UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05962

Name of Registrant: Vanguard Variable Insurance Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 – December 31, 2015

Item 1: Reports to Shareholders

Annual Report | December 31, 2015

Vanguard Variable Insurance Fund

Balanced Portfolio Growth Portfolio REIT Index Portfolio

Capital Growth Portfolio High Yield Bond Portfolio Short-Term Investment-Grade Portfolio

Conservative Allocation Portfolio International Portfolio Small Company Growth Portfolio

Diversified Value Portfolio Mid-Cap Index Portfolio Total Bond Market Index Portfolio

Equity Income Portfolio Moderate Allocation Portfolio Total Stock Market Index Portfolio

(with underlying Equity Index Portfolio)

Equity Index Portfolio Money Market Portfolio

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| |

| A Message from Vanguard's Chairman | 1 |

| Market Perspective | 2 |

| Balanced Portfolio | 3 |

| Capital Growth Portfolio | 25 |

| Conservative Allocation Portfolio | 37 |

| Diversified Value Portfolio | 47 |

| Equity Income Portfolio | 58 |

| Equity Index Portfolio | 73 |

| Growth Portfolio | 87 |

| High Yield Bond Portfolio | 102 |

| International Portfolio | 120 |

| Mid-Cap Index Portfolio | 137 |

| Moderate Allocation Portfolio | 150 |

| Money Market Portfolio | 160 |

| REIT Index Portfolio | 173 |

| Short-Term Investment-Grade Portfolio | 185 |

| Small Company Growth Portfolio | 223 |

| Total Bond Market Index Portfolio | 239 |

| Total Stock Market Index Portfolio | |

| (with underlying Equity Index Portfolio) | 295 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the sailing block helps coordinate the setting of the sails.

At Vanguard, the intricate coordination of technology and people allows us to help millions of clients around the world reach their financial goals.

A Message from Vanguard’s Chairman

Dear Planholder,

During most of 2015, investors kept a watchful eye on U.S. economic indicators, seeking clues as to when the Federal Reserve would raise interest rates for the first time in nearly a decade. And as soon as the answer was revealed in mid-December, speculation turned to when the next rise would occur.

Other global developments—Greece again teetering on the brink of leaving the euro zone, for example, and oil prices that continued to fall—also held investors’ attention. Meanwhile, the impact of other changes remains to be seen. These include the election of new leaders in Argentina and Canada and the International Monetary Fund’s addition of China’s renminbi to its basket of reserve currencies.

Every day, Vanguard’s global economists analyze such developments, along with reams of data, and use proprietary economic indicators and statistical models to help frame investment expectations. To treat the future with the deference it deserves, they present a range and probabilities of potential longer-term outcomes, along with thoughtful analysis to spark discussion and help investors reach their goals.

In that spirit, here are some highlights from Vanguard’s latest Economic and Investment Outlook (You can read the entire paper at vanguard.com/research.):

• Global economic growth will remain “frustratingly fragile” in 2016. Longer-term, we think the global economy will ultimately converge toward a more balanced, healthier equilibrium after the debt-deleveraging cycle in the global private sector is complete (notably in China).

• At full employment, the U.S. economy is unlikely to accelerate in 2016. Yet it is on course to experience its longest expansion in nearly a century, underscoring that it is resilient in the face of global headwinds, though not immune to them.

• We anticipate a “dovish tightening” by the Fed. We see a high likelihood of an extended pause in interest rates at, say, 1%. And we expect the global low-rate environment to continue.

• Although not bearish, our outlook for global stocks and bonds remains guarded, given the low-interest-rate and low-earnings-yield environment.

Given this muted outlook, what’s the best course of action for an investor? Focus on what you can control. For example, if you’re still in saving mode, consider saving more than you think you may need, to help prepare for volatility that may lie ahead. And even if you’re spending down your assets, it’s important to continue paying attention to costs because the lower your costs, the more of your returns you can hold on to. (Keeping costs low is one of Vanguard’s four timeless principles for investing success, summarized on the facing page.)

This report starts with a brief overview of the financial markets during the past year. In the pages that follow, you’ll find a review of the performance of your portfolio. Each portfolio in Vanguard Variable Insurance Fund can serve as part of an investment program that includes a combination of stock, bond, and money market funds appropriate for your own long-term goals, risk tolerance, and time horizon.

Thank you for entrusting your assets to Vanguard.

F. William McNabb III

Chairman and Chief Executive Officer

January 15, 2016

1

Market Perspective

Key drivers were similar to 2014, but market returns were lower

Many of the forces that influenced capital markets during 2014 continued in 2015. Stock and bond returns, however, were generally lower.

Oil prices fell again, especially later in 2015, and other commodity prices also declined. Among other factors that again influenced the markets, the stronger U.S. dollar held back international stock and bond returns for U.S. investors, central bank policies diverged, merger-and-acquisition activity was brisk (a record volume of deals was announced), and economic growth in the United States was generally stronger than elsewhere.

The broad U.S. market outpaced many international stock markets

Ending more than a year of speculation, the Federal Reserve raised its short-term interest rate target to 0.25%–0.5% in mid-December and signaled that future increases were likely to be gradual. Soon after, Congress averted a federal government shutdown by approving tax and spending legislation to fund it through September 2016.

With these uncertainties removed, the broad U.S. stock market bounced back from its third-quarter drubbing with a return of more than 6% in the fourth quarter. For the 12 months ended December 31, 2015, it eked out a modest total return of 0.48%, the seventh straight calendar-year advance. Large-company stocks (as represented by the Russell 1000 Index) mostly outperformed smaller ones, as they had in 2014. Growth-oriented stocks of all sizes generally outpaced their value-oriented counterparts.

International stocks returned –4.72% for U.S.-based investors, held back in part by the stronger dollar. Measured in local currencies, the broad international market advanced. European markets were disappointed when additional monetary easing announced by the European Central Bank (ECB) in December fell short of expectations. But developed markets in Europe and the Pacific were ahead of emerging markets, which declined for the year in both dollars and local currencies; resource-rich and export-dependent developing economies have been hit hard by slower growth in China.

Central bank policies continued to diverge across the globe

While investors awaited the Fed’s move, many other central banks—including the People’s Bank of China—pursued monetary stimulus during 2015. The ECB’s significant bond-buying program and other steps helped push yields on many European sovereign bonds into negative territory.

After the Fed’s action, some other central banks also raised rates, but the Bank of Japan paved the way for additional stimulus if needed.

The broad U.S. bond market returned 0.55% for the 12 months. The benchmark 10-year Treasury note’s yield settled at 2.30%, up slightly from 2.19% at year-end 2014. Intermediate-term and higher-quality bonds were some of the best performers. High-yield bonds (not included in the investment-grade index) struggled; oil and gas-related companies, pinched by lower prices, make up a sizable slice of this segment of the bond market.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –6.02% for U.S. dollar-based investors. After hedging for currency exposure, the broad market advanced modestly.

| | | |

| Market Barometer | | | |

| | Average Annual Total Returns |

| | Periods Ended December 31, 2015 |

| One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 0.92% | 15.01% | 12.44% |

| Russell 2000 Index (Small-caps) | -4.41 | 11.65 | 9.19 |

| Russell 3000 Index (Broad U.S. market) | 0.48 | 14.74 | 12.18 |

| FTSE All-World ex US Index (International) | -4.72 | 2.04 | 1.48 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 0.55% | 1.44% | 3.25% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.30 | 3.16 | 5.35 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.03 | 0.02 | 0.04 |

| |

| CPI | | | |

| Consumer Price Index | 0.73% | 1.00% | 1.53% |

2

Vanguard® Balanced Portfolio

Advisor’s Report

Vanguard Balanced Portfolio returned 0.09% for the 12 months ended December 31, 2015. This result lagged the 1.38% return of its blended benchmark (a mix of 65% large-capitalization stocks and 35% high-quality corporate bonds) but was ahead of the –1.20% average return of peer funds. The stock portfolio lagged its benchmark, the Standard & Poor’s 500 Index (+1.38%), while the bond portfolio modestly outperformed its benchmark, the Barclays U.S. Credit A or Better Bond Index (+0.69%).

Please note that the returns for Vanguard Variable Insurance Fund are different from those of Vanguard Variable Annuity (and other plans that invest in the fund), which take into account insurance-related expenses.

The investment environment

The S&P 500 Index outperformed the MSCI World Index and the MSCI EAFE Index, both of which declined slightly. Large-cap growth stocks generally outperformed large-cap value stocks, as measured by the Russell 1000 Growth and Russell 1000 Value Indexes.

This was a challenge for the equity portfolio compared with the S&P 500 benchmark, as our investment strategy is aimed at identifying undervalued stocks. In addition, stock returns in the S&P 500 Index were narrow and largely driven by big names such as Amazon.com, Facebook, and Alphabet (formerly known as Google). Although we did own Alphabet during the period, these companies typically have below-market yields and therefore would not meet our criteria for the portfolio’s equity portion.

The U.S. fixed income market rose modestly, with the Barclays U.S. Aggregate Bond Index returning 0.55%. The yield of the 10-year U.S. Treasury note increased from 2.19% to 2.30%. Investors grappled with a mixed global economic picture, accommodative monetary policies, and the risk that Greece might exit the euro zone.

Greece took center stage over the summer after debt negotiations broke off and it defaulted on its payment to the International Monetary Fund, producing a risk-off tone throughout the global financial markets. Fears further escalated in late August, amid an unexpected devaluation in China’s currency and deepening concerns about China’s economic slowdown and the potential spillover effects. The slide in oil prices, weakening emerging-market fundamentals, and fears of commodity-related defaults in the credit sector all weighed on investor sentiment.

At its mid-December meeting, the Federal Reserve raised the federal funds rate from a target range of 0%–0.25% to 0.25%–0.5%, ending seven years of near-zero interest rates. The Fed also reiterated that any further increase would most likely be gradual and would depend on the direction of economic data.

Our successes

In the stock portfolio, strong security selection in the information technology and financial sectors contributed to relative returns. Our overweight position and selection in health care also helped results. In IT, our positions in Microsoft and Accenture drove relative returns; in financials, relative performance was boosted by strong performance from MUFG and JPMorgan Chase and by our avoidance of weak-performing benchmark constituents Berkshire Hathaway and American Express.

Pharmaceutical company Eli Lilly was the equity portfolio’s top absolute and relative contributor during the year. Shares rose more than 25% as investors were encouraged by management’s greater focus on new product launches and pipeline advancements, boosting the stock price.

For the fixed income portfolio, selection in corporate bonds generated favorable results, particularly among financial issuers. Selection in taxable municipal

| | |

| Total Returns | | |

| | Ten Years Ended |

| | December 31, 2015 |

| Year Ended | Average |

| December 31, 2015 | Annual Return |

| Vanguard Balanced Portfolio | 0.09% | 7.31% |

| Composite Stock/Bond Index1 | 1.38 | 6.71 |

| Variable Insurance Mixed-Asset Target Growth Funds Average2 | -1.20 | 4.97 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

| | |

| Expense Ratios3 | | |

| Your Portfolio Compared With Its Peer Group | | |

| Variable Insurance |

| Mixed-Asset |

| Target Growth |

| Portfolio | Funds Average |

| Balanced Portfolio | 0.25% | 0.61% |

1 Weighted 65% S&P 500 Index and 35% Barclays U.S. Credit A or Better Bond Index.

2 Derived from data provided by Lipper, a Thomson Reuters Company.

3 The portfolio expense ratio shown is from the prospectus dated April 30, 2015, and represents estimated costs for the current fiscal year. For the fiscal year ended December 31, 2015, the Balanced expense ratio was 0.23%. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2014.

3

Vanguard Balanced Portfolio

bonds and an out-of-benchmark allocation to collateralized loan obligations (a form of asset-backed security) also helped relative returns.

Our shortfalls

In the equity portfolio, weak security selection and an underweight allocation to the strong-performing consumer discretionary sector hurt relative results. Selection in consumer staples and industrials also detracted.

