NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

China Green Agriculture, Inc. (the “Company”, “we”, “us”), through its subsidiaries, is engaged in the research, development, production, distribution and sale of humic acid-based compound fertilizer, and the development, production and distribution of agricultural products. The Company was incorporated in 1987, but entered its current lines of business in December 2007.

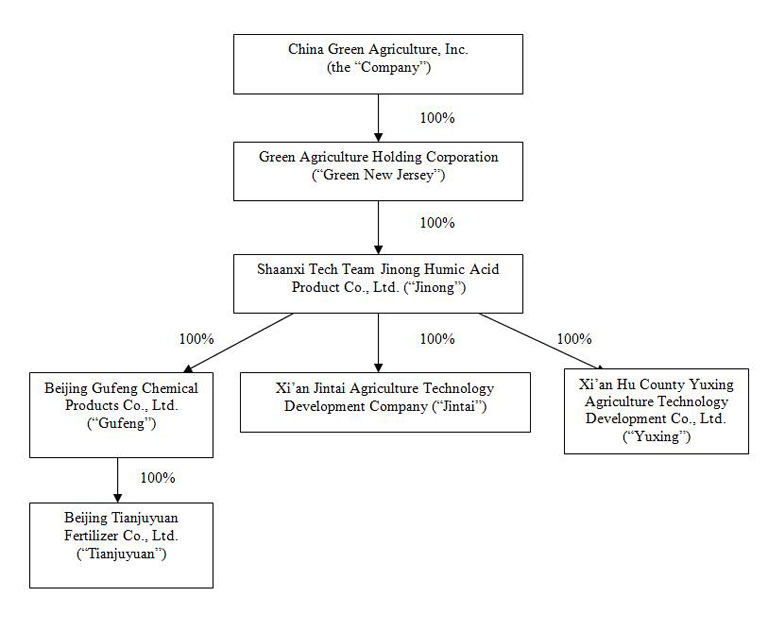

The Company’s corporate structure as of September 30, 2010 is set forth in the diagram below:

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The consolidated condensed interim financial statements included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading.

These statements reflect all adjustments, consisting of normal recurring adjustments, which, in the opinion of management, are necessary for fair presentation of the information contained therein. It is suggested that these consolidated condensed financial statements be read in conjunction with the financial statements and notes thereto included in the Company’s annual report on Form 10-K for the year ended June 30, 2010. The Company follows the same accounting policies in preparation of interim reports. Results of operations for the interim periods are not indicative of annual results.

Principle of consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Green New Jersey, Jinong, Jintai, Yuxing, Gufeng and Tianjuyuan. All significant inter-company accounts and transactions have been eliminated in consolidation.

Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results.

Subsequent Events

The Company evaluates events subsequent to the end of the fiscal quarter through the date the financial statements are filed with the Securities and Exchange Commission for recognition or disclosure in the consolidated financial statements. Events that provide additional evidence about material conditions that existed at the date of the balance sheet are evaluated for recognition in the consolidated financial statements. Events that provide evidence about conditions that did not exist at the date of the balance sheet but occurred after the balance sheet date are evaluated for disclosure in the notes to the consolidated financial statements.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Cash and cash equivalents and concentration of cash

For statement of cash flows purposes, the Company considers all cash on hand and in banks, certificates of deposit with state owned banks in the PRC and banks in the United States, and other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents. The Company maintains balances at financial institutions which, from time to time, may exceed deposit insurance limits for the banks located in the United States. Balances at financial institutions or state owned banks within the PRC are not covered by insurance. Cash overdraft as of balance sheet date will be reflected as liabilities in the balance sheet. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Accounts receivable

The Company's policy is to maintain reserves for potential credit losses on accounts receivable. Management regularly reviews the composition of accounts receivable and analyzes customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves at each year-end. Accounts considered uncollectible are written off through a charge to the valuation allowance. As of September 30, 2010 and June 30, 2010, the Company had accounts receivable of $16,482,643 and $15,571,888, net of allowance for doubtful accounts of $234,804 and $193,403, respectively.

Inventories

Inventory is valued at the lower of cost (determined on a weighted average basis) or market. Inventories consist of raw materials, work in process, finished goods and packaging materials. The Company reviews its inventories regularly for possible obsolete goods and establishes reserves when determined necessary.

Property, plant and equipment

Property, plant and equipment are recorded at cost. Gains or losses on disposals are reflected as gain or loss in the year of disposal. The cost of improvements that extend the life of plant, property, and equipment are capitalized. These capitalized costs may include structural improvements, equipment, and fixtures. All ordinary repair and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

| | Estimated Useful Life |

| Building | 10-25 years |

| Agricultural assets | 8 years |

| Machinery and equipment | 5-15 years |

| Vehicles | 3-5 years |

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Construction in Progress

Construction in progress represents the costs incurred in connection with the construction of buildings or new additions to the Company’s plant facilities. Costs classified to construction in progress include all costs of obtaining the asset and bringing it to the location and condition necessary for its intended use. No depreciation is provided for construction in progress until such time as the assets are completed and are placed into service. Interest incurred during construction is capitalized into construction in progress. All other interest is expensed as incurred.

Long-Lived Assets

The Company tests long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value.

Intangible Assets

The Company records intangible assets acquired individually or as part of a group at fair value. Intangible assets with definitive lives are amortized over the useful life of the intangible asset, which is the period over which the asset is expected to contribute directly or indirectly to the entity’s future cash flows. The Company evaluates intangible assets for impairment at least annually and more often whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value.

The Company has not recorded impairment of intangible assets as of September 30, 2010 and June 30, 2010, respectively.

