Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX OF FINANCIAL STATEMENTS

TABLE OF CONTENTS 2

INDEX OF FINANCIAL STATEMENTS 2

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| South Hertfordshire United Kingdom Fund, Ltd. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

N/A |

| | | (2) | | Aggregate number of securities to which transaction applies:

N/A |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

For purposes of calculating the filing fee only, the underlying value of transaction of $22,864,513 was determined by multiplying (i) the purchase price of £14,293,000 to be paid by ntl (B) Limited to acquire 299,390 A ordinary shares of ntl (South Hertfordshire) Limited from South Hertfordshire United Kingdom Fund, Ltd. by (ii) the exchange rate of $1.5997 per £1.00, the noon buying rate for cable transfers in pounds sterling as certified for custom purposes by the Federal Reserve Bank of New York as of January 21, 2011. |

| | | (4) | | Proposed maximum aggregate value of transaction:

$22,864,513 |

| | | (5) | | Total fee paid:

$2,654.57, determined by multiplying the proposed maximum aggregate value of transaction by 0.0001161 |

ý |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

PRELIMINARY COPY—SUBJECT TO COMPLETION, DATED [ • ], 2011

SOUTH HERTFORDSHIRE UNITED KINGDOM FUND, LTD.

SPECIAL MEETING OF UNITHOLDERS

[ • ], 2011

Dear Unitholder,

You are cordially invited to attend a special meeting of holders ("unitholders") of the limited partnership interests (the "Partnership units") of South Hertfordshire United Kingdom Fund, Ltd. (the "Partnership") on [ • ], 2011 at [ • ], local time, at [ • ].

At the special meeting, you will be asked to consider and vote upon a proposal to approve the sale (the "Asset Sale") of the Partnership's 66.7% ownership interest in ntl (South Hertfordshire) Limited ("ntl South Herts") to ntl (B) Limited for £14,293,000 ($22,864,513, assuming an exchange rate of $1.5997 per £1.00 as of January 21, 2011). ntl (B) Limited is an indirect wholly owned subsidiary of Virgin Media Inc. and an affiliate of ntl Fawnspring Limited, the general partner of the Partnership (the "General Partner").

The Partnership's 66.7% ownership interest in ntl South Herts, which consists of 299,390 A ordinary shares of ntl South Herts (the "Partnership Asset"), is the Partnership's sole asset.

The agreement governing the Partnership (the "Partnership Agreement") requires that the price to be paid in a sale of the Partnership Asset to an affiliate of the General Partner must be determined by the average of three separate independent appraisals of the fair market value of the Partnership Asset and that the sale must be approved by unitholders (other than the General Partner or its affiliates) holding a majority of the outstanding Partnership units. Accordingly, the purchase price to be paid by ntl (B) Limited for the Partnership Asset represents the average of three separate independent appraisals, as more fully described in the proxy statement accompanying this letter, and you and the other unitholders of the Partnership are being asked to consider and vote upon the proposal to approve the Asset Sale.

If the proposal to approve the Asset Sale is approved and the Asset Sale is completed, then, as required by the Partnership Agreement, the Partnership will be dissolved and the General Partner will commence the process of liquidating and winding up the Partnership. The General Partner will use the proceeds of the Asset Sale to pay and provide for the outstanding liabilities and other obligations of the Partnership (including indebtedness owed by the Partnership to Virgin Media Inc. and its affiliates) and establish cash reserves in an amount equal to $335,000 for the payment of contingent or unforeseen liabilities of the Partnership. The actual amount of reserves established by the General Partner may be increased at the discretion of the General Partner, as more fully described in the proxy statement accompanying this letter.

The General Partner will distribute the remaining proceeds to the unitholders of record as of the record date of the distribution in accordance with the terms of the Partnership Agreement. The General Partner estimates that unitholders will receive approximately $300 per unit upon the initial distribution of the proceeds of the Asset Sale, based on, among other things, the purchase price for the Partnership Asset and estimates of the Partnership's outstanding liabilities, expenses and required cash reserves described in the preceding paragraph, and assuming an exchange rate of $1.5997 per £1.00. To the extent that all or a portion of the Partnership's cash reserves are not used to settle any contingent or unforeseen liabilities of the Partnership after our dissolution, a further distribution of the unused portion of the cash reserves will be made to unitholders at a later date to be established by the General Partner. The actual amounts distributed to unitholders will depend on, among other things, the actual amount of liabilities and obligations of the Partnership upon its dissolution (including contingent liabilities paid out of the cash reserves following the dissolution), expenses incurred by the Partnership prior to or in connection with its dissolution and winding up, the amount of the General Partner's

Table of Contents

capital account deficit, and the exchange rate at the time the proceeds of the Asset Sale are converted into U.S. Dollars, as further described in the proxy statement accompanying this letter.

Following the Asset Sale, the dissolution of the Partnership and the distributions of all remaining Partnership funds to unitholders of record, the Partnership will be terminated.

If the Asset Sale and the dissolution of the Partnership are not completed, there will be no distribution in connection with the Asset Sale and the Partnership's term will otherwise expire on December 31, 2016, at which time the Partnership will be dissolved and liquidated in accordance with the Partnership Agreement. There can be no assurance that, prior to or upon the expiration of the Partnership term, Virgin Media Inc., any of its affiliates or any other party will offer to acquire the Partnership Asset for an amount equal to or greater than the purchase price contemplated in the proposed Asset Sale or that unitholders will receive distributions equal to or greater than the distributions expected to be made in connection with the Asset Sale.

YOUR VOTE IS VERY IMPORTANT

Whether or not you plan to attend the special meeting, please complete, date, sign and return, as promptly as possible, the enclosed proxy card in the accompanying prepaid reply envelope, or submit your proxy by telephone or the Internet. If you attend the special meeting and vote in person, your vote by ballot will revoke any proxy previously submitted.The failure to vote will have the same effect as a vote "AGAINST" the proposal to approve the Asset Sale.

The accompanying proxy statement provides you with detailed information about the special meeting and the items of business, the three separate independent appraisals, the Asset Sale and the dissolution of the Partnership.You are encouraged to read the entire proxy statement and its annexes carefully. You may also obtain additional information about the Partnership from documents it has filed with the Securities and Exchange Commission.

If you have any questions or need assistance voting your Partnership units, please call Georgeson Inc., the Partnership's proxy solicitor ("Georgeson"), toll-free, at 877-797-1153. If calling from outside the United States, please call collect: 212-440-9800. You can also email Georgeson at southherts@georgeson.com.

Thank you in advance for your cooperation.

Sincerely,

| | |

Robert Mackenzie

Director | | Robert Gale

Director |

For and on behalf of the General Partner, ntl Fawnspring Limited

The proxy statement is dated [ • ], 2011, and is first being mailed to the Partnership's unitholders on or about [ • ], 2011.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE ASSET SALE, PASSED UPON THE MERITS OR FAIRNESS OF THE ASSET SALE, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THE ENCLOSED PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Table of Contents

PRELIMINARY COPY—SUBJECT TO COMPLETION, DATED [ • ], 2011

SOUTH HERTFORDSHIRE UNITED KINGDOM FUND, LTD.

7103 South Revere Parkway, Englewood Colorado 80112, United States

Address of principal executive office:

Media House, Bartley Wood Business Park, Hook, Hampshire, RG27 9UP, England

NOTICE OF SPECIAL MEETING OF UNITHOLDERS

TO BE HELD ON[ • ], 2011

To the Unitholders of South Hertfordshire United Kingdom Fund, Ltd.,

A special meeting of unitholders of the Partnership will be held on [ • ], 2011 at [ • ], local time, at [ • ], to consider and vote upon a proposal to approve the sale of the Partnership's 299,390 A ordinary shares of ntl South Herts (representing a 66.7% ownership interest) to ntl (B) Limited pursuant to a Share Purchase Agreement, dated as of January 31, 2011, by and between the Partnership and ntl (B) Limited, a copy of which is attached asAnnex A to the proxy statement accompanying this notice.

