UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One) |

|

ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended December 31, 2005 |

|

or |

|

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the transition period from to |

Commission file number: 000-19889

South Hertfordshire United Kingdom Fund, Ltd.

(Exact name of registrant as specified in its charter)

Colorado | | 84-1145140 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

ntl House, Bartley Wood Business Park, Hook,

Hampshire, RG27 9UP, England

+44 1256 752000

(Address and Telephone Number of Principal

Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities Registered Pursuant to Section 12(g) of the Act:

Limited Partnership Interests

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant’s limited partnership interests held by non-affiliates as of June 30, 2005, based on a price per limited partnership interest of $91.18, which was the weighted average price at which limited partnership interests were transferred during the second fiscal quarter, was $5,191,333.

As of March 24, 2006, there were 56,935 limited partnership interests of the Registrant outstanding. There is no established public market for the Registrant’s limited partnership interests.

DOCUMENTS INCORPORATED BY REFERENCE

None

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

Various statements contained in this document constitute “forward-looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995. Words like “believe,” “anticipate,” “should,” “intend,” “plan,” “will,” “expects,” “estimates,” “projects,” “positioned,” “strategy,” and similar expressions identify these forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements or industry results to be materially different from those contemplated, projected, forecasted, estimated or budgeted whether expressed or implied, by these forward-looking statements. These factors include those set forth under the caption “Risk Factors” in the Form 10-K filed on March 1, 2006 by NTL Incorporated, (now known as NTL Holdings Inc.) such as:

• The failure to obtain and retain expected synergies from the merger between NTL Incorporated and Telewest Global, Inc. or Telewest;

• Rates of success in executing, managing and integrating key acquisitions, including the merger between NTL and Telewest;

• The ability to achieve business plans for the combined NTL/Telewest group;

• NTL Incorporated’s (formerly known as Telewest Global, Inc.) or NTL’s ability to manage and maintain key customer relationships;

• NTL’s ability to fund debt service obligations through operating cash flow;

• NTL’s ability to obtain additional financing in the future and react to competitive and technological changes;

• NTL’s ability to comply with restrictive covenants in its indebtedness agreements;

• NTL’s ability to control customer churn;

• NTL’s ability to compete with a range of other communications and content providers;

• The effect of technological changes on NTL’s businesses;

• The functionality or market acceptance of new products that NTL may introduce;

• Possible losses in revenues due to systems failures;

• NTL’s ability to maintain and upgrade its networks in a cost-effective and timely manner;

• NTL’s reliance on single-source suppliers for some equipment and software;

• NTL’s ability to provide attractive programming at a reasonable cost; and

• The extent to which NTL’s future earnings will be sufficient to cover its fixed charges.

We assume no obligation to update the forward-looking statements contained herein to reflect actual results, changes in assumptions or changes in factors affecting these statements.

4

PART I

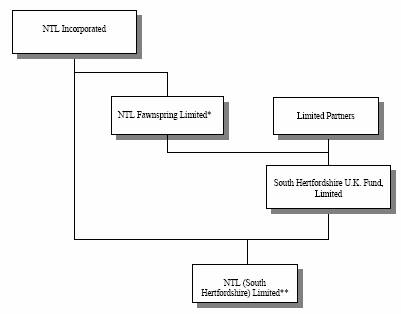

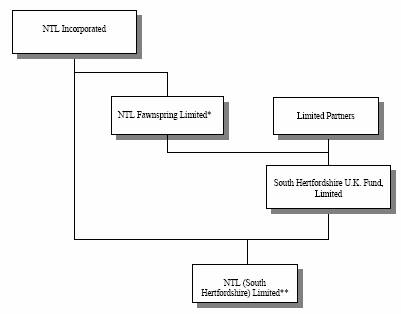

NTL CORPORATE STRUCTURE

Historical Structure

We are a Colorado limited partnership that was formed in December 1991 pursuant to the public offering of our limited partnership interests for the purpose of acquiring one or more cable television/telephone systems in the U.K. Upon acquisition of our system, our primary investment objective was to obtain capital appreciation in the value of our investment in the system over the term such investment is held by us.

We hold 66.7% of the shares of NTL (South Hertfordshire) Limited, or NTL South Herts, which is principally engaged in the development, construction, management and operation of broadband communications networks for telephone, cable television and internet services in the U.K. As a result of our ownership of 66.7% of the shares of NTL South Herts, for accounting purposes we have consolidated the results of NTL South Herts with our results. NTL indirectly holds the remaining 33.3% of the shares of NTL South Herts. We are reliant on the support of NTL, the indirect parent company of NTL Fawnspring Limited, our General Partner, to continue our operations as a going concern.

The General Partner may, pursuant to our Partnership Agreement, provide consulting services to us or delegate the performance of such consulting services to NTL or other affiliates. The General Partner purchased one of our partnership interests by contributing $1,000 to our capital.

On January 10, 2003, NTL emerged from reorganization under Chapter 11 of the U.S. Bankruptcy Code. Pursuant to the plan of reorganization, which we refer to as the Plan, NTL’s former parent, NTL Europe, Inc, or NTL Europe, and its subsidiaries and affiliates, were split into two separate groups, with NTL and NTL Europe each emerging as independent public companies. NTL was renamed “NTL Incorporated” and became the holding company for the former NTL group’s principal U.K. and Ireland assets and the ultimate parent company of our General Partner. NTL Europe became the holding company for the former NTL group’s continental European and various other assets. All of the outstanding securities of NTL’s former parent and some of its subsidiaries, including NTL, were cancelled. NTL issued shares of its common stock and Series A warrants, and NTL Europe issued shares of its common stock and preferred stock, to various former creditors and stockholders. As a result, NTL and we are no longer affiliated with NTL Europe, which has since changed its name to PTV Inc., or PTV.

Effective March 3, 2006, pursuant to the Amended and Restated Agreement and Plan of Merger, dated as of December 14, 2005, as amended by Amendment No.1 thereto, among Telewest Global, Inc., NTL Incorporated, Neptune Bridge Borrower LLC, and, for certain limited purposes set forth therein, Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of Old NTL, Neptune Bridge Borrower LLC was merged with and into NTL Incorporated, which was renamed “NTL Holdings Inc.” in the merger, continuing as the surviving corporation and as a wholly owned subsidiary of Telewest Global, Inc. Immediately following the Merger, the name of the registrant was changed from “Telewest Global, Inc.” to “NTL Incorporated.”

5

Summary Corporate Structure

The following chart shows on a condensed basis the corporate structure of NTL and its relationship to us as of December 31, 2005. The chart does not show NTL’s operating or other intermediate companies.

* NTL Fawnspring Limited, an indirect wholly-owned subsidiary of NTL and our General Partner.

** NTL (South Hertfordshire) Limited, or NTL South Herts, our 66.7% subsidiary of which NTL owns 33.3%.

6

Exchange rates

The following table sets forth, for the periods indicated, the high, low, period average and period end noon buying rate in the City of New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York expressed as U.S. dollars per £1.00. The noon buying rate of the pound sterling on March 24, 2006 was $1.7427 per £1.00.

Year Ended December 31, | | Period End | | Average(1) | | High | | Low | |

| | | | | | | | | |

2003 | | 1.78 | | 1.64 | | 1.78 | | 1.55 | |

2004 | | 1.92 | | 1.84 | | 1.95 | | 1.75 | |

2005 | | 1.72 | | 1.81 | | 1.93 | | 1.71 | |

2006 (through March 24, 2006) | | 1.74 | | 1.74 | | 1.79 | | 1.73 | |

(1) The average rate is the average of the noon buying rates on the last day of each month during the relevant period.

