Item 8: Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9: Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10: Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Not applicable. The Trustees’ Fees and Expenses are included in the financial statements filed under Item 7 of this Form.

Item 11: Statement Regarding Basis for Approval of Investment Advisory Contracts.

Trustees Approve Advisory Arrangement – VVIF Balanced Portfolio

The board of trustees of Vanguard Variable Insurance Funds Balanced Portfolio has renewed the portfolio’s investment advisory arrangement with Wellington Management Company LLP (Wellington Management). The board determined that renewing the portfolio’s advisory arrangement was in the best interests of the portfolio and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Oversight and Manager Search team (OMS), which is responsible for fund and advisor oversight and product management. OMS met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by OMS. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the portfolio’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on OMS’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the portfolio’s investment management services over both the short and long term; it also took into account the organizational depth and stability of the advisor. The board considered that Wellington Management, founded in 1928, is among the nation’s oldest and most respected institutional investment managers. The portfolio managers leverage tenured teams of equity and fixed income research analysts who conduct detailed fundamental analysis of their respective industries and companies. In managing the equity portion of the portfolio, the advisor employs a bottom-up, fundamental research approach focusing on high-quality companies with above-average yields, strong balance sheets, sustainable competitive advantages, and attractive valuations. In managing the fixed income portion of the portfolio, the advisor focuses on investment-grade corporate bonds. The firm has advised the portfolio since its inception in 1991.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the portfolio, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the portfolio’s expense ratio was below the average expense ratio charged by funds in its peer group and that the portfolio’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of Wellington Management in determining whether to approve the advisory fee, because Wellington Management is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the portfolio’s shareholders benefit from economies of scale because of breakpoints in the portfolio’s advisory fee schedule. The breakpoints reduce the effective rate of the fee as the portfolio’s assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

