UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a- 6(e)(2) ) |

| | |

| þ | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material Pursuant to §240.14a-12 |

CHINA GREEN AGRICULTURE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | | | |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | |

| | | | |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | | |

| | |

| | (3) | | Filing Party: |

| | |

| | | | |

| | |

| | (4) | | Date Filed: |

| | |

October 28, 2009

Dear Stockholder:

On behalf of the Board of Directors of China Green Agriculture, Inc. (the “Company” or “we”), I invite you to attend our 2009 Annual Meeting of Stockholders (the “Annual Meeting”). We hope you can join us. The Annual Meeting will be held:

| | At: | NYSE Board Room |

| | 2 Broad Street |

| | 6th Floor |

| | New York, NY 10005 |

| | Time: | 11:30 a.m., local time |

The Notice of Annual Meeting of Stockholders, the Proxy Statement, the proxy card, and our 2009 Annual Report accompany this letter.

At the Annual Meeting, we will report on important activities and accomplishments of the Company and review the Company’s financial performance and business operations. You will have an opportunity to ask questions and gain an up-to-date perspective on the Company and its activities, and to meet certain directors and key executives of the Company.

As discussed in the enclosed Proxy Statement, the Annual Meeting will also be devoted to the election of directors, approval of the adoption of the Company’s 2009 Equity Incentive Plan, and consideration of any other business matters properly brought before the Annual Meeting.

We know that many of our stockholders will be unable to attend the Annual Meeting. We are soliciting proxies so that each stockholder has an opportunity to vote on all matters that are scheduled to come before the stockholders at the Annual Meeting. Whether or not you plan to attend, please take the time now to read the Proxy Statement and vote via the Internet or, if you prefer, submit by mail a paper copy of your proxy or voter instructions card, so that your shares are represented at the meeting. You may also revoke your proxy or voter instructions before or at the Annual Meeting. Regardless of the number of Company shares you own, your presence in person or by proxy is important for quorum purposes and your vote is important for proper corporate action.

Thank you for your continuing interest in China Green Agriculture, Inc. We look forward to seeing you at the Annual Meeting.

If you have any questions about the Proxy Statement, please contact us at China Green Agriculture, Inc., at 3rd Floor, Borough A, Block A. No. 181, South Taibai Road, Xian, Shaanxi Province, People’s Republic of China 710065.

| Sincerely, | |

| | |

| /s/ Tao Li | |

| Tao Li | |

| President and Chief Executive Officer | |

TABLE OF CONTENTS

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | 4 |

| PROXY STATEMENT | 5 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 7 |

| PROPOSAL 1 – ELECTION OF DIRECTORS | 8 |

| EXECUTIVE COMPENSATION | 11 |

| EXECUTIVE COMPENSATION TABLES | 11 |

| PAYMENTS UPON TERMINATION OR CHANGE-IN-CONTROL | 12 |

| DIRECTOR COMPENSATION | 13 |

| PROPOSAL 2 – ADOPTION OF 2009 EQUITY INCENTIVE PLAN | 14 |

| BOARD INFORMATION | 18 |

| REPORT OF THE AUDIT COMMITTEE | 19 |

| STOCKHOLDER PROPOSALS | 20 |

| ANNUAL REPORT ON FORM 10-K | 20 |

| OTHER MATTERS | 20 |

CHINA GREEN AGRICULTURE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on

December 11, 2009

To the Stockholders of CHINA GREEN AGRICULTURE, INC.:

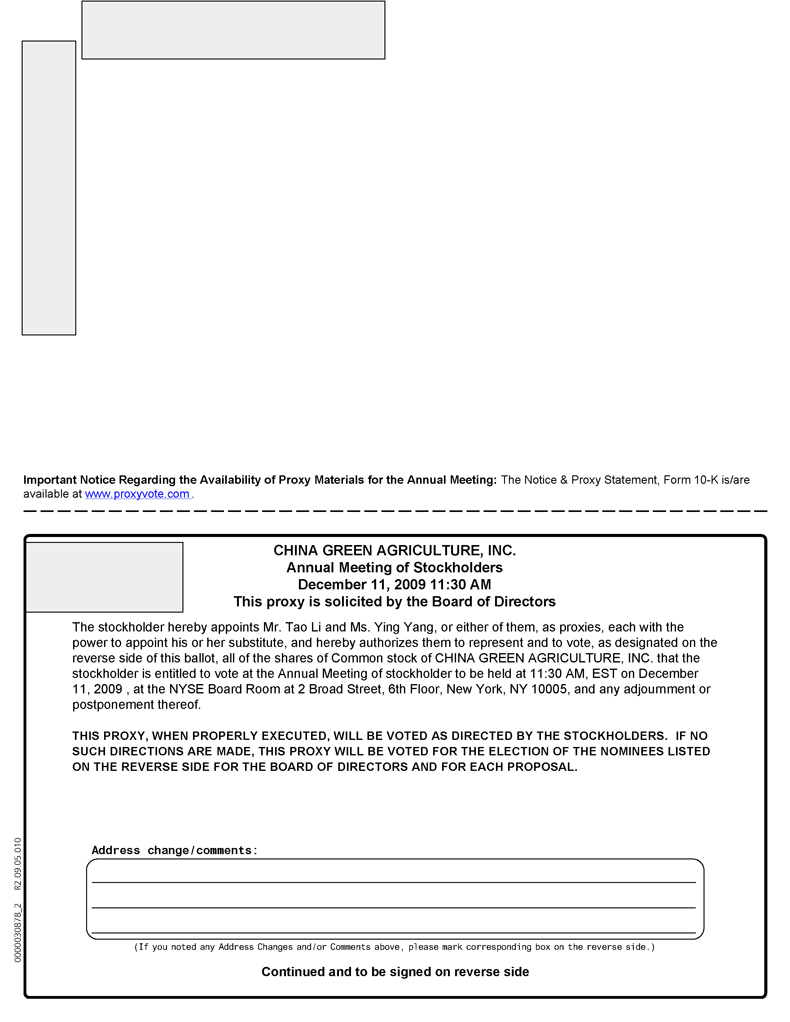

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of China Green Agriculture, Inc., a Nevada corporation (the “Company”), will be held on Friday, December 11, 2009, at 11:30 a.m., local time, at the NYSE Board Room, 2 Broad Street, 6th Floor, New York, NY 10005, for the following purposes:

| 1. | To elect 5 persons to the Board of Directors of the Company, each to serve until the next annual meeting of stockholders of the Company or until such person shall resign, be removed or otherwise leave office; |

| 2. | To approve the adoption of the Company’s 2009 Equity Incentive Plan; and |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Only stockholders of record at the close of business on October 16, 2009 (the “Record Date”) are entitled to notice and to vote at the Annual Meeting and any adjournment or postponement thereof. In accordance with the rules of the Securities and Exchange Commission, we posted our proxy materials on the Internet beginning on October 30, 2009, the date we mailed Notices of Internet Availability of Proxy Materials (and, to the extent required or appropriate, full sets of proxy materials) to the holders of record and beneficial owners of our common stock as of the close of business on the Record Date.

A Proxy Statement describing the matters to be considered at the Annual Meeting is attached to this Notice. Our 2009 Annual Report accompanies this notice, but it is not deemed to be part of the Proxy Statement.

It is important that your shares are represented at the Annual Meeting. We urge you to review the attached Proxy Statement and, whether or not you plan to attend the Annual Meeting in person, please vote your shares promptly by casting your vote via the Internet or, if you receive a full set of proxy materials by mail or request one be mailed to you, and prefer to mail your proxy or voter instructions, please complete, sign, date, and return your proxy or voter instructions card in the pre-addressed envelope provided, which requires no additional postage if mailed in the United States. You may revoke your vote by submitting a subsequent vote over the Internet or by mail before the Annual Meeting, or by voting in person at the Annual Meeting.