The above rates may differ from the actual rates used in the preparation of the consolidated financial statements and other financial information appearing in this annual report on Form 10-K. Our inclusion of these exchange rates is not meant to suggest that the pound sterling amounts actually represent these U.S. dollar amounts or that these amounts could have been converted into U.S. dollars at any particular rate, if at all.

Unless we otherwise indicate, all U.S. dollar amounts as of December 31, 2005 are translated to U.S. dollars at an exchange rate of $1.7188 to £1.00, and all amounts disclosed for the year ended December 31, 2005 are based on an average exchange rate of $1.82 to £1.00. All amounts disclosed as of December 31, 2004 are based on an exchange rate of $1.9160 to £1.00, and all amounts disclosed for the year ended December 31, 2004 are based on an average exchange rate of $1.8326 to £1.00. All amounts disclosed as of December 31, 2003 are based on an exchange rate of $1.7842 to £1.00, and all amounts disclosed for the year ended December 31, 2003 are based on an average exchange rate of $1.6348 to £1.00. U.S. dollar amounts for any individual quarter are determined by multiplying the pound sterling financial result for the period from January 1 to the end of the current quarter by the average exchange rate for the same period and subtracting from this total the U.S. dollar converted financial result for the period from January 1 to the end of the previous quarter of that fiscal year as computed above. The variation among the exchange rates for 2005, 2004 and 2003 has impacted the dollar comparisons significantly.

7

Item 1. Business

About South Hertfordshire U.K. Fund, Ltd

We are a Colorado limited partnership that was formed in December 1991 pursuant to the public offering of our limited partnership interests for the purpose of acquiring one or more cable television/telephone systems in the United Kingdom, or U.K. Upon acquisition of our system, our primary investment objective was to obtain capital appreciation in the value of our investment in the system over the term such investment is held by us.

We hold 66.7% of the shares of NTL (South Hertfordshire) Limited, or NTL South Herts, which is principally engaged in the development, construction, management and operation of broadband communications networks for telephone, cable television and internet services in the U.K. As a result of our ownership of 66.7% of the shares of NTL South Herts, for accounting purposes we have consolidated the results of NTL South Herts with our results. NTL indirectly holds the remaining 33.3% of the shares of NTL South Herts. We are reliant on the support of NTL, the ultimate parent company of the General Partner, to continue our operations as a going concern.

We, as well as NTL, file annual, quarterly, and current reports with the SEC. You may read and copy any materials we or NTL files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You may also access electronically the information we file with the SEC via its website, located at http://www.sec.gov.

About NTL South Herts

Franchise Area

The South Hertfordshire franchise area comprises the three administrative areas of Three Rivers, Watford and Hertsmere. The franchise area covers commuter suburbs of London, and many people who reside in the franchise area use the available fast rail and motorway services to travel to work in central London. South Hertfordshire has benefited from the completion in 1986 of the M25 London Motorway, which makes commuting from the franchise area to other areas in or near London more convenient. An M1 motorway link exists to give London-bound commuters direct access from Watford to the London highway system. The M1 link is half a mile from our headend. There are approximately 95,000 homes in the franchise area, of which approximately 94,000 are passed by our cable television/telephone network. Construction in the franchise area is substantially complete.

Operations

Construction of a cable television-only network in the South Hertfordshire franchise area commenced in early 1991 and, integrated cable television/telephone network architecture was developed for this franchise in late 1991. As of December 31, 2005, approximately 94,000 of the total homes in this area had been passed. Cable television services commenced in April 1992 and telephone services commenced in February 1993, following completion of the installation of a telephone switch. In January 2000, NTL commenced the rollout of digital cable television services within the South Herts franchise and in 2001 commenced broadband internet access services. As of December 31, 2005, NTL South Herts serviced 21,709 digital cable customers, 31,927 residential telephone customers and 20,078 broadband customers, representing a total of 36,975 customers with a penetration level of 39.2%.

Management control is exercised by NTL Fawnspring Limited, a U.K. corporation, which is a wholly owned indirect subsidiary of NTL and is our General Partner, although management control is delegated to other affiliated companies of NTL. Our business is managed by NTL Group Limited, or NTLG, a subsidiary of NTL, from its headquarters in Hook, Hampshire. NTL and we believe that management of our business as an integral part of the larger NTL group reaps the benefits of synergy and maximizes returns. NTLG performs a variety of management functions and procures services on our behalf. Pursuant to an agreement with NTLG, we have the legal right to offset amounts receivable from NTLG against amounts payable to NTLG. Consequently, the net balance payable to NTL is disclosed under accounts payable to affiliates and related parties in the accompanying financial statements.

Our operations are fully integrated into the operations of NTL. Accordingly, the following business description describes NTL’s operations of which we comprise a part.

8

NTL’s Business

On March 3, 2006 NTL (Old NTL) merged into a subsidiary of Telewest Global, Inc., pursuant to which the two businesses have combined, creating the UK’s second largest communications company. Immediately following the merger, Telewest Global, Inc. changed its name to NTL Incorporated (New NTL).

Following the merger, which was effective on March 3, 2006, NTL’s stockholders owned approximately 75% and Telewest stockholders approximately 25% of the combined company on a fully diluted basis. Following the merger, NTL, which has changed its name to NTL Holdings Inc. is wholly owned by New NTL. NTL’s common stock, which traded on NASDAQ under the symbol “NTLI,” was delisted. Telewest’s ticker symbol was changed to “NTLI.”

Further details relating to the merger are contained in NTL’s Form 8-K, which was filed on March 3, 2006.

NTL was incorporated in 1993 as a Delaware corporation. New NTL was incorporated in 2003 as a Delaware corporation. New NTL’s principal executive offices are located at 909 Third Avenue, Suite 2863, New York, New York 10022, United States, and NTL’s telephone number is (212) 906-8440. New NTL’s U.K. headquarters are located outside of London, England in Hook, Hampshire, United Kingdom. New NTL’s website is www.ntl.com and the investor relations section of their website can be accessed under the heading “Investors” where New NTL makes available free of charge annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments thereto, as soon as reasonably practical after they are filed with the SEC.

The following description relates to Telewest’s business prior to its merger with NTL.

Telewest is a leading broadband communications and media group in the U.K., providing:

• television, telephone and internet access services to residential customers in the U.K.;

• voice, data and managed solutions services for businesses in the U.K.;

• basic television channels and related services to the U.K. multi-channel broadcasting market; and

• a wide variety of consumer products by means of auction-based televised shopping programs.

Telewest’s television and communications services are delivered through its wholly owned broadband, local access communications network, passing approximately 4.7 million homes in the U.K. Telewest’s networks consist of local distribution networks, a “national network” and an internet protocol, or IP, services platform and provide high-speed interconnection and two-way interactivity with directly connected residential and business customers. Like NTL, Telewest offers the “triple play” of internet, telephone and television services to its residential customers.

Telewest’s television channels, auction-based shopping programs and related services are provided through its wholly owned subsidiaries, Flextech Limited, or Flextech, and sit-up Limited, or sit-up. Flextech has ten genre-based entertainment channels, four of which are multi-phased versions of its other channels. Flextech also owns a 50% interest in the companies that comprise the UKTV Group, a series of joint ventures with BBC Worldwide Limited, or BBC Worldwide. Together Flextech and the UKTV Group are the largest supplier of basic channels to the U.K. pay-television market. sit-up provides a wide-variety of consumer products through three interactive auction-based television channels: price drop TV, bid tv and speed auction tv.

