UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

Rule 13e-3 Transaction Statement under Section 13(e) of the

Securities Exchange Act of 1934

BIRCH BRANCH, INC.

(Name of the Issuer)

Birch Branch Acquisition Corp.

Wang Xinshun

Li Weitian

(Name of Persons Filing Statement)

Common Stock, no par value

(Title of Class of Securities)

09068B204

(CUSIP Number of Class of Securities)

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Qian Hu, Esq.

McLaughlin & Stern, LLP

260 Madison Avenue

New York, NY 10016

This statement is filed in connection with (check the appropriate box):

| | | |

| | | |

| x | a. | The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14-C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| | | |

| o | b. | The filing of a registration statement under the Securities Act of 1933. |

| | | |

| o | c. | A tender offer. |

| | | |

| o | d. | None of the above. |

| | | |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: o

Check the following box if the filing is a final amendment reporting the results of the transaction: ¨

CALCULATION OF FILING FEE

| Transaction Valuation* | | | Amount of Filing Fee** | |

| $ | 181,347.2 | | | $ | 24.74 | |

| | *The filing fee is calculated based on the aggregate cash payment for the proposed per share cash payment of $0.10 for 1,813,472 outstanding common stock of the issuer subject to the transaction (the “Transaction Valuation”). **The amount of the filing fee, calculated in accordance with Exchange Act Rule 0-11(b)(1) and the Securities and Exchange CommissionFee Rate Advisory #7 for Fiscal Year 2013 , was calculated by multiplying the Transaction Valuation by .00013640. |

| ¨ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | Form or Registration No.: | Schedule 13E-3 |

| | Filing Party: | Birch Branch Acquisition Corp., Wang Xinshun, Li Weitian |

| | Date Filed: | October 5, 2012 |

NEITHER THE SECURITIES EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| TRANSACTION STATEMENT | | Page No. |

| Item 1. Summary Term Sheet | | 1 |

| Item 2. Subject Company Information | | 1 |

| Item 3. Identity and Background of Filing Persons | | 2 |

| Item 4. Terms of The Transaction | | 2 |

| Item 5. Past Contacts, Transactions, Negotiations and Agreements | | 3 |

| Item 6. Purposes of the Transaction and Plans or Proposals | | 4 |

| Item 7. Purposes, Alternatives, Reasons, and Effects of the Merger | | 4 |

| Item 8. Fairness of the Transaction | | 4 |

| Item 9. Reports, Opinions, Appraisals, and Negotiations | | 5 |

| Item 10. Source and Amount of Funds or Other Consideration | | 5 |

| Item 11. Interest in Securities of the Subject Company | | 5 |

| Item 12. The Solicitation or Recommendation | | 6 |

| Item 13. Financial Statements | | 6 |

| Item 14. Personal/Assets, Retained, Employed, Compensated or Used | | 6 |

| Item 15. Additional Information | | 6 |

| Item 16. Exhibits | | 6 |

| SIGNATURES | | 7 |

TRANSACTION STATEMENT

Item 1. Summary Term Sheet

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

Item 2. Subject Company Information

Name and Address

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Subject Company” |

Securities

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ Other Information - Securities, Dividends, Trading Markets & Prices” |

Trading Market and Price.

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ Other Information - Securities, Dividends, Trading Markets & Prices” |

Dividends

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ Other Information - Securities, Dividends, Trading Markets & Prices” |

Prior Public Offerings

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ Other Information – Prior Public Offerings and Purchases by Filing Persons” |

Prior Stock Purchases

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ Other Information – Prior Public Offerings and Purchases by Filing Persons” |

Item 3. Identity and Background of Filing Persons

Birch Branch Acquisition Corp. (“Acquisition Corp.”)

Name and Business Address

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Acquisition Corp.” |

Business and Background of Entity

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Acquisition Corp.” |

Business and Background of Natural Persons

Not applicable.

Wang Xinshun

Name and Business Address

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Mr. Wang Xinshun” |

Business and Background of Entity

Not applicable.

Business and Background of Natural Persons

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Mr. Wang Xinshun” |

Li Weitian

Name and Business Address.

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Mr. Li Weitian” |

Business and Background of Entity.

Not applicable.

Business and Background of Natural Persons.

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger - Background of the Transaction: Mr. Li Weitian” |

Item 4. Terms of the Transaction

Material Terms and Consideration

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Terms of the Transaction” |

| - | “Appendix A: Agreement and Plan of Merger” |

Purchases

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Terms of the Transaction” |

| - | “Appendix A: Agreement and Plan of Merger” |

Different Terms

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Terms of the Transaction” |

| - | “Appendix A: Agreement and Plan of Merger” |

Appraisal Rights

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Shareholder Rights – Appraisal Rights and Exercise Procedure” |

Provisions for Unaffiliated Security Holders

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Shareholder Rights - Access to Records and Retainer of Counsel by Unaffiliated Security Holders” |

Eligibility for Listing or Trading

Not applicable.

Item 5. Past Contacts, Transactions, Negotiations and Agreements

Transactions

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger – Background of the Merger: Pre-Merger Share Exchange” |

Significant Corporate Events and Negotiations or Contacts

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger – Background of the Merger: Pre-Merger Share Exchange” |

Conflict of Interest

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger – Background of the Merger: Mr. Wang Xinshun” |

| - | “ The Merger – Background of the Merger: Subject Company” |

| - | “ The Merger – Background of the Merger: Pre-Merger Share Exchange” |

Agreements Involving the Subject Company’s Securities

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger – Background of the Merger: Pre-Merger Share Exchange” |

Item 6. Purposes of the Transaction and Plans or Proposals

Use of Securities Acquired.

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger –Terms of the Merger” |

Plans.

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Effects of the Merger” |

| - | “ The Merger – Conduct of Business After the Transaction” |

Item 7. Purposes, Alternatives, Reasons, and Effects of the Merger

Purpose

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Background of the Transaction” |

Alternatives

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Alternatives to the Transaction” |

Reasons

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Reasons for Conducting the Transaction” |

Effects of the Merger

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Effects of the Merger” |

| - | “ The Merger – Conduct of Business After the Transaction” |

Item 8. Fairness of the Transaction

Opinion of Financial Advisor and Factors Considered

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Fairness of the Transaction” |

| - | “Appendix E: Fairness Opinion by P.K. Hickey Co., Inc.” |

Approval of Security Holders

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Shareholder Rights - Shareholder Approval Requirement” |

Unaffiliated Representative

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger – Fairness of the Transaction” |

| - | “ The Merger – Reasons for Conducting the Transaction” |

| - | “Shareholder Rights– Access to Records and Retainer of Counsel by Unaffiliated Security Holders |

Approval of Directors

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Fairness of the Transaction” |

Other Offers

None.

Item 9. Reports, Opinions, Appraisals, and Negotiations

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Fairness of the Transaction” |

| - | “Appendix E: Fairness Opinion by P.K. Hickey Co., Inc.” |

Item 10. Source and Amount of Funds or Other Consideration

Source of Funds

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Source of Funds or Other Consideration” |

Conditions

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Terms of the Transaction” |

Expenses

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Other Information – Expenses Involved in the Transaction” |

Borrowed Funds

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Source of Funds or Other Consideration” |

Item 11. Interest in Securities of the Subject Company

Securities Ownership

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “ The Merger – Background of the Transaction: Pre-Merger Share Exchange” |

| - | “Other Information – Securities, Dividends, Trading Markets & Prices” |

Securities Transactions

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “The Merger – Background of the Merger: Pre-Merger Share Exchange” |

Item 12. The Solicitation or Recommendation

Not Applicable.

Item 13. Financial Statements

Financial Information

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Other Information – Financial Information” |

Pro Forma Information

Not Applicable.

Item 14. Personal/Assets, Retained, Employed, Compensated or Used

Solicitations or Recommendations

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Other Information – Solicitations or Recommendations” |

Employees and Corporate Assets

The information set forth in the attached 14c Information Statement under the following captions is incorporated herein by reference:

| - | “Other Information – Employees and Corporate Assets” |

Item 15. Additional Information

None.