If you plan to attend the meeting, please notify us of your intentions. This will assist us with meeting preparations. If your shares are not registered in your own name and you would like to attend the Annual Meeting, please follow the instructions contained in the Notice of Internet Availability of Proxy Materials and any other information forwarded to you by your broker, trust, bank, or other holder of record to obtain a valid proxy from it. This will enable you to gain admission to the Annual Meeting and vote in person.

| By Order of the Board of Directors, | |

| | |

| /s/ Tao Li | |

Tao Li Chairman of the Board | |

October 28, 2009

CHINA GREEN AGRICULTURE, INC.

3rd Floor, Borough A, Black A. No. 181

South Taibai Road, Xi’an, Shaanxi Province

People’s Republic of China 710065

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

This Proxy Statement and the accompanying proxy are being furnished with respect to the solicitation of proxies by the Board of Directors of China Green Agriculture, Inc., a Nevada corporation (the “Company” or “we”), for the Company’s 2009 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held on Friday, December 11, 2009, at 11:30 a.m., local time, and at any adjournment(s) or postponement(s) thereof, at the NYSE Board Room, 2 Broad Street, 6th Floor, New York, NY 10005.

The date on which the Proxy Statement and form of proxy card are intended to be sent or made available to stockholders is October 30, 2009.

The purposes of the Annual Meeting are to seek stockholder approval of three proposals: (i) electing five (5) directors to the Board of Directors of the Company (the “Board”); and (ii) approving the adoption of our 2009 Equity Incentive Plan. We will also transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

Who May Vote

Only stockholders of record of our common stock, par value $.001 per share (“Common Stock”), as of the close of business on October 16, 2009 (the “Record Date”) are entitled to notice and to vote at the Annual Meeting and any adjournment or adjournments thereof.

A list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting, during office hours, at the executive offices of the Company at 3rd Floor, Borough A, Block A. No. 181, South Taibai Road, Xian, Shaanxi Province, People’s Republic of China 710065, by contacting the Secretary to the Board.

The presence at the Annual Meeting of a majority of the outstanding shares of Common Stock as of the Record Date, in person or by proxy, is required for a quorum. Should you submit a proxy or voter instructions, even though you abstain as to one or more proposals, or you are present in person at the Annual Meeting, your shares shall be counted for the purpose of determining if a quorum is present.

Broker “non-votes” are included for the purposes of determining whether a quorum of shares is present at the Annual Meeting. A broker “non-vote” occurs when a nominee holder, such as a brokerage firm, bank or trust company, holding shares of record for a beneficial owner does not vote on a particular proposal because the nominee holder does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

As of the Record Date, we had issued and outstanding 22,681,425 shares of Common Stock. Each holder of Common Stock on the Record Date is entitled to one vote for each share then held on all matters to be voted at the Annual Meeting. No other class of voting securities was then outstanding.

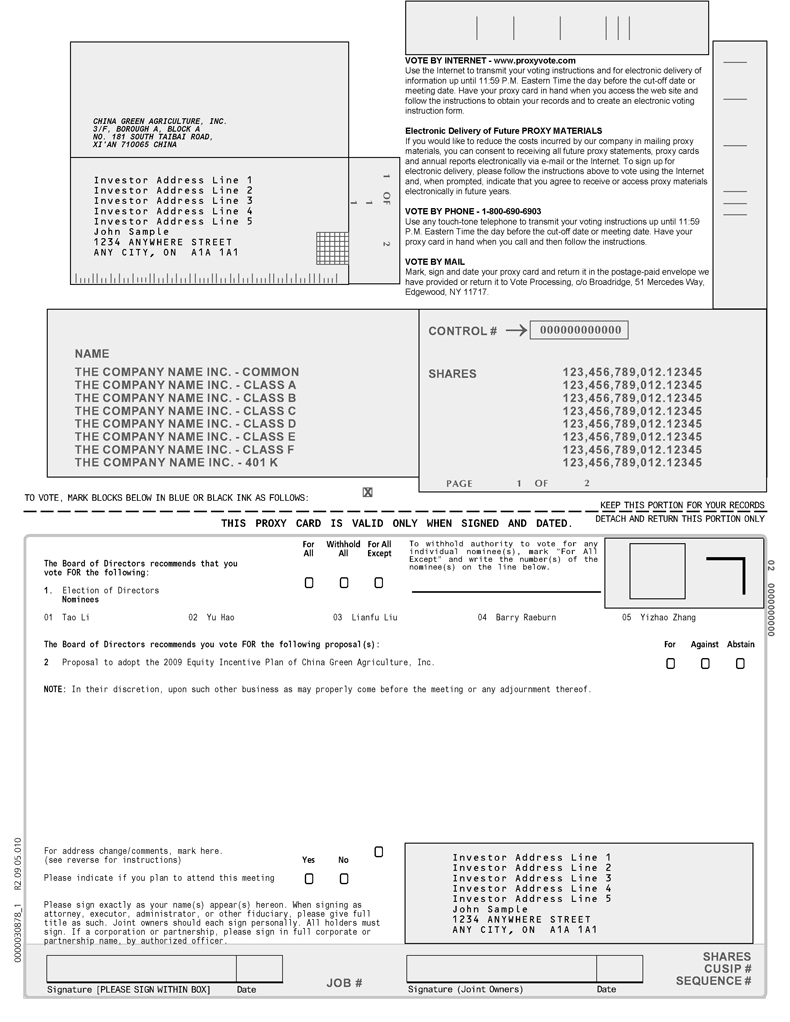

Voting Your Proxy

You may vote by proxy over the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials mailed to you or your household. If you have received printed copies of the proxy materials by mail, or if you request printed copies of the proxy materials by mail by following the instructions on the Notice of Internet Availability of Proxy Materials, you can also vote by mail by completing, dating, and signing the proxy or voter instructions card and mailing it in the pre-addressed envelope provided, which requires no additional postage if mailed in the United States. You may submit your vote over the Internet until 11:59pm (EST) on December 10, 2009. If you vote by mail, please be aware that we can recognize your vote only if we receive it by close of business of the day before the Annual Meeting.

You may also vote in person at the Annual Meeting. If your shares are held through a broker, trust, bank, or other nominee, please refer to the Notice of Internet Availability of Proxy Materials and any other information forwarded to you by such holder of record to obtain a valid proxy from it. You will need to bring this legal proxy with you to the Annual Meeting in order to vote in person.

The shares represented by any proxy duly given will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted (i) FOR the election of the nominees for director set forth herein, and (ii) FOR the approval of the adoption of the Company’s 2009 Equity Incentive Plan. In addition, if other matters come before the Annual Meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment with respect to such matters.

Each share of Common Stock outstanding on the Record Date will be entitled to one vote on all matters. Under Proposal 1 (Election of Directors), the five candidates proposed for election as directors at the Annual Meeting are uncontested. In uncontested elections, directors are elected by majority of the votes cast at the Annual Meeting. Proposal 2 (Adoption of the 2009 Equity Incentive Plan) requires for approval the vote of a majority of the votes cast at the Annual Meeting. In counting the votes cast, only those cast “for” and “against” a matter are included. Please note that you cannot vote “against” a nominee for director, although you may withhold your vote from a nominee.

Shares which abstain or which are withheld from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, abstentions, withheld votes, and “broker non-votes” will have no effect on the voting on matters that require the affirmative vote of a plurality or a majority of the votes cast or the shares voting on the matter.

Stockholders have no cumulative voting rights or dissenter’s or appraisal rights relating to the matters to be acted upon at the Annual Meeting.

Revoking Your Proxy

Even if you submit a proxy or voter instructions, you may revoke your proxy and change your vote. You may revoke your proxy or voter instructions by submitting a new proxy or voter instructions over the Internet by using the procedure to vote your shares online described in the Notice of Internet Availability of Proxy Materials. You may also revoke your proxy by mail by requesting a copy be mailed to you, executing a subsequently dated proxy or voter instructions card, and mailing it in the pre-addressed envelope, which requires no additional postage if mailed in the United States. You may also revoke your proxy by your attendance and voting in person at the Annual Meeting. Mere attendance at the meeting will not revoke a proxy or voter instructions. We will vote the shares in accordance with the directions given in the last proxy or voter instructions submitted in a timely manner before the Annual Meeting. You may revoke your vote over the Internet until 11:59pm (EST) on December 10, 2009. If you revoke your vote by mail, please be aware that we can recognize the revoked vote only if we receive it by close of business of the day before the Annual Meeting.

