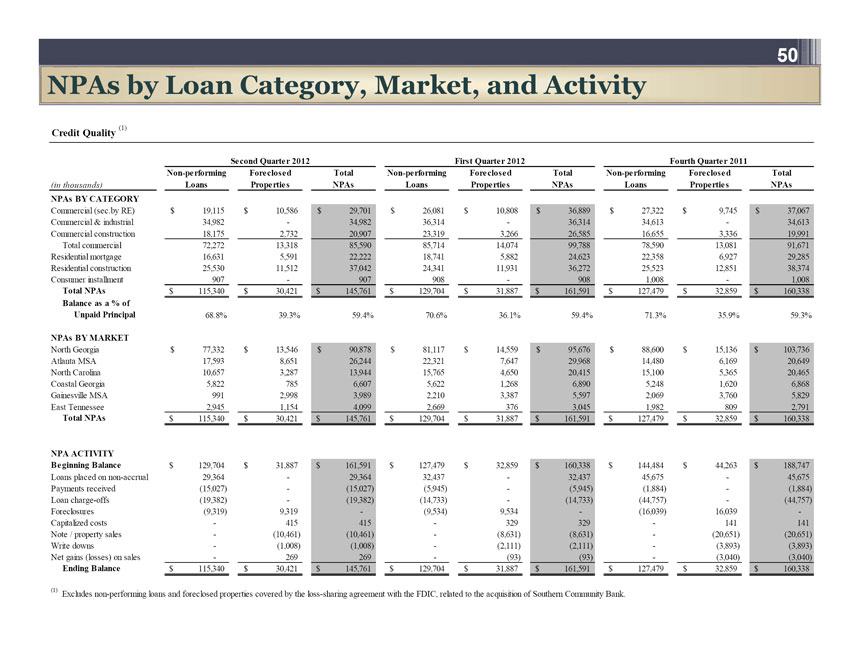

50

NPAs by Loan Category, Market, and Activity 50

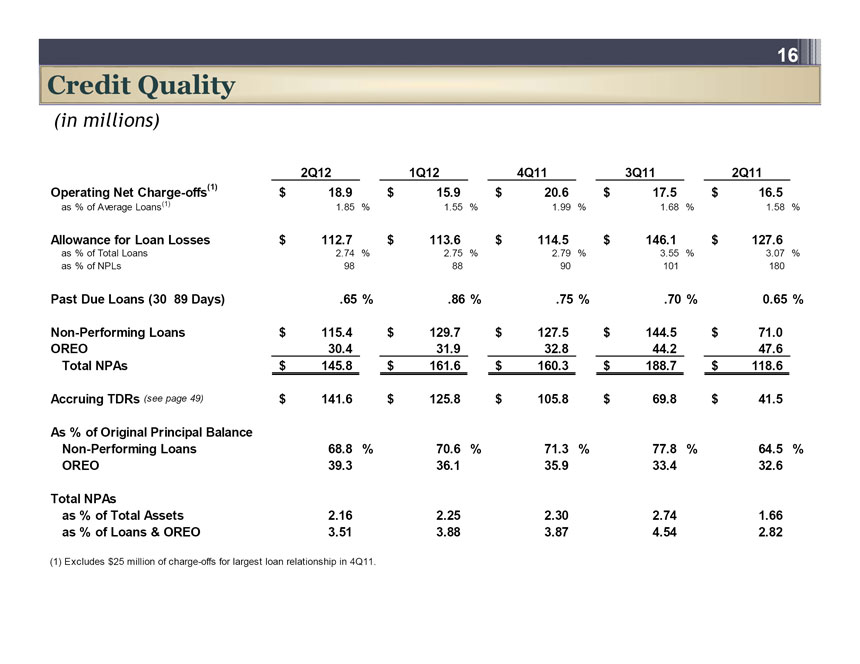

Credit Quality (1)

Second Quarter 2012 First Quarter 2012Fourth Quarter 2011

Non-performing Foreclosed Total Non-performing Foreclosed TotalNon-performingForeclosedTotal