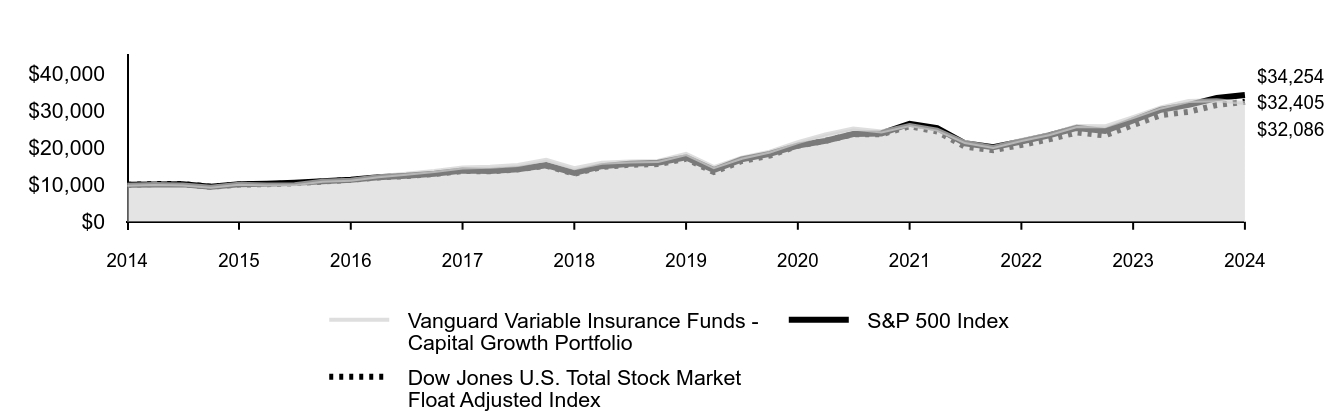

Trustees Approve Advisory Arrangement – VVIF Capital Growth Portfolio

The board of trustees of Vanguard Variable Insurance Funds Capital Growth Portfolio has renewed the portfolio’s investment advisory arrangement with PRIMECAP Management Company (PRIMECAP). The board determined that renewing the portfolio’s advisory arrangement was in the best interests of the portfolio and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Oversight and Manager Search team (OMS), which is responsible for fund and advisor oversight and product management. OMS met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by OMS. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the portfolio’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on OMS’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the portfolio’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that PRIMECAP, founded in 1983, is recognized for its long-term approach to equity investing. Five experienced portfolio managers are responsible for separate sub-portfolios, and each portfolio manager employs a fundamental, research-driven approach in seeking to identify companies with long-term growth potential that the market has yet to appreciate. The multi-counselor approach that the advisor employs is designed to emphasize individual decision-making and enable the portfolio managers to invest only in their highest-conviction ideas. PRIMECAP’s fundamental research focuses on developing opinions independent from Wall Street’s consensus and maintaining a long-term horizon. The firm has managed the portfolio since its inception in 2002.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the portfolio, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the portfolio’s expense ratio was below the average expense ratio charged by funds in its peer group and that the portfolio’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of PRIMECAP in determining whether to approve the advisory fee, because PRIMECAP is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the portfolio realizes economies of scale that are built into the negotiated advisory fee rate without any need for asset-level breakpoints. The advisory fee rate is very low relative to the average rate paid by funds in the portfolio’s peer group.

The board will consider whether to renew the advisory arrangement again after a one-year period.

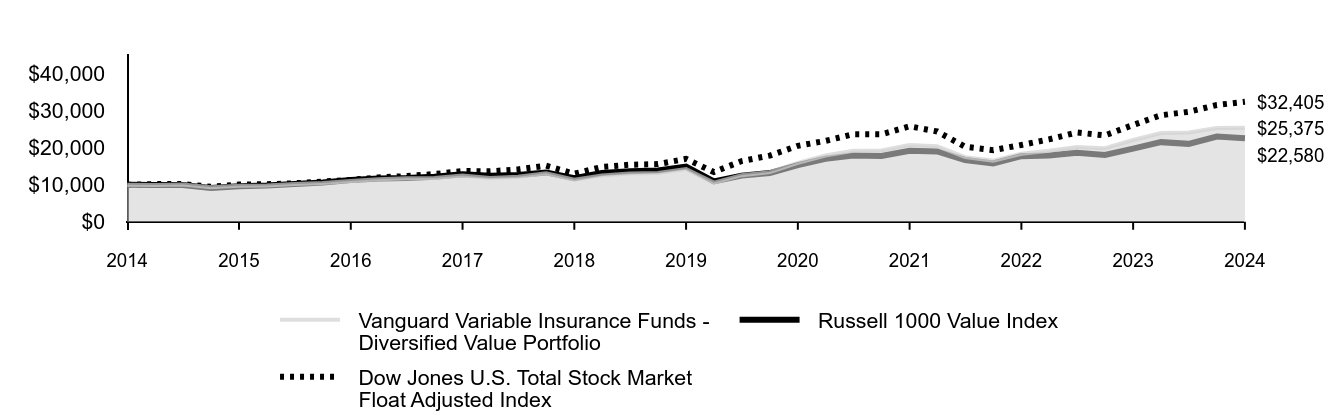

Trustees Approve Advisory Arrangements – Diversified Value Portfolio

The board of trustees of Vanguard Variable Insurance Funds Diversified Value Portfolio has renewed the portfolio’s investment advisory arrangement with Hotchkis and Wiley Capital Management, LLC (Hotchkis and Wiley), and Lazard Asset Management LLC (Lazard). The board determined that renewing the portfolio’s advisory arrangements was in the best interests of the portfolio and its shareholders.

