Exhibit 99.1

ucbi.com | 1

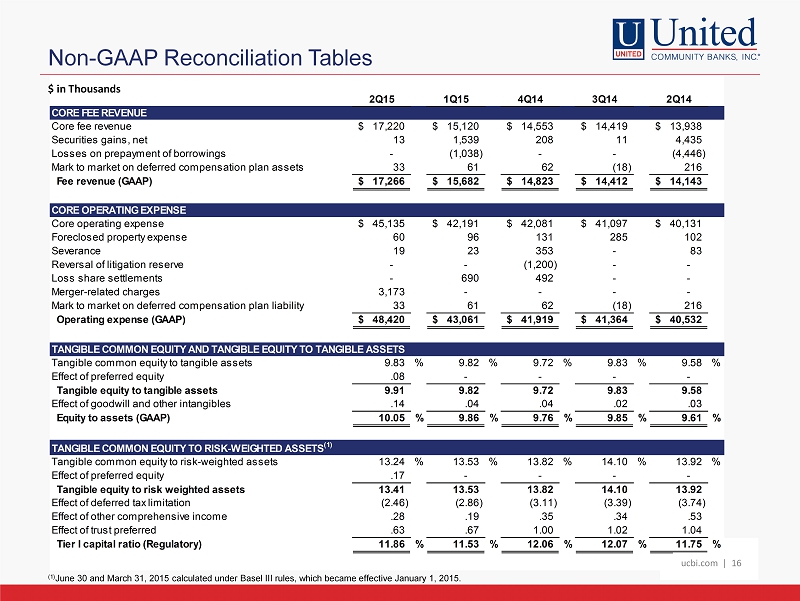

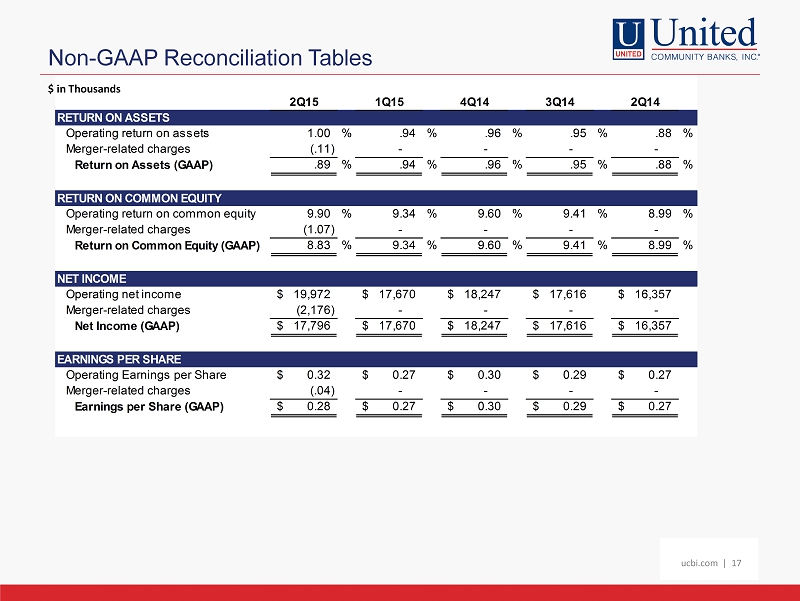

ucbi.com | 2 ucbi.com | 2 Disclosures efficiency ratio, operating dividend payout ratio, core fee revenue, core operating expense, core earnings, tangible common equity to tangible assets, tangible equity to tangible assets and tangible common equity to risk - weighted assets . The most comparable GAAP measures to these measures are : net income, net income available to common shareholders, diluted income per common share, ROE, ROA, efficiency ratio, dividend payout ratio, fee revenue, operating expense, net income, and equity to assets . Management uses these non - GAAP financial measures because we believe they are useful for evaluating our operations and performance over periods of time, as well as in managing and evaluating our business and in discussions about our operations and performance . Management believes these non - GAAP financial measures provide users of our financial information with a meaningful measure for assessing our financial results and credit trends, as well as for comparison to financial results for prior periods . These non - GAAP financial measures should not be considered as a substitute for financial measures determined in accordance with GAAP and may not be comparable to other similarly titled financial measures used by other companies . For a reconciliation of the differences between our non - GAAP financial measures and the most comparable GAAP measures, please refer to the ‘Non - GAAP Reconcilement Tables’ at the end of the Appendix to this presentation . CAUTIONARY STATEMENT This investor presentation may contain forward - looking statements, as defined by federal securities laws, including statements about United’s financial outlook and business environment . These statements are based on current expectations and are provided to assist in the understanding of future financial performance . Such performance involves risks and uncertainties that may cause actual results to differ materially

from those expressed or implied in any such statements . For a discussion of some of the risks and other factors that may cause such forward - looking statements to differ materially from actual results, please refer to United Community Banks, Inc . ’s filings with the Securities and Exchange Commission, including its 2014 Annual Report on Form 10 - K and its most recent quarterly report on Form 10 - Q under the sections entitled “Forward - Looking Statements” . Forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements . NON - GAAP MEASURES This presentation also contains financial measures determined by methods other than in accordance with generally accepted accounting principles (“GAAP”) . Such non - GAAP financial measures include : operating net income, operating net income available to common shareholders, operating diluted income per common share, operating ROE, operating ROA, operating

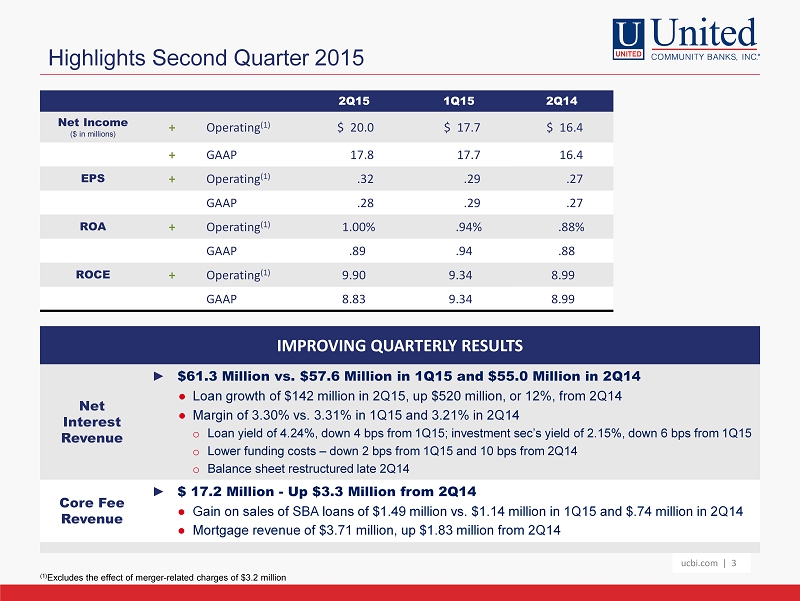

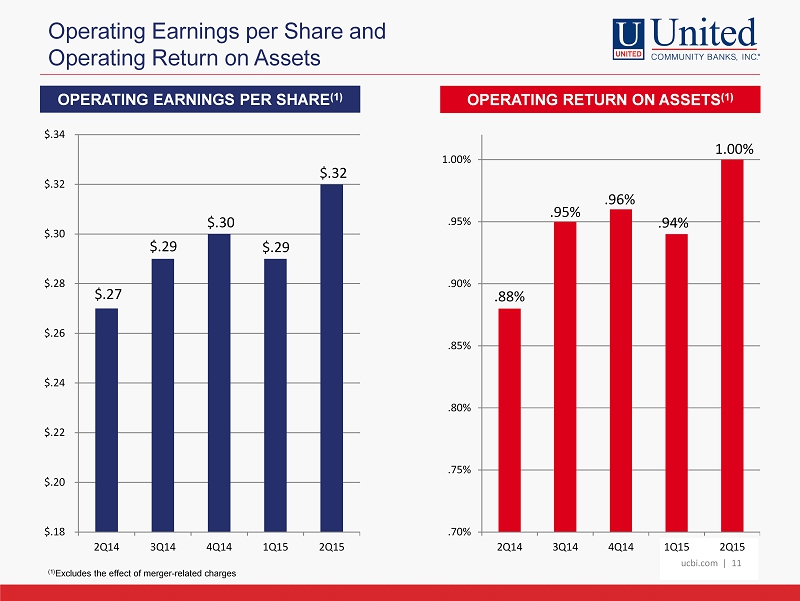

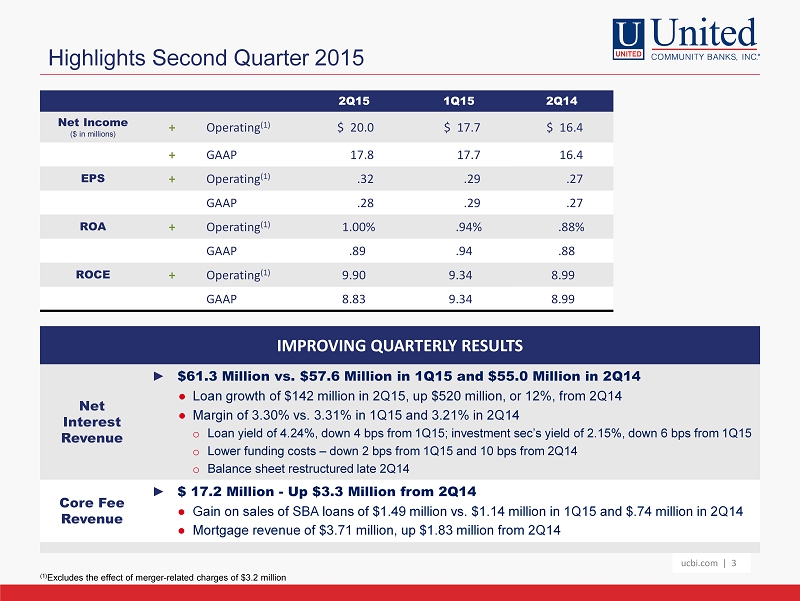

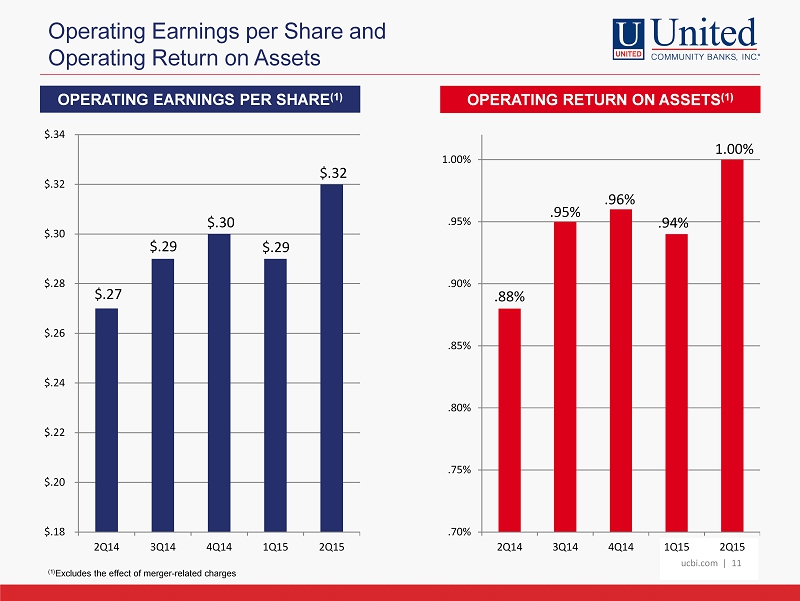

ucbi.com | 3 Highlights Second Quarter 2015 (in millions) 2Q15 1Q15 2Q14 Net Income ($ in millions) + Operating (1) $ 20.0 $ 17.7 $ 16.4 + GAAP 17.8 17.7 16.4 EPS + Operating (1) .32 .29 .27 GAAP .28 .29 .27 ROA + Operating (1) 1.00% .94% .88% GAAP .89 .94 .88 ROCE + Operating (1) 9.90 9.34 8.99 GAAP 8.83 9.34 8.99 ucbi.com | 3 IMPROVING QUARTERLY RESULTS Net Interest Revenue ► $61.3 Mill

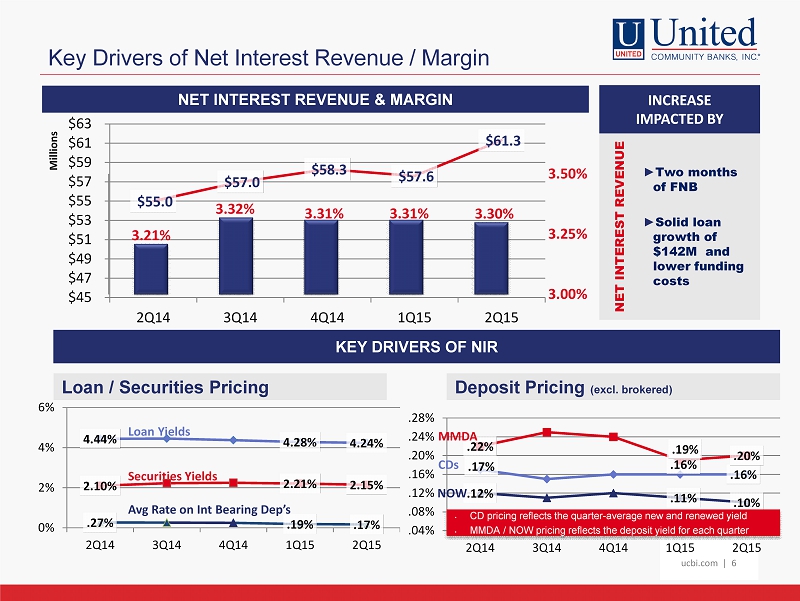

ion vs. $57.6 Million in 1Q15 and $55.0 Million in 2Q14 ● Loan growth of $142 million in 2Q15, up $520 million, or 12%, from 2Q14 ● Margin of 3.30% vs. 3.31% in 1Q15 and 3.21% in 2Q14 o Loan yield of 4.24%, down 4 bps from 1Q15; investment sec’s yield of 2.15%, down 6 bps from 1Q15 o Lower funding costs – down 2 bps from 1Q15 and 10 bps from 2Q14 o Balance sheet restructured late 2Q14 Core Fee Revenue ► $ 17.2 Million - Up $3.3 Million from 2Q14 ● Gain on sales of SBA loans of $1.49 million vs. $1.14 million in 1Q15 and $.74 million in 2Q14 ● Mortgage revenue of $3.71 million, up $1.83 million from 2Q14 ( 1) Excludes the effect of merger - related charges of $3.2 million