In consumer discretionary, Twenty-First Century Fox detracted from relative performance amid weak U.S. broadcast ratings and industry concerns about the health of the pay TV market. Not owning the strong-performing benchmark constituent Amazon.com also hurt. In consumer staples, our position in Wal-Mart Stores detracted. In industrials, our allocation to U.S.-based CSX hindered results as transportation companies generally struggled during the period. CSX’s stock was also hurt by coal industry difficulties and sluggish global growth. Although coal remains weak in the near term, we continue to hold CSX because we like its fundamentals and we believe it is trading at an attractive valuation.

The bond portfolio’s yield curve positioning detracted during the period as the curve steepened. In industrials, our overweight allocation to, and credit selection among, communications issuers also hurt relative performance.

Portfolio positioning

In the equity portfolio, our largest sector overweights were in financials and health care, and our largest underweights were in information technology and consumer discretionary.

Within health care, we favor large-cap pharmaceutical companies, including Merck and AstraZeneca. We believe that their solid pipelines are underappreciated by investors and should be sufficient for a return to modest growth. Although we are overweighted in the health care sector overall, our allocation to the biotechnology industry is significantly lower than the industry’s weighting in the S&P 500 Index.

We believe that our holdings in financials—the largest absolute sector weighting at year-end— have already discounted the low interest rates and stand to benefit from rising rates. We continue to find opportunities, particularly among banks and insurance companies, which have improved in quality in part because of increased regulation. We believe that financial companies, with less leverage and more solid underwriting than they have had historically, could withstand a future recessionary environment better than many investors are forecasting.

A sharp decline in oil prices has created a buying opportunity in the energy sector. Weak global consumption did not slow overall production as quickly as anticipated, which led to heightened uncertainty about oil. We took advantage of apathy toward the sector to add to positions in companies we believe will benefit most from the eventual rebound in oil prices, such as Exxon Mobil, Chevron, and Anadarko. Although timing the bottom in the price of oil is difficult, we believe it should occur in the next six to 12 months as oil companies reduce production; the portfolio will be positioned to advance with the recovery. As a result, we increased our energy sector exposure.

We continue to seek investment ideas that fit with our process and philosophy. For equities, we remain focused on the significance of dividends, positive capital stewardship, and franchise value. We believe we have a solid portfolio of undervalued market leaders, stocks in industries with improving supply/demand trends, and solid companies that are temporarily out of favor.

For the fixed income portfolio, we expect rates to continue to rise over the long-term as the U.S. recovery lengthens and broadens, and we remain disposed to continue to reduce the portfolio’s sensitivity to interest rates. We believe the bond portfolio is positioned for continued growth in the U.S. economic cycle, and we expect a slow and steady increase in rates as the Fed continues to adjust its monetary policy.

Our outlook is not without uncertainty, however. External forces can greatly affect our capital markets. In particular, quantitative-easing programs in Europe and Japan, tensions in Ukraine and the Middle East, rising credit concerns in the South American sovereign states, sovereign wealth funds’ sales of portions of their massive U.S. Treasury holdings to finance internal needs, and, most recently, the routs in commodities and Chinese equities represent risks we should not ignore. The sharp decline in oil and other energy prices adds to uncertainty; lower energy prices have boosted consumer spending but have also lowered the inflation numbers that drive Fed decision makers as well as depressed capital investment in the energy sector. Even the act of raising interest rates can create concerns and higher volatility.

Greater clarity about banks’ new regulatory environment makes them less inclined to support trading activities in the fixed income markets in which we invest. Companies such as Morgan Stanley, Credit Suisse, UBS, RBS, and Deutsche Bank have announced cutbacks, and we expect to see more of the same from other large market makers. This leads us toward holding more liquidity in fixed income, notably with Treasury bonds and agency mortgage-backed securities as our “all-weather” liquidity buffer. With this buffer, we seek to provide downside protection for shareholders if the economic cycle takes an unfavorable turn.

Edward P. Bousa, CFA, Senior Managing Director and Equity Portfolio Manager

John C. Keogh, Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

January 13, 2016

4

Vanguard Balanced Portfolio

Portfolio Profile

As of December 31, 2015

| |

| Total Portfolio Characteristics | |

| |

| Yield1 | 2.43% |

| Turnover Rate | 45% |

| Expense Ratio2 | 0.25% |

| Short-Term Reserves | 2.3% |

| | |

| Total Portfolio Volatility Measures3 | |

| Portfolio Versus | Portfolio Versus |

| Composite Index4 | Broad Index5 |

| R-Squared | 0.98 | 0.94 |

| Beta | 1.00 | 0.65 |

| | | |

| Equity Characteristics | | |

| | Comparative | Broad |

| Portfolio | Index6 | Index5 |

| Number of Stocks | 93 | 504 | 3,960 |

| Median Market Cap | $109.6B | $81.0B | $51.4B |

| Price/Earnings Ratio | 17.7x | 20.5x | 21.9x |

| Price/Book Ratio | 2.2x | 2.8x | 2.7x |

| Dividend Yield | 2.7% | 2.2% | 2.1% |

| Return on Equity | 17.6% | 18.3% | 17.2% |

| Earnings Growth Rate | 6.7% | 9.2% | 9.5% |

| Foreign Holdings | 6.3% | 0.0% | 0.0% |

| | | |

| Fixed Income Characteristics | | |

| | Comparative | Broad |

| Portfolio | Index7 | Index8 |

| Number of Bonds | 740 | 3,331 | 9,681 |

| Yield to Maturity | 2.9%9 | 2.9% | 2.6% |

| Average Coupon | 3.6% | 3.6% | 3.2% |

| Average Effective | | | |

| Maturity | 9.4 years | 9.5 years | 7.9 years |

| Average Duration | 6.4 years | 6.6 years | 5.7 years |

| | |

| Ten Largest Stocks10 (% of equity portfolio) |

| |

| Wells Fargo & Co. | Diversified Banks | 3.9% |

| Microsoft Corp. | Systems Software | 3.6 |

| Merck & Co. Inc. | Pharmaceuticals | 2.9 |

| JPMorgan Chase & Co. | Diversified Banks | 2.6 |

| Alphabet Inc. | Internet Software | |

| | & Services | 2.6 |

| Verizon | Integrated | |

| Communications | Telecommunication | |

| Inc. | Services | 2.5 |

| Comcast Corp. | Cable & Satellite | 2.5 |

| Intel Corp. | Semiconductors | 2.4 |

| Chevron Corp. | Integrated Oil | |

| | & Gas | 2.3 |

| ACE Ltd. | Property | |

| | & Casualty | |

| | Insurance | 2.2 |

| Top Ten | 27.5% |

| Top Ten as % of Total Net Assets | 17.5% |

| | | |

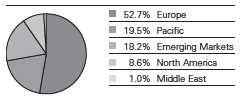

| Sector Diversification (% of equity exposure) |

| | Comparative Broad |

| Portfolio | Index6 | Index5 |

| Consumer Discretionary | 6.7% | 12.9% | 13.4% |

| Consumer Staples | 9.8 | 10.1 | 8.8 |

| Energy | 8.7 | 6.5 | 5.9 |

| Financials | 23.9 | 16.5 | 18.3 |

| Health Care | 18.2 | 15.2 | 14.8 |

| Industrials | 11.3 | 10.1 | 10.6 |

| Information Technology | 13.6 | 20.5 | 19.8 |

| Materials | 1.6 | 2.8 | 3.1 |

| Telecommunication | | | |

| Services | 2.5 | 2.4 | 2.2 |

| Utilities | 3.7 | 3.0 | 3.1 |

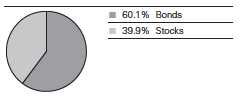

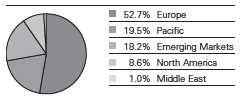

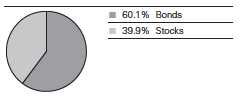

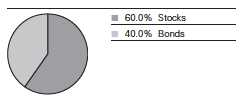

Portfolio Asset Allocation

1 30-day SEC yield for the portfolio. See definition on the next page.

2 The expense ratio shown is from the prospectus dated April 30, 2015, and represents estimated costs for the current fiscal year. For the fiscal year ended December 31, 2015, the Balanced Portfolio’s expense ratio was 0.23%.

3 For an explanation of R-squared, beta, and other terms used here, see definitions on the next page.

4 Composite Stock/Bond Index, weighted 65% S&P 500 Index and 35% Barclays U.S. Credit A or Better Bond Index.

5 Dow Jones U.S. Total Stock Market Float Adjusted Index.

6 S&P 500 Index.

7 Barclays U.S. Credit A or Better Bond Index.

8 Barclays U.S. Aggregate Bond Index.

9 Before expenses.

10 The holdings listed exclude any temporary cash investments and equity index products.

5

Vanguard Balanced Portfolio

| |

| Distribution by Credit Quality1 | |

| (% of fixed income portfolio) | |

| |

| U.S. Government | 20.9% |

| Aaa | 6.2 |

| Aa | 12.9 |

| A | 40.5 |

| Baa | 19.5 |

| |

| Sector Diversification2 | |

| (% of fixed income portfolio) | |

| |

| Asset-Backed/Commercial Mortgage-Backed | 5.2% |

| Finance | 25.9 |

| Foreign | 2.9 |

| Government Mortgage-Backed | 2.3 |

| Industrial | 34.1 |

| Treasury | 18.3 |

| Utilities | 6.1 |

| Other | 5.2 |

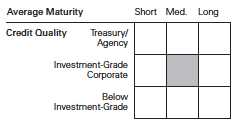

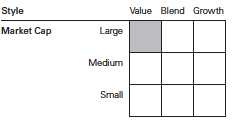

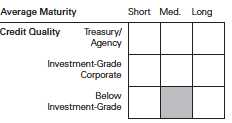

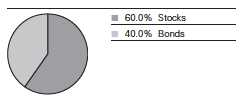

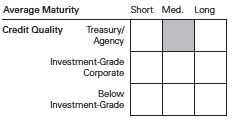

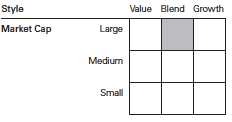

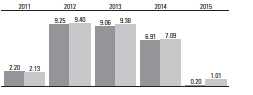

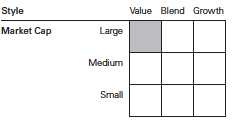

Equity Investment Focus

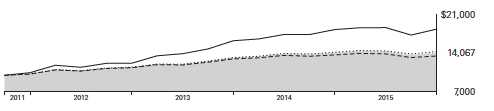

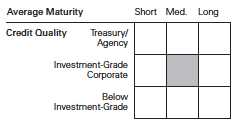

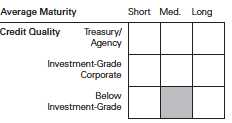

Fixed Income Investment Focus

30-Day SEC Yield. A portfolio’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the portfolio’s security holdings in the previous 30 days are used to calculate the portfolio’s hypothetical net income for that period, which is then annualized and divided by the portfolio’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the portfolio’s actual experience. As a result, the portfolio’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a portfolio’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a portfolio with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the portfolio and the index.

Credit Quality. Credit-quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). U.S. Treasury, U.S. Agency, and U.S. Agency mortgage-backed securities appear under “U.S. Government.” Credit-quality ratings are obtained from Barclays and are from Moody’s, Fitch, and S&P. When ratings from all three agencies are used, the median rating is shown. When ratings from two of the agencies are used, the lower rating for each issue is shown. “Not Rated” is used to classify securities for which a rating is not available. Not rated securities include a fund’s investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts.

Equity Exposure. A measure that reflects a portfolio’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

R-Squared. A measure of how much of a portfolio’s past returns can be explained by the returns from the market in general, as measured by a given index. If a portfolio’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the portfolio’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the portfolio and the index.

1 Source: Moody’s Investor Services.

2 The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are not backed by the full faith and credit of the U.S. government.

6

Vanguard Balanced Portfolio

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the portfolio. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on portfolio distributions or on the sale of portfolio shares. Nor do the returns reflect fees and expenses associated with the annuity or life insurance program through which a shareholder invests. If these fees and expenses were included, the portfolio’s returns would be lower.