Item 16. Exhibits

Exhibit Number | | Description |

| (a)(1) | | None |

| (a)(2) | | None |

| (a)(3) | | Preliminary Information Statement of Birch Branch Inc. Pursuant to Rule 14(c) of The Exchange Act |

| (a)(4) | | None |

| (b) | | None |

| (c) | | Fairness Opinion by P.K. Hickey Co., Inc. |

| (d) | | Form of Agreement and Plan of Merger |

| (e) | | None |

| (f) | | Article 113 of the Colorado Business Corporations Act |

| (g) | | None |

SIGNATURES

After due inquiry and to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this Transaction Statement is true, complete and correct.

| BIRCH BRANCH ACQUISITION CORP. | |

| | | | |

| | By: | /s/ Wang Xinshun | |

| | Name: | Wang Xinshun | |

| | Title: | President | |

| | Date: | October 5, 2012 | |

| | | | |

| WANG XINSHUN | | |

| | By: | /s/ Wang Xinshun | |

| | Date: | October 5, 2012 | |

| | | |

| LI WEITIAN | |

| | By: | /s/ Li Weitian | |

| | Date: | October 5, 2012 | |

Exhibit (a)(3)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement

Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

| a. | x Preliminary Information Statement (Definitive Information Statement to be released to shareholders on ________, 2012) |

| b. | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule l4c-5(d) (2)) |

| c. | ¨ | Definitive Information Statement |

BIRCH BRANCH, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): $ |

| | (4) | Proposed maximum aggregate value of transaction: $ |

| | (5) | Total fee paid: $ |

| ¨ | Fee paid previously with preliminary materials. |

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount Previously Paid: $ |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

BIRCH BRANCH, INC.

Henan Shuncheng Group Coal Coke Co., Ltd. (New Building),

Cai Cun Road Intersection,

Anyang County, Henan Province, China 455141

+86 372 323 7890

INFORMATION STATEMENT UNDER REGULATION 14C

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

To Shareholders of Birch Branch Inc. Common Stock, no par value per share:

The Board of Directors of Birch Branch Inc. (the “Company”) is furnishing this Information Statement to all holders of record of the issued and outstanding shares of the Company’s common stock, no par value (“Shares”), as of the close of business on November 3, 2012 (the “Approval Record Date”), in connection with a short-form merger through which the Company will merge into and with Birch Branch Acquisition Corp. (“Acquisition Corp.”). A copy of the Agreement and Plan of Merger is attached hereto as Appendix A and is incorporated herein by this reference.

When the short-form merger is consummated, the Company will be privately-held and 100% of its outstanding shares of common stock will be owned by Acquisition Corp. which is controlled by Mr. Wang Xinshun and Mr. Li Weitian. The remaining 1,813,472 shares will be purchased for cash consideration of $0.10 per share. As required by the Securities Exchange Act of 1934, as amended, the Company has filed Schedule 13e Transaction Statement with the Securities and Exchange Commission (the SEC). A copy of the Schedule 13e is attached hereto as Appendix B.

As a privately-held corporation, the Company will terminate its periodic reporting obligations under Sections 13 and 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), will terminate the registration of its common stock under the Exchange Act and will terminate the quotation of its common stock in the OTC Bulletin Board.

For the proposed short-form merger, Section 7-113-102 of the Colorado Revised Statute (the CRS) does NOT require voting of shareholders of the Company. As shareholders, you will have the rights of a dissenting owner if you choose to exercise those rights. The rights of dissenting owners are found in Article 113 of the Colorado Business Corporations Act (the CBCA). A copy of the statute is attached hereto as Appendix C. If you wish to exercise dissenting rights in connection with the short-form merger, you must deliver to the Company a written notice of your intent to do so not later than _________, 2012. A copy of the form of notice is attached hereto as Appendix D.

The Company will pay the expenses of furnishing this Information Statement, including the cost of preparing, assembling and mailing this Information Statement. After the SEC approves its Schedule 13e Transaction Statement, the Company will send this Information Statement to the record holders of Share(s) as of the close of business on the Approval Record Date.

Only one Information Statement is being delivered to multiple security holders sharing an address unless the Company receives contrary instructions from one or more of the security holders. The Company will undertake to deliver promptly upon written or oral request a separate copy of this Information Statement to a security holder at a shared address to which a single copy of the documents was delivered.

TABLE OF CONTENTS

| | Page |

| | |

| ITEM 1. SUMMARY TERM SHEETS | 1 |

| ITEM 2. THE MERGER | 2 |

| Background of the Transaction | 2 |

| Reasons for Conducting the Transaction | 3 |

| Terms of the Transaction | 4 |

| Alternatives to the Transaction | 4 |

| Effects of the Merger | 5 |

| Fairness of the Transaction | 5 |

| Source of Funds or Other Consideration | 6 |

| Conduct of Business After the Transaction | 6 |

| ITEM 3. SHAREHOLDER RIGHTS | 7 |

| Shareholder Approval Requirement | 7 |

| Appraisal Rights and Exercise Procedures | 7 |

| Access to Records and Retainer of Counsel by Unaffiliated Security Holders | 8 |

| ITEM 4. OTHER INFORMATION | 9 |

| Securities, Dividends, Trading Markets & Prices | 9 |

| Prior Public Offering and Purchases by Filing Persons | 10 |

| Financial Information | 10 |

| Expenses Involved in the Transaction | 10 |

| Person/ Assets, Retained, Employed, Compensated or Used | 11 |

| Available Information | 11 |

| APPENDIX | |

| Appendix A: Agreement and Plan of Merger | |

| Appendix B: Schedule 13e Transaction Statement of Birch Branch, Inc. | |

| Appendix C: Article 113 of the Colorado Business Corporation Act | |

| Appendix D: Form of Demand For Payment of Fair Price | |

| Appendix E: Fairness Opinion by P.K. Hickey Co., Inc. | |

| Appendix F: Transmittal Letter to Shareholders | |

| ITEM 1. | SUMMARY TERM SHEET |

The Company is a Colorado corporation with 32,047, 222 Shares currently outstanding. These Shares are quoted on the OTC Bulletin Board (“OTCBB”). The purpose of the proposed merger (“Merger”) is to enable Acquisition Corp., Mr. Wang Xinshun and Li Weitian (collectively the “Filing Persons”) to acquire 100% control of the Company. Holders of Shares (other than Acquisition Corp.) will be cashed out in exchange for $0.10 per Share and Filing Persons will bear the rewards and risks of the surviving company after the merger, including any future earnings and growth of the surviving company as a result of improvements to its operations.

Following the consummation of the Merger, the surviving company will not be a publicly-traded company and will instead become a private company owned by the Filing Persons. In addition, after the Merger, Shares will no longer be listed on any securities exchange or any quotation system, including the OTCBB.

Acquisition Corp. is a newly formed corporation created by the Filing Persons for the purpose of causing the Company to merger with and into such entity through a short-form merger. Prior to the Merger, Acquisition Corp. owns approximately 94.4% of the Shares. The Filing Persons intend to cause the Company to merge with and into Acquisition Corp. in a short-form merger (the “Merger”) under Section 7-111-104 of the CBCA, pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), a form of which is Appendix A of this Information Statement. Pursuant to the Merger Agreement, each holder of Share(s) (other than Acquisition Corp.) will be entitled to receive cash (the “Cash Merger Price”) in the amount of $0.10, without interest. The Filing Persons have calculated that pursuant to this procedure, approximately 1,813,472 shares will be cashed out, which would not result in any cost to the company. The Filing Persons will provide the necessary funding for the Merger from personal funds.

Under the CBCA, no action is required by the holders of Shares for the Merger to become effective. Holders of Shares will not be entitled to vote with respect to the Merger but will be entitled to certain appraisal rights under the CBCA.

Upon the completion of the Merger, Acquisition Corp. will be the surviving entity. It will be a privately-held company with all its shares beneficially owned by Mr. Wang Xinshun and Li Weitian.