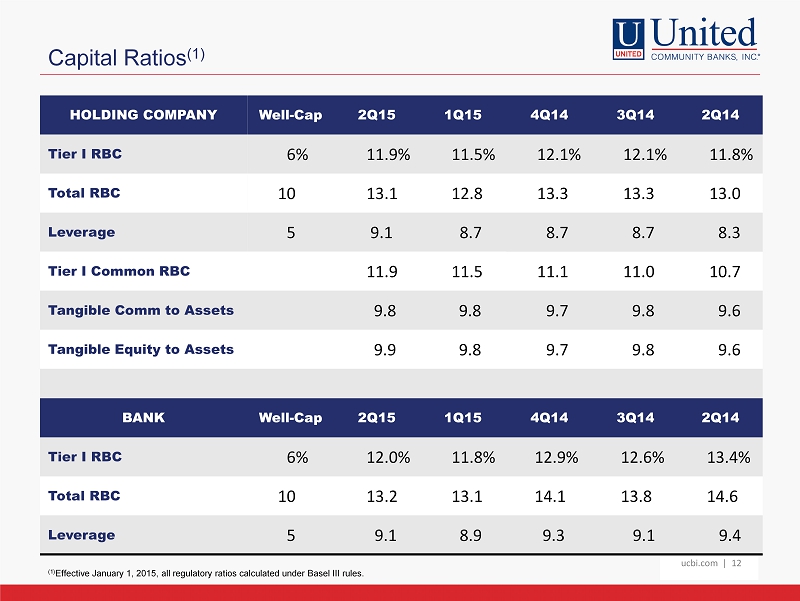

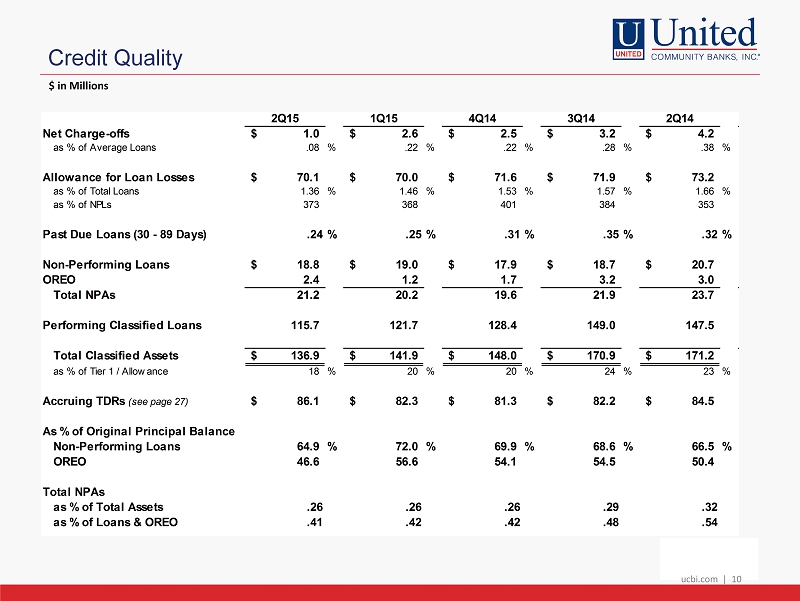

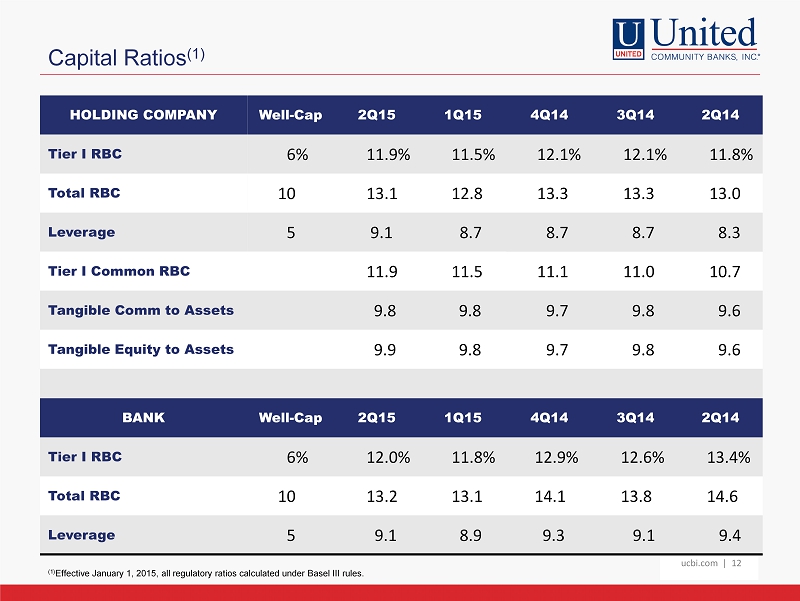

ucbi.com | 4 Highlights Second Quarter 2015 ucbi.com | 4 IMPROVING QUARTERLY RESULTS Loan Growth ► Growth in Many Sectors ● Loan growth of $142 million, or 12% annualized (excludes FNB - $238 million) ● Loan Production of $518 million vs. $423 million 1Q15 and $357 million year ago Core Transactio n Deposits ► Up $109 Million from First Quarter, or 11% Annualized ● Up $381 million from 2Q14, or 11% ● Represents 68% of total customer deposits Credit Quality ► Solid Improvement ● Provision of $.9 million vs. $1.8 million in 1Q15 ● Net charge - offs decline to .08% of total loans vs. .22% in 1Q15 ● NPAs were .26% of total assets vs. .26% in 1Q15 and .32% in 2Q14 ● Allowance 1.36% (1.42% FNB) of total loans vs. 1.46% at 1Q15 and 1.66% at 2Q14 Capital Ratios ► Solid and Well - Capitalized ● Quarterly dividend of 5 cents per share ● Tier I Common to Risk Weighted Assets of 11.9%; Tangible Common to RWAs of 13.2% ● Tier I Risk Based Capital of 11.9% and Tier I Leverage of 9.1% Acquisition ► Executing Growth Strategy ● Closed merger with MoneyTree Corporation (First National Bank: “FNB”) on May 1 ● Announced merger with Palmetto Bancshares (The Palmetto Bank) on April 22; received all regulatory approvals; shareholders’ meeting on August 12; expect closing on September 1

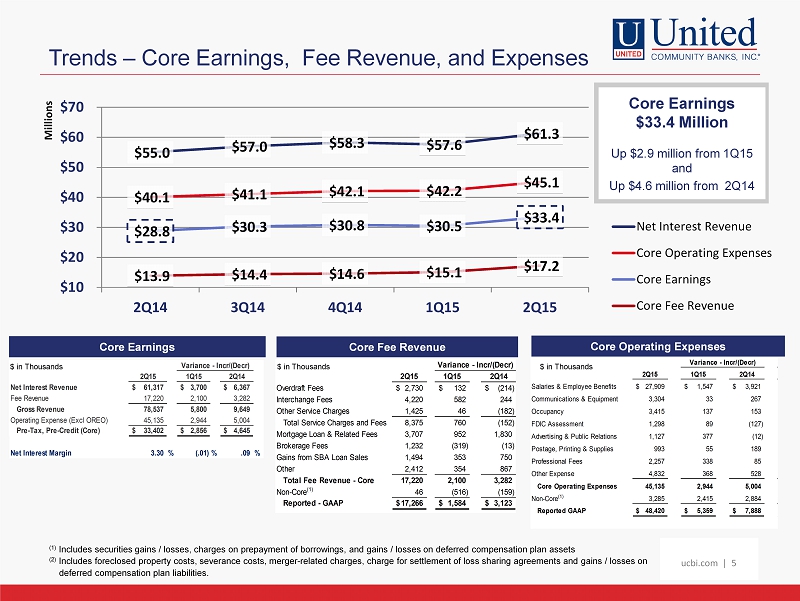

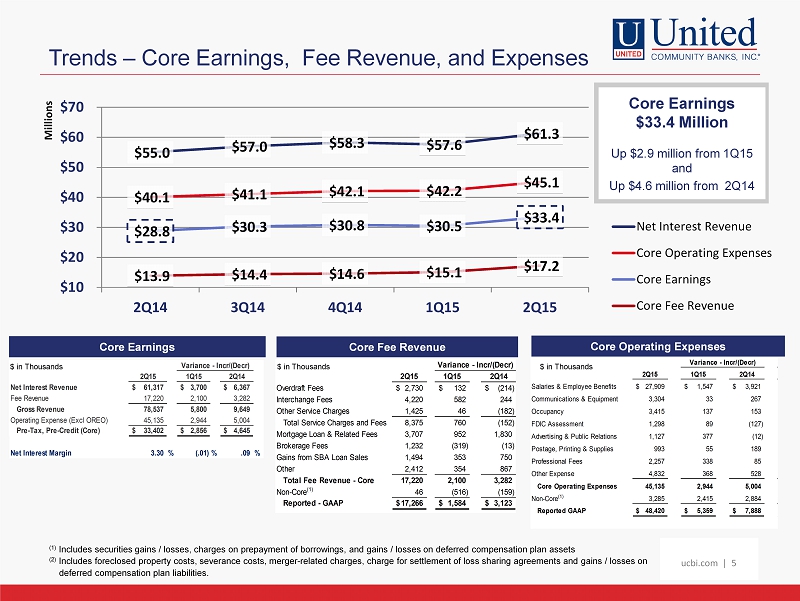

ucbi.com | 5 $55.0 $57.0 $58.3 $57.6 $61.3 $40.1 $41.1 $42.1 $42.2 $45.1 $28.8 $30.3 $30.8 $30.5 $33.4 $13.9 $14.4 $14.6 $15.1 $17.2 $10 $20 $30 $40 $50 $60 $70 2Q14 3Q14 4Q14 1Q15 2Q15 Net Interest Revenue Core Operating Expenses Core Earnings Core Fee Revenue 2Q15 1Q15 2Q14 Salaries & Employee Benefits 27,909$ 1,547$ 3,921$ Communications & Equipment 3,304 33 267 Occupancy 3,415 137 153 FDIC Assessment 1,298 89 (127) Advertising & Public Relations 1,127 377 (12) Postage, Printing & Supplies 993 55 189 Professional Fees 2,257 338 85 Other Expense 4,832 368 528 Core Operating Expenses 45,135 2,944 5,004 Non-Core (1) 3,285 2,415 2,884 Reported GAAP 48,420$ 5,359$ 7,888$ Variance - Incr/(Decr) 2Q15 1Q15 2Q14 Overdraft Fees 2,730$ 132$ (214)$ Interchange Fees 4,220 582 244 Other Service Charges 1,425 46 (182) Total Service Charges and Fees 8,375 760 (152) Mortgage Loan & Related Fees 3,707 952 1,830 Brokerage Fees 1,232 (319) (13) Gains from SBA Loan Sales 1,494 353 750 Other 2,412 354 867 Total Fee Revenue - Core 17,220 2,100 3,282 Non-Core (1) 46 (516) (159) Reported - GAAP 17,266$ 1,584$ 3,123$ Variance - Incr/(Decr) 2Q15 1Q15 2Q14 Net Interest Revenue 61,317$ 3,700$ 6,367$ Fee Revenue 17,220 2,100 3,282 Gross Revenue 78,537 5,800 9,649 Operating Expense (Excl OREO) 45,135 2,944 5,004 Pre-Tax, Pre-Credit (Core) 33,402$ 2,856$ 4,645$ Net Interest Margin 3.30 % (.01) % .09 % Variance - Incr/(Decr) Trends – Core Earnings, Fee Revenue, and Expenses $ in Thousands $ in Thousands (1) Includes securities gains / losses, charges on prepayment of borrowings, and gains / losses on deferred compensation plan assets (2) Includes foreclosed pro

perty costs, severance costs, merger - related charges, charge for settlement of loss sharing agreements and gains / losses on deferred compensation plan liabilities. $ in Thousands Core Earnings $33.4 Million Up $2.9 million from 1Q15 and Up $4.6 million from 2Q14 Core Operating Expenses Millions Core Earnings Core Fee Revenue ucbi.com | 5