If the Annual Meeting is postponed or adjourned for any reason, at any subsequent reconvening of the Annual Meeting, all proxies will be voted in the same manner as the proxies would have been voted at the original convening of the Annual Meeting (except for any proxies that have at that time effectively been revoked or withdrawn), even if the proxies had been effectively voted on the same or any other matter at a previous meeting.

You are requested, regardless of the number of shares you own or your intention to attend the Annual Meeting, to vote your shares as described above.

Solicitation of Proxies

The expenses of solicitation of proxies will be paid by the Company. We may solicit proxies by mail, and the officers and employees of the Company may solicit proxies personally or by telephone and will receive no extra compensation from such activities. The Company will reimburse brokerage houses and other nominees for their expenses incurred in sending proxies and proxy materials to the beneficial owners of shares held by them.

Delivery of Proxy Materials to Households

Only one copy of the Company’s 2009 Annual Report, this Proxy Statement, and/or Notice of Internet Availability of Proxy Materials, as applicable, will be delivered to an address where two or more stockholders reside with the same last name or whom otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of the 2009 Annual Report, this Proxy Statement, and/or Notice of Internet Availability of Proxy Materials, as applicable, upon such request. If you share an address with at least one other stockholder, currently receive one copy of our annual report, proxy statement, and/or Notice of Internet Availability of Proxy Materials at your residence, and would like to receive a separate copy of our annual report, proxy statement, and Notice of Internet Availability of Proxy Materials for future stockholder meetings of the Company, please follow the instructions for requesting materials indicated on the Notice of Internet Availability of Proxy Materials sent to your residence and specify this preference in your request.

If you share an address with at least one other stockholder and currently receive multiple copies of annual reports, proxy statements, or Notices of Internet Availability of Proxy Materials, and you would like to receive a single copy of annual reports, proxy statements, or Notices of Internet Availability of Proxy Materials, please follow the instructions for requesting materials indicated on the Notice of Internet Availability of Proxy Materials sent to you and specify this preference in your request.

Interest of Officers and Directors in Matters to Be Acted Upon

None of our officers or directors has any interest in any of the matters to be acted upon at the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of October 16, 2009 with respect to the beneficial ownership of our common stock, the sole outstanding class of our voting securities, by (i) any person or group owning more than 5% of each class of voting securities, (ii) each director, (iii) each executive officer and (iv) all executive officers and directors as a group.

As of October 16, 2009, an aggregate of 22,681,425 shares of our common stock were outstanding.

| Title of Class | | Name and Address of Beneficial Owners (1) (2) | | Amount and Nature of Beneficial Ownership | | Percent of Class (3) | |

| | | | | | | | |

| | | Greater Than 5% Shareholders | | | | | | | |

| Common Stock | | Tao Li | | | 7,897,710 | (4) | | 34.8 | % |

| | | | | | | | | | |

| | | Directors and Executive Officers | | | | | | | |

| Common Stock | | Tao Li President, CEO and Chairman of the Board | | | Same as the above | | | Same as the above | |

| Common Stock | | Ying Yang | | | 19,938 | | | — | (6) |

| | | CFO | | | | | | | |

| Common Stock | | Yu Hao | | | 33,017 | | | — | (6) |

| | | Director | | | | | | | |

| Common Stock | | Barry Raeburn | | | 25,000 | (5) | | — | (6) |

| | | Director | | | | | | | |

| Common Stock | | Yizhao Zhang | | | 5,681 | | | — | (6) |

| | | Director | | | | | | | |

| Common Stock | | Lianfu Liu Director | | | 0 | | | 0 | |

| | | | | | | | | | |

| | | All executive officers and directors as a group | | | 7,968,004 | | | 35.1 | % |

| (1) | Pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), a person has beneficial ownership of any securities as to which such person, directly or indirectly, through any contract, arrangement, undertaking, relationship or otherwise has or shares voting power and/or investment power or as to which such person has the right to acquire such voting and/or investment power within 60 days. |

| (2) | Unless otherwise stated, each beneficial owner has sole power to vote and dispose of the shares and the address of such person is c/o China Green Agriculture, Inc., 3rd Floor, Borough A, Block A. No. 181, South Taibai Road, Xian, Shaanxi Province, People’s Republic of China 710065. |

| (3) | In determining the percent of common stock owned by the beneficial owners, (a) the numerator is the number of shares of common stock beneficially owned by such owner, including shares the beneficial ownership of which may be acquired, within 60 days upon the exercise of the options, if any, held by the owner; and (b) the denominator is the sum of (i) the total 22,681,425 shares of common stock outstanding as of October 16, 2009, and (ii) the number of shares underlying the options, which such owner has the right to acquire upon the exercise of the options within 60 days (for those who have options). |

| (4) | Excludes (i) 597,387 shares held by Mr. Li’s wife and (ii) 897,387 shares held by Mr. Li’s son. Mr. Li disclaims beneficial ownership with respect to the shares held by his wife and son. |

| (5) | Represents shares of common stock issuable upon the exercise of fully vested stock options. |

| (6) | Represents percent that is less than 1%. |

ELECTION OF DIRECTORS

General

Our Articles of Incorporation provides that our Board of Directors shall be comprised of not less than one (1) director nor more than nine (9) directors, and directors are elected annually at the annual shareholders meeting. The Board of Directors is currently comprised of five (5) directors and will be comprised of five (5) directors effective immediately following the election if all the nominees are elected.

The Board of Directors has nominated for election five (5) persons as directors. Each nominee currently serves as a Company director. All of the nominees have consented to serve as directors. If a nominee should not be available for election as contemplated, the proxy holders will vote for a substitute designated by the current Board of Directors. We are not aware of any nominee who will be unable or who will decline to serve as a director.

Directors Nominees

| Directors | | Position/Title | | Age |

| | | | | |

| Tao Li | | Chairman of the Board of Directors | | 43 |

| | | | | |

| Yu Hao | | Director | | 44 |

| | | | | |

| Lianfu Liu | | Director | | 71 |

| | | Chairman of the Nominating Committee | | |

| | | Audit Committee Member | | |

| | | Compensation Committee Member | | |

| | | | | |

| Barry Raeburn | | Director | | 37 |

| | | Chairman of the Compensation Committee | | |

| | | Audit Committee Member | | |

| | | Compensation Committee Member | | |

| | | | | |

| Yizhao Zhang | | Director | | 39 |

| | | Chairman of the Audit Committee | | |

| | | Compensation Committee Member | | |

| | | Nominating Committee Member | | |

For information as to the shares of Common Stock beneficially owned by each nominee, see the section “Securities Ownership of Certain Beneficial Owners and Management”, and as to other Board matters, see the section “Board Information.”

The following are biographical summaries for our nominees for election as directors:

Tao Li, Chairman of the Board of Directors, Chief Executive Officer and President from December 26, 2007. Mr. Li has served as the President and CEO of Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd., the wholly-owned subsidiary of the Company (“TechTeam”), since 2000. Mr. Li established Xi’an TechTeam Industry (Group) Co., Ltd. in 1996 and established TechTeam in 2000. He graduated from Northwest Polytechnic University and obtained his Master’s degree in heat and metal treatment. Mr. Li is the current Vice Chairman of the China Green Food Association. Previously, he has held positions at the World Bank Loan Office of China Education Commission, National Key Laboratory for Low Temperature Technology, and Northwest Polytechnic University. Mr. Li is active in Shaanxi Province business and trade organizations including as a member of the CPPCC Shaanxi Committee, the Shaanxi Provincial Decision-Making Consultation Committee, Vice Chairman of the Shaanxi Provincial Federation of Industry and Commerce, Vice President of the Shaanxi Overseas Friendship Association, Vice Chairman of the Shaanxi Provincial Credit Association, Vice Chairman of the Shaanxi Provincial Youth Entrepreneurs Association, Vice Chairman of the Xi’an Municipal Federation of Industry and Commerce and Vice Chairman of the Xi’an Municipal Youth Entrepreneurs Association.