Fair Value Measurement and Disclosures

Our accounting for Fair Value Measurement and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. This topic also establishes a fair value hierarchy which requires classification based on observable and unobservable inputs when measuring fair value. The fair value hierarchy distinguishes between assumptions based on market data (observable inputs) and an entity’s own assumptions (unobservable inputs). The hierarchy consists of three levels:

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Level one — Quoted market prices in active markets for identical assets or liabilities;

Level two — Inputs other than level one inputs that are either directly or indirectly observable; and

Level three — Unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use.

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each quarter.

The carrying values of cash and cash equivalents, trade and other receivables, trade and other payables approximate their fair values due to the short maturities of these instruments.

Revenue recognition

Sales revenue is recognized on the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectability is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue. As of September 30, 2010 and June 30, 2010, the Company had unearned revenues of $22,851,799 and $ 41,645, respectively.

The Company's revenue consists of invoiced value of goods, net of a value-added tax (VAT). No product return or sales discount allowance is made as products delivered and accepted by customers are normally not returnable and sales discounts are normally not granted after products are delivered.

Stock-Based Compensation

The costs of all employee stock options, as well as other equity-based compensation arrangements, are reflected in the consolidated financial statements based on the estimated fair value of the awards on the grant date. That cost is recognized over the period during which an employee is required to provide service in exchange for the award—the requisite service period (usually the vesting period). Stock compensation for stock granted to non-employees is determined as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

Income taxes

The Company accounts for income taxes using an asset and liability approach which allows for the recognition and measurement of deferred tax assets based upon the likelihood of realization of tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future deductibility is uncertain.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Foreign currency translation

The reporting currency of the Company is the US dollar. The functional currency of the Company and Green New Jersey is the US dollar. The functional currency of Jinong and its subsidiaries Jintai and Yuxing is the Chinese Yuan or Renminbi (“RMB”). For the subsidiaries whose functional currencies are other than the US dollar, all asset and liability accounts were translated at the exchange rate on the balance sheet date; stockholder's equity is translated at the historical rates and items in the cash flow statements are translated at the average rate in each applicable period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. The resulting translation gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Fair values of financial instruments

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities measured at fair value are categorized based on whether or not the inputs are observable in the market and the degree that the inputs are observable. The categorization of financial assets and liabilities within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The Company's financial instruments primarily consist of cash and cash equivalents, accounts receivable, other receivables, advances to suppliers, accounts payable, other payables, tax payable, and related party advances and borrowings.

As of the balance sheet dates, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheet. This is attributed to the short maturities of the instruments and that interest rates on the borrowings approximate those that would have been available for loans of similar remaining maturity and risk profile at respective balance sheet dates.

Statement of cash flows

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The Company's cash flows from operations are calculated based on the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

Earnings per share

Basic earnings per share is computed based on the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed based on the weighted average number of shares of common stock plus the effect of dilutive potential common shares outstanding during the period using the treasury stock method. Dilutive potential common shares include outstanding stock options and stock awards.

The components of basic and diluted earnings per share as of September 30, 2010 and 2009 were as follows:

| | | 2010 | | | 2009 | |

| Net Income for Basic Earnings Per Share | | $ | 7,787,785 | | | $ | 5,247,274 | |

| Basic Weighted Average Number of Shares | | | 25,922,880 | | | | 21,632,488 | |

| Net Income per Share – Basic | | | 0.30 | | | | 0.24 | |

| Net Income for Diluted Earnings Per Share | | | 7,787,785 | | | | 5,247,274 | |

| Diluted Weighted Average Number of Shares | | | 26,035,426 | | | | 21,650,546 | |

| Net Income per Share – Diluted | | $ | 0.30 | | | $ | 0.24 | |

Recent accounting pronouncements

In January 2010, the FASB issued Accounting Standards Update No. 2010-06 (ASU 2010-06), Fair Value Measurements and Disclosures which amends ASC Topic 820, adding new requirements for disclosures for Levels 1 and 2, separate disclosures of purchases, sales, issuances, and settlements relating to Level 3 measurements and clarification of existing fair value disclosures. ASU 2010-06 is effective for interim and annual periods beginning after December 15, 2009, except for the requirement to provide Level 3 activity of purchases, sales, issuances, and settlements on a gross basis, which will be effective for fiscal year beginning after December 15, 2010 (the Company’s fiscal year 2011); early adoption is permitted. The Company is currently evaluating the impact of adopting ASU -2010-06 on its financial statements.

In July 2010, the FASB issued Accounting Standards Update (ASU) No. 2010-20, “Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses.” ASU No. 2010-20 amends the guidance with ASC Topic 310, “Receivables” to facilitate financial statement users’ evaluation of (1) the nature of credit risk inherent in the entity’s portfolio of financing receivables; (2) how that risk is analyzed and assessed in arriving at the allowance for credit losses; and (3) the changes and reasons for those changes in the allowance for credit losses. The amendments in ASU No. 2010-20 also require an entity to provide additional disclosures such as a rollforward schedule of the allowance for credit losses on a portfolio segment basis, credit quality indicators of financing receivables and the aging of past due financing receivables. The Company is required to adopt ASU No. 2010-20 as of December 15, 2010 and is currently evaluating the impact the new disclosure requirements will have on its financials statements and notes.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 3 – ACQUISITION

Beijing Gufeng Chemical Products Co., Ltd. (“Gufeng”) and its wholly-owned subsidiary Beijing Tianjuyuan Fertilizer Co., Ltd. (“Tianjuyuan”):

Gufeng was founded in 1993. Its wholly-owned subsidiary Tianjuyuan was founded in 2001 and was acquired by Gufeng on May 4, 2010. Both companies are based in Beijing, and registered to produce compound fertilizer, blended fertilizer, organic compound fertilizer and mixed, organic-inorganic compound fertilizer and sell their products throughout China and abroad.