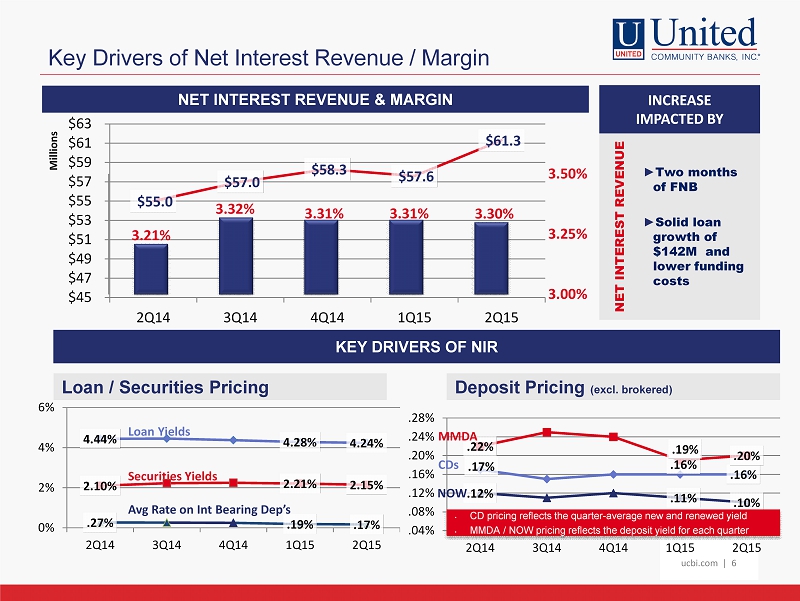

ucbi.com | 6 .17% .16% .16% .22% .19% .20% .12% .11% .10% .04% .08% .12% .16% .20% .24% .28% 2Q14 3Q14 4Q14 1Q15 2Q15 $55.0 $57.0 $58.3 $57.6 $61.3 $45 $47 $49 $51 $53 $55 $57 $59 $61 $63 2Q14 3Q14 4Q14 1Q15 2Q15 Key Drivers of Net Interest Revenue / Margin KEY DRIVERS OF NIR NET INTEREST REVENUE & MARGIN Loan / Securities Pricing Deposit Pricing (excl. brokered) Loan Yields Securities Yields Avg Rate on Int Bearing Dep’s • CD pricing reflects the quarter - average new and renewed yield • MMDA / NOW pricing reflects the deposit yield for each quarter CDs MMDA NOW INCREASE IMPACTED BY NET INTEREST REVENUE ► Two months of FNB ► Solid loan growth of $142M and lower funding costs Millions ucbi.com | 6 3.21% 3.32% 3.31% 3.31% 3.30% 3.00% 3.25% 3.50% 4.44% 4.28% 4.24% 2.10% 2.21% 2.15% .27% .19% .17% 0% 2% 4% 6% 2Q14 3Q14 4Q14 1Q15 2Q15

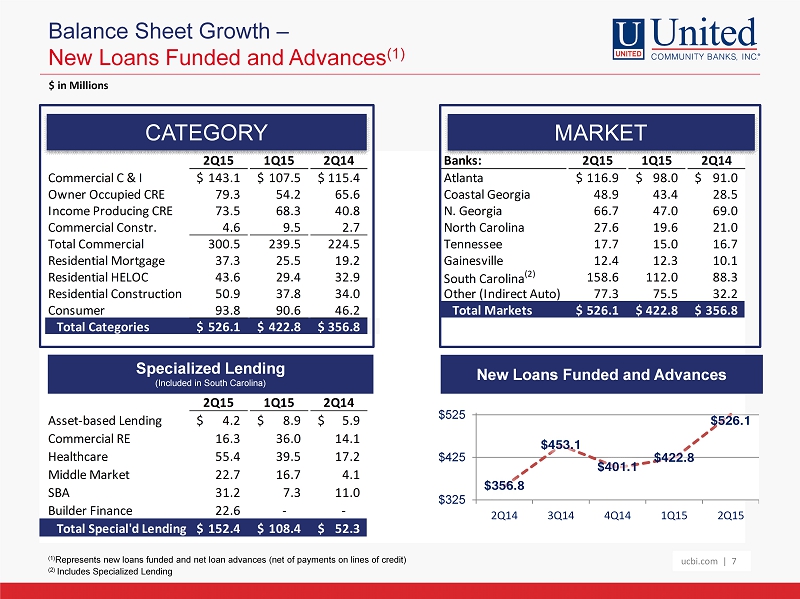

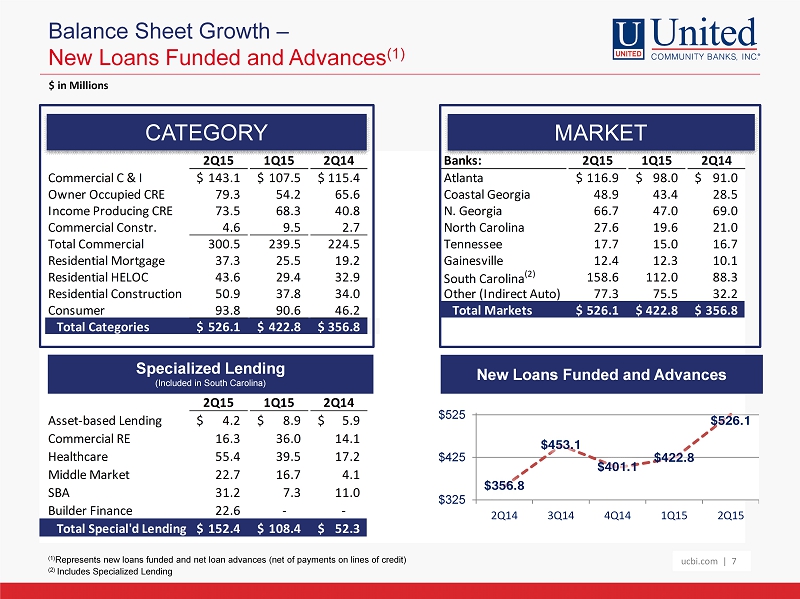

ucbi.com | 1 2Q15 1Q15 2Q14 Banks: 2Q15 1Q15 2Q14 Commercial C & I 143.1$ 107.5$ 115.4$ Atlanta 116.9$ 98.0$ 91.0$ Owner Occupied CRE 79.3 54.2 65.6 Coastal Georgia 48.9 43.4 28.5 Income Producing CRE 73.5 68.3 40.8 N. Georgia 66.7 47.0 69.0 Commercial Constr. 4.6 9.5 2.7 North Carolina 27.6 19.6 21.0 Total Commercial 300.5 239.5 224.5 Tennessee 17.7 15.0 16.7 Residential Mortgage 37.3 25.5 19.2 Gainesville 12.4 12.3 10.1 Residential HELOC 43.6 29.4 32.9 South Carolina (2) 158.6 112.0 88.3 Residential Construction 50.9 37.8 34.0 Other (Indirect Auto) 77.3 75.5 32.2 Consumer 93.8 90.6 46.2 Total Markets 526.1$ 422.8$ 356.8$ Total Categories 526.1$ 422.8$ 356.8$ 2Q15 1Q15 2Q14 Asset-based Lending 4.2$ 8.9$ 5.9$ Commercial RE 16.3 36.0 14.1 Healthcare 55.4 39.5 17.2 Middle Market 22.7 16.7 4.1 SBA 31.2 7.3 11.0 Builder Finance 22.6 - - Total Special'd Lending 152.4$ 108.4$ 52.3$ Balance Sheet Growth – New Loans Funded and Advances (1) CATEGORY (1) Represents new loans funded and net loan advances (net of payments on lines of credit) (2) Includes Specialized Lending New Loans Funded and Advances Specialized Lending (Included in South Carolina) $ in Millions MARKET ucbi.com | 7 $356.8 $453.1 $401.1 $422.8 $526.1 $325 $425 $525 2Q14 3Q14 4Q14 1Q15 2Q15

of credit) (2) Includes Specialized Lending New Loans Funded and Advances Specialized Lending (Included in South Carolina) $ in Millions MARKET ucbi.com | 7 $356.8 $453.1 $401.1 $422.8 $517.9 $325 $375 $425 $475 $525 2Q14 3Q14 4Q14 1Q15 2Q15

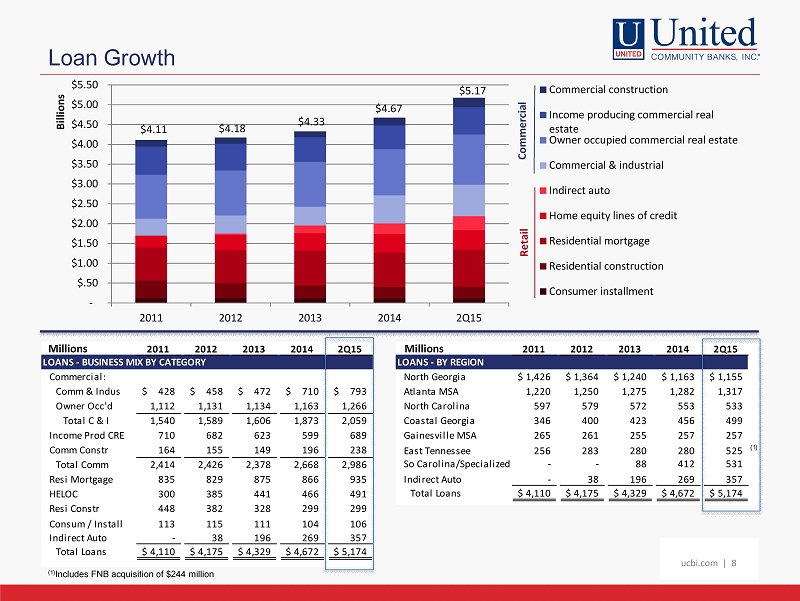

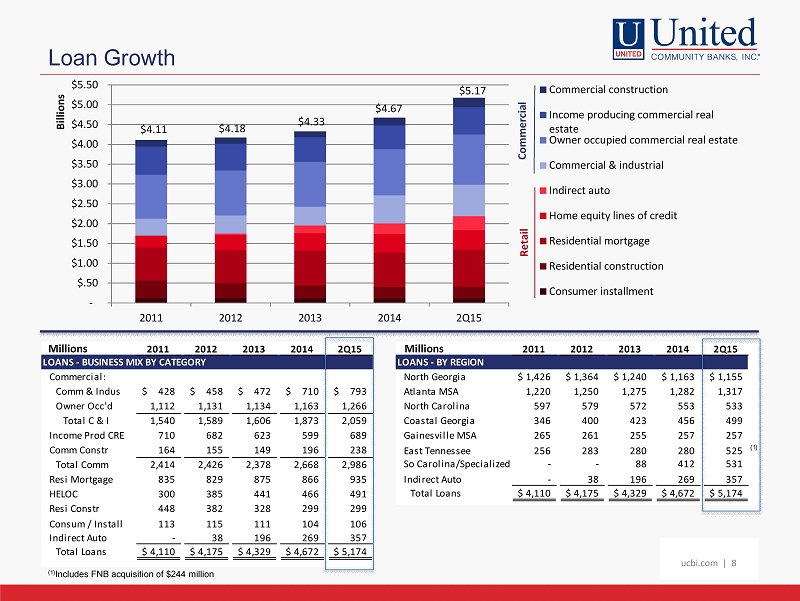

ucbi.com | 8 Loan Growth $4.11 $4.18 $4.33 $4.67 $5.17 - $.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 2011 2012 2013 2014 2Q15 Billions Commercial construction Income producing commercial real estate Owner occupied commercial real estate Commercial & industrial Indirect auto Home equity lines of credit Residential mortgage Residential construction Consum

er installment Commercial Retail 2011 2012 2013 2014 2Q15 LOANS - BUSINESS MIX BY CATEGORY Commercial: Comm & Indus 428$ 458$ 472$ 710$ 793$ Owner Occ'd 1,112 1,131 1,134 1,163 1,266 Total C & I 1,540 1,589 1,606 1,873 2,059 Income Prod CRE 710 682 623 599 689 Comm Constr 164 155 149 196 238 Total Comm 2,414 2,426 2,378 2,668 2,986 Resi Mortgage 835 829 875 866 935 HELOC 300 385 441 466 491 Resi Constr 448 382 328 299 299 Consum / Install 113 115 111 104 106 Indirect Auto - 38 196 269 357 Total Loans 4,110$ 4,175$ 4,329$ 4,672$ 5,174$ 2011 2012 2013 2014 2Q15 LOANS - BY REGION North Georgia 1,426$ 1,364$ 1,240$ 1,163$ 1,155$ Atlanta MSA 1,220 1,250 1,275 1,282 1,317 North Carolina 597 579 572 553 533 Coastal Georgia 346 400 423 456 499 Gainesville MSA 265 261 255 257 257 East Tennessee 256 283 280 280 525 (1) So Carolina/Specialized - - 88 412 531 Indirect Auto - 38 196 269 357 Total Loans 4,110$ 4,175$ 4,329$ 4,672$ 5,174$ Millions Millions ucbi.com | 8 (1) Includes FNB acquisition of $244 million