Background of the Transaction

Subject Company

The full name of the subject company is Birch Branch Inc. The principal executive offices of the Company are located at Henan Shuncheng Group Coal Coke Co., Ltd. (New Building), Cai Cun Road Intersection, Anyang County, Henan Province, China 455141. The telephone number is 86 372 323 7890. The Company is subject to the informational reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and in accordance therewith is required to file reports, proxy statements, and other information with the SEC relating to its business, financial condition, and other matters. Such reports, proxy statements and other information are available for inspection and copying at the SEC’s public reference room located at 100 F. Street, N.E., Room 1580, Washington, D.C. 20549. Copies may be obtained from the SEC’s principal office at 450 Fifth Street, N.W., Washington, D.C. 20549. The SEC also maintains a web site that contains reports, proxy, and information statements, and other information regarding registrants that file electronically with the SEC at http://www.sec.gov.

Acquisition Corp.

Acquisition Corp. was recently formed by the Filing Persons for the purpose of effecting the Merger. Its principal business address is Henan Shuncheng Group Coal Coke Co., Ltd. (New Building), Cai Cun Road Intersection, Anyang County, Henan Province, China 455141. Acquisition Corp. has not (1) been convicted in a criminal proceeding during the past five years or (2) been a party to any judicial or administrative proceeding during the past five years (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree, or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Mr. Wang Xinshun

Mr. Wang Xinshun is an individual with a business address at Henan Shuncheng Group Coal Coke Co., Ltd. (New Building), Cai Cun Road Intersection, Anyang County, Henan Province, China 455141. Mr. Wang is a founder and the sole director of SC Coke, the operating subsidiary of The Company in China. He has held this position since February 2005. Since May 2008, Mr. Wang has also served as the General Manager of Bailianpo, in which he owns a 43.86% interest. From August 1997 to January 2005 Mr. Wang serviced as general manager of Anyang Shuncheng Coal Washing Co., Ltd. Mr. Wang founded Anyang Tiexi Coal Washery in March 1991 where he worked as a factory director until July 1997. Mr. Wang serves on the board of directors of Angang Steel Group Metallurgy Furnace Co., Ltd., Anyang Commercial Bank Co. Ltd. and Bailianpo. Mr. Wang’s experience in the coal and coke industry and the operation and management of large-scale coke and refined coal operations are valuable resources in formulating business strategy, addressing business opportunities and resolving operational issues that arise from time to time.

Mr. Li Weitian

Li Weitian is an individual with a business address at 1220 N. Market Street, Suite 806, Wilmington, DE 19801. Li Weitian is businessman in the finance industry.

Pre-Merger Share Exchange

Prior to the Merger, companies controlled by Mr. Wang Xinshun and Li Weitian entered into two share exchange agreements with Acquisition Corp. Pursuant to the terms and conditions of these agreements, companies controlled by Mr. Wang Xinshun and Li Weitian transferred their Shares to Acquisition Corp. in exchange for the capital stock of Acquisition Corp. Mr. Wang Xinshun and Li Weitian collectively own 100% of Acquisition Corp.

Other than the transactions described above, there has been no transaction that occurred during the past two years between (1) any of the Filing Persons or, to the best knowledge of any of the Filing Persons and (2) the Company or its affiliates.

Reasons for Conducting the Transaction

In determining whether to acquire the outstanding public minority equity interest in the Company and to effect the Merger, the Filing Persons considered the following factors to be the principal benefits of taking the Company private through the Merger:

| · | decreased costs associated with being a public company. As a privately held company, the Company would no longer be required to file quarterly, annual, or other periodic reports with the SEC, publish and distribute to its stockholders annual reports and proxy statements, or comply with certain provisions of the Sarbanes-Oxley Act of 2002; |

| · | elimination of additional burdens on management associated with public reporting and other tasks resulting from the Company’s public company status, including, for example, the dedication of time and resources to stockholder inquiries and investor and public relations; |

| · | the opportunity for minority shareholders to receive cash for their Shares quickly and allows the Company to become a privately held company without any action by the majority of the Company shareholders. |

The Filing Persons also weighed a variety of risks and other potentially negative factors for the non-affiliated holder of Share(s) and the Filing Persons concerning the Merger, including the fact that:

| · | Following the Merger, if the Company’s financial condition improves, the shareholders who are cashed out will not participate in any future earnings of or benefit from any increases in the Company’s value; |

| · | For U.S. federal income tax purposes generally, the cash payments made to the shareholders who are cashed out pursuant to the Merger may be taxable to such shareholders; |

| · | The smaller shareholders have not been represented in discussions about the Merger, either by the board of directors of the Company or an independent committee representing the interests of the disinterested shareholders; and |

| · | Acquisition Corp. as the only remaining holder of Shares will be the sole beneficiary of the cost savings that result from going private. |

Terms of the Transaction

Immediately prior to the Merger, Acquisition Corp. owned approximately 94.4% of the Shares. Pursuant to the Merger Agreement, each holder of Share(s) (other than Acquisition Corp. ) will be entitled to receive the Cash Merger Price without interest. The Filing Persons have calculated that pursuant to this procedure, approximately 1,813,472 shares will be cashed out, which would result in a cost to the company of $181, 347.20.

There are no conditions to the Merger or the financing of the Merger. However, the Filing Persons are not under any obligation to consummate the Merger and could decide to withdraw the transaction at any time prior to the effective date of the Merger, although they do not have a present intention to do so.

No Shares will be purchased from any officer, director or affiliate of the Company in the Merger. Any Shares held by any officer, director or affiliate of the Company will be treated the same as all other Shares in the Merger.

Under the CBCA, no action is required by the stockholders of the Company for the Merger to become effective. Holders of Shares will not be entitled to vote with respect to the Merger but will be entitled to certain appraisal rights under the CBCA. Upon the completion of the Merger, Acquisition Corp. will be the surviving entity. It will be a privately-held company with all its shares indirectly held by Mr. Wang Xinshun and Li Weitian. The Shares acquired in the Merger will be cancelled.

For more information concerning terms of the short-form merger, see Appendix A: Agreement and Plan of Merger.

Except for the pre-merger share exchange and the Merger, there have been no negotiations or material contacts that occurred during the past two years between (1) any of the Filing Persons and (2) the Company or its affiliates concerning any merger, consolidation, acquisition, tender offer for or other acquisition of any class of the Company’s securities, election of the Company’s directors or sale or other transfer of a material amount of assets of the Company.

Alternatives to the Transaction

The Filing Persons considered the advantages and disadvantages of certain alternatives to acquiring the minority interests of the unaffiliated holders of Shares, including leaving the Company as a majority-owned public company. In the view of the Filing Persons, the principal advantage of leaving the Company as a majority-owned public company would be for the potential investment liquidity of owning securities of a public company and for the possibility of using the Company’s securities to raise capital. However, the Filing Persons do not believe that either of these rationales is persuasive. The Filing Persons also noted that companies of similar size and public float to the Company do not typically receive the necessary attention from stock analysts and the investment community to create substantial liquidity. Therefore, the Filing Persons concluded that the advantages of leaving the Company as a majority-owned public subsidiary were outweighed by the disadvantages of doing so, and accordingly that alternative was rejected.

The Filing Persons have determined to effect the Merger at this time because they wish to realize as immediately as possible the benefits of taking the Company private, as discussed above. The current market price of the Company’s common stock was not a factor in the timing of the Filing Persons’ decision to effect the Merger.

The Filing Persons believe that effecting the transaction by way of a short-form merger under Section 7-111-104 of the CBCA is also the quickest and most cost-effective way for Acquisition Corp. to acquire the outstanding Shares that it has not already owned, as well as an equitable and fair way to provide liquidity, in the form of cash consideration, to the smaller public holders of Shares. As a result, the Filing Persons rejected such transactions as a long-form merger, tender offer or reverse stock split. The short-form merger allows the unaffiliated holders of Shares to receive cash for their Shares quickly, and avoids the additional expense of soliciting proxies or launching a tender offer, either of which would be very costly.

