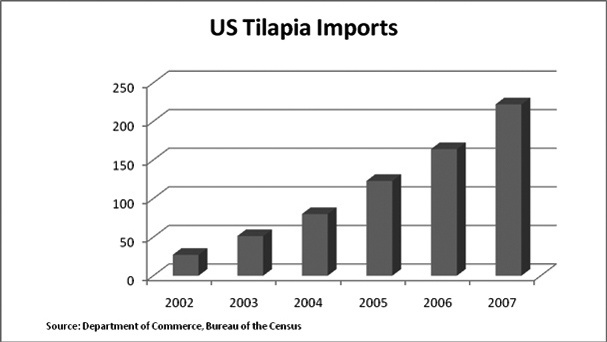

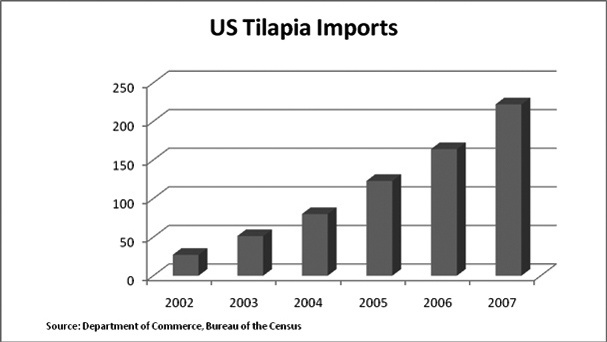

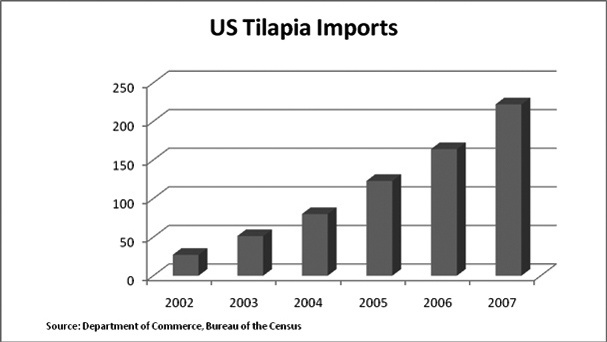

The following chart reflects the increase in imported tilapia to the United States during the periods indicated.

Separately, according to theInternational Trade Report produced in 2005 by the United States Department of Agriculture, or the USDA, U.S. per-capita seafood consumption has remained around 15 billion pounds

S-5

through the late 1980s and 1990s; it is expected to increase as farm-raised products become cheaper. Currently, the United States consumes nearly 12 billion pounds of fish a year. By 2025, demand for seafood is projected to grow by another 4.4 billion pounds (2 million metric tonnes) above what is consumed today. In addition, it is estimated that by 2020, 50% of the U.S. seafood supply will come from aquaculture. Presently, more than 70% of the seafood consumed in the United States is imported, and at least 40% of that is farm-raised. Major changes in U.S. population, along with shifting demographics and economic growth, will alter the U.S. seafood market over the next decade, affecting the selection of products consumed. It is expected that fresh and frozen fish products will account for a growing share of overall seafood consumption, with shrimp remaining at the top. By 2020, shrimp, salmon, tilapia, and catfish will be the top four seafood products consumed.

According to Globefish.org, during the past ten years, tilapia captured by fisheries have stabilized at 0.6 million metric tonnes, while their aquaculture production has grown from 0.55 million metric tonnes to 2.0 million metric tonnes. Tilapia is one of the top five seafood imports in the world. In 2005, more than $2.4 billion of tilapia was sold worldwide according to the FAO Fishstat 2007. In 2005, tilapia moved up to the fourth-ranked most popular seafood after farm-raised shrimp, tuna and Atlantic salmon in terms of aquaculture products imported into the United States. The United States is now the world’s largest consumer of tilapia after China, having imported 437 thousand metric tonnes of tilapia in 2007. In terms of volume, frozen whole round fish ranks first, followed by frozen fillets and, lastly, fresh fillets.

Health Benefits as the Driving Force for Growth in Tilapia Industry

The growing consumer demand for seafood is largely evolving from a new public awareness regarding its health and nutritional benefits. The USDA pyramid guidelines continue to support frequent fish consumption, and the USDA recently completed a highly technical nutritional analysis report about tilapia for the general public. The USDA’s Agriculture Research Service Lab reports that tilapia is moderate in polyunsaturated fatty acid (0.387 g/100g raw, 0.600 g/100g cooked), moderate in omega 3 fatty acids (0.141g/100g raw, 0.220g/100g cooked) and low in mercury (0.010 parts per million, which we refer to as PPM), which is considered to be non-detectable. With the increased awareness of the health concerns surrounding mercury, tilapia’s low mercury levels (0.010 PPM) distinguish tilapia favorably from other types of fish with higher mercury levels, such as swordfish (0.976 PPM), mackerel (0.730 PPM) and yellow fin tuna (0.325 PPM).

Over-the-Counter Marine Bio and Healthcare Products

Due to its aging population, China is demographically attractive for healthcare companies. According to the Chinese Ministry of Health’s 2009 figures, of the 1.3 billion people in China less than 8% are 65 or older; however, by 2050 that proportion is expected to rise to 24%. It is expected as well that Chinese will benefit from double-digit annual growth in disposable incomes during this period. We anticipate that this will lead to increasing use of western therapeutics and “over the counter” remedies. In addition, the market place is highly fragmented with more than 4,000 manufacturers of such remedies in China, most of whom lack scale and access to capital. From 2009 to 2011, we believe approximately $124 billion will be allocated to healthcare expenditure in China. HQS has benefited from regulatory consolidation that resulted in the imposition of higher Chinese Good Manufacturing Practice (“GMP”) standards in 2007 and intends to be a leader in its emphasis on the highest quality standards.

The marine bio and healthcare products industry in China is also sizable, with approximately $6 billion in sales, which still constitutes only 3% of the world market. Currently, overall sales of these products in China have fallen slightly, as compared to the previous year, as consumers gravitate toward branded products meeting international quality standards and with proven benefit for consumers, and away from less known brands and traditional remedies.

S-6

In general, sales of marine bio and healthcare products are made through retail and direct sales channels. Direct sales in China are relatively new, and restrictions on direct sales imposed on large foreign companies have been implemented in China, which has allowed for a growth in sales for PRC-based direct sales companies. These restrictions require foreign direct sellers to manufacture their products and to capitalize their businesses in China. Several companies have met these requirements, including HQS through its PRC-subsidiaries, and growth in this sector is expected to be strong in the next few years.

We believe that nutraceutical supplements in the feed industry is a sector that has strong growth potential, as the importance of aquaculture and aquaculture feeds increases. We manufacture actualized feeds, which involves choosing additives to be included in the feed, such as vitamin E, that promote health in fish, thus reducing the need for curative measures such as antibiotics. Once ingested and present in the flesh of the fish, vitamin E increases the shelf life of the fish and also introduces an additional source of vitamin E to its consumers. Other similar nutraceutical supplements can also be used.

Our Products

Tilapia

Tilapia is currently farmed throughout many countries around the world because this fish is disease-resistant, reproduces easily, eats a wide variety of feeds and tolerates a variety of poor water quality even water with low dissolved oxygen levels. Although there are many species of tilapia, only a few species are farmed for human consumption. The most common species that is farmed commercially is the black, or Nile, tilapia that is grown in ponds, cages or rice fields.

In response to increasing demand for tilapia, we export from our subsidiary in the PRC varying quantities of tilapia in different forms to the United States, Europe, Asia and other regions. In 2007 we launched a marketing and distribution initiative in the United States and Europe with our TILOVEYA® brand tilapia. We continue to promote our TILOVEYA® brand with several leading distributors and retailers in Europe and the United States. We also entered into an exclusive agreement with the Beijing division of Newly Weds® Foods, Inc. to introduce an innovative line of battered and breaded flavored TILOVEYA® fillet for the Chinese consumer. In addition, we co-developed a process and natural flavoring giving tilapia the taste, texture and aroma of fresh ocean-caught fish. We will process such products without the drawbacks of ocean-caught product such as ocean waste and, ecological management. The tilapia products sold by us are mainly in the following forms: whole round frozen, gutted and scaled, boneless-skinless tilapia fillets and, more recently, we began selling boneless-skin-on tilapia fillets.

In 2008 and 2009, we developed a family of frozen tilapia meal products under the brand name of Lillian’s Healthy Gourmet. The family of products will have three lines focusing on organic, natural and regular frozen meals. These meals are processed by a variety of manufacturing facilities in North America including Marsan Foods located in Toronto, Canada. Marsan is the top Canadian processor of private label entrées and branded meal products. The Company has extended brokerage and distribution arrangements across the United States and is continuing to roll out products and expand its range of value-added products from 12 ounce meals to 8 ounce meals and adding flavors. Other value-added products are in the pipeline using our tilapia products catering to an all-natural value-added market.

Our principal operating subsidiary with respect to our seafood products is Hainan Quebec Ocean Fishing Co. Ltd., a company organized in the PRC (“HQOF”).

Marine Bio and Healthcare Products

Since the August 2004 acquisition of our wholly-owned subsidiary, Hainan Jiahua Marine BioProducts Co. Ltd. (Jiahua Marine), a Chinese limited liability company, we have also been engaged in the development,

S-7

production, and sales of marine bio and healthcare products in the PRC. We acquired Jiahua Marine pursuant to a purchase agreement with Sino-Sult Canada Limited (SSC), a Canadian limited liability company, and Sealink Wealth Limited (Sealink), a British Virgin Islands limited liability company, a wholly-owned subsidiary of SSC and the then sole shareholder of Jiahua Marine.

The principal products of Jiahua Marine are manufactured from fish by-products (tilapia and non-endangered shark) that include shark cartilage capsules and shark liver oil products which are distributed exclusively in China. We currently produce over 25 products all of which were developed internally. The products undergo substantial independent laboratory testing in China administered by the Ministry of Health in China and have resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits. As part of our vertical integration plan for tilapia, Jiahua Marine has introduced new bio and healthcare products made from tilapia in 2008. These products include calcium supplement tablets made from the bones of tilapia and collagen facial creams made from the skin and head of the tilapia.

These products have medicinal and health benefits that include:(1) increasing the efficacy of the immune system, correcting blood acidity, (2) reducing fatigue, (3) improving absorption of oxygen into the blood, (4) activating the anti-cancer cells (a major component of the innate immune system), (5) strengthening of bones, and (6) increasing subcutaneous moisture which has anti-wrinkle qualities. All of our healthcare products have undergone stringent independent laboratory testing in China. These tests are administered by the Ministry of Health in China. As part of this process, several laboratories are selected at random from a pool of top university laboratories to conduct tests which must confirm the results and claims of the applicant company. The applicant company can make claims about the health benefits of its products only after such stringent, independent validation of its claims by selected laboratories have been verified. Our claims in respect of our healthcare products have been rigorously tested and proven in China through the above process. Clinical trials and laboratory testing in China by selected university laboratories have resulted in a PRC National Certification of Excellence.

As part of the HQS’s vertical integration plan for tilapia, Jiahua Marine has introduced and will continue to introduce new bio and healthcare products made from tilapia in 2010. The products introduced thus far include; (1) Shalitong Capsules, which are made from the amino acids of tilapia and help in the digestive functions of the body; (2) Xueyuan Capsules vitamin supplement including collagen polypeptides and vitamins; (3) Yubaobaokang Capsules, which contain iron supplements and increase appetite; and (4) Cephalin Capsules made with tilapia brain extract that improve brain function and memory functions and help resist the aging process of the brain.

Shark cartilage—This product is highly alkalescent; it contains chondroitin sulfate and calcium and impacts the human body positively in the following ways:

| | • | | increases efficiency of immune system and activates NK cells associated with combating cancer, as sharks are cancer free; and |

| | • | | reduces blood acidity, thus improving: |

S-8

Shark liver oil—This product is rich in squalene and other nutrients, to which we add vitamins D and E, and impacts the human body positively in the following ways:

| | • | | improves absorption of oxygen in the body; |

| | • | | eliminates fatigue; and |

| | • | | improves health, through the high levels of omega 3 oils. |

In addition to the marine bio and healthcare products that we currently produce, we started manufacturing nutraceuticals generated from palm oil, and other natural or organic matters to enrich feed formulations for tilapia and shrimp farmed in the Hainan area. The enriched feed will have a longer shelf life, and we expect that the benefits of the enriched feed will pass to the end users of our tilapia products, the ultimate customers. These ingredients help improve general health, growth, feed conversion and meat quality of fish and shrimp. Our marine bio and healthcare products processing plant is located in the Wenchang City of Hainan Province and has two production lines, a powder-product line and an oil-product line. These production lines are suited for the manufacture of nutraceutical components. The plant is equipped with a specific gravity molecular separator and accessory equipment for the manufacture of nutraceutical products that serve as feed additives in the production of feed, including tilapia and shrimp feed.

These products are currently sold throughout China, are naturally derived from ocean-harvested by-products and are winners of Science and Technology Progress Awards in China.

Jiahua Marine also had established a long-term relationship with the Qingdao University of Oceanography for research and training relating to the production of our marine bio and healthcare products up to 2006. Currently, HQOF and Jiahua Marine are in preliminary discussions with other universities in the PRC for further research and development.

Health Product Store Opportunity

Through laboratory testing and the use of documented and original research, Jiahua Marine has developed a unique range of marine bio and healthcare products. The products undergo substantial independent laboratory testing in China administered by the Ministry of Health in China and have resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits. As part of the Company’s vertical integration plan of tilapia, Jiahua Marine introduced new bio and healthcare products made from tilapia in 2009. These products include calcium supplement tablets made from the bones of tilapia and collagen facial creams made from the skin and head of the tilapia. Currently, the Company is analyzing a proposal to develop its own flagship health product store in China and ten other stores in tier one cities throughout China, as well as the opportunity to enter into a franchise license to foster a franchisee founded network of health product stores. The Company believes that this and the creation of larger, “superstores” will give consumers access to its award winning marine aquatic-themed health products.

Proposed Equity Offering and Listing

On June 7, 2010, our board of directors authorized management to plan and prepare for a public offering of equity securities of a newly formed, wholly owned subsidiary (“NewCo”) that will hold our health and bio-products segment. Our board also authorized management to plan and prepare for the listing of such equity securities on The Stock Exchange of Hong Kong Limited (“HKEX”) or another stock exchange. NewCo will act as a holding company for, and own 100% of the common stock of, Jiahua Marine, our wholly owned subsidiary engaged in the manufacturing and selling of marine bio and healthcare products in China.

S-9

The offering will be limited to a minority stake of no more than 35% of NewCo’s equity securities. Following the completion of the offering, the Company will retain at least 65% of the outstanding shares of NewCo and will continue to be its controlling stockholder. The primary purposes of the offering and the listing are to (i) unlock the value of Jiahua Marine’s business by allowing direct public investment in Jiahua Marine; (ii) increase the overall value of the Company by capturing the expected valuation premium given to the Company’s marine bio and healthcare products segment by Asian investors; (iii) create a public market for NewCo’s common stock; (iv) obtain additional capital for the Company through the net proceeds of the offering; (v) support Jiahua Marine’s business growth by providing a vehicle through which it may have future access to the public capital markets; and (vi) improve the Company’s competitive position by further strengthening our financial condition.

The offering and stock exchange listing remain subject to a number of conditions, including, among others:

| | • | | Approval from our board of directors; |

| | • | | Regulatory approval from Hong Kong securities regulators and other applicable regulators; and |

| | • | | HKEK approval for listing of NewCo’s common stock. |

Shrimp

Our principal shrimp product is the white shrimp. Our shrimp is exported to various countries in the following forms: head-on shell-on shrimps, headless shell on shrimps, peeled tail-on shrimps, peeled and deveined shrimps, peeled and undeveined shrimps. All orders can be packaged in accordance with the requirements of the buyer, either block or individually quick frozen.