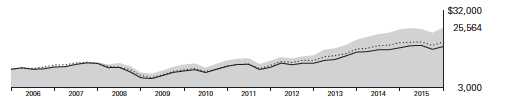

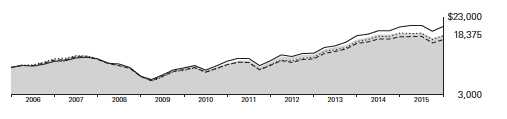

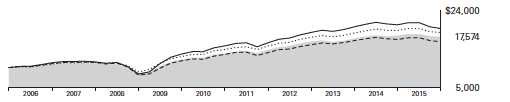

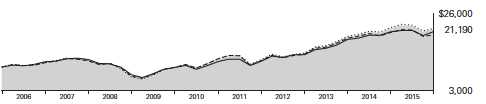

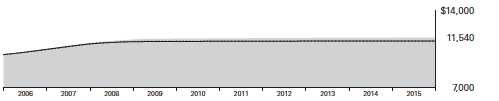

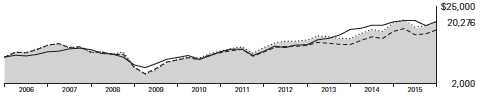

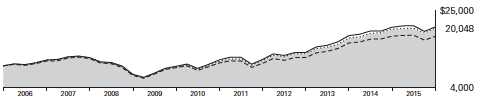

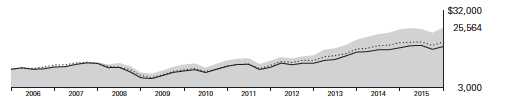

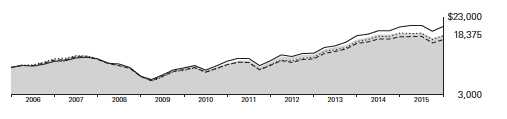

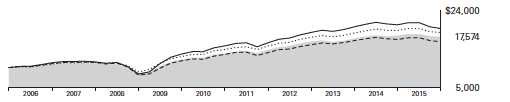

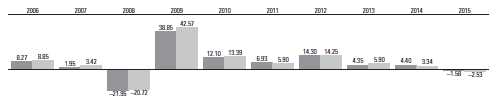

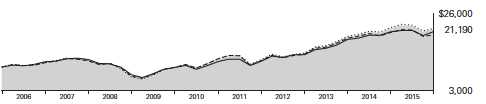

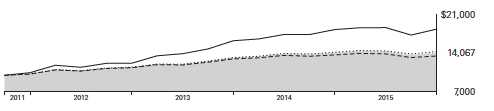

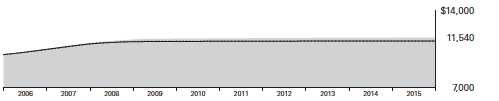

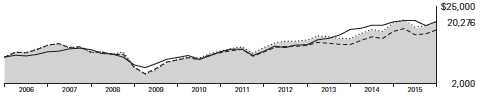

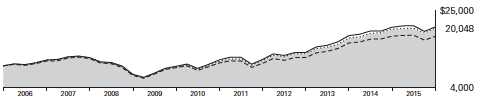

Cumulative Performance: December 31, 2005–December 31, 2015

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | Final Value |

| | Periods Ended December 31, 2015 | of a $10,000 |

| | One Year | Five Years | Ten Years | Investment |

| Balanced Portfolio | 0.09% | 9.00% | 7.31% | $20,247 |

| S&P 500 Index | 1.38 | 12.57 | 7.31 | 19,138 |

| Composite Stock/Bond Index1 | 1.38 | 9.76 | 6.71 | 16,237 |

| Variable Insurance Mixed-Asset | | | | |

| Target Growth Funds Average2 | -1.20 | 6.82 | 4.97 | 15,552 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | 0.44 | 12.14 | 7.48 | 20,563 |

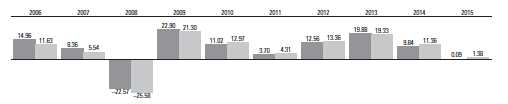

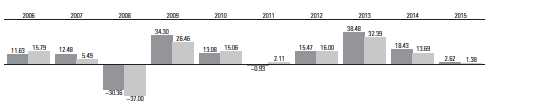

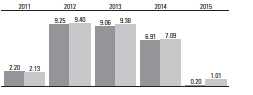

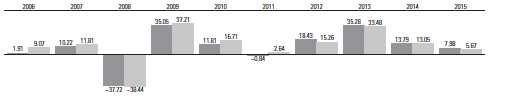

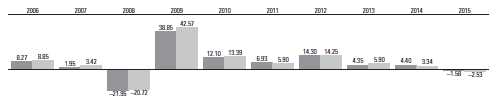

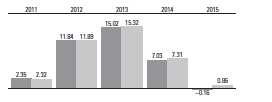

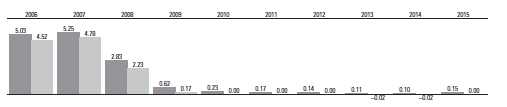

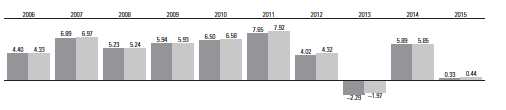

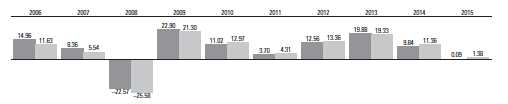

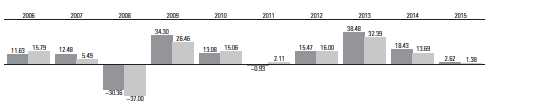

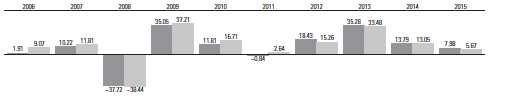

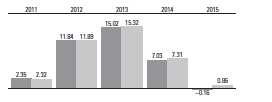

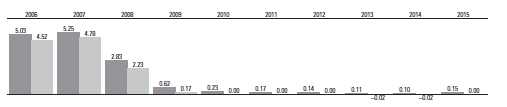

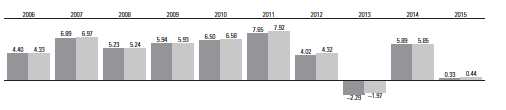

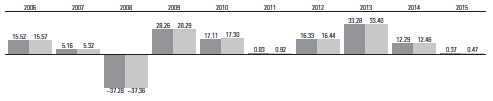

Fiscal-Year Total Returns (%): December 31, 2005–December 31, 2015

| |

| Balanced Portfolio |

| Composite Stock/Bond Index |

1 Weighted 65% S&P 500 Index and 35% Barclays U.S. Credit A or Better Bond Index.

2 Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend and capital gains information.

7

Vanguard Balanced Portfolio

Financial Statements

Statement of Net Assets

As of December 31, 2015

The portfolio reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the portfolio’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the portfolio files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the portfolio’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| Market |