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan by purchasing all of Gufeng’s outstanding equity interests and delivering acquisition consideration of approximately $8.8 million cash and approximately 1.4 million shares of the Company’s common stock (valued at approximately $11.6 million) to the former shareholders of Gufeng or their designees (the “Gufeng Shareholders”). Additionally, the Company may be required to deliver up to an additional 0.9 million shares of common stock, which are being held in escrow (the “Escrowed Shares”), to be released based upon achievement of following conditions:

1) If Gufeng achieves certain sales revenue targets for its fiscal year ending June 30, 2011 (the “Sales Target”), 341,390 of the Escrowed Shares will be released from escrow to the Gufeng Shareholders, which is subject to adjustment based on a three-tier system. If Gufeng achieves at least 80% of the Sales Target, then 227,593 of the Escrowed Shares will be released from escrow to the Gufeng Shareholder, and if Gufeng achieves at least 60% of the Sales Target, then 113,797 of the Escrowed Shares will be released from escrow to the Gufeng Shareholders.

2) If Gufeng achieves certain net profit after tax targets for its fiscal year ending June 30, 2011 (the “Profit Target”), 341,390 of the Escrowed Shares will be released from escrow to the Gufeng Shareholders, which is subject to adjustment based on a three-tier system. If Gufeng achieves at least 80% of the Profit Target, then 227,593 of the Escrowed Shares will be released from escrow to the Gufeng Shareholders, and if Gufeng achieves at least 60% of the Profit Target, then 113,797 of the Escrowed Shares will be released from escrow to the Gufeng Shareholders.

3) If Gufeng obtains a land use right with respect to certain real property located in China, along with ownership of the buildings thereon, then 227,593 of the Escrowed Shares will be released from escrow to the Gufeng Shareholders.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Any Escrowed Shares that are not released from escrow to the Gufeng Shareholders for failure to achieve the conditions described above will be forfeited and returned to the Company for cancellation. While the Escrowed Shares are held in escrow, the Gufeng Shareholders will retain all voting rights with respect to the Shares.

The Company has recognized a liability based on the acquisition date fair value of the acquisition-related contingent consideration based on the probability of the achievement of the targets. Based on the Company’s estimation, an initial liability of $2.9 million (341,390 shares) was recorded. Changes in the fair value of the acquisition-related contingent consideration subsequent to the acquisition date, including changes from events after the acquisition date, such as changes in the Company’s estimate of the revenue and net income expected to be achieved and changes in their stock price, are being recognized in earnings in the period in which the estimated fair value changes. The accompanying consolidated financial statements include the financial results of these companies from the date of acquisition.

The estimated fair values of net assets acquired and presented below are preliminary and are based on the information that was available as of the acquisition date and prior to the filing of this Form 10-Q. The Company believes that the information provides a reasonable basis for estimating the fair values of assets acquired and liabilities assumed; however, the Company is awaiting the finalization of certain third-party valuations to finalize those fair values. Thus, the preliminary measurements of fair value set forth below are subject to change. The Company expects to finalize the valuation and complete the purchase price allocations as soon as practicable, but no later than one year from the respective acquisition date.

The following table summarizes the fair values of the assets acquired and liabilities assumed from the acquisition of Gufeng. Since the acquisition and the initial preliminary purchase price allocation were included in the Company’s Form 8-K for the quarter ended June 30, 2010, net adjustments of $12.5 million were made to the fair values of the assets acquired and liabilities assumed with a corresponding adjustment to goodwill. These adjustments are summarized in the table presented below.

| ($ in millions) | | |

| Purchase Price | | $ | 23.3 | |

| Fair Value of Assets Acquired: | | | | |

| Current assets | | | 25.1 | |

| Fixed assets | | | 17.3 | |

| Intangible assets | | | 15.8 | |

| Other assets | | | - | |

| Total Assets Acquired | | $ | 58.2 | |

| | |

| Fair Value of Liabilities Assumed: | | | | |

| Current liabilities | | $ | 15.9 | |

| Deferred revenue | | | 19.4 | |

| Deferred tax liabilities, net | | | - | |

| Total Liabilities Assumed | | $ | 35.3 | |

| | |

| Goodwill (1) | | $ | 0.4 | |

(1) The goodwill of $0.4 million is non-deductible for tax purposes.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The following table summarizes the preliminary fair value of amortizable and indefinite-lived intangible assets as of their respective acquisition dates:

| | | Gufeng at July 2, 2010 | |

| ($ in millions) | | Fair Value | | | Estimated useful life (in years) | |

| Amortizable intangible assets: | | | | | | |

| Customer relationships | | $ | 8.4 | | | | 10 | |

| | | | | | | | | |

| Indefinite-lived intangibles: | | | | | | | | |

| Trademarks | | $ | 7.4 | | | | | |

| | | | | | | | | |

| Total intangible assets acquired | | $ | 15.8 | | | | | |

| | | | | | | | | |

Pro Forma Condensed Combined Financial Information

The following unaudited pro forma condensed combined comparative financial information presents the results of operations of the Company as they may have appeared if the acquisition of Gufeng had been completed on July 1, 2009.

| | | For the Three Months Ended September 30, | |

| ($ in millions, except per share data) | | 2009 | |

| Net Sales | | $ | 28.8 | |

| Net Income | | $ | 6.8 | |

| Basic earnings per share | | $ | 0.30 | |

| Diluted earnings per share | | $ | 0.29 | |

Acquisition related expenses consist of integration related professional services, certain business combination adjustments after the measurement period or purchase price allocation period has ended, and certain other operating expenses, net.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

A pretax charges approximating $0.2 million were recorded for acquisition and integration related costs in the period ended September 30, 2010. These charges were recorded as General and administrative expenses. As the acquisition took place on July 2, 2010, statement of income for the period ended September 30, 2010 included the operations of the Company and Gufeng.