Effects of the Merger

The beneficial ownership of the Filing Persons in the Company immediately prior to the consummation of the Merger amounts to approximately 94.4 % in the aggregate. Upon completion of the Merger, the Filing Persons will have complete control over the surviving company’s business.

Once the Merger is effective, trading in Shares on the OTC Bulletin Board will cease. There will no longer be price quotations for Shares. The registration of Shares under the Exchange Act will be terminated. The Filing Persons intend to deregister the Shares under the Exchange Act. As a result, the surviving company will no longer be required to file annual, quarterly, or other periodic reports with the SEC under Section 13(a) of the Exchange Act and will no longer be subject to the proxy rules under Section 14 of the Exchange Act. In addition, the Filing Persons will no longer be subject to reporting requirements regarding their ownership of Shares under Section 13 of the Exchange Act or to the requirement under Section 16 of the Exchange Act to disgorge certain profits from the purchase and sale of Shares.

Following the consummation of the Merger, the business and operations of the Company will, except as set forth in this Information Statement, be conducted substantially as they currently are being conducted. For more information concerning the impact of the Merger on the Company’s business, see “Conduct of Business After the Transaction” under Item 2 of this Information Statement.

Fairness of the Transaction

Pursuant to an engagement letter dated as of May 11, 2012, the Company retained P.K. Hickey Co., Inc. (“P.K. Hickey”) to act as its financial advisor in connection with the merger. P.K. Hickey provided a written opinion dated July 17, 2012, that based upon and subject to the assumptions, procedures, considerations and limitations set forth in the written opinion and based upon such other factors as P.K. Hickey considered relevant, the per share merger consideration of $0.10 in cash is fair, from a financial point of view, to the holders of Shares (other than the Filing Persons), as of the date of the opinion.

In addition, the Merger has been approved by a majority of the independent directors of the the Company. The Filing Persons also considered requesting that independent directors of the Company form a special committee for the purpose of determining the fairness of the Merger but decided not to pursue this option. The Filing Persons believed that the cost of legal counsel and the diversion of management resources to assist the special committee would have been an unnecessary and imprudent drain on the already limited resources of the Company.

For more information concerning fairness of the transaction, see Appendix E: Fairness Opinion by P.K. Hickey Co., Inc.

Source of Funds or Other Consideration

The total amount of funds required by Acquisition Corp. to pay the Cash Merger Price to all unaffiliated holders of Shares and to pay related fees and expenses, is estimated to be approximately $ 240,291.85. The Filing Persons will personally finance the funds required to pay Merger fees and expenses. Because the Filing Persons intend to provide the necessary funding for the Merger, Acquisition Corp. has not arranged for any alternative financing.

Conduct of Business After the Transaction

Following the consummation of the Merger, the business and operations of the Company will, except as set forth in this Information Statement, be conducted substantially as they currently are being conducted. The Filing Persons intend to continue to evaluate the business and operations of the Company with a view to maximizing its potential, and they will take such actions as they deem appropriate under the circumstances and market conditions then existing. The Filing Persons intend to cause the Company to terminate the registration of the Shares under the Exchange Act following the Merger, which would result in the suspension of the Company’s duty to file reports pursuant to the Exchange Act.

The Filing Persons do not currently have any commitment or agreement and are not currently negotiating for the sale of any of the Company’s businesses. Except as otherwise described in this Information Statement, neither the Company or any of the Filing Persons has, as of the date of this Information Statement, approved any specific plans or proposals for:

| | • | any extraordinary corporate transaction involving Acquisition Corp. after the completion of the Merger; |

| | | |

| | • | any sale or transfer of a material amount of assets currently held by the Company after the completion of the Merger; |

| | | |

| | • | any material change in the Company’s dividend rate or policy, or indebtedness or capitalization; |

| | | |

| | • | any change in the present board of directors or management of the Company; or |

| | | |

| | • | any other material change in the Company’s corporate structure or business. |

| ITEM 3. | SHAREHOLDERS RIGHTS |

Shareholder Approval Requirement For the Merger

Immediately prior to the Merger, Acquisition Corp. owns approximately 94.4% of the Company Shares. The Merger is a short-form merger where the Company as the subsidiary will be merger into and with its parent company Acquisition Corp. that owns more than 90% of the Company Shares before the Merger.

Under the CBCA, no action by the stockholders of the Company is required for the Merger to become effective. Holders of Shares will not be entitled to vote with respect to the short-form merger but will be entitled to certain appraisal rights under the CBCA.

Appraisal Rights and Exercise Procedures

Right to Dissent

Under the CBCA, a holder of Share(s), whether or not entitled to vote, is entitled to dissent and obtain payment of the fair value of the Share(s) in the event of the proposed Merger. Subject to certain conditions, record holders of Shares who follow the procedures set forth in Section 7-113-102, will be entitled to have their Share(s) appraised and to receive payment of the fair value of the Shares.

Section 7-113-103(2) of the CBCA provides that a beneficial shareholder may assert dissenters’ rights as to the shares held on the beneficial shareholder’s behalf only if (a) the beneficial shareholder causes the corporation to receive the record shareholder’s written consent to the dissent not later than the time the beneficial shareholder asserts dissenters’ rights and (b) the beneficial shareholder dissents with respect to all shares beneficially owned by the beneficial shareholder.

Notice of Intent to Demand Payment

The notice accompanying this Information Statement states that holder of Share(s) are entitled to assert dissenters’ rights under Article 113 of the CBCA. A shareholder who wishes to assert dissenters’ rights shall cause the Company to receive written notice (Appendix D of this Information Statement) of the shareholder’s intention to demand payment for the shareholder’s Shares before ______, 2012. A shareholder who does not satisfy the foregoing requirement will not be entitled to demand payment for his or her shares under Article 113 of the CBCA.

Procedure to Demand Payment

A shareholder who is given a dissenters’ notice to assert dissenters’ rights will, in accordance with the terms of the dissenters’ notice, (a) cause us to receive a payment demand (which may be a demand form supplied by us and duly completed or other acceptable writing) and (b) deposit the shareholder’s stock certificates. A shareholder who demands payment in accordance with the foregoing retains all rights of a shareholder, except the right to transfer the shares, and has only the right to receive payment for the shares after the completion of the Merger. A shareholder who does not demand payment and deposit his or her share certificates as required by the date or dates set forth in the dissenters’ notice will not be entitled to demand payment for his, her or its shares under Article 113 of the CBCA, and he, she or it will receive cash consideration for each of his, her or its shares equal to the per share price received by non-dissenting shareholders.

Offer by the Company

At the receipt of a payment demand or upon consummation of the Merger, whichever is later, the Company will pay each dissenter who complied with the notice requirements referenced in the preceding paragraph the Company’s estimate of the fair value of the dissenter’s shares plus accrued interest.

If the Dissenter Dissatisfied with the Offer

If a dissenter disagrees with the Company’s payment or offer, such dissenter may give notice to us in writing of the dissenter’s estimate of the fair value of the dissenter’s shares and of the amount of interest due and may demand payment of such estimate, less any payment made prior thereto, or reject the Company’s offer and demand payment of the fair value of the shares and interest due if: (a) the dissenter believes that the amount paid or offered is less than the fair value of the shares or that the interest due was incorrectly calculated, (b) the company fail to make payment within 60 days after the date set by the Company by which the Company must receive the payment demand or (c) the Company do not return deposited certificates if the Merger is consumed 60 days after the date set by us by which the payment demand must be received by the shareholder asserting dissenters’ rights.

A dissenter waives the right to demand payment under this paragraph unless he or she causes us to receive the notice referenced in this paragraph within 30 days after we make or offer payment for the shares of the dissenter, in which event, such dissenter will receive all cash for his or her shares in an amount equal to the amount paid or offered by the Company.

Judicial Appraisal of Shares

If a demand for payment made by a dissenter as set forth above is unresolved, the Company may, within 60 days after receiving the payment demand, commence a proceeding and petition a court to determine the fair value of the shares and accrued interest. If the Company does not commence the proceeding within the 60 day period, the Company shall pay to each dissenter whose demand remains unresolved the amount demanded.