| Value• |

| | Shares | ($000) |

| Common Stocks (64.1%) | | |

| Consumer Discretionary (4.3%) | |

| Comcast Corp. Class A | 649,989 | 36,679 |

| Ford Motor Co. | 1,321,880 | 18,625 |

| Twenty-First Century Fox | | |

| | Inc. Class A | 595,134 | 16,164 |

| Lowe’s Cos. Inc. | 174,680 | 13,283 |

| Hilton Worldwide Holdings | | |

| | Inc. | 480,126 | 10,275 |

| Bayerische Motoren | | |

| | Werke AG | 40,364 | 4,252 |

| 99,278 |

| Consumer Staples (6.3%) | | |

| CVS Health Corp. | 316,570 | 30,951 |

| Coca-Cola Co. | 407,980 | 17,527 |

| Philip Morris International | | |

| | Inc. | 182,720 | 16,063 |

| PepsiCo Inc. | 145,150 | 14,503 |

| Colgate-Palmolive Co. | 217,360 | 14,481 |

| Mondelez International Inc. | | |

| | Class A | 310,290 | 13,913 |

| Diageo plc | 469,316 | 12,816 |

| Walgreens Boots Alliance | | |

| | Inc. | 105,900 | 9,018 |

| Wal-Mart Stores Inc. | 139,230 | 8,535 |

| Costco Wholesale Corp. | 43,070 | 6,956 |

| Diageo plc ADR | 7,760 | 846 |

| 145,609 |

| Energy (5.6%) | | |

| Chevron Corp. | 382,790 | 34,436 |

| Exxon Mobil Corp. | 357,195 | 27,843 |

| TOTAL SA | 285,573 | 12,803 |

| Anadarko Petroleum Corp. | 237,230 | 11,525 |

| Royal Dutch Shell plc | | |

| | Class B | 485,276 | 11,060 |

| EOG Resources Inc. | 142,210 | 10,067 |

| Schlumberger Ltd. | 110,944 | 7,738 |

| Hess Corp. | 158,100 | 7,665 |

| Marathon Oil Corp. | 256,590 | 3,230 |

| Marathon Petroleum Corp. | 58,520 | 3,034 |

| 129,401 |

| Financials (15.2%) | | |

| Wells Fargo & Co. | 1,067,390 | 58,023 |

| JPMorgan Chase & Co. | 573,018 | 37,836 |

| ACE Ltd. | 283,120 | 33,083 |

| Prudential Financial Inc. | 333,590 | 27,158 |

| PNC Financial Services | | |

| | Group Inc. | 256,310 | 24,429 |

| | | |

| Market |

| Value• |

| | Shares | ($000) |

| BlackRock Inc. | 61,920 | 21,085 |

| Bank of America Corp. | 1,063,140 | 17,893 |

| Citigroup Inc. | 335,590 | 17,367 |

| Marsh & McLennan | | |

| | Cos. Inc. | 254,390 | 14,106 |

| MetLife Inc. | 250,473 | 12,075 |

| Northern Trust Corp. | 158,530 | 11,428 |

| Mitsubishi UFJ Financial | | |

| | Group Inc. | 1,681,430 | 10,415 |

| US Bancorp | 226,080 | 9,647 |

| American Tower | | |

| | Corporation | 94,922 | 9,203 |

| Bank of Nova Scotia | 209,660 | 8,479 |

| American International | | |

| | Group Inc. | 121,000 | 7,498 |

| Hartford Financial Services | | |

| | Group Inc. | 168,040 | 7,303 |

| UBS Group AG | 375,603 | 7,275 |

| * | Synchrony Financial | 221,500 | 6,736 |

| AvalonBay Communities | | |

| | Inc. | 23,200 | 4,272 |

| BNP Paribas SA | 73,853 | 4,178 |

| American Express Co. | 29,800 | 2,073 |

| 351,562 |

| Health Care (11.7%) | | |

| Merck & Co. Inc. | 826,349 | 43,648 |

| Bristol-Myers Squibb Co. | 439,970 | 30,265 |

| Johnson & Johnson | 253,960 | 26,087 |

| AstraZeneca plc ADR | 746,138 | 25,331 |

| Medtronic plc | 315,450 | 24,264 |

| Pfizer Inc. | 671,343 | 21,671 |

| Cardinal Health Inc. | 197,050 | 17,591 |

| Eli Lilly & Co. | 203,565 | 17,152 |

| UnitedHealth Group Inc. | 137,535 | 16,180 |

| Novartis AG | 159,545 | 13,724 |

| Baxter International Inc. | 266,600 | 10,171 |

| Roche Holding AG | 31,877 | 8,833 |

| * | Celgene Corp. | 55,140 | 6,603 |

| Gilead Sciences Inc. | 43,844 | 4,437 |

| Takeda Pharmaceutical Co. | | |

| | Ltd. | 80,300 | 4,004 |

| 269,961 |

| Industrials (7.3%) | | |

| United Parcel Service Inc. | | |

| | Class B | 254,648 | 24,505 |

| Honeywell International Inc. | 199,370 | 20,649 |

| General Electric Co. | 552,493 | 17,210 |

| Lockheed Martin Corp. | 73,820 | 16,030 |

| | | |

| Market |

| Value• |

| | Shares | ($000) |

| CSX Corp. | 527,249 | 13,682 |

| United Technologies Corp. | 115,940 | 11,138 |

| Caterpillar Inc. | 160,221 | 10,889 |

| FedEx Corp. | 69,760 | 10,394 |

| Eaton Corp. plc | 189,870 | 9,881 |

| Canadian National Railway | | |

| | Co. | 155,948 | 8,714 |

| Raytheon Co. | 64,642 | 8,050 |

| Schneider Electric SE | 118,047 | 6,706 |

| Illinois Tool Works Inc. | 56,175 | 5,206 |

| ABB Ltd. ADR | 280,048 | 4,965 |

| 168,019 |

| Information Technology (8.7%) | |

| Microsoft Corp. | 953,060 | 52,876 |

| * | Alphabet Inc. Class A | 48,610 | 37,819 |

| Intel Corp. | 1,013,220 | 34,905 |

| Cisco Systems Inc. | 964,146 | 26,181 |

| Apple Inc. | 210,742 | 22,183 |

| Accenture plc Class A | 202,100 | 21,119 |

| Texas Instruments Inc. | 124,020 | 6,798 |

| 201,881 |

| Materials (1.0%) | | |

| Praxair Inc. | 118,200 | 12,104 |

| International Paper Co. | 284,420 | 10,723 |

| BHP Billiton plc | 103,979 | 1,159 |

| 23,986 |

| Telecommunication Services (1.6%) | |

| Verizon Communications | | |

| | Inc. | 803,880 | 37,155 |

| |

| Utilities (2.4%) | | |

| NextEra Energy Inc. | 207,090 | 21,514 |

| Dominion Resources Inc. | 249,820 | 16,898 |

| Exelon Corp. | 379,870 | 10,549 |

| Duke Energy Corp. | 87,766 | 6,266 |

| 55,227 |

| Total Common Stocks | | |

| (Cost $1,154,058) | 1,482,079 |

8

| | | | | |

| Vanguard Balanced Portfolio | | | | |

| |

| |

| |

| |

| Face | Market |

| Maturity | Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| U.S. Government and Agency Obligations (7.1%) | | | |

| U.S. Government Securities (6.1%) | | | | |

| United States Treasury Note/Bond | 0.500% | 7/31/16 | 4,900 | 4,897 |

| United States Treasury Note/Bond | 0.875% | 9/15/16 | 2,200 | 2,203 |

| United States Treasury Note/Bond | 0.625% | 12/31/16 | 4,045 | 4,038 |

| United States Treasury Note/Bond | 0.875% | 1/31/17 | 534 | 534 |

| United States Treasury Note/Bond | 0.500% | 3/31/17 | 12,200 | 12,147 |

| United States Treasury Note/Bond | 0.625% | 7/31/17 | 8,000 | 7,956 |

| United States Treasury Note/Bond | 1.000% | 9/15/17 | 15,000 | 14,993 |

| United States Treasury Note/Bond | 0.750% | 10/31/17 | 9,200 | 9,151 |

| United States Treasury Note/Bond | 1.000% | 5/31/18 | 5,500 | 5,473 |

| United States Treasury Note/Bond | 1.375% | 9/30/18 | 19,000 | 19,062 |

| United States Treasury Note/Bond | 1.750% | 9/30/19 | 17,000 | 17,117 |

| United States Treasury Note/Bond | 1.375% | 2/29/20 | 4,130 | 4,083 |

| United States Treasury Note/Bond | 1.625% | 6/30/20 | 2,840 | 2,828 |

| United States Treasury Note/Bond | 2.250% | 11/15/24 | 550 | 550 |

| United States Treasury Note/Bond | 2.000% | 2/15/25 | 11,780 | 11,509 |

| United States Treasury Note/Bond | 2.875% | 5/15/43 | 13,173 | 12,827 |

| United States Treasury Note/Bond | 3.750% | 11/15/43 | 694 | 798 |

| United States Treasury Note/Bond | 3.375% | 5/15/44 | 4,410 | 4,726 |

| United States Treasury Note/Bond | 3.125% | 8/15/44 | 1,740 | 1,776 |

| United States Treasury Note/Bond | 2.500% | 2/15/45 | 6,210 | 5,563 |

| 142,231 |

| Conventional Mortgage-Backed Securities (0.8%) | | | |

| 1,2,3 Fannie Mae Pool | 3.500% | 11/1/25– | | |

| | | 1/1/46 | 7,500 | 7,737 |

| 1,2 Fannie Mae Pool | 4.500% | 11/1/33– | | |

| | | 1/1/46 | 7,479 | 8,134 |

| 1,2 Freddie Mac Gold Pool | 4.000% | 9/1/24– | | |

| | | 9/1/41 | 10 | 10 |

| 1,2 Freddie Mac Gold Pool | 4.500% | 3/1/29– | | |

| | | 1/1/46 | 1,832 | 1,993 |

| 1 | Ginnie Mae I Pool | 7.000% | 11/15/31– | | |

| | | 11/15/33 | 140 | 165 |

| 1 | Ginnie Mae I Pool | 8.000% | 9/15/30 | 67 | 69 |

| 18,108 |

| Nonconventional Mortgage-Backed Securities (0.2%) | | |

| 1,2 Fannie Mae REMICS | 3.500% | 4/25/31 | 245 | 254 |

| 1,2 Fannie Mae REMICS | 4.000% | 9/25/29– | | |

| | | 5/25/31 | 470 | 506 |

| 1,2 Freddie Mac REMICS | 3.500% | 3/15/31 | 145 | 150 |

| 1,2 Freddie Mac REMICS | 4.000% | 12/15/30– | | |

| | | 4/15/31 | 2,726 | 2,946 |

| 3,856 |

| Total U.S. Government and Agency Obligations | | | |

| (Cost $163,046) 164,195 |

| Asset-Backed/Commercial Mortgage-Backed Securities (1.6%) | | |

| 1 | Ally Master Owner Trust Series 2012-5 | 1.540% | 9/15/19 | 2,695 | 2,680 |

| 1 | Ally Master Owner Trust Series 2014-5 | 1.600% | 10/15/19 | 3,715 | 3,697 |

| 4 | American Tower Trust I | 1.551% | 3/15/18 | 380 | 377 |

| 4 | American Tower Trust I | 3.070% | 3/15/23 | 1,100 | 1,071 |

| 1 | AmeriCredit Automobile Receivables | | | | |

| | Trust 2012-1 | 4.720% | 3/8/18 | 580 | 587 |

| 1,4,5 Apidos CDO | 1.815% | 4/17/26 | 1,295 | 1,286 |

| 1,4,5 ARES CLO Ltd. | 1.835% | 4/17/26 | 1,200 | 1,192 |

| 1,4,5 Atlas Senior Loan Fund Ltd. | 1.861% | 10/15/26 | 355 | 351 |

| 1,4,5 Atlas Senior Loan Fund V Ltd. | 1.867% | 7/16/26 | 305 | 303 |

| 1 | Banc of America Commercial | | | | |

| | Mortgage Trust 2006-2 | 5.834% | 5/10/45 | 141 | 142 |

| 1 | Banc of America Commercial | | | | |

| | Mortgage Trust 2006-5 | 5.414% | 9/10/47 | 411 | 416 |

| 1 | Bear Stearns Commercial Mortgage | | | | |

| | Securities Trust 2006-PWR13 | 5.540% | 9/11/41 | 426 | 432 |

| 1,4,5 CECLO 2013-20A 144A | 1.800% | 1/25/26 | 1,300 | 1,280 |

| 1,4,5 Cent CLO | 1.813% | 7/27/26 | 420 | 416 |

| 1,4,5 Cent CLO 22 Ltd. | 1.824% | 11/7/26 | 935 | 924 |

| 1,4,5 CIFC Funding Ltd. | 1.815% | 4/18/25 | 1,185 | 1,176 |

| | | | | |

| Face | Market |

| Maturity Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| 1 | COMM 2006-C7 Mortgage Trust | 5.768% | 6/10/46 | 363 | 366 |

