- UCB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

United Community Banks (UCB) 8-KResults of Operations and Financial Condition

Filed: 26 Apr 12, 12:00am

| United Community Banks, Inc. Investor Presentation First Quarter 2012 April 26,2012 Jimmy C. Tallent President & CEO Rex S. Schuette EVP & CFO rex_schuette@ucbi.com (706) 781-2266 David P. Shearrow EVP & CRO |

| 2 Cautionary Statement This news release contains forward-looking statements, as defined by federal securities laws, including statements about United’s financial outlook and business environment. These statements are based on current expectations and are provided to assist in the understanding of future financial performance. Such performance involves risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements. For a discussion of some of the risks and other factors that may cause such forward-looking statements to differ materially from actual results, please refer to United Community Banks, Inc.’s filings with the Securities and Exchange Commission including its 2011 Annual Report on Form 10-K under the sections entitled “Forward-Looking Statements”. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements. |

| 3 Non-GAAP Measures This presentation also contains financial measures determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). Such non-GAAP financial measures include the following: net interest margin – pre credit, core net interest margin, core net interest revenue, core fee revenue, core operating expense, core earnings, net operating (loss) income and net operating (loss) earnings per share, tangible common equity to tangible assets, tangible equity to tangible assets and tangible common equity to risk-weighted assets. The most comparable GAAP measures to these measures are: net interest margin, net interest revenue, fee revenue, operating expense, net (loss) income, diluted (loss) earnings per share and equity to assets. Management uses these non-GAAP financial measures because we believe it is useful for evaluating our operations and performance over periods of time, as well as in managing and evaluating our business and in discussions about our operations and performance. Management believes these non-GAAP financial measures provide users of our financial information with a meaningful measure for assessing our financial results and credit trends, as well as for comparison to financial results for prior periods. These non-GAAP financial measures should not be considered as a substitute for financial measures determined in accordance with GAAP and may not be comparable to other similarly titled financial measures used by other companies. For a reconciliation of the differences between our non-GAAP financial measures and the most comparable GAAP measures, please refer to the ‘Non-GAAP Reconcilement Tables’ at the end of the Appendix to this presentation. |

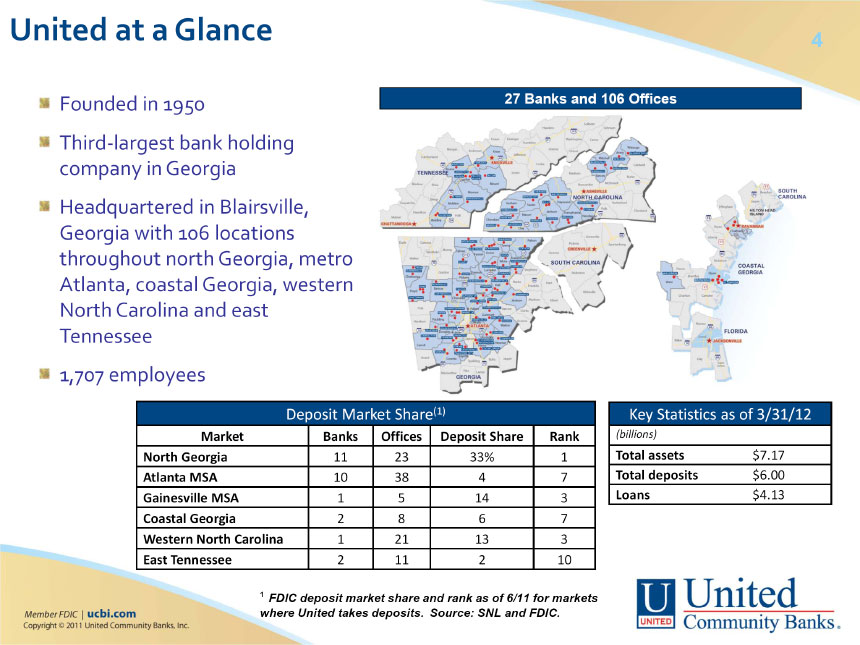

| 4 United at a Glance Founded in 1950 Third-largest bank holding company in Georgia Headquartered in Blairsville, Georgia with 106 locations throughout north Georgia, metro Atlanta, coastal Georgia, western North Carolina and east Tennessee 1,707 employees 27 Banks and 106 Offices Deposit Market Share(1) Market Banks Offices Deposit Share Rank North Georgia 11 23 33% 1 Atlanta MSA 10 38 4 7 Gainesville MSA 1 5 14 3 Coastal Georgia 2 8 6 7 Western North 1 21 13 3 East Tennessee Carolina 2 11 2 10 Key Statistics as of 3/31/12 (billions) Total assets $7.17 Total deposits $6.00 Loans $4.13 ¹ FDIC deposit market share and rank as of 6/11 for markets where United takes deposits. Source: SNL and FDIC. |

| 5 Highlights First Quarter Improving Quarterly Results Net Income of $11.5 million, or 15 cents per share Third quarterly profit in past four quarters Core earnings (pre-tax, pre-credit) of $29.3 million; highest level since 4Q 2009 Loan Growth Traction Second linked-quarter with loan growth, first time since March 2008 Strong Core Transaction Deposit Growth Up 21% annualized Building customer deposit base Represents 52% of total customer deposits compared to 34% Non Performing Assets Hold Steady Charge-offs declining |

| 6 LOAN PORTFOLIO & CREDIT QUALITY |

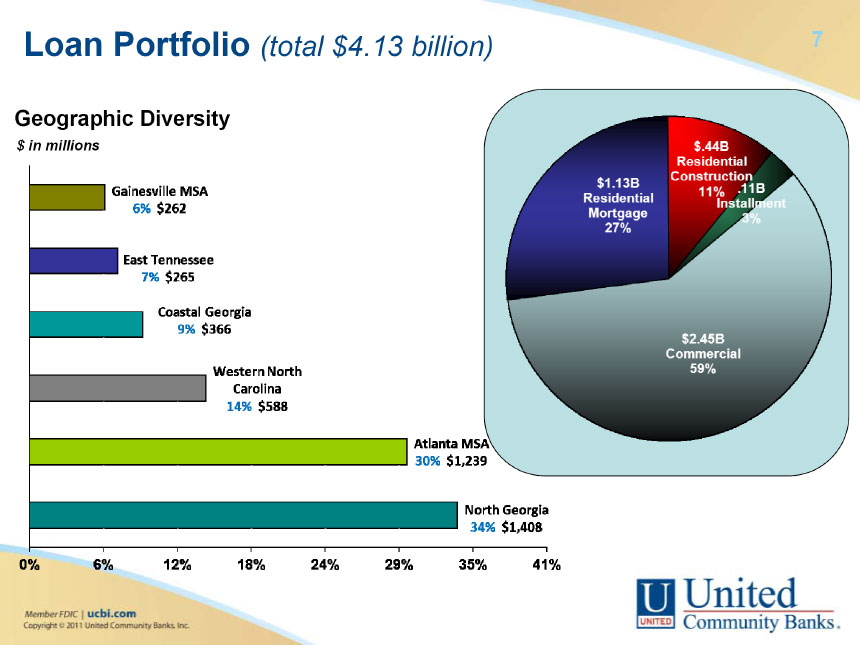

| 7 Loan Portfolio (total $4.13 billion) Geographic Diversity $ in millions |

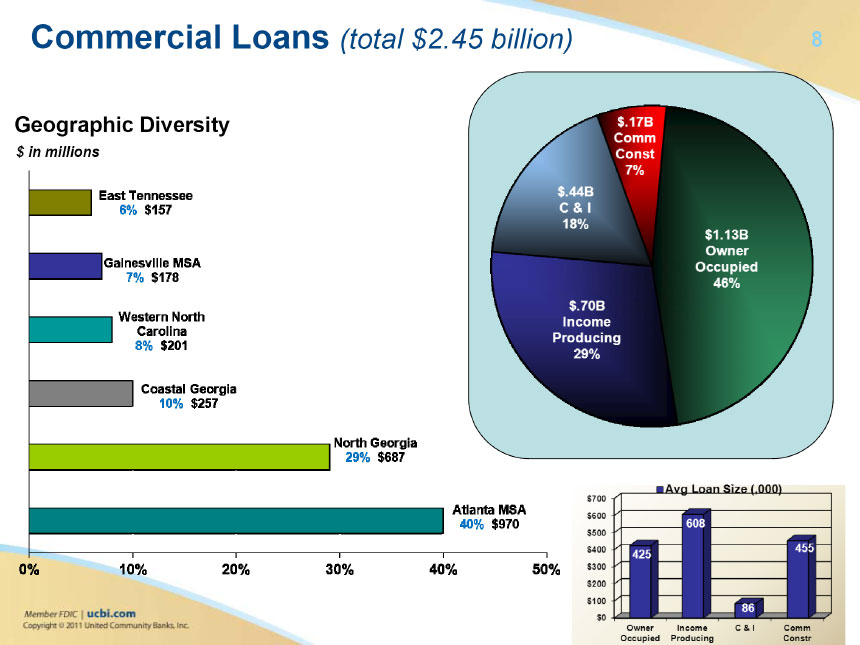

| 8 Commercial Loans (total $2.45 billion) Geographic Diversity $ in millions |

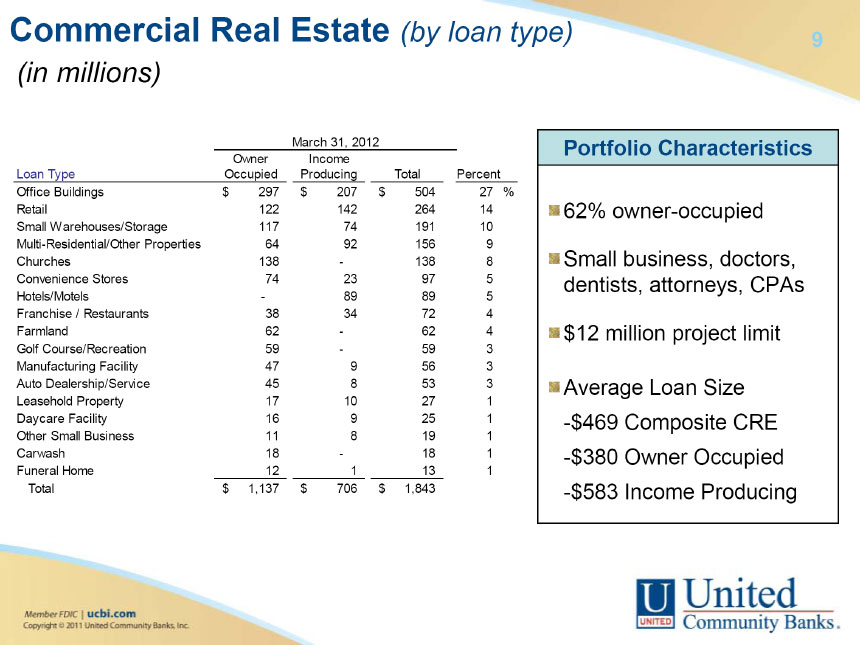

| 9 Commercial Real Estate (by loan type) (in millions) March 31, 2012 Loan Type Owner Occupied Income Producing Total Percent Office Buildings $297 $207 $504 27% Retail 122 142 264 14 Small Warehouses/Storage 117 74 191 10 Multi-Residential/Other Properties 64 92 156 9 Churches 138 - 138 8 Convenience Stores 74 23 97 5 Hotels/Motels - 89 89 5 Franchise / Restaurants 38 34 72 4 Farmland 62 - 62 4 Golf Course/Recreation 59 - 59 3 Manufacturing Facility 47 9 56 3 Auto Dealership/Service 45 8 53 3 Leasehold Property 17 10 27 1 Daycare Facility 16 9 25 1 Other Small Business 11 8 19 1 Carwash 18 - 18 1 Funeral Home 12 1 13 1 Total $1,137 $706 $1,843 Portfolio Characteristics 62% owner-occupied Small business, doctors, dentists, attorneys, CPAs $12 million project limit Average Loan Size -$469 Composite CRE -$380 Owner Occupied -$583 Income Producing |

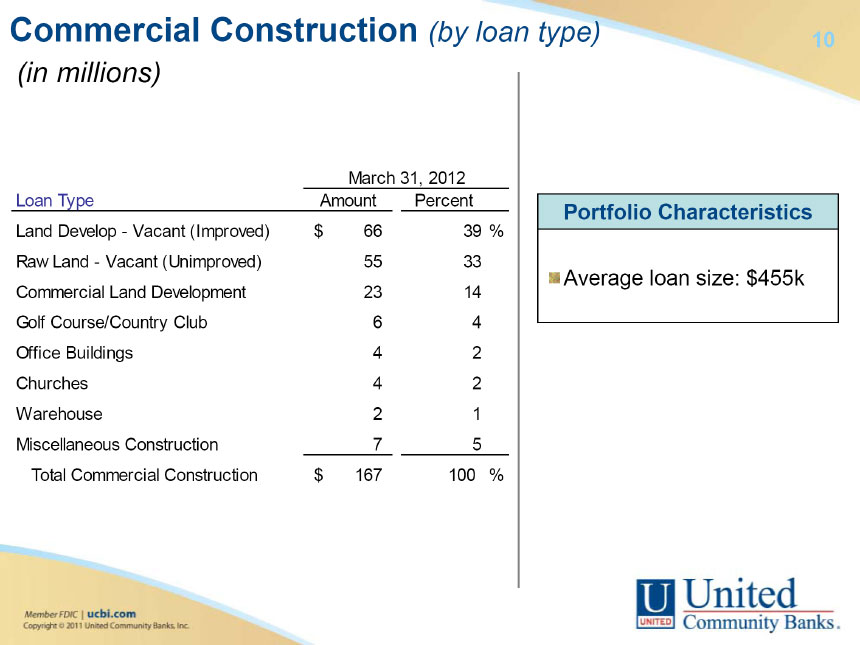

| 10 Commercial Construction (by loan type) (in millions) March 31, 2012 Loan Type Amount Percent Land Develop - Vacant (Improved) $66 39% Raw Land - Vacant (Unimproved) 55 33 Commercial Land Development 23 14 Golf Course/Country Club 6 4 Office Buildings 4 2 Churches 4 2 Warehouse 2 1 Miscellaneous Construction 7 5 Total Commercial Construction $167 100% Portfolio Characteristics Average loan size: $455k |

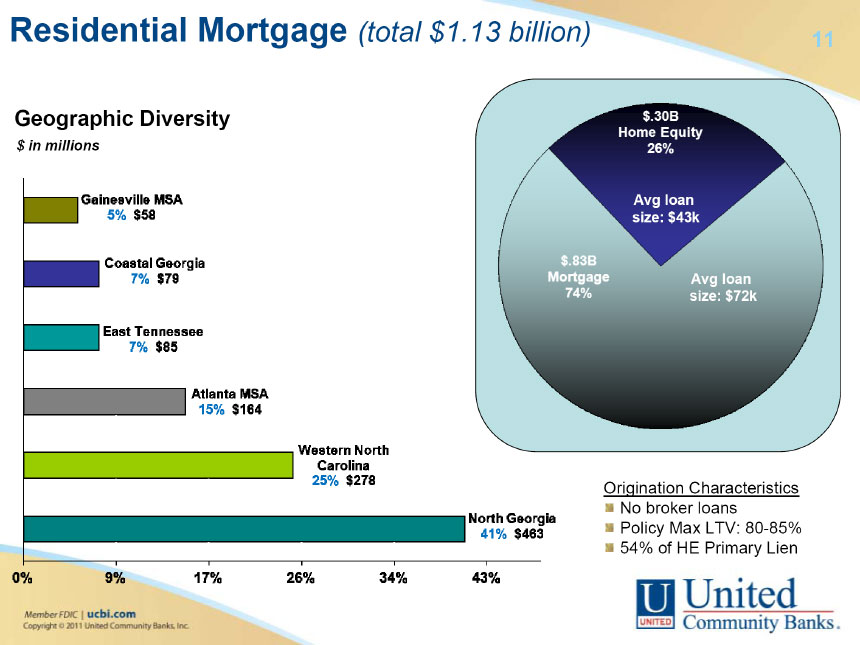

| 11 Residential Mortgage (total $1.13 billion) Geographic Diversity $ in millions Origination Characteristics No broker loans Policy Max LTV: 80-85% 54% of HE Primary Lien |