The following description relates to NTL’s business prior to its merger with Telewest.

NTL is one of the leading communications and content distribution companies in the U.K., providing internet access, telephone and television services to 3.3 million residential customers, including 1.8 million broadband customers. NTL also provide internet and telephone services to its residential customers who are not connected to its cable network via access to other companies’ telecommunications networks and via an internet service provider operated by its subsidiary, Virgin Net Limited. NTL offers what it refers to as a “triple play” bundle of internet, telephone and television services through competitively priced bundled packages. NTL also provides a range of voice services to businesses and public sector organizations, as well as a variety of data communications solutions from high speed internet access to fully managed business communications networks and communication transport services.

NTL’s services are delivered through its wholly owned local access communications network passing approximately 7.7 million homes in the U.K. The design and capability of NTL’s network provides it with the ability to offer “triple play” bundled services to residential customers and a broad portfolio of reliable, competitive communications solutions to business customers.

9

NTL provided services to customers through two sales channels: Consumer and Business.

Consumer

NTL provides broadband and dial-up internet, telephone and television services to residential customers in the U.K.

NTL’s services to residential customers are distributed principally via its wholly-owned, local access communications network to an addressable market of approximately 7.7 million homes in the U.K. The network covers parts of many major metropolitan areas in the U.K., and includes England, Wales and Scotland. In addition, NTL provides services to residential customers not connected to its network via access to other telecommunications networks and via an ISP, virgin.net, operated through its subsidiary Virgin Net Limited.

NTL’s wholly-owned, local access communications network provides it with several competitive advantages in its industry:

• it provides real two-way interactivity with residential customers who are connected to the network;

• it enables NTL to provide true “triple play” bundled services of internet, telephone and television services to residential customers in its franchise areas without relying on another service provider or network; and

• the connection of customers to its networks is by means of a twin cable, consisting of both coaxial and twisted copper pair elements enabling NTL to deliver broadband and high-speed services over each type of cable to customers. NTL’s length of copper pairs is generally much shorter than its principal telephone competitor, allowing potentially higher speed services to be utilized in the future.

In contrast:

• direct to home satellite service providers do not have the capacity to offer two-way interactivity except by adding a phone line or other cable facility; and

• telephone service providers today have only a limited capacity to provide video over existing digital subscriber lines, or DSL, technology.

NTL’s packaging and pricing are designed to encourage its residential customers to use multiple bundled services like dual telephone and broadband internet access, dual telephone and dial-up internet access, dual telephone and television, or triple telephone, television and internet access. For example, NTL’s Family Pack bundle offers over 100 television channels and a telephone line rental. In addition, NTL’s “value packs” offer discounts to subscribers taking two or more products.

NTL believes that it is well-positioned in its service areas to use bundling to increase its customer base, reduce its customer churn rate and increase its profitability. As of December 31, 2005, approximately two thirds of its residential customers received multiple services from NTL. NTL refers to each service it provides as a revenue generating unit, or RGU, and, as of December 31, 2005, each of its on-net customers represented on average approximately two revenue generating units. For example, if NTL provided one customer with broadband internet and telephone services, this customer would represent two RGUs. NTL’s “triple play” customer base has been increasing as a percentage of its total residential customers. At the end of the fourth quarter of 2004, 24.0% of NTL’s on-net customers were triple play customers, and as of December 31, 2005, 29.3% of NTL’s on-net customers were triple play.

10

In its service areas, NTL is the primary service provider that provides the full range of services that NTL offers, although competition in each of these services individually is significant and some of the other service providers have substantial resources. See “—Competition.”

The table below shows other typical service providers who offer their services in NTL’s areas:

| | | | BT | | BSkyB | | Broadband

Resellers | | Telephone

Resellers | | Freeview | | Home

Choice | | TUTV | |

| | NTL | | (1) | | (1) | | (2) | | (3) | | (4) | | (5) | | (6) | |

Telephone | | ü | | ü | | × | | × | | ü | | × | | ü | | × | |

Broadband Internet | | ü | | ü | | × | | ü | | ü | | × | | ü | | × | |

Dial Up | | ü | | ü | | × | | ü | | ü | | × | | × | | × | |

Television | | ü | | × | | ü | | × | | × | | ü | | ü | | ü | |

Bundled services | | ü | | × | | × | | × | | × | | × | | ü | | × | |

ü = service available

× = service not available

(1) Although BT Group plc, referred to as BT, and British Sky Broadcasting Group plc, referred to as BSkyB, co-market each other’s telephone and television services, customer and technical support remains distinct and customers are required to retain and pay for the different services separately. BSkyB also offers a CPS service through Sky Talk.

(2) For example, Wanadoo.

(3) For example, Alpha Telecom, Tesco and Carphone Warehouse’s Talk Talk.

(4) Freeview refers to a free-to-air digital television service offered by a consortium. Freeview provides digital television services through a Freeview-enabled set-top box or a television with a digital tuner, with no subscription fees for basic service of about 35 channels. For a subscription fee, some additional channels are available.

(5) Home Choice is the brand name for Video Networks Ltd., whose services are available only in parts of the London metropolitan area.

(6) TUTV refers to Top Up TV, a company offering approximately eleven pay TV channels available to subscribers who otherwise receive Freeview and have purchased TUTV software.

Internet Services

NTL offers several different packages of broadband and dial-up internet services with different features, speeds and pricing. NTL provides broadband and dial-up internet services to customers within reach of its access network, by direct connection to its network. NTL also provides broadband and dial-up internet services to customers not within reach of its access network by providing a connection to its network via BT’s local access network. NTL is the largest direct provider of residential broadband services in the U.K. Broadband provides users with a high-speed always-connected internet service. Users connect their home computers to NTL’s broadband network via high-speed cable modem. NTL offers broadband services at varying speeds: currently 1Mb, 2Mb and 10Mb.

11

virgin.net

Through NTL’s Virgin Net Limited subsidiary, NTL provide internet services to residential customers who live inside or outside NTL’s service areas. Virgin Net offers both broadband and dial-up internet services. Various price and feature packages are available including metered and unmetered dial-up, and broadband ranging from 512Kb to 2Mb. Services up to 8Mb are planned for 2006. NTL has a license from Virgin Enterprises Limited to use the Virgin name and logo in connection with the activities of virgin.net. As of December 31, 2005, NTL had approximately 481,000 residential customers using virgin.net, including approximately 166,500 broadband customers.

Features and Content

Some features and content are provided free to all subscribers to NTL’s internet services, e.g. email, newsgroups and NetGuard, NTL’s internet security package. NetGuard provides PC anti-virus and a number of security tools including pop-up blocker, form filler and privacy manager.

Other features and content are provided on a subscription basis, or free to higher tier subscribers e.g. Broadband Plus, which is offered free to higher tier broadband subscribers and, for an additional monthly fee, to lower tier broadband subscribers. Broadband Plus gives residential customers access to premium subscription content, such as online gaming, educational, music and other entertainment content.

Internet Market Growth

Broadband is a dynamic and growing industry. NTL intends to continue to maximize its share of this market by leveraging the competitive advantages of its network to create broadband propositions that are superior in speed, value and features.