Holders of Partnership units as of the close of business on [ • ], 2011 will be entitled to notice of, and to vote at, the special meeting and at any adjournments or postponements of the meeting.

YOUR VOTE IS VERY IMPORTANT

Whether or not you plan to attend the special meeting, please complete, date, sign and return, as promptly as possible, the enclosed proxy card in the accompanying prepaid reply envelope, or submit your proxy by telephone or the Internet. If you attend the special meeting and vote in person, your vote by ballot will revoke any proxy previously submitted.The failure to vote will have the same effect as a vote "AGAINST" the proposal to approve the Asset Sale.

By order of the General Partner, ntl Fawnspring Limited

| | |

Robert Mackenzie

Director | | Robert Gale

Director |

[ • ], 2011

The proxy statement is dated [ • ], 2011, and is first being mailed to the Partnership's unitholders on or about [ • ], 2011.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE ASSET SALE, PASSED UPON THE MERITS OR FAIRNESS OF THE ASSET SALE, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THE ENCLOSED PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE

Table of Contents

TABLE OF CONTENTS

| | | | |

SUMMARY TERM SHEET | | 1 |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE ASSET SALE | | 9 |

| | The Special Meeting | | 9 |

| | The Asset Sale | | 11 |

SPECIAL FACTORS | | 15 |

| | The Parties to the Asset Sale | | 15 |

| | The Partnership Asset | | 15 |

| | Certain Relevant Provisions of the Partnership Agreement | | 16 |

| | Dissolution of the Partnership Following the Asset Sale and Distributions to Unitholders | | 18 |

| | Background of the Asset Sale | | 19 |

| | The General Partner's Reasons for the Asset Sale and Factors Considered in Determining Fairness | | 22 |

| | Reasons and Position of ntl (B) Limited and its Affiliates Regarding the Fairness of the Asset Sale | | 26 |

| | Alternatives to the Asset Sale | | 27 |

| | Certain Other Effects of the Asset Sale | | 28 |

| | Plans for ntl South Herts After the Asset Sale | | 29 |

| | Interests of Certain Persons in the Asset Sale | | 29 |

| | Reports of the Appraisal Firms | | 30 |

| | Material U.S. Federal Income Tax Consequences of the Asset Sale and the Dissolution of the Partnership | | 43 |

| | Material United Kingdom Income Tax Consequences of the Asset Sale and Dissolution of the Partnership | | 46 |

| | ntl (B) Limited's Financing of the Asset Sale | | 46 |

| | Rights of Dissenting Unitholders | | 47 |

| | Regulatory Approvals | | 47 |

FORWARD-LOOKING STATEMENTS | | 48 |

THE SHARE PURCHASE AGREEMENT | | 50 |

| | The Asset Sale | | 50 |

| | Effective Time of the Asset Sale | | 50 |

| | Representations and Warranties | | 50 |

| | Conditions to the Closing of the Asset Sale | | 51 |

| | Termination | | 51 |

PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS | | 52 |

| | Consulting and Management Fees | | 52 |

| | General Partner Services and Interest Expense Reimbursement | | 52 |

| | Arrangements between ntl South Herts and Affiliates of Virgin Media Inc. | | 52 |

| | Outstanding Indebtedness | | 53 |

THE SPECIAL MEETING | | 54 |

| | Time, Place and Purpose of the Special Meeting | | 54 |

| | Record Date | | 54 |

| | Attendance | | 54 |

| | Vote Required | | 54 |

| | Solicitation of Proxies; Payment of Solicitation Expenses | | 55 |

| | No Unitholder Proposals | | 56 |

| | Dissenter's Rights | | 56 |

| | Other Matters of Action at the Special Meeting | | 56 |

OTHER IMPORTANT INFORMATION REGARDING THE PARTNERSHIP | | 57 |

| | Description of Business | | 57 |

i

Table of Contents

| | | | |

| | Description of Property | | 57 |

| | Legal Proceedings | | 57 |

| | Financial Statements and Supplementary Financial Information | | 57 |

| | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 57 |

| | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 57 |

| | Historical Selected Financial Data | | 57 |

| | Currencies and Exchange Rates | | 60 |

| | Book Value Per Unit | | 61 |

| | Quantitative and Qualitative Disclosures about Market Risk | | 63 |

| | Officers and Directors | | 63 |

| | Business Address | | 63 |

OTHER IMPORTANT INFORMATION REGARDING THE GENERAL PARTNER, NTL (B) LIMITED AND THEIR AFFILIATES | | 64 |

| | The General Partner | | 64 |

| | ntl (B) Limited | | 64 |

| | Virgin Media Inc. | | 65 |

| | Virgin Media Limited | | 69 |

INCORPORATION BY REFERENCE | | 70 |

WHERE YOU CAN FIND MORE INFORMATION ABOUT US | | 70 |

Annex A—Share Purchase Agreement, dated January 31, 2011, between South Hertfordshire United Kingdom Fund, Ltd. and ntl (B) Limited | | |

Annex B—Annual Report on Form 10-K for the fiscal year ended December 31, 2009 | | |

Annex C—Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2010 | | |

ii

Table of Contents

SUMMARY TERM SHEET

The following summary highlights selected information in this proxy statement and may not contain all the information that may be important to you. Accordingly, we encourage you to read carefully this entire proxy statement, its annexes and the documents referred to in this proxy statement. Each item in this summary includes a page reference directing you to a more complete description of that item. References to the "Partnership," "we", "our" or "us" in this proxy statement refer to South Hertfordshire United Kingdom Fund, Ltd. unless otherwise indicated by context.

This proxy statement is dated [ • ], 2011, and is first being mailed to unitholders on or about [ • ], 2011.

Overview: The Asset Sale Proposal

- •

- You are being asked to consider and vote upon a proposal to approve the sale, which is referred to as the "Asset Sale", of the Partnership's 66.7% ownership interest in ntl (South Hertfordshire) Limited, which is referred to as "ntl South Herts", to ntl (B) Limited for £14,293,000 ($22,864,513, assuming an exchange rate of $1.5997 per £1.00 as of January 21, 2011, which is referred to as the "Current Exchange Rate").

- •

- The Partnership's 66.7% ownership interest in ntl South Herts, which consists of 299,390 A ordinary shares of ntl South Herts, which collectively are referred to as the "Partnership Asset", is the Partnership's sole asset. As the Asset Sale would constitute the sale of all the assets of the Partnership, if approved and completed, the Asset Sale will result in the dissolution and termination of the Partnership.

- •

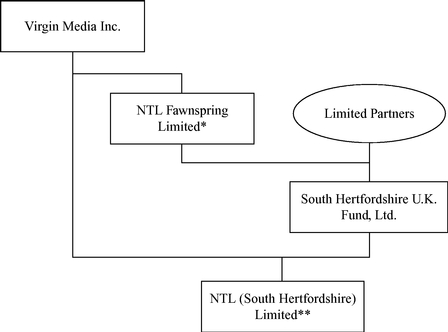

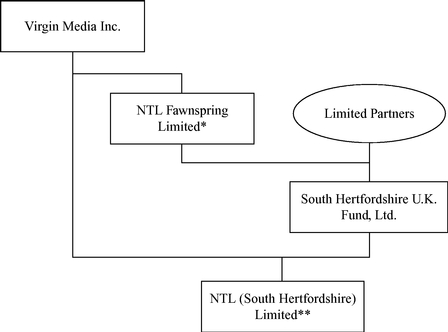

- ntl (B) Limited, which owns the remaining 33.3% of ntl South Herts, is an indirect wholly owned subsidiary of Virgin Media Inc. and an affiliate of the general partner of the Partnership, ntl Fawnspring Limited, which is referred to as the "General Partner".