The information above is a summary of dissenters’ rights available to our shareholders, which is not intended to be a complete statement of applicable Colorado law and is qualified in its entirety by reference to Article 113 of the Colorado Business Corporation Act (“CBCA”), which is set forth in its entirety as Appendix C: Article 113 of the Colorado Business Corporations Act.

Access to Records and Retainer of Counsel by Unaffiliated Security Holders

None of the Filing Persons intends to grant the nonaffiliated security holders special access to the Company’s records in connection with the Merger. That said, information regarding the Company is available from its public filings with the SEC which can be found atwww.sec.gov.

None of the Filing Persons intends to obtain counsel or appraisal services for the nonaffiliated security holders.

Securities, Dividends, Trading Markets & Prices

The exact title of the classes of equity securities subject to the Merger is common stock, no par value, of the Company. As of October 5, 2012, there are 32,047,222 Shares outstanding.

Acquisition Corp. is the holder of record of an aggregate of 30,284,624 Shares, representing approximately 94.4% of the Shares. To the knowledge of the Filing Persons, the Company has never declared or paid any dividends in respect of the Shares during the past two years. After a reasonable inquiry, the Filing Persons believe that the Company will neither declare nor pay any dividends in the future.

The Company’s Shares are listed for quotation on the OTC Bulletin Board under the trading symbol “BRBH.” The current trading price as of October 5, 2012 is $0.155 per Share. The following table sets forth the bid prices quoted for the Company’s common stock on the OTC Bulletin Board during the last two years, as reported in publicly available sources.

| | | High | | | Low | |

| Fiscal Quarter Ended | | | | | | | | |

| June 30, 2012 | | $ | 0.155 | | | $ | 0.155 | |

| March 31, 2012 | | $ | 0.19 | | | $ | 0 | |

| December 31, 2011 | | $ | 0.15 | | | $ | 0.15 | |

| September 30, 2011 | | $ | 1.3 | | | $ | 0.22 | |

| June 30, 2011 | | $ | 2.5 | | | $ | 1.02 | |

| March 31, 2011 | | $ | 3.98 | | | $ | 3.5 | |

| December 31, 2010 | | $ | 5 | | | $ | 3.98 | |

| September 30, 2010 | | $ | 4.5 | | | $ | 0 | |

Prior Public Offerings and Purchases by Filing Persons

None of the Filing Persons has made an underwritten public offering of the Shares for cash during the past three years that was registered under the Securities Act of 1933, as amended (the “Securities Act”), or exempt from registration thereunder pursuant to Regulation A.

None of the Filing Persons, nor any affiliate of any of the Filing Persons, has purchased any Shares during the past two years.

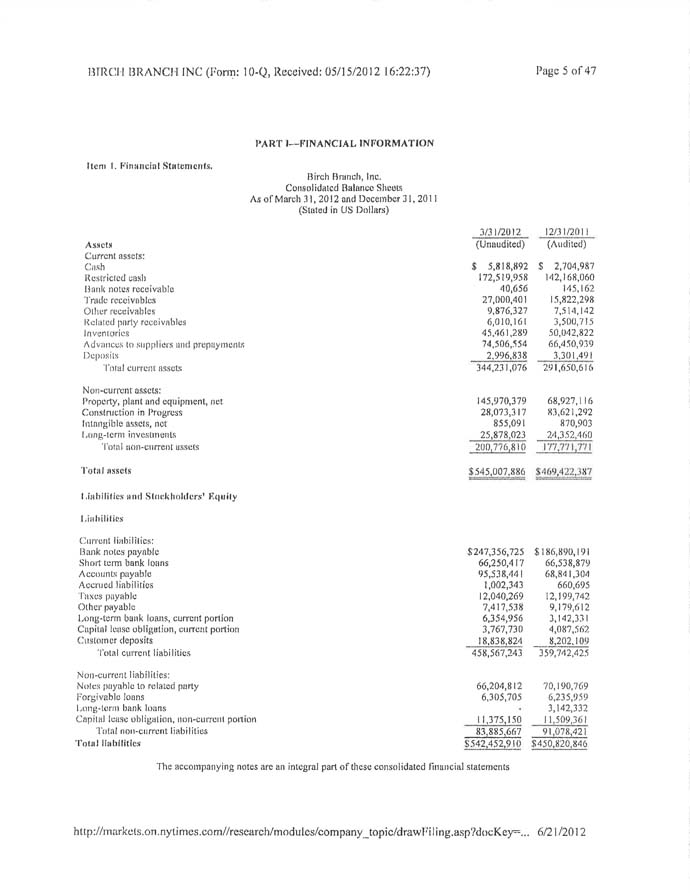

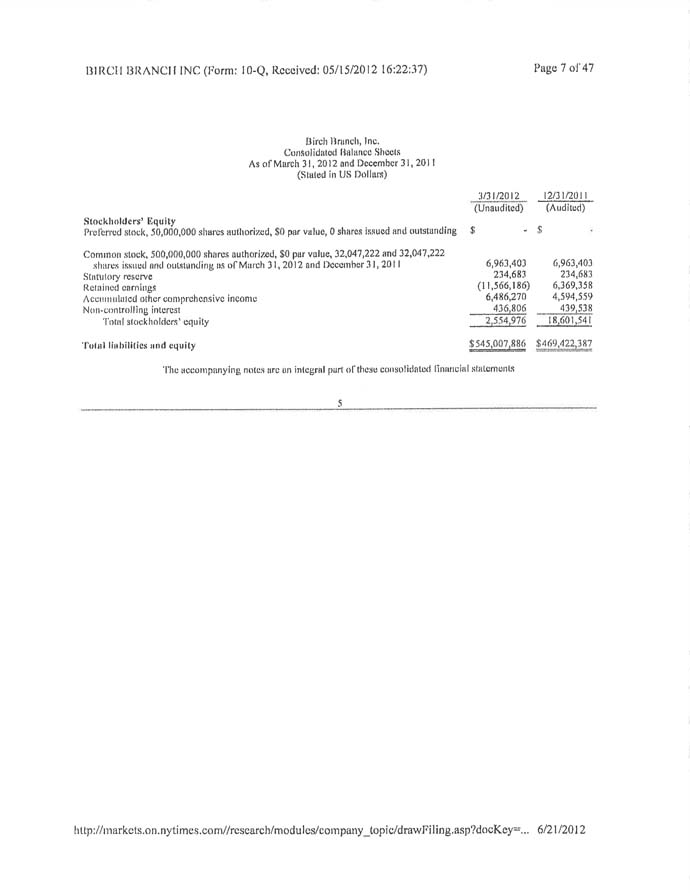

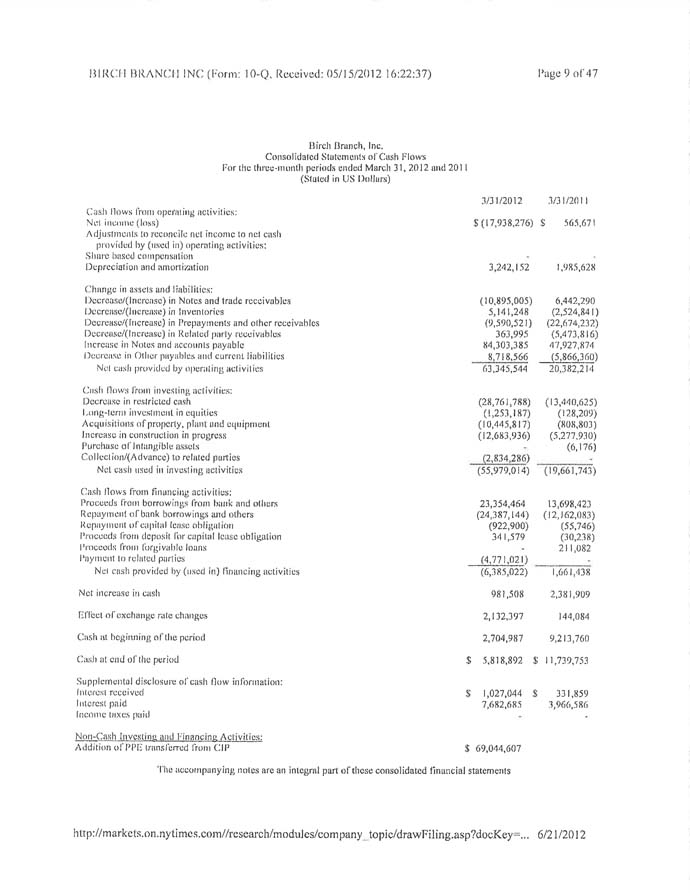

Financial Information

The audited consolidated financial statements of Birch Branch for the fiscal years ended December 31, 2011 and the fiscal year ended December 31, 2010 have been included in Birch Branch’s Annual Report on Forms 10-K for these two fiscal years(the “Forms 10-K”). The unaudited consolidated financial statements of Birch Branch for the quarterly periods ended September 30, 2011, March 31, 2012 and June 30, 2012 are also incorporated herein by reference to the Consolidated Financial Statements included in Birch Branch’s Quarterly Reports on Form 10-Q for these quarters (the “Forms 10-Q”).

The Forms 10-K and Forms 10-Q, and other Birch Branch’s SEC filings, are available for inspection and copying at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The Forms 10-K and Forms 10-Q are also available to the public from the SEC’s website at http://www.sec.gov.

The book value per share of Birch Branch as of June 30, 2012 was $ (0.23).

Expenses Involved in the Transaction

The transfer agent of the Company will receive reasonable and customary compensation for its services and will be reimbursed for certain reasonable out-of-pocket expenses and will be indemnified against certain liabilities and expenses in connection with the Merger, including certain liabilities under U.S. federal securities laws.

None of the Filing Persons will pay any fees or commissions to any broker or dealer in connection with the Merger. The following is an estimate of fees and expenses to be incurred by the Filing Persons in connection with the Merger:

| | | Fees | |

| Legal fees and expenses | | $ | 50,000.00 | |

| Filing | | $ | 24.74 | |

| Printing | | $ | 2,600.00 | |

| Transfer Agent and Mailing | | $ | 2,319.91 | |

| Miscellaneous fees and expenses | | $ | 4,000.00 | |

| Total | | $ | 58,944.65 | |

Personal/Assets, Retained, Employed, Compensated or Used

Solicitations or Recommendations

There are no persons or classes of persons who are directly or indirectly employed, retained, or to be compensated to make solicitations or recommendations in connection with the Merger.

Employees and Corporate Assets

No officers, class of employees, or corporate assets of the Company has been or will be employed by or used by the Filing Persons in connection with the Merger.

Available Information

The Company is subject to the informational requirements of the Exchange Act and, in accordance therewith, the Company is required to file reports and other information with the SEC relating to our business, financial condition and other matters. The SEC provides electronic document retrieval on its website for most reports, proxy and information statements and other information regarding registrants that file electronically with the SEC, which can be found at the SEC’s website, http://www.sec.gov. Such information should also be available for inspection at the public reading rooms of the SEC at 100 F Street, N.E., Room 1580, Washington, DC 20549. Investors may call the SEC at (202) 551-8090 for further information on the public reading rooms. Copies of such information that is not posted to the SEC’s website may be obtained (i) by mail by writing to the Office of FOIA/PA Operations at the SEC at 100 F Street, N.E., Washington, DC 20549, (ii) by faxing such request to (202) 772-9337, or (iii) by using their online form available at their website athttp://www.sec.gov.

Dated: Oct. 5, 2012

THE BOARD OF DIRECTORS OF BIRCH BRANCH, INC.

To avoid duplication, Appendices A, B, C, and E of the 14c Information Statements are not included in this Transaction Statement. These Appendices can be found in Exhibits of this Transaction Statement.

14 C Information Statement

- Appendix D

BIRCH BRANCH INC.

c/o McLaughlin & Stern, LLP

260 Madison Avenue

New York, NY 10026

Attention: Qian Hu, Esq.

| | | |

| | Re: | Demand for Payment of Fair Value of Shares in |

| | | Connection with Short-form Merger |

It is understood that a short-form merger is to be effected by Birch Branch Inc. (the “Company”) as described in the Information Statement, dated ________, 2012, sent by the Company to its stockholders. The undersigned stockholder of the Company hereby demands, pursuant to Article 113 of the Colorado Business Corporations Act, that the Company pay to the undersigned the fair value of the shares of Common Stock, no par value. The fair value is to be determined based on the fair value that the undersigned would be entitled to in connection with the short-form merger if the Company had not elected to pay cash as the merger consideration.

The undersigned hereby certifies that he/she currently beneficially owns ______ shares of the Company common stock, before giving effect to the proposed short-form merger. The undersigned hereby certifies that he acquired beneficial ownership of ______ such shares before ____________, the date on which the Company first publicly announced, by press release and by current report filed with the United States Securities and Exchange Commission, its intention to effect the short-form merger. The undersigned hereby certifies that he or she did not vote for the transaction. The undersigned does not accept the Company’s offer of the estimated fair value. The undersigned estimates that the fair value of the shares currently owned is $__________ per share. The undersigned hereby makes a demand for payment of this estimated value plus interest.

| |

|

| (Name as it appears on share certificates) |

| |

|

| Address |

| |

|

| (Signature) |

| |

|

| (Date) |

14 C Information Statement

- Appendix F

FORM OF LETTER OF TRANSMITTAL

Corporate Stock Transfer, Inc.

3200 Cherry Creek Drive South, Ste. 430

Denver, Colorado 80209

Phone: (303) 282-4800 Fax: (303) 282-5800

[Insert Shareholder Name and Address]

The board of directors and shareholders of Birch Branch, Inc. a Colorado corporation (the “Company”) has approved a “short-form” merger under Colorado law with and into Birch Branch Acquisition Corp.., a Nevada corporation, with an effective date of [__________].

Pursuant to the Plan of Merger,dated as of [________], 2012, please complete the following and forward it attached to your certificate(s) to Corporate Stock Transfer, Inc. at the above address. We recommend that you send your certificate(s) via certified mail.

| 1) | Name/ Address | | 2) | Certificate # | Shares |

| | | | | | |

| | ______________________________ | | ________________ | ____________ |

| | ______________________________ | | ________________ | ____________ |

| | ______________________________ | | ________________ | ____________ |

| | |

| | Social Security Number:______________________________________________ |

| | | | | | |

| 3) | SPECIAL MAILING INSTRUCTIONS: | | |

| | | | | | |

| | To: (name/address): | ________________________________________________ |

| | | ________________________________________________ |

| | | ________________________________________________ |

INSTRUCTIONS:

| 1) | Enter your current address and indicate if this is a change of address. |

| | |

| 2) | Enter your certificate number(s) and corresponding number of shares represented by each certificate. |

| 3) | Special Mailing Instructions: Indicate the address to which you desire the replacement certificate(s) mailed. Note: Please do not complete this section if you wish to have the certificate(s) returned to your present address as indicated in Section 1 above. |

| | |

| 4) | There is no need to endorse your certificate(s), as there will be no change in registration. |

| 5) | Include your payment for transfer/mailing fees, made payable to Corporate Stock Transfer, Inc. |

Exhibit (d)

AGREEMENT AND PLAN OF MERGER

Between

Birch Branch Acquisition Corp.

and

BIRCH BRANCH INC

________, 2012

THIS AGREEMENT AND PLAN OF MERGER (“Agreement”) is made and entered into as of ______, 2012, by and between, Birch branch Acquisition corp., a Nevada Corporation (“ACQUISITION CORP.”),birch branch, Inc., a Colorado corporation (the “Company”), where ACQUISITION CORP. owns 94.4% of the Company Shares.

RECITALS

WHEREAS, the Company is a corporation organized and existing under the laws of Colorado with thirty-two million, forty-seven thousand, two hundred and twenty-two (32,047,222) shares of common stock issued and outstanding (the “Shares”).