NOTE 4 – INVENTORIES

Inventories consisted of the following as of September 30, 2010 and June 30, 2010:

| | | September 30,

2010 | | | June 30,

2010 | |

| Raw materials | | $ | 5,829,268 | | | $ | 314,268 | |

| Supplies and packing materials | | | 657,819 | | | | 113,146 | |

| Work in progress | | | 2,203,926 | | | | 10,686,325 | |

| Finished goods | | | 18,557,941 | | | | 148,909 | |

| Total | | $ | 27,248,954 | | | $ | 11,262,647 | |

NOTE 5 – OTHER CURRENT ASSETS

As of September 30, 2010 and June, 30 2010, other current assets comprised of the following:

| | | September 30,

2010 | | | June 30,

2010 | |

| Advancement | | $ | 65,630 | | | $ | 41,875 | |

| Promotion material | | | 304,103 | | | | 44,949 | |

| Total | | $ | 369,733 | | | $ | 86,824 | |

Advancement represents advances made to non-related parties and employees. The amounts were unsecured, interest free, and due on demand.

NOTE 6 - PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following as of September 30, 2010 and June, 30, 2010:

| | | September 30,

2010 | | | June, 30,

2010 | |

| Building and improvements | | $ | 32,277,792 | | | $ | 11,719,363 | |

| Auto | | | 961,775 | | | | 117,295 | |

| Machinery and equipment | | | 21,398,234 | | | | 21,628,525 | |

| Agriculture assets | | | 1,365,316 | | | | 1,528,898 | |

| Total property, plant and equipment | | | 56,003,117 | | | | 34,994,081 | |

| Less: accumulated depreciation | | | (9,725,409 | ) | | | (5,625,566 | ) |

| Total property, plant and equipment, net | | $ | 46,277,708 | | | $ | 29,368,515 | |

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Depreciation expense for the three months ended September 30, 2010 and 2009 were $852,963 and $444,215, respectively.

Agriculture assets consist of reproductive trees that are expected to be commercially productive for a period of eight years.

NOTE 7 – CONSTRUCTION IN PROGRESS

As of September 30, 2010 and June 30, 2010, construction in progress, representing construction for a new product line and other buildings amounted to $1,179,818 and $257,077, respectively.

NOTE 8 - INTANGIBLE ASSETS AND GOODWILL

The intangible assets comprised of the following as of September 30, 2010 and June 30, 2010:

| | | September 30,

2010 | | | June 30,

2010 | |

| Land use right, net | | $ | 11,708,070 | | | $ | 11,495,059 | |

| Technology patent, net | | | 69,790 | | | | 90,512 | |

| Customer relationships, net | | | 8,159,802 | | | | - | |

| Trademarks | | | 7,364,988 | | | | - | |

| Total | | $ | 27,302,650 | | | $ | 11,585,570 | |

LAND USE RIGHT

On September 25, 2009, Yuxing was granted a land use right for approximately 88 acres (353,000 square meters or 3.8 million square feet) by the People’s Government and Land & Resources Bureau of Hu County, Xi’an, Shaanxi Province. The fair value of the related intangible asset was determined to be the respective cost of $10,938,628 (or RMB 73,184,895). The intangible asset is being amortized over the grant period of 50 years.

On August 13, 2003, Tianjuyuan was granted a certificate of Land Use Right for a parcel of land of approximately 11 acres (42,726 square meters or 459,898 square feet) at Ping Gu District, Beijing. The purchase cost was recorded at $156,334 (or RMB 1,045,950). The intangible asset is being amortized over the grant period of 50 years.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

On August 16, 2001, Jinong received a land use right as a contribution from a shareholder, which was granted by the People’s Government and Land & Resources Bureau of Yanling District, Shaanxi Province. The fair value of the related intangible asset at the time of the contribution was determined to be $1,088,872 (or RMB 7,285,099). The intangible asset is being amortized over the grant period of 50 years.

The Land Use Rights consist of the following as of September 30, 2010 and June 30, 2010:

| | | September 30,

2010 | | | June 30,

2010 | |

| Land use rights | | $ | 12,183,834 | | | $ | 11,866,105 | |

| Less: accumulated amortization | | | (475,764 | ) | | | (371,047 | ) |

| Total Land use rights, net | | $ | 11,708,070 | | | $ | 11,495,059 | |

TECHNOLOGY PATENT

On August 16, 2001, Jinong was issued a technology patent related to a proprietary formula used in the production of humid acid. The fair value of the related intangible asset was determined to be the respective cost of $878,121 (or RMB 5,875,068). The intangible asset is being amortized over the patent period of 10 years.

The technology know-how consisted of the following as of September 30, 2010 and June 30, 2010:

| | | September 30,

2010 | | | June 30,

2010 | |

| Technology know-how | | $ | 878,121 | | | $ | 866,338 | |

| Less: accumulated amortization | | | (808,331 | ) | | | (775,826 | ) |

| Total Technology know-how, net | | $ | 69,790 | | | $ | 90,512 | |

CUSTOMER RELATIONSHIP

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The preliminary fair value on the acquired customer relationships was estimated to be $8,369,028 (or RMB 80,720,740) and is amortized over the remaining useful life of ten years. See Note 3.

| | | September 30,

2010 | | | June 30,

2010 | |

| Customer relationships | | $ | 8,369,028 | | | $ | - | |

| Less: accumulated amortization | | | (209,226 | ) | | | - | |

| Total Customer relationships, net | | $ | 8,159,802 | | | $ | - | |

TRADEMARKS

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The preliminary fair value on the acquired trademarks was estimated to be $7,364,988 and is subject to an annual impairment test. See Note 3.