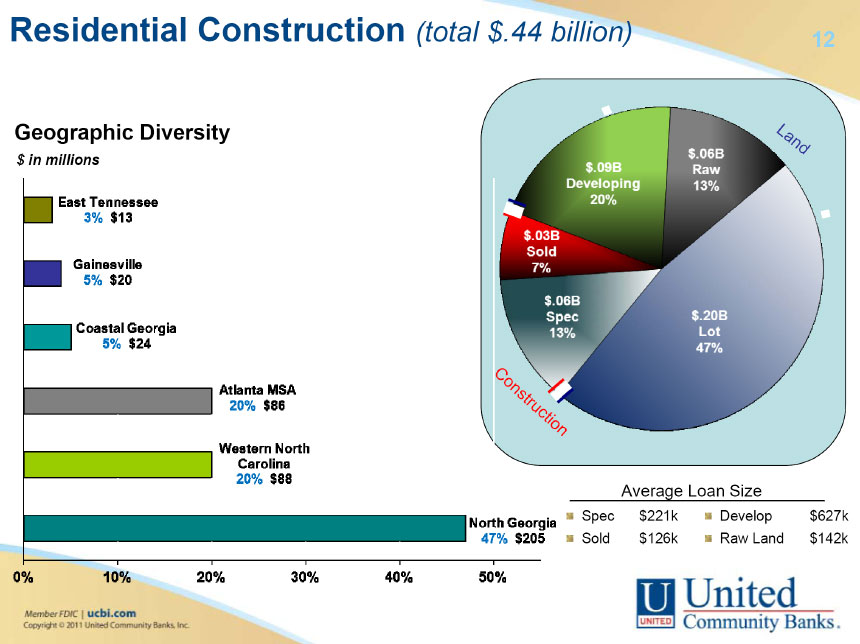

| 12 Residential Construction (total $.44 billion) Geographic Diversity $ in millions Average Loan Size Spec $221k Sold $126k Develop $627k Raw Land $142k |

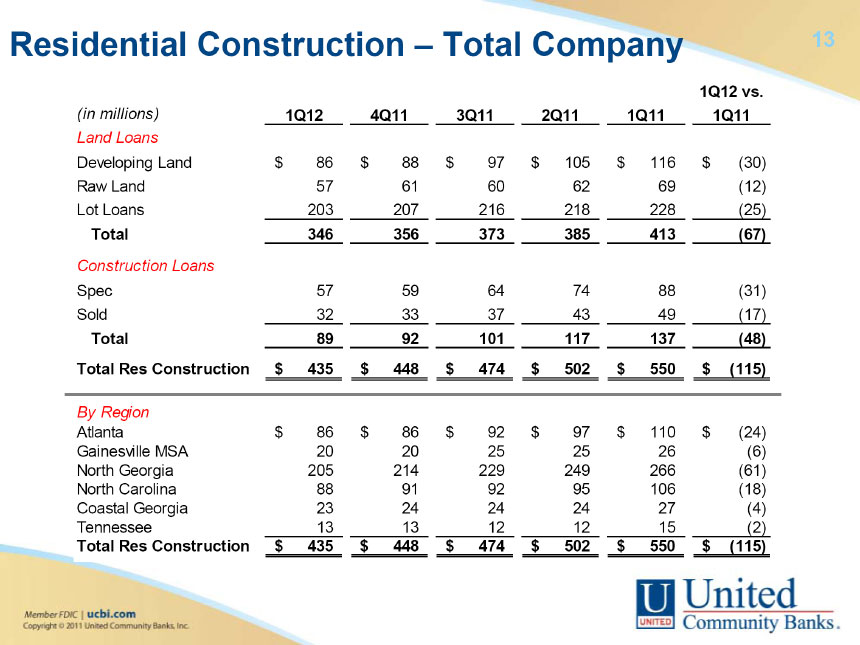

| 13 Residential Construction – Total Company (in millions) 1Q12 4Q11 3Q11 2Q11 1Q11 1Q12 vs. 1Q11 Land Loans Developing Land $86 $88 $97 $105 $116 $(30) Raw Land 57 61 60 62 69 (12) Lot Loans 203 207 216 218 228 (25) Total 346 356 373 385 413 (67) Construction Loans Spec 57 59 64 74 88 (31) Sold 32 33 37 43 49 (17) Total 89 92 101 117 137 (48) Total Res Construction $435 $448 $474 $502 $550 $(115) By Region Atlanta $86 $86 $92 $97 $110 $(24) Gainesville MSA 20 20 25 25 26 (6) North Georgia 205 214 229 249 266 (61) North Carolina 88 91 92 95 106 (18) Coastal Georgia 23 24 24 24 27 (4) Tennessee 13 13 12 12 15 (2) Total Res Construction $435 $448 $474 $502 $550 $(115) |

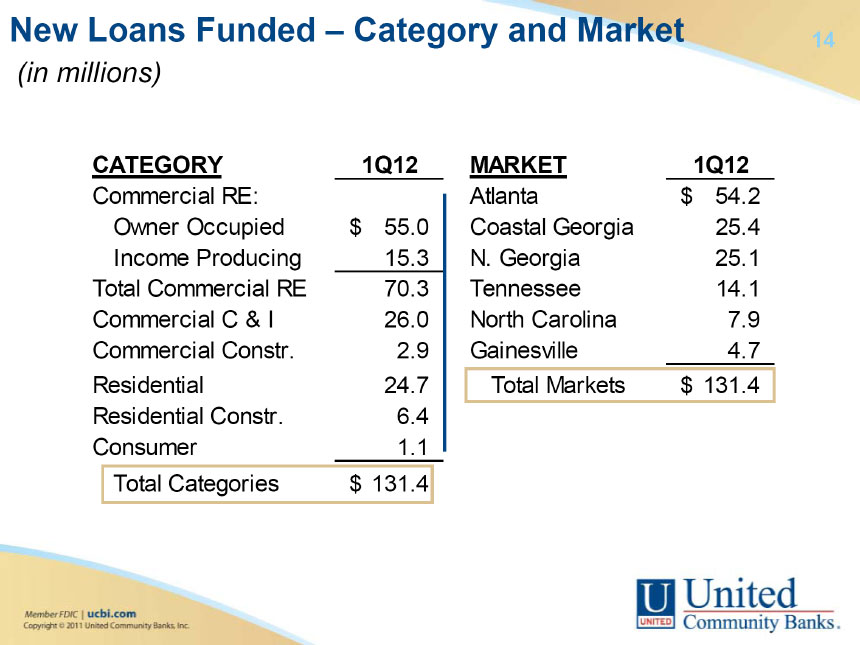

| 14 New Loans Funded – Category and Market (in millions) CATEGORY 1Q12 Commercial RE: Owner Occupied $55.0 Income Producing 15.3 Total Commercial RE 70.3 Commercial C & I 26.0 Commercial Constr. 2.9 Residential 24.7 Residential Constr. 6.4 Consumer 1.1 Total Categories $131.4 MARKET 1Q12 Atlanta $54.2 Coastal Georgia 25.4 N. Georgia 25.1 Tennessee 14.1 North Carolina 7.9 Gainesville 4.7 Total Markets $131.4 |

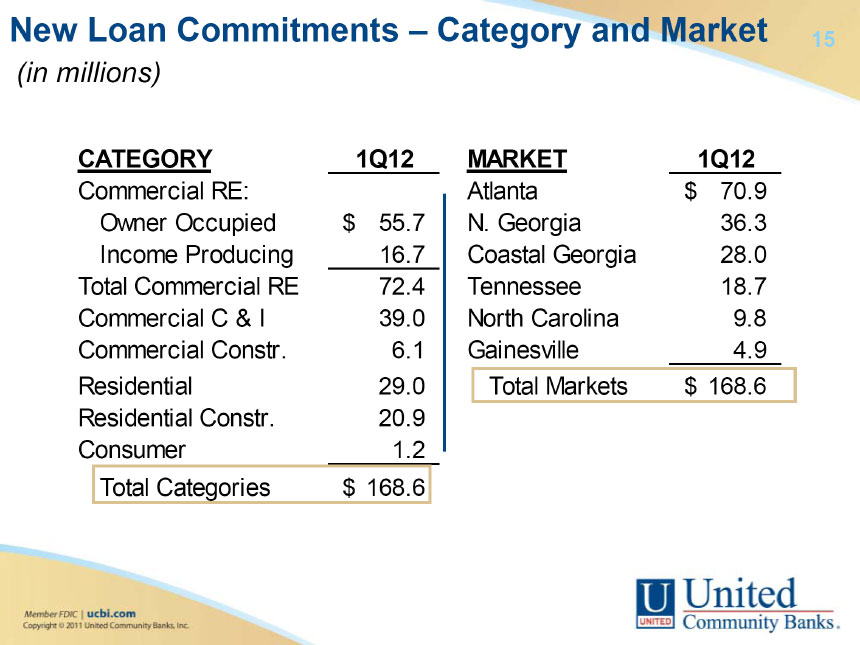

| 15 New Loan Commitments – Category and Market (in millions) CATEGORY 1Q12 Commercial RE: Owner Occupied $55.7 Income Producing 16.7 Total Commercial RE 72.4 Commercial C & I 39.0 Commercial Constr. 6.1 Residential 29.0 Residential Constr. 20.9 Consumer 1.2 Total Categories $168.6 MARKET 1Q12 Atlanta $70.9 N. Georgia 36.3 Coastal Georgia 28.0 Tennessee 18.7 North Carolina 9.8 Gainesville 4.9 Total Markets $168.6 |

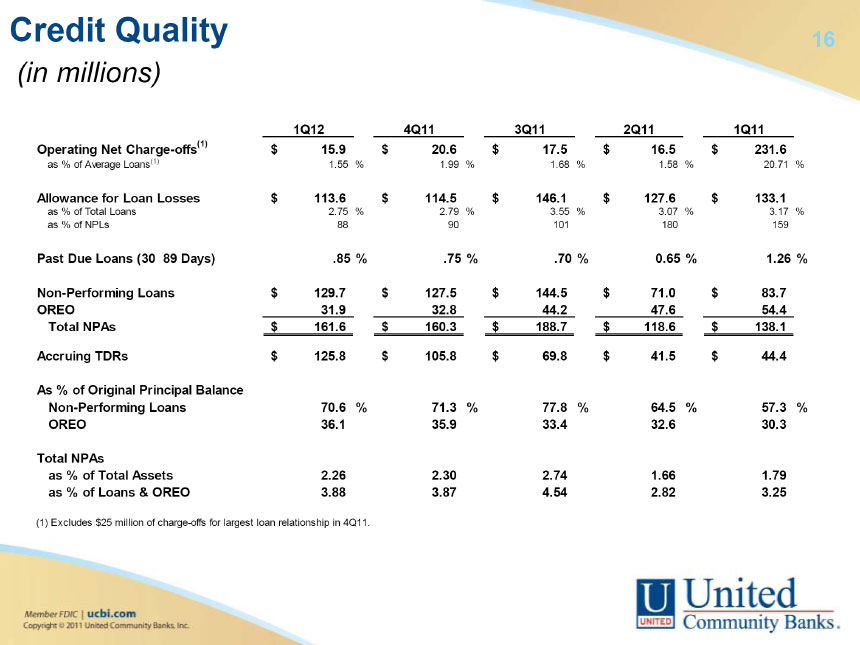

| 16 Credit Quality (in millions) 1Q12 4Q11 3Q11 2Q11 1Q11 Operating Net Charge-offs(1) $15.9 $20.6 $17.5 $16.5 $231.6 as % of Average Loans(1) 1.55% 1.99% 1.68% 1.58% 20.71% Allowance for Loan Losses $113.6 $114.5 $146.1 $127.6 $133.1 as % of Total Loans 2.75% 2.79% 3.55% 3.07% 3.17% as % of NPLs 88 90 101 180 159 Past Due Loans (30 89 Days) .85% .75% .70% 0.65% 1.26% Non-Performing Loans $129.7 $127.5 $144.5 $71.0 $83.7 OREO 31.9 32.8 44.2 47.6 54.4 Total NPAs $161.6 $160.3 $188.7 $118.6 $138.1 Accruing TDRs $125.8 $105.8 $69.8 $41.5 $44.4 As % of Original Principal Balance Non-Performing Loans 70.6% 71.3% 77.8% 64.5% 57.3% OREO 36.1 35.9 33.4 32.6 30.3 Total NPAs as % of Total Assets 2.26 2.30 2.74 1.66 1.79 as % of Loans & OREO 3.88 3.87 4.54 2.82 3.25 (1) Excludes $25 million of charge-offs for largest loan relationship in 4Q11. |

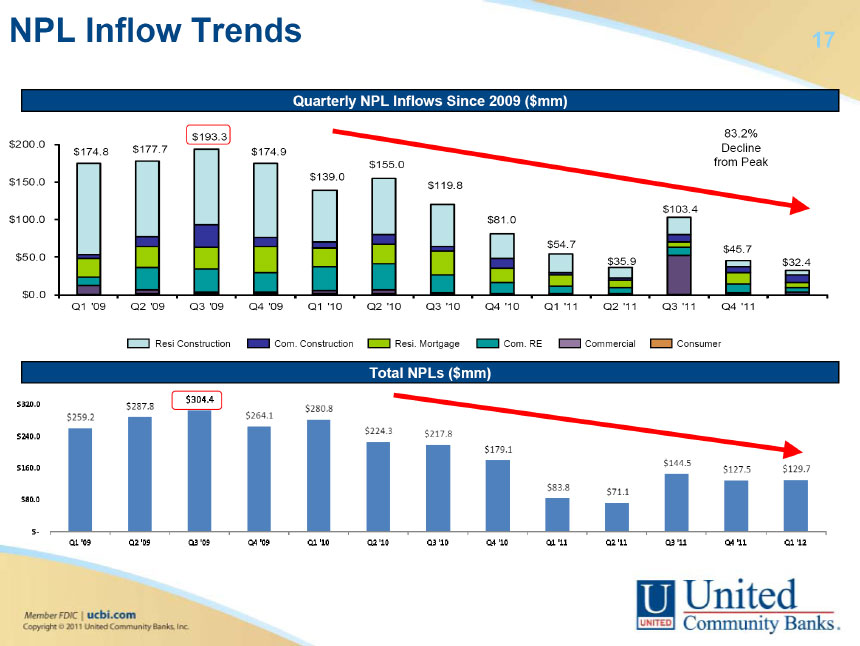

| 17 NPL Inflow Trends Quarterly NPL Inflows Since 2009 ($mm) 83.2% Decline from Peak $200.0 $150.0 $100.0 $50.0 $0.0 $174.8 $177.7 $193.3 $174.9 $139.0 $155.0 $119.8 $81.0 $54.7 $35.9 $103.4 $45 7 $32.4 Q1 ‘09 Q2 ‘09 Q3 ‘09 Q4 ‘09 Q1 ‘10 Q2 ‘10 Q3 ‘10 Q4 ‘10 Q1 ‘11 Q2 ‘11 Q3 ‘11 Q4 ‘11 Resi Construction Com. Construction Resi. Mortgage Com. RE Commercial Consumer Total NPLs ($mm) |

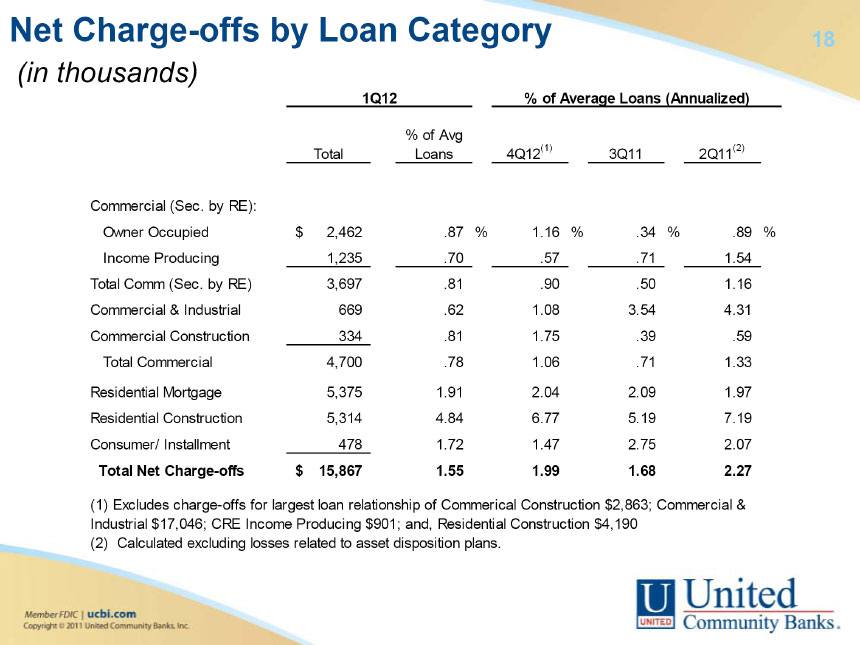

| 18 Net Charge-offs by Loan Category (in thousands) 1Q12 % of Average Loans (Annualized) Total % of Avg Loans 4Q12(1) 3Q11 2Q11(2) Commercial (Sec. by RE): Owner Occupied $2,462 .87% 1.16% .34% .89% Income Producing 1,235 .70 .57 .71 1.54 Total Comm (Sec. by RE) 3,697 .81 .90 .50 1.16 Commercial & Industrial 669 .62 1.08 3.54 4.31 Commercial Construction 334 .81 1.75 .39 .59 Total Commercial 4,700 .78 1.06 .71 1.33 Residential Mortgage 5,375 1.91 2.04 2.09 1.97 Residential Construction 5,314 4.84 6.77 5.19 7.19 Consumer/ Installment 478 1.72 1.47 2.75 2.07 Total Net Charge-offs $15,867 1.55 1.99 1.68 2.27 (1) Excludes charge-offs for largest loan relationship of Commerical Construction $2,863; Commercial & Industrial $17,046; CRE Income Producing $901; and, Residential Construction $4,190 (2) Calculated excluding losses related to asset disposition plans. |