- •

- The purchase price to be paid by ntl (B) Limited for the Partnership Asset represents the average of three separate independent appraisals of the fair market value of the Partnership Asset, which appraisals are more fully described below under "Reports of the Independent Appraisers" beginning on page [ • ], as required by the terms of the partnership agreement governing the Partnership, which is referred to as the "Partnership Agreement". The purchase price was determined in accordance with the Partnership Agreement, and neither the purchase price nor the other terms of the Asset Sale were subject to arm's-length negotiation. Any transaction between the General Partner and an affiliate of Virgin Media Inc. should not be deemed to be free of conflicts of interest.

- •

- The Asset Sale is subject to the approval by holders (other than the General Partner and its affiliates) of a majority of the Partnership's limited partnership interests, which are referred to as the "Partnership units". The Asset Sale is also subject to the other terms and conditions set forth in the share purchase agreement, dated January 31, 2011, between the Partnership and ntl (B) Limited, which is referred to as the "Share Purchase Agreement", as described below under "The Share Purchase Agreement", beginning on page [ • ].

The Parties to the Asset Sale (page [ • ])

- •

- The Partnership. We are a Colorado limited partnership formed on December 31, 1991 in connection with the public offering of our Partnership units for the purpose of acquiring, constructing, developing, owning and operating cable television/telephone systems in the United Kingdom. Our sole asset consists of a 66.7% ownership interest in ntl South Herts. Our business is managed by our General Partner and our only operations consist of those of ntl South Herts. We rely on Virgin Media Inc.'s management, organization, financing and infrastructure to carry on our business and operations.

1

Table of Contents

- •

- The General Partner. The General Partner is an English company incorporated on April 29, 1994 and is an indirect wholly owned subsidiary of Virgin Media Inc. The General Partner manages our business, properties and activities in accordance with the terms of the Partnership Agreement, although operating control is delegated to other affiliated companies of Virgin Media Inc. The General Partner holds a general partnership interest in the Partnership, but will not vote on the proposal to approve the Asset Sale.

- •

- ntl (B) Limited. ntl (B) Limited is an English company incorporated on July 30, 1992 and is an indirect wholly owned subsidiary of Virgin Media Inc. ntl (B) Limited holds the 33.3% of the shares of ntl South Herts not owned by the Partnership and has no other assets or operations. ntl (B) Limited relies on the employees and management of Virgin Media Inc. and its affiliates for its business and operations.

The Dissolution of the Partnership Following the Asset Sale (page [ • ])

- •

- If the Asset Sale is approved and completed, the Partnership will be dissolved and the General Partner will commence the process of liquidating and winding up the Partnership. In connection with the dissolution, the General Partner intends to first pay or provide for the outstanding liabilities and obligations of the Partnership (which consist of indebtedness owed by the Partnership to Virgin Media Inc. and its affiliates). The General Partner intends to then convert the remaining proceeds of the Asset Sale from U.K. pounds sterling into U.S. Dollars and pay or provide for expenses to be incurred by the Partnership prior to and in connection with its dissolution and winding up.

- •

- The General Partner also intends to establish cash reserves, which are referred to as the "Cash Reserves", in an amount equal to $335,000 out of Partnership funds for the payment of contingent or unforeseen liabilities of the Partnership, as provided for by the Partnership Agreement. The General Partner may increase the amount of the Cash Reserves if, prior to the initial distribution to unitholders, the General Partner becomes aware of circumstances or events that in its judgment would increase the amount of potential liabilities (or the likelihood of their realization) of the Partnership following its dissolution. Portions of the Cash Reserves may be used to pay any indemnification obligations of the Partnership in favor of the General Partner permitted under the terms of the Partnership Agreement.

- •

- Subsequent to the Asset Sale, the Partnership may seek termination of its obligation to file reports under the Securities and Exchange Act of 1934, which is referred to as the "Exchange Act". Following the Asset Sale, the dissolution of the Partnership and the distributions of all remaining Partnership funds to unitholders of record, the Partnership will be terminated and will cease to exist.

Distributions to Unitholders in Connection with the Asset Sale and the Dissolution of the Partnership (page [ • ])

- •

- Upon completion of the Asset Sale and after paying or providing for the outstanding liabilities and obligations of the Partnership and establishing the Cash Reserves, the General Partner estimates that unitholders of record as of the record date of the initial distribution will receive a distribution of approximately $300 per unit (assuming the Current Exchange Rate), without interest, less any applicable withholding taxes, for each Partnership unit that they own.

- •

- To the extent that all or a portion of the Cash Reserves are not used to settle any contingent or unforeseen liabilities of the Partnership after our dissolution, a further distribution of remaining amounts will be made to unitholders at a later date established by the General Partner.

- •

- The actual amounts distributed to unitholders will depend on, among other things, the actual amount of liabilities and obligations of the Partnership upon our dissolution (including

2

Table of Contents

contingent or unforeseen liabilities paid for out of the Cash Reserves after the dissolution), expenses incurred by us prior to or in connection with our dissolution and winding up, the actual amount of the General Partner's capital account deficit, and the exchange rate at the time the proceeds of the Asset Sale are converted into U.S. Dollars.

- •

- The following table summarizes the calculation of the amount per unit that the General Partner estimates will be initially distributed to unitholders by the Partnership in connection with the Asset Sale and the dissolution of the Partnership:

| | | | | |

| | Proceeds of the Asset Sale | | | £14,293,000 | |

| | Estimated outstanding Partnership liabilities (1) | | | £(3,100,000 | ) |

| | | | | |

| | | | | £11,193,000 | |

| | Conversion into U.S. dollars, assuming the Current Exchange Ratio ($1.5997 per £1.00) | | $ | 17,905,442 | |

| | Estimated expenses | | $ | (645,000 | ) |

| | Estimated Cash Reserves | | $ | (335,000 | ) |

| | Estimated General Partner's capital account deficit contribution | | $ | 400,000 | |

| | | | | |

| | Estimated aggregate amount of initial distribution to unitholders | | $ | 17,325,442 | |

| | Estimated per unit amount of initial distribution to unitholders (2)(3) | | $ | 304.30 | |

- (1)

- Based on estimated liabilities as at September 30, 2010.

- (2)

- Computed based on 56,935 Partnership units outstanding as of [ • ].

- (3)

- In estimating that unitholders will receive approximately $300 per unit in the initial distribution as described elsewhere in this proxy statement, the General Partner rounded $304.30 to the nearest $10. The actual amount per unit that will be initially distributed to unitholders in connection with the Asset Sale will be determined at the time of the initial distribution and will be affected by currency exchange rates and other factors. See "Special Factors—Dissolution of the Partnership Following the Asset Sale and Distributions to Unitholders" beginning on page [ • ].

Certain Relevant Provisions of the Partnership Agreement (page [ • ])

The following are certain provisions of the Partnership Agreement relevant to the Asset Sale proposal:

- •

- Dissolution. The Partnership Agreement provides that upon the dissolution of the Partnership, the General Partner will wind up the affairs of the Partnership, sell all of the assets of the Partnership and pay or provide for all of its liabilities including the costs of dissolution and fees due to the General Partner. The General Partner will then distribute the remainder of the Partnership's funds to the unitholders and the General Partner in accordance with the distribution priorities specified in the Partnership Agreement.

- •

- Certain Sales of Partnership Assets. The Partnership Agreement provides that the General Partner may sell cable television/telephony property, including shares of a company holding cable television/telephony property such as the Partnership Asset, to the General Partner or its affiliates if the sale price for the property is determined by the average of three separate independent appraisals of the fair market value of the property and if the sale is approved by unitholders (other than the General Partner and its affiliates) holding a majority of the outstanding Partnership units. The cost of the appraisals is borne by the General Partner or its affiliate and not by the Partnership.

- •

- Allocations of Book Loss. Pursuant to the terms of the Partnership Agreement, the General Partner will allocate the loss on the disposition of the Partnership Asset for purposes of

3

Table of Contents

determining capital accounts of the partners (i) 99% to the unitholders and 1% to the General Partner, and (ii) among the unitholders, so that each unitholder will have an equal capital account per Partnership interest.