NTL has experienced substantial growth in its broadband customer base since 2002. For example, as of the close of 2002, NTL had 517,000 broadband customers. At the end of 2003, NTL had 949,200 broadband customers, at the end of 2004 NTL had 1,330,300 broadband customers and at the end of 2005, NTL had 1,823,900 broadband customers. This represents an average growth rate over this period of over 53.6%, including the 62,000 broadband customers already with virgin.net at the time of its acquisition by NTL in 2004, and over 52.0% excluding those customers.

Telephone

NTL provides local, national and international telephone services to its residential customers. NTL tiers its product offering with attractive pricing that includes “Talk Plans” that enable customers to make unlimited local and national calls for a fixed monthly fee in addition to the standard line rental. NTL provides telephone services to its residential customers who are within reach of NTL’s access network by direct connection to its network and also via BT’s local access network to customers off NTL’s network, a process known as indirect access. NTL also provides national and international directory inquiry services. As of December 31, 2005, NTL provided telephone services to approximately 2.6 million residential customers.

Cable Television

NTL offers a wide range of digital and analog television services to its customers. NTL’s digital services include access to over 130 channels, advanced interactive features and a range of premium and pay-per-view services. NTL’s analog service packages offer up to 45 channels including premium and/or pay-per-view services. In addition to offering all of the popular basic and premium channels available on BSkyB’s satellite platform, NTL also offers to its digital customers, through its joint venture with a subsidiary of Telewest Global, Inc., or Telewest, a cable-only movie, sport and special events pay-per-view television service called “Front Row.” Front Row provides NTL’s customers with similar access to films and special pay per view events as BSkyB’s “Sky Box Office”.

NTL’s network technology enables a significant range of digital interactive services to be delivered by making use of the always-connected broadband connection from a customer’s home to the network, known as the always-on return path. Examples of interactive services include games, television email and access to news, entertainment and information services from an on-screen menu. Interactive services also include enhanced television functionality utilizing the “red button” for BBC and other commercial broadcasters. “Red button” functionality in the U.K. permits television viewers to press a red button on their remote control handset to receive additional interactive services including multiple broadcasts. For example, during last year’s live Wimbledon tennis broadcast on BBC, a viewer could press the red button and receive a choice of multiple live tennis matches to watch, with the ability to switch back and forth between one match and several others.

12

As of December 31, 2005, NTL provided cable television services to approximately 1.9 million residential customers, of which approximately 1.4 million received its DTV service and approximately 0.5 million received its ATV service.

Video on Demand

In January 2005, NTL launched its Video on Demand, or VOD, DTV service. This new service, called ntl On Demand, is being rolled out regionally to NTL’s DTV customers throughout the U.K. As of December 31, 2005 over 500,000 existing customers were able to receive the VOD service.

ntl On Demand is a significant enhancement to the existing ntl DTV service, offering viewers choice over and above scheduled programming. The VOD movie service, provided by FilmFlex, a joint venture company between Sony, Disney and the On Demand Group, offers hundreds of films, including many of the latest blockbusters and classics. The VOD service provides access to hundreds of hours of additional programming, including advertising-free children’s programs, a “Pick of the Week” option showing a selection of top shows from the previous seven days, and a music video jukebox service.

Companies who have already agreed to provide VOD content include the BBC, Nickelodeon, Jetix, Warner Music, Entertainment Rights, VPL, The Walt Disney Company, Hollywood Pictures, Touchstone Pictures, Miramax Film Corporation, Buena Vista International, Inc., Sony Pictures Entertainment, Sony Pictures Classics, Columbia Pictures, TriStar, Pathé, Icon Films and Playboy TV. Additional partners are expected to join the service as it develops.

ntl On Demand offers DVD-style features including freeze frame, fast-forward and rewind, and programs are available for 24 hours after purchase. These features provide a customer with full control over the content and timing of their television viewing. There is also an increasing amount of free content available to view at any time. Current films appear on television first through VOD, up to nine months before scheduled TV movie channels. To help customers choose which film to watch, film trailers can be viewed before purchasing.

As soon as this service goes live in each of NTL’s regions, it is available to all of NTL’s DTV customers. No new equipment, installation or additional subscription is required. ntl On Demand appears within the existing Electronic Programming Guide and customers can purchase films and television programs whenever they choose via the remote control.

Sales and Marketing

NTL uses a variety of advertising and marketing channels to sell its services to residential customers, including its dedicated door-to-door sales force and its telephone sales team. These channels are supported by direct marketing initiatives and national and regional press advertising.

NTL uses its residential customer database to identify the profiles of its customers so that it can design offers to match the needs of its customers. NTL’s offers encourage customers to purchase new services and upgrades to existing services.

Customer Service

Improving its customer service has continued to be a central focus for NTL during 2005. NTL now operates its customer service operations from three main custom-built centers based in the U.K. at Glasgow, Swansea and Manchester. These sites are virtualized, which means that calls come in to one access point and are distributed automatically to the first available agent in Glasgow, Swansea or Manchester. This allows real-time call routing between each center, depending on call volumes. A separate service performance team ensures peak call times are resourced properly. NTL uses various tools and processes to ensure that it matches its customers’ calls to the right service center staff and to meet peak demand. NTL’s employees are graded in terms of their expertise in specific call types, which allows the call routing to be linked to skill types of employees, ensuring customers are serviced by experts within their field of enquiry.

In addition, NTL has two specialist teams based in Manchester and Swansea, which deal in high-level fault diagnostics. These teams are staffed by employees trained in on-line diagnosis of faults for NTL’s products. NTL also employs approximately 587 service technicians whose role involves visiting customers who have registered a fault which cannot be rectified remotely. This team is tasked to restore service within 10 hours. During 2005, over 75% of faults were restored within the 10 hour window and a total of 92% within 24 hours. NTL constantly monitors its network to ensure that it detects and repairs network outages promptly, and to enable early communication with its customers.

13

NTL’s customer service operation has over 1,600 staff handling over 24 million calls per year. The average call is answered within 187 seconds, with 34% of calls answered within 30 seconds. However, disruptions in service or other special situations can result in increases in call volumes and waiting times.

Since the 2004 call centre consolidation programme and the cessation of billing migration work there have been improvements in service levels, customer advocacy and churn. Customer research shows all aspects of service have improved with overall satisfaction of the Contact Centers having increased from 48% to 53% across 2005 and helped drive overall advocacy to 55%. This is further supported by the customer advocacy for those customers that have had a reason to call NTL. This advocacy measure has increased 11% year-on-year to 52% and is reflected in the likelihood of customers to purchase a new product with us (Customer Satisfaction and Advocacy measure) to 37% from a low in the year of 28%. Correspondingly controllable customer churn (excluding movers) has dropped to below 3% annualized with “service related churn” at 0.7% annualized.

Business

NTL provides voice, data and internet retail and wholesale services to a broad range of commercial and public sector organizations.

NTL believes that it benefits from both cost and performance competitive advantages from its network, in terms of its reach, bandwidth and performance, over that of its competitors, who largely depend on the BT local access network for the end connection to customers. NTL’s network infrastructure passes within 200 meters of more than 600,000 business premises in the U.K.

NTL derives approximately 40% of its retail business revenue from the public sector, particularly local government and the health and education markets. Where NTL’s network overlaps with the communities served by these organizations, NTL leverages its competitive advantage through cost of delivery or network performance. NTL also leverages its competitive advantage in the commercial markets around regional businesses.