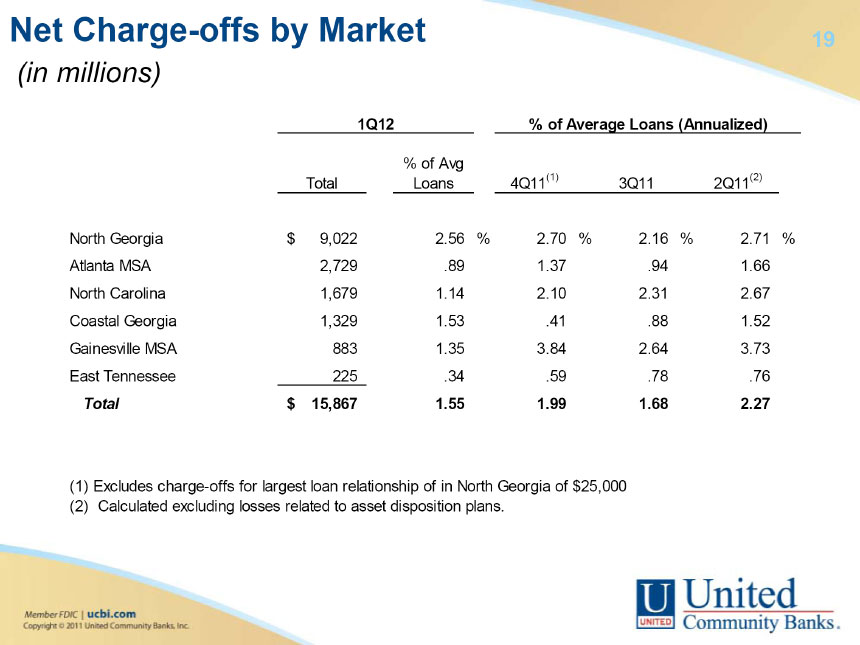

| 19 Net Charge-offs by Market (in millions) 1Q12 % of Average Loans (Annualized) Total % of Avg Loans 4Q11(1) 3Q11 2Q11(2) North Georgia $9,022 2.56% 2.70% 2.16% 2.71% Atlanta MSA 2,729 .89 1.37 .94 1.66 North Carolina 1,679 1.14 2.10 2.31 2.67 Coastal Georgia 1,329 1.53 .41 .88 1.52 Gainesville MSA 883 1.35 3.84 2.64 3.73 East Tennessee 225 .34 .59 .78 .76 Total $15,867 1.55 1.99 1.68 2.27 (1) Excludes charge-offs for largest loan relationship of in North Georgia of $25,000 (2) Calculated excluding losses related to asset disposition plans. |

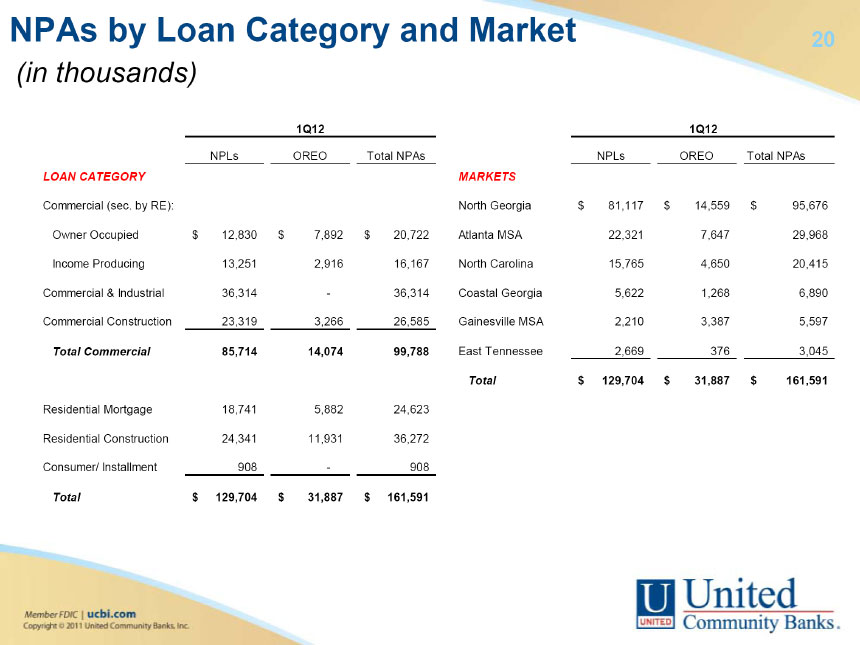

| 20 NPAs by Loan Category and Market (in thousands) 1Q12 NPLs OREO Total NPAs LOAN CATEGORY Commercial (sec. by RE): Owner Occupied $12,830 $7,892 $20,722 Income Producing 13,251 2,916 16,167 Commercial & Industrial 36,314 - 36,314 Commercial Construction 23,319 3,266 26,585 Total Commercial 85,714 14,074 99,788 Residential Mortgage 18,741 5,882 24,623 Residential Construction 24,341 11,931 36,272 Consumer/ Installment 908 - 908 Total $129,704 $31,887 $161,591 1Q12 NPLs OREO Total NPAs MARKETS North Georgia $81,117 $14,559 $95,676 Atlanta MSA 22,321 7,647 29,968 North Carolina 15,765 4,650 20,415 Coastal Georgia 5,622 1,268 6,890 Gainesville MSA 2,210 3,387 5,597 East Tennessee 2,669 376 3,045 Total $129,704 $31,887 $161,591 |

| 21 Financial Review |

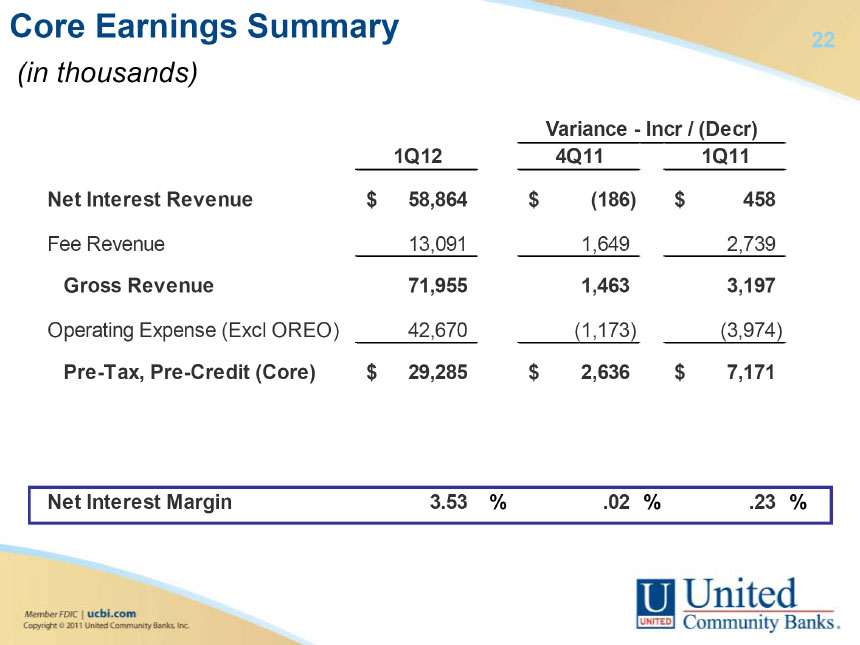

| 22 Core Earnings Summary (in thousands) Variance - Incr / (Decr) 1Q12 4Q11 1Q11 Net Interest Revenue $58,864 $(186) $458 Fee Revenue 13,091 1,649 2,739 Gross Revenue 71,955 1,463 3,197 Operating Expense (Excl OREO) 42,670 (1,173) (3,974) Pre-Tax, Pre-Credit (Core) $29,285 $2,636 $7,171 Net Interest Margin 3.53% .02% .23% |

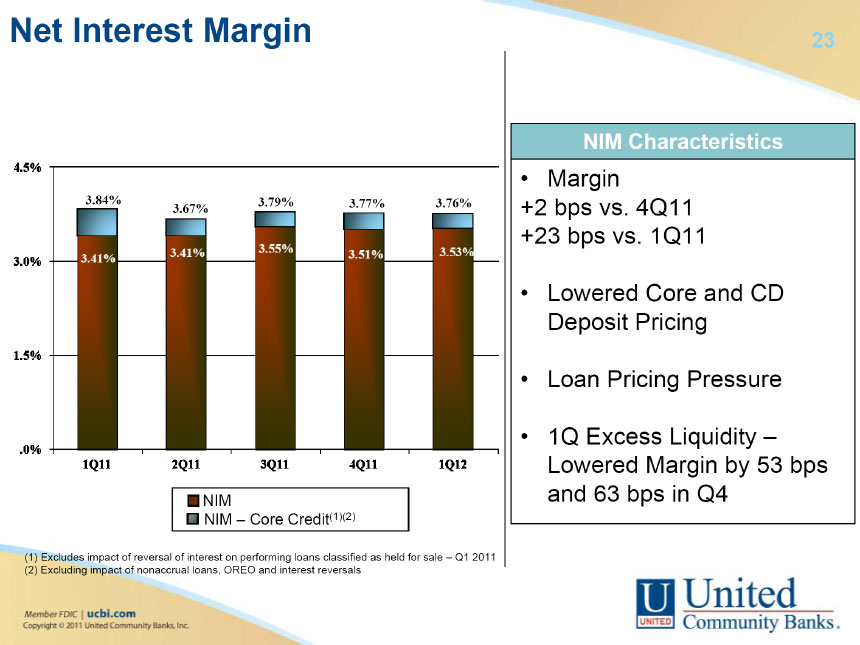

| 23 Net Interest Margin NIM Characteristics Margin +2 bps vs. 4Q11 +23 bps vs. 1Q11 Lowered Core and CD Deposit Pricing Loan Pricing Pressure 1Q Excess Liquidity – Lowered Margin by 53 bps and 63 bps in Q4 NIM NIM – Core Credit(1)(2) (1) Excludes impact of reversal of interest on performing loans classified as held for sale – Q1 2011 (2) Excluding impact of nonaccrual loans, OREO and interest reversals |

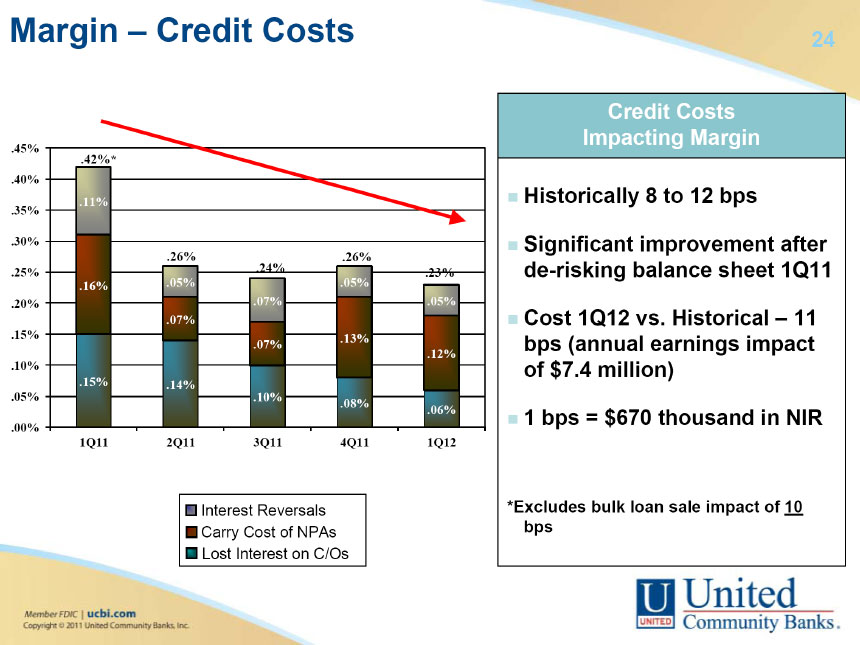

| 24 Margin – Credit Costs .45% .40% .35% .30% .25% .20% .15% .10% .05% .00% 1Q11 .42%* .11% .16% .15% 2Q11 .26% .05% .07% .14% 3Q11 .24% .07% .07% .10% 4Q11 .26% .05% .13% .08% 1Q12 .23% .05% .12% .06% Interest Reversals Carry Cost of NPAs Lost Interest on C/Os Credit Costs Impacting Margin Historically 8 to 12 bps Significant improvement after de-risking balance sheet 1Q11 Cost 1Q12 vs. Historical – 11 bps (annual earnings impact of $7.4 million) 1 bps = $670 thousand in NIR *Excludes bulk loan sale impact of 10 bps |

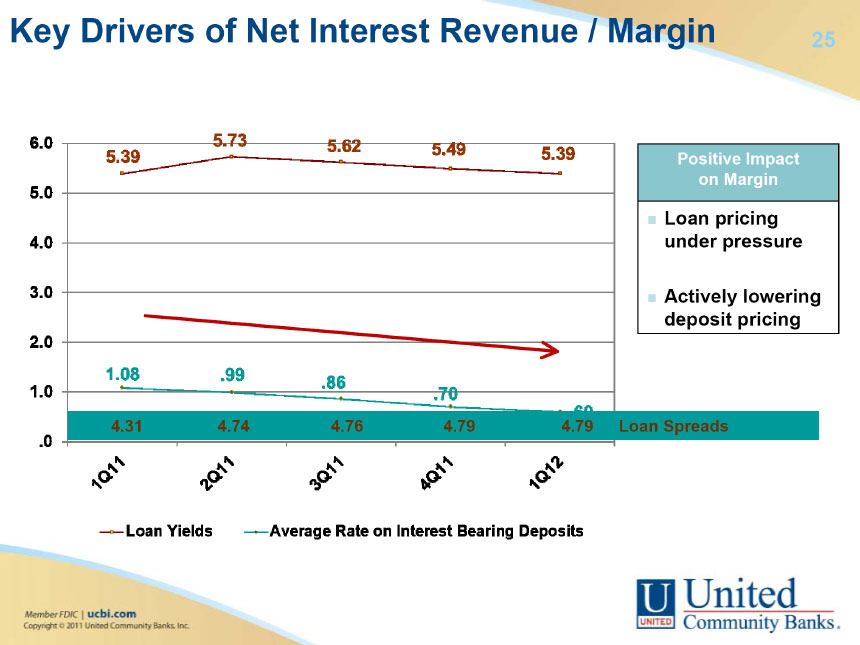

| 25 Key Drivers of Net Interest Revenue / Margin Positive Impact on Margin Loan pricing under pressure Actively lowering deposit pricing |

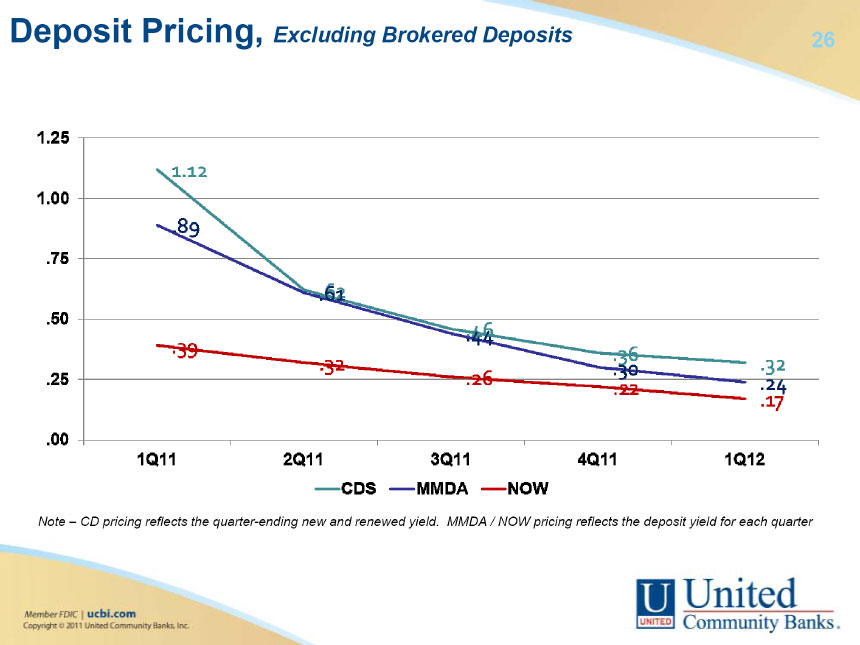

| 26 Deposit Pricing, Excluding Brokered Deposits Note – CD pricing reflects the quarter-ending new and renewed yield. MMDA / NOW pricing reflects the deposit yield for each quarter |