The board based its decisions upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Oversight and Manager Search team (OMS), which is responsible for fund and advisor oversight and product management. OMS met regularly with the advisors and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by OMS. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the portfolio’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on OMS’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board considered the quality of the investment management services to be provided by Hotchkis and Wiley and Lazard and took into account the organizational depth and stability of each advisor. The board considered the following:

Hotchkis and Wiley. Founded in 1980, Hotchkis and Wiley is a value-oriented firm that manages various large-, mid-, and small-cap portfolios. Hotchkis and Wiley invests in companies where it believes that the present value of future cash flows exceeds the market price. The firm believes that the market frequently undervalues companies because of the extrapolation of current trends, while capital flows normally cause a company’s returns and profitability to normalize over the long term. Hotchkis and Wiley seeks to identify these companies with a disciplined, bottom-up research process. The portfolio managers leverage the support of a broad analyst team, which is organized into sector teams in an effort to better understand the impact that industry dynamics and macroeconomic risk factors might have on individual companies. Hotchkis and Wiley has managed a portion of the portfolio since 2019.

Lazard. Lazard, a subsidiary of the investment bank Lazard Ltd., provides investment management services for clients around the world in a variety of investment mandates, including international equities, domestic equities, and fixed income securities.

The investment team at Lazard employs a relative value, bottom-up stock selection process to identify stocks with sustainable financial productivity and attractive valuations. Utilizing scenario analysis, the team seeks to understand the durability and future direction of financial productivity and valuation. Lazard has managed a portion of the portfolio since 2019.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted approval of the advisory arrangements.

Investment performance

The board considered the performance of each advisor, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangements should continue.

Cost

The board concluded that the portfolio’s expense ratio was below the average expense ratio charged by funds in its peer group and that the portfolio’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of Hotchkis and Wiley and Lazard in determining whether to approve the advisory fees, because the firms are independent of Vanguard and the advisory fees are the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the portfolio will realize economies of scale that are built into the advisory fee rates negotiated with Hotchkis and Wiley and Lazard without any need for asset-level breakpoints. The advisory fee rates are very low relative to the average rate paid by funds in the portfolio’s peer group.

The board will consider whether to renew the advisory arrangements again after a one-year period.