Yu Hao, Director. Mr. Hao has served as a director of the Company since December 26, 2007, and had served as interim Chief Financial Officer of the Company from December 26, 2007 through April 23, 2008. Mr. Hao has also served as the Director of Finance at TechTeam since 2002. Prior to that, he was a financial manager for Shaanxi Fengxiang Automobile Repair Plant, and Shaanxi Baoji Xinsanwei Import & Export Trading Co., Ltd. Mr. Hao holds a degree in Accounting from Northwest Institute of Light Industry.

Lianfu Liu, Director, Chairman of Nominating Committee, Audit Committee Member and Compensation Committee Member. Mr. Liu has served as a director of the Company since December 26, 2007. Mr. Liu has served as the Chairman of the China Green Food Association since 1998. From 1992 to 1998, Mr. Liu was a Director and Senior Engineer for the China Green Food Development Center. Prior to that, Mr. Liu was a Vice Director of the PRC Ministry of Agriculture. Mr. Li graduated from Beijing Forestry University and studied soil conservation.

Barry L. Raeburn, Director, Chairman of Compensation Committee, Audit Committee Member and Nominating Committee Member. Mr. Raeburn has served as a director of the Company since March 31, 2008. Mr. Raeburn is currently Senior Vice President and Partner at Sandpiper Capital Management, a private equity investment manager. Previously, he was Chief Financial Officer and Chief Operating Officer of LS2, Inc., a government services contractor based in Reston, VA, from November 2007 to May 2009. From September 2005 to October 2007, Mr. Raeburn was Executive Vice President of Finance and Corporate Development for Harbin Electric, a developer and manufacturer of customized linear motors and other special electric motors based in China. During his tenure at Harbin Electric as Head of U.S. Operations, he led the company in their successful upgrade listing to the NASDAQ Stock Exchange, assisted in various M&A evaluations, and provided key leadership in the areas of finance, accounting, investor and public relations, SEC compliance, corporate governance, and administration. Mr. Raeburn has extensive experience in global public equity markets. From to April 2003 to September 2005, Mr. Raeburn worked as a specialty technology analyst an investment bank covering early stage companies within multiple industries. Mr. Raeburn spent the prior 6 years at a multi-billion dollar investment advisory firm as a financial analyst responsible for developing various quantitative ranking models and analyzing equity investments. His previous experience also includes forecasting and analysis of major macro economic activity. Mr. Raeburn graduated in 1996 with a BBA degree in Finance and Risk Management from Temple University. Mr. Raeburn has been a director of Fushi Copperweld, Inc. since June 15, 2007 (NASDAQ: FSIN).

Yizhao Zhang, Director, Chairman of Audit Committee, Compensation Committee Member and Nominating Committee Member. He has been serving as a director of the Company since March 27, 2008. Mr. Zhang has over 13 years of experience in portfolio investment, corporate finance, and accounting. Currently he is the Chief Financial Officer of Universal Travel Group (NYSE: UTA). From August 2008 to January 2009, he was the Chief Financial Officer of Energroup Holdings Corp. From May 2007 through May 2008, he was Chief Financial Officer of Shengtai Pharmaceutical Inc., an OTCBB company. From April 2006 through December 2006, he was the Deputy Chief Financial Officer of China Natural Resources, Inc., a NASDAQ-listed company. From April 2005 through April 2006, he was the vice president and senior manager in Chinawe Asset Management Consultancy Limited, a US public company which mainly manages non-performing loan assets in China. He was a financial consultant with Hendrickson Asset Management Assistance LLP from January 2004 through November 2004. Prior to that, he worked from a foreign exchange and common stock trader to a portfolio manager in the South Financial Service Corporation from 1993 to 1999. Mr. Zhang is a certified public accountant in Delaware, and a member of the American Institute of Certified Public Accountants (AICPA). Mr. Zhang received a bachelors degree in Economics from Fudan University, Shanghai in 1992 and obtained an MBA degree with Financial Analysis and Accounting concentrations from the State University of New York, University at Buffalo in 2003. Currently Mr. Yizhao Zhang is a director of China Education Alliance, Inc., a NYSE Amex listed company. He is also a director of Kaisa Group Holdings Ltd., one of the biggest property developers in China.

Executive Officers of the Company

| Executive Officers | | Position/Title | | Age |

| | | | | |

| Tao Li | | Chief Executive Officer and President | | 43 |

| | | | | |

| Ying Yang | | Chief Financial Officer | | 34 |

The following is a biographical summary of Ying Yang, our Chief Financial Officer. Mr. Yang does not serve on our Board of Directors:

Ying Yang, Chief Financial Officer. Ms. Yang has served as the Chief Financial Officer of the Company since September 2008. Immediately prior to joining the Company, she worked as the Financial Reporting and Analysis Manager of Beckman Coulter, Inc., where she was employed since August 2006. From December 2004 through July 2006, Ms. Yang worked for the financial department of Ready Pac Foods, Inc., a supplier of fresh-cut produce in California. Prior to that, from May 2003 through December 2004, Ms. Yang was a senior business analyst for Neman Brothers Assoc. Inc., which is engaged in the textile and apparel industry, and from July 2002 through April 2003, she was a business consultant for American Elite Professional Management, Inc. Prior to her arrival to the U.S., Ms. Yang worked for China National Chemical Fiber Corp. in Beijing. Ms. Yang received a Master’s degree in Business Administration with a major in Finance from University of California, Irvine in 2002, and received a Bachelor’s degree in Economics from University of International Business & Economics in Beijing, China in June 1997. Ms. Yang has also received an Associate in Risk Management (ARM) designation.

Independence of the Board of Directors

Our Board of Directors is currently composed of five (5) members. Messrs. Yizhao Zhang, Barry Raeburn and Lianfu Liu qualify as independent directors in accordance with the published listing requirements of the NYSE Amex (formerly the American Stock Exchange). The NYSE Amex independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his or her family members has engaged in various types of business dealings with us. In addition, as further required by NYSE Amex rules, our Board of Directors has made an affirmative determination as to each independent director that no relationships exist which, in the opinion of our Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities as they may relate to us and our management. Our directors hold office until their successors have been elected and qualified or their earlier death, resignation or removal.

Certain Relationships and Related Transactions

Our principal executive offices of approximately 800 square meters are leased from Xi’an Techteam Science and Technology Industry (Group) Co., Ltd. (the “Group Company”) which is controlled by Mr. Li, our Chairman, President and CEO, for a five-year term beginning in January 2008, at the annual rent of $19,266, the market rate in that area. Techteam’s factory office buildings of 340 square meters are also leased from the Group Company for a five-year term beginning on July 1, 2007 at an annual rent of $4,091, the market rate in that area.

Procedures for Approval of Related Party Transactions

Our policy is that our Board of Directors is charged with reviewing and approving all potential related party transactions. All such related party transactions are then required to be reported under applicable SEC rules. Otherwise, we have not adopted procedures for review of, or standards for approval of, these transactions, but instead review such transactions on a case-by-case basis.

Vote Required and Board of Directors’ Recommendation

Assuming a quorum is present, the affirmative vote of a plurality of the votes cast at the Meeting, either in person or by proxy, is required for the election of a director. For purposes of the election of directors, abstentions and broker non-votes will have no effect on the result of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE

FOR THESE NOMINEES.