NTL generally divides its business customers by market segment into wholesale and retail. Retail customers are divided further into three categories based on revenues generated or expected from that customer:

• Tier 1 — customer generating revenue of more than £100,000 per year;

• Tier 2 — customer generating revenue of between £25,000 and £100,000 per year; and

��

• Tier 3 — customer generating revenue of less than £25,000 per year.

This tiering of existing retail customers has enabled NTL to develop cost-effective account management, business development and customer service processes appropriate to levels of customer revenues. Revenue from business retail customers for the year ended December 31, 2005 was £250.0 million, distributed across these Tiers, with 20% in Tier 3, 9% in Tier 2 and 71% in Tier 1.

Revenue from business wholesale customers was £177.6 million for the year ended December 31, 2005.

Services

Voice Services

Business Exchange Lines

NTL’s business exchange lines provide its business customers with analog telephone services that connect to customer telephone handsets or private automatic branch exchanges, or PABXs. Revenues for this service are derived from service installation, line rental and usage charges.

Business Line ISDN 30

NTL’s Business Line ISDN 30 service delivers 30 digital exchange lines over a single physical access link. The exchange lines may be used for voice or data applications or a mix of both. The number of digital exchange lines is sized to a customer’s needs. Revenues for this service are derived from service installation, line rental and usage charges.

14

Centrex

NTL’s single and multi-site Centrex solutions provide customers with the facilities of a PABX without the need to invest in the provision and maintenance of a local PABX. Telephone calls between users within a building or in different buildings are handled through NTL’s network but appear to the user to be transferred through a local PABX. Revenues for this service are derived from installation, equipment rental, line rental and call charges.

Non-Geographic Numbers

NTL provides a range of freecall, non-geographic and premium rate number services for tele-business, including advice lines, call centers and telemarketing applications. Revenues for these services are derived from service installation, line rental, usage charges and revenue share with the tele-business line operator.

Data Services

Leased Lines

NTL’s leased line services provide high-quality dedicated connections between two customer locations. Customers use leased lines for voice, data and video applications, and for forming the basis of private networks. Service speeds are available at 2Mb/s, 10Mb/s, 34Mb/s, 45Mb/s, 100Mb/s and 155Mb/s. Revenues for this service are derived from service installation and recurring rental charges based on distance.

Ethernet Services

NTL provides point-to-point, point to multi-point and virtual private network capability, at 10 Mb/s, 100 Mb/s and 1 Gb/s bandwidth. Increasingly, customers use Ethernet as a means of achieving local area network, or LAN, performance over their Wide Area Networks; NTL provides users with the benefit of a dedicated private network at a lower cost. Revenues for this service are derived from installation, access circuit rental and virtual connection rental charges.

Structured Cabling/LAN Solutions

NTL provides in-building structured cabling services which include design, installation and project management of cable installations and upgrades. Revenues for this service are determined on a project-by-project basis.

Internet

Internet Access—Cable Modem/ADSL

NTL provides internet services across the U.K., with access by means of cable modem in areas served by its network or by means of asymmetric digital subscriber line, or ADSL, elsewhere. This allows NTL to provide services across the SME market and ubiquitous national access for larger enterprises.

High Speed Dedicated Internet Access

NTL provides high speed dedicated internet access from 2 Mb/s up to 45 Mb/s to organizations that support web services from their own locations as well as organizations that have heavy demands for access to the internet. Because NTL owns its network, it can provide competitively-priced internet access at higher speeds. NTL’s pricing is based on installation charges and recurring rental charges that vary based on the speed of access.

NTL’s Network

NTL’s business is underpinned by significant investment in its network infrastructure. This consists of a national core backbone network and a high capacity two-way local broadband network in the UK. The entire network was designed for large scale, high-speed telecommunications traffic from its inception. NTL’s core network infrastructure transports its voice, internet, data and digital television platforms, whilst its access networks deliver these services directly to its customers.

15

NTL’s broadband communications network in the U.K. currently passes approximately 7.7 million homes in its regional franchise areas. NTL’s cables also pass a significant number of businesses in these areas. NTL’s service areas include parts of many of the major metropolitan areas in the U.K., including London, Manchester, Leeds, Southampton, Portsmouth, Brighton, Derby, Teesside, Cambridge, Oxford, Reading, Nottingham, Leicester, Coventry, Glasgow, Belfast, Cardiff and Swansea. NTL has the largest service area of any cable operator in the U.K. in terms of homes passed.

The core network has a fiber backbone that is approximately 11,000 kilometers long. This includes over 8,400 kilometers which are owned and operated by NTL and approximately 2,600 kilometers which are leased fiber from other network owners. Over 100 switches direct telephone traffic around the core and local networks. In addition, NTL has more than 500 hub sites, points of presence, repeater nodes or other types of network site, and facilities at over 150 radio sites.

NTL’s local access networks deliver internet, telephone and digital and analog television services to its customers’ homes and businesses. NTL’s access network is comprised of two networks together. First, to provide television services and high-speed broadband internet access, its local fiber network is connected to a customer’s premises via high capacity, two-way, coaxial cables. Second, NTL uses Time Division Multiplex (TDM) technology over the fiber network to provide telephone services. This is then connected to a customer’s premises via a relatively short length twisted copper-pair. Additionally, the copper-pair cables are capable of hosting digital subscriber line (DSL) services (NTL intend to pilot this service in 2006). Shorter lengths of copper provide a structural advantage in delivering very high-speed data services (for example 20Mbps ADSL2+ services).

NTL has a variety of alternative methods to connect its national telecommunications network over the “last mile” to the premises of those customers which are located outside of NTL’s cabled areas. NTL:

• obtains permits to construct telecommunications networks and build-out its network to reach its customers. Although this is often the most costly means of reaching a customer, the expense can be justified in the case of larger customers or where a significant level of traffic is obtained from a customer; and

• leases circuits and DSL connections on the local networks of other service providers to connect to the customers’ premises. Although this may reduce the operating margin on a particular account, it requires significantly less capital expenditure than a direct connection and can often be put into place relatively quickly and can be replaced with a direct connection at a later date if traffic volumes justify doing so.

Nationally, approximately 85% of the homes passed by NTL’s network can receive all of its broadband, digital television and telephone services. NTL cannot however currently provide all three of the main services on some older parts of the network. In 2005, NTL continued a network upgrade program targeting approximately half a million homes in the London area, where there is older, less robust cable network. Approximately 230,000 of the London homes were upgraded during 2005, compared to 102,000 in 2004; these homes can now be offered broadband, interactive digital television and telephone services. This program is scheduled to be completed in 2006 with the upgrade of approximately 200,000 homes.

Once the London upgrade program is completed, approximately 88% of the homes passed by NTL’s network nationally will be able to receive all of its broadband, interactive digital television and telephone services.

Information Technology

NTL outsources the management of the primary elements of its information technology systems to various suppliers. These suppliers include IBM, pursuant to an agreement which terminates in 2013 or, if NTL pays a termination fee, on or after May 23, 2006. NTL retains control of its information technology activities that are fundamental to NTL’s competitive advantage and key to the development of its intellectual property. The services IBM provides include:

• management of NTL’s Wintel and mid-range information technology equipment;

• software application development;

• software application maintenance and support;

• end-user help desk services; and

• end-user desk top and laptop computing support.