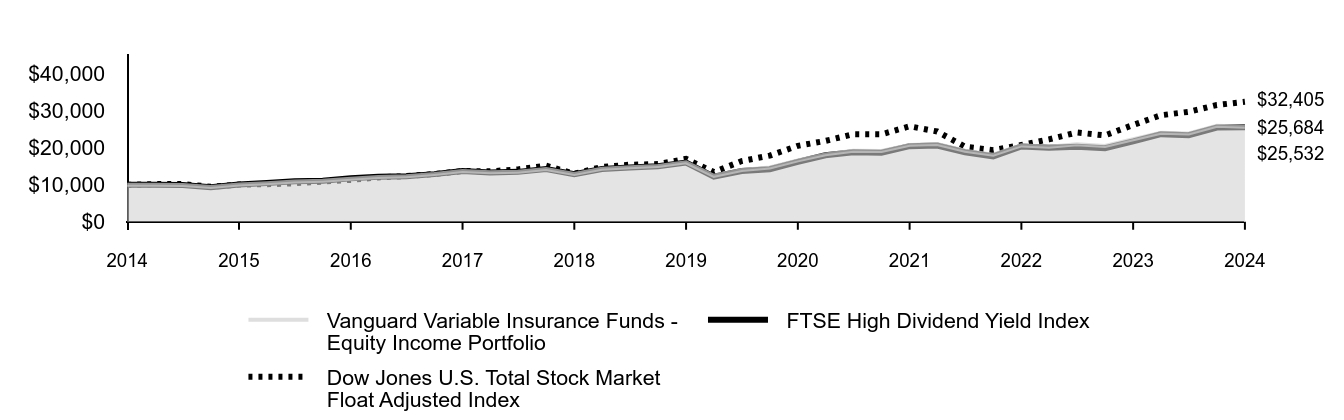

Trustees Approve Advisory Arrangements – VVIF Equity Income Portfolio

The board of trustees of Vanguard Variable Insurance Funds Equity Income Portfolio has renewed the portfolio’s investment advisory arrangement with Wellington Management Company LLP (Wellington Management). The board determined that renewing the portfolio’s advisory arrangement was in the best interests of the portfolio and its shareholders. The Vanguard Group, Inc. (Vanguard), through its Quantitative Equity Group is also an advisor to the portfolio.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Oversight and Manager Search team (OMS), which is responsible for fund and advisor oversight and product management. OMS met regularly with the advisors and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by OMS. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the portfolio’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on OMS’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of the portfolio’s investment management services over both the short and long term, and took into account the organizational depth and stability of each advisor. The board considered that Wellington Management, founded in 1928, is among the nation’s oldest and most respected institutional investment managers. Utilizing fundamental research, Wellington Management seeks to build a portfolio with an above-market yield, superior growth rate, and very attractive valuation. While every company purchased for the portfolio will pay a dividend, the goal is to build a portfolio with an above-market yield in aggregate, allowing for individual companies with below-market yields. Normalized earnings, normalized price-to-earnings ratios, and improving returns on capital are key to the research process. The firm has advised a portion of the portfolio since 2003.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangements.

Investment performance

The board considered the short- and long-term performance of the advisor, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that the portfolio’s expense ratio was below the average expense ratio charged by funds in its peer group and that the portfolio’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of Wellington Management in determining whether to approve the advisory fee, because Wellington Management is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the portfolio realizes economies of scale that are built into the advisory fee rate negotiated with Wellington Management without any need for asset-level breakpoints. Wellington Management’s advisory fee rate is very low relative to the average rate paid by funds in the portfolio’s peer group.

The board will consider whether to renew the advisory arrangement again after a one-year period.

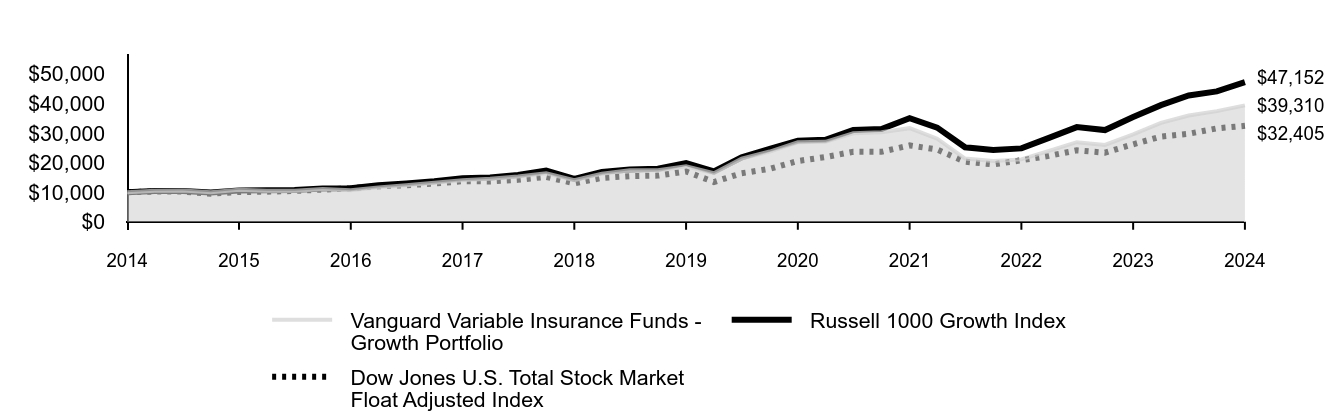

Trustees Approve Advisory Arrangement – VVIF Growth Portfolio

The board of trustees of Vanguard Variable Insurance Funds Growth Portfolio has renewed the portfolio’s investment advisory arrangement with Wellington Management Company LLP (Wellington Management). The board determined that renewing the portfolio’s advisory arrangement was in the best interests of the portfolio and its shareholders.

The board based its decisions upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Oversight and Manager Search team, which is responsible for fund and advisor oversight and product management. OMS met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by OMS. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the portfolio’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on OMS’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the portfolio’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Wellington Management, founded in 1928, is among the nation’s oldest and most respected institutional investment managers. The firm employs a traditional, bottom-up fundamental research approach to identify companies with sustainable competitive advantages that can drive a higher rate or longer duration of growth than the market expects, while trading at reasonable valuations. Wellington Management has advised the portfolio since 2010.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangements.