EXECUTIVE COMPENSATION

Summary of Executive Compensation

The following table sets forth information concerning cash and non-cash compensation paid by the Company to its Chief Executive Officer and Chief Financial Officer for each of the two fiscal years ended June 30, 2009 and June 30, 2008.

| SUMMARY COMPENSATION TABLE | |

Name and principal position | | Year Ended | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tao Li | | June 30, 2009 | | $ | 129,000 | (1) | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | $ | 129,000 | |

Chief Executive Officer, President and Chairman of the Board | | June 30, 2008 | | $ | 128,508 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 128,508 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ying Yang | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chief Financial Officer | | June 30, 2009 | | $ | 105,000 | (2) | | | — | | | | — | | | $ | 92,116 | | | | — | | | | — | | | | — | | | $ | 197,116 | |

(1) Mr. Li’s salary compensation is comprised of (i) $120,000 paid by the Company and (ii) $9,000 (RMB60,000) payable by Techteam. As of June 30, 2009, Mr. Li had not received the RMB60,000 payable by Techteam.

(2) Represents Ms. Yang's pro-rated annual salary of $130,000 for the period from September 2008, when she began her employment with the Company, and the end of the fiscal year.

Narrative Disclosure to the Summary Compensation Table

Employment Agreements

Tao Li. Pursuant to an employment agreement between Techteam and Mr. Tao Li dated January 16, 2008, Mr. Li is employed by Techteam as its Chairman of the Board and Chief Executive Officer for a term of five years. The agreement will be automatically renewed on the same term and conditions for additional five-year periods unless either party provides written notice of termination at least 60 days prior to the end of any five-year term. The agreement is terminable immediately, or upon 30-days prior written notice, upon the occurrence of certain events. The agreement provides for an annual salary of RMB60,000 (approximately $8,508).

In addition, Tao Li is entitled to annual salary of $120,000 payable by the Company.

Ying Yang. Pursuant to an employment agreement between the Company and Ms. Ying Yang, Ms. Yang will serve as Chief Financial Officer of the Company for a term of one year and is entitled to annual compensation consisting of base salary of $130,000 per year and options to purchase 28,000 shares of common stock at an exercise price of $4.00 per share. The agreement may be extended for an additional year upon the same terms and conditions. Either party may terminate the agreement upon prior written notice, and the Company may terminate the agreement at any time for cause without prior written notice.

Outstanding Equity Awards at Fiscal Year-End.

The following table provides information on all restricted stock and stock option awards held by our named executive officers as of June 30, 2009.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| | | | | | |

| | | Option Awards | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | Option Exercise Price ($) | | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units of Stock That Have Not Vested ($) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |

Ying Yang Chief Financial Officer | | | 28,000 | | — | | | — | | $ | 4.00 | | | 06/30/2011 | | — | | | — | | — | | | — | |

Discussion of Summary Compensation and Grants of Plan-based Awards Tables

A summary of certain material terms of our compensation plans and arrangements is set forth below.

On August 17, 2009, Ms. Ying Yang elected to exercise her options to purchase 28,000 shares of our common stock via cashless exercise, pursuant to which we issued Ms. Yang 19,938 shares of common stock.

Payments upon Termination or Change-in-Control

Tao Li. Pursuant to the terms of Mr. Li’s employment agreement, except in connection with certain gross misconduct, in order to terminate the agreement the Company must either (i) provide Mr. Li with 30 days prior written notice of termination or (ii) pay Mr. Li one (1) month’s salary upon termination in lieu of providing 30 days prior written notice.

Ying Yang. Pursuant to the terms of Ms. Yang’s employment agreement, except in connection with termination for cause as defined therein, the Company must provide 30 days prior written notice of termination to Ms. Yang.

PRC Law. Under the applicable laws of the PRC, we must pay severance to all employees who are Chinese nationals and who are terminated with or without cause, or whose employment agreement with us expires and with whom we choose not to continue their employment. The severance benefit required to be paid under the laws of the PRC equals the average monthly compensation paid to the terminated employee (including any bonuses or other payments made in the 12 months prior to the employee’s termination) multiplied by the number of years the employee has been employed with us, plus an additional month’s salary if 30 days’ prior notice of such termination has not been given. However, if the average monthly compensation to be received by the terminated employee exceeds three times the average monthly salary of the employee’s local area, as determined and published by the local government, such average monthly compensation shall be capped at three times the average monthly salary of the employee’s local area. Except as described above, none of our executive officers have any other agreement or arrangement under which he or she may be entitled to severance payments upon termination of employment.

2009 Equity Incentive Plan

On October 27, 2009, our Board of Directors adopted the Company’s 2009 Equity Incentive Plan (the “Incentive Plan”), a copy of which is attached to this proxy statement as Annex A. The Incentive Plan gives us the ability to grant stock options, stock appreciation rights (SARs), restricted stock and other stock-based awards (collectively, “Awards”) to employees or consultants of our company or of any subsidiary of our company and to non-employee members of our advisory board or our Board of Directors or the board of directors of any of our subsidiaries. Our Board of Directors believes that adoption of the Incentive Plan is in the best interests of our company and our stockholders because the ability to grant stock options and make other stock-based awards under the Incentive Plan is an important factor in attracting, stimulating and retaining qualified and distinguished personnel with proven ability and vision to serve as employees, officers, consultants or members of the Board of Directors or advisory board of our company and our subsidiaries, and to chart our course towards continued growth and financial success. Therefore, our Board of Directors believes the Incentive Plan will be a key component of our compensation program.

As of October 27, 2009, 2,260,000 shares of our common stock remained available for future grants under the Incentive Plan and no Awards had been granted under the Incentive Plan.

The description of the 2009 Equity Incentive Plan contained in Proposal 2 of this Proxy Statement is incorporated herein by reference.

Change in Control Provisions

In the event of a change in control of the Company, and except as otherwise set forth in the applicable Award agreement, all unvested portions of Awards shall vest immediately. Awards, whether or not then vested, shall be continued, assumed, or have new rights as determined by a committee of the board of directors designated to administer the Incentive Plan (the “Committee”), and restrictions to which any shares of restricted stock or any other Award granted prior to the change in control are subject shall not lapse. Awards shall, where appropriate at the discretion of the Committee, receive the same distribution of the Company’s common stock on such terms as determined by the Committee. Upon a change in control, the Committee may also provide for the purchase of any Awards for an amount of cash per share of common stock issuable under the Award equal to the excess of the highest price per share of the Company’s common stock paid in any transaction related to a change in control of the Company over the exercise price of such Award.

Director Compensation

The following table sets forth information concerning cash and non-cash compensation paid by the Company to its directors during the last fiscal year ended June 30, 2009.

| DIRECTOR COMPENSATION | |

| | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Non-Qualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| Yu Hao | | | 0 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | |

| Lianfu Liu | | | 12,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 12,000 | |

| Barry Raeburn | | | 15,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 15,000 | |

| Yizhao Zhang | | | 15,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 15,000 | |

In addition to $15,000 annual cash compensation as listed in the table above, Barry Raeburn is entitled to $500 for each in-person meeting of our Board of Directors and $250 for each in person meeting of a committee of our Board of Directors. During the fiscal year ended June 30, 2009, all meetings of our Board of Directors or any committee thereof were held via teleconference.