| 1 | COMM 2012-CCRE2 Mortgage Trust | 3.147% | 8/15/45 | 480 | 485 |

| 1 | Credit Suisse Commercial Mortgage | | | | |

| | Trust Series 2006-C4 | 5.467% | 9/15/39 | 272 | 275 |

| 1,4,5 Dryden Senior Loan Fund | 1.667% | 4/18/26 | 1,165 | 1,152 |

| 1,4 First Investors Auto Owner Trust | | | | |

| | 2013-2 | 1.230% | 3/15/19 | 92 | 91 |

| 1,4 Ford Credit Floorplan Master Owner | | | | |

| | Trust A | 2.090% | 3/15/22 | 330 | 329 |

| 1 | Ford Credit Floorplan Master Owner | | | | |

| | Trust A Series 2012-2 | 1.920% | 1/15/19 | 772 | 776 |

| 1,4 Hilton USA Trust 2013-HLT | 2.662% | 11/5/30 | 1,165 | 1,163 |

| 1,4,5 ING Investment Management Co. | 1.815% | 4/18/26 | 1,165 | 1,156 |

| 1 | LB-UBS Commercial Mortgage Trust | | | | |

| | 2006-C4 | 5.820% | 6/15/38 | 322 | 324 |

| 1,5 LB-UBS Commercial Mortgage Trust | | | | |

| | 2008-C1 | 6.087% | 4/15/41 | 713 | 762 |

| 1,4,5 Limerock CLO | 1.817% | 4/18/26 | 1,300 | 1,281 |

| 1,4,5 Madison Park Funding XII Ltd. | 1.765% | 1/19/25 | 755 | 749 |

| 1,4,5 Madison Park Funding XIII Ltd. | 1.817% | 7/20/26 | 920 | 913 |

| 1 | Merrill Lynch Mortgage Trust 2006-C1 | 5.666% | 5/12/39 | 351 | 352 |

| 1,4,5 OZLM VI Ltd. | 1.865% | 4/17/26 | 955 | 949 |

| 1 | Santander Drive Auto Receivables | | | | |

| | Trust 2013-2 | 2.570% | 3/15/19 | 515 | 514 |

| 1 | Santander Drive Auto Receivables | | | | |

| | Trust 2014-2 | 2.330% | 11/15/19 | 335 | 336 |

| 4 | SBA Tower Trust | 2.898% | 10/15/19 | 1,205 | 1,185 |

| 1,4,5 Seneca Park CLO Ltd. | 1.795% | 7/17/26 | 680 | 674 |

| 1,4,5 SFAVE Commercial Mortgage | | | | |

| | Securities Trust 2015-5AVE | 4.144% | 1/5/35 | 700 | 678 |

| 1,4,5 Shackleton CLO Ltd. | 1.795% | 7/17/26 | 660 | 654 |

| 1,4 Springleaf Funding Trust | 2.410% | 12/15/22 | 1,105 | 1,102 |

| 1,4 Springleaf Funding Trust | 3.160% | 11/15/24 | 1,375 | 1,365 |

| 1,4 Springleaf Funding Trust 2015-B | 3.480% | 5/15/28 | 590 | 588 |

| 1,4 Springleaf Mortgage Loan Trust | | | | |

| | 2013-1A | 2.310% | 6/25/58 | 220 | 218 |

| 1,4,5 SYMP 14-14AA2 144A | 1.801% | 7/14/26 | 1,125 | 1,116 |

| 1,4,5 Thacher Park CLO 2014-1 | 1.787% | 10/20/26 | 505 | 500 |

| 1 | Utility Debt Securitization Authority | | | | |

| | Series 2013T | 3.435% | 12/15/25 | 210 | 218 |

| 1,4 Westlake Automobile Receivables | | | | |

| | Trust | 0.970% | 10/16/17 | 325 | 324 |

| Total Asset-Backed/Commercial Mortgage-Backed Securities | | |

| (Cost $37,290) | 36,925 |

| Corporate Bonds (22.3%) | | | | |

| Finance (8.7%) | | | | |

| Banking (6.9%) | | | | |

| American Express Centurion Bank | 6.000% | 9/13/17 | 500 | 536 |

| American Express Co. | 1.550% | 5/22/18 | 1,635 | 1,620 |

| American Express Credit Corp. | 2.375% | 3/24/17 | 1,920 | 1,941 |

| American Express Credit Corp. | 2.125% | 7/27/18 | 1,235 | 1,243 |

| American Express Credit Corp. | 2.250% | 8/15/19 | 800 | 800 |

| Bank of America Corp. | 6.050% | 5/16/16 | 2,000 | 2,033 |

| Bank of America Corp. | 6.000% | 9/1/17 | 1,010 | 1,075 |

| Bank of America Corp. | 5.750% | 12/1/17 | 500 | 535 |

| Bank of America Corp. | 6.875% | 4/25/18 | 1,250 | 1,379 |

| Bank of America Corp. | 5.625% | 7/1/20 | 85 | 94 |

| Bank of America Corp. | 5.875% | 1/5/21 | 3,000 | 3,396 |

| Bank of America Corp. | 3.300% | 1/11/23 | 120 | 118 |

| Bank of America Corp. | 4.100% | 7/24/23 | 150 | 155 |

| Bank of America Corp. | 4.000% | 4/1/24 | 340 | 348 |

| Bank of America Corp. | 4.000% | 1/22/25 | 875 | 857 |

| Bank of America Corp. | 5.875% | 2/7/42 | 260 | 303 |

| Bank of America Corp. | 5.000% | 1/21/44 | 1,230 | 1,283 |

| Bank of America Corp. | 4.875% | 4/1/44 | 870 | 898 |

| Bank of America NA | 5.300% | 3/15/17 | 2,000 | 2,080 |

| Bank of Montreal | 1.300% | 7/15/16 | 800 | 802 |

| Bank of Montreal | 2.500% | 1/11/17 | 2,030 | 2,053 |

| Bank of New York Mellon Corp. | 2.150% | 2/24/20 | 1,580 | 1,564 |

9

| | | | | |

| Vanguard Balanced Portfolio | | | | |

| |

| |

| |

| |

| Face | Market |

| Maturity Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| Bank of New York Mellon Corp. | 3.000% | 2/24/25 | 720 | 708 |

| Bank of Nova Scotia | 2.050% | 10/30/18 | 1,600 | 1,606 |

| Bank of Nova Scotia | 2.800% | 7/21/21 | 750 | 759 |

| 4 | Bank of Tokyo-Mitsubishi UFJ Ltd. | 1.700% | 3/5/18 | 1,390 | 1,379 |

| 4 | Banque Federative du Credit Mutuel | | | | |

| | SA | 2.750% | 10/15/20 | 1,200 | 1,204 |

| 4 | Barclays Bank plc | 6.050% | 12/4/17 | 1,400 | 1,489 |

| Barclays Bank plc | 2.500% | 2/20/19 | 800 | 805 |

| Barclays Bank plc | 5.125% | 1/8/20 | 240 | 264 |

| Barclays Bank plc | 5.140% | 10/14/20 | 160 | 174 |

| Barclays Bank plc | 3.750% | 5/15/24 | 1,150 | 1,171 |

| BB&T Corp. | 4.900% | 6/30/17 | 1,000 | 1,042 |

| Bear Stearns Cos. LLC | 6.400% | 10/2/17 | 235 | 253 |

| Bear Stearns Cos. LLC | 7.250% | 2/1/18 | 425 | 468 |

| BNP Paribas SA | 2.400% | 12/12/18 | 1,300 | 1,310 |

| BNP Paribas SA | 3.250% | 3/3/23 | 305 | 304 |

| BPCE SA | 2.500% | 12/10/18 | 220 | 222 |

| BPCE SA | 2.500% | 7/15/19 | 1,400 | 1,404 |

| BPCE SA | 4.000% | 4/15/24 | 775 | 803 |

| 4 | BPCE SA | 5.150% | 7/21/24 | 1,260 | 1,270 |

| Capital One Bank USA NA | 2.150% | 11/21/18 | 1,215 | 1,204 |

| Capital One Financial Corp. | 3.150% | 7/15/16 | 300 | 303 |

| Capital One Financial Corp. | 4.750% | 7/15/21 | 400 | 434 |

| Capital One Financial Corp. | 3.750% | 4/24/24 | 1,305 | 1,315 |

| Capital One Financial Corp. | 3.200% | 2/5/25 | 1,050 | 1,015 |

| Capital One Financial Corp. | 4.200% | 10/29/25 | 310 | 306 |

| Citigroup Inc. | 1.750% | 5/1/18 | 500 | 495 |

| Citigroup Inc. | 2.500% | 9/26/18 | 500 | 504 |

| Citigroup Inc. | 2.550% | 4/8/19 | 1,800 | 1,812 |

| Citigroup Inc. | 2.500% | 7/29/19 | 965 | 962 |

| Citigroup Inc. | 2.400% | 2/18/20 | 800 | 790 |

| Citigroup Inc. | 4.500% | 1/14/22 | 1,975 | 2,115 |

| Citigroup Inc. | 6.625% | 6/15/32 | 2,000 | 2,359 |

| Citigroup Inc. | 8.125% | 7/15/39 | 101 | 144 |

| Citigroup Inc. | 5.300% | 5/6/44 | 270 | 280 |

| Compass Bank | 2.750% | 9/29/19 | 375 | 371 |

| Cooperatieve Centrale | | | | |

| | Raiffeisen-Boerenleenbank BA | 2.250% | 1/14/19 | 1,350 | 1,356 |

| 4 | Credit Agricole SA | 2.500% | 4/15/19 | 1,460 | 1,467 |

| Credit Suisse | 1.750% | 1/29/18 | 840 | 837 |

| Credit Suisse | 2.300% | 5/28/19 | 2,845 | 2,848 |

| Credit Suisse | 3.000% | 10/29/21 | 735 | 733 |

| Credit Suisse | 3.625% | 9/9/24 | 250 | 252 |

| 4 | Credit Suisse Group Funding | | | | |

| | Guernsey Ltd. | 3.800% | 9/15/22 | 1,335 | 1,331 |

| 4 | Credit Suisse Group Funding | | | | |

| | Guernsey Ltd. | 3.750% | 3/26/25 | 1,595 | 1,555 |

| Deutsche Bank AG | 2.500% | 2/13/19 | 1,000 | 1,006 |

| Fifth Third Bank | 2.875% | 10/1/21 | 425 | 424 |

| Goldman Sachs Group Inc. | 5.350% | 1/15/16 | 1,500 | 1,502 |

| Goldman Sachs Group Inc. | 5.625% | 1/15/17 | 490 | 509 |

| Goldman Sachs Group Inc. | 5.950% | 1/18/18 | 1,325 | 1,425 |

| Goldman Sachs Group Inc. | 2.375% | 1/22/18 | 555 | 560 |

| Goldman Sachs Group Inc. | 5.375% | 3/15/20 | 405 | 445 |

| Goldman Sachs Group Inc. | 2.600% | 4/23/20 | 170 | 170 |

| Goldman Sachs Group Inc. | 6.000% | 6/15/20 | 3,350 | 3,788 |

| Goldman Sachs Group Inc. | 5.250% | 7/27/21 | 865 | 957 |

| Goldman Sachs Group Inc. | 5.750% | 1/24/22 | 360 | 409 |

| Goldman Sachs Group Inc. | 3.625% | 1/22/23 | 1,205 | 1,219 |

| Goldman Sachs Group Inc. | 6.450% | 5/1/36 | 2,000 | 2,254 |

| Goldman Sachs Group Inc. | 6.750% | 10/1/37 | 1,360 | 1,589 |

| Goldman Sachs Group Inc. | 4.750% | 10/21/45 | 680 | 676 |

| 4 | HSBC Bank plc | 4.750% | 1/19/21 | 1,700 | 1,865 |

| HSBC Holdings plc | 4.000% | 3/30/22 | 2,395 | 2,513 |

| HSBC Holdings plc | 6.500% | 5/2/36 | 1,000 | 1,191 |

| HSBC Holdings plc | 6.100% | 1/14/42 | 375 | 472 |

| HSBC Holdings plc | 5.250% | 3/14/44 | 440 | 455 |

| HSBC USA Inc. | 1.625% | 1/16/18 | 1,005 | 1,000 |

| HSBC USA Inc. | 2.350% | 3/5/20 | 1,825 | 1,806 |

| | | | | |

| Face | Market |

| Maturity | Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| HSBC USA Inc. | 3.500% | 6/23/24 | 800 | 802 |