Investment performance

The board considered the short- and long-term performance of the portfolio, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the portfolio’s expense ratio was below the average expense ratio charged by funds in its peer group and that the portfolio’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of Wellington Management in determining whether to approve the advisory fee, because the firm is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the portfolio realizes economies of scale that are built into the advisory fee rate negotiated with Wellington Management without any need for asset-level breakpoints. The advisory fee rate is very low relative to the average rate paid by funds in the portfolio’s peer group.

The board will consider whether to renew the advisory arrangement again after a one-year period.

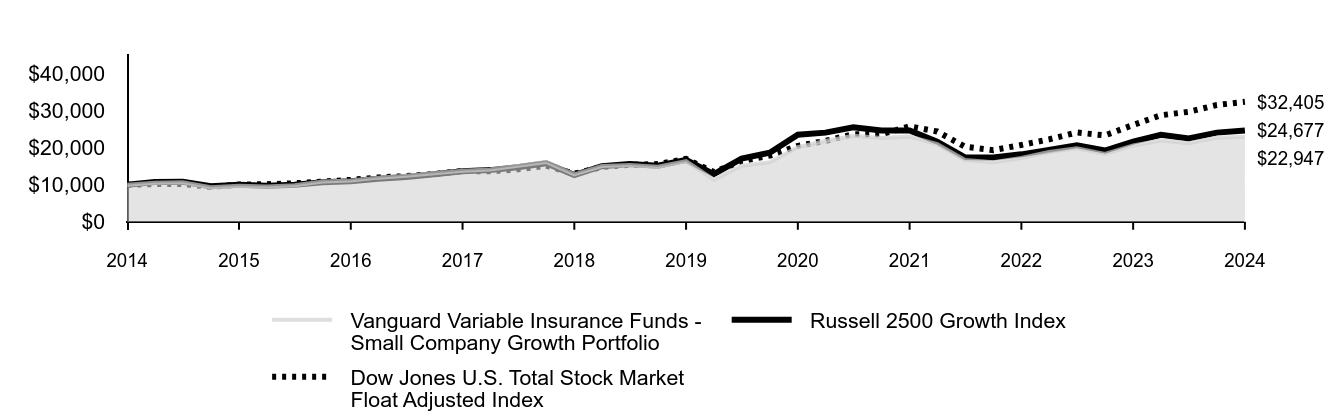

Trustees Approve Advisory Arrangements – VVIF Small Company Growth Portfolio

The board of trustees of Vanguard Variable Insurance Funds Small Company Growth Portfolio has renewed the portfolio’s investment advisory arrangements with ArrowMark Colorado Holdings, LLC (ArrowMark Partners). The board determined that renewing the portfolio’s advisory arrangements was in the best interests of the portfolio and its shareholders. The Vanguard Group, Inc. (Vanguard), through its Quantitative Equity Group is also an advisor to the fund.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Oversight and Manager Search team (OMS), which is responsible for fund and advisor oversight and product management. OMS met regularly with the advisors and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by OMS. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the portfolio’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on OMS’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of the portfolio’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that ArrowMark Partners, founded in 2007, offers a wide range of investment strategies, including equity, fixed income, and structured products to institutional, high-net-worth, and retail investors. The team is led by two experienced co-portfolio managers and supported by six equity research analysts and a research associate. ArrowMark Partners has managed a portion of the portfolio since 2016.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the performance of the portfolio including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the portfolio’s expense ratio was below the average expense ratio charged by funds in its peer group and that the portfolio’s advisory fee rate was also below the peer-group average.

The board did not consider the profitability of ArrowMark Partners in determining whether to approve the advisory fee, because the firm is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the portfolio realizes economies of scale that are built into the negotiated advisory fee rate with ArrowMark Partners without any need for asset-level breakpoints. The advisory fee rate is very low relative to the average rate paid by funds in the portfolio’s peer group.

The board will consider whether to renew the advisory arrangement again after a one-year period.