The directors will also be reimbursed for all of their out-of-pocket expenses in traveling to and attending meetings of the Board of Directors and committees on which they serve.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal 2009 were Messrs. Yizhao Zhang, Barry Raeburn and Lianfu Liu. During fiscal 2009:

| | · | none of the members of the Compensation Committee was an officer (or former officer) or employee of our company or any of its subsidiaries; |

| | · | none of the members of the Compensation Committee had a direct or indirect material interest in any transaction in which we were a participant and the amount involved exceeded $120,000; |

| | · | none of our executive officers served on the compensation committee (or another board committee with similar functions or, if none, the entire Board of Directors) of another entity where one of that entity’s executive officers served on our Compensation Committee; |

| | · | none of our executive officers was a director of another entity where one of that entity’s executive officers served on our Compensation Committee; and |

| | · | none of our executive officers served on the compensation committee (or another board committee with similar functions or, if none, the entire Board of Directors) of another entity where one of that entity’s executive officers served as a director on our Board of Directors. |

PROPOSAL 2

2009 EQUITY INCENTIVE PLAN

General

On October 27, 2009, our Board of Directors adopted the Company’s 2009 Equity Incentive Plan (the “Incentive Plan”), a copy of which is attached to this proxy statement as Annex A. The Incentive Plan gives us the ability to grant stock options, stock appreciation rights (SARs), restricted stock and other stock-based awards (collectively, “Awards”) to employees or consultants of our company or of any subsidiary of our company and to non-employee members of our advisory board or our Board of Directors or the board of directors of any of our subsidiaries. Our Board of Directors believes that adoption of the Incentive Plan is in the best interests of our company and our stockholders because the ability to grant stock options and make other stock-based awards under the Incentive Plan is an important factor in attracting, stimulating and retaining qualified and distinguished personnel with proven ability and vision to serve as employees, officers, consultants or members of the Board of Directors or advisory board of our company and our subsidiaries, and to chart our course towards continued growth and financial success. Therefore, our Board of Directors believes the Incentive Plan will be a key component of our compensation program.

As of October 27, 2009, 2,260,000 shares of our common stock remained available for future grants under the Incentive Plan and no Awards had been granted under the Incentive Plan.

Summary of the Provisions of the Incentive Plan

The following summary briefly describes the material features of the Incentive Plan and is qualified, in its entirety, by the specific language of the Incentive Plan, a copy of which is attached to this proxy statement as Annex A.

Shares Available

Our Board of Directors has authorized, subject to stockholder approval, 2,260,000 shares of our common stock for issuance under the Incentive Plan. In the event of any stock dividend, stock split, reverse stock split, share combination, recapitalization, merger, consolidation, spin-off, split-up, reorganization, rights offering, liquidation, or any similar change event of or by our company, appropriate adjustments will be made to the shares subject to the Incentive Plan and to any outstanding Awards. Shares available for Awards under the Incentive Plan may be either newly-issued shares or treasury shares.

In certain circumstances, shares subject to an outstanding Award may again become available for issuance pursuant to other Awards available under the Incentive Plan. For example, shares subject to forfeited, terminated, canceled or expired Awards will again become available for future grants under the Incentive Plan. In addition, shares subject to an Award that are withheld by us to satisfy tax withholding obligations shall also be made available for future grants under the Incentive Plan.

Administration

The Incentive Plan will be administered by a committee of our Board of Directors appointed by our Board of Directors to administer the Incentive Plan or if such a committee is not appointed or unable to act, then our entire Board of Directors (the “Committee”). The Committee will consist of at least two members who are non-employee directors within the meaning of Rule 16b-3 under the Exchange Act. With respect to the participation of individuals who are subject to Section 16 of the Exchange Act, the Incentive Plan is administered in compliance with the requirements of Rule 16b-3 under the Exchange Act. In the event that the Compensation Committee of the Board (“Compensation Committee”) meets the requirements stated above, such Compensation Committee shall be the Committee hereunder unless otherwise determined by the Board. Subject to the provisions of the Incentive Plan, the Committee determines the persons to whom grants of options, SARs and shares of restricted stock are to be made, the number of shares of common stock to be covered by each grant and all other terms and conditions of the grant. If an option is granted, the Committee determines whether the option is an incentive stock option or a nonstatutory stock option, the option's term, vesting and exercisability, the amount and type of consideration to be paid to our company upon the option's exercise and the other terms and conditions of the grant. The terms and conditions of restricted stock and SAR Awards are also determined by the Committee. The Committee has the responsibility to interpret the Incentive Plan and to make determinations with respect to all Awards granted under the Incentive Plan. All determinations of the Committee are final and binding on all persons having an interest in the Incentive Plan or in any Award made under the Incentive Plan. The costs and expenses of administering the Incentive Plan are borne by our company.

Eligibility

Eligible individuals include our and our subsidiaries' employees (including our and our subsidiaries' officers and directors who are also employees) or consultants whose efforts, in the judgment of the Committee, are deemed worthy of encouragement to promote our growth and success. Non-employee directors of our Board of Directors are also eligible to participate in the Incentive Plan. All eligible individuals may receive one or more Awards under the Plan, upon the terms and conditions set forth in the Incentive Plan. There is no assurance that an otherwise eligible individual will be selected by the Committee to receive an Award under the Incentive Plan. Because future Awards under the Incentive Plan will be granted in the discretion of the Committee, the type, number, recipients and other terms of such Awards cannot be determined at this time.

Stock Options and SARs

Under the Incentive Plan, the Committee is authorized to grant both stock options and SARs. Stock options may be either designated as non-qualified stock options or incentive stock options. Incentive stock options, which are intended to meet the requirements of Section 422 of the Internal Revenue Code such that a participant can receive potentially favorable tax treatment, may only be granted to employees. Therefore, any stock option granted to consultants and non-employee directors are non-qualified stock options. The tax treatment of incentive and non-qualified stock options is generally described later in this summary. SARs may be granted either alone or in tandem with stock options. A SAR entitles the participant to receive the excess, if any, of the fair market value of a share on the exercise date over the strike price of the SAR. This amount is payable in cash, except that the Committee may provide in an Award agreement that benefits may be paid in shares of our common stock. In general, if a SAR is granted in tandem with an option, the exercise of the option will cancel the SAR, and the exercise of the SAR will cancel the option. Any shares that are canceled will be made available for future Awards. The Committee, in its sole discretion, determines the terms and conditions of each stock option and SAR granted under the Incentive Plan, including the grant date, option or strike price (which, in no event, will be less than the par value of a share), whether a SAR is paid in cash or shares, the term of each option or SAR, exercise conditions and restrictions, conditions of forfeitures, and any other terms, conditions and restrictions consistent with the terms of the Incentive Plan, all of which will be evidenced in an individual Award agreement between us and the participant.

Certain limitations apply to incentive stock options and SARs granted in tandem with incentive stock options. The per share exercise price of an incentive stock option may not be less than 100% of the fair market value of a share of our common stock on the date of the option's grant and the term of any such option shall expire not later than the tenth anniversary of the date of the option's grant. In addition, the per share exercise price of any option granted to a person who, at the time of the grant, owns stock possessing more than 10% of the total combined voting power or value of all classes of our stock must be at least 110% of the fair market value of a share of our common stock on the date of grant and such option shall expire not later than the fifth anniversary of the date of the option's grant.

Options and SARs granted under the Incentive Plan become exercisable at such times as may be specified by the Committee. In general, options and SARs granted to participants become exercisable in three equal annual installments, subject to the optionee's continued employment or service with us. However, the aggregate value (determined as of the grant date) of the shares subject to incentive stock options that may become exercisable by a participant in any year may not exceed $100,000. If a SAR is granted in tandem with an option, the SAR will become exercisable at the same time or times as the option becomes exercisable.

Except as otherwise set forth in the Award agreement, options shall expire after a term of five years. However, the maximum term of options and SARs granted under the Incentive Plan is ten years. If any participant terminates employment due to death or disability or retirement, the portion of his or her option or SAR Awards that were exercisable at the time of such termination may be exercised for one year from the date of termination. In the case of any other termination, the portion of his or her option or SAR Awards that were exercisable at the time of such termination may be exercised for three months from the date of termination. However, if the remainder of the option or SAR term is shorter than the applicable post-termination exercise period, the participant's rights to exercise the option or SAR will expire at the end of the term. In addition, if a participant's service terminates due to cause, all rights under an option or SAR will immediately expire, including rights to the exercisable portion of the option or SAR. Shares attributable to an option or SAR that expire without being exercised will be forfeited by the participant and will again be available for Award under the Incentive Plan.

Unless limited by the Committee in an Award agreement, payment for shares purchased pursuant to an option exercise may be made (i) in cash, check or wire transfer, (ii) subject to the Committee's approval, in shares already owned by the participant (including restricted shares held by the participant at least six months prior to the exercise of the option) valued at their fair market value on the date of exercise, or (iii) through broker-assisted cashless exercise procedures.

Restricted Stock

Under the Incentive Plan, the Committee is also authorized to make Awards of restricted stock. A restricted stock Award entitles the participant to all of the rights of a stockholder of our company, including the right to vote the shares and the right to receive any dividends. However, the Committee may require the payment of cash dividends to be deferred and if the Committee so determines, re-invested in additional shares of restricted stock. Before the end of a restricted period and/or lapse of other restrictions established by the Committee, shares received as restricted stock shall contain a legend restricting their transfer, and may be forfeited (i) in the event of termination of employment, (ii) if our company or the participant does not achieve specified performance goals after the grant date and before the participant's termination of employment or (iii) upon the failure to achieve other conditions set forth in the Award agreement.

An Award of restricted stock will be evidenced by a written agreement between us and the participant. The Award agreement will specify the number of shares of our common stock subject to the Award, the nature and/or length of the restrictions, the conditions that will result in the automatic and complete forfeiture of the shares and the time and manner in which the restrictions will lapse, subject to the Award holder's continued employment by us, and any other terms and conditions the Committee shall impose consistent with the provisions of the Incentive Plan. The Committee also determines the amount, if any, that the participant shall pay for the shares of restricted stock. However, the participant must be required to pay at least the par value for each share of restricted stock. Upon the lapse of the restrictions, any legends on the shares of our common stock subject to the Award will be re-issued to the participant without such legend.

Unless the Committee determines otherwise in the Award or other agreement, if a participant terminates employment for any reason, all rights to restricted stock that are then forfeitable will be forfeited. Restricted stock that is forfeited by the participant will again be available for Award under the Incentive Plan.

Other Stock-Based Awards

Under the Incentive Plane, the Committee is also authorized to grant other stock-based awards valued in whole or in part by reference to or otherwise based on stock (“Other Stock-Based Awards”), which include performance shares, convertible preferred stock (to the extent a series of preferred stock is authorized), convertible debentures, warrants, exchangeable securities and awards based of stock or options based on fair market value, book value, or performance by the Company or any subsidiary, affiliate or division. Other Stock-Based Awards may be granted in tandem with other Awards under the Incentive Plan.

Other Stock-Based Awards may not be sold, assigned, transferred, pledged or otherwise encumbered prior to the date to which the stock is issued or, if later, the date on which any applicable restriction, performance or deferral period lapses. The recipient of an Other Stock-Based Award, subject to the terms of the grant agreement, is entitled to interest or dividends with respect to the number of shares covered by their Other Stock-Based Award.

Change in Control Provisions

In the event of a change in control of the Company, and except as otherwise set forth in the applicable grant agreement, all unvested portions of Awards shall vest immediately. Awards, whether or not then vested, shall be continued, assumed, or have new rights as determined by the Committee in its sole discretion, and restrictions to which any shares of Restricted Stock or any other Award granted prior to the change in control are subject shall not lapse. Awards shall, where appropriate at the Committee’s discretion, receive the same distribution of the Company’s common stock on such terms as determined by the Committee. Upon a change in control, the Committee may also provide for the purchase of any Awards for an amount of cash per share of common stock issuable under the Award equal to the excess of the highest price per share of the Company’s common stock paid in any transaction related to a change in control of the Company over the exercise price of such Award.

Fair Market Value

Under the Incentive Plan, fair market value means the fair market value of the shares based upon (i) the closing selling price of a share of our common stock as quoted on the principal national securities exchange on which the stock is traded, if the stock is then traded on a national securities exchange, or (ii) the closing bid price per share last quoted on that date by an established quotation service for over-the-counter securities, if the common stock is not then traded on a national securities exchange.

Transferability Restrictions

Generally and unless otherwise provided in an Award agreement, shares or rights subject to an Award cannot be assigned or transferred other than by will or by the laws of descent and distribution and Awards may be exercised during the participant's lifetime only by the participant or his or her guardian or legal representative. However, a participant may, if permitted by the Committee, in its sole discretion, transfer an Award, or any portion thereof, to one or more of the participant's spouse, children or grandchildren, or may designate in writing a beneficiary to exercise an Award after his or her death.

Termination or Amendment of the Incentive Plan

Unless sooner terminated, no Awards may be granted under the Incentive Plan after October 27, 2019. Our Board of Directors may amend or terminate the Incentive Plan at any time, but our Board of Directors may not, without stockholder approval, amend the Incentive Plan to increase the total number of shares of our common stock reserved for issuance of Awards. In addition, any amendment or modification of the Incentive Plan shall be subject to stockholder approval as required by any securities exchange on which our common stock is listed. No amendment or termination may deprive any participant of any rights under Awards previously made under the Incentive Plan.

Summary of Federal Income Tax Consequences of the Incentive Plan

The following summary is intended only as a general guide as to the federal income tax consequences under current United States law with respect to participation in the Incentive Plan and does not attempt to describe all possible federal or other tax consequences of such participation. Furthermore, the tax consequences of awards made under the Incentive Plan are complex and subject to change, and a taxpayer's particular situation may be such that some variation of the described rules is applicable.

Options and SARS. There are three points in time when a participant and our company could potentially incur federal income tax consequences: date of grant, upon exercise and upon disposition. First, when an option or a SAR is granted to a participant, the participant does not recognize any income for federal income tax purposes on the date of grant. We similarly do not have any federal income tax consequences at the date of grant. Second, depending upon the type of option, the exercise of an option may or may not result in the recognition of income for federal income tax purposes. With respect to an incentive stock option, a participant will not recognize any ordinary income upon the option's exercise (except that the alternative minimum tax may apply). However, a participant will generally recognize ordinary income upon the exercise of a non-qualified stock option. In this case, the participant will recognize income equal to the difference between the option price and the fair market value of shares purchased pursuant to the option on the date of exercise. With respect to the exercise of a SAR, the participant must generally recognize ordinary income equal to the cash received (or, if applicable, value of the shares received).

Incentive stock options are subject to certain holding requirements before a participant can dispose of the shares purchased pursuant to the exercise of the option and receive capital gains treatment on any income realized from the exercise of the option. Satisfaction of the holding periods determines the tax treatment of any income realized upon exercise. If a participant disposes of shares acquired upon exercise of an incentive stock option before the end of the applicable holding periods (called a "disqualifying disposition"), the participant must generally recognize ordinary income equal to the lesser of (i) the fair market value of the shares at the date of exercise of the incentive stock option minus the exercise price or (ii) the amount realized upon the disposition of the shares minus the exercise price. Any excess of the fair market value on the date of such disposition over the fair market value on the date of exercise must be recognized as capital gains by the participant. If a participant disposes of shares acquired upon the exercise of an incentive stock option after the applicable holding periods have expired, such disposition generally will result in long-term capital gain or loss measured by the difference between the sale price and the participant's tax "basis" in such shares (generally, in such case, the tax "basis" is the exercise price).

Generally, we will be entitled to a tax deduction in an amount equal to the amount recognized as ordinary income by the participant in connection with the exercise of options and SARs. However, we are generally not entitled to a tax deduction relating to amounts that represent capital gains to a participant. Accordingly, if the participant satisfies the requisite holding period with respect to an incentive stock option before disposition to receive the favorable tax treatment accorded incentive stock options, we will not be entitled to any tax deduction with respect to an incentive stock option. In the event the participant has a disqualifying disposition with respect to an incentive stock option, we will be entitled to a tax deduction in an amount equal to the amount that the participant recognized as ordinary income.