| Huntington National Bank | 2.200% | 4/1/19 | 560 | 554 |

| Huntington National Bank | 2.400% | 4/1/20 | 1,160 | 1,141 |

| 4 | ING Bank NV | 3.750% | 3/7/17 | 600 | 614 |

| 4 | ING Bank NV | 1.800% | 3/16/18 | 1,340 | 1,340 |

| JPMorgan Chase & Co. | 6.000% | 1/15/18 | 1,500 | 1,617 |

| JPMorgan Chase & Co. | 6.300% | 4/23/19 | 465 | 521 |

| JPMorgan Chase & Co. | 4.950% | 3/25/20 | 1,000 | 1,087 |

| JPMorgan Chase & Co. | 4.350% | 8/15/21 | 4,862 | 5,175 |

| JPMorgan Chase & Co. | 4.500% | 1/24/22 | 495 | 533 |

| JPMorgan Chase & Co. | 3.250% | 9/23/22 | 970 | 976 |

| JPMorgan Chase & Co. | 3.375% | 5/1/23 | 875 | 856 |

| JPMorgan Chase & Co. | 3.875% | 2/1/24 | 800 | 819 |

| JPMorgan Chase & Co. | 3.900% | 7/15/25 | 370 | 379 |

| JPMorgan Chase & Co. | 4.125% | 12/15/26 | 765 | 763 |

| JPMorgan Chase & Co. | 4.250% | 10/1/27 | 1,895 | 1,883 |

| JPMorgan Chase & Co. | 5.400% | 1/6/42 | 750 | 843 |

| JPMorgan Chase & Co. | 5.625% | 8/16/43 | 400 | 432 |

| JPMorgan Chase & Co. | 4.950% | 6/1/45 | 400 | 400 |

| 4 | Macquarie Bank Ltd. | 2.400% | 1/21/20 | 330 | 326 |

| Manufacturers & Traders Trust Co. | 2.100% | 2/6/20 | 495 | 486 |

| Manufacturers & Traders Trust Co. | 2.900% | 2/6/25 | 685 | 663 |

| Morgan Stanley | 5.450% | 1/9/17 | 1,000 | 1,038 |

| Morgan Stanley | 1.875% | 1/5/18 | 255 | 255 |

| Morgan Stanley | 2.125% | 4/25/18 | 1,375 | 1,377 |

| Morgan Stanley | 2.500% | 1/24/19 | 2,500 | 2,509 |

| Morgan Stanley | 5.625% | 9/23/19 | 645 | 711 |

| Morgan Stanley | 5.750% | 1/25/21 | 1,740 | 1,956 |

| Morgan Stanley | 3.700% | 10/23/24 | 750 | 751 |

| Morgan Stanley | 6.250% | 8/9/26 | 3,000 | 3,521 |

| Morgan Stanley | 4.300% | 1/27/45 | 850 | 805 |

| National City Corp. | 6.875% | 5/15/19 | 1,000 | 1,130 |

| 4 | Nationwide Building Society | 2.350% | 1/21/20 | 785 | 780 |

| Northern Trust Corp. | 3.450% | 11/4/20 | 255 | 266 |

| PNC Bank NA | 4.875% | 9/21/17 | 1,500 | 1,568 |

| PNC Bank NA | 3.300% | 10/30/24 | 460 | 461 |

| PNC Bank NA | 2.950% | 2/23/25 | 1,105 | 1,067 |

| PNC Bank NA | 4.200% | 11/1/25 | 255 | 269 |

| PNC Financial Services Group Inc. | 3.900% | 4/29/24 | 580 | 594 |

| Santander Bank NA | 2.000% | 1/12/18 | 715 | 710 |

| Santander Holdings USA Inc. | 2.650% | 4/17/20 | 580 | 566 |

| Santander Issuances SAU | 5.179% | 11/19/25 | 800 | 781 |

| 4 | Skandinaviska Enskilda Banken AB | 2.450% | 5/27/20 | 1,600 | 1,593 |

| State Street Corp. | 5.375% | 4/30/17 | 2,775 | 2,919 |

| Svenska Handelsbanken AB | 2.875% | 4/4/17 | 1,000 | 1,017 |

| Synchrony Financial | 3.000% | 8/15/19 | 1,055 | 1,054 |

| Synchrony Financial | 2.700% | 2/3/20 | 405 | 398 |

| UBS AG | 1.800% | 3/26/18 | 1,020 | 1,019 |

| 4 | UBS Group Funding Jersey Ltd. | 2.950% | 9/24/20 | 1,160 | 1,150 |

| US Bancorp | 3.700% | 1/30/24 | 1,560 | 1,631 |

| Wachovia Corp. | 7.500% | 4/15/35 | 1,000 | 1,294 |

| Wells Fargo & Co. | 5.625% | 12/11/17 | 820 | 880 |

| Wells Fargo & Co. | 2.150% | 1/15/19 | 2,915 | 2,930 |

| Wells Fargo & Co. | 3.000% | 1/22/21 | 505 | 513 |

| Wells Fargo & Co. | 3.500% | 3/8/22 | 640 | 659 |

| Wells Fargo & Co. | 3.450% | 2/13/23 | 930 | 931 |

| Wells Fargo & Co. | 4.480% | 1/16/24 | 1,199 | 1,262 |

| Wells Fargo & Co. | 3.000% | 2/19/25 | 890 | 860 |

| Wells Fargo & Co. | 3.550% | 9/29/25 | 860 | 866 |

| Wells Fargo & Co. | 5.606% | 1/15/44 | 2,276 | 2,519 |

| Wells Fargo & Co. | 4.900% | 11/17/45 | 515 | 517 |

| |

| Brokerage (0.0%) | | | | |

| Ameriprise Financial Inc. | 5.300% | 3/15/20 | 305 | 338 |

| |

| Finance Companies (0.4%) | | | | |

| 4 | General Electric Capital Corp. | 2.342% | 11/15/20 | 1,567 | 1,554 |

| 4 | General Electric Capital Corp. | 3.373% | 11/15/25 | 3,460 | 3,496 |

| 4 | General Electric Capital Corp. | 4.418% | 11/15/35 | 4,635 | 4,725 |

10

| | | | | |

| Vanguard Balanced Portfolio | | | | |

| |

| |

| |

| |

| Face | Market |

| Maturity | Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| Insurance (1.2%) | | | | |

| ACE INA Holdings Inc. | 5.800% | 3/15/18 | 1,295 | 1,406 |

| ACE INA Holdings Inc. | 2.300% | 11/3/20 | 170 | 168 |

| ACE INA Holdings Inc. | 3.350% | 5/15/24 | 555 | 560 |

| ACE INA Holdings Inc. | 3.350% | 5/3/26 | 395 | 394 |

| ACE INA Holdings Inc. | 4.350% | 11/3/45 | 800 | 809 |

| Aetna Inc. | 1.750% | 5/15/17 | 60 | 60 |

| 1 | Allstate Corp. | 6.125% | 5/15/67 | 1,000 | 1,000 |

| Anthem Inc. | 2.300% | 7/15/18 | 375 | 374 |

| Anthem Inc. | 3.125% | 5/15/22 | 1,610 | 1,575 |

| Anthem Inc. | 3.300% | 1/15/23 | 1,100 | 1,071 |

| Anthem Inc. | 4.650% | 8/15/44 | 276 | 263 |

| Cigna Corp. | 3.250% | 4/15/25 | 1,730 | 1,691 |

| CNA Financial Corp. | 3.950% | 5/15/24 | 135 | 135 |

| 4 | Five Corners Funding Trust | 4.419% | 11/15/23 | 210 | 219 |

| 4 | Liberty Mutual Group Inc. | 4.250% | 6/15/23 | 360 | 366 |

| Loews Corp. | 2.625% | 5/15/23 | 440 | 417 |

| 1,4 Massachusetts Mutual Life | | | | |

| | Insurance Co. | 7.625% | 11/15/23 | 2,000 | 2,440 |

| MetLife Inc. | 1.903% | 12/15/17 | 225 | 226 |

| MetLife Inc. | 3.600% | 4/10/24 | 580 | 597 |

| MetLife Inc. | 4.125% | 8/13/42 | 145 | 137 |

| MetLife Inc. | 4.875% | 11/13/43 | 530 | 554 |

| 4 | Metropolitan Life Global Funding I | 1.500% | 1/10/18 | 1,480 | 1,472 |

| 4 | Metropolitan Life Global Funding I | 1.875% | 6/22/18 | 950 | 950 |

| 4 | New York Life Global Funding | 1.650% | 5/15/17 | 600 | 602 |

| 4 | New York Life Insurance Co. | 5.875% | 5/15/33 | 2,100 | 2,448 |

| Prudential Financial Inc. | 3.000% | 5/12/16 | 450 | 453 |

| 4 | QBE Insurance Group Ltd. | 2.400% | 5/1/18 | 235 | 235 |

| 4 | Teachers Insurance & Annuity | | | | |

| | Association of America | 4.900% | 9/15/44 | 375 | 379 |

| UnitedHealth Group Inc. | 6.000% | 6/15/17 | 500 | 533 |

| UnitedHealth Group Inc. | 6.000% | 2/15/18 | 700 | 761 |

| UnitedHealth Group Inc. | 3.875% | 10/15/20 | 601 | 634 |

| UnitedHealth Group Inc. | 2.875% | 3/15/22 | 27 | 27 |

| UnitedHealth Group Inc. | 2.875% | 3/15/23 | 1,175 | 1,159 |

| UnitedHealth Group Inc. | 4.625% | 7/15/35 | 815 | 849 |

| UnitedHealth Group Inc. | 4.250% | 3/15/43 | 1,600 | 1,549 |

| UnitedHealth Group Inc. | 4.750% | 7/15/45 | 760 | 796 |

| |

| Other Finance (0.0%) | | | | |

| 4 | LeasePlan Corp. NV | 2.875% | 1/22/19 | 970 | 955 |

| |

| Real Estate Investment Trusts (0.2%) | | | | |

| AvalonBay Communities Inc. | 3.625% | 10/1/20 | 520 | 541 |

| Duke Realty LP | 6.500% | 1/15/18 | 210 | 227 |

| HCP Inc. | 3.750% | 2/1/16 | 210 | 210 |

| Realty Income Corp. | 4.650% | 8/1/23 | 640 | 665 |

| 4 | WEA Finance LLC / Westfield UK | | | | |

| | & Europe Finance plc | 1.750% | 9/15/17 | 375 | 372 |

| 4 | WEA Finance LLC / Westfield UK | | | | |

| | & Europe Finance plc | 2.700% | 9/17/19 | 1,330 | 1,318 |

| 201,818 |

| Industrial (11.5%) | | | | |

| Basic Industry (0.2%) | | | | |

| BHP Billiton Finance USA Ltd. | 3.850% | 9/30/23 | 1,050 | 989 |

| CF Industries Inc. | 5.375% | 3/15/44 | 880 | 767 |

| LyondellBasell Industries NV | 4.625% | 2/26/55 | 900 | 728 |

| Monsanto Co. | 4.700% | 7/15/64 | 230 | 176 |

| Rio Tinto Finance USA Ltd. | 6.500% | 7/15/18 | 1,500 | 1,625 |

| Rio Tinto Finance USA Ltd. | 3.750% | 9/20/21 | 685 | 666 |

| Rio Tinto Finance USA plc | 3.500% | 3/22/22 | 400 | 376 |

| |

| Capital Goods (1.1%) | | | | |

| 4 | BAE Systems Holdings Inc. | 2.850% | 12/15/20 | 160 | 159 |

| 4 | BAE Systems Holdings Inc. | 3.850% | 12/15/25 | 285 | 284 |

| Caterpillar Financial Services Corp. | 2.625% | 3/1/23 | 1,360 | 1,312 |

| Caterpillar Inc. | 3.900% | 5/27/21 | 1,170 | 1,243 |

| Caterpillar Inc. | 2.600% | 6/26/22 | 705 | 696 |

| | | | | |

| Face | Market |

| Maturity Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| Caterpillar Inc. | 3.400% | 5/15/24 | 1,185 | 1,195 |