- •

- Certain Distributions. Since the amounts that will be distributed in connection with the Asset Sale will not exceed each unitholder's capital contributions, under the terms of the Partnership Agreement, distributions will be made only to the unitholders, in proportion to their positive capital account balances. The capital account balances, subsequent to the allocation of book losses described above under "—Allocations of Book Loss", will be equal for each Partnership unit, and, accordingly, distributions will be made equally with respect to each Partnership unit. No distributions will be made to the General Partner with respect to its general partnership interest.

- •

- Certain Restrictions on Transfers of Partnership Units. The Partnership Agreement contains certain restrictions on the assignment and transfer of Partnership units, including those set forth under "Certain Relevant Provisions of the Partnership Agreement—Certain Restrictions on Transfers of Partnership Units" beginning on page [ • ].

The General Partner's Reasons for the Asset Sale and Factors Considered in Determining Fairness (page [ • ])

- •

- For the past several years, the General Partner has been aware that certain unitholders have desired increased liquidity with respect to their Partnership units. The proposed Asset Sale will provide unitholders with an opportunity to liquidate their investment in the Partnership units at a price determined in accordance with the Partnership Agreement in advance of the scheduled expiration of the Partnership term on December 31, 2016.

- •

- The board of directors of the General Partner, on behalf of itself, the General Partner and the Partnership, believes that the proposed Asset Sale is procedurally and substantively fair to the Partnership's unitholders that are unaffiliated with ntl (B) Limited, Virgin Media Limited and Virgin Media Inc. Its belief is based upon consideration of the factors set forth below under "The General Partner's Reasons for the Asset Sale and Factors Considered in Determining Fairness" beginning on page [ • ].

- •

- ntl (B) Limited, Virgin Media Limited and Virgin Media Inc. each believes that the Asset Sale is substantively and procedurally fair to the Partnership's unitholders that are unaffiliated with ntl (B) Limited, Virgin Media Limited and Virgin Media Inc. ntl (B) Limited, Virgin Media Limited and Virgin Media Inc. each expressly adopts the analysis of the board of directors of the General Partner of the factors upon which its determination as to the fairness of the proposed Asset Sale is based and the conclusions of the board of directors of the General Partner with respect to the fairness of the proposed Asset Sale, as described under "The General Partner's Reasons for the Asset Sale and Factors Considered in Determining Fairness" beginning on page [ • ].

Reports of the Appraisals Firms (page [ • ])

Appraisal Report of BTG Mesirow Financial Consulting, LLC

- •

- On November 24, 2010, BTG Mesirow Financial Consulting, LLC, which is referred to as "BTG MFC", furnished its report as to the fair market value of the Partnership Asset, and concluded, based on the assumptions made, procedures followed and matters considered as set forth in its report, that the value of the Partnership Asset, as of September 30, 2010, was estimated to be £14.2 million.

- •

- The assumptions made, procedures followed and matters considered by BTG MFC in reaching its conclusion are more fully described in "Special Factors—Reports of the Appraisal Firms—

4

Table of Contents

Appraisal Report of BTG Mesirow Financial Consulting, LLC" beginning on page [ • ]. The General Partner agreed to pay BTG MFC a fee equal to £46,600, exclusive of expenses, for its services in connection with the appraisal. The fee paid to BTG MFC was not contingent upon the conclusion reached by BTG MFC in its report or whether or not the Asset Sale is successfully completed.

Appraisal Report of Duff & Phelps Ltd.

- •

- On November 23, 2010, Duff & Phelps Ltd, which is referred to as "Duff & Phelps", furnished its report as to the fair market value of the Partnership Asset, and concluded, based on the assumptions made, procedures followed and matters considered as set forth in its report, that the value of the Partnership Asset, as of September 30, 2010, was estimated to be £15.8 million.

- •

- The assumptions made, procedures followed and matters considered by Duff & Phelps in reaching its conclusion are more fully described in "Special Factors—Reports of the Appraisal Firms—Appraisal Report of Duff & Phelps Ltd." beginning on page [ • ]. The General Partner agreed to pay Duff & Phelps a fee equal to £60,000, exclusive of expenses, for its services in connection with the appraisal. The fee paid to Duff & Phelps is not contingent upon the conclusion reached by Duff & Phelps in its report or whether or not the Asset Sale is successfully completed.

Appraisal Report of Grant Thornton LLP

- •

- On November 24, 2010, Grant Thornton LLP, which is referred to as "Grant Thornton", furnished its report as to the fair market value of the Partnership Asset, and concluded, based on the assumptions made, procedures followed and matters considered as set forth in its report, that the value of the Partnership Asset, as of September 30, 2010, was estimated to be £12.879 million.

- •

- The assumptions made, procedures followed and matters considered by Grant Thornton in reaching its conclusion are more fully described in "Special Factors—Reports of the Appraisal Firms—Appraisal Report of Grant Thornton LLP" beginning on page [ • ]. The General Partner agreed to pay Grant Thornton a fee equal to £69,300, exclusive of expenses, for its services in connection with the appraisal. The fee paid to Grant Thornton is not contingent upon the conclusion reached by Grant Thornton in its report or whether or not the Asset Sale is successfully completed.

Material Tax Consequences of the Asset Sale and the Dissolution of the Partnership (page [ • ])

- •

- Material United States Income Tax Consequences. For U.S. federal income tax purposes, each unitholder will be required to include in its income (subject to certain limitations) its allocable share of the loss (or gain) realized by the Partnership upon the sale of the Partnership Asset pursuant to the Asset Sale and will recognize loss (or gain) to the extent the amount of the liquidating distribution received by the unitholder is less than (or exceeds) the unitholder's adjusted tax basis in its Partnership units. You should consult your own tax advisor for a complete analysis of the effect of the Asset Sale and the dissolution of the Partnership on your federal, state and local and/or foreign taxes. See "Material U.S. Federal Income Tax Consequences of the Asset Sale and Dissolution of the Partnership" for more detail including information regarding limitations on the ability to claim certain losses realized by the Partnership.

- •

- Material United Kingdom Income Tax Consequences. The following tax description is not addressed to any unitholder of the Partnership who is resident, ordinarily resident or domiciled in the United Kingdom for U.K. tax purposes. Neither the Asset Sale, the subsequent distribution of the proceeds of the Asset Sale by the Partnership nor the dissolution of the

5

Table of Contents

Partnership should result in any unitholder of the Partnership who is non-U.K. resident and non-U.K. ordinarily resident being liable to U.K. taxation on any gain realized on such disposal, provided that the unitholder concerned is not carrying on a trade in the U.K. through a branch or agency in the U.K.

ntl (B) Limited's Financing of the Asset Sale (page [ • ])

- •

- ntl (B) Limited's obligation to complete the Asset Sale is not conditioned on its ability to obtain financing. ntl (B) Limited estimates that the total amount of funds necessary to consummate the Asset Sale and pay related fees and expenses, including the cost of the three separate independent appraisals, will be approximately £14.8 million, which will be funded by an equity contribution from available cash on hand by Virgin Media Inc. or one of its wholly-owned subsidiaries.

Interests of Certain Persons in the Asset Sale (page [ • ])

You should be aware that the General Partner, its directors and management, and their affiliates have interests in the Asset Sale that are different from, or in addition to, the interests of the Partnership's unitholders generally as described in "Interests of Certain Persons in the Asset Sale" beginning on page [ • ], including the following:

Affiliations with Virgin Media Inc.

- •

- Virgin Media Inc. and its affiliates, including ntl (B) Limited, have an economic interest in acquiring the Partnership Asset on favorable terms. All of the directors, management and employees of the General Partner and the Partnership are directors, management or employees of Virgin Media Inc. or its affiliates. The General Partner and its directors, management and employees each owe a fiduciary duty to Virgin Media Inc. and its affiliates as a result of their respective relationships with Virgin Media Inc. and its affiliates.