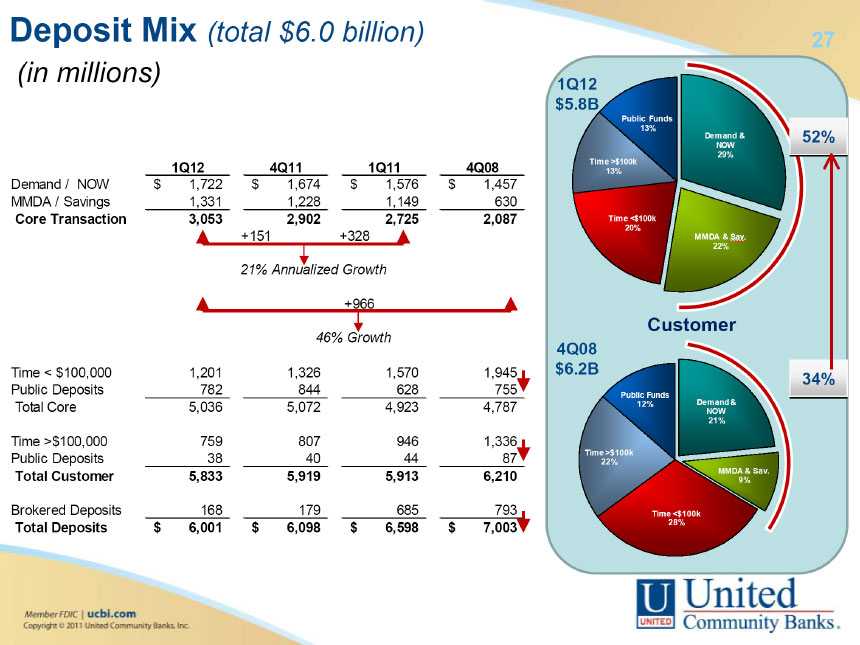

| 27 Deposit Mix (total $6.0 billion) (in millions) 1Q12 4Q11 1Q11 4Q08 Demand / NOW $1,722 $1,674 $1,576 $1,457 MMDA / Savings 1,331 1,228 1,149 630 Core Transaction 3,053 2,902 2,725 2,087 +151 +328 21% Annualized Growth +966 46% Growth Time < $100,000 1,201 1,326 1,570 1,945 Public Deposits 782 844 628 755 Total Core 5,036 5,072 4,923 4,787 Time >$100,000 759 807 946 1,336 Public Deposits 38 40 44 87 Total Customer 5,833 5,919 5,913 6,210 Brokered Deposits 168 179 685 793 Total Deposits $6,001 $6,098 $6,598 $7,003 1Q12 $5.8B 52% Public Funds 13% Demand & NOW 29% Time >$100k 13% Time <$100k 20% MMDA & Sav. 22% Customer 4Q08 $6.2B 34% Public Funds 12% Demand & NOW 21% Time >$100k 22% MMDA & Sav.9% Time <$100k 28% |

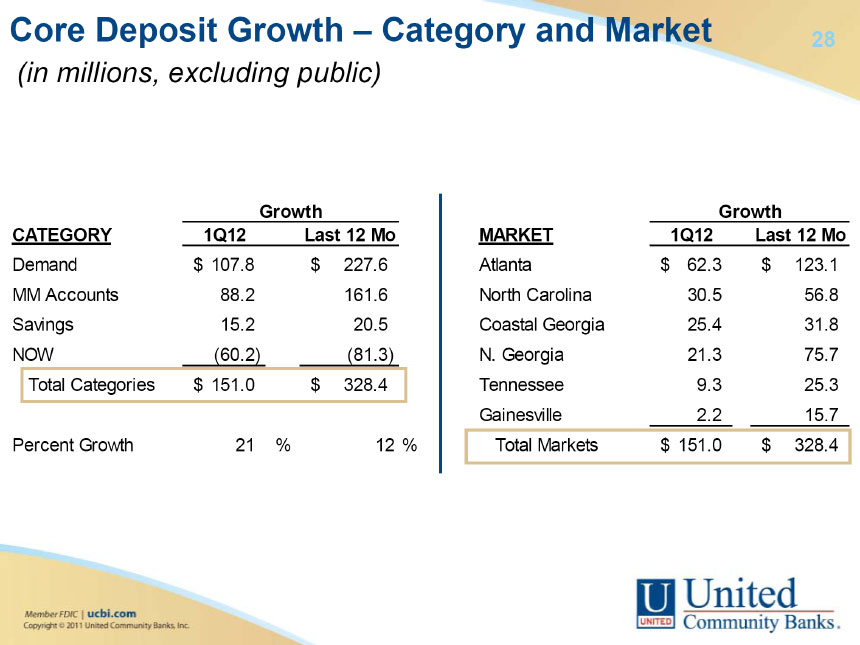

| 28 Core Deposit Growth – Category and Market (in millions, excluding public) Growth CATEGORY 1Q12 Last 12 Mo Demand $107.8 $227.6 MM Accounts 88.2 161.6 Savings 15.2 20.5 NOW (60.2) (81.3) Total Categories $151.0 $328.4 Percent Growth 21 % 12 % Growth MARKET 1Q12 Last 12 Mo Atlanta $62.3 $123.1 North Carolina 30.5 56.8 Coastal Georgia 25.4 31.8 N. Georgia 21.3 75.7 Tennessee 9.3 25.3 Gainesville 2.2 15.7 Total Markets $151.0 $328.4 |

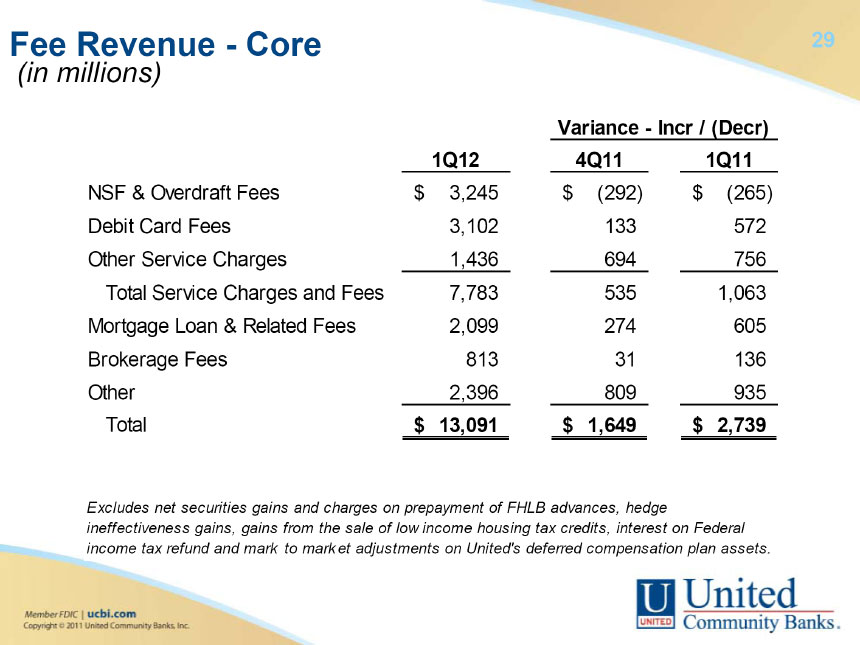

| 29 Fee Revenue - Core (in millions) Variance - Incr / (Decr) 1Q12 4Q11 1Q11 NSF & Overdraft Fees $3,245 $(292) $(265) Debit Card Fees 3,102 133 572 Other Service Charges 1,436 694 756 Total Service Charges and Fees 7,783 535 1,063 Mortgage Loan & Related Fees 2,099 274 605 Brokerage Fees 813 31 136 Other 2,396 809 935 Total $13,091 $1,649 $2,739 Excludes net securities gains and charges on prepayment of FHLB advances, hedge ineffectiveness gains, gains from the sale of low income housing tax credits, interest on Federal income tax refund and mark to market adjustments on United’s deferred compensation plan assets. |

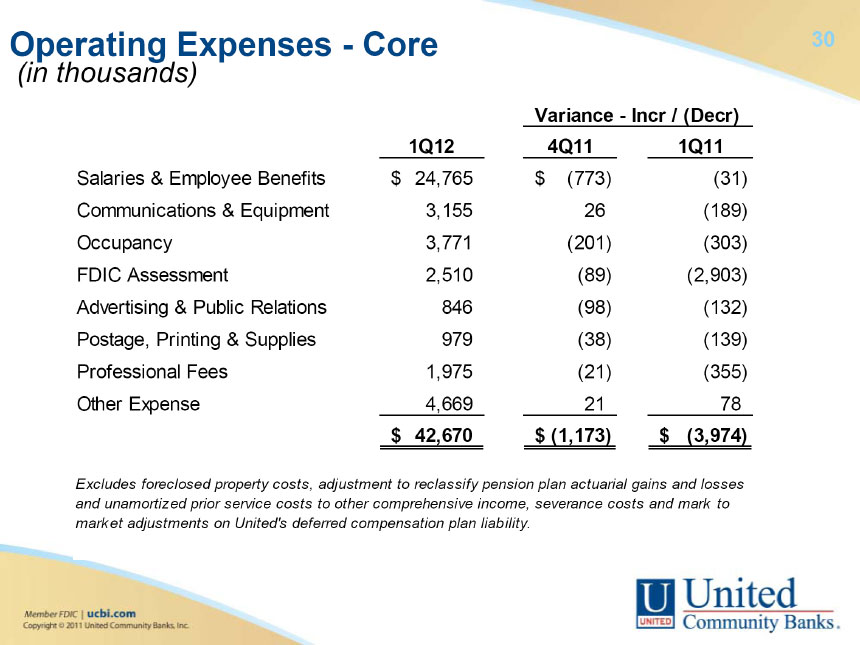

| 30 Operating Expenses - Core (in thousands) Variance - Incr / (Decr) 1Q12 4Q11 1Q11 Salaries & Employee Benefits $24,765 $(773) (31) Communications & Equipment 3,155 26 (189) Occupancy 3,771 (201) (303) FDIC Assessment 2,510 (89) (2,903) Advertising & Public Relations 846 (98) (132) Postage, Printing & Supplies 979 (38) (139) Professional Fees 1,975 (21) (355) Other Expense 4,669 21 78 $42,670 $(1,173) $(3,974) Excludes foreclosed property costs, adjustment to reclassify pension plan actuarial gains and losses and unamortized prior service costs to other comprehensive income, severance costs and mark to market adjustments on United’s deferred compensation plan liability. |

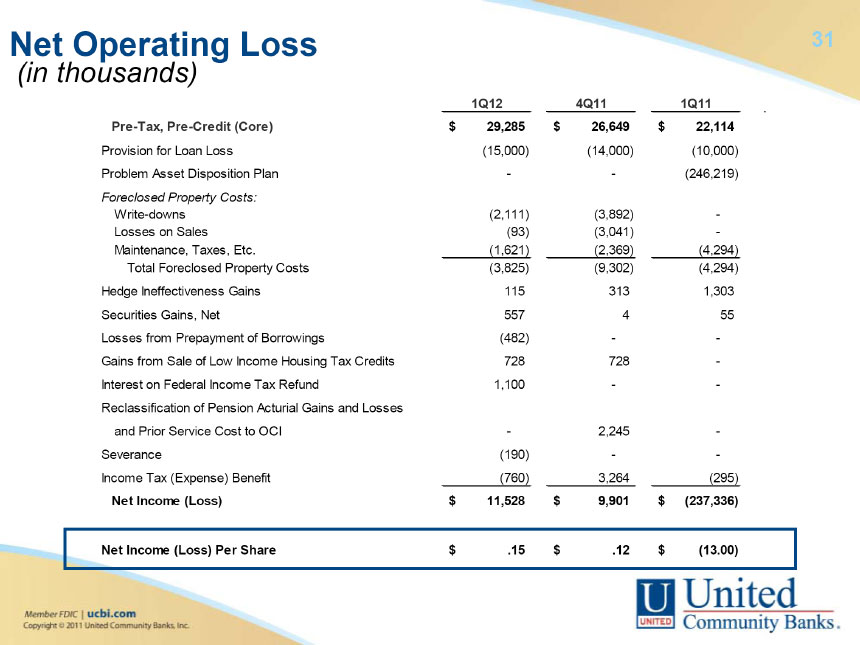

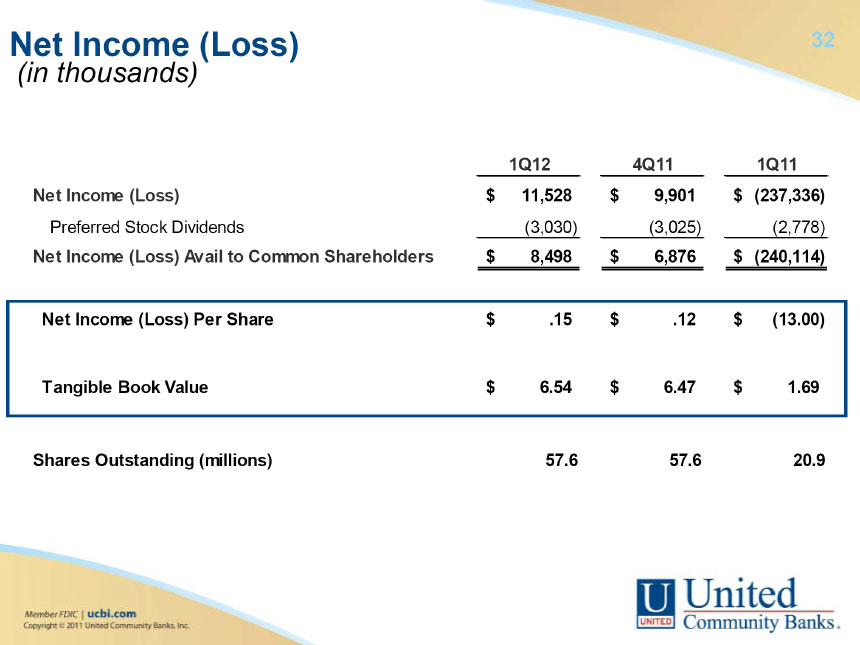

| 31 Net Operating Loss (in thousands) 1Q12 4Q11 1Q11 Pre-Tax, Pre-Credit (Core) $29,285 $26,649 $22,114 Provision for Loan Loss (15,000) (14,000) (10,000) Problem Asset Disposition Plan - - (246,219) Foreclosed Property Costs: Write-downs (2,111) (3,892) - Losses on Sales (93) (3,041) - Maintenance, Taxes, Etc. (1,621) (2,369) (4,294) Total Foreclosed Property Costs (3,825) (9,302) (4,294) Hedge Ineffectiveness Gains 115 313 1,303 Securities Gains, Net 557 4 55 Losses from Prepayment of Borrowings (482) - - Gains from Sale of Low Income Housing Tax Credits 728 728 - Interest on Federal Income Tax Refund 1,100 - - Reclassification of Pension Acturial Gains and Losses and Prior Service Cost to OCI - 2,245 - Severance (190) - - Income Tax (Expense) Benefit (760) 3,264 (295) Net Income (Loss) $11,528 $9,901 $(237,336) Net Income (Loss) Per Share $ .15 $ .12 $ (13.00) |

| 32 Net Income (Loss) (in thousands) 1Q12 4Q11 1Q11 Net Income (Loss) $11,528 $9,901 $(237,336) Preferred Stock Dividends (3,030) (3,025) (2,778) Net Income (Loss) Avail to Common Shareholders $ 8,498 $ 6,876 $ (240,114) Net Income (Loss) Per Share $.15 $.12 $(13.00) Tangible Book Value $6.54 $6.47 $1.69 Shares Outstanding (millions) 57.6 57.6 20.9 |