| Caterpillar Inc. | 4.300% | 5/15/44 | 745 | 718 |

| General Dynamics Corp. | 3.875% | 7/15/21 | 355 | 375 |

| General Electric Capital Corp. | 4.625% | 1/7/21 | 321 | 352 |

| General Electric Capital Corp. | 5.300% | 2/11/21 | 228 | 257 |

| General Electric Capital Corp. | 3.150% | 9/7/22 | 967 | 990 |

| General Electric Capital Corp. | 3.100% | 1/9/23 | 360 | 365 |

| General Electric Capital Corp. | 6.750% | 3/15/32 | 135 | 175 |

| General Electric Capital Corp. | 6.150% | 8/7/37 | 633 | 791 |

| General Electric Capital Corp. | 5.875% | 1/14/38 | 443 | 542 |

| General Electric Capital Corp. | 6.875% | 1/10/39 | 187 | 255 |

| General Electric Co. | 2.700% | 10/9/22 | 610 | 607 |

| General Electric Co. | 4.125% | 10/9/42 | 320 | 313 |

| General Electric Co. | 4.500% | 3/11/44 | 1,050 | 1,079 |

| Honeywell International Inc. | 4.250% | 3/1/21 | 1,002 | 1,096 |

| Illinois Tool Works Inc. | 3.500% | 3/1/24 | 1,295 | 1,333 |

| John Deere Capital Corp. | 2.250% | 4/17/19 | 1,465 | 1,472 |

| John Deere Capital Corp. | 1.700% | 1/15/20 | 520 | 506 |

| Lockheed Martin Corp. | 2.500% | 11/23/20 | 390 | 389 |

| Lockheed Martin Corp. | 2.900% | 3/1/25 | 1,010 | 970 |

| Lockheed Martin Corp. | 4.500% | 5/15/36 | 211 | 213 |

| Lockheed Martin Corp. | 4.700% | 5/15/46 | 520 | 533 |

| Parker-Hannifin Corp. | 4.450% | 11/21/44 | 450 | 470 |

| 4 | Siemens Financieringsmaatschappij NV | 5.750% | 10/17/16 | 2,225 | 2,305 |

| 4 | Siemens Financieringsmaatschappij NV | 2.900% | 5/27/22 | 800 | 800 |

| 4 | Siemens Financieringsmaatschappij NV | 4.400% | 5/27/45 | 800 | 825 |

| United Technologies Corp. | 3.100% | 6/1/22 | 535 | 545 |

| United Technologies Corp. | 7.500% | 9/15/29 | 770 | 1,041 |

| United Technologies Corp. | 6.050% | 6/1/36 | 675 | 814 |

| United Technologies Corp. | 4.500% | 6/1/42 | 325 | 326 |

| |

| Communication (2.0%) | | | | |

| 21st Century Fox America Inc. | 4.500% | 2/15/21 | 375 | 404 |

| 21st Century Fox America Inc. | 3.000% | 9/15/22 | 245 | 242 |

| America Movil SAB de CV | 3.125% | 7/16/22 | 1,880 | 1,837 |

| America Movil SAB de CV | 4.375% | 7/16/42 | 530 | 474 |

| American Tower Corp. | 3.450% | 9/15/21 | 1,125 | 1,130 |

| AT&T Inc. | 1.400% | 12/1/17 | 1,090 | 1,084 |

| AT&T Inc. | 5.600% | 5/15/18 | 1,000 | 1,087 |

| AT&T Inc. | 2.300% | 3/11/19 | 295 | 295 |

| AT&T Inc. | 6.450% | 6/15/34 | 845 | 950 |

| CBS Corp. | 4.300% | 2/15/21 | 675 | 703 |

| Comcast Corp. | 2.850% | 1/15/23 | 240 | 238 |

| Comcast Corp. | 3.600% | 3/1/24 | 550 | 568 |

| Comcast Corp. | 4.250% | 1/15/33 | 1,032 | 1,028 |

| Comcast Corp. | 4.200% | 8/15/34 | 620 | 614 |

| Comcast Corp. | 5.650% | 6/15/35 | 110 | 128 |

| Comcast Corp. | 4.400% | 8/15/35 | 700 | 707 |

| Comcast Corp. | 6.500% | 11/15/35 | 115 | 144 |

| Comcast Corp. | 6.400% | 5/15/38 | 120 | 147 |

| Comcast Corp. | 4.650% | 7/15/42 | 1,290 | 1,304 |

| Comcast Corp. | 4.500% | 1/15/43 | 500 | 498 |

| Comcast Corp. | 4.750% | 3/1/44 | 525 | 546 |

| Comcast Corp. | 4.600% | 8/15/45 | 845 | 856 |

| 4 | Cox Communications Inc. | 4.800% | 2/1/35 | 1,540 | 1,275 |

| 4 | Deutsche Telekom International | | | | |

| | Finance BV | 4.875% | 3/6/42 | 705 | 712 |

| DIRECTV Holdings LLC / | | | | |

| | DIRECTV Financing Co. Inc. | 1.750% | 1/15/18 | 810 | 808 |

| DIRECTV Holdings LLC / | | | | |

| | DIRECTV Financing Co. Inc. | 5.200% | 3/15/20 | 255 | 276 |

| DIRECTV Holdings LLC / | | | | |

| | DIRECTV Financing Co. Inc. | 4.600% | 2/15/21 | 100 | 106 |

| Discovery Communications LLC | 5.625% | 8/15/19 | 80 | 87 |

| Discovery Communications LLC | 5.050% | 6/1/20 | 420 | 447 |

| Grupo Televisa SAB | 6.625% | 1/15/40 | 630 | 661 |

| Grupo Televisa SAB | 6.125% | 1/31/46 | 410 | 410 |

| 4 | GTP Acquisition Partners I LLC | 2.350% | 6/15/20 | 580 | 564 |

| 4 | NBCUniversal Enterprise Inc. | 1.662% | 4/15/18 | 1,920 | 1,920 |

11

| | | | | |

| Vanguard Balanced Portfolio | | | | |

| |

| |

| |

| |

| Face | Market |

| Maturity | Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| 4 | NBCUniversal Enterprise Inc. | 1.974% | 4/15/19 | 2,530 | 2,528 |

| NBCUniversal Media LLC | 4.375% | 4/1/21 | 600 | 652 |

| Orange SA | 4.125% | 9/14/21 | 1,740 | 1,835 |

| Orange SA | 9.000% | 3/1/31 | 360 | 509 |

| 4 | SBA Tower Trust | 2.933% | 12/15/17 | 840 | 843 |

| 4 | Sky plc | 2.625% | 9/16/19 | 975 | 967 |

| 4 | Sky plc | 3.750% | 9/16/24 | 1,435 | 1,391 |

| Time Warner Cable Inc. | 5.850% | 5/1/17 | 1,030 | 1,077 |

| Time Warner Cable Inc. | 8.750% | 2/14/19 | 25 | 29 |

| Time Warner Cable Inc. | 8.250% | 4/1/19 | 364 | 418 |

| Time Warner Entertainment Co. LP | 8.375% | 3/15/23 | 95 | 117 |

| Time Warner Inc. | 4.875% | 3/15/20 | 700 | 757 |

| Time Warner Inc. | 4.750% | 3/29/21 | 350 | 376 |

| Time Warner Inc. | 6.500% | 11/15/36 | 620 | 701 |

| Verizon Communications Inc. | 4.500% | 9/15/20 | 1,280 | 1,376 |

| Verizon Communications Inc. | 3.450% | 3/15/21 | 485 | 497 |

| Verizon Communications Inc. | 3.500% | 11/1/21 | 1,040 | 1,059 |

| Verizon Communications Inc. | 6.400% | 9/15/33 | 2,230 | 2,548 |

| Verizon Communications Inc. | 5.850% | 9/15/35 | 475 | 510 |

| Verizon Communications Inc. | 6.900% | 4/15/38 | 290 | 348 |

| Verizon Communications Inc. | 4.750% | 11/1/41 | 290 | 266 |

| Verizon Communications Inc. | 6.550% | 9/15/43 | 1,360 | 1,610 |

| Verizon Communications Inc. | 4.862% | 8/21/46 | 2,201 | 2,078 |

| Walt Disney Co. | 4.125% | 6/1/44 | 560 | 567 |

| |

| Consumer Cyclical (1.6%) | | | | |

| Amazon.com Inc. | 2.500% | 11/29/22 | 885 | 856 |

| Amazon.com Inc. | 4.800% | 12/5/34 | 995 | 1,044 |

| Amazon.com Inc. | 4.950% | 12/5/44 | 645 | 687 |

| 4 | American Honda Finance Corp. | 1.500% | 9/11/17 | 490 | 491 |

| 4 | American Honda Finance Corp. | 1.600% | 2/16/18 | 810 | 804 |

| American Honda Finance Corp. | 2.125% | 10/10/18 | 1,110 | 1,118 |

| AutoZone Inc. | 3.700% | 4/15/22 | 1,371 | 1,396 |

| AutoZone Inc. | 3.125% | 7/15/23 | 600 | 587 |

| CVS Health Corp. | 5.750% | 6/1/17 | 176 | 186 |

| CVS Health Corp. | 2.750% | 12/1/22 | 1,200 | 1,167 |

| CVS Health Corp. | 4.875% | 7/20/35 | 1,135 | 1,172 |

| CVS Health Corp. | 5.125% | 7/20/45 | 1,310 | 1,381 |

| 4 | Daimler Finance North America LLC | 2.375% | 8/1/18 | 900 | 902 |

| 4 | Daimler Finance North America LLC | 2.250% | 7/31/19 | 1,575 | 1,555 |

| Daimler Finance North America LLC | 8.500% | 1/18/31 | 1,000 | 1,452 |

| eBay Inc. | 1.350% | 7/15/17 | 325 | 323 |

| Ford Motor Credit Co. LLC | 2.375% | 3/12/19 | 1,700 | 1,675 |

| Ford Motor Credit Co. LLC | 3.157% | 8/4/20 | 975 | 970 |

| Home Depot Inc. | 2.250% | 9/10/18 | 975 | 997 |

| Home Depot Inc. | 2.700% | 4/1/23 | 720 | 715 |

| Home Depot Inc. | 4.400% | 3/15/45 | 780 | 807 |

| Lowe’s Cos. Inc. | 6.875% | 2/15/28 | 710 | 900 |

| Lowe’s Cos. Inc. | 6.500% | 3/15/29 | 1,000 | 1,245 |

| McDonald’s Corp. | 2.625% | 1/15/22 | 195 | 190 |

| McDonald’s Corp. | 3.250% | 6/10/24 | 140 | 139 |

| 4 | Nissan Motor Acceptance Corp. | 1.950% | 9/12/17 | 1,186 | 1,188 |

| 4 | Nissan Motor Acceptance Corp. | 1.800% | 3/15/18 | 1,100 | 1,096 |

| 4 | Nissan Motor Acceptance Corp. | 2.650% | 9/26/18 | 585 | 592 |

| PACCAR Financial Corp. | 1.600% | 3/15/17 | 1,002 | 1,004 |

| Target Corp. | 2.900% | 1/15/22 | 825 | 837 |

| Toyota Motor Credit Corp. | 1.750% | 5/22/17 | 1,200 | 1,208 |

| Toyota Motor Credit Corp. | 1.250% | 10/5/17 | 900 | 897 |

| 4 | Volkswagen Group of America | | | | |

| | Finance LLC | 2.450% | 11/20/19 | 440 | 420 |

| Wal-Mart Stores Inc. | 3.250% | 10/25/20 | 742 | 782 |

| Wal-Mart Stores Inc. | 4.250% | 4/15/21 | 1,000 | 1,106 |

| Wal-Mart Stores Inc. | 2.550% | 4/11/23 | 1,250 | 1,231 |

| Wal-Mart Stores Inc. | 5.625% | 4/15/41 | 2,790 | 3,308 |

| Wal-Mart Stores Inc. | 4.300% | 4/22/44 | 525 | 535 |

| |

| Consumer Noncyclical (3.7%) | | | | |

| AbbVie Inc. | 1.750% | 11/6/17 | 775 | 773 |

| Actavis Funding SCS | 3.000% | 3/12/20 | 475 | 474 |

| | | | | |

| Face | Market |

| Maturity Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| Actavis Funding SCS | 3.450% | 3/15/22 | 840 | 840 |

| Actavis Funding SCS | 4.850% | 6/15/44 | 450 | 445 |

| Altria Group Inc. | 4.750% | 5/5/21 | 590 | 641 |

| Altria Group Inc. | 2.850% | 8/9/22 | 455 | 445 |

| Altria Group Inc. | 4.500% | 5/2/43 | 385 | 365 |

| AmerisourceBergen Corp. | 3.500% | 11/15/21 | 1,310 | 1,337 |

| Amgen Inc. | 3.875% | 11/15/21 | 835 | 870 |

| Amgen Inc. | 5.150% | 11/15/41 | 945 | 958 |

| Anheuser-Busch InBev Worldwide Inc. | 5.375% | 1/15/20 | 820 | 907 |

| Anheuser-Busch InBev Worldwide Inc. | 4.375% | 2/15/21 | 80 | 87 |

| Anheuser-Busch InBev Worldwide Inc. | 2.500% | 7/15/22 | 4,615 | 4,431 |

| Anheuser-Busch InBev Worldwide Inc. | 3.750% | 7/15/42 | 520 | 443 |

| AstraZeneca plc | 1.950% | 9/18/19 | 390 | 388 |

| AstraZeneca plc | 2.375% | 11/16/20 | 1,180 | 1,172 |

| AstraZeneca plc | 6.450% | 9/15/37 | 615 | 767 |

| AstraZeneca plc | 4.375% | 11/16/45 | 800 | 795 |

| 1,4,5 Avery 2014 A 144A | 1.840% | 4/25/26 | 1,190 | 1,182 |

| 4 | BAT International Finance plc | 2.750% | 6/15/20 | 550 | 552 |

| 4 | BAT International Finance plc | 3.250% | 6/7/22 | 1,480 | 1,484 |

| 4 | BAT International Finance plc | 3.500% | 6/15/22 | 235 | 238 |

| 4 | Bayer US Finance LLC | 2.375% | 10/8/19 | 200 | 201 |

| 4 | Bayer US Finance LLC | 3.000% | 10/8/21 | 1,980 | 1,998 |

| 4 | Bayer US Finance LLC | 3.375% | 10/8/24 | 295 | 296 |

| Biogen Inc. | 2.900% | 9/15/20 | 550 | 548 |

| Bristol-Myers Squibb Co. | 3.250% | 11/1/23 | 990 | 1,025 |

| Cardinal Health Inc. | 1.700% | 3/15/18 | 75 | 75 |

| Cardinal Health Inc. | 2.400% | 11/15/19 | 625 | 626 |

| Cardinal Health Inc. | 3.200% | 3/15/23 | 1,065 | 1,054 |

| Cardinal Health Inc. | 3.500% | 11/15/24 | 580 | 580 |

| Cardinal Health Inc. | 4.500% | 11/15/44 | 665 | 646 |

| 4 | Cargill Inc. | 4.307% | 5/14/21 | 2,092 | 2,241 |

| 4 | Cargill Inc. | 6.875% | 5/1/28 | 645 | 790 |

| 4 | Cargill Inc. | 4.760% | 11/23/45 | 1,560 | 1,580 |

| Catholic Health Initiatives Colorado GO | 1.600% | 11/1/17 | 55 | 55 |

| Catholic Health Initiatives Colorado GO | 2.600% | 8/1/18 | 255 | 256 |

| 1 | Catholic Health Initiatives Colorado GO | 4.350% | 11/1/42 | 461 | 432 |

| Celgene Corp. | 2.250% | 5/15/19 | 160 | 158 |

| Celgene Corp. | 3.550% | 8/15/22 | 475 | 479 |

| Coca-Cola Co. | 3.300% | 9/1/21 | 300 | 313 |

| Coca-Cola Enterprises Inc. | 3.500% | 9/15/20 | 500 | 511 |

| Coca-Cola Femsa SAB de CV | 2.375% | 11/26/18 | 768 | 769 |

| Coca-Cola Femsa SAB de CV | 3.875% | 11/26/23 | 850 | 862 |

| Colgate-Palmolive Co. | 7.600% | 5/19/25 | 480 | 637 |

| Diageo Capital plc | 2.625% | 4/29/23 | 1,230 | 1,187 |

| Diageo Investment Corp. | 2.875% | 5/11/22 | 525 | 517 |

| Dignity Health California GO | 2.637% | 11/1/19 | 140 | 141 |

| Dignity Health California GO | 3.812% | 11/1/24 | 300 | 306 |

| Eli Lilly & Co. | 3.700% | 3/1/45 | 635 | 595 |

| 4 | EMD Finance LLC | 2.950% | 3/19/22 | 605 | 585 |

| 4 | EMD Finance LLC | 3.250% | 3/19/25 | 1,200 | 1,137 |

| Express Scripts Holding Co. | 2.650% | 2/15/17 | 1,072 | 1,083 |

| Express Scripts Holding Co. | 2.250% | 6/15/19 | 575 | 571 |

| Express Scripts Holding Co. | 4.750% | 11/15/21 | 160 | 172 |

| 4 | Forest Laboratories Inc. | 4.875% | 2/15/21 | 575 | 620 |

| Gilead Sciences Inc. | 2.550% | 9/1/20 | 615 | 615 |

| Gilead Sciences Inc. | 3.700% | 4/1/24 | 1,010 | 1,032 |

| Gilead Sciences Inc. | 3.500% | 2/1/25 | 560 | 563 |

| Gilead Sciences Inc. | 4.500% | 2/1/45 | 695 | 683 |

| GlaxoSmithKline Capital Inc. | 2.800% | 3/18/23 | 385 | 384 |

| GlaxoSmithKline Capital Inc. | 5.375% | 4/15/34 | 2,000 | 2,275 |

| 4 | Grupo Bimbo SAB de CV | 3.875% | 6/27/24 | 360 | 349 |

| 4 | Heineken NV | 2.750% | 4/1/23 | 340 | 328 |

| 4 | Imperial Tobacco Finance plc | 3.750% | 7/21/22 | 530 | 532 |

| 4 | Japan Tobacco Inc. | 2.100% | 7/23/18 | 545 | 547 |

| Johnson & Johnson | 5.150% | 7/15/18 | 500 | 548 |

| Kaiser Foundation Hospitals | 3.500% | 4/1/22 | 560 | 568 |

| Kaiser Foundation Hospitals | 4.875% | 4/1/42 | 355 | 364 |

| Kraft Foods Group Inc. | 2.250% | 6/5/17 | 295 | 297 |

| 4 | Kraft Heinz Foods Co. | 5.000% | 7/15/35 | 230 | 236 |

12

| | | | | |

| Vanguard Balanced Portfolio | | | | |

| |

| |

| |

| |

| Face | Market |

| Maturity Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| 4 | Kraft Heinz Foods Co. | 5.200% | 7/15/45 | 255 | 266 |

| Kroger Co. | 3.300% | 1/15/21 | 1,570 | 1,595 |

| Kroger Co. | 3.850% | 8/1/23 | 270 | 278 |

| Kroger Co. | 4.000% | 2/1/24 | 540 | 561 |

| McKesson Corp. | 3.250% | 3/1/16 | 175 | 176 |

| McKesson Corp. | 2.700% | 12/15/22 | 195 | 187 |

| McKesson Corp. | 2.850% | 3/15/23 | 190 | 182 |

| McKesson Corp. | 3.796% | 3/15/24 | 465 | 468 |

| Medtronic Inc. | 1.375% | 4/1/18 | 225 | 224 |

| Medtronic Inc. | 2.500% | 3/15/20 | 935 | 941 |

| Medtronic Inc. | 3.150% | 3/15/22 | 1,290 | 1,303 |

| Medtronic Inc. | 3.625% | 3/15/24 | 270 | 277 |

| Medtronic Inc. | 3.500% | 3/15/25 | 2,196 | 2,222 |

| Medtronic Inc. | 4.375% | 3/15/35 | 265 | 268 |

| Memorial Sloan-Kettering Cancer | | | | |

| | Center | 4.200% | 7/1/55 | 405 | 389 |

| Memorial Sloan-Kettering Cancer | | | | |

| | Center New York GO | 4.125% | 7/1/52 | 275 | 256 |

| Merck & Co. Inc. | 2.350% | 2/10/22 | 790 | 775 |

| Merck & Co. Inc. | 2.800% | 5/18/23 | 1,175 | 1,169 |

| Merck & Co. Inc. | 2.750% | 2/10/25 | 1,210 | 1,176 |

| Merck & Co. Inc. | 4.150% | 5/18/43 | 760 | 751 |

| Molson Coors Brewing Co. | 3.500% | 5/1/22 | 690 | 694 |

| Molson Coors Brewing Co. | 5.000% | 5/1/42 | 215 | 208 |

| New York & Presbyterian Hospital | 4.024% | 8/1/45 | 735 | 693 |

| Novartis Capital Corp. | 3.400% | 5/6/24 | 415 | 428 |

| Novartis Capital Corp. | 4.400% | 5/6/44 | 640 | 665 |

| Partners Healthcare System | | | | |

| | Massachusetts GO | 3.443% | 7/1/21 | 50 | 51 |

| PepsiCo Inc. | 3.125% | 11/1/20 | 330 | 342 |

| PepsiCo Inc. | 2.750% | 3/5/22 | 670 | 672 |

| PepsiCo Inc. | 4.000% | 3/5/42 | 845 | 814 |

| Pfizer Inc. | 6.200% | 3/15/19 | 1,400 | 1,576 |

| Pfizer Inc. | 3.000% | 6/15/23 | 755 | 768 |

| Philip Morris International Inc. | 4.500% | 3/26/20 | 250 | 272 |

| Philip Morris International Inc. | 4.125% | 5/17/21 | 1,025 | 1,096 |

| Philip Morris International Inc. | 2.500% | 8/22/22 | 575 | 562 |

| Philip Morris International Inc. | 2.625% | 3/6/23 | 1,150 | 1,126 |

| 1 | Procter & Gamble - Esop | 9.360% | 1/1/21 | 1,072 | 1,282 |

| 4 | Roche Holdings Inc. | 6.000% | 3/1/19 | 333 | 373 |

| 4 | Roche Holdings Inc. | 2.875% | 9/29/21 | 850 | 860 |

| 4 | SABMiller Holdings Inc. | 2.450% | 1/15/17 | 400 | 404 |

| 4 | SABMiller Holdings Inc. | 3.750% | 1/15/22 | 400 | 411 |

| Sanofi | 4.000% | 3/29/21 | 1,130 | 1,207 |

| St. Jude Medical Inc. | 2.500% | 1/15/16 | 666 | 666 |

| The Pepsi Bottling Group Inc. | 7.000% | 3/1/29 | 500 | 671 |

| Thermo Fisher Scientific Inc. | 1.850% | 1/15/18 | 530 | 529 |

| Unilever Capital Corp. | 4.250% | 2/10/21 | 2,805 | 3,061 |

| |

| Energy (1.6%) | | | | |

| 4 | BG Energy Capital plc | 4.000% | 10/15/21 | 200 | 207 |

| BP Capital Markets plc | 1.846% | 5/5/17 | 650 | 653 |

| BP Capital Markets plc | 4.750% | 3/10/19 | 795 | 852 |

| BP Capital Markets plc | 2.315% | 2/13/20 | 160 | 158 |

| BP Capital Markets plc | 4.500% | 10/1/20 | 400 | 428 |

| BP Capital Markets plc | 3.062% | 3/17/22 | 1,100 | 1,078 |

| BP Capital Markets plc | 3.245% | 5/6/22 | 650 | 647 |

| BP Capital Markets plc | 2.500% | 11/6/22 | 500 | 477 |

| BP Capital Markets plc | 3.994% | 9/26/23 | 420 | 426 |

| BP Capital Markets plc | 3.814% | 2/10/24 | 650 | 648 |

| BP Capital Markets plc | 3.506% | 3/17/25 | 1,280 | 1,245 |

| Chevron Corp. | 3.191% | 6/24/23 | 1,235 | 1,240 |

| ConocoPhillips | 5.200% | 5/15/18 | 1,500 | 1,602 |

| ConocoPhillips Co. | 2.875% | 11/15/21 | 375 | 364 |

| ConocoPhillips Co. | 3.350% | 11/15/24 | 1,095 | 1,017 |

| ConocoPhillips Co. | 3.350% | 5/15/25 | 330 | 297 |

| ConocoPhillips Co. | 4.300% | 11/15/44 | 1,570 | 1,299 |

| Devon Energy Corp. | 5.850% | 12/15/25 | 1,310 | 1,275 |

| Devon Energy Corp. | 5.000% | 6/15/45 | 565 | 428 |

| | | | | |

| Face | Market |

| Maturity | Amount | Value • |

| | Coupon | Date | ($000) | ($000) |

| Dominion Gas Holdings LLC | 3.550% | 11/1/23 | 470 | 464 |

| Encana Corp. | 6.500% | 5/15/19 | 810 | 838 |

| EOG Resources Inc. | 5.625% | 6/1/19 | 425 | 464 |

| EOG Resources Inc. | 2.625% | 3/15/23 | 1,050 | 991 |

| Halliburton Co. | 3.375% | 11/15/22 | 635 | 627 |

| Halliburton Co. | 3.500% | 8/1/23 | 1,980 | 1,931 |

| Occidental Petroleum Corp. | 4.100% | 2/1/21 | 1,120 | 1,175 |

| Occidental Petroleum Corp. | 2.700% | 2/15/23 | 250 | 235 |

| Phillips 66 | 4.875% | 11/15/44 | 280 | 248 |

| 4 | Schlumberger Holdings Corp. | 3.000% | 12/21/20 | 800 | 790 |

| 4 | Schlumberger Investment SA | 2.400% | 8/1/22 | 630 | 599 |

| Schlumberger Investment SA | 3.650% | 12/1/23 | 1,120 | 1,145 |

| Shell International Finance BV | 4.375% | 3/25/20 | 800 | 858 |

| Shell International Finance BV | 2.250% | 11/10/20 | 1,600 | 1,575 |

| Shell International Finance BV | 4.125% | 5/11/35 | 1,200 | 1,142 |

| Shell International Finance BV | 5.500% | 3/25/40 | 345 | 371 |

| Shell International Finance BV | 4.375% | 5/11/45 | 2,150 | 2,032 |

| Suncor Energy Inc. | 3.600% | 12/1/24 | 625 | 592 |

| Suncor Energy Inc. | 5.950% | 12/1/34 | 500 | 499 |

| Sunoco Logistics Partners | | | | |

| | Operations LP | 4.400% | 4/1/21 | 1,225 | 1,187 |

| Total Capital International SA | 1.550% | 6/28/17 | 1,365 | 1,365 |

| Total Capital International SA | 2.700% | 1/25/23 | 885 | 843 |

| Total Capital International SA | 3.750% | 4/10/24 | 1,400 | 1,424 |

| Total Capital SA | 2.125% | 8/10/18 | 850 | 852 |

| TransCanada PipeLines Ltd. | 3.800% | 10/1/20 | 1,220 | 1,249 |

| |

| Other Industrial (0.1%) | | | | |

| 4 | Hutchison Whampoa International | | | | |