Restricted Stock Awards. A participant will not be required to recognize any income for federal income tax purposes upon the grant of shares of restricted stock. With respect to Awards involving shares or other property, such as restricted stock Awards, that contain restrictions as to their transferability and are subject to a substantial risk of forfeiture, the participant must generally recognize ordinary income equal to the fair market value of the shares or other property received at the time the shares or other property become transferable or are no longer subject to a substantial risk of forfeiture, whichever occurs first. We generally will be entitled to a deduction in an amount equal to the ordinary income recognized by the participant. A participant may elect to be taxed at the time he or she receives shares (e.g., restricted stock) or other property rather than upon the lapse of transferability restrictions or the substantial risk of forfeiture. However, if the participant subsequently forfeits such shares he or she would not be entitled to any tax deduction or, to recognize a loss, for the value of the shares or property on which he or she previously paid tax. Alternatively, if an Award that results in a transfer to the participant of cash, shares or other property does not contain any restrictions as to their transferability and is not subject to a substantial risk of forfeiture, the participant must generally recognize ordinary income equal to the cash or the fair market value of shares or other property actually received. We generally will be entitled to a deduction for the same amount.

Vote Required and Board of Directors’ Recommendation

Assuming a quorum is present, the affirmative vote of a majority of the shares present at the Meeting and entitled to vote, either in person or by proxy, is required for approval of Proposal No. 2. For purposes of the approval of our 2009 Equity Incentive Plan, abstentions will have the same effect as a vote against this proposal and broker non-votes will have no effect on the result of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE

FOR PROPOSAL NO. 2

BOARD INFORMATION

Board Meetings

The Board of Directors held four meetings, either in person or by telephone, in the fiscal year ended June 30, 2009. In addition, the Board of Directors unanimously approved nine written consents on matters between meetings. During 2008, each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors and applicable committee meetings (held during the period for which he or she was a director) on which he or she served. We do not have a formal policy regarding attendance by members of the Board of Directors at the annual meeting of stockholders, but we strongly encourage all members of the Board of Directors to attend the Meeting and expect such attendance except in the event of extraordinary circumstances.

Board Committees

Our Board of Directors has established the following three standing committees which, pursuant to delegated authority, perform various duties on behalf of and report to the Board of Directors: (i) Audit Committee, (ii) Compensation Committee and (iii) Nominating Committee. From time to time, the Board of Directors may establish other committees.

Audit Committee

The Audit Committee is responsible for: (i) overseeing the corporate accounting and financial reporting practices; (ii) recommending the selection of our registered public accounting firm; (iii) reviewing the extent of non-audit services to be performed by the auditors; and (iv) reviewing the disclosures made in our periodic financial reports. The members of the Audit Committee are Messrs. Yizhao Zhang, Barry Raeburn and Lianfu Liu, each of whom is an independent director within the meaning of the rules of the NYSE Amex and Rule 10A-3 promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, the Board of Directors has determined that each of Messrs. Zhang and Raeburn qualifies as an Audit Committee Financial Expert under applicable SEC Rules. The Chairman of the Audit Committee is Mr. Zhang. The Audit Committee held four meetings during the fiscal year ended June 30, 2009. The Audit Committee carries out its responsibilities in accordance with the terms of its Audit Committee Charter, a copy of which attached hereto as Annex B.

Compensation Committee

The Compensation Committee determines matters pertaining to the compensation of executive officers and other significant employees, and administers our stock and incentive plans. The members of the Compensation Committee are Messrs. Yizhao Zhang, Barry Raeburn and Lianfu Liu. The Chairman of the Compensation Committee is Mr. Raeburn. The Compensation Committee held one meeting during the fiscal year ended June 30, 2009. Each of the members of the Compensation Committee is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act, and an “outside director” within the meaning of Section 162(m) under the Internal Revenue Code. The Compensation Committee carries out its responsibilities pursuant to a written charter, a copy of which is attached hereto as Annex C.

Nominating Committee

The Nominating Committee identifies and nominates candidates to serve on our Board of Directors. The members of the Nominating Committee are Messrs. Yizhao Zhang, Barry Raeburn and Lianfu Liu. The Chairman of the Nominating Committee is Mr. Liu. The Nominating Committee did not hold a meeting during the fiscal year ended June 30, 2009. A copy of this Committee’s Charter is attached hereto as Annex D. See “Director Nominations” below for the procedures for the nomination of directors.

Director Nominations

The Nominating Committee recommends director candidates and will consider for such recommendation director candidates proposed by management, other directors and stockholders. All director candidates will be evaluated based on the criteria identified below, regardless of the identity of the individual or the entity or person who proposed the director candidate.

The selection of director nominees includes consideration of factors deemed appropriate by the Corporate Governance and Nominating Committee and the Board of Directors. We may engage a firm to assist in identifying, evaluating, and conducting due diligence on potential board nominees. Factors will include integrity, achievements, judgment, intelligence, personal character, any prior contact or relationship between a candidate and a current or former director or officer of our company, the interplay of the candidate’s relevant experience with the experience of other Board members, the willingness of the candidate to devote adequate time to Board duties and the likelihood that he or she will be willing and able to serve on the Board of Directors for a sustained period. The Corporate Governance and Nominating Committee will consider the candidate’s independence, as defined by the rules of the SEC and the NYSE Amex. In connection with the selection, due consideration will be given to the Board’s overall balance of diversity of perspectives, backgrounds, and experiences. Experience, knowledge, and skills to be represented on the Board of Directors include, among other considerations, financial expertise (including an “audit committee financial expert” within the meaning of the SEC’s rules), financing experience, related industry experience, strategic planning, business development, and community leadership.

Code of Ethics

We have adopted a Code of Conduct and Ethics that applies to all of our employees and officers, and the members of our Board of Directors. The Code of Conduct and Ethics was filed as an exhibit incorporated by refence into our Annual Report on Form 10-K for the year ending June 30, 2009. Printed copies are available upon request without charge. Any amendment to or waiver of the Code of Conduct and Ethics will be disclosed on our website promptly following the date of such amendment or waiver.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities (“Reporting Persons”), to file reports of ownership and changes in ownership with the SEC and with the NYSE Amex. The Reporting Persons are also required to furnish us with copies of all such reports. Based solely on our review of the reports received by us, and a review of the reports filed with the SEC, we believe that, during the year ended June 30, 2009, the Reporting Persons met all applicable Section 16(a) filing requirements, other than the following:

| Name | | Reporting Event |

| | | |

| Yu Hao | | On August 17, 2009, Yu Hao received 7,661 shares of common stock upon the cashless exercise of vested options to purchase 10,000 shares of common stock. A Form 4 reporting such transaction has not been filed. |

Stockholder Communications with the Board

Stockholders wishing to communicate with the Board of Directors may send correspondence directed to the Board, care of Mr. Tao Li, Chairman, China Green Agriculture, Inc., 3rd Floor, Borough A, Block A. No. 181, South Taibai Road, Xian, Shaanxi Province, People’s Republic of China 710065. Mr. Li will review all correspondence addressed to the Board of Directors, or any individual Board member, for any inappropriate correspondence and correspondence more suitably directed to management. He will summarize all correspondence not forwarded to the Board and make the correspondence available to the Board of Directors for its review at the Board’s request. Mr. Li will forward stockholder communications to the Board of Directors prior to the next regularly scheduled meeting of the Board following the receipt of the communication as appropriate. Correspondence intended for our independent directors as a group should be addressed to us at the address above, Attention: Independent Directors.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board is comprised of three non-employee directors, each of whom has been determined by the Board to be “independent” under the meaning of Rule 10A-3(b)(1) under the Exchange Act. Messrs. Yizhao Zhang and Barry Raeburn qualify as financial experts within the meaning of Item 401(h) of SEC Regulation S-K. The Audit Committee assists the Board’s oversight of the integrity of our financial reports, compliance with legal and regulatory requirements, the qualifications and independence of our independent registered public accounting firm, the audit process, and internal controls. The Audit Committee operates pursuant to a written charter adopted by the Board. The current Audit Committee charter is attached as Annex B to this proxy statement. The Audit Committee is responsible for overseeing our corporate accounting and financial reporting practices, recommending the selection of our registered public accounting firm, reviewing the extent of non-audit services to be performed by the auditors, and reviewing the disclosures made in our periodic financial reports. The Audit Committee also reviews and recommends to the Board that the audited financial statements be included in our Annual Report on Form 10-K.