16

Competition

Consumer

NTL believes that it has a competitive advantage in the U.K. residential market because it offers integrated communications services including high-speed broadband internet, telephone and television services. NTL offers most of its products on a stand-alone basis or as part of bundled packages designed to encourage customers to subscribe to multiple services. There is only one other significant cable service provider in the U.K., Telewest, which has different service areas than NTL. NTL has merged with Telewest, effective March 3, 2006. NTL offers internet and telephone services nationally. Television services are offered on NTL’s network in its service areas only.

Internet

NTL provides broadband and dial-up internet services to customers within reach of NTL’s access network, by direct connection to its network. NTL also provides broadband and dial-up internet services to customers not within reach of NTL’s access network by providing a connection to NTL’s network via BT’s local access network. NTL’s internet services compete with BT, which provides broadband and dial-up internet access services over its own network. NTL also competes with ISPs, including Wanadoo (rebranding as Orange in 2006), AOL and Tiscali which do not own an access network infrastructure but offer internet access services by providing access to BT’s network.

Additionally, NTL competes with an increasing number of companies who deploy their own network access equipment in BT exchanges. These companies are known as Local Loop Unbundlers (LLU), for example Easynet (recently acquired by BSkyB) and Bulldog (part of Cable & Wireless). BT and third-party service providers use DSL technologies which, like NTL’s network, permit internet access to be provided at substantially greater speeds than conventional dial-up access. NTL anticipate that BT, as well as NTL’s other major competitors, will increase their access speeds during 2006 to as much as 24Mb.

NTL operates in a highly competitive marketplace which is reflected in the increasing pressures NTL sees on pricing and speeds. Additionally NTL sees an increasing number of new entrants aggressively moving into the market during 2006 (e.g. Carphone Warehouse, BSkyB and Be) as LLU begins to gain traction in the UK. Also, third generation (or 3G) mobile technology or other wireless technologies (like Wi-Max) may subject NTL to increased competition over time in the provision of broadband services.

Telephone

NTL provides fixed line telephone services to customers who are within reach of NTL’s network by direct connection to its network and, like NTL’s internet services, to customers off NTL’s network via BT’s local access network. This process is known as indirect access. NTL competes primarily with BT in providing telephone services to residential customers in the U.K. BT occupies an established market position and has substantial resources. NTL also competes with other telecommunications companies that provide indirect access telephone services, including One.Tel, Carphone Warehouse under the brand name Talk Talk, Caudwell Group under the brand name Homecall, and Tesco.

Previously, when providing indirect access services, calls were routed onto another operator’s network by customers dialing additional digits before entering the primary telephone number or via a dialer box that had to be provided to each customer. Calls can now be routed directly within a BT switch, through a method known as carrier pre-selection. Carrier pre-selection dispenses with the need to dial additional digits or use a dialer box, creating a simpler connection process for the customer. Carrier pre-selection is encouraging new companies to provide indirect access telephone services, increasing the pressure on NTL’s telephone services.

NTL also competes with mobile telephone networks that may threaten the competitive position of its networks by providing a substitute to fixed line telephone services. Mobile telephone services also contribute to the downward price pressure in fixed line telephone services. However, NTL expects that any decrease in demand for fixed line telephone services as a result of competition from mobile telephone networks may be at least partially offset by increased demand for its wholesale services to mobile telecommunications operators.

On December 5, 2005, NTL confirmed that it had approached Virgin Mobile about a potential offer to combine itself with Virgin Mobile, and that NTL had engaged in discussions with Virgin Enterprises to extend its existing license for use of the Virgin name in the internet services area also to cover telephone (as well as television and mobile telephone services). On January 16, 2006, NTL and the independent directors of Virgin Mobile confirmed discussions to enable a cash offer, with share alternative offers, to be made by NTL or

17

one or more of NTL’s subsidiaries to acquire 100% of the shares of Virgin Mobile. However, no assurances can be made that an offer will be made, of the terms on which any offer may be made, or whether any transaction will be completed.

Television

NTL competes primarily with BSkyB in providing pay DTV to residential customers in the U.K. BSkyB is the only pay-satellite television platform and has high market share of the UK pay television market. BSkyB owns the UK rights to various sports and movie programming content which it has used to create some of the most popular premium pay TV channels in the U.K. BSkyB is therefore both NTL’s principal competitor in the pay-television market, and a critical supplier of content to NTL. The Office of Fair Trading, a U.K. regulatory agency which we refer to as the OFT, has previously determined that BSkyB is dominant in the wholesale supply of channels carrying certain premium sports content and premium movies. Subject to a continuing finding of dominance, this should prevent BSkyB from abusing its market position in relation to the supply of these channels to NTL. Even so NTL believes that the current pricing for this content is not favorable to it and should be improved. NTL has an agreement in place with BSkyB for their basic service. NTL currently trade on BSkyB’s rate card terms and pricing for their premium service. Residential customers may also receive digital terrestrial television, or DTT. Digital signals are delivered to customer homes through a conventional television aerial and a separately purchased set top box or an integrated digital television set.

The free-to-air DTT service in the U.K. is branded Freeview. This service is provided by a consortium of BSkyB, National Grid Wireless and the BBC and offers customers a limited range of television channels, which include the traditional analog channels. Customers do not pay a monthly subscription fee for basic Freeview service but must acquire a freeview-enabled set top box or a television with a digital tuner. Presently Freeview does not offer several of the most popular pay television channels, such as Sky Sports, Sky Movies and MTV.

Top Up TV offers a pay television service offering staggered times approximately eleven pay television channels for a fixed fee to subscribers who otherwise receive freeview and have purchased Top Up TV software. Currently a limited number of residential customers can receive DTV over BT’s ADSL lines. Video Networks Limited, under the brand name Homechoice, supplies this service, including video on demand, to customers in parts of the London metropolitan area, and Kingston Interactive Television supplies to customers in one region in England.

Following NTL’s merger with Telewest, no other competitors are able to offer the full range of services NTL provides. Some new competitors are using DSL technology to offer a comparable “triple play.” For example, Homechoice, provides bundled services to approximately 30,000 customers, according to Homechoice. However, the offerings of both of these companies are on a significantly smaller scale than NTL’s.

Pay television and pay-per-view services offered by NTL compete to varying degrees with other communications and entertainment media, including home video, video games and DVDs. NTL are introducing video on demand services which may compete in the future with programming provided by video on demand services offered by other parties and may compete against other video formats.

Telecommunications is a constantly evolving industry and NTL expects that there will continue to be many advances in communications technology and in content. These advances, together with changes in consumer behavior, and in the regulatory and competitive environments, mean that it will be difficult to predict how NTL’s operations and businesses will be affected in the future.

The U.K. government has stated that it will terminate ATV transmission by 2012. Consumers wishing to receive television services will have to convert to DTV, currently available via digital satellite, DTT, DSL or cable. However, when ATV transmission is terminated the terrestrial DTV signal and network may be increased. This will enable terrestrial DTV to be made available to customers’ homes that cannot currently receive it. Some customers may wish to subscribe for free DTT, via Freeview, rather than pay for DTV.

18

Business

NTL faces a wide range of competitors in the U.K. market. The nature of this competition varies depending on geography, service offerings and size of the marketable area. Only BT and Telewest have both extensive local access networks and a national backbone network. However, as Telewest’s local networks do not overlap with NTL’s networks, NTL does not compete with Telewest to any material extent. BT is a major competitor in almost all of NTL’s opportunities. Cable and Wireless plc, or C&W, and its recently acquired subsidiary Energis own national backbone networks and they tend to focus on the large enterprise and corporate markets. However, these companies do not own local networks to any material extent and rely on wholesale arrangements to supply their customers.