Total amortization expenses of intangible assets for the periods ended September 30, 2010 and 2009 were $290,369 and $43,185, respectively.

AMORTIZATION EXPENSE

Estimated amortization expenses of intangible assets for the next twelve month periods September 30, are as follows:

| September 30, 2011 | | $ | 1,150,369 | |

| September 30, 2012 | | | 1,080,579 | |

| September 30, 2013 | | | 1,080,579 | |

| September 30, 2014 | | | 1,080,579 | |

| September 30, 2015 | | | 1,080,579 | |

NOTE 9 - AMOUNT DUE TO RELATED PARTIES

As of September 30, 2010 and June 30, 2010, the amount due to related parties was $444,877 and $68,164, respectively. These amounts represent unsecured, non-interest bearing loans that are due on demand. These loans are not subject to written agreements. The large increase in amounts due to related parties as of September 30, 2010 is attributable to the previously outstanding loans payable by Gufeng to Mr. Qing Xin Jiang, the Chief Executive Officer and former controlling shareholder of Gufeng, which we acquired in the Gufeng acquisition.

NOTE 10 - ACCRUED EXPENSES AND OTHER PAYABLES

Accrued expenses and other payables consisted of the following as of September 30, 2010 and June 30, 2010:

| | | September 30,

2010 | | | June 30,

2010 | |

| Payroll payable | | $ | 211,050 | | | $ | 8,848 | |

| Welfare payable | | | 319,010 | | | | 164,051 | |

| Accrued expenses | | | 888,773 | | | | 334,806 | |

| Other levy payable | | | 147,146 | | | | - | |

| Total | | $ | 1,565,979 | | | $ | 507,705 | |

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 11 - LOAN PAYABLES

As of September 30, 2010and June 30, 2010, the loan payables were as follows:

| | | September 30,

2010 | | | June 30,

2010 | |

| Short term loans payable: | | $ | 6,227,481 | | | $ | - | |

| Total | | $ | 6,227,481 | | | $ | - | |

The interest expense from these short-term loans was $176,675 and $61,309 for the three months ended September 30, 2010 and 2009, respectively.

NOTE 12 - TAXES PAYABLE

Enterprise Income Tax

Effective January 1, 2008, the new Enterprise Income Tax (“EIT”) law of the PRC replaced the existing tax laws for Domestic Enterprises (“DES”) and Foreign Invested Enterprises (“FIEs”). The new EIT rate of 25% replaced the 33% rate that was applicable to both DES and FIEs. The two year tax exemption and three year 50% tax reduction tax holiday for production-oriented FIEs was eliminated. Since January 1, 2008, Jinong became subject to income tax in China at a rate of 15% as a high-tech company, as a result of the expiration of its tax exemption on December 31, 2007, and accordingly, it made provision for income taxes for the three months ended September 30, 2010 and 2009 of $1,713,743 and $930,757, respectively, which is mainly due to the operating income from Jinong. Gufeng is subject to 25% EIT rate and thus it made provision for income taxes of $426,334 for the three months ended September 30, 2010. Jintai has been exempt from paying income tax since its formation as it produces products which fall into the tax exemption list set out in the EIT. This exemption is expected to last as long as the applicable provisions of the EIT do not change.

Value-Added Tax

All of the Company’s fertilizer products that are produced and sold in the PRC were subject to a Chinese Value-Added Tax (VAT) of 13% of the gross sales price. On April 29, 2008, the PRC State of Administration of Taxation (SAT) released Notice #56, “Exemption of VAT for Organic Fertilizer Products”, which allows certain fertilizer products to be exempt from VAT beginning June 1, 2008. The Company submitted the application for exemption in May 2009, which was granted effective September 1, 2009, continuing through December 31, 2015. The VAT exemption applies to all agricultural products sold by Jingtai, and all but a nominal amount of agricultural products sold by Jinong.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Income Taxes and Related Payables

Taxes payable consisted of the following as of September 30, 2010 and June 30, 2010:

| | | September 30,

2010 | | | June 30,

2010 | |

| VAT provision (credit) | | $ | 40,718 | | | | (24,655 | ) |

| Income tax payable | | | 3,766,933 | | | | 2,020,253 | |

| Other levies | | | 311,939 | | | | 308,784 | |

| Total | | $ | 4,119,590 | | | | 2,304,382 | |

Income Taxes in the Consolidated Statements of Operations and Comprehensive Income

Income taxes consisted of the following as of September 30, 2010 and 2009:

| | | 2010 | | | 2009 | |

| Current Tax | | $ | 1,713,743 | | | $ | 930,757 | |

| Deferred Tax | | | - | | | | - | |

| Total | | $ | 1,713,743 | | | $ | 930,757 | |

Tax Rate Reconciliation

Substantially all of the Company’s income before income taxes and related tax expense are from PRC sources. Actual income tax benefit reported in the consolidated statements of operations and comprehensive income differ from the amounts computed by applying the US statutory income tax rate of 34% to income before income taxes for the three months ended September 30, 2010 and 2009 for the following reasons:

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

| September 30, 2010 | | China | | | | | | | |

| | | 15% - 25% | | | 34% | | | Total | |

| | | | | | | | | | | | | | | | |

| Pretax income (loss) | | | 10,702,296 | | | | | | | (1,200,768 | ) | | | | | | 9,501,528 | |

| | | | | | | | | | | | | | | | | | | |

| Expected income tax expense (benefit) | | | 2,636,058 | | | | 9.50 | % | | | (408,261 | ) | | | 34.00 | % | | | | |

| High-tech income benefits on Jinong | | | (858,273 | ) | | | -3.09 | % | | | | | | | | | | | | |

Income tax benefit of nontaxable income on Jintai | | | (109,368 | ) | | | -0.39 | % | | | | | | | | | | | | |

Income tax benefit of nontaxable income on Yuxing | | | 45,326 | | | | 0.16 | % | | | | | | | | | | | | |

Change in valuation allowance on deferred tax asset from US tax benefit | | | | | | | | | | | 408,261 | | | | -34.00 | % | | | | |

| Actual tax expense | | | 1,713,743 | | | | 6.17 | % | | | - | | | | 0.00 | % | | | 18.04 | % |

| September 30, 2009 | | China | | | United States | | | | |

| | | 15% | | | 34% | | | Total | |

| | | | | | | | | | | | | | | | |

| Pretax income (loss) | | | 6,513,257 | | | | | | | (335,226 | ) | | | | | | 6,178,031 | |

| | | | | | | | | | | | | | | | | | | |

| Expected income tax expense (benefit) | | | 993,774 | | | | 15.00 | % | | | (113,977 | ) | | | 34.00 | % | | | | |

| Income tax benefit of nontaxable income on Jintai | | | (65,694 | ) | | | -2.02 | % | | | | | | | | | | | | |

| Income tax benefit of nontaxable income on Yuxing | | | 2,677 | | | | -0.16 | % | | | | | | | | | | | | |

Change in valuation allowance on deferred tax asset from US tax benefit | | | | | | | | | | | 113,977 | | | | -34.00 | % | | | | |

| Actual tax expense | | | 930,757 | | | | 3.35 | % | | | - | | | | 0.00 | % | | | 15.07 | % |

NOTE 13 – STOCKHOLDERS’ EQUITY

Reclassification of Temporary Equity

On December 26, 2007 the Company issued 6,313,617 shares (the “Shares”) of common stock to 31 accredited investors (the “Investors”) at $3.25 per share in a private placement (the “Private Placement”). The Securities Purchase Agreement (“SPA”) set forth a contingency which gave the Investors the right to redeem the Shares in the event the Share Exchange was forced to be unwound as a result of any material adverse effect due to PRC governmental actions. As a result of the redemption feature, the Company recorded the Private Placement as temporary equity. In July 2009, the Investors and the Company entered into a Waiver and Consent where the Investors consented to waive all their rights associated with the liquidated damages under Section 4.16 of SPA. As a result, such temporary equity was no longer necessary for the purposes of the Company’s balance sheet as of June 30, 2010.

Common Stock

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The Company issued 4,025,000 shares of common stock at a public offering price of $7.15 per share in an underwritten offering and received total gross proceeds of approximately $28.8 million on July 24, 2009. The shares were sold under the Company's previously filed shelf registration statement, which was declared effective by the SEC on June 12, 2009. The Company uses the net proceeds to expand its production facilities through the construction of new greenhouse at Yuxing.

The Company completed the sale of 1,282,052 shares of common stock at a public offering price of $15.60 per share on November 25, 2009 in a registered direct offering for gross proceeds of $20,000,011. On December 16, 2009, the placement agent exercised rights to place up to 320,512 additional shares of common stock at a price of $15.60 per share, for additional gross proceeds of $4,999,987. The shares were sold under the Company's previously filed shelf registration statement, which was declared effective by the SEC on June 12, 2009.

On January 3, 2010, the Company made a one-time grant of an aggregate of 120,000 shares of restricted common stock of the Company to certain members of management and officers under the 2009 Equity Incentive Plan of the Company. Pursuant to the terms of the grant, one-third of the shares vested on February 2, 2010, one-third of the shares will vest on December 31, 2010 if certain financial targets are achieved and the remaining one-third of the shares will vest on December 31, 2011 if certain financial targets are achieved. Additionally, the Company made a one-time grant of an aggregate of 22,961 shares of performance-based restricted common stock to certain officers, which vests in three equal installments on September 30, 2010, 2011 and 2012 because the Company achieved both net sales and income from operations targets for the fiscal year ended June 30, 2010.

On February 10, 2010, the Company made a one-time grant of an aggregate of 50,700 shares of restricted common stock to certain independent directors and key employees under the 2009 Equity Incentive Plan. Pursuant to the terms of the grant, one-third of the shares vested on March 10, 2010, one-third of the shares will vest on December 31, 2010 if certain financial targets are achieved and the remaining one-third of the shares will vest on December 31, 2011 if certain financial targets are achieved. Additionally, the Company also granted to certain independent directors and key employees an aggregate of 70,500 shares of performance-based restricted common stock, which automatically vests in three equal installments on September 30, 2010, 2011 and 2012 because the Company achieved both net sales and income from operations targets for the fiscal year ended June 30, 2010.

On February 10, 2010, the Company issued a total of 8,000 shares of restricted common stock under its 2009 Equity Incentive Plan to a consultant pursuant to the terms of a service agreement, half of which was vested on August 9, 2010 and half of which was forfeited due to the disengagement of the service on September 15, 2010.

On July 2, 1010, the Company issued a total of 2,275,931 shares of common stock to Gufeng’s previous shareholders or their designees. Of the shares being issued in the acquisition, 40% will be held in escrow pending satisfaction of certain conditions such as make good targets set for Gufeng for the fiscal year ended June 30, 2011. See Note 3.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Preferred Stock

Under the Company’s articles of incorporation, the board of directors has the authority, without further action by stockholders, to designate up to 20,000,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges, qualifications and restrictions granted to or imposed upon the preferred stock, including dividend rights, conversion rights, voting rights, rights and terms of redemption, liquidation preference and sinking fund terms, any or all of which may be greater than the rights of the common stock. If the Company sells preferred stock under its registration statement on Form S-3, it will fix the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series in the certificate of designation relating to that series and will file the certificate of designation that describes the terms of the series of preferred stock the Company offers before the issuance of the related series of preferred stock.