WHEREAS, ACQUISITION CORP. is a corporation organized and existing under the laws of Nevada with a total authorized share of one hundred thousand (100,000) with a par value of $0.0001.

WHEREAS, the respective Boards of Directors of ACQUISITION CORP. and the Company have determined that a merger of the Company with and into ACQUISITION CORP. (the "Merger"), upon the terms and subject to the conditions set forth in this Agreement, would be fair and in the best interests of their respective shareholders, and such Boards of Directors have approved such Merger.

WHEREAS, the parties hereto intend and accordingly designate the Merger so that the Merger shall qualify as a reorganization for federal income tax purposes under the provisions of Section 368 of the Internal Revenue Code of 1986, as amended (the "Code").

WHEREAS, the parties hereto desire to make certain representations, warranties, covenants and agreements in connection with the Merger.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the Company and ACQUISITION CORP. hereby agree as follows:

ARTICLE I

The Merger

SECTION 1.01 The Merger. Upon the terms and subject to the conditions set forth in this Agreement, and in accordance with the Colorado Business Corporation Act (the “CBCA”) and the Nevada Revised Statutes (the "NRS"), the Company shall merge with and into ACQUISITION CORP. at the Effective Time of the Merger (as defined in Section 1.03). Following the Effective Time, the separate existence of the Company shall cease, and ACQUISITION CORP. shall continue as the surviving corporation (the “Surviving Corporation”).

SECTION 1. 02 The Closing. The Closing of the transactions contemplated by this Agreement (the "Closing") shall take place in the offices of McLaughlin & Stern LLP, 260 Madison Avenue, New York, New York 10016 on the ___day of_____, 2012, commencing at 10:00am Eastern Daylight Saving Time (the "Closing Date"), unless another place or time is mutually agreed upon in writing by the parties, but in any event no later than December 31, 2012 unless extended by a written agreement of the parties in writing (the “Termination Date”).

SECTION 1.03 Effective Time.

(a) Subject to the provisions of this Agreement, as soon as practicable on or after the Closing Date, the Company shall file the Statement of Merger or other appropriate documents (in any such case, the “Statement of Merger”) executed in accordance with the relevant provisions of the CBCA and the NRS and shall make all other filings or recordings required under the CBCA and the NRS in order to effectuate the Merger and in order to accomplish the proper execution of the obligations of the Company and ACQUISITION CORP. under this Agreement.

(b) The Merger shall become effective at such time as the Statement of Merger are duly filed with the Colorado Secretary of State and the Nevada Secretary of State, or at such other time as the Company and ACQUISITION CORP. shall agree as should be specified in the Statement of Merger (the time the Merger becomes effective being hereinafter referred to as the “Effective Time”).

(c) ACQUISITION CORP. may, at any time after the Effective Time, take any action (including executing and delivering any document) in the name and on behalf of either itself or the Company in order to carry out and effectuate the transactions contemplated by this Agreement. From the Effective Time, ACQUISITION CORP. shall possess all of the rights, privileges, powers and franchises and be subject to all of the restrictions, disabilities and duties of the Company, all as provided under the CBCA.

SECTION 1.04 Effects of the Merger. At the Effective Time, and without any further action on the part of the Company or ACQUISITION CORP., the Merger shall have the effects set forth in the applicable provisions of the CBCA.

(a) Articles of Incorporation. The Articles of Incorporation of ACQUISITION CORP. as in effect immediately prior to the Effective Time shall be the Articles of Incorporation of the Surviving Corporation until thereafter changed or amended as provided therein or by applicable law.

(b) Bylaws. The bylaws of ACQUISITION CORP. as in effect immediately prior to the Effective Time shall be the bylaws of the Surviving Corporation until thereafter changed or amended as provided therein or by applicable law.

(c) Name Change. The name of the Surviving Corporation should be changed to Shun Cheng International Nevada upon Closing.

(d) Directors and Officers. At the Closing Date, the officers and directors of the Company shall become the officers and directors of the Surviving Corporation to hold the positions in the Surviving Corporation to which they have been elected as officers of the Company as to serve in accordance with the bylaws of the Surviving Corporation.

(e) Rights and Obligations. At the Effective Time, the separate corporate existence of the Company shall cease, and ACQUISITION CORP. as the Surviving Corporation shall possess all the rights, privileges, powers and franchises of a public and private nature and be subject to all the restrictions, disabilities, and duties of the Company; and property, real, personal and mixed, and all debts due to the Company on whatever account shall be vested in the Surviving Corporation.

SECTION 1.05 Merger Consideration. Each shareholder of record as of the Effective Time (other than ACQUISITION CORP.) shall be entitled to receive for each issued and outstanding Share held by such shareholder an amount in cash, without interest, equal to 10 United States cents (US $0.10) per share unless such shareholder exercises his, her or its dissenters’ right pursuant to Section 1.09 of this Agreement.

SECTION 1.06 Transfer Agent and Deposit. The Company shall authorize Corporate Stock Transfer, Inc. as its transfer agent (“Transfer Agent”) for theMerger. On the Effective Date, ACQUISITION CORP. shall deposit or otherwise takereasonable steps necessary to cause to be deposited cashin the amount of 243, 291.90 in trust with the Transfer Agent for the benefit of the shareholders of the Company that are entitled to payment under Section 1.05 of this Agreement. At or as promptly as practicable after the Closing Date (but in no event later than five (5) Business Days following the Closing Date), the Transfer Agent shall deliver to each holder of the Shares (other than ACQUISITION CORP.) a shareholder transmittal letter (“Shareholder Transmittal Letter”).

SECTION 1.07 Surrender of Shares and Payment. Upon the duly execution and delivery of the Shareholder Transmittal Letter by holder(s) of Share(s) together with accompanying share certificates representing the Shares(the “Stock Certificates”), the Transfer Agent shall pay such holder(s) pursuant to Section 1.05 of the Agreement.

SECTION 1.08 Shareholder Taxes. Each holder of Share(s) that has received cash payment pursuant to Section 1.05 of the Agreement shall pay taxes as required to be paid under the United States Internal Revenue Code or any provision of state, local or foreign tax law with respect to the making of such payment. None of the Company, ACQUISITION CORP. or the Transfer Agent(s) shall be responsible for deducting and withholding taxes from the consideration otherwise payable pursuant to this Agreement to any holder of Share(s).

SECTION 1.09 Dissenting Shares and Appraisal Right

(a) Any holder of the Share(s) who perfects such holder's rights of dissent and appraisal in accordance with and as contemplated by Article 113 of the CBCA (“Dissenting Shareholder”) shall not receive payment pursuant to Section 1.05 but shall instead be entitled to receive from ACQUISITION CORP. the fair value of such shares in cash as determined pursuant to such provision of the CBCA; provided, that no such payment shall be made to any Dissenting Shareholder unless and until such Dissenting Shareholder has complied with the applicable provisions of the CBCA and surrendered to the certificate(s) representing the Shares for which payment is being made.

(b) Notwithstanding the provisions of Section 1.09(a) hereof, if any Dissenting Shareholder shall effectively withdraw or lose (through failure to perfect or otherwise) such holder’s appraisal rights with respect to such Shares under the CBCA, if applicable, then, as of the later of the Effective Time and the occurrence of such event, such shares shall automatically be converted into and represent only the right to receive the consideration set forth in and subject to the provisions of this Agreement, upon surrender of the certificate(s) formerly representing such shares.

(c) The Company shall give ACQUISITION CORP. prompt notice of any written demands for appraisal or payment for Shares received by the Company, attempted withdrawals of such demands and any other instruments served pursuant to applicable law that are received by with respect to shareholders' rights to dissent. The Company shall not, without the prior written consent of ACQUISITION CORP., voluntarily make any payment with respect to, or settle or offer to settle, any such demands.

(d) The Company shall not, except with the prior written consent of ACQUISITION CORP., voluntarily make any payment with respect to any such demands or offer to settle or settle any such demands. Any communication to be made by the Company to any holder of Share(s) with respect to such demands shall be submitted to ACQUISITION CORP. in advance and shall not be presented to any shareholder prior to the Company receiving ACQUISITION CORP.’s consent (which consent shall not be unreasonably withheld or delayed).