- •

- All of the directors, management and employees of the General Partner will continue their employment with Virgin Media Inc. or its affiliates after completion of the Asset Sale.

- •

- The General Partner and its directors, employees and management did not seek any independent legal, accounting or financial advice in connection with the Asset Sale (other than the reports of the independent appraisal firms which were jointly retained with an affiliate of Virgin Media Inc.) but rather received legal, accounting and financial advice from the legal, accounting and financial advisors of Virgin Media Inc.

Payments to the General Partner and Affiliates of Virgin Media Inc. in Connection with the Asset Sale.

- •

- Following completion of the Asset Sale and upon the subsequent dissolution of the Partnership, the General Partner will cause the Partnership to repay in full the outstanding liabilities owed by the Partnership to Virgin Media Limited, an affiliate of Virgin Media Inc., which totalled £3.1 million as of September 30, 2010.

- •

- Following the Asset Sale, the liabilities owed by ntl South Herts to Virgin Media Inc., which totalled £19.2 million as of September 30, 2010, will remain with ntl South Herts.

- •

- The General Partner will establish and manage the Cash Reserves in connection with the Asset Sale and the dissolution of the Partnership. Portions of the Cash Reserves may be used to pay any indemnification obligations of the Partnership in favor of the General Partner permitted under the terms of the Partnership Agreement.

6

Table of Contents

Rights of Dissenting Unitholders (page [ • ])

- •

- Under Colorado law, appraisal or dissenters' rights are not available to our unitholders with respect to the proposal to approve the Asset Sale to be voted on at the special meeting.

The Share Purchase Agreement (page [ • ])

- •

- The closing of the Asset Sale will occur on the third business day following notification by the Partnership of the satisfaction or waiver of the conditions set forth in the Share Purchase Agreement or on such other date as the parties may agree.

- •

- The Share Purchase Agreement contains warranties made by the parties solely for the benefit of each other and for the purpose of the Share Purchase Agreement, as described below under "The Share Purchase Agreement—Representations and Warranties" beginning on page [ • ].

- •

- The obligations of ntl (B) Limited and the Partnership to complete the Asset Sale are subject to the approval of the Asset Sale by holders (other than the General Partner and its affiliates) of a majority of the outstanding Partnership units. In addition, both parties may abandon the Asset Sale if the Share Purchase Agreement is terminated in accordance with its terms at any time prior to closing.

- •

- The Share Purchase Agreement grants the parties certain termination rights. The Share Purchase Agreement may be terminated:

- •

- by mutual written consent of the parties;

- •

- by ntl (B) Limited, if requisite unitholder approval of the Asset Sale is not obtained on or before June 30, 2011;

- •

- by ntl (B) Limited, if there has been a material breach of any of the Partnership's warranties or any of the Partnership's warranties become untrue after the date of the Share Purchase Agreement and such breach is not curable or, if curable, has not been cured within 10 business days;

- •

- by the Partnership, if there has been a material breach of any of ntl (B) Limited's warranties or any of ntl (B) Limited's warranties become untrue after the date of the Share Purchase Agreement and such breach is not curable or, if curable, has not been cured within 10 business days;

- •

- by either the Partnership or ntl (B) Limited if the special meeting is held and completed and requisite unitholder approval of the Asset Sale is not obtained at the meeting or any adjournment or postponement thereof; and

- •

- by ntl (B) Limited, if prior to closing there occurs a material adverse change to the business, results of operations or financial condition, properties, liabilities or assets of ntl South Herts (other than any such change arising or reasonably likely to arise as a result of, out of or related to (a) changes in the economy or financial markets generally in countries in which ntl South Herts conducts material operations or (b) changes that are the result of factors generally affecting the principal industries in which ntl South Herts operates).

- •

- In addition, if either the Partnership or ntl (B) Limited fails to comply with any material obligation required to be performed by it upon the closing of the Asset Sale, then the Partnership, in the case of non-compliance by ntl (B) Limited, or ntl (B) Limited, in the case of non-compliance by the Partnership, may defer the closing of the Asset Sale to a date not more than 21 days or less than seven days after the date on which the closing was first scheduled or may terminate the Share Purchase Agreement (in addition to other rights that may be available).

7

Table of Contents

The Special Meeting (page [ • ])

- •

- Time, Place and Purpose of the Special Meeting. The special meeting is to be held on [ • ], 2011 at [ • ], local time, at [ • ], unless it is adjourned, recessed or postponed to a later time.

- •

- Attendance. Only unitholders of record, their duly authorized proxy holders and our guests may attend the special meeting.

- •

- Record Date. We have fixed [ • ], 2011 as the record date for the special meeting, and only unitholders who owned our Partnership units at the close of business on the record date are entitled to vote at the special meeting.

- •

- Vote Required. Approval of the proposed Asset Sale requires the affirmative vote of the holders (other than the General Partner and its affiliates) of a majority of the outstanding Partnership units. For the proposal to approve the Asset Sale, you may vote"FOR","AGAINST" or"ABSTAIN". Abstentions will not be counted as votes cast in favor of the proposal to approve the Asset Sale.If you fail to submit a proxy or to vote in person at the special meeting, or abstain, it will have the same effect as a vote "AGAINST" the proposal to approve the Asset Sale.

- •

- Proxies and Revocation. You have the right to revoke a proxy, whether delivered over the Internet, by telephone, televote or by mail, at any time before it is exercised, by voting again at a later date through any of the methods available to you, by giving written notice of revocation to our proxy solicitor, Georgeson Inc., at 199 Water Street, New York, New York 10038, Attention: Donna M. Ackerly. This notice of revocation must be received by our proxy solicitor by the time the special meeting begins, or you may revoke your proxy by attending the special meeting and voting in person.

8

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE ASSET SALE

The following questions and answers are intended to address briefly some commonly asked questions regarding the special meeting, the proposed Asset Sale and, the subsequent dissolution of the Partnership. These questions and answers may not address all the questions that may be important to you as a Partnership unitholder. Please refer to the "Summary Term Sheet" and the more detailed information contained elsewhere in this proxy statement, the annexes to this proxy statement and the documents referred to in this proxy statement. For instructions on obtaining more information, see "Where You Can Find More Information" beginning on page [ • ].

The Special Meeting

Q: Why am I receiving this proxy statement and proxy card?

- A:

- You are receiving this proxy statement and proxy card because you own limited liability partnership units ("Partnership units") of South Hertfordshire United Kingdom Fund, Ltd (the "Partnership"). ntl Fawnspring Limited (the "General Partner"), the general partner of the Partnership, has called a special meeting of unitholders. This proxy statement describes matters on which we urge you to vote and is intended to assist you in deciding how to vote your Partnership units at the special meeting.

Q: When and where is the special meeting?

- A:

- The special meeting is to be held on [ • ], 2011 at [ • ], local time, at [ • ], unless it is adjourned, recessed or postponed to a later time.

The special meeting may be adjourned, recessed or postponed by the General Partner at its discretion to another date for any proper purposes (including, without limitation, for the purpose of soliciting additional proxies), subject to applicable law.

Q: What am I being asked to vote on at the special meeting?

- A:

- ntl (B) Limited, an affiliate of our General Partner, has entered into a Share Purchase Agreement with the Partnership to acquire the Partnership's sole asset, being the Partnership's 299,390 A ordinary shares (the "Partnership Asset") of ntl (South Hertfordshire) Limited ("ntl South Herts"), which represents a 66.7% interest in ntl South Herts. In accordance with the Partnership Agreement, the Asset Sale must be approved by the holders of a majority of the outstanding Partnership units, other than the General Partner and its affiliates. Accordingly, you are being asked to consider and vote on a proposal to approve the Asset Sale.

Q: Who is entitled to vote at the special meeting?

- A:

- All unitholders who owned our Partnership units at the close of business on the record date, [ • ], are entitled to receive notice of the special meeting and to vote the Partnership units that they held on the record date at the special meeting, or any postponements or adjournments of the special meeting.

Q: What do I need to do to vote?

- A:

- You may vote using one of the following methods if you hold your units in your own name as unitholder of record:

Internet. You may submit a proxy to vote on the Internet up until 11:59 p.m. Eastern Time on [ • ] by going to the website for Internet voting on your proxy card (www.georgeson.com) and

9

Table of Contents

following the instructions on your screen. Have your proxy card available when you access the web page. If you vote by the Internet, you should not return your proxy card.

Telephone. You may submit a proxy to vote by telephone by calling the toll-free telephone number on your proxy card, 24 hours a day and up until 11:59 p.m. Eastern Time on [ • ], and following the prerecorded instructions. Have your proxy card available when you call. If you vote by telephone, you should not return your proxy card.

Mail. You may submit a proxy to vote by mail by marking the enclosed proxy card, dating and signing it, and returning it in the postage-paid envelope provided. If you own the Partnership units in various registered forms, such as jointly with your spouse, as trustee of a trust or as custodian for a minor, you will receive, and will need to sign and return, a separate proxy card for those units because they are held in a different form of record ownership. Partnership units held by a corporation or business entity must be voted by an authorized officer of the entity.

Televote™. You may submit a proxy by way of Televote™. Georgeson, our proxy solicitor, will call investors to solicit their voting instructions. The procedures for executing a vote via this method will be provided by telephone.

In Person. You may vote in person by attending the special meeting. If you plan to attend the special meeting and wish to vote in person, you will be given a ballot at the special meeting. Whether or not you plan to attend the special meeting, you should submit your proxy as described in this proxy statement.

Q: Can I change my vote after I return my proxy card?

- A:

- You have the right to revoke a proxy, whether delivered over the Internet, by telephone, televote or by mail, at any time before it is exercised, by voting again at a later date through any of the methods available to you, by giving written notice of revocation to our proxy solicitor, Georgeson Inc., at 199 Water Street, New York, New York 10038, Attention: Donna M. Ackerly. This notice of revocation must be received by our proxy solicitor by the time the special meeting begins, or you may revoke your proxy by attending the special meeting and voting in person.

Q: Can I vote in person at the special meeting rather than completing the proxy card?

- A:

- Yes, you can vote in person at the special meeting at [ • ].

Q: What is a proxy?

- A:

- A proxy is your legal designation of another person, referred to as a "proxy", to vote your Partnership units. The written document describing the matters to be considered and voted on at the special meeting is called a "proxy statement". The document used to designate a proxy to vote your Partnership units is called a "proxy card". Our General Partner has designated Robert Gale, Robert Mackenzie and Sarah Bateman, and each of them, with full power of substitution, as proxies for the special meeting.

Q: If a unitholder gives a proxy, how are the Partnership units voted?

- A:

- Regardless of the method you choose to vote, the individuals named on the enclosed proxy card, or your proxies, will vote your Partnership units in the way that you indicate. When completing the Internet or telephone processes or the proxy card, you may specify whether your Partnership units should be voted for or against or to abstain from voting on the specific items of business to come before the special meeting.

10

Table of Contents

If you properly sign your proxy card but do not mark the boxes showing how your units should be voted on a matter, the units represented by your properly signed proxy will be voted "FOR" the proposal to approve the Asset Sale.

Q: What constitutes a quorum?

- A:

- No quorum is required at the special meeting; however, in order to approve the proposal, the holders (other than the General Partner and its affiliates) of a majority of the outstanding Partnership units must vote in favor of the proposal.

Q: What vote is required to approve the Asset Sale proposal?

- A:

- In accordance with the Partnership Agreement, holders (other than the General Partner and its affiliates) of a majority of the outstanding Partnership units (representing not less than 28,468 Partnership units) must vote in favor of the proposal to approve the Asset Sale at this special meeting. If you fail to submit a proxy or vote in person at the special meeting, or abstain, the effect will be the same as a vote "AGAINST" the proposal to approve the Asset Sale and for purposes of the vote required under the Partnership Agreement.

Q: Will my vote really make a difference?

- A:

- Yes! Every vote counts and it is important to us that you have your say.YOUR VOTE IS VERY IMPORTANT, regardless of the number of Partnership units you own. We cannot complete the proposed Asset Sale and the distribution of proceeds in connection with the dissolution of the Partnership unless the holders (other than the General Partner and its affiliates) of a majority of the outstanding Partnership units vote to approve the Asset Sale.

The Asset Sale

Q: What is the proposed Asset Sale?

- A:

- The Partnership has agreed to sell, and ntl (B) Limited has agreed to buy, the Partnership Asset for £14,293,000 ($22,864,513, assuming an exchange rate of $1.5997 per £1.00, which is referred to as the "Current Exchange Rate"), subject to the approval by holders (other than the General Partner and its affiliates) of a majority of the outstanding Partnership units. The actual U.S. dollar value of the purchase price for the Partnership Asset at the time of the Asset Sale is dependent on the exchange rate between the U.K. pound sterling and the U.S. dollar at that time. The Asset Sale is subject to the terms and conditions set forth in the Share Purchase Agreement as described below under "The Share Purchase Agreement", beginning on page [ • ]. The Partnership Asset proposed to be sold is the Partnership's 299,390 A ordinary shares of ntl South Herts, representing a 66.7% ownership interest in ntl South Herts. The Partnership Asset constitutes the sole asset of the Partnership.

Q: How were the purchase price to be paid for the Partnership Asset and the other terms of the Asset Sale determined?

- A:

- The Partnership Agreement provides for the price to be paid in a sale of the Partnership Asset to an affiliate of the General Partner to be determined by the average of three separate independent appraisals of the fair market value of the Partnership Asset and for the sale to be approved by holders (other than the General Partner and its affiliates) of a majority of Partnership units. The purchase price to be paid by ntl (B) Limited for the Partnership Asset represents the average of three separate independent appraisals, which appraisals are more fully described below under "Reports of the Independent Appraisers" beginning on page [ • ]. The purchase price was determined in accordance with the Partnership Agreement and was not subject to arm's-length

11

Table of Contents

negotiation. As the General Partner and the Partnership do not have any employees or management other than the employees and management of Virgin Media, Inc., none of the other terms of the Asset Sale or the Share Purchase Agreement were subject to arm's-length negotiation. Any transaction between the General Partner and an affiliate of Virgin Media Inc. should not be deemed to be free of conflicts of interest.

Q: What will happen if the vote to approve the sale of the Partnership Asset is passed?

- A:

- If the unitholders approve the Asset Sale and the other conditions in the Share Purchase Agreement have been met, the Asset Sale will be consummated no later than three business days after the Partnership gives notice that the conditions to closing have been satisfied, or on another date as the parties may agree.

Following the completion of the Asset Sale, the Partnership will be dissolved and the General Partner will commence the process of liquidating and winding up the Partnership in accordance with the Partnership Agreement and Colorado law.

In connection with the dissolution of the Partnership, the General Partner intends to first pay or provide for the outstanding liabilities and obligations of the Partnership (including indebtedness owed by the Partnership to Virgin Media Inc. and its affiliates). The General Partner intends to then convert the remaining proceeds of the Asset Sale from U.K. pounds sterling into U.S. dollars and pay or provide for expenses to be incurred by the Partnership prior to and in connection with its dissolution and winding up. The General Partner also intends to establish cash reserves (the "Cash Reserves") in an amount equal to $335,000 out of Partnership funds for the payment of contingent or unforeseen liabilities of the Partnership. The General Partner may increase the amount of the Cash Reserves if, prior to the initial distribution to unitholders, the General Partner becomes aware of circumstances or events that in its judgment would increase the amount of potential liabilities (or the likelihood of their realization) of the Partnership following its dissolution. Portions of the Cash Reserves may be used to pay any indemnification obligations of the Partnership in favor of the General Partner permitted under the terms of the Partnership Agreement.