(in thousands) Loans Properties NPAs Loans Properties NPAsLoansPropertiesNPAs

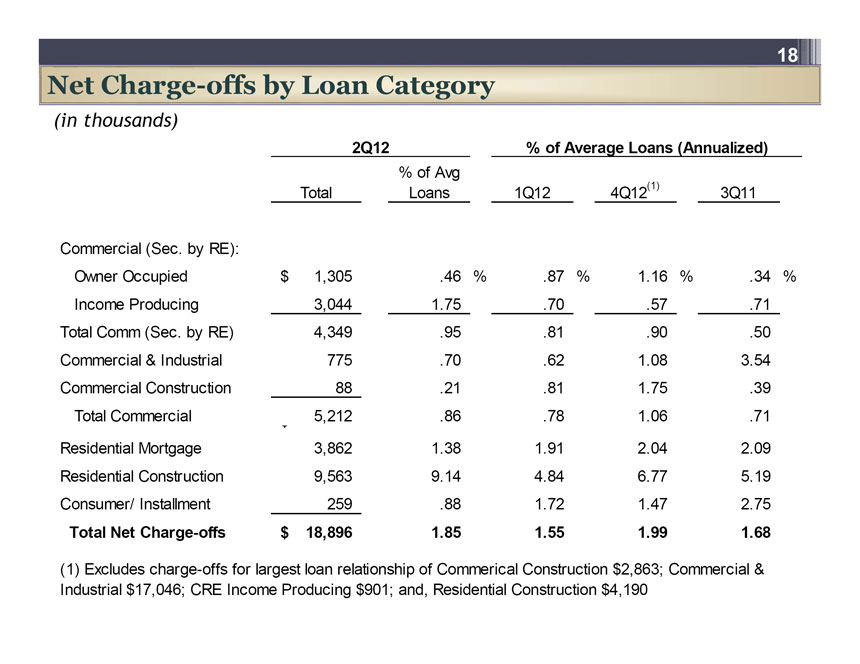

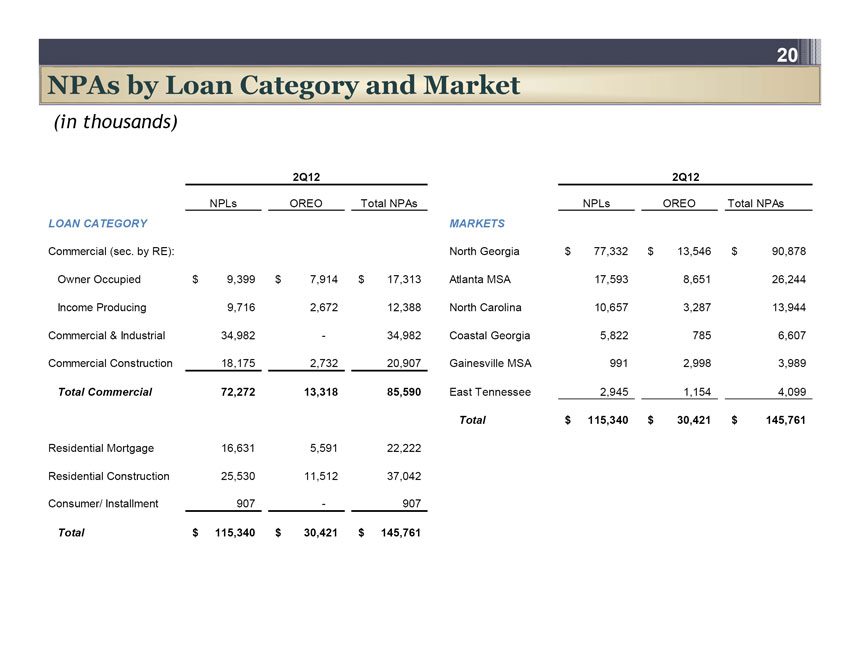

NPAs BY CATEGORY

Commercial (sec.by RE) $ 19,115 $ 10,586 $ 29,701 $ 26,081 $ 10,808 $ 36,889$27,322$9,745$37,067