Colt Telecom Group plc has an extensive network particularly in London and also focuses on large enterprise and corporate accounts. Thus Group plc has its network in Scotland, principally in Edinburgh and Glasgow, and United Utilities plc has its network in Manchester. NTL faces these competitors on a local basis mainly in the medium to large end of the SME (small and medium size enterprises) market and in the market for larger corporate accounts and public sector organizations. In addition, for voice services NTL competes with a number of resellers who purchase wholesale minutes from BT and others and competes aggressively in the retail market.

Although many customers have a dual supplier sourcing policy, competition remains based on price and quality of service. NTL expects price competition to intensify as existing and other new entrants compete aggressively. Most of these competitors have substantial resources and NTL cannot assure you that these or other competitors will not expand their businesses in its existing markets or that NTL will be able to continue to compete successfully with these competitors in the business telecommunications market.

BT and C&W are NTL’s principal competitors in NTL’s wholesale services markets. Competition is based on the price, range and quality of services. BT has a local access network across the U.K. that puts BT in a strong competitive position. Competition is most intense on key city-to-city routes where new entrants have increased the number of suppliers and had a significant negative impact on prices. Where opportunities are more closely aligned to the geographic areas NTL serves, the number of its competitors is reduced.

19

Government Regulation

Regulation in the European Union (EU)

The European Parliament and Commission regulate our principal business activities through Directives and various other regulatory instruments.

In particular, in February 2002, the European Commission adopted a package of new Directives which, together, set out a new framework for the regulation of electronic communications networks and services throughout the EU. This new framework consisted of four Directives, namely:

• Directive 2002/21 on a common regulatory framework for electronic communications networks and services (the Framework Directive)

• Directive 2002/20 on the authorization of electronic communications networks and services (the Authorization Directive)

• Directive 2002/19 on access to and interconnection of electronic communications networks and associated facilities (the Access and Interconnection Directive), and

• Directive 2002/22 on universal service and users rights relating to electronic communications networks and services (the Universal Service Directive).

This package of Directives was supplemented, subsequently, by the Communications and Privacy Directive which dealt, among other things, with data protection issues in relation to the provision of electronic communications services.

The U.K. Government incorporated these Directives into its national laws under the Communications Act 2003, which came into effect on July 25, 2003, and the Communications Privacy Regulations, which came into effect on December 11, 2003.

During 2006, the European Commission will be conducting a review of these Directives (the 2006 Review) to assess their continuing suitability and efficacy and whether any amendments are necessary. It is not possible, at this stage, to express any opinion as to the likely outcomes of this review.

In addition, the European Parliament and Commission are currently carrying out a review of the Television Without Frontiers Directive. This Directive, which was originally adopted in 1989, has been a cornerstone of EU audiovisual media policy. It requires the Member States of the EU, among other things, to set certain minimum standards for broadcasting and controls on the amount and content of advertising. The Directive also requires Member States to take active measures to ensure that broadcasters under their jurisdiction support the European film and TV production industry. This requirement is achieved, in large part, through the imposition of a European content quota under which broadcasters must reserve a majority of their transmission time for European works.

In December 2005, the European Commission published proposed amendments to the Directive which are designed to update the Directive in the light of technological and market developments. The main proposal is that on-demand services, which the European Commission refer to as “non-linear services”, should be brought within the scope of the Directive and should be made subject to some of its requirements. In particular, there is a proposal that on-demand service providers such as ourselves should be required, where practicable and by appropriate means, to promote production of and access to European works. The Commission cites content quotas and investment levies as examples of how this might be achieved.

Debate on the proposed amendments will continue throughout 2006 and, in particular, the proposals will be debated in the European Parliament within this period. It is not possible, at this stage, to predict the outcome with certainty but there is a risk that our on-demand services will become more heavily regulated as a result and that we may be required to take steps, similar to those which already apply to traditional linear broadcasters, to support European film and TV production.

20

Regulation in the U.K.

We are subject to regulation under the Communications Act 2003, the Broadcasting Acts 1990 and 1996 and other U.K. statutes and subordinate legislation.

The Communications Act 2003 established a new regulatory authority, the Office of Communications (Ofcom), as the single regulatory authority for the entire communications sector. Ofcom replaced a number of sectoral regulatory authorities such as the Office of Telecommunications (Oftel) and the Independent Television Commission (ITC).

Under the Communications Act 2003, communications providers, such as ourselves, are no longer required to hold individual licenses in order to provide electronic communications networks and services, although certain licenses are required (see below under Cable TV regulation) in order to own or operate TV channels or to provide certain facilities such as electronic programme guides on the cable TV platform. Even so, all communications providers are subject to a set of basic conditions imposed by Ofcom, which are known as the General Conditions of Entitlement. Any breach of these conditions could lead to the imposition of fines by Ofcom and, ultimately, to the suspension or revocation of a company’s right to provide electronic communications networks and services.

The General Conditions of Entitlement and SMP conditions

Full details of the General Conditions of Entitlement are available on Ofcom’s website (www.ofcom.org.uk). Some of the requirements under the General Conditions of Entitlement with which we must comply include:

• a requirement to negotiate interconnection arrangements with other network providers

• a requirement to ensure that any end-user can access the emergency services

• a requirement to offer outbound number portability to customers wishing to switch to another network provider and to support inbound number portability where we acquire a customer from another network provider

• a requirement to ensure that any end-user can access a directory enquiry service

• a requirement to publish up-to-date price and tariff information

• a requirement to provide itemized billing on request from each customer.

Our entitlement to provide electronic communications networks and services extends throughout the UK and is not constrained in time.

Under current arrangements, any company, including ourselves, providing an electronic communications network or service is liable to pay annual administrative fees to Ofcom if its turnover in the second calendar year before the charging year in question was £5 million or more. These fees are calculated at a rate set by Ofcom each year and are applied to relevant turnover bands.

In addition to the General Conditions of Entitlement, Ofcom is under an obligation to impose further conditions on providers of electronic communications networks or services who have significant market power (SMP) in identified markets. In regulatory terms, SMP equates to the competition law concept of dominance. The new EU regulatory framework, adopted in 2002, required Ofcom to carry out a number of initial market reviews to establish which providers held SMP in these markets, and should therefore be subject to further conditions, and to keep these markets and any other relevant markets identified by Ofcom under regular review. This has resulted in British Telecommunications plc (BT) being found to have SMP in a substantial number of markets. As a result, BT has been made subject to further regulatory requirements in both wholesale and retail markets.

All fixed operators, including ourselves, have been found to possess SMP in relation to the termination of calls on their own networks. This has resulted in the imposition of a requirement on all fixed operators to provide access to their networks on fair and reasonable terms for terminating calls, with additional requirements being imposed on BT and Kingston Communications. This apart, we have not been found to possess SMP in any of the other voice, data or Internet markets in which we operate.

21

The Strategic Review of Telecommunications

Following the passing of the Communications Act 2003, Ofcom announced that one of its first tasks would be to carry out a strategic review of telecommunications in the UK (TSR).