Amounts of the Cash Reserves remaining after payment of any contingent or unforeseen liabilities will be distributed by the General Partner at a later date to be established by the General Partner in its discretion.

Subsequent to the Asset Sale, the Partnership may seek termination of its obligation to file reports under the Exchange Act. Following the Asset Sale, the dissolution of the Partnership and the distributions of all remaining Partnership funds to unitholders of record, the Partnership will be terminated and will cease to exist.

Q: What will I receive if the Asset Sale and the dissolution of the Partnership is completed?

- A:

- Upon completion of the Asset Sale and after paying or providing for the outstanding liabilities and obligations of the Partnership and establishing the Cash Reserves, the General Partner estimates that unitholders of record as of the record date of the initial distribution will receive a distribution of approximately $300 per unit (assuming the Current Exchange Rate), without interest, less any applicable withholding taxes, for each Partnership unit that they own.

Amounts reserved by the General Partner remaining after payment of any contingent or unforeseen liabilities will be distributed by the General Partner at a later date to be established by the General Partner in its discretion. The actual amounts distributed to unitholders will depend on, among other things, the actual amount of liabilities and obligations of the Partnership upon our dissolution (including contingent and unforeseen liabilities to be paid for out of the Cash

12

Table of Contents

Reserves), expenses incurred by us prior to or in connection with our dissolution and winding up, the actual amount of the General Partner's capital account deficit, and the exchange rate at the time the proceeds of the Asset Sale are converted into U.S. Dollars.

Q: When is the Asset Sale and the dissolution of the Partnership expected to be completed if approved by the Partnership unitholders?

- A:

- We are working toward completing the Asset Sale as quickly as possible after the special meeting date. The Asset Sale cannot be completed until certain conditions are satisfied, including the approval by the Partnership's unitholders at the special meeting. If the holders of a majority of the outstanding Partnership units vote in favor of the Asset Sale proposal and the other conditions set forth in the Share Purchase Agreement are met, the Asset Sale will be consummated no later than three business days after the Partnership gives notice of the satisfaction of such conditions, or on another date as the parties may agree. Upon the completion of the Asset Sale, the Partnership will be dissolved and the General Partner will commence the process of liquidating and winding up the Partnership. The General Partner expects to cause the Partnership to make the initial distribution to unitholders as soon as reasonably practical following the commencement of the dissolution of the Partnership.

Q: What will happen if the Asset Sale is not approved?

- A:

- If the Asset Sale is not approved by the unitholders or if the Asset Sale is not completed for any other reason, the Partnership will retain its interest in ntl South Herts and the Partnership's unitholders will not receive any payment for their Partnership units in connection with the Asset Sale. Instead, the Partnership will continue its operations and the Partnership units will continue to be registered with the Securities and Exchange Commission ("SEC"). The Partnership Agreement provides that the Partnership will be dissolved upon the scheduled expiration of the Partnership's term on December 31, 2016, at which time the Partnership will be dissolved and liquidated in accordance with the Partnership Agreement.

Q: Why is the Partnership engaging in the Asset Sale at the present time?

- A:

- As more fully set forth below under "The General Partner's Reasons for the Asset Sale and Factors Considered in Determining Fairness" beginning on page [ • ], the proposed Asset Sale will provide unitholders with an opportunity to liquidate their investment in the Partnership units, at a price determined in accordance with the Partnership Agreement, in advance of the scheduled expiration of the Partnership term on December 31, 2016. While at the present time ntl (B) Limited is willing and able to engage in the Asset Sale subject to the terms and conditions of the Share Purchase Agreement, there can be no assurance that ntl (B) Limited or any other affiliate of Virgin Media Inc. will have the financial means or willingness to engage in a similar transaction in the future. In addition, there can be no assurance that, prior to or upon the expiration of the Partnership term, any other party would offer to acquire the Partnership Asset for an amount equal to or greater than the purchase price contemplated in the proposed Asset Sale or that unitholders would receive distributions equal to or greater than the distributions expected to be made in connection with the Asset Sale.

Q: What are the material U.S. federal income tax consequences of the Asset Sale and the dissolution of the Partnership to me?

- A:

- For U.S. federal income tax purposes each unitholder will be required to include in its income (subject to certain limitations) its allocable share of the loss (or gain) realized by the Partnership upon the sale of the Partnership Asset pursuant to the Asset Sale and will recognize loss (or gain) to the extent the amount of the liquidating distribution received by the unitholder is less than (or

13

Table of Contents

exceeds) the unitholder's adjusted tax basis in its Partnership units. You should consult your own tax advisor for a complete analysis of the effect of the Asset Sale and the dissolution of the Partnership on your federal, state and local and/or foreign taxes. See "Material U.S. Federal Income Tax Consequences of the Asset Sale and Dissolution of the Partnership" for more detail including information regarding limitations on the ability to claim certain losses realized by the Partnership.

Q: Who can help answer my other questions?

- A:

- If you have additional questions about the Asset Sale proposal, need assistance in submitting your proxy or voting your Partnership units, or need additional copies of this proxy statement or the enclosed proxy card, please contact Georgeson Inc., our proxy solicitor, by calling toll-free at 877-797-1153. If calling from outside the United States, please call collect at 212-440-9800. You can also email Georgeson at southherts@georgeson.com.

14

Table of Contents

SPECIAL FACTORS

The Parties to the Asset Sale

The Partnership

We are a Colorado limited partnership formed on December 31, 1991 in connection with the public offering of our Partnership units for the purpose of acquiring, constructing, developing, owning and operating cable television/telephone systems in the United Kingdom. Our sole asset consists of a 66.7% ownership interest in ntl South Herts.

Our business is managed by our General Partner and our only operations consist of those of ntl South Herts. We do not directly employ personnel of our own. The various personnel required to carry out our business and the operations of ntl South Herts are employed by affiliates of Virgin Media Inc., including Virgin Media Limited, an indirect wholly owned subsidiary of Virgin Media Inc. We rely on Virgin Media Inc.'s management, organization, financing and infrastructure to carry on our business and operations.

The General Partner

The General Partner is an English company incorporated on April 29, 1994 and is an indirect wholly owned subsidiary of Virgin Media Inc. The General Partner manages our business, properties and activities in accordance with the terms of the Partnership Agreement, although operating control is delegated to other affiliated companies of Virgin Media Inc. The General Partner holds a general partnership interest in the Partnership, but will not vote on the proposal to approve the Asset Sale. Neither Virgin Media Inc., ntl (B) Limited nor any of their affiliates hold any Partnership units.

ntl (B) Limited

ntl (B) Limited is an English company incorporated on July 30, 1992 and is an indirect wholly owned subsidiary of Virgin Media Inc. ntl (B) Limited holds the 33.3% of the shares of ntl South Herts not owned by the Partnership and has no other assets or operations. ntl (B) Limited relies on the employees and management of Virgin Media Inc. for its business and operations.

For further information regarding the parties to the Asset Sale, see "Past Contacts, Transactions, Negotiations and Agreements" beginning on page [ • ], "Other Important Information Regarding the Partnership" beginning on page [ • ] and "Other Important Information Regarding the General Partner, ntl (B) Limited and Their Affiliates" beginning on page [ • ]. In addition, see our Annual Report on Form 10-K for the fiscal year ended December 31, 2009, which is attached asAnnex B to this proxy statement and is referred to as the "Form 10-K", and our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2010, which is attached to this proxy statement asAnnex C and is referred to as the "Third Quarter Form 10-Q". The Form 10-K attached to this proxy statement does not include the exhibits originally filed with that report.

The Partnership Asset

The Partnership Asset consists of our 299,390 A ordinary shares of ntl South Herts, which represents a 66.7% ownership interest in ntl South Herts. ntl (B) Limited holds the remaining stake in ntl South Herts.

ntl South Herts is an English company principally engaged in the development, construction, management and operation of broadband communications networks for telephone, cable television and internet services in the United Kingdom.

15

Table of Contents

The area covered by the ntl South Herts cable television/telephone system, which is referred to as the franchise area, comprises the administrative areas in South Hertfordshire: Three Rivers, Watford and Hertsmere. Construction in the franchise area is complete.

As of September 30, 2010, ntl South Herts serviced 28,103 digital television subscribers, 30,539 residential telephony subscribers and 29,163 broadband internet subscribers, representing a total of 34,829 residential customers.

ntl South Herts owns the local cable television/telephone network infrastructure, but it is not a stand-alone business as its network is totally integrated with that of Virgin Media Inc. and its affiliates. Virgin Media Limited performs a variety of management functions and procures services on behalf of ntl South Herts, including technology infrastructure, cable television content, marketing and billing services, customer and technical support, financing and back office services, and employs the various personnel required to operate the cable television/telephone network. ntl South Herts' customers procure services through Virgin Media Limited and its affiliates and under the Virgin Media name.

Management control of ntl South Herts is exercised by our General Partner, although operating control is delegated to Virgin Media Limited and other affiliated companies of Virgin Media Inc.

For further information regarding ntl South Herts, see "Past Contacts, Transactions, Negotiations and Agreements" beginning on page [ • ] and our Form 10-K and Third Quarter Form 10-Q, which are attached to this proxy statement asAnnex B andAnnex C, respectively.

Certain Relevant Provisions of the Partnership Agreement

Dissolution

Under the Partnership Agreement, the term of the Partnership will expire on December 31, 2016, at which time the Partnership will be dissolved. Prior to this date, however the Partnership shall also be dissolved upon the occurrence of certain other events, including the disposition of substantially all of the assets of the Partnership or upon a vote by the unitholders to dissolve the Partnership. The Asset Sale will constitute a disposition of substantially all of the assets of the Partnership.

The Partnership Agreement provides that upon the dissolution of the Partnership, the General Partner will wind up the affairs of the Partnership, sell all of the assets of the Partnership and pay or provide for all of its liabilities including the costs of dissolution and fees due to the General Partner. The General Partner will then distribute the remainder of the Partnership's funds to the unitholders and the General Partner in accordance with the distribution priorities specified in the Partnership Agreement. The General Partner will also be required to contribute funds equal to the amount of any accumulated deficit that may exist in the capital account of the General Partner. Upon completion of the dissolution, the Partnership will be terminated.

Certain Sales of Partnership Assets

The Partnership Agreement provides that the General Partner may sell cable television/telephony property, including shares of a company holding cable television/telephony property such as the Partnership Asset, to the General Partner or its affiliates if the sale price for the property is determined by the average of three separate independent appraisals of the fair market value of the property and if the sale is approved by unitholders (other than the General Partner and its affiliates) holding a majority of the outstanding Partnership units. The cost of the appraisals is borne by the General Partner or its affiliate and not by the Partnership.

16

Table of Contents

Allocations of Book Loss

Pursuant to the Partnership Agreement, for purposes of determining the capital accounts of the partners, items of loss are generally required to be allocated 99% to the unitholders and 1% to the General Partner. Additionally, if a Partnership asset is sold at a loss as determined for book purposes pursuant to the Partnership Agreement after the admission of additional unitholders as limited partners, book loss is to be allocated as deemed appropriate by the General Partner on the advice of its counsel or its accountants to conform the allocations to the order of distributions described in Section 5.4(b) of the Partnership Agreement. Section 5.4(b) of the Partnership Agreement requires certain distributions to be made first to each unitholder in an amount that will equal the unitholder's adjusted capital contribution (generally, the amount of cash contributed by the unitholder to the Partnership taking into account certain adjustments thereto), and if the amount of the distribution is insufficient to satisfy that amount, in proportion to the amount which each unitholder would receive if the amount were sufficient. The General Partner will allocate the loss on the disposition of the Partnership Asset (i) 99% to the unitholders and 1% to the General Partner, and (ii) among the unitholders, so that each unitholder will have an equal capital account per unit, an allocation which would cause each unitholder to receive distributions in proportion to that unitholder's capital contribution.

Certain Distributions

Under the Partnership Agreement any distribution upon dissolution of the Partnership Agreement is made as follows: first, to each unitholder having a positive balance in its capital account after having income or gain allocated pursuant to the Partnership Agreement in an amount equal to such positive balance in proportion to such positive balance, but in an amount not to exceed each unitholder's capital contributions after taking into account certain adjustments thereto; second, to each unitholder having a positive balance in its capital account after having income or gain allocated pursuant to the Partnership Agreement in an amount equal to such positive balance in proportion to such positive balance, but in an amount not to exceed each unitholder's 12% per annum return; third to the General Partner to the extent it has a positive balance in its capital account after having income or gain allocated to it pursuant to the Partnership Agreement in an amount equal to such positive balances. Since the amounts that will be distributed in connection with the Asset Sale will not exceed each unitholder's capital contributions, distributions will be made only to the unitholders, in proportion to their positive capital account balances. The capital account balances, subsequent to the allocation of book losses described above under "—Allocations of Book Loss", will be equal for each Partnership unit, and, accordingly, distributions will be made equally with respect to each Partnership unit. No distributions will be made to the General Partner with respect to its general partnership interest.

Certain Restrictions on Transfers of Partnership Units

The Partnership Agreement contains certain restrictions on the assignment and transfer of Partnership units, including the following:

- •

- that Partnership units may be assigned only with the consent of the General Partner in its sole discretion;

- •

- the transfer of Partnership units must be accomplished by an instrument in writing, in form and substance satisfactory to the General Partner, which writing may include a power of attorney and which shall set forth if it is the intention that the purchaser is to be an additional limited partner of the Partnership;

- •

- no assignments will be permitted if such assignments would result in 50% or more of the interests being transferred within a twelve-month period;

17

Table of Contents

- •

- the transferor and the purchaser must execute and deliver to the General Partner an amended Partnership Agreement;

- •

- the purchaser shall become a limited partner of the Partnership only upon amendment of the Partnership Agreement; and

- •

- the General Partner may also refuse to consent to any transfer if, in its sole discretion and judgment, the transfer would cause the aggregate transfers to exceed permissible safe harbors under administrative interpretations under Section 7704 of the Internal Revenue Code of 1986, as amended.

Notwithstanding the foregoing and the other applicable restrictions on assignments and transfers contained in the Partnership Agreement, the economic benefits of ownership of the Partnership units may be transferred without receiving the written consent of the General Partner or executing an amended Partnership Agreement.

Dissolution of the Partnership Following the Asset Sale and Distributions to Unitholders

The Asset Sale will constitute the sale of all of our assets, which will result in the dissolution and, ultimately, the termination of the Partnership. Immediately following the completion of the Asset Sale, the General Partner intends to begin to wind up our affairs in accordance with the terms of the Partnership Agreement and Colorado law.

The General Partner intends first to apply the proceeds received by us in the Asset Sale to pay or provide for our outstanding liabilities and obligations. As of September 30, 2010, our outstanding liabilities totalled approximately £3.1 million. These outstanding liabilities were comprised solely of debt obligations owed to Virgin Media Limited, an indirectly wholly owned subsidiary of Virgin Media Inc. and an affiliate of the General Partner and ntl (B) Limited, as more fully described under "Past Contacts, Transactions, Negotiations and Agreements" beginning on page [ • ].

After paying or providing for our outstanding liabilities and obligations, the General Partner intends to convert the remaining proceeds into U.S. Dollars at the spot exchange rate and pay or provide for expenses to be incurred by the Partnership prior to and in connection with its dissolution and winding up. We currently estimate that we will incur approximately $645,000 in additional transaction, operating and other expenses prior to or in connection with our dissolution and winding up, which will be paid or provided for out of Partnership funds. Other than costs and expenses attributable to the dissolution and winding up of the Partnership, including certain costs incurred in connection with this proxy solicitation, ntl (B) Limited will pay for any expenses in connection with the Asset Sale, including the fees associated with obtaining the three independent appraisals.