ARTICLE II

Effect of the Merger on the Capitalization of

the Constituent Entities

SECTION 2.01 Effect on Capitalization. As of the Effective Time, by such actions to be taken by the parties’ hereto, or otherwise by virtue of the Merger and without any action on the part of the holders of Share(s), the Shares (other than the Shares owned by ACQUISITION CORP.) shall no longer be outstanding and shall automatically be canceled and retired and shall cease to exist, and holders of certificates representing the Shares shall cease to have any rights with respect thereto, except the right to receive the Merger Consideration and appraisal rights under the CBCA.

ARTICLE III

Representations and Warranties of ACQUISITION CORP.

ACQUISITION CORP. hereby represents and warrants to the Company that the statements contained in this Article III are true, correct, and complete as of the date of this Agreement and will be true and correct as of the Closing Date.

SECTION 3.01 Organization. ACQUISITION CORP. is a corporation duly organized, validly existing and in good standing under the laws of the state of Nevada and it has all requisite corporate power and authority to carry on their business as now being conducted, except where the failure to be so organized, existing and in good standing or to have such power and authority could not be reasonably expected to (i) prevent or materially delay the consummation of the Merger, or (ii) have a material adverse effect on ACQUISITION CORP.

SECTION 3.02 Authority. ACQUISITION CORP. has the requisite power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby. The execution, delivery and performance of this Agreement and the consummation by ACQUISITION CORP. of the Merger and the other transactions contemplated hereby have been duly authorized by all necessary action on its part and no other proceedings on its part are necessary to authorize this Agreement or to consummate the transactions so contemplated, subject to the filing of the Articles of Merger. This Agreement has been duly executed and delivered by ACQUISITION CORP., and constitutes a valid and binding obligation of ACQUISITION CORP. and enforceable against ACQUISITION CORP. in accordance with its terms, except as limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally.

SECTION 3.03 Acquired Shares. ACQUISITION CORP. understands and agrees that Shares it acquires pursuant to the Agreement will be taken for investment purposes without any intent to distribute.

ARTICLE IV

Representations and Warranties of The Company

The Company represents and warrants to ACQUISITION CORP. that the statements contained in this Article IV are true, correct, and complete as of the date of this Agreement and will be true and correct as of the Closing Date:

SECTION 4.01 Organization. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Colorado, and has all requisite corporate power and authority to carry on its business as now being conducted or to have such power and authority could not be reasonably expected to (i) prevent or materially delay the consummation of the Merger, or (ii) have a material adverse effect on the Company. The Company is in good standing in each jurisdiction, in which the property owned, leased or operated by it or the nature of the business conducted by it makes such good standing necessary.

SECTION 4.03 Capitalization. The authorized capitalization of the Company consists of 500,000,000 shares of common stock with no par value and 50,000,000 shares of preferred stock with no par value. 32,047,222 shares of common stock are currently issued and outstanding. All Shares are legally issued, fully paid, and non-assessable and not issued in violation of the preemptive or other right of any person or any federal or state securities laws. There are no dividends or other amounts due or payable with respect to any Share(s). There are no preemptive rights applicable with respect to the Shares. Prior to the Date of Closing, the Company’s shareholders shall not have agreed to transfer any of their Shares to any third-party.

SECTION 4.04 Authorization. The Company has all requisite power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby. The board of directors of the Company has approved the execution and delivery of this Agreement and the transactions contemplated by this Agreement including the Merger in accordance with the applicable Colorado law and with the Company’s articles of incorporation and bylaws. This Agreement has been duly executed and delivered by the Company and constitutes its valid and binding obligations, enforceable against each of them in accordance with its terms.

SECTION 4.05 Consents and Approvals; No Violations. Except for filings, permits, authorizations, consents and approvals as may be required under the CBCA, and except for the filings required to consummate the Merger and any required Form 8-K, neither the execution, delivery or performance of this Agreement by the Company nor the consummation by the Company of the transactions contemplated hereby will: (i) conflict with or result in any breach of any provision of theArticles of Incorporation or bylaws of the Company, (ii) result in a violation or breach of, or constitute (with or without due notice or lapse of time or both) a default (or give rise to any right of termination, amendment, cancellation or acceleration) under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, lease, license, contract, agreement or other instrument or obligation to which the Company is a party or by which the Company or its respective properties or assets may be bound; or (iii) violate any order, writ, injunction, decree, statute, rule or regulation applicable to the Company or any of its respective properties or assets, except in the case of clauses (iii) or (iv) for violations, breaches or defaults that could not reasonably be expected to have a material adverse effect on the Company or prevent or materially delay the consummation of the Merger.

SECTION 4.06 Financial Statements / SEC Status.

(a) Included in the last Form 10-K filed by the Company with the Securities and Exchange Commission (the SEC) are its audited balance sheet as of December 31, 2010 and 2011, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the fiscal year ended December 31, 2011, including the notes thereto, and the accompanying report of the Company’s independent certified public accountant.

(b) The financial statements of Form 10-Q of the Company for the three months ended June 30, 2012 (the “Most Recent Filing Date”) have been prepared in accordance with GAAP and in accordance with the published rules and regulations of the SEC with respect thereto throughout the periods involved as explained in the notes to such financial statements. The Company’s financial statements present fairly, in all material respects, as of their respective dates, the financial position of the Company. The Company did not have, as of the date of any such financial statements, except as and to the extent reflected or reserved against therein, any liabilities or obligations (absolute or contingent) which should be reflected therein in accordance with GAAP, and all assets reflected therein present fairly the assets of the Company in accordance with GAAP.

(c) The Shares are registered pursuant to the Securities and Exchange Act of 1934. As of the Execution Date, the Company has timely filed all reports required by the SEC Rules. Each of the Company’s Forms 10K and Forms 10Q that have been filed with the SEC (“SEC Documents”) has complied in all material respects with the Exchange Act in effect as of their respective dates. None of the Company’s SEC Documents, as of their respective dates, contained any untrue statement of a material fact or omitted to state a material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading.

SECTION 4.07 Absence of Certain Changes or Events. Since the Most Recent Filing Date, the Company has conducted its business only in the ordinary course consistent with past practice, and there has not been any material adverse change (as defined in Section 7.03) with respect to the Company.

SECTION 4.11 Litigation. There is no suit, claim, action, proceeding pending or threatened against the Company, nor is there any investigation against the Company threatened or pending before any governmental entity. The Company is not subject to any outstanding order, judgment, writ, injunction or decree.

SECTION 4.12 Permits; Compliance with Law. The Company is not in violation of, or has not violated, any applicable provisions of any laws, statutes, ordinances or regulations. To the best knowledge of the Company, as of the date of this Agreement, no investigation, inquiry or review by any governmental entity with respect to the Company is pending or threatened, nor has any governmental entity indicated an intention to conduct any such investigation, inquiry or review.

SECTION 4.17 Title to Property. The Company has good and defensible title to all of its properties and assets, free and clear of all liens, charges and encumbrances, except liens for taxes not yet due and payable and such liens or other imperfections of title, if any, as do not materially detract from the value of or interfere with the present use of the property affected thereby or which could not reasonably be expected to have a material adverse effect.

SECTION 4.22 Full Disclosure. No statement contained in any certificate or schedule furnished or to be furnished by the Company to ACQUISITION CORP., or pursuant to the provisions of, this Agreement, contains or will contain any untrue statement of a material fact or omits or will omit to state any material fact necessary, in light of the circumstances under which it was made, in order to make the statements herein or therein not misleading.

ARTICLE V

Covenants

SECTION 5.01 Mutual Use of Best Efforts. The Parties agree as follows with respect to the period from and after the execution of this Agreement.

(a) Each of the parties hereto will use its reasonable best efforts to take all action and to do all things necessary in order to consummate and make effective the transactions contemplated by this Agreement, including the preparation of an 8-K regarding the Merger, Schedule 13e-3 and the Information Statement to be filed after the Effective Date.