Commercial & industrial 34,982 - 34,982 36,314 - 36,314 34,613-34,613

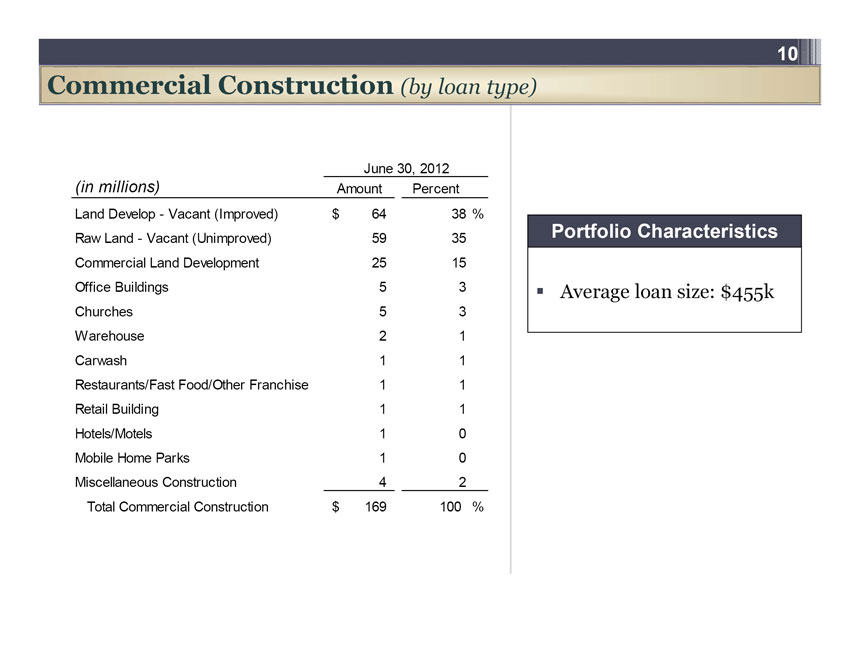

Commercial construction 18,175 2,732 20,907 23,319 3,266 26,585 16,6553,33619,991