Our Principal Competitive Strengths

We believe we have the following principal competitive strengths:

| | • | | Quality All Natural Tilapia Products.We produce all natural tilapia products and have developed a farming system that avoids the use of antibiotics, hormones and other potentially toxic chemicals. Our tilapia is raised in ponds of pure rain water collected for aquaculture. Two other species of fish are introduced into the ponds to maintain the ponds’ health naturally. One of the species is a bottom feeder that cleans up all the waste at the bottom of the ponds (carp), and the other species is a predator fish that eliminates all of the unhealthy fish (snakehead). We formulate feed without fishmeal and produce feed supplements in our healthcare products processing plant to enrich this feed. It is our policy to raise all natural tilapia to distinguish our company from other tilapia producers. The latitude and the pristine environment of the Hainan province of China have provided us with what we believe to be the optimal conditions for all natural aquaculture production. |

| | • | | Vertically Integrated Operations. Our newly completed feed mill is an important additional step towards our goal of complete vertical integration of our operations, which will allow us to further control and monitor the quality of our aquaculture products, as well as control our costs. The local farmers that we have cooperative arrangements with use our production methods and allow us to constantly monitor the production process for highly consistent production that results in high quality products at the time of harvest. |

| | • | | Environmental and Quality Assurances.We are a leader in environmental and quality assurances of aquaculture products. We have adopted and implemented stringent quality control measures and procedures throughout the production process, in order to comply with the various environmental and quality standards, such as the HACCP and the EU import standards. We are also certified in accordance with the ACC standards and positioning ourselves for completely organic production certification of our tilapia products in accordance with market demands. We use state-of-the-art |

S-10

| | technologies in our farming, feed formulation and processing operations. We have adopted modern and environmentally friendly and responsible technology in our production and processing of tilapia, shrimp, and marine bio and healthcare products, which we believe have been recognized as such through the certifications our plants possess. |

| | • | | Strategic Location in Hainan Province, China. Our processing facilities are geographically well-positioned in Hainan Province to leverage favorable climatic conditions, abundant water supply, pristine environment and a readily available source of labor for our processing plant. We are also located near a seaport, near the city of Wenchang, and our processing facilities are conveniently located near the farmers from whom we obtain our supply of tilapia and shrimp. |

| | • | | International and Domestic Sales and Marketing Efforts.Our Seattle office allows us to differentiate our TILOVEYA® brand and marketing initiative of our all natural tilapia products. Following the success of the TILOVEYA® brand, we introduced in 2009 a family of frozen tilapia meal products under the brand name of “Lillian’s Healthy Gourmet.” The family of products will have three lines focusing on organic, natural and regular frozen meals. The “Lillian’s Healthy Gourmet” brand will help us continue to establish our products as the all natural tilapia products of choice both domestically and internationally. Sales from both the Seattle and China offices complement our multi-national sales efforts to become a world leader in all natural tilapia products. |

| | • | | An Established Track Record and Brand Name in the Industry.We have an established track record and recognized brand name in the industry and have received numerous awards and certifications, which we believe reflect the success of the company in distinguishing itself from its competition. |

| | • | | Competitive Cost Structure.We benefit from competitive cost structures due to the lower labor costs in China as compared to other companies that produce similar products. |

Our Growth Strategies

Our objective is to become the world leader in vertically integrated production, processing and raising of all natural tilapia products. This includes the use of tilapia by-products to increase the range and variety of our marine bio and healthcare products, with a primary focus on increasing our own seafood products. To achieve this goal, we intend to implement the following strategies:

| | • | | Our newly completed large-scale feed mill to supply our existing and anticipated new cooperative fish farmers with our fish food formula. We anticipate that the new feed mill will help increase our aquatic profit margin, help guarantee our product quality and further vertically integrate our operations; |

| | • | | We intend to achieve completely organic production of our tilapia products and to pursue organic certification of our farms as market demand dictates; |

| | • | | We plan to expand direct and retail sales of our health products in China and internationally and to add other products we currently have in the development pipeline; |

| | • | | We plan to expand our development of health products by using the by-products of tilapia, which will help increase the overall aquatic products’ gross margins; |

| | • | | We plan to expand our cooperative farming arrangements to increase the availability of tilapia to meet anticipated growth in demand; and |

| | • | | We plan to construct our own tilapia farmed ponds to improve growth time and quality of our product and further vertically integrate our operations. |

The Company plans to expand production of value added seafood products in a new re-processing production facility in close proximity to our current production facility. The Company sees increasing demand in

S-11

China for value added seafood products and believes this new re-processing plant will help the Company expand its production capacity to meet this increased demand. We commenced construction of this new re-processing plant early this year and expect to complete construction in the first half of 2011.

In addition, the Company has undertaken the development of a fry breeding and genetics facility to target improvements in the growth rate of Tilapia. The opportunity to improve the genetics of its Tilapia and improve growth rates will help the Company take a leadership position as a low cost producer of high quality Tilapia. We acquired the land for our fry breeding and genetics facility at the end of 2009 and began construction early this year. We expect to complete construction by the end of the third quarter or early fourth quarter of this year.

Manufacturing and Production

Marine Bio and Healthcare Products

Our plant for processing marine bio and healthcare products consists of two production lines: a powder-product line and an oil-product line. The production lines are equipped with a complete set of imported and domestic made devices, including a vacuum frozen dryer for bio-products, a molecular distillation device, a micro-disintegrator, a packing machine and test instruments. Our raw material treatment workshops (e.g. work area) includes an extraction workshop, a freezing and drying workshop, a powder distillation workshop, and a finished product workshop for our powder line. Our pre-treatment workshops include a cooling and filtration workshop, a molecular distillation workshop, a supplemental items workshop and a capsule workshop for our oil line.

This plant is equipped with a molecular distillation device, which produces a variety of refined oil products including vitamin E used for human consumption and as a supplement to tilapia and other feeds. These vitamins are processed from natural products, such as palm oil. This plant has been certified in accordance with the China National Health Inspection program as a Chinese Good Manufacturing Practice (GMP) by the Hainan Provincial Health Bureau. We believe that our nutraceutical business is closely connected to our planned expansion including the completion of our own feed mill described below. Actualized feed additives provide health benefits to the fish, such as increasing health and avoiding the use of curative measures involving antibiotics. The consumers of these fish products in turn benefit from increased shelf life of the fish products, and from the additional sources of vitamin E resulting from the consumption of our products.

Aquaculture Products

Our plant for processing aquatic products is a Canadian designed facility located in Hainan, China. We operate six processing lines, which consist of two filleting lines, two whole round fish processing lines (principally tilapia which is gutted, scaled and gilled), and two block processing lines . This processing plant is capable of processing an average of approximately 40,000 metric tonnes (additional capacity of 10,000 metric tonnes was completed in November 2009) per year of whole round fish (principally, tilapia), 10,000 metric tonnes per year of fillet tilapia and 3,000 metric tonnes per year of all forms of shrimp. Such capacity may become inadequate to meet our projected demand from our existing customers and the national retail food service chains targeted by us. In 2009 we completed a large scale organic feed mill, to supply our existing and anticipated new cooperative fish farmers with our fish food formula. We have completed taste trials with several national retail food service chains, and we expect to phase in deliveries in the second half of 2010. The scale of production is a critical factor for such chains, and we expect that expanded production will enable us to enter into larger supply arrangements with several chains.

Construction of Feed Mill and Processing Plant

In order to maintain the high quality of our products, we have constructed our own feed mill that began operations in late 2009 for the production of organic, extruded (floating) feed formulations. This type of feed is

S-12

the most efficient feed for our farming operations. In early 2010, we began production of the feed, and also began using feed additives manufactured in our nutraceutical plant. The feed formulations will be prepared with the benefit of the latest technologies to assure a minimum of toxicity. The feed will be enriched using vitamin E, as well as naturally sourced amino acids, which provide actualized benefits to the fish and the consumers thereof. The floating feed formulations will reduce waste in the aquaculture reservoirs, thus reducing the requirement for chemicals to stabilize reservoir health. The feed mill will allow us to continue our vertically integrated production strategy, ensuring quality control throughout the entire production and processing cycle. We plan to partner with other parties, as appropriate, to produce the optimum formulation of feed. Presently, there is no high quality floating or organic feed production in Hainan. This expanded production will satisfy our own demand, as well as to manufacture feed for other farmed operations in Hainan such as shrimp and other farmed species. The plant can manufacture some 100,000 metric tones annually of feed.

We expect that the new processing plant will provide for value added production, allowing us to make fish sticks and fish patties, as well as the fillets and whole round products that we currently manufacture. We expect that it will take approximately nine to 12 months to build the new processing plant.

Distribution Channels

Our current sales activity is primarily directed to distributor within the People’s Republic of China (“PRC”), rather than within the U.S. At the present time, we sell more than 90% of our seafood products in China to Asian clients, who then distribute the products principally in the United States and Europe, and we sell all of our marine bio and healthcare products exclusively in the PRC. Through our Seattle office, we are able to work directly with wholesale and retail buyers. The programs established with retail distributors are rather different than with wholesalers. Retailers require product introduction and marketing support and pay differently than wholesalers. The latter generally take delivery of product ex-plant and pay through a letter of credit, while the former take delivery in the United States and pay on negotiated terms.

The Seattle office is charged with maintaining existing accounts and introducing our all natural tilapia products to a new target market of retail and food service industry purchasers. We introduced our family of products branded “Lillian’s Healthy Gourmet” throughout North America in 2009. We are currently selling our all natural tilapia products to the European market through distributors and retailers. We are actively seeking to expand our distributor network in Europe for our TILOVEYA® brand.

Currently, all of our marine bio and healthcare products are sold in the PRC. Through our subsidiary Jiahua Marine, we currently sell a range of healthcare products under the brand name “Jiahua” in the PRC.

Our China sales are principally marketed through our offices in Wenchang to customers that include domestic supermarkets, airlines, hotels and local distributors. Direct sales of healthcare products target tourists in various popular destinations in China, such as Sanya, Beihai and the Three Gorges project. Seminars are organized for these tourists that usually result in the purchase of our products. These products are also sold in various chain stores, over the internet, and through mail order sales throughout China.

Advertising and Marketing

Our sales and marketing team consists of ten members that are under the overall supervision of Mr. Harry Wang Hua, our Chief Operating Officer. Our sales and marketing team is responsible for establishing our sales and distribution networks both domestically and internationally, promoting our image and product awareness and maintaining our customer relationships. As part of his duties, Mr. Harry Wang Hua leads our plant management

S-13

teams for both marine bio and healthcare products and aquaculture products. The Seattle personnel are responsible for increasing awareness and focus of our branding and marketing initiative, the rollout of our all natural TILOVEYA® brand, and the rollout of our family of products under the Lillian’s Healthy Gourmet brand.

We believe that our principal operating subsidiary, HQOF, is the only vertically integrated PRC based producer present at the international seafood shows (e.g.,Brussels Seafood Show and Boston Seafood Expo). Participation in these industry events enables us to establish high level and immediate contacts with potential buyers. Buyer preferences and our response to these preferences, as well as prices and response to quality and quantity concerns, can be promptly addressed without the usual screening and middleman costs. We plan to aggressively market our products throughout North America, Europe and Asia through such shows.

In February 2006, we established our corporate headquarters, marketing and sales office in Seattle, Washington, thus creating a strong presence in the U.S. market. This office allows us to increase awareness of the importance of our all natural product focus and to reap the benefits of more direct sales, increasing our overall sales, market penetration and profitability. We expect to also be able to broaden the scope of our products to cater to additional seafood purchasing requirements.

Sustainable Farming

The concept of sustainable development has been popularized by the 1987 World Commission on Environment and Development. It defined sustainable development as meeting the needs of the present generation, without compromising the needs of future generations. The idea of sustainability has caught up with aquaculture partly because of pressure from environmental groups. In 1998, the Holmenkollen Guidelines for Sustainable Aquaculture were formulated. These guidelines recommended, among other things, that new technologies and management procedures should be utilized so that the quality and quantity of aquaculture products is improved and the risk of adverse effects on the environment and on the livelihood of other people, including future generations, is reduced. The guidelines also recommended (1) strict compliance with the internationally agreed food safety, environmental safety and ethical criteria if genetically modified organisms or hormones are utilized in the production, as well as (2) giving priority to the development of integrated fish farming and of sources for animal feed other than fish protein and fish lipid. We fully endorse the idea of sustainable farming and implement it in our operations through our cooperative supply arrangements.

Organic Farming

We believe that organic farming may be considered to be the next step after sustainable farming. Organic farming is a trend towards simple and moderate farming methods that are inherently sustainable. Organic farming advocates against the use of hormones and certain drugs, genetically modified organisms, very intensive culture systems, use of fish meal from the fish meal industry and oils from animals. As the market demand for sustainable and environmentally sustainable practices increases, the aquaculture industry is in the process of adjusting to such demand by starting to offer organic products. Further, we believe that many companies are finding that the use of waste streams from aquaculture can be used as a nutrient source for the culture of other aquatic flora and fauna, as well as land based agriculture.

We believe that operating costs for organic culture should be lower than intensive farming, with the feed remaining the key operating cost. We have determined that organic production of tilapia is technically possible in Hainan Province. Further, our preliminary evaluation of farm production economics (such as feed costs, feed conversion ratios, growth rates and yields) as they relate to expected market demand indicates that we could engage in organic farming profitably. In late 2009, we finished construction of a large-scale organic feed mill and began pursuing organic certification of our farms in order to commence organic tilapia production.

S-14

We anticipate that our tilapia products will meet organic standards as defined by The US Department of Agriculture.

In January of 2008 the Company received the Certification attesting to the organic standards for its tilapia production, processing, labeling, marketing and management system. The Company obtained this Certification following an initial annual audit conducted by Beijing Continental Hengtong Certification Co., Ltd. (CHTC), a certifier authorized by The China National Accreditation Service for Conformity (CNAS) and the Certification and Accreditation Administration of the PRC (CNCA).

Our Cooperative Supply Arrangements

We purchase and process farm-bred and ocean caught aquatic products through cooperative supply arrangements with local fishermen and cooperatives. Our farmed tilapia products come from approximately 1,647 pond acres of farms situated in the Wenchang area of Hainan. These farms are grouped through cooperatives to supply us with the highest quality tilapia in accordance with the sustainable farming standards described above.

We strive to implement the principles underlying sustainable farming and elements of organic farming in our cooperative supply arrangements with local fishermen and cooperatives, from which we purchase and process farm-bred and ocean caught aquatic products. Under our related cooperatives, or collaboration agreements, the farmers or holders of the concession retain their proprietary status, while agreeing to operate under planned and scheduled practices put forward by our company as cooperative partner of the concessions. The farmers are trained to our standards for deploying appropriate feeds and using poly-culture techniques, while we monitor compliance with these standards on an on-going basis. The farmers are also required to agree to treat waste water responsibly as a nutrient rich fertilizer for the vegetable fields maintained by neighboring farmers.

We typically have between five and ten cooperative supply agreements, which number may vary from time to time. We believe that these cooperative supply arrangements provide mutual benefits to the parties involved, as they help increase revenues of the local farmers, while ensuring a stable supply of quality raw tilapia to us.

Trademarks and Patents

We have the following patents on our products: Chinese Patent Number 460000X340-2001—Shark Cartilage; Chinese Patent Number 460000X131-2001—Shark Cartilage; Chinese Patent Number 460000X338-2001—Shark Liver Oil; and Patent Number 460000X342-2001—Shark Liver Oil. These patents are for a 20 year period and will expire in 2021. Two products are produced from refined shark cartilage and two from shark liver, both harvested from non-endangered shark species.

We consider our service marks, trademarks, trade secrets, patents and similar intellectual property to be critical to our success. We rely on trademark, patent and trade secret law, as well as confidentiality and license agreements with our employees, customers, partners and others to protect our proprietary rights. We have received patent protection and applied for trademark protection for our products in the PRC. We have also applied for trademark protection in the U.S., as described below, in connection with our branding of all natural tilapia. Effective trademark, service mark, patent and trade secret protection may not be available in every country in which we sell or may in the future sell our products, and our competitors may independently develop formulations and processes that are substantially equivalent or superior to our own.

TILOVEYA®

In May 2006, we introduced our new all natural tilapia brand TILOVEYA® at the European Seafood Exposition in Brussels, the largest seafood show in the world. This brand is designed to celebrate the health benefits of our tilapia produced in Hainan Province, China. Our freshwater tilapia products are made without

S-15

hormones, antibiotics and free of heavy metals and other toxins associated with ocean sourced products. The United States Patent and Trademark Office (USPTO) has issued registrations with respect to the following trademarks as used in connection with our branding of all natural tilapia:

| | • | | Registration Number 3313536 for the TILOVEYA® mark; and |

| | • | | Registration Number 3304756 for the TILOVEYA® Logo. |

Lillian’s Healthy Gourmet®

In August of 2008, we developed the concept of a family of products under the brand of Lillian’s Healthy Gourmet. This family of products is based on the concept of our all natural tilapia products produced in Hainan Province, China. Individuals should be able to eat a convenient, healthy seafood meal at a reasonable price, while maintaining their demanding life style. This family of products is designed to meet the need for a convenient, healthy seafood meal at a reasonable price. The USPTO has allowed the following applications for trademark registrations in connection with our branding of the Lillian’s Healthy Gourmet family of products, and registrations will issue once we submit, and the USPTO accepts, affidavits that we are using these marks in commerce:

| | • | | Application Serial Number 77614994 for the LILLIAN’S HEALTHY GOURMET mark; |

| | • | | Application Serial Number 77614989 for the LILLIAN’S ORGANIC GOURMET mark; and |

| | • | | Application Serial Number 77614981 for the LILLIAN’S KITCHEN GOURMET mark. |

Competition

In general, the aquaculture industry is intensely competitive and highly fragmented. The PRC aquaculture industry is further open to competition from local and overseas operators engaged in aquaculture and from other captured fish producers. We compete with various companies, many of which are developing or can be expected to develop products similar to ours. For example, 8th Sea—The Organic Seafood Company currently produces and processes tilapia fillets in Brazil’s Parana state. Our main aquaculture products (tilapia and shrimp) are also facing competition from some other PRC-based aquaculture producers. Some of the other aquaculture processing companies in Hainan Province have obtained certifications similar to those we possess. However, we believe that the competition from such producers is minimal because, to the best of our knowledge, there are no competitors in Hainan Province that have a similar operating scale and production capacity, or that have developed the vertically integrated business model under which we operate.

Many of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements, and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We intend to create greater brand awareness for our brand name(s) so that we can successfully compete with our competitors. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors, or that the competitive pressures we face will not harm our business.

With respect to potential new competitors, although there are no formal barriers to entry for engaging in similar aquaculture processing production and activities in the PRC, we believe that the high infrastructure costs associated with developing and constructing processing plants and facilities does pose a barrier to potential competitors. Fish farms are tied directly to a processing plant and a new processing plant must either enlist new

S-16

farms or build its own. Furthermore, measures addressing environmental considerations, such as water quality and waste water processing requirements, are costly to deploy on a greenfield site and are not readily available to all new companies. Accordingly, potential competitors have to mobilize extensive resources in order to maintain a presence similar to ours.

Government Regulation

Our company complies with various national, provincial and local environmental protection laws and regulations, as well as certifications and inspections relating to the quality control of our production and the environmental and social impact of our operations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Also, all of our healthcare products have met stringent independent testing by selected university laboratories in China. Our costs of compliance with applicable environmental laws are minimal. Penalties would be levied upon us if we fail to adhere to and maintain our compliance with the applicable environmental regulations in the PRC. Such failure has not occurred in the past, and we generally do not anticipate that it may occur in the future, although no assurance can be given in this regard.

HACCP Standards

Our facilities are certified in accordance with the Hazard Analysis Critical Control Points, or HACCP, standards for exporting aquatic products to the United States. The HACCP standards are developed by the FDA pursuant to the FDA’s HACCP regulation, Title 21, Code of Federal Regulations, part 123, and are used by the FDA to help ensure food safety and control sanitary standards. These standards focus on monitoring the quality of production and sanitation measures in processing plants for food products, and also take into account the environmental and social impact of the operations of the certified company. Compliance with the HACCP procedures is mandatory, and the successful implementation of these procedures depends on the design and performance of facilities and equipment, and excellent quality control and hygiene practices. HACCP conducts sample laboratory testing on our processed aquatic products to ensure no forbidden substances are present in them. Laboratory testing of our processed aquatic products was initiated by the HACCP in compliance with strict quarantine guidelines imposed by domestic export control government agencies and foreign import control government agencies.

In addition, our facilities continuously pass USDA inspection.

ACC Standards

We have completed the process of certification of our processing plant in China in relation to shrimp and tilapia processing in accordance with the Aquaculture Certification Counsel, Inc., or the ACC standards. The ACC standards are considered super HACCP standards, as they also take into account various environmental and social issues. ACC certification is required by many large retailers in the United States.

The ACC is a U.S.-based, non-governmental body established to certify social, environmental and food safety standards at aquaculture facilities throughout the world. The ACC uses a certification system that combines site inspections and effluent sampling with sanitary controls, therapeutic controls and traceability. Part of the ACC’s mission is to help educate the aquaculture public regarding the benefits of applying best aquaculture practices and the advancing scientific technology that directs them. The ACC believes that, by implementing such standards, seafood producers can better meet the demands of the growing global market for safe, wholesome seafood produced in an environmentally and socially responsible manner. The ACC offers a primarily process, rather than product, certification, with an orientation toward seafood buyers. Successful participation in the ACC program is visually represented by limited use of a Best Aquaculture Practices certification mark. The ACC currently certifies only shrimp hatcheries, farms and processing plants.

S-17

Assignment of EU Code

Our facilities have been assigned a European Union (EU) approval registration, referred to as an EU Code, required for exporting aquatic products to the EU. This requirement applies to production both inside and outside of the EU, and defines the applicable standards of the EEC for handling, processing, storing and transporting fish. Our aquatic products processing plant in China must meet or exceed these standards every year, in order to maintain the assigned EU Code. The assignment of the EU Code to us, and our ability to maintain it on an annual basis, evidence the fact that our products meet the EU importable food standards set by the relevant inspection agencies.

ISO Certification

The Company received ISO 9001 and 22000 certifications for both the seafood and feed mill plants in the fourth quarter of 2009.

| | • | | ISO 9001 is the internationally recognized standard for the quality management of businesses. It applies to the processes that create and control the products and services an organization supplies. It prescribes systematic control of activities to ensure that the needs and expectations of customers are met. It is designed and intended to apply to virtually any product or service, made by any process anywhere in the world. |

| | • | | ISO 22000 specifies requirements for a food safety management system where an organization in the food chain needs to demonstrate its ability to control food safety hazards in order to ensure that food is safe at the time of human consumption. It is applicable to all organizations, regardless of size, which are involved in any aspect of the food chain and want to implement systems that consistently provide safe products. |

Product Liability Insurance

We have purchased general commercial liability insurance, which provides adequate aggregate product liability insurance based on industry standards. However, there is a possibility that our customers, or the ultimate buyers of our products, may have adverse reactions to the tilapia and other aquatic products or marine bio and healthcare products that we process and sell. Any such adverse reaction may result in actual or potential product liability claims against us, which may not be covered by our insurance or, if covered, may be significantly higher than the insurance amount. Such actual or potential product liability claims may have an adverse effect on our reputation and profitability.