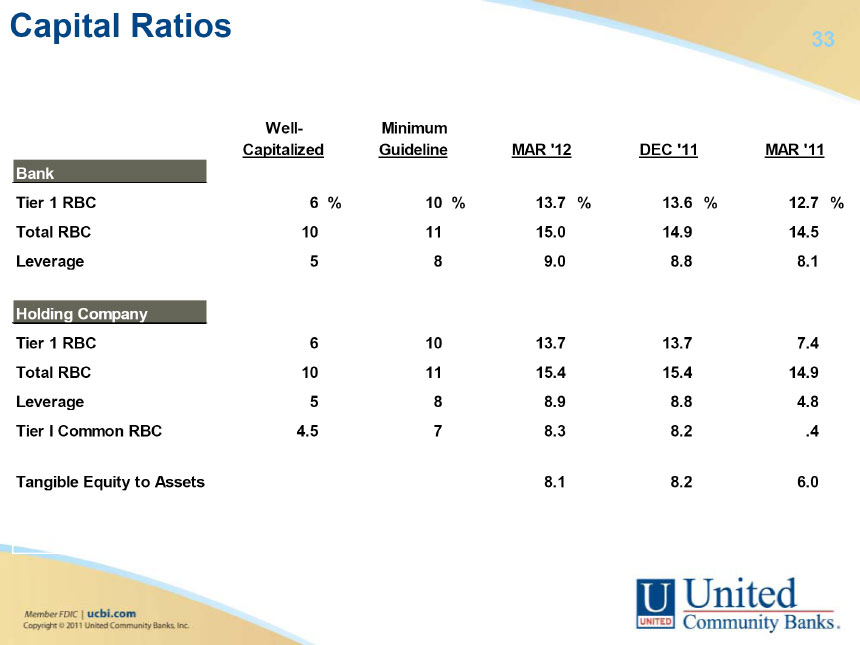

| 33 Capital Ratios Well- Capitalized Minimum Guideline MAR ‘12 DEC ‘11 MAR ‘11 Bank Tier 1 RBC 6% 10% 13.7% 13.6% 12.7% Total RBC 10 11 15.0 14.9 14.5 Leverage 5 8 9.0 8.8 8.1 Holding Company Tier 1 RBC 6 10 13.7 13.7 7.4 Total RBC 10 11 15.4 15.4 14.9 Leverage 5 8 8.9 8.8 4.8 Tier I Common RBC 4.5 7 8.3 8.2 .4 Tangible Equity to Assets 8.1 8.2 6.0 |

| 34 |

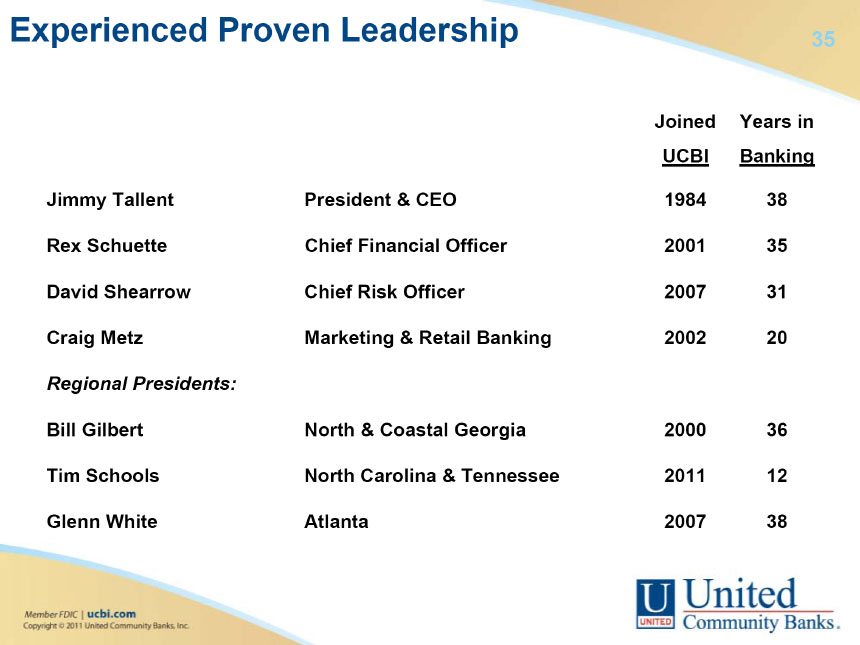

| 35 Experienced Proven Leadership Joined UCBI Years in Banking Jimmy Tallent President & CEO 1984 38 Rex Schuette Chief Financial Officer 2001 35 David Shearrow Chief Risk Officer 2007 31 Craig Metz Marketing & Retail Banking 2002 20 Regional Presidents: Bill Gilbert North & Coastal Georgia 2000 36 Tim Schools North Carolina & Tennessee 2011 12 Glenn White Atlanta 2007 38 |

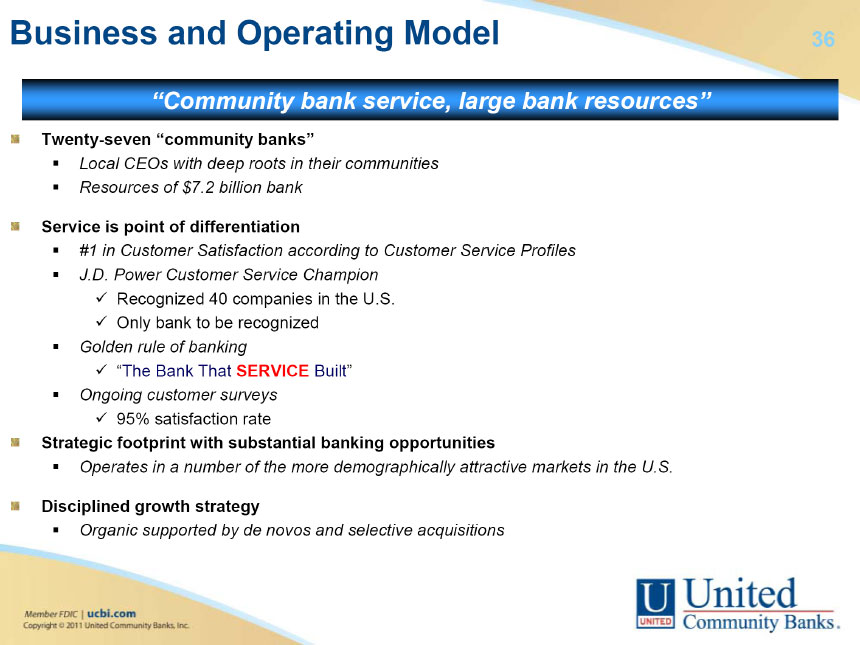

| 36 Business and Operating Model “Community bank service, large bank resources” Twenty-seven “community banks” Local CEOs with deep roots in their communities Resources of $7.2 billion bank Service is point of differentiation #1 in Customer Satisfaction according to Customer Service Profiles J.D. Power Customer Service Champion Recognized 40 companies in the U.S. Only bank to be recognized Golden rule of banking “The Bank That SERVICE Built” Ongoing customer surveys 95% satisfaction rate Strategic footprint with substantial banking opportunities Operates in a number of the more demographically attractive markets in the U.S. Disciplined growth strategy Organic supported by de novos and selective acquisitions |

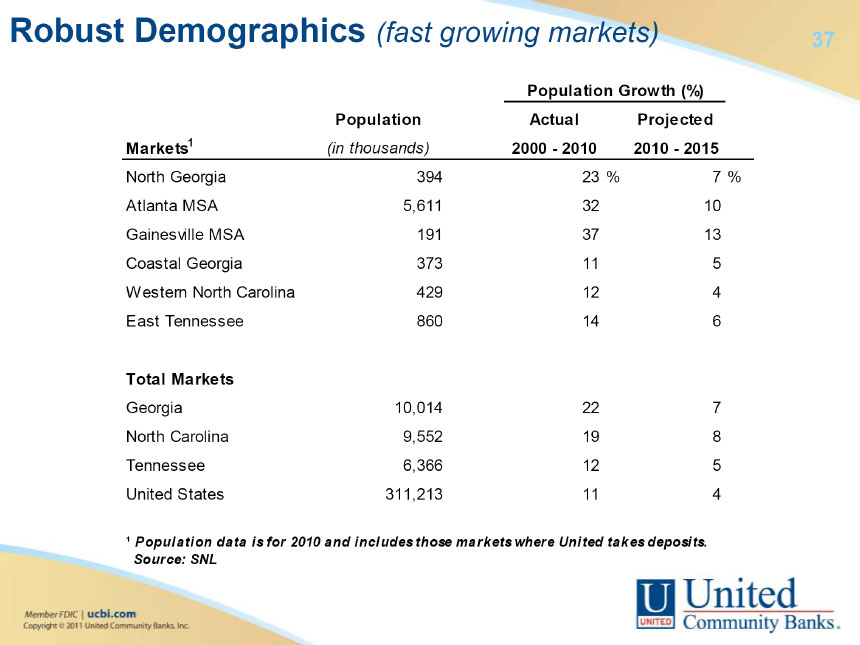

| 37 Robust Demographics (fast growing markets) Population Growth (%) Markets1 Population (in thousands) Actual 2000 - 2010 Projected 2010 - 2015 North Georgia 394 23% 7% Atlanta MSA 5,611 32 10 Gainesville MSA 191 37 13 Coastal Georgia 373 11 5 Western North Carolina 429 12 4 East Tennessee 860 14 6 Total Markets Georgia 10,014 22 7 North Carolina 9,552 19 8 Tennessee 6,366 12 5 United States 311,213 11 4 ¹ Population data is for 2010 and includes those markets where United takes deposits. Source: SNL |

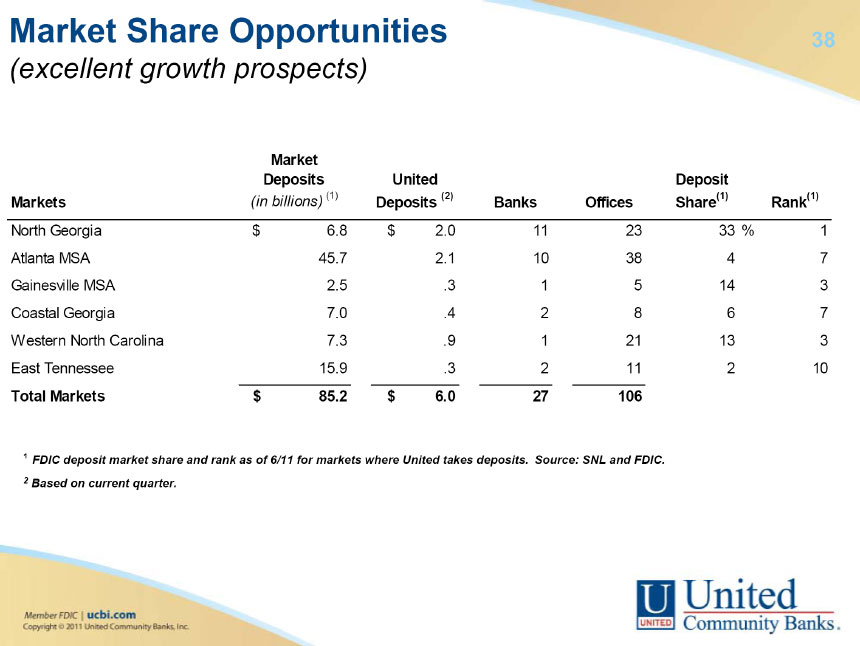

| 38 Market Share Opportunities (excellent growth prospects) Market Deposits (in billions) (1) United Deposits (2) Banks Offices Deposit Share(1) Rank(1) North Georgia $6.8 $2.0 11 23 33% 1 Atlanta MSA 45.7 2.1 10 38 4 7 Gainesville MSA 2.5 .3 1 5 14 3 Coastal Georgia 7.0 .4 2 8 6 7 Western North Carolina 7.3 .9 1 21 13 3 East Tennessee 15.9 .3 2 11 2 10 Total Markets $85.2 $6.0 27 106 ¹ FDIC deposit market share and rank as of 6/11 for markets where United takes deposits. Source: SNL and FDIC. 2 Based on current quarter. |

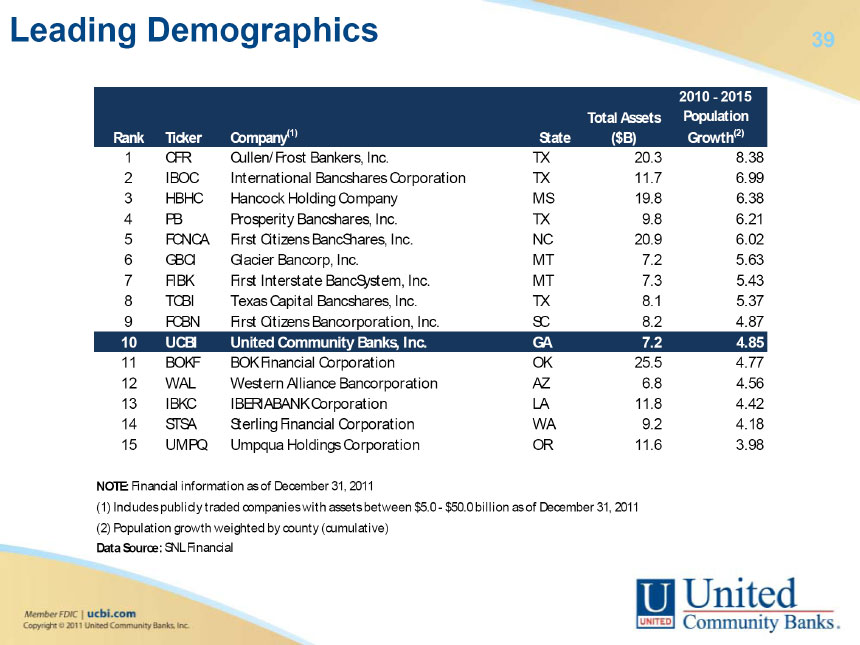

| 39 Leading Demographics Rank Ticker Company(1) State Total Assets ($B) 2010 - 2015 Population Growth(2) 1 CFR Cullen/Frost Bankers, Inc. TX 20.3 8.38 2 IBOC International Bancshares Corporation TX 11.7 6.99 3 HBHC Hancock Holding Company MS 19.8 6.38 4 PB Prosperity Bancshares, Inc. TX 9.8 6.21 5 FCNCA First Citizens BancShares, Inc. NC 20.9 6.02 6 GBCI Glacier Bancorp, Inc. MT 7.2 5.63 7 FIBK First Interstate BancSystem, Inc. MT 7.3 5.43 8 TCBI Texas Capital Bancshares, Inc. TX 8.1 5.37 9 FCBN First Citizens Bancorporation, Inc. SC 8.2 4.87 10 UCBI United Community Banks, Inc. GA 7.2 4.85 11 BOKF BOK Financial Corporation OK 25.5 4.77 12 WAL Western Alliance Bancorporation AZ 6.8 4.56 13 IBKC IBERIABANK Corporation LA 11.8 4.42 14 STSA Sterling Financial Corporation WA 9.2 4.18 15 UMPQ Umpqua Holdings Corporation OR 11.6 3.98 NOTE: Financial information as of December 31, 2011 (1) Includes publicly traded companies with assets between $5.0 - $50.0 billion as of December 31, 2011 (2) Population growth weighted by county (cumulative) Data Source: SNL Financial |

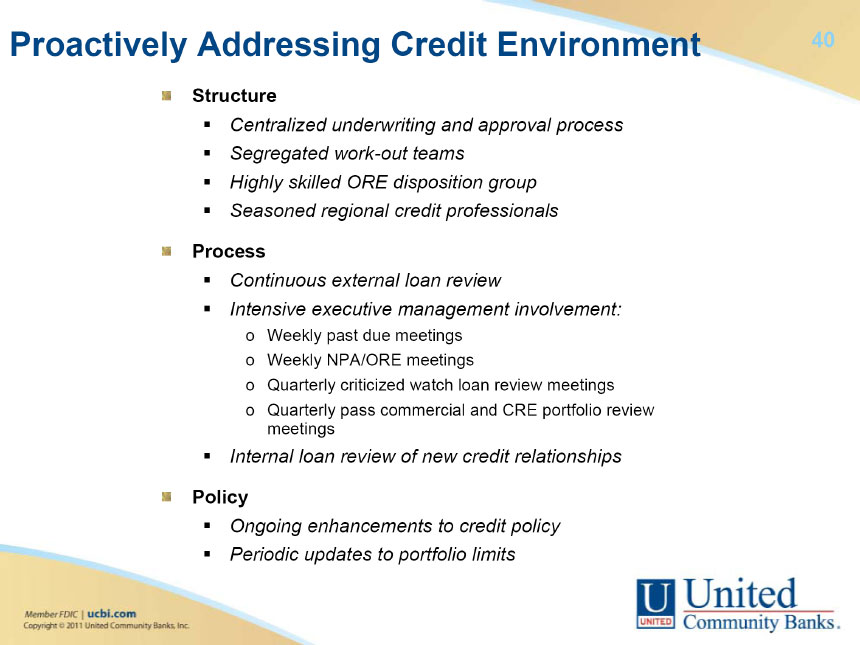

| 40 Proactively Addressing Credit Environment Structure Centralized underwriting and approval process Segregated work-out teams Highly skilled ORE disposition group Seasoned regional credit professionals Process Continuous external loan review Intensive executive management involvement: Weekly past due meetings Weekly NPA/ORE meetings Quarterly criticized watch loan review meetings Quarterly pass commercial and CRE portfolio review meetings Internal loan review of new credit relationships Policy Ongoing enhancements to credit policy Periodic updates to portfolio limits |

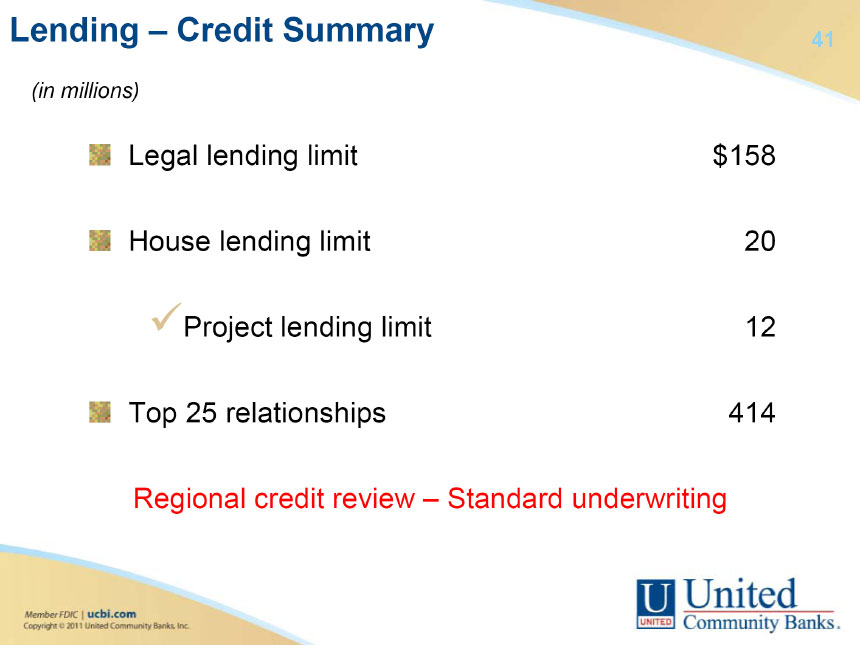

| 41 Lending – Credit Summary (in millions) Legal lending limit $158 House lending limit 20 Project lending limit 12 Top 25 relationships 414 Regional credit review – Standard underwriting |

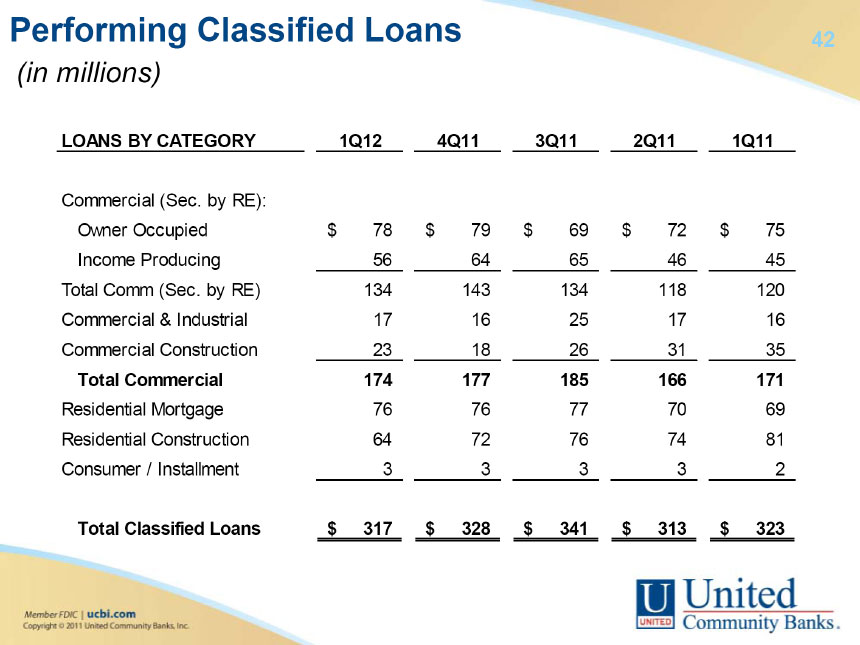

| 42 Performing Classified Loans (in millions) LOANS BY CATEGORY 1Q12 4Q11 3Q11 2Q11 1Q11 Commercial (Sec. by RE): Owner Occupied $78 $79 $69 $72 $75 Income Producing 56 64 65 46 45 Total Comm (Sec. by RE) 134 143 134 118 120 Commercial & Industrial 17 16 25 17 16 Commercial Construction 23 18 26 31 35 Total Commercial 174 177 185 166 171 Residential Mortgage 76 76 77 70 69 Residential Construction 64 72 76 74 81 Consumer / Installment 3 3 3 3 2 Total Classified Loans $317 $328 $341 $313 $323 |

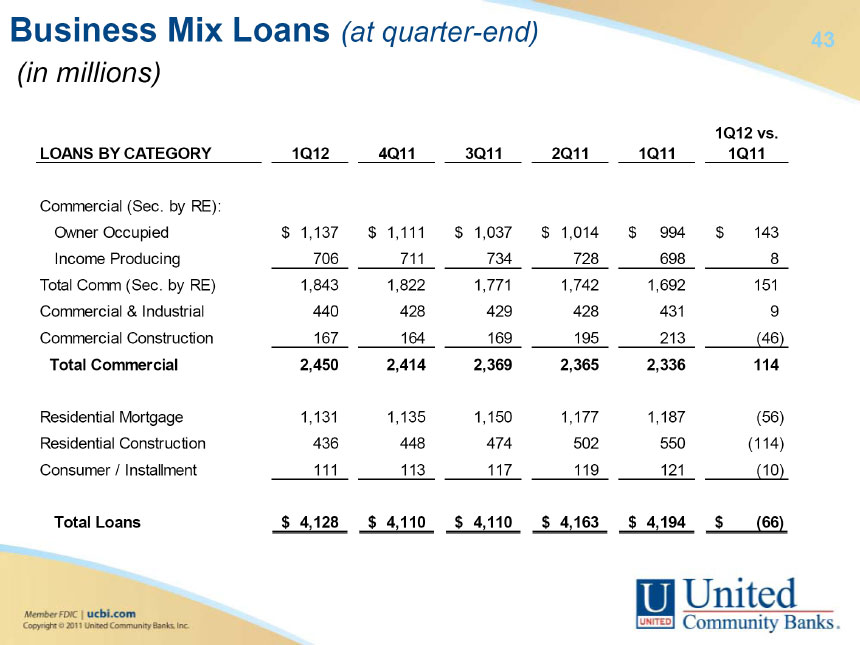

| 43 Business Mix Loans (at quarter-end) (in millions) LOANS BY CATEGORY 1Q12 4Q11 3Q11 2Q11 1Q11 1Q12 vs 1Q11 Commercial (Sec. by RE): Owner Occupied $ 1,137 $1,111 $1,037 $1,014 $994 $143 Income Producing 706 711 734 728 698 8 Total Comm (Sec. by RE) 1,843 1,822 1,771 1,742 1,692 151 Commercial & Industrial 440 428 429 428 431 9 Commercial Construction 167 164 169 195 213 (46) Total Commercial 2,450 2,414 2,369 2,365 2,336 114 Residential Mortgage 1,131 1,135 1,150 1,177 1,187 (56) Residential Construction 436 448 474 502 550 (114) Consumer / Installment 111 113 117 119 121 (10) Total Loans $4,128 $4,110 $4,110 $4,163 $4,194 $(66) |

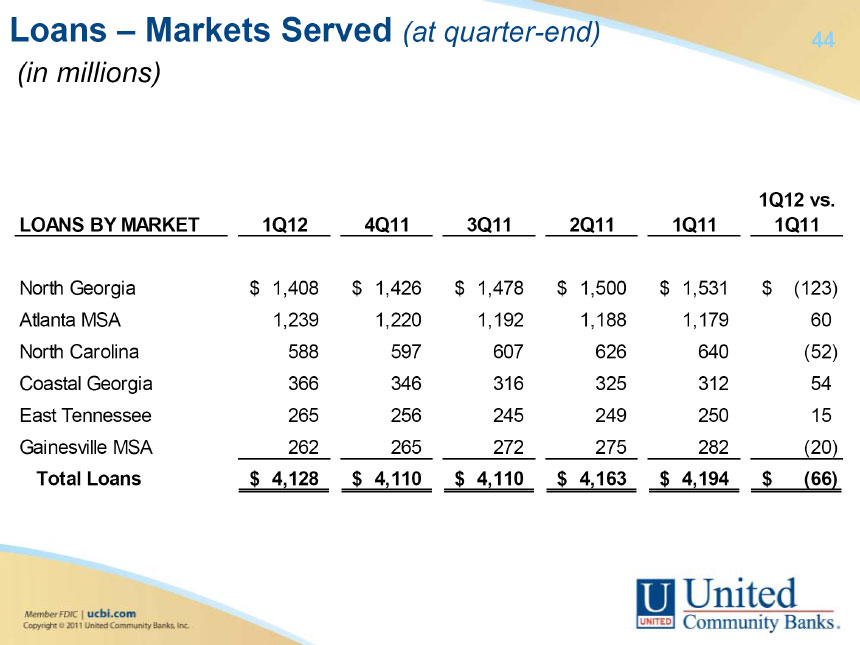

| 44 Loans – Markets Served (at quarter-end) (in millions) LOANS BY MARKET 1Q12 4Q11 3Q11 2Q11 1Q11 1Q12 vs.1Q11 North Georgia $1,408 $1,426 $1,478 $1,500 $1,531 $(123) Atlanta MSA 1,239 1,220 1,192 1,188 1,179 60 North Carolina 588 597 607 626 640 (52) Coastal Georgia 366 346 316 325 312 54 East Tennessee 265 256 245 249 250 15 Gainesville MSA 262 265 272 275 282 (20) Total Loans $4,128 $4,110 $4,110 $4,163 $4,194 $(66) |

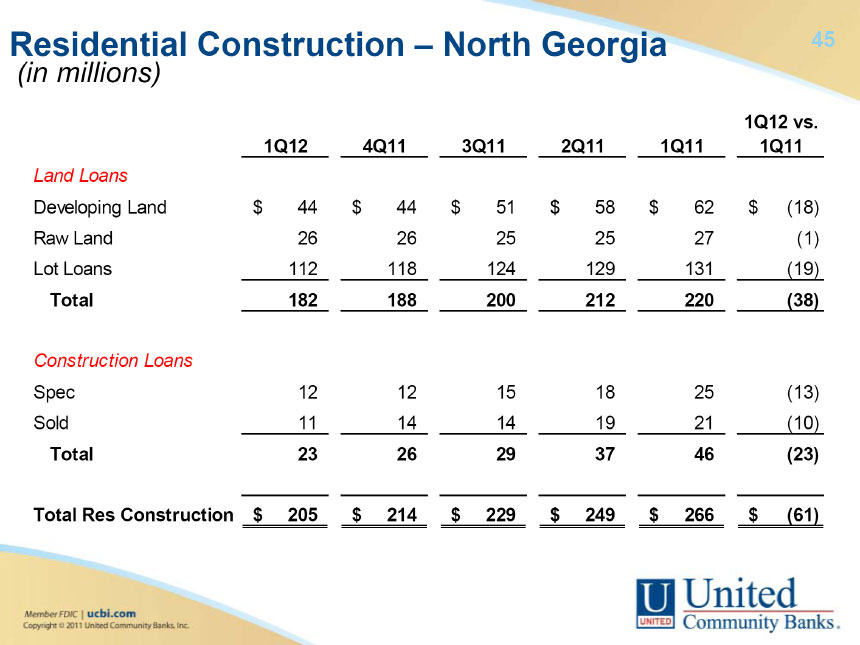

| 45 Residential Construction – North Georgia (in millions) 1Q12 4Q11 3Q11 2Q11 1Q11 1Q12 vs.1Q11 Land Loans Developing Land $44 $44 $51 $58 $62 $(18) Raw Land 26 26 25 25 27 (1) Lot Loans 112 118 124 129 131 (19) Total 182 188 200 212 220 (38) Construction Loans Spec 12 12 15 18 25 (13) Sold 11 14 14 19 21 (10) Total 23 26 29 37 46 (23) Total Res Construction $205 $214 $229 $249 $266 $(61) |

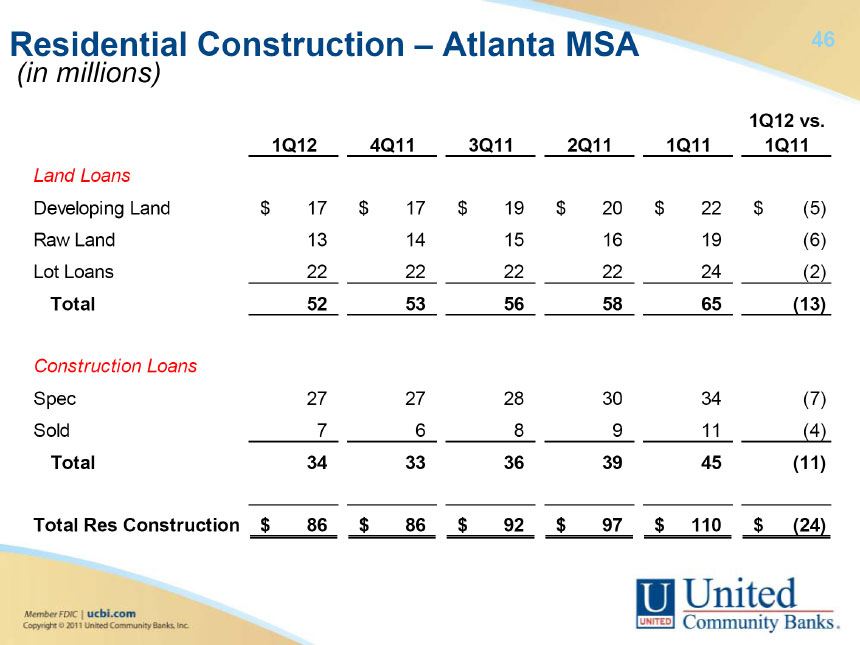

| 46 Residential Construction – Atlanta MSA (in millions) 1Q12 4Q11 3Q11 2Q11 1Q11 1Q12 vs. 1Q11 Land Loans Developing Land $17 $17 $19 $20 $22 $(5) Raw Land 13 14 15 16 19 (6) Lot Loans 22 22 22 22 24 (2) Total 52 53 56 58 65 (13) Construction Loans Spec 27 27 28 30 34 (7) Sold 7 6 8 9 11 (4) Total 34 33 36 39 45 (11) Total Res Construction $86 $86 $92 $97 $110 $(24) |

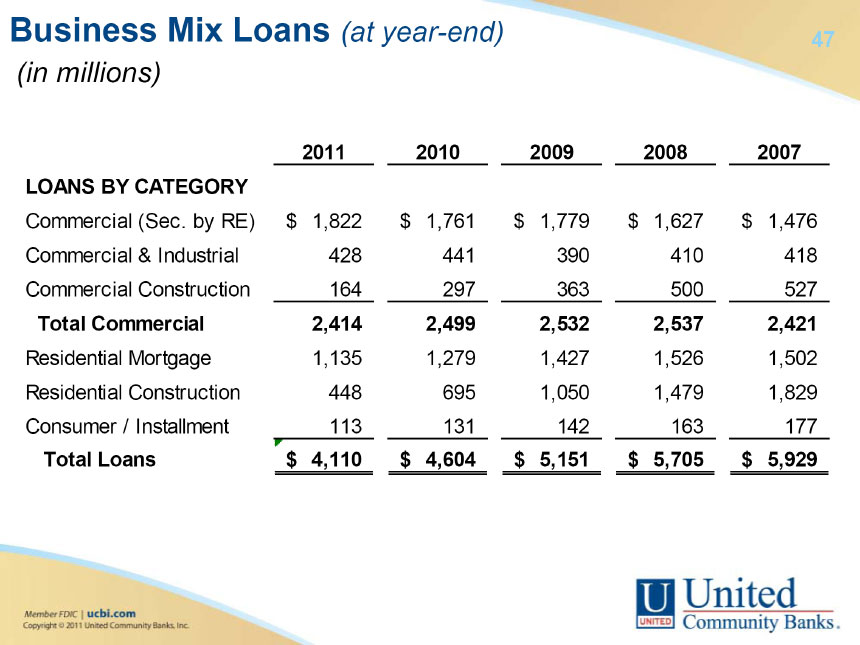

| 47 Business Mix Loans (at year-end) (in millions) 2011 2010 2009 2008 2007 LOANS BY CATEGORY Commercial (Sec. by RE) $1,822 $1,761 $1,779 $1,627 $1,476 Commercial & Industrial 428 441 390 410 418 Commercial Construction 164 297 363 500 527 Total Commercial 2,414 2,499 2,532 2,537 2,421 Residential Mortgage 1,135 1,279 1,427 1,526 1,502 Residential Construction 448 695 1,050 1,479 1,829 Consumer / Installment 113 131 142 163 177 Total Loans $4,110 $4,604 $5,151 $5,705 $5,929 |

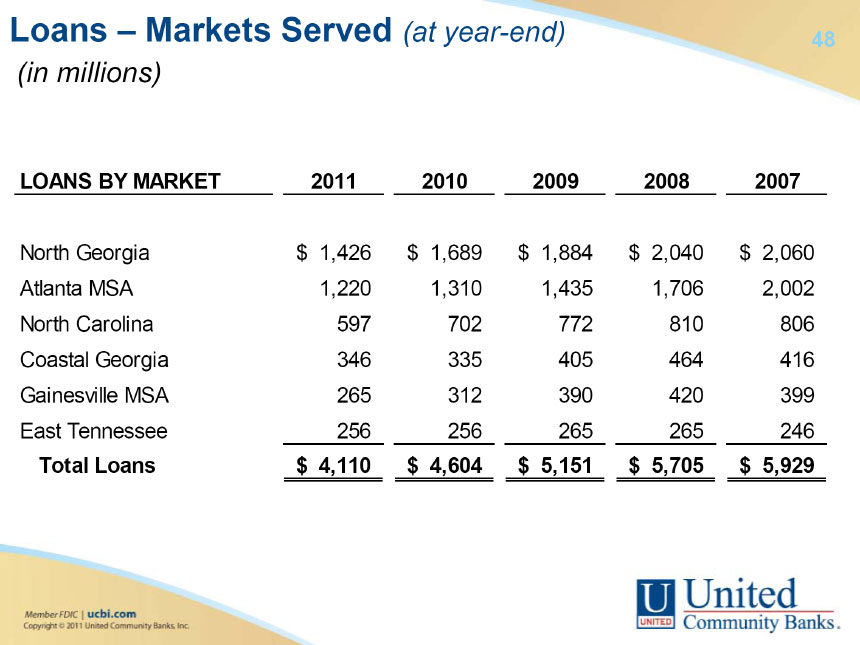

| 48 Loans – Markets Served (at year-end) (in millions) LOANS BY MARKET 2011 2010 2009 2008 2007 North Georgia $1,426 $1,689 $1,884 $2,040 $2,060 Atlanta MSA 1,220 1,310 1,435 1,706 2,002 North Carolina 597 702 772 810 806 Coastal Georgia 346 335 405 464 416 Gainesville MSA 265 312 390 420 399 East Tennessee 256 256 265 265 246 Total Loans $4,110 $4,604 $5,151 $5,705 $5,929 |

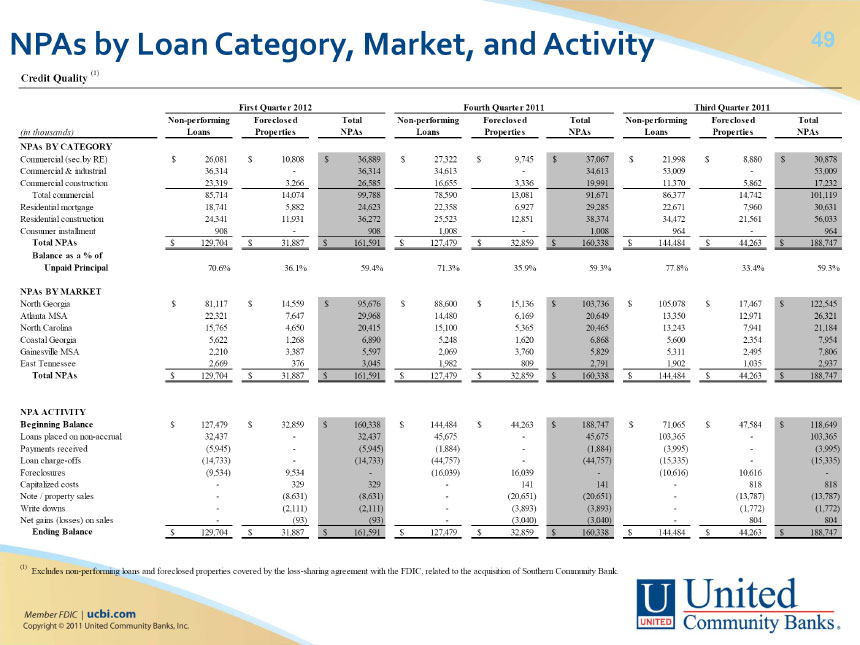

| 49 NPAs by Loan Category, Market, and Activity Credit Quality (1) First Quarter 2012 Fourth Quarter 2011 Third Quarter 2011 (in thousands) Non-performing Loans Foreclosed Properties Total NPAs Non-performing Loans Foreclosed Properties Total NPAs Non-performing Loans Foreclosed Properties Total NPAs NPAs BY CATEGORY Commercial (sec.by RE) $26,081 $10,808 $36,889 $27,322 $9,745 $37,067 $21,998 $8,880 $30,878 Commercial & industrial 36,314 - 36,314 34,613 - 34,613 53,009 - 53,009 Commercial construction 23,319 3,266 26,585 16,655 3,336 19,991 11,370 5,862 17,232 Total commercial 85,714 14,074 99,788 78,590 13,081 91,671 86,377 14,742 101,119 Residential mortgage 18,741 5,882 24,623 22,358 6,927 29,285 22,671 7,960 30,631 Residential construction 24,341 11,931 36,272 25,523 12,851 38,374 34,472 21,561 56,033 Consumer installment 908 - 908 1,008 - 1,008 964 - 964 Total NPAs $129,704 $31,887 $161,591 $127,479 $32,859 $160,338 $144,484 $44,263 $188,747 Balance as a % of Unpaid Principal 70.6% 36.1% 59.4% 71.3% 35.9% 59.3% 77.8% 33.4% 59.3% NPAs BY MARKET North Georgia $81,117 $14,559 $95,676 $88,600 $15,136 $103,736 $105,078 $17,467 $122,545 Atlanta MSA 22,321 7,647 29,968 14,480 6,169 20,649 13,350 12,971 26,321 North Carolina 15,765 4,650 20,415 15,100 5,365 20,465 13,243 7,941 21,184 Coastal Georgia 5,622 1,268 6,890 5,248 1,620 6,868 5,600 2,354 7,954 Gainesville MSA 2,210 3,387 5,597 2,069 3,760 5,829 5,311 2,495 7,806 East Tennessee 2,669 376 3,045 1,982 809 2,791 1,902 1,035 2,937 Total NPAs $129,704 $31,887 $161,591 $127,479 $32,859 $160,338 $144,484 $44,263 $188,747 NPA ACTIVITY Beginning Balance $127,479 $32,859 $160,338 $144,484 $44,263 $188,747 $71,065 $47,584 $118,649 Loans placed on non-accrual 32,437 - 32,437 45,675 - 45,675 103,365 - 103,365 Payments received (5,945) - (5,945) (1,884) - (1,884) (3,995) - (3,995) Loan charge-offs (14,733) - (14,733) (44,757) - (44,757) (15,335) - (15,335) Foreclosures (9,534) 9,534 - (16,039) 16,039 - (10,616) 10,616 - Capitalized costs - 329 329 - 141 141 - 818 818 Note / property sales - (8,631) (8,631) - (20,651) (20,651) - (13,787) (13,787) Write downs - (2,111) (2,111) - (3,893) (3,893) - (1,772) (1,772) Net gains (losses) on sales - (93) (93) - (3,040) (3,040) - 804 804 Ending Balance $129,704 $31,887 $161,591 $127,479 $32,859 $160,338 $144,484 $44,263 $188,747 (1) Excludes non-performing loans and foreclosed properties covered by the loss-sharing agreement with the FDIC, related to the acquisition of Southern Community Bank. |

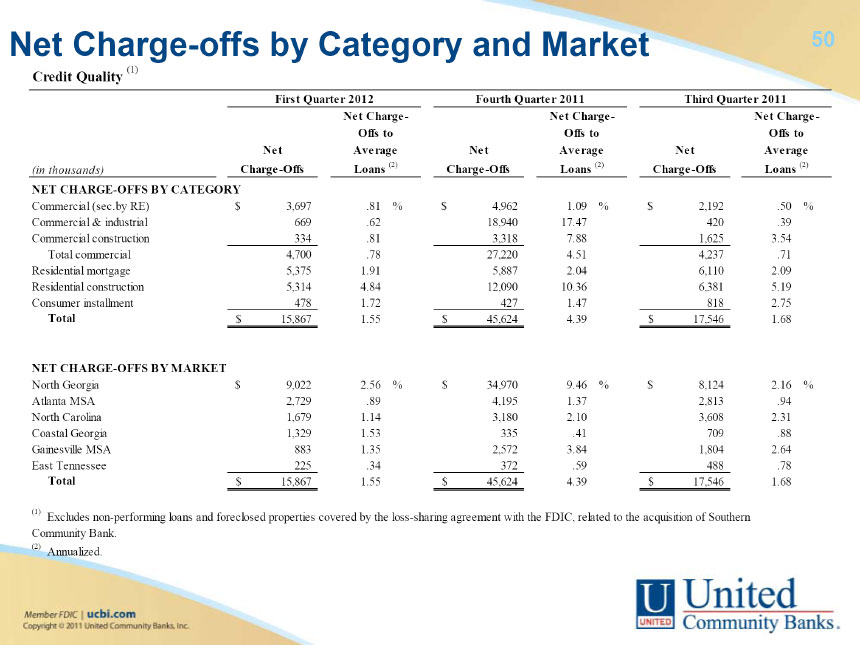

| 50 Net Charge-offs by Category and Market Credit Quality (1) First Quarter 2012 Fourth Quarter 2011 Third Quarter 2011 (in thousands) Net Charge-Offs Net Charge- Offs to Average Loans (2) Net Charge-Offs Net Charge- Offs to Average Loans (2) Net Charge-Offs Net Charge- Offs to Average Loans (2)NET CHARGE-OFFS BY CATEGORY Commercial (sec.by RE) $3,697 .81% $4,962 1.09% $2,192 .50% Commercial & industrial 669 .62 18,940 17.47 420 .39 Commercial construction 334 .81 3,318 7.88 1,625 3.54 Total commercial 4,700 .78 27,220 4.51 4,237 .71 Residential mortgage 5,375 1.91 5,887 2.04 6,110 2.09 Residential construction 5,314 4.84 12,090 10.36 6,381 5.19 Consumer installment 478 1.72 427 1.47 818 2.75 Total $15,867 1.55 $45,624 4.39 $17,546 1.68 NET CHARGE-OFFS BY MARKET North Georgia $9,022 2.56% $34,970 9.46% $8,124 2.16% Atlanta MSA 2,729 .89 4,195 1.37 2,813 .94 North Carolina 1,679 1.14 3,180 2.10 3,608 2.31 Coastal Georgia 1,329 1.53 335 .41 709 .88 Gainesville MSA 883 1.35 2,572 3.84 1,804 2.64 East Tennessee 225 .34 372 .59 488 .78 Total $15,867 1.55 $45,624 4.39 $17,546 1.68 (1) Excludes non-performing loans and foreclosed properties covered by the loss-sharing agreement with the FDIC, related to the acquisition of Southern Community Bank. (2) Annualized. |

| 51 Net Charge-offs by Category and Market Asset Disposition Plan as of March 31, 2011 Credit Quality - Net Charge-Offs First Quarter 2011 (1) Asset Disposition Plan Bulk Loan Sale (2) (in thousands) Performing Loans Nonperforming Loans Other Bulk Loan Sales (3) Foreclosure Charge-Offs (4) Other Net Charge-Offs First Quarter 2011 Net Charge- Offs NET CHARGE-OFFS BY CATEGORY Commercial (sec. by RE) $29,451 $11,091 $3,318 $1,905 $2,842 $48,607 Commercial construction 32,530 15,328 292 419 1,146 49,715 Commercial & industrial 365 2,303 859 - 513 4,040 Total commercial 62,346 28,722 4,469 2,324 4,501 102,362 Residential construction 43,018 23,459 3,325 11,693 10,643 92,138 Residential mortgage 13,917 14,263 1,676 1,538 4,989 36,383 Consumer / installment 86 168 30 24 383 691 Total $119,367 $66,612 $9,500 $15,579 $20,516 $231,574 NET CHARGE-OFFS BY MARKET Atlanta MSA $37,186 $8,545 $1,428 $6,034 $3,296 $56,489 Gainesville MSA 3,563 2,442 957 700 954 8,616 North Georgia 57,969 47,699 2,508 6,585 8,544 123,305 Western North Carolina 11,138 4,743 2,415 1,402 6,749 26,447 Coastal Georgia 6,835 2,180 2,013 634 341 12,003 East Tennessee 2,676 1,003 179 224 632 4,714 Total $119,367 $66,612 $9,500 $15,579 $20,516 $231,574 (1) Excludes non-performing loans and foreclosed properties covered by the loss-sharing agreement with the FDIC, related to the acquisition of Southern Community Bank. (2) Charge-offs totaling $186 million were recognized on the bulk loan sale in the first quarter of 2011. The loans were transferred to the loans held for sale category in anticipation of the second quarter bulk loan sale that was completed on April 18, 2011. (3) Losses on smaller bulk sale transactions completed during the first quarter of 2011. (4) Loan charge-offs recognized in the first quarter of 2011 related to loans transferred to foreclosed properties. Such charge-offs were elevated in the first quarter as a result of the asset disposition plan, which called for aggressive write downs to expedite sales in the second and third quarters of 2011. |

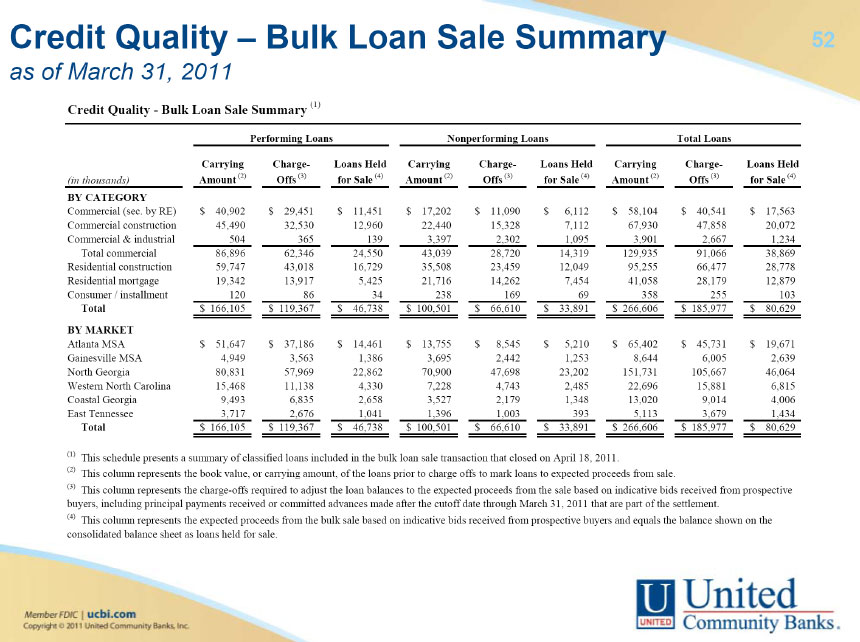

| 52 Credit Quality – Bulk Loan Sale Summary as of March 31, 2011 Credit Quality - Bulk Loan Sale Summary (1) Performing Loans Nonperforming Loans Total Loans (in thousands) Carrying Amount (2) Charge- Offs (3) Loans Held for Sale (4) Carrying Amount (2) Charge- Offs (3) Loans Held for Sale (4) Carrying Amount (2) Charge- Offs (3) Loans Held for Sale (4) BY CATEGORY Commercial (sec. by RE) $40,902 $29,451 $11,451 $17,202 $11,090 $6,112 $58,104 $40,541 $17,563 Commercial construction 45,490 32,530 12,960 22,440 15,328 7,112 67,930 47,858 20,072 Commercial & industrial 504 365 139 3,397 2,302 1,095 3,901 2,667 1,234 Total commercial 86,896 62,346 24,550 43,039 28,720 14,319 129,935 91,066 38,869 Residential construction 59,747 43,018 16,729 35,508 23,459 12,049 95,255 66,477 28,778 Residential mortgage 19,342 13,917 5,425 21,716 14,262 7,454 41,058 28,179 12,879 Consumer / installment 120 86 34 238 169 69 358 255 103 Total $166,105 $119,367 $46,738 $100,501 $66,610 $33,891 $266,606 $185,977 $80,629 BY MARKET Atlanta MSA $51,647 $37,186 $14,461 $13,755 $8,545 $5,210 $65,402 $45,731 $19,671 Gainesville MSA 4,949 3,563 1,386 3,695 2,442 1,253 8,644 6,005 2,639 North Georgia 80,831 57,969 22,862 70,900 47,698 23,202 151,731 105,667 46,064 Western North Carolina 15,468 11,138 4,330 7,228 4,743 2,485 22,696 15,881 6,815 Coastal Georgia 9,493 6,835 2,658 3,527 2,179 1,348 13,020 9,014 4,006 East Tennessee 3,717 2,676 1,041 1,396 1,003 393 5,113 3,679 1,434 Total $166,105 $119,367 $46,738 $100,501 $66,610 $33,891 $266,606 $185,977 $80,629 (1) This schedule presents a summary of classified loans included in the bulk loan sale transaction that closed on April 18, 2011. (2) This column represents the book value, or carrying amount, of the loans prior to charge offs to mark loans to expected proceeds from sale. (3) This column represents the charge-offs required to adjust the loan balances to the expected proceeds from the sale based on indicative bids received from prospective buyers, including principal payments received or committed advances made after the cutoff date through March 31, 2011 that are part of the settlement. (4) This column represents the expected proceeds from the bulk sale based on indicative bids received from prospective buyers and equals the balance shown on the consolidated balance sheet as loans held for sale. |

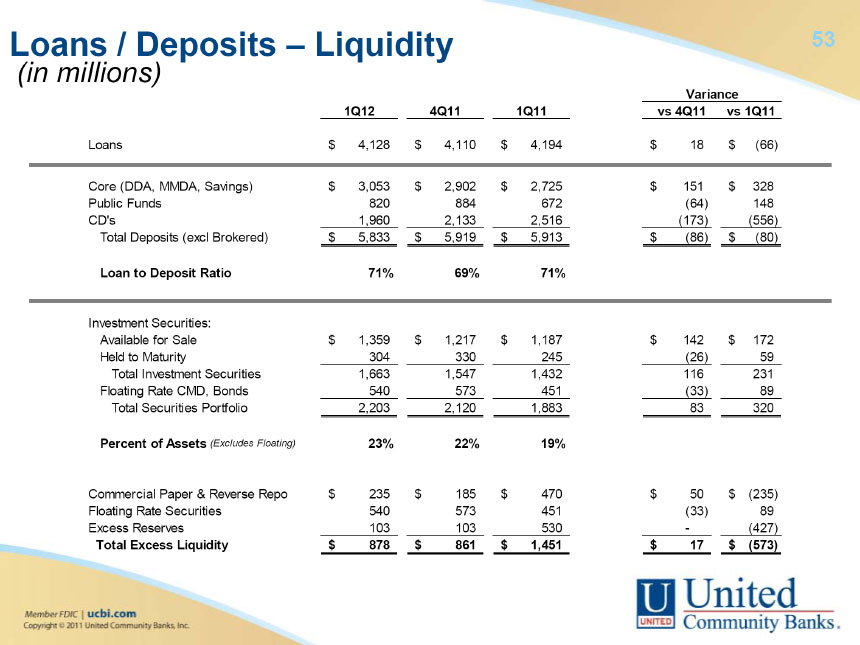

| 53 Loans / Deposits – Liquidity (in millions) Variance 1Q12 4Q11 1Q11 vs 4Q11 vs 1Q11 Loans $4,128 $4,110 $4,194 $18 $(66) Core (DDA, MMDA, Savings) $3,053 $2,902 $2,725 $151 $328 Public Funds 820 884 672 (64) 148 CD’s 1,960 2,133 2,516 (173) (556) Total Deposits (excl Brokered) $5,833 $5,919 $5,913 $(86) $(80) Loan to Deposit Ratio 71% 69% 71% Investment Securities: Available for Sale $1,359 $1,217 $1,187 $142 $172 Held to Maturity 304 330 245 (26) 59 Total Investment Securities 1,663 1,547 1,432 116 231 Floating Rate CMD, Bonds 540 573 451 (33) 89 Total Securities Portfolio 2,203 2,120 1,883 83 320 Percent of Assets (Excludes Floating) 23% 22% 19% Commercial Paper & Reverse Repo $235 $185 $470 $50 $(235) Floating Rate Securities 540 573 451 (33) 89 Excess Reserves 103 103 530 - (427) Total Excess Liquidity $878 $861 $1,451 $17 $(573) |

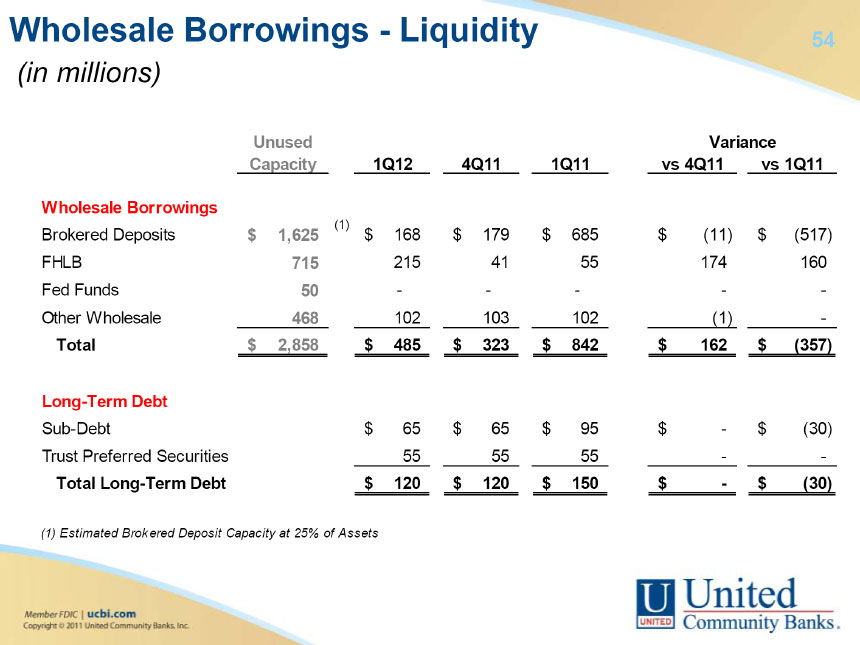

| 54 Wholesale Borrowings - Liquidity (in millions) Variance Unused Capacity 1Q12 4Q11 1Q11 vs 4Q11 vs 1Q11 Wholesale Borrowings Brokered Deposits $1,625 (1) $168 $179 $685 $(11) $(517) FHLB 715 215 41 55 174 160 Fed Funds 50 - - - - - Other Wholesale 468 102 103 102 (1) - Total $2,858 $485 $323 $842 $162 $(357) Long-Term Debt Sub-Debt $65 $65 $95 $- $(30) Trust Preferred Securities 55 55 55 - - Total Long-Term Debt $120 $120 $150 $- $(30) (1) Estimated Brokered Deposit Capacity at 25% of Assets |

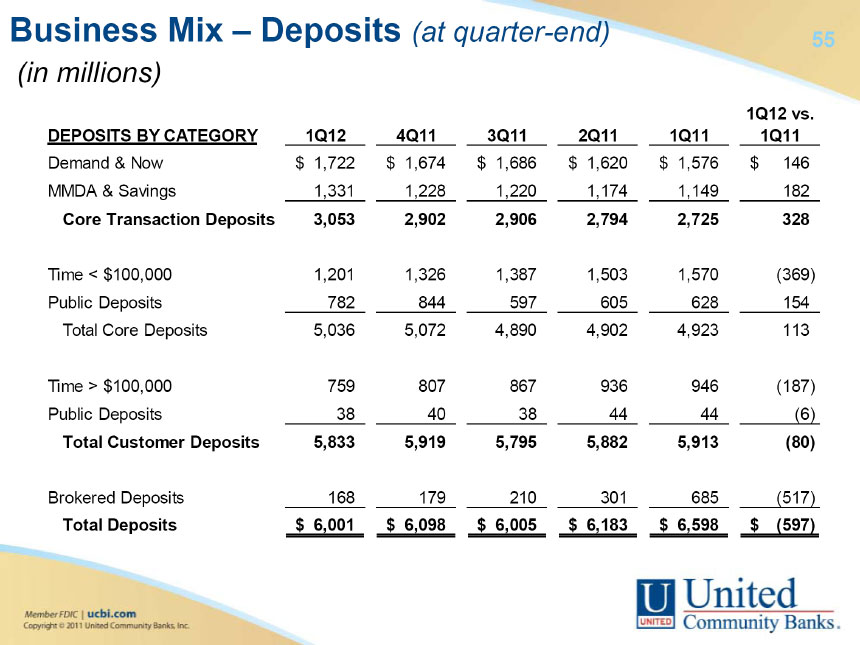

| 55 Business Mix – Deposits (at quarter-end) (in millions) DEPOSITS BY CATEGORY 1Q12 4Q11 3Q11 2Q11 1Q11 1Q12 vs. 1Q11 Demand & Now $1,722 $1,674 $1,686 $1,620 $1,576 $146 MMDA & Savings 1,331 1,228 1,220 1,174 1,149 182 Core Transaction Deposits 3,053 2,902 2,906 2,794 2,725 328 Time < $100,000 1,201 1,326 1,387 1,503 1,570 (369) Public Deposits 782 844 597 605 628 154 Total Core Deposits 5,036 5,072 4,890 4,902 4,923 113 Time > $100,000 759 807 867 936 946 (187) Public Deposits 38 40 38 44 44 (6) Total Customer Deposits 5,833 5,919 5,795 5,882 5,913 (80) Brokered Deposits 168 179 210 301 685 (517) Total Deposits $6,001 $6,098 $6,005 $6,183 $6,598 $(597) |

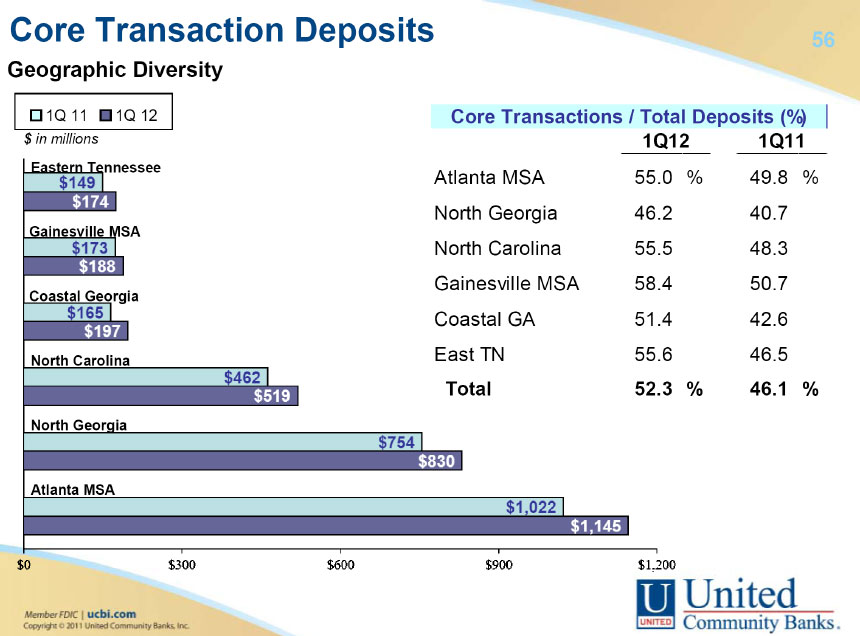

| 56 Core Transaction Deposits Geographic Diversity 1Q 11 1Q 12 $ in millions Eastern Tennessee Gainesville MSA Coastal Georgia North Carolina North Georgia Atlanta MSA Core Transactions / Total Deposits (%) 1Q12 1Q11 Atlanta MSA 55.0% 49.8% North Georgia 46.2 40.7 North Carolina 55.5 48.3 Gainesville MSA 58.4 50.7 Coastal GA 51.4 42.6 East TN 55.6 46.5 Total 52.3% 46.1% |

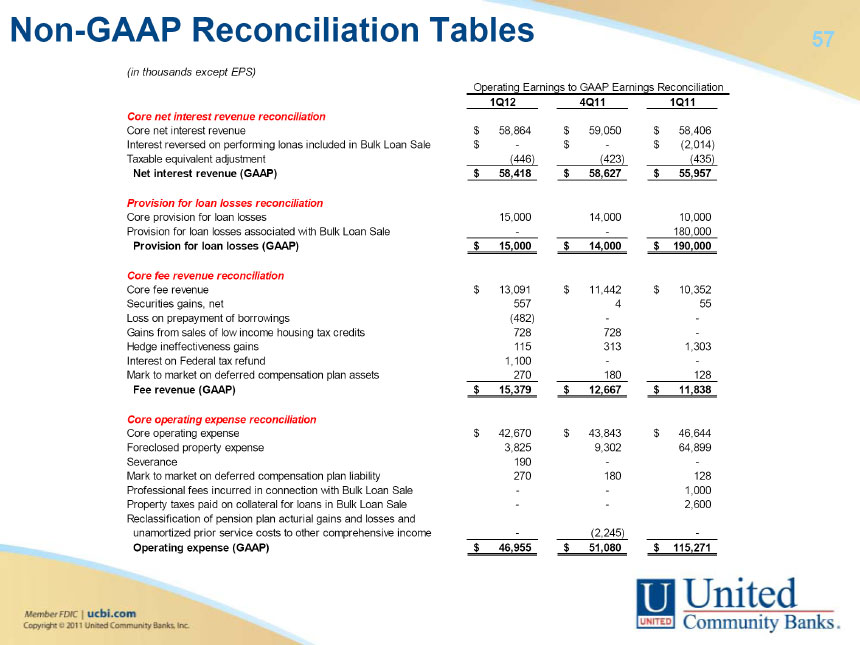

| 57 Non-GAAP Reconciliation Tables (in thousands except EPS) Operating Earnings to GAAP Earnings Reconciliation 1Q12 4Q11 1Q11 Core net interest revenue reconciliation Core net interest revenue $58,864 $59,050 $58,406 Interest reversed on performing lonas included in Bulk Loan Sale $- $- $(2,014) Taxable equivalent adjustment (446) (423) (435) Net interest revenue (GAAP) $58,418 $58,627 $55,957 Provision for loan losses reconciliation Core provision for loan losses 15,000 14,000 10,000 Provision for loan losses associated with Bulk Loan Sale - - 180,000 Provision for loan losses (GAAP) $15,000 $14,000 $190,000 Core fee revenue reconciliation Core fee revenue $13,091 $11,442 $10,352 Securities gains, net 557 4 55 Loss on prepayment of borrowings (482) - - Gains from sales of low income housing tax credits 728 728 - Hedge ineffectiveness gains 115 313 1,303 Interest on Federal tax refund 1,100 - - Mark to market on deferred compensation plan assets 270 180 128 Fee revenue (GAAP) $15,379 $12,667 $11,838 Core operating expense reconciliation Core operating expense $42,670 $43,843 $46,644 Foreclosed property expense 3,825 9,302 64,899 Severance 190 - - Mark to market on deferred compensation plan liability 270 180 128 Professional fees incurred in connection with Bulk Loan Sale - - 1,000 Property taxes paid on collateral for loans in Bulk Loan Sale - - 2,600 Reclassification of pension plan acturial gains and losses and unamortized prior service costs to other comprehensive income - (2,245) - Operating expense (GAAP) $46,955 $51,080 $115,271 |

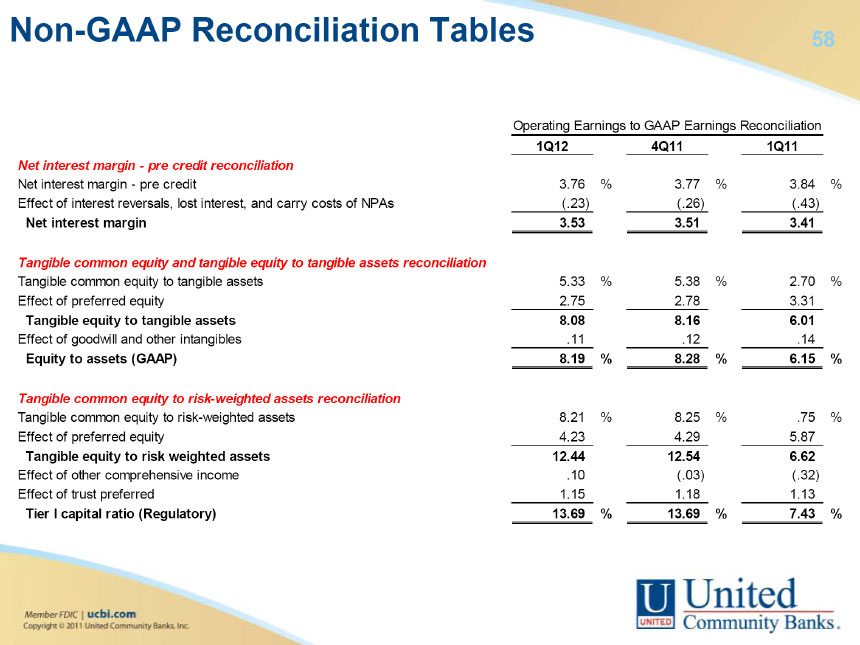

| 58 Non-GAAP Reconciliation Tables Operating Earnings to GAAP Earnings Reconciliation 1Q12 4Q11 1Q11 Net interest margin - pre credit reconciliation Net interest margin - pre credit 3.76% 3.77% 3.84% Effect of interest reversals, lost interest, and carry costs of NPAs (.23) (.26) (.43) Net interest margin 3.53 3.51 3.41 Tangible common equity and tangible equity to tangible assets reconciliation Tangible common equity to tangible assets 5.33% 5.38% 2.70% Effect of preferred equity 2.75 2.78 3.31 Tangible equity to tangible assets 8.08 8.16 6.01 Effect of goodwill and other intangibles .11 .12 .14 Equity to assets (GAAP) 8.19% 8.28% 6.15% Tangible common equity to risk-weighted assets reconciliation Tangible common equity to risk-weighted assets 8.21% 8.25% .75% Effect of preferred equity 4.23 4.29 5.87 Tangible equity to risk weighted assets 12.44 12.54 6.62 Effect of other comprehensive income .10 (.03) (.32) Effect of trust preferred 1.15 1.18 1.13 Tier I capital ratio (Regulatory) 13.69% 13.69% 7.43% |

| 59 Analyst Coverage FIG Partners (Market Perform - Mar 22, 2012) Guggenheim Securities, LLC (Neutral - Jan 27, 2012) Keefe, Bruyette & Woods (Market Perform - Jan 26, 2012) Macquarie Capital (USA) (Neutral - Jan 25, 2012) Raymond James & Assoc. (Market Perform - Jan 27, 2012) Sandler O’Neill & Partners (Hold, Apr 4, 2012) Stephens, Inc. (Equal Weight - Jan 27, 2012) SunTrust Robinson Humphrey (Neutral - Jan 26, 2012) |

| 60 United Community Banks, Inc. Investor Presentation First Quarter 2012 Copyright 2012 United Community Banks, Inc. All rights reserved. |