As of September 30, 2010, the Company had 20,000,000 shares of preferred stock authorized, with a par value of $.001 per share, of which no shares are outstanding.

NOTE 14 – STOCK OPTIONS

On August 17, 2009, some directors, officers and employees exercised 84,500 options to purchase an aggregate of 84,500 shares of common stock in a cashless manner and received 61,239 shares of common stock as a result of the cashless exercise.

On January 3, 2010, the Company made a one-time grant of options to purchase an aggregate of 150,000 shares of common stock to certain officers and directors under the 2009 Equity Incentive Plan at an exercise price of $14.70 per share, the closing price of common stock on the previous trading day. Pursuant to the terms of the grant, one-third of the options vested on February 2, 2010, one-third of the options will vest on December 31, 2010 if certain financial targets are achieved and the remaining one-third of the options will vest on December 31, 2011 if certain financial targets are achieved.

On January 3, 2010, the Company also made a grant of performance-based options to purchase an aggregate of 45,291 shares of common stock to certain officers and directors under the 2009 Equity Incentive Plan at an exercise price of $14.70 per share, the closing price of the common stock on the previous trading day. Pursuant to the terms of the grant, the options automatically vest in three equal installments on September 30, 2010, 2011 and 2012 because the Company achieved both net sales and income from operations targets for the fiscal year ended June 30, 2010.

On February 3, 2010, one independent director resigned and all his vested and unvested options were forfeited pursuant to his grant agreement with the Company.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

On February 7, 2010, the Company appointed a new independent director and issued to him performance-based options to purchase 10,000 shares of common stock under the 2009 Equity Incentive Plan at an exercise price of $14.02 per share, the closing price of the common stock on the previous trading day. Pursuant to the terms of the grant, one-third of the options vested on March 8, 2010, one-third of the options will vest on December 31, 2010 if certain financial targets are achieved and the remaining one-third of the options will vest on December 31, 2011 if certain financial targets are achieved.

The Company’s calculations are made using the Black-Scholes option-pricing model with the following weighted average assumptions: expected life of 2 years; 75.2%-75.6% stock price volatility; risk-free interest rate of 1.63% and no dividends during the expected term. Stock compensation expense is recognized based on awards expected to vest. The forfeitures are estimated at the time of grant and revised in subsequent periods pursuant to actual forfeitures, if it is different from those estimates. During the three months ended September 30, 2010 and 2009, the Company recognized stock-based compensation expense of $644,075 and $0, respectively.

Options outstanding as of September 30, 2010 and related weighted average price and intrinsic value are as follows:

Exercise Prices | | Total Options Outstanding | | Weighted Average Remaining Life (Years) | | Total Weighted Average Exercise Price | | Options Exercisable | | | Aggregate Intrinsic Value |

| $14.02-14.70 | | 195,291 | | 1.56 | | $14.67 | | 65,100 | | | - |

The following table summarizes the options outstanding as of September 30, 2010:

| | Options Outstanding | |

| Outstanding, July 1, 2008 | | | 121,500 | |

| Granted | | | 28,000 | |

| Forfeited/Canceled | | | (28,000 | ) |

| Exercised | | | - | |

| Outstanding, June 30, 2009 | | | 121,500 | |

| Granted | | | 205,291 | |

| Forfeited/Canceled | | | (22,000 | ) |

| Exercised | | | (109,500 | ) |

| Outstanding, June 30, 2010 | | | 195,291 | |

| | | | | |

| Outstanding, September 30, 2010 | | | 195,291 | |

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 15 – SIGNIFICANT RISKS AND UNCERTAINTIES INCLUDING BUSINESS AND CREDIT CONCENTRATIONS AND LITIGIATION

Market Concentration

All of the Company's revenue-generated operations are all conducted in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC's economy.

The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company's results may be adversely affected by, among other things, changes in governmental policies with respexct to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation.

Vendor and Customer Concentration

There was one vendor from which the Company purchased more than 10% of its raw materials for the three months ended September 30, 2010. There is no accounts payable to this vender as of September 30, 2010.

There were three vendors from which the Company purchased more than 10% of its raw materials for the three months ended September 30, 2009 with each vendor individually accounting for about 13%, 12% and 10%. Accounts payable to those venders amounted to $0 as of September 30, 2009.

There was no customer that accounted over 10% of the total sales as of three months ended September 30, 2010 and September 30, 2009.

Concentration of Cash

The Company maintains large sums of cash in three major banks in China. The aggregate balance in such accounts as of September 30, 2010 was $51,199,499. There is no insurance securing these deposits in China. In addition, the Company also had $2,747,595 in cash in two banks in the United States as of September 30, 2010, with $500,000 secured by the U.S. Federal Deposit Insurance Corporation.

Litigation

On October 15, 2010, a class action lawsuit was filed against the Company and certain of its current and former officers in the United States District Court for the District of Nevada on behalf of purchasers of the Company’s common stock between November 12, 2009 and September 1, 2010. The complaint alleges that the Company and certain of its current and former officers violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, by making material misstatements and omissions about the Company’s true financial condition. The complaint alleges, among other things, that the financial statements for the fiscal year ended June 30, 2010 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission are materially false and misleading on the basis that such financial statements materially differ from certain financial information the Company reported to certain governmental agencies in the People’s Republic of China. The plaintiffs claim that such allegedly misleading financial statements inflated the price of the Company’s common stock and seek monetary damages in an amount to be determined at trial.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The Company believes the allegations are without merit and it intends to vigorously defend this lawsuit. However, it is possible that additional similar complaints and related derivative actions may be filed in the future. If this does occur, the Company expects that all similar class action complaints will eventually be consolidated into a single action.