Government Regulation in China

Aquaculture producers in the PRC have to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Such rules and regulations include, among others, Environmental Protection Law of the PRC, Ocean Environmental Protection Law of the PRC, Regulations on Administration over Dumping of Wastes in the Ocean of the PRC, Ocean Aquatic Industry Administration Regulation, Fishing License Administration Regulation, Regulations on Administration of Hygiene Registration of Exported Food Manufacturers, and Regulations on Administration of Quality Control of Food Processors.

In addition, HACCP and sanitary programs in China in accordance with the FDA’s HACCP standards are verified by the China Inspection and Quarantine Office, or CIQ, which is a branch of the State Administration for Entry-Exit Inspection and Quarantine of the PRC and, in our case, also by the Hainan Entry-Exit Inspection and

S-18

Quarantine Bureau of the PRC. In addition, the CIQ evaluates the compliance by our processing plant with the EU standards described above under “—Assignment of EU Code.” As a result of such review, our aquatic products processing plant in China has received a CIQ certificate. The CIQ certificate must be renewed on an annual basis.

Our Work with the Hainan Province

We have enjoyed close collaboration with the local government as we conduct our operations in the Hainan Province. We have continued to expand our operations in that area and to foster close ties with the local government through the construction of our large-scale organic feed mill, which was completed in late 2009. See “Prospectus Supplement Summary—Manufacturing and Production—Construction of Feed Mill and Processing Plant.” The success of our operations in the PRC depends in part on the continued investment by Hainan Province in the development of the local aquaculture industry. While there can be no assurances that such investment will continue, we believe that it should continue for the following reasons. The central government of China has limited Hainan Province to two areas of economic activity, agri-food and tourism. The resulting focus of the Hainan Province on the agri-food and tourism sectors creates a strong potential synergy with private sector companies intent on further development of these sectors. Part of the attraction for investors is the low tax rate in Hainan. In addition, foreign companies setting up new ventures in Hainan do not pay any tax for the two first years of profitable operations, then pay 7.5% for the following three years and 15% thereafter. For this reason, we plan to continue to structure and conduct our operations in China through the use of separate subsidiaries, held by foreign holding companies which are separate and distinct from holding companies already incorporated. In turn, these holding companies are held by HQS. Under these arrangements, we are not considered involved in joint ventures, but rather in wholly owned foreign enterprises, under the local law. Government support for such ventures meeting local needs is positive, and we believe our operations have already demonstrated our ability to channel this support in the manner favorable to our business and Hainan. We believe that not having a joint venture with the local government is the best way to minimize the potential for government interference and to maximize government support, and we plan to continue to conduct our business in China accordingly.

Furthermore, on March 17, 2007, a new PRC Enterprise Income Tax Law (EIT) was promulgated and introduced a new uniform tax regime in the PRC. The EIT became effective on January 1, 2008. That new law provides, amongst other issues, that income derived from preliminary processing of fishery products and processing of agricultural products will be exempt from the EIT tax rate. Starting in 2008, our existing fish processing unit and our feed mill plant both benefit from a 0% tax rate. With regards to our nutraceutical unit, the income tax rate, under the new law, will increase by approximately 2% yearly until it reaches a maximum of 25% in 2012.

Employees

Through our subsidiaries, we currently employ approximately 620 employees, all of whom are full-time employees. They are located predominantly in the PRC. Of our key employees, Harry Wang Hua, He Jian Bo and Wang Fu Hai are located in China and are fully dedicated to our China operations. In addition, Lillian Wang Li, Norbert Sporns, and William Sujian contribute to both our China operations and our U.S. operations, depending on the needs of our business over time.

In addition, during the high season, we hire up to 100 part-time employees. We typically pay our local employees much higher wages than the required minimum wages, in order to attract and retain key employees. We have employment agreements with many of our full-time employees. None of our employees are covered by a collective bargaining agreement, and we believe our employee relations are good.

S-19

Properties

We own three processing plants located in Wenchang, Hainan Province, PRC, and the related manufacturing equipment, office equipment and motor vehicles. We use one plant to process the seafood products we produce, a second plant to process our marine bio and healthcare products and since the last quarter of 2009, a third plant to process our fish feed products.

In addition, we currently lease corporate premises for our United States headquarters located in Seattle, Washington, consisting of approximately 4,170 square feet, from Doncaster Investments NV, Inc. The term of the related lease is sixty months, which commenced on December 1, 2005 and will end on December 1, 2010. Our base rental payment under the lease is $6,950 per month for 2009 and 2010. In 2010, we will move our headquarters to California. We plan to use our new headquarters as, among other things, the center of our United States direct sales effort. In connection with this move, we leased approximately 5,400 square feet of office space with a base monthly rental of approximately $11,000.

Our properties are in good condition and are sufficient to meet our needs at this time. We do not plan to obtain additional space in the foreseeable future for the above cited plants, but we intend to build or acquire additional processing facilities in the near future.

Principal Shareholders

The following table sets forth certain information regarding beneficial ownership of common stock as of June 30, 2010 by:

| | • | | each person known to us to own beneficially more than 5 percent, in the aggregate, of the outstanding shares of our common stock; |