Total commercial 72,272 13,318 85,590 85,714 14,074 99,788 78,59013,08191,671

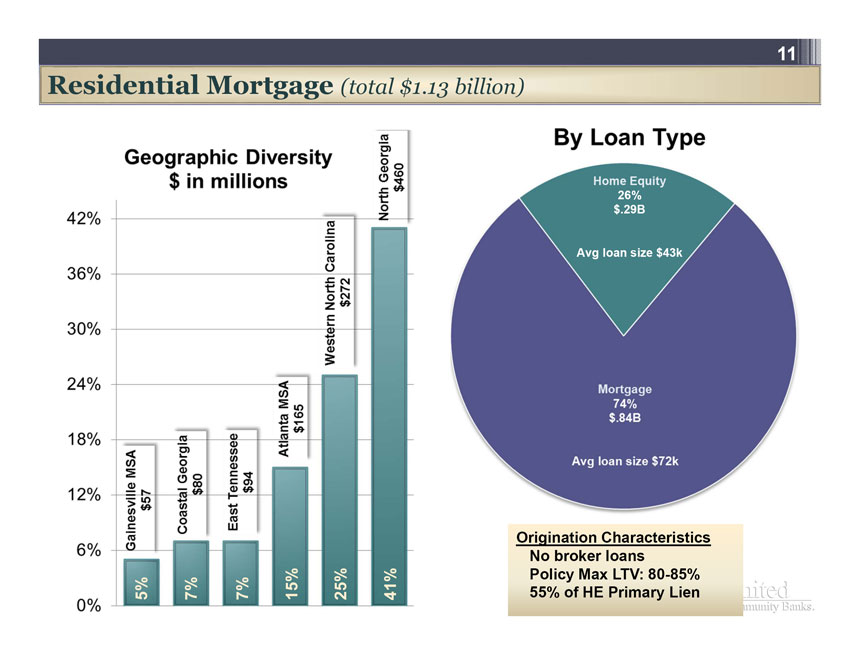

Residential mortgage 16,631 5,591 22,222 18,741 5,882 24,623 22,3586,92729,285

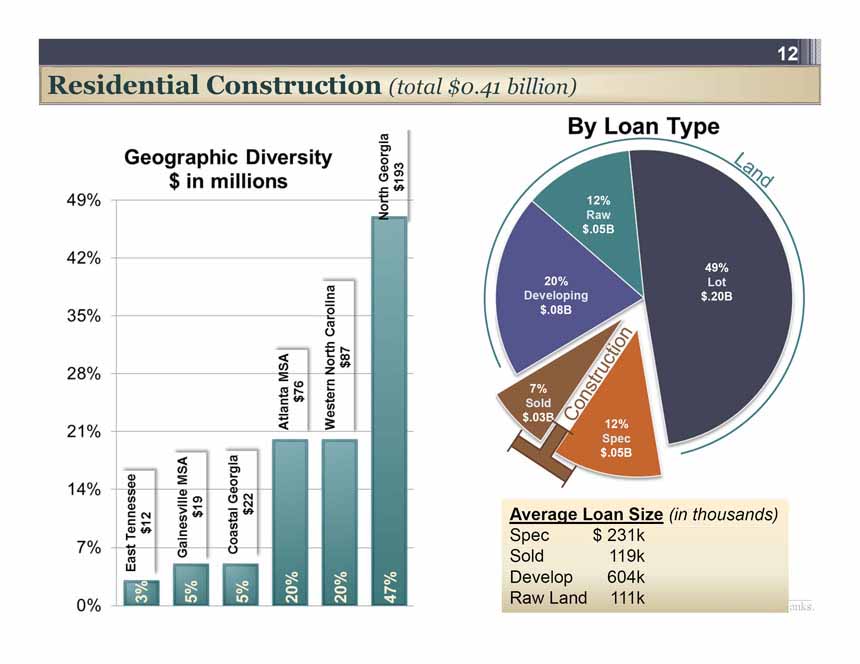

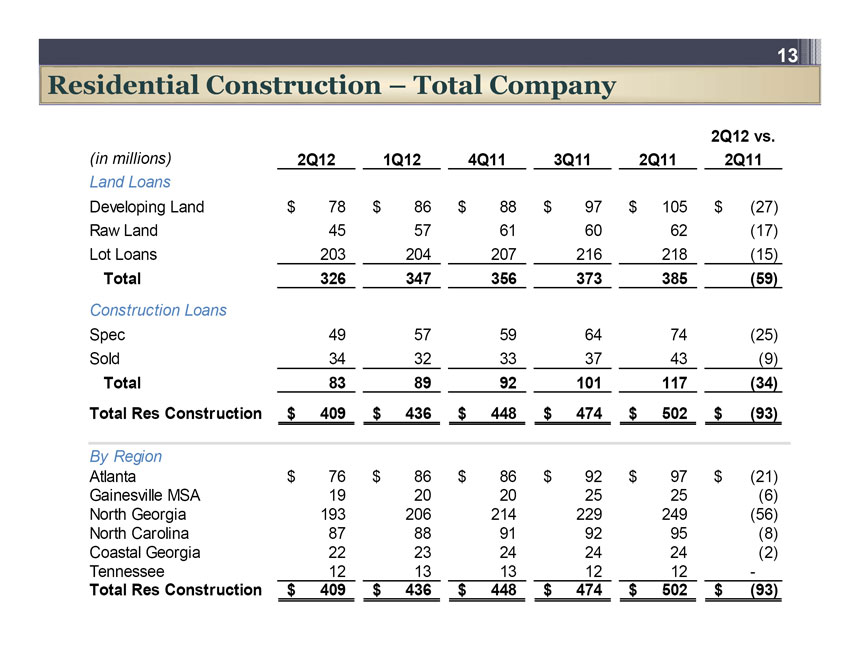

Residential construction 25,530 11,512 37,042 24,341 11,931 36,272 25,52312,85138,374

Consumer installment 907 - 907 908 - 908 1,008 - 1,008

Total NPAs $ 115,340 $ 30,421 $ 145,761 $ 129,704 $ 31,887 $ 161,591 $ 127,479$32,859$160,338

Balance as a % of

Unpaid Principal 68.8% 39.3% 59.4% 70.6% 36.1% 59.4% 71.3%35.9%59.3%

NPAs BY MARKET

North Georgia $ 77,332 $ 13,546 $ 90,878 $ 81,117 $ 14,559 $ 95,676 $ 88,600$15,136$103,736

Atlanta MSA 17,593 8,651 26,244 22,321 7,647 29,968 14,4806,16920,649

North Carolina 10,657 3,287 13,944 15,765 4,650 20,415 15,1005,36520,465

Coastal Georgia 5,822 785 6,607 5,622 1,268 6,890 5,248 1,6206,868

Gainesville MSA 991 2,998 3,989 2,210 3,387 5,597 2,069 3,7605,829

East Tennessee 2,945 1,154 4,099 2,669 376 3,045 1,982 809 2,791

Total NPAs $ 115,340 $ 30,421 $ 145,761 $ 129,704 $ 31,887 $ 161,591 $ 127,479$32,859$160,338

NPA ACTIVITY

Beginning Balance $ 129,704 $ 31,887 $ 161,591 $ 127,479 $ 32,859 $ 160,338 $ 144,484$44,263$188,747

Loans placed on non-accrual 29,364 - 29,364 32,437 - 32,43745,675-45,675

Payments received (15,027) - (15,027) (5,945) - (5,945) (1,884)-(1,884)

Loan charge-offs (19,382) - (19,382) (14,733) - (14,733) (44,757)-(44,757)

Foreclosures (9,319) 9,319 - (9,534) 9,534 - (16,039)16,039-

Capitalized costs - 415 415 - 329 329 - 141 141

Note / property sales - (10,461) (10,461) - (8,631) (8,631) -(20,651)(20,651)

Write downs - (1,008) (1,008) - (2,111) (2,111) - (3,893)(3,893)

Net gains (losses) on sales - 269 269 - (93) (93) - (3,040)(3,040)

Ending Balance $ 115,340 $ 30,421 $ 145,761 $ 129,704 $ 31,887 $ 161,591 $ 127,479$32,859$160,338

(1) Excludes non-performing loans and foreclosed properties covered by the loss-sharing agreement with the FDIC, related to the acquisition of Southern Community Bank.26