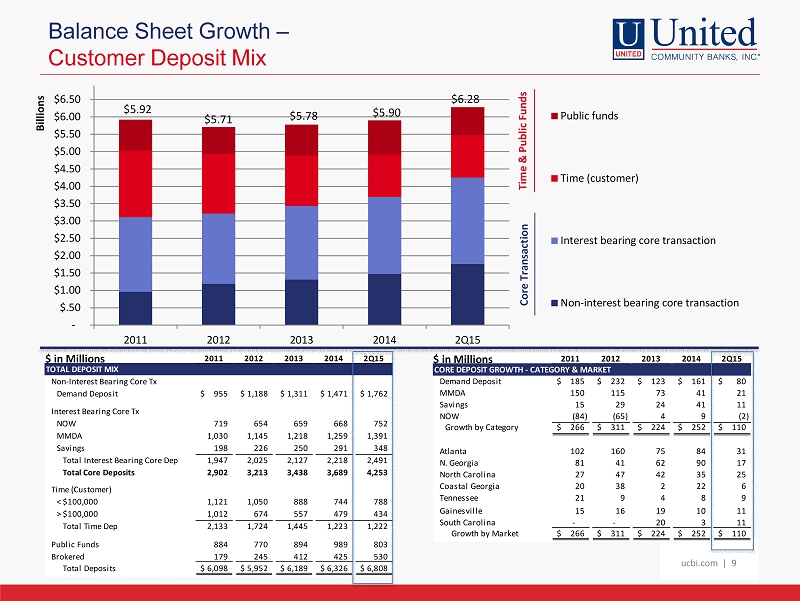

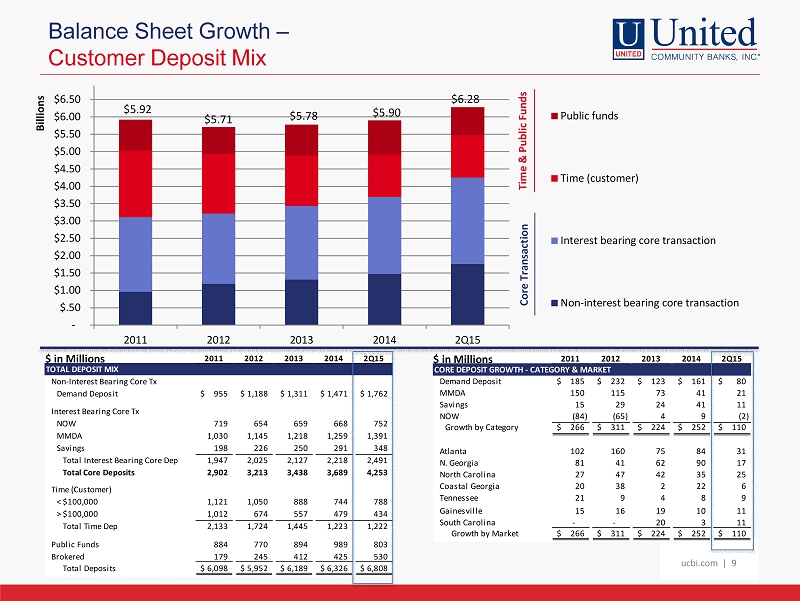

ucbi.com | 9 Balance Sheet Growth – Customer Deposit Mix $5.92 $5.71 $5.78 $5.90 $6.28 - $.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 2011 2012 2013 2014 2Q15 Billions Public funds Time (customer) Interest bearing core transaction Non-interest bearing core transaction Time & Public Funds Core Transaction 2011 2012 2013 2014 2Q15 TOTAL DEPOSIT MIX Non-Interest Bearing Core Tx Demand Deposit 955$ 1,188$ 1,311$ 1,471$ 1,762$ Interest Bearing Core Tx NOW 719 654 659 668 752 MMDA 1,030 1,145 1,218 1,259 1,391 Savings 198 226 250 291 348 Total Interest Bearing Core Dep 1,947 2,025 2,127 2,218 2,491 Total Core Deposits 2,902 3,213 3,438 3,689 4,253 Time (Customer) < $100,000 1,121 1,050 888 744 788 > $100,000 1,012 674 557 479 434 Total Time Dep 2,133 1,724 1,445 1,223 1,222 Public Funds 884 770 894 989 803 Brokered 179 245 412 425 530 Total Deposits 6,098$ 5,952$ 6,189$ 6,326$ 6,808$ 2011 2012 2013 2014 2Q15 CORE DEPOSIT GROWTH - CATEGORY & MARKET Demand Deposit 185$ 232$ 123$ 161$ 80$ MMDA 150 115

73 41 21 Savings 15 29 24 41 11 NOW (84) (65) 4 9 (2) Growth by Category 266$ 311$ 224$ 252$ 110$ Atlanta 102 160 75 84 31 N. Georgia 81 41 62 90 17 North Carolina 27 47 42 35 25 Coastal Georgia 20 38 2 22 6 Tennessee 21 9 4 8 9 Gainesville 15 16 19 10 11 South Carolina - - 20 3 11 Growth by Market 266$ 311$ 224$ 252$ 110$ $ in Millions $ in Millions ucbi.com | 9

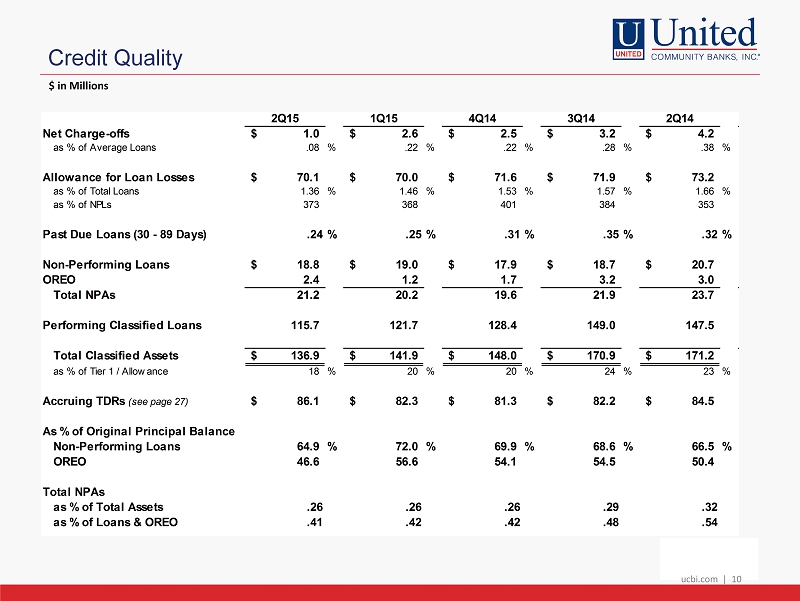

ucbi.com | 10 Credit Quality ucbi.com | 10 2Q15 1Q15 4Q14 3Q14 2Q14 Net Charge-offs 1.0$ 2.6$ 2.5$ 3.2$ 4.2$ as % of Average Loans .08 % .22 % .22 % .28 % .38 % Allowance for Loan Losses 70.1$ 70.0$ 71.6$ 71.9$ 73.2$ as % of Total Loans 1.36 % 1.46 % 1.53 % 1.57 % 1.66 % as % of NPLs 373 368 401 384 353 Past Due Loans (30 - 89 Days) .24% .25% .31% .35% .32% Non-Performing Loans

18.8$ 19.0$ 17.9$ 18.7$ 20.7$ OREO 2.4 1.2 1.7 3.2 3.0 Total NPAs 21.2 20.2 19.6 21.9 23.7 Performing Classified Loans 115.7 121.7 128.4 149.0 147.5 Total Classified Assets 136.9$ 141.9$ 148.0$ 170.9$ 171.2$ as % of Tier 1 / Allowance 18 % 20 % 20 % 24 % 23 % Accruing TDRs (see page 27) 86.1$ 82.3$ 81.3$ 82.2$ 84.5$ As % of Original Principal Balance Non-Performing Loans 64.9 % 72.0 % 69.9 % 68.6 % 66.5 % OREO 46.6 56.6 54.1 54.5 50.4 Total NPAs as % of Total Assets .26 .26 .26 .29 .32 as % of Loans & OREO .41 .42 .42 .48 .54 $ in Millions

ucbi.com | 11 Operating Earnings per Share and Operating Return on Assets $.27 $.29 $.30 $.29 $.32 $.18 $.20 $.22 $.24 $.26 $.28 $.30 $.32 $.34 2Q14 3Q14 4Q14 1Q15 2Q15 OPERATING EARNINGS PER SHARE (1) .88% .95% .96% .94% 1.00% .70% .75% .80% .85% .90% .95% 1.00% 2Q14 3Q14 4Q14 1Q15 2Q15 OPERATING RETURN ON ASSETS (1) ucbi.com | 11 (1) Excludes the effect of merger - related charges

ucbi.com | 12 Capital Ratios (1) ucbi.com | 12 HOLDING COMPANY Well - Cap 2Q15 1Q15 4Q14 3Q14 2Q14 Tier I RBC 6% 11.9% 11.5% 12.1% 12.1% 11.8% Total RBC 10 13.1 12.8 13.3 13.3 13.0 Leverage 5 9.1 8.7 8.7 8.7 8.3 Tier I Common RBC 11.9 11.5 11.1 11.0 10.7 Tangible Comm to Assets 9.8 9.8 9.7 9.8 9.6 Tangible Equity to Assets 9.9 9.8 9.7 9.8 9.6 BANK Well - Cap 2Q15 1Q15 4Q14 3Q14 2Q14 T

ier I RBC 6% 12.0 % 11.8% 12.9% 12.6% 13.4% Total RBC 10 13.2 13.1 14.1 13.8 14.6 Leverage 5 9.1 8.9 9.3 9.1 9.4 (1) Effective January 1, 2015, all regulatory ratios calculated under Basel III rules.

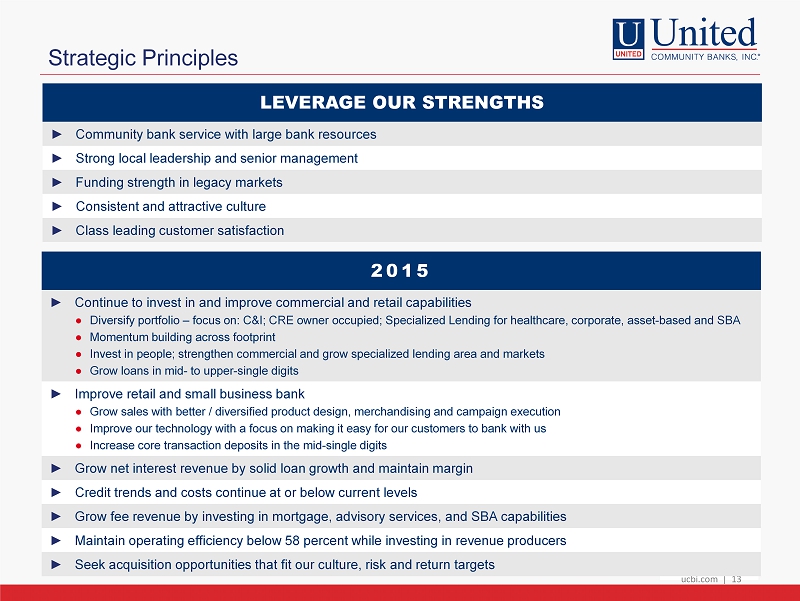

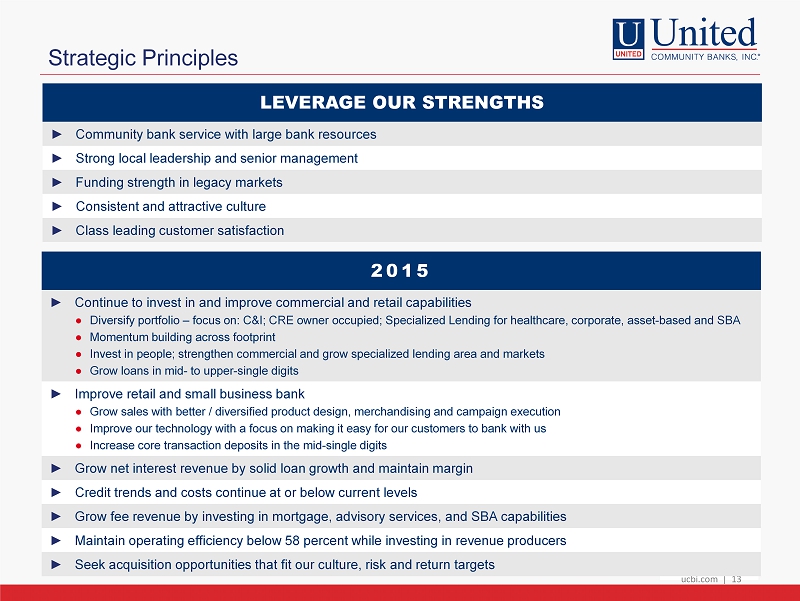

ucbi.com | 13 Strategic Principles ucbi.com | 13 LEVERAGE OUR STRENGTHS ► Community bank service with large bank resources ► Strong local leadership and senior management ► Funding strength in legacy markets ► Consistent and attractive culture ► Class leading customer satisfaction 2015 ► Continue to invest in and improve commercial and retail capabilities ● Diversify portfolio – focus on: C&I; CRE owner occupied; Specialized Lending for healthcare, corporate, asset - based and SBA ● Momentum building across footprint ● Invest in people; strengthen commercial and grow specialized lending area and markets ● Grow loans in mid - to upper - single digits ► Improve retail and small business bank ● Grow sales with better / diversified product design, merchandising and campaign execution ● Improve our technology with a focus on making it easy for our customers to bank with us ● Incr

ease core transaction deposits in the mid - single digits ► Grow net interest revenue by solid loan growth and maintain margin ► Credit trends and costs continue at or below current levels ► Grow fee revenue by investing in mortgage, advisory services, and SBA capabilities ► Maintain operating efficiency below 58 percent while investing in revenue producers ► Seek acquisition opportunities that fit our culture, risk and return targets

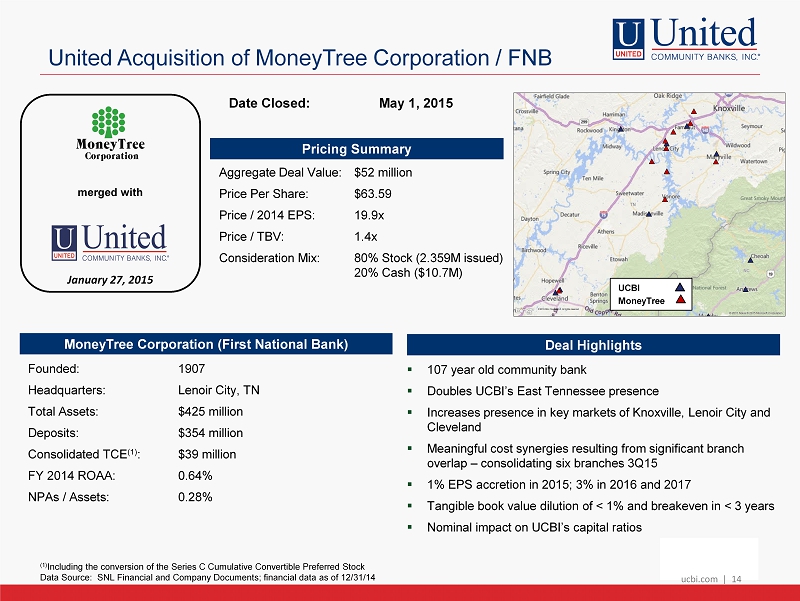

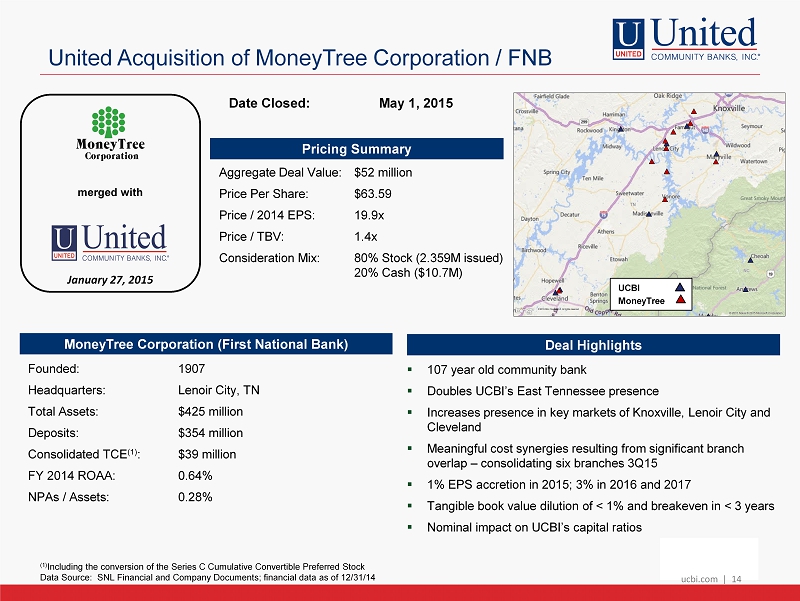

ucbi.com | 14 United Acquisition of MoneyTree Corporation / FNB ucbi.com | 14 ( 1) Including the conversion of the Series C Cumulative Convertible Preferred Stock Data Source: SNL Financial and Company Documents; financial data as of 12/31/14 Founded: 1907 Headquarters: Lenoir City, TN Total Assets: $425 million Deposits: $354 million Consolidated TCE (1) : $39 million FY 2014 ROAA: 0.64% NPAs / Assets: 0.28% January 27 , 2015 merged with MoneyTree Corporation (First National Bank) ▪ 107 year old community bank ▪ Doubles UCBI’s East Tennessee presence ▪ Increases presence in key markets of Knoxville, Lenoir City and Cleveland ▪ Meaningful cost synergies resulting from significant branch overlap – consolidating six branches 3Q15 ▪ 1 % EPS accretion in 2015; 3% in 2016 and 2017 ▪ Tangible book value dilution of < 1% and breakeven in < 3 years ▪ Nominal impact on UCBI’s capital ratios Deal Highlights Date Closed: May 1, 2015 UCBI MoneyTree Aggregate Dea

l Value: $52 million Price Per Share: $63.59 Price / 2014 EPS: 19.9x Price / TBV: 1.4x Consideration Mix: 80% Stock (2.359M issued) 20% Cash ($10.7M) Pricing Summary

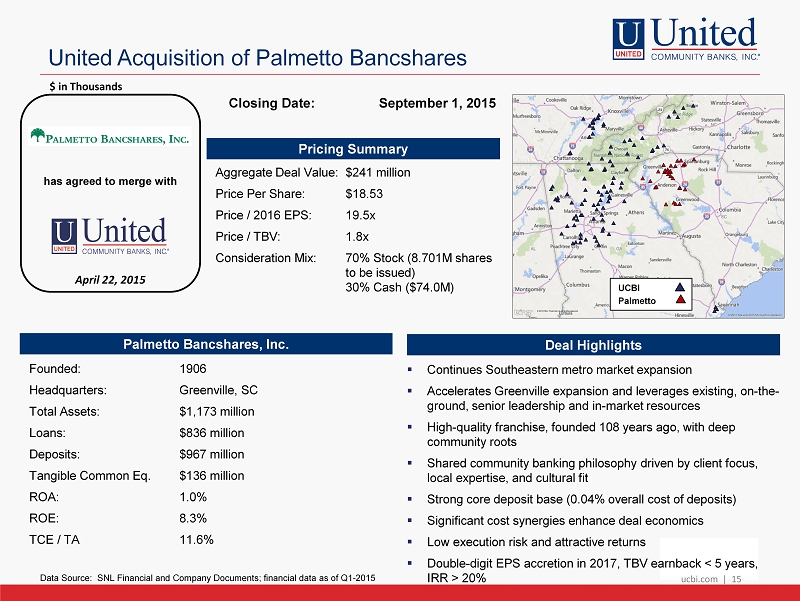

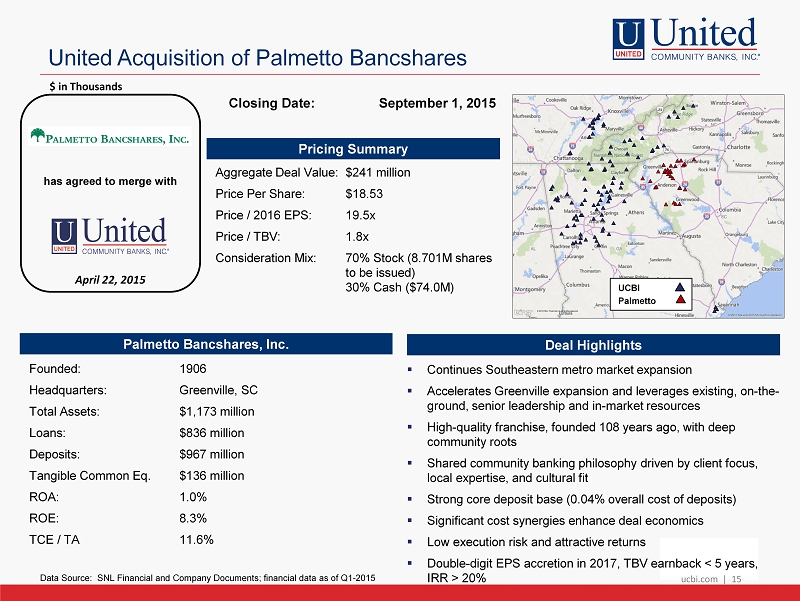

ucbi.com | 15 United Acquisition of Palmetto Bancshares $ in Thousands ucbi.com | 15 Founded: 1906 Headquarters: Greenville, SC Total Assets: $1,173 million Loans: $836 million Deposits: $967 million Tangible Common Eq. $136 million ROA: 1.0% ROE: 8.3% TCE / TA 11.6% April 22 , 2015 has agreed to merge with Palmetto Bancshares, Inc. ▪ Continues Southeastern metro market expansion ▪ Accelerates Greenville expansion and leverages existing, on - the - ground, senior leadership and in - market resources ▪ High - quality franchise, founded 108 years ago, with deep community roots ▪ Shared community banking philosophy driven by client focus, local expertise, and cultural fit ▪ Strong core deposit base (0.04% overall cost of deposits) ▪ Significant cost synergies enhance deal economics ▪ Low execution risk and attractive returns ▪ Double - digit EPS accretion in 2017, TBV earnback < 5 years, IRR > 20% Deal Highlights Closing Date: September 1, 2015 UCBI Palmetto Data Sourc

e: SNL Financial and Company Documents; financial data as of Q1 - 2015 Aggregate Deal Value: $241 million Price Per Share: $18.53 Price / 2016 EPS: 19.5x Price / TBV: 1.8x Consideration Mix: 70% Stock (8.701M shares to be issued) 30% Cash ($74.0M) Pricing Summary

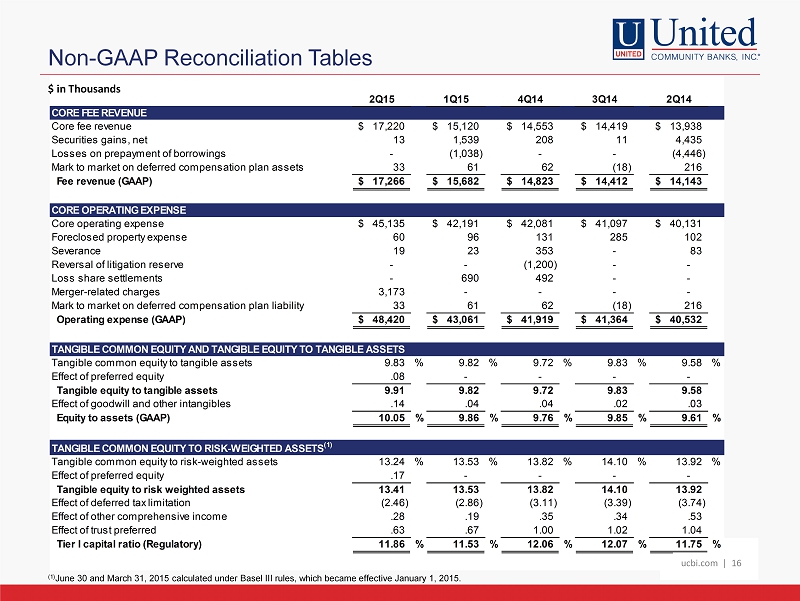

ucbi.com | 16 2Q15 1Q15 4Q14 3Q14 2Q14 CORE FEE REVENUE Core fee revenue 17,220$ 15,120$ 14,553$ 14,419$ 13,938$ Securities gains, net 13 1,539 208 11 4,435 Losses on prepayment of borrowings - (1,038) - - (4,446) Mark to market on deferred compensation plan assets 33 61 62 (18) 216 Fee revenue (GAAP) 17,266$ 15,682$ 14,823$ 14,412$ 14,143$ CORE OPERATING EXPENSE Core operating expense 45,135$ 42,191$ 42,081$ 41,097$ 40,131$ Foreclosed property expense 60 96 131 285 102 Severance 19 23 353 - 83 Reversal of litigation reserve - - (1,200) - - Loss share settlements - 690 492 - - Merger-related charges 3,173 - - - - Mark to market on deferred compensation plan liability 33 61 62 (18) 216 Operating expense (GAAP) 48,420$ 43,061$ 41,919$ 41,364$ 40,532$ TANGIBLE COMMON EQUITY AND TANGIBLE EQUITY TO TANGIBLE ASSETS Tangible common equity to tangible assets 9.83 % 9.82 % 9.72 % 9.83 % 9.58 % Effect of preferred equity .08 - - - - Tangible equity to tangible assets 9.91 9.82 9.72 9.83 9.58 Effect of goodwill and other intangibles .14 .04 .04 .02 .03 Equity to assets (GAAP) 10.05 % 9.86 % 9.76 % 9.85 % 9.61 % TANGIBLE COMMON EQUITY TO RISK-WEIGHTED ASSETS (1) Tangible common equity to risk-weighted assets 13.24 % 13.53 % 13.82 % 14.10 % 13.92 % Effect of preferred equity .17 - - - - Tangible equity to risk weighted assets 13.41 13.53 13.82 14.10 13.92 Effect of deferred tax limitation (2.46) (2.86) (3.11) (3.39) (3.74) Effect of other comprehensive income .28 .19 .35 .34 .53 Effect of trust preferred .63 .67 1.00 1.02 1.04 Tier I capital ratio (Regulatory) 11.86 % 11.53 % 12.06 % 12.07 % 11.75 % Non - GAAP Reconciliation Tables $ in Thousands ucbi.com |

16 (1) June 30 and March 31, 2015 calculated under Basel III rules, which became effective January 1, 2015.

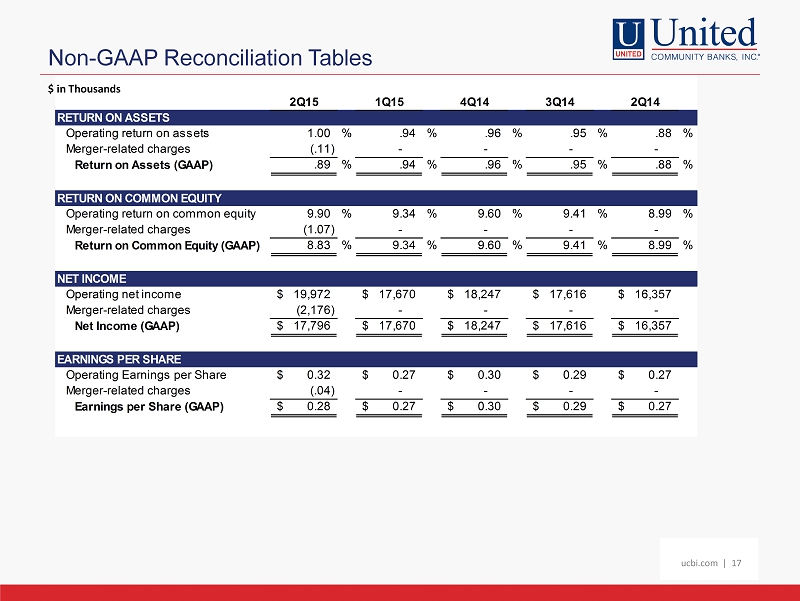

ucbi.com | 17 2Q15 1Q15 4Q14 3Q14 2Q14 RETURN ON ASSETS Operating return on assets 1.00 % .94 % .96 % .95 % .88 % Merger-related charges (.11) - - - - Return on Assets (GAAP) .89 % .94 % .96 % .95 % .88 % RETURN ON COMMON EQUITY Operating return on common equity 9.90 % 9.34 % 9.60 % 9.41 % 8.99 % Merger-related charges (1.07) - - - - Return on Common Equit

y (GAAP) 8.83 % 9.34 % 9.60 % 9.41 % 8.99 % NET INCOME Operating net income 19,972$ 17,670$ 18,247$ 17,616$ 16,357$ Merger-related charges (2,176) - - - - Net Income (GAAP) 17,796$ 17,670$ 18,247$ 17,616$ 16,357$ EARNINGS PER SHARE Operating Earnings per Share 0.32$ 0.27$ 0.30$ 0.29$ 0.27$ Merger-related charges (.04) - - - - Earnings per Share (GAAP) 0.28$ 0.27$ 0.30$ 0.29$ 0.27$ Non - GAAP Reconciliation Tables $ in Thousands ucbi.com | 17

ucbi.com | 18 UNITED COMMUNITY BANKS, INC. SECOND QUARTER 2015 EXHIBITS July 22, 2015 ucbi.com | 18

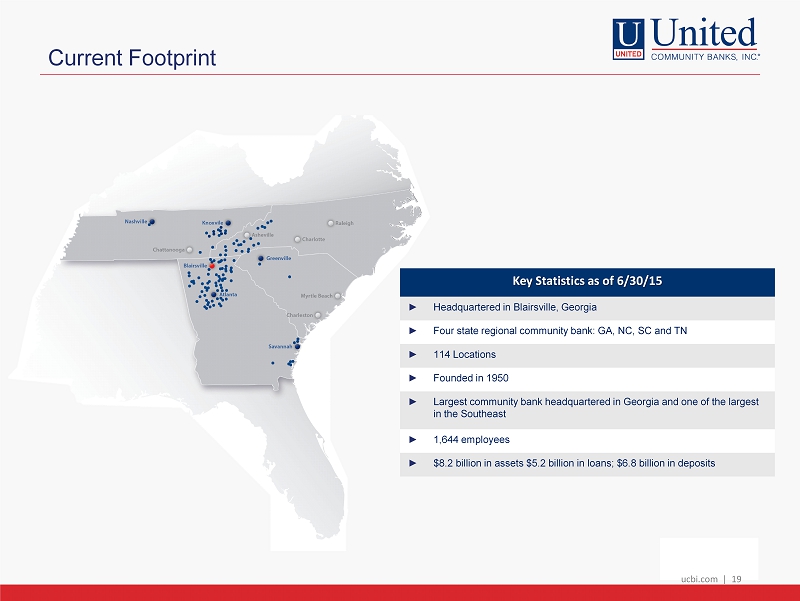

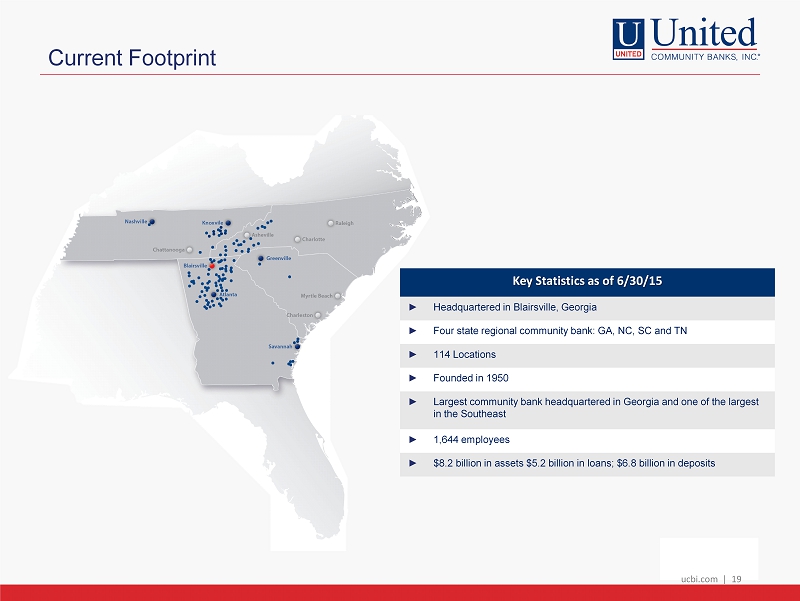

ucbi.com | 19 Current Footprint ucbi.com | 19 Key Statistics as of 6/30/15 ► Headquartered in Blairsville, Georgia ► Four state regional community bank: GA, NC, SC and TN ► 114 Locations ► Founded in 1950 ► Largest community bank headquartered in Georgia and one of the largest in the Southeast ► 1,644 employees ► $8.2 billion in assets $5.2 billion in loans; $6.8 billion in deposits

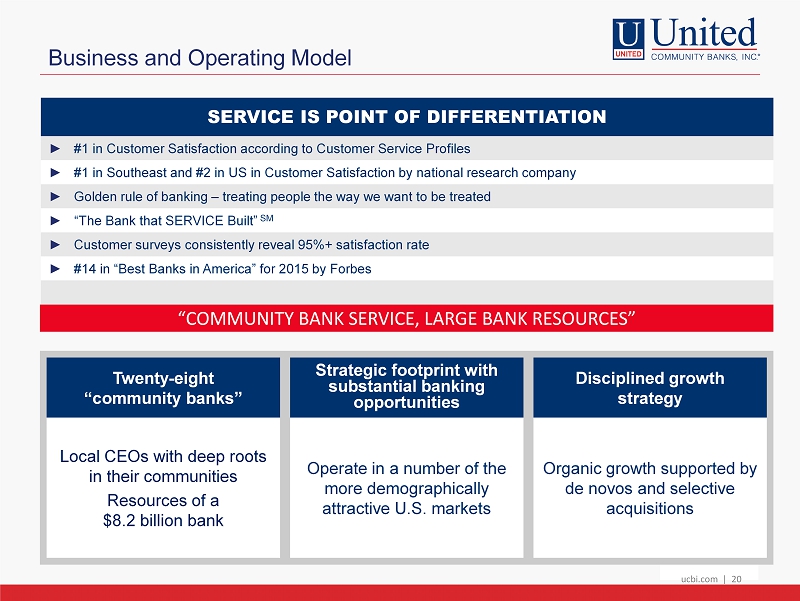

ucbi.com | 20 Business and Operating Model Local CEOs with deep roots in their communities Resources of a $8.2 billion bank Operate in a number of the more demographically attractive U.S. markets Organic growth supported by de novos and selective acquisitions Twenty - eight “community banks” Strategic footprint with substantial banking opportunities Disciplined growth strategy SERVICE IS POINT OF DIFFERENTIATION ► #1 in Customer Satisfaction according to Customer Service Profiles ► #1 in Southeast and #2 in US in Customer Satisfaction by national research company ► Golden rule of banking – treating people the way we want to be treated ► “The Bank that SERVICE Built” SM

► Customer surveys consistently reveal 95%+ satisfaction rate ► #14 in “Best Banks in America” for 2015 by Forbes “COMMUNITY BANK SERVICE, LARGE BANK RESOURCES ” ucbi.com | 20

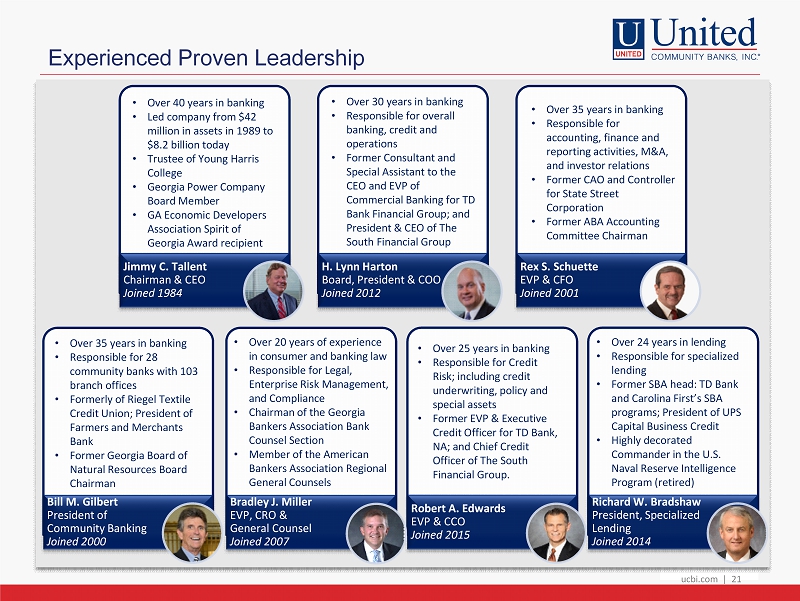

ucbi.com | 21 Experienced Proven Leadership Jimmy C. Tallent Chairman & CEO Joined 1984 H. Lynn Harton Board, President & COO Joined 2012 Bill M. Gilbert President of Community Banking Joined 2000 Bradley J. Miller EVP, CRO & General Counsel Joined 2007 • Over 40 years in banking • Led company from $42 million in assets in 1989 to $8.2 billion today • Trustee of Young Harris College • Georgia Power Company Board Member • GA Economic Developers Association Spirit of Georgia Award recipient • Over 30 years in banking • Responsible for overall banking, credit and operations • Former Consultant and Special Assistant to the CEO and EVP of Commercial Banking for TD Bank Financial Group; and President & CEO of The South Financial Group • Over 35 years in banking • Responsible for accounting, finance and reporting activities, M&A, and investor relations • Former CAO and Controller for State Street Corporation • Former ABA Accounting Committee Chairman • Over 35 years in banking • Responsible

for 28 community banks with 103 branch offices • Formerly of Riegel Textile Credit Union; President of Farmers and Merchants Bank • Former Georgia Board of Natural Resources Board Chairman • Over 20 years of experience in consumer and banking law • Responsible for Legal, Enterprise Risk Management, and Compliance • Chairman of the Georgia Bankers Association Bank Counsel Section • Member of the American Bankers Association Regional General Counsels Robert A. Edwards EVP & CCO Joined 2015 Richard W. Bradshaw President, Specialized Lending Joined 2014 • Over 24 years in lending • Responsible for specialized lending • Former SBA head: TD Bank and Carolina First’s SBA programs; President of UPS Capital Business Credit • Highly decorated Commander in the U.S. Naval Reserve Intelligence Program (retired) • Over 25 years in banking • Responsible for Credit Risk; including credit underwriting, policy and special assets • Former EVP & Executive Credit Officer for TD Bank, NA; and Chief Credit Officer of The South Financial Group. ucbi.com | 21 Rex S. Schuette EVP & CFO Joined 2001

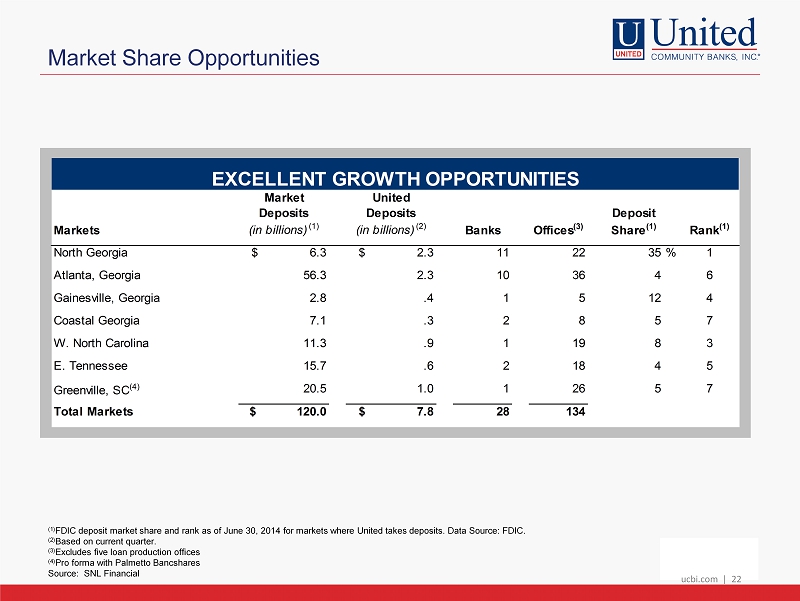

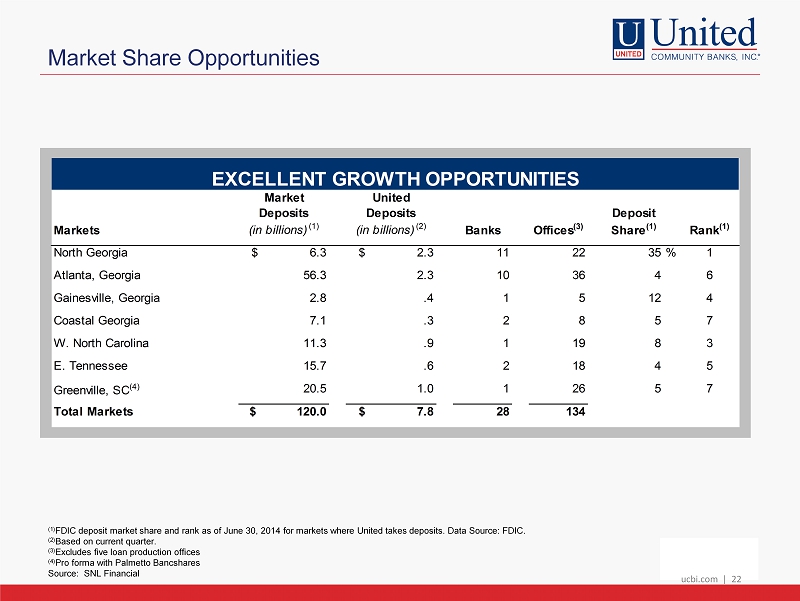

ucbi.com | 22 Market Share Opportunities ucbi.com | 22 North Georgia $ 6.3 $ 2.3 11 22 35% 1 Atlanta, Georgia 56.3 2.3 10 36 4 6 Gainesville, Georgia 2.8 .4 1 5 12 4 Coastal Georgia 7.1 .3 2 8 5 7 W. North Carolina 11.3 .9 1 19 8 3 E. Tennessee 15.7 .6 2 18 4 5 Greenville, SC (4) 20.5 1.0 1 26 5 7 Total Markets $ 120.0 $ 7.8 28 134 EXCELLENT GROWTH OPPORTUNITIES Markets Banks Offices (3) Rank (1) Market Deposits (in billions) (1) United Deposits (in billions) (2) Deposit Share (1) (1) FDIC deposit market share and rank as of June 30, 2014 for markets where United takes deposits. Data Source: FDIC . (2) Based on current quarter. (3) Excludes five loan production offices (4) Pro forma with Palmetto Bancshares Source: SNL Financial

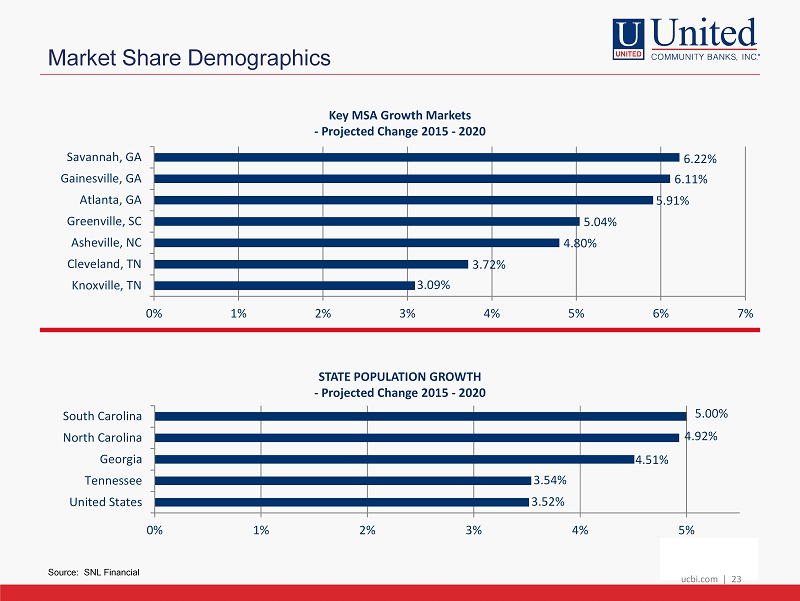

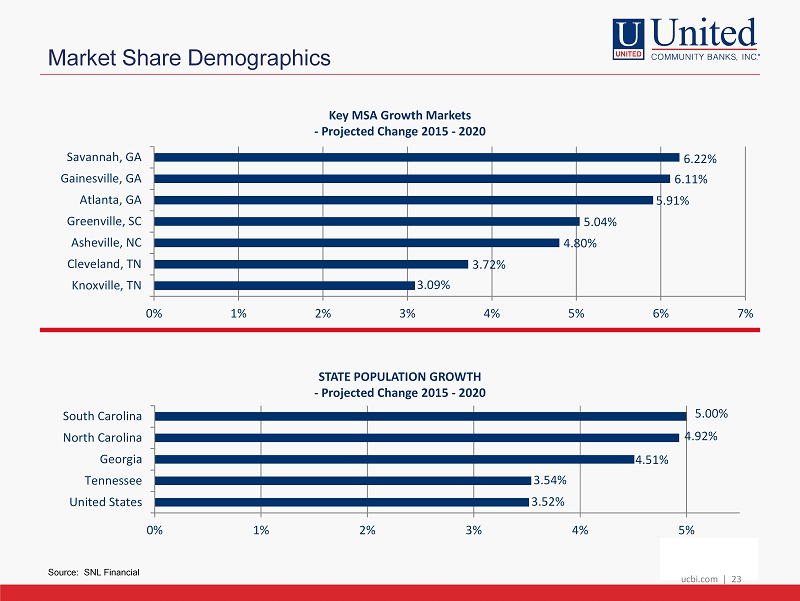

ucbi.com | 23 Market Share Demographics ucbi.com | 23 3.09% 3.72% 4.80% 5.04% 5.91% 6.11% 6.22% 0% 1% 2% 3% 4% 5% 6% 7% Knoxville, TN Cleveland, TN Asheville, NC Greenville, SC Atlanta, GA Gainesville, GA Savannah, GA Key MSA Growth Markets - Projected Change 2015 - 2020 3.52% 3.54% 4.51% 4.92% 5.00% 0% 1% 2% 3% 4% 5% United States Tennessee Georgia North Carolina South Carolina STATE POP

ULATION GROWTH - Projected Change 2015 - 2020 Source: SNL Financial

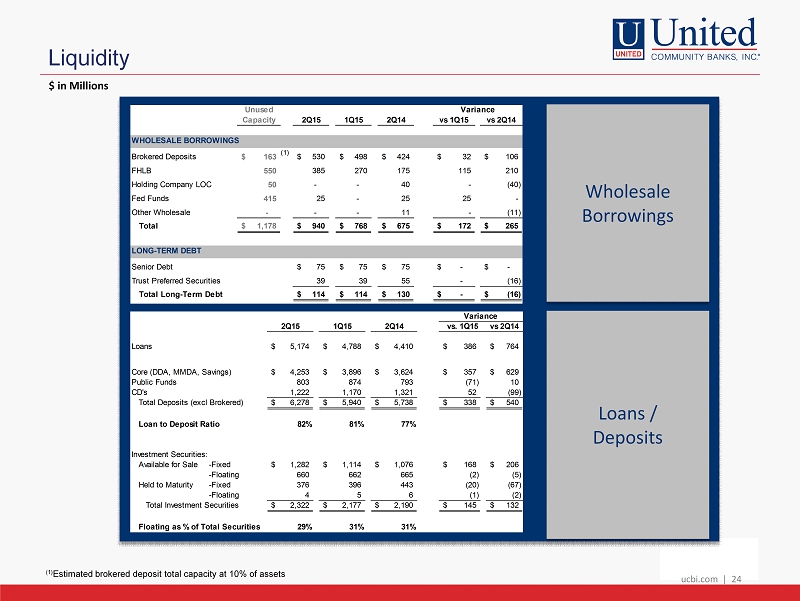

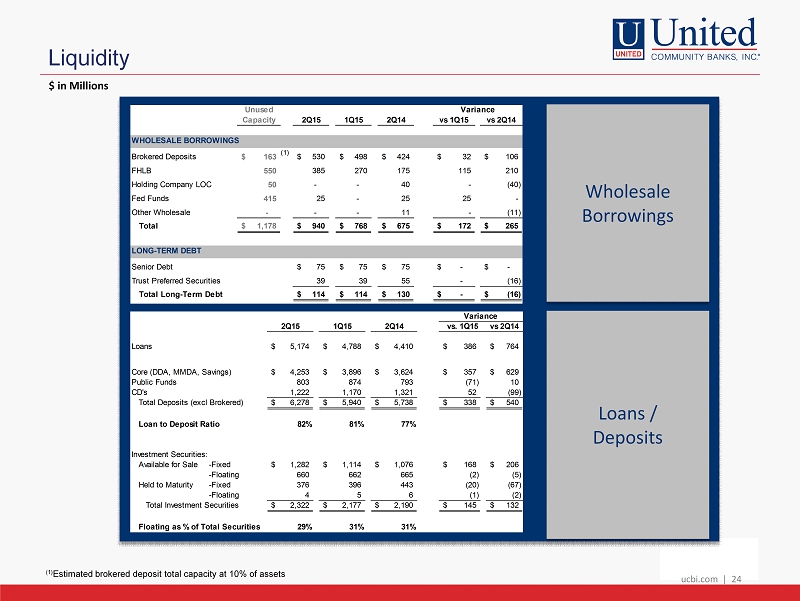

ucbi.com | 24 Liquidity ucbi.com | 24 Unused Capacity 2Q15 1Q15 2Q14 vs 1Q15 vs 2Q14 WHOLESALE BORROWINGS Brokered Deposits 163$ (1) 530$ 498$ 424$ 32$ 106$ FHLB 550 385 270 175 115 210 Holding Company LOC 50 - - 40 - (40) Fed Funds 415 25 - 25 25 - Other Wholesale - - - 11 - (11) Total 1,178$ 940$ 768$ 675$ 172$ 265$ LONG-TERM DEBT Senior Debt 75$ 75$ 75$ -$ -$ Trust Preferred Securities 39 39 55 - (16) Total Long-Term Debt 114$ 114$ 130$ -$ (16)$ Variance 2Q15 1Q15 2Q14 vs 2Q14 Loans 5,174$ 4,788$ 4,410$ 386$ 764$ Core (DDA, MMDA, Savings) 4,253$ 3,896$ 3,624$ 357$ 629$ Public Funds 803 874 793 (71) 10 CD's 1,222 1,170 1,321 52 (99) Total Deposits (excl Brokered) 6,278$ 5,940$ 5,738$ 338$ 540$ Loan to Deposit Ratio 82% 81% 77% Investment Securities: Available for Sale -Fixed 1,282$ 1,114$ 1,076$ 168$ 206$ -Floating 660 662 665 (2) (5) Held to Maturity -Fixed 376 396 443 (20) (67) -Floating 4 5 6 (1) (2) Total Investment Securities 2,322$ 2,177$ 2,190$ 145$ 132$ Floating as % of Total Securities 29% 31% 31% vs. 1Q15 V

ariance Wholesale Borrowings Loans / Deposits (1) Estimated brokered deposit total capacity at 10% of assets $ in Millions

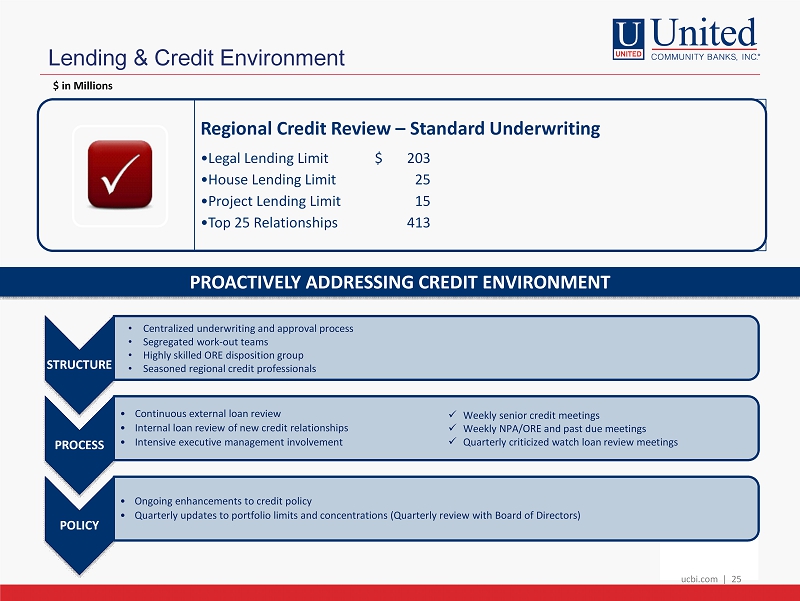

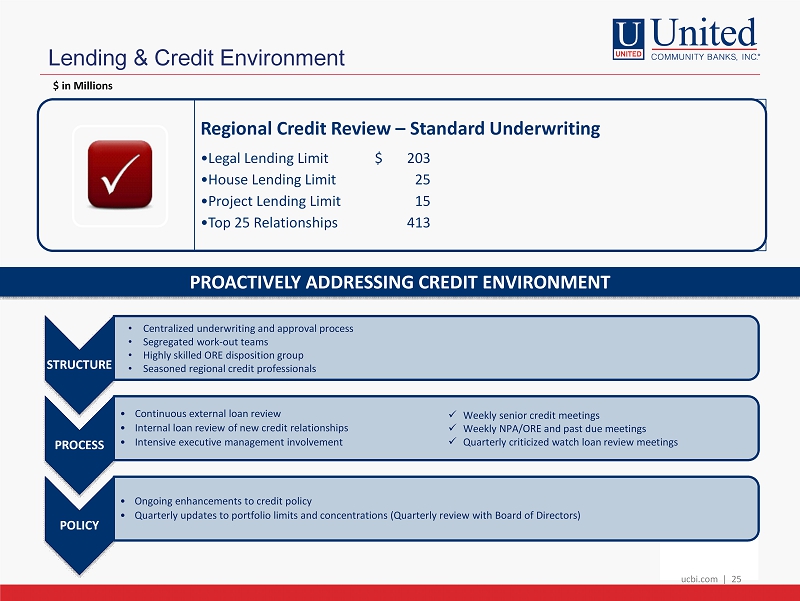

ucbi.com | 25 Lending & Credit Environment ucbi.com | 25 $ in Millions Regional Credit Review – Standard Underwriting • Legal Lending Limit $ 203 • House Lending Limit 25 • Project Lending Limit 15 • Top 25 Relationships 413 STRUCTURE PROCESS • Continuous external loan review • Internal loan review of new credit relationships • Intensive executive management involvement POLICY • Ongoing enhancements to credit policy • Quarterly updates to portfolio limits and concentrations (Quarterly review with Board of Directors) • Centralized underwriting and approval process • Segregated work - out teams • Highly skilled ORE disposition group • Seasoned regional credit professionals x Weekly senior credit meetings x Weekly NPA/ORE and past due meetings x Quarterly criticized watch loan review meetings PROACTIVELY ADDRESSING CREDIT ENVIRONMENT

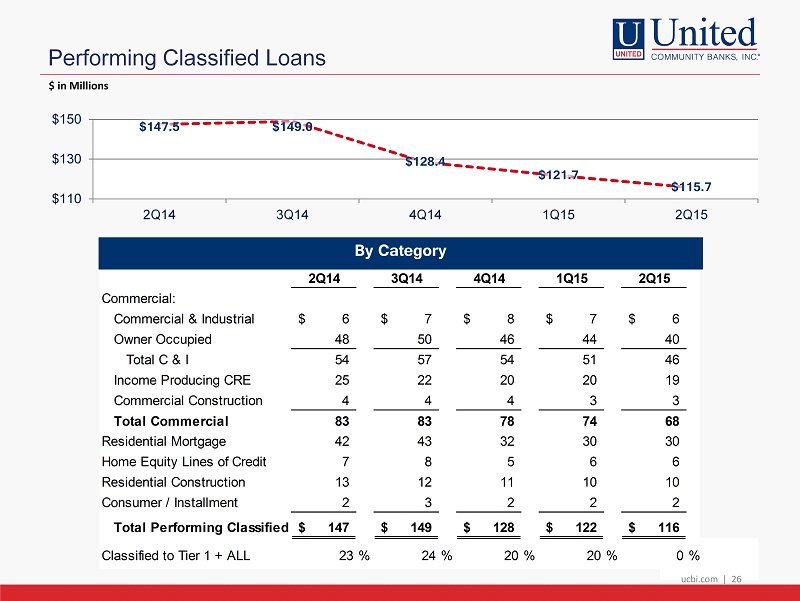

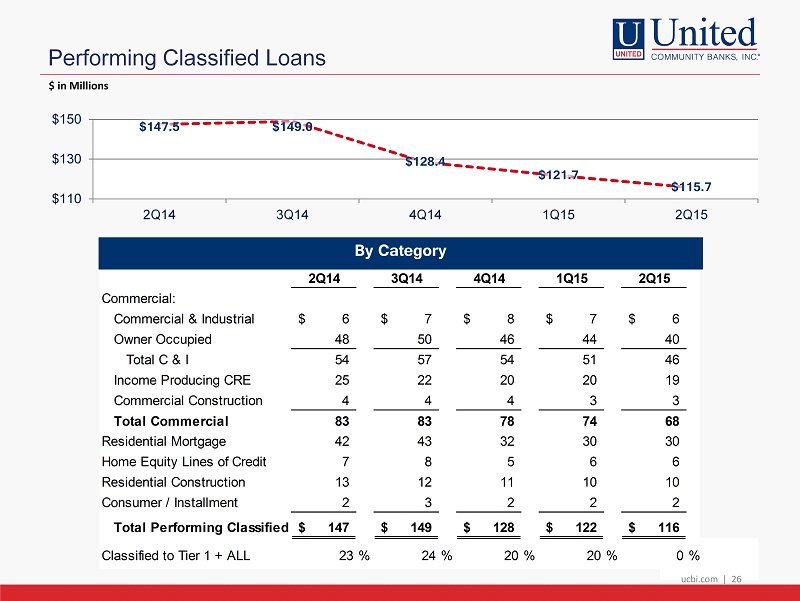

ucbi.com | 26 Performing Classified Loans ucbi.com | 26 By Category $ in Millions 2Q14 3Q14 4Q14 1Q15 2Q15 Commercial: Commercial

& Industrial 6$ 7$ 8$ 7$ 6$ Owner Occupied 48 50 46 44 40 Total C & I 54 57 54 51 46 Income Producing CRE 25 22 20 20 19 Commercial Construction 4 4 4 3 3 Total Commercial 83 83 78 74 68 Residential Mortgage 42 43 32 30 30 Home Equity Lines of Credit 7 8 5 6 6 Residential Construction 13 12 11 10 10 Consumer / Installment 2 3 2 2 2 Total Performing Classified 147$ 149$ 128$ 122$ 116$ Classified to Tier 1 + ALL 23% 24% 20% 20% 0% $147.5 $149.0 $128.4 $121.7 $115.7 $110 $130 $150 2Q14 3Q14 4Q14 1Q15 2Q15

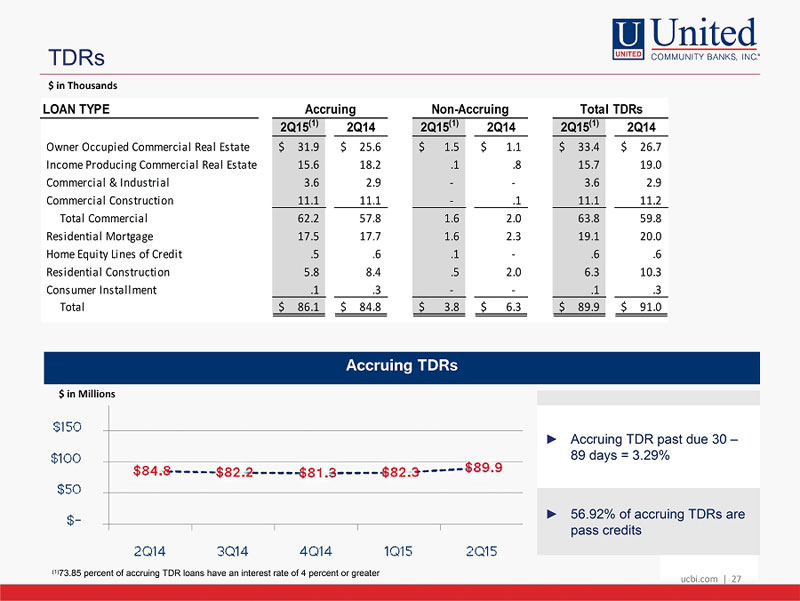

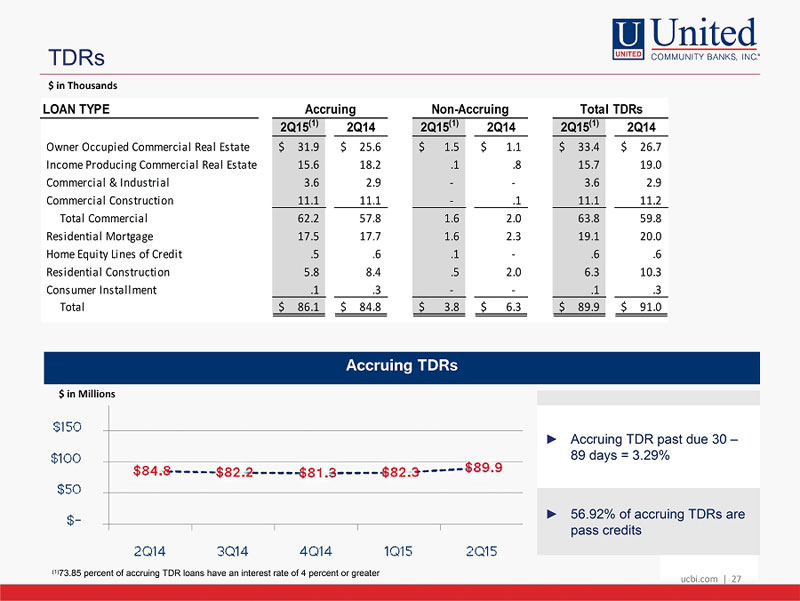

ucbi.com | 27 $84.8 $82.2 $81.3 $82.3 $89.9 $- $50 $100 $150 2Q14 3Q14 4Q14 1Q15 2Q15 TDRs ucbi.com | 27 $ in Thousands $ in Millions LOAN TYPE 2Q15 (1) 2Q14 2Q15 (1) 2Q14 2Q15 (1) 2Q14 Owner Occupied Commercial Real Estate 31.9$ 25.6$ 1.5$ 1.1$ 33.4$ 26.7$ Income Producing Commercial Real Estate 15.6 18.2 .1 .8 15.7 19.0 Commercial & Industrial 3.6 2.9 - - 3.6 2

.9 Commercial Construction 11.1 11.1 - .1 11.1 11.2 Total Commercial 62.2 57.8 1.6 2.0 63.8 59.8 Residential Mortgage 17.5 17.7 1.6 2.3 19.1 20.0 Home Equity Lines of Credit .5 .6 .1 - .6 .6 Residential Construction 5.8 8.4 .5 2.0 6.3 10.3 Consumer Installment .1 .3 - - .1 .3 Total 86.1$ 84.8$ 3.8$ 6.3$ 89.9$ 91.0$ Accruing Non-Accruing Total TDRs Accruing TDRs ► Accruing TDR past due 30 – 89 days = 3.29% ► 56.92% of accruing TDRs are pass credits (1) 73.85 percent of accruing TDR loans have an interest rate of 4 percent or greater

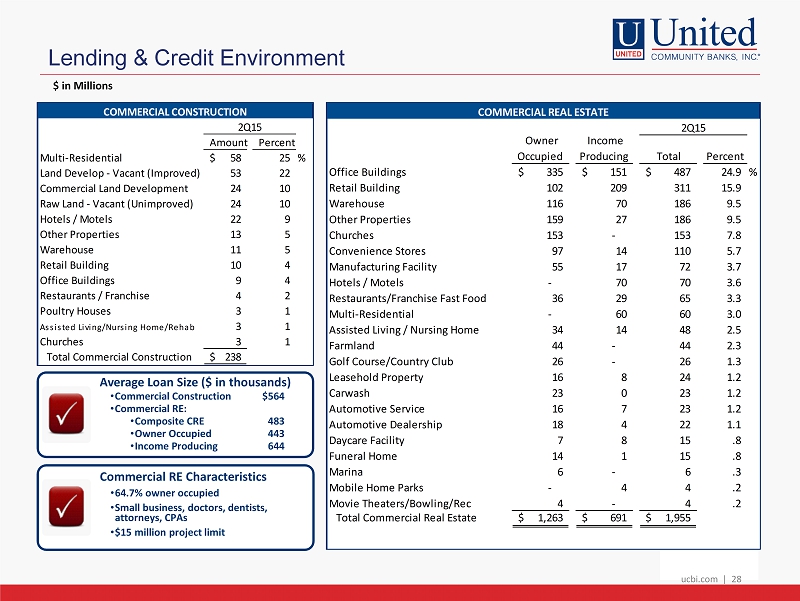

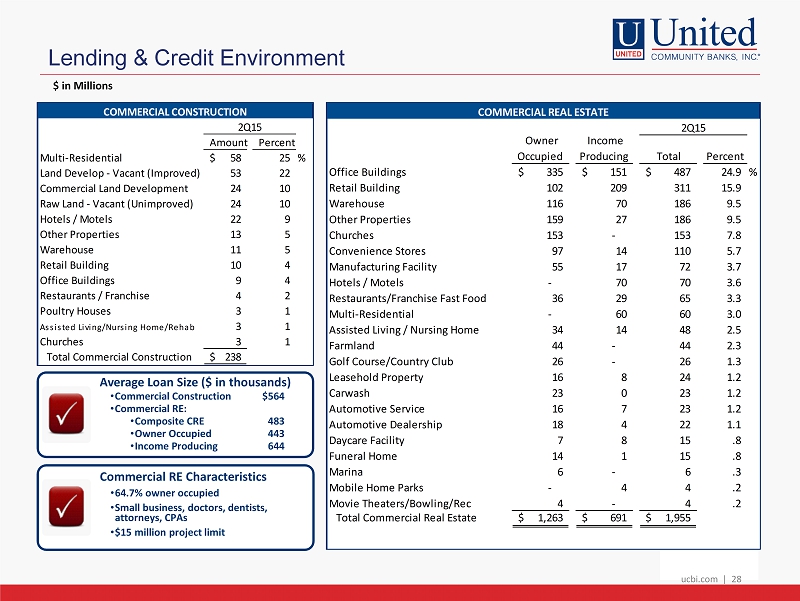

ucbi.com | 28 Lending & Credit Environment ucbi.com | 28 $ in Millions Average Loan Size ($ in thousands) • Commercial Construction $564 • Commercial RE: • Composite CRE 483 • Owner Occupied 443 • Income Producing 644 Commercial RE Characteristics • 64.7% owner occupied • Small business, doctors, dentists, attorneys, CPAs • $15 million project limit Amount Percent Multi-Residential 58$ 25 % Land Develop - Vacant (Improved) 53 22 Commercial Land Development 24 10 Raw Land - Vacant (Unimproved) 24 10 Hotels / Motels 22 9 Other Properties 13 5 Warehouse 11 5 Retail Building 10 4 Office Buildings 9 4 Restaurants / Franchise 4 2 Poultry Houses 3 1 Assisted Living/Nursing Home/Rehab 3 1 Churches 3 1 Total Commercial Construction 238$ 2Q15 COMMERCIAL CONSTRUCTION Owner Occupied Income Producing Total Percent Office Buildings 335$ 151$ 487$ 24.9 % Retail Building 102 209 311 15.9 Warehouse 116 70 186 9.5 Other Properties 159 27 186 9.5 Churches 153 - 153 7.8 Convenience Stores 97 14 110 5.7 Manufacturing Facility 55 17 72 3.7 Hotels / Motels - 70 70 3.6 Restaurants/Franchise Fast Food 36 29 65 3.3 Multi-Residential - 60 60 3.0 Assisted Living / Nursing Home 34 14 48 2.5 Farmland 44 - 44 2.3 Golf Course/Country Club 26 - 26 1.3 Leasehold Property 16 8 24 1.2 Carwash 23 0 23 1.2 Automotive Service 16 7 23 1.2 Automotive Dealership 18 4 22 1.1 Daycare Facility 7 8 15 .8 Funeral Home 14 1 15 .8 Marina 6 - 6 .3 Mobile Home Parks - 4 4 .2 Movie Theaters/Bowling/Rec 4 - 4 .2 Total Commercial Real Estate 1,263$ 691$ 1,955$ 2Q15 COMMERCIAL REAL ESTATE