NOTE 16 – SEGMENT REPORTING

The Company was organized into four main business segments: fertilizer production (Jinong & Gufeng), agricultural products production (Jintai) and future research and development center that is currently under construction (Yuxing). The following tables present a summary of our businesses’ and operating segments’ results.

| | | For the three months ended September 30, | |

| | | 2010 | | | 2009 | |

| Revenues from unaffiliated customers: | | | | | | |

| Jinong | | $ | 16,571,293 | | | $ | 10,178,649 | |

| Gufeng | | | 21,801,034 | | | | - | |

| Jintai | | | 1,110,594 | | | | 1,098,171 | |

| Yuxing | | | - | | | | - | |

| Consolidated | | $ | 39,482,921 | | | $ | 11,276,820 | |

| | | | | | | | | |

| Operating income : | | | | | | | | |

| Jinong | | $ | 8,519,558 | | | $ | 6,124,274 | |

| Gufeng | | | 1,922,981 | | | | - | |

| Jintai | | | 437,446 | | | | 437,906 | |

| Yuxing | | | (54,062 | ) | | | (17,846 | ) |

| Reconciling item (1) | | | - | | | | - | |

| Reconciling item (2) | | | (556,693 | ) | | | (335,226 | ) |

| Reconciling item (2)--stock compensation | | | (644,075 | ) | | | - | |

| Consolidated | | $ | 9,625,155 | | | $ | 6,209,108 | |

| | | | | | | | | |

| Net income: | | | | | | | | |

| Jinong | | $ | 7,295,318 | | | $ | 5,159,879 | |

| Gufeng | | | 1,307,706 | | | | - | |

| Jintai | | | 437,473 | | | | 437,956 | |

| Yuxing | | | (53,731 | ) | | | (17,846 | ) |

| Reconciling item (1) | | | 1,787 | | | | 2,512 | |

| Reconciling item (2) | | | (1,200,768 | ) | | | (335,226 | ) |

| Consolidated | | $ | 7,787,785 | | | $ | 5,247,274 | |

| | | | | | | | | |

| Depreciation and Amortization: | | | | | | | | |

| Jinong | | $ | 578,765 | | | $ | 444,215 | |

| Gufeng | | | 268,613 | | | | - | |

| Jintai | | | 31,374 | | | | 25,346 | |

| Yuxing | | | 55,084 | | | | 17,839 | |

| Consolidated | | $ | 933,836 | | | $ | 487,400 | |

| | | | | | | | | |

| Interest expense: | | | | | | | | |

| Jinong | | $ | - | | | $ | 61,309 | |

| Gufeng | | | 176,675 | | | | - | |

| Consolidated | | $ | 176,675 | | | $ | 61,309 | |

| | | | | | | | | |

| Capital Expenditure: | | | | | | | | |

| Jinong | | $ | 553,899 | | | $ | 2,437,738 | |

| Gufeng | | | 209,432 | | | | - | |

| Jintai | | | - | | | | - | |

| Yuxing | | | 13,338 | | | | 10,703,302 | |

| Consolidated | | $ | 776,669 | | | $ | 13,141,040 | |

| | | | | | | | | |

| Identifiable assets: | | As of 09/30/10 | | | As of 06/30/10 | |

| Jinong | | $ | 95,724,716 | | | $ | 103,519,520 | |

| Gufeng | | | 64,428,315 | | | | - | |

| Jintai | | | 13,144,736 | | | | 12,198,845 | |

| Yuxing | | | 15,077,316 | | | | 12,748,003 | |

| Reconciling item (1) | | | 2,753,409 | | | | 3,311,943 | |

| Reconciling item (2) | | | (5,405 | ) | | | (9,631 | ) |

| Consolidated | | $ | 191,123,087 | | | $ | 131,787,942 | |

(1) Reconciling amounts refer to the unallocated assets or expenses of Green New Jersey.

(2) Reconciling amounts refer to the unallocated assets or expenses of the parent company.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 17 - COMMITMENTS AND LEASES

In July 2007, Jinong signed an office lease with the Group Company and started to pay the rent for $954 (RMB 6,460) per month. On September 30, 2010, Jinong cancelled the lease agreement with the Group Company without penalty and signed a two year lease starting from July 1, 2010 directly with Xi’an Kingtone Information Technology Co., Ltd. (“Kingtone Information”), who owns the property. Kingtone Information is a Variable Interest Entity (“VIE”) with Kingtone Wirelessinfo Solution Holoding Ltd. (“Kingtone Wirelessinfo”), whose Chairman and majority shareholder is Mr. Tao Li, the Chairman, President and Chief Executive Officer of the Company. According to the new lease agreement, the monthly rent is $1,596 (RMB 10,800).

In January 2008, Jintai signed a ten year land lease with Xi’an Jinong Hi-tech Agriculture Demonstration Zone for a monthly rent of $768 (RMB 5,200).

In February 2004, Tianjuyuan signed a fifty year lease with village committee of Dong Gao Village and Zhen Nan Zhang Dai Village in the Beijing Ping Gu District, with a monthly rent of $437 (RMB 2,958).

Accordingly, the Company recorded an aggregate of $8,403 and $5,113 as rent expenses for the three months ended September 30, 2010 and 2009, respectively. Rent expenses for the next twelve month periods ended September 30, 2010 is as follows:

| September 30, 2011 | | $ | 33,611 | |

| September 30, 2012 | | | 28,824 | |

| September 30, 2013 | | | 14,464 | |

| September 30, 2014 | | | 14,464 | |

| September 30, 2015 | | | 14,464 | |

| | | | | |