The TSR commenced in April 2004 with the observation from Ofcom that, despite almost twenty years of telecommunications liberalization in the UK, BT remained dominant in almost all telecommunications markets. Ofcom’s preliminary assessment was that although the true infrastructure competition offered by the cable industry was highly desirable and had resulted in substantial consumer benefits, it did not represent a sufficient competitive constraint on BT. Similarly, the intensity of competition to BT based on access by third party service providers to the BT network via wholesale products, was insufficient. Ofcom felt, therefore, that it should seek to increase competitive intensity by improving third party access to the BT network.

Having reached this conclusion, Ofcom has developed a concept known as “equivalence”. Broadly, this concept has been defined as enabling BT’s competitors to gain access to BT’s network infrastructure on exactly the same (i.e. equivalent) terms as BT itself enjoys.

At the conclusion of the TSR, BT offered and Ofcom accepted a number of undertakings to put the concept of equivalence into practice in its dealings with competitors. This will be achieved primarily through the creation of a new division within BT called “openreach” which will manage and sell network services to competitors and the rest of BT on the same terms and conditions (including prices) and in accordance with the same processes. By giving these undertakings, BT avoided a reference by Ofcom to the UK competition authorities.

The outcome of the TSR is expected to create further commercial opportunities for new entrants in markets across the communications sector and therefore to meet Ofcom’s objective of increasing competitive intensity.

Universal Service

The concept of universal service is designed to ensure that basic fixed-line telecommunications services are available at an affordable price to all citizens across the EU. The scope of universal service obligations is defined by the Universal Service Directive (see above under Regulation in the European Union) and is transposed into U.K. regulation by the Universal Service Order. This Order has been implemented by Ofcom which has imposed a number of specific universal service requirements on BT and Kingston Communications, both of which have been designated by Ofcom as universal service providers.

The European Commission is expected to review the future scope of universal service obligations as part of the 2006 Review (see above under Regulation in the European Union). This review is likely to consider, among other things, whether universal service should extend to the provision of broadband internet connectivity and whether there is scope in the future for making use of mobile technologies in the provision of some aspects of universal service. We would be impacted by any future decision to require us to provide or to contribute to the funding of universal service in the U.K.

Electronic Communications Code

Under the Telecommunications Act 1984, which was largely replaced by the Communications Act 2003, licensed public telecommunications operators were eligible for enhanced legal powers under the electronic communications code annexed to the Telecommunications Act 1984, or Code Powers. Code Powers are of particular benefit to those who construct and maintain networks because they give enhanced legal rights of access to private land, exemption from some requirements of general planning law and the right to install equipment in the public highway.

The Communications Act 2003 retained the broad structure of Code Powers. Any operator which possessed Code Powers under the previous licensing regime automatically retained those powers under the Communications Act regime. Any operator wishing to obtain new Code Powers must now apply to Ofcom. NTL’s subsidiaries that provide electronic communications networks and services, ntl Group Limited and ntl National Networks Limited, both have Code Powers.

Although Code Powers give operators the right to install equipment in public highways, each operator is required to certify to Ofcom each year that it has sufficient and acceptable financial security in place to cover the costs which could be incurred by local councils or road authorities if they were required to remove equipment or restore the public roads following the insolvency of that operator. This security is commonly described as “funds for liabilities.” Ofcom has indicated that it will generally require an operator to provide board-level certification of third party security for this purpose.

22

Cable TV regulation

Although NTL are no longer required to hold individual licenses to provide electronic communications networks and services, NTL are still required to hold individual licenses under the Broadcasting Acts 1990 and 1996 for any television channels which it owns or operates and for the provision of certain other services (e.g. electronic programme guides) on our cable TV platform.

NTL therefore holds a number of Television Licensable Content Service Licenses (TLCS licenses) under the Broadcasting Act 1990 for the provision of promotional channels and for the provision of our electronic programme guide.

TLCS licenses are granted and administered by Ofcom. The licenses require that each licensed service complies with a number of Ofcom codes, including the recently published Broadcasting Code, and with all directions issued by Ofcom. Breach of any of the terms of a TLCS license may result in the imposition of fines on the license holder and, ultimately, to the license being revoked.

Holders of TLCS licenses are required to pay an annual fee to Ofcom. The fees are related to the revenue-earning capacity of each television service and are based on a percentage, set by Ofcom, of revenues from advertising, sponsorship, subscriptions and interactive services, with special rules applying to shopping channels.

U.K. competition law

The Competition Act 1998, which came into force in March 2000, introduced a prohibition on the abuse of a dominant market position and a prohibition on anti-competitive agreements, modeled on Articles 81 and 82 of the Treaty of Rome. The Act also introduced third party rights, stronger investigative and enforcement powers and the ability for the competition authorities to issue interim measures. The new enforcement powers include the ability to impose fines of up to 10% of worldwide turnover. The Competition Act is enforced by the Office of Fair Trading (OFT) and gives concurrent investigative and enforcement powers in matters concerning communications to Ofcom.

The U.K.’s competition law framework was further strengthened by the competition provisions of the Enterprise Act 2002, which came into force in June 2003. Under these provisions, among other things, decisions on mergers are now made by the independent competition authorities, using competition-based tests, rather than by the U.K. Government.

NTL’s merger with Telewest Global, Inc was cleared by the OFT on December 30, 2005. The OFT’s detailed decision in this case was published on January 10, 2006. The time for any third party appeal of this decision has expired.

Under other provisions of the Enterprise Act, individuals who cause, encourage, participate in or, in some cases, even those who have knowledge of, the making of agreements between competitors which are designed to fix prices, share markets, limit supply or production or rig bids in the U.K., can be prosecuted and punished with unlimited fines and imprisonment for up to five years. The courts may also order the disqualification for up to fifteen years of directors whose companies have committed a breach of U.K. or EU competition law.

Seasonality

Some revenue streams are subject to seasonal factors. For example, telephone usage revenue by customers and businesses tends to be slightly lower during summer holiday months. NTL’s customer churn rates include persons who disconnect service because of moves, resulting in a seasonal increase in its churn rates during the summer months when higher levels of U.K. house moves occur and students leave their accommodations between school years.

Research and Development

NTL’s research and development activities involve the analysis of technological developments affecting its cable television, telephone and telecommunications business, the evaluation of existing services and sales and marketing techniques and the development of new services and techniques.

23

Patents, Trademarks, Copyrights and Licenses

NTL does not have any material patents or copyrights nor does it believe that patents play a material role in its business. NTL owns and has the right to use registered trademarks, which in some cases are, and in others may be, of material importance to its business, including the “ntl:” logo. NTL uses the Virgin.net name and logo in connection with the activities of its virgin.net ISP under license from Virgin Enterprises Limited.

Employees

As the management of our business is performed by NTL, we do not have any employees on our payroll. At December 31, 2005, NTL had 9,820 employees, 8,896 of whom were permanent and 924 of whom were temporary or contract. NTL believes that its relationship with its employees is generally good.

Item 1B Unresolved Staff Comments

None.

Item 2. Properties

We do not own or lease any properties. NTL South Herts owns a freehold property at 9 Greycaine Road, Watford for use as offices and to house network equipment.

Item 3. Legal Proceedings

We are from time to time subject to legal proceedings and claims that arise in the ordinary course of our business. In the opinion of the management, the amount of ultimate liability with respect to these actions will not materially affect our financial position, results of operations or liquidity.

Item 4. Submission of Matters to a Vote of Security Holders

There were no matters that were submitted to a vote of the holders of our limited partnership interests during the quarter ended December 31